The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

The Trade Desk

Youtube Subscribe

Open: 73.68 Close: 73.59 Change: -0.09

How to know if The Trade Desk is a risky investment without reading the whole internet.

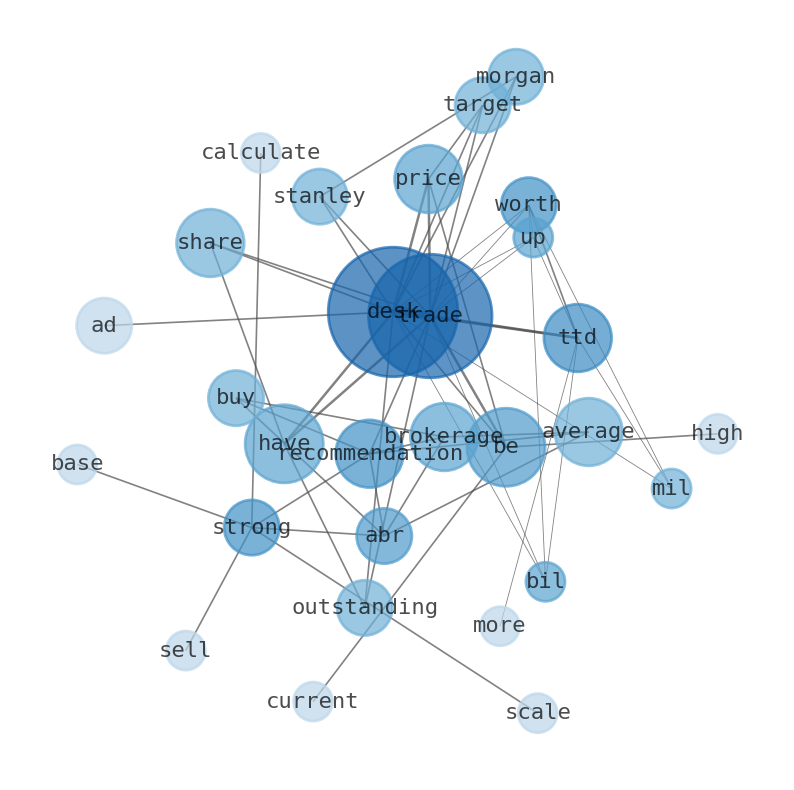

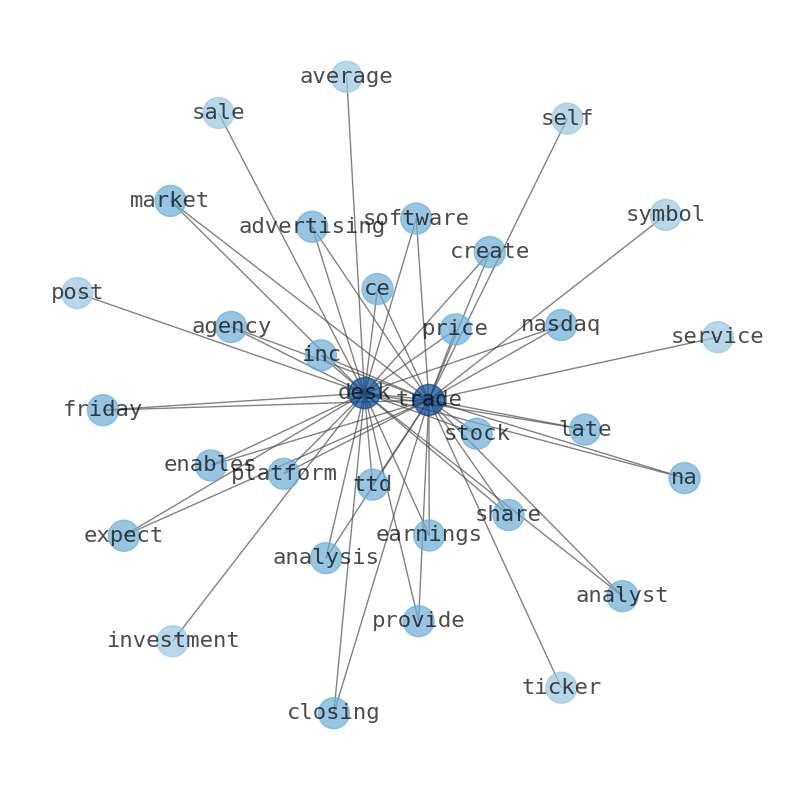

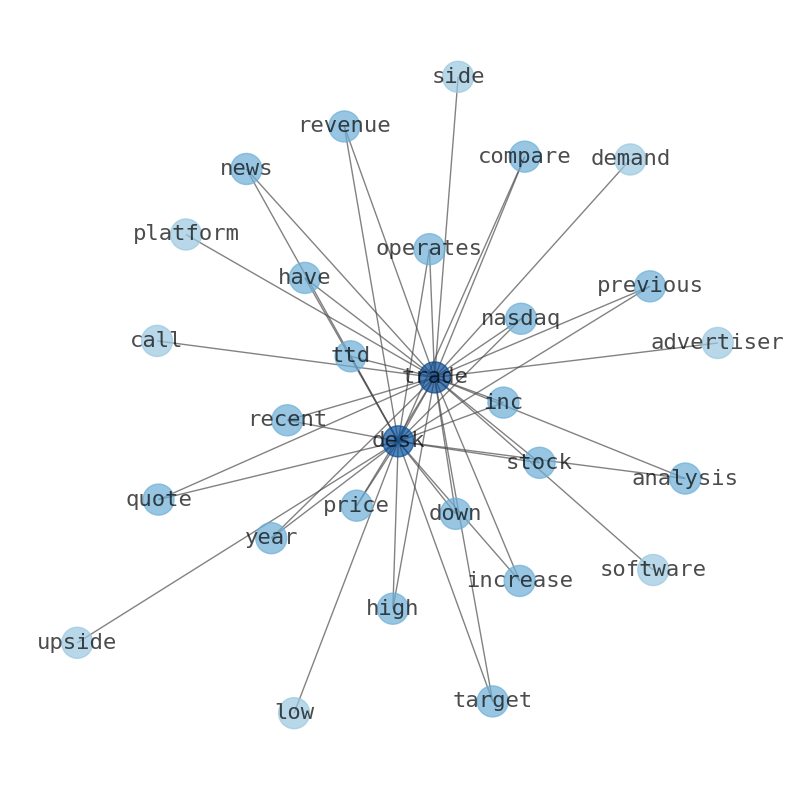

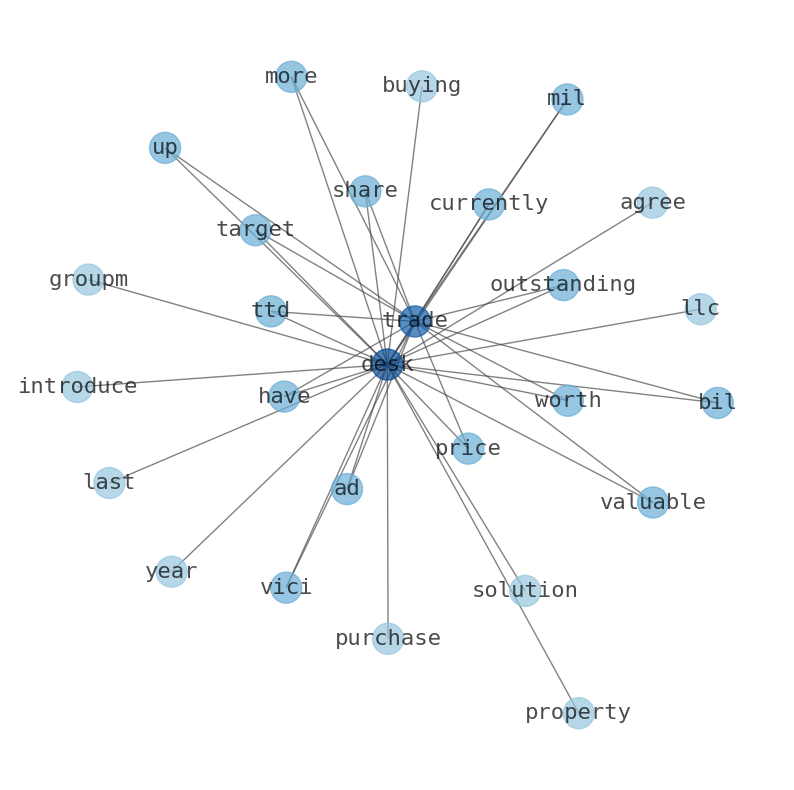

The game is changing. There is a new strategy to evaluate The Trade Desk fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about The Trade Desk are: Trade, Desk, TTD, brokerage, recommendation, …

Stock Summary

The Trade Desk is down over 20% from its recent high. The adtech provider fell after releasing its latest results despite reporting solid growth. Director Gokul Rajaram sold 2,999 shares of the firms stock in a transaction on.

Today's Summary

The Trade Desk (TTD) worth $33 bil (up $71 mil), more valuable than vici properties. Average brokerage recommendation (ABR) of 1.52, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations made by 27 brokerage firms.

Today's News

The Trade Desk (TTD) worth $33 bil (up $71 mil), more valuable than vici properties. Average brokerage recommendation (ABR) of 1.52, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations made by 27 brokerage firms. The Trade Desk plays in the ad-tech space, offering a marketplace that allows customers to purchase various types of advertisements to run global campaigns in digital media such as display advertising, social media, and advanced TV. The average brokerage recommendation (ABR) is equivalent to a Buy. The Trade Desk (TTD) stock is ready for a major change on July 17 when it will replace Activision Blizzard on the the Nasdaq 100 Index. Synopsis ( SNPS ) shares fell 6.3% after Reuters reported it had submitted one of the aforementioned offers to acquire Ansys. Synopsis. Morgan Stanley gives The Trade Desk an upgrade and new price target from Morgan Stanley. The Trade Desks agreed to purchase Automated Trading Desk LLC for $680 million. Last year, The Trade Desk and GroupM introduced solutions for buying ads directly from publishers. The Trade Desk, Inc. (TTD) has a market cap or net worth of $36.08 billion. The trade desk has 490.30 million shares outstanding. Average price target for The Trade Desk is $84.92, which is 15.40% higher than the current price. The Trade desk currently has 490,297,013 outstanding shares.

Stock Profile

" The Trade Desk, Inc. (TTD) stock price, quote & news - stock analysis. The Trade Desks revenue was $1.58 billion, an increase of 31.87% compared to the previous years $1.20 billion. Price Target $83.35 (9.80% upside) Analyst Consensus: Buy Stock Forecasts. The Trade Desk, Inc. (NASDAQ:TTD) appears to be overvalued by 39% at the moment, based on my discounted cash flow valuation. This means that the opportunity to buy Trade Desk at a good price has disappeared! But, is there another opportunity to buying low in the future? The Trade Desk is down over 20% from its recent high. The adtech provider fell after releasing its latest results despite reporting solid growth. 37 hedge fund portfolios held The Trade. The Trade Desk operates software called a demand-side platform that advertisers use to buy ads across the internet. Starting in September, it will bid below the asking price on ads. Trade Desk (NASDAQ:TTD) is in the Communication Services sector and Media industry. Q3 earnings are confirmed for Wednesday, November 8, 2023. There are no upcoming dividends for Trade Desk. Director Gokul Rajaram sold 2,999 shares of the firms stock in a transaction on Wednesday, August 16th. The Trade Desk, Inc operates as a technology company. The Trade Desk is down over 20% from its recent high. Analysts estimate an earnings increase this quarter of$0.06 per share, an increase next quarter of $0.08 per share. TTD stock is rated a Sell. The Trade Desk, Inc. (TTD) worth $35 bil (down $0), more valuable than Otis worldwide. Private Advisor Group LLC bought a new position in The Trade. Sepio Capital LP Lowers Stock Holdings in The Trade Desk, Inc. (NASDAQ:TTD) Zolmax. Private Advisor Group LLC Makes New Investment in The trade desk plans to lowball ssp floor prices; ai is coming for sports. The Trade Desk has displayed strong performance in recent years achieving a 52-week low of $39.43. The company has a high of $91.85."

Keywords

Are looking for the most relevant information about The Trade Desk? Investor spend a lot of time searching for information to make investment decisions in The Trade Desk. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about The Trade Desk are: Trade, Desk, TTD, brokerage, recommendation, share, price, and the most common words in the summary are: trade, desk, stock, job, market, share, company, . One of the sentences in the summary was: The Trade Desk (TTD) worth $33 bil (up $71 mil), more valuable than vici properties. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #trade #desk #stock #job #market #share #company.

Read more →Related Results

The Trade Desk

Open: 68.13 Close: 66.96 Change: -1.17

Read more →

The Trade Desk

Open: 74.51 Close: 75.91 Change: 1.4

Read more →

The Trade Desk

Open: 73.68 Close: 73.59 Change: -0.09

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo