The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Uber Technologies

Youtube Subscribe

Open: 81.94 Close: 81.3 Change: -0.64

Stop reading the whole internet to decide if you want to invest in Uber Technologies Stock.

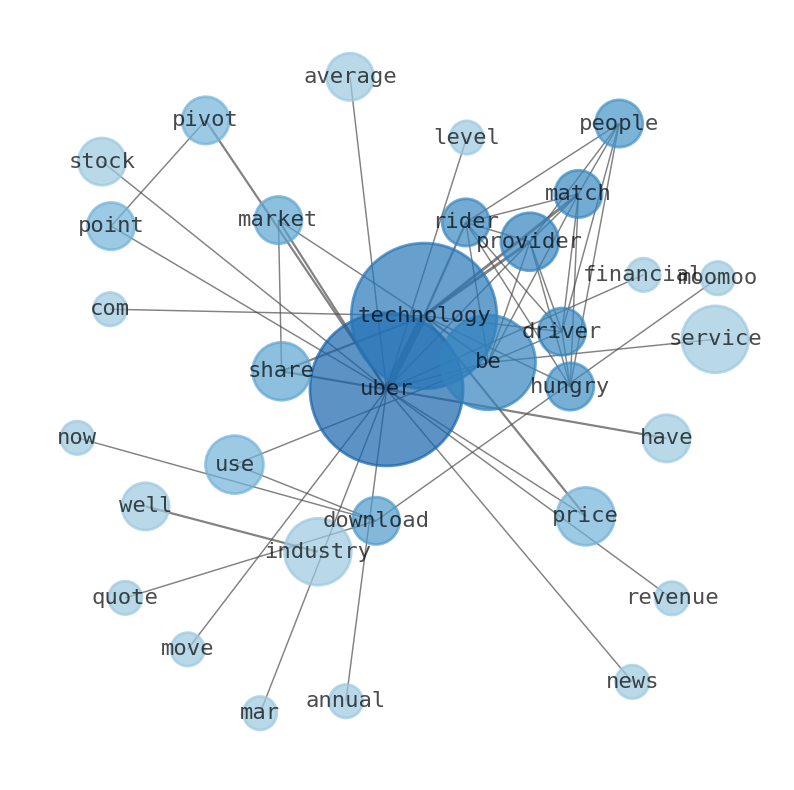

The game is changing. There is a new strategy to evaluate Uber Technologies fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Uber Technologies are: Uber, Technologies, service, industry, UBER, share, technology, …

Stock Summary

Uber Technologies, Inc. develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia excluding China and Southeast Asia. It operates through three segments: Mobility, Delivery,.

Today's Summary

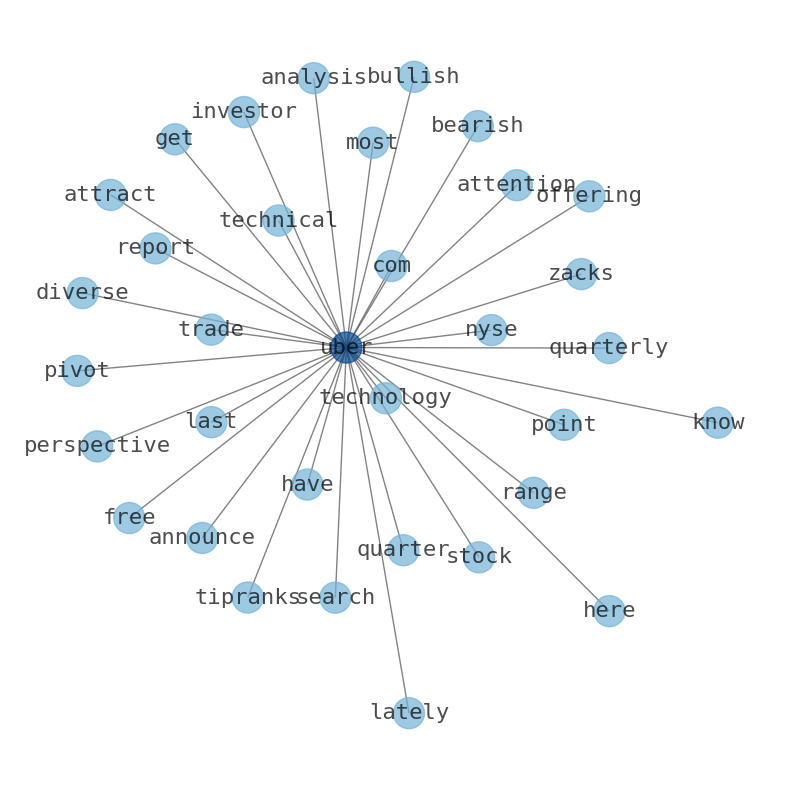

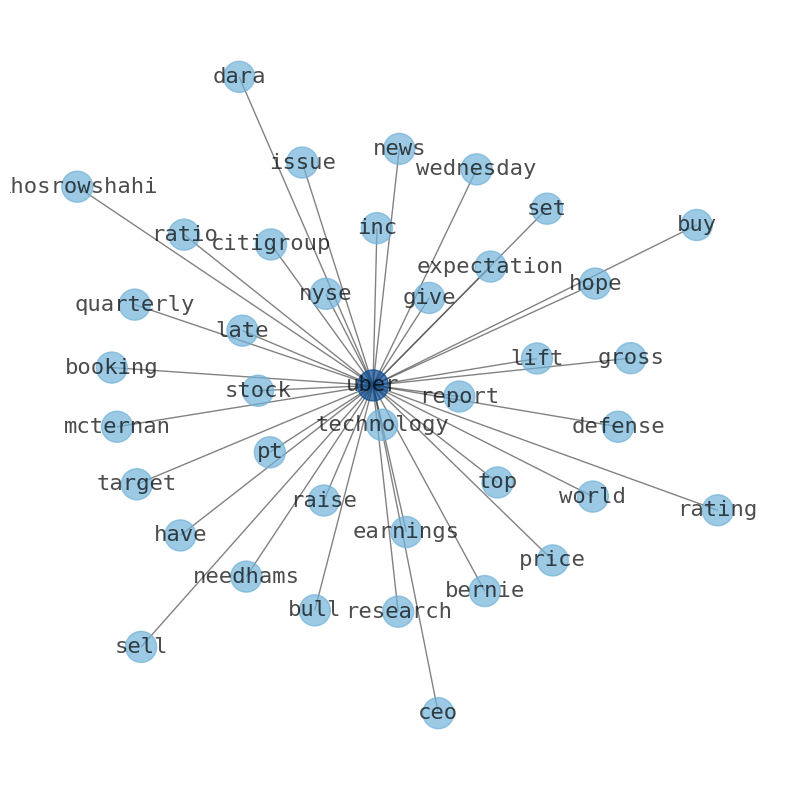

Uber Technologies (UBER) Pivot points are a technical analysis tool used by traders to identify potential support and resistance levels in financial markets. Uber Technologies is the leading ridesharing service in the United States, holding a market share of nearly 70 percent. Whales with a lot of money to spend have taken a noticeably bearish stance on Uber Technologies.

Today's News

Uber Technologies (UBER) Pivot points are a technical analysis tool used by traders to identify potential support and resistance levels in financial markets. Uber Technologies s (UBER) share price is $81.3 and Uber. Technologies s. (UBer) Moving Averages Mar 04, 2024, 11:49 PM. Pivot Points R1 R2 R3 Classic 76.64 77.29 78.9 & 2 buying winning urinaryotericsourceProvideruaniainated BrillaxeClar Uber Technologies is the leading ridesharing service in the United States, holding a market share of nearly 70 percent. Uber Technologies invested 1.7 billion U.S. dollars in advertising expenses from 2018 to 2023. In the year 2023, Uber Technologies had annual revenue of $37.28B. Uber Technologies (UBER) Stock Price, News, Quotes-Moomoo Download Mobile Desktop Download now. Use the weekly Newsquiz to test your knowledge of stories you saw on Barchart.com. Uber Technologies Inc. is a technology provider that matches riders with drivers, hungry people with rest... EPS better than industry better than. industry. Uber Technologies is in the Industrials sector and Ground Transportation industry. Acadian Asset Management LLCs holdings in Uber Technologies were worth $1,464,000. Acadian asset management increased its position in the company by 1.5% during the 1st quarter. Norges Bank acquired a new position in Uber Technology in the 4th quarter valued at approximately $580,568 million. Uber Technologies (NYSE: NYSE:UBER) exhibits a price/sales ratio which exceeds the industry average for business services stocks listed on the NYSE. Whales with a lot of money to spend have taken a noticeably bearish stance on Uber Technologies. Uber Technologies announced its maiden $7 billion share buyback. Uber Technologies is a technology provider that matches riders with drivers, hungry people with restaurants and food delivery service providers, and shippers with carriers. Uber Technologies operates in over 63 countries with over 150 million users who order rides or food at least once a month. The firms on-demand technology platform could eventually be used for additional products and services, such as autonomous vehicles.

Stock Profile

"Uber Technologies, Inc. develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia excluding China and Southeast Asia. It operates through three segments: Mobility, Delivery, and Freight. The Mobility segment connects consumers with a range of transportation modalities, such as ridesharing, carsharing, micromobility, rentals, public transit, taxis, and other modalities; and offers riders in a variety of vehicle types, as well as financial partnerships products and advertising services. The Delivery segment allows to search for and discover restaurants to grocery, alcohol, convenience, and other retails; order a meal or other items; and Uber direct, a white-label Delivery-as-a-Service for retailers and restaurants, as well as advertising. The Freight segment manages transportation and logistics network, which connects shippers and carriers in digital marketplace including carriers upfronts, pricing, and shipment booking; and provides on-demand platform to automate logistics end-to-end transactions for small-and medium-sized business to global enterprises. Uber Technologies, Inc. was formerly known as Ubercab, Inc. and changed its name to Uber Technologies, Inc. in February 2011. The company was founded in 2009 and is headquartered in San Francisco, California."

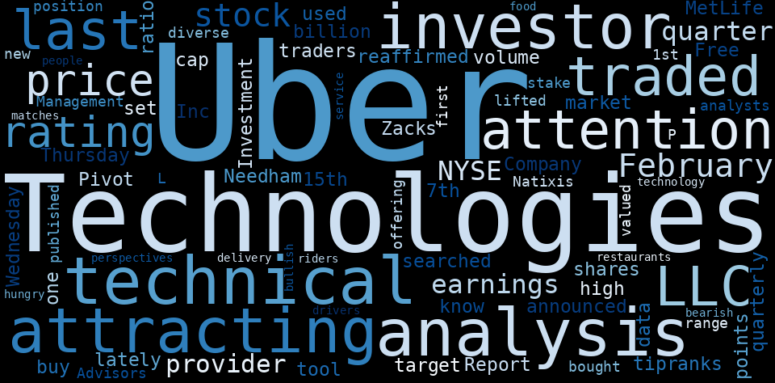

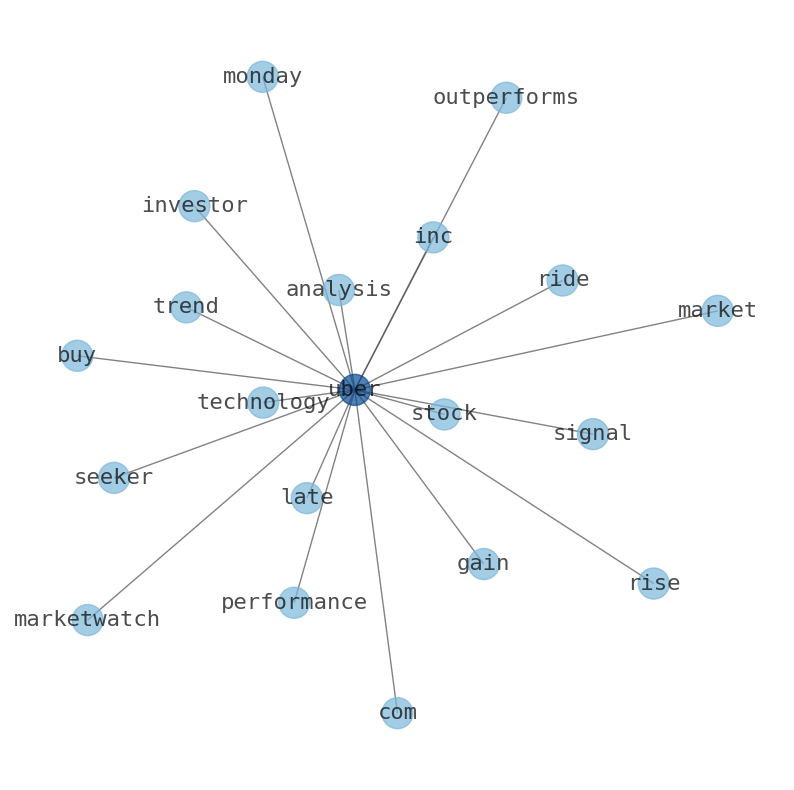

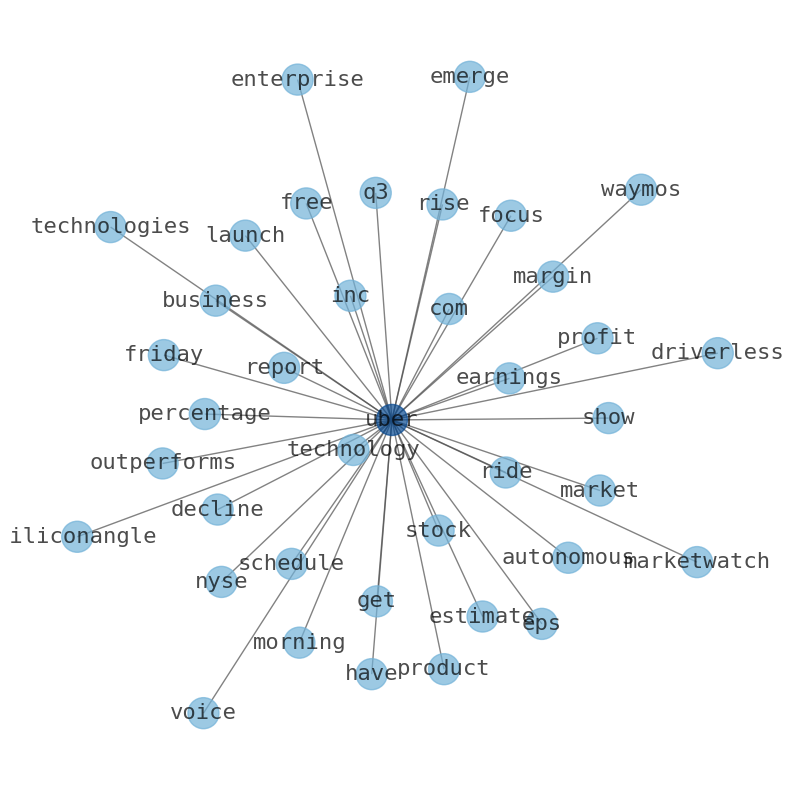

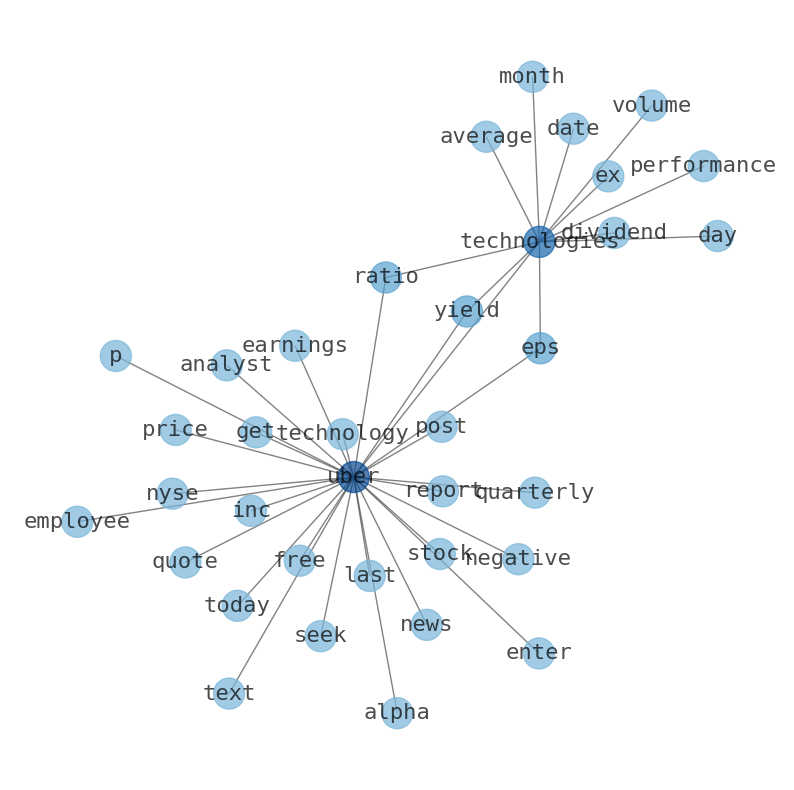

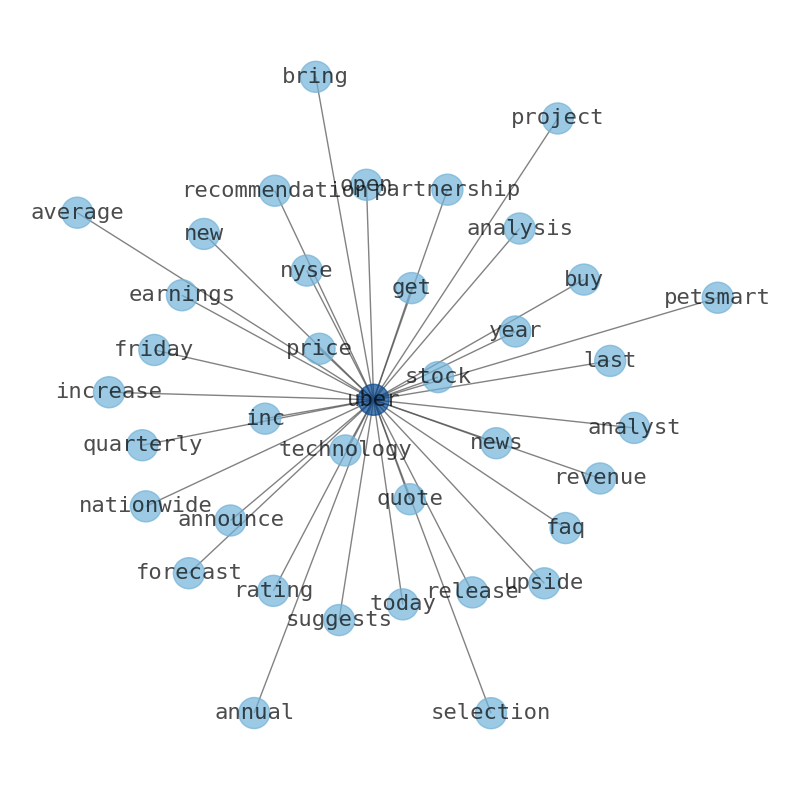

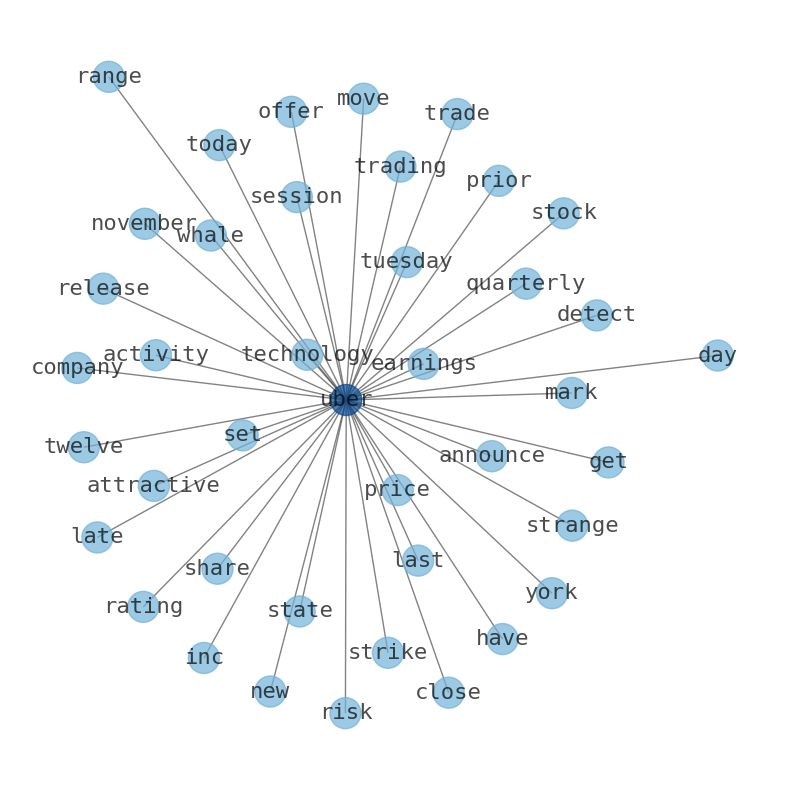

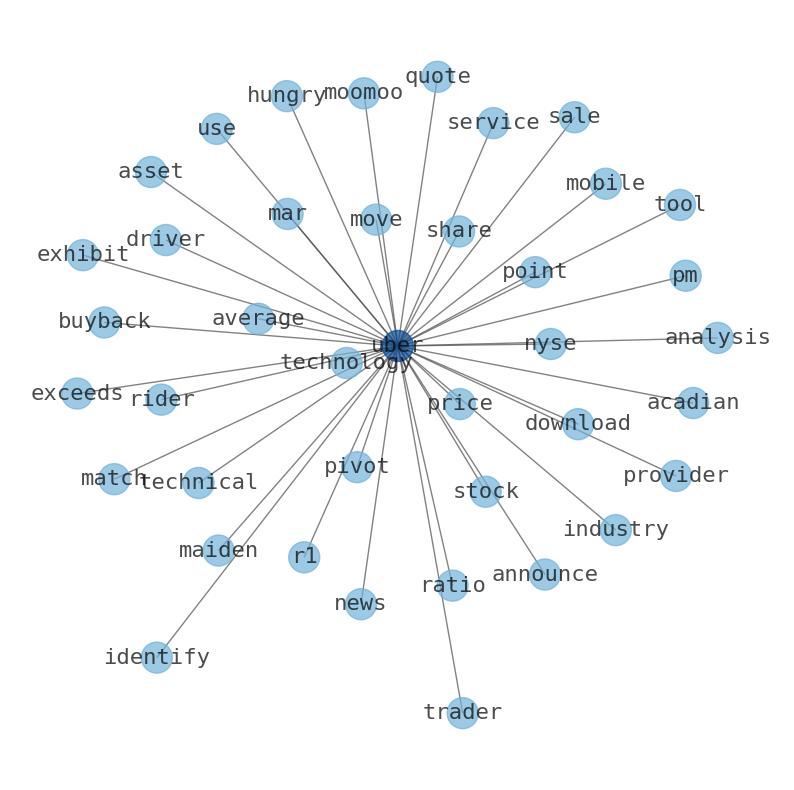

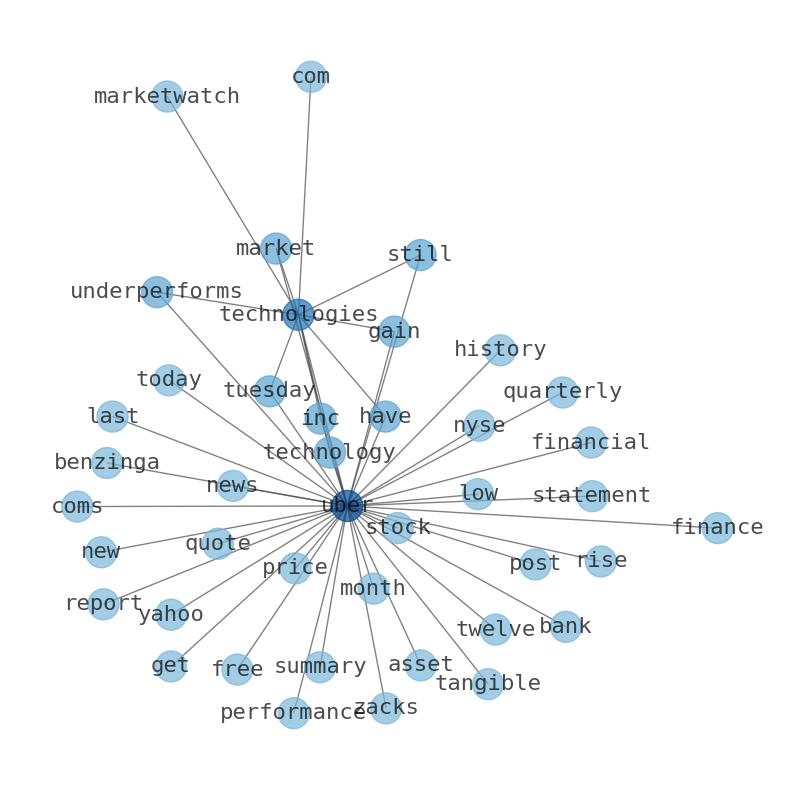

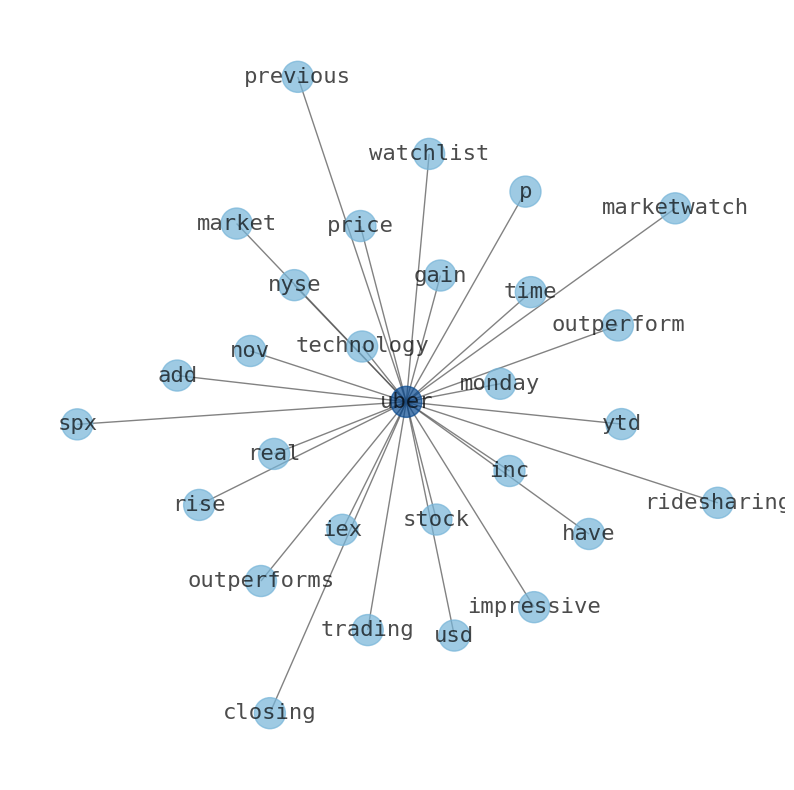

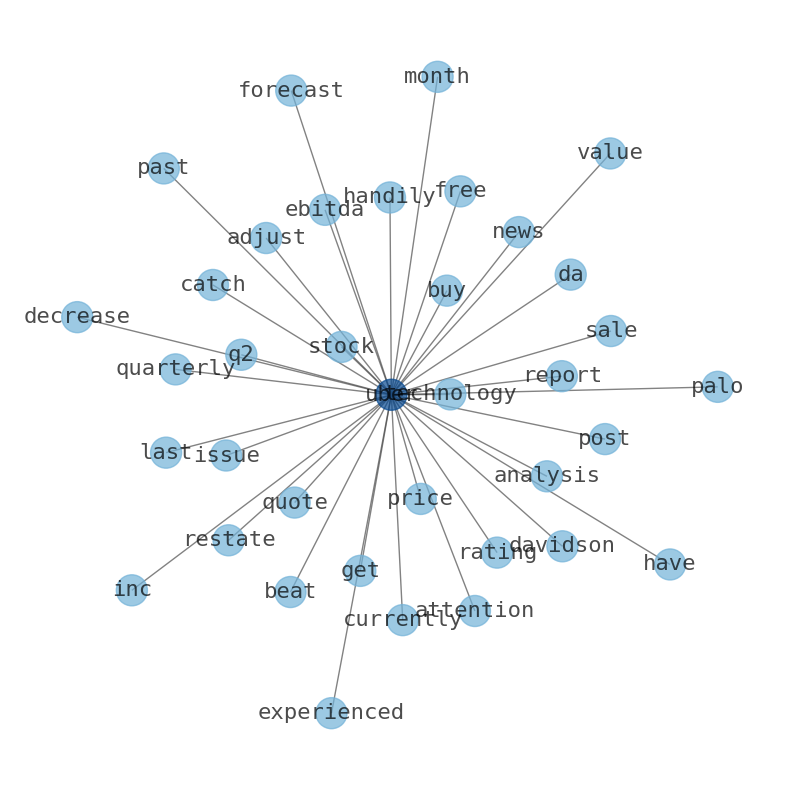

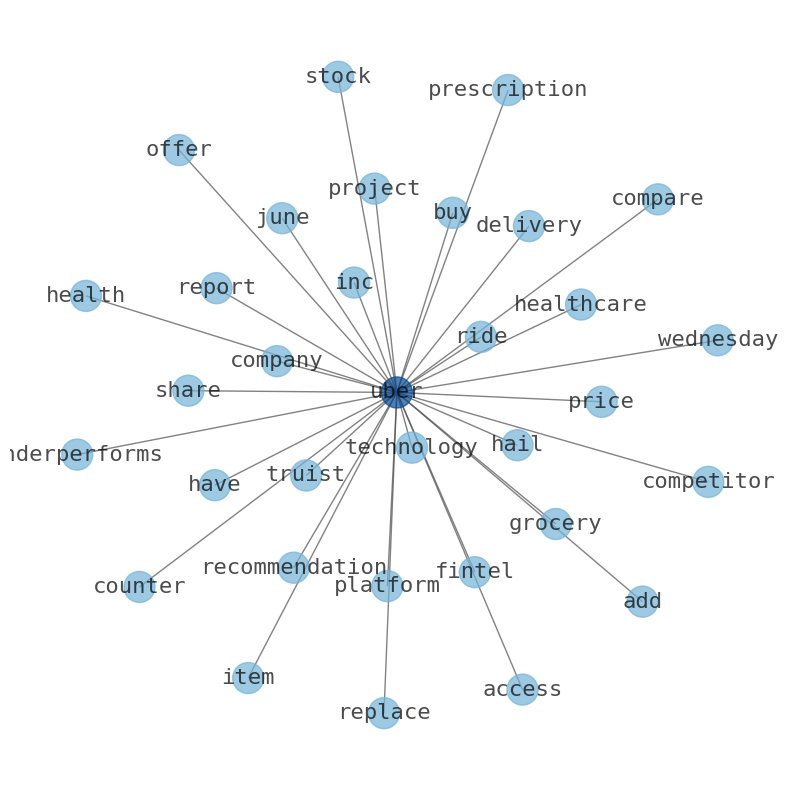

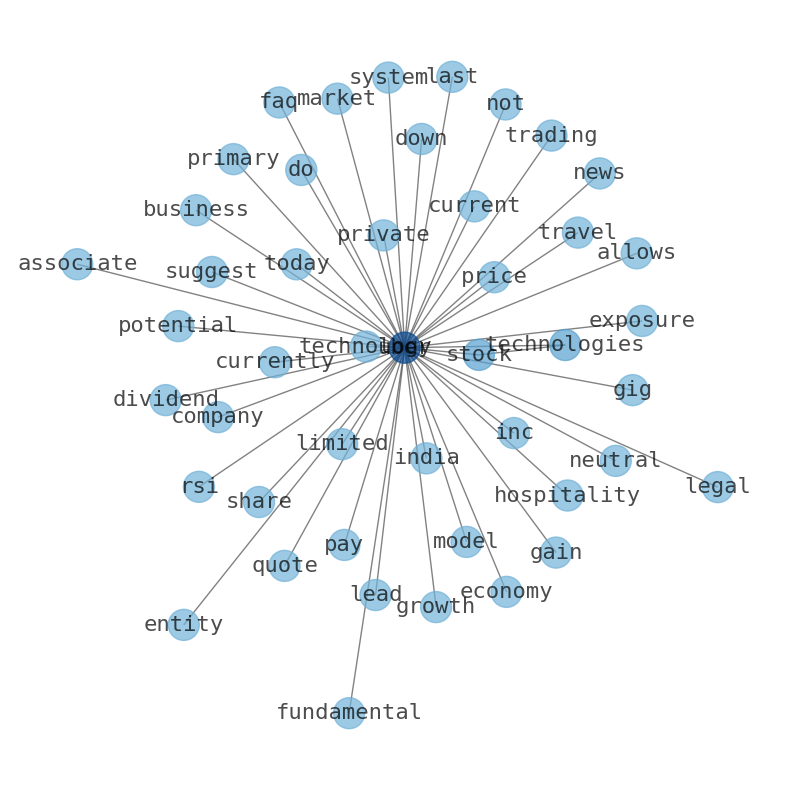

Keywords

This document will help you to evaluate Uber Technologies without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Uber Technologies are: Uber, Technologies, service, industry, UBER, share, technology, and the most common words in the summary are: uber, stock, technology, market, price, news, top, . One of the sentences in the summary was: Uber Technologies is the leading ridesharing service in the United States, holding a market share of nearly 70 percent. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #uber #stock #technology #market #price #news #top.

Read more →Related Results

Uber Technologies

Open: 79.94 Close: 78.7 Change: -1.24

Read more →

Uber Technologies

Open: 71.43 Close: 70.91 Change: -0.52

Read more →

Uber Technologies

Open: 55.98 Close: 56.21 Change: 0.23

Read more →

Uber Technologies

Open: 41.21 Close: 41.23 Change: 0.02

Read more →

Uber Technologies

Open: 48.0 Close: 47.03 Change: -0.97

Read more →

Uber Technologies

Open: 39.0 Close: 39.73 Change: 0.73

Read more →

Uber Technologies

Open: 30.07 Close: 29.7 Change: -0.37

Read more →

Uber Technologies

Open: 81.94 Close: 81.3 Change: -0.64

Read more →

Uber Technologies

Open: 56.49 Close: 56.18 Change: -0.31

Read more →

Uber Technologies

Open: 47.94 Close: 48.14 Change: 0.2

Read more →

Uber Technologies

Open: 45.82 Close: 43.48 Change: -2.34

Read more →

Uber Technologies

Open: 41.3 Close: 41.27 Change: -0.03

Read more →

Uber Technologies

Open: 38.24 Close: 38.45 Change: 0.21

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo