The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Texas Instruments

Youtube Subscribe

Open: 167.55 Close: 171.05 Change: 3.5

Can you guess what an AI found about Texas Instruments.

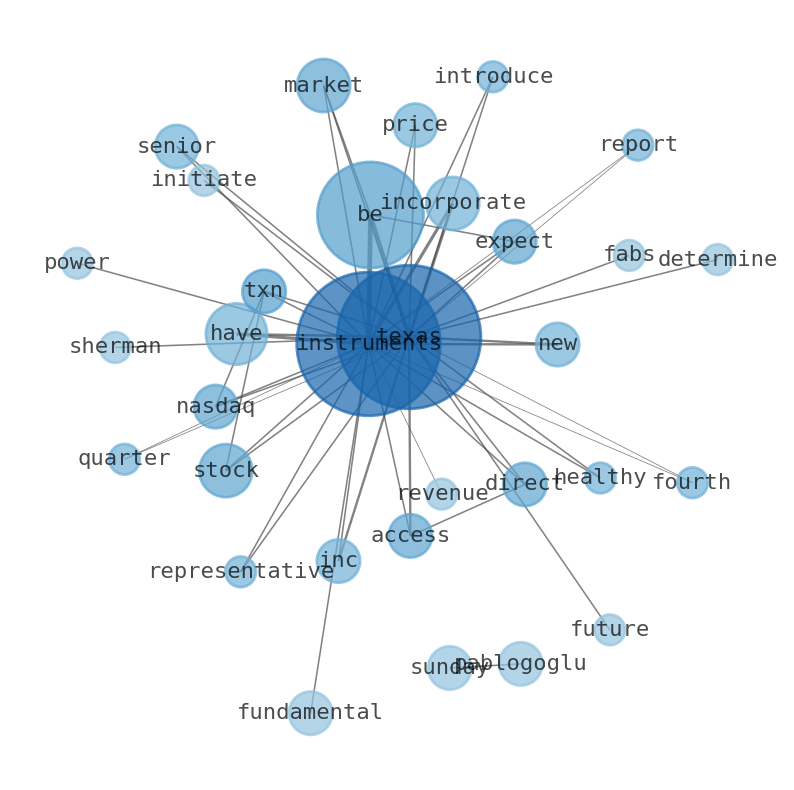

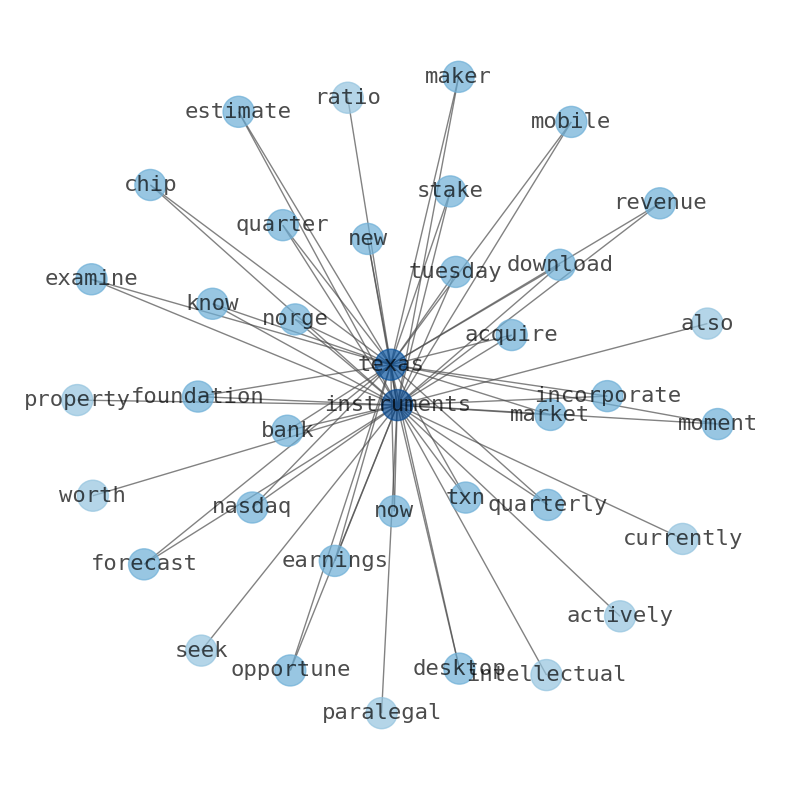

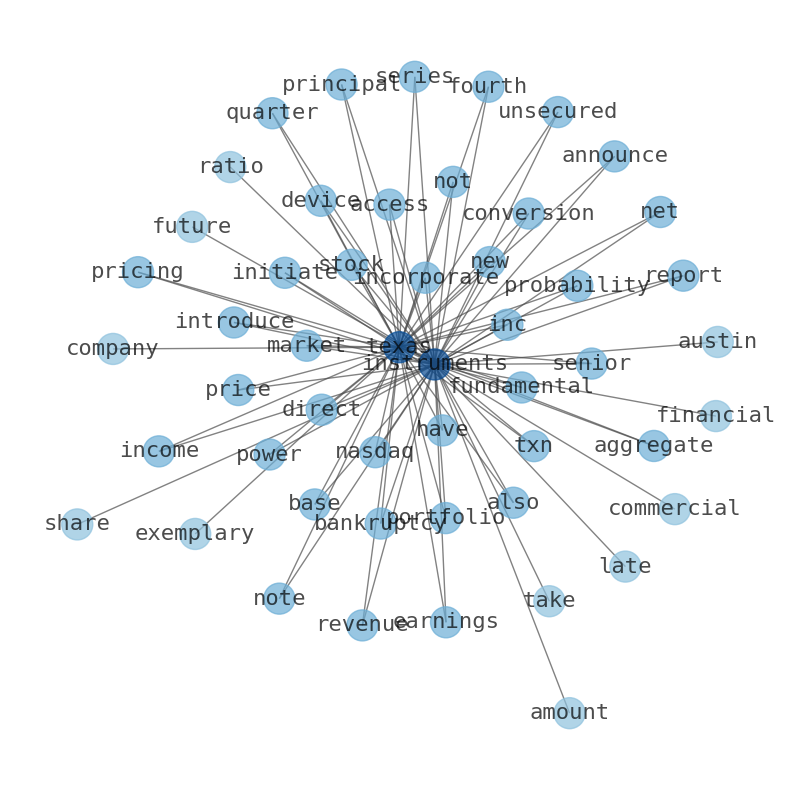

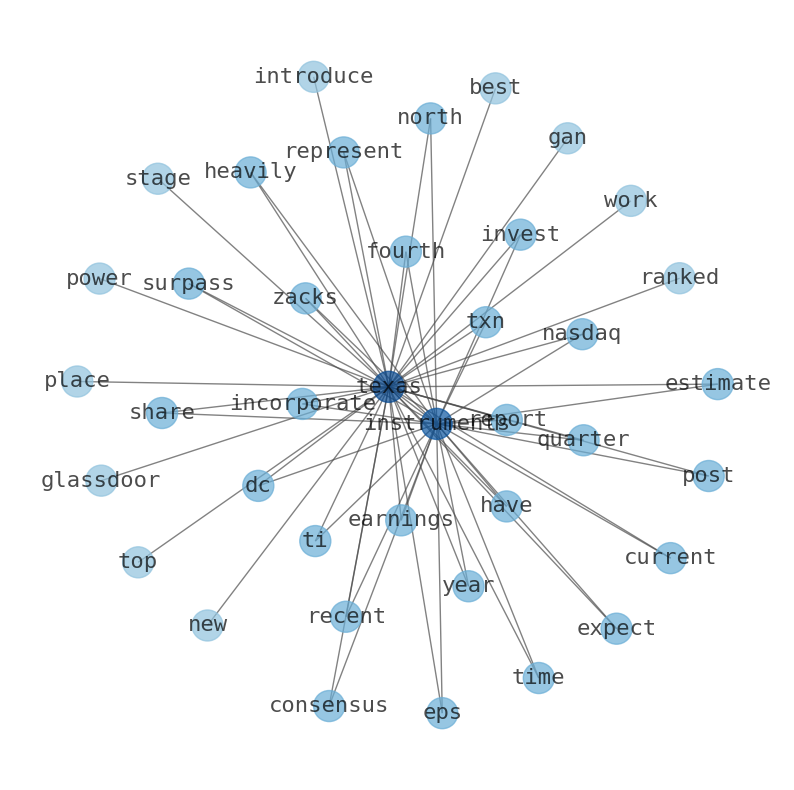

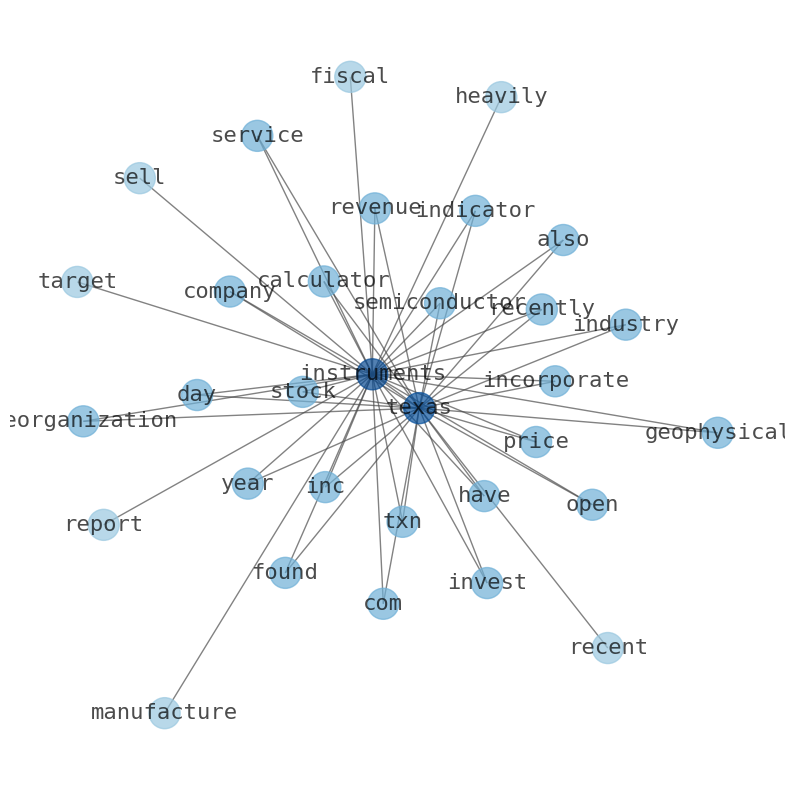

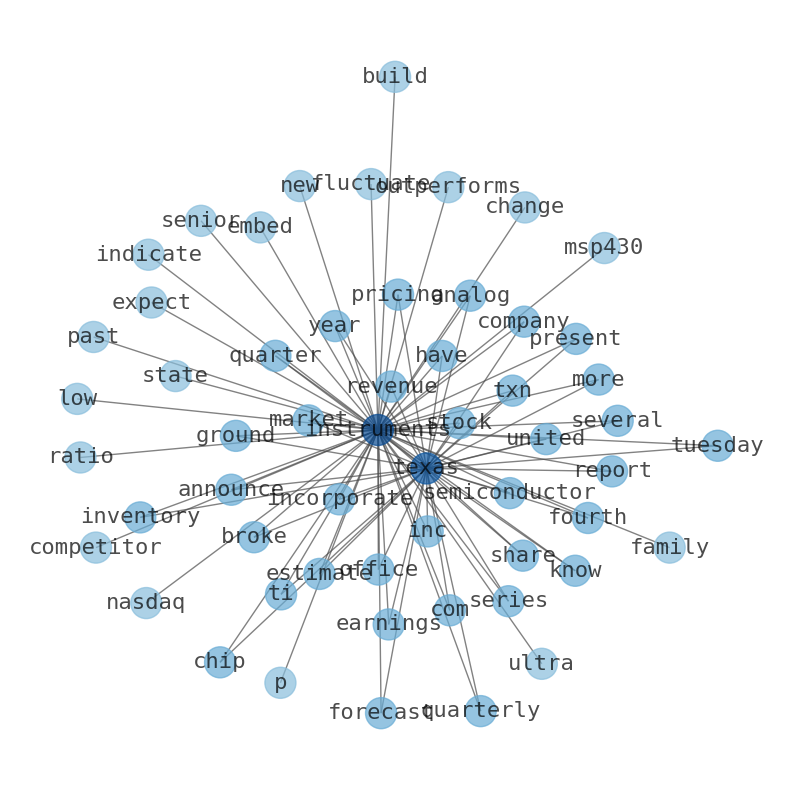

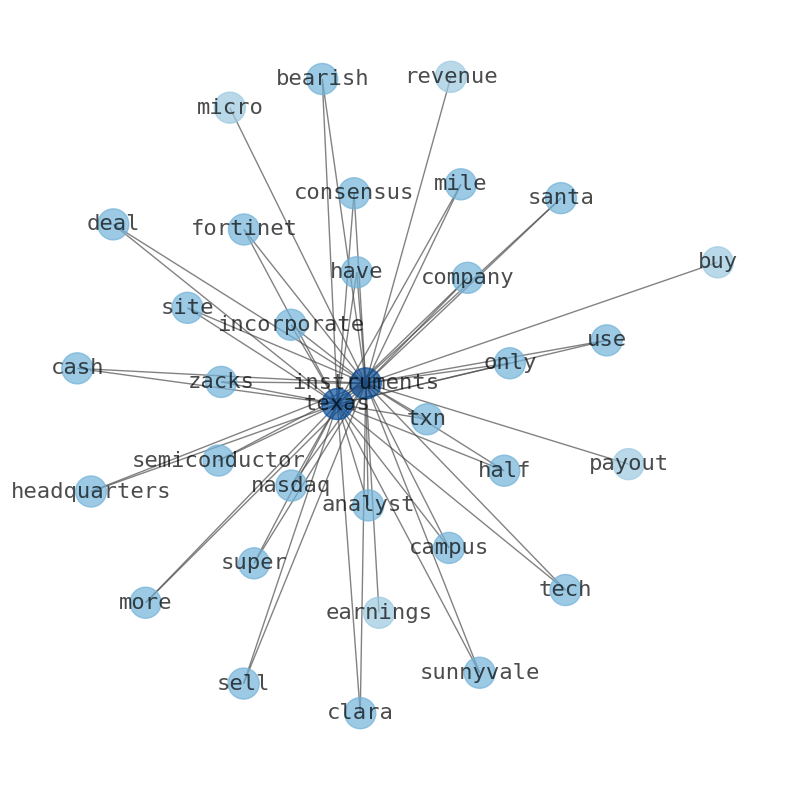

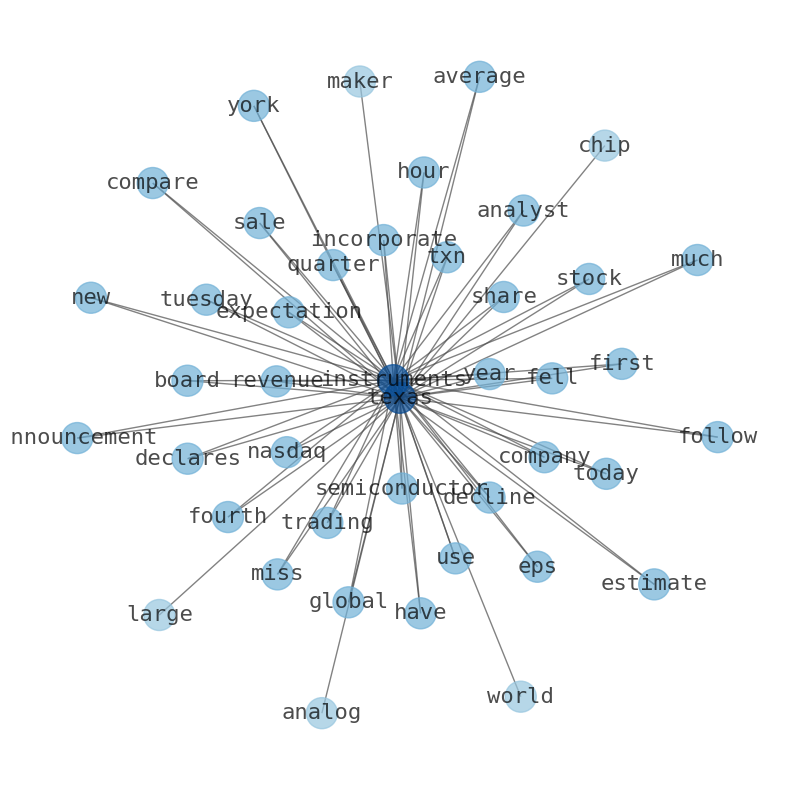

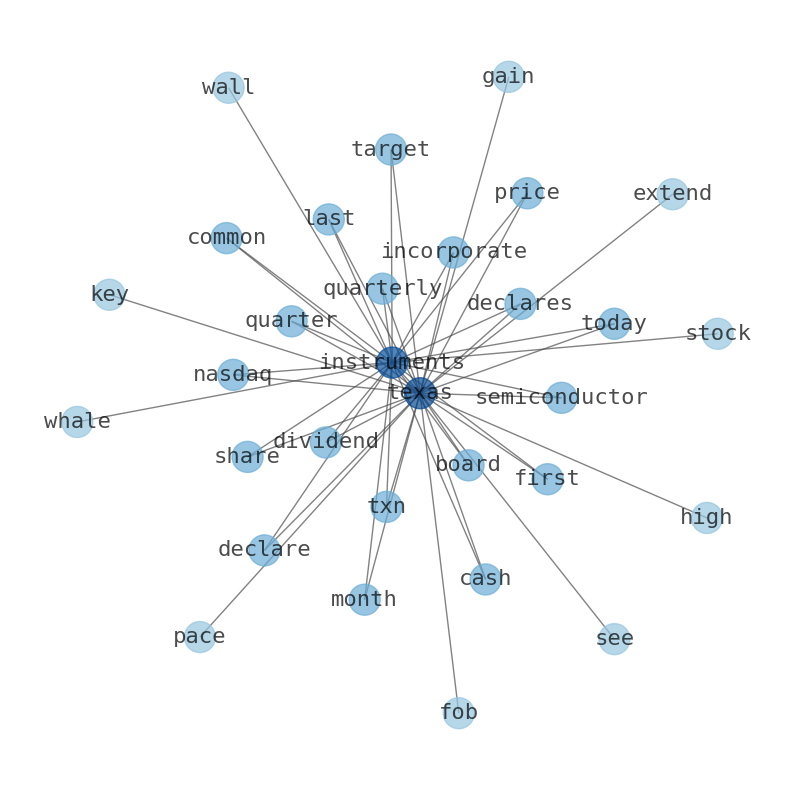

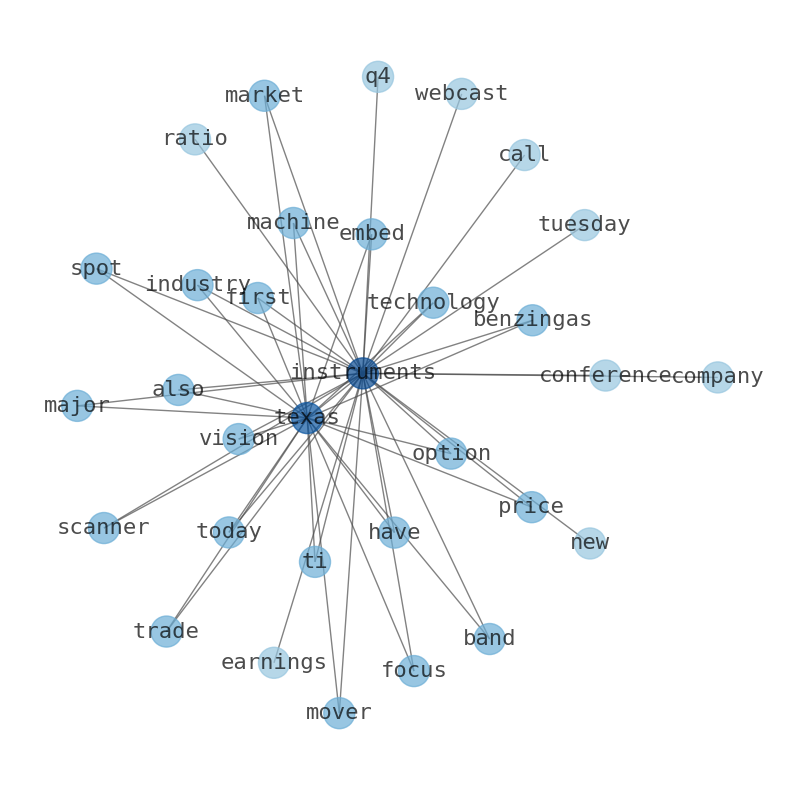

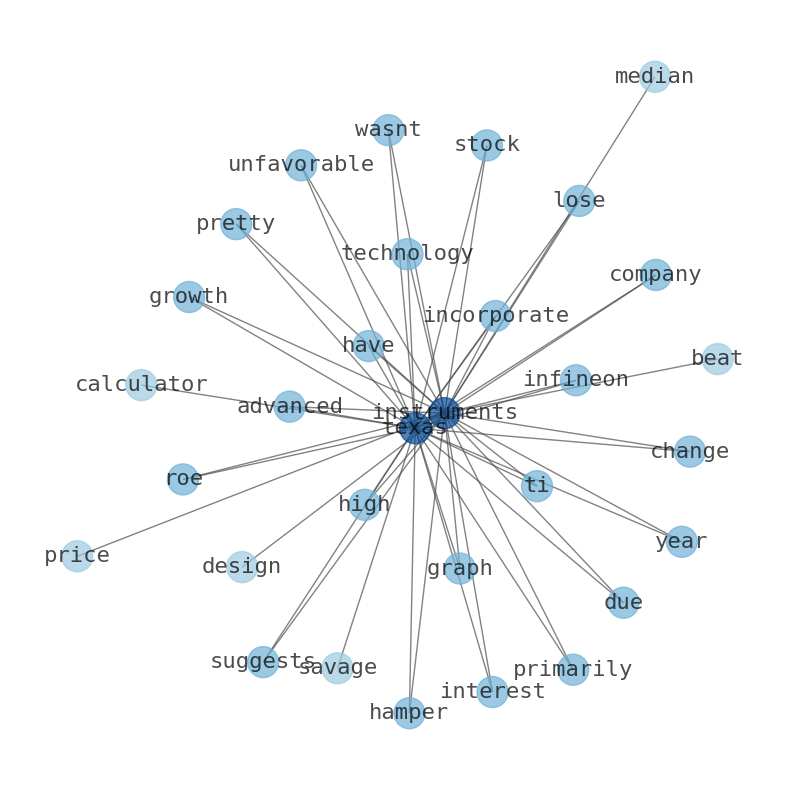

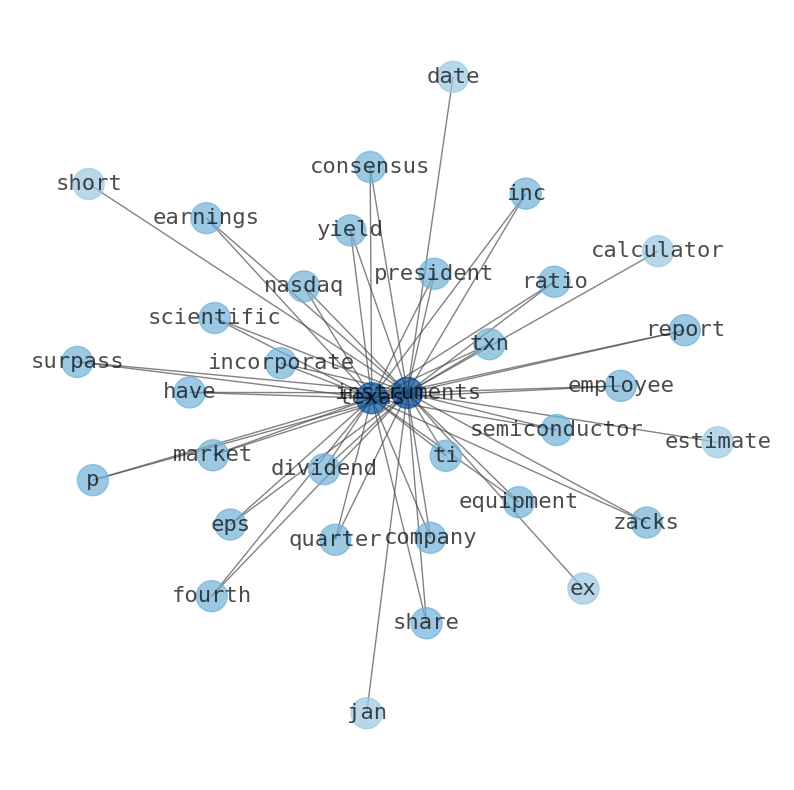

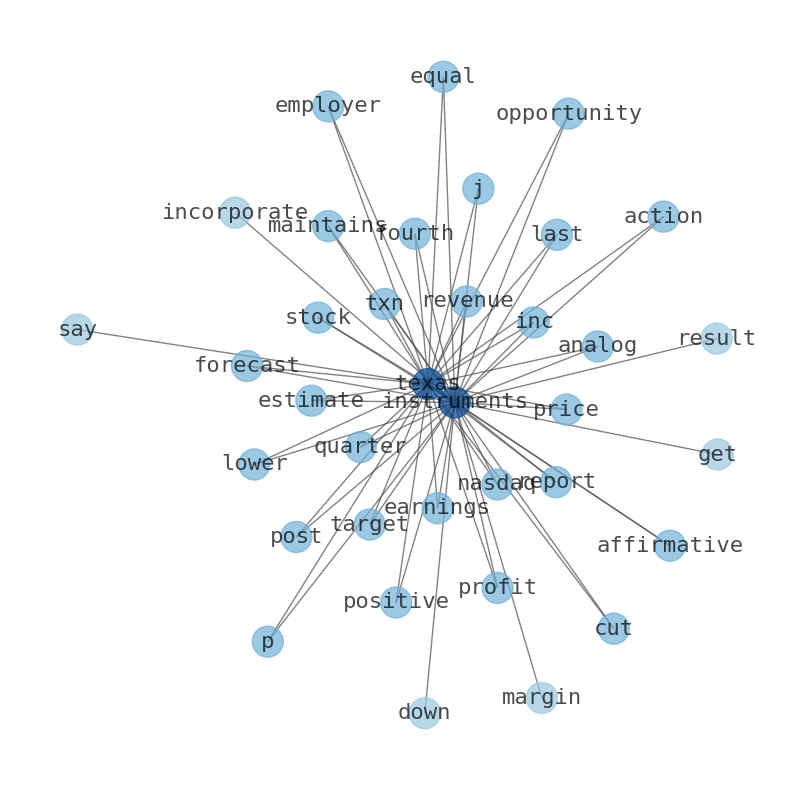

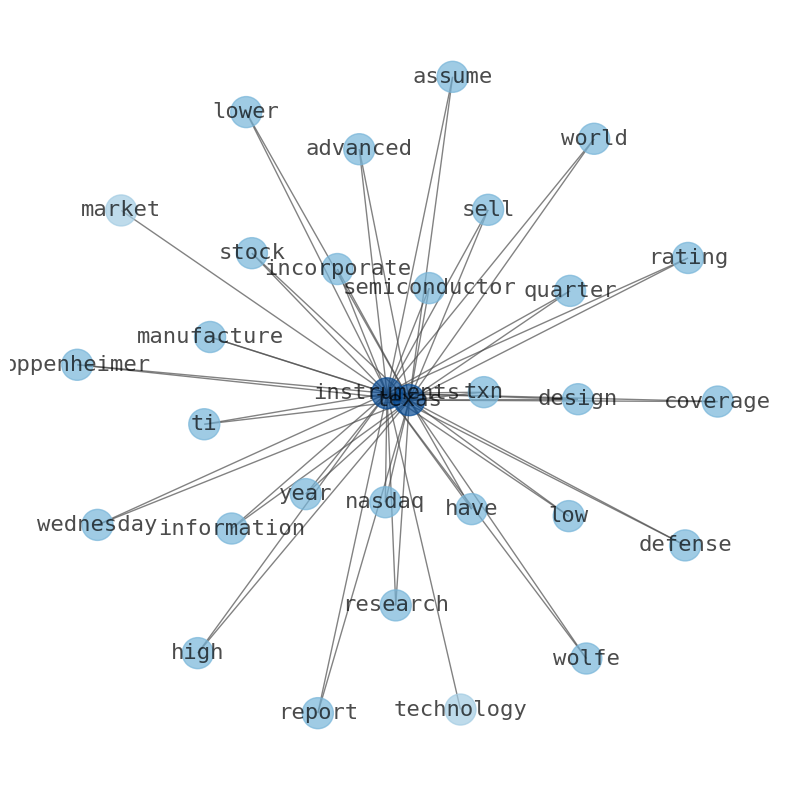

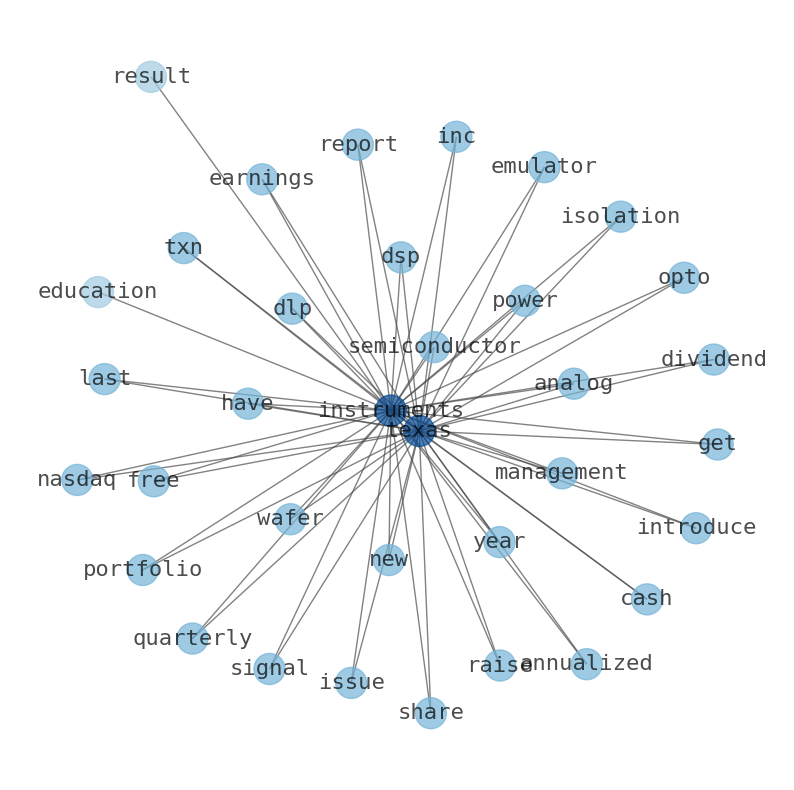

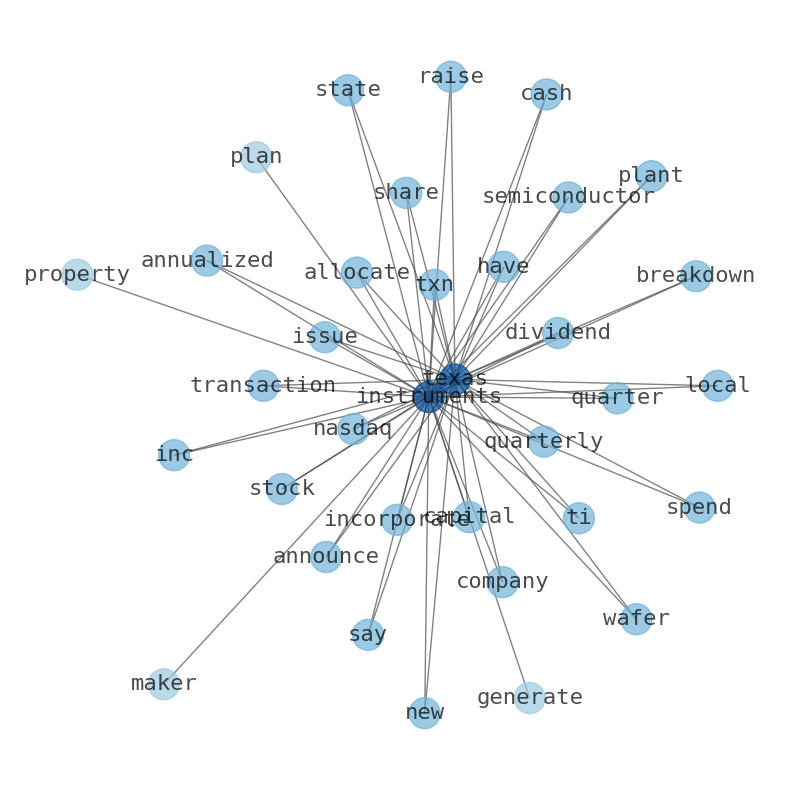

Are looking for the most relevant information about Texas Instruments? Investor spend a lot of time searching for information to make investment decisions in Texas Instruments. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Texas Instruments are: Texas, Instruments, stock, market, Inc, price, senior, and the most common words in the summary are: texas, instrument, job, stock, market, value, share, . One of the sentences in the summary was: reported fourth quarter revenue of $4.08 billion, net income of $1.37 …

Stock Summary

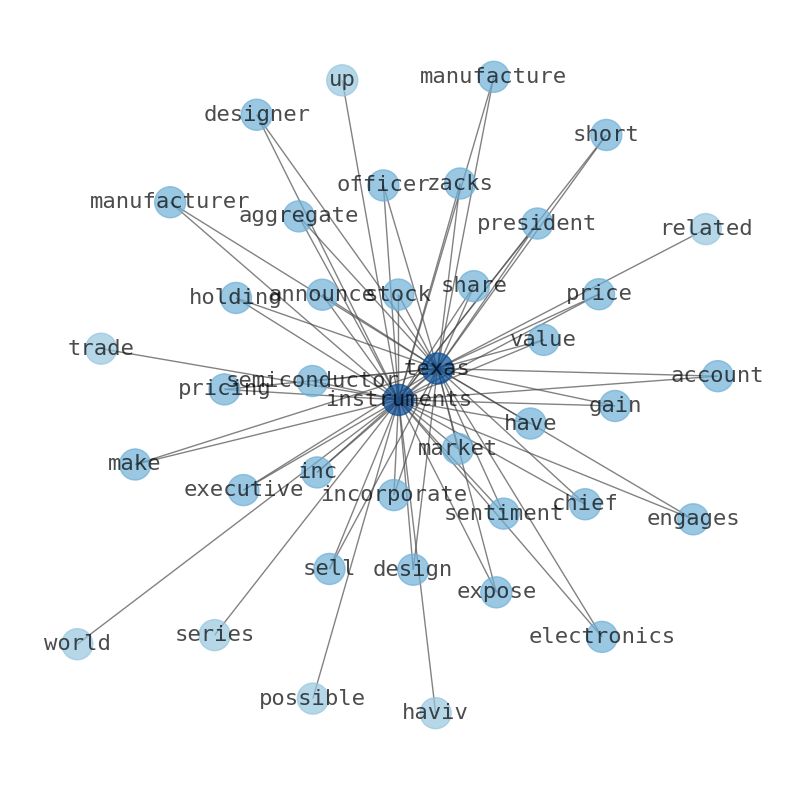

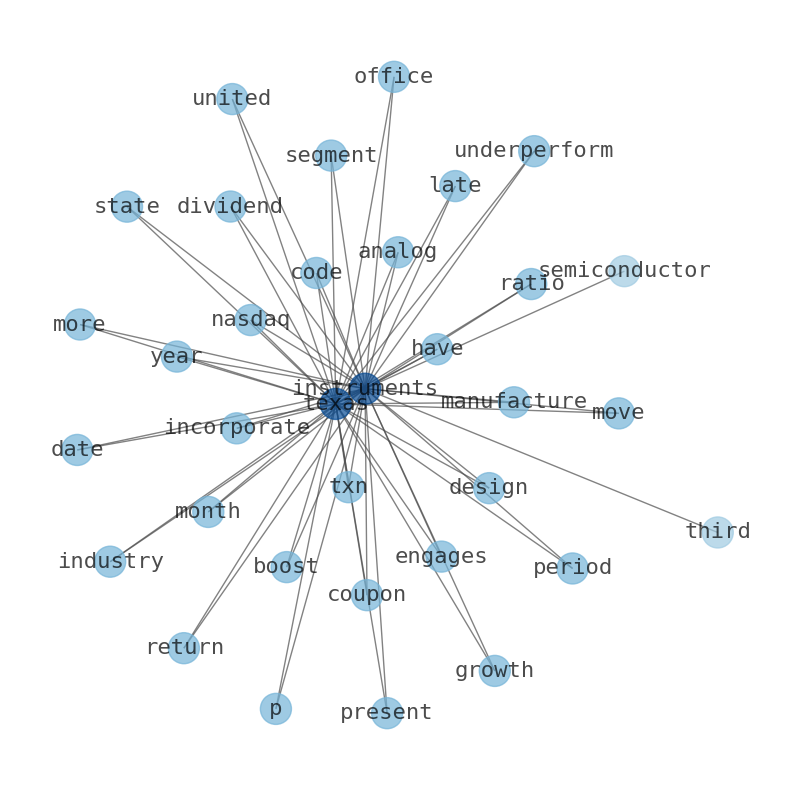

Texas Instruments designs, manufactures, and sells semiconductors to electronics designers and manufacturers. The company operates in two segments, Analog and Embedded Processing. The Embedded processing segment offers microcontrollers that are used in electronic equipment..

Today's Summary

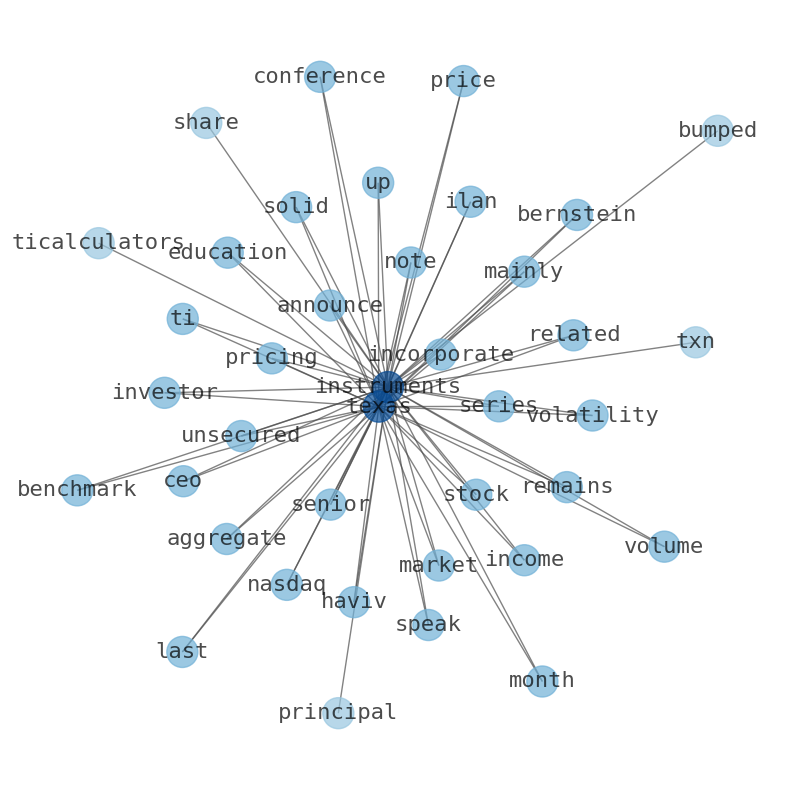

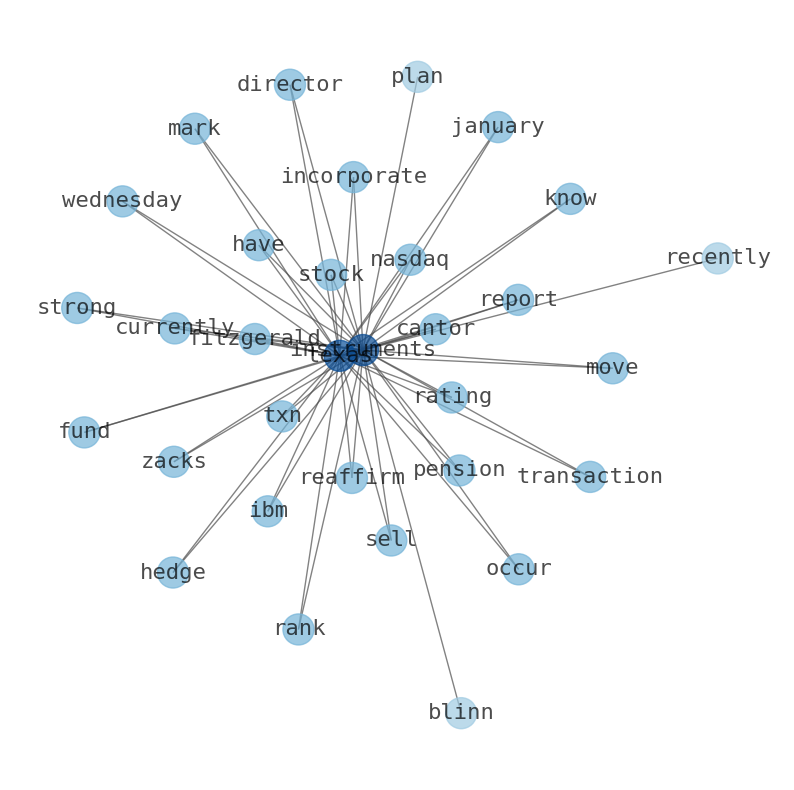

Cantor Fitzgerald Reiterates Neutral on Texas Instruments, Maintains $170 Price Target. Texas Instruments Inc. reported fourth quarter revenue of $4.08 billion, net income of $1.37 billion and earnings per share of $3.0 billion.

Today's News

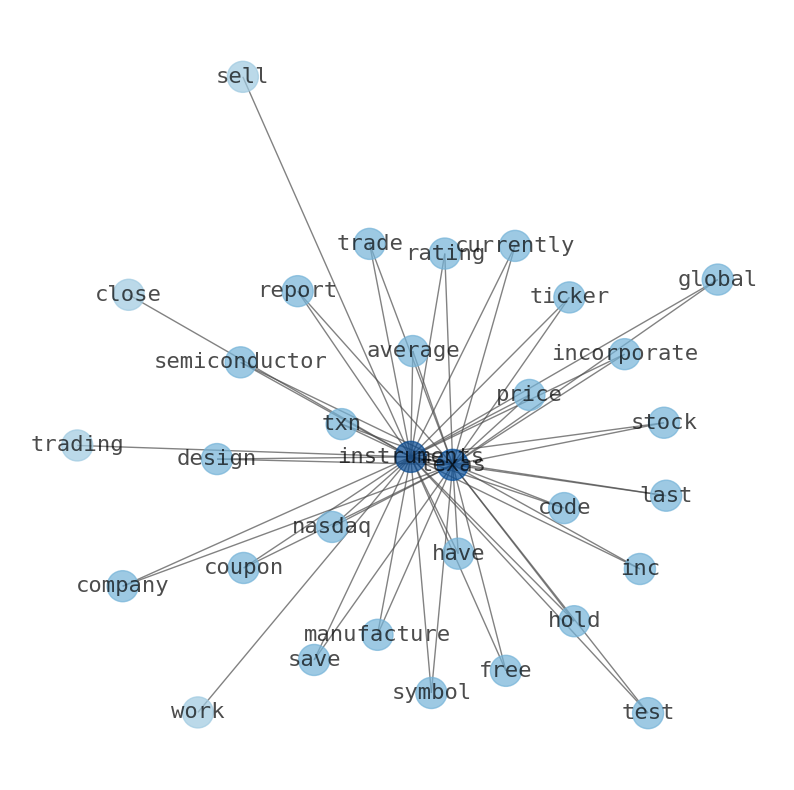

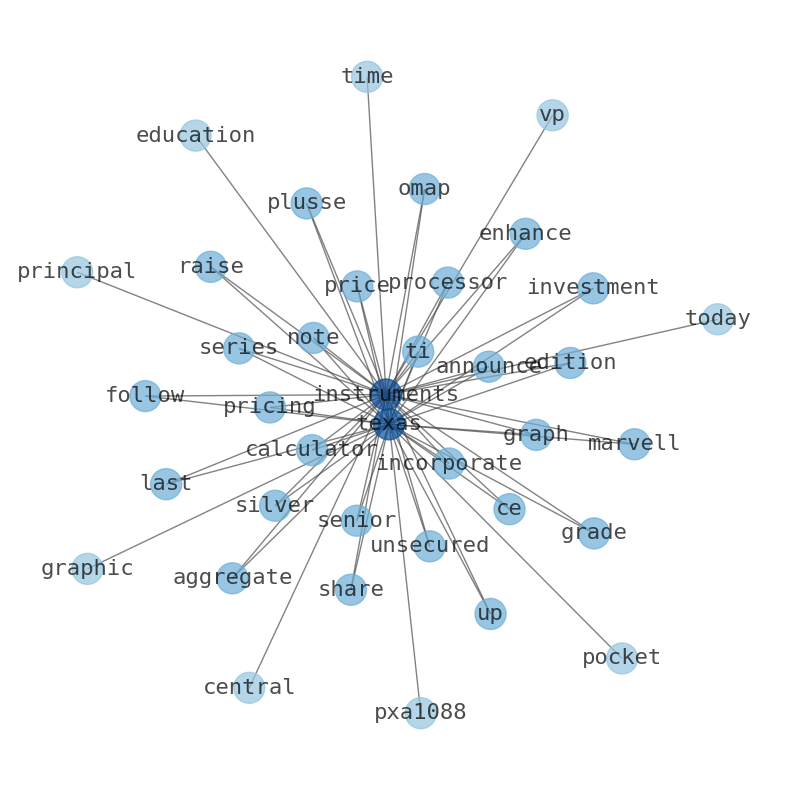

Texas Instruments Inc. reported fourth quarter revenue of $4.08 billion, net income of $1.37 billion and earnings per share of $3.0 billion. Texas Instruments announced the pricing of five series of senior unsecured notes for an aggregate principal amount of $3.00 bi... Texas Instruments is currently trading at a Forward P/E ratio of 31.88. Austin Commercial is building the first of Texas Instruments future fabs in Sherman, Texas. Texas Instruments Inc. initiating 2024 direct access with exemplary companies: texas instruments incorporated. Event will provide attendees with direct access to a senior representative of Texas Instruments. Texas Instruments introduced two new power conversion device portfolios. Texas Instruments has a new line of ARM Cortex M0+ parts that get under 40 cents in volume in their cheapest form. The latest batch of retro hardware theyve added support for is a number of calculators from the 90s and early 00s. Analysts estimate the true value of Texas Instruments more accurately as focusing exclusively on Texas Instruments fundamentals will not take into account other important factors. Texas Instruments stock price is the clearest measure of market expectations about its performance. Dividend Yield is likely to grow to 0.03, while Payment of Dividends and Other Cash Distributions is expected to drop. Texas Instruments market volatility, profitability, liquidity, solvency, efficiency, growth potential, financial leverage, and other vital indicators. We have many different tools that can be utilized to determine how healthy Texas Instruments is. Texas Instruments Incorporated has a Probability Of Bankruptcy of 3.0% based on the latest financial disclosure. Peer analysis of Texas Instruments could also be used in its relative valuation. Texas Instruments (NASDAQ:TXN) stock increased by 7.2% over the past three months. Texas Instruments has outperformed the market over the last 10 years by 3.35% on an annualized basis producing an average annual return of 13.97%. Texas Instruments Incorporated (NASDAQ:TXN) on an uptrend: Could Fundamentals be driving the stock? Cantor Fitzgerald Reiterates Neutral on Texas Instruments, Maintains $170 Price Target. Overall Tech Sector Is Also Lower Following Worse-than-expected US Inflation Data. Texas Instruments TAS6424Q1 vs STS FDA()! or HFDA801A for automotive application ? Thread starter Pablogoglu Start date Sunday at 3:47 AM Jump to Latest PabLogoglu Member Joined 2024 Sunday at.

Stock Profile

"Texas Instruments Incorporated designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States and internationally. It operates in two segments, Analog and Embedded Processing. The Analog segment offers power products to manage power requirements across various voltage levels, including battery-management solutions, DC/DC switching regulators, AC/DC and isolated controllers and converters, power switches, linear regulators, voltage references, and lighting products. This segment also provides signal chain products that sense, condition, and measure signals to allow information to be transferred or converted for further processing and control, including amplifiers, data converters, interface products, motor drives, clocks, and logic and sensing products. The Embedded Processing segment offers microcontrollers that are used in electronic equipment; digital signal processors for mathematical computations; and applications processors for specific computing activity. This segment offers products for use in various markets, such as industrial, automotive, personal electronics, communications equipment, enterprise systems, and calculators and other. The company also provides DLP products primarily for use in project high-definition images; calculators; and application-specific integrated circuits. It markets and sells its semiconductor products through direct sales and distributors, as well as through its website. Texas Instruments Incorporated was founded in 1930 and is headquartered in Dallas, Texas."

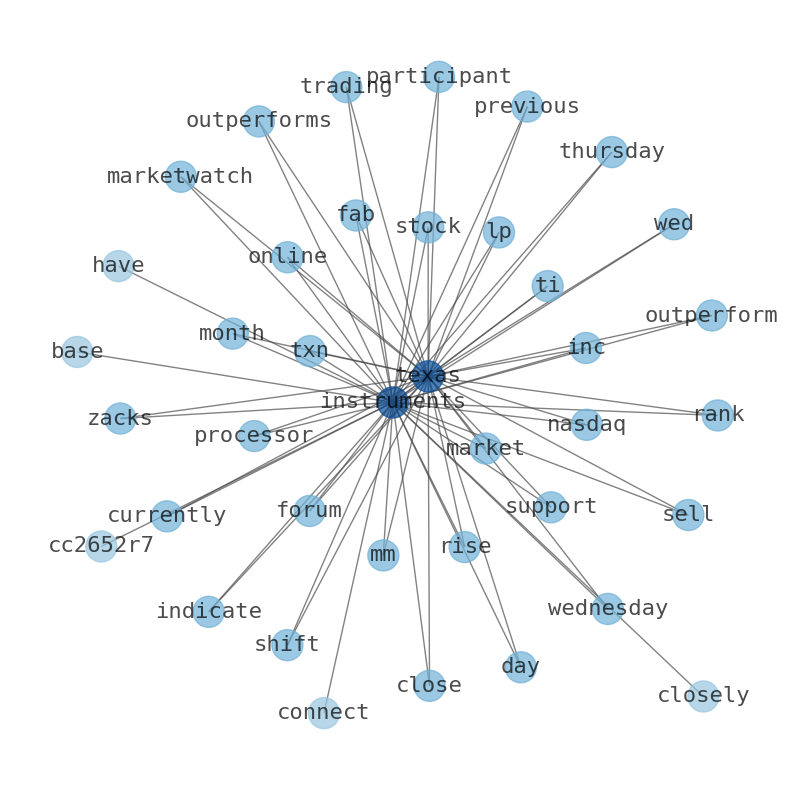

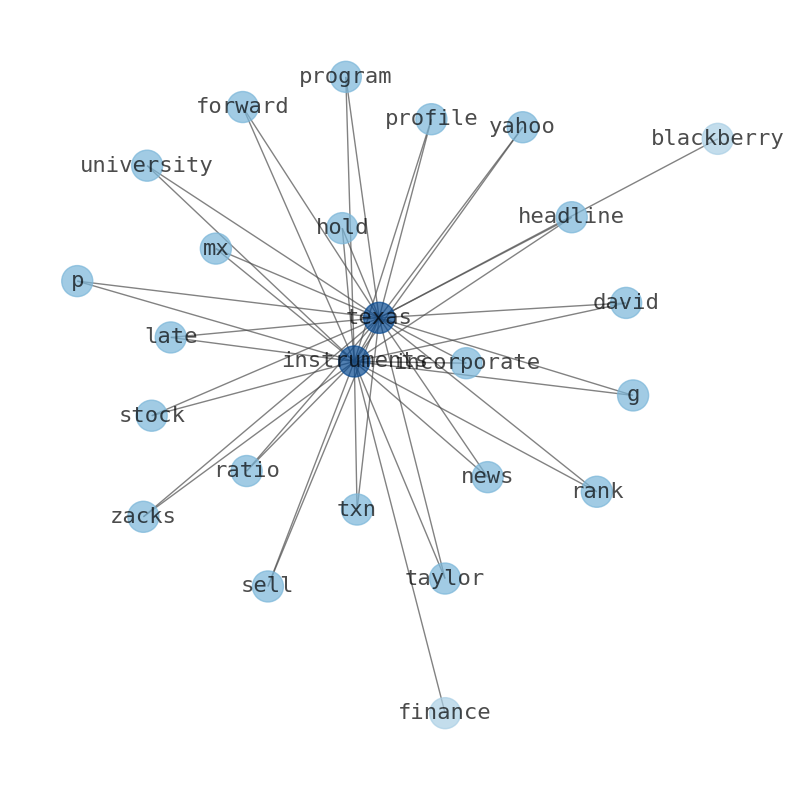

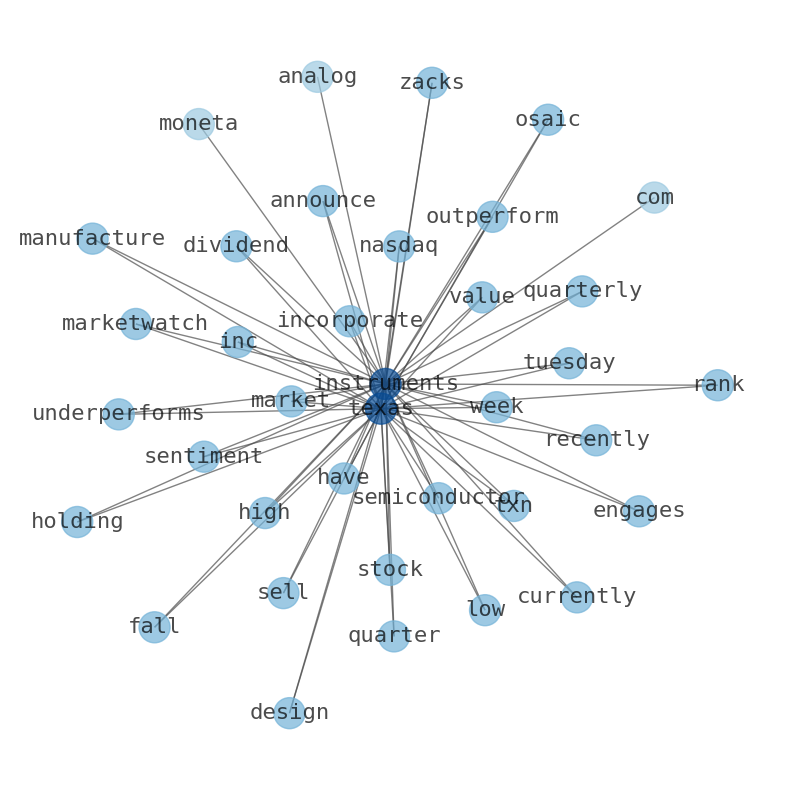

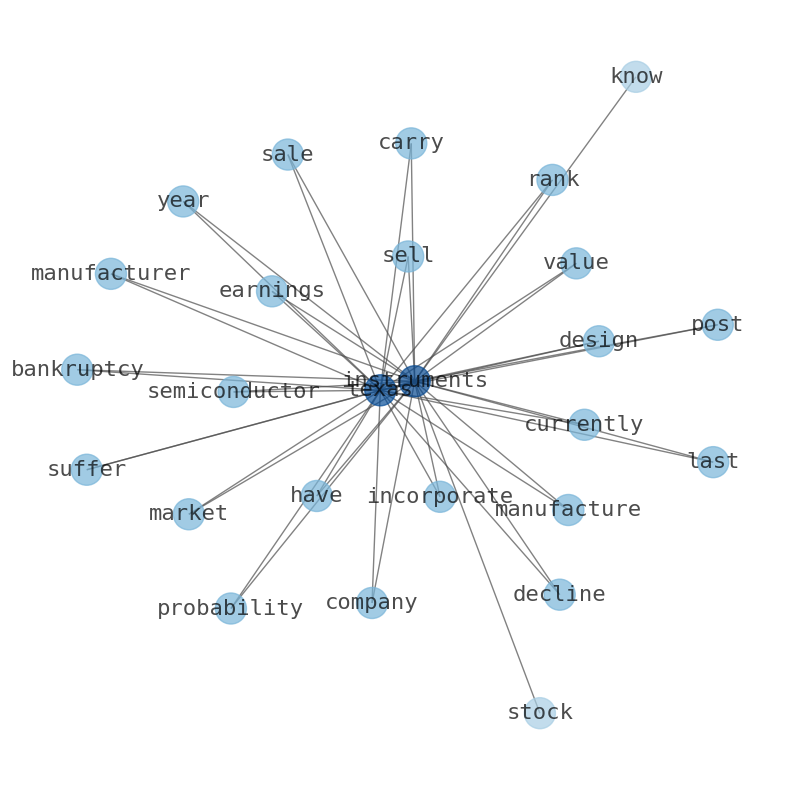

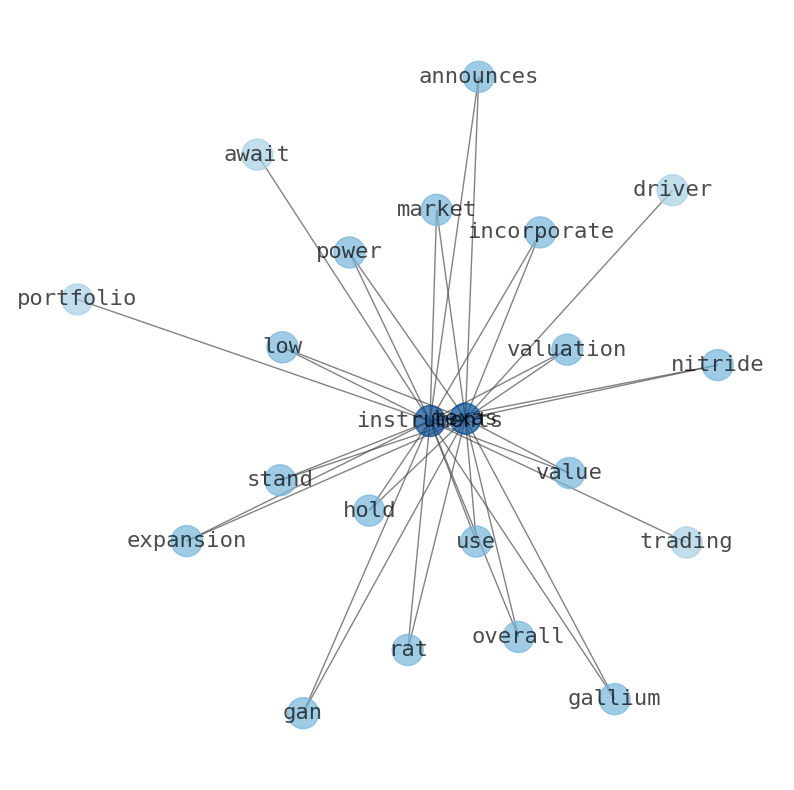

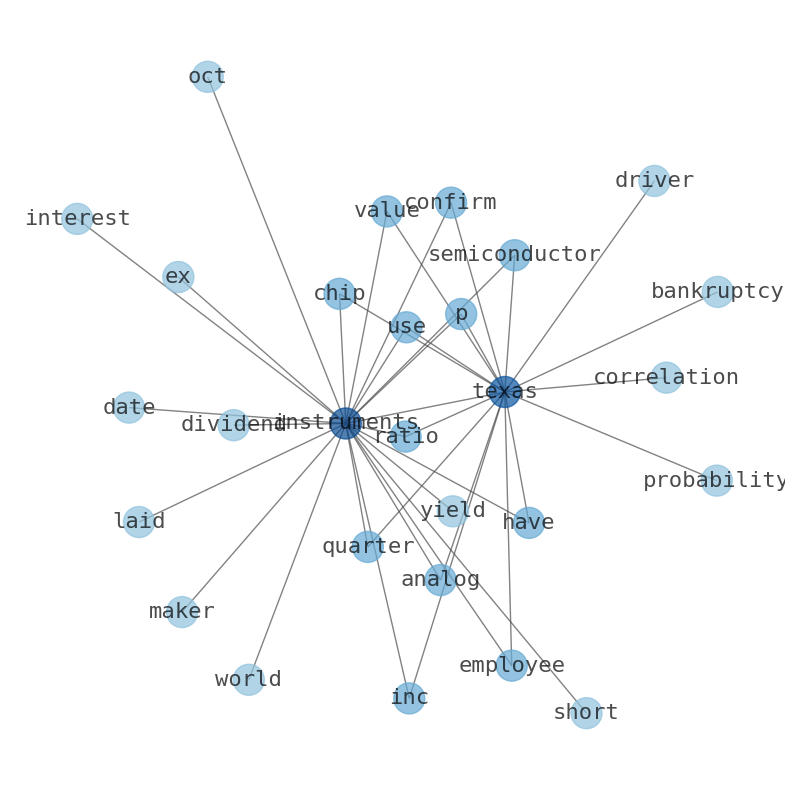

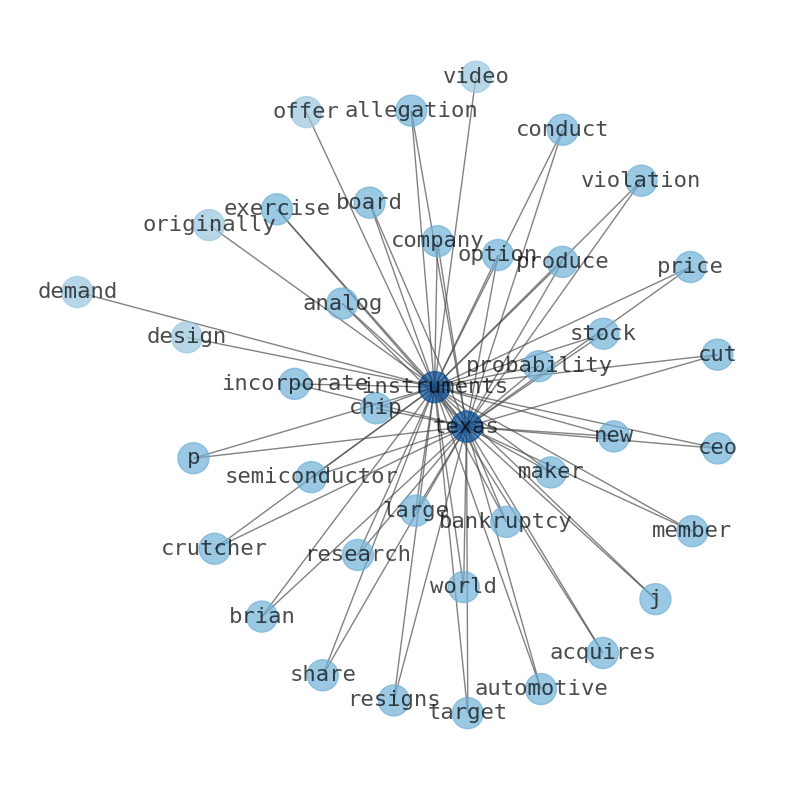

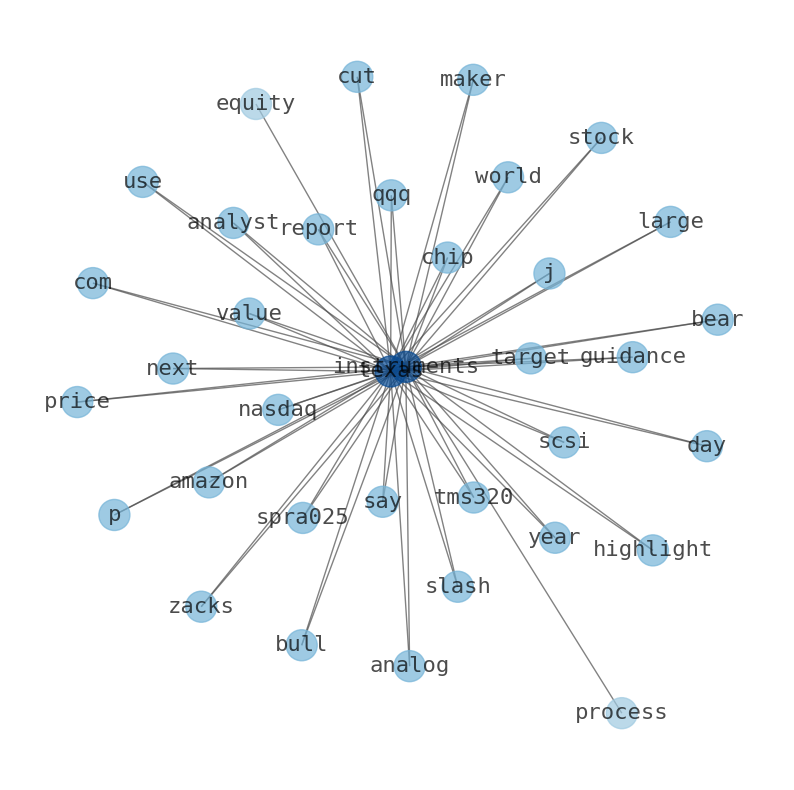

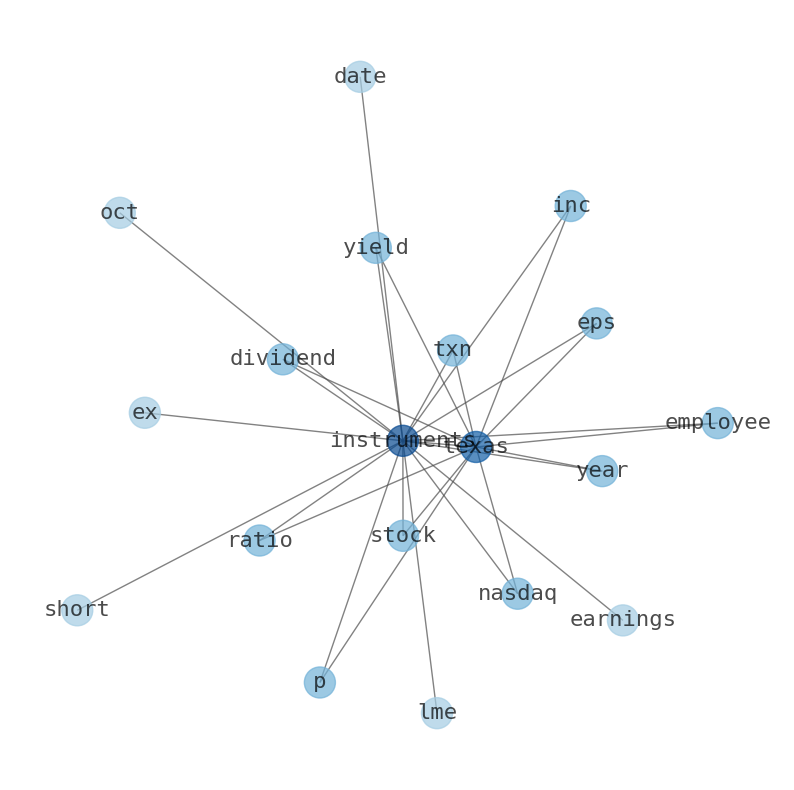

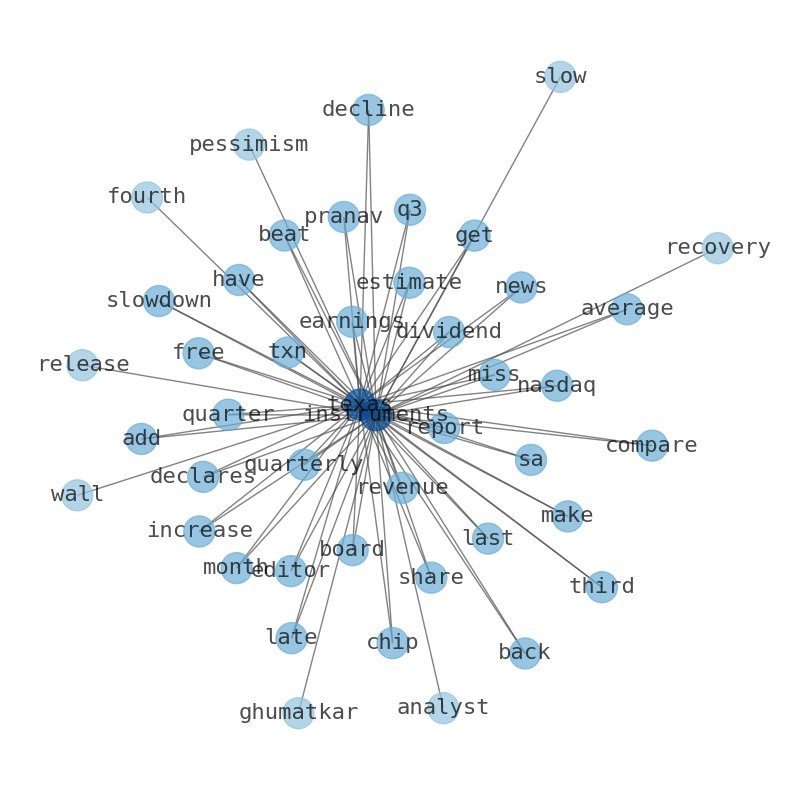

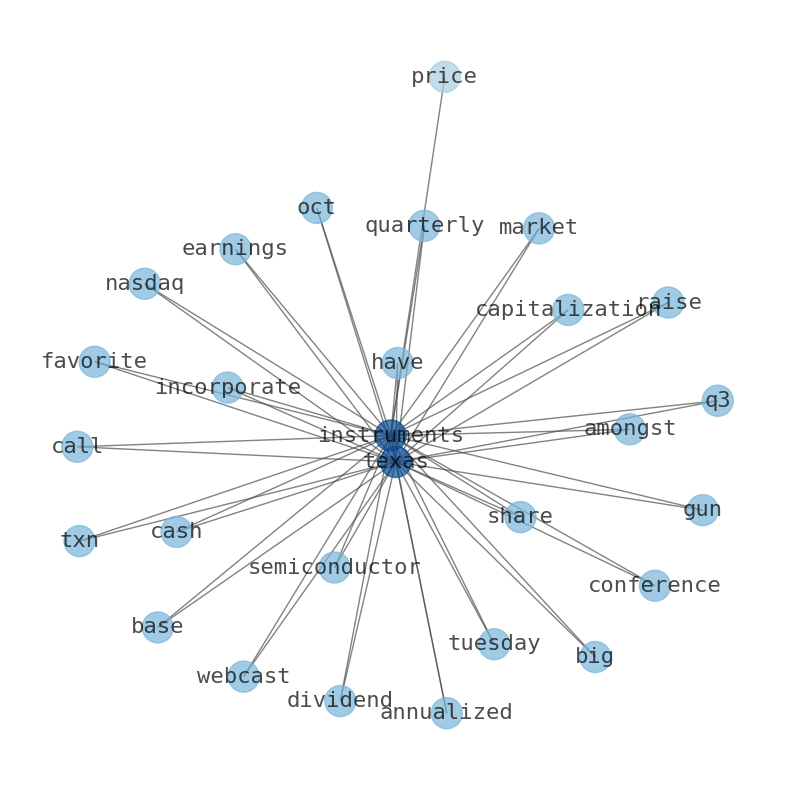

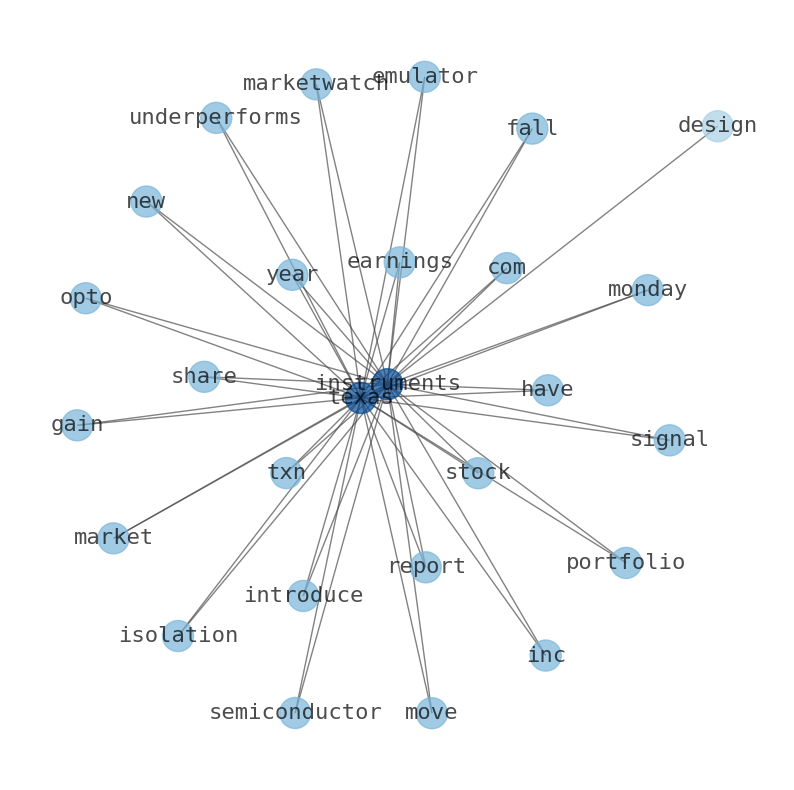

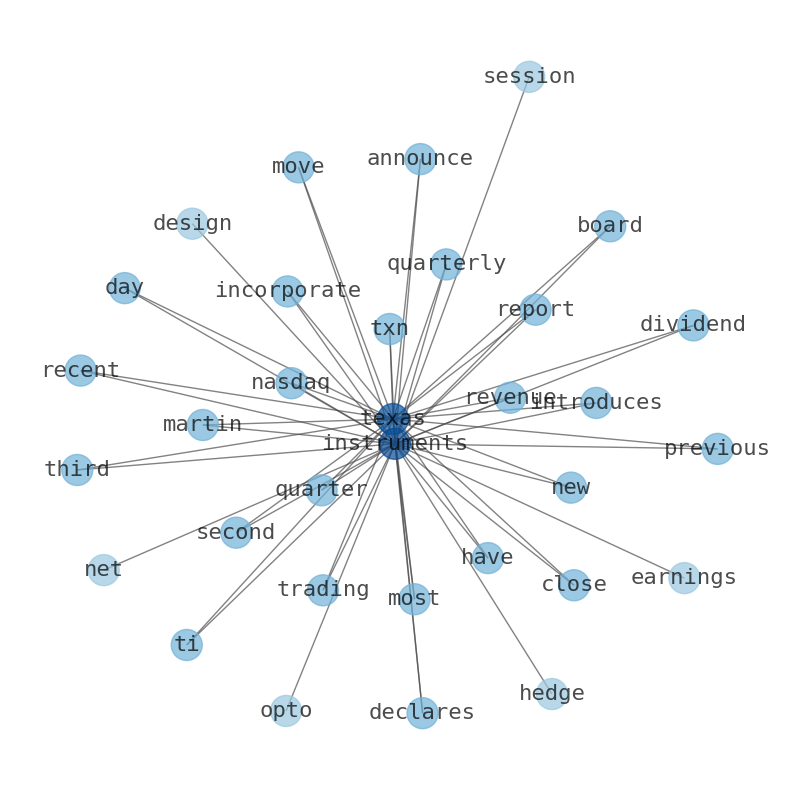

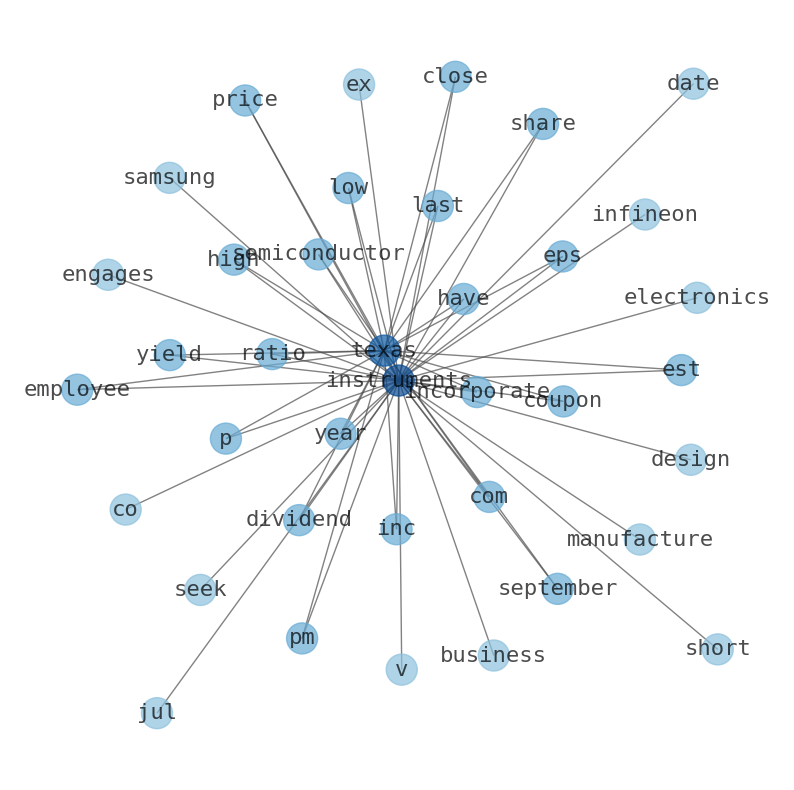

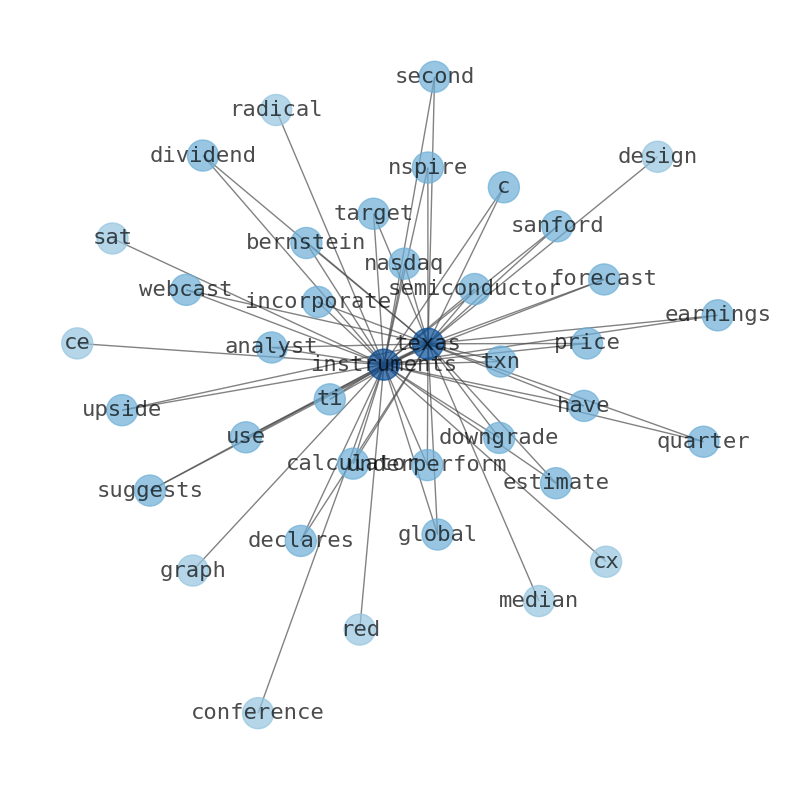

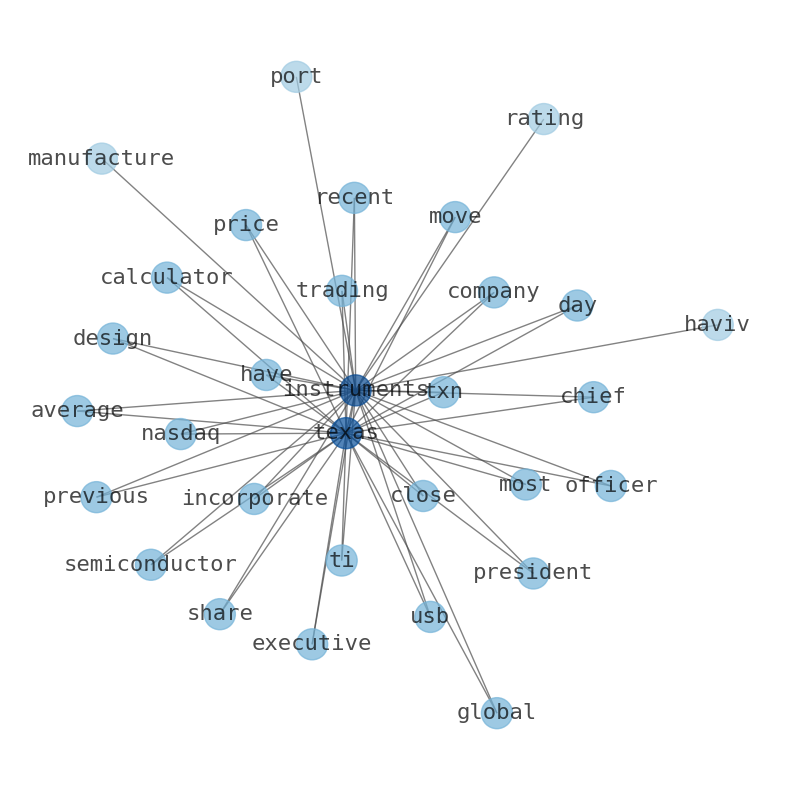

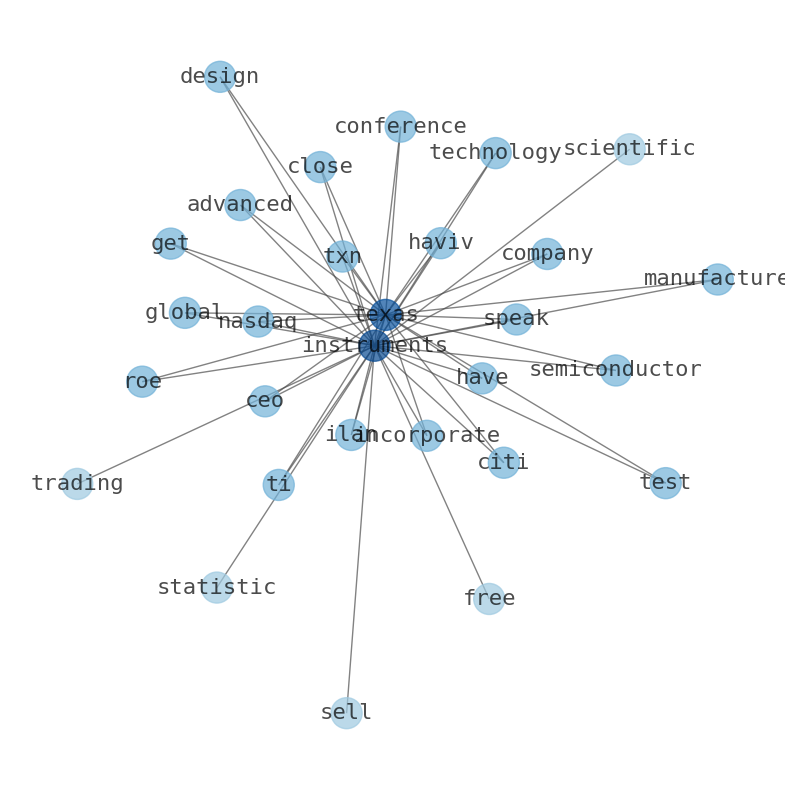

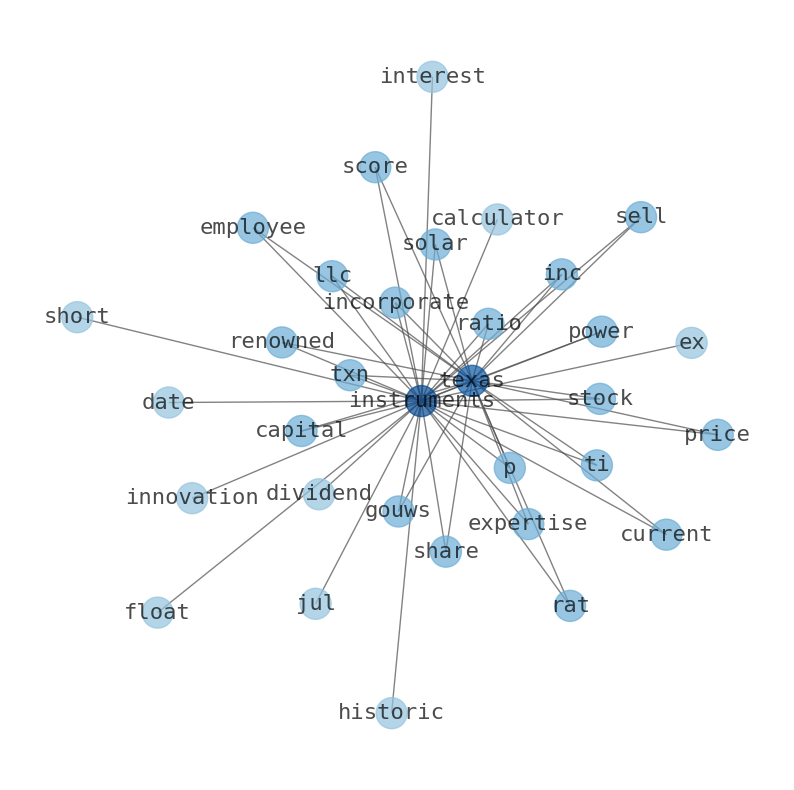

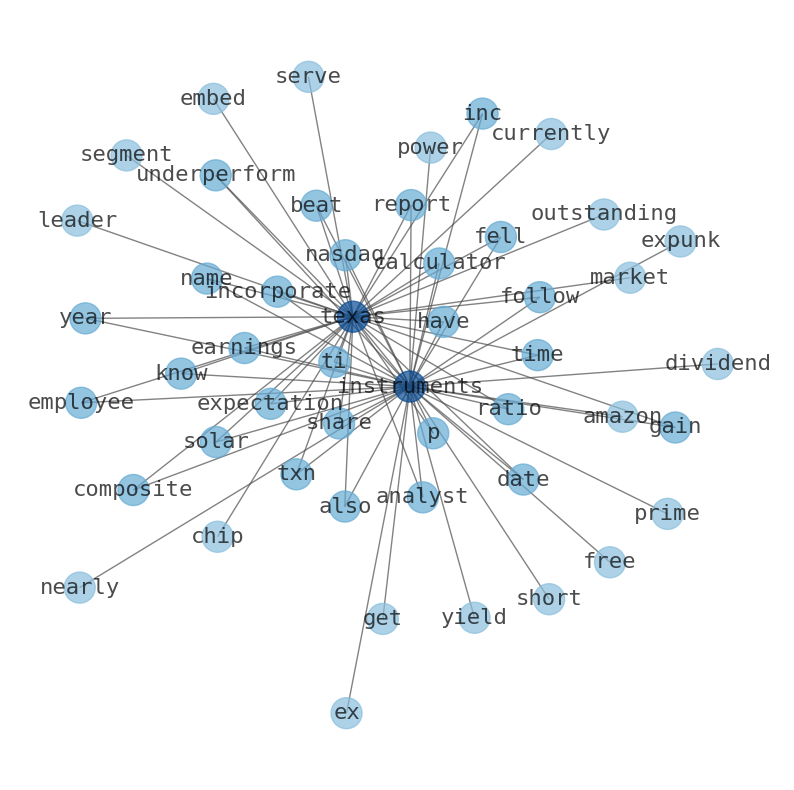

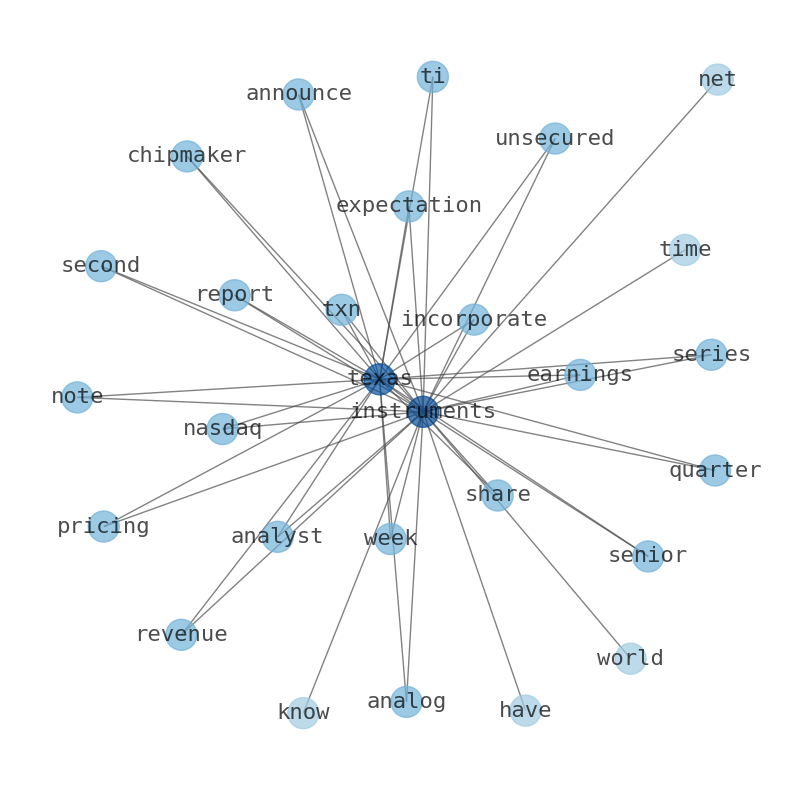

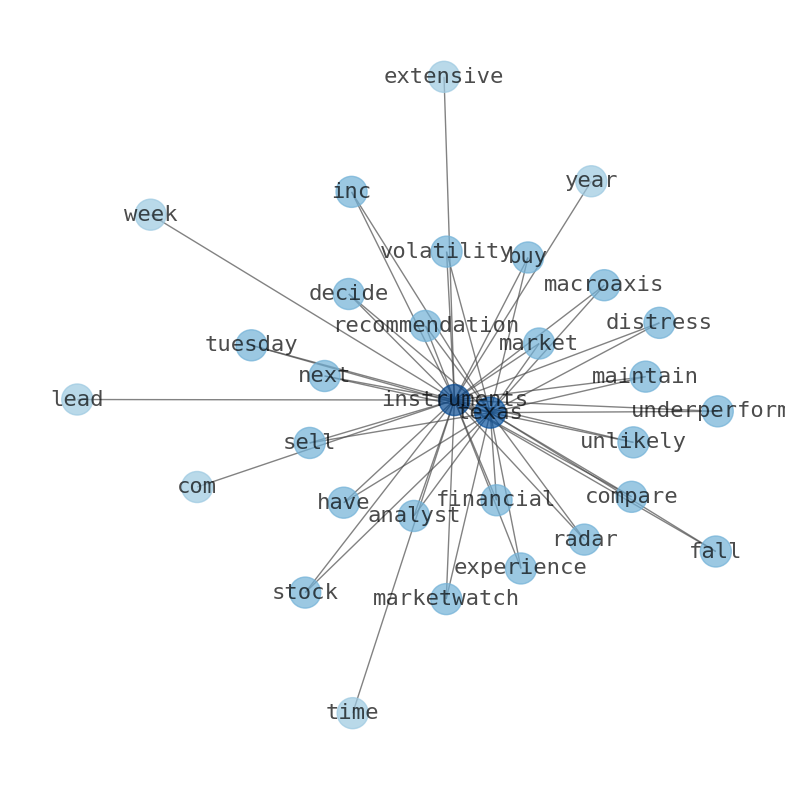

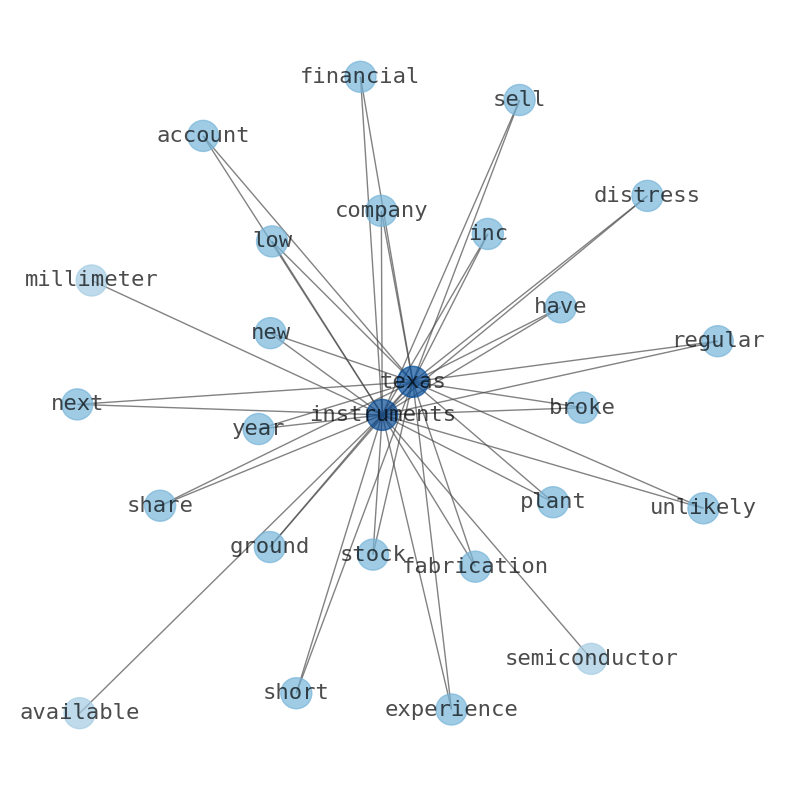

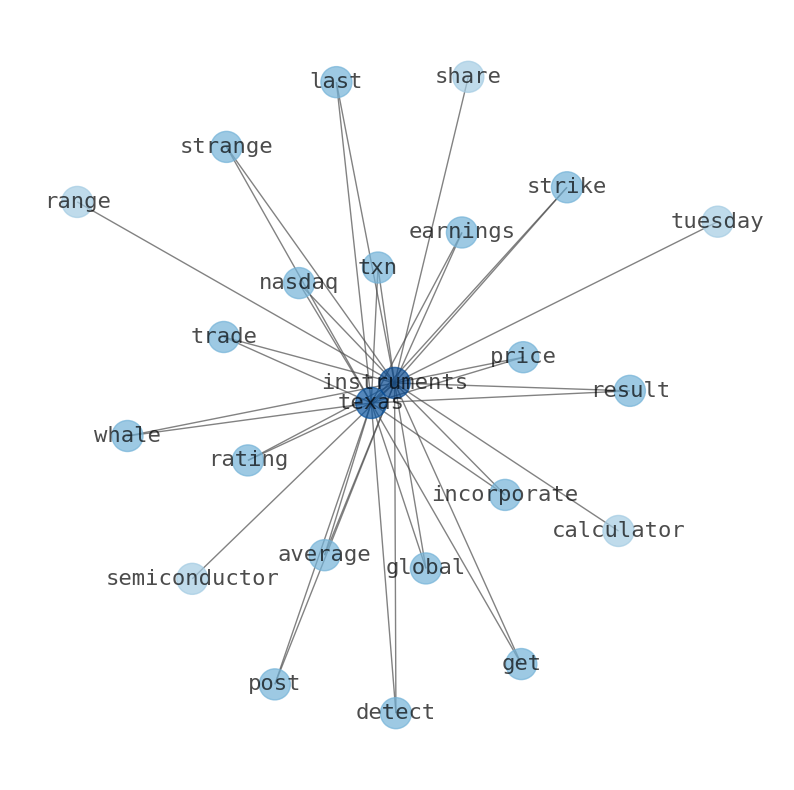

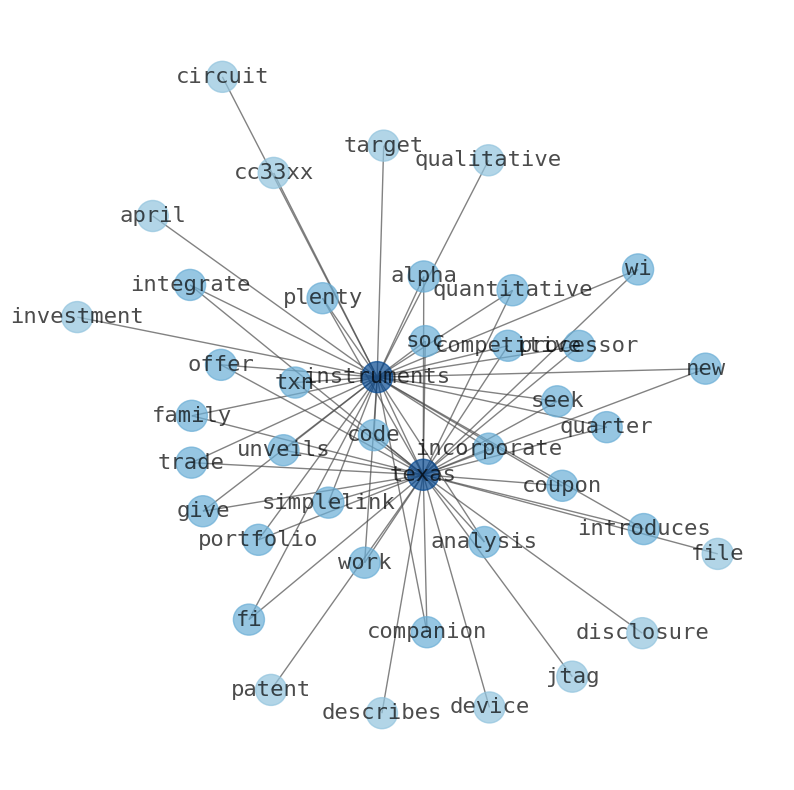

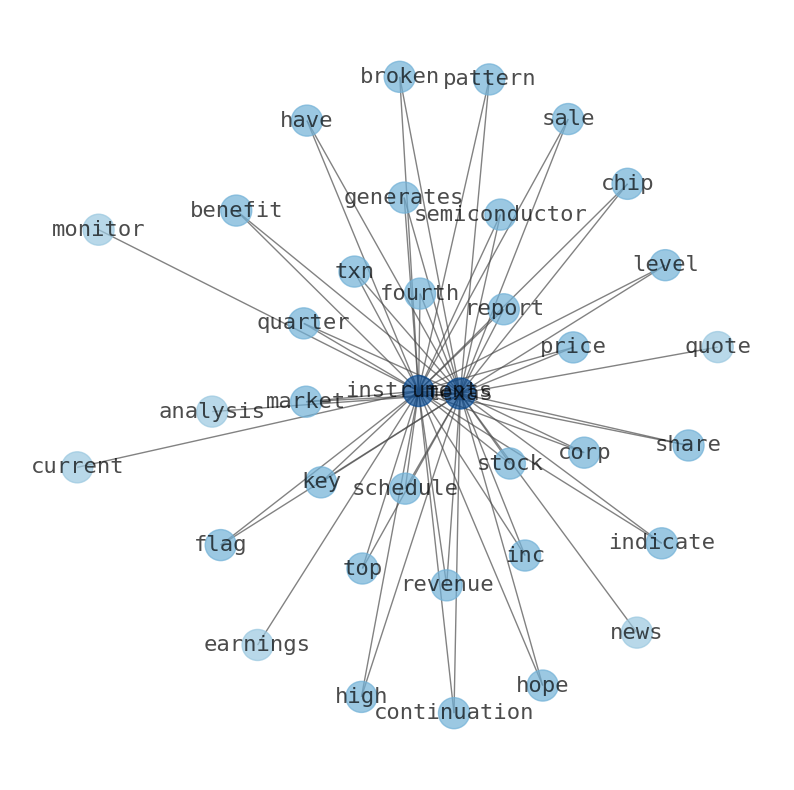

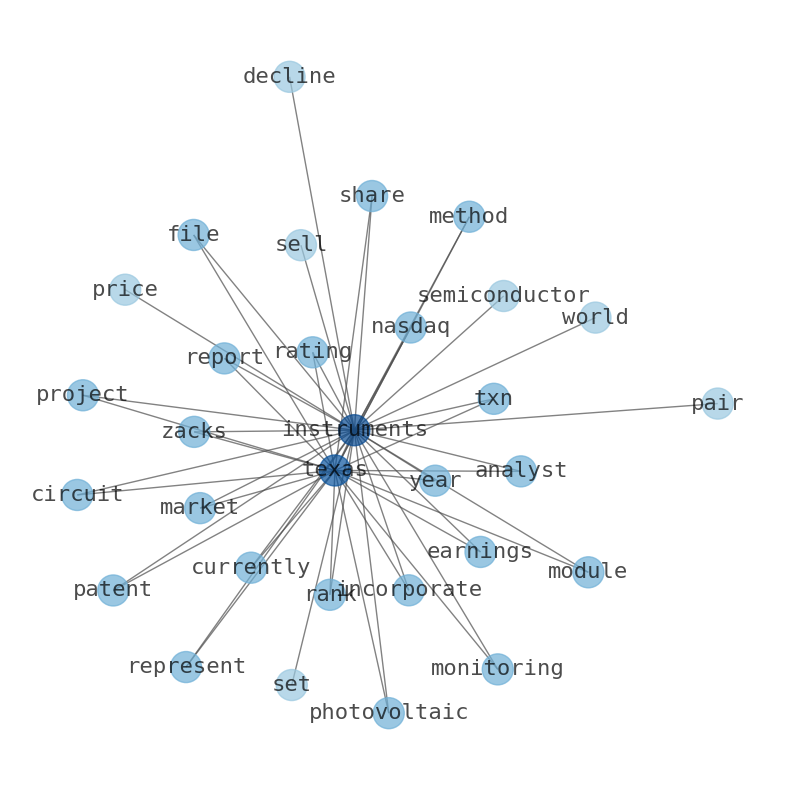

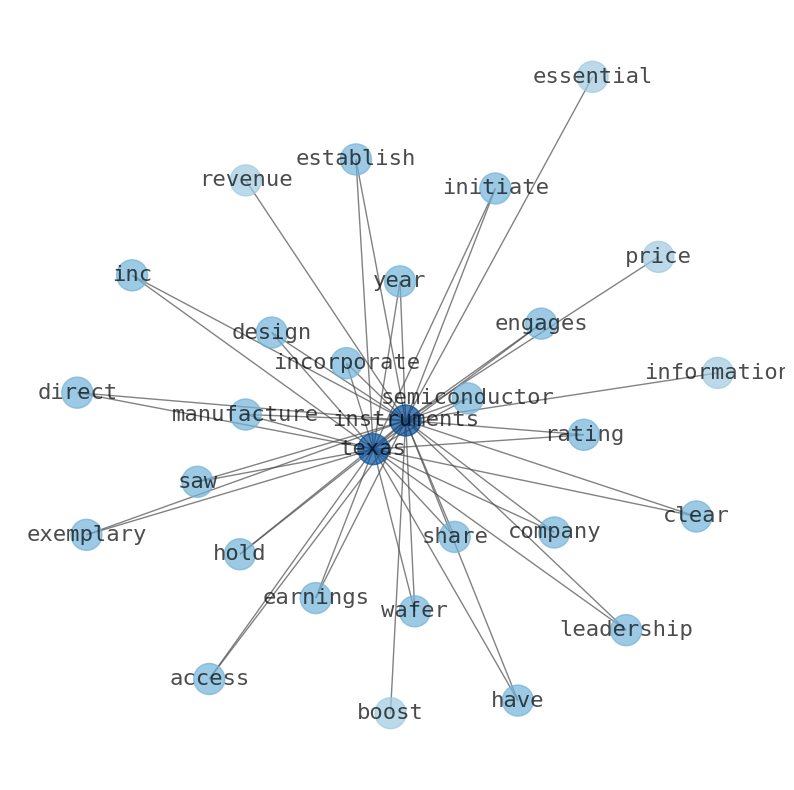

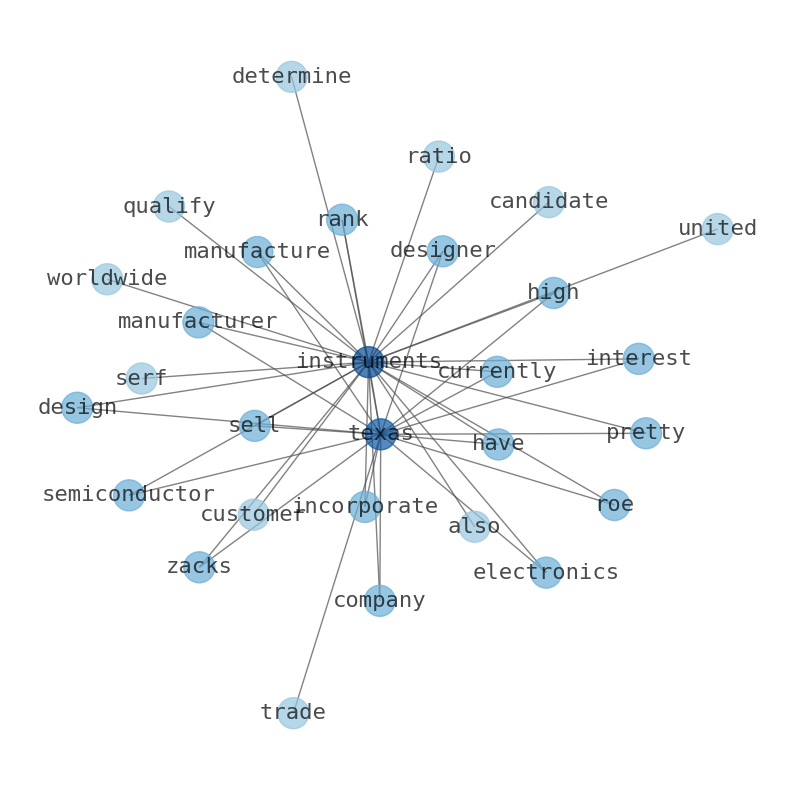

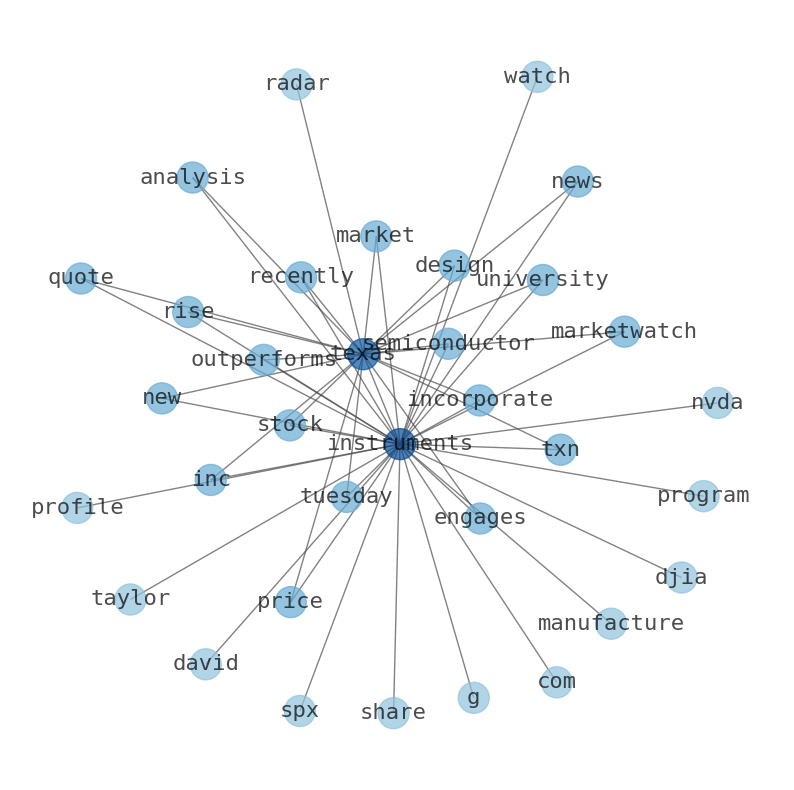

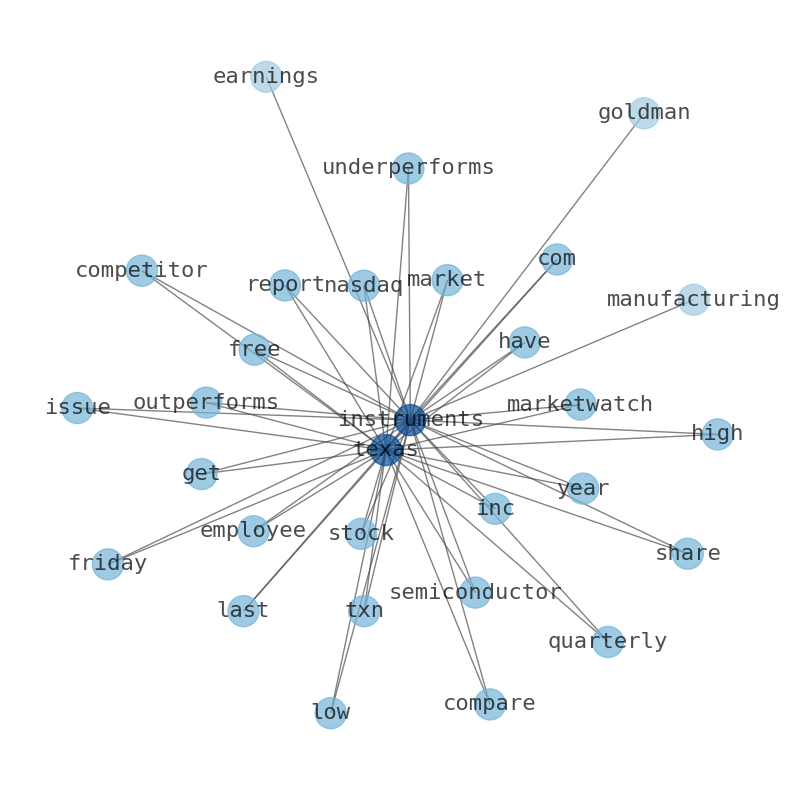

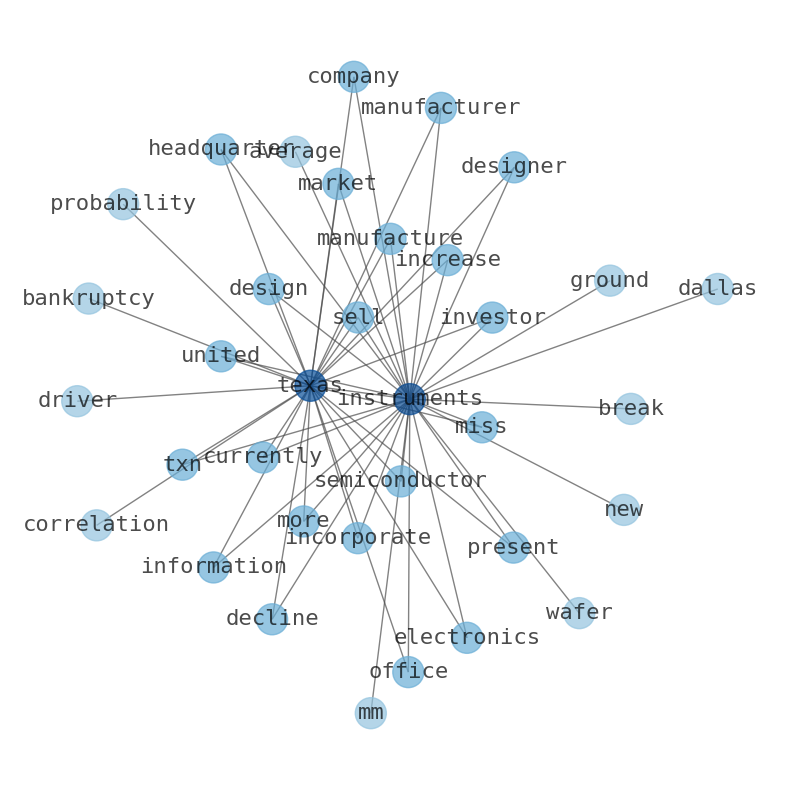

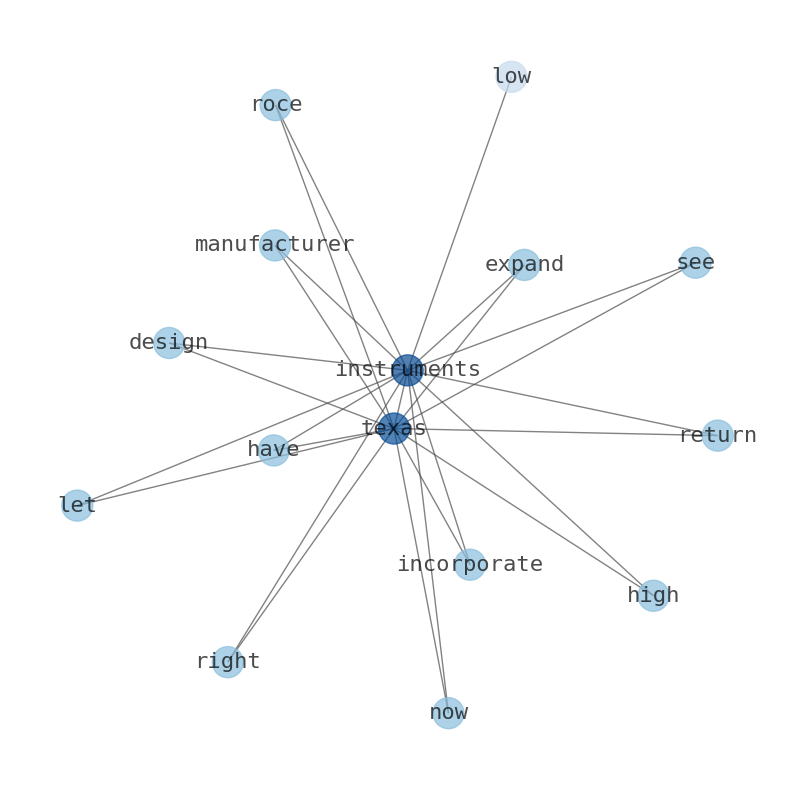

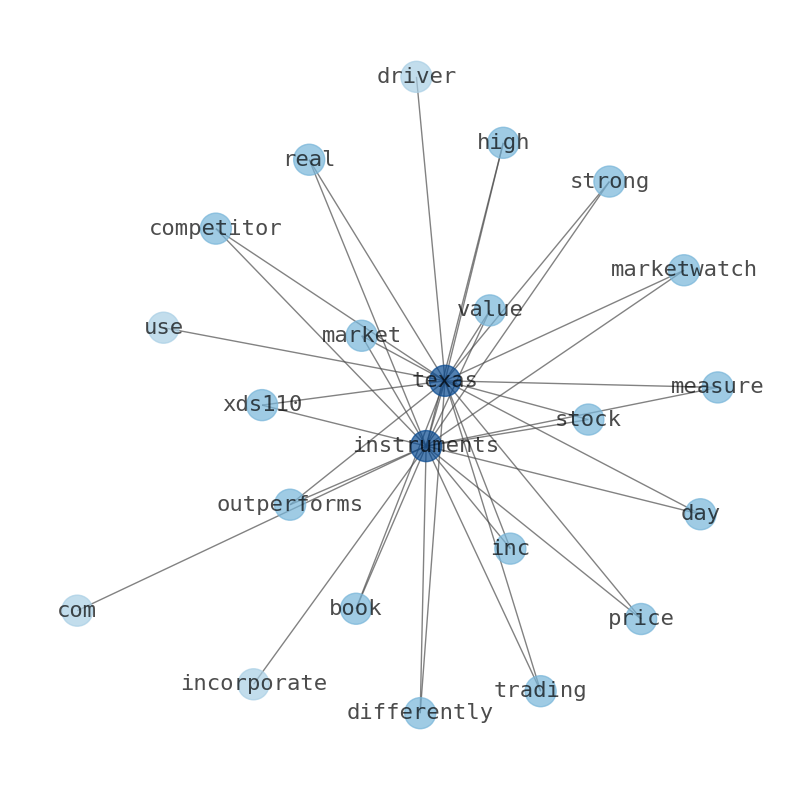

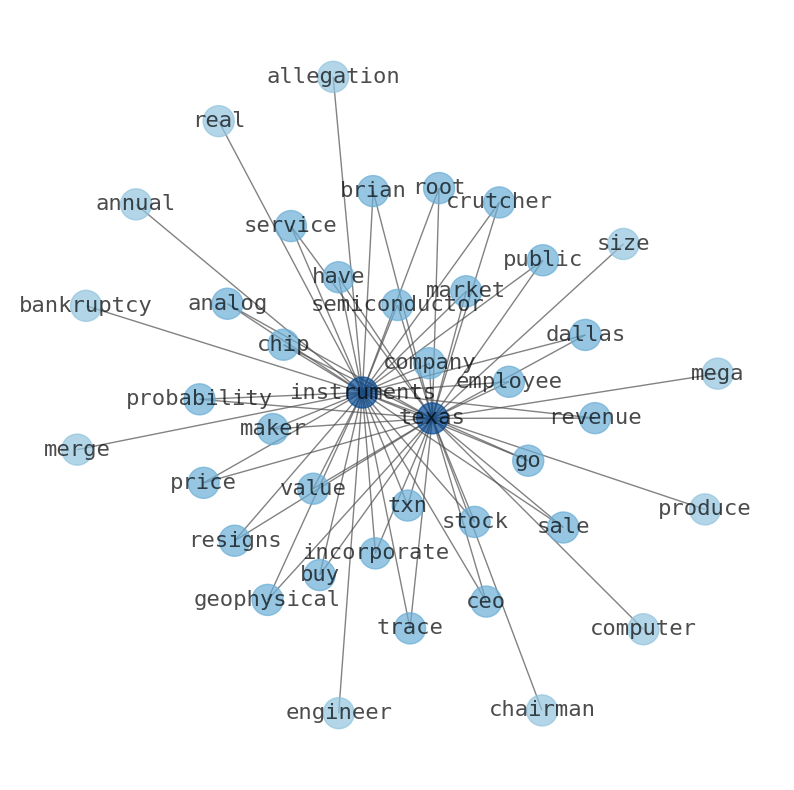

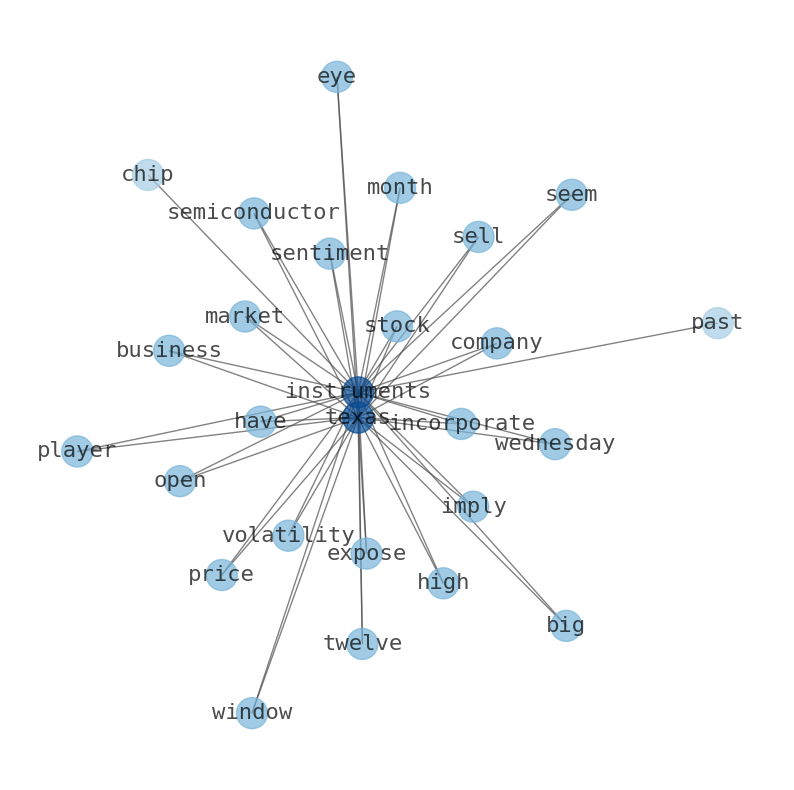

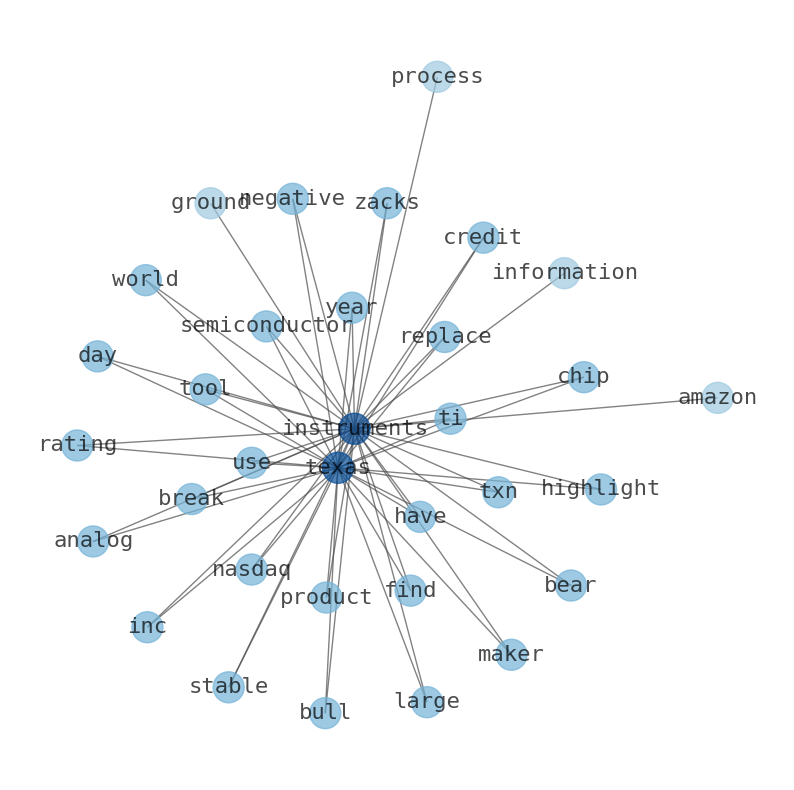

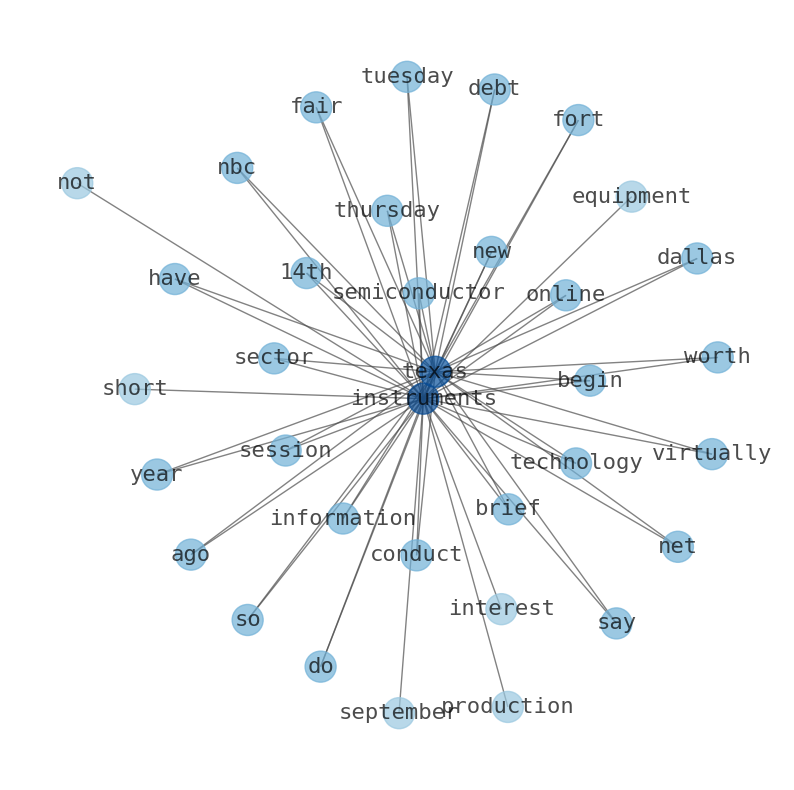

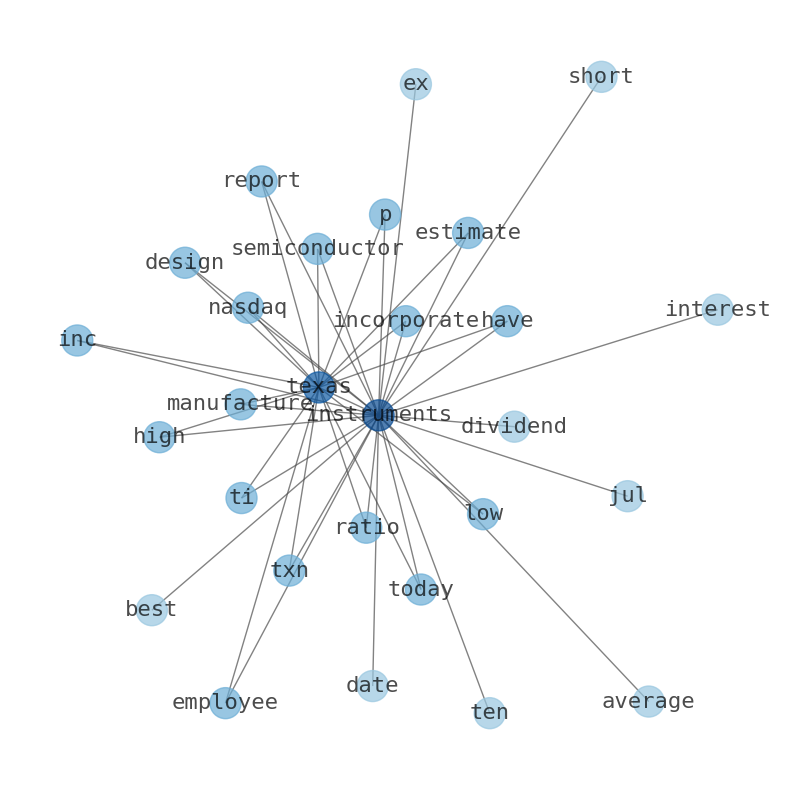

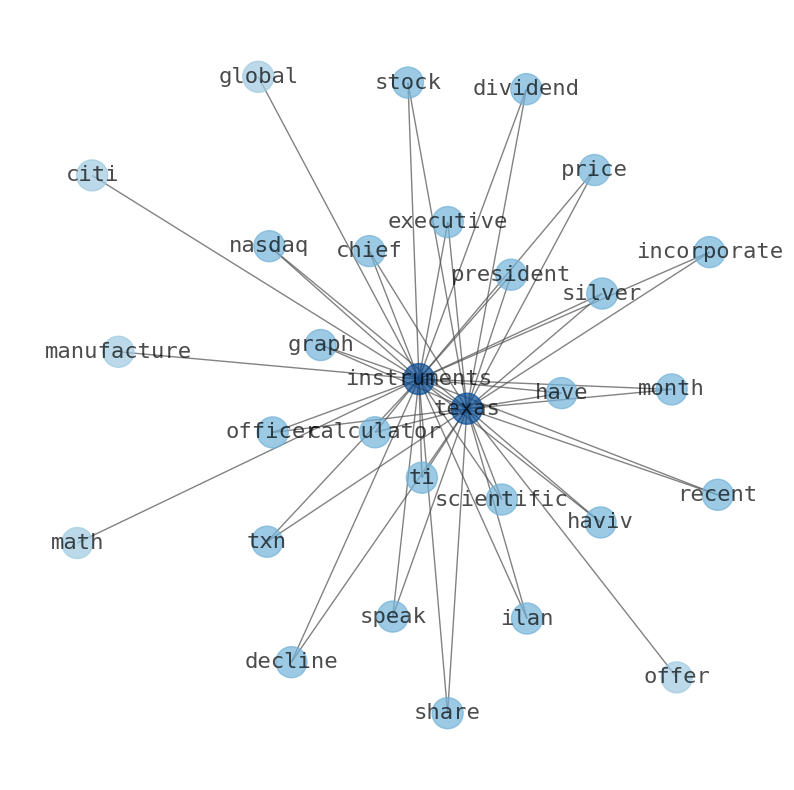

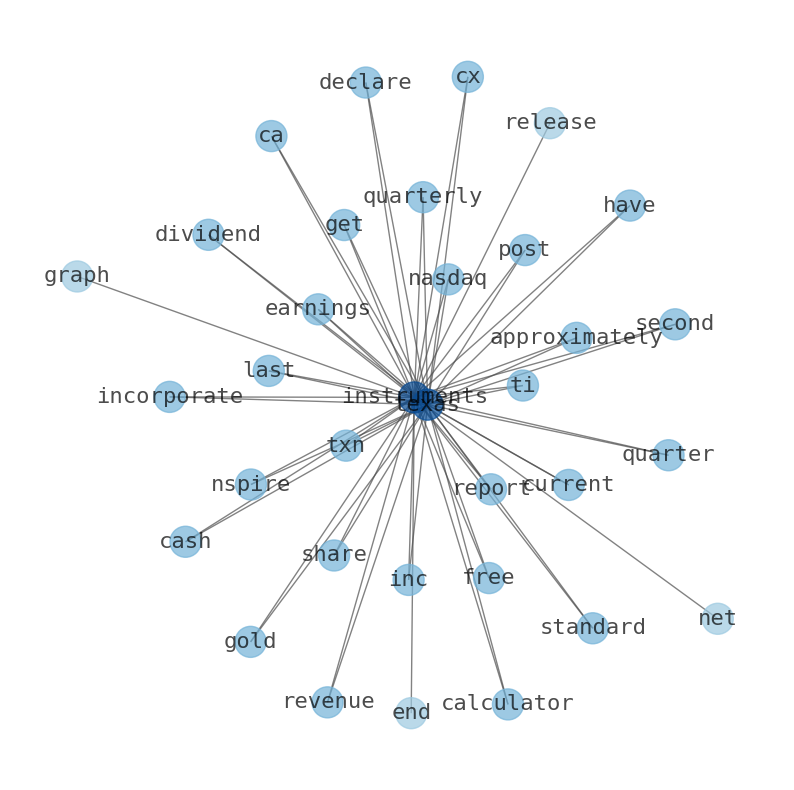

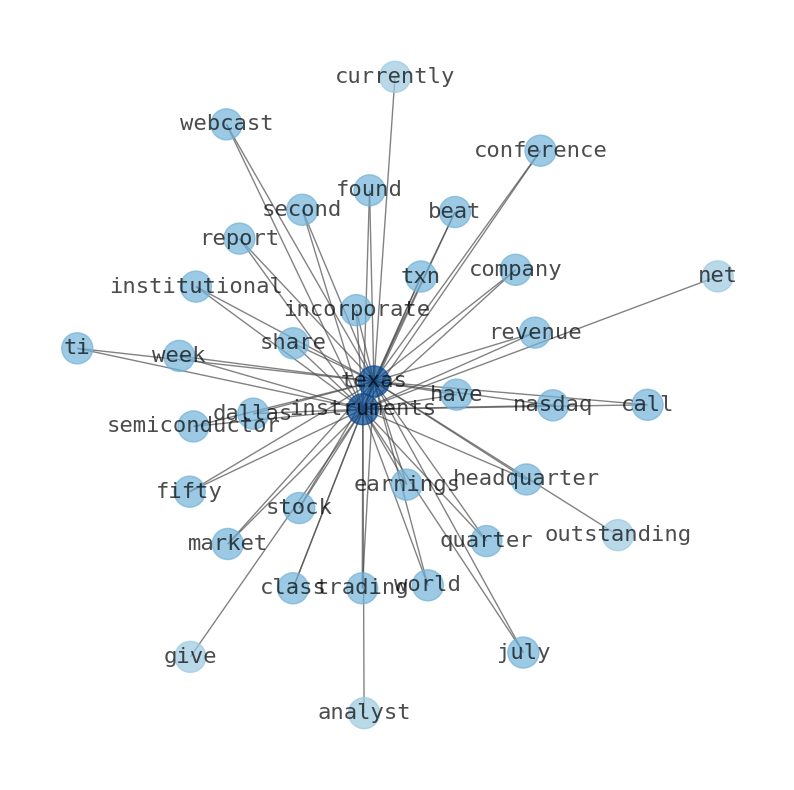

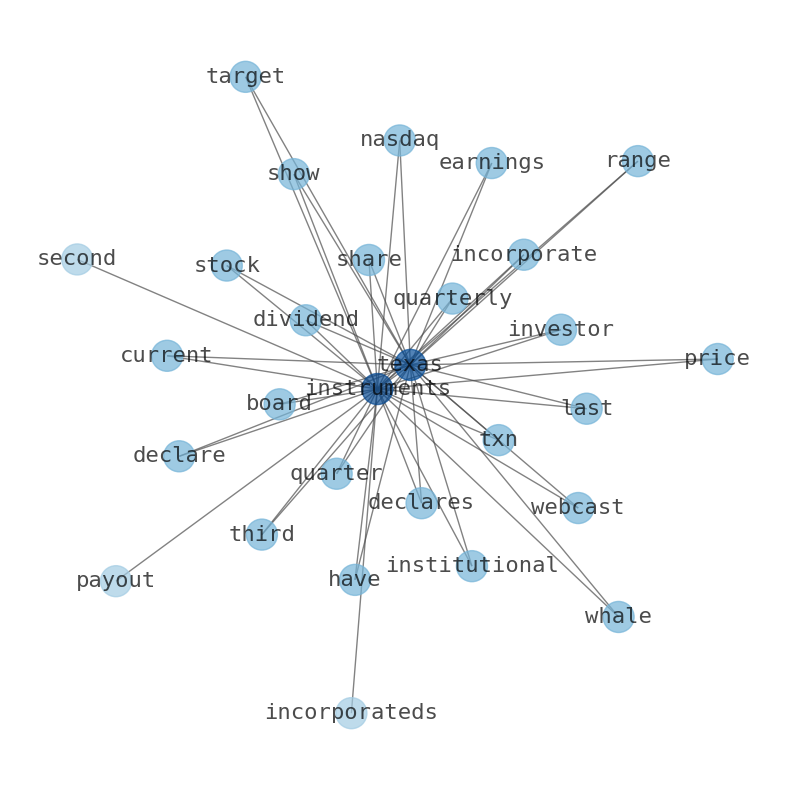

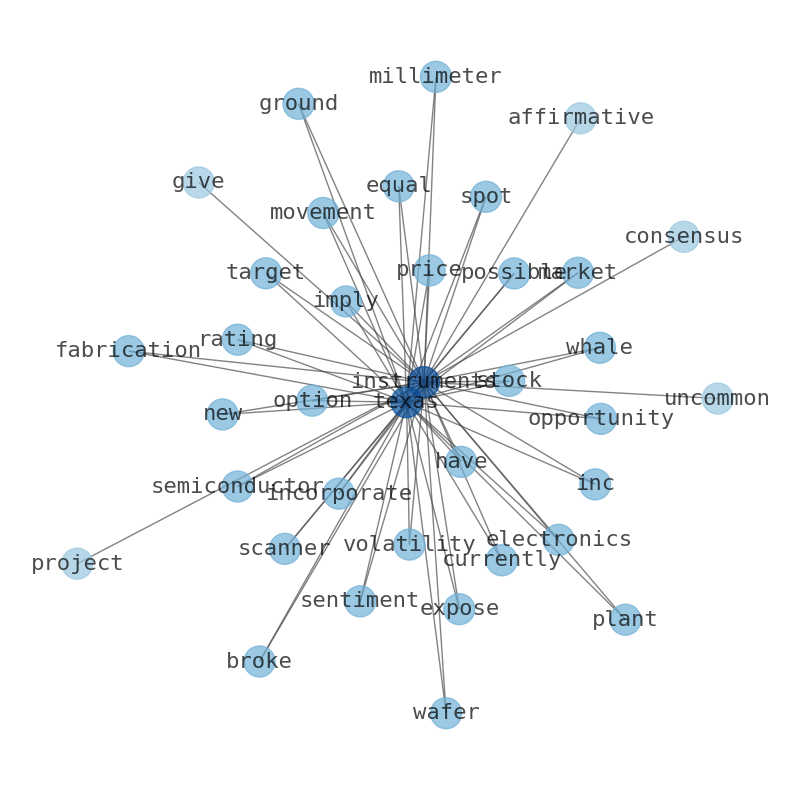

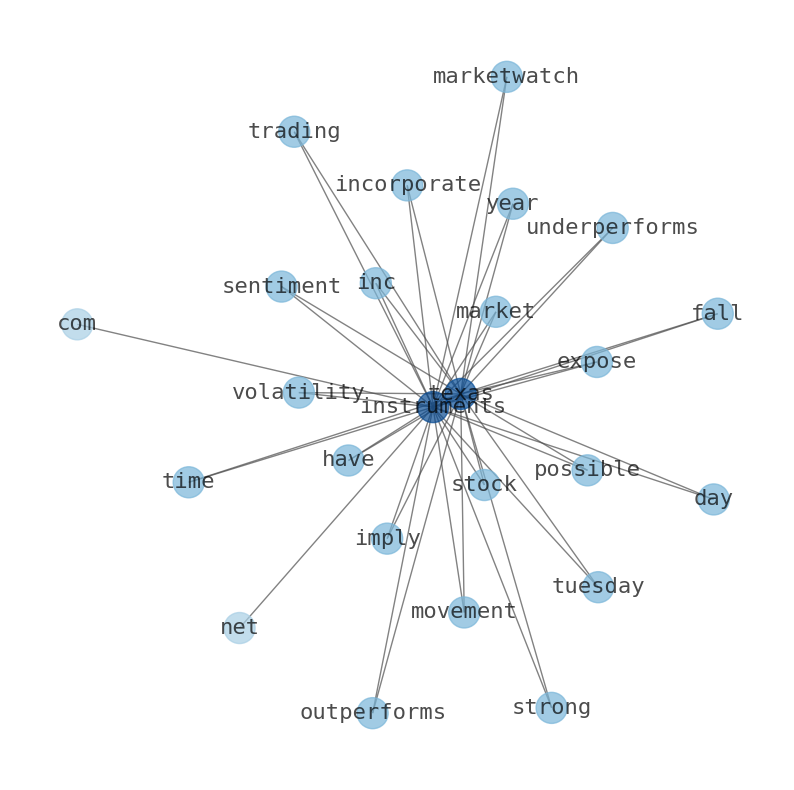

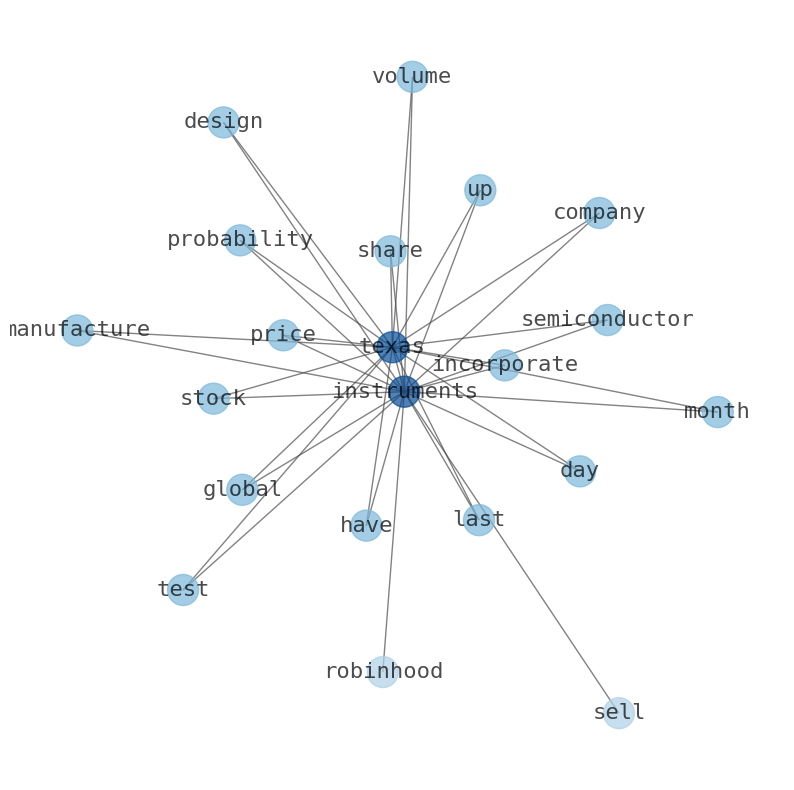

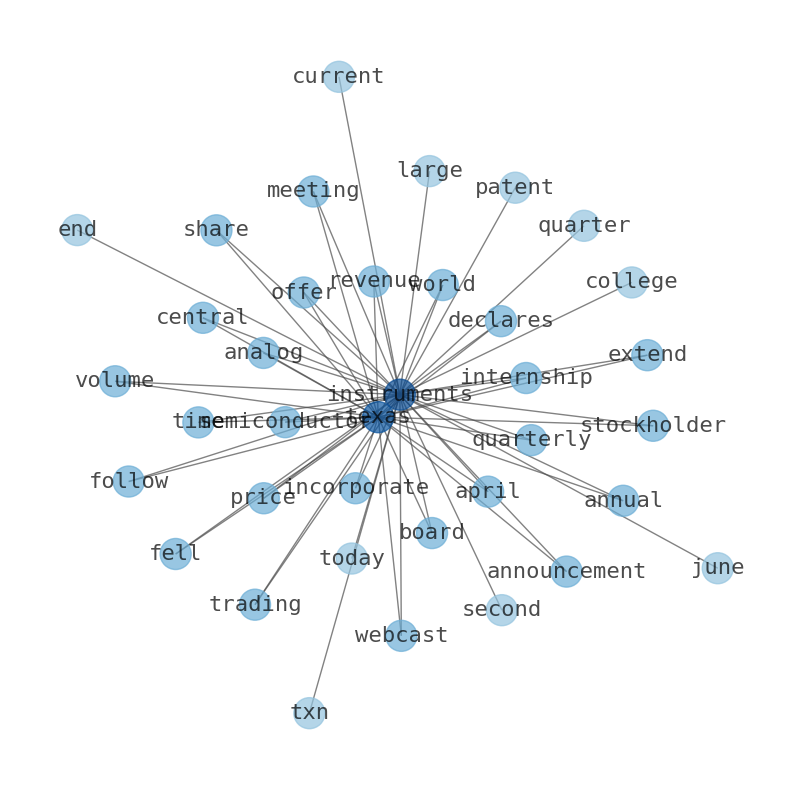

Keywords

This document will help you to evaluate Texas Instruments without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Texas Instruments are: Texas, Instruments, stock, market, Inc, price, senior, and the most common words in the summary are: texas, instrument, job, stock, market, value, share, . One of the sentences in the summary was: reported fourth quarter revenue of $4.08 billion, net income of $1.37 billion and earnings per share of $3.0 billion.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #texas #instrument #job #stock #market #value #share.

Read more →Related Results

Texas Instruments

Open: 173.89 Close: 172.68 Change: -1.21

Read more →

Texas Instruments

Open: 167.55 Close: 171.05 Change: 3.5

Read more →

Texas Instruments

Open: 165.83 Close: 164.25 Change: -1.58

Read more →

Texas Instruments

Open: 160.35 Close: 160.38 Change: 0.03

Read more →

Texas Instruments

Open: 161.28 Close: 162.4 Change: 1.12

Read more →

Texas Instruments

Open: 160.41 Close: 160.12 Change: -0.29

Read more →

Texas Instruments

Open: 171.29 Close: 170.5 Change: -0.79

Read more →

Texas Instruments

Open: 170.9 Close: 173.65 Change: 2.75

Read more →

Texas Instruments

Open: 166.66 Close: 164.87 Change: -1.79

Read more →

Texas Instruments

Open: 171.54 Close: 170.46 Change: -1.08

Read more →

Texas Instruments

Open: 172.0 Close: 171.72 Change: -0.28

Read more →

Texas Instruments

Open: 167.26 Close: 168.24 Change: 0.98

Read more →

Texas Instruments

Open: 163.67 Close: 168.78 Change: 5.11

Read more →

Texas Instruments

Open: 156.84 Close: 157.68 Change: 0.84

Read more →

Texas Instruments

Open: 153.11 Close: 155.21 Change: 2.1

Read more →

Texas Instruments

Open: 152.57 Close: 152.6 Change: 0.03

Read more →

Texas Instruments

Open: 152.3 Close: 154.62 Change: 2.32

Read more →

Texas Instruments

Open: 152.3 Close: 154.62 Change: 2.32

Read more →

Texas Instruments

Open: 145.93 Close: 143.27 Change: -2.66

Read more →

Texas Instruments

Open: 141.42 Close: 141.79 Change: 0.37

Read more →

Texas Instruments

Open: 155.32 Close: 152.75 Change: -2.57

Read more →

Texas Instruments

Open: 156.72 Close: 157.62 Change: 0.9

Read more →

Texas Instruments

Open: 163.98 Close: 162.1 Change: -1.88

Read more →

Texas Instruments

Open: 165.11 Close: 164.66 Change: -0.45

Read more →

Texas Instruments

Open: 168.82 Close: 168.06 Change: -0.76

Read more →

Texas Instruments

Open: 163.93 Close: 169.83 Change: 5.9

Read more →

Texas Instruments

Open: 169.63 Close: 167.11 Change: -2.52

Read more →

Texas Instruments

Open: 165.72 Close: 166.05 Change: 0.33

Read more →

Texas Instruments

Open: 165.79 Close: 166.2 Change: 0.41

Read more →

Texas Instruments

Open: 165.79 Close: 166.2 Change: 0.41

Read more →

Texas Instruments

Open: 174.11 Close: 173.7 Change: -0.41

Read more →

Texas Instruments

Open: 169.91 Close: 167.68 Change: -2.23

Read more →

Texas Instruments

Open: 172.5 Close: 170.48 Change: -2.02

Read more →

Texas Instruments

Open: 169.4 Close: 170.36 Change: 0.96

Read more →

Texas Instruments

Open: 170.59 Close: 170.11 Change: -0.48

Read more →

Texas Instruments

Open: 170.59 Close: 169.95 Change: -0.64

Read more →

Texas Instruments

Open: 161.39 Close: 165.26 Change: 3.87

Read more →

Texas Instruments

Open: 162.11 Close: 161.88 Change: -0.23

Read more →

Texas Instruments

Open: 168.21 Close: 166.68 Change: -1.53

Read more →

Texas Instruments

Open: 175.6 Close: 177.02 Change: 1.42

Read more →

Texas Instruments

Open: 172.28 Close: 175.27 Change: 2.99

Read more →

Texas Instruments

Open: 164.58 Close: 164.85 Change: 0.27

Read more →

Texas Instruments

Open: 162.52 Close: 164.08 Change: 1.56

Read more →

Texas Instruments

Open: 160.35 Close: 160.38 Change: 0.03

Read more →

Texas Instruments

Open: 159.31 Close: 160.21 Change: 0.9

Read more →

Texas Instruments

Open: 171.06 Close: 167.42 Change: -3.64

Read more →

Texas Instruments

Open: 174.0 Close: 174.83 Change: 0.83

Read more →

Texas Instruments

Open: 162.56 Close: 162.41 Change: -0.15

Read more →

Texas Instruments

Open: 164.9 Close: 165.1 Change: 0.2

Read more →

Texas Instruments

Open: 171.54 Close: 170.46 Change: -1.08

Read more →

Texas Instruments

Open: 168.94 Close: 170.81 Change: 1.87

Read more →

Texas Instruments

Open: 170.21 Close: 168.64 Change: -1.57

Read more →

Texas Instruments

Open: 157.29 Close: 157.03 Change: -0.26

Read more →

Texas Instruments

Open: 156.46 Close: 157.25 Change: 0.79

Read more →

Texas Instruments

Open: 154.68 Close: 152.71 Change: -1.97

Read more →

Texas Instruments

Open: 154.66 Close: 153.21 Change: -1.45

Read more →

Texas Instruments

Open: 152.3 Close: 154.62 Change: 2.32

Read more →

Texas Instruments

Open: 144.99 Close: 147.19 Change: 2.2

Read more →

Texas Instruments

Open: 140.87 Close: 140.5 Change: -0.37

Read more →

Texas Instruments

Open: 152.82 Close: 154.26 Change: 1.44

Read more →

Texas Instruments

Open: 155.32 Close: 152.75 Change: -2.57

Read more →

Texas Instruments

Open: 160.84 Close: 159.01 Change: -1.83

Read more →

Texas Instruments

Open: 166.21 Close: 162.62 Change: -3.59

Read more →

Texas Instruments

Open: 168.82 Close: 168.06 Change: -0.76

Read more →

Texas Instruments

Open: 166.49 Close: 167.81 Change: 1.32

Read more →

Texas Instruments

Open: 169.63 Close: 167.11 Change: -2.52

Read more →

Texas Instruments

Open: 169.63 Close: 167.11 Change: -2.52

Read more →

Texas Instruments

Open: 166.2 Close: 170.48 Change: 4.28

Read more →

Texas Instruments

Open: 165.79 Close: 166.2 Change: 0.41

Read more →

Texas Instruments

Open: 182.0 Close: 184.32 Change: 2.32

Read more →

Texas Instruments

Open: 169.91 Close: 167.68 Change: -2.23

Read more →

Texas Instruments

Open: 170.0 Close: 171.58 Change: 1.58

Read more →

Texas Instruments

Open: 172.5 Close: 170.48 Change: -2.02

Read more →

Texas Instruments

Open: 169.77 Close: 170.86 Change: 1.09

Read more →

Texas Instruments

Open: 170.59 Close: 170.11 Change: -0.48

Read more →

Texas Instruments

Open: 166.32 Close: 169.81 Change: 3.49

Read more →

Texas Instruments

Open: 162.11 Close: 161.88 Change: -0.23

Read more →

Texas Instruments

Open: 162.11 Close: 160.87 Change: -1.24

Read more →

Texas Instruments

Open: 168.21 Close: 166.68 Change: -1.53

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo