The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Palo Alto Networks

Youtube Subscribe

Open: 191.56 Close: 192.15 Change: 0.59

Stop reading the whole internet to decide if you want to invest in Palo Alto Networks.

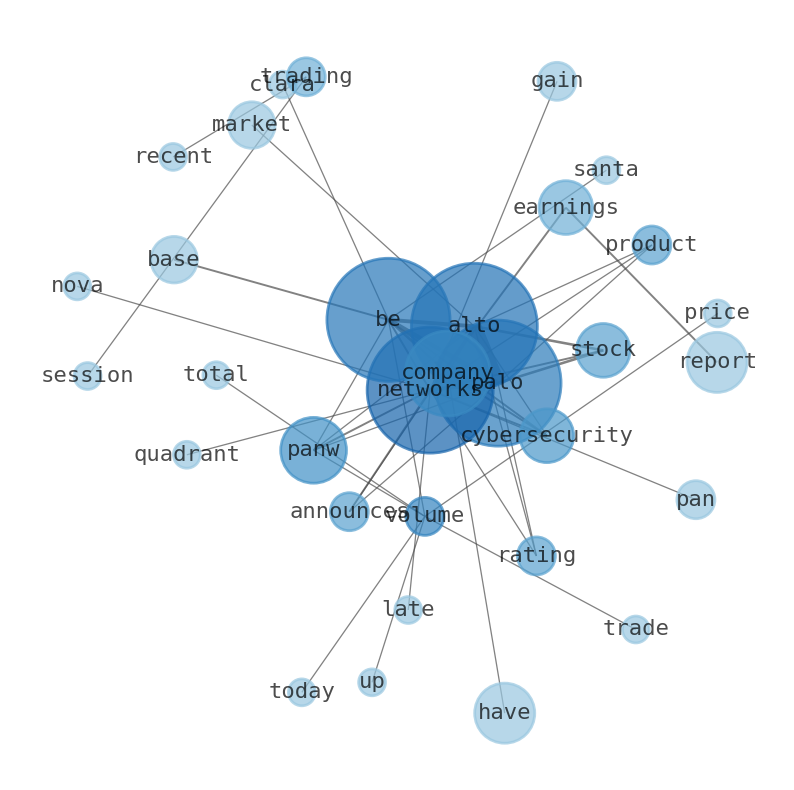

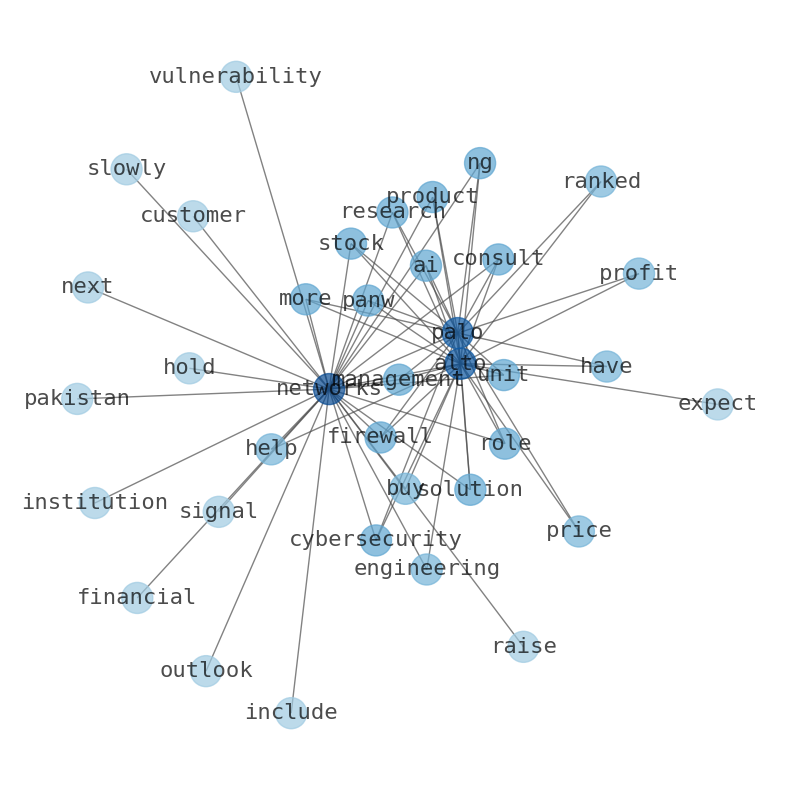

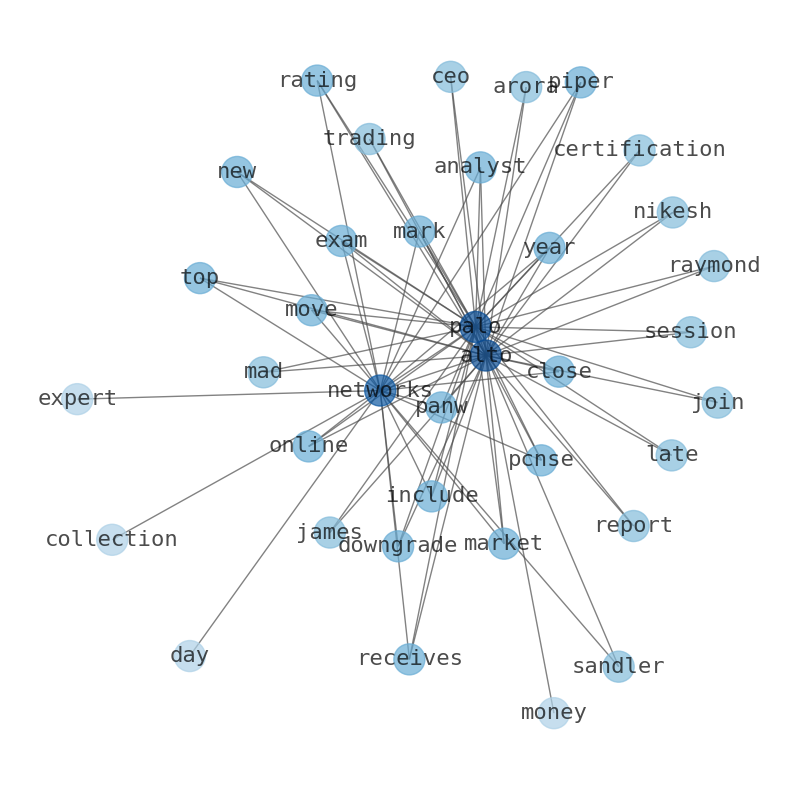

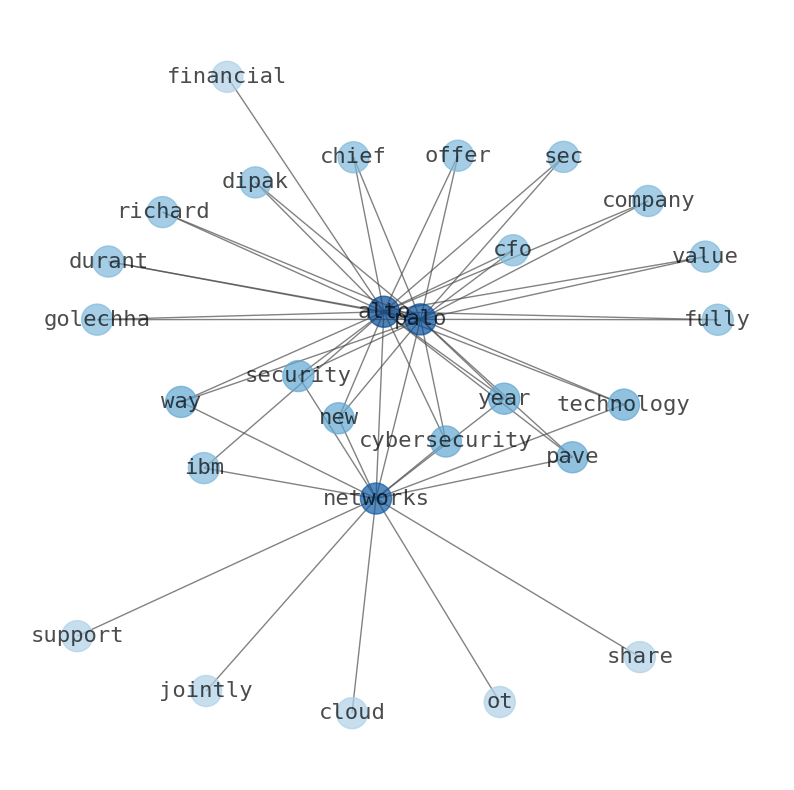

The game is changing. There is a new strategy to evaluate Palo Alto Networks fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Palo Alto Networks are: Palo, Alto, Networks, company, PANW, …

Stock Summary

Palo Alto Networks, Inc. provides cybersecurity solutions worldwide. The company offers firewall appliances and software; Panorama, a security management solution. It also provides subscription services covering the areas of threat prevention, malware and persistent threat, URL filtering,.

Today's Summary

Palo Alto Networks (PANW) is a cybersecurity company. Wall Street will be looking for positivity from Palo Alto Network as it approaches its next earnings report date. WallStreetZen was designed to help everyday investors perform more in-depth fundamental.

Today's News

Palo Alto Networks (NYSE: PANW) is a cybersecurity company. Palo Alto. Networks was founded in 2005 and is based in Santa Clara, California. The company has filed 556 patents. The mean open interest for Palo Alto Networks options trades today is 1209.0 with a total volume of 1,688.00. With a volume of 450,898, the price of PANW is up 1.05%. Palo Alto Networks will host a video webcast that day at 1:30 p.m. PT. The company has been positioned as a Leader in the 2022 Gartner Magic Quadrant™ for Network Firewall. Palo Alto Networks announces Medical IoT Security to protect connected devices critical to patient care. Palo Alto Network announces PAN-OS 11.0 Nova, the latest version of its industry leading PAN- OS software, unleashing 50+ product updates. Palo Alto Networks (PANW) closed the most recent trading day at $191.52, moving +0.05% from the previous trading session. Palo Alto. Networks received an upgrade to its Relative Strength (RS) Rating, from 90 to 93, on Tuesday. Palo Alto Networks (PANW) Outpaces Stock Market Gains: What You Should Know: What you Should Know. The PSE Strata is a cloud-based NAC service… Securing Microsoft M365 and Azure Active Directory. Palo Alto Networks is scheduled to announce FQ3 earnings results on Tuesday, May 23rd, after market close. Wall Street will be looking for positivity from Palo Alto Network as it approaches its next earnings report date. Palo Alto. Networks stock has gained 35.2% YTD. Palo Alto Networks is a cybersecurity company known for providing advanced firewall protection services. The company recently released its Q3 earnings report for the year 2021, which has been the talk of the town ever since. The report highlights the significant rise in the companys subscription-based services. Palo Alto Networks Q3 earnings report shows that the companys revenue and growth prospects are optimistic. The companys growth can be attributed to several factors, including innovative solutions and strategic acquisitions. Palo Alto Networks is known for providing some of the best cybersecurity solutions in the industry. The company offers firewalls, cloud security, endpoint protection, email security, and more. Palo Alto is committed to ensuring that their products and services. Palo Alto Networks has shown impressive numbers in terms of growth. In 2019, the company reported a revenue of $2.9 billion, a 28% increase from the previous year. With cybersecurity breaches becoming more frequent and sophisticated, businesses are investing more in security. Palo Alto Networks is currently +45% from its 52-week high of $132,22-57. Palo Alto Implied Volatility exposes the markets sentiment of Palo Altos stocks possible movements over time. Wall Street will be looking for positivity from Palo Alto. WallStreetZen was designed to help everyday investors perform more in-depth fundamental analysis. The consensus analyst rating on Palo Alto Networks stock is a Strong Buy. Out of 24 Equities analysts who monitor PANW, the consensus recommendation is to buy PANW.

Stock Profile

"Palo Alto Networks, Inc. provides cybersecurity solutions worldwide. The company offers firewall appliances and software; Panorama, a security management solution for the control of firewall appliances and software deployed on a customer's network, as well as their instances in public or private cloud environments, as a virtual or a physical appliance; and virtual system upgrades, which are available as extensions to the virtual system capacity that ships with physical appliances. It also provides subscription services covering the areas of threat prevention, malware and persistent threat, URL filtering, laptop and mobile device protection, and firewall; and DNS security, Internet of Things security, SaaS security API, and SaaS security inline, as well as threat intelligence, and data loss prevention. In addition, the company offers cloud security, secure access, security operations, and threat intelligence and cyber security consulting; professional services, including architecture design and planning, implementation, configuration, and firewall migration; education services, such as certifications, as well as online and in-classroom training; and support services. Palo Alto Networks, Inc. sells its products and services through its channel partners, as well as directly to medium to large enterprises, service providers, and government entities operating in various industries, including education, energy, financial services, government entities, healthcare, Internet and media, manufacturing, public sector, and telecommunications. The company was incorporated in 2005 and is headquartered in Santa Clara, California."

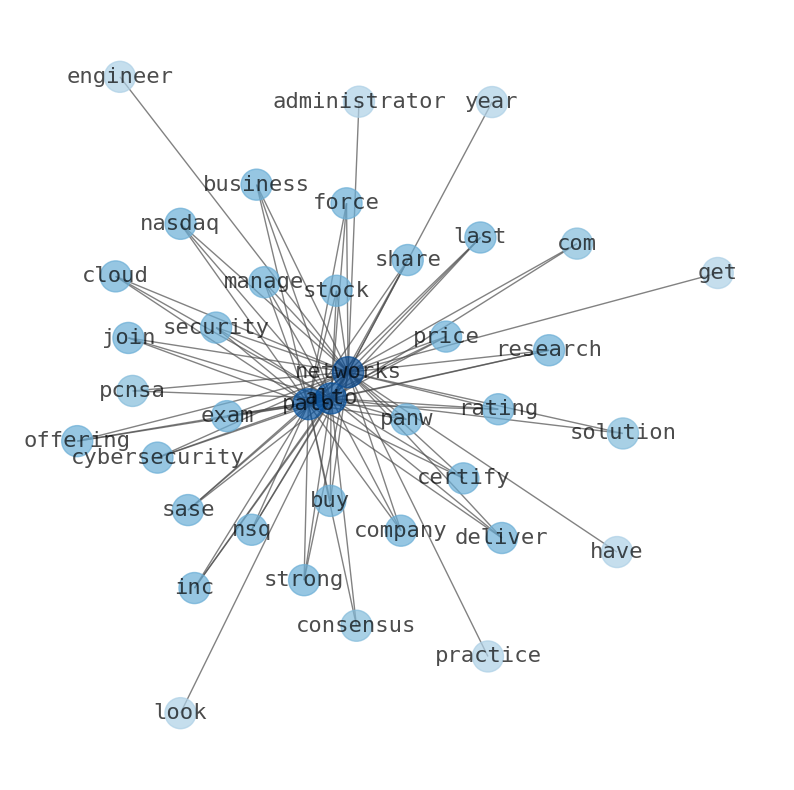

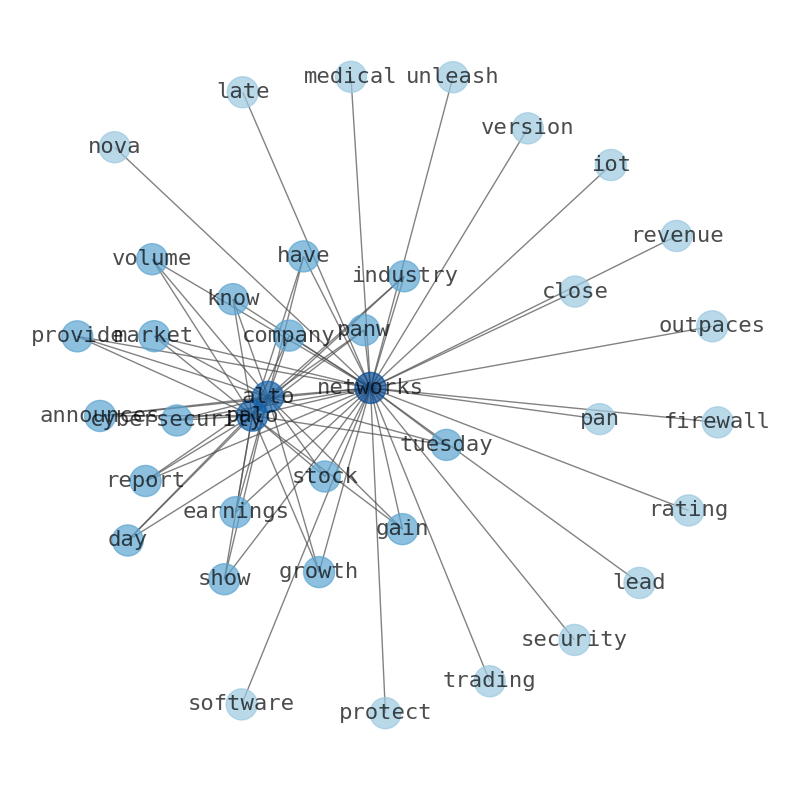

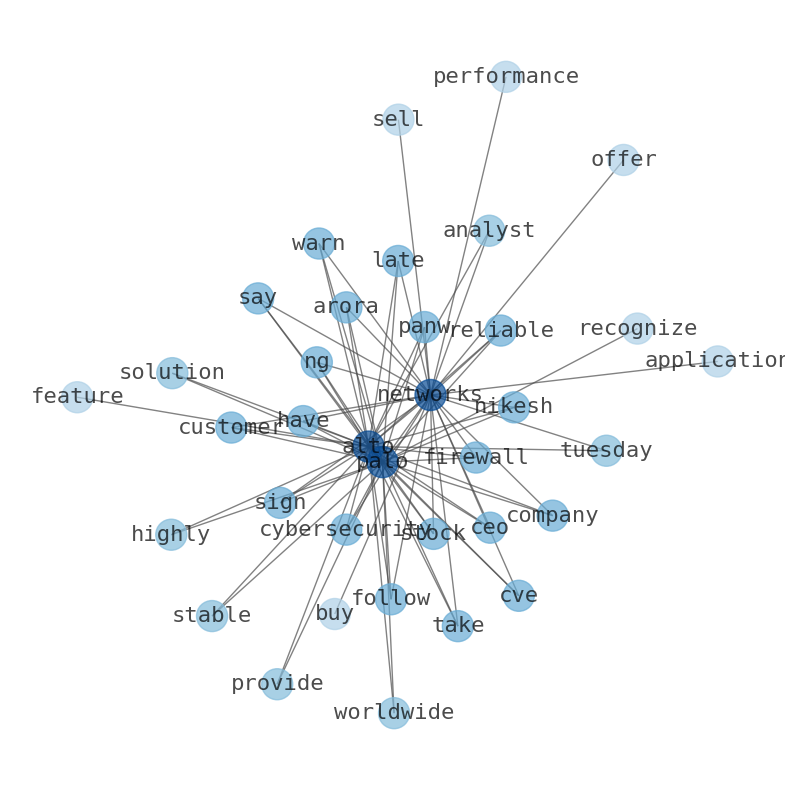

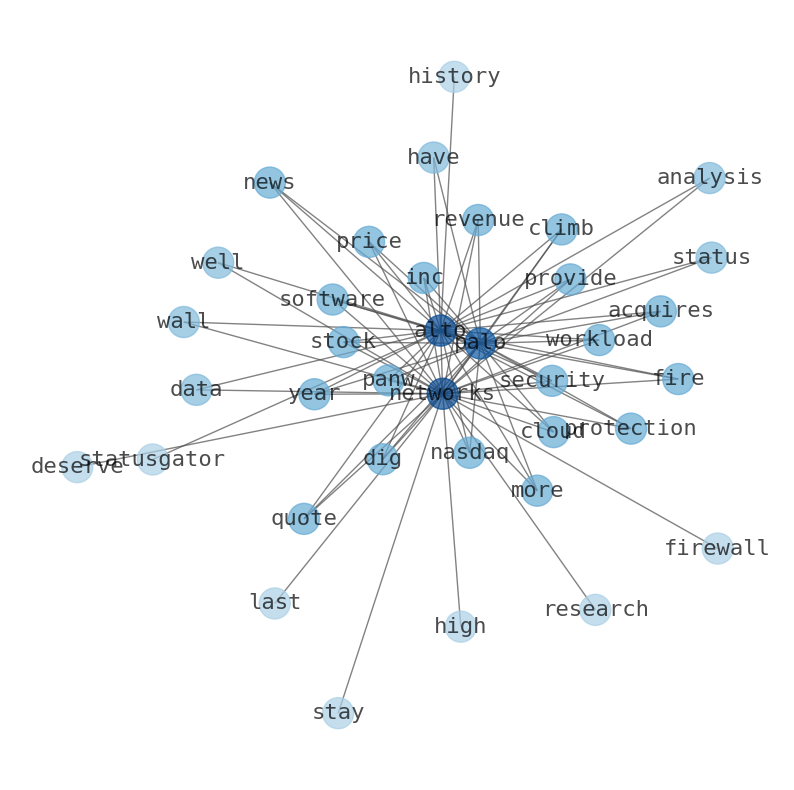

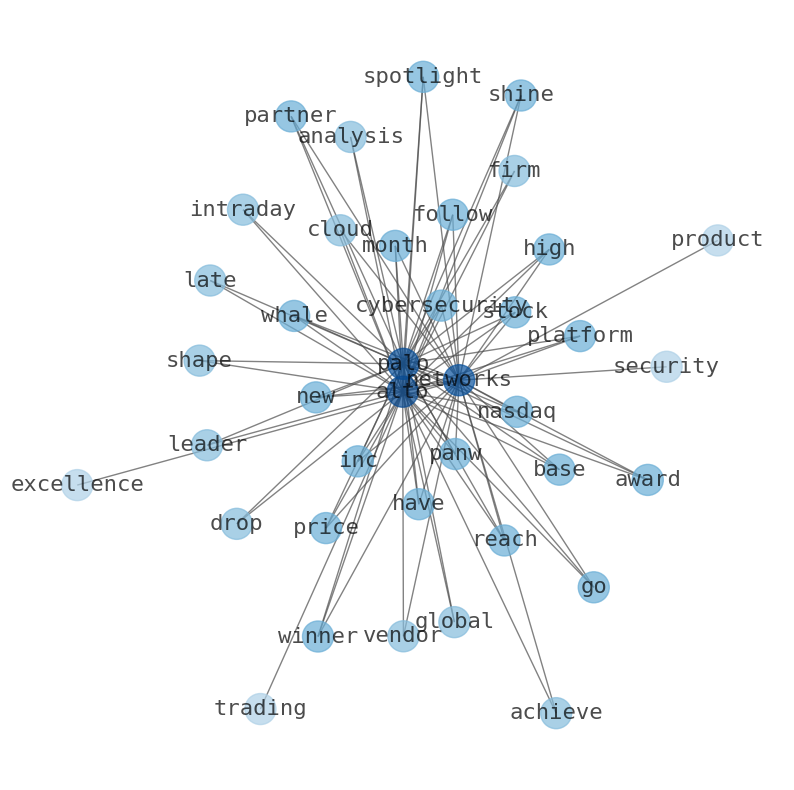

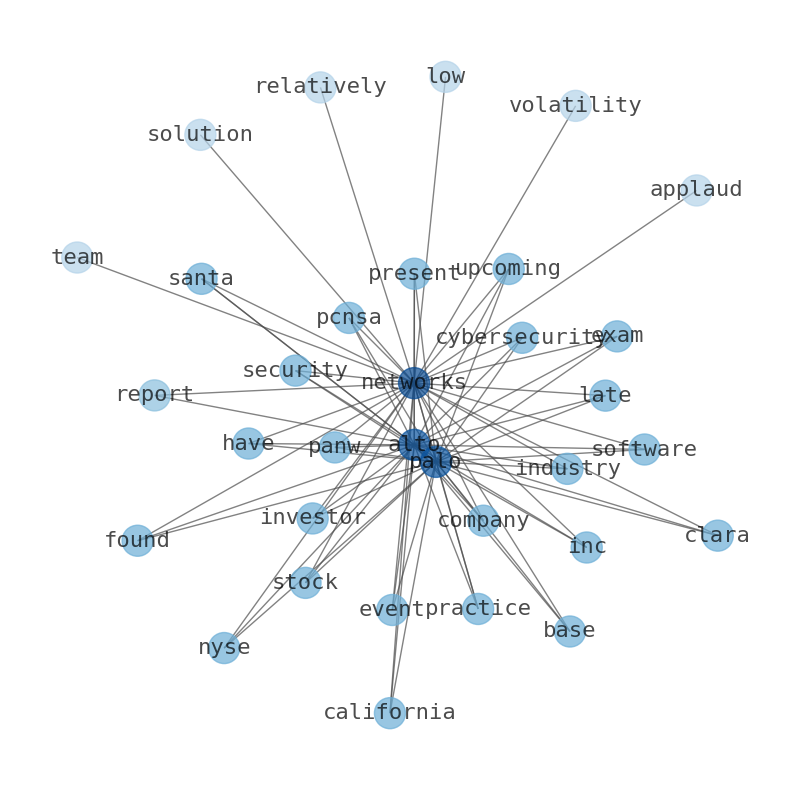

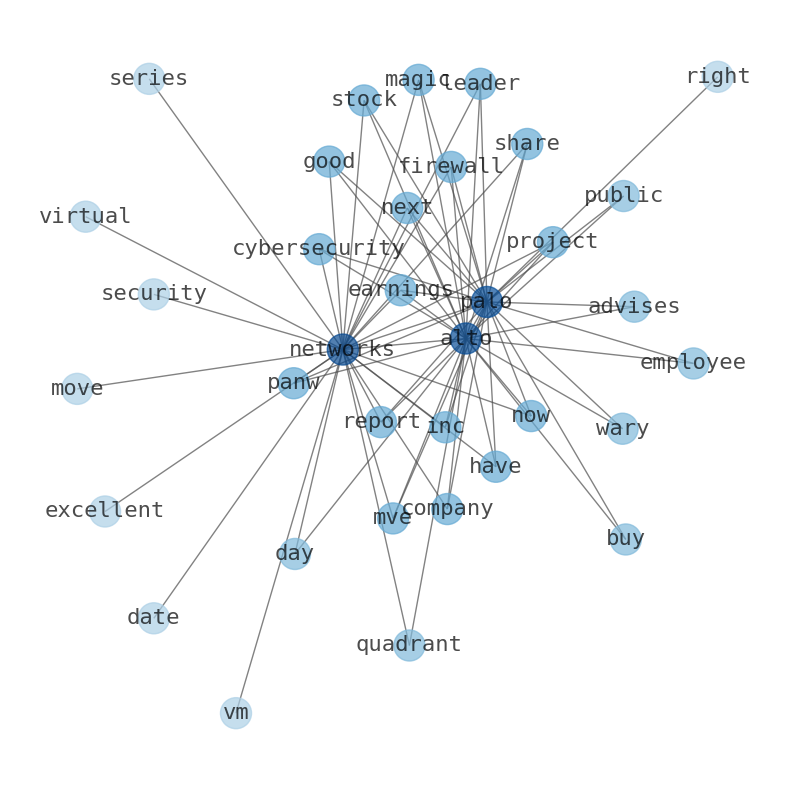

Keywords

Are looking for the most relevant information about Palo Alto Networks? Investor spend a lot of time searching for information to make investment decisions in Palo Alto Networks. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Palo Alto Networks are: Palo, Alto, Networks, company, PANW, report, cybersecurity, and the most common words in the summary are: palo, alto, network, stock, panw, price, security, . One of the sentences in the summary was: Palo Alto Networks (PANW) is a cybersecurity company. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #palo #alto #network #stock #panw #price #security.

Read more →Related Results

Palo Alto Networks

Open: 339.56 Close: 345.06 Change: 5.5

Read more →

Palo Alto Networks

Open: 286.0 Close: 283.3 Change: -2.7

Read more →

Palo Alto Networks

Open: 294.24 Close: 286.61 Change: -7.63

Read more →

Palo Alto Networks

Open: 238.91 Close: 249.15 Change: 10.24

Read more →

Palo Alto Networks

Open: 191.56 Close: 192.15 Change: 0.59

Read more →

Palo Alto Networks

Open: 330.54 Close: 327.79 Change: -2.75

Read more →

Palo Alto Networks

Open: 315.0 Close: 300.44 Change: -14.56

Read more →

Palo Alto Networks

Open: 292.31 Close: 296.16 Change: 3.85

Read more →

Palo Alto Networks

Open: 217.06 Close: 217.24 Change: 0.18

Read more →

Palo Alto Networks

Open: 192.27 Close: 193.25 Change: 0.98

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo