The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Sysco

Youtube Subscribe

Open: 80.98 Close: 80.84 Change: -0.14

The top 16 things about Sysco Stock found by an AI.

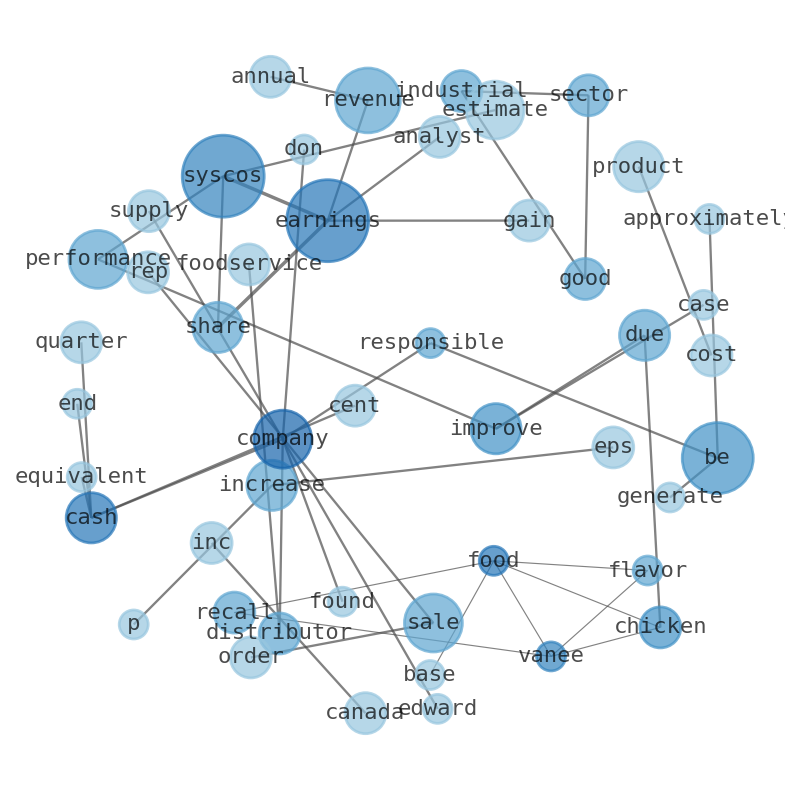

The game is changing. There is a new strategy to evaluate Sysco fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Sysco are: Sysco, Syscos, earnings, revenue, sale, performance, due, and the …

Stock Summary

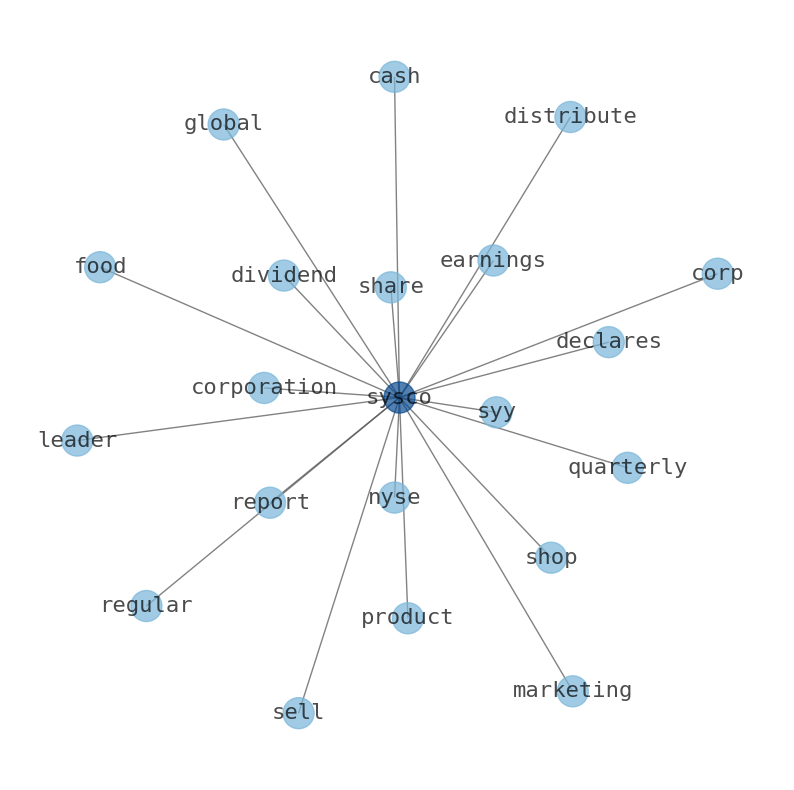

Sysco Corporation engages in the marketing and distribution of various food and related products. It operates through U.S. Foodservice Operations, International Foodservice operations, SYGMA, and Other segments. The company distributes frozen food.

Today's Summary

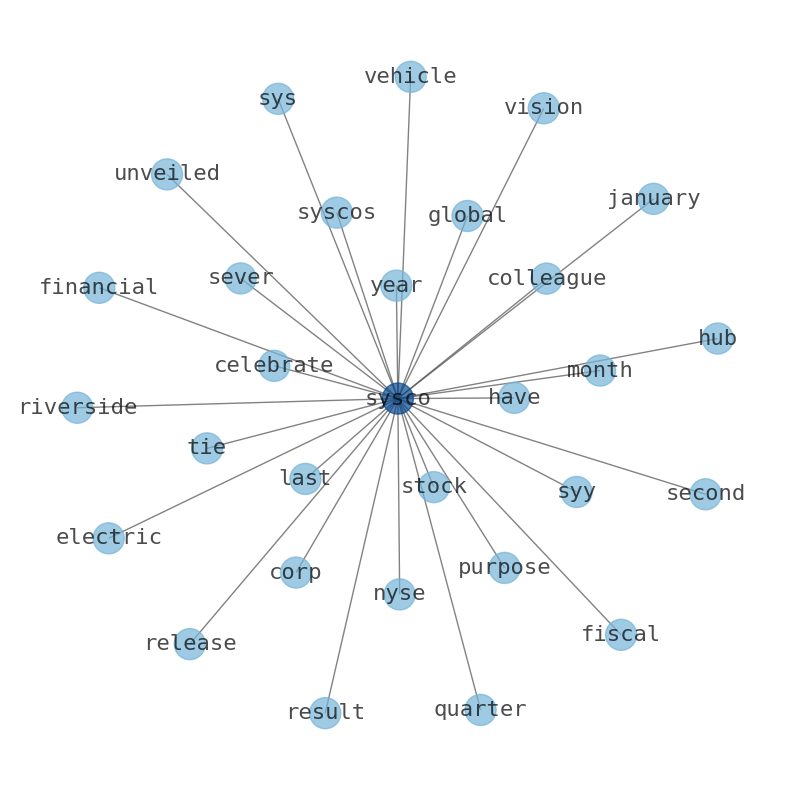

Sysco Corp ( NYSE: SYY ) was trading lower in Tuesdays premarket after the foodservice distributor reported a $30M miss on fiscal Q2 revenue that overshadowed a penny beat on adjusted profit. Analysts predict Syscos earnings per share (EPS) will increase from $4.30 to $4.69 in the next year.

Today's News

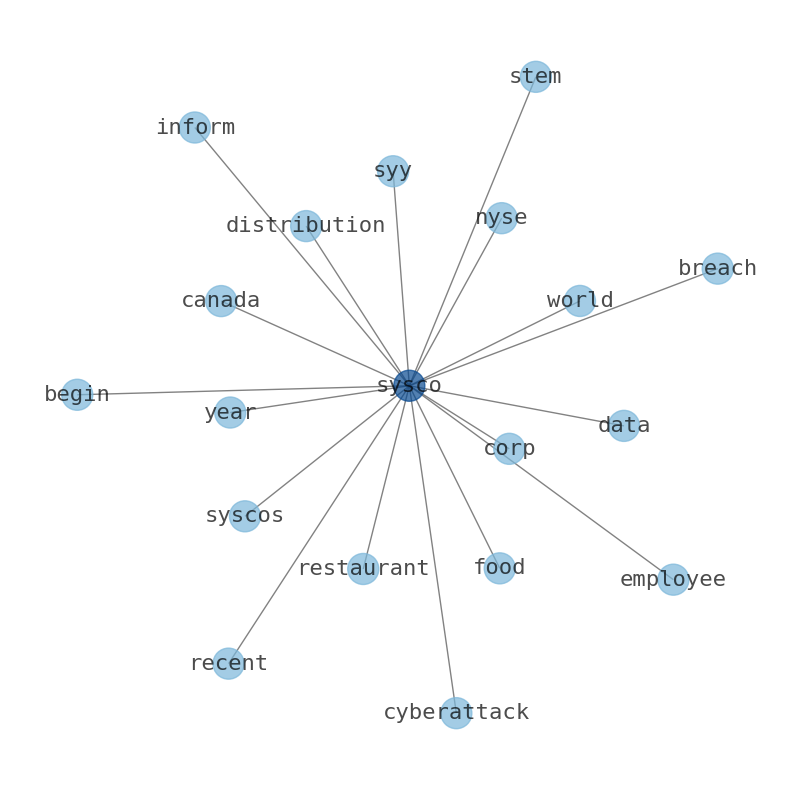

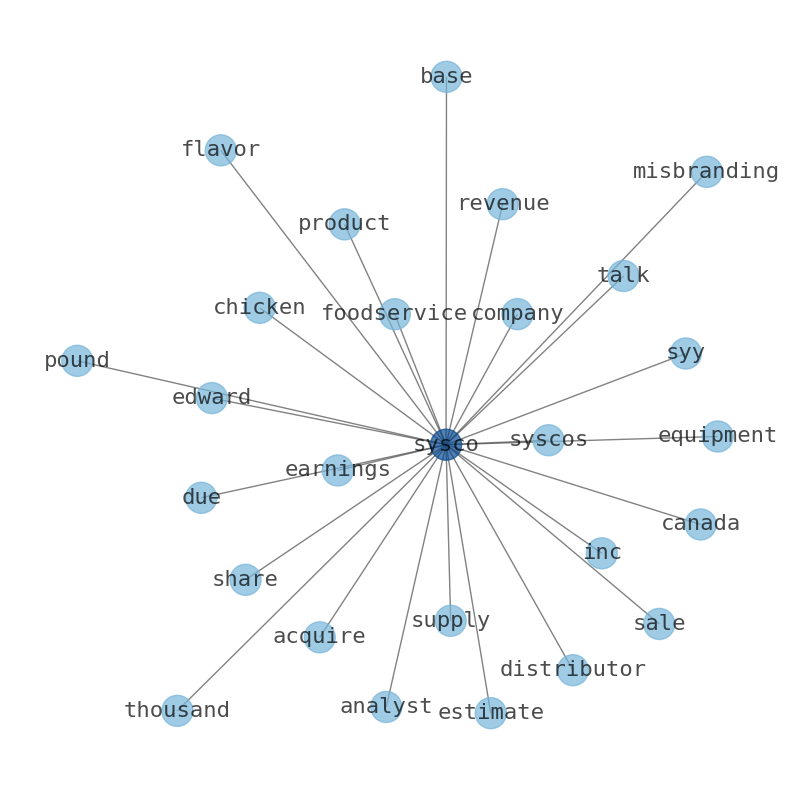

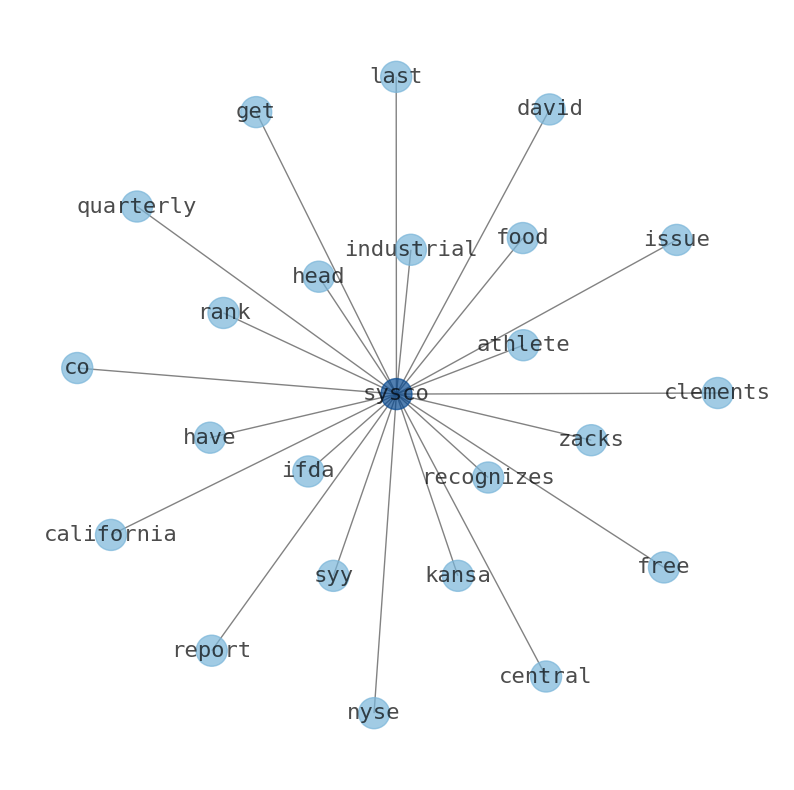

Vanee Foods recalls Sysco chicken-flavored base products due to misbranding. Thousands of pounds of chicken were recalled due to. misbrandating and undeclared allergens. Sysco Corp ( NYSE: SYY ) was trading lower in Tuesdays premarket after the foodservice distributor reported a $30M miss on fiscal Q2 revenue that overshadowed a penny beat on adjusted profit. Sysco expects full-year earnings in the range of $4.20 to $4.40 per share. Analysts have been eager to weigh in on the Industrial Goods sector with new ratings on the industrial goods sector. Order today on Sysco Shop, talk to your sales rep or contact our Wholesale Pick-up Department for Cash & Carry service. Send your fresh fish order to your BFS sales rep for weekly delivery. Sysco anticipates a 7% adjusted EPS growth in 2024 due to improving performance. Syscos recorded improved case volume performance. Sysco Canada Inc. 28,309 followers 2mo Strategic Success for Restaurants in 2024. Syscos Canada Inc.: Sustainability Report: #OnePlanetOneTable #SustainabilityAtSysco. Sysco estimated and actual revenue data provide valuable insights into the companys revenue trends and performance. By staying informed about Syscos earnings date, you can gain a deeper understanding. Sysco reports its earnings on a quarterly basis. Analysts predict Syscos earnings per share (EPS) will increase from $4.30 to $4.69 in the next year, representing a 9.07% increase. The P/E ratio suggests investor confidence in its future earnings growth prospects. Sysco does not charge a fee at any stage of the recruitment process. Syscos key financial metrics include annual revenue of $77.5 billion, net income of $1.77 billion, and a trailing price-to-earnings ratio of 19.92. Sysco President and CEO Kevin Hourican talked with Jim Cramer on Mad Money yesterday to discuss how improving sales effectiveness and supply chain productivity drove Syscos strong performance in Q2. Sysco sales for the second quarter increased 3.7% to $19.3 billion. Product cost inflation was 1.1% at the total enterprise level, as measured by the estimated change in Syscos product costs, primarily in the meat and frozen categories. During the first 26 weeks of fiscal year 2024, SysCo returned $705.5 million to shareholders. Sysco to Acquire Foodservice Equipment And Supply Distributor Edward Don & Company. The company, which was founded in 1921, is responsible for generating approximately $1.3 billion in annual revenue. Sysco (Syy) q2 earnings top estimates, volume gains a driver. Syscos adjusted earnings of 89 cents per share surpassed the Zacks Consensus Estimate of 88 cents. The company ended the quarter with cash and cash equivalents of $962 million.

Stock Profile

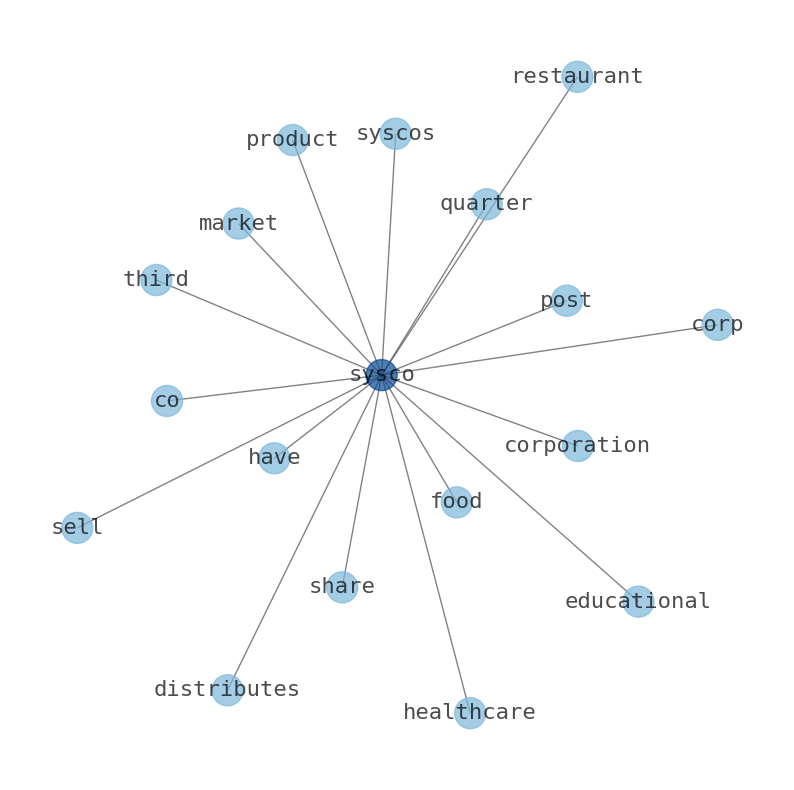

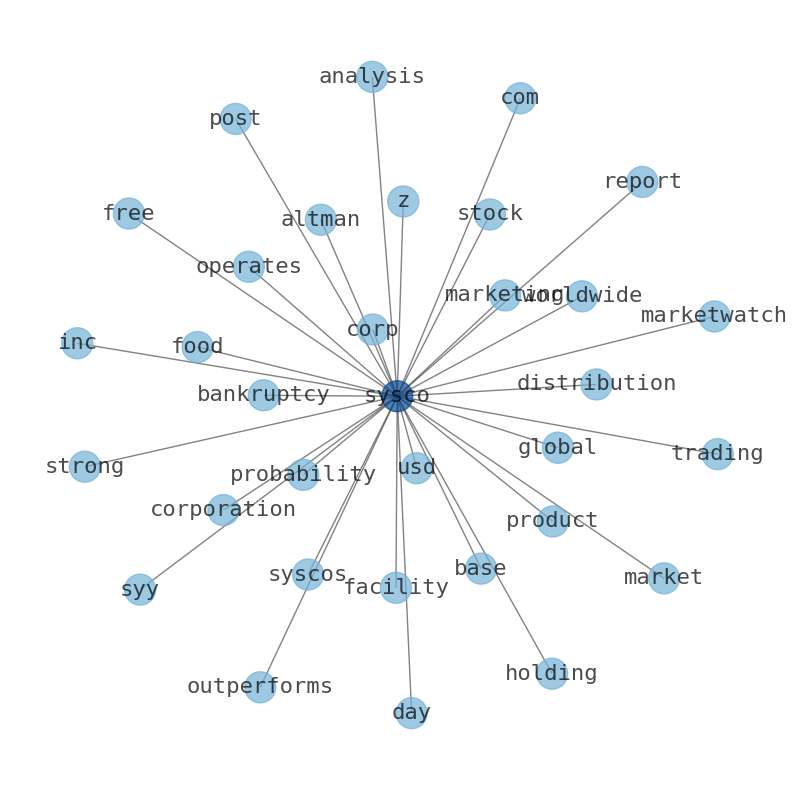

"Sysco Corporation, through its subsidiaries, engages in the marketing and distribution of various food and related products primarily to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally. It operates through U.S. Foodservice Operations, International Foodservice Operations, SYGMA, and Other segments. The company distributes frozen food, such as meat, seafood, fully prepared entrées, fruits, vegetables, and desserts; canned and dry food products; fresh meat and seafood products; dairy products; beverages; imported specialties; and fresh produce products. It also supplies various non-food items, including paper products comprising disposable napkins, plates, and cups; tableware consisting of China and silverware; cookware, which include pots, pans, and utensils; restaurant and kitchen equipment and supplies; and cleaning supplies. The company serves restaurants, hospitals and nursing homes, schools and colleges, hotels and motels, industrial caterers, and other foodservice venues. As of July 2, 2022, it operated 333 distribution facilities. Sysco Corporation was incorporated in 1969 and is headquartered in Houston, Texas."

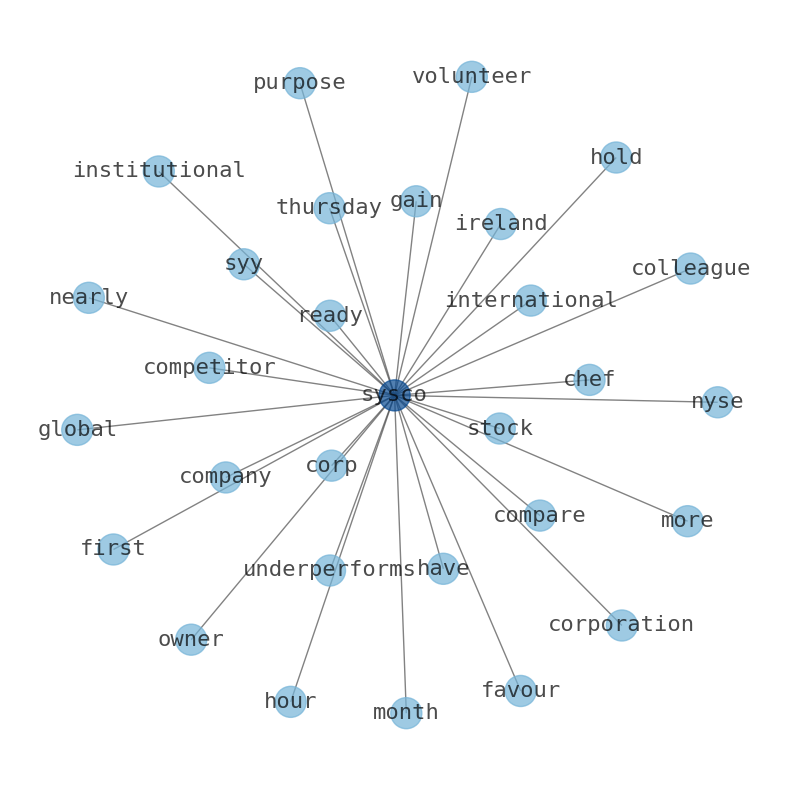

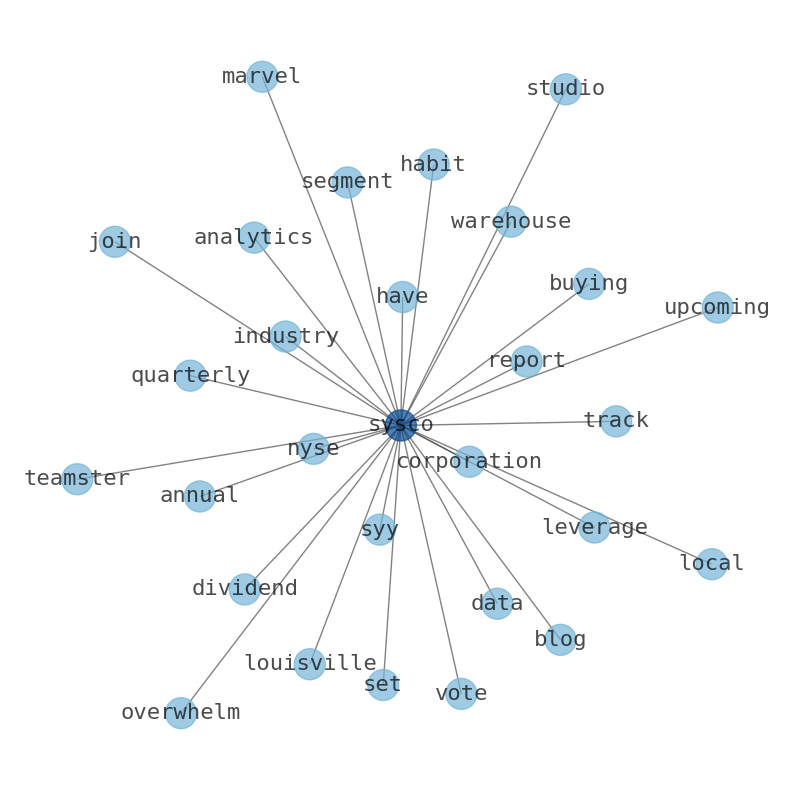

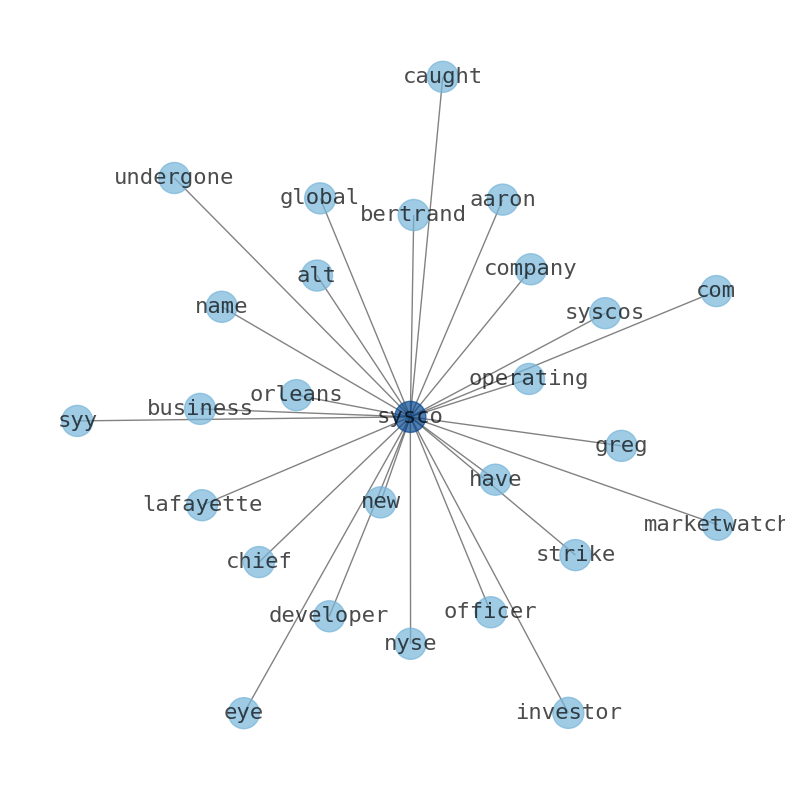

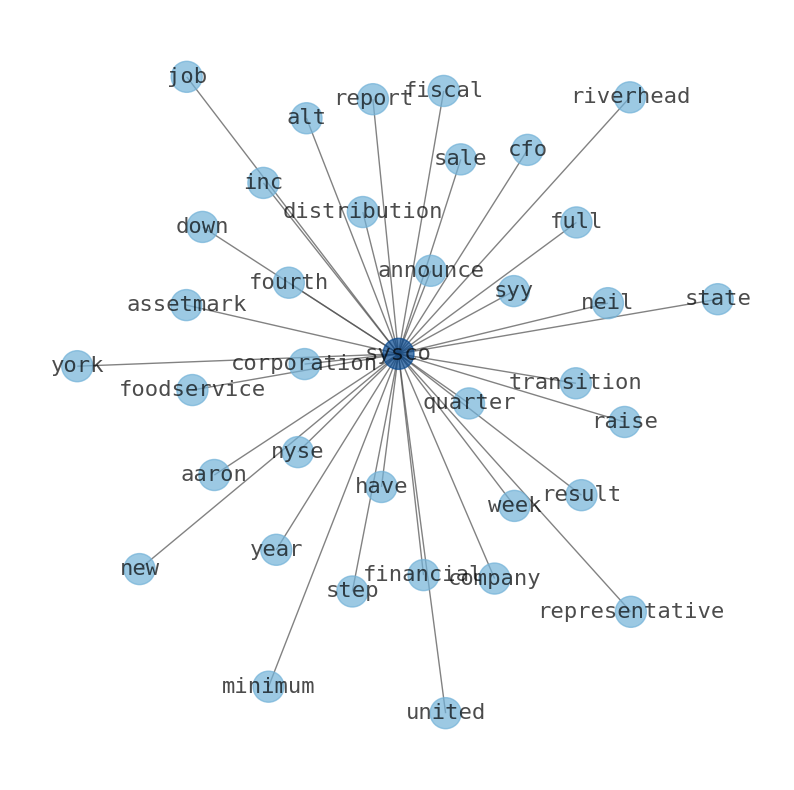

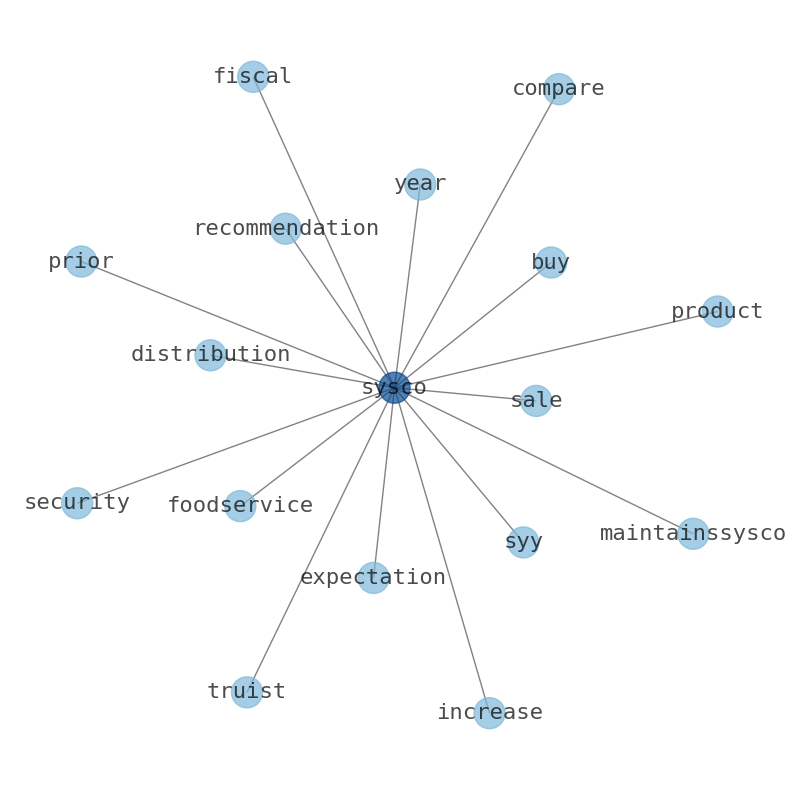

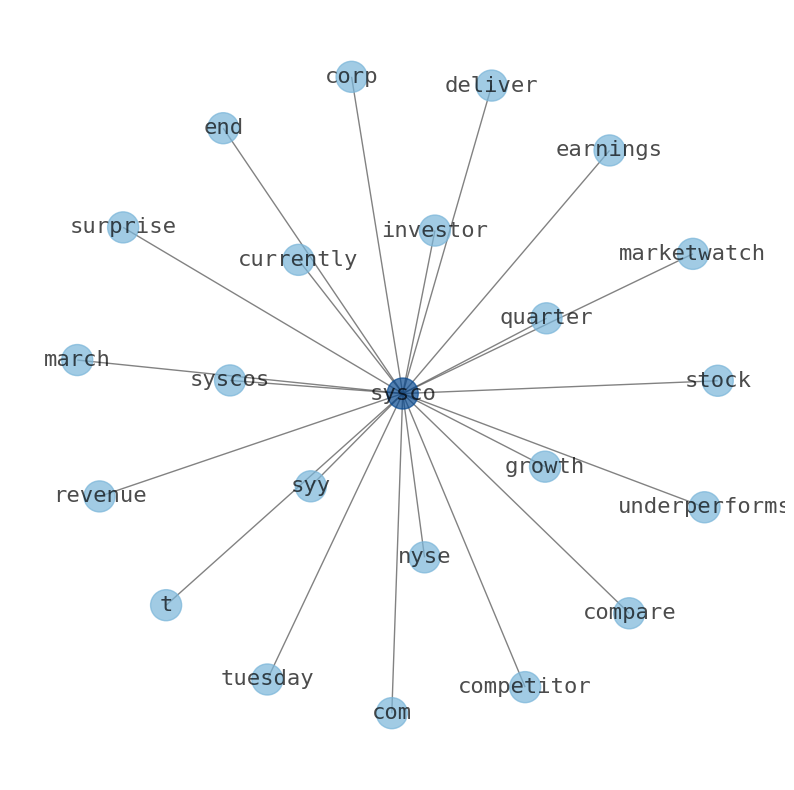

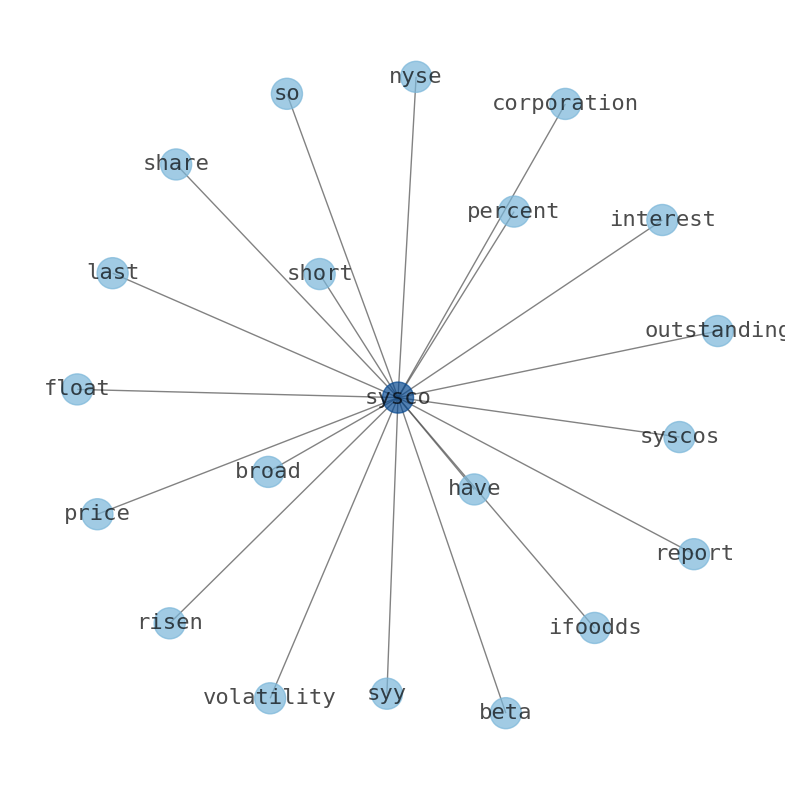

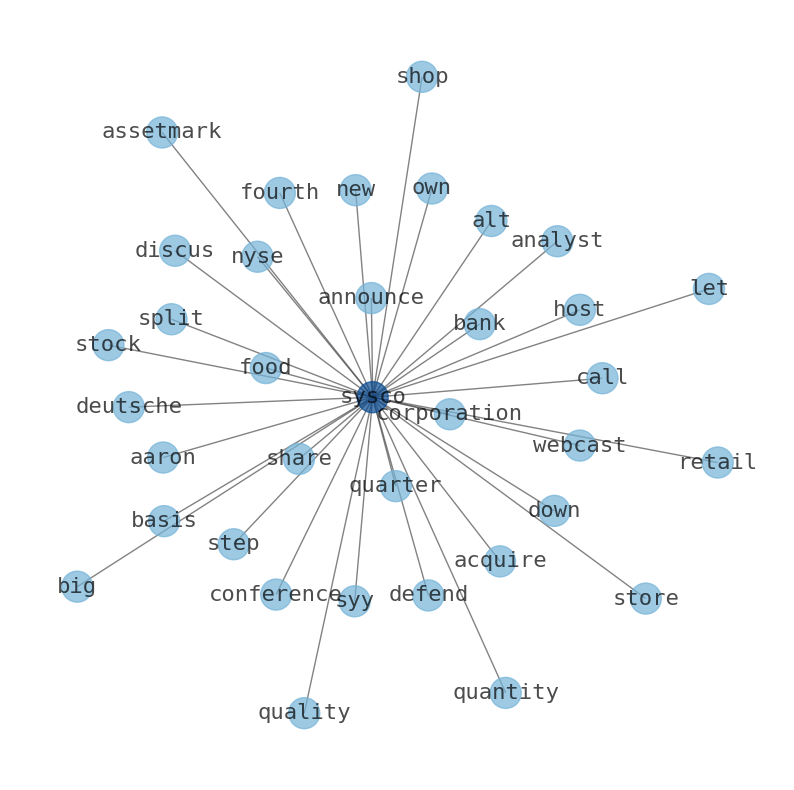

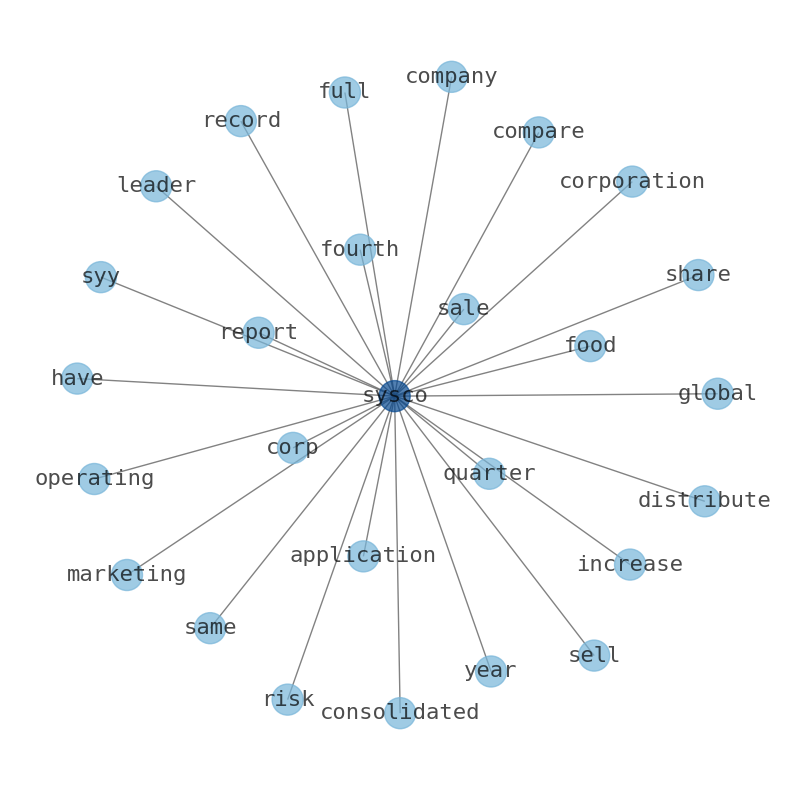

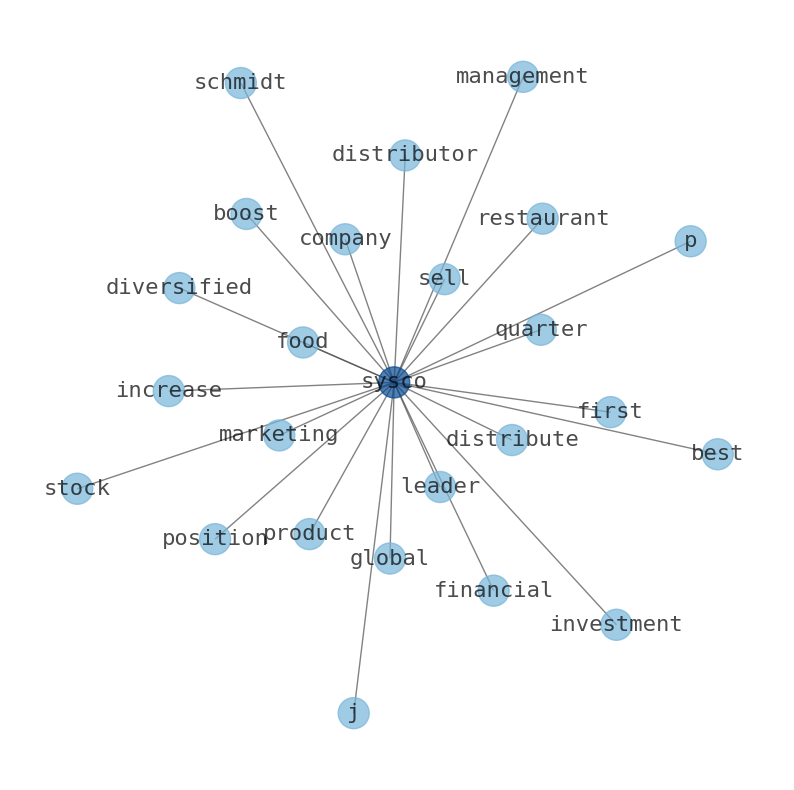

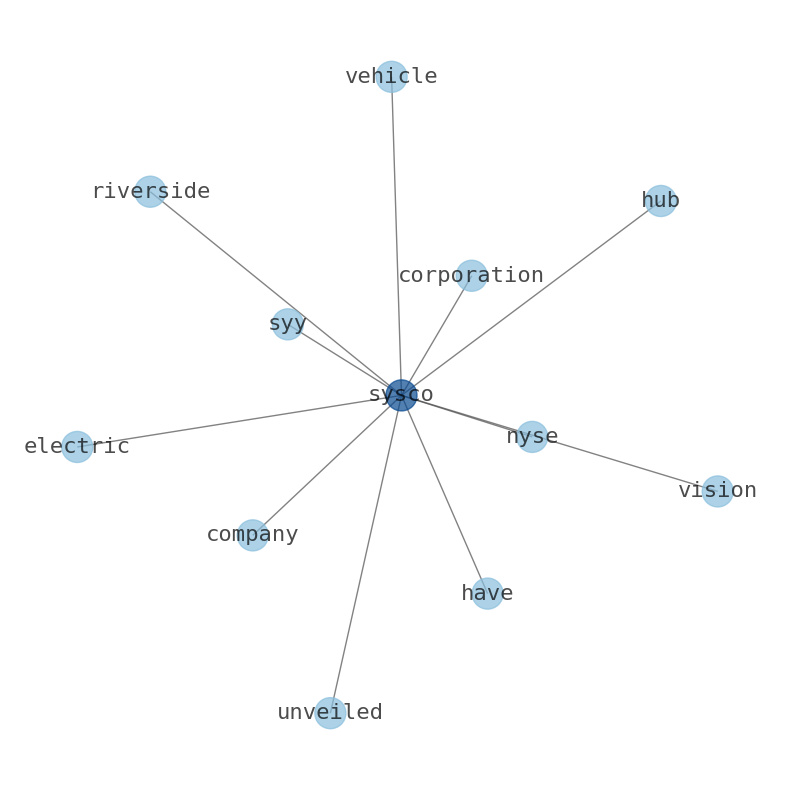

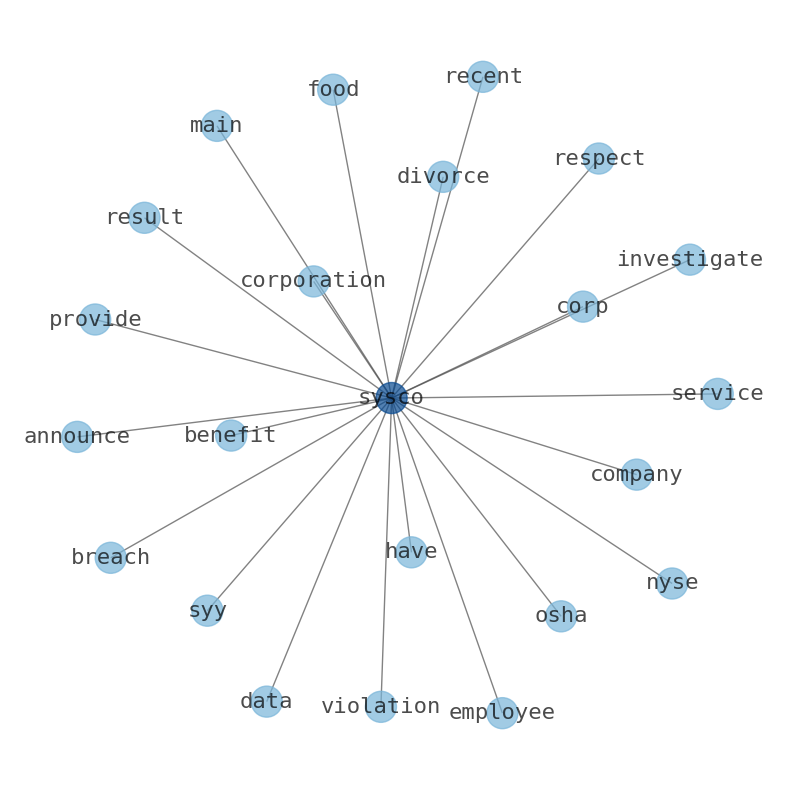

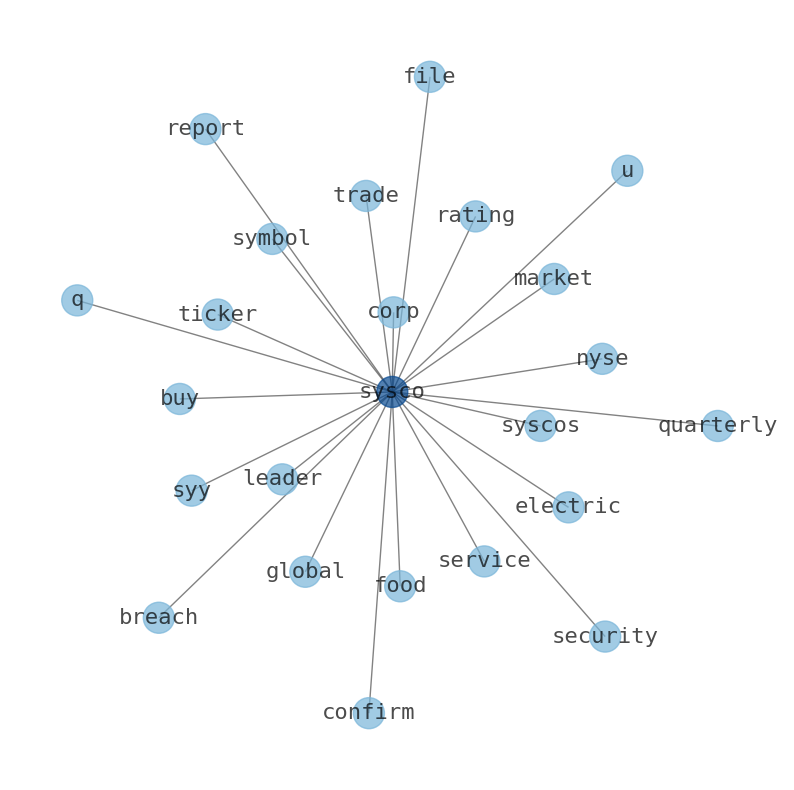

Keywords

This document will help you to evaluate Sysco without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Sysco are: Sysco, Syscos, earnings, revenue, sale, performance, due, and the most common words in the summary are: sysco, earnings, job, syscos, share, report, sale, . One of the sentences in the summary was: Sysco Corp ( NYSE: SYY ) was trading lower in Tuesdays premarket after the foodservice distributor reported a $30M miss on fiscal Q2 revenue that overshadowed a penny beat on adjusted profit. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #sysco #earnings #job #syscos #share #report #sale.

Read more →Related Results

Sysco

Open: 80.62 Close: 80.82 Change: 0.2

Read more →

Sysco

Open: 75.41 Close: 75.03 Change: -0.38

Read more →

Sysco

Open: 74.08 Close: 73.83 Change: -0.25

Read more →

Sysco

Open: 67.01 Close: 66.05 Change: -0.96

Read more →

Sysco

Open: 70.14 Close: 69.7 Change: -0.44

Read more →

Sysco

Open: 72.0 Close: 70.95 Change: -1.05

Read more →

Sysco

Open: 75.09 Close: 74.22 Change: -0.87

Read more →

Sysco

Open: 72.49 Close: 72.57 Change: 0.08

Read more →

Sysco

Open: 71.85 Close: 72.64 Change: 0.79

Read more →

Sysco

Open: 74.14 Close: 73.42 Change: -0.72

Read more →

Sysco

Open: 80.98 Close: 80.84 Change: -0.14

Read more →

Sysco

Open: 73.54 Close: 73.53 Change: -0.01

Read more →

Sysco

Open: 72.17 Close: 72.15 Change: -0.02

Read more →

Sysco

Open: 70.24 Close: 71.07 Change: 0.83

Read more →

Sysco

Open: 70.54 Close: 71.21 Change: 0.67

Read more →

Sysco

Open: 74.31 Close: 73.79 Change: -0.52

Read more →

Sysco

Open: 75.67 Close: 75.2 Change: -0.47

Read more →

Sysco

Open: 73.33 Close: 73.39 Change: 0.06

Read more →

Sysco

Open: 70.51 Close: 70.72 Change: 0.21

Read more →

Sysco

Open: 74.52 Close: 74.45 Change: -0.07

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo