The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Southern Copper

Youtube Subscribe

Open: 70.99 Close: 70.78 Change: -0.21

You're running out of time to find out about Southern Copper Company Inc using an AI.

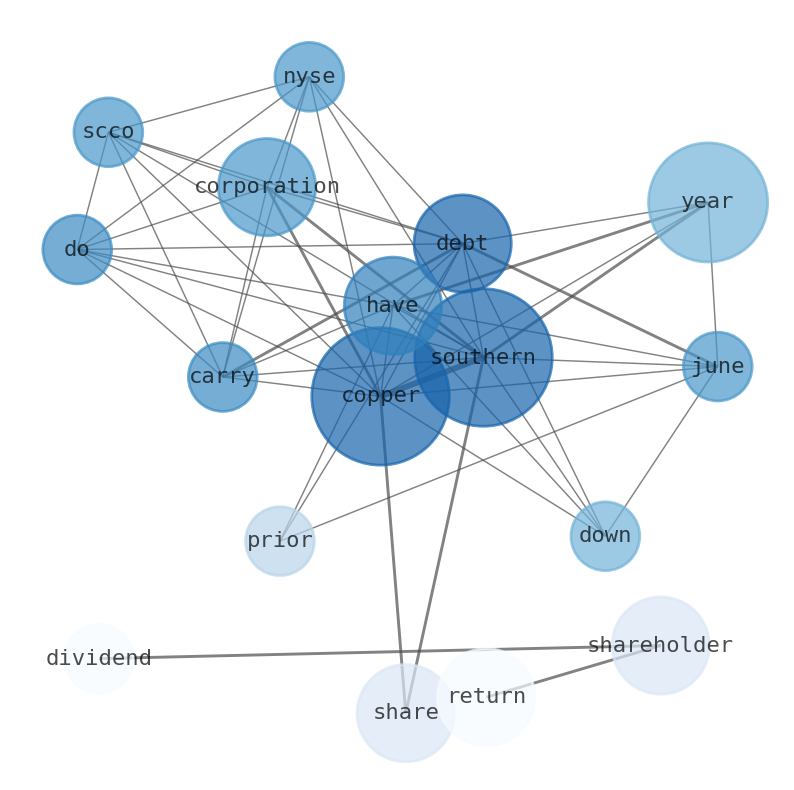

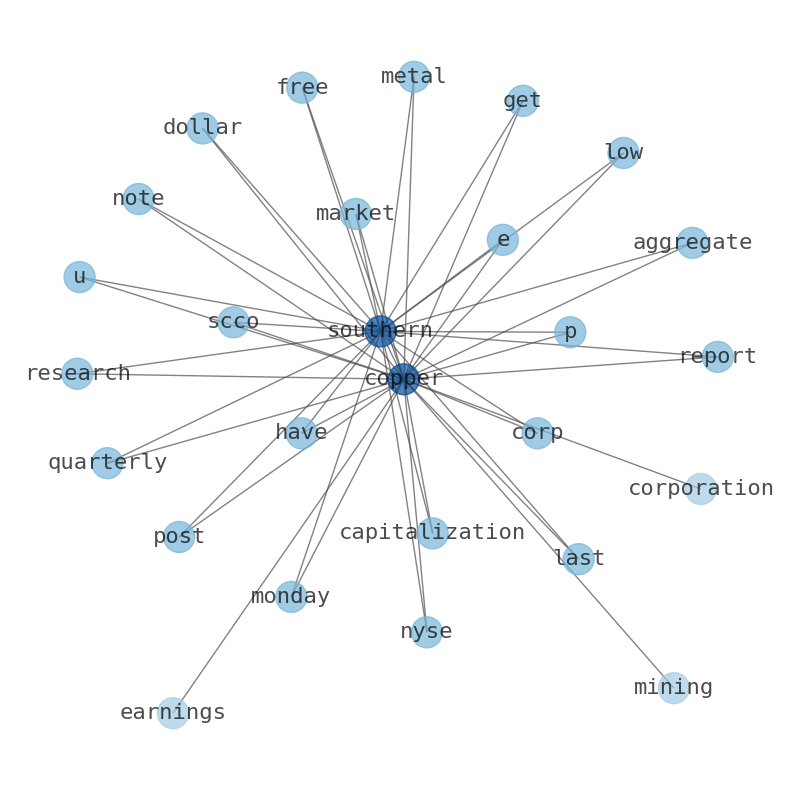

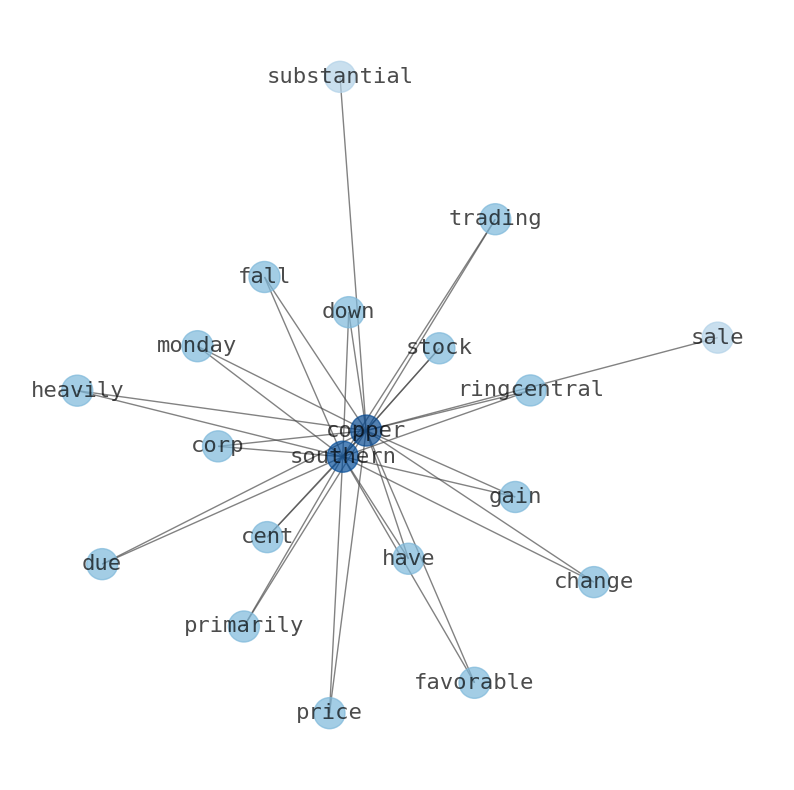

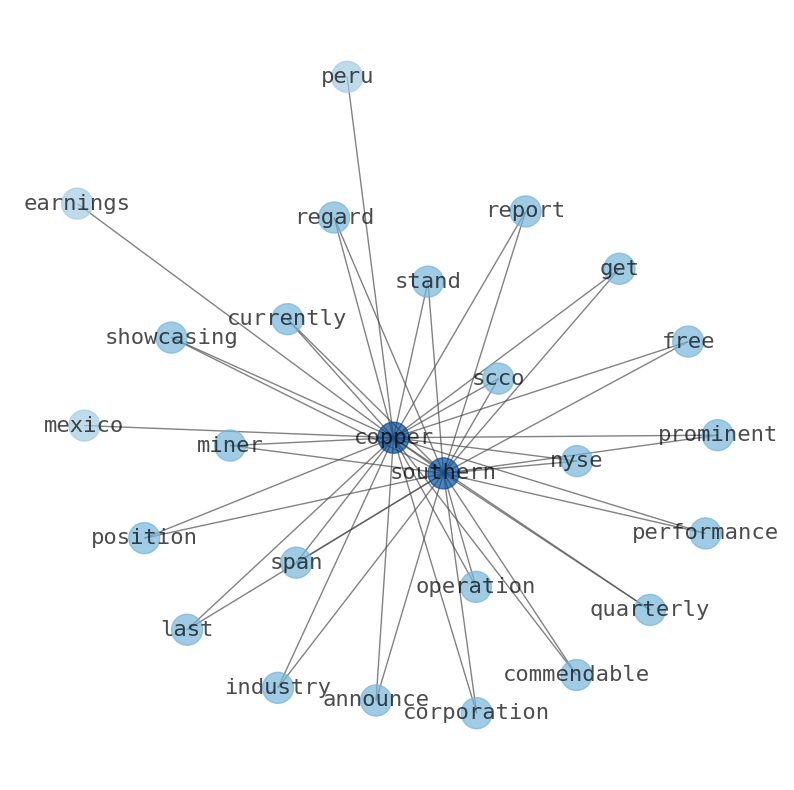

This document will help you to evaluate Southern Copper without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Southern Copper are: Southern, Copper, year, Corporation, debt, share, return, …

Stock Summary

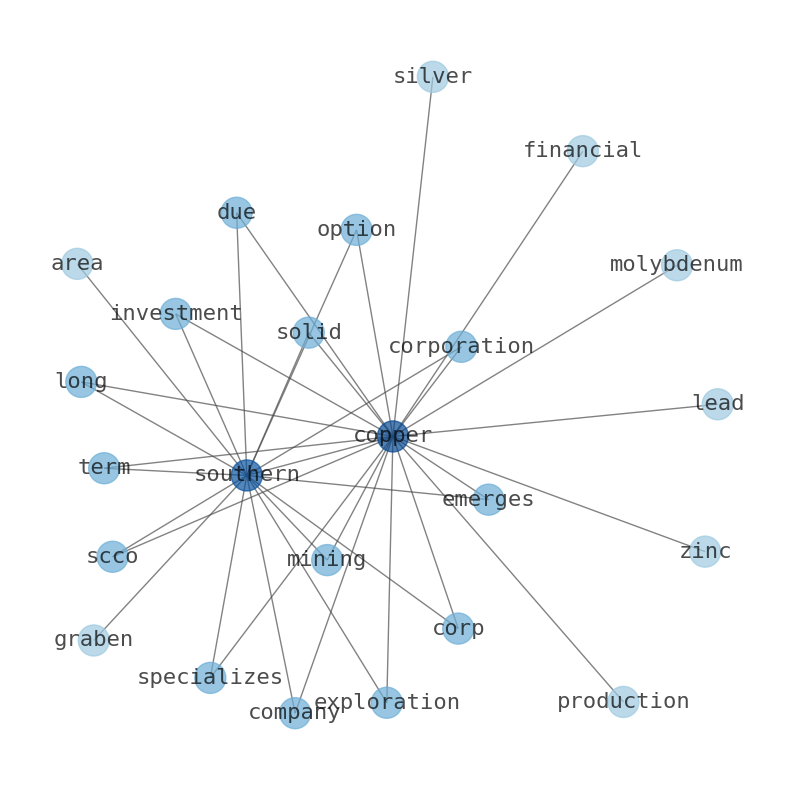

Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals. It operates mines in Peru, Mexico, Argentina, Ecuador, and Chile. Southern Copper has interests in 493,117 hectares of exploration.

Today's Summary

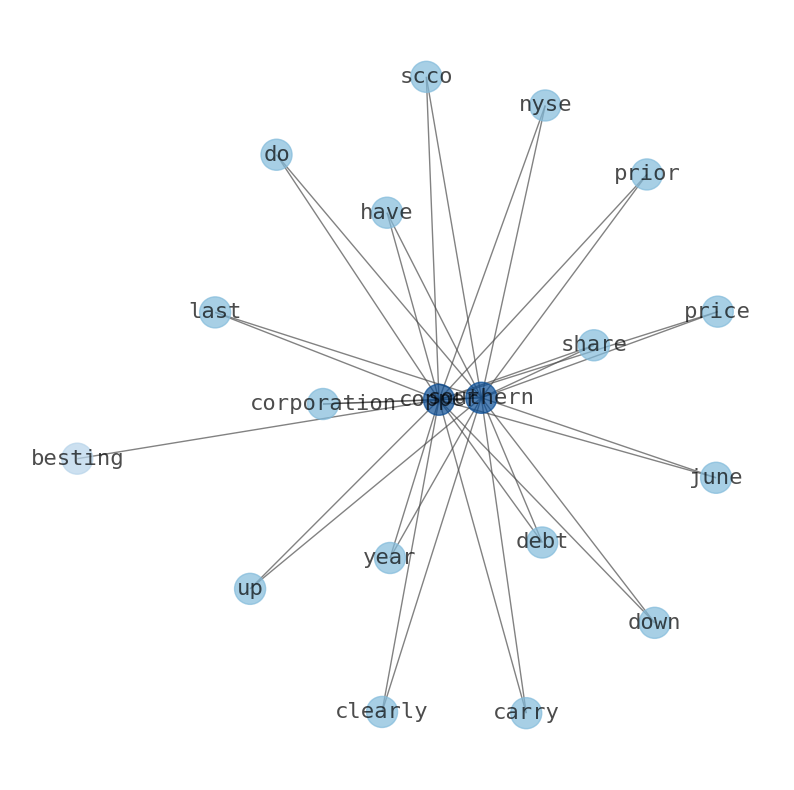

Southern Copper Corporation ( NYSE:SCCO ) does carry debt. Southern Copper had US$6.25b of debt at June 2023, down from US $6.55b a year prior. Southern Copper Corporation share price is up 88% in the last 5 years, clearly besting the market return of around 50% (ignoring dividends) Shareholders have received a total shareholder return of 61% over one year. Over half a decade, Southern Copper managed to grow its earnings per share.

Today's News

Southern Copper Corporation ( NYSE:SCCO ) does carry debt. Southern Copper had US$6.25b of debt at June 2023, down from US $6.55b a year prior. Southern Copper Corporation share price is up 88% in the last 5 years, clearly besting the market return of around 50% (ignoring dividends) Shareholders have received a total shareholder return of 61% over one year. Over half a decade, Southern Copper managed to grow its earnings per share.

Stock Profile

"Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile. The company is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates; smelting of copper concentrates to produce blister and anode copper; refining of anode copper to produce copper cathodes; production of molybdenum concentrate and sulfuric acid; production of refined silver, gold, and other materials; and mining and processing of zinc, copper, molybdenum, silver, gold, and lead. It operates the Toquepala and Cuajone open-pit mines, and a smelter and refinery in Peru; and La Caridad, an open-pit copper mine, as well as a copper ore concentrator, a SX-EW plant, a smelter, refinery, and a rod plant in Mexico. The company also operates Buenavista, an open-pit copper mine, as well as two copper concentrators and two operating SX-EW plants in Mexico. In addition, it operates five underground mines that produce zinc, lead, copper, silver, and gold; a coal mine that produces coal and coke; and a zinc refinery. The company has interests in 493,117 hectares of exploration concessions in Peru and Mexico; 239,077 hectares of exploration concessions in Argentina; 30,568 hectares of exploration concessions in Chile; and 7,299 hectares of exploration concessions in Ecuador. Southern Copper Corporation was incorporated in 1952 and is based in Phoenix, Arizona. Southern Copper Corporation is a subsidiary of Americas Mining Corporation."

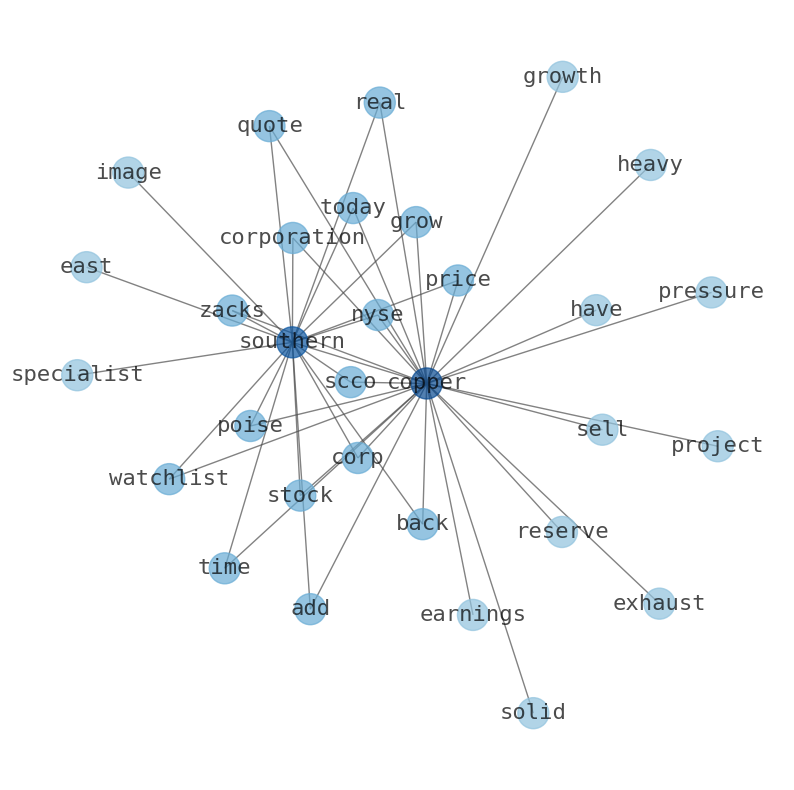

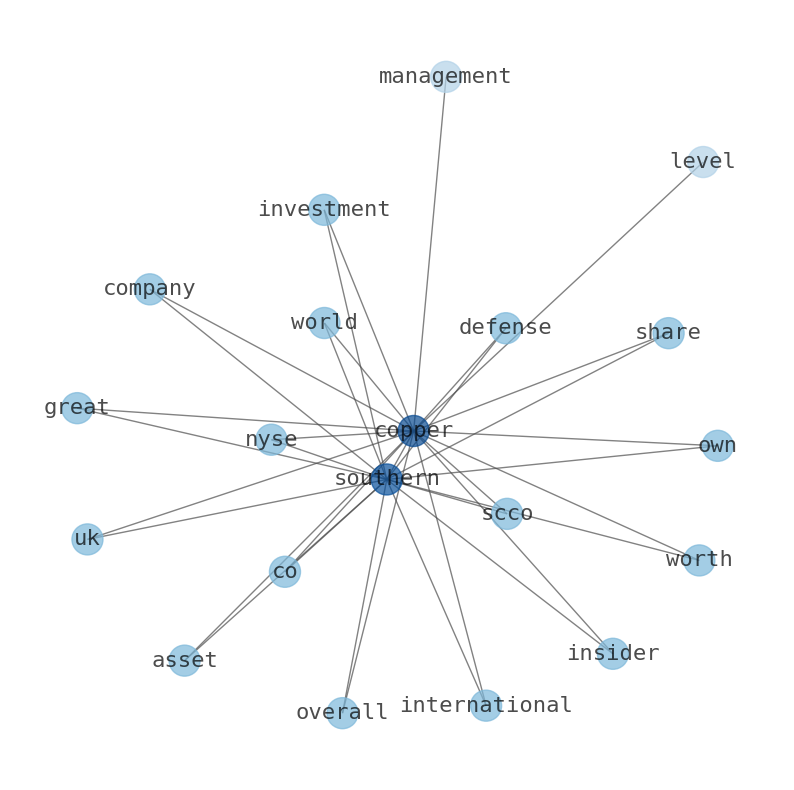

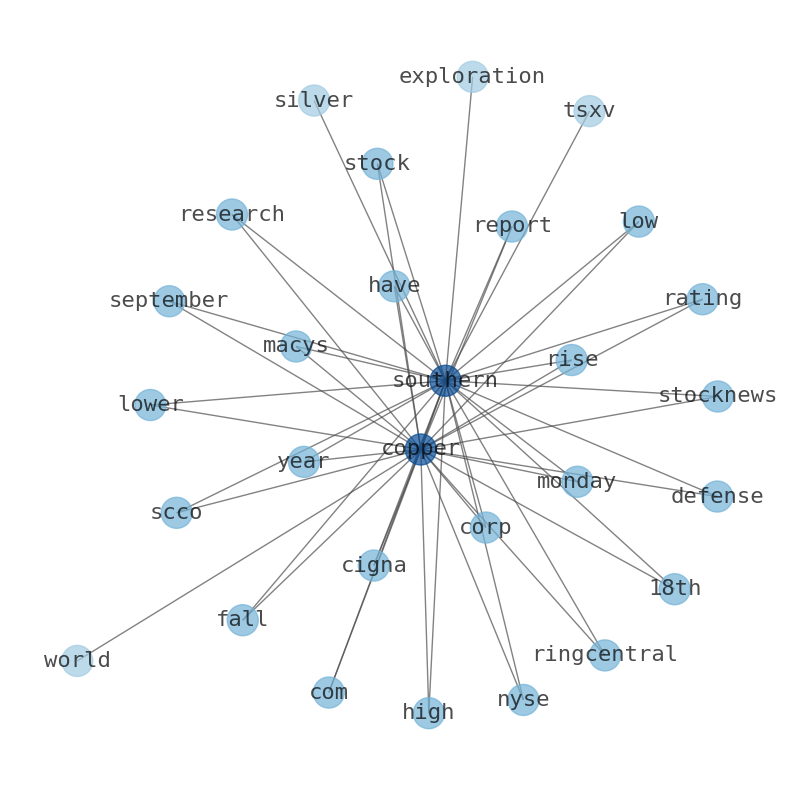

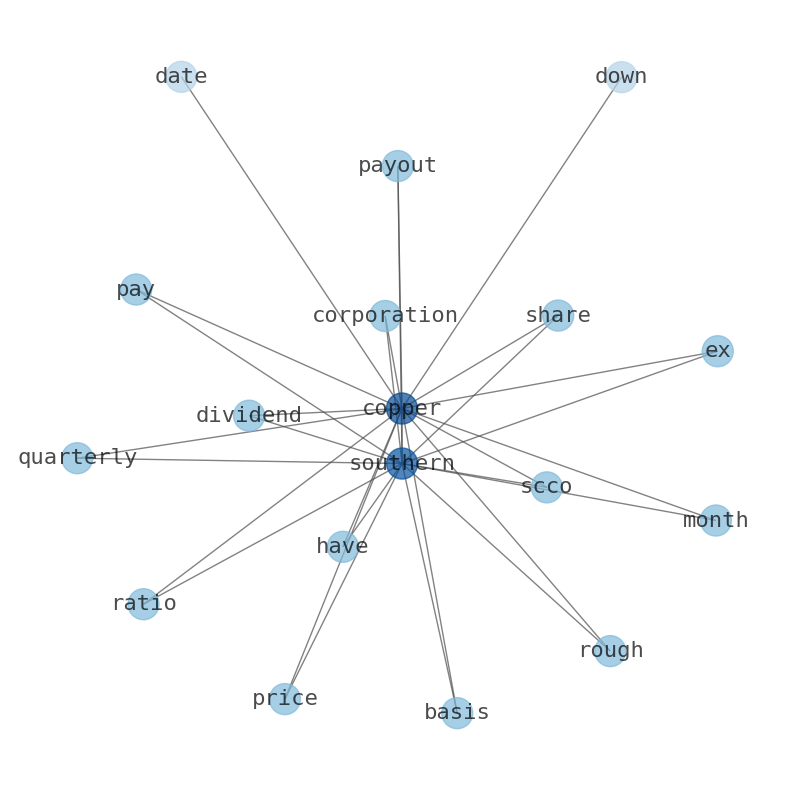

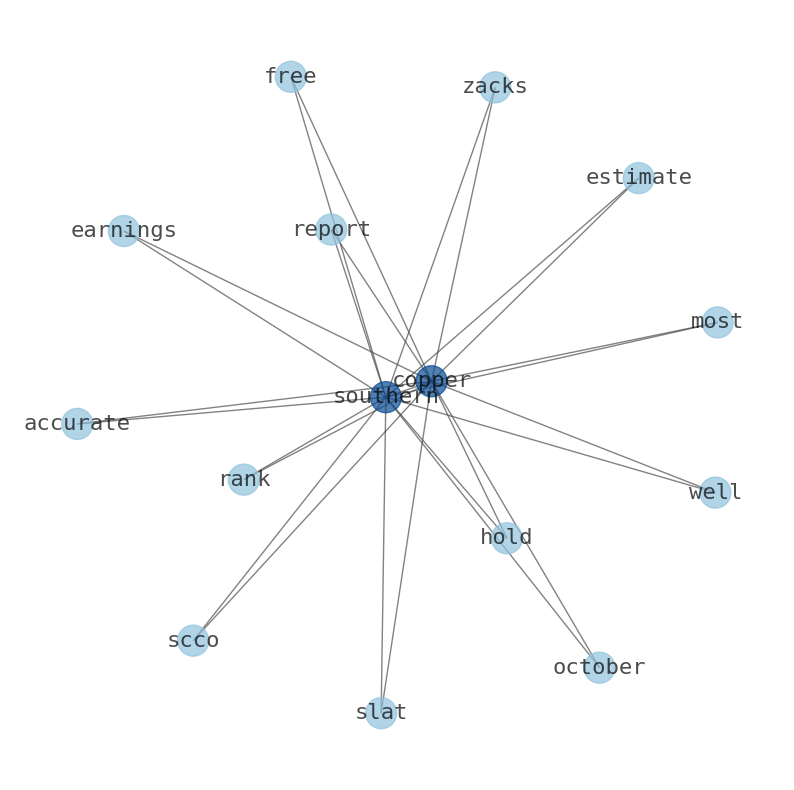

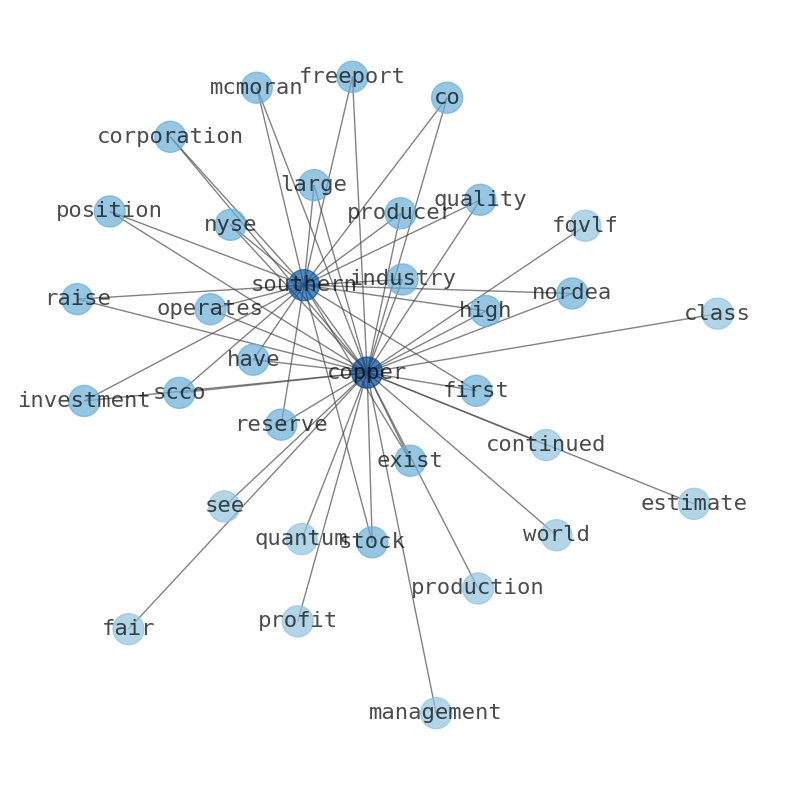

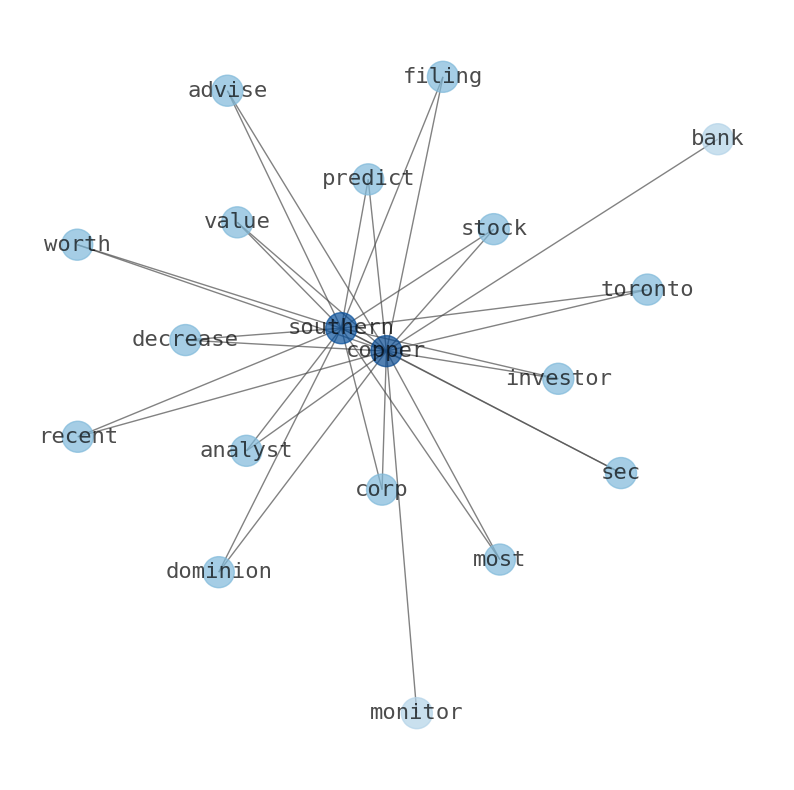

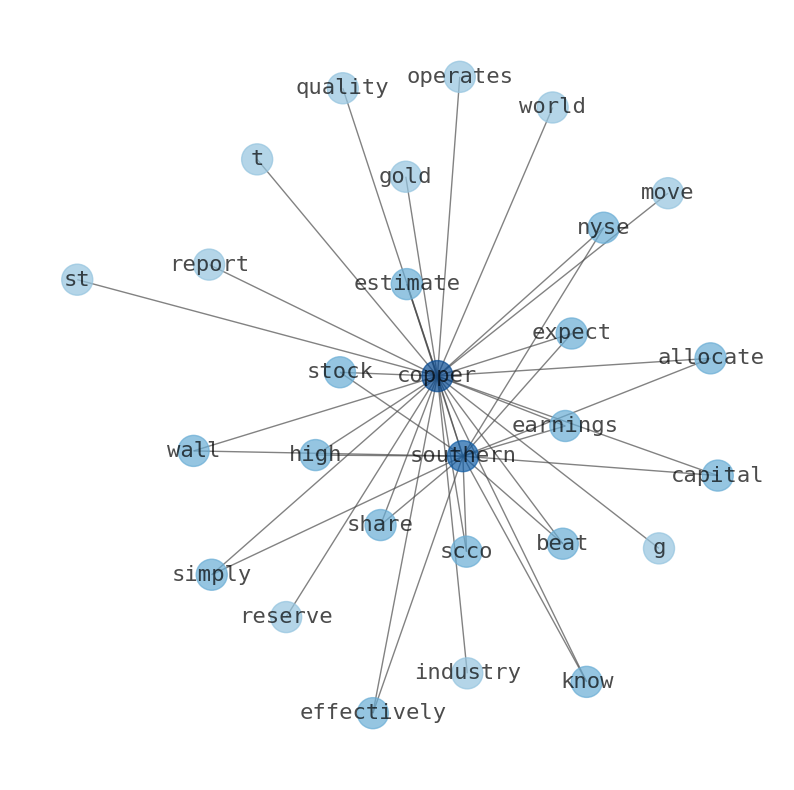

Keywords

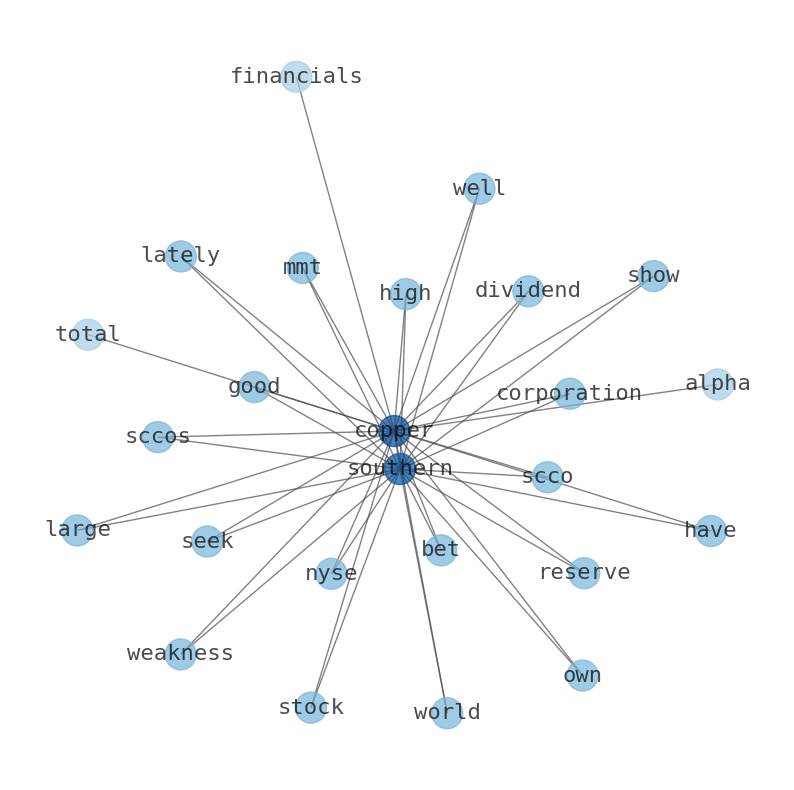

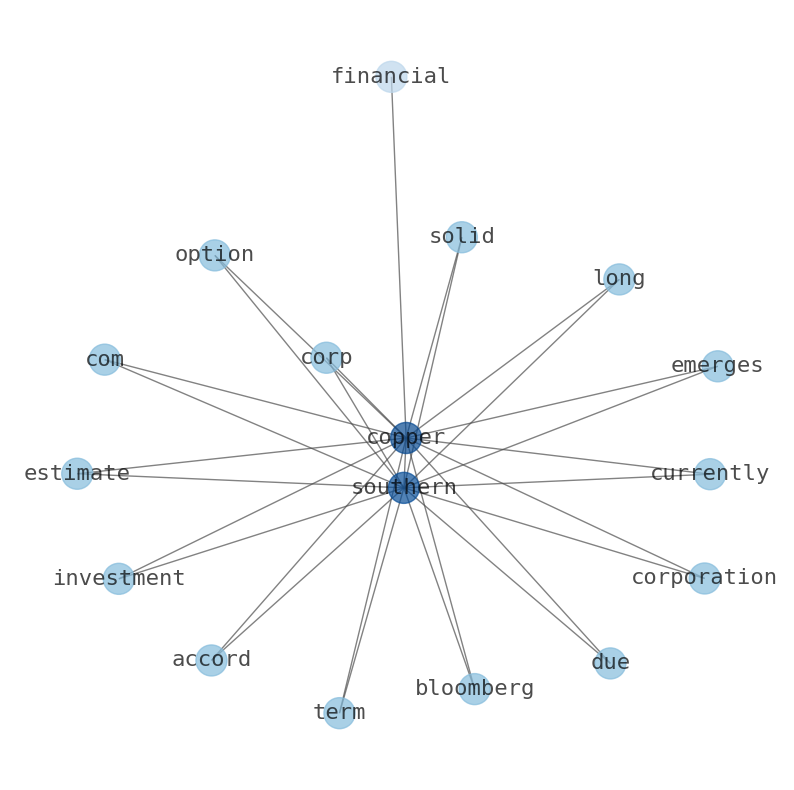

Are looking for the most relevant information about Southern Copper? Investor spend a lot of time searching for information to make investment decisions in Southern Copper. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Southern Copper are: Southern, Copper, year, Corporation, debt, share, return, and the most common words in the summary are: copper, republic, stock, news, southern, market, price, . One of the sentences in the summary was: Southern Copper Corporation ( NYSE:SCCO ) does carry debt. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #copper #republic #stock #news #southern #market #price.

Read more →Related Results

Southern Copper

Open: 87.76 Close: 88.04 Change: 0.28

Read more →

Southern Copper

Open: 81.1 Close: 82.28 Change: 1.18

Read more →

Southern Copper

Open: 72.13 Close: 75.45 Change: 3.32

Read more →

Southern Copper

Open: 70.99 Close: 70.78 Change: -0.21

Read more →

Southern Copper

Open: 72.71 Close: 73.47 Change: 0.76

Read more →

Southern Copper

Open: 79.49 Close: 79.28 Change: -0.21

Read more →

Southern Copper

Open: 78.04 Close: 78.72 Change: 0.68

Read more →

Southern Copper

Open: 73.0 Close: 73.42 Change: 0.42

Read more →

Southern Copper

Open: 84.25 Close: 84.96 Change: 0.71

Read more →

Southern Copper

Open: 78.99 Close: 80.47 Change: 1.48

Read more →

Southern Copper

Open: 70.52 Close: 70.18 Change: -0.34

Read more →

Southern Copper

Open: 72.26 Close: 73.93 Change: 1.67

Read more →

Southern Copper

Open: 77.0 Close: 74.73 Change: -2.27

Read more →

Southern Copper

Open: 78.04 Close: 78.72 Change: 0.68

Read more →

Southern Copper

Open: 72.57 Close: 72.82 Change: 0.25

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo