The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Western Alliance Bancorporation

Youtube Subscribe

Open: 38.82 Close: 37.75 Change: -1.07

What an AI found about Western Alliance Bancorporation Company Inc Stock after reading the whole Internet.

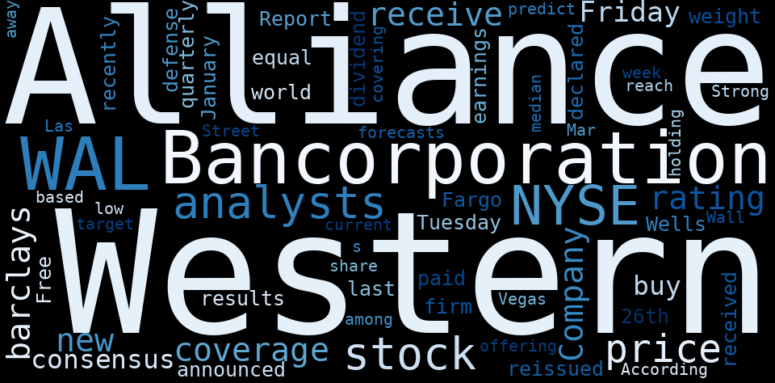

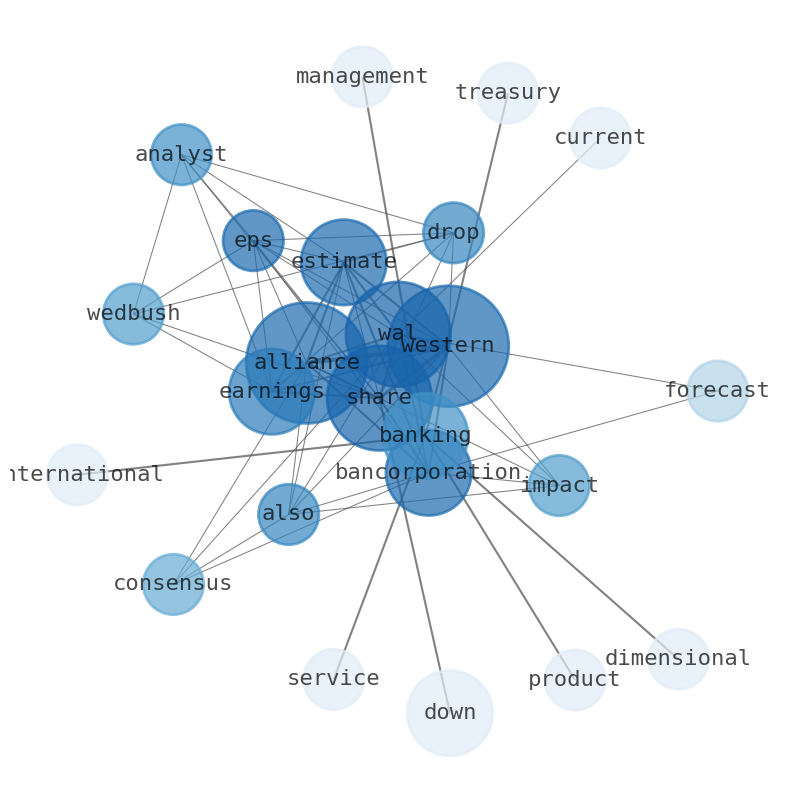

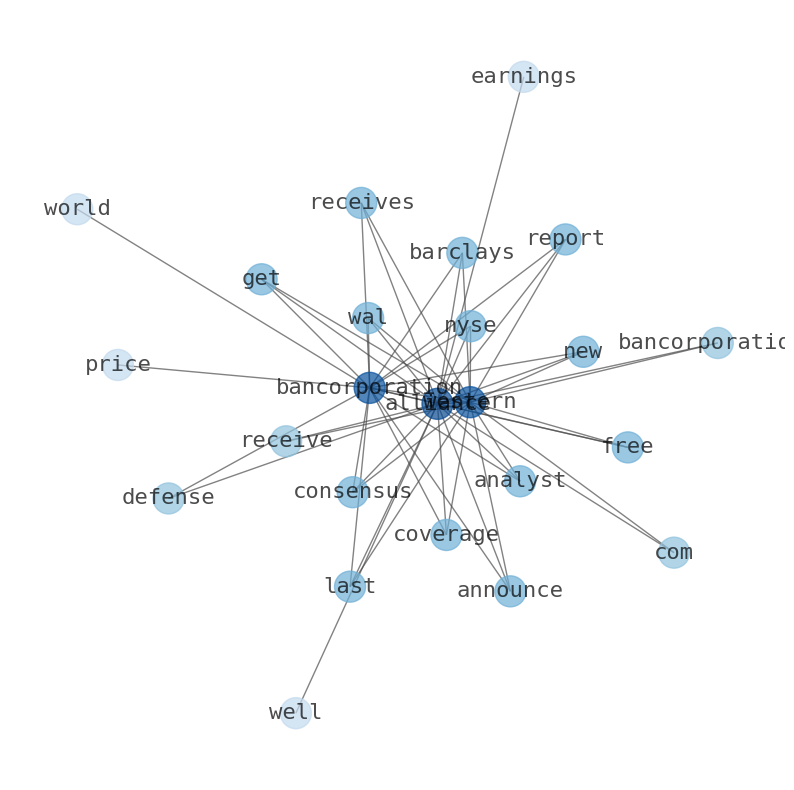

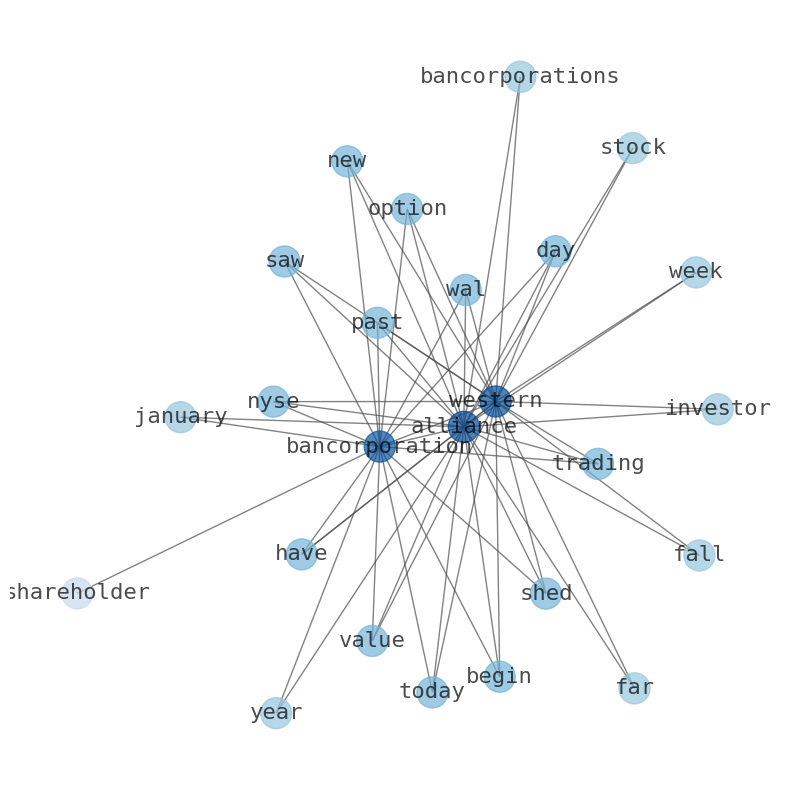

The game is changing. There is a new strategy to evaluate Western Alliance Bancorporation fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Western Alliance Bancorporation are: Western, Alliance, earnings, share, estimate, …

Stock Summary

Western Alliance Bancorporation operates as the bank holding company for Western Alliance Bank. It provides various banking products and related services primarily in Arizona, California, and Nevada. The company offers deposit products, including checking, savings, and money.

Today's Summary

Wedbush analysts dropped their earnings per share (EPS) estimates for Western Alliance Bancorporation (WAL) This could also impact the consensus forecast for the current full-year earnings, bringing it down to an estimated $8.34 per share. Western Alliance Bancorporation (WAL) down 2.20% in premarket trading. Shares of NYSE:WAL opened at $39.55 on Friday. Western Alliance Bancorp is a bank holding company, which engages in the provision of deposit, lending, treasury management, international banking, and online banking products and services. Dimensional Fund Advisors LP grew its holdings in Western Alliance. by 0.4% during the 1st quarter.

Today's News

Wedbush analysts dropped their earnings per share (EPS) estimates for Western Alliance Bancorporation (WAL) This could also impact the consensus forecast for the current full-year earnings, bringing it down to an estimated $8.34 per share. Western Alliance Bancorporation (WAL) down 2.20% in premarket trading. Shares of NYSE:WAL opened at $39.55 on Friday. Western Alliance Bancorp is a bank holding company, which engages in the provision of deposit, lending, treasury management, international banking, and online banking products and services. Dimensional Fund Advisors LP grew its holdings in Western Alliance. by 0.4% during the 1st quarter.

Stock Profile

"Western Alliance Bancorporation operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada. It operates through Commercial and Consumer Related segments. The company offers deposit products, including checking, savings, and money market accounts, as well as fixed-rate and fixed maturity certificates of deposit accounts; demand deposits; and treasury management and residential mortgage products and services. It also offers commercial and industrial loan products, such as working capital lines of credit, loans to technology companies, inventory and accounts receivable lines, mortgage warehouse lines, equipment loans and leases, and other commercial loans; commercial real estate loans, which are secured by multi-family residential properties, professional offices, industrial facilities, retail centers, hotels, and other commercial properties; construction and land development loans for single family and multi-family residential projects, industrial/warehouse properties, office buildings, retail centers, medical office facilities, and residential lot developments; and consumer loans. In addition, the company provides other financial services, such as internet banking, wire transfers, electronic bill payment and presentment, funds transfer and other digital payment offerings, lock box services, courier, and cash management services. Further, it holds certain investment securities, municipal and non-profit loans, and leases; invests primarily in low-income housing tax credits and small business investment corporations; and holds certain real estate loans and related securities. Western Alliance Bancorporation was founded in 1994 and is headquartered in Phoenix, Arizona."

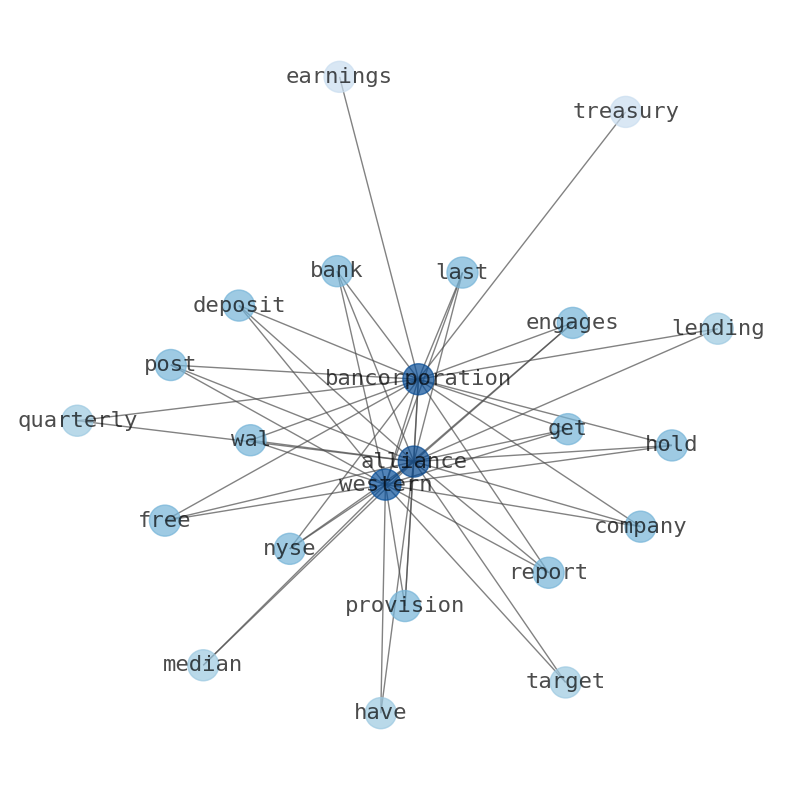

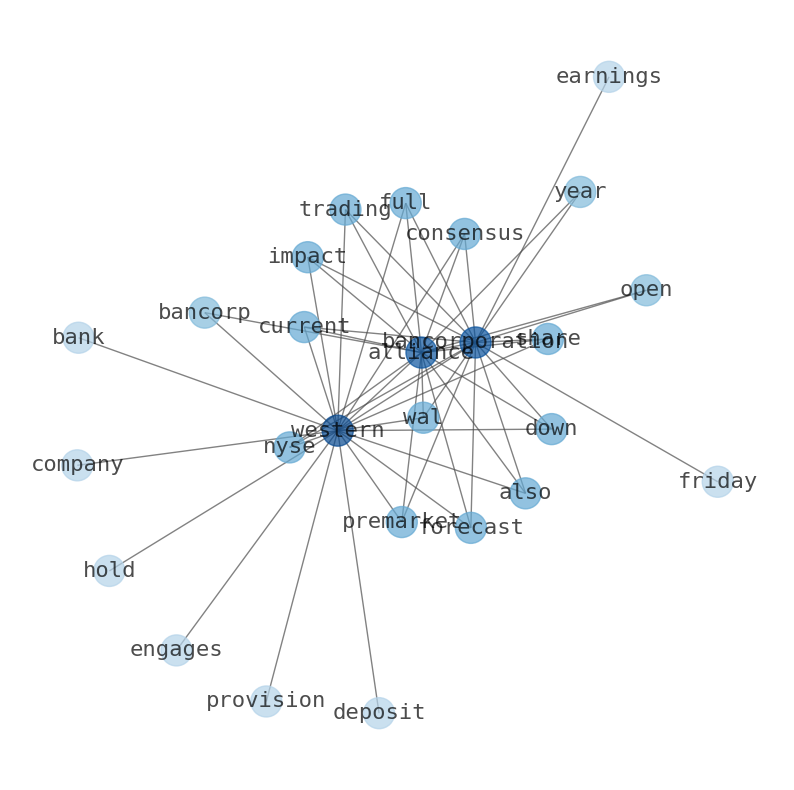

Keywords

Are looking for the most relevant information about Western Alliance Bancorporation? Investor spend a lot of time searching for information to make investment decisions in Western Alliance Bancorporation. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Western Alliance Bancorporation are: Western, Alliance, earnings, share, estimate, Bancorporation, WAL, and the most common words in the summary are: alliance, western, bank, stock, job, bancorporation, wal, . One of the sentences in the summary was: Wedbush analysts dropped their earnings per share (EPS) estimates for Western Alliance Bancorporation (WAL) This could also impact the consensus forecast for the current full-year earnings, bringing it down to an estimated $8.34 per share. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #alliance #western #bank #stock #job #bancorporation #wal.

Read more →Related Results

Western Alliance Bancorporation

Open: 61.82 Close: 60.31 Change: -1.51

Read more →

Western Alliance Bancorporation

Open: 39.25 Close: 37.42 Change: -1.83

Read more →

Western Alliance Bancorporation

Open: 45.78 Close: 45.28 Change: -0.5

Read more →

Western Alliance Bancorporation

Open: 38.82 Close: 37.75 Change: -1.07

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo