The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

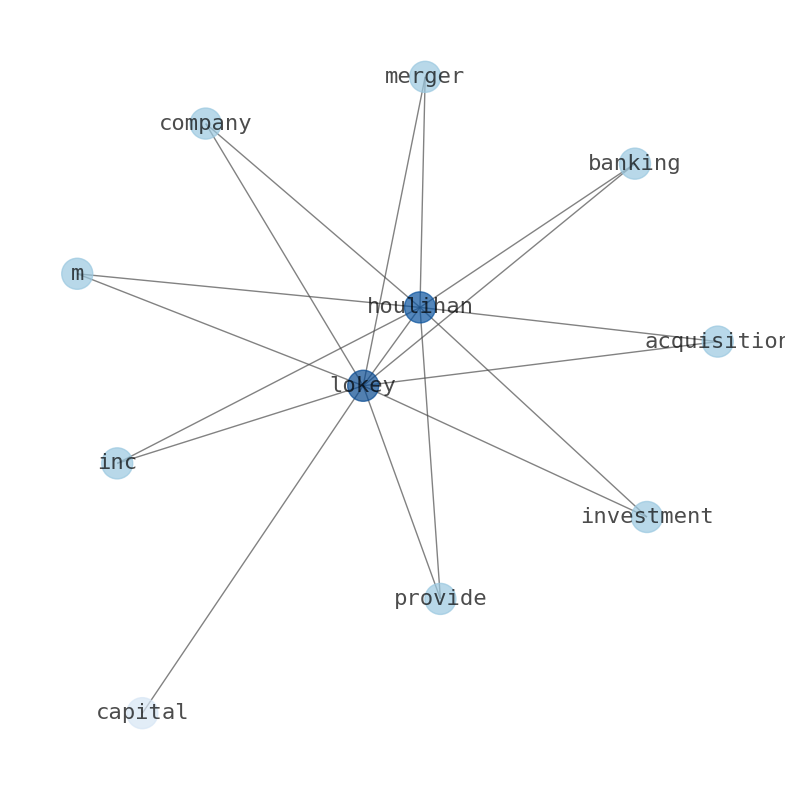

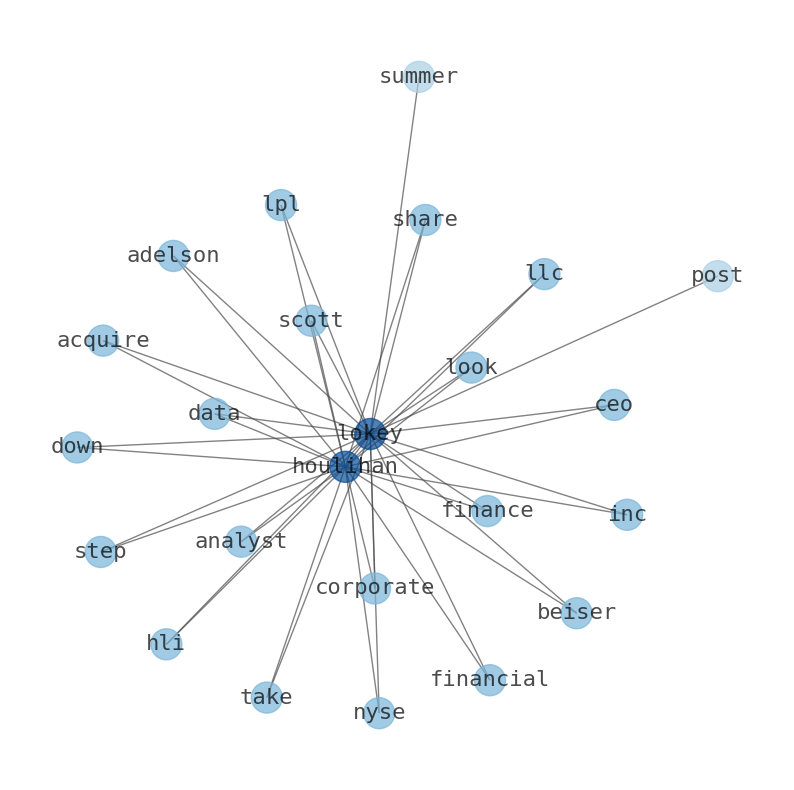

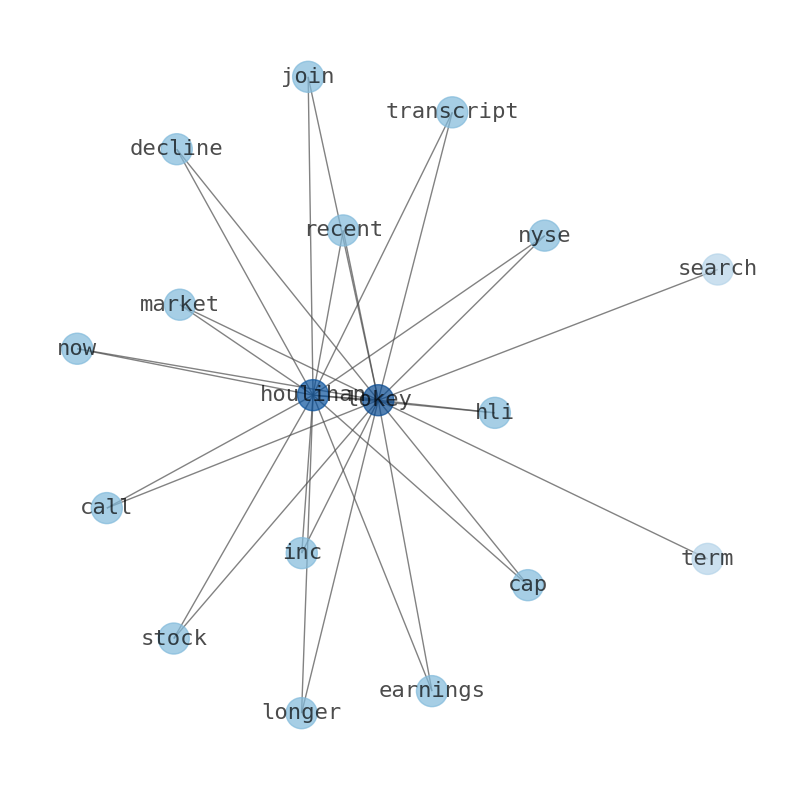

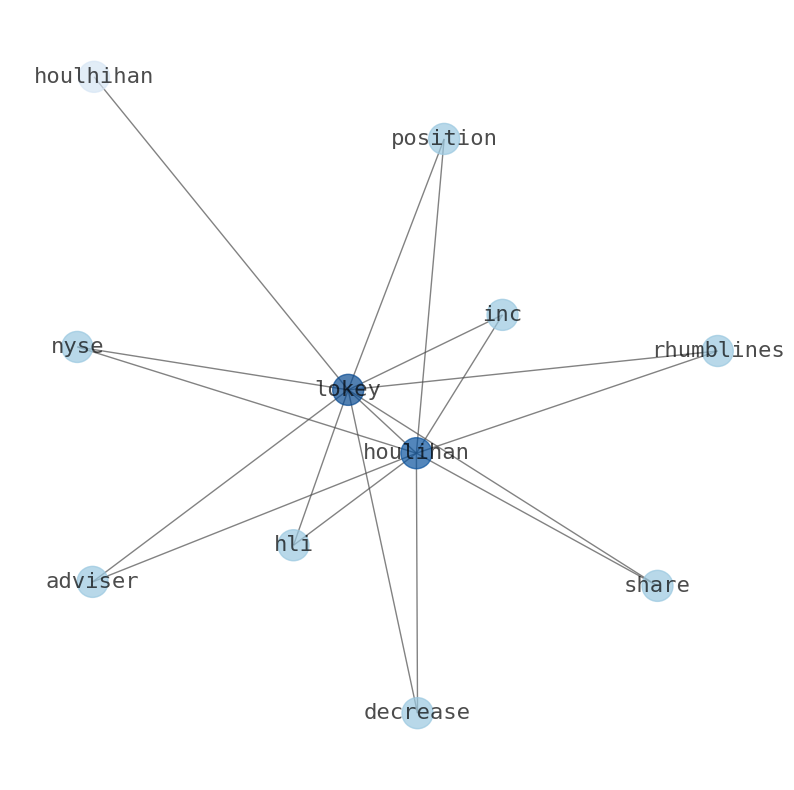

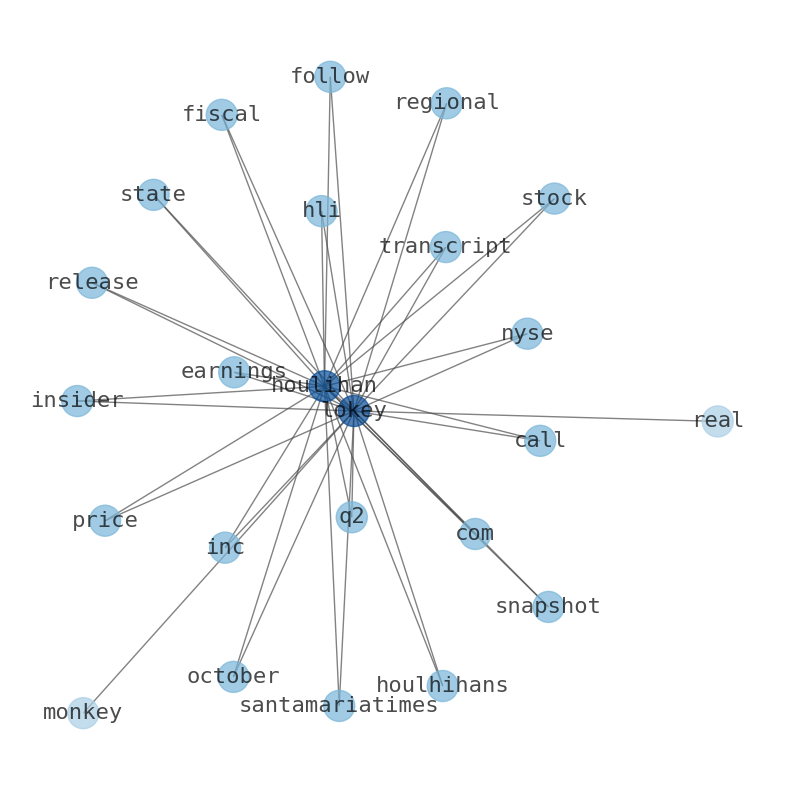

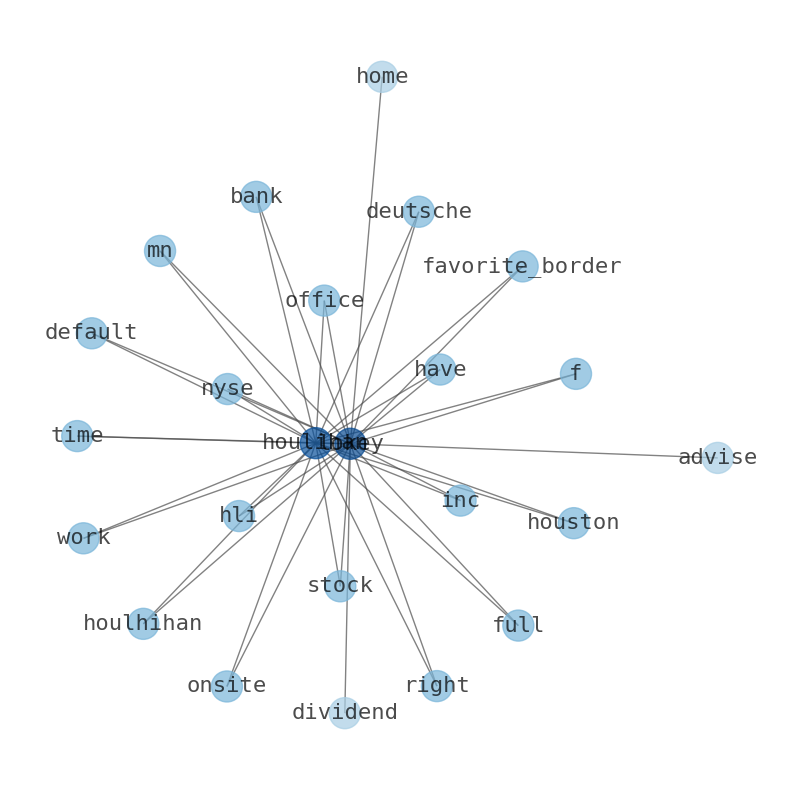

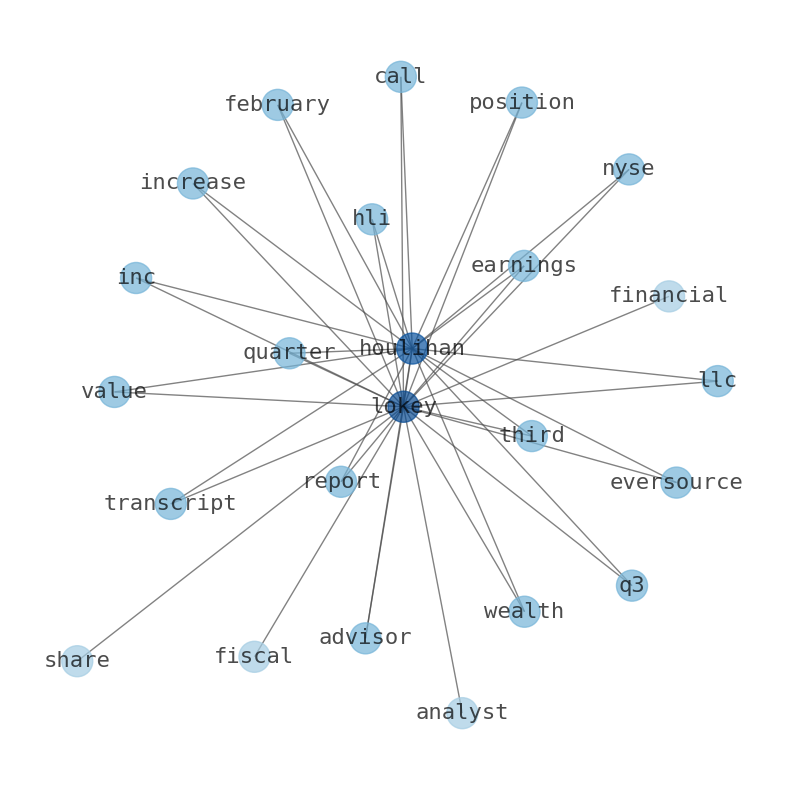

Houlihan Lokey

Youtube SubscribeTicker: HLI

Sector: Capital Markets

Houlihan Lokey

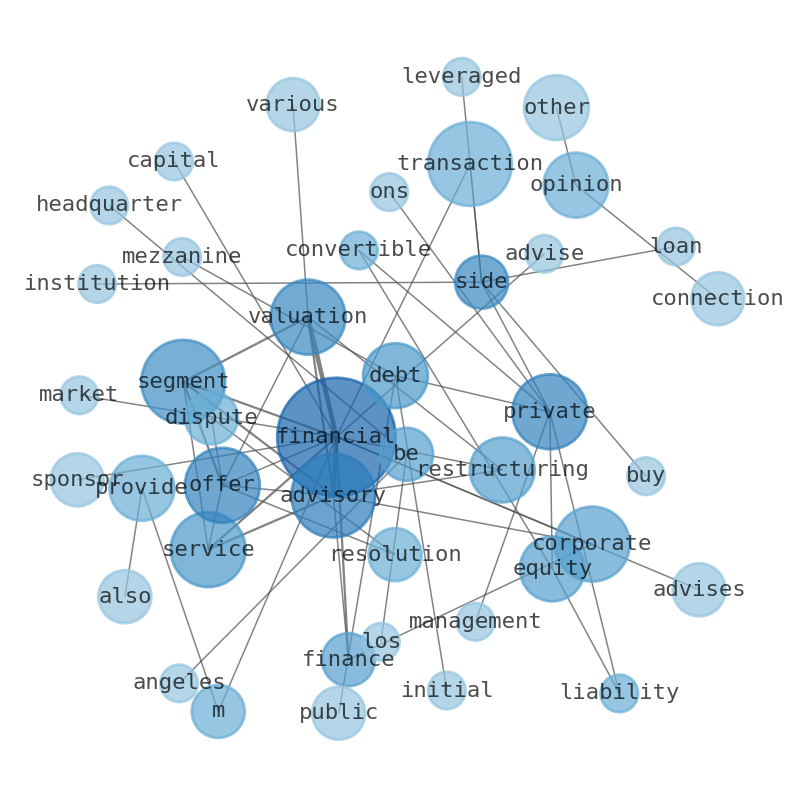

Houlihan Lokey, Inc., an investment banking company, provides merger and acquisition (M&A), capital market, financial restructuring, and financial and valuation advisory services worldwide. It operates in three segments: Corporate Finance, Financial Restructuring, and Financial and Valuation Advisory. The Corporate Finance segment offers general financial advisory services; and advises public and private institutions on buy-side and sell-side transactions, leveraged loans, private mezzanine debt, high-yield debt, initial public offerings, follow-ons, convertibles, equity private placements, private equity, and liability management transactions, as well as advise financial sponsors on various transactions. The Financial Restructuring segment advises debtors, creditors, and other parties-in-interest related to recapitalization/deleveraging transactions. It also provides a range of advisory services, including structuring, negotiation, and confirmation of plans of reorganization; structuring and analysis of exchange offers; corporate viability assessment; dispute resolution and expert testimony; and procuring debtor-in-possession financing. The Financial and Valuation Advisory segment offers valuations of various assets, such as companies, illiquid debt and equity securities, and intellectual property. It also provides fairness opinions in connection with M&A and other transactions, solvency opinions in connection with corporate spin-offs and dividend recapitalizations, and other types of financial opinions. In addition, this segment offers dispute resolution services. It serves corporations, financial sponsors, and government agencies. The company was incorporated in 1972 and is headquartered in Los Angeles, California.

Related Results

Houlihan Lokey

Open: 124.92 Close: 124.53 Change: -0.39

Read more →

Houlihan Lokey

Open: 115.32 Close: 114.47 Change: -0.85

Read more →

Houlihan Lokey

Open: 103.58 Close: 105.59 Change: 2.01

Read more →

Houlihan Lokey

Open: 99.3 Close: 98.43 Change: -0.87

Read more →

Houlihan Lokey

Open: 88.25 Close: 90.44 Change: 2.19

Read more →

Houlihan Lokey

Open: 128.51 Close: 126.9 Change: -1.61

Read more →

Houlihan Lokey

Open: 115.32 Close: 114.47 Change: -0.85

Read more →

Houlihan Lokey

Open: 100.07 Close: 100.0 Change: -0.07

Read more →

Houlihan Lokey

Open: 100.9 Close: 100.54 Change: -0.36

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo

- Sony Group

- Caterpillar

- Deere & Company

- PayPal Holdings

- BlackRock

- Netflix

- Citigroup

- The Boeing Company

- Automatic Data Processing

- The Estee Lauder Companies

- Rio Tinto

- Starbucks

- Prologis

- British American Tobacco

- Applied Materials

- BP plc

- Petroleo Brasileiro

- JD

- Anheuser-Busch InBev

- ServiceNow

- Enbridge

- Analog Devices

- Mondelez International

- Cigna

- Canadian National Railway Company

- GSK plc

- Zoetis

- Duke Energy

- General Electric Company

- Infosys

- 3M Company

- Intuitive Surgical

- The Southern Company

- Brookfield Asset Management

- Stryker

- Altria Group

- Crown Castle International

- Booking Holdings

- Chubb

- Target

- Gilead Sciences

- Northrop Grumman

- The TJX Companies

- Canadian Pacific Railway

- The Bank of Nova Scotia

- ICICI Bank

- Charter Communications

- Mitsubishi UFJ Financial Group

- Fomento Economico Mexicano

- Airbnb

- CME Group

- Vertex Pharmaceuticals

- CSX Corporation

- Becton, Dickinson and Company

- Micron Technology

- Lam Research

- The PNC Financial Services Group

- Colgate-Palmolive Company

- Fiserv

- Waste Management

- Dominion Energy

- Truist Financial

- Bank of Montreal

- Illinois Tool Works

- The Progressive Corporation

- Moderna

- Regeneron Pharmaceuticals

- Equinix

- EOG Resources

- The Sherwin-Williams Company

- Fidelity National Information Services

- Activision Blizzard

- Canadian Natural Resources

- HCA Healthcare

- General Dynamics

- Edwards Lifesciences

- FedEx

- Ford Motor Company

- Occidental Petroleum

- America Movil

- Pinduoduo

- NetEase

- Humana

- Aon plc

- Norfolk Southern

- Eaton

- Boston Scientific

- Enterprise Products Partners

- ABB Ltd

- Dollar General

- Public Storage

- UBS Group AG

- Relx PLC

- Synopsys

- Moodys

- Intercontinental Exchange

- Pioneer Natural Resources Company

- Keurig Dr Pepper

- KLA Corporation

- Air Products & Chemicals

- Thomson Reuters

- General Motors Company

- Centene

- Atlassian

- Emerson Electric Company

- Marriott International

- Monster Beverage

- Sempra Energy

- TC Energy

- Schlumberger

- MetLife

- Palo Alto Networks

- American Electric Power Company

- Cadence Design Systems

- National Grid

- McKesson

- VMware

- Marathon Petroleum

- NXP Semiconductors NV

- Uber Technologies

- Fortinet

- Snowflake

- Ecolab

- Autodesk

- Archer-Daniels-Midland Company

- The Hershey Company

- Marvell Technology

- Baidu

- L3Harris Technologies

- Constellation Brands

- Shopify

- Nutrien

- Suncor Energy

- The Kraft Heinz Company

- Stellantis

- Roper Technologies

- Kimberly-Clark

- Amphenol

- Paychex

- Canadian Imperial Bank of Commerce

- General Mills

- OReilly Automotive

- Exelon

- Block

- Honda Motor Company

- Ambev

- IQVIA Holdings

- Realty Income

- Takeda Pharmaceutical Company

- Itau Unibanco Holding

- Sysco

- Sumitomo Mitsui Financial Group

- Valero Energy

- Republic Services

- Sea Limited

- Chipotle Mexican Grill

- Woodside Energy Group

- Cintas

- Freeport-McMoRan

- Eni SpA

- CrowdStrike Holdings

- TE Connectivity

- AutoZone

- Capital One Financial

- Phillips 66

- The Williams Companies

- Vodafone Group

- Banco Santander

- Corteva

- MercadoLibre

- Simon Property Group

- Devon Energy

- Kinder Morgan

- American International Group

- Xcel Energy

- Banco Santander Brasil

- Agilent Technologies

- BioNTech SE

- Motorola Solutions

- Lululemon Athletica

- Workday

- Welltower

- Ferrari

- Alcon

- Microchip Technology

- Lloyds Banking Group

- Enphase Energy

- Digital Realty Trust

- Johnson Controls International

- Dollar Tree

- Prudential Financial

- Cheniere Energy

- The Travelers Companies

- Southern Copper

- Parker-Hannifin

- Electronic Arts

- Aflac

- Arista Networks

- ING Group

- Global Payments

- SBA Communications

- Cenovus Energy

- Newmont

- Brown-Forman

- Nucor

- Hilton Worldwide Holdings

- Banco Bradesco

- Cognizant Technology Solutions

- Yum! Brands

- ResMed

- Bank of New York Mellon

- Energy Transfer LP

- Consolidated Edison

- Manulife Financial

- Veeva Systems

- STMicroelectronics

- Walgreens Boots Alliance

- Old Dominion Freight Line

- TransDigm Group

- Apollo Global Management

- Trane Technologies

- Carrier Global

- Haleon

- Waste Connections

- Illumina

- Hess Corporation

- NIO Inc.

- Dell Technologies

- IDEXX Laboratories

- Prudential

- The Kroger Company

- Otis Worldwide

- VICI Properties

- Li Auto

- DexCom

- NatWest Group

- Public Service Enterprise Group

- WEC Energy Group

- MPLX LP

- Barclays

- Datadog

- Seagen

- Coupang

- The Allstate Corporation

- International Flavors & Fragrances

- Tyson Foods

- TELUS

- PACCAR

- Zoom Video Communications

- Mizuho Financial Group

- Eversource Energy

- Lucid Group

- Rivian Automotive

- Cummins

- Mettler-Toledo International

- Copart

- DuPont de Nemours

- AmerisourceBergen

- PPG Industries

- Biogen

- Imperial Oil

- Corning

- Verisk Analytics

- Equity Residential

- Fastenal Company

- Baxter International

- Nokia

- Nasdaq

- Keysight Technologies

- Wipro

- GlobalFoundries

- First Republic Bank

- Rockwell Automation

- AvalonBay Communities

- CRH Plc

- Ameriprise Financial

- Las Vegas Sands

- Aptiv

- Ross Stores

- Royalty Pharma

- Banco Bilbao Vizcaya Argentaria

- LyondellBasell Industries NV

- American Water Works Company

- Telkom Indonesia

- AMETEK

- CoStar Group

- Albemarle

- Sociedad Quimica y Minera de Chile

- Discover Financial Services

- Barrick Gold

- CBRE Group

- ON Semiconductor

- Weyerhaeuser Company

- Orange

- Sun Life Financial

- Roblox

- Extra Space Storage

- Ferguson

- ONEOK

- Sirius XM Holdings

- Equifax

- Halliburton Company

- Edison International

- Telefonica

- DTE Energy Company

- Ericsson

- West Pharmaceutical Services

- Coca-Cola Europacific Partners

- Restaurant Brands International

- CDW Corporation

- Franco-Nevada

- ANSYS

- Lennar

- Brookfield Renewable Partners

- Ameren

- Coterra Energy

- Interactive Brokers Group

- Entergy

- Fifth Third Bancorp

- Ball Corporation

- Rogers Communications

- FirstEnergy

- Zimmer Biomet Holdings

- Genmab

- Fortive

- Southwest Airlines Company

- Willis Towers Watson

- United Rentals

- Align Technology

- Steris

- Spotify Technology

- The Trade Desk

- Diamondback Energy

- Live Nation Entertainment

- Tractor Supply Company

- Gartner

- MongoDB

- Ecopetrol

- Mid-America Apartment Communities

- Monolithic Power Systems

- Palantir Technologies

- ORIX Corporation

- Ares Management

- PPL Corporation

- Constellation Energy

- Ventas

- ArcelorMittal

- Raymond James Financial

- Take-Two Interactive Software

- Match Group

- EPAM Systems

- XPeng

- Pembina Pipeline

- VeriSign

- Delta Air Lines

- Northern Trust

- The Hartford Financial Services Group

- Sun Communities

- ZTO Express (Cayman)

- Ulta Beauty

- PerkinElmer

- Catalent

- Ingersoll Rand

- Quanta Services

- CenterPoint Energy

- Regions Financial

- CF Industries Holdings

- Rocket Companies

- Amcor

- Agnico Eagle Mines

- ICON plc

- Rollins

- Pagaya Technologies

- Garmin

- Broadridge Financial Solutions

- HEICO

- Molina Healthcare

- Avangrid

- Essex Property Trust

- Polestar Automotive Holding UK

- Zebra Technologies

- Nu Holdings

- Citizens Financial Group

- The Mosaic Company

- Horizon Therapeutics

- Magna International

- Teledyne Technologies

- Brookfield Infrastructure Partners LP

- Koninklijke Philips

- Fox Corporation