The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Xcel Energy

Youtube Subscribe

Open: 58.9 Close: 59.35 Change: 0.45

12 risks of investing in Xcel Energy Company Inc Stock found by an AI after reading the whole internet.

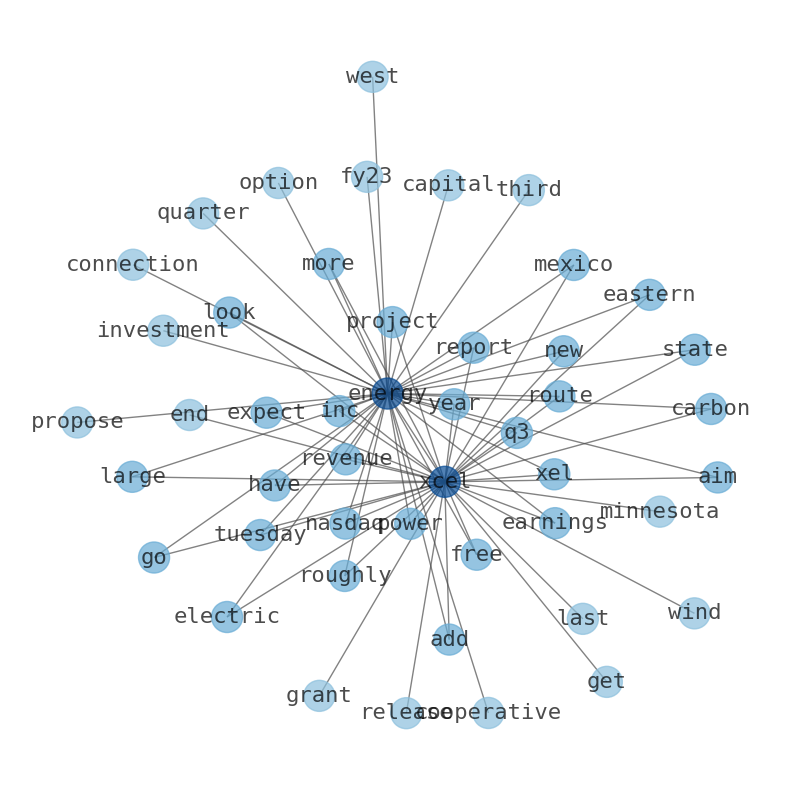

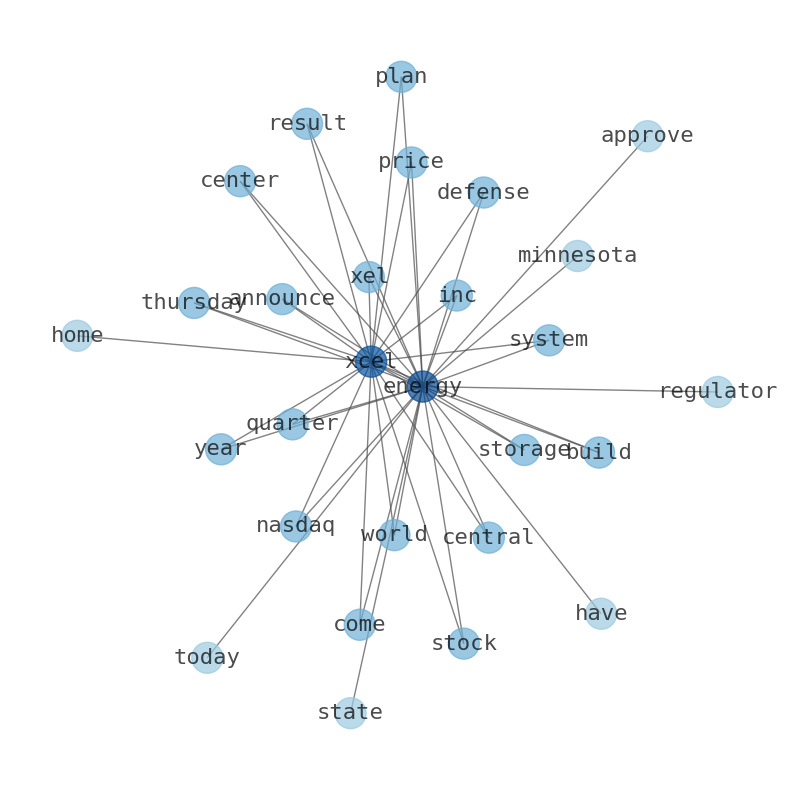

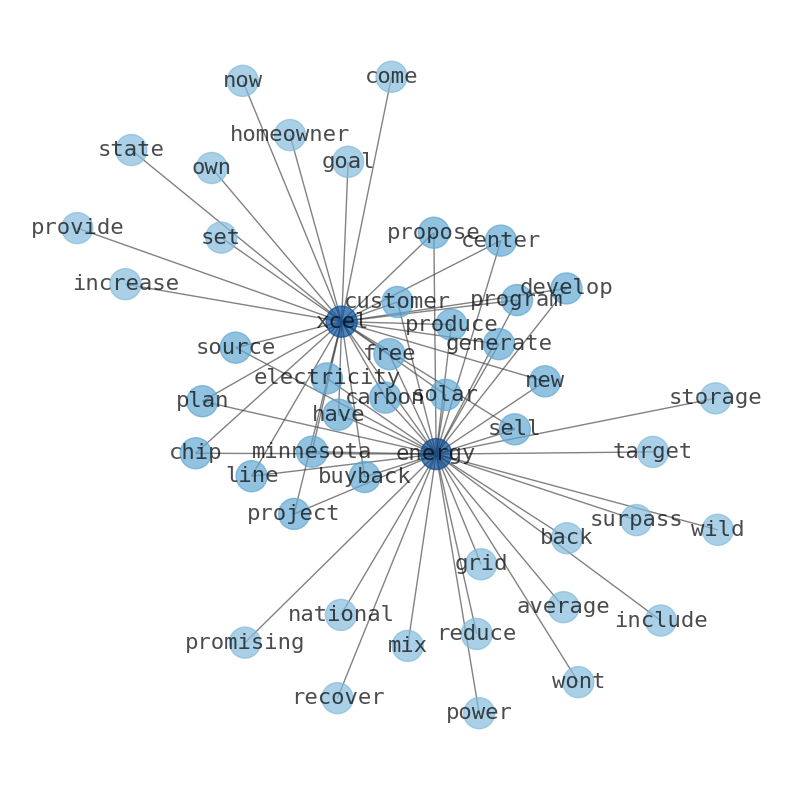

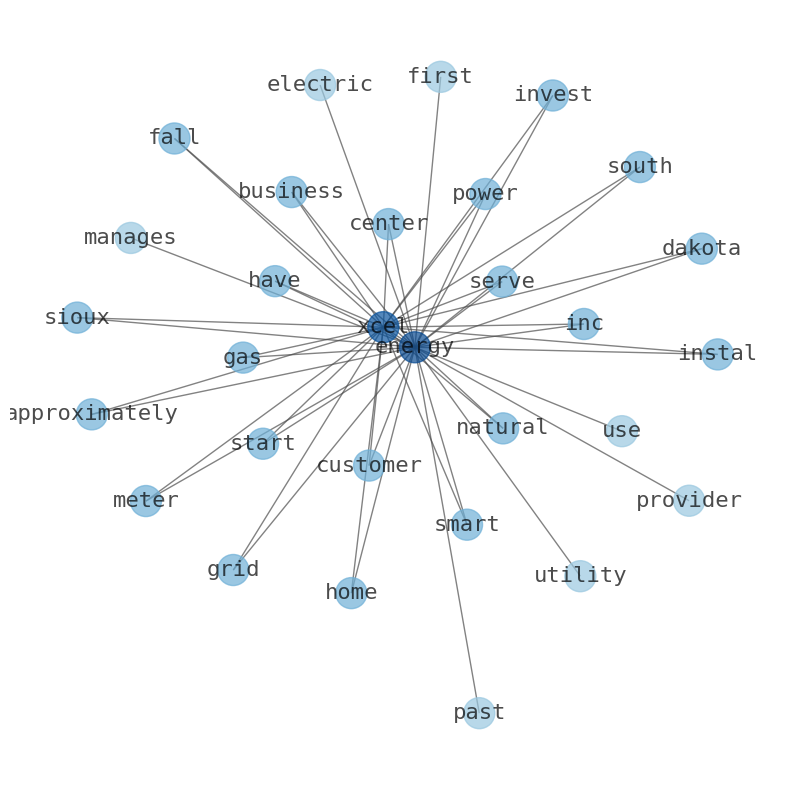

How much time have you spent trying to decide whether investing in Xcel Energy? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Xcel Energy are: …

Stock Summary

Xcel Energy generates electricity through coal, nuclear, natural gas, hydroelectric, solar, biomass, oil, wood/refuse, and wind energy sources. It also purchases, transports, distributes, and sells natural gas to retail.

Today's Summary

Xcel Energy posted lower-than-expected revenue in the latest quarter, but still saw growth in its bottom line. Xcel energy reaffirms 2024 EPS guidance of $3.50 to $3.60 per share. The firm also recently disclosed a quarterly dividend, which was paid on Saturday, January 20th.

Today's News

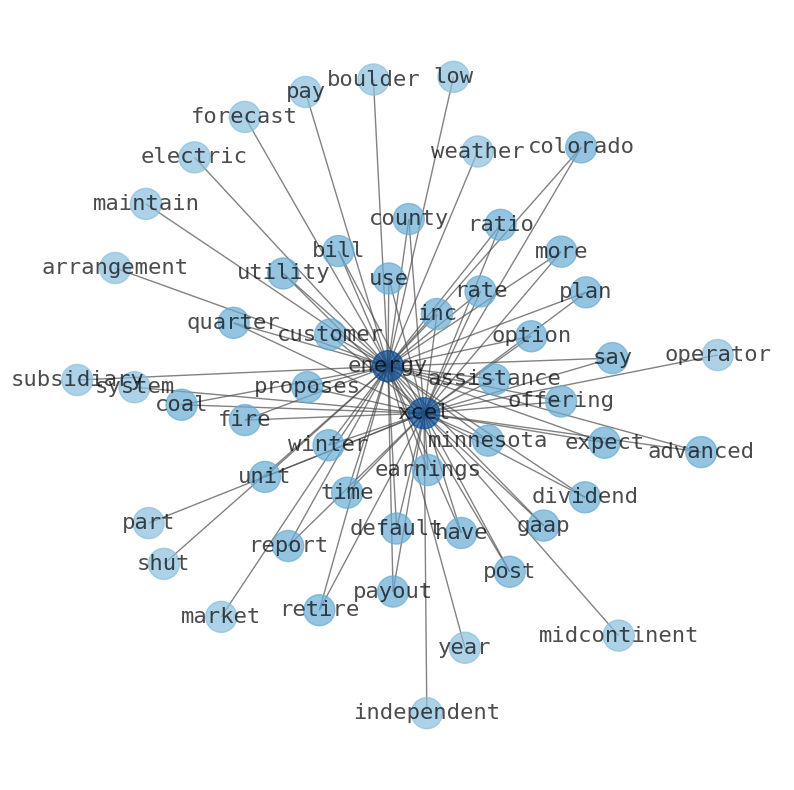

Xcel Energy advanced its Colorado Energy Plan, retired coal-fired units, and maintained low customer bills. Xcel energy reaffirms 2024 EPS guidance of $3.50 to $3.60 per share. Xcel Energy Inc. and its utility subsidiaries had the following committed credit facilities available to meet liquidity needs. Xcel Energys generally expects with approximately 40% additional capital investment expenditures forecast. Xcel Energy Inc. reported earnings are prepared in accordance with GAAP. Xcel Energys management believes that ongoing earnings, or GAAP earnings adjusted for certain items, reflect managements performance. Xcel Energy posted lower-than-expected revenue in the latest quarter, but still saw growth in its bottom line. The company found a modest shift in customers reducing energy in peak periods, enough to support broader adoption across its Minnesota territory. Xcel is part of the Midcontinent Independent System Operator. Xcel Energy proposes time-of-use rates as the default option for Minnesota customers. The Public Utilities Commission has not scheduled any hearings. Xcel Energy ( NASDAQ:XEL – Get Free Report ) last posted its quarterly earnings results on Thursday, January 25th. The firm also recently disclosed a quarterly dividend, which was paid on Saturday, January 20th. Xcel Energys dividend payout ratio (DPR) is presently 65.82%. Xcel Energy shut down unit at Sherburne County Generating Plant, Minnesotas largest power plant. South Dakota Public Utilities Commission (SDPUC) fired off a letter urging the company to reconsider those plans. Xcel Energy proposes time-of-use rates as the default option for Minnesota customers. The utilitys rate during peak hours would double, encouraging customers to conserve energy, but the plan raises questions about electrification efforts. Xcel is part of the Midcontinent Independent System Operator (MISO) regional energy market, one of two in the country forecasted to have a “capacity crunch” over the next five years. Xcel Energy has a payout ratio of 61.57%. For every $100 invested in the stock, investors would receive $3.53 in dividends per year. The companys ex-dividend date is December 27, 2023. Xcel Energy Inc. is scheduled to release fourth-quarter 2023 earnings on Jan 25 before market open. The Zacks Equity Research model does conclusively predict an earnings beat for Xcel energy. Atmos Energy and Xcel Energy offering bill assistance during winter weather. Boulder County governments file lawsuit against Xcel Energy for Marshall Fire injuries and damages. Xcel energy says more electric substations needed in Denver to meet growing demands for... more transmission capacity is needed. Xcel Energy reminds customers of winter energy assistance, pay arrangements. Xcel energy proposes time-of-use rates as the default option for minnesota customers.

Stock Profile

"Xcel Energy Inc., through its subsidiaries, generates, purchases, transmits, distributes, and sells electricity. It operates through Regulated Electric Utility, Regulated Natural Gas Utility, and All Other segments. The company generates electricity through coal, nuclear, natural gas, hydroelectric, solar, biomass, oil, wood/refuse, and wind energy sources. It also purchases, transports, distributes, and sells natural gas to retail customers, as well as transports customer-owned natural gas. In addition, the company develops and leases natural gas pipelines, and storage and compression facilities; and invests in rental housing projects, as well as procures equipment for the construction of renewable generation facilities. It serves residential, commercial, and industrial customers in the portions of Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas, and Wisconsin. The company was incorporated in 1909 and is headquartered in Minneapolis, Minnesota."

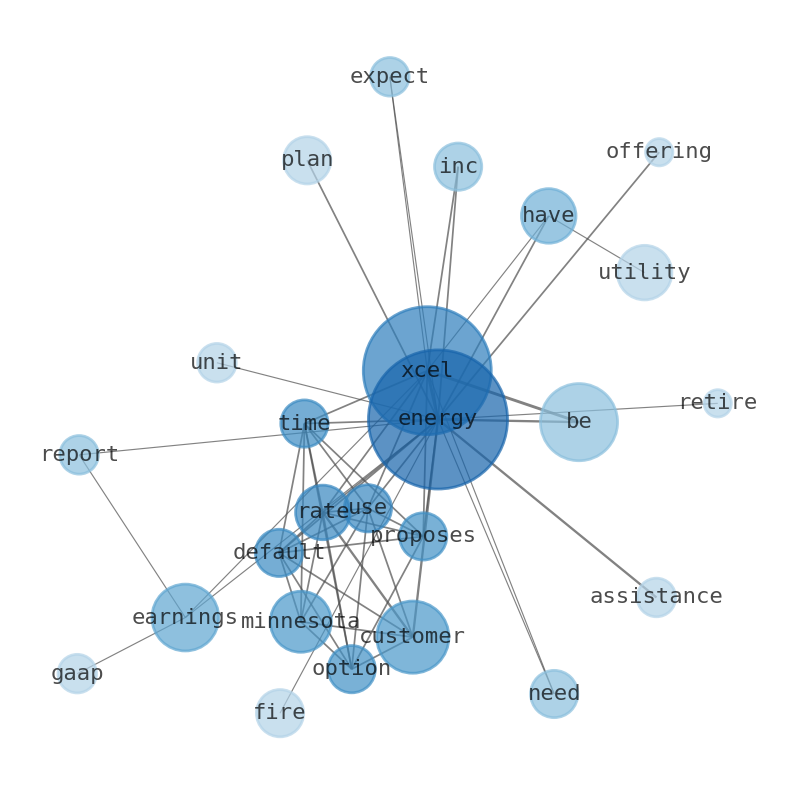

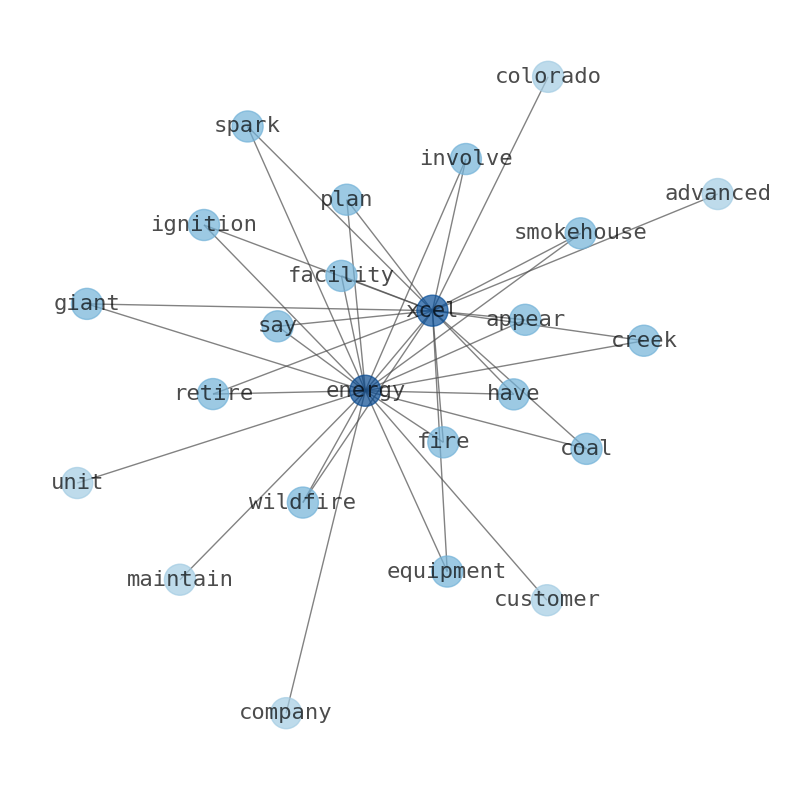

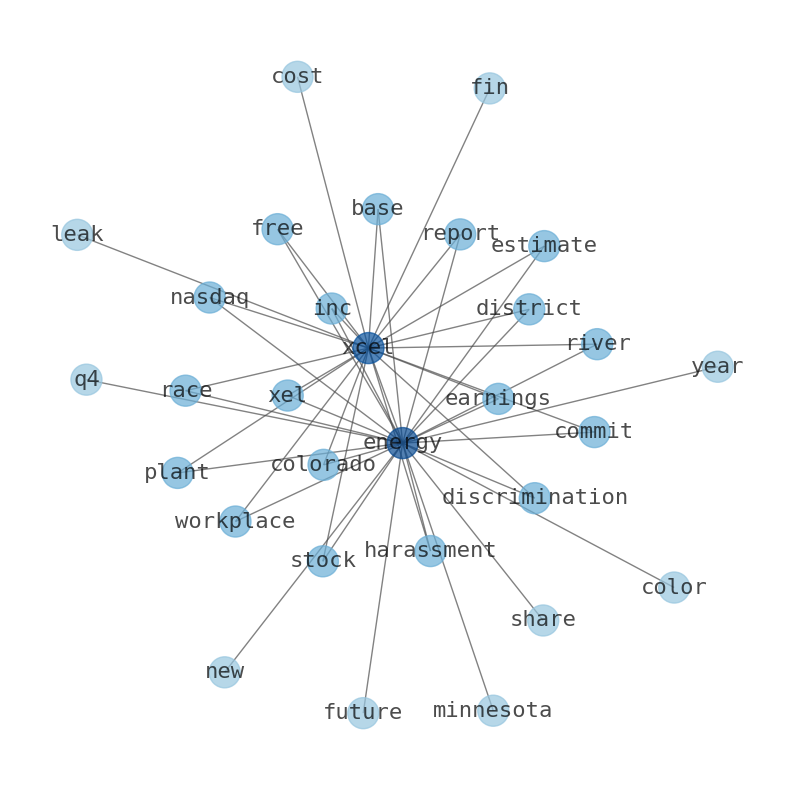

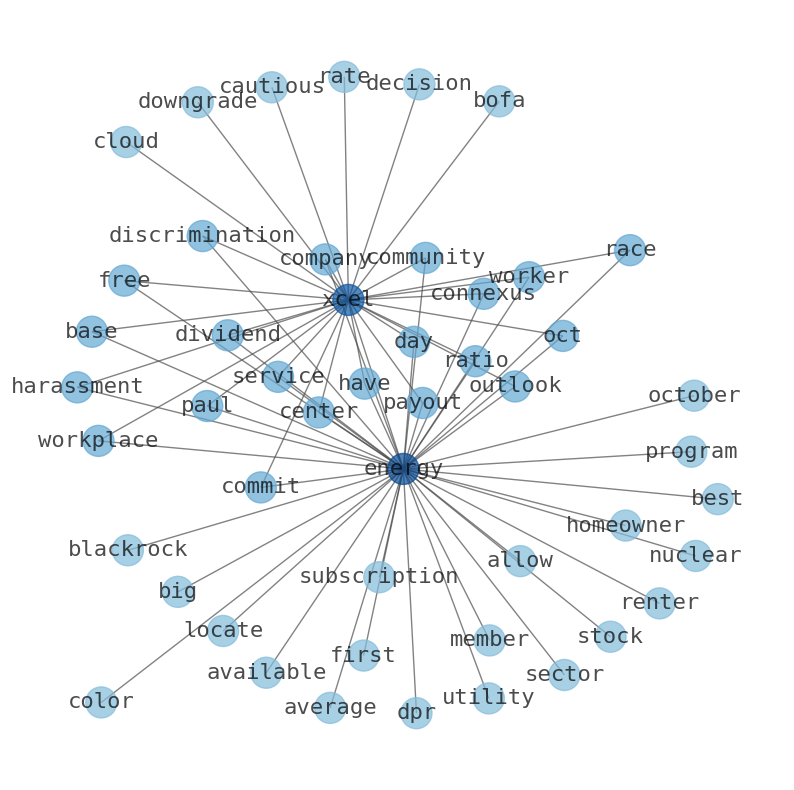

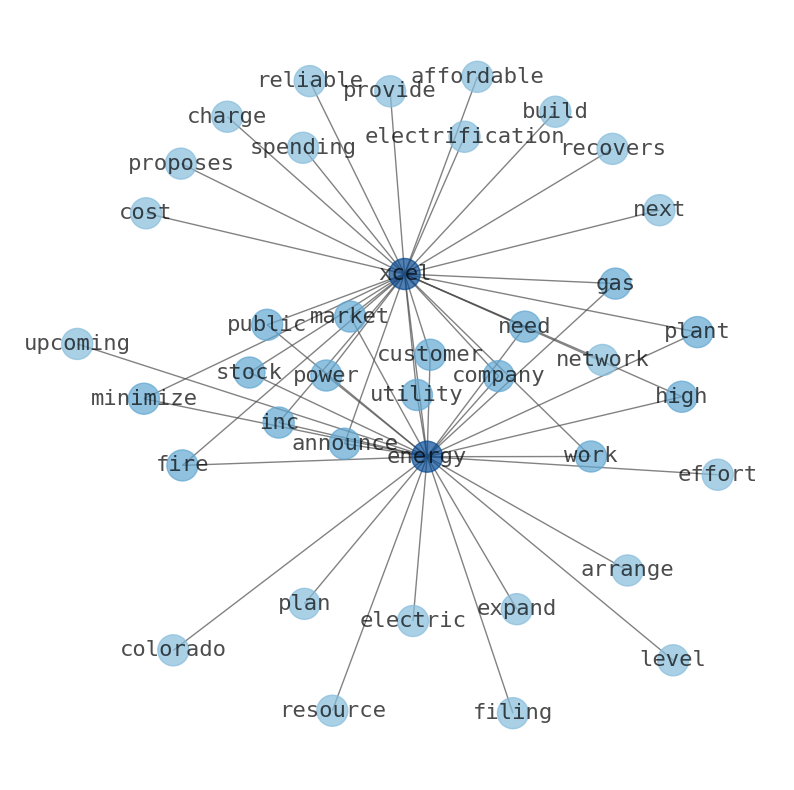

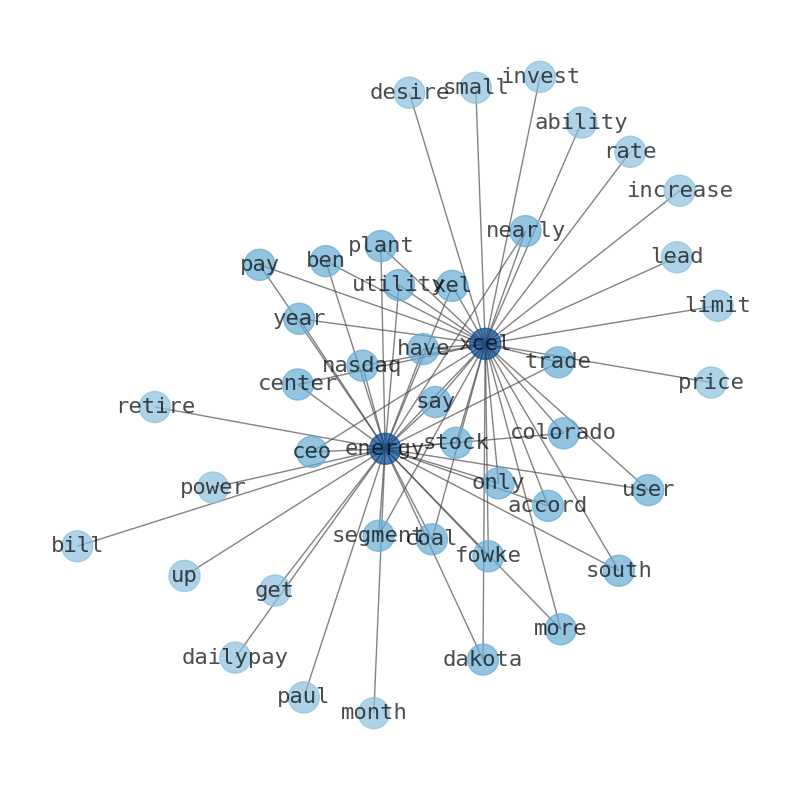

Keywords

The game is changing. There is a new strategy to evaluate Xcel Energy fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Xcel Energy are: Xcel, Energy, energy, customer, earnings, rate, Inc, and the most common words in the summary are: energy, xcel, news, customer, earnings, job, inc, . One of the sentences in the summary was: Xcel energy reaffirms 2024 EPS guidance of $3.50 to $3.60 per share. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #energy #xcel #news #customer #earnings #job #inc.

Read more →Related Results

Xcel Energy

Open: 52.06 Close: 51.97 Change: -0.1

Read more →

Xcel Energy

Open: 58.9 Close: 59.35 Change: 0.45

Read more →

Xcel Energy

Open: 59.25 Close: 59.62 Change: 0.37

Read more →

Xcel Energy

Open: 63.38 Close: 63.76 Change: 0.38

Read more →

Xcel Energy

Open: 62.21 Close: 62.86 Change: 0.65

Read more →

Xcel Energy

Open: 49.28 Close: 49.53 Change: 0.26

Read more →

Xcel Energy

Open: 61.98 Close: 62.06 Change: 0.08

Read more →

Xcel Energy

Open: 56.7 Close: 57.32 Change: 0.62

Read more →

Xcel Energy

Open: 60.7 Close: 61.29 Change: 0.59

Read more →

Xcel Energy

Open: 63.92 Close: 63.45 Change: -0.47

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo