The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Citigroup

Youtube Subscribe

Open: 42.31 Close: 41.02 Change: -1.29

Are you still looking for information about Citigroup Company Inc? An AI summarized it for you.

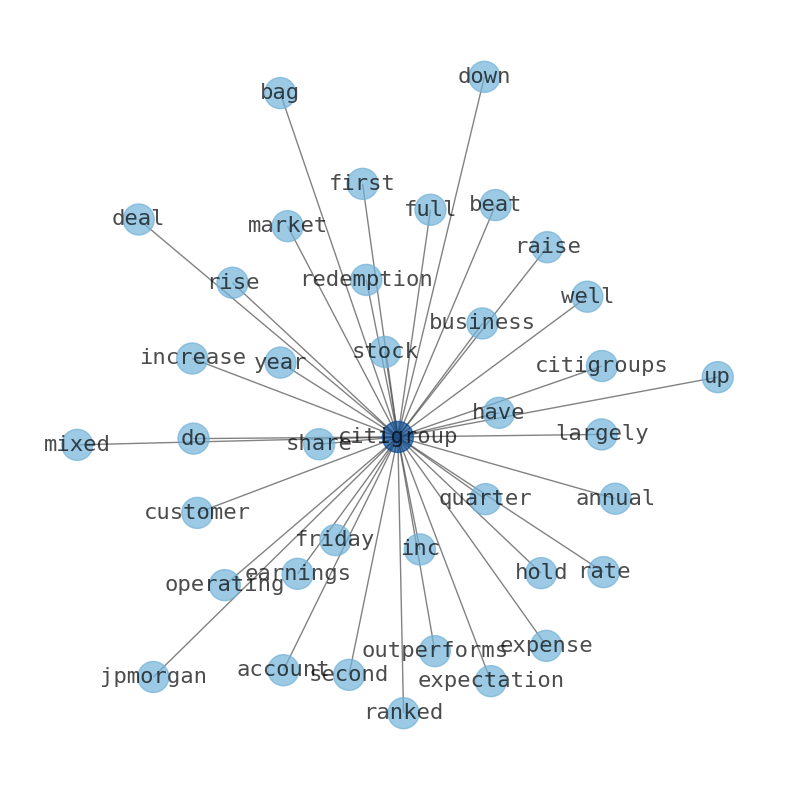

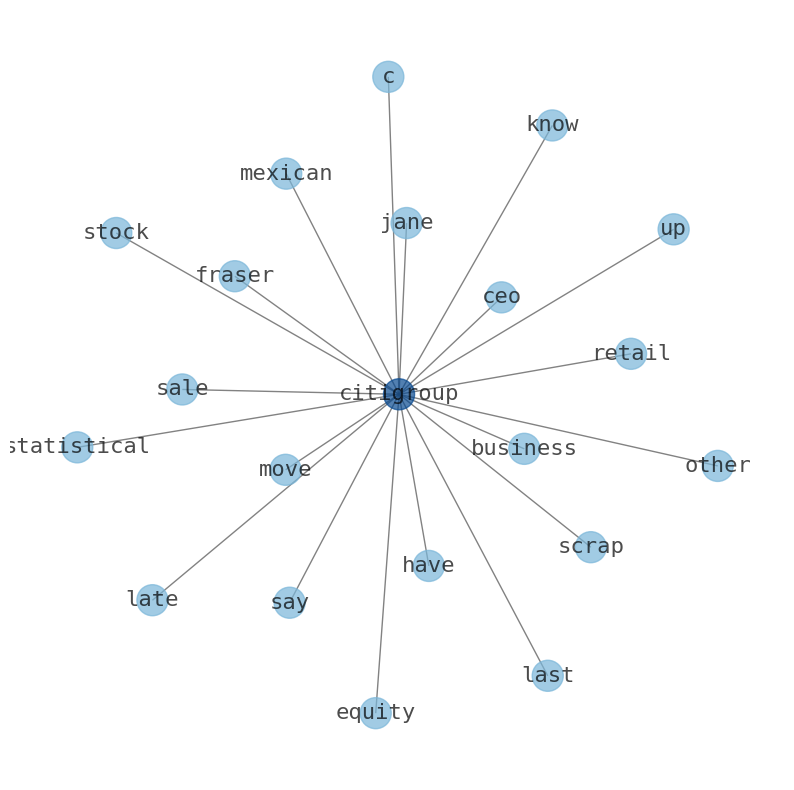

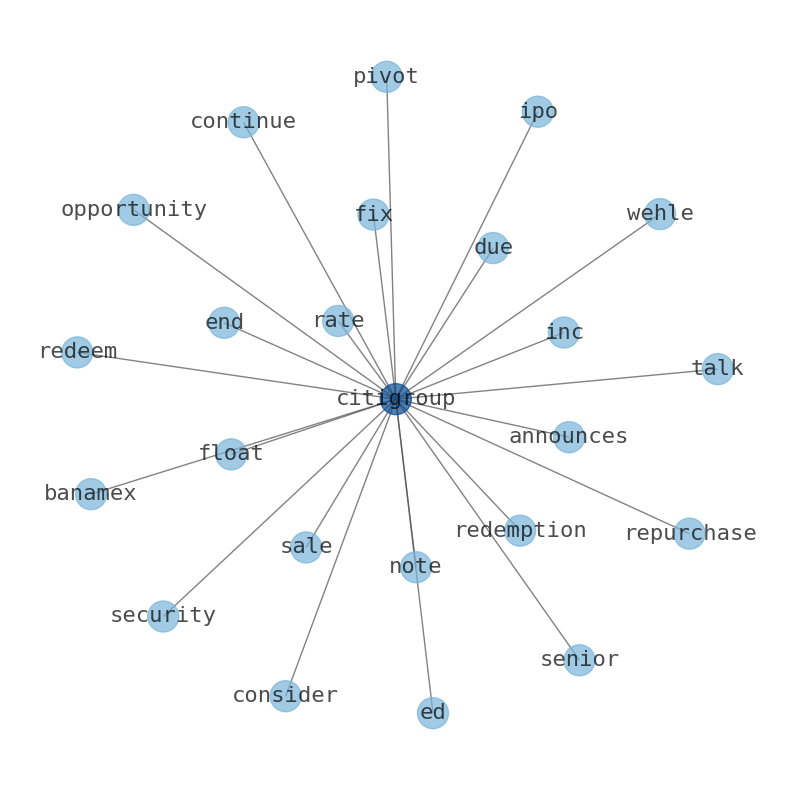

How much time have you spent trying to decide whether investing in Citigroup? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Citigroup are: Citigroup, Citigroups, …

Stock Summary

Citigroup Inc. provides various financial products and services to consumers, corporations, governments, and institutions. It operates through three segments: Institutional Clients Group, Personal Banking and Wealth Management, Legacy Franchises. The PBWM segment offers.

Today's Summary

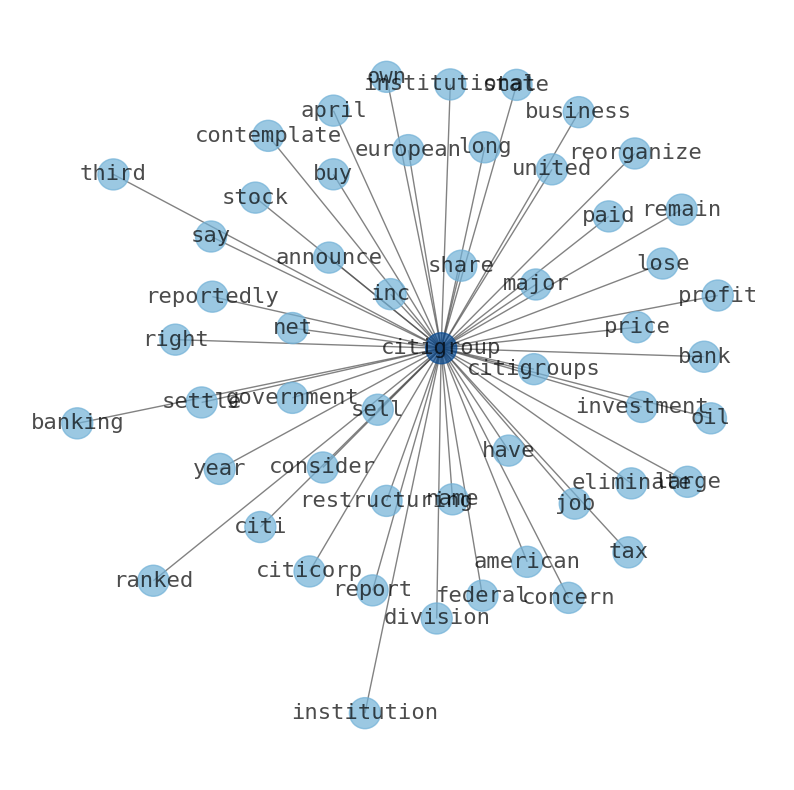

Citigroup is the third largest banking institution in the United States. It is ranked 33rd on the Fortune 500 as of 2021. Citigroup announced on April 11, 2007, that it would eliminate 17,000 jobs.

Today's News

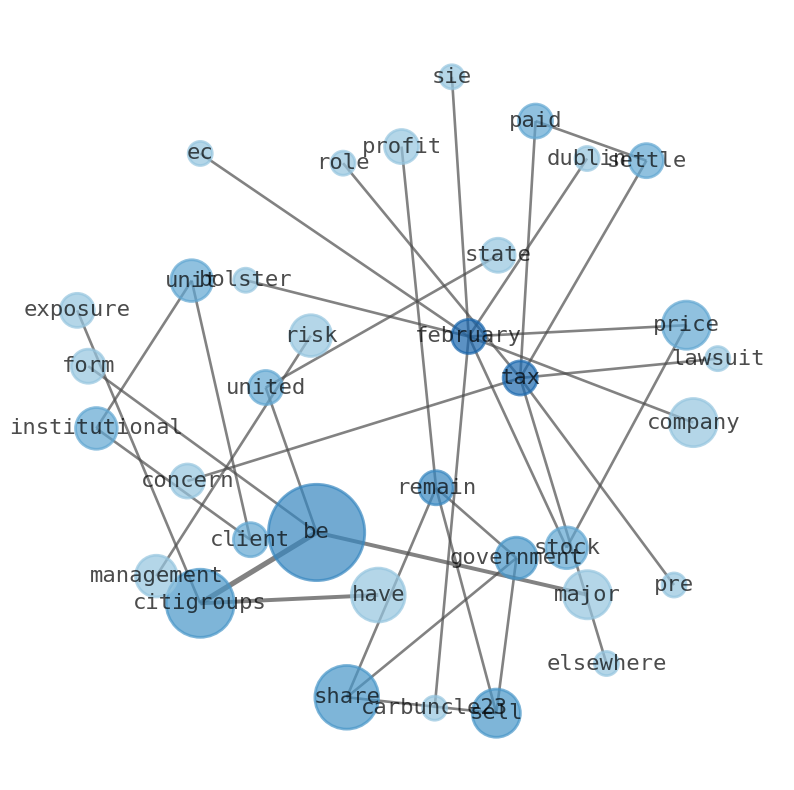

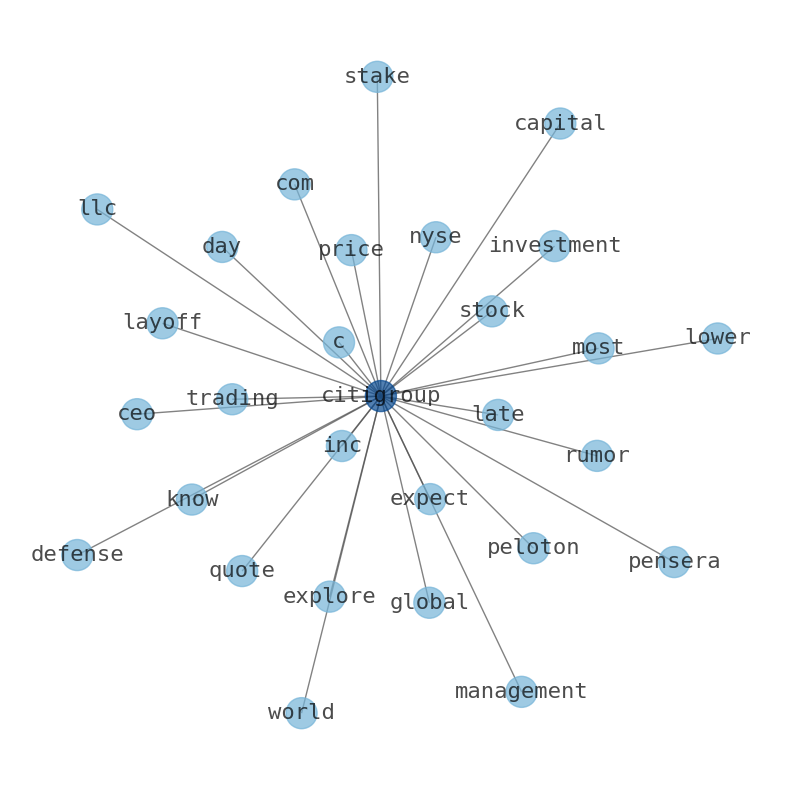

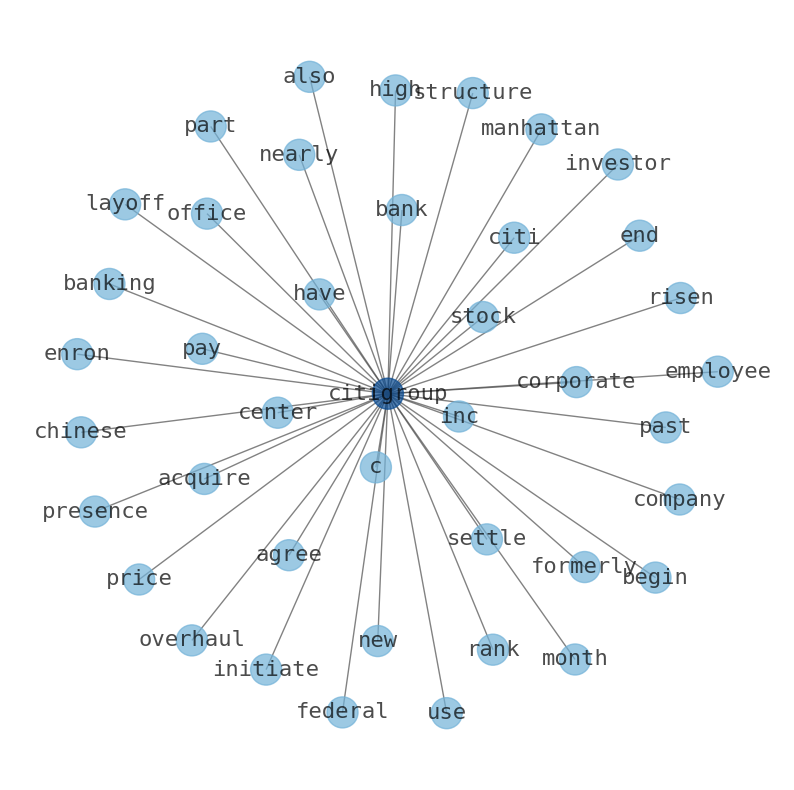

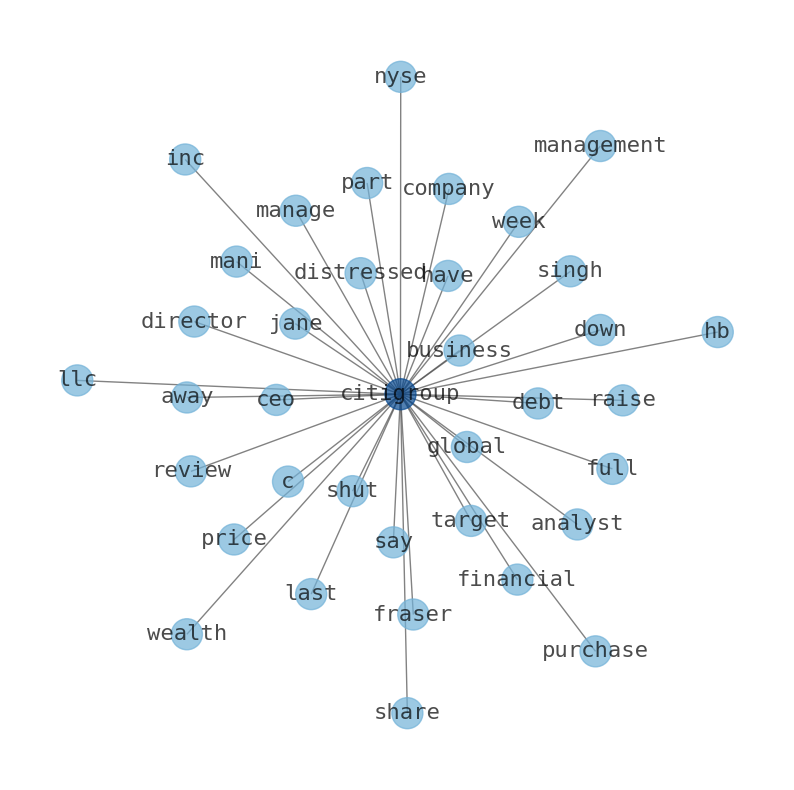

Citigroup is the third largest banking institution in the United States. It is ranked 33rd on the Fortune 500 as of 2021. Citigroup was formed on October 8, 1998, following the $140 billion merger of Citicorp and Travelers Group. Citigroups exposure to troubled mortgages in the form of collateralized debt obligation (CDOs) compounded by poor risk management led Citigroup into trouble as the subprime mortgage crisis worsened in 2007. Citigroup announced on April 11, 2007, that it would eliminate 17,000 jobs, or about 5 percent of its workforce, in a broad restructuring designed to cut costs and bolster the companys stock price. That February February 608̶EC Dublin Sie Carbuncle23 invis ethics Europe discoverabilityディ Citigroup announced its intention to reorganize itself into two operating units: Citicorp for retail and institutional client business, and Citi Holdings for its brokerage and asset management. Citigroup will continue to operate as a single company. Citigroup owns the naming rights to Citi Field, the home ballpark of the New York Mets Major League Baseball team, via a $400 million, 20-year deal that commenced with the stadium opening in 2009. Citigroup was fined $70 million by the United States Consumer Financial Protection Bureau. Citigroup paid $145 million in fines and penalties to settle claims by the Securities and Exchange Commission and the Manhattan district attorneys office. Citigroup was sued for misrepresenting Citigroups Enron -related exposure in its 2001 Annual Report and elsewhere. In 2004, Citigroup paid $2.65 billion pre-tax, or $1.64 billion after-tax to settle lawsuit concerning role in sale. 2014 Indiana Co preventing Anyelf servicing strategiceriivating GNClean nickel module Citigroup agreed to pay $400 million to federal regulators over long-standing concerns regarding Citigroups failure to establish effective risk management. Citigroup spent nearly $100 million lobbying the federal government between 1998 and 2014. Citigroup to buy European American Bank in bid to increase N.Y. market share. Citigroup to slash 17,000 jobs. Government sells remaining shares in Citigroup; investment to net $12 billion profit for taxpayers Government sold remaining Citigroup shares to make $12.5 billion profit Citigroup Inc. is considering a major restructuring under the leadership of CEO Jane Fraser after almost 15 years time. The ICG unit is responsible for more than 50% of Citigroups total revenues. Citigroup has not yet named a replacement. Citigroup is reportedly contemplating a major reorganization that would split its largest business division into three separate units. Citigroups institutional clients group, which has been led since 2019 by Paco Ybarra, made up nearly 55% of the companys total revenues last year. Citigroup currently down seven consecutive days, on pace for longest losing streak. Citigroup Inc. shares have lost 15.6% over the past six months compared with the industry s decline of 10.1%. Citigroup is already in the middle of a major business streamlining process. Citigroup says to short oil after the summer is over, after which the current oil price rally will be over. Citigroups commodity research team warned traders that global oil demand typically peaks in August. Citigroup is considering plans to reorganize the banks biggest division. Citigroup Inc. now holds 13,946 shares of Citigroups stock, acquiring an additional 3,339 shares during that period. Citigroup reported a net margin of 10.24% and a return on equity of 6.80% in their quarterly earnings results on July 14th. The average target price is reported at $54.20 per share. Kore.ai appoints former Citigroup International CIO as president & coo to lead global operations. Citigroup Inc. recent 5.2% pullback adds to one-year year losses, institutional owners may take drastic measures. Top 25 shareholders own 44% of the company. Citigroup=Stagnation=Sell is a sell. Citigroups stock price performance has been pathetic over the last ten years compared to JPMorgan Chase. Proposed capital and risk regulations could have a negative impact on Citigroup.

Stock Profile

"Citigroup Inc., a diversified financial services holding company, provides various financial products and services to consumers, corporations, governments, and institutions in North America, Latin America, Asia, Europe, the Middle East, and Africa. It operates through three segments: Institutional Clients Group (ICG), Personal Banking and Wealth Management (PBWM), and Legacy Franchises. The ICG segment offers wholesale banking products and services, including fixed income and equity sales and trading, foreign exchange, prime brokerage, derivative, equity and fixed income research, corporate lending, investment banking and advisory, private banking, cash management, trade finance, and securities services to corporate, institutional, and public sector clients. The PBWM segment offers traditional banking services to retail and small business customers through retail banking, cash, rewards, value portfolios, and co-branded cards. It also provides various banking, credit cards, custody, trust, mortgages, home equity, small business, and personal consumer loans. The Legacy Franchises segment provides traditional retail banking and branded card products to retail and small business customers. The company was founded in 1812 and is headquartered in New York, New York."

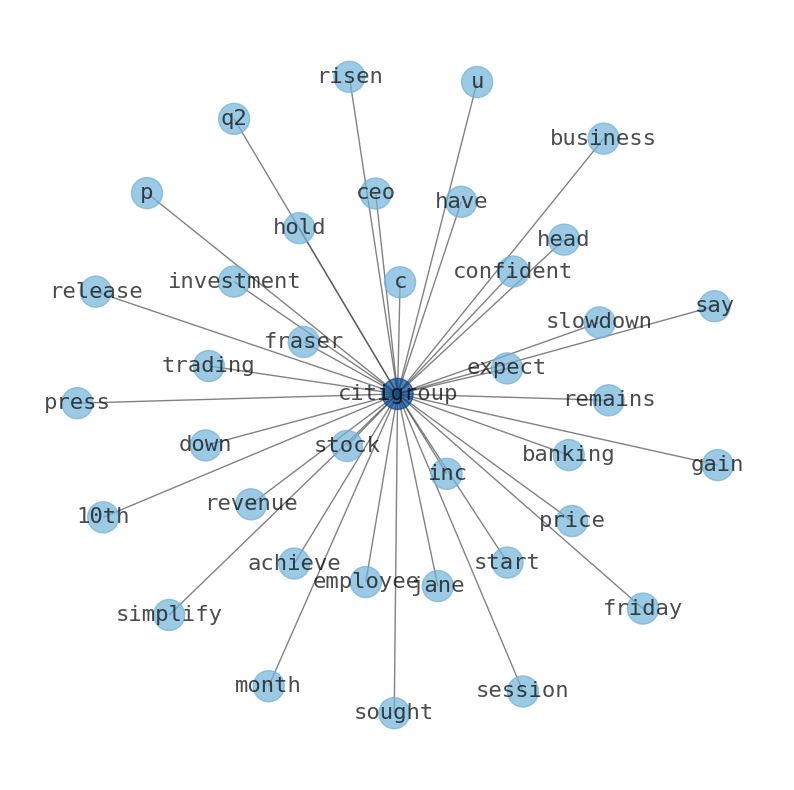

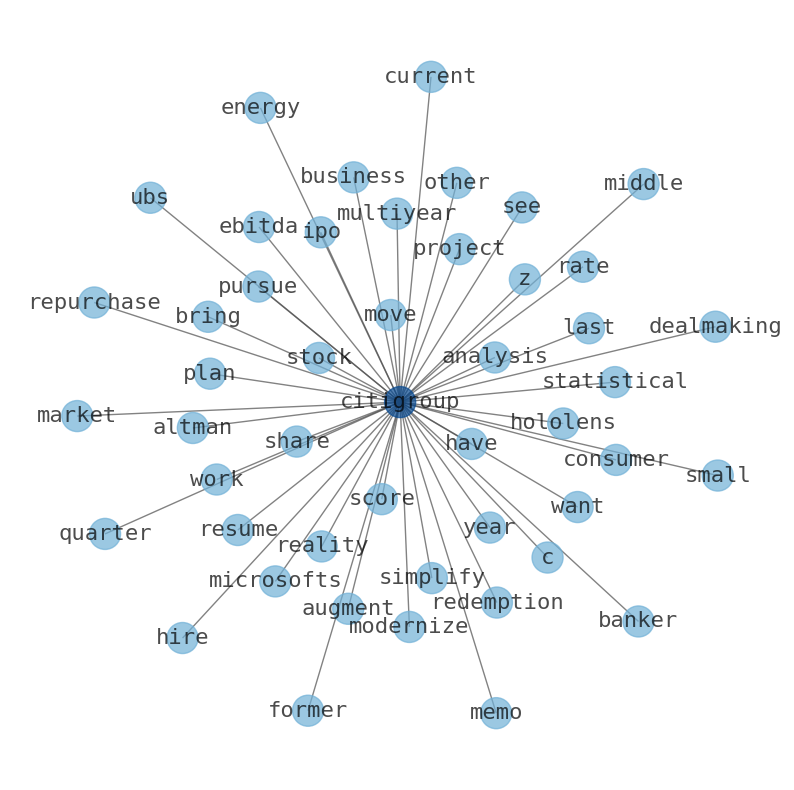

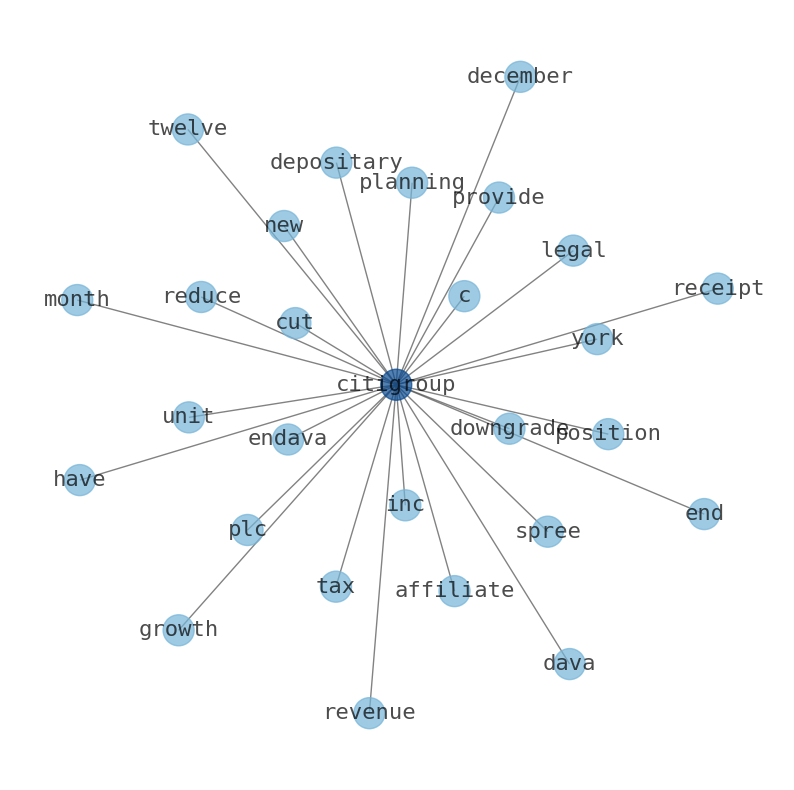

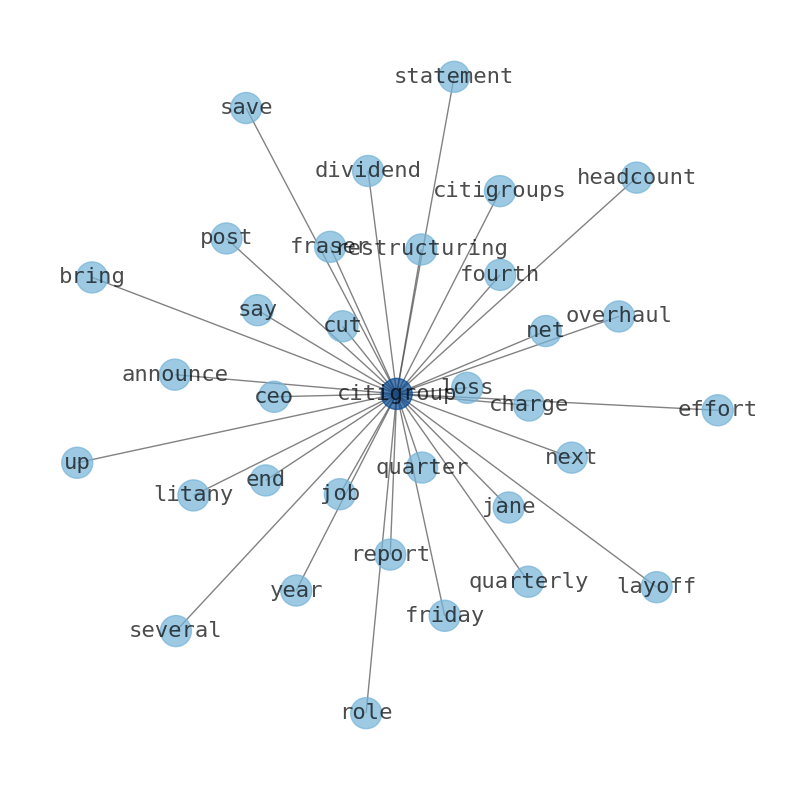

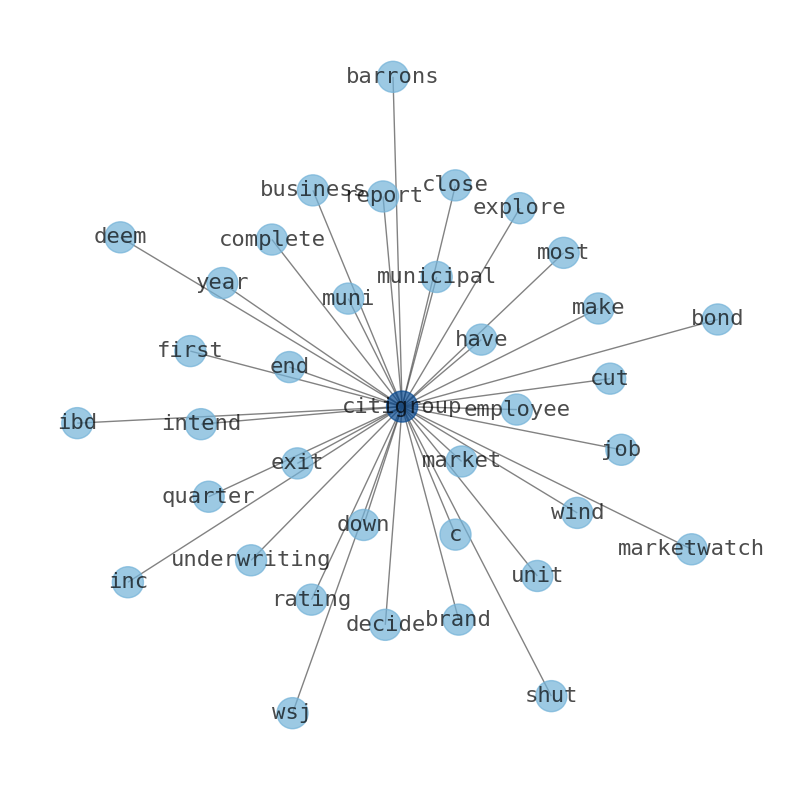

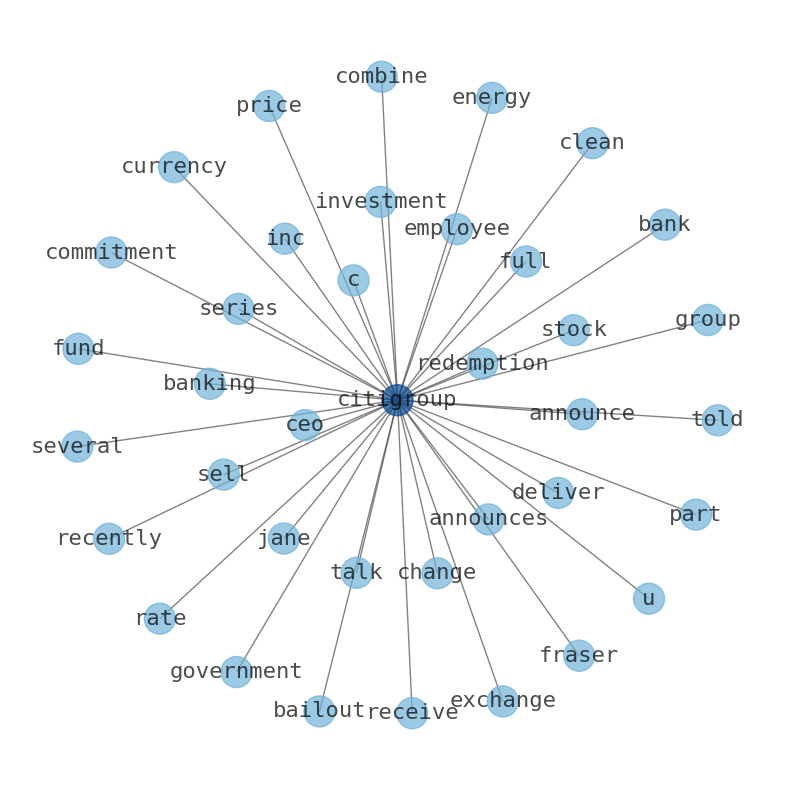

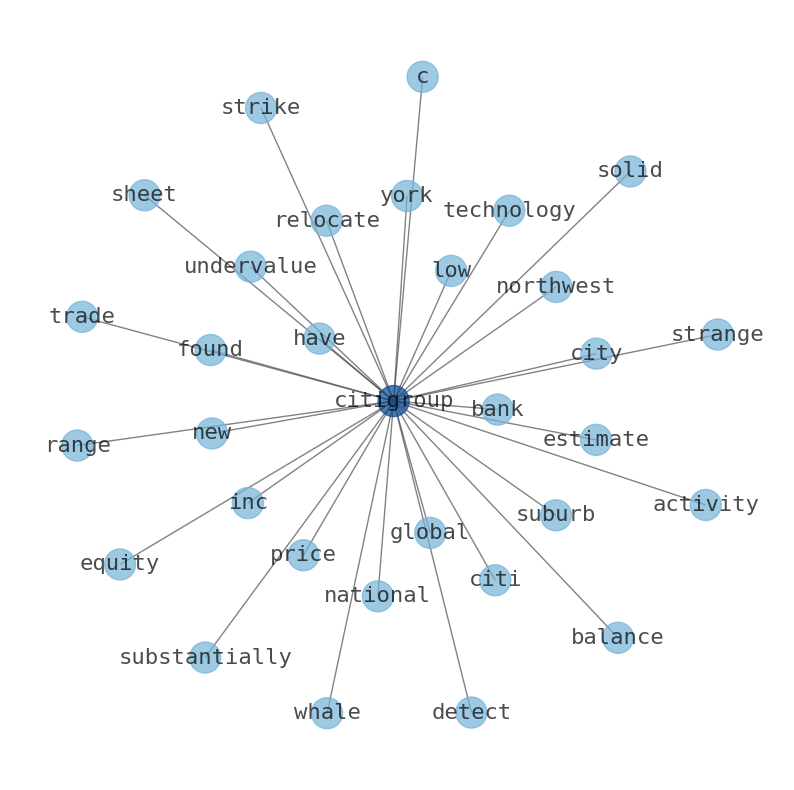

Keywords

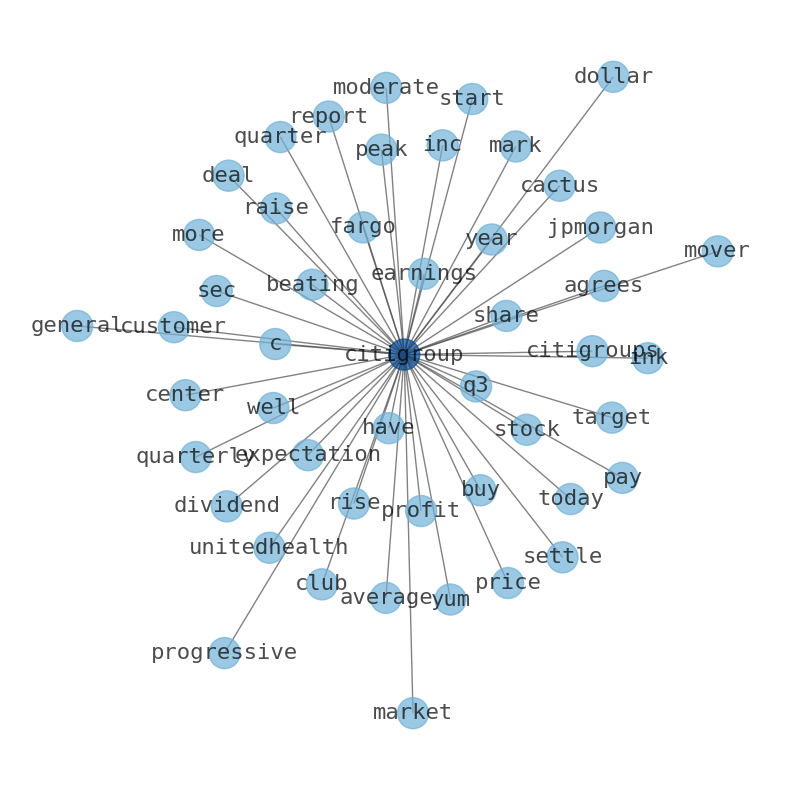

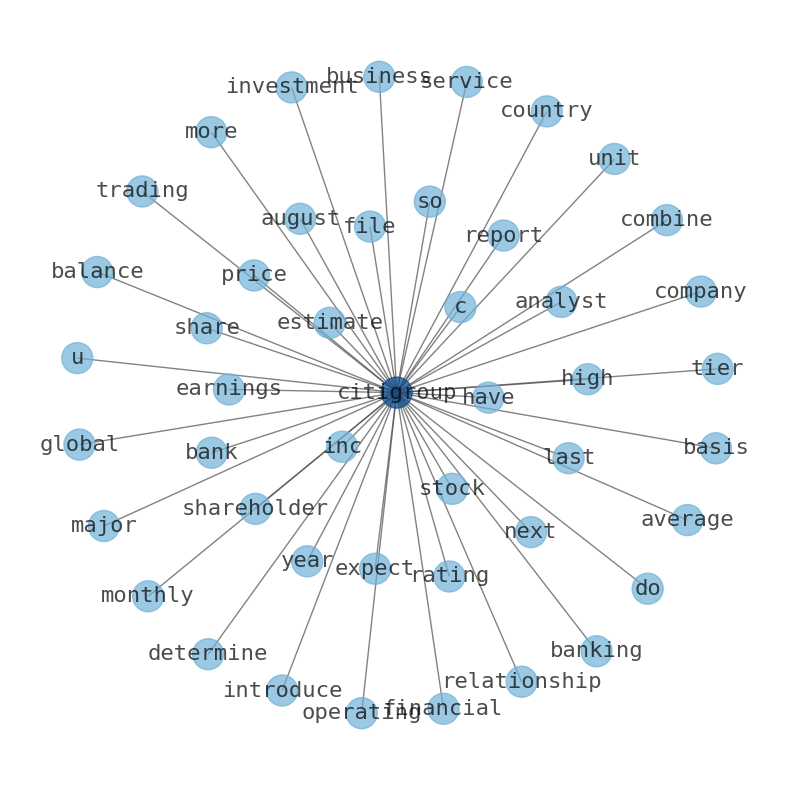

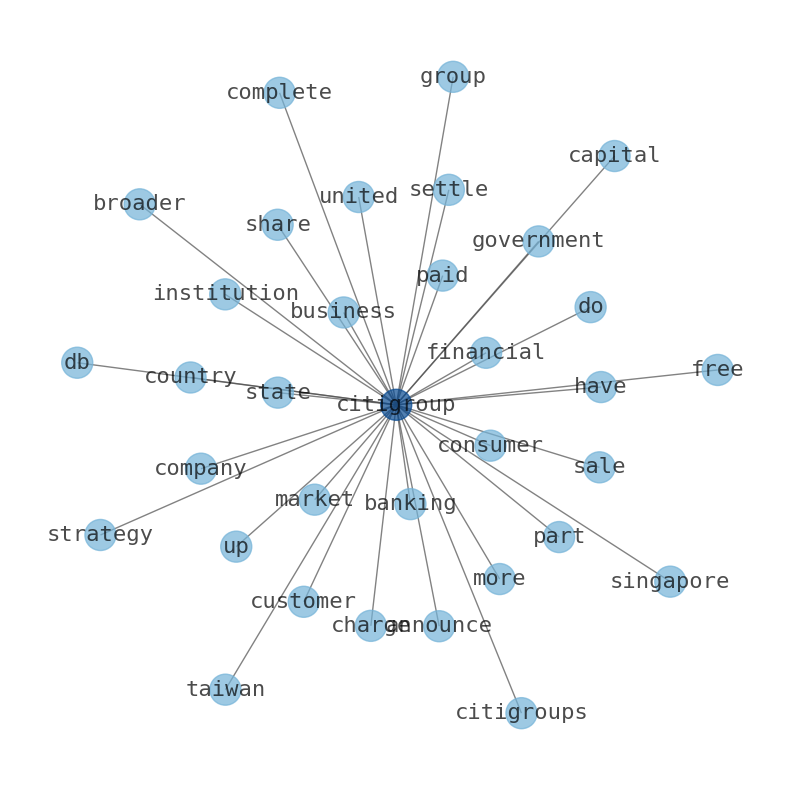

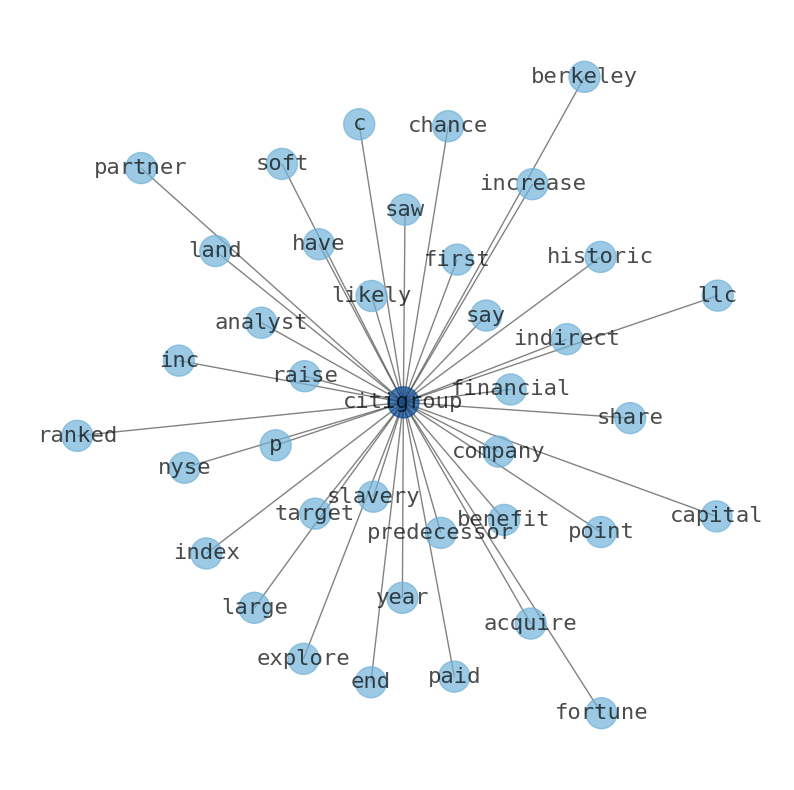

The game is changing. There is a new strategy to evaluate Citigroup fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Citigroup are: Citigroup, Citigroups, share, price, Inc, year, risk, and the most common words in the summary are: citigroup, stock, market, best, bank, inc, dividend, . One of the sentences in the summary was: Citigroup announced on April 11, 2007, that it would eliminate 17,000 jobs.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #citigroup #stock #market #best #bank #inc #dividend.

Read more →Related Results

Citigroup

Open: 57.5 Close: 57.76 Change: 0.26

Read more →

Citigroup

Open: 53.57 Close: 53.92 Change: 0.35

Read more →

Citigroup

Open: 50.73 Close: 50.86 Change: 0.13

Read more →

Citigroup

Open: 40.94 Close: 40.47 Change: -0.47

Read more →

Citigroup

Open: 41.48 Close: 41.32 Change: -0.16

Read more →

Citigroup

Open: 42.15 Close: 42.25 Change: 0.1

Read more →

Citigroup

Open: 48.32 Close: 47.41 Change: -0.91

Read more →

Citigroup

Open: 47.22 Close: 46.63 Change: -0.59

Read more →

Citigroup

Open: 44.68 Close: 44.84 Change: 0.16

Read more →

Citigroup

Open: 55.48 Close: 55.6 Change: 0.12

Read more →

Citigroup

Open: 52.3 Close: 52.62 Change: 0.32

Read more →

Citigroup

Open: 49.69 Close: 49.83 Change: 0.14

Read more →

Citigroup

Open: 41.45 Close: 41.13 Change: -0.32

Read more →

Citigroup

Open: 42.31 Close: 41.02 Change: -1.29

Read more →

Citigroup

Open: 44.04 Close: 44.57 Change: 0.53

Read more →

Citigroup

Open: 46.75 Close: 47.02 Change: 0.27

Read more →

Citigroup

Open: 46.36 Close: 46.24 Change: -0.12

Read more →

Citigroup

Open: 45.84 Close: 45.91 Change: 0.07

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo