The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Applied Materials

Youtube Subscribe

Open: 202.02 Close: 199.57 Change: -2.45

You're running out of time to find out about Applied Materials Stock using an AI.

This document will help you to evaluate Applied Materials without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Applied Materials are: Applied, Materials, AMAT, earnings, share, EPS, analyst, …

Stock Summary

Applied Materials, Inc. engages in the semiconductor, display, and related industries. It operates through three segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. The Semiconductonductor Systems segment.

Today's Summary

Shares of Applied Materials have gained 79.8% over a year, outperforming the industrys rally of 53.6%. Long-term prospects look promising, thanks to the demand rebound in China and growing opportunities in the areas of AI and cloud infrastructure.

Today's News

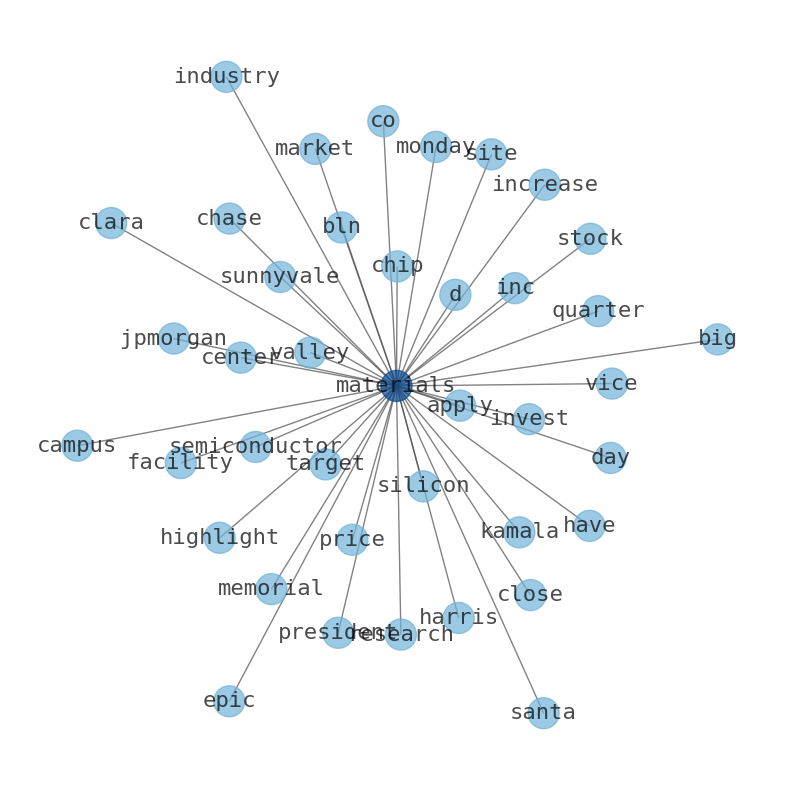

Applied Materials Inc. per Employee $777.85K P/E Ratio 23.48 EPS $8.50 Yield 0.64% Dividend $0.32 Ex-Dividend Date Feb 21, 2024 Short Interest 16.78M 01/31/24 % of Float Shorted 2.02% Average Volume 61M. Applied Materials (AMAT) stock was up in after-hours trading following the release of its Q1 2024 earnings results. Shares of Applied Materials have gained 79.8% over a year, outperforming the industrys rally of 53.6%. Shares popped 12.5% in extended-hours. Long-term prospects look promising, thanks to the demand rebound in China and growing opportunities in the areas of AI and cloud infrastructure. The consensus among analysts for Applied Materials was for an earnings per share (EPS) of $1.91. Applied Materials is the leader in materials engineering solutions used to produce virtually every new chip and advanced display in the world. The company has 26,461 employees. Applied Materials stock price today (nasdaq: amat) quote, market cap, chart | WallStreetZen Screener Stock Ideas Top Analysts Pricing Try It for Just $1. Applied Materials is one of the worlds largest suppliers of equipment for the fabrication of semiconductor, flat panel liquid crystal displays (LCDs), and solar photovoltaic (PV) cells and modules. Headquartered in Santa Clara, California, Applied Materials (AMAT) has received quite a bit of attention. Applied Materials (AMAT) delivered earnings and revenue surprises of 5.18% and 0.80% for the quarter ended January 2023. Coca Cola, Cisco and Applied Materials are highlights of the Zacks Earnings Preview article. $SPX : 5,005.57 (-0.48%) SPY : 499.51 (-0.50%) $IUXX : 17,685.98 (-037%) QQQ : 430.57 -0.91%) AMAT : 199.57 (+6.35%) TTD : 88.93 (+17.46%) IR : 89.47 (+1.47%) Shahne Investor Alliance Colt Karemunrition1990ESEconsSum Germankies Riv Applied Materials reported earnings of $2.12 per share in the previous quarter, beating the analysts consensus estimate of $1.98 per share. The company is expected to experience a 10.71% increase in EPS next year. The forecasted EPS growth highlights Applied Materialss strong position in the semiconductor industry. Analysts maintain a Buy rating on Applied Materials (AMAT) Craig-Hallum analyst Christian Schwab maintained a Buy Rating for Applied Materials. The word on The Street in general, suggests a Moderate Buy analyst consensus rating. The Fly provides the latest financial news as it breaks. Analysts at Zacks Research upped their Q2 2024 earnings per share estimates for shares of Applied Materials.

Stock Profile

"Applied Materials, Inc. engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries. It operates through three segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. The Semiconductor Systems segment develops, manufactures, and sells various manufacturing equipment that is used to fabricate semiconductor chips or integrated circuits. This segment also offers various technologies, including epitaxy, ion implantation, oxidation/nitridation, rapid thermal processing, physical vapor deposition, chemical vapor deposition, chemical mechanical planarization, electrochemical deposition, atomic layer deposition, etching, and selective deposition and removal, as well as metrology and inspection tools. The Applied Global Services segment provides integrated solutions to optimize equipment and fab performance and productivity comprising spares, upgrades, services, remanufactured earlier generation equipment, and factory automation software for semiconductor, display, and other products. The Display and Adjacent Markets segment offers products for manufacturing liquid crystal displays; organic light-emitting diodes; and other display technologies for TVs, monitors, laptops, personal computers, electronic tablets, smart phones, and other consumer-oriented devices. The company operates in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe. Applied Materials, Inc. was incorporated in 1967 and is headquartered in Santa Clara, California."

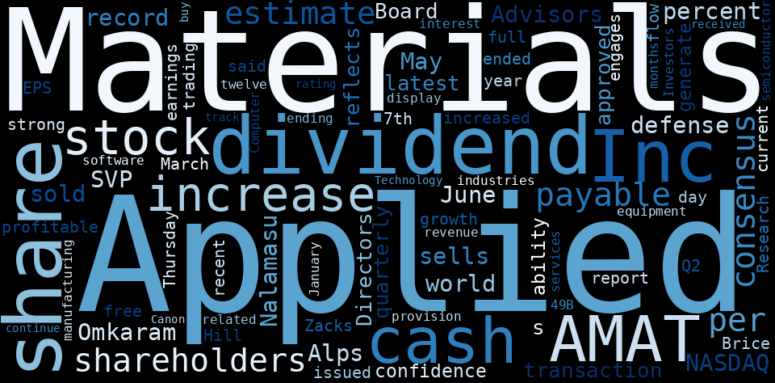

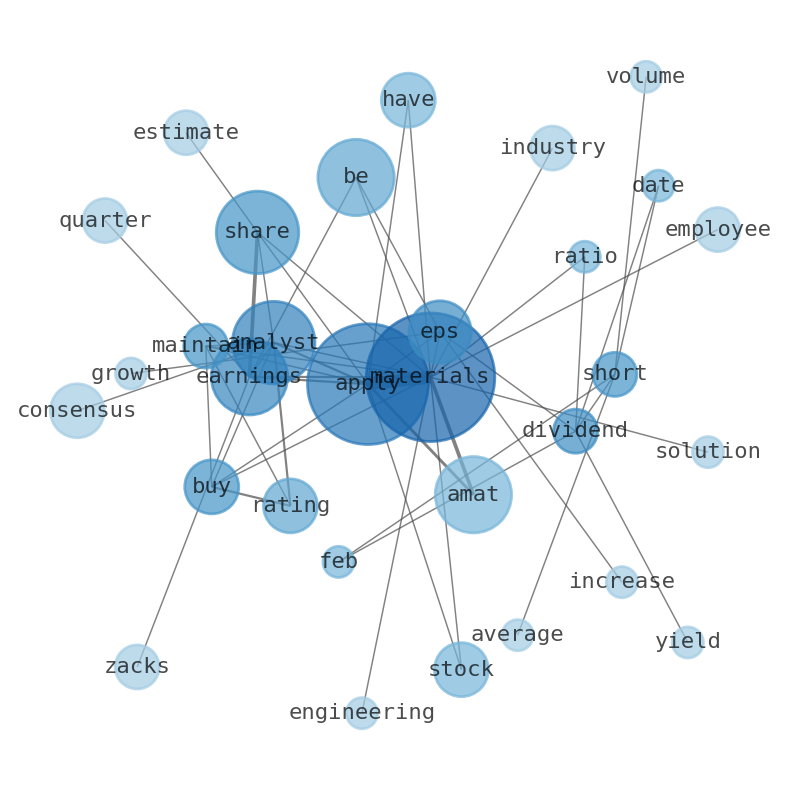

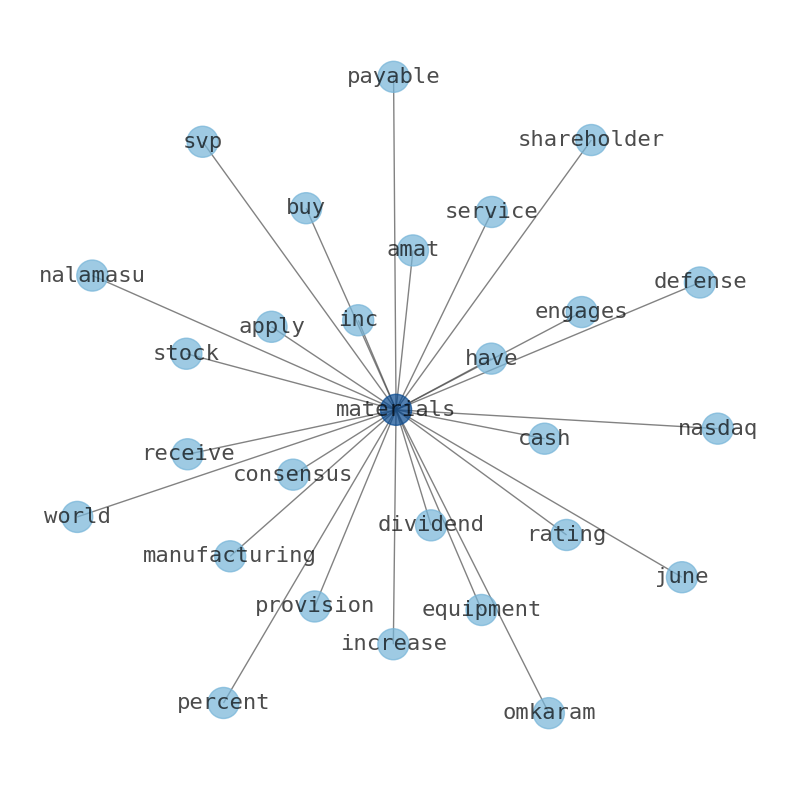

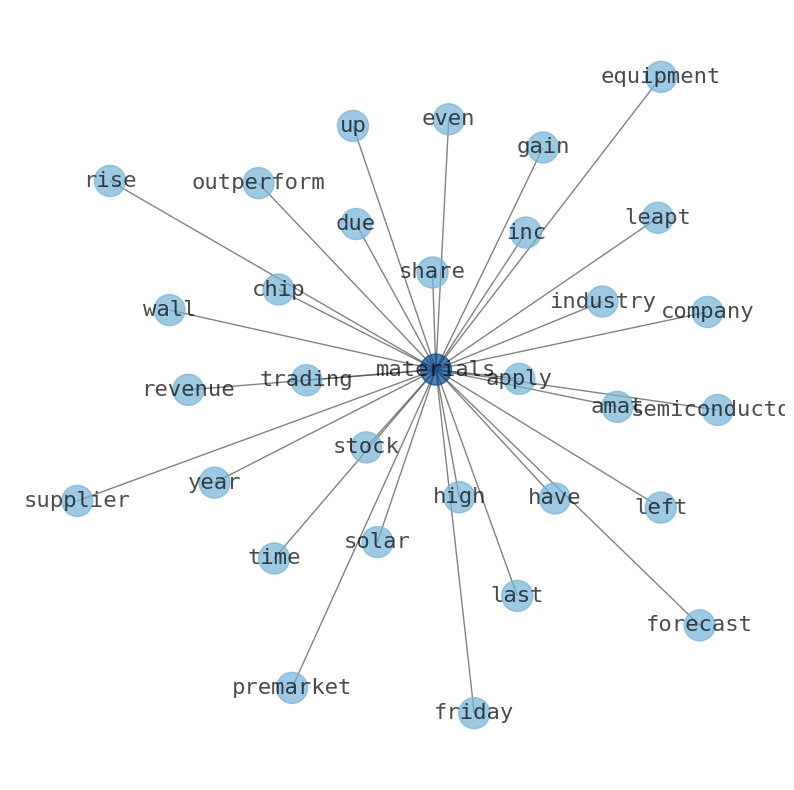

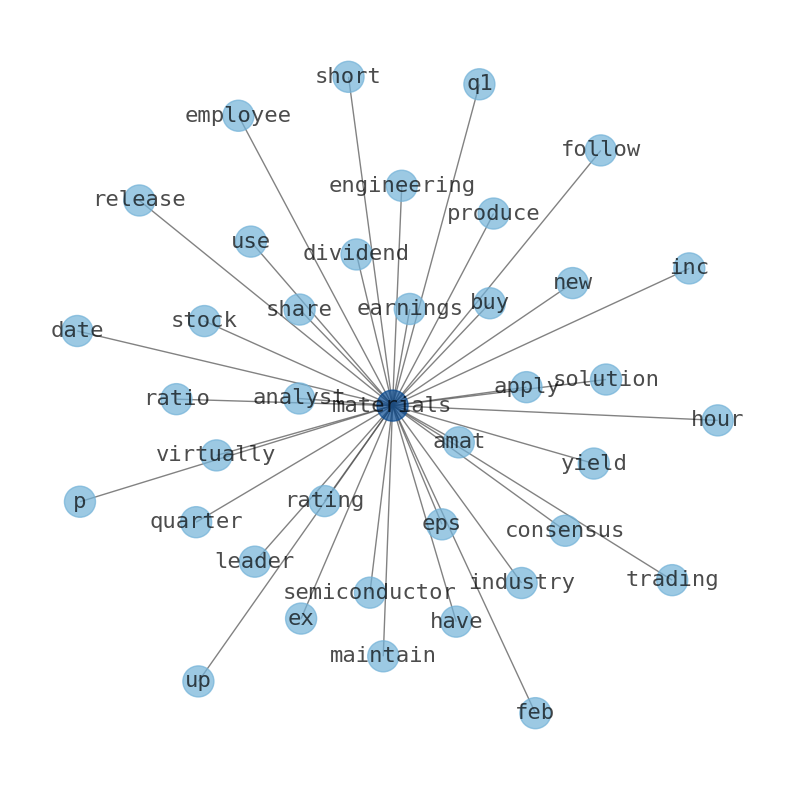

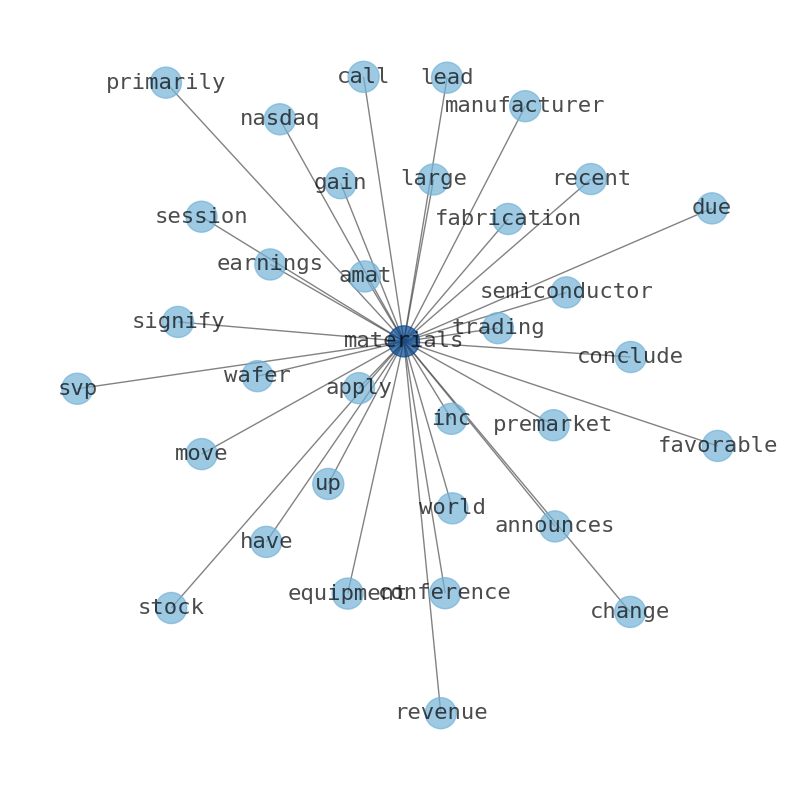

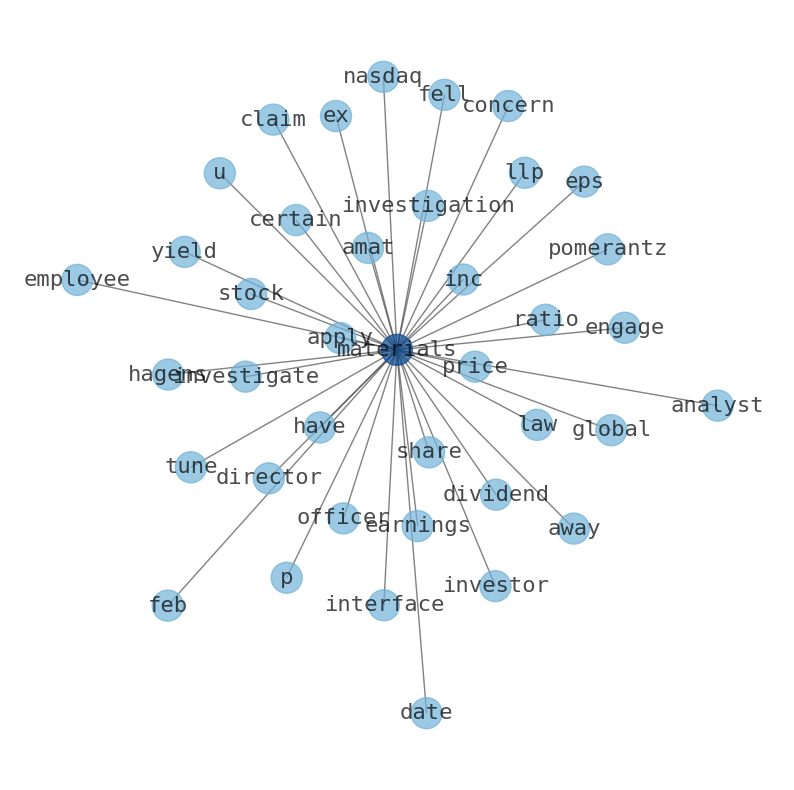

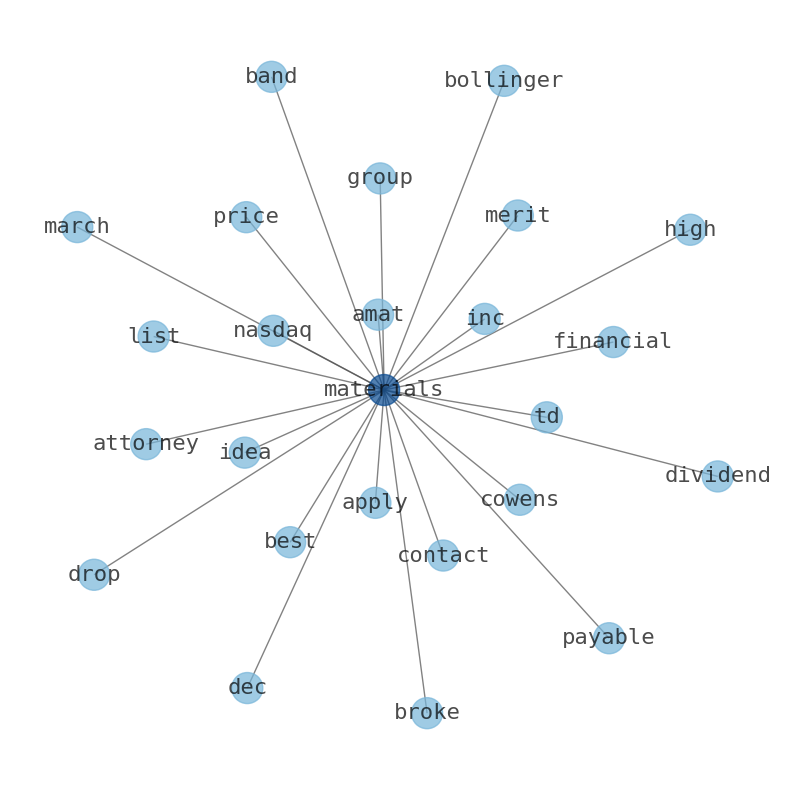

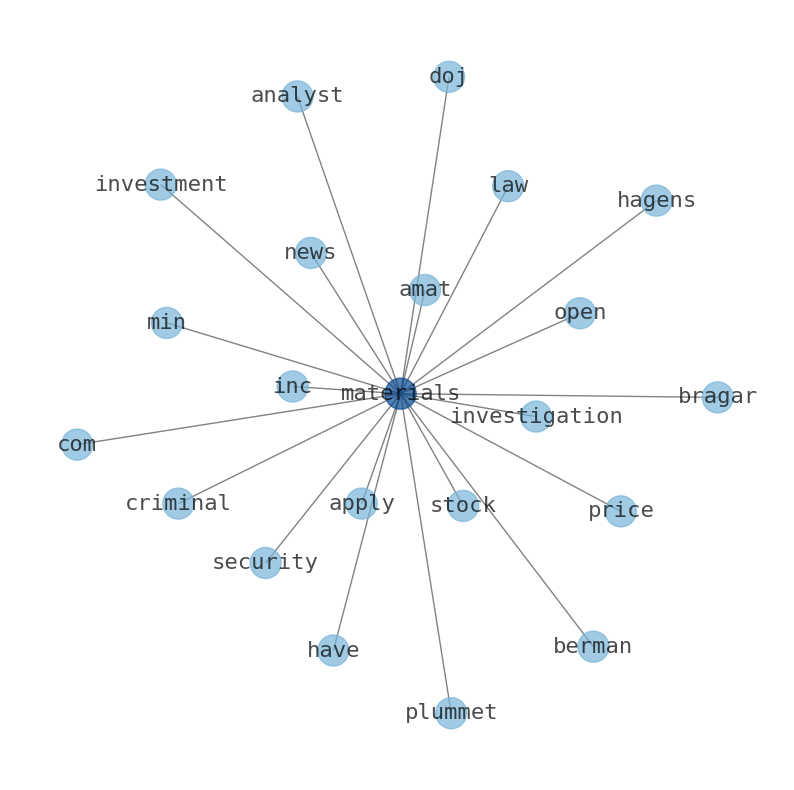

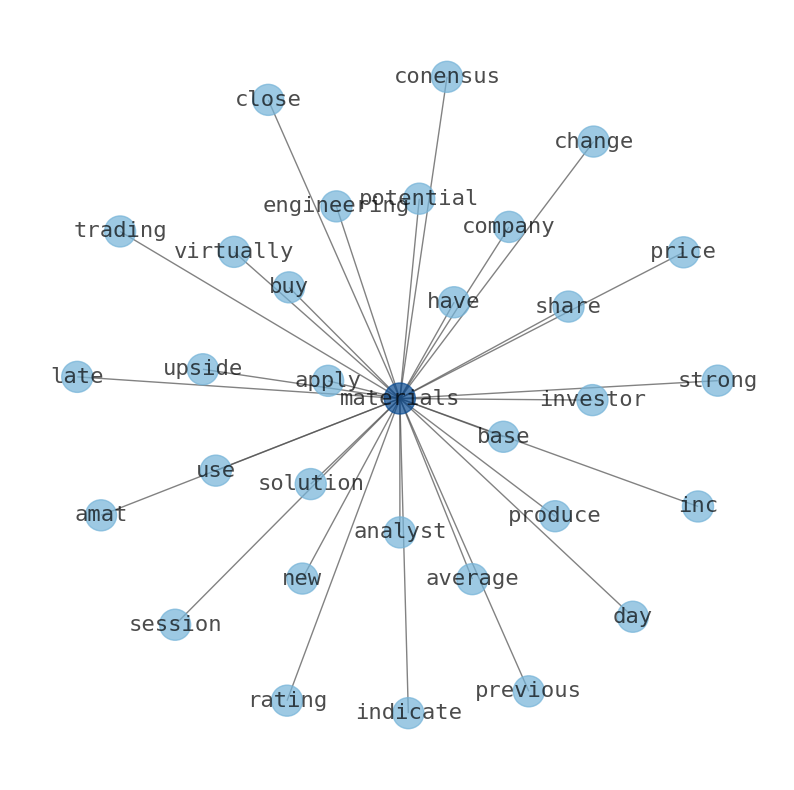

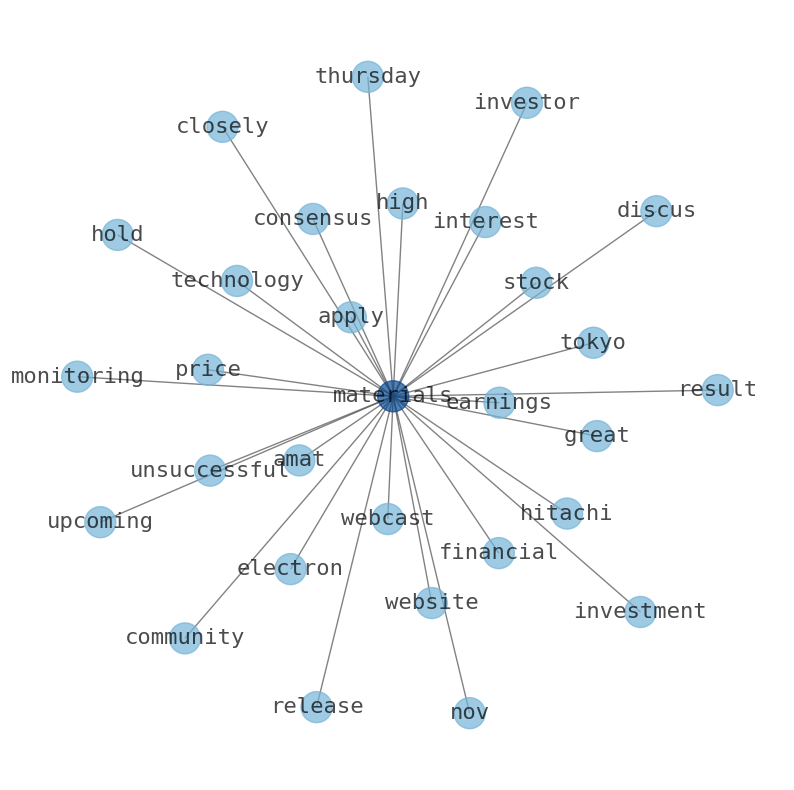

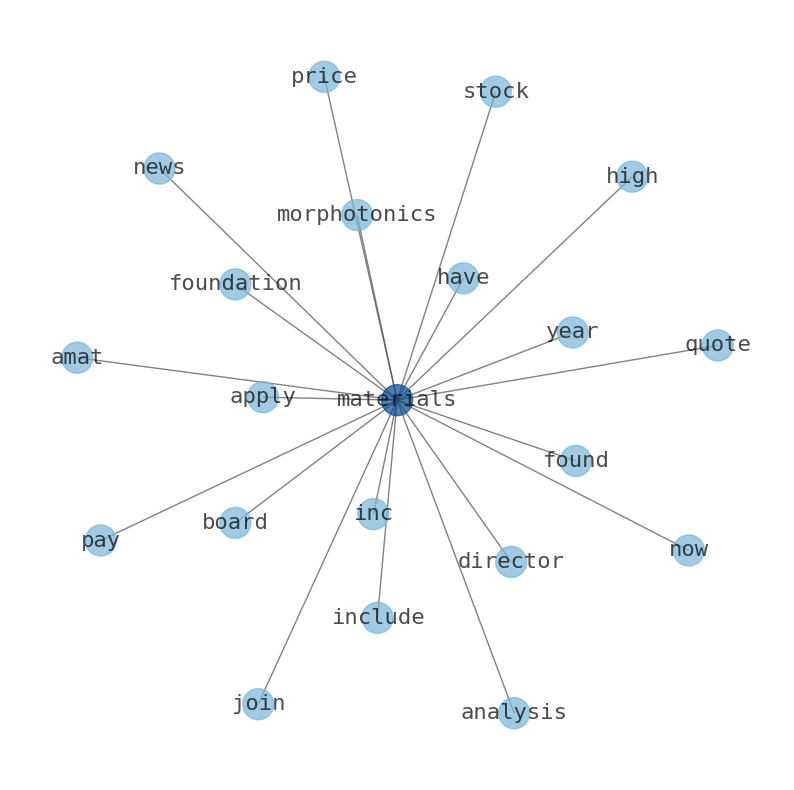

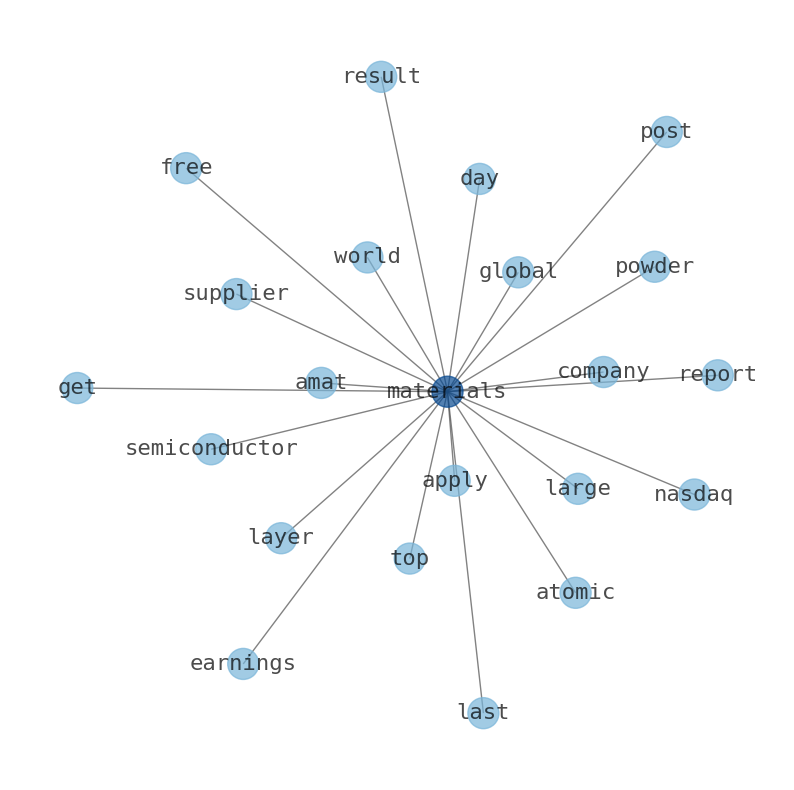

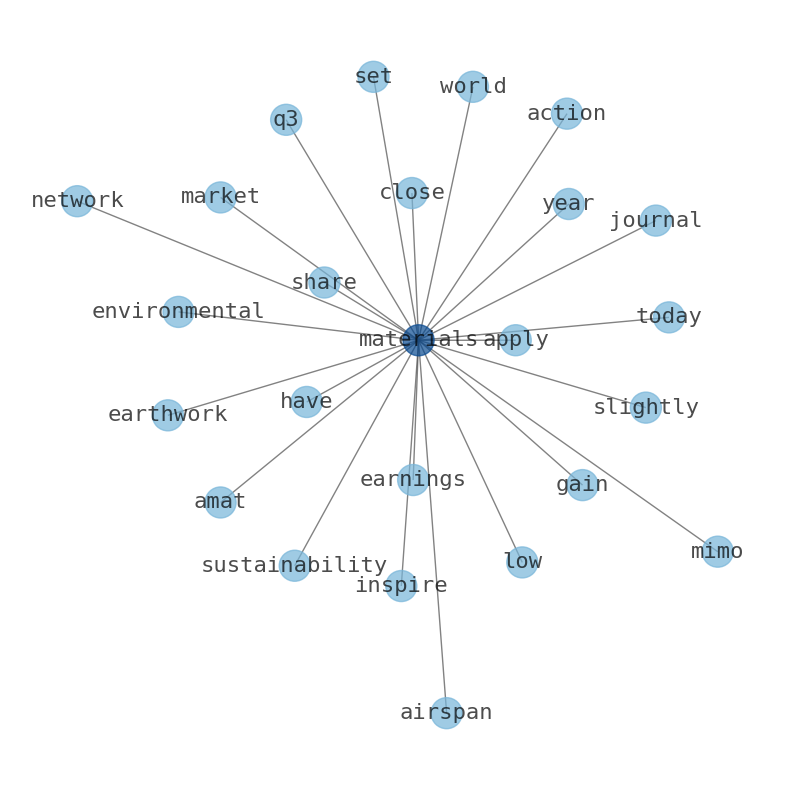

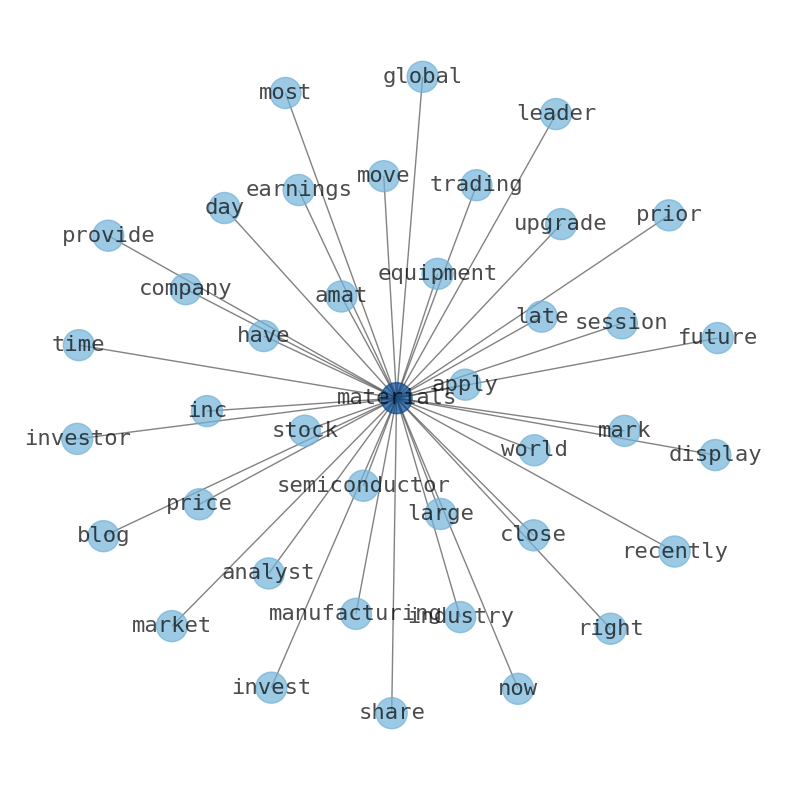

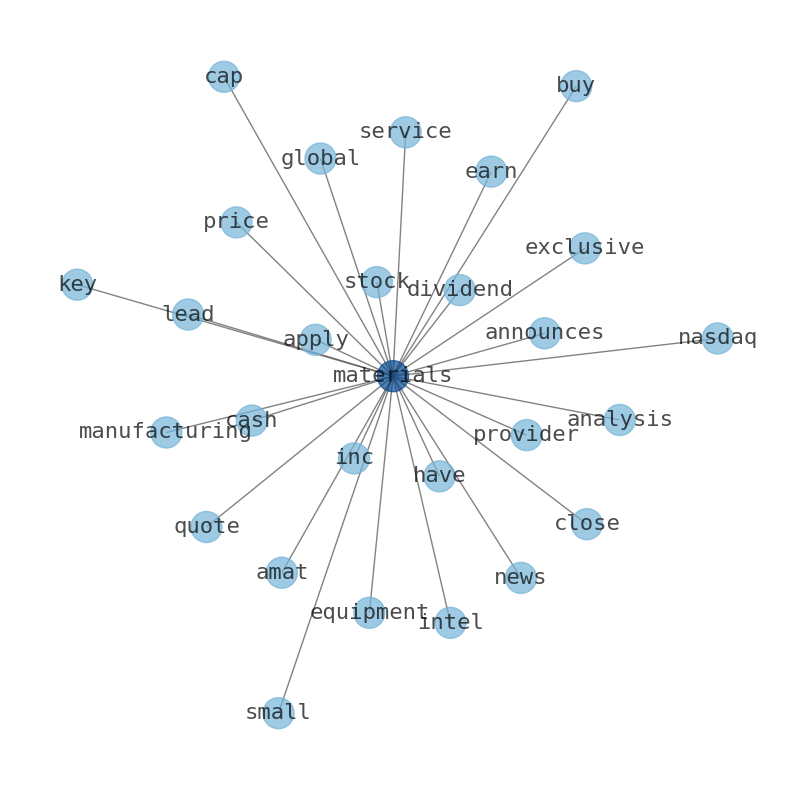

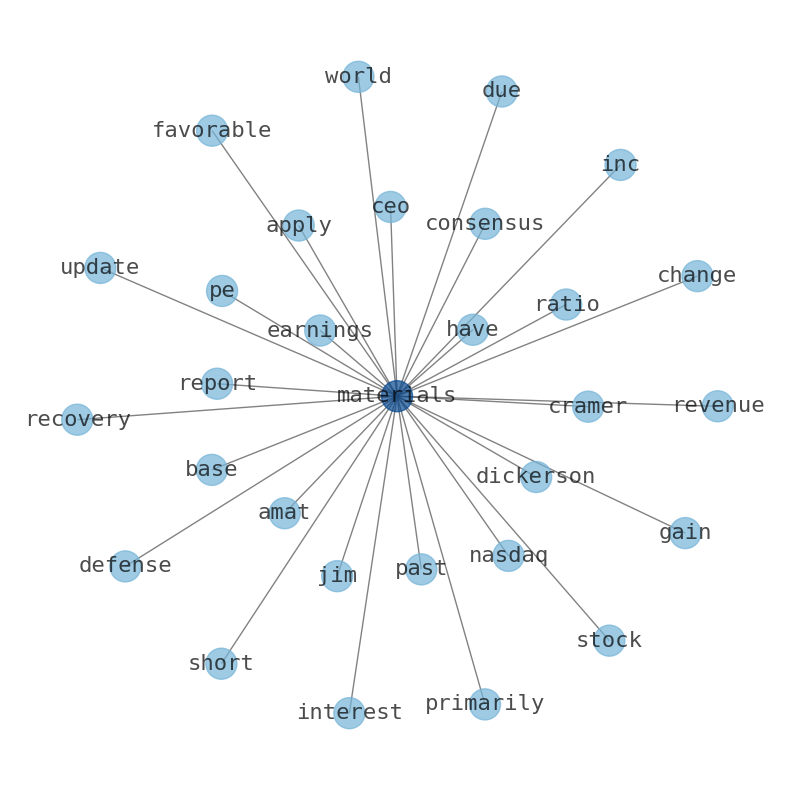

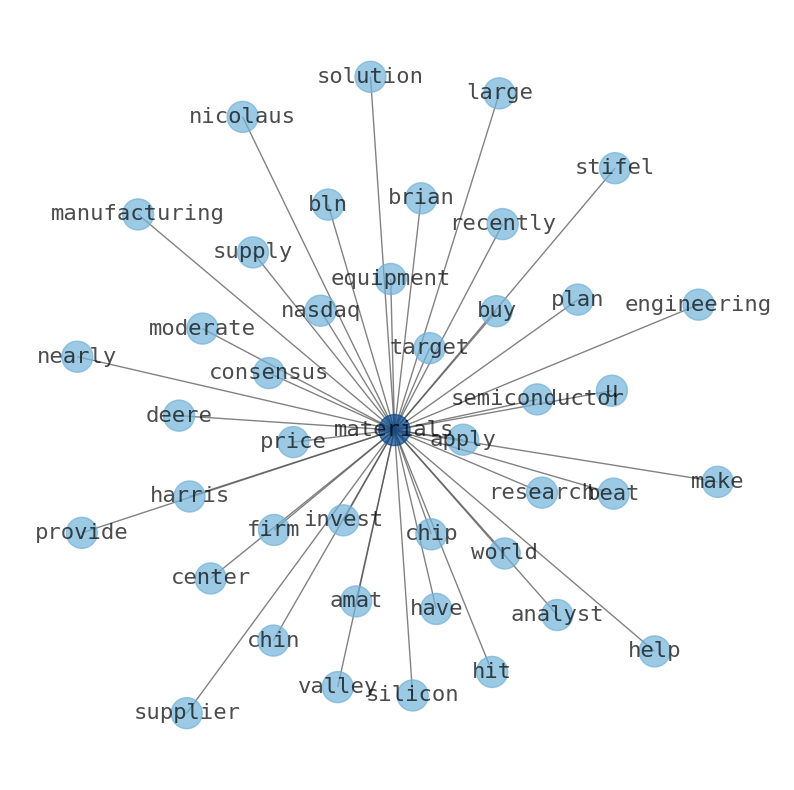

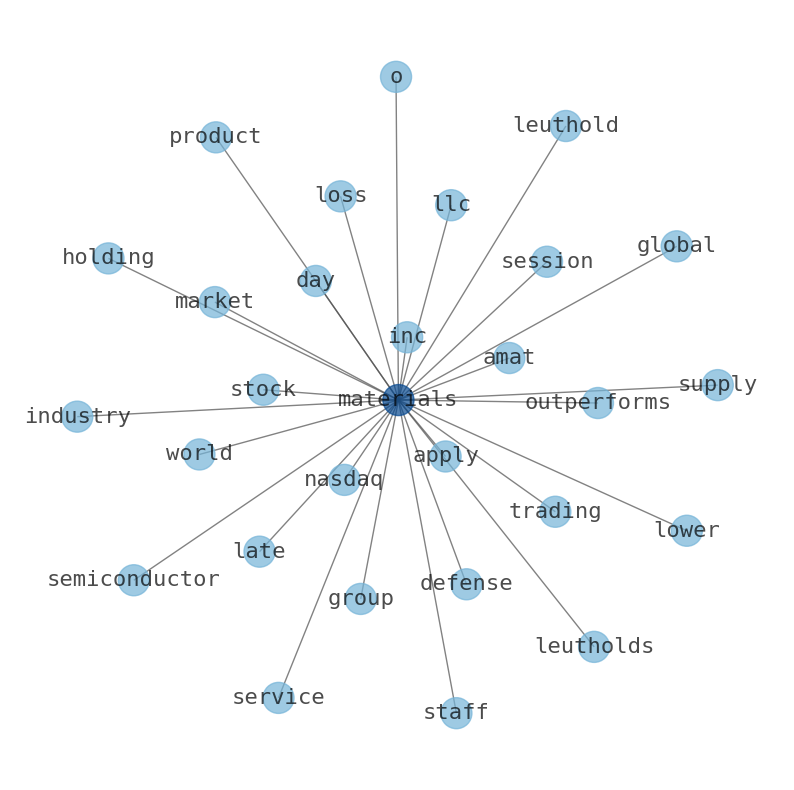

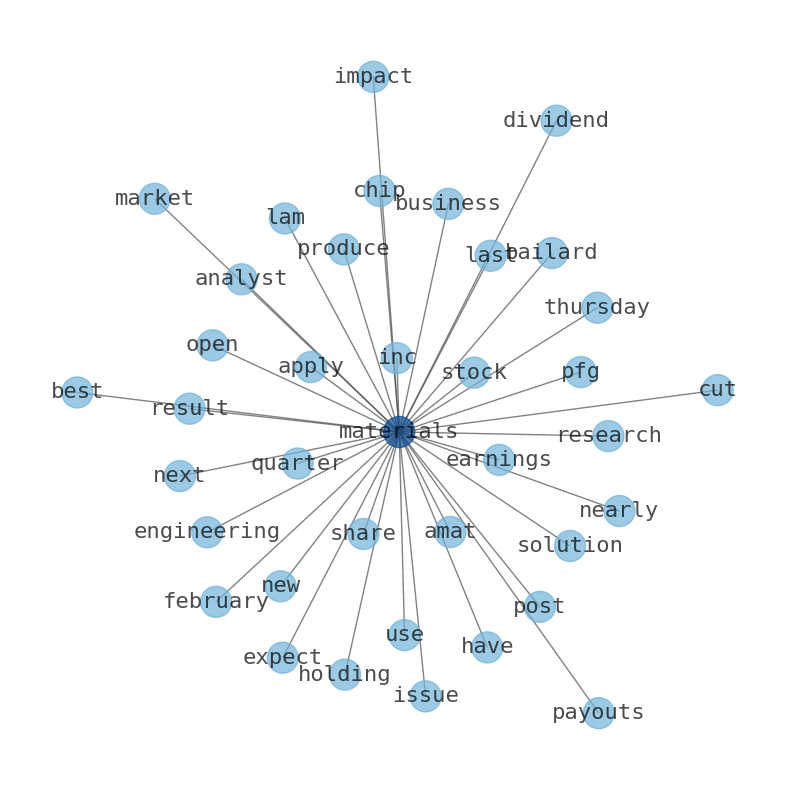

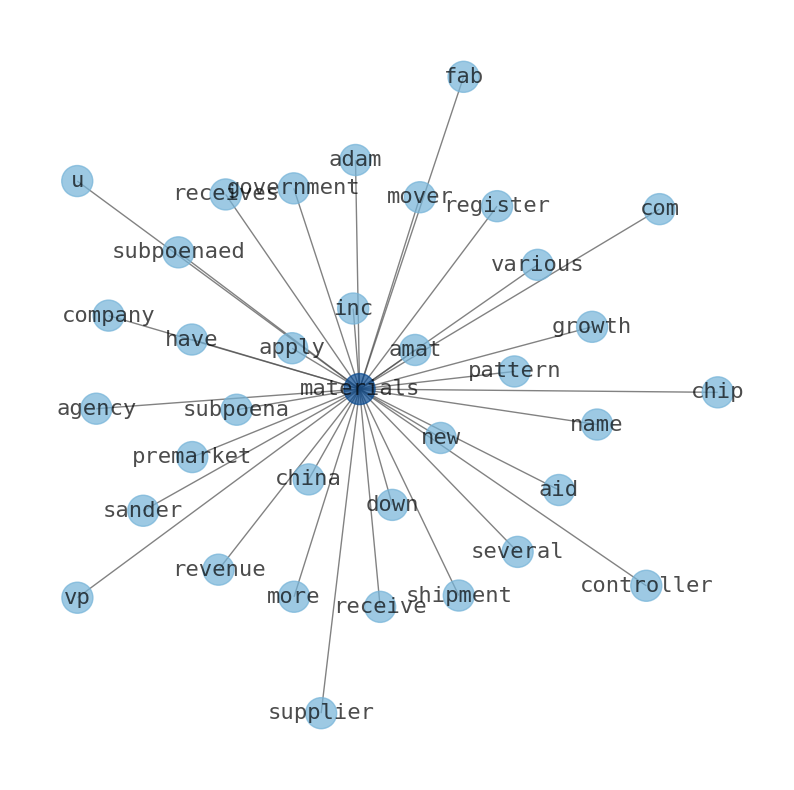

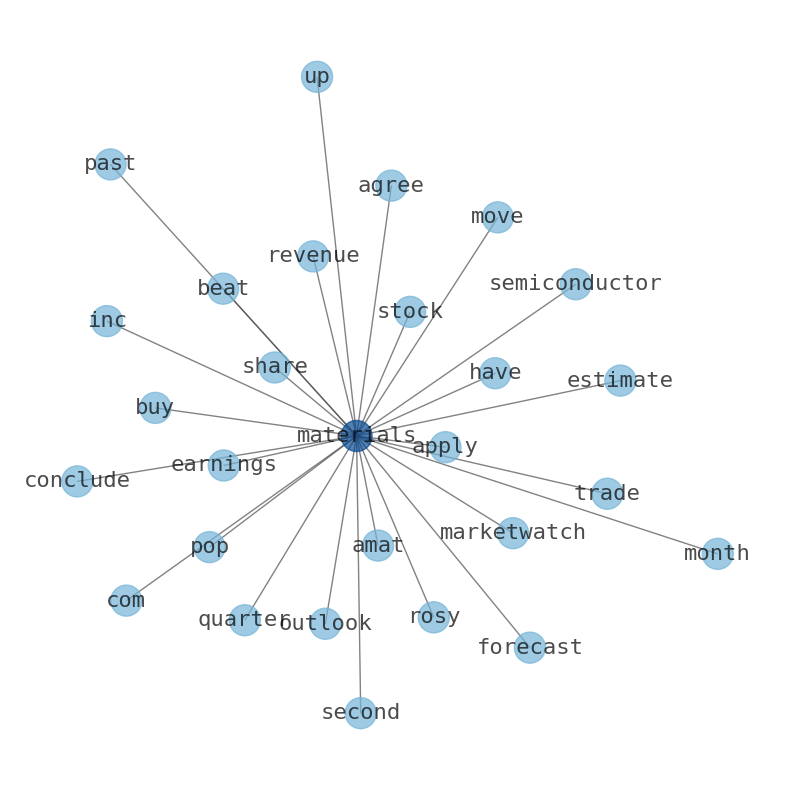

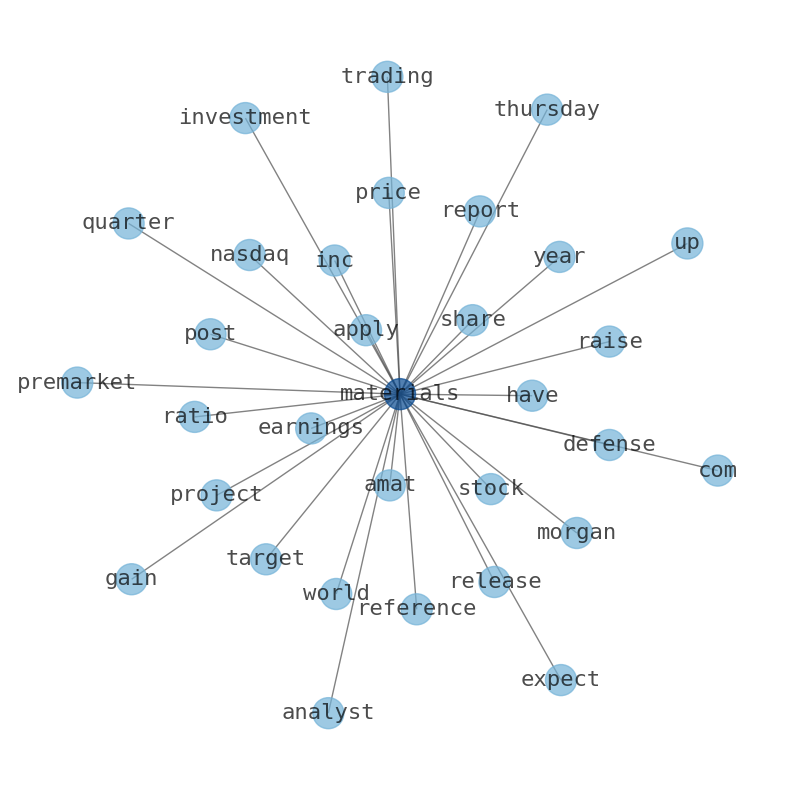

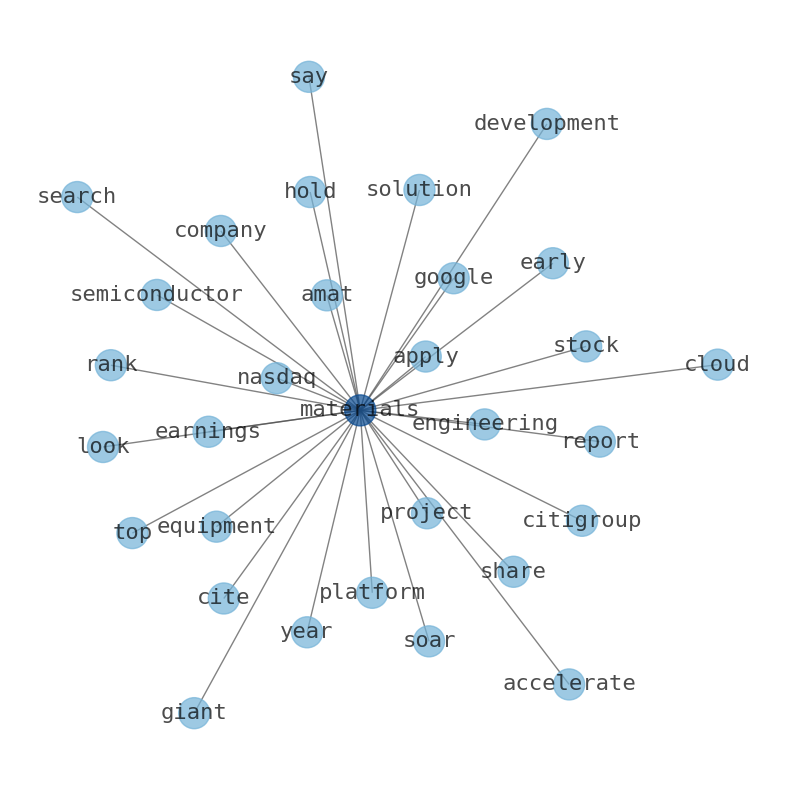

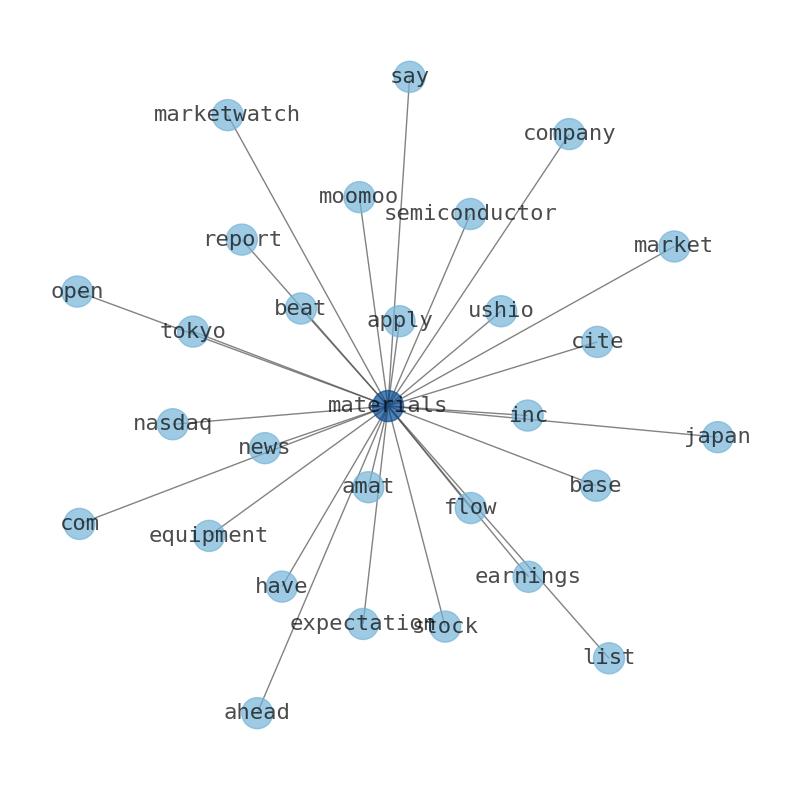

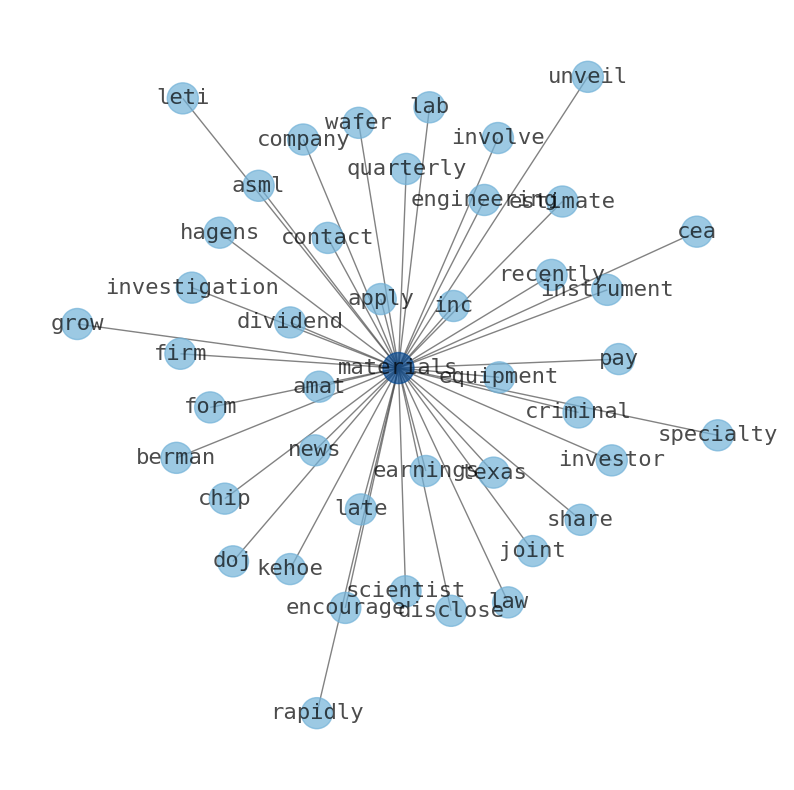

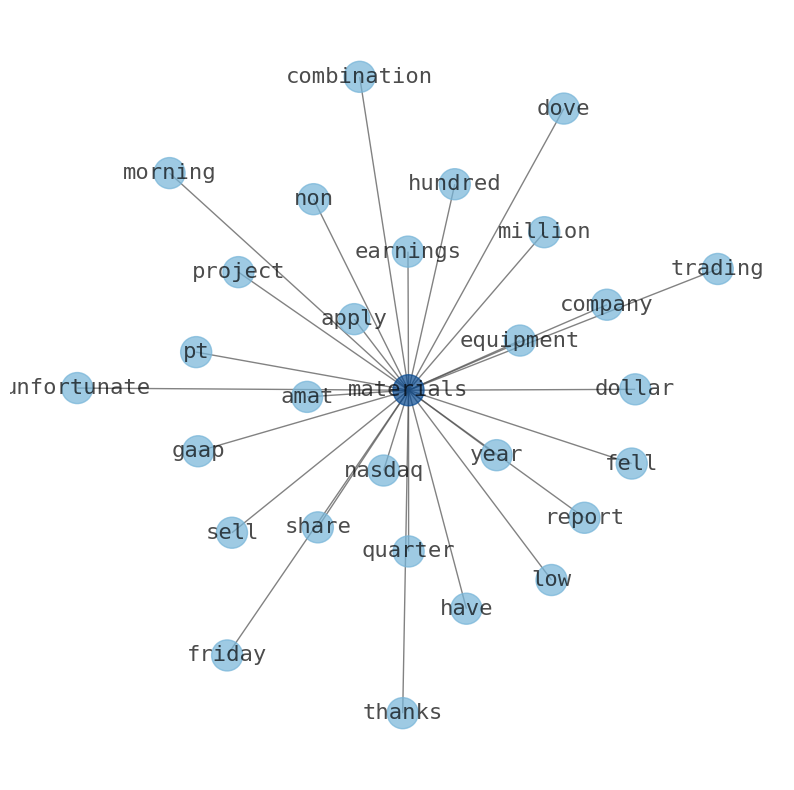

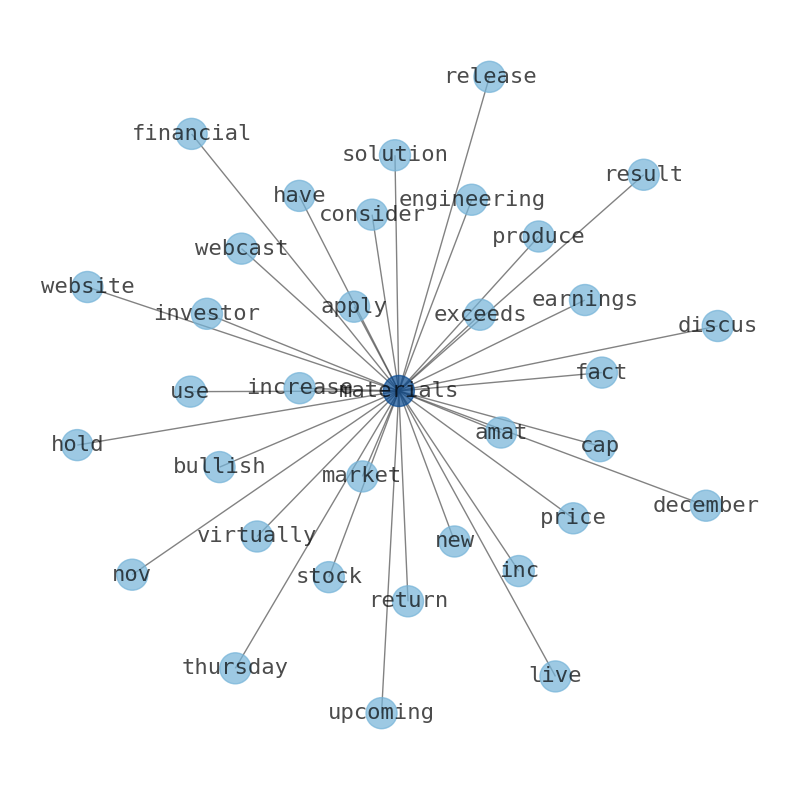

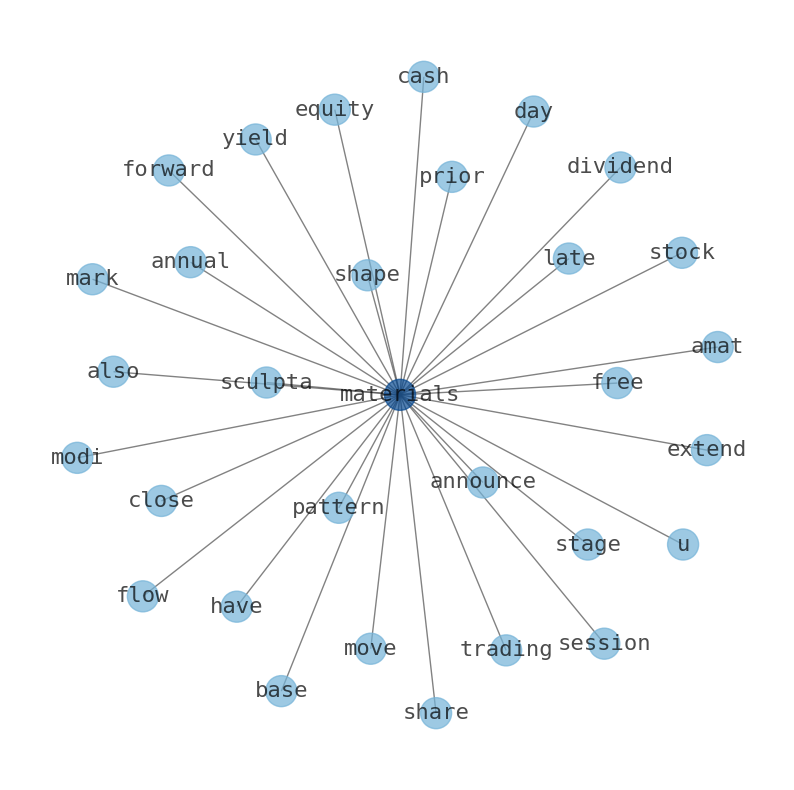

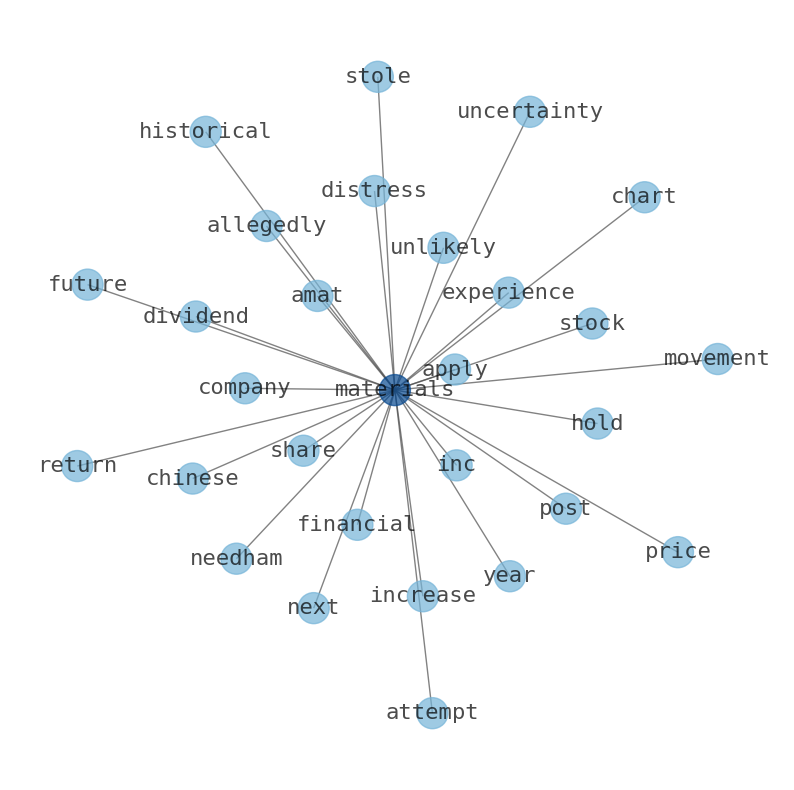

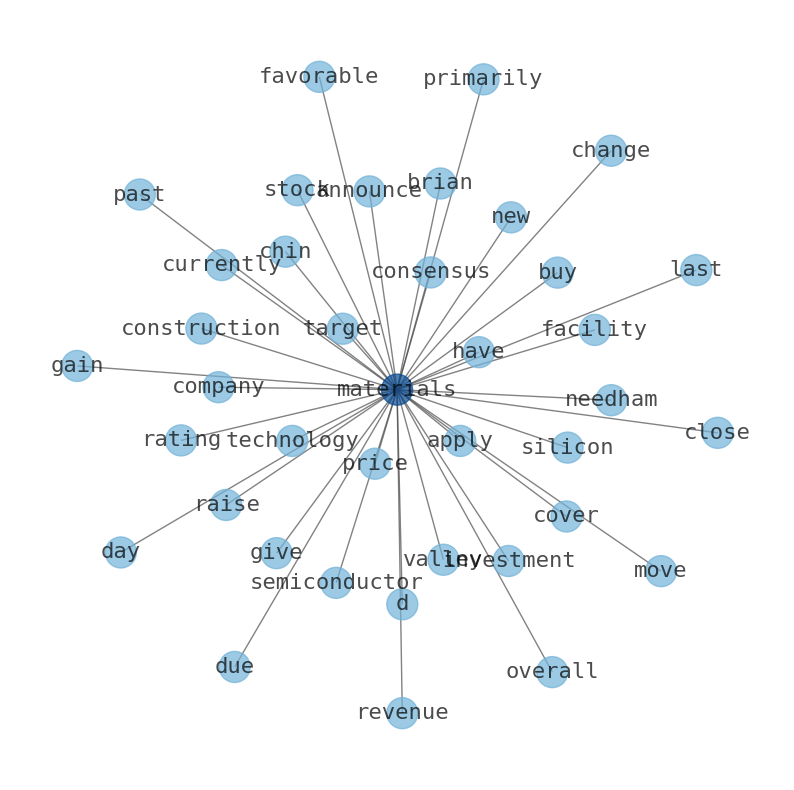

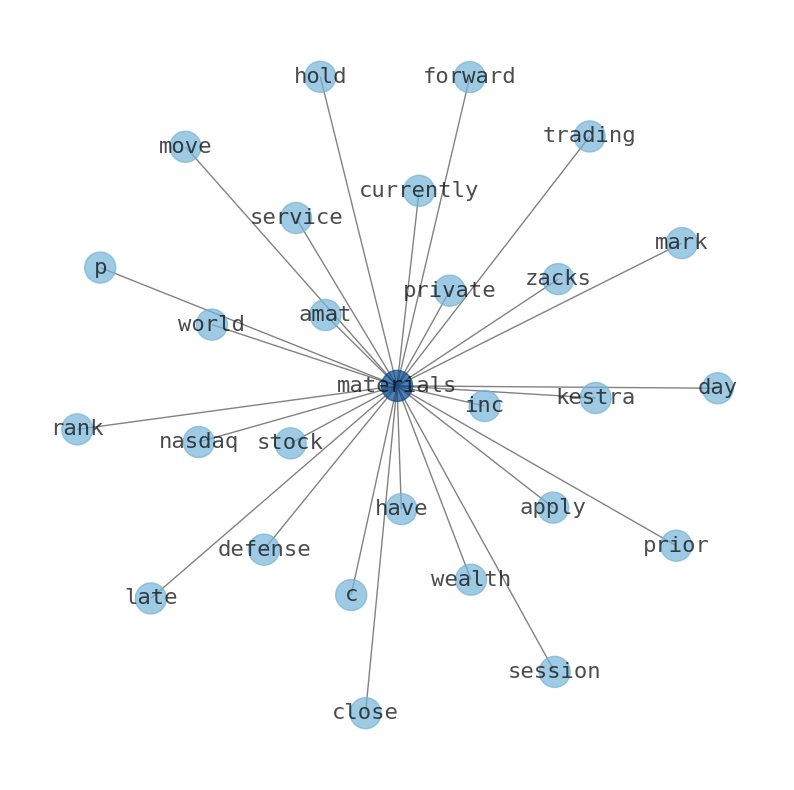

Keywords

Are looking for the most relevant information about Applied Materials? Investor spend a lot of time searching for information to make investment decisions in Applied Materials. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Applied Materials are: Applied, Materials, AMAT, earnings, share, EPS, analyst, and the most common words in the summary are: material, apply, stock, earnings, applied, amat, market, . One of the sentences in the summary was: Long-term prospects look promising, thanks to the demand rebound in China and growing opportunities in the areas of AI and cloud infrastructure.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #material #apply #stock #earnings #applied #amat #market.

Read more →Related Results

Applied Materials

Open: 202.97 Close: 200.56 Change: -2.41

Read more →

Applied Materials

Open: 198.28 Close: 199.73 Change: 1.45

Read more →

Applied Materials

Open: 202.02 Close: 199.57 Change: -2.45

Read more →

Applied Materials

Open: 179.04 Close: 185.84 Change: 6.8

Read more →

Applied Materials

Open: 161.6 Close: 162.05 Change: 0.45

Read more →

Applied Materials

Open: 157.03 Close: 159.19 Change: 2.16

Read more →

Applied Materials

Open: 149.33 Close: 150.34 Change: 1.01

Read more →

Applied Materials

Open: 145.19 Close: 150.68 Change: 5.49

Read more →

Applied Materials

Open: 142.37 Close: 144.23 Change: 1.86

Read more →

Applied Materials

Open: 131.96 Close: 130.45 Change: -1.51

Read more →

Applied Materials

Open: 146.41 Close: 144.57 Change: -1.84

Read more →

Applied Materials

Open: 142.22 Close: 138.83 Change: -3.39

Read more →

Applied Materials

Open: 144.57 Close: 142.74 Change: -1.83

Read more →

Applied Materials

Open: 144.02 Close: 145.47 Change: 1.45

Read more →

Applied Materials

Open: 135.14 Close: 134.63 Change: -0.51

Read more →

Applied Materials

Open: 138.0 Close: 137.08 Change: -0.92

Read more →

Applied Materials

Open: 111.3 Close: 111.68 Change: 0.38

Read more →

Applied Materials

Open: 113.47 Close: 113.46 Change: -0.01

Read more →

Applied Materials

Open: 207.75 Close: 208.41 Change: 0.66

Read more →

Applied Materials

Open: 187.92 Close: 190.33 Change: 2.41

Read more →

Applied Materials

Open: 178.6 Close: 180.31 Change: 1.71

Read more →

Applied Materials

Open: 152.2 Close: 151.25 Change: -0.95

Read more →

Applied Materials

Open: 162.21 Close: 163.3 Change: 1.09

Read more →

Applied Materials

Open: 148.68 Close: 145.12 Change: -3.56

Read more →

Applied Materials

Open: 142.04 Close: 148.59 Change: 6.55

Read more →

Applied Materials

Open: 144.9 Close: 143.17 Change: -1.73

Read more →

Applied Materials

Open: 139.49 Close: 139.75 Change: 0.26

Read more →

Applied Materials

Open: 138.76 Close: 137.45 Change: -1.31

Read more →

Applied Materials

Open: 147.01 Close: 148.0 Change: 0.99

Read more →

Applied Materials

Open: 147.52 Close: 148.01 Change: 0.49

Read more →

Applied Materials

Open: 139.62 Close: 141.54 Change: 1.92

Read more →

Applied Materials

Open: 140.89 Close: 138.93 Change: -1.96

Read more →

Applied Materials

Open: 133.73 Close: 134.83 Change: 1.1

Read more →

Applied Materials

Open: 130.77 Close: 136.06 Change: 5.29

Read more →

Applied Materials

Open: 113.47 Close: 113.46 Change: -0.01

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo