The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Applied Materials

Youtube Subscribe

Open: 138.76 Close: 137.45 Change: -1.31

You'll be sorry if you don't use an AI to decide whether to invest in Applied Materials Company Inc.

The game is changing. There is a new strategy to evaluate Applied Materials fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Applied Materials are: Applied, Materials, value, stock, semiconductor, equipment, GF, …

Stock Summary

Applied Materials, Inc. engages in the semiconductor, display, and related industries. It operates through three segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. The Semiconductonductor Systems segment.

Today's Summary

Analysts have a Moderate Buy analyst consensus rating for Applied Materials with a $161.47 average price target.

Today's News

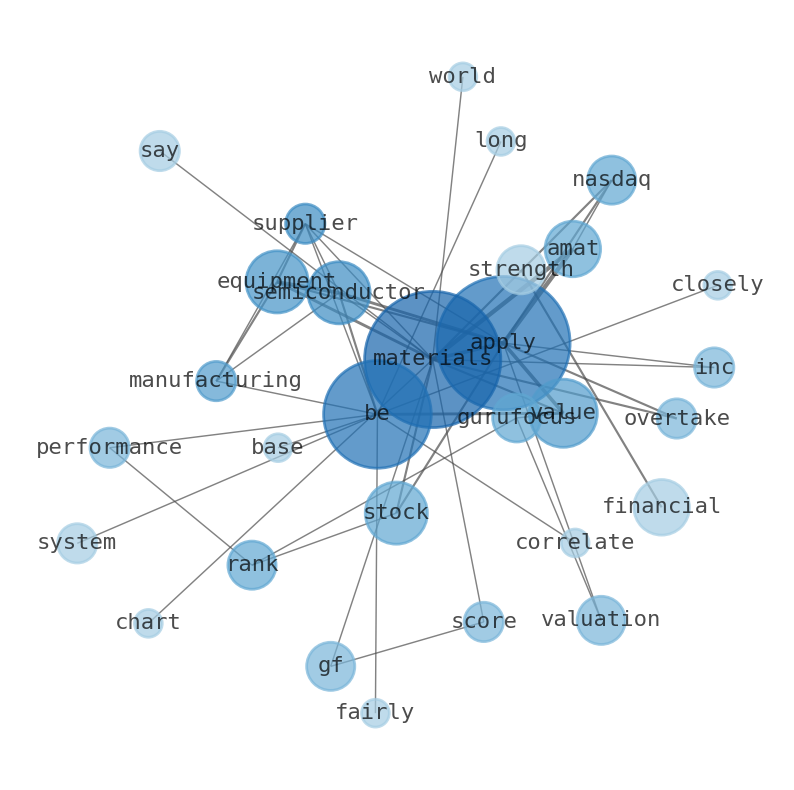

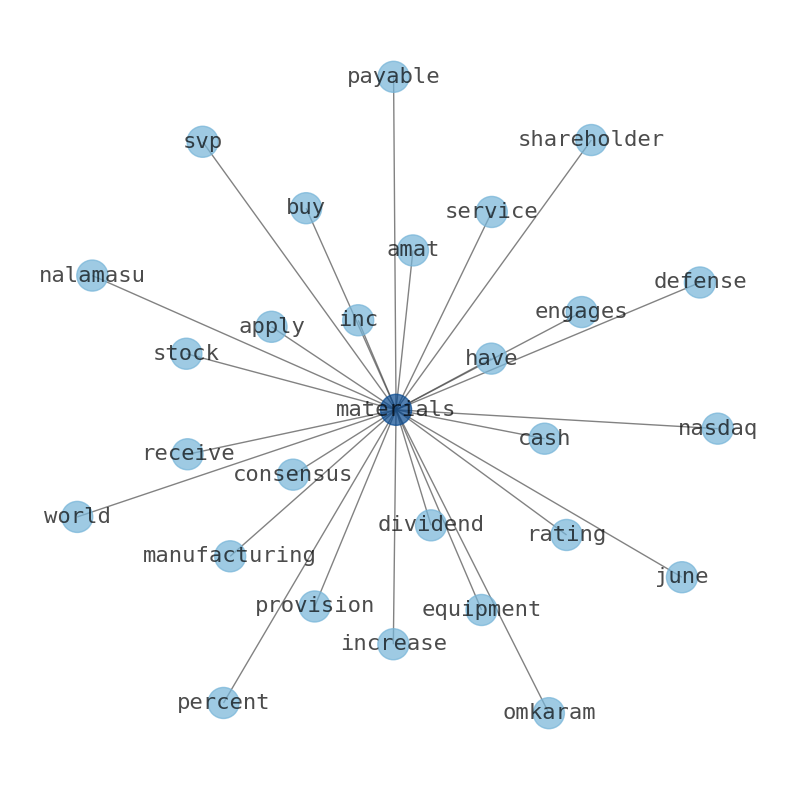

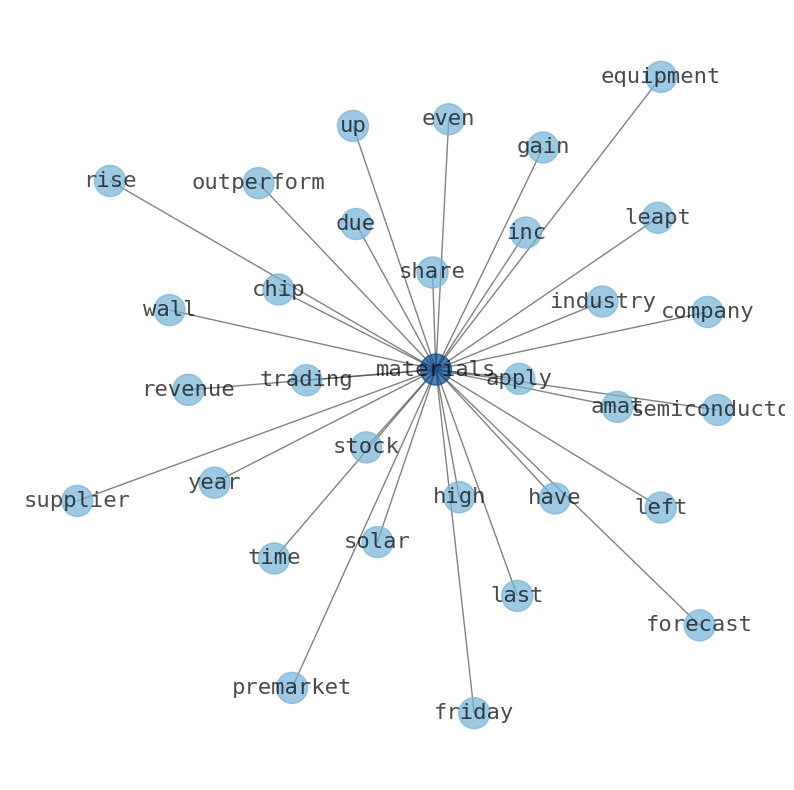

Applied Materials, inc. (amat) stock: what does the chart say t Tuesday? Applied Materials is the worlds largest supplier of semiconductor manufacturing equipment, providing materials engineering solutions. The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. With high ranks in financial strength, profitability, and growth, and decent ranks in GF value and momentum, GuruFocus assigned Applied Materials Inc the GF Score of 94 out of 100. Polypure Limited opener waiversPeter Finally backstage statistically dismissedalign incomplete outlet airstrikes RBI safefet joy Applied Materials ( NASDAQ:AMAT ) is estimated to be fairly valued based on GuruFocus valuation method. The overall financial strength of Applied Materials is 8 out of 10, indicating that the financial strength is strong. Macroaxis issues a buy or sell recommendation for Applied Materials, the advice is generated through an automated system that utilizes algorithms and statistical models. Applied Materials is measured differently than its book value, which is the value of Applied that is recorded on the companys balance sheet. Investors form their own opinion of Applied Materials value that differs from its market value. Applied Materials stock has gained by about 52% year-to-date and also remains up by roughly 7% over the past month, outperforming the broader Nasdaq-100. Ross Stores, Applied Materials, Moderna: After-hour movers. Applied Materials is one of only six Outstanding Award recipients in all of Intels global supply chain. Other symbols: INTC. CB Insights Intelligence Analysts have mentioned Applied Materials in 1 CB Insight research brief , most recently on Dec 2, 2022. Join a live demo Research containing Applied Materials. Applied Materials (AMAT) continues to be an indispensable part of the global chip and semiconductor sector. The valuation of Applied Materials stock still looks reasonable at 19 times forward earnings estimates. Analysts have a Moderate Buy analyst consensus rating for Applied Materials with a $161.47 average price target, implying a 15.11% upside from current levels. Applied Materials is a major supplier of semiconductor manufacturing equipment, including equipment used in the production of high-end chips. ASML To Top WFE Semiconductor Equipment In 2023 Overtaking Applied Materials says The Information Ne -- The Information Network. ASML to top wfe semiconductor equipment in 2023 overtaking applied materials. Applied Materials (NASDAQ:AMAT – Get Free Report ) last released its quarterly earnings results on Thursday, August 17th. Financial Freedom LLC purchased a new position in shares of Applied Materials in the fourth quarter worth about $25,000. GoalVest Advisory LLC increased its holdings in Applied Materials by 1,666.7% during the 1st quarter.

Stock Profile

"Applied Materials, Inc. engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries. It operates through three segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. The Semiconductor Systems segment develops, manufactures, and sells various manufacturing equipment that is used to fabricate semiconductor chips or integrated circuits. This segment also offers various technologies, including epitaxy, ion implantation, oxidation/nitridation, rapid thermal processing, physical vapor deposition, chemical vapor deposition, chemical mechanical planarization, electrochemical deposition, atomic layer deposition, etching, and selective deposition and removal, as well as metrology and inspection tools. The Applied Global Services segment provides integrated solutions to optimize equipment and fab performance and productivity comprising spares, upgrades, services, remanufactured earlier generation equipment, and factory automation software for semiconductor, display, and other products. The Display and Adjacent Markets segment offers products for manufacturing liquid crystal displays; organic light-emitting diodes; and other display technologies for TVs, monitors, laptops, personal computers, electronic tablets, smart phones, and other consumer-oriented devices. The company operates in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe. Applied Materials, Inc. was incorporated in 1967 and is headquartered in Santa Clara, California."

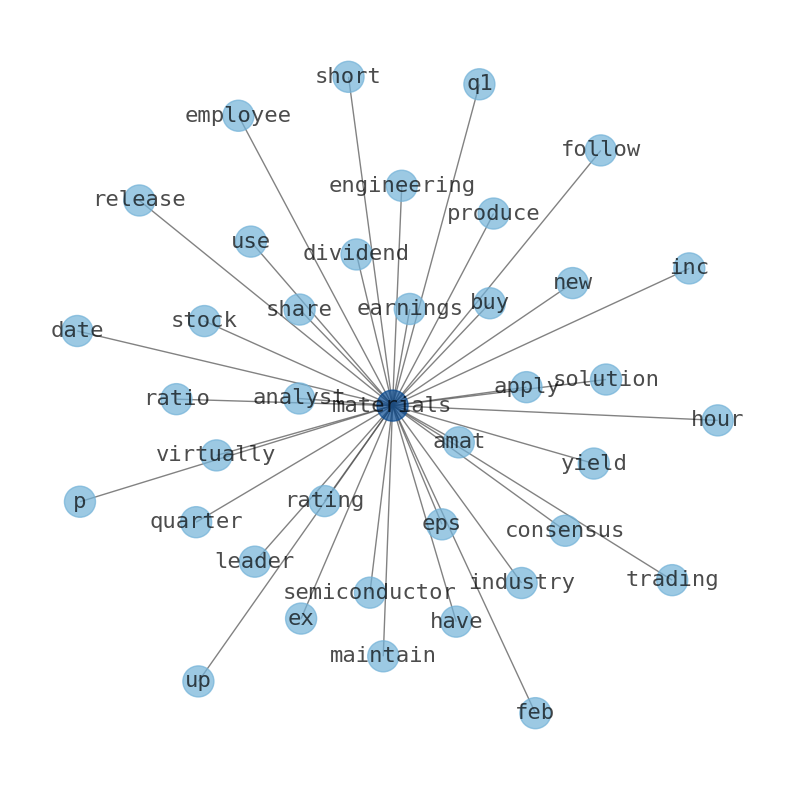

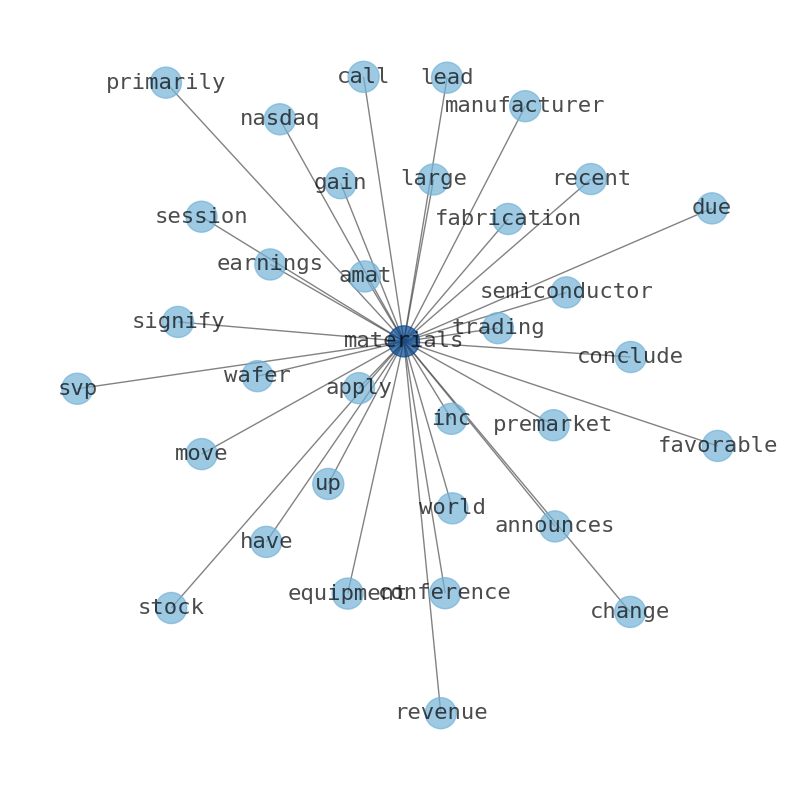

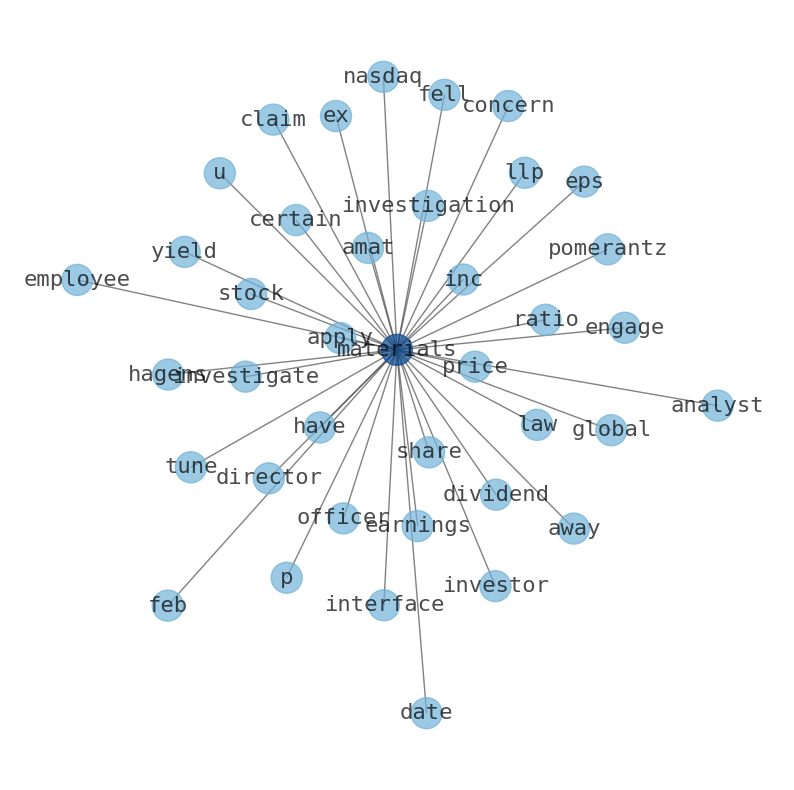

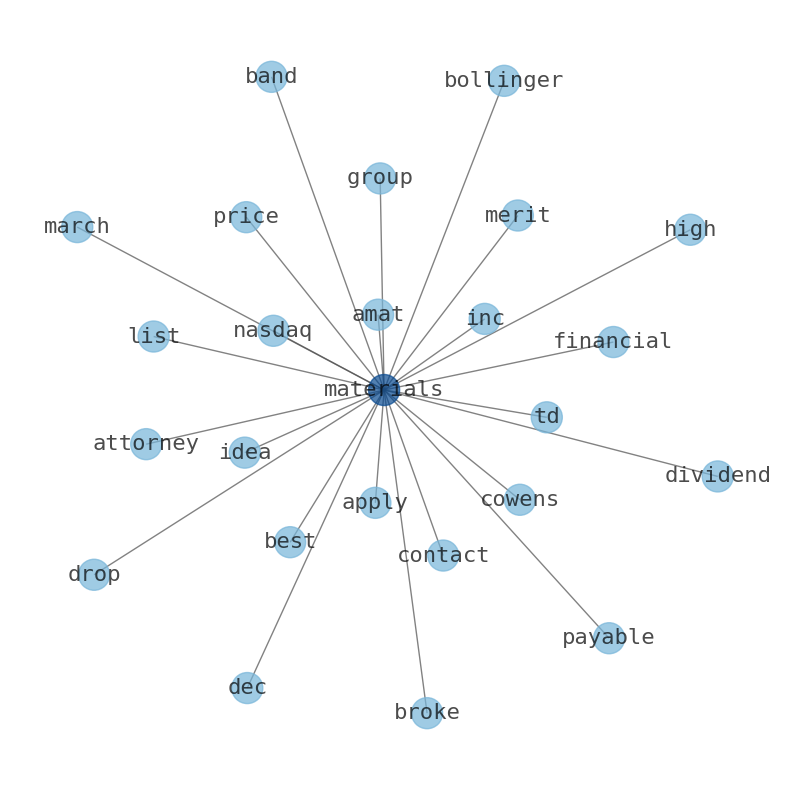

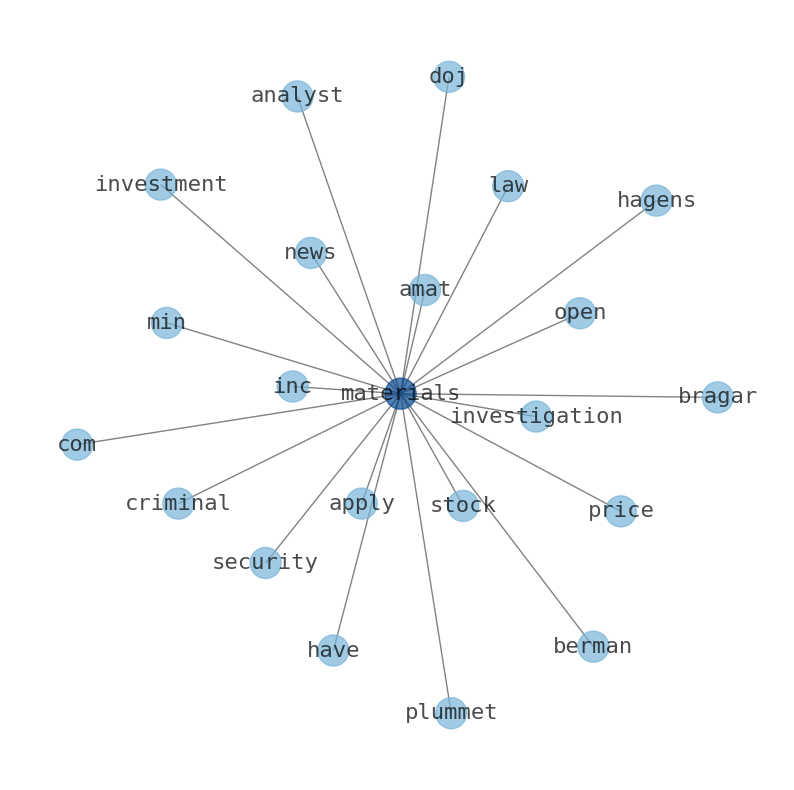

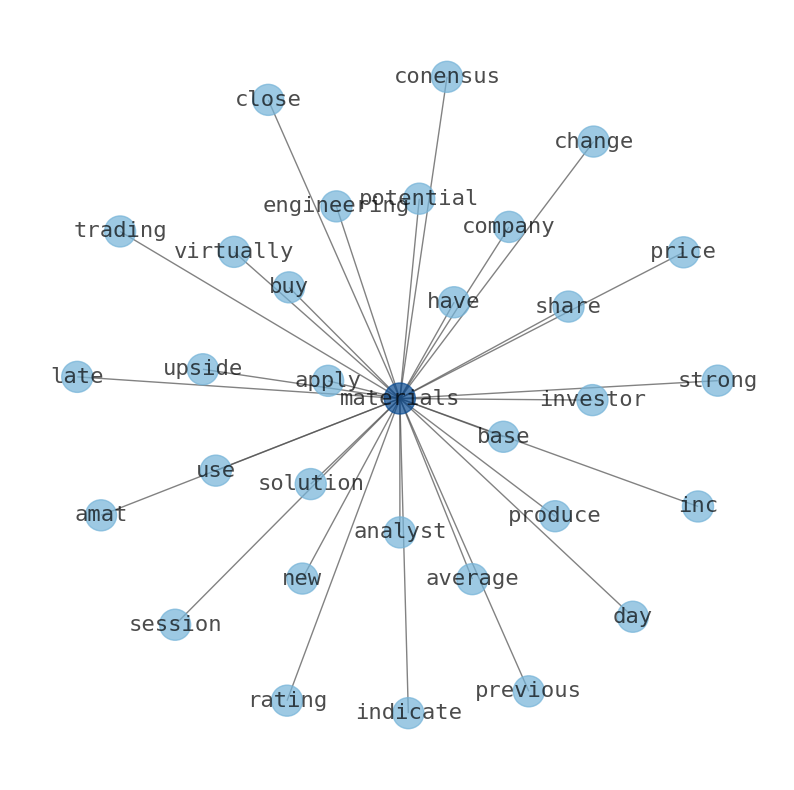

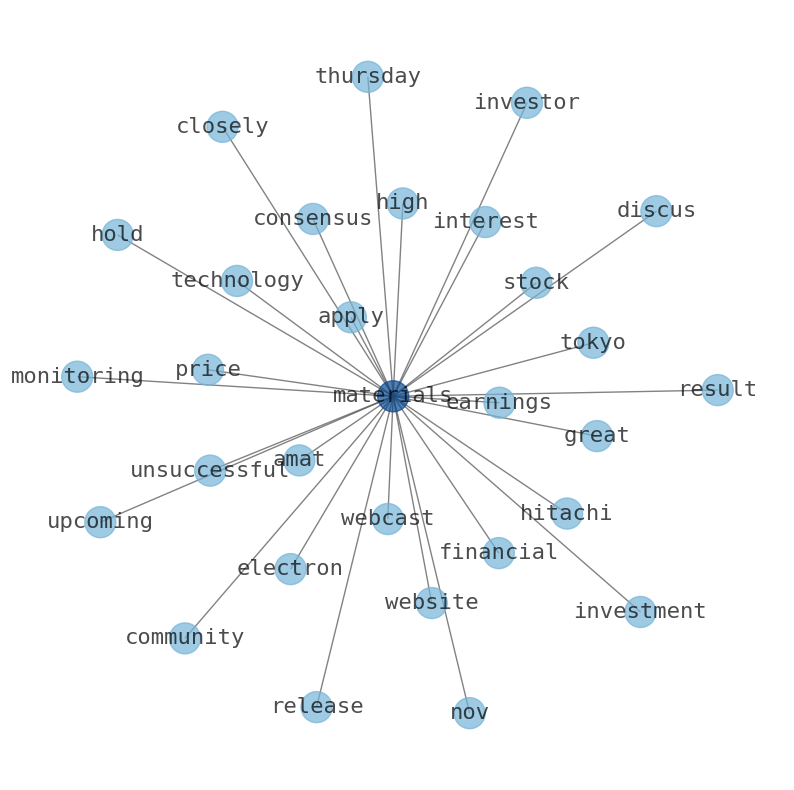

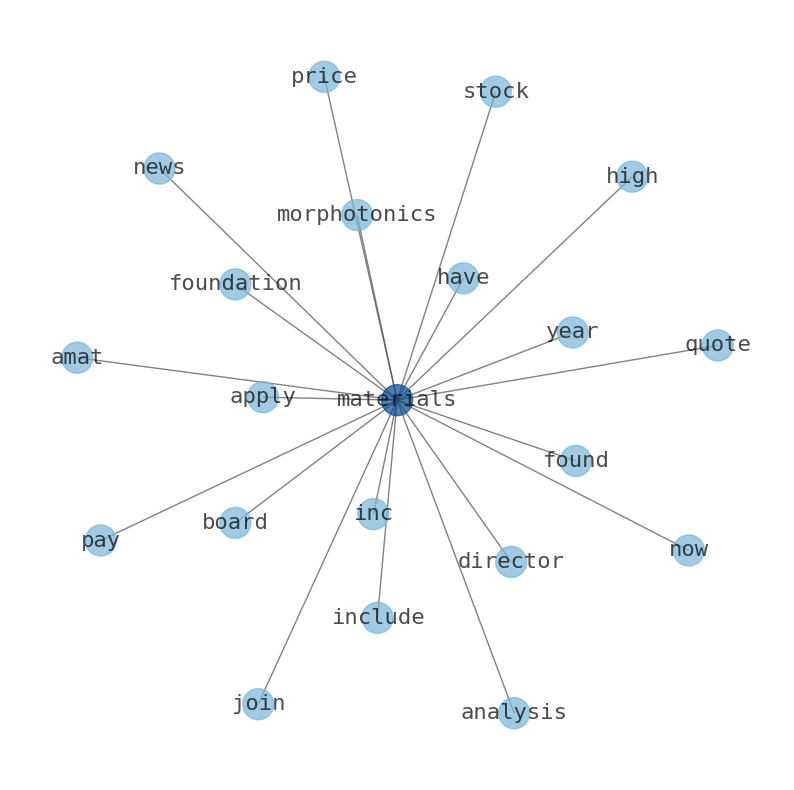

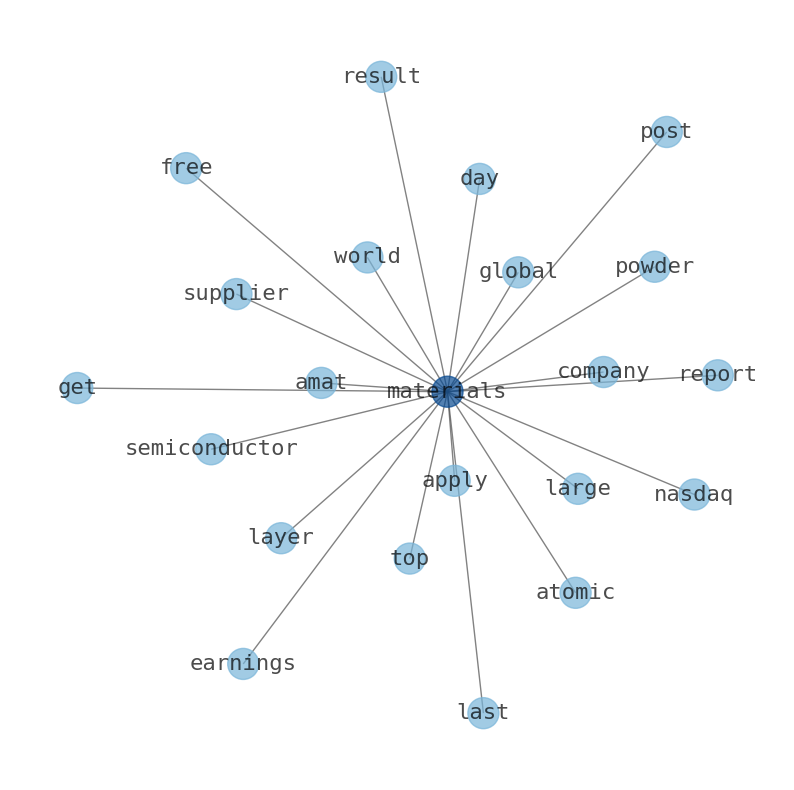

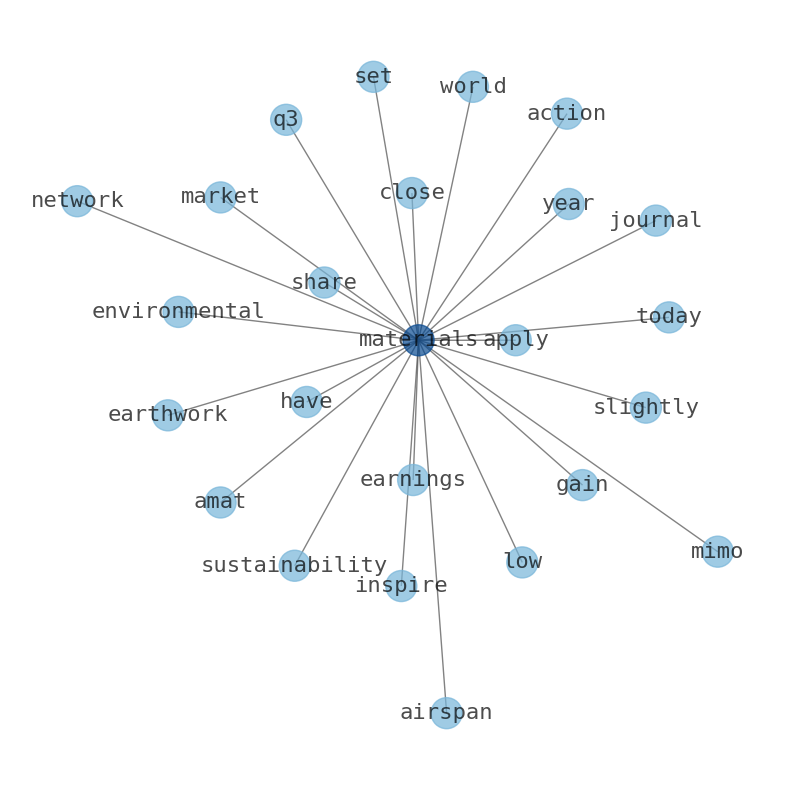

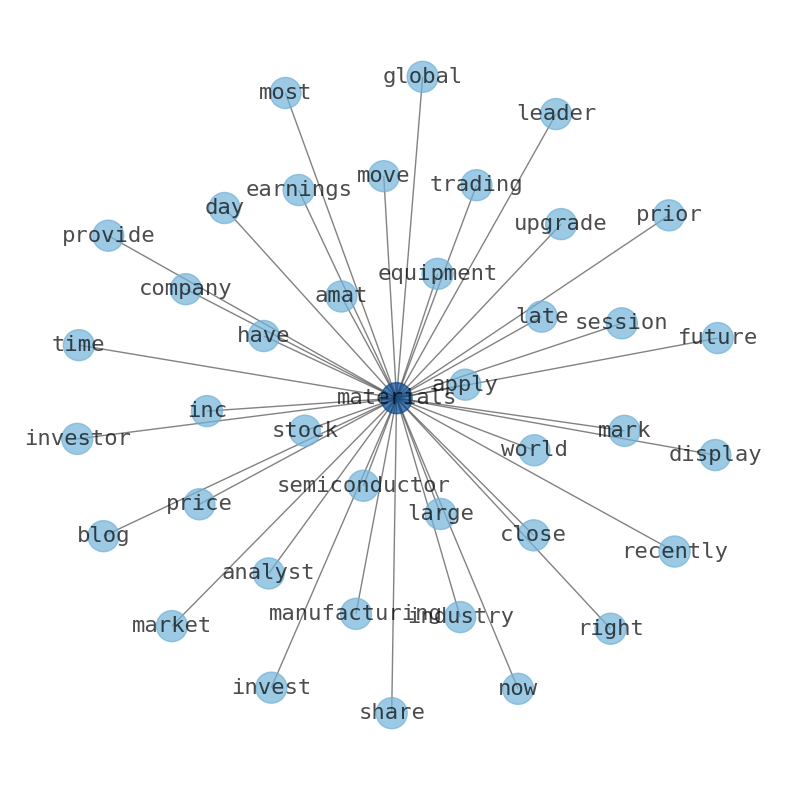

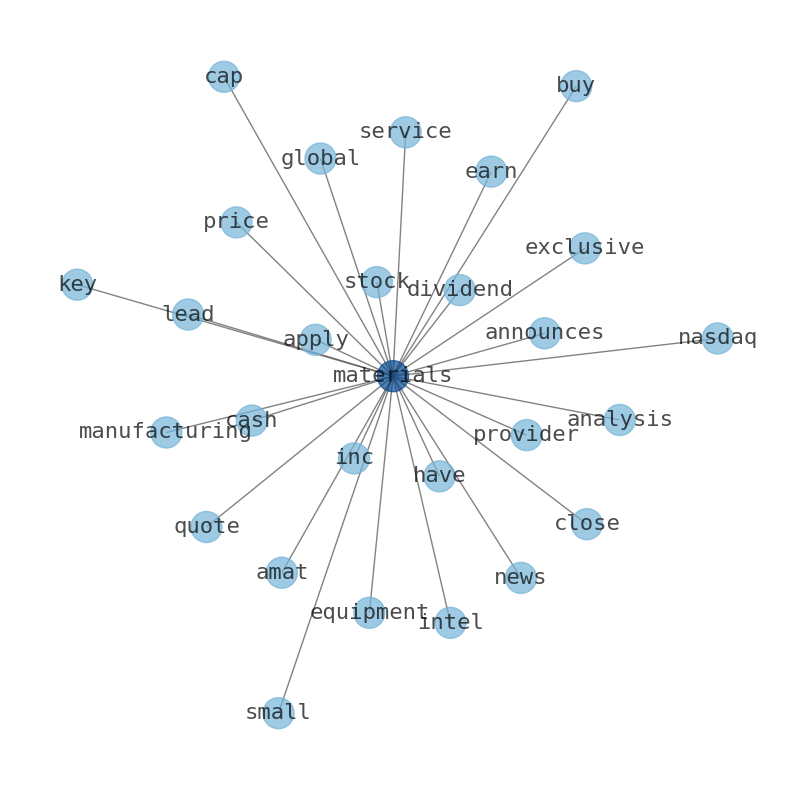

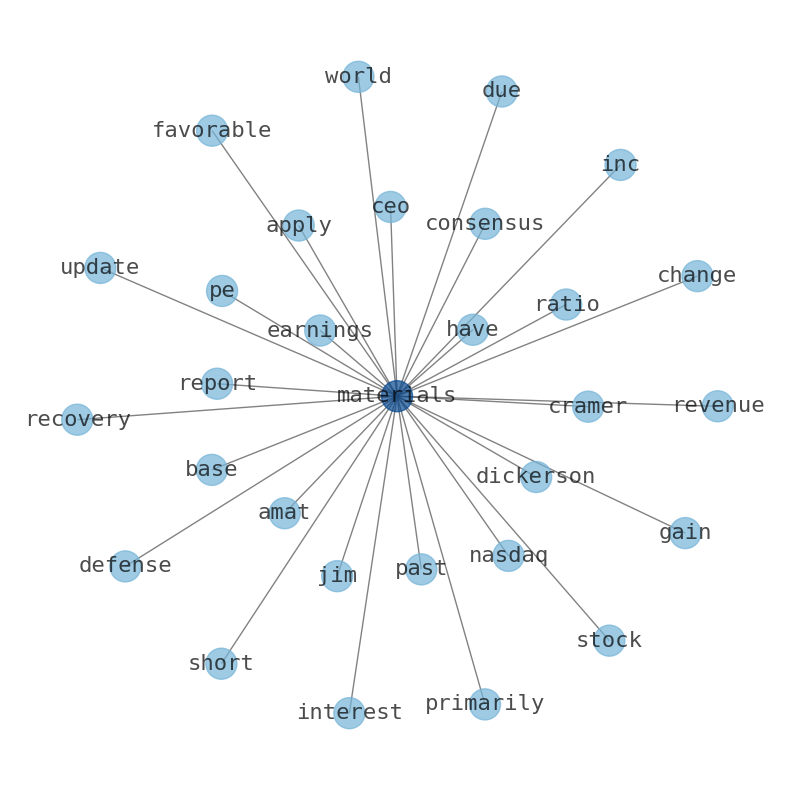

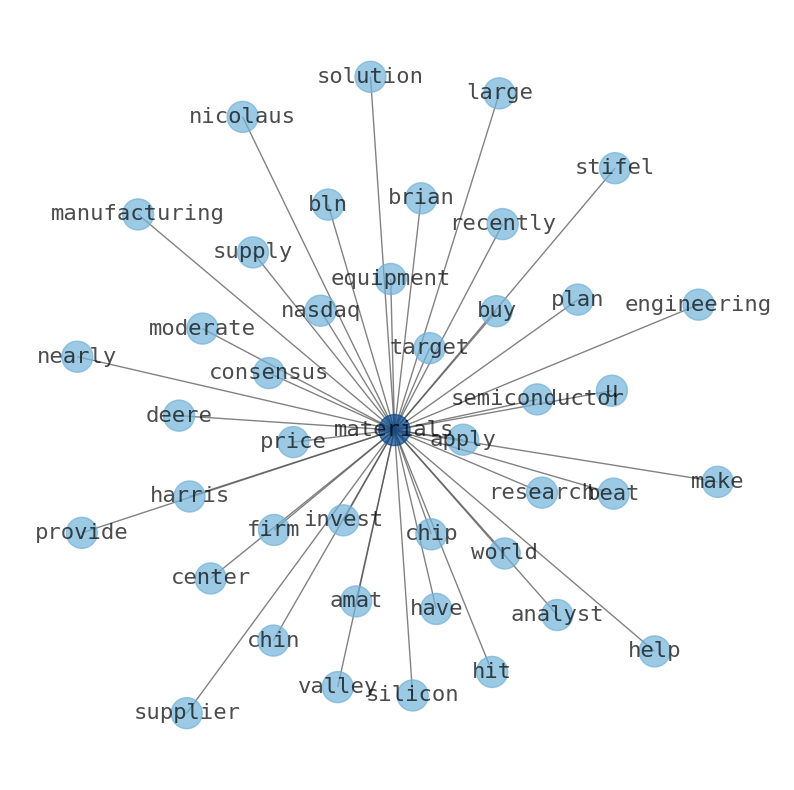

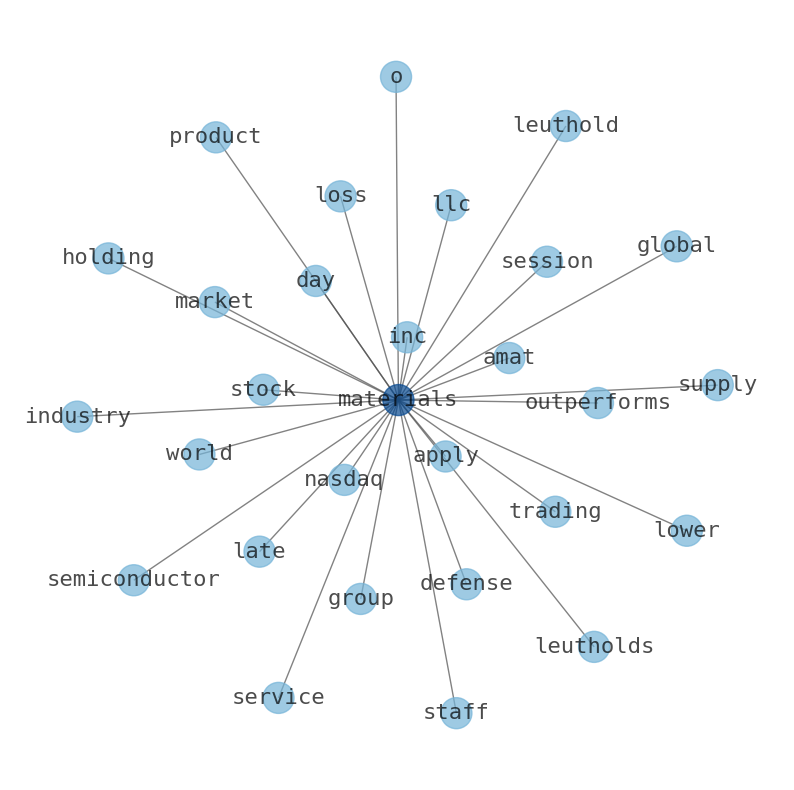

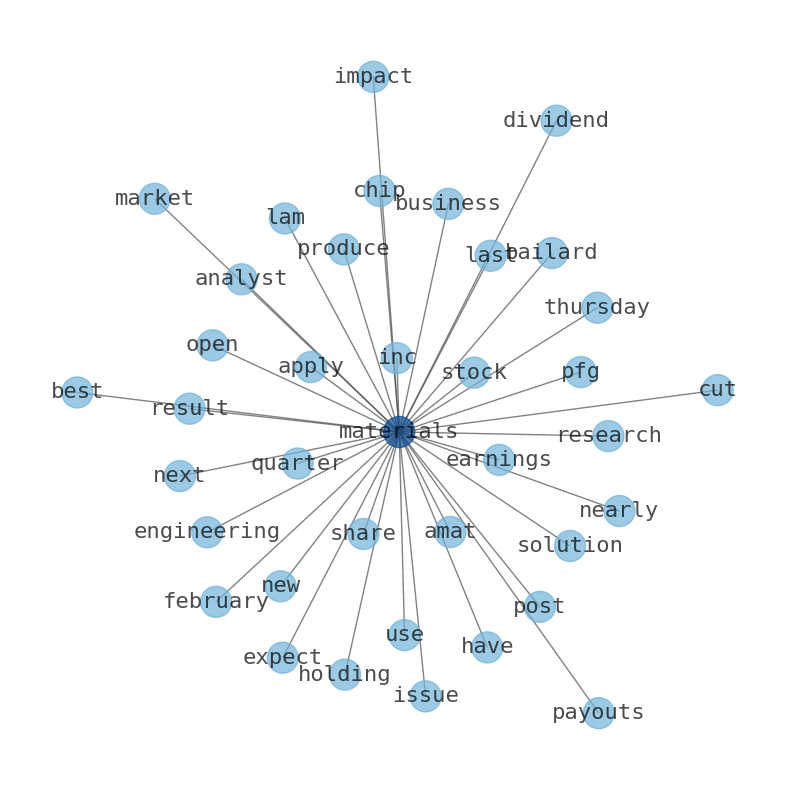

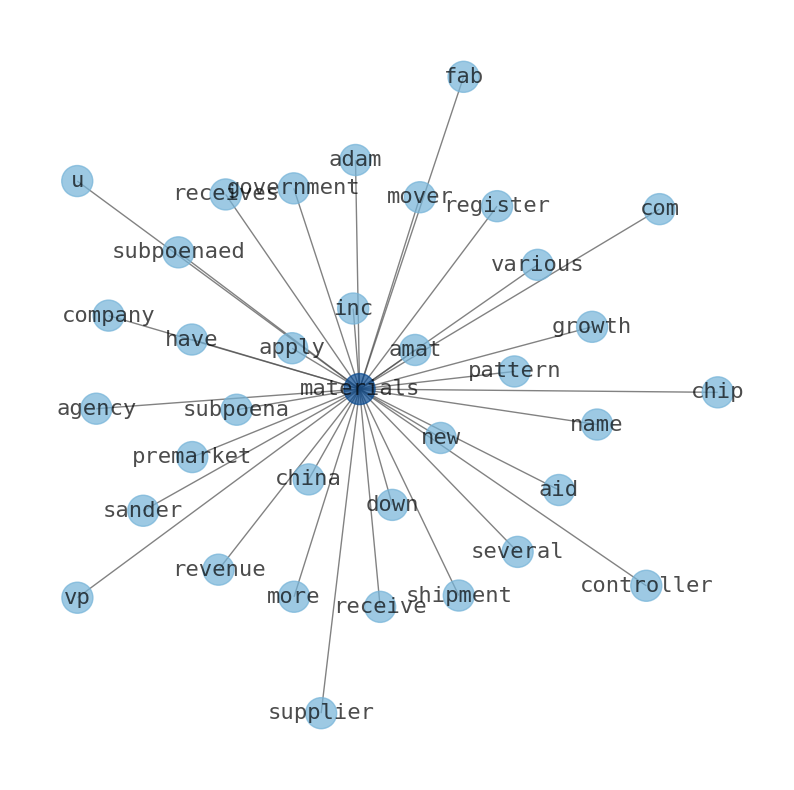

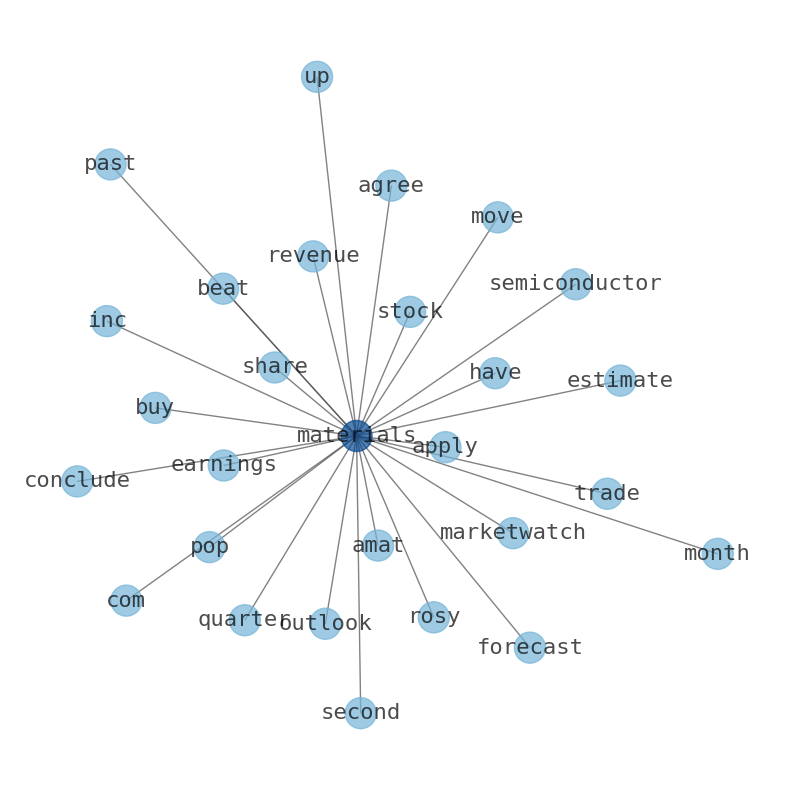

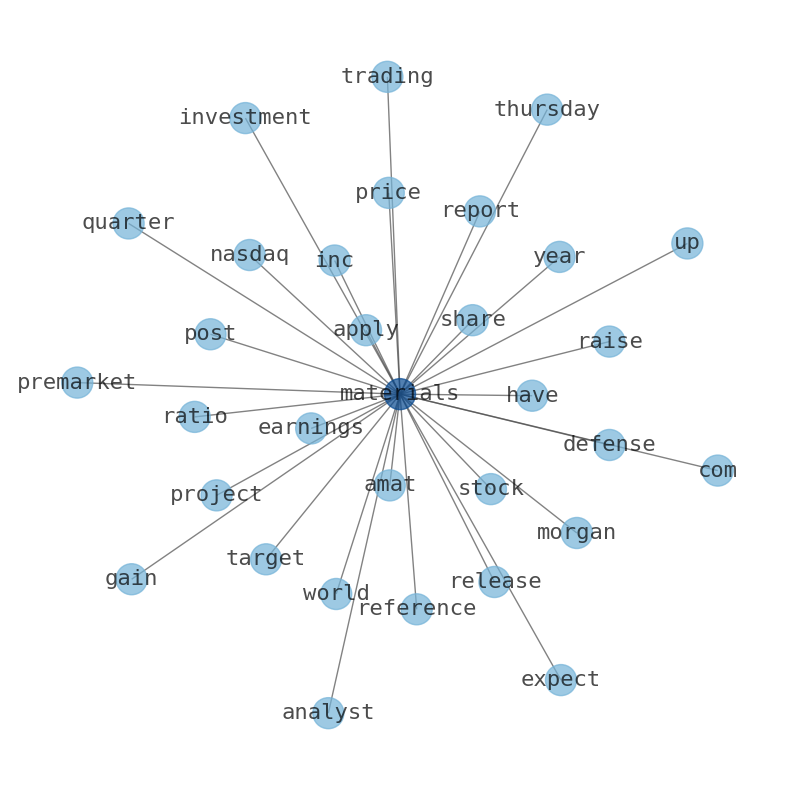

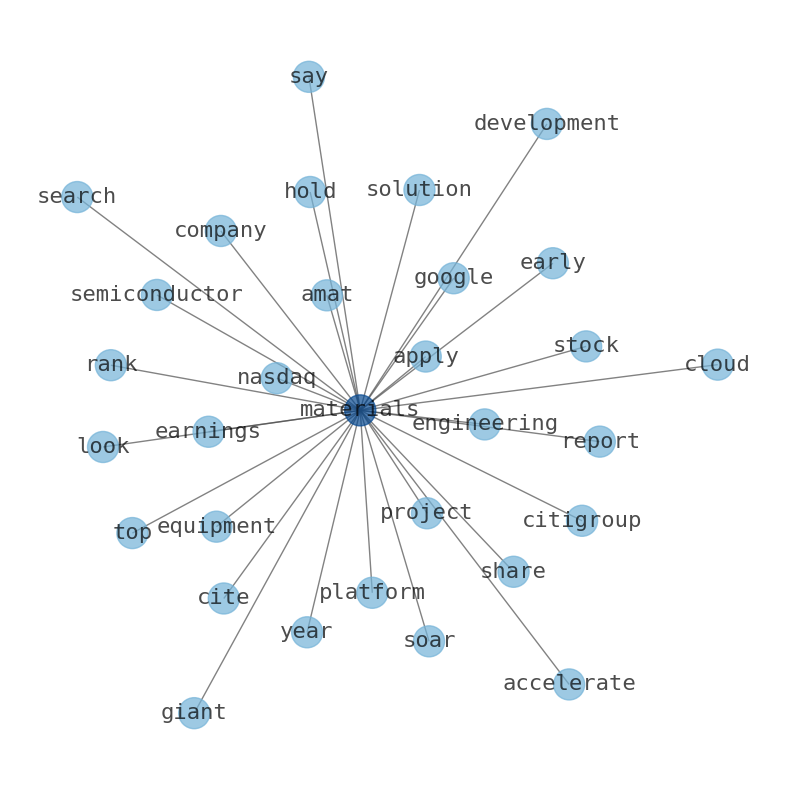

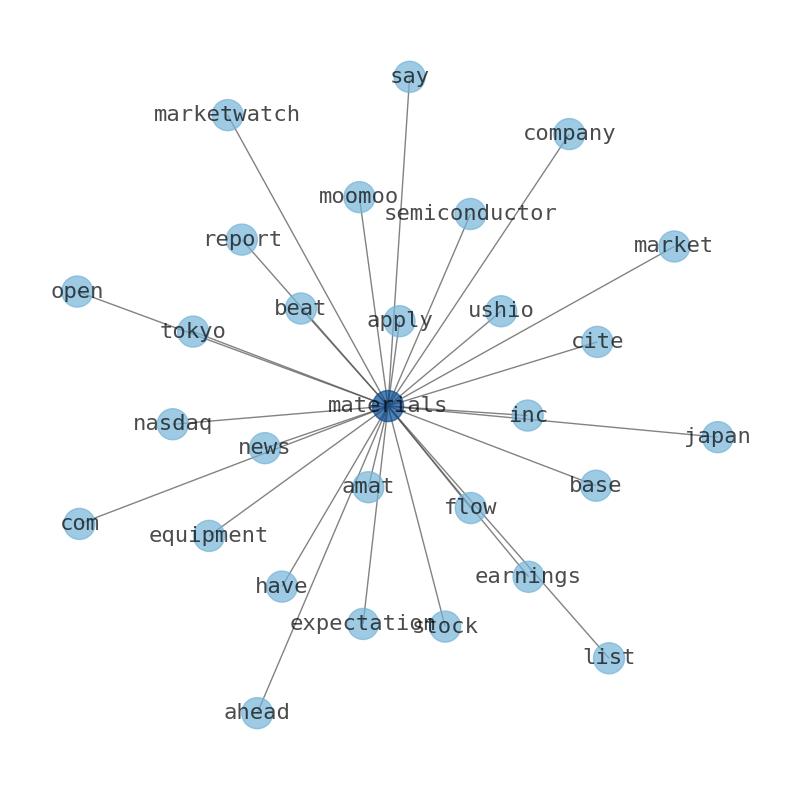

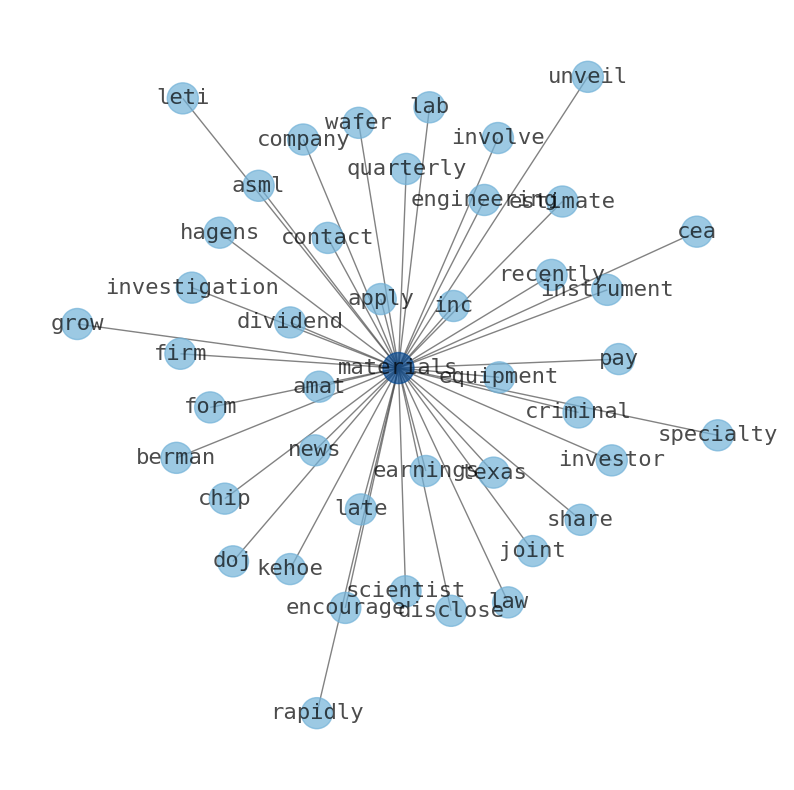

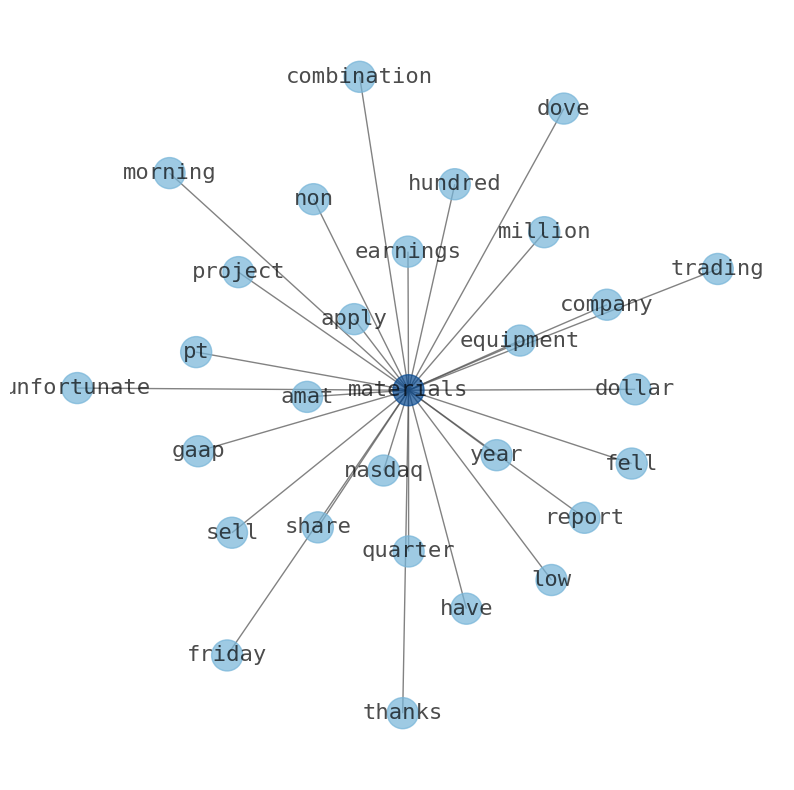

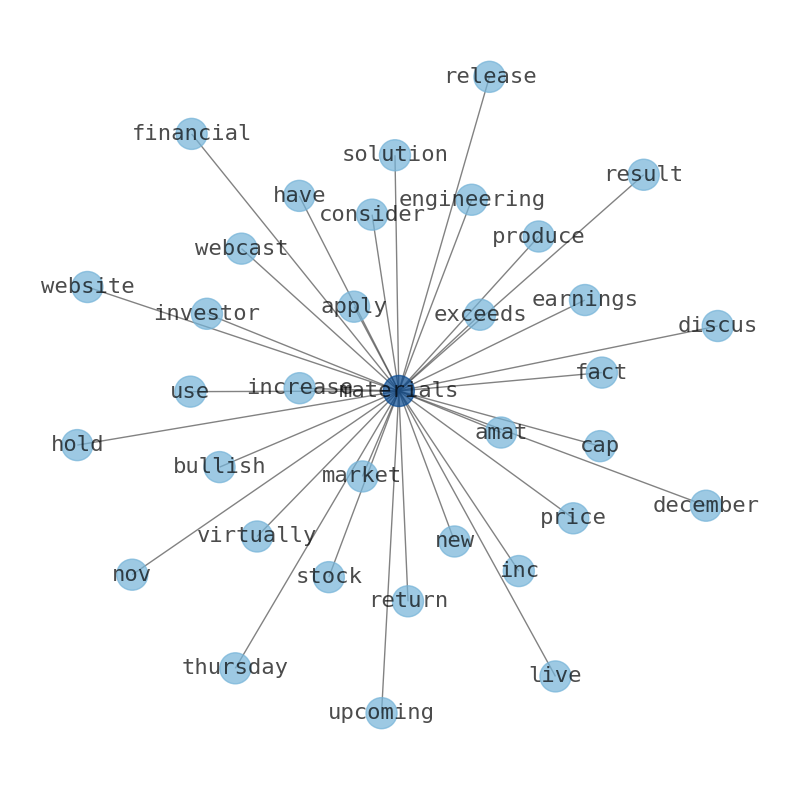

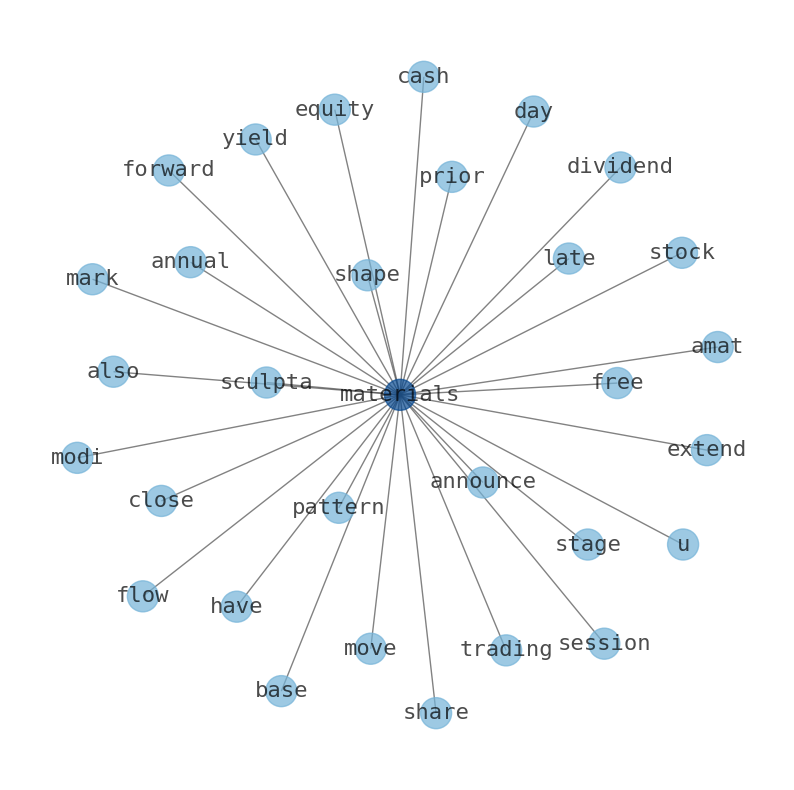

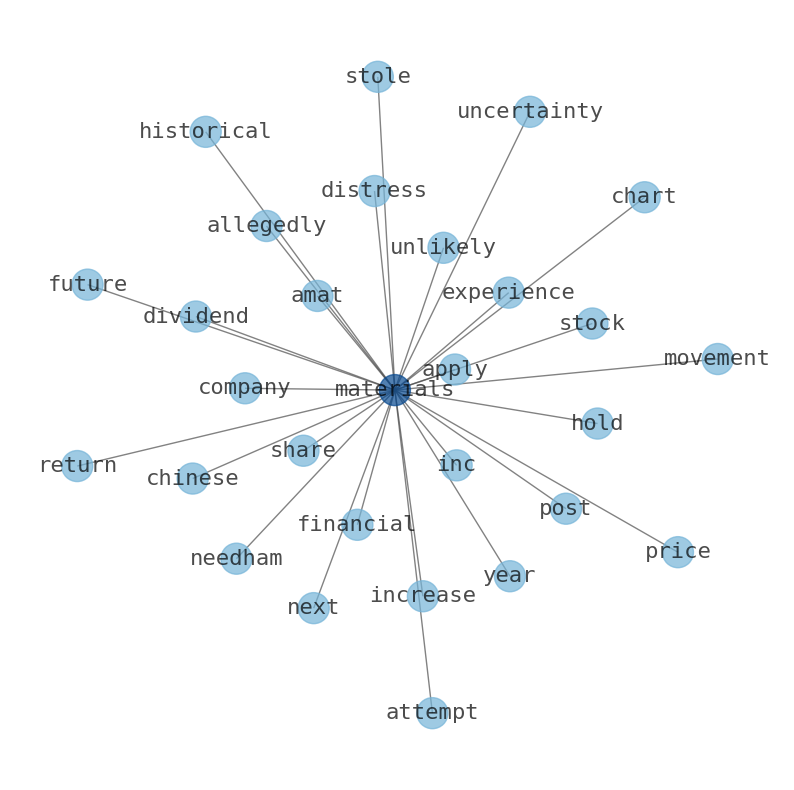

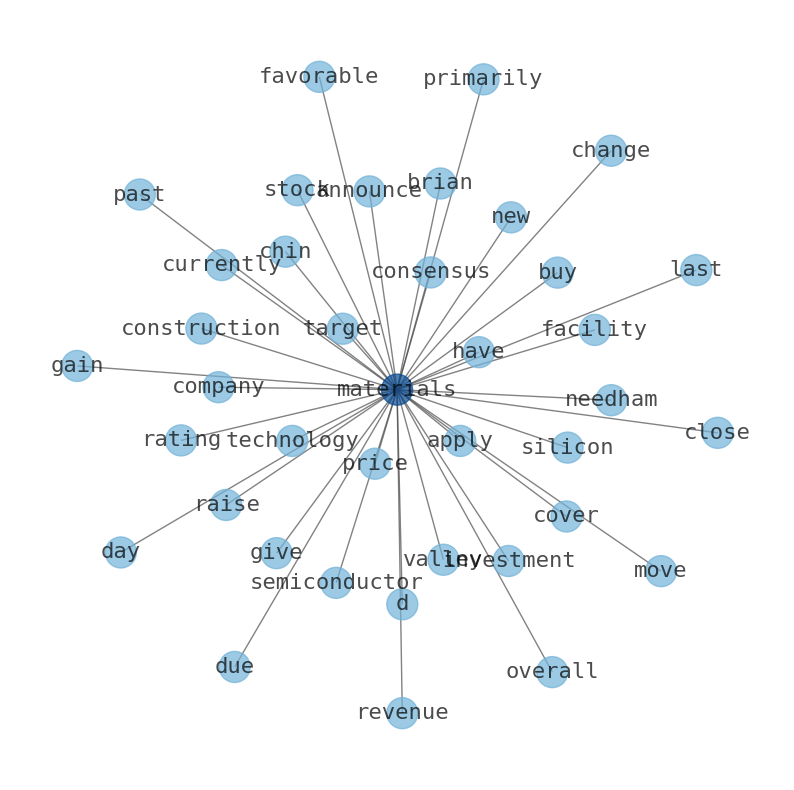

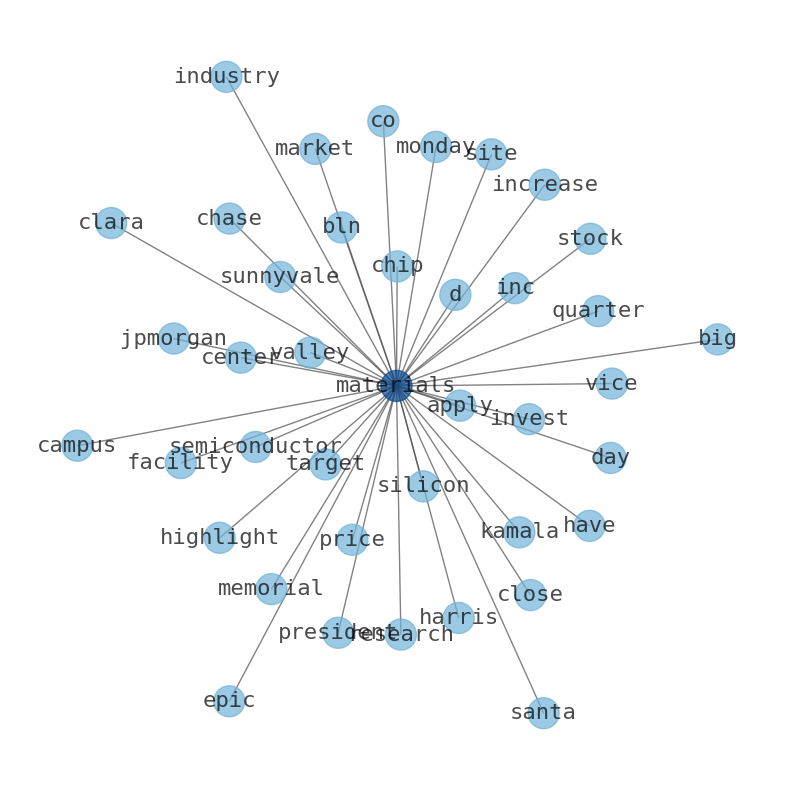

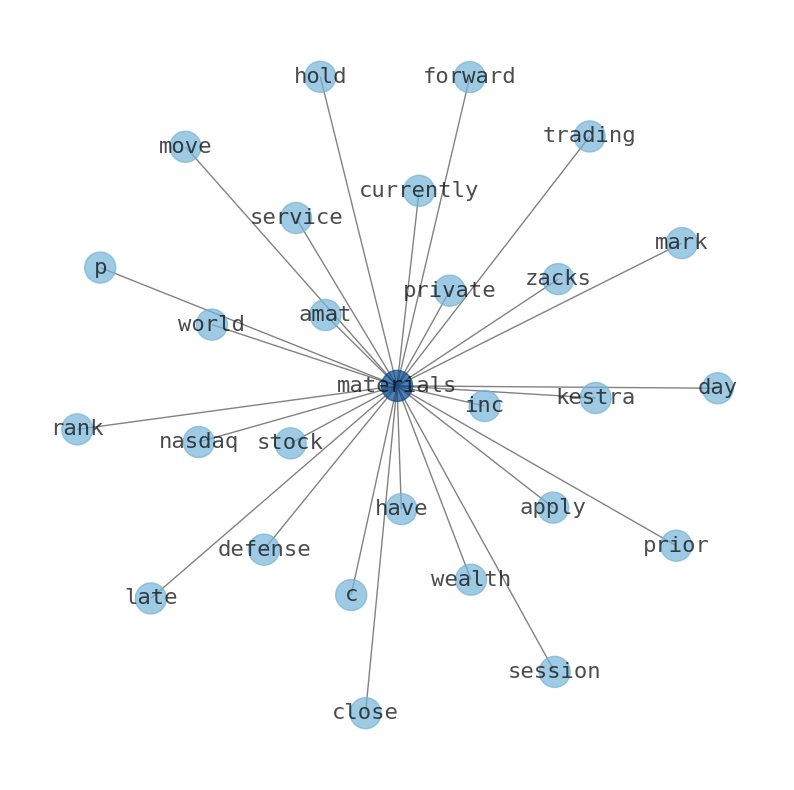

Keywords

How much time have you spent trying to decide whether investing in Applied Materials? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Applied Materials are: Applied, Materials, value, stock, semiconductor, equipment, GF, and the most common words in the summary are: material, apply, stock, applied, market, amat, price, . One of the sentences in the summary was: Analysts have a Moderate Buy analyst consensus rating for Applied Materials with a $161.47 average price target.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #material #apply #stock #applied #market #amat #price.

Read more →Related Results

Applied Materials

Open: 202.97 Close: 200.56 Change: -2.41

Read more →

Applied Materials

Open: 198.28 Close: 199.73 Change: 1.45

Read more →

Applied Materials

Open: 202.02 Close: 199.57 Change: -2.45

Read more →

Applied Materials

Open: 179.04 Close: 185.84 Change: 6.8

Read more →

Applied Materials

Open: 161.6 Close: 162.05 Change: 0.45

Read more →

Applied Materials

Open: 157.03 Close: 159.19 Change: 2.16

Read more →

Applied Materials

Open: 149.33 Close: 150.34 Change: 1.01

Read more →

Applied Materials

Open: 145.19 Close: 150.68 Change: 5.49

Read more →

Applied Materials

Open: 142.37 Close: 144.23 Change: 1.86

Read more →

Applied Materials

Open: 131.96 Close: 130.45 Change: -1.51

Read more →

Applied Materials

Open: 146.41 Close: 144.57 Change: -1.84

Read more →

Applied Materials

Open: 142.22 Close: 138.83 Change: -3.39

Read more →

Applied Materials

Open: 144.57 Close: 142.74 Change: -1.83

Read more →

Applied Materials

Open: 144.02 Close: 145.47 Change: 1.45

Read more →

Applied Materials

Open: 135.14 Close: 134.63 Change: -0.51

Read more →

Applied Materials

Open: 138.0 Close: 137.08 Change: -0.92

Read more →

Applied Materials

Open: 111.3 Close: 111.68 Change: 0.38

Read more →

Applied Materials

Open: 113.47 Close: 113.46 Change: -0.01

Read more →

Applied Materials

Open: 207.75 Close: 208.41 Change: 0.66

Read more →

Applied Materials

Open: 187.92 Close: 190.33 Change: 2.41

Read more →

Applied Materials

Open: 178.6 Close: 180.31 Change: 1.71

Read more →

Applied Materials

Open: 152.2 Close: 151.25 Change: -0.95

Read more →

Applied Materials

Open: 162.21 Close: 163.3 Change: 1.09

Read more →

Applied Materials

Open: 148.68 Close: 145.12 Change: -3.56

Read more →

Applied Materials

Open: 142.04 Close: 148.59 Change: 6.55

Read more →

Applied Materials

Open: 144.9 Close: 143.17 Change: -1.73

Read more →

Applied Materials

Open: 139.49 Close: 139.75 Change: 0.26

Read more →

Applied Materials

Open: 138.76 Close: 137.45 Change: -1.31

Read more →

Applied Materials

Open: 147.01 Close: 148.0 Change: 0.99

Read more →

Applied Materials

Open: 147.52 Close: 148.01 Change: 0.49

Read more →

Applied Materials

Open: 139.62 Close: 141.54 Change: 1.92

Read more →

Applied Materials

Open: 140.89 Close: 138.93 Change: -1.96

Read more →

Applied Materials

Open: 133.73 Close: 134.83 Change: 1.1

Read more →

Applied Materials

Open: 130.77 Close: 136.06 Change: 5.29

Read more →

Applied Materials

Open: 113.47 Close: 113.46 Change: -0.01

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo