The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Vermilion Energy

Youtube Subscribe

Open: 12.28 Close: 12.47 Change: 0.19

How to get information about Vermilion Energy without reading the whole internet.

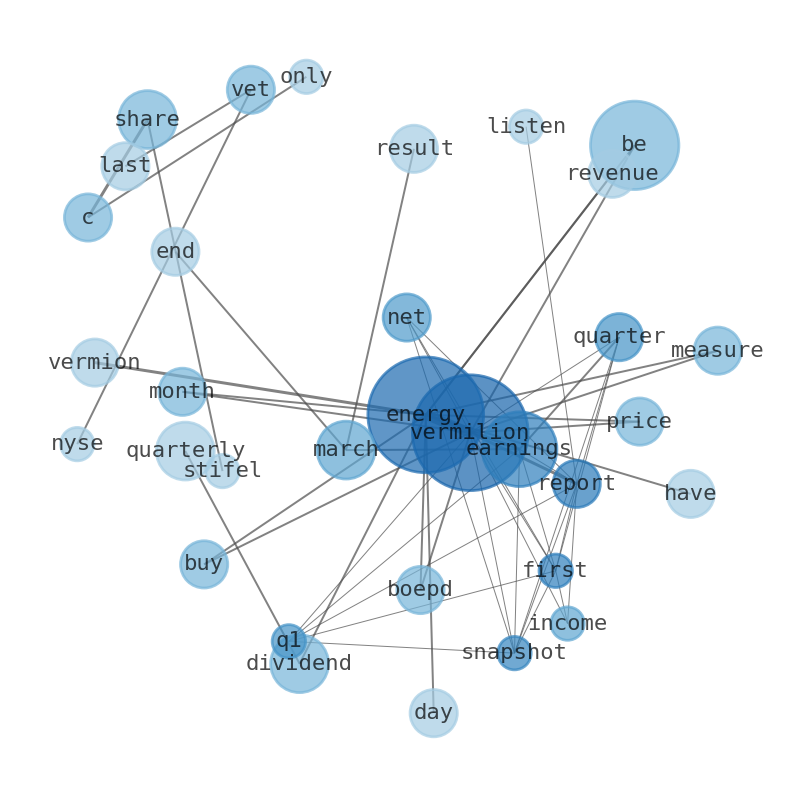

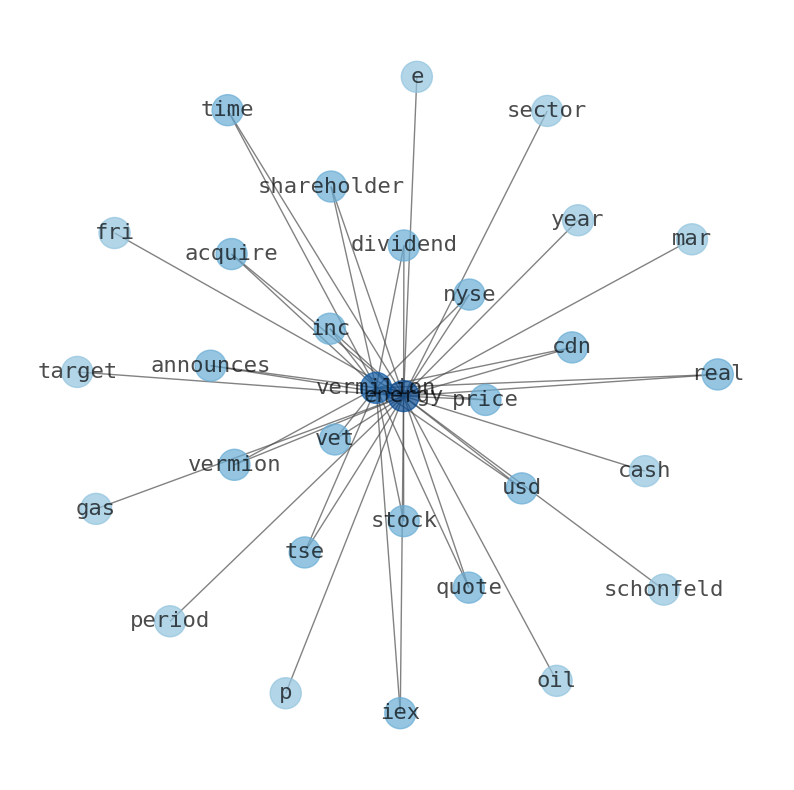

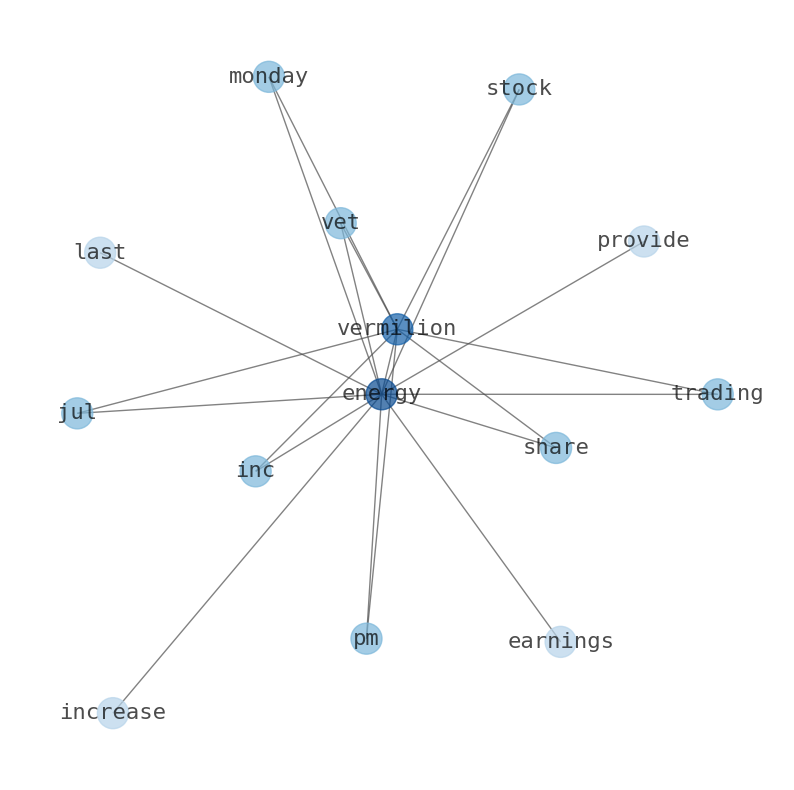

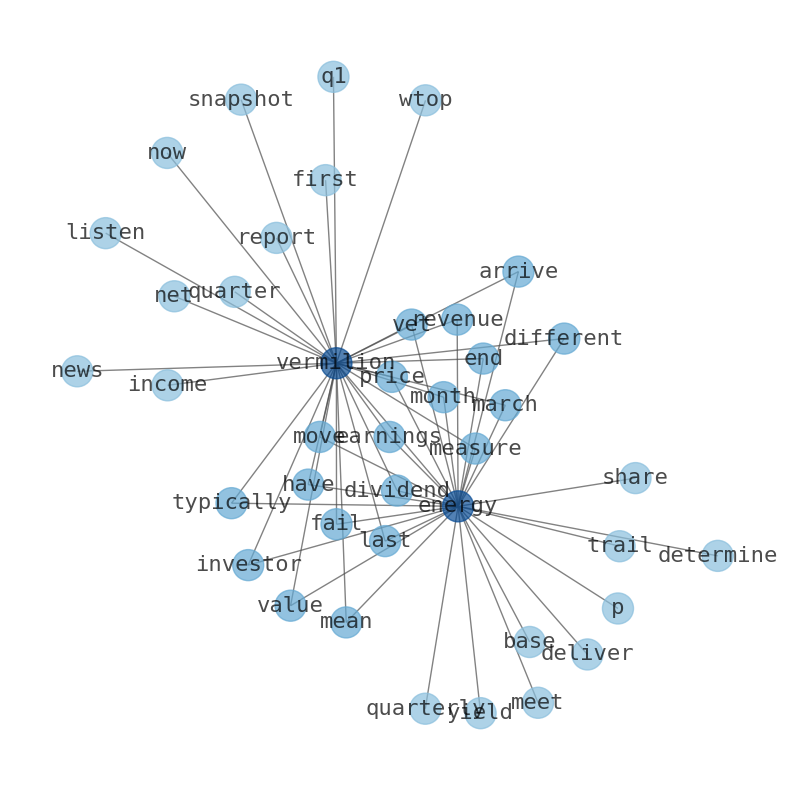

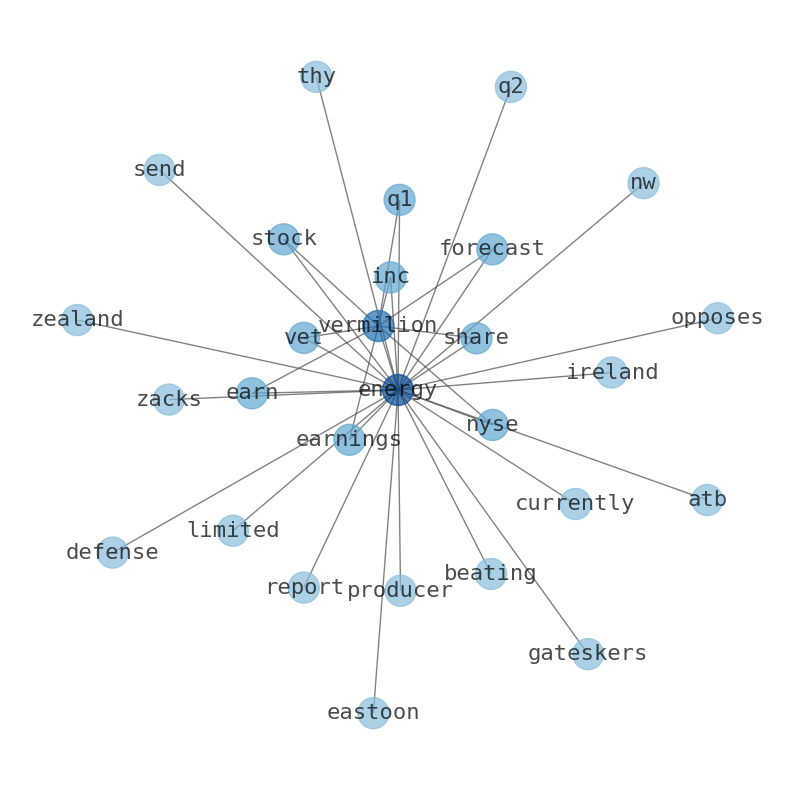

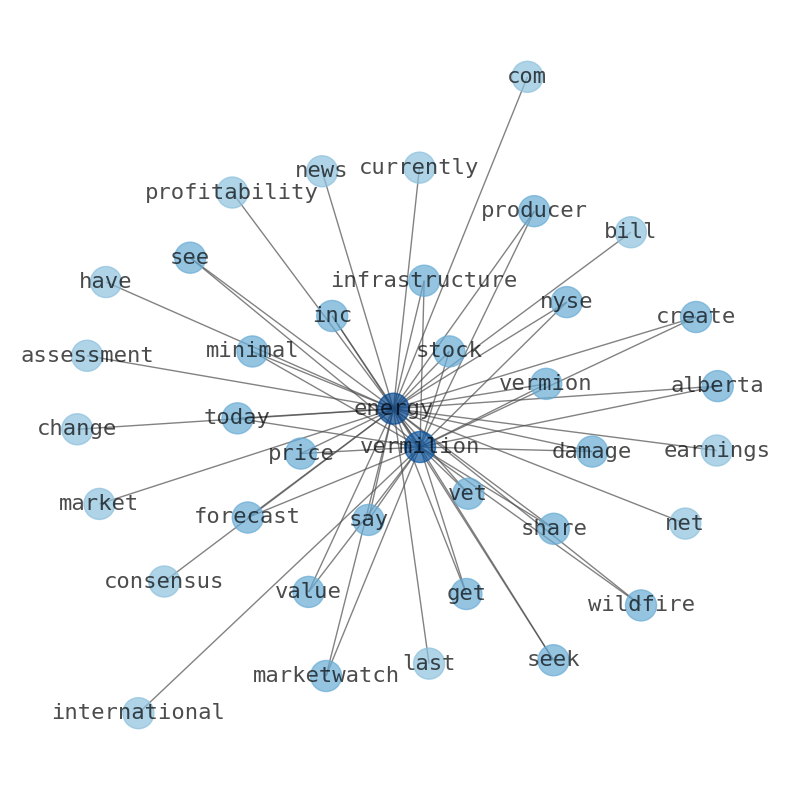

This document will help you to evaluate Vermilion Energy without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Vermilion Energy are: Energy, Vermilion, earnings, share, March, Vermilions, report, …

Stock Summary

Vermilion Energy Inc. engages in the acquisition, exploration, development, and production of petroleum and natural gas. The company owns 82% working interest in 796,648 net acres of developed land in Canada; 85% working interests.

Today's Summary

Vermilion Energy failed to meet expectations, with reported earnings hitting only C$0.05 per share, representing a shortfall of C($0.25) per share. The overall consensus recommendation for Vermion Energy is Buy.

Today's News

Vermilion: Q1 Earnings Snapshot Vermilions reported first-quarter net income of $281.3… Listen now to WTOP News. There is a significant difference between Vermilion Energy value and its price as these two measures arrived at by different means. Investors typically determine if Vermion Energy is a good investment by looking at earnings, sales, fundamental and technical indicators, competition as well as analyst projections. Vermilion Energy is a statistical measure of how it moves in relation to other equities. Correlation analysis and pair trading evaluation can also be used as hedging techniques within a particular sector or industry. Alberta declares state of emergency due to wildfires shutting in at least 319,000 barrels of oil equivalent per day (boepd), or 3.7% of countrys production. Vermilion Energy said it had temporarily shut in about 30,000 boepd. Vermilion Energy failed to meet expectations, with reported earnings hitting only C$0.05 per share, representing a shortfall of C($0.25) per share. Stifel Nicolaus revised its estimates from $37 down to $31 recently. Vermilion Energy shares last closed at CA$16.61 and the price had moved by -39.47% over the past 365 days. The overall consensus recommendation for Vermion Energy is Buy. The Vermilions Energy dividend yield is 1.93% based on the trailing twelve month period. Vermilion Energy Inc. Announces Results for the Three Months Ended March 31, 2023. Vermilion Energy delivered earnings and revenue surprises of 37.50% and 0.10% for the quarter ended March 2023. J.P. Morgan Upgraded to Buy gut Vermilion Energy Estimates* in CAD Yearly Quarterly 2023 2024 2025 2026 Revenue 2,323 2,574 2,211 - Dividend 0.39 0.42 0.51 0.40 - P/E Ratio 4.46 3.86 4.90 3.83 - EBITDA 1,526 1,704 - Net profit t? Vermilion Energy ( NYSE:VET – Get Rating ) (TSE:Vet) last posted its quarterly earnings results on Wednesday, March 8th. The business also recently disclosed a quarterly dividend, which will be paid on Monday, July 17th.

Stock Profile

"Vermilion Energy Inc., together with its subsidiaries, engages in the acquisition, exploration, development, and production of petroleum and natural gas in North America, Europe, and Australia. The company owns 82% working interest in 796,648 net acres of developed land and 85% working interest in 384,237 net acres of undeveloped land in Canada; 149,043 net acres of land in the Powder River basin in the United States; 96% working interest in 258,125 net acres of developed land and 100% working interest in 106,993 net acres of undeveloped land in the Aquitaine and Paris Basins in France; 53% working interest in 1,604,206 net acres of land in the Netherlands; 107,351 net developed acres and 1,549,929 net undeveloped acres in Germany; 975,374 net acres land in Croatia; 614,625 net acres land in Hungary; and 97,907 net acres land in Slovakia. It also owns 20% interests in the offshore Corrib natural gas field located to the northwest coast of Ireland; and 100% working interest in the Wandoo offshore oil field and related production facilities that covers 59,552 acres located on Western Australia's northwest shelf. Vermilion Energy Inc. was founded in 1994 and is headquartered in Calgary, Canada."

Keywords

How much time have you spent trying to decide whether investing in Vermilion Energy? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Vermilion Energy are: Energy, Vermilion, earnings, share, March, Vermilions, report, and the most common words in the summary are: vermilion, energy, price, earnings, stock, chevron_right, market, . One of the sentences in the summary was: Vermilion Energy failed to meet expectations, with reported earnings hitting only C$0.05 per share, representing a shortfall of C($0.25) per share. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #vermilion #energy #price #earnings #stock #chevron_right #market.

Read more →Related Results

Vermilion Energy

Open: 11.48 Close: 11.45 Change: -0.03

Read more →

Vermilion Energy

Open: 12.49 Close: 12.54 Change: 0.05

Read more →

Vermilion Energy

Open: 12.28 Close: 12.47 Change: 0.19

Read more →

Vermilion Energy

Open: 14.2 Close: 13.96 Change: -0.24

Read more →

Vermilion Energy

Open: 11.89 Close: 11.76 Change: -0.13

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo