The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Yum! Brands

Youtube Subscribe

Open: 135.05 Close: 134.28 Change: -0.77

The best way to get information about Yum! Brands Company Inc: Use an AI.

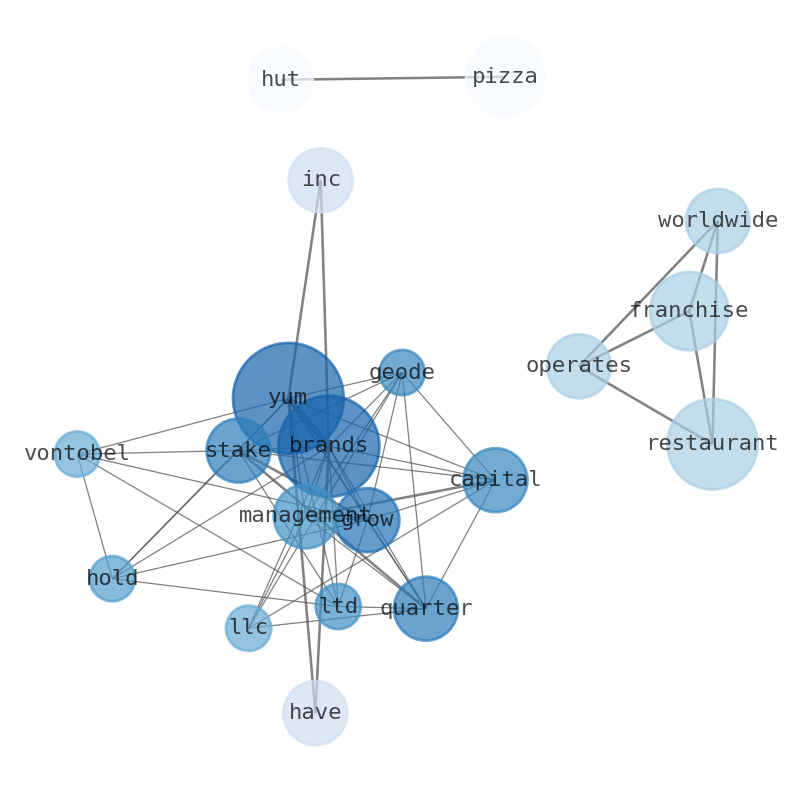

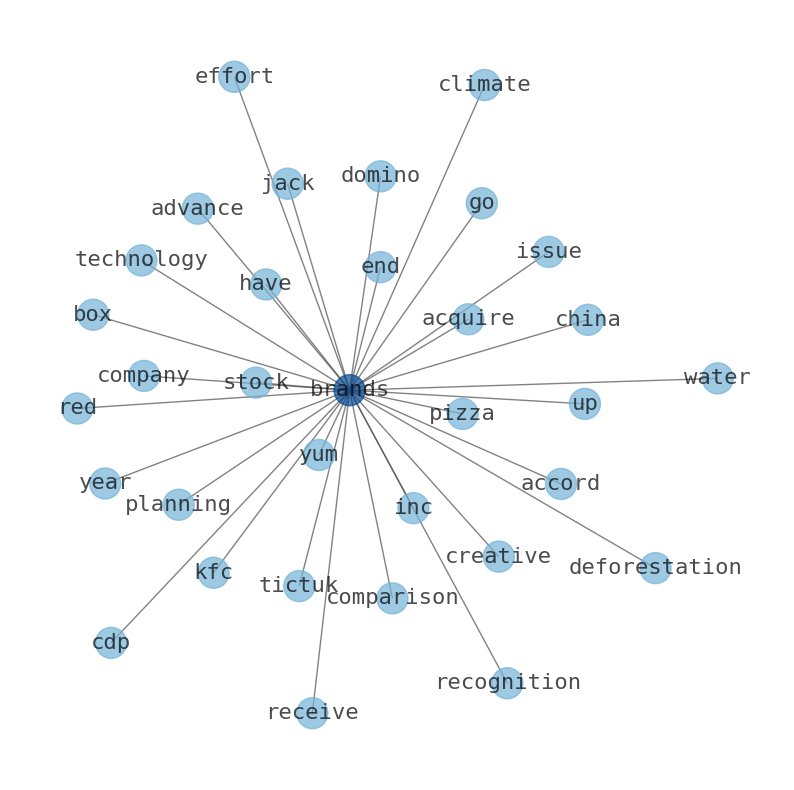

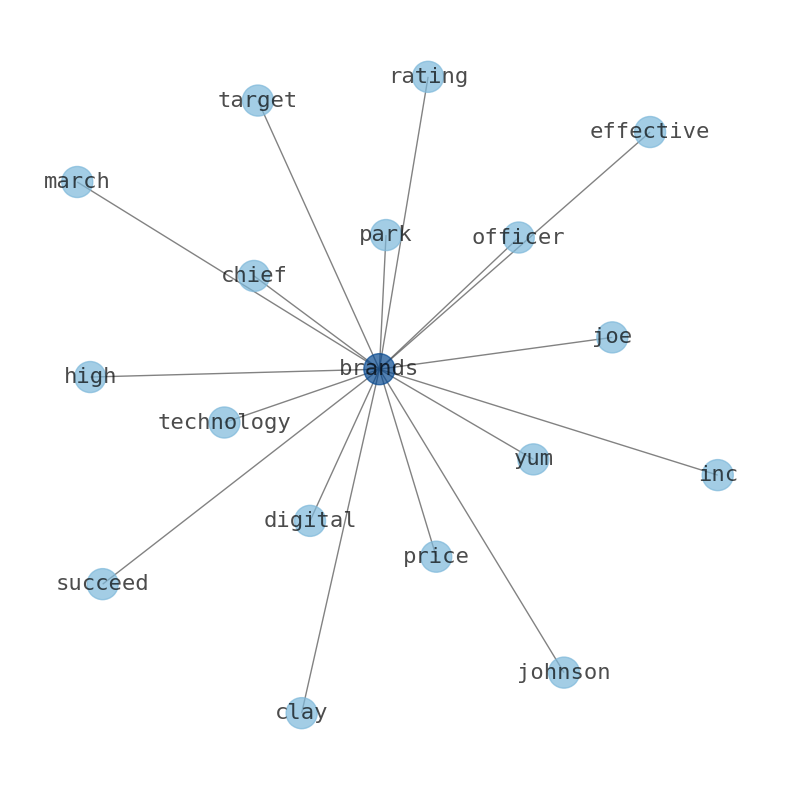

This document will help you to evaluate Yum! Brands without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Yum! Brands are: Yum, Brands, restaurant, franchise, grow, stake, quarter, …

Stock Summary

Yum! Brands, Inc. operates restaurants under the KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill brands. The company was formerly known as TRICON Global Restaurants, Inc..

Today's Summary

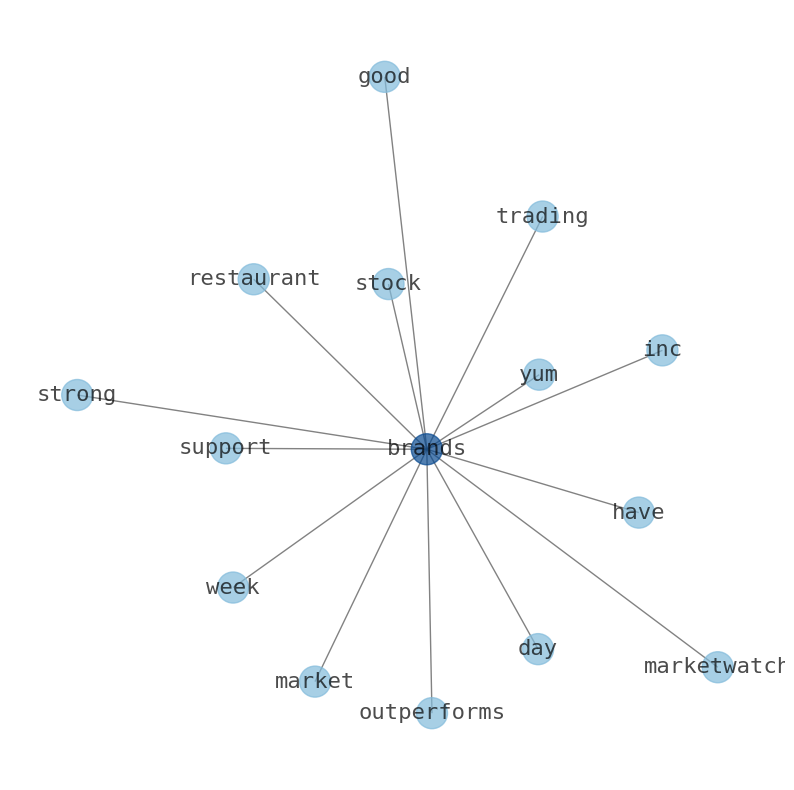

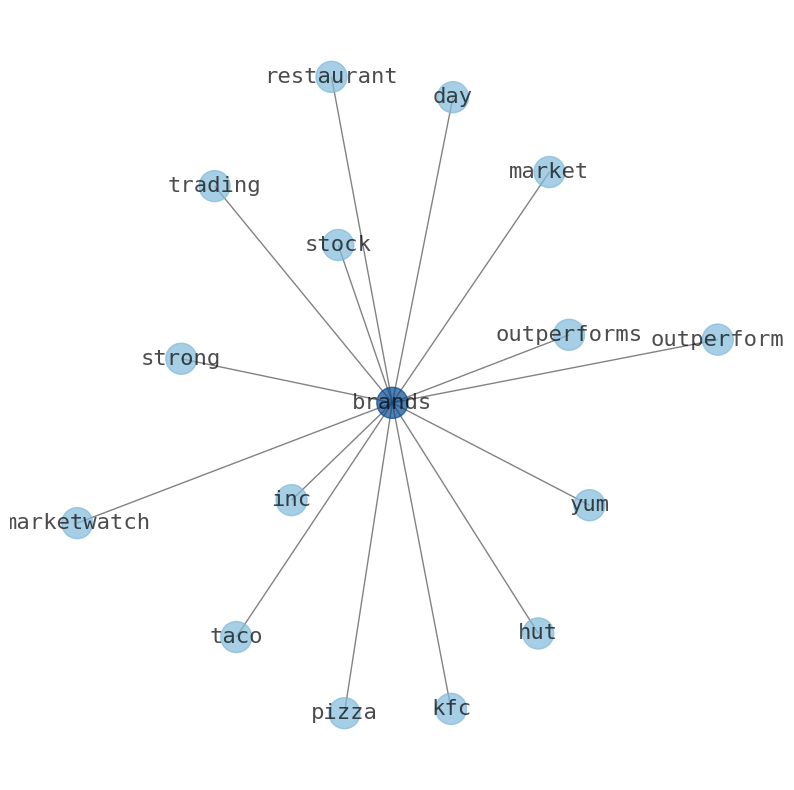

Yum! Brands stock has shown strong growth over the last year, with a current range of $103.96 to $143.24. KFC, Pizza Hut and Taco Bell are global leaders of the chicken, pizza and Mexican-style food categories.

Today's News

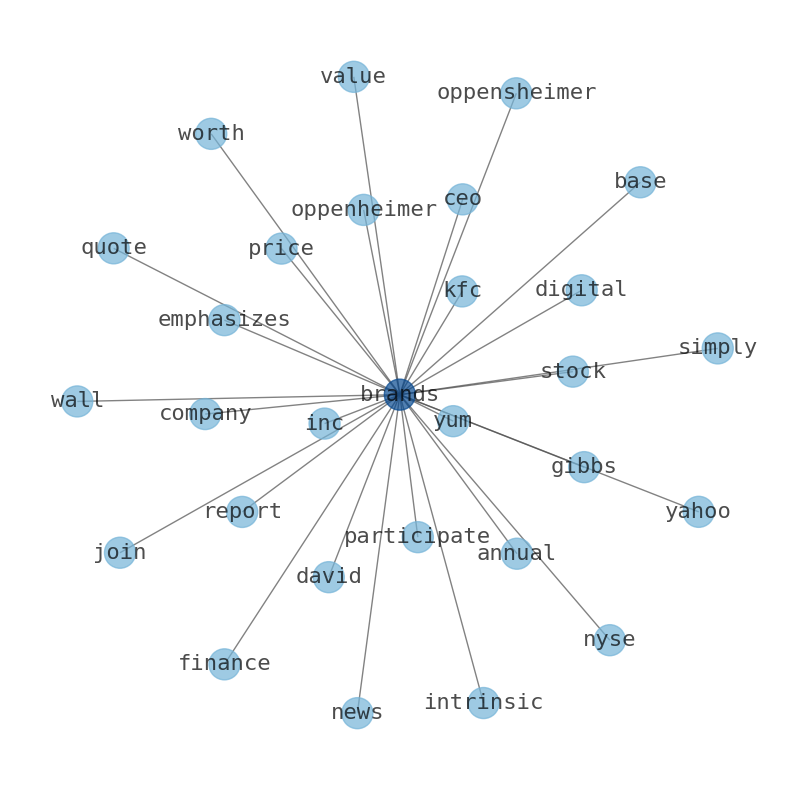

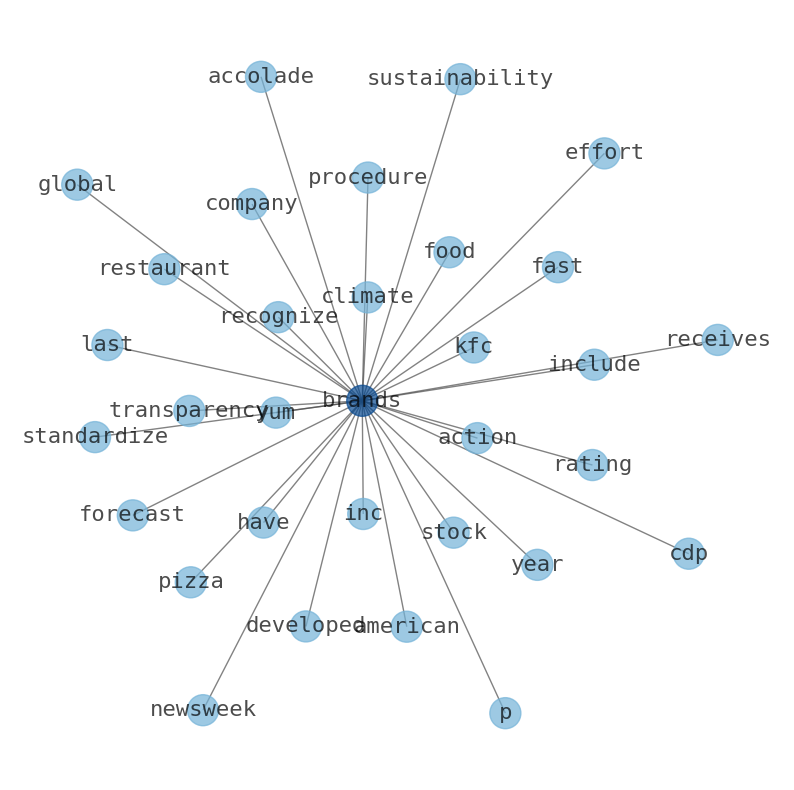

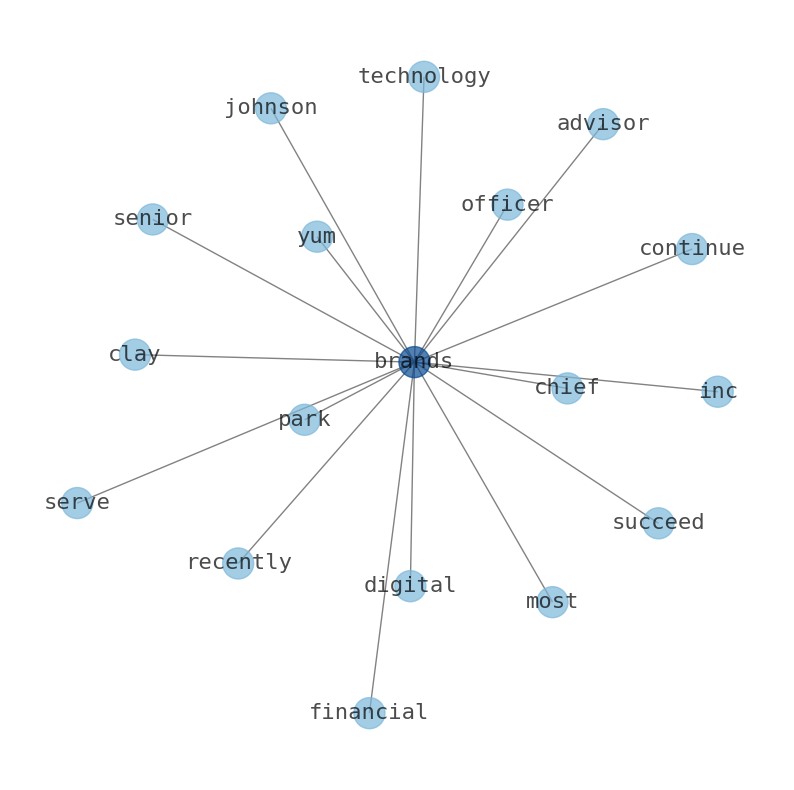

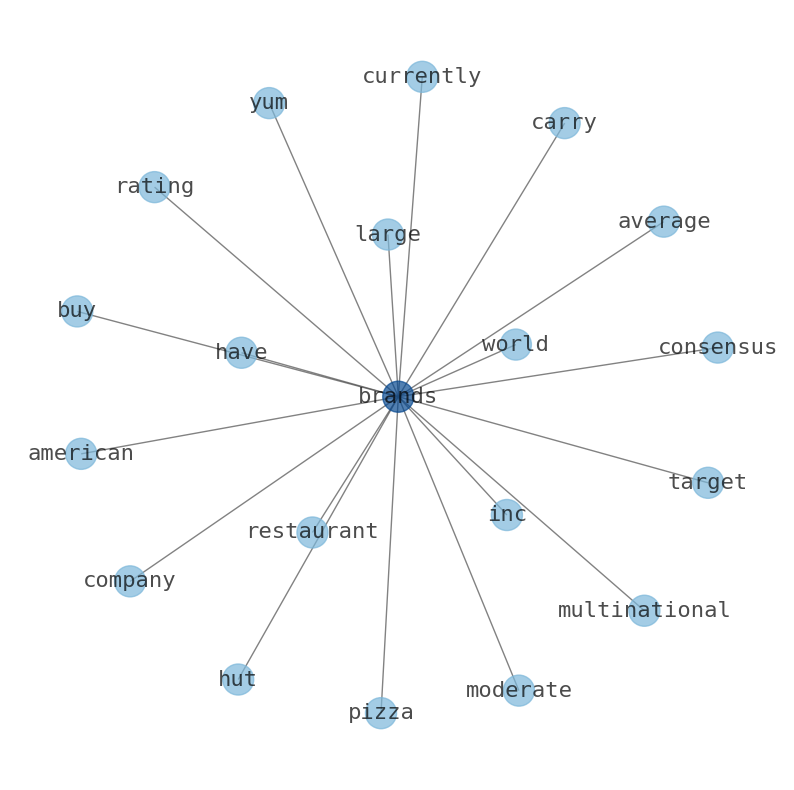

Vontobel Holding Ltd. grew its stake in Yum! Brands by 6.6% during the 3rd quarter. Geode Capital Management LLC grew its. stake by 1.3% during 4th quarter. The business also recently disclosed a quarterly dividend, which was paid on Friday. McElhenny Sheffield Capital Management Increases Investment by Over 160%. Yum! Brands stock has shown strong growth over the last year, with a current range of $103.96 to $143.24. Yum! Brands, Inc. develops, operates, and franchises quick service restaurants worldwide. The company, together with its subsidiaries, developed, operates and franchises restaurants worldwide. Yum! Brands CEO David Gibbs joins Yahoo Finance Live to discuss company earnings, inflationary pressures, consumer spending, pricing constructs, AI, and the outlook for Yum!. Pizza Hut is an American multinational restaurant and international franchise chain founded in 1958 in Wichita, Kansas by Dan and Frank Carney. Yum! Brands, Inc. has over 54,000 restaurants in more than 155 countries and territories. KFC, Pizza Hut and Taco Bell are global leaders of the chicken, pizza and Mexican-style food categories.

Stock Profile

"Yum! Brands, Inc., together with its subsidiaries, develops, operates, and franchises quick service restaurants worldwide. The company operates through four segments: the KFC Division, the Taco Bell Division, the Pizza Hut Division, and the Habit Burger Grill Division. It operates restaurants under the KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill brands, which specialize in chicken, pizza, made-to-order chargrilled burgers, sandwiches, Mexican-style food categories, and other food products. The company was formerly known as TRICON Global Restaurants, Inc. and changed its name to Yum! Brands, Inc. in May 2002. Yum! Brands, Inc. was incorporated in 1997 and is headquartered in Louisville, Kentucky."

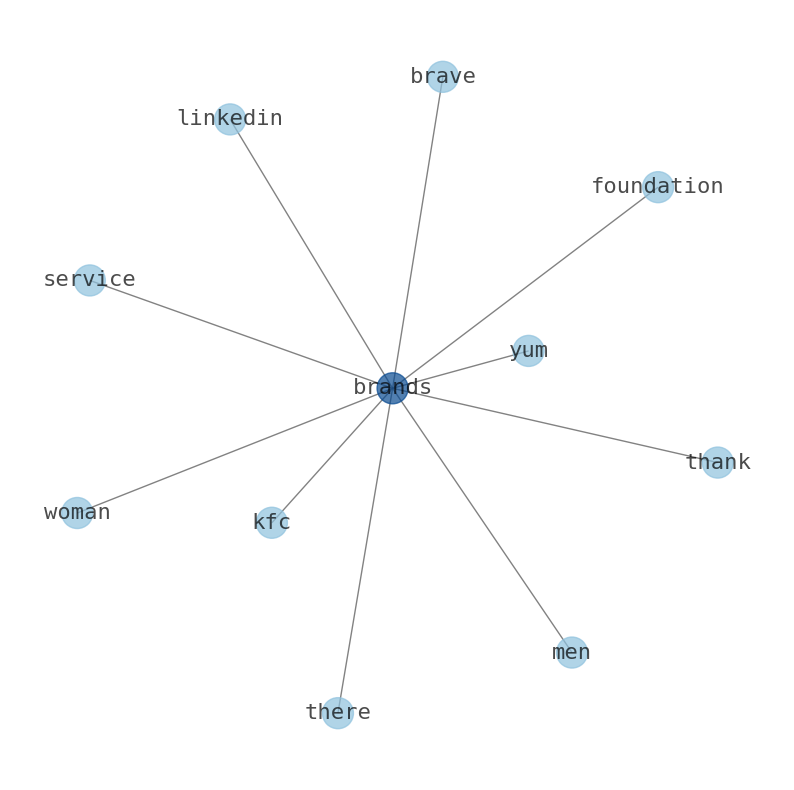

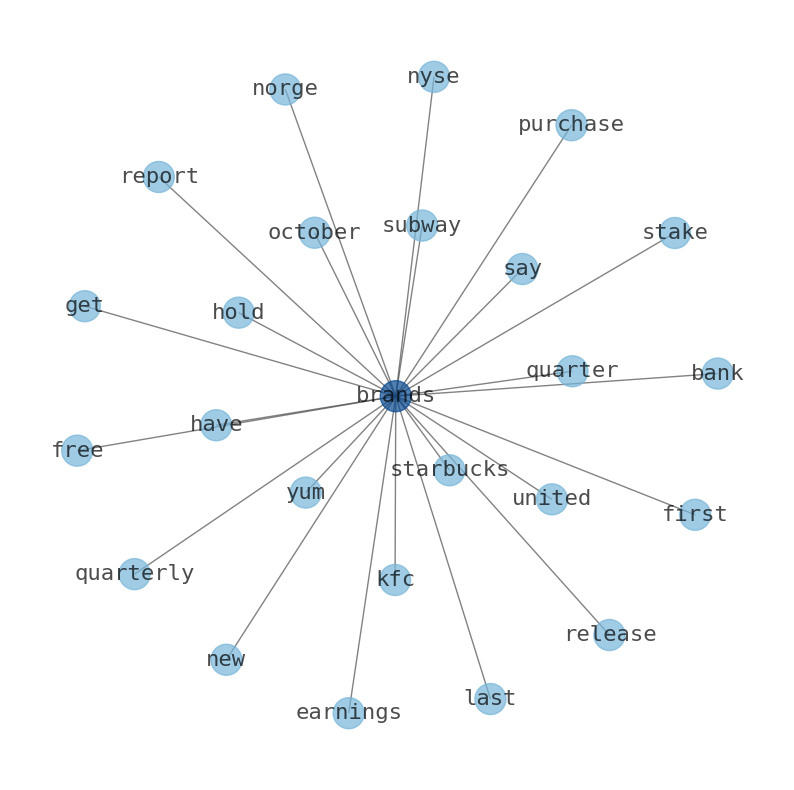

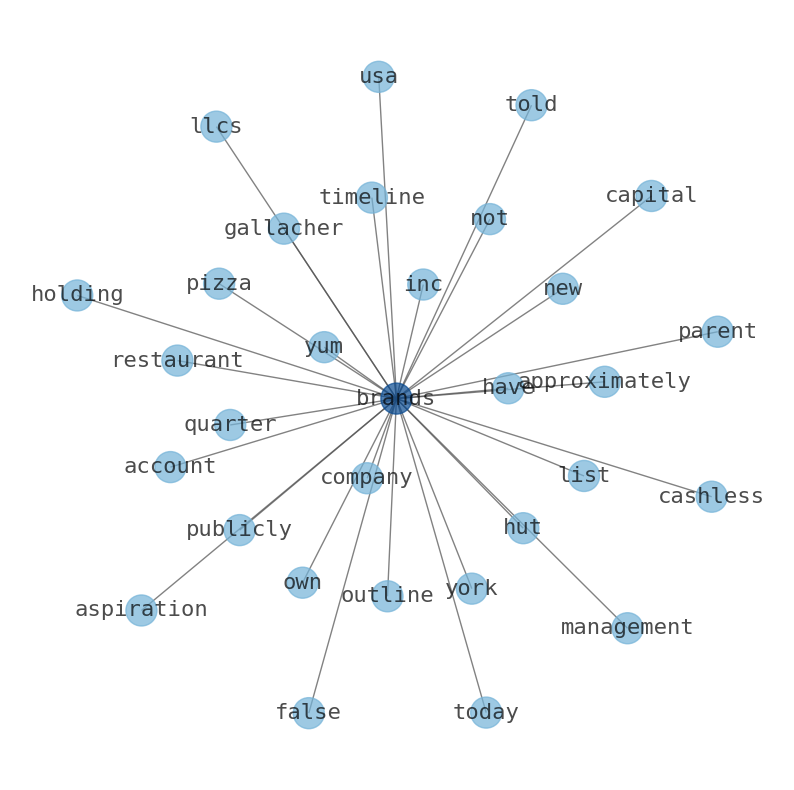

Keywords

How much time have you spent trying to decide whether investing in Yum! Brands? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Yum! Brands are: Yum, Brands, restaurant, franchise, grow, stake, quarter, and the most common words in the summary are: brand, yum, inc, pizza, taco, restaurant, stock, . One of the sentences in the summary was: Yum! Brands stock has shown strong growth over the last year, with a current range of $103.96 to $143.24. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #brand #yum #inc #pizza #taco #restaurant #stock.

Read more →Related Results

Yum! Brands

Open: 140.05 Close: 140.6 Change: 0.55

Read more →

Yum! Brands

Open: 128.0 Close: 129.2 Change: 1.2

Read more →

Yum! Brands

Open: 125.59 Close: 127.33 Change: 1.74

Read more →

Yum! Brands

Open: 128.92 Close: 128.94 Change: 0.02

Read more →

Yum! Brands

Open: 125.81 Close: 125.61 Change: -0.2

Read more →

Yum! Brands

Open: 124.01 Close: 123.19 Change: -0.82

Read more →

Yum! Brands

Open: 135.05 Close: 134.28 Change: -0.77

Read more →

Yum! Brands

Open: 131.55 Close: 133.2 Change: 1.65

Read more →

Yum! Brands

Open: 137.46 Close: 137.42 Change: -0.04

Read more →

Yum! Brands

Open: 128.0 Close: 129.2 Change: 1.2

Read more →

Yum! Brands

Open: 125.59 Close: 127.33 Change: 1.74

Read more →

Yum! Brands

Open: 126.02 Close: 124.01 Change: -2.01

Read more →

Yum! Brands

Open: 120.01 Close: 120.28 Change: 0.27

Read more →

Yum! Brands

Open: 129.55 Close: 128.94 Change: -0.61

Read more →

Yum! Brands

Open: 139.63 Close: 138.58 Change: -1.05

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo