The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Vertex Pharmaceuticals

Youtube Subscribe

Open: 425.96 Close: 422.91 Change: -3.05

Don't invest before reading what an AI found about Vertex Pharmaceuticals.

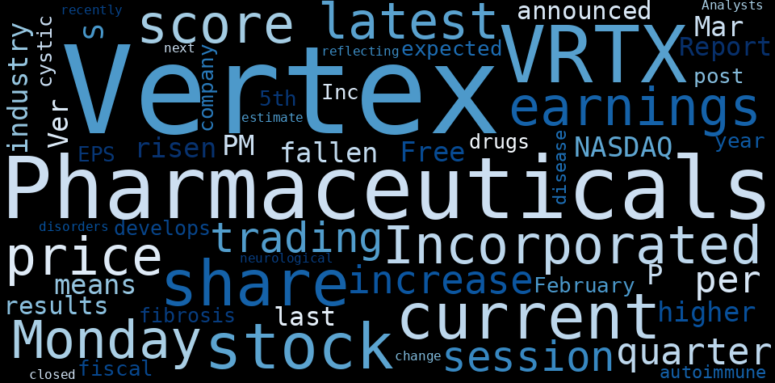

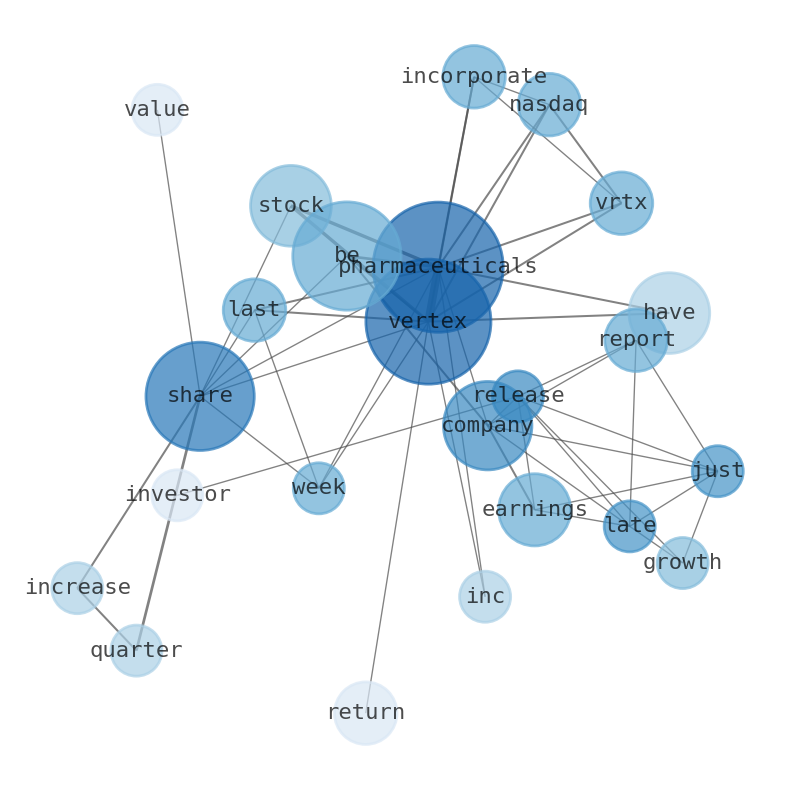

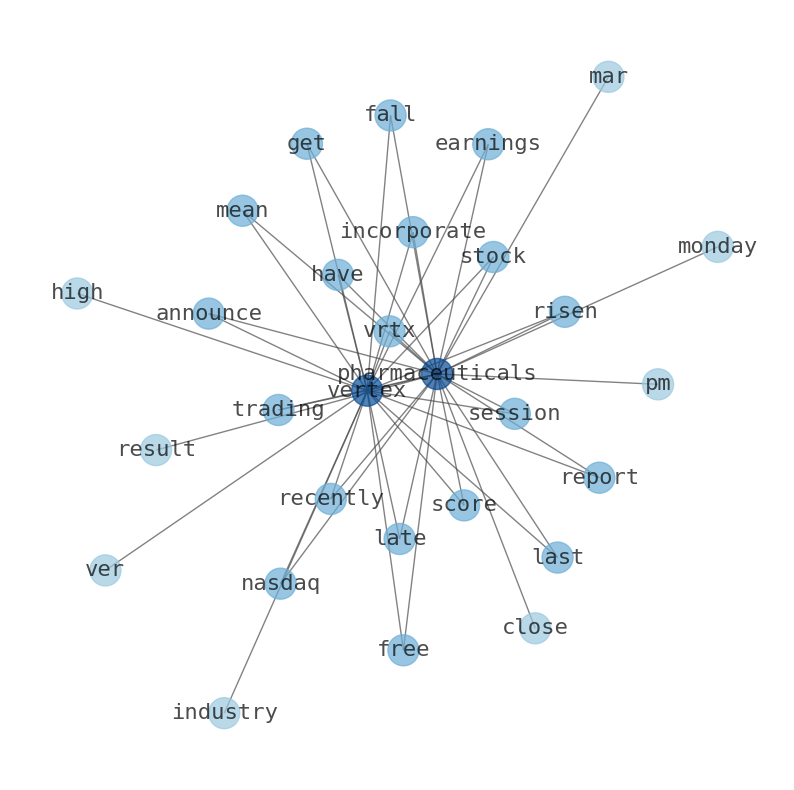

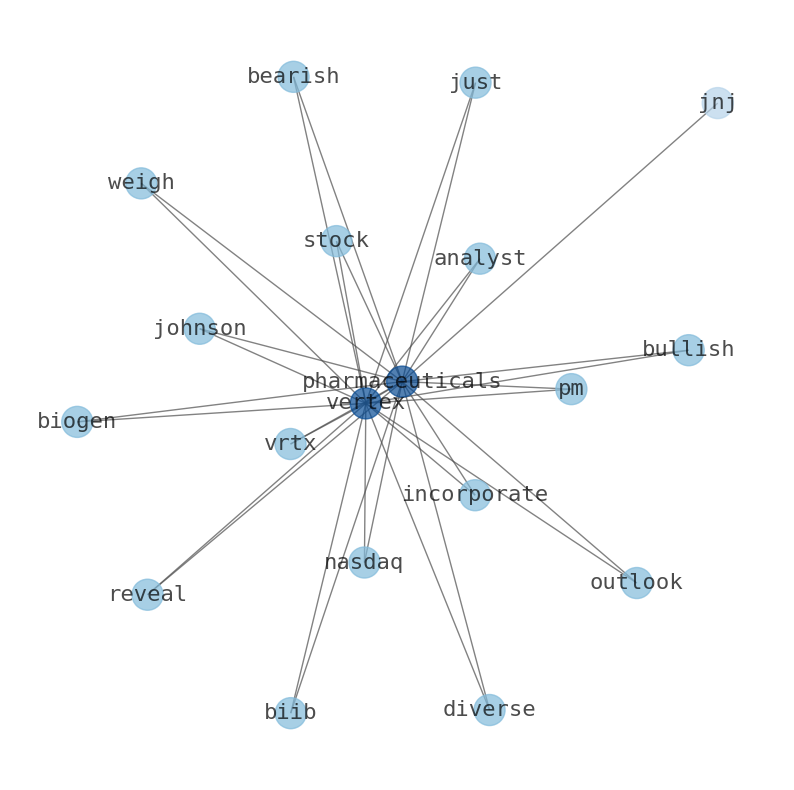

The game is changing. There is a new strategy to evaluate Vertex Pharmaceuticals fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Vertex Pharmaceuticals are: Vertex, Pharmaceuticals, share, company, stock, earnings, Incorporated, …

Stock Summary

Vertex Pharmaceuticals Incorporated engages in developing and commercializing therapies for treating cystic fibrosis (CF) It markets TRIKAFTA/KAFTRIO and SYMDEKO/SYMKEVI for people with CF with.

Today's Summary

Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) stock closed at $423.06 per share on February 8, 2024. One-month return of Vertex pharmaceuticals Inc. was -2.39%, and its shares gained 42.25% of their value over the last 52 weeks.

Today's News

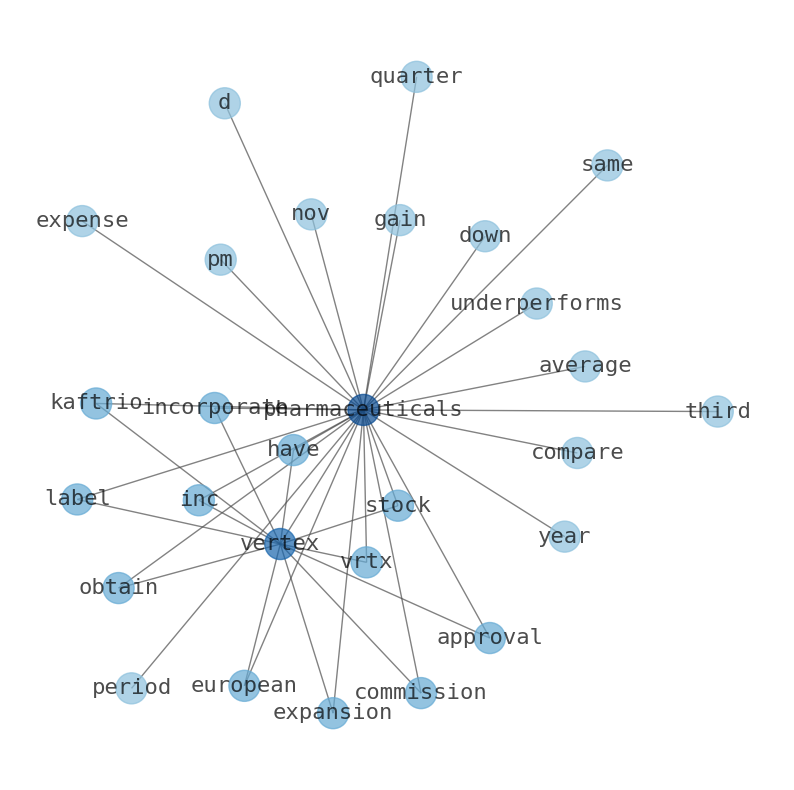

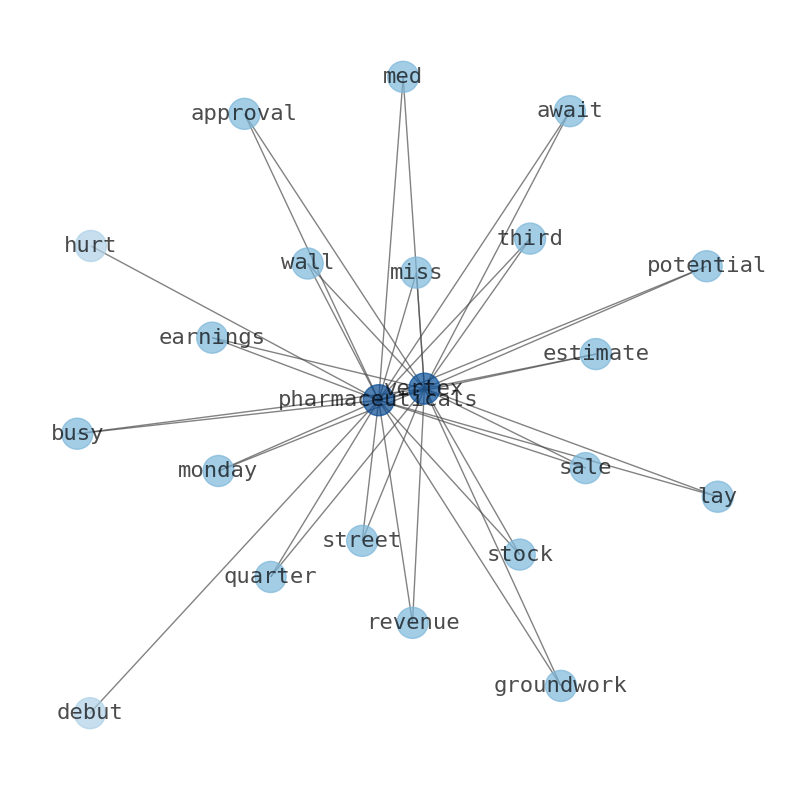

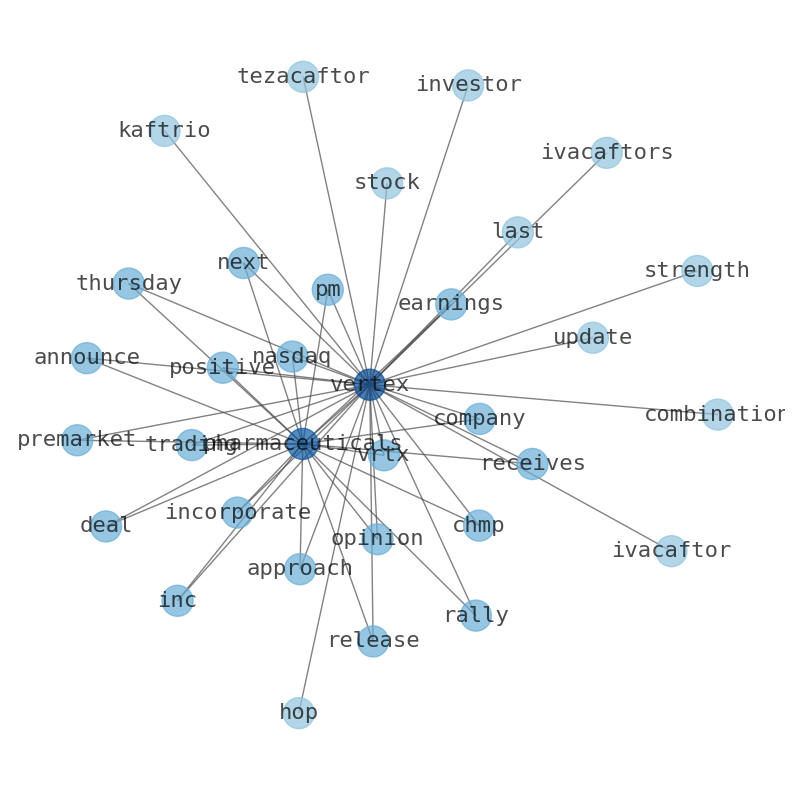

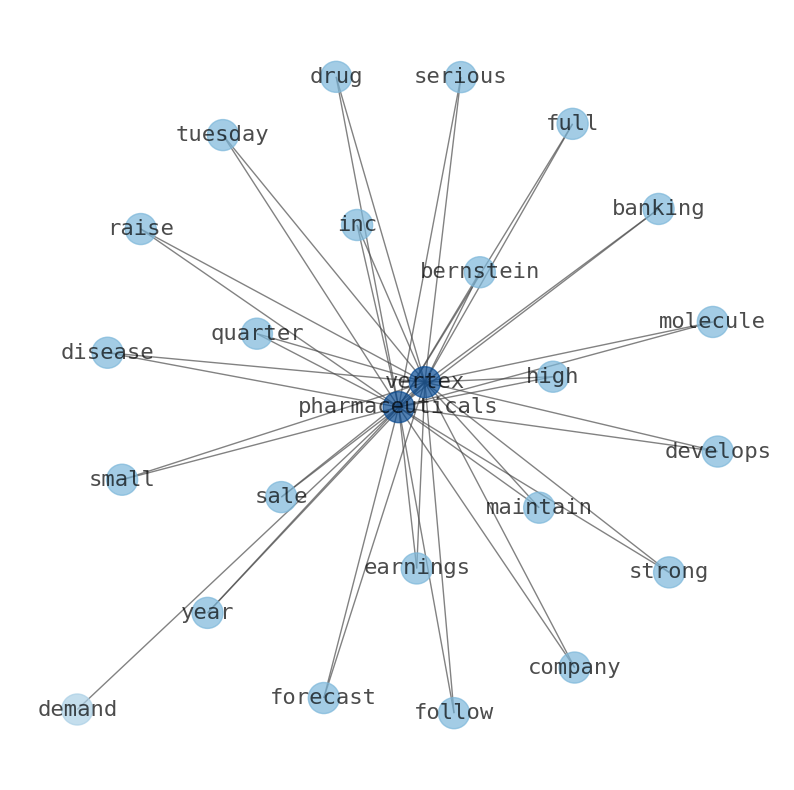

Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) stock closed at $423.06 per share on February 8, 2024. One-month return of Vertex pharmaceuticals Inc. was -2.39%, and its shares gained 42.25% of their value over the last 52 weeks. Vertex Pharmaceuticals Incorporated is a global biotechnology company that discovers and develops small-molecule drugs for the treatment of serious diseases. The company just released its latest earnings report, and growth investors may be a little disappointed. In the year 2022, Vertex. Pharmaceuticals had annual revenue of $8.93B with 17.91%. Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) reported in line with analyst predictions, delivering revenues of US$9.9b and statutory earnings per share of US $13.89. The most bullish analyst values the company at US$578 per share, while the most bearish prices it at US $314. Vertex Pharmaceuticals stock price is 422.91 USD today. The Vertex pharmaceuticals stock is a publicly traded company. Analysts estimate an earnings increase this quarter of $0.22 per share, an increase next quarter of$0.38 per share and $1.64 per share. FDA approves use of Casgevy, a therapy from Vertex Pharmaceuticals and CRISPR Therapeutics that uses CRisPR gene-editing to treat the serious blood disorder transfusio... FDA approved use of the therapy. Vertex Pharmaceuticals stock price per share is $422.91 today (as of Feb 9, 2024) If you had invested in the company at $16.50, your return over the last 26 years would have been 2,463.09%. Vertex Pharmaceuticals Inc.s market capitalization is $108.07 B by 257.68 M shares outstanding. The high in the last 52 weeks of Vertex. Pharmaceuticals stock has received a consensus rating of buy. Vertex Pharmaceuticals (NASDAQ:VRTX) has outperformed the market over the past 5 years by 5.51% on an annualized basis producing an average annual return of 18.17%. The company just released its latest earnings report and growth investors may be disappointed.

Stock Profile

"Vertex Pharmaceuticals Incorporated, a biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF). It markets TRIKAFTA/KAFTRIO and SYMDEKO/SYMKEVI for people with CF with at least one F508del mutation for 6 years of age or older; ORKAMBI for CF homozygous F508del mutation for CF patients 2 year or older; and KALYDECO for the treatment of patients with 4 months or older who have CF with a mutation that is responsive to ivacaftor, and R117H mutation or one of certain gating mutations. The company's pipeline includes VX-522, a CF mRNA therapeutic designed to treat the underlying cause of CF, which is in Phase 1 clinical trial; VX-548, a non-opioid medicine for the treatment of acute and neuropathic pain which is in Phase 3 clinical trial; Exa-cel, for the treatment of sickle cell disease and transfusion-dependent beta thalassemia which is in Phase 2/3 clinical trial; and VX-864 for treatment of AAT deficiency, which is in Phase 2 clinical trial. In addition, it provides VX-147 for the treatment of APOL1-mediated focal segmental glomerulosclerosis and co-morbidities, such as hypertension which is in single Phase 2/3; VX- 880, treatment for Type 1 Diabetes which is in Phase 1/2 clinical trial; VX-970, which is in Phase 2 clinical trial for the treatment of cancer; and VX-803 and VX-984 for treatment of cancer in Phase 1 clinical trial. Further, it sell the products to specialty pharmacy and specialty distributors in the United States, as well as retail pharmacies or pharmacy chains, hospitals, and clinics. Additionally, the company has collaborations with CRISPR Therapeutics AG.; Moderna, Inc.; Entrada Therapeutics, Inc.; Affinia Therapeutics; Arbor Biotechnologies, Inc.; Kymera Therapeutics, Inc.; Mammoth Biosciences, Inc.; Obsidian Therapeutics, Inc.; Verve Therapeutics; Skyhawk Therapeutics; and Ribometrix, Inc. Vertex Pharmaceuticals Incorporated was founded in 1989 and is headquartered in Boston, Massachusetts."

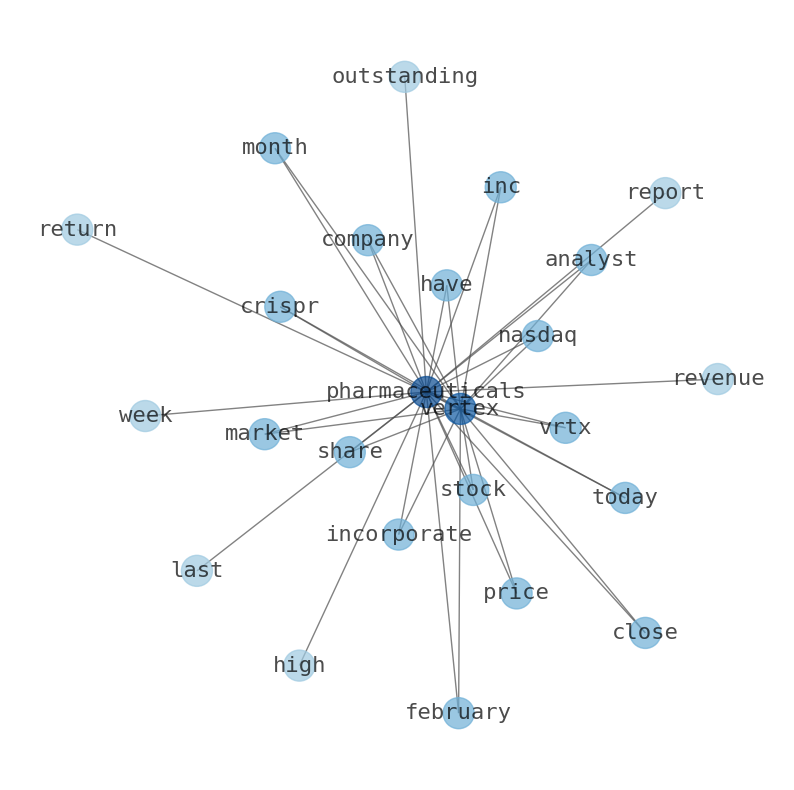

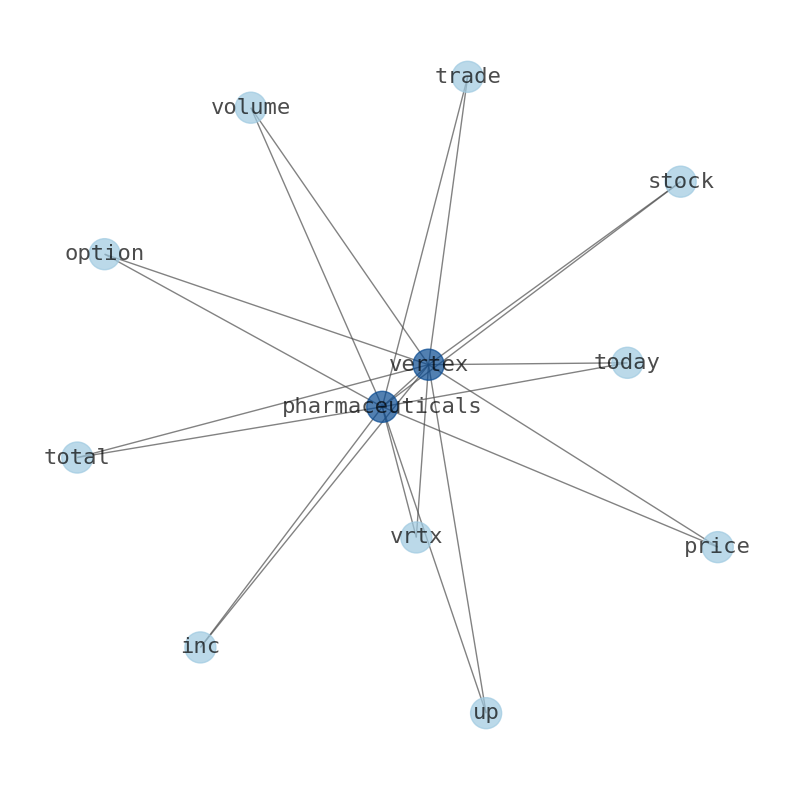

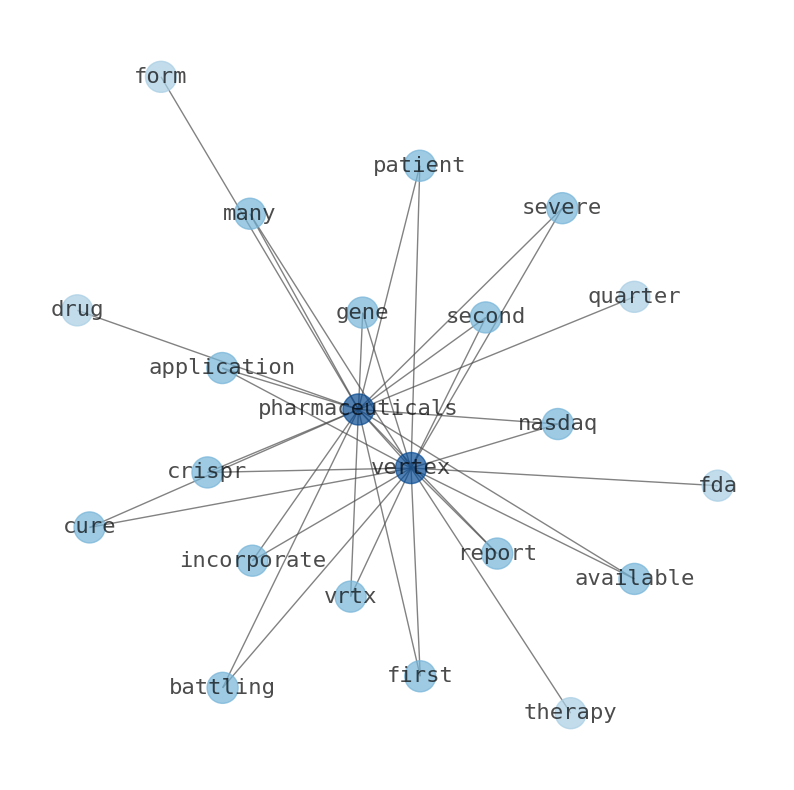

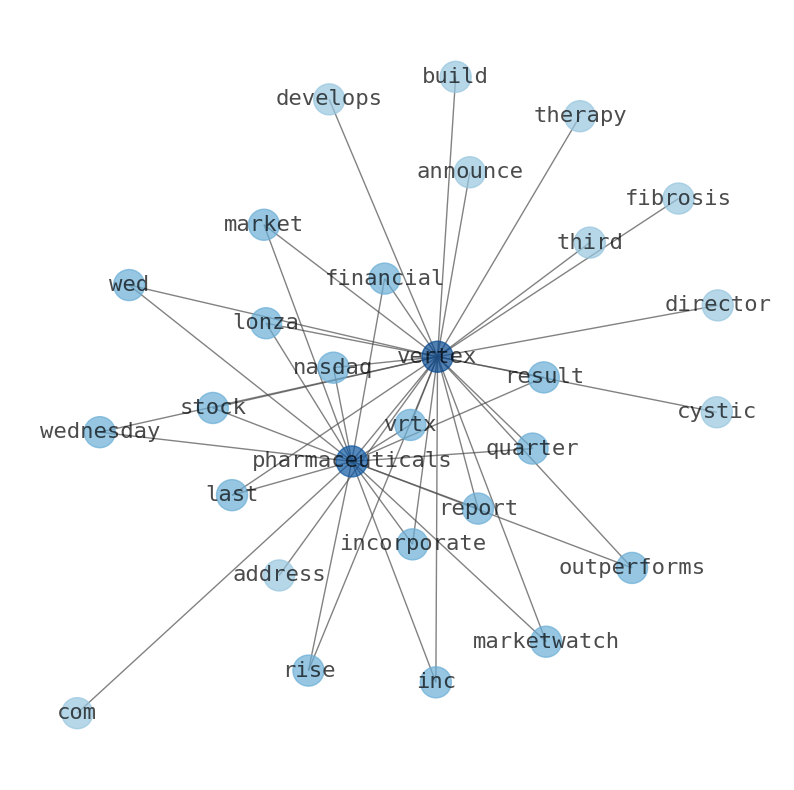

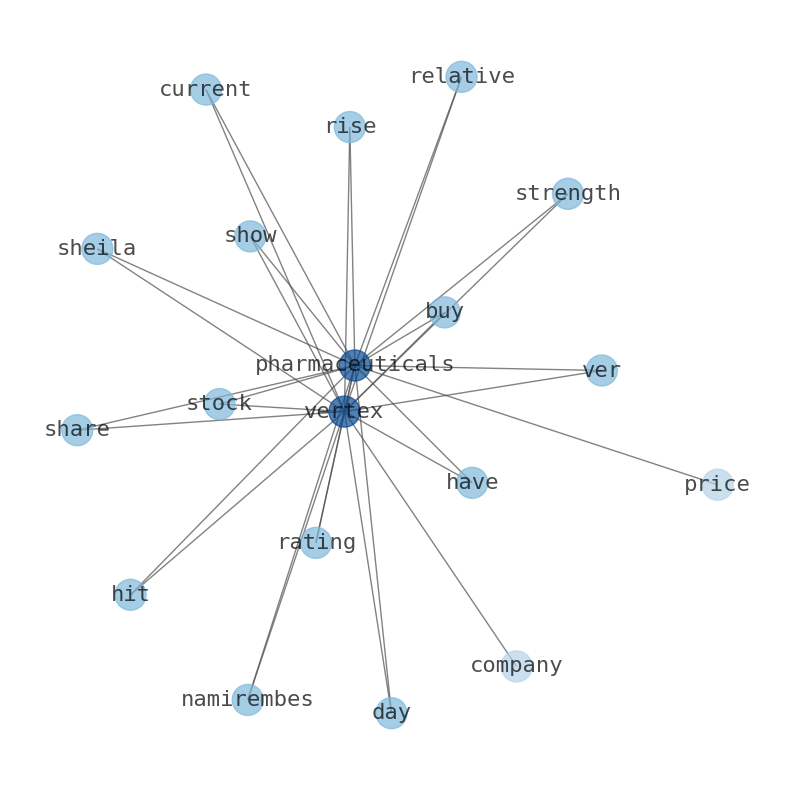

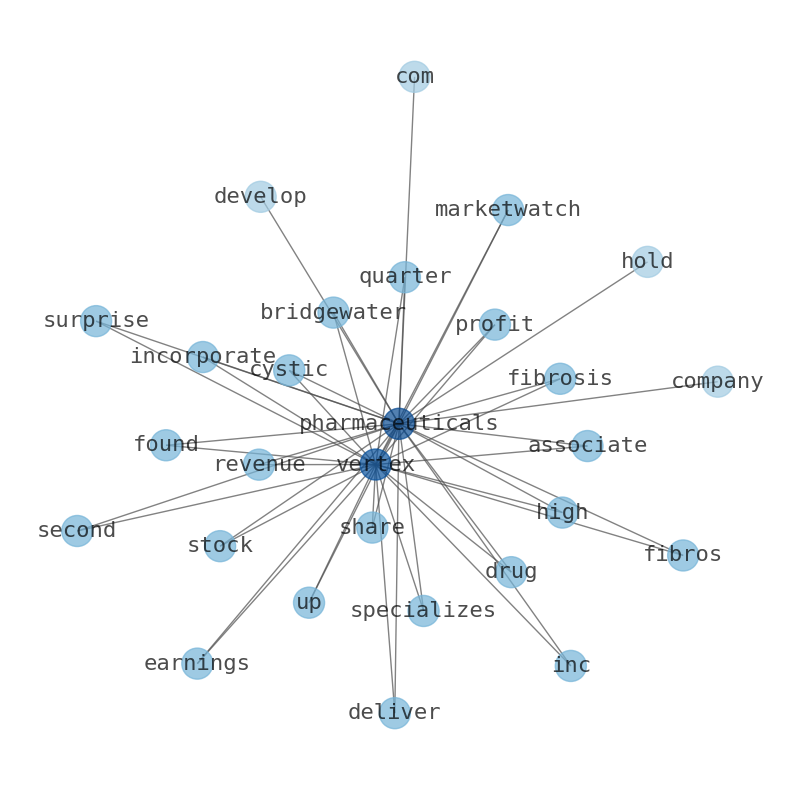

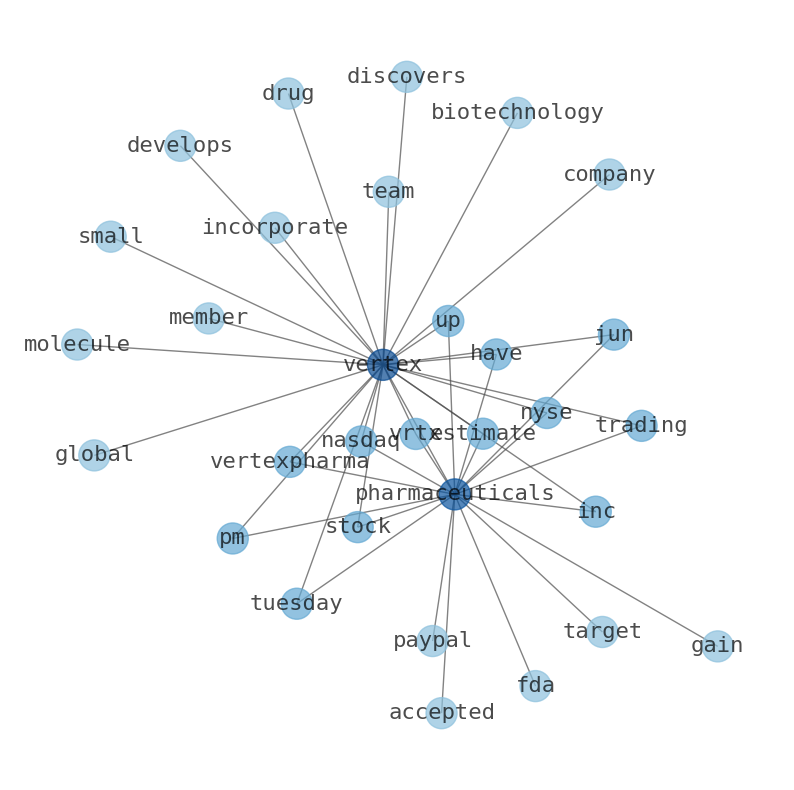

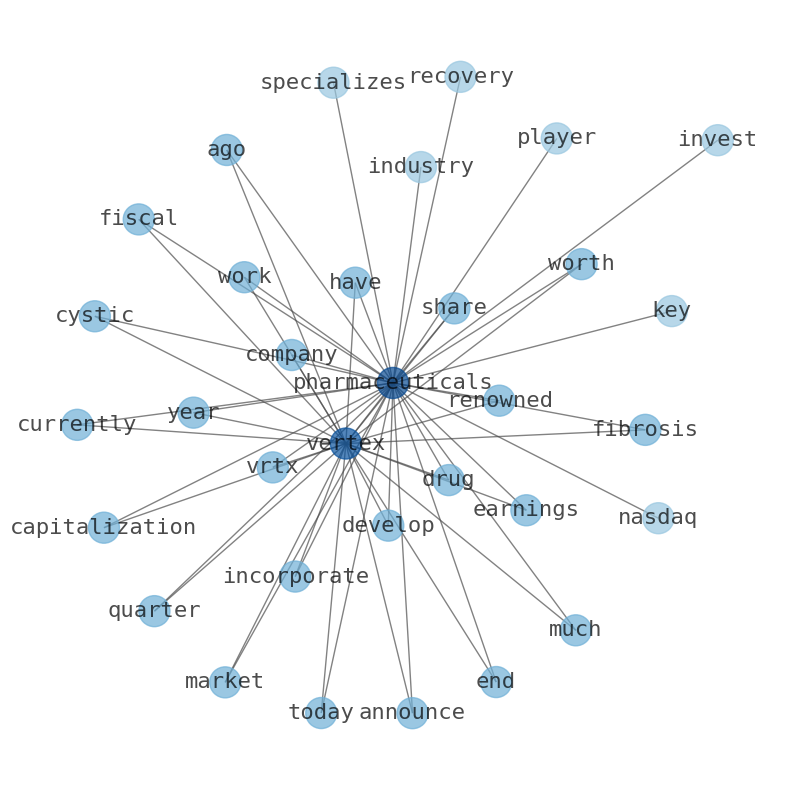

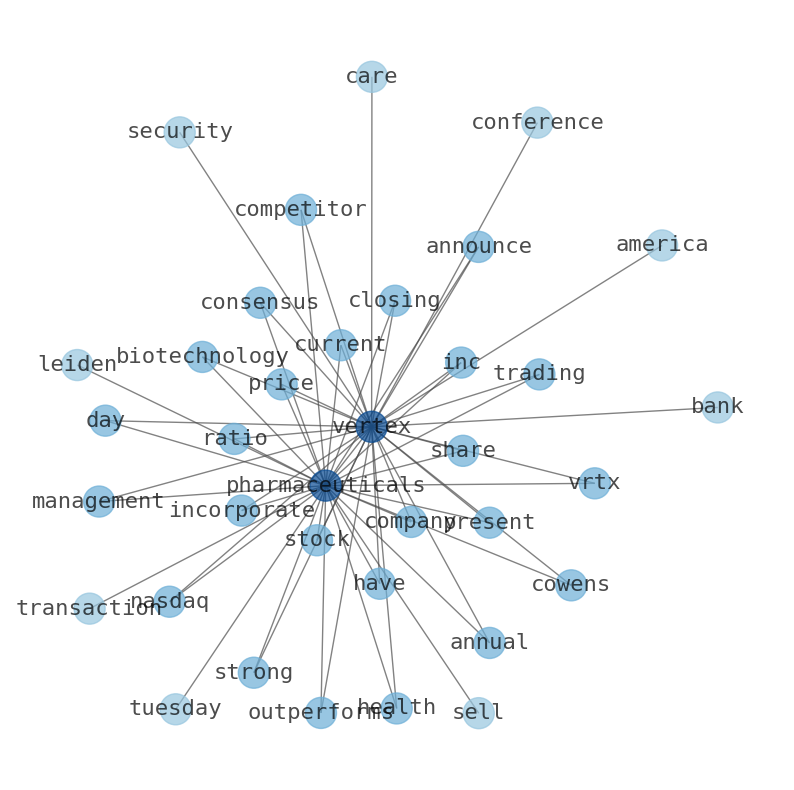

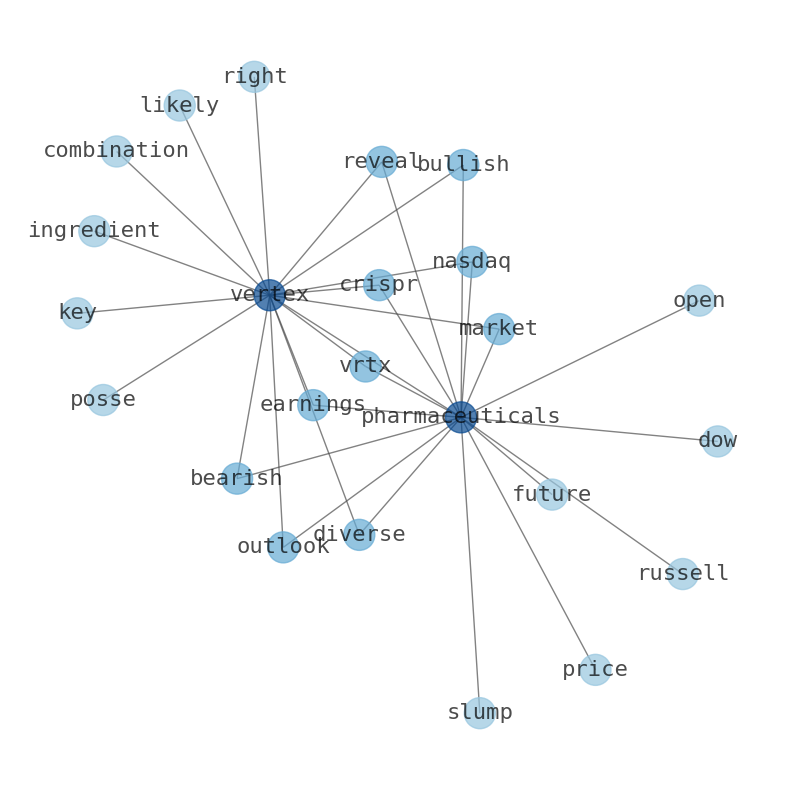

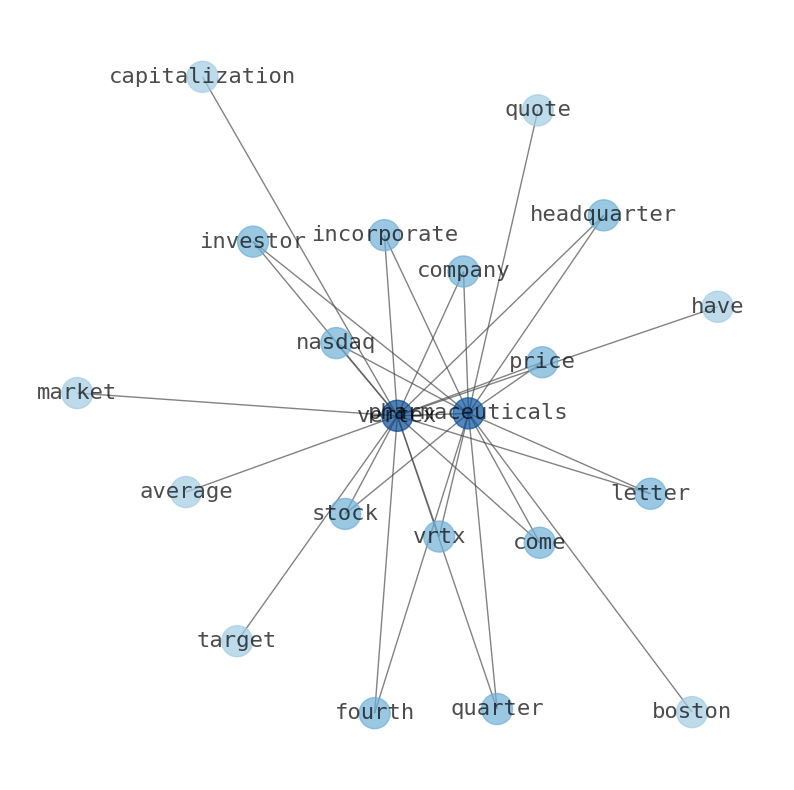

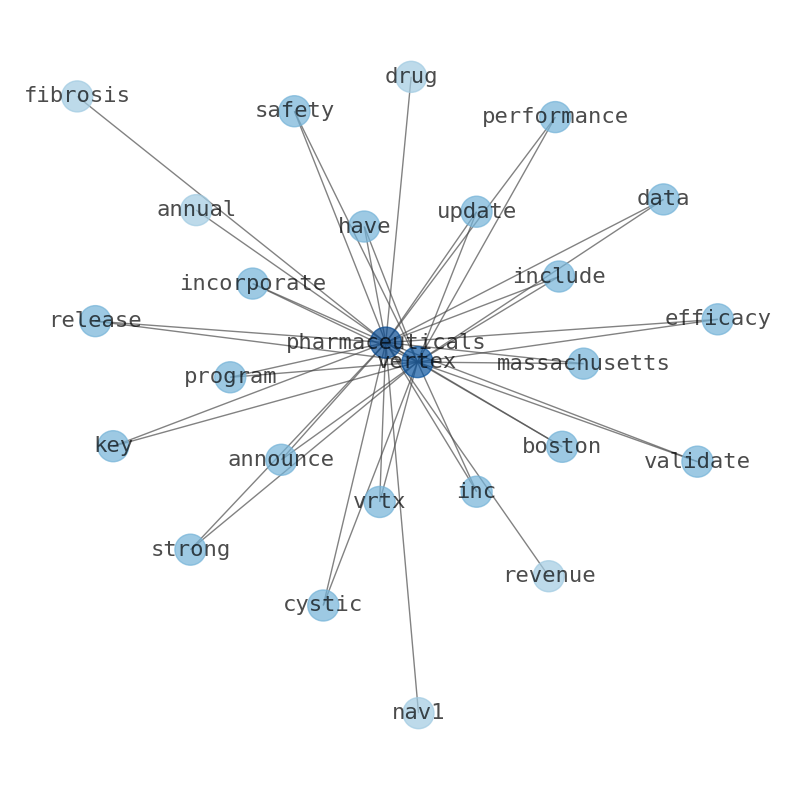

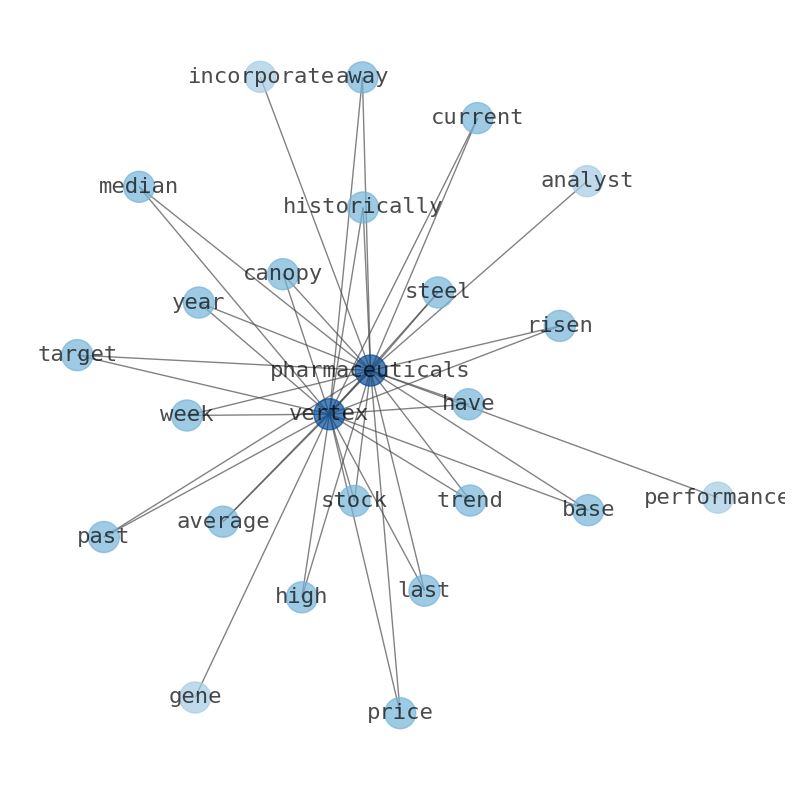

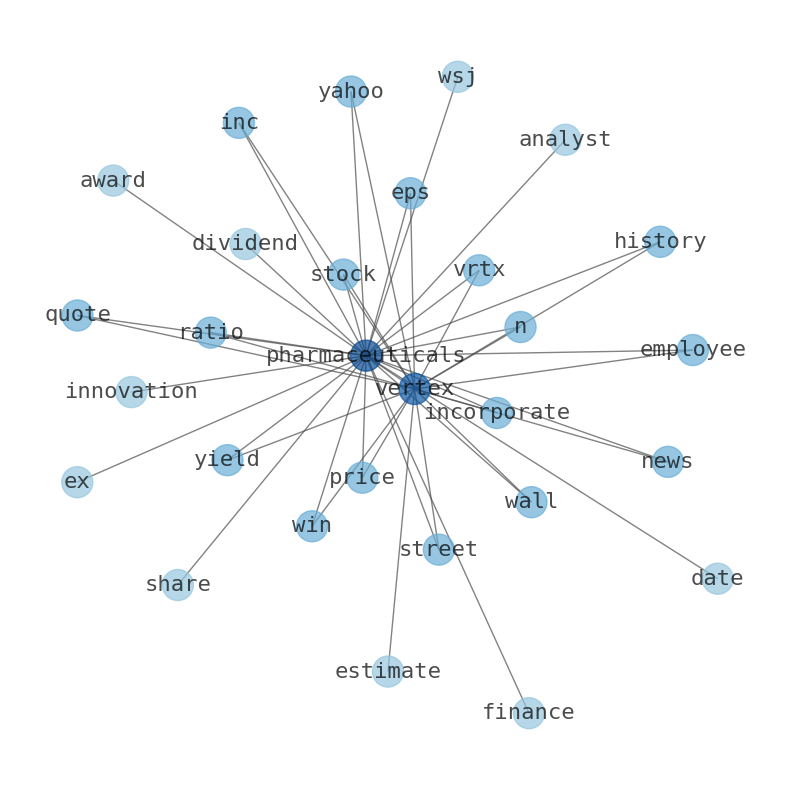

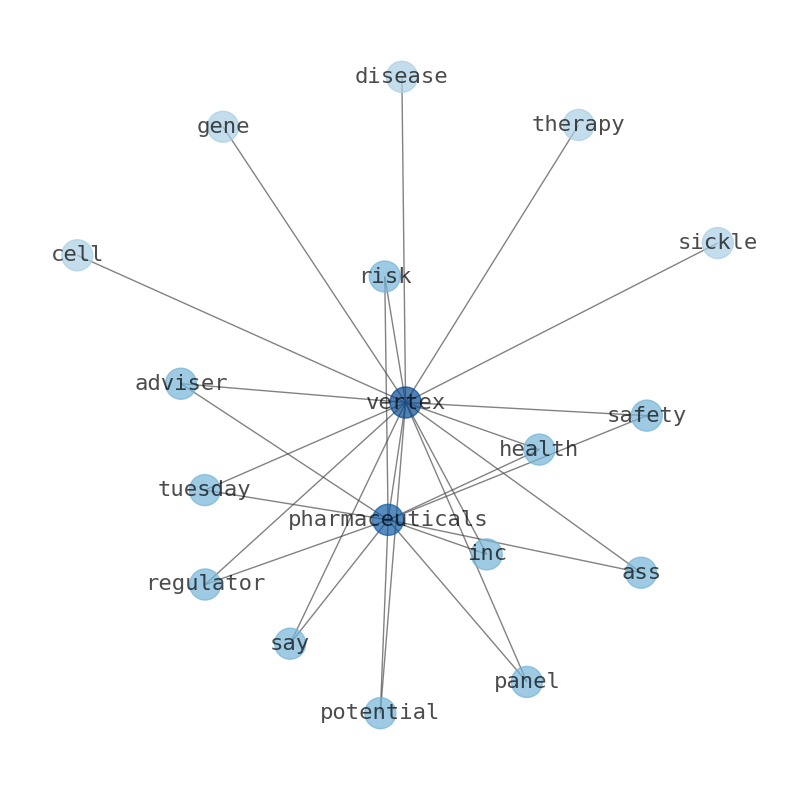

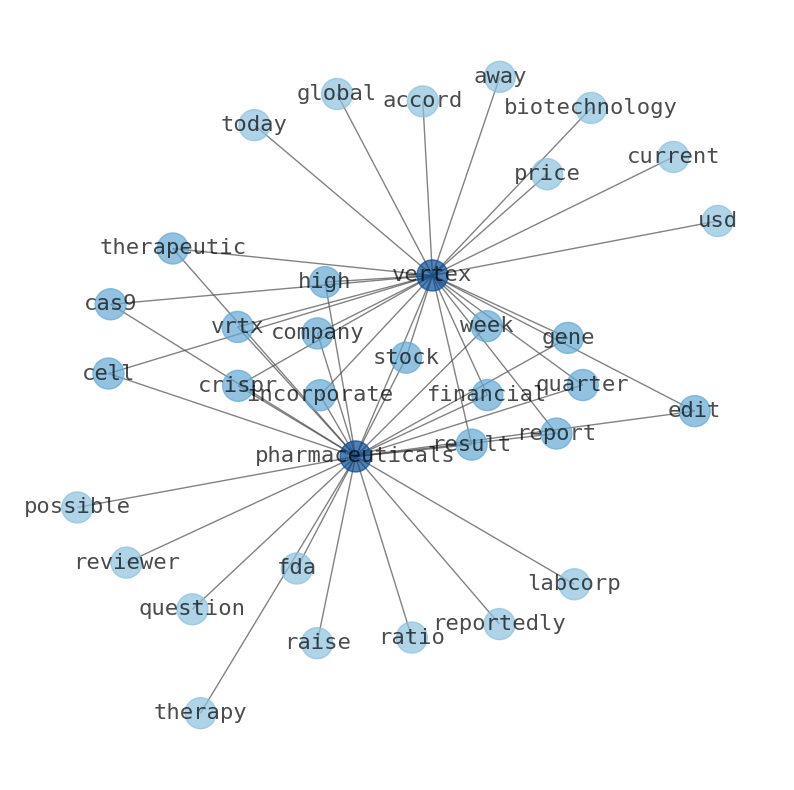

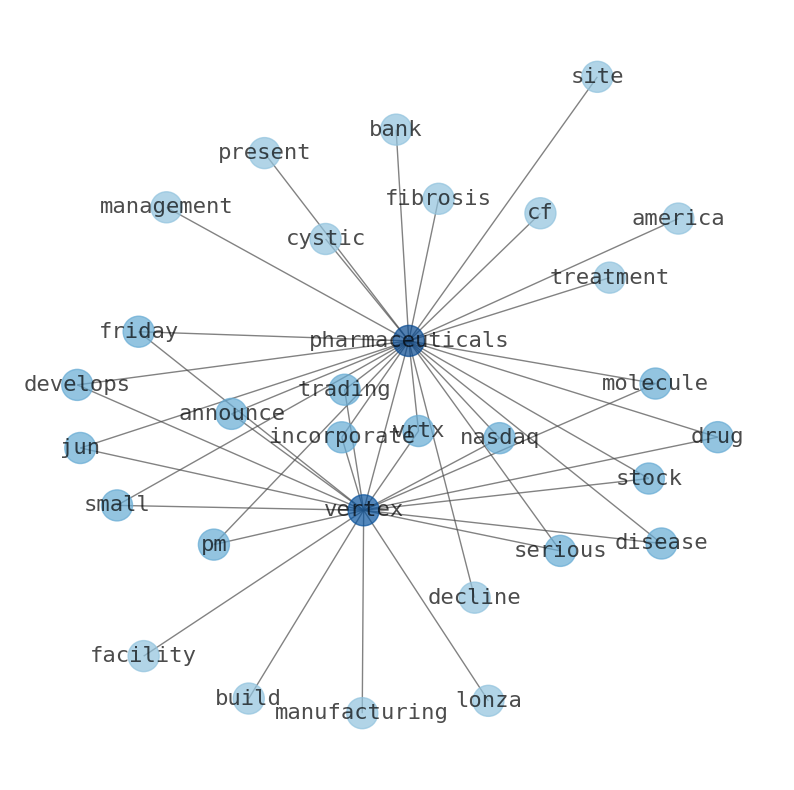

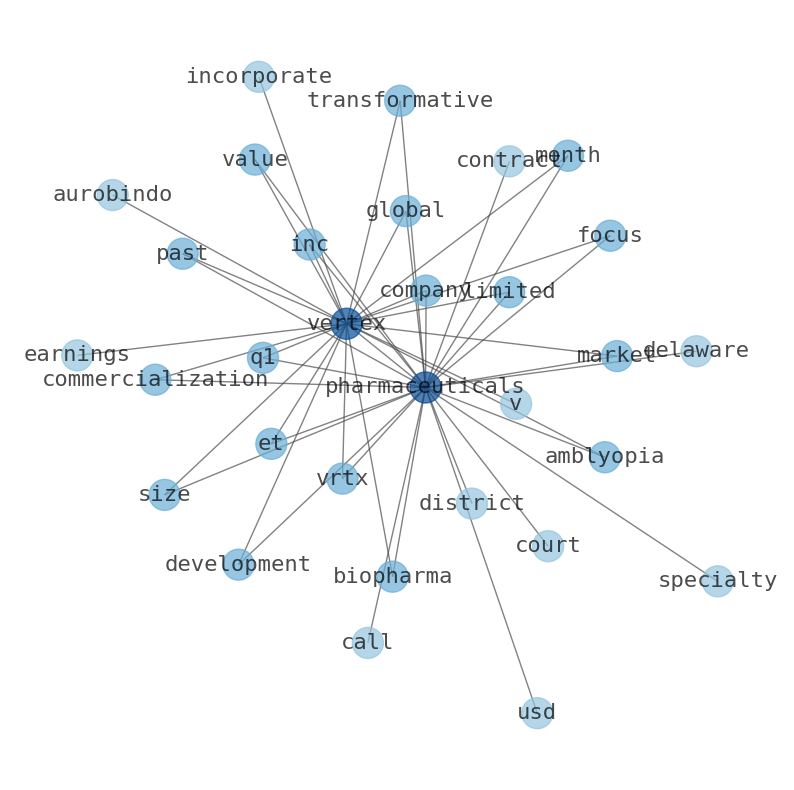

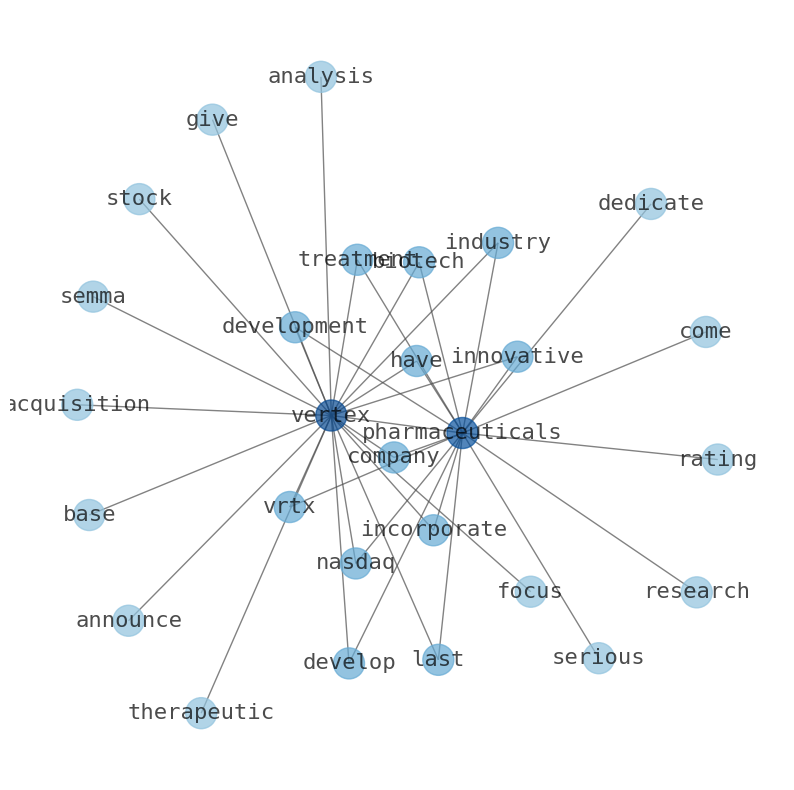

Keywords

Are looking for the most relevant information about Vertex Pharmaceuticals? Investor spend a lot of time searching for information to make investment decisions in Vertex Pharmaceuticals. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Vertex Pharmaceuticals are: Vertex, Pharmaceuticals, share, company, stock, earnings, Incorporated, and the most common words in the summary are: vertex, pharmaceutical, stock, market, vrtx, job, price, . One of the sentences in the summary was: was -2.39%, and its shares gained 42.25% of their value over the last 52 weeks.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #vertex #pharmaceutical #stock #market #vrtx #job #price.

Read more →Related Results

Vertex Pharmaceuticals

Open: 412.34 Close: 413.59 Change: 1.25

Read more →

Vertex Pharmaceuticals

Open: 421.77 Close: 419.63 Change: -2.14

Read more →

Vertex Pharmaceuticals

Open: 425.96 Close: 422.91 Change: -3.05

Read more →

Vertex Pharmaceuticals

Open: 405.0 Close: 410.91 Change: 5.91

Read more →

Vertex Pharmaceuticals

Open: 353.95 Close: 350.19 Change: -3.76

Read more →

Vertex Pharmaceuticals

Open: 373.16 Close: 378.35 Change: 5.19

Read more →

Vertex Pharmaceuticals

Open: 364.95 Close: 369.33 Change: 4.38

Read more →

Vertex Pharmaceuticals

Open: 361.46 Close: 365.25 Change: 3.79

Read more →

Vertex Pharmaceuticals

Open: 343.4 Close: 344.82 Change: 1.42

Read more →

Vertex Pharmaceuticals

Open: 351.42 Close: 347.74 Change: -3.68

Read more →

Vertex Pharmaceuticals

Open: 342.63 Close: 340.54 Change: -2.09

Read more →

Vertex Pharmaceuticals

Open: 330.92 Close: 332.63 Change: 1.71

Read more →

Vertex Pharmaceuticals

Open: 343.29 Close: 344.83 Change: 1.54

Read more →

Vertex Pharmaceuticals

Open: 421.77 Close: 419.63 Change: -2.14

Read more →

Vertex Pharmaceuticals

Open: 418.38 Close: 415.51 Change: -2.87

Read more →

Vertex Pharmaceuticals

Open: 415.01 Close: 416.5 Change: 1.49

Read more →

Vertex Pharmaceuticals

Open: 408.16 Close: 410.68 Change: 2.52

Read more →

Vertex Pharmaceuticals

Open: 354.95 Close: 353.04 Change: -1.91

Read more →

Vertex Pharmaceuticals

Open: 379.64 Close: 376.2 Change: -3.44

Read more →

Vertex Pharmaceuticals

Open: 357.15 Close: 357.45 Change: 0.3

Read more →

Vertex Pharmaceuticals

Open: 351.26 Close: 348.9 Change: -2.36

Read more →

Vertex Pharmaceuticals

Open: 350.0 Close: 358.4 Change: 8.4

Read more →

Vertex Pharmaceuticals

Open: 349.91 Close: 350.87 Change: 0.96

Read more →

Vertex Pharmaceuticals

Open: 329.82 Close: 325.3 Change: -4.52

Read more →

Vertex Pharmaceuticals

Open: 341.37 Close: 343.2 Change: 1.83

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo