The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Vodafone Group

Youtube Subscribe

Open: 9.6 Close: 9.62 Change: 0.02

Don't invest in Vodafone Group Company Inc before reading this automated analysis produce by an AI.

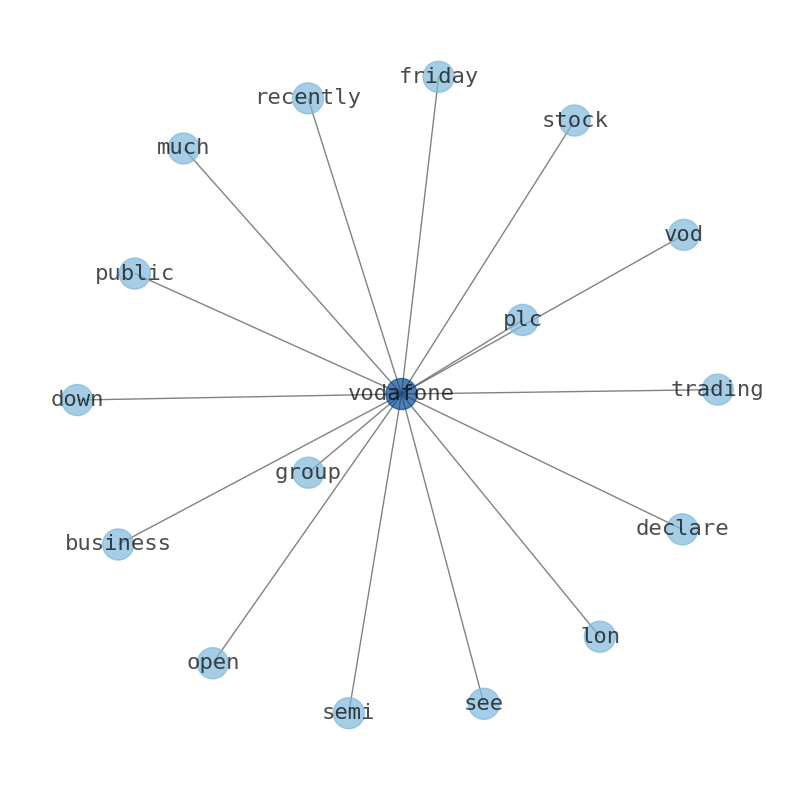

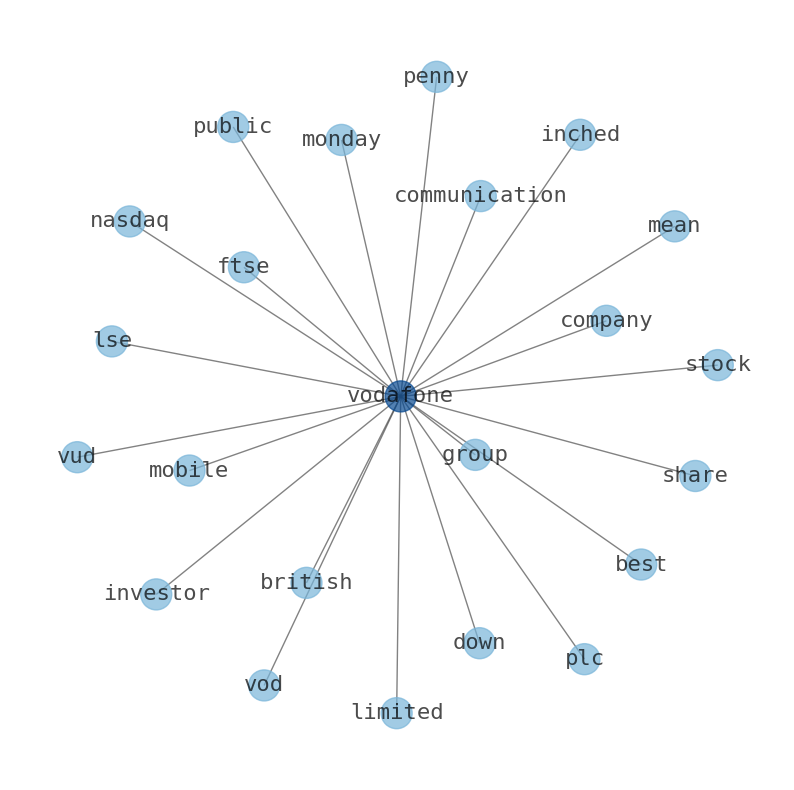

How much time have you spent trying to decide whether investing in Vodafone Group? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Vodafone Group are: …

Stock Summary

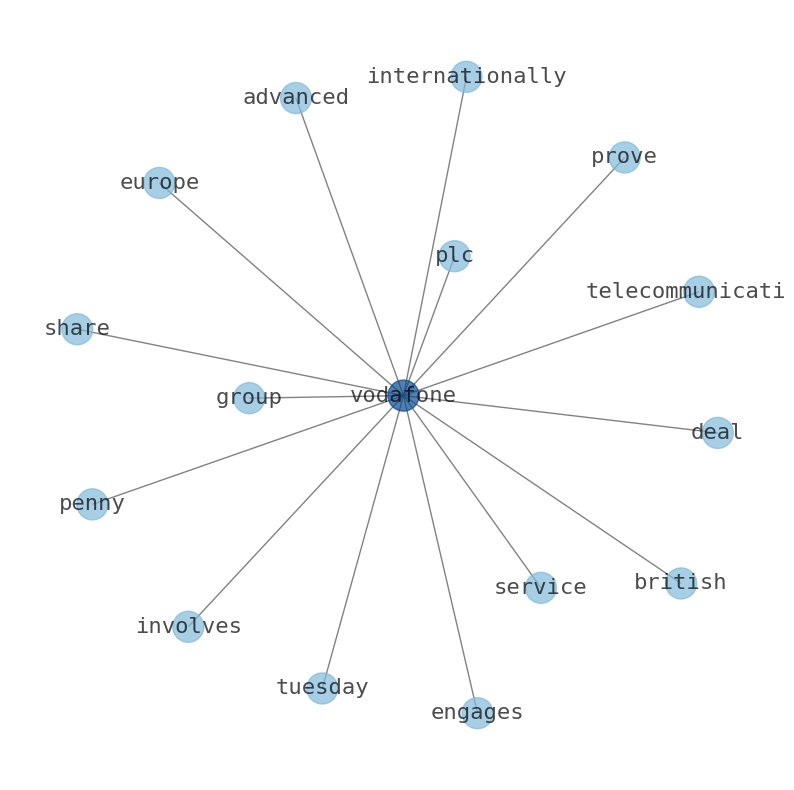

Vodafone Group Public Limited Company provides telecommunication services in Europe and internationally. It offers mobile connectivity services, fixed line connectivity, fixed voice and data, broadband, software-defined networks, managed WAN, LAN, ethernet.

Today's Summary

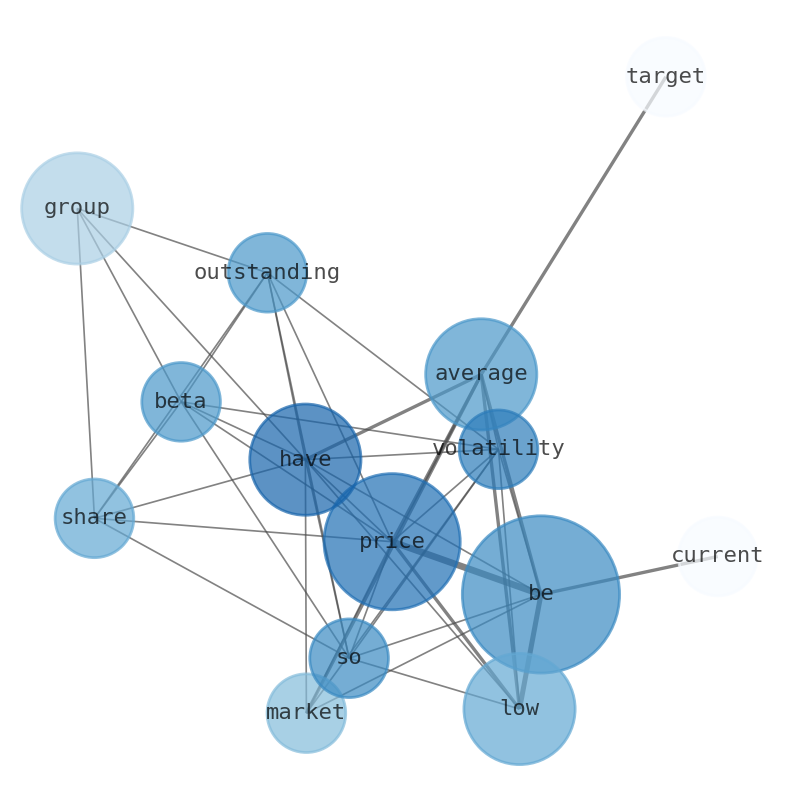

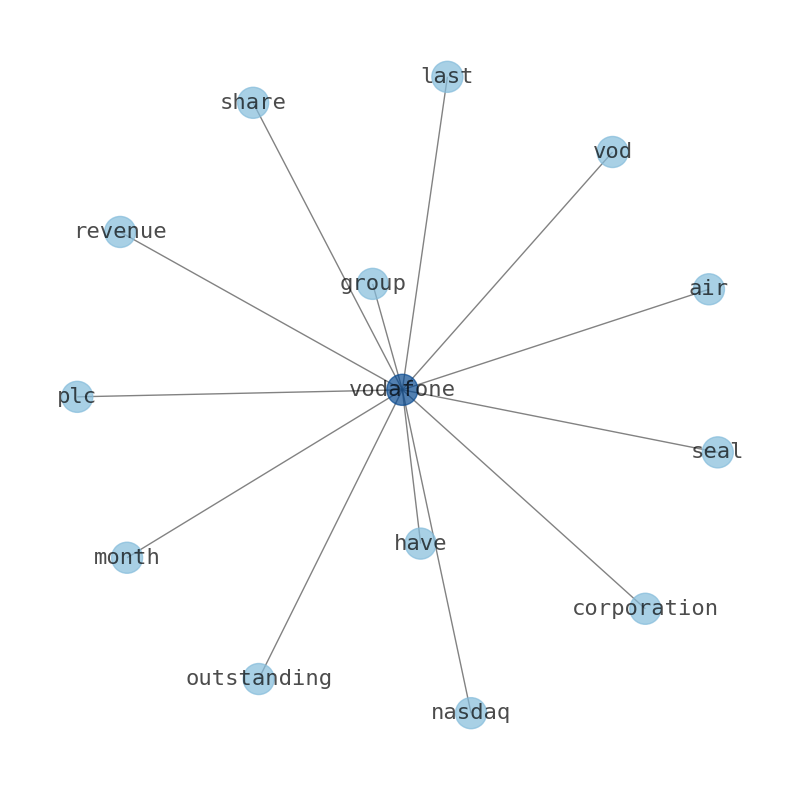

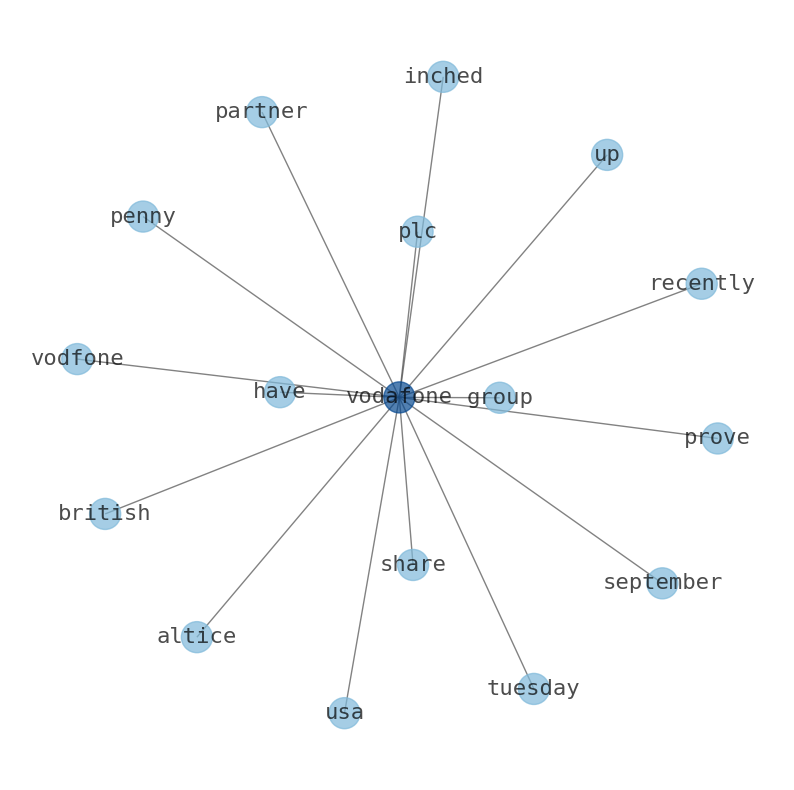

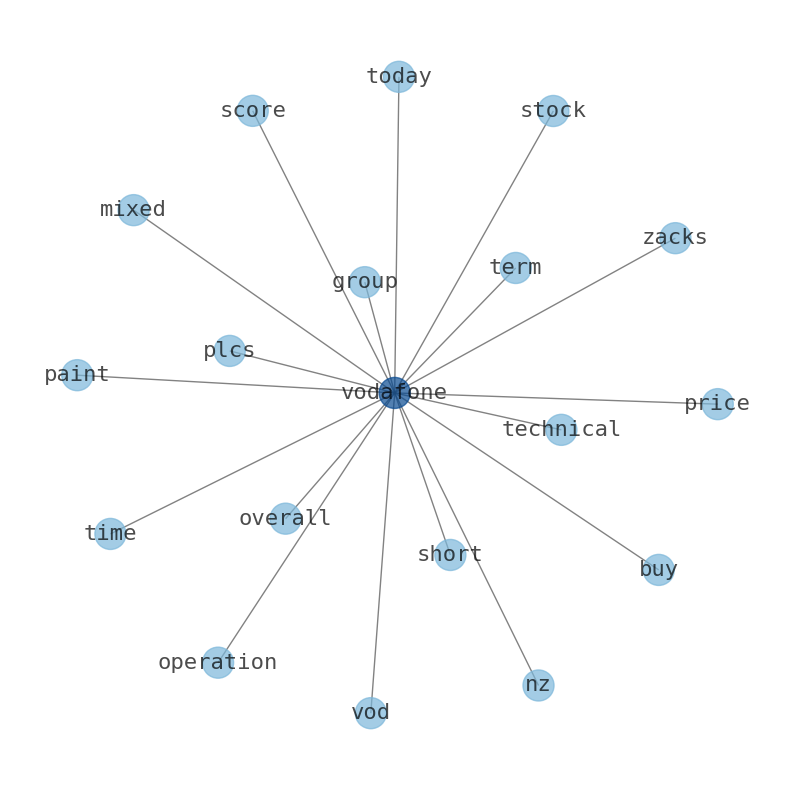

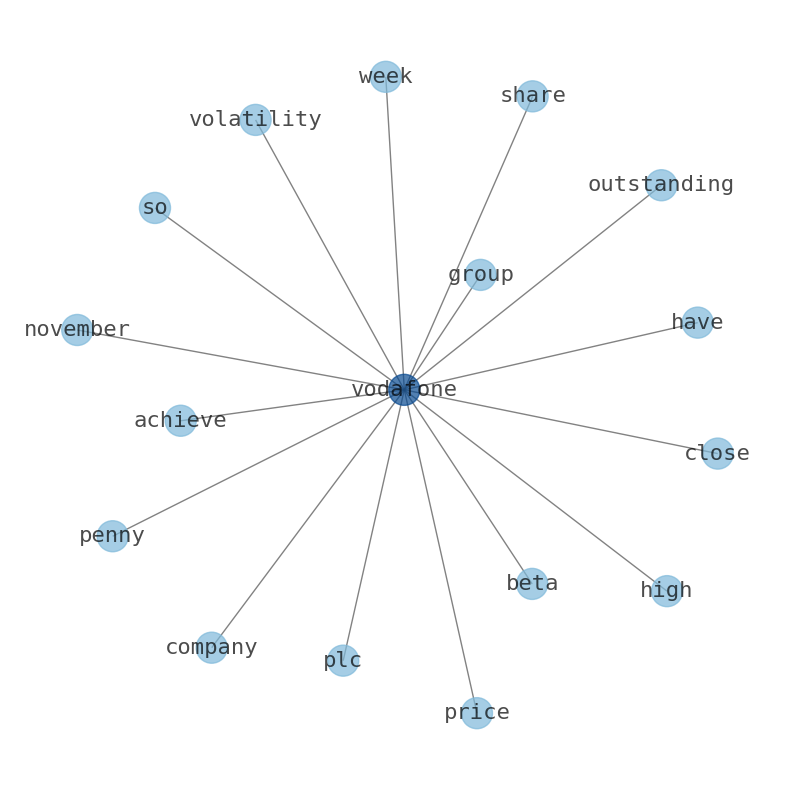

Vodafone Group has 2.71 billion shares outstanding. The beta is 0.52, so the price volatility has been lower than the market average. The average price target is $7.70, which is -19.96% lower than current price. Vodafone Group PLC closed 30.54 pence below its 52-week high (£1.08), which the company achieved on November 8.

Today's News

Vodafone Group has 2.71 billion shares outstanding. The beta is 0.52, so the price volatility has been lower than the market average. The average price target is $7.70, which is -19.96% lower than current price. Vodafone Group PLC closed 30.54 pence below its 52-week high (£1.08), which the company achieved on November 8.

Stock Profile

"Vodafone Group Public Limited Company provides telecommunication services in Europe and internationally. It offers mobile connectivity services comprising end-to-end services for mobile voice and data, messaging, device management, BYOx, and telecoms management, as well as professional and consulting services; and fixed line connectivity, such as fixed voice and data, broadband, software-defined networks, managed WAN, LAN, ethernet, and satellite; and financial services, as well as business and merchant services. The company also provides consumer Internet of Things (IoT) propositions, as well as security and insurance products; mobile services; logistics, fleet management, and smart metering services; WiFi; digital services comprising mobile application development, multi-access edge computing, worker insights, AI assistant, drone detection, visual inspection, and mixed reality, as well as Vodafone Analytics platform; and traditional IT hosting services, including colocation, managed hosting, security, hosting infrastructure, and flexible computing for government. In addition, it offers integrated business communication services, as well as fixed mobile convergence services; and carrier services, as well as IoT devices comprising managed tablets and integrated terminals. Further, it offers M-Pesa, an African mobile money platform to make payments and provide financial services; Vodafone Business multi-cloud platform; and productivity solutions, as well as operates digital cloud-based television platforms. It serves private and public sector customers in the manufacturing, retail, automotive, banking finance, healthcare, smart cities and public, agriculture, transport and logistics, and energy and utilities management industries. It offers its products and services through digital and physical channels. Vodafone Group Public Limited Company has a strategic partnership with Open Fiber. The company was incorporated in 1984 and is based in Newbury, the United Kingdom."

Keywords

Are looking for the most relevant information about Vodafone Group? Investor spend a lot of time searching for information to make investment decisions in Vodafone Group. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Vodafone Group are: price, Vodafone, Group, low, average, share, outstanding, and the most common words in the summary are: gbx, group, vodafone, rating, target, buy, set, . One of the sentences in the summary was: Vodafone Group PLC closed 30.54 pence below its 52-week high (£1.08), which the company achieved on November 8.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #gbx #group #vodafone #rating #target #buy #set.

Read more →Related Results

Vodafone Group

Open: 9.21 Close: 8.98 Change: -0.23

Read more →

Vodafone Group

Open: 9.97 Close: 10.03 Change: 0.06

Read more →

Vodafone Group

Open: 9.4 Close: 9.31 Change: -0.09

Read more →

Vodafone Group

Open: 9.44 Close: 9.45 Change: 0.01

Read more →

Vodafone Group

Open: 9.6 Close: 9.62 Change: 0.02

Read more →

Vodafone Group

Open: 9.33 Close: 9.36 Change: 0.03

Read more →

Vodafone Group

Open: 9.14 Close: 9.1 Change: -0.04

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo