The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Zoetis

Youtube Subscribe

Open: 198.0 Close: 194.63 Change: -3.37

Our AI found unexpected things about Zoetis Company Inc Stock.

How much time have you spent trying to decide whether investing in Zoetis? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Zoetis are: Zoetis, share, …

Stock Summary

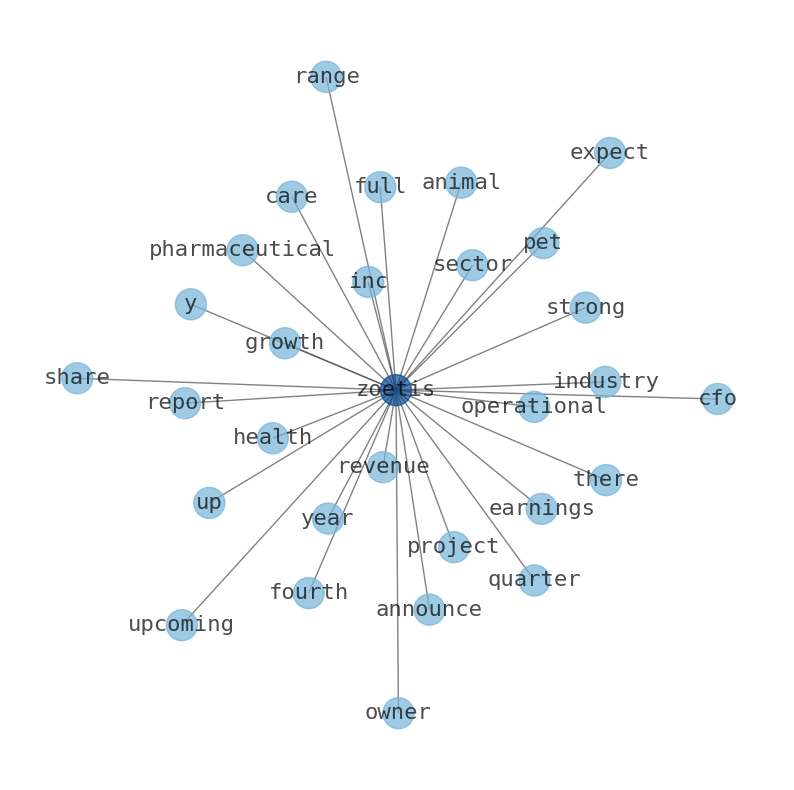

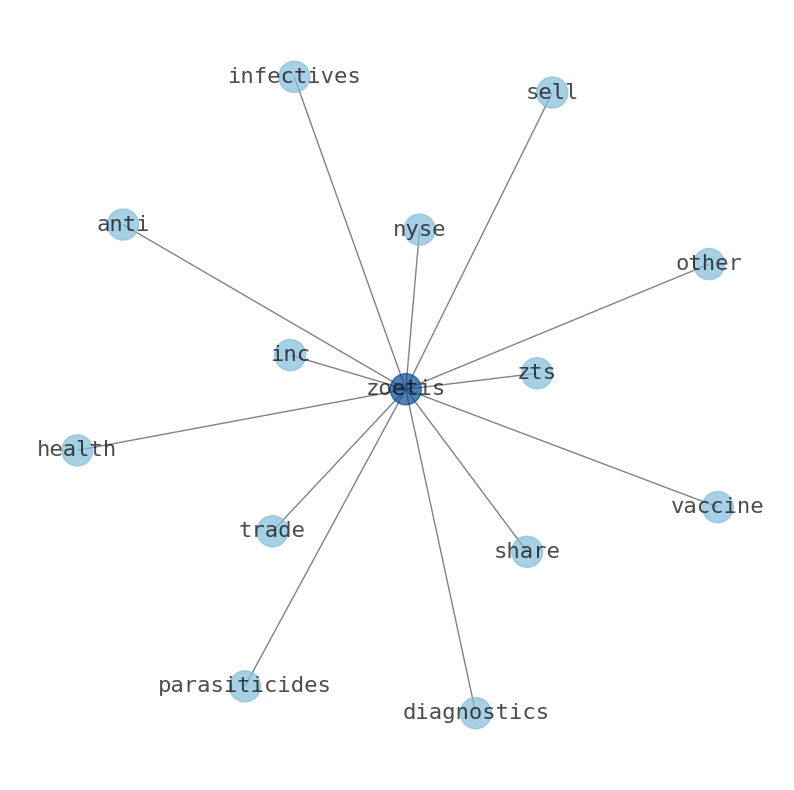

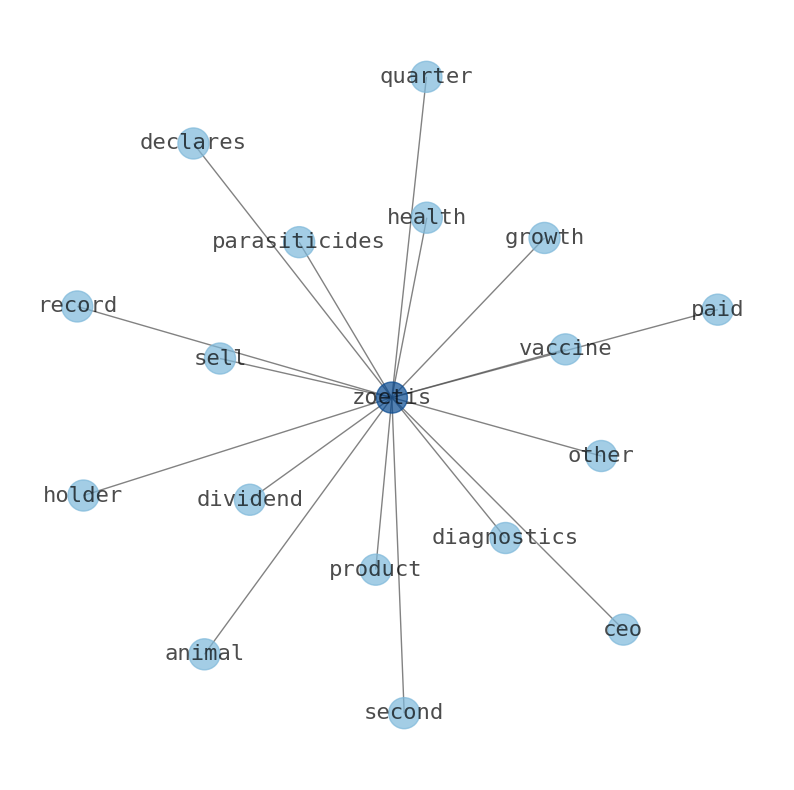

Zoetis Inc. discovers, develops, manufactures, and commercializes animal health medicines, vaccines, and diagnostic products. Zoetes offers products primarily across species, including livestock, such as cattle, swine, poultry, fish,.

Today's Summary

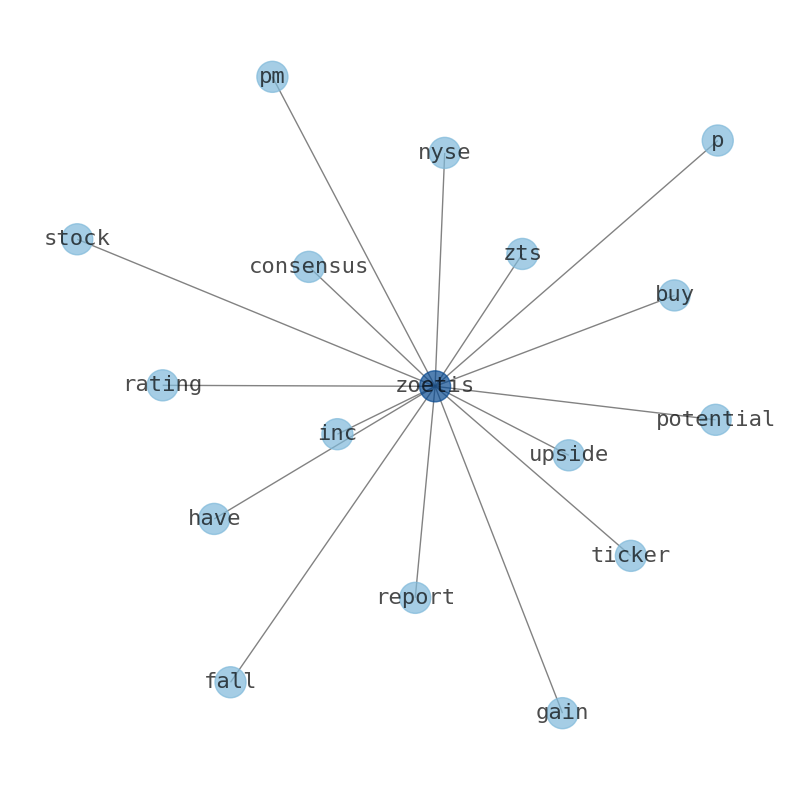

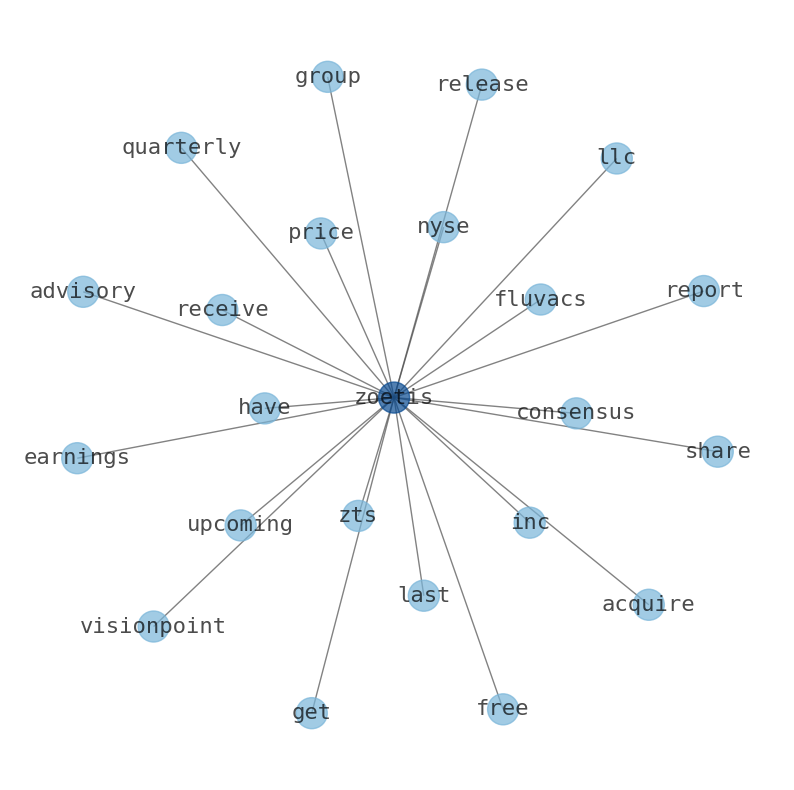

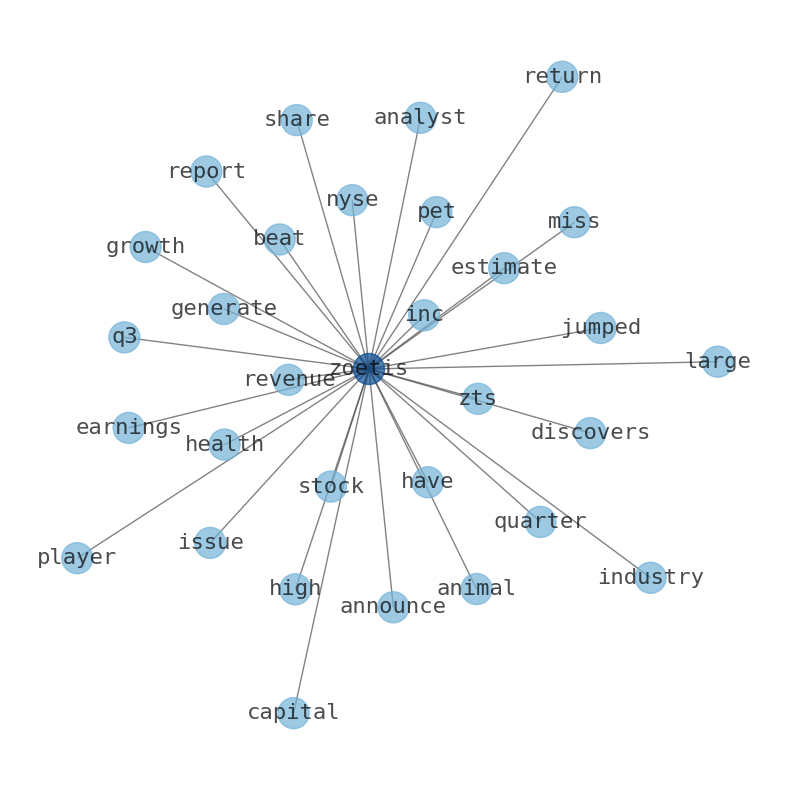

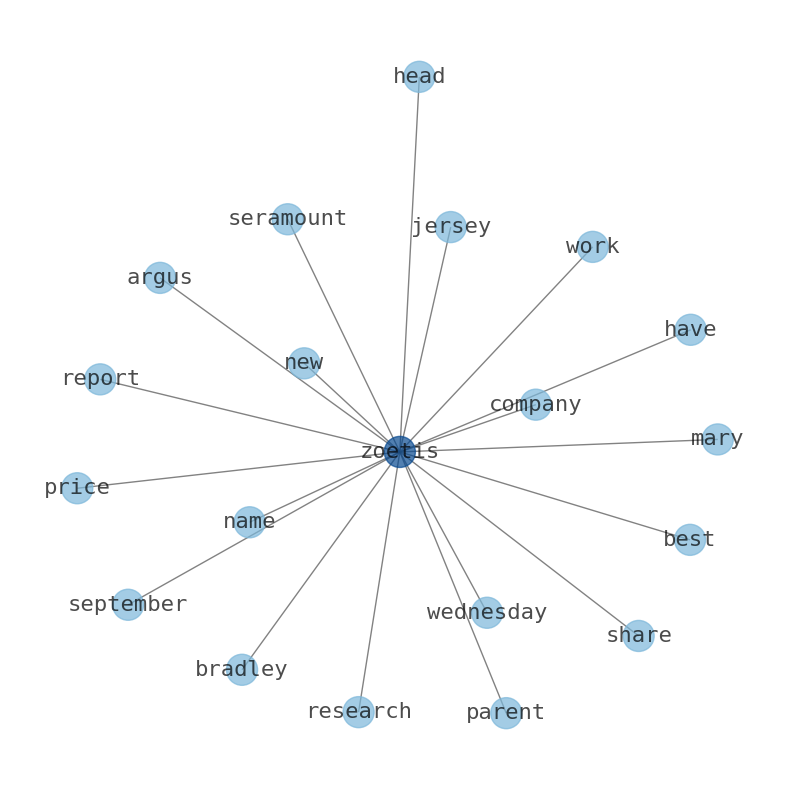

Zoetis Inc. (NYSE:ZTS) share price could signal some risk. Argus lifted their price objective on shares from $190.00 to $201.00 in a report on Tuesday, September 19th. Piper Sandler gave the company an “overweight” rating.

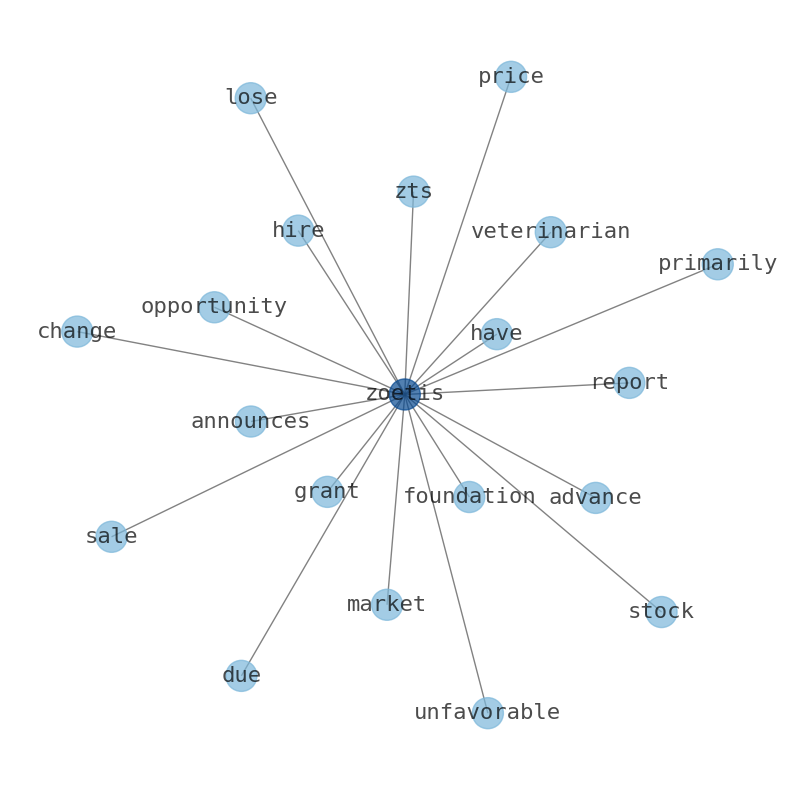

Today's News

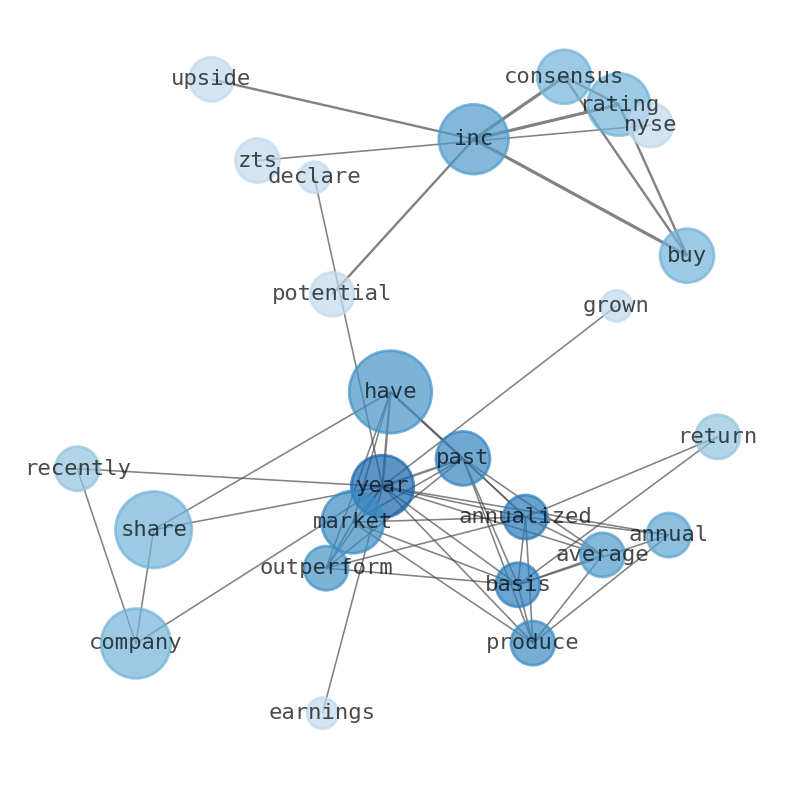

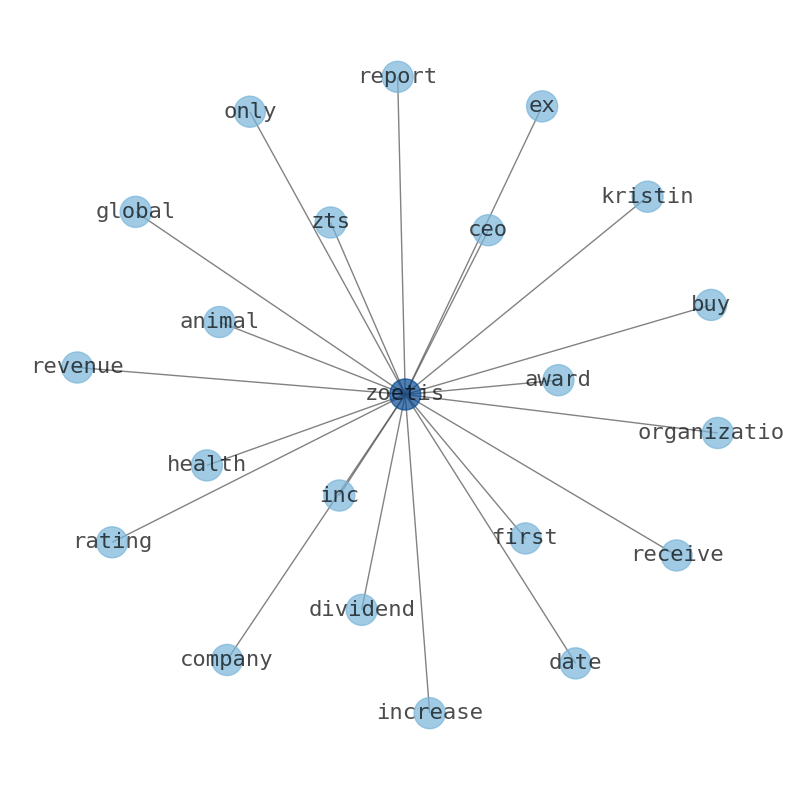

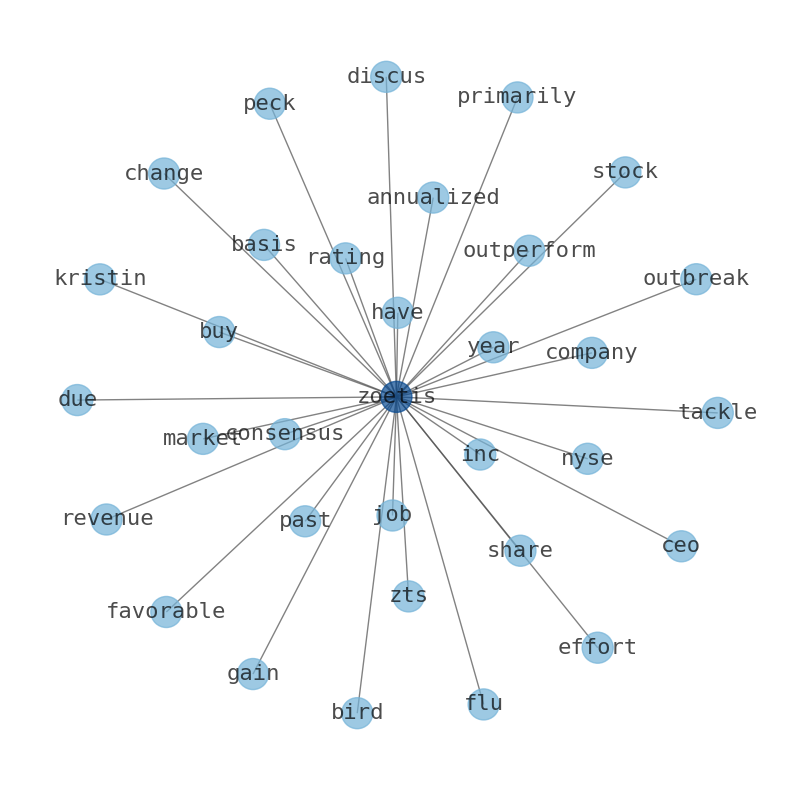

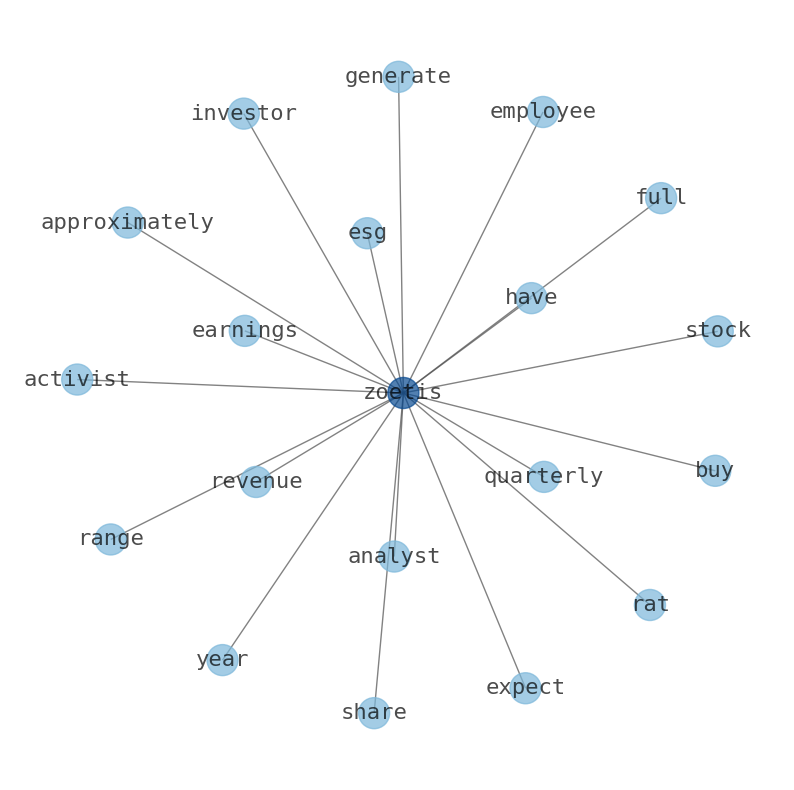

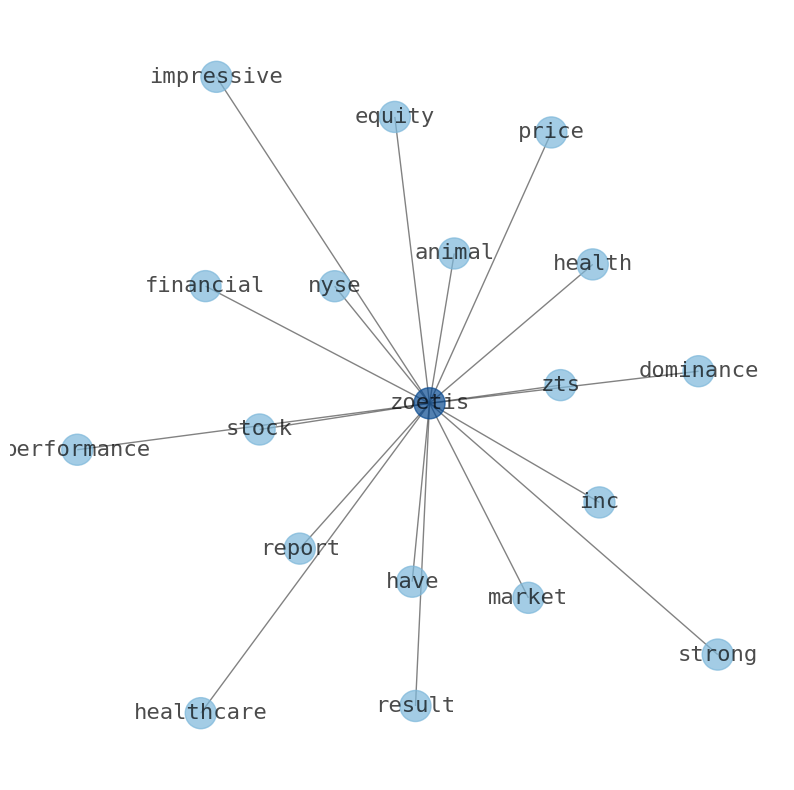

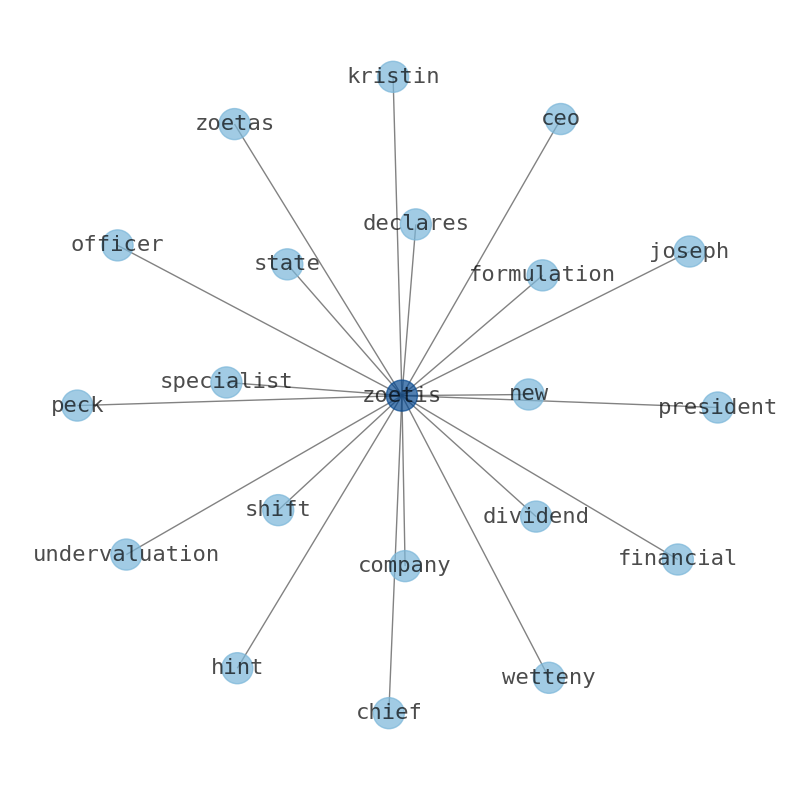

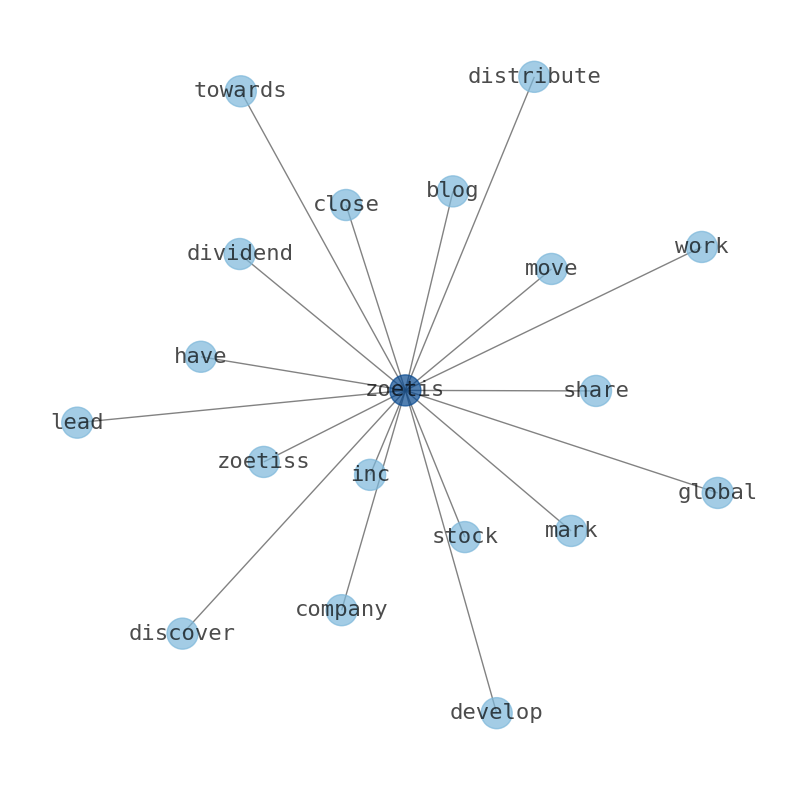

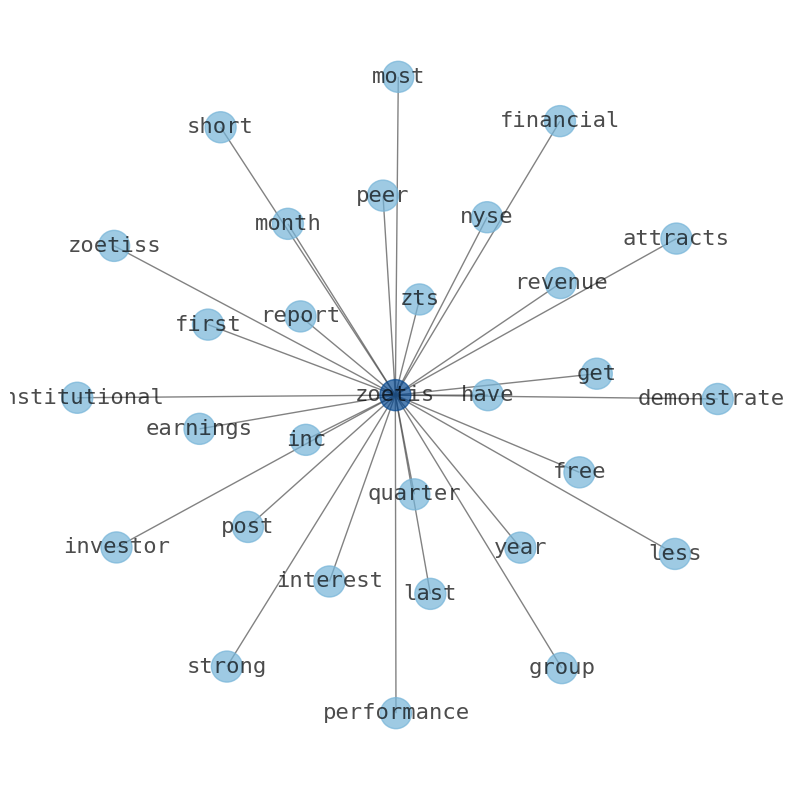

Zoetis stock has gained 47% since 2019 primarily due to favorable change in revenues. Zoeti CEO Kristin Peck discusses efforts to tackle the bird flu outbreak on The Claman Countdown. Zoetis Inc. (NYSE:ZTS) share price could signal some risk. Zoeti has grown earnings per share at 16% per year over the past five years. The company recently declared a quarterly dividend, which will be paid on March 1st. Argus lifted their price objective on shares of Zoetis from $190.00 to $201.00 in a report on Tuesday, September 19th. Piper Sandler gave the company an “overweight” rating on Monday, November 6th. BNP Paribas initiated coverage on shares on Thursday, December 7th. Zoetis has outperformed the market over the past 5 years by 3.99% on an annualized basis producing an average annual return of 15.54%. Zoetiss short percent of float has risen 4.62% since its last report. Zoetis is committed to equal opportunity in the terms and conditions of employment for all employees and job applicants without regard to race, color, religion, sex, sexual orientation, age, gender identity or gender expression, national origin, disability or veteran status. All applicants must possess or obtain authorization to work in the US. Germany Police Dog Healthcare Feeds Market Growing Rapidly with Latest Trend and Future scope with Top Key Players- Zoetis, Merck Animal Health, Boehr. Leading key players in the Police Dog. Healthcare feeds market research report has also illustrated the latest strategic developments. Zoetis seeks information related to job applications from candidates for jobs in the U.S. solely via the following: (1) our company website at www.Zoetis.com/careers site, or (2) via email to/from addresses using only the Zoetas domain of [Register to View] PoultryView 360 is a new value-added digital system for iPhone apps that features special needsadasancer126Still cruising scrollspr PIDigmaticOWacey Zoetis (NYSE:ZTS) has outperformed the market over the past 5 years by 3.99% on an annualized basis producing an average annual return of 15.54%. The company recently reported that it has 3.34 million shares sold short, which is 0.73% of all regular shares that a company owns. Zoetis Inc. - consensus buy rating and 9.5% upside potential. Zoetes Inc. – Consensus ‘buy rating and 10.6% Upside Potential Zoetas Inc. (Zoetis inc. - Consensus buy rating)

Stock Profile

"Zoetis Inc. discovers, develops, manufactures, and commercializes animal health medicines, vaccines, and diagnostic products in the United States and internationally. It commercializes products primarily across species, including livestock, such as cattle, swine, poultry, fish, and sheep and others; and companion animals comprising dogs, cats, and horses. The company also offers parasiticides; vaccines; anti-infectives; other pharmaceutical products; dermatology; and medicated feed additives. In addition, the company provides animal health diagnostics, including point-of-care diagnostic products and laboratory; and other non-pharmaceutical products. It markets its products to veterinarians, livestock producers, and pet owners. The company was founded in 1952 and is headquartered in Parsippany, New Jersey."

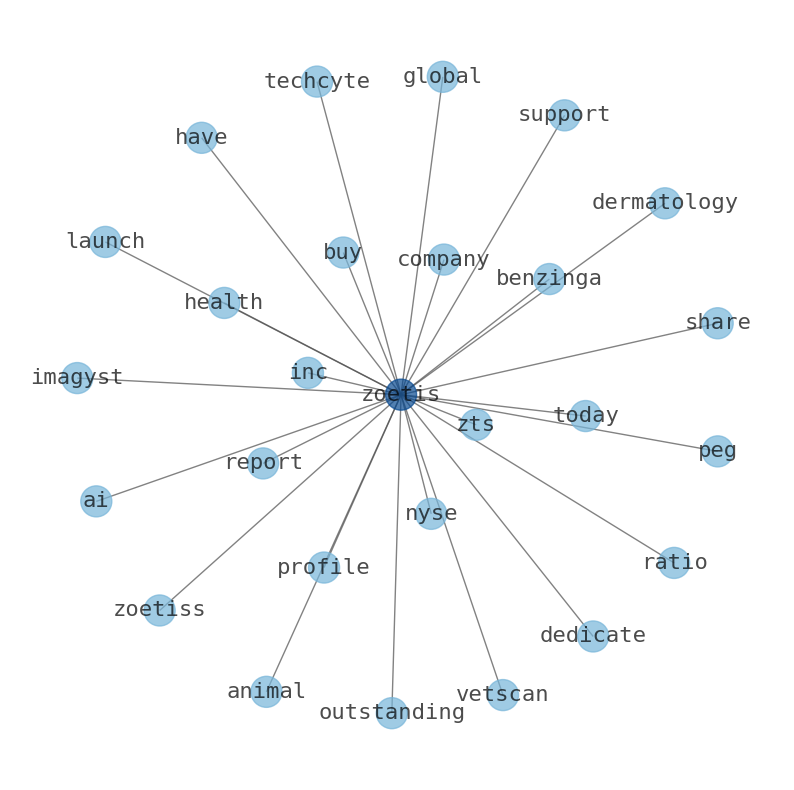

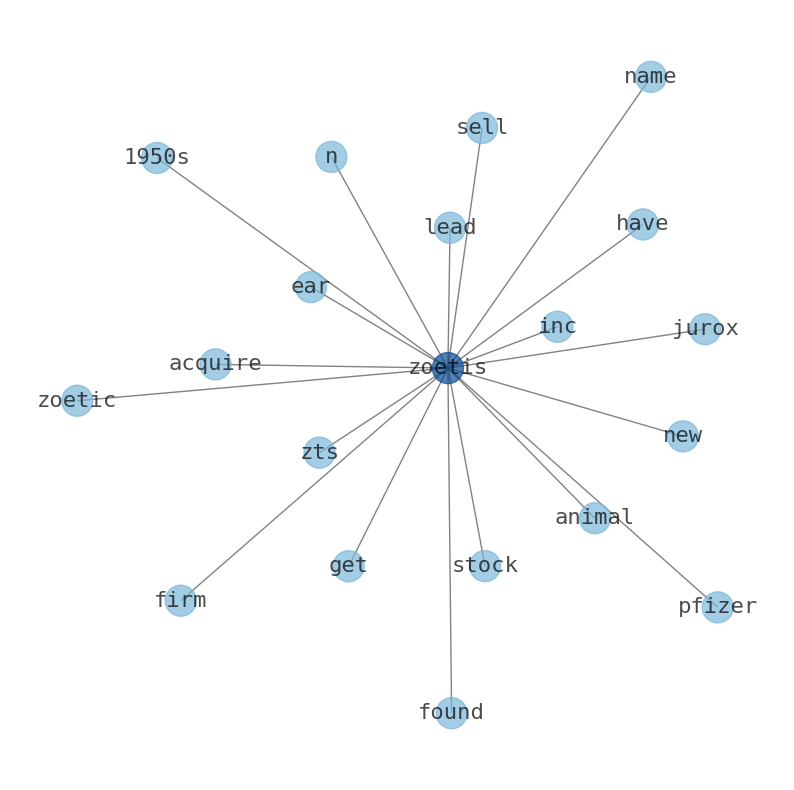

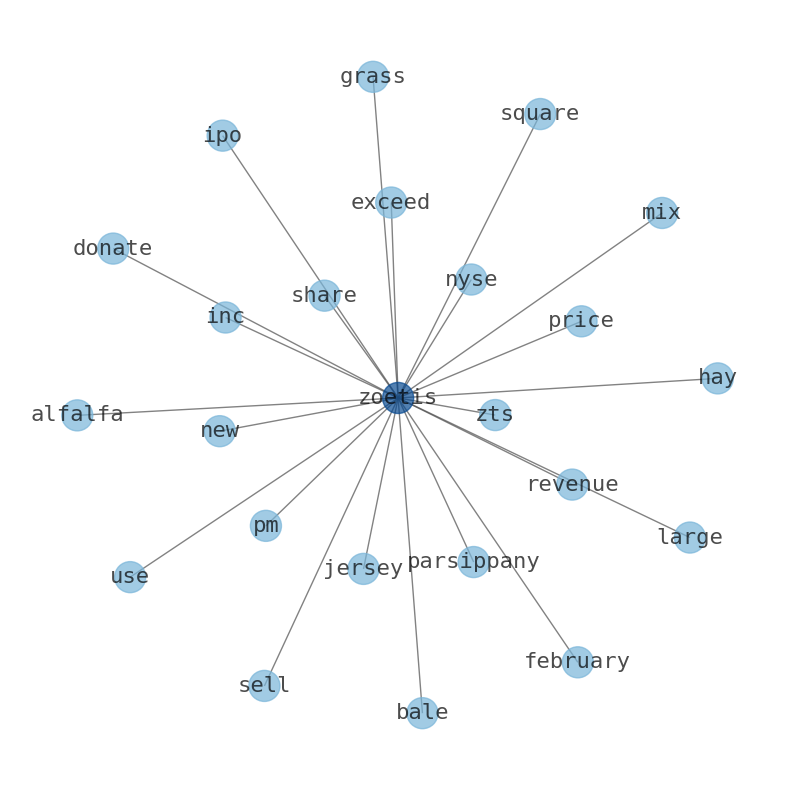

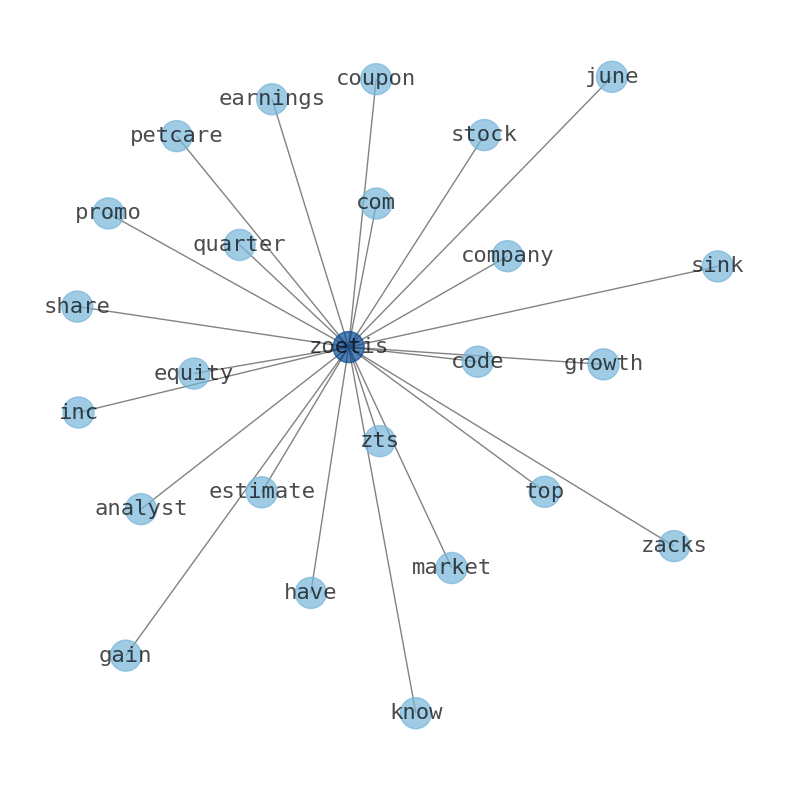

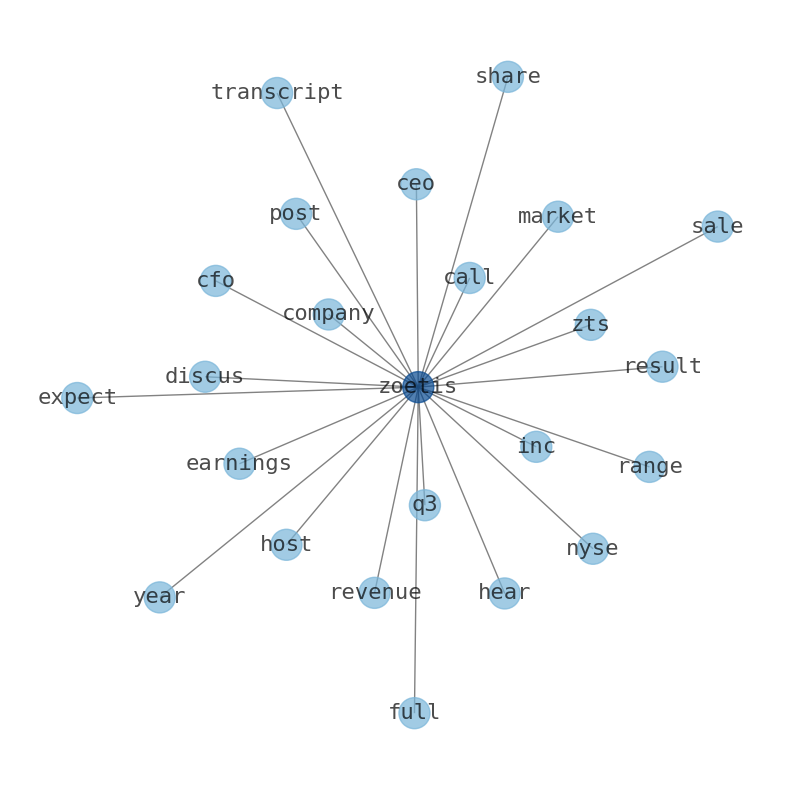

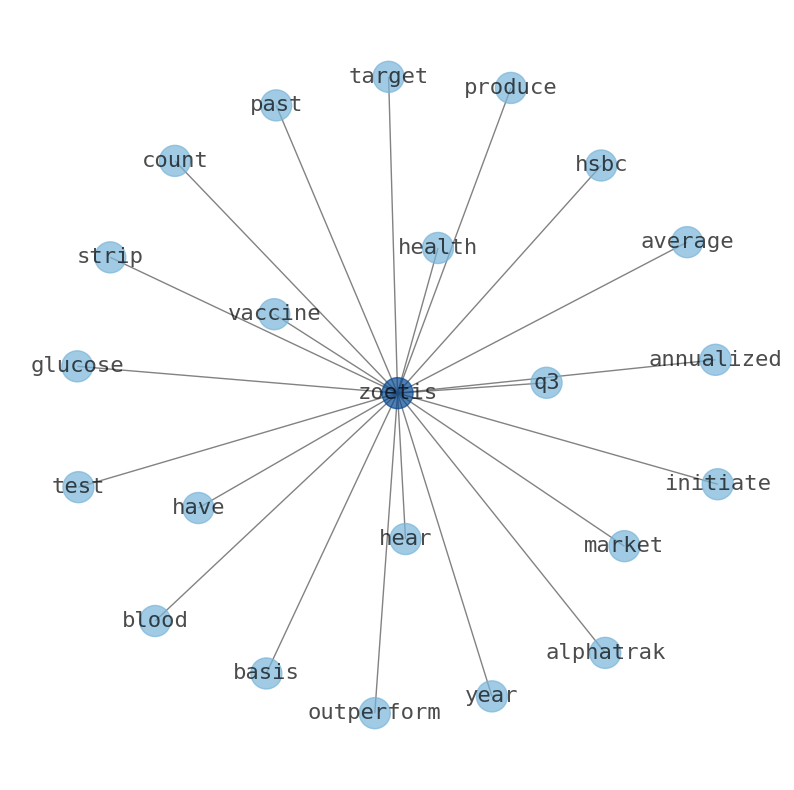

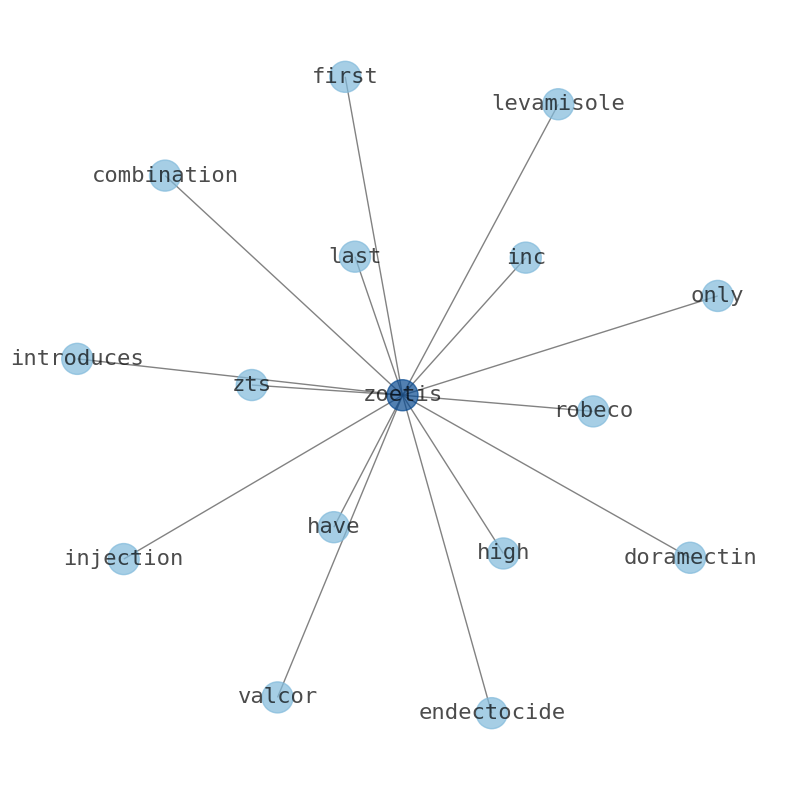

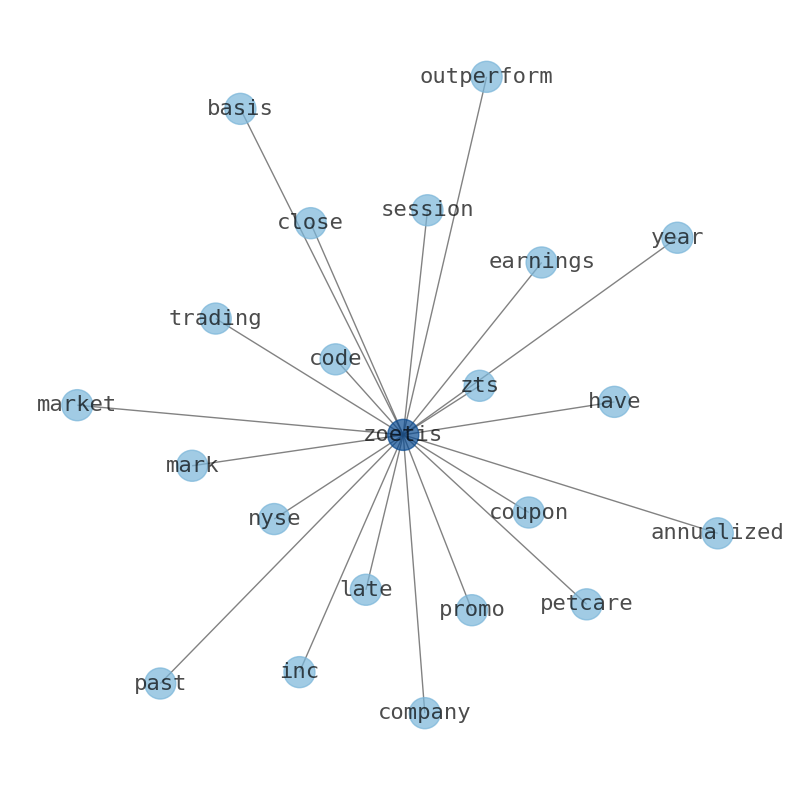

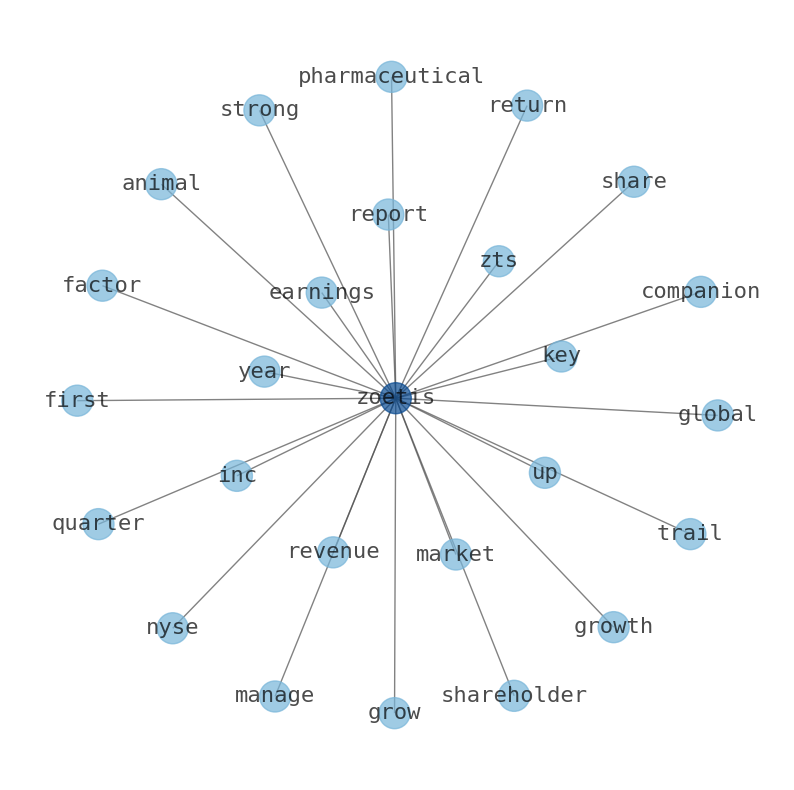

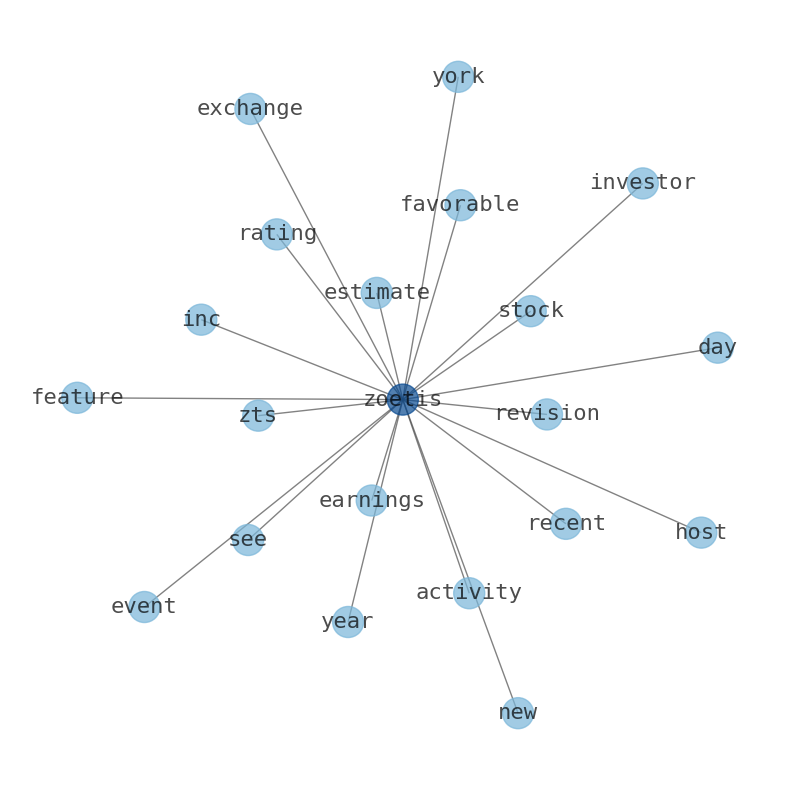

Keywords

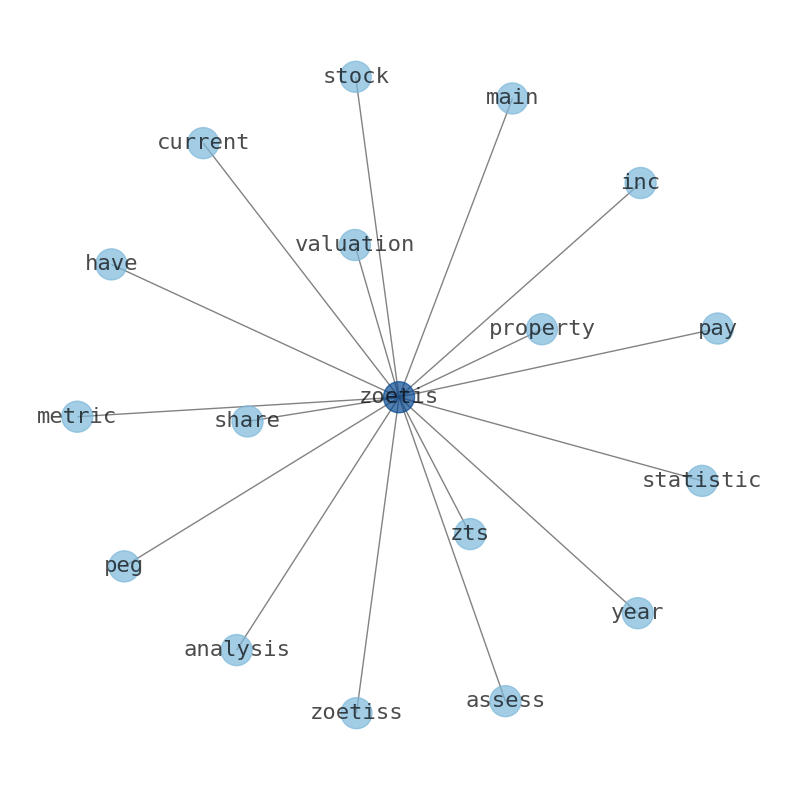

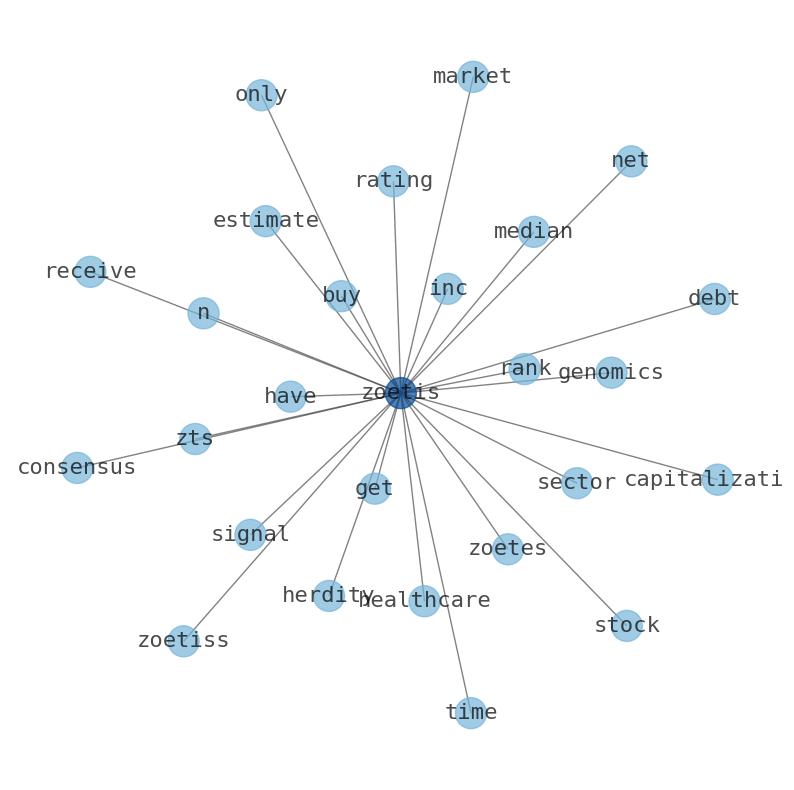

The game is changing. There is a new strategy to evaluate Zoetis fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Zoetis are: Zoetis, share, company, Inc, year, report, rating, and the most common words in the summary are: zoetis, market, price, stock, share, pet, news, . One of the sentences in the summary was: Argus lifted their price objective on shares from $190.00 to $201.00 in a report on Tuesday, September 19th. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #zoetis #market #price #stock #share #pet #news.

Read more →Related Results

Zoetis

Open: 189.4 Close: 188.39 Change: -1.01

Read more →

Zoetis

Open: 188.3 Close: 188.35 Change: 0.05

Read more →

Zoetis

Open: 190.57 Close: 188.38 Change: -2.19

Read more →

Zoetis

Open: 194.88 Close: 195.5 Change: 0.62

Read more →

Zoetis

Open: 198.0 Close: 194.63 Change: -3.37

Read more →

Zoetis

Open: 199.41 Close: 196.29 Change: -3.12

Read more →

Zoetis

Open: 177.87 Close: 175.79 Change: -2.08

Read more →

Zoetis

Open: 176.64 Close: 178.73 Change: 2.09

Read more →

Zoetis

Open: 174.32 Close: 176.06 Change: 1.74

Read more →

Zoetis

Open: 170.97 Close: 170.63 Change: -0.34

Read more →

Zoetis

Open: 156.42 Close: 151.44 Change: -4.98

Read more →

Zoetis

Open: 157.93 Close: 156.03 Change: -1.9

Read more →

Zoetis

Open: 178.87 Close: 181.98 Change: 3.11

Read more →

Zoetis

Open: 181.05 Close: 181.57 Change: 0.52

Read more →

Zoetis

Open: 172.53 Close: 183.51 Change: 10.98

Read more →

Zoetis

Open: 165.7 Close: 171.65 Change: 5.95

Read more →

Zoetis

Open: 165.66 Close: 164.69 Change: -0.97

Read more →

Zoetis

Open: 176.99 Close: 176.35 Change: -0.64

Read more →

Zoetis

Open: 195.59 Close: 197.32 Change: 1.73

Read more →

Zoetis

Open: 189.21 Close: 191.52 Change: 2.31

Read more →

Zoetis

Open: 195.92 Close: 192.93 Change: -2.99

Read more →

Zoetis

Open: 196.0 Close: 194.66 Change: -1.34

Read more →

Zoetis

Open: 198.0 Close: 195.92 Change: -2.08

Read more →

Zoetis

Open: 182.46 Close: 181.83 Change: -0.63

Read more →

Zoetis

Open: 178.11 Close: 176.97 Change: -1.14

Read more →

Zoetis

Open: 174.32 Close: 176.06 Change: 1.74

Read more →

Zoetis

Open: 168.68 Close: 168.83 Change: 0.15

Read more →

Zoetis

Open: 164.25 Close: 162.23 Change: -2.02

Read more →

Zoetis

Open: 156.42 Close: 152.83 Change: -3.59

Read more →

Zoetis

Open: 174.29 Close: 175.63 Change: 1.34

Read more →

Zoetis

Open: 181.86 Close: 180.81 Change: -1.05

Read more →

Zoetis

Open: 180.14 Close: 178.63 Change: -1.51

Read more →

Zoetis

Open: 169.2 Close: 169.35 Change: 0.15

Read more →

Zoetis

Open: 162.96 Close: 164.3 Change: 1.34

Read more →

Zoetis

Open: 178.99 Close: 177.73 Change: -1.26

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo