The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Vertex Pharmaceuticals

Youtube Subscribe

Open: 341.37 Close: 343.2 Change: 1.83

10 lessons that an AI found about Vertex Pharmaceuticals Stock after reading internet.

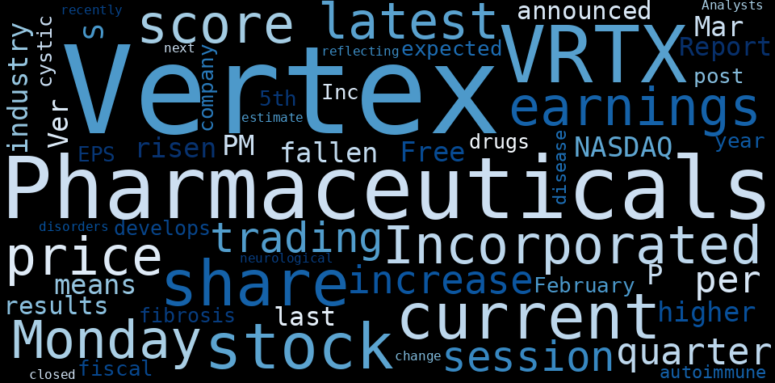

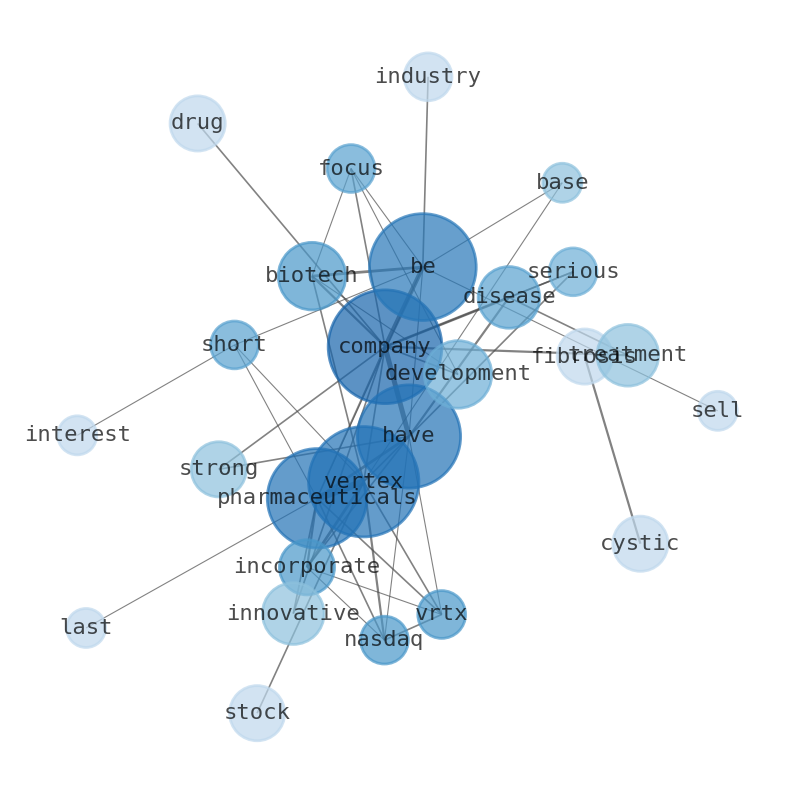

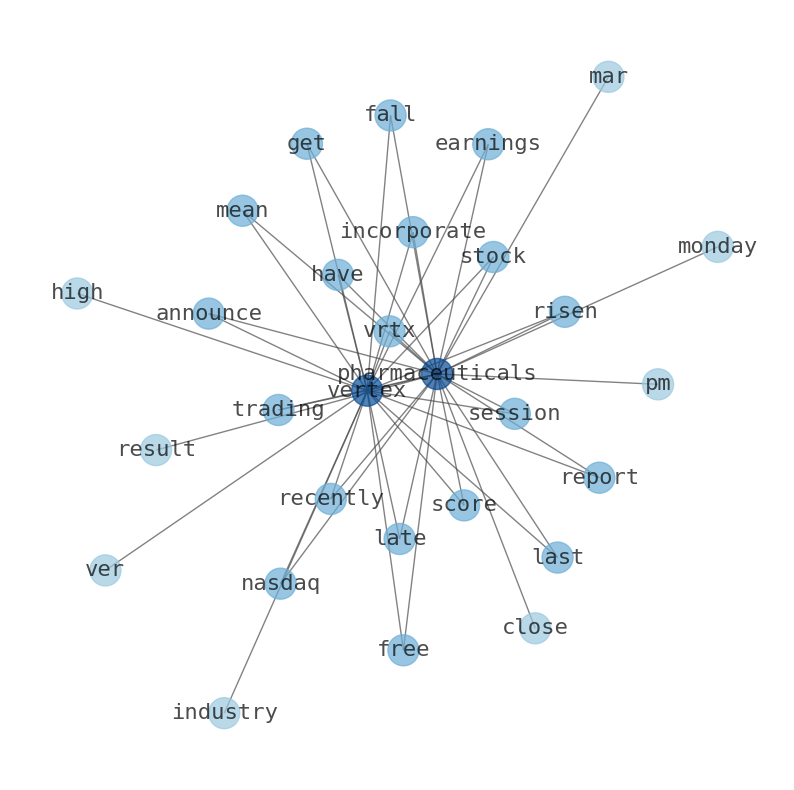

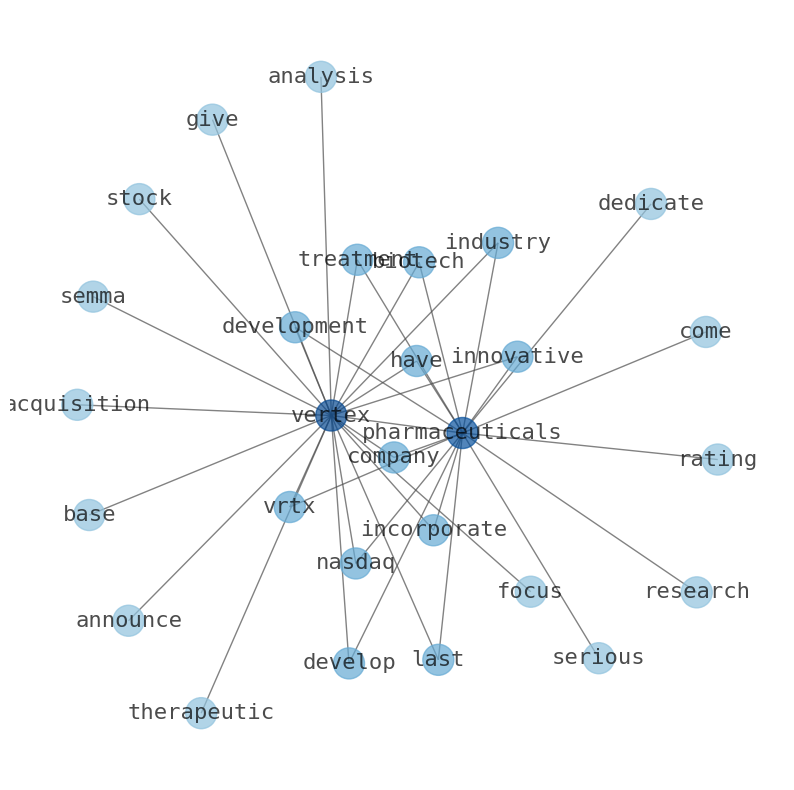

This document will help you to evaluate Vertex Pharmaceuticals without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Vertex Pharmaceuticals are: company, Vertex, Pharmaceuticals, biotech, development, innovative, treatment, …

Stock Summary

Vertex Pharmaceuticals Incorporated engages in developing and commercializing therapies for treating cystic fibrosis (CF) It markets TRIKAFTA/KAFTRIO and SYMDEKO/SYMKEVI for people with CF with.

Today's Summary

Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) has a market capitalization of $87.877 billion. The company has a strong pipeline of drugs in development, solid fundamentals, and a sound strategy for growth. The biotech industry is projected to grow at a steady pace due to the increasing demand for innovative treatments.

Today's News

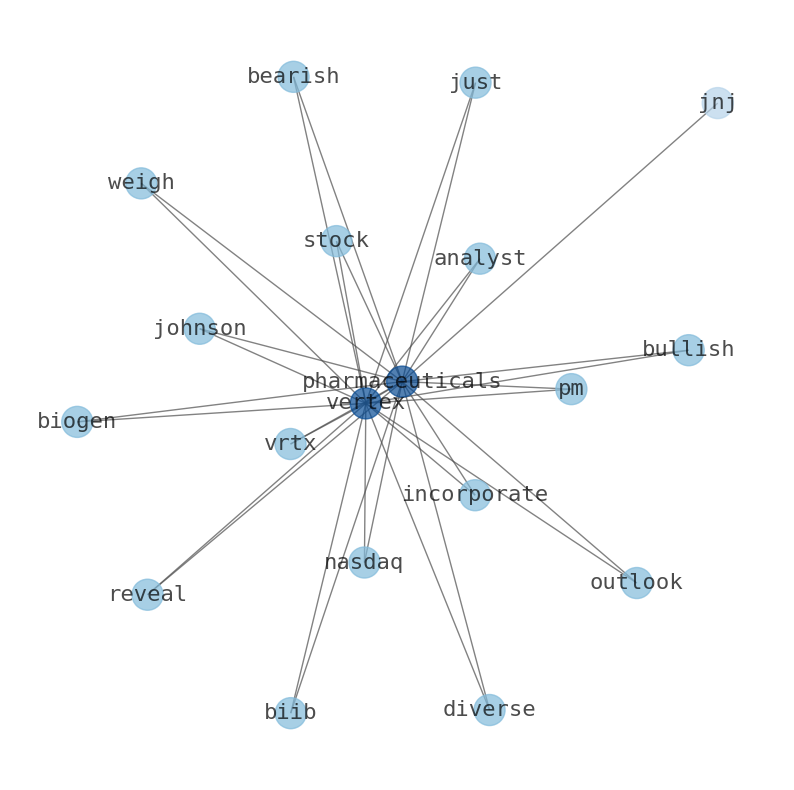

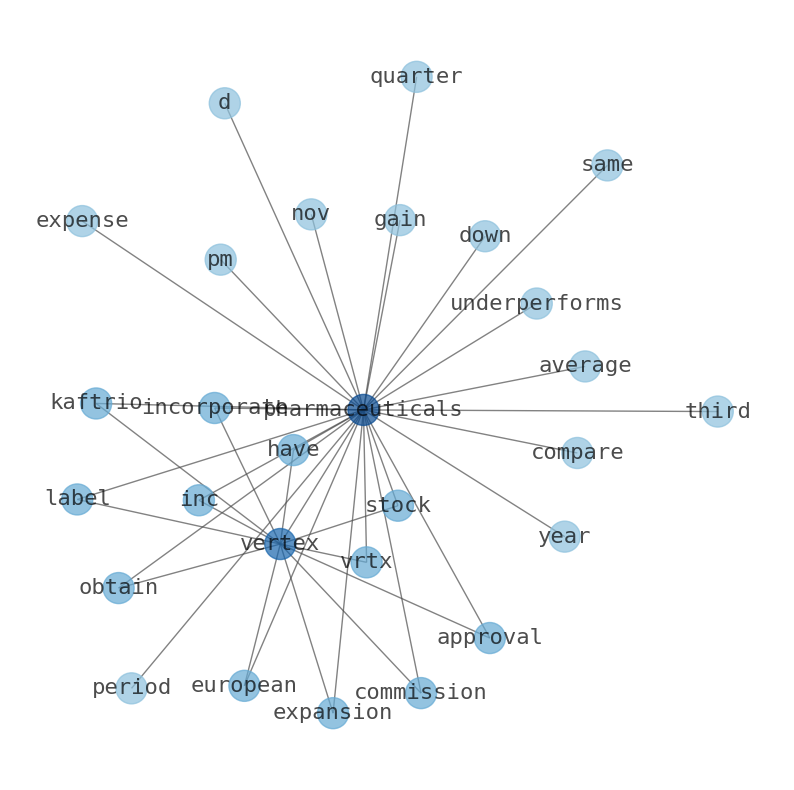

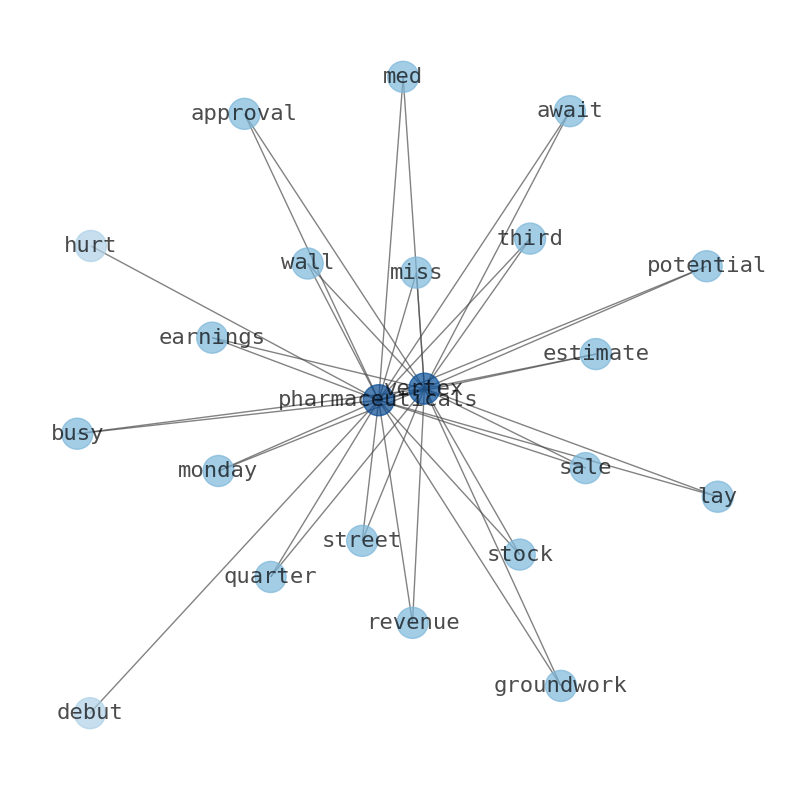

Percentage of shares that are sold short for Vertex Pharmaceuticals has grown since its last report. Peer group average for short interest as a percentage of float is 4.62%, which means the company has less short interest. Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) has a market capitalization of $87.877 billion. Baron Health Care Fund highlighted stocks like Vertex. in the first quarter 2023 investor letter. Vertex Pharmaceuticals stock analysis is based on the TipRanks Smart Score which is derived from 8 unique data sets including Analyst recommendations, Crowd Wisdom, Hedge Fund Activity, Media Sentiment and multiple Technical stock factors. The business Vertex is a Boston-based biotech company focused on the development and commercialization of therapies for treating cystic fibrosis. Vertex Pharmaceuticals has made 9 investments. In 2021, Vertex announced the acquisition of Semma Therapeutics with an aim to strengthen its position in the field of regenerative medicine and expands its pipeline of innovative therapies for cystic fibrosis. Vertex Pharmaceuticals (NASDAQ:VRTX – Get Rating ) last issued its quarterly earnings results on Monday, May 1st. The company had a net margin of 35.40% and a return on equity of 25.06%. Vertex Pharmaceuticals Incorporated is a renowned biopharmaceutical company dedicated to developing treatments for cystic fibrosis and sickle cell disease. The company has a strong pipeline of drugs in development, solid fundamentals, and a sound strategy for growth. Despite some of the risks associated with investing in biotech stocks, many analysts remain bullish on Vertexs prospects. Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) has been given a “Moderate Buy’ rating by the twenty-three brokerages that are currently covering it. The biotech industry is projected to grow at a steady pace due to the increasing demand for innovative treatments. Vertex Pharmaceuticals is one of the most innovative companies in the pharmaceutical industry when it comes to research and development. The company has dedicated over 20 years of its existence to researching and developing new drugs. Vertex Pharmaceuticals is a leading biotech company that develops and sells drugs for the treatment of serious diseases. The company has a strong pipeline of drugs in development and several already approved by the FDA. The future looks bright for the company, with a strong focus on innovation. Vertex Pharmaceuticals is a biotechnology company that specializes in discovering and developing innovative treatments for serious diseases. The company has seen impressive growth over the years, with a compound annual growth rate (CAGR) of over 30%. Vertex Pharmaceuticals is a biotech company that focuses on the development of innovative medicines for serious diseases. The company has made remarkable progress in the treatment of cystic fibrosis, a life-threatening genetic disease. In 2020, the company reported an annual revenue of $6.2 billion. Vertex Pharmaceuticals Incorporated has been a strong performer in the biotech industry. The company has consistent revenue growth and significant investments in research and development. However, the companys net income has been somewhat inconsistent.

Stock Profile

"Vertex Pharmaceuticals Incorporated, a biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF). It markets TRIKAFTA/KAFTRIO and SYMDEKO/SYMKEVI for people with CF with at least one F508del mutation for 6 years of age or older; ORKAMBI for CF homozygous F508del mutation for CF patients 2 year or older; and KALYDECO for the treatment of patients with 4 months or older who have CF with a mutation that is responsive to ivacaftor, and R117H mutation or one of certain gating mutations. The company's pipeline includes VX-522, a CF mRNA therapeutic designed to treat the underlying cause of CF, which is in Phase 1 clinical trial; VX-548, a non-opioid medicine for the treatment of acute and neuropathic pain which is in Phase 3 clinical trial; Exa-cel, for the treatment of sickle cell disease and transfusion-dependent beta thalassemia which is in Phase 2/3 clinical trial; and VX-864 for treatment of AAT deficiency, which is in Phase 2 clinical trial. In addition, it provides VX-147 for the treatment of APOL1-mediated focal segmental glomerulosclerosis and co-morbidities, such as hypertension which is in single Phase 2/3; VX- 880, treatment for Type 1 Diabetes which is in Phase 1/2 clinical trial; VX-970, which is in Phase 2 clinical trial for the treatment of cancer; and VX-803 and VX-984 for treatment of cancer in Phase 1 clinical trial. Further, it sell the products to specialty pharmacy and specialty distributors in the United States, as well as retail pharmacies or pharmacy chains, hospitals, and clinics. Additionally, the company has collaborations with CRISPR Therapeutics AG.; Moderna, Inc.; Entrada Therapeutics, Inc.; Affinia Therapeutics; Arbor Biotechnologies, Inc.; Kymera Therapeutics, Inc.; Mammoth Biosciences, Inc.; Obsidian Therapeutics, Inc.; Verve Therapeutics; Skyhawk Therapeutics; and Ribometrix, Inc. Vertex Pharmaceuticals Incorporated was founded in 1989 and is headquartered in Boston, Massachusetts."

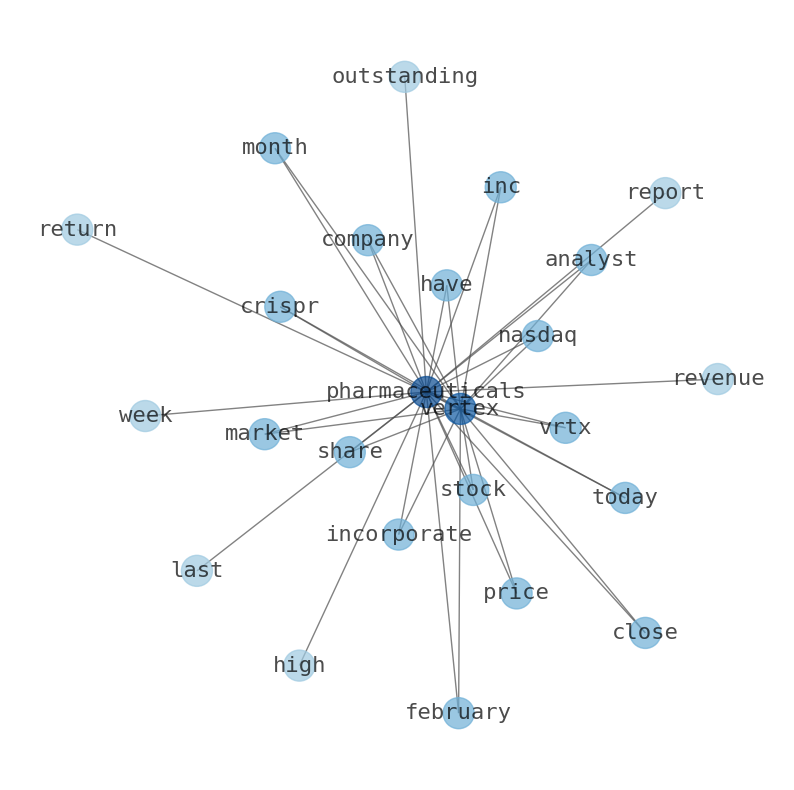

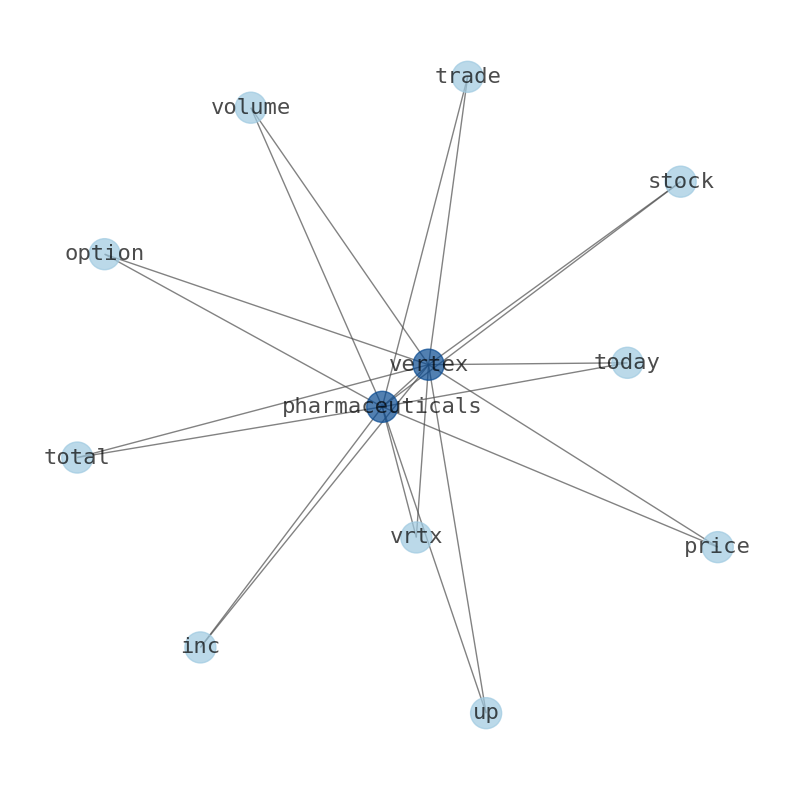

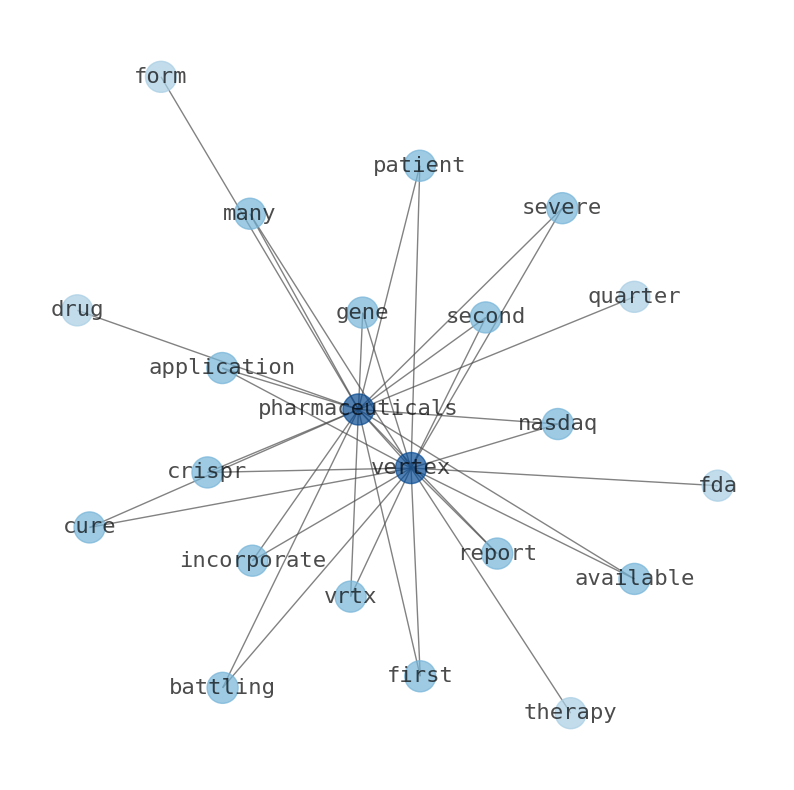

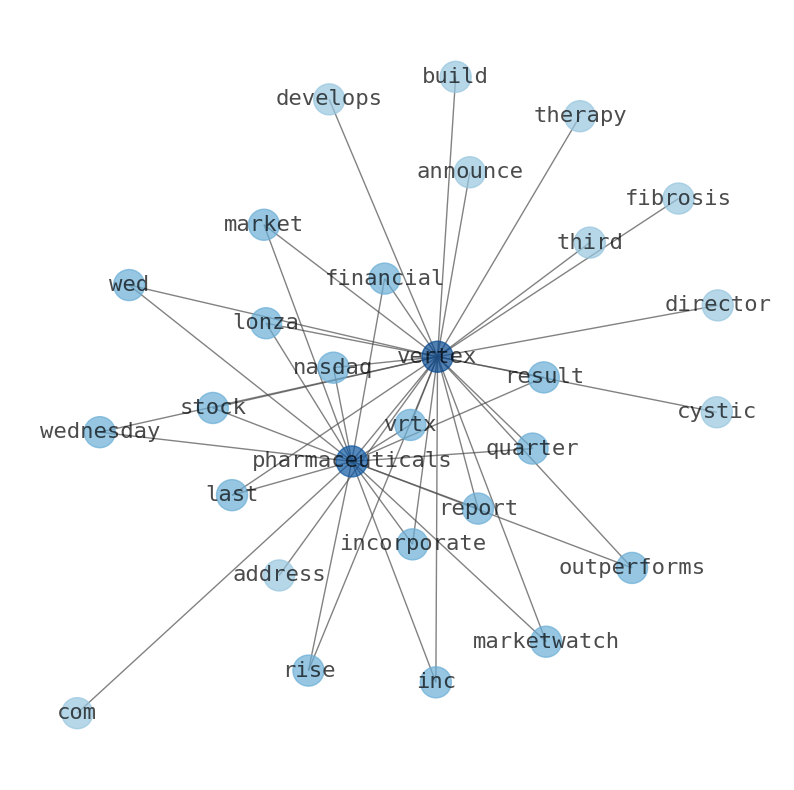

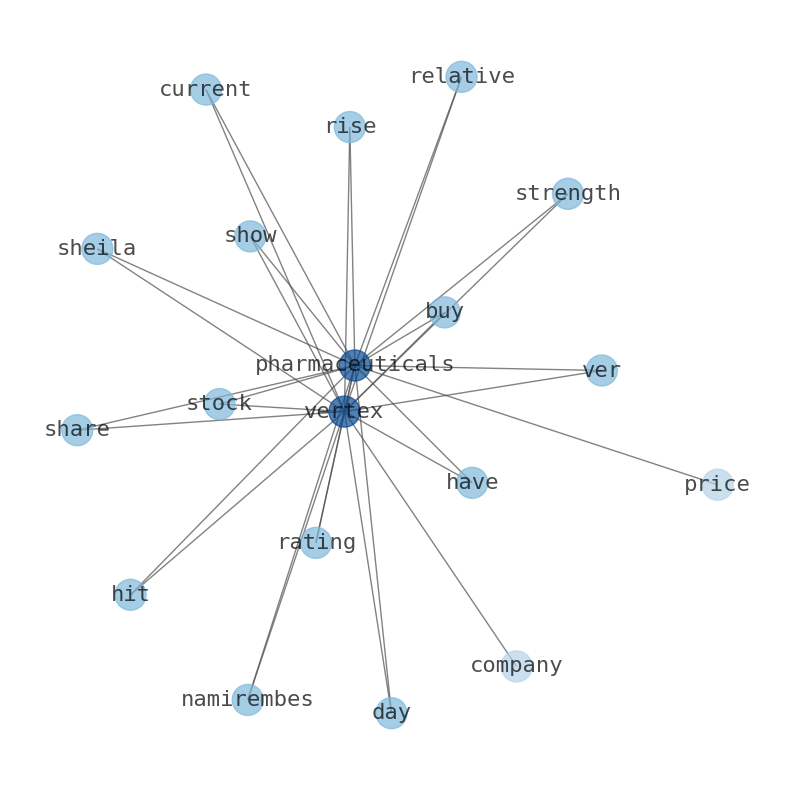

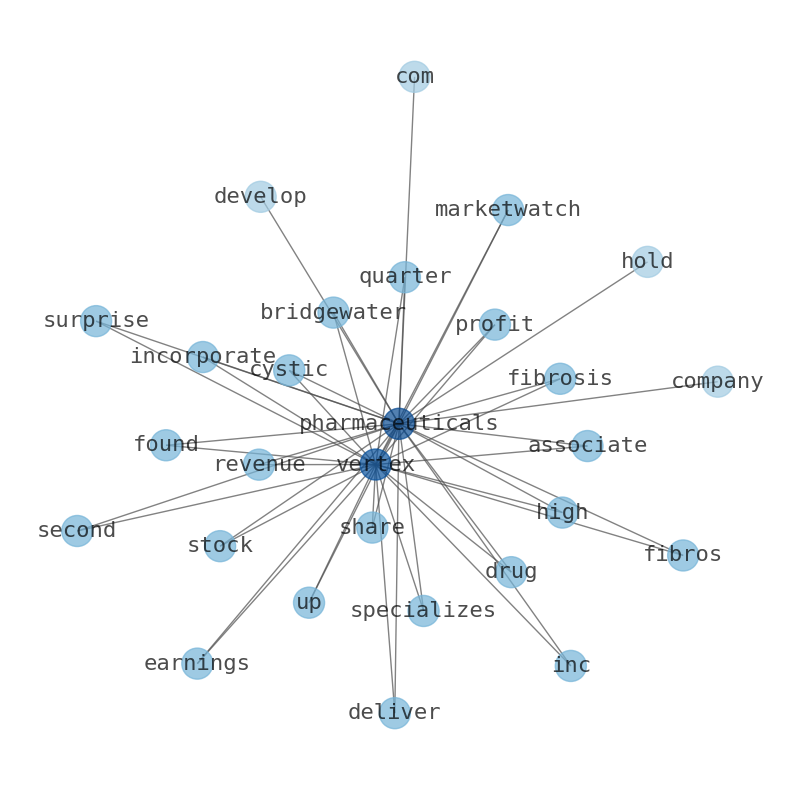

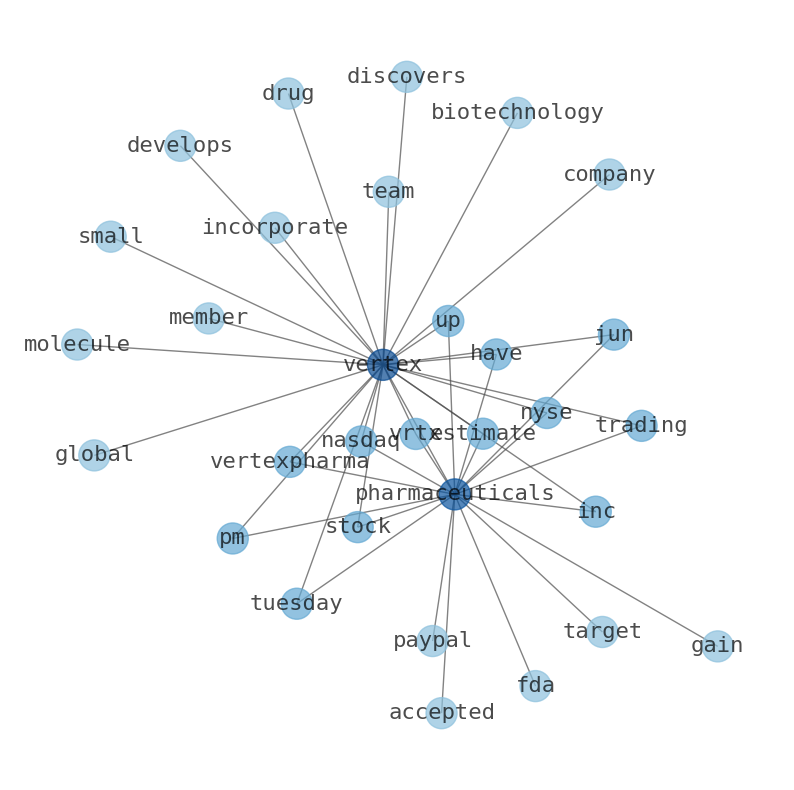

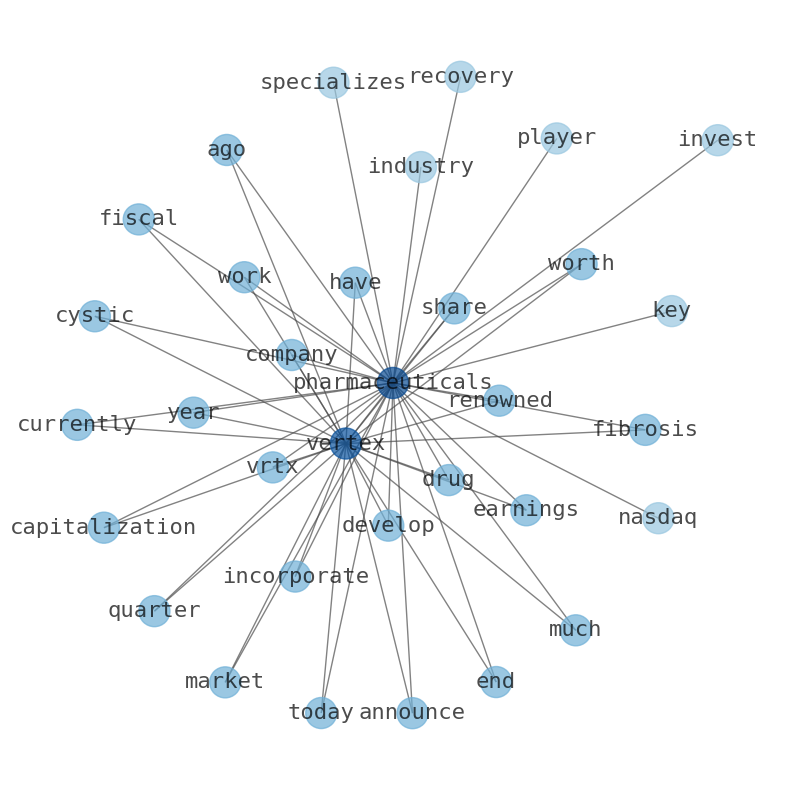

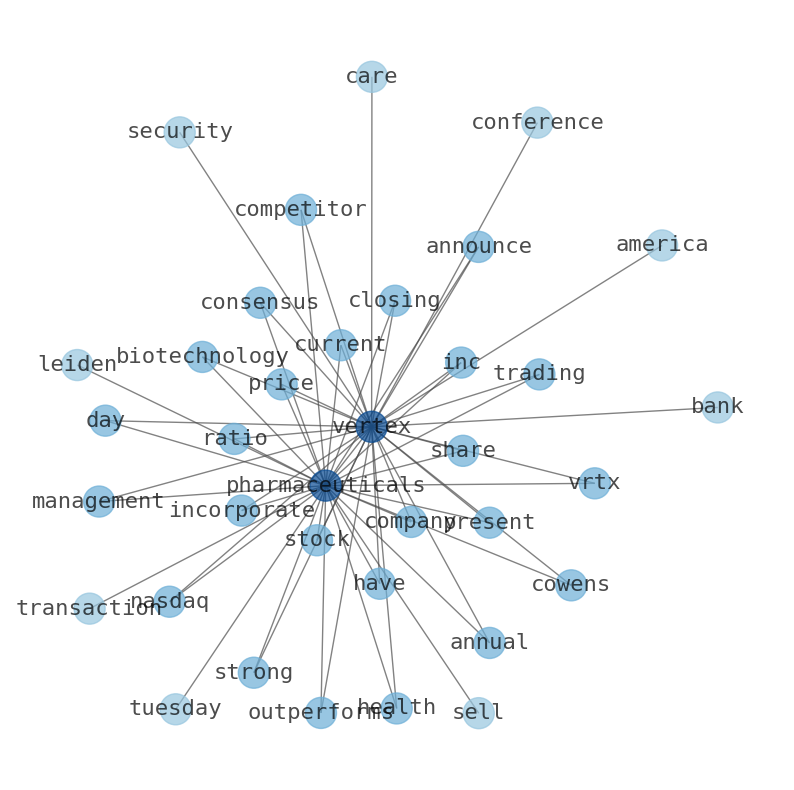

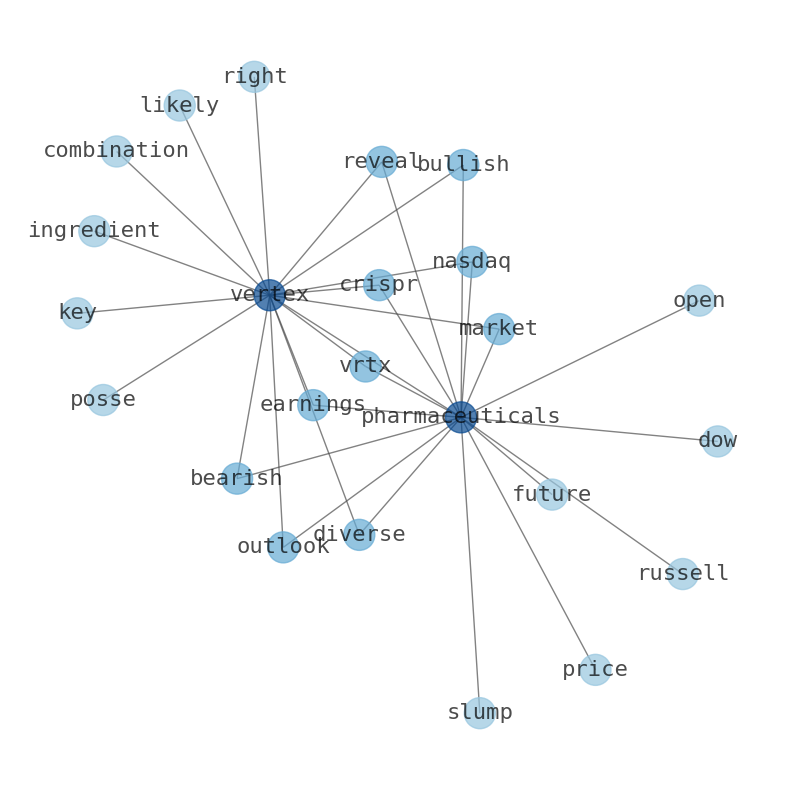

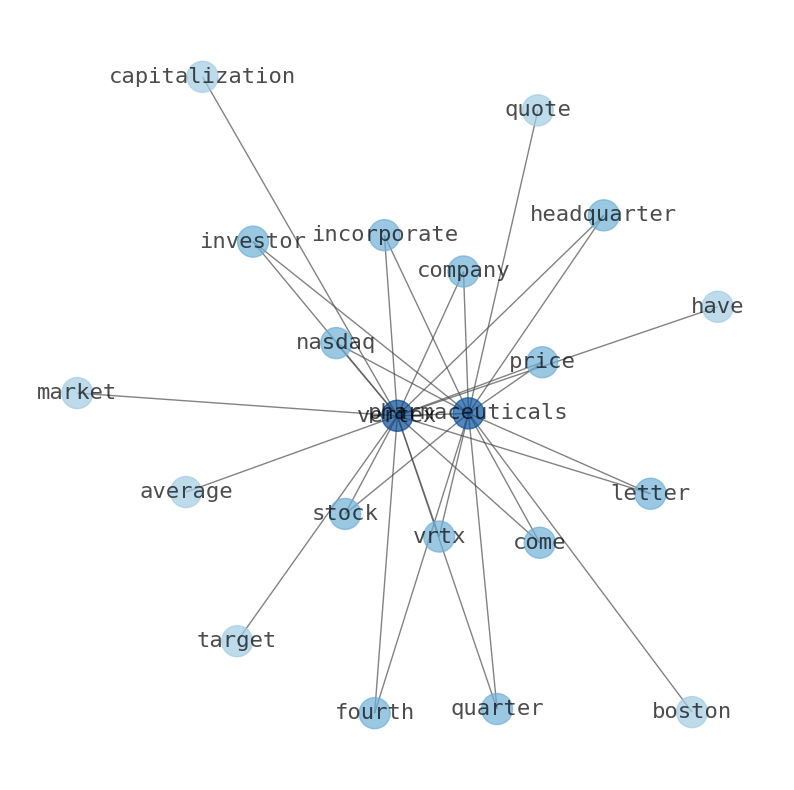

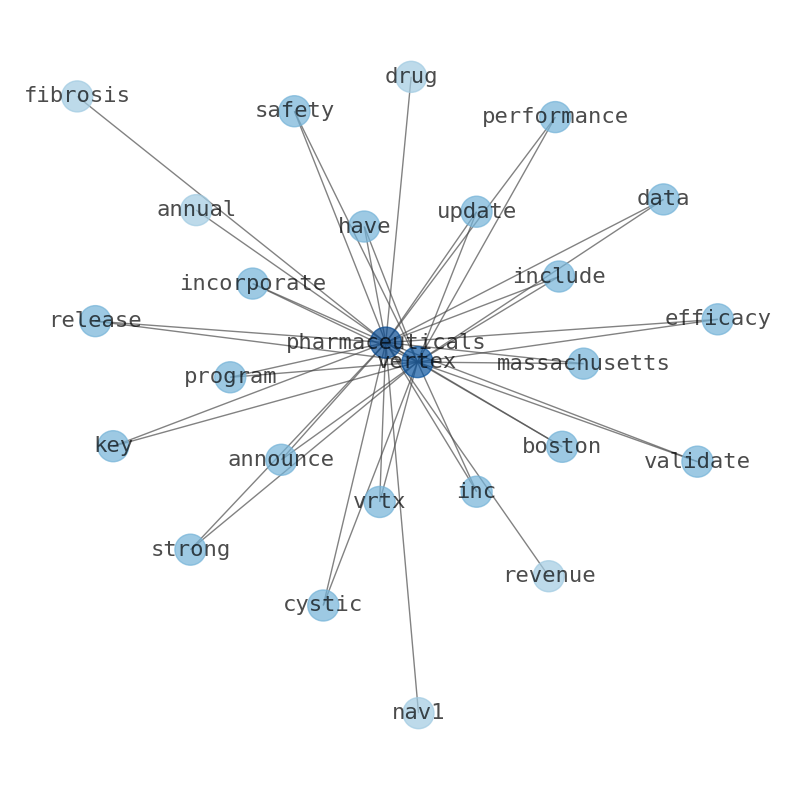

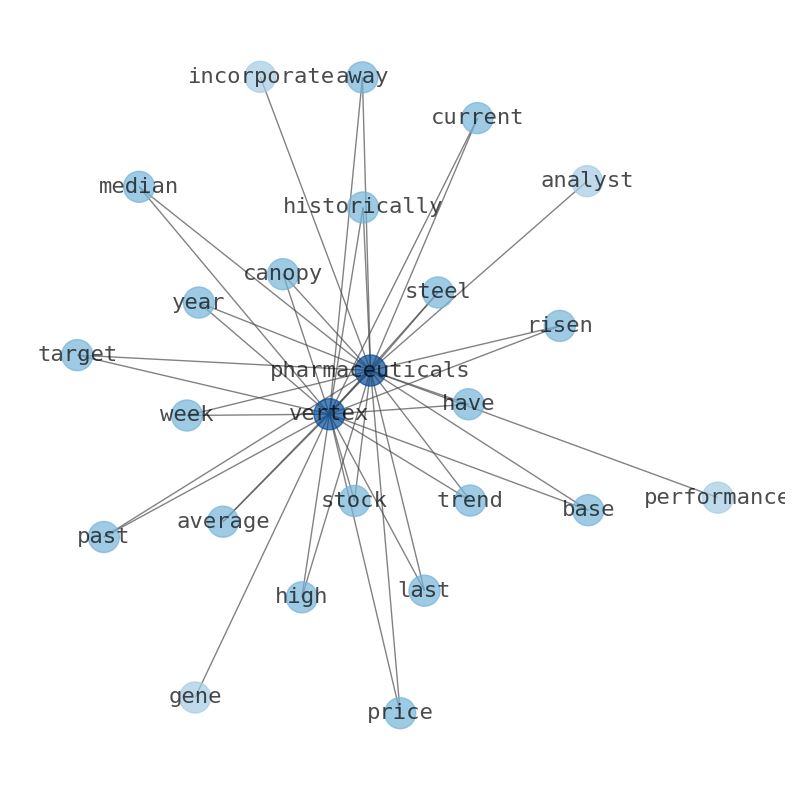

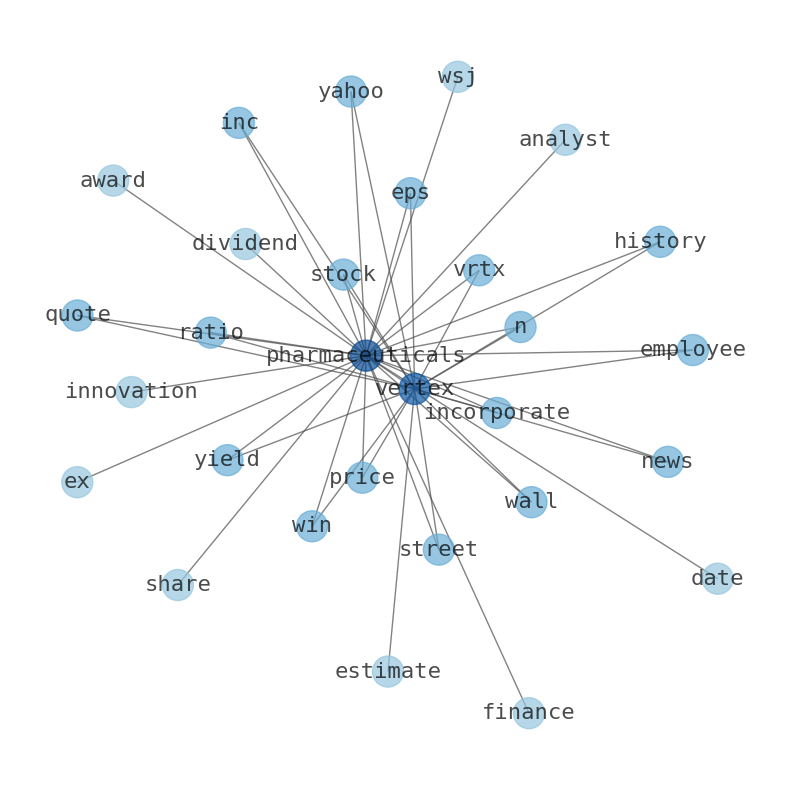

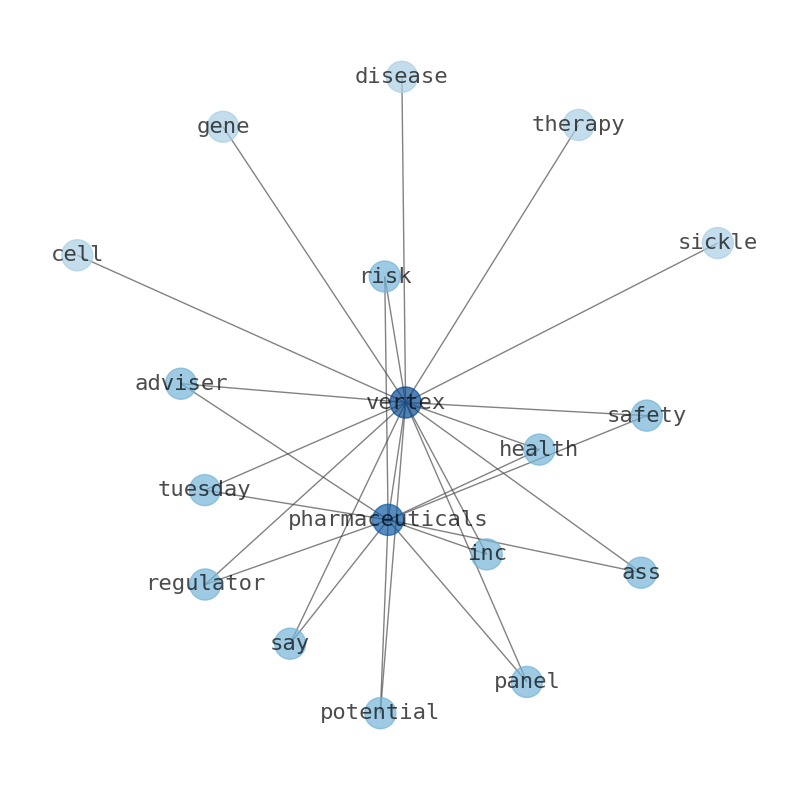

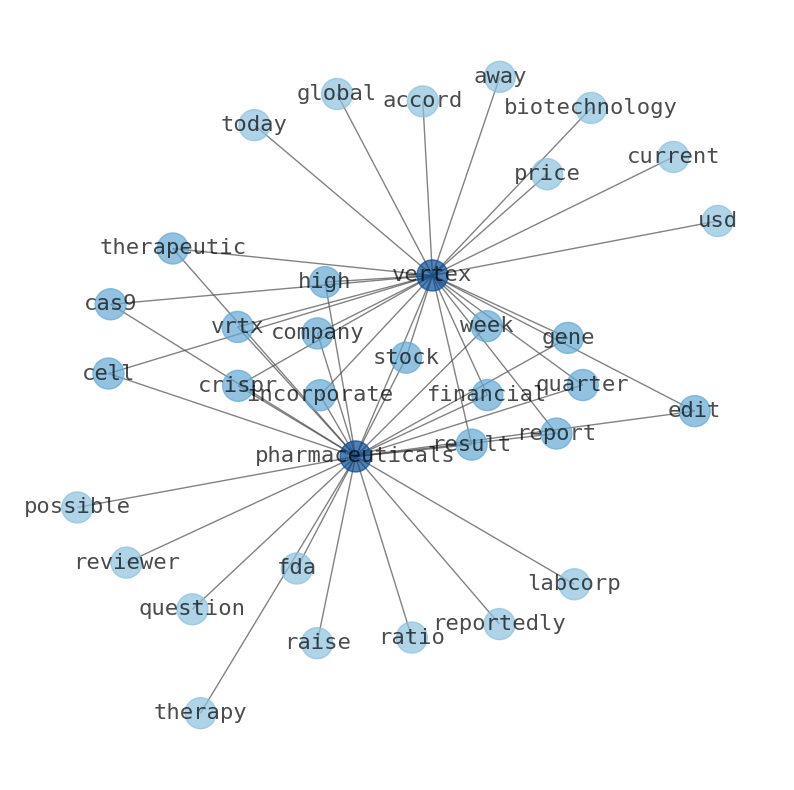

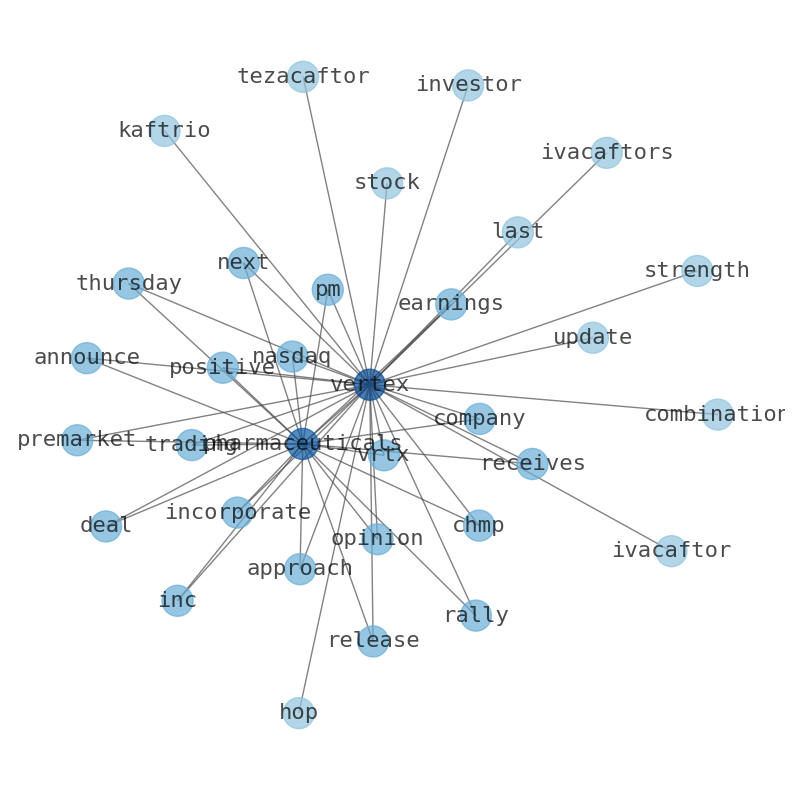

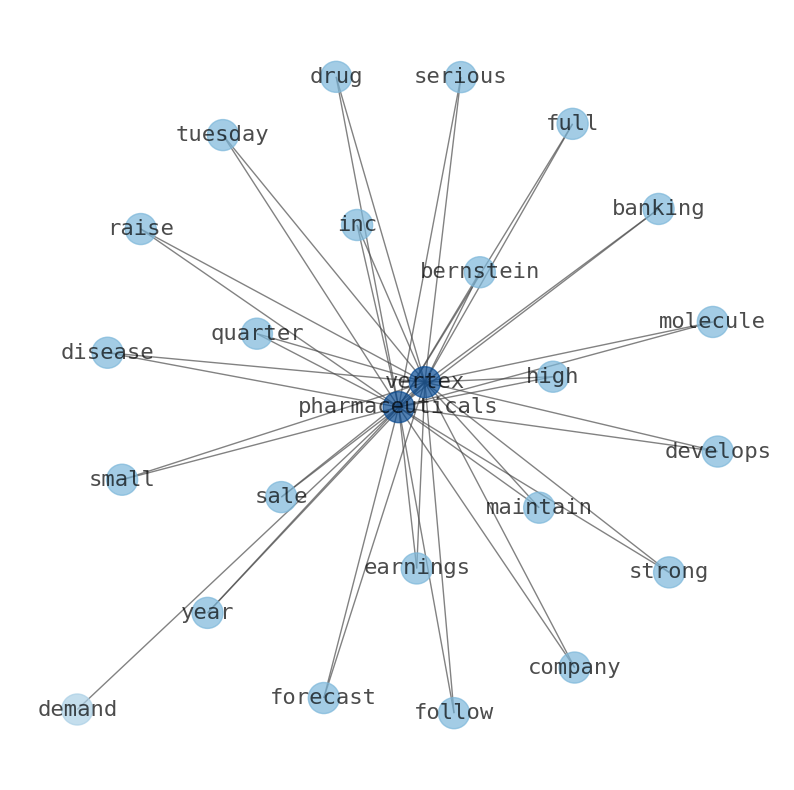

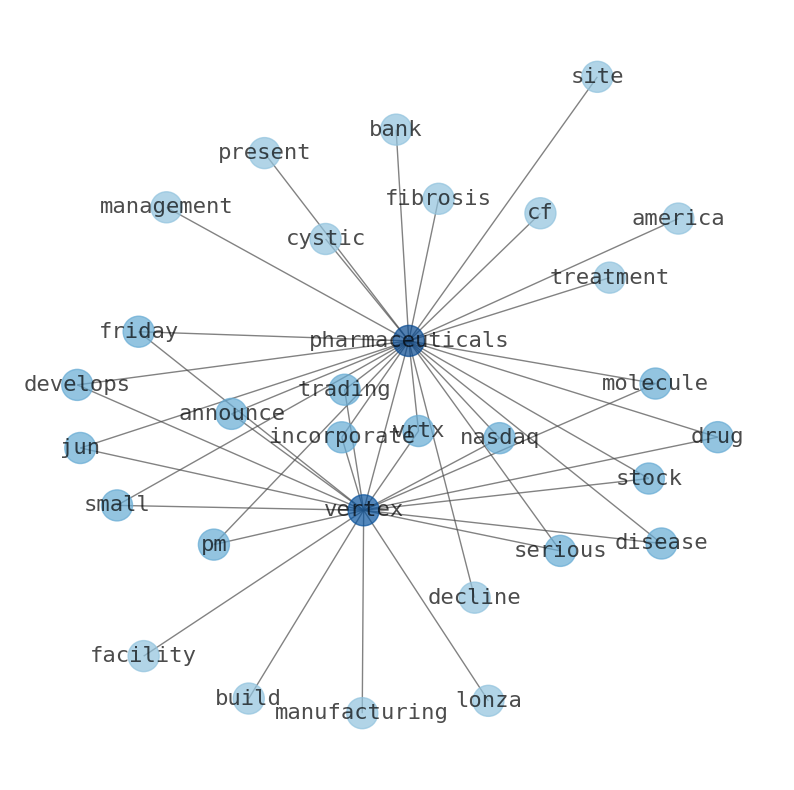

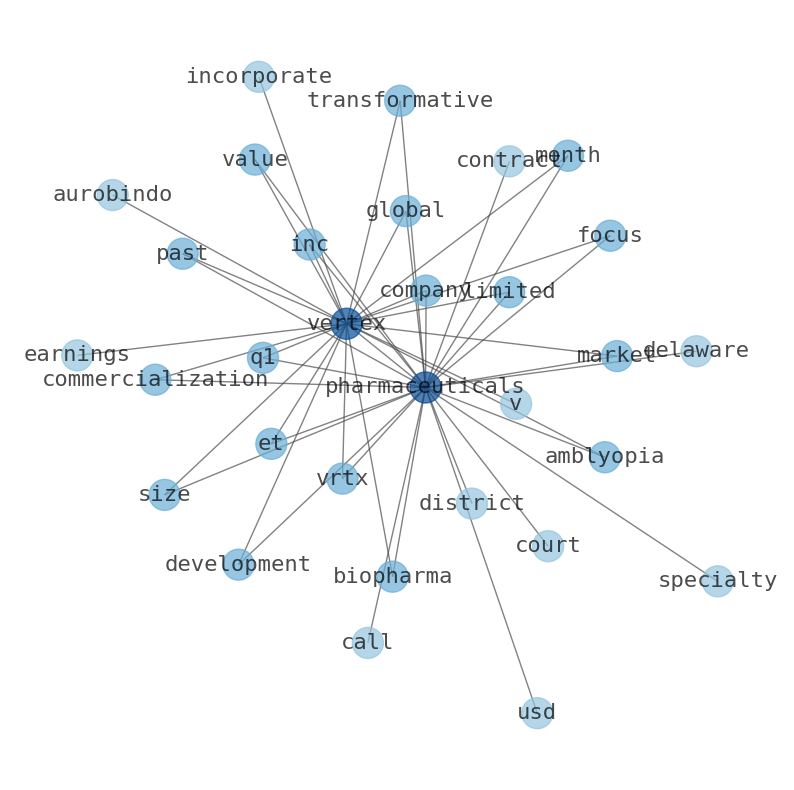

Keywords

How much time have you spent trying to decide whether investing in Vertex Pharmaceuticals? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Vertex Pharmaceuticals are: company, Vertex, Pharmaceuticals, biotech, development, innovative, treatment, and the most common words in the summary are: vertex, pharmaceutical, stock, company, vrtx, market, news, . One of the sentences in the summary was: The biotech industry is projected to grow at a steady pace due to the increasing demand for innovative treatments.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #vertex #pharmaceutical #stock #company #vrtx #market #news.

Read more →Related Results

Vertex Pharmaceuticals

Open: 412.34 Close: 413.59 Change: 1.25

Read more →

Vertex Pharmaceuticals

Open: 421.77 Close: 419.63 Change: -2.14

Read more →

Vertex Pharmaceuticals

Open: 425.96 Close: 422.91 Change: -3.05

Read more →

Vertex Pharmaceuticals

Open: 405.0 Close: 410.91 Change: 5.91

Read more →

Vertex Pharmaceuticals

Open: 353.95 Close: 350.19 Change: -3.76

Read more →

Vertex Pharmaceuticals

Open: 373.16 Close: 378.35 Change: 5.19

Read more →

Vertex Pharmaceuticals

Open: 364.95 Close: 369.33 Change: 4.38

Read more →

Vertex Pharmaceuticals

Open: 361.46 Close: 365.25 Change: 3.79

Read more →

Vertex Pharmaceuticals

Open: 343.4 Close: 344.82 Change: 1.42

Read more →

Vertex Pharmaceuticals

Open: 351.42 Close: 347.74 Change: -3.68

Read more →

Vertex Pharmaceuticals

Open: 342.63 Close: 340.54 Change: -2.09

Read more →

Vertex Pharmaceuticals

Open: 330.92 Close: 332.63 Change: 1.71

Read more →

Vertex Pharmaceuticals

Open: 343.29 Close: 344.83 Change: 1.54

Read more →

Vertex Pharmaceuticals

Open: 421.77 Close: 419.63 Change: -2.14

Read more →

Vertex Pharmaceuticals

Open: 418.38 Close: 415.51 Change: -2.87

Read more →

Vertex Pharmaceuticals

Open: 415.01 Close: 416.5 Change: 1.49

Read more →

Vertex Pharmaceuticals

Open: 408.16 Close: 410.68 Change: 2.52

Read more →

Vertex Pharmaceuticals

Open: 354.95 Close: 353.04 Change: -1.91

Read more →

Vertex Pharmaceuticals

Open: 379.64 Close: 376.2 Change: -3.44

Read more →

Vertex Pharmaceuticals

Open: 357.15 Close: 357.45 Change: 0.3

Read more →

Vertex Pharmaceuticals

Open: 351.26 Close: 348.9 Change: -2.36

Read more →

Vertex Pharmaceuticals

Open: 350.0 Close: 358.4 Change: 8.4

Read more →

Vertex Pharmaceuticals

Open: 349.91 Close: 350.87 Change: 0.96

Read more →

Vertex Pharmaceuticals

Open: 329.82 Close: 325.3 Change: -4.52

Read more →

Vertex Pharmaceuticals

Open: 341.37 Close: 343.2 Change: 1.83

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo