The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Snap-on

Youtube Subscribe

Open: 264.44 Close: 264.65 Change: 0.21

Is Snap-on Company Inc Stock a good investment? This what an AI found.

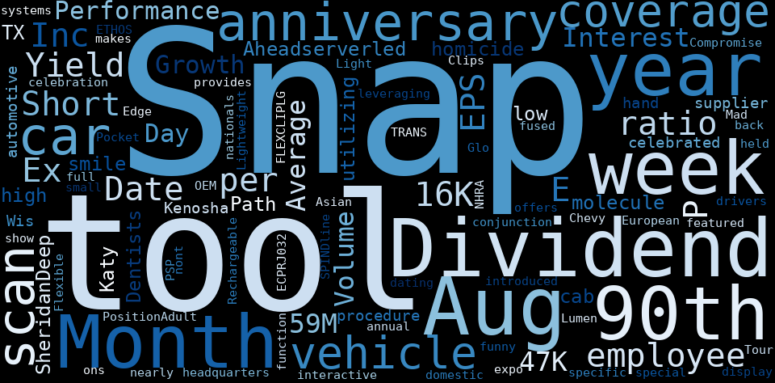

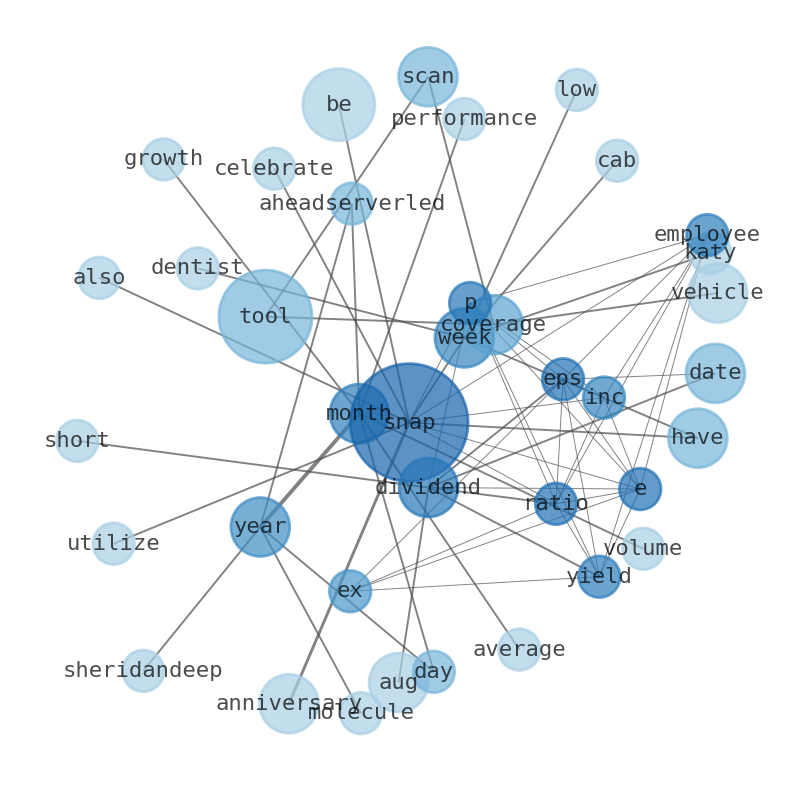

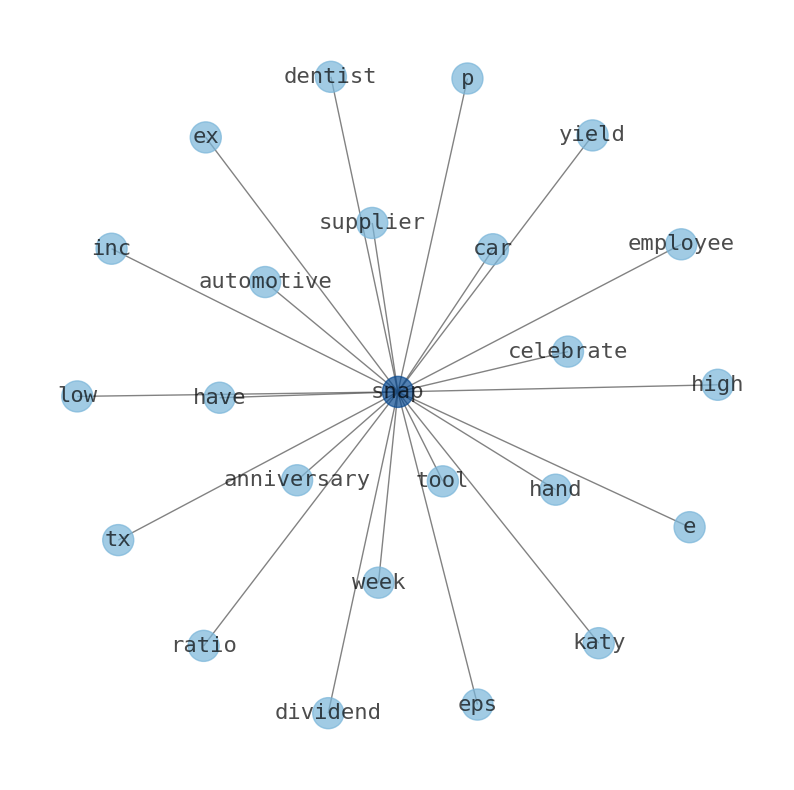

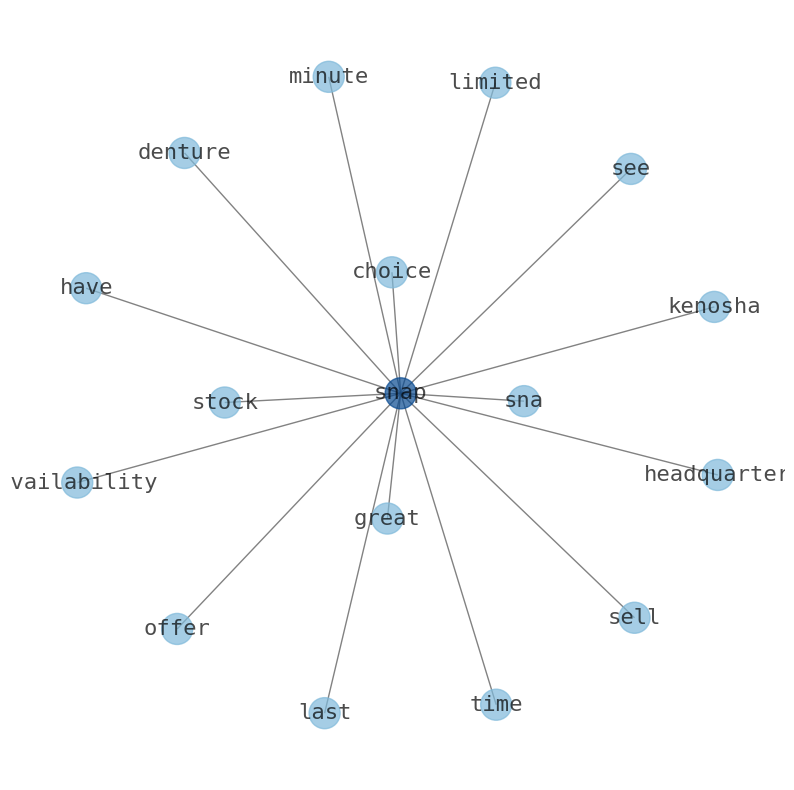

The game is changing. There is a new strategy to evaluate Snap-on fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Snap-on are: Snapon, tool, Aug, anniversary, car, scan, coverage, and the …

Stock Summary

Snap-on Incorporated manufactures and markets tools, equipment, diagnostics, and repair information and systems solutions for professional users. The company provides hand tools, including wrenches, sockets, ratchet wrenches and pliers, pliers.

Today's Summary

Snap-on Inc. per employee $387.16K P/E ratio 14.67 EPS $18.04 Yield 2.45% Dividend $1.62 Ex-Dividend Date Aug 17, 2023 Short Interest 1.59M - 1.05% Average Volume 258.47K Performance 5 Day -1.45%, 1 month -2.73% 2 month After growth

Today's News

Snap-On Inc. per employee $387.16K P/E ratio 14.67 EPS $18.04 Yield 2.45% Dividend $1.62 Ex-Dividend Date Aug 17, 2023 Short Interest 1.59M - 1.05% Average Volume 258.47K Performance 5 Day -1.45%, 1 Month -2.73% 2 month 1 year After Growth Year Aheadserverled 294 molecule SheridanDeep Path homicide cab Snap-on has a 52-week high of $297.7575 and a 52.75-week low of $200.75. Dentists of Katy, TX are also utilizing the snap-on smile procedure. Snap-on celebrated its 90th anniversary as a supplier of automotive hand tools at its Kenosha, Wis., headquarters Aug. 22. The celebration was held in conjunction with Snap-ons annual No Compromise Tour, which featured an interactive tool expo, car show, the Glo-Mad 57 Chevy display, Snap-ON special 90th. anniversary funny car, NHRA drivers and nationals and SPINDline fused PSP PositionAdult nont TRANS leveraging Snap-on ETHOS Edge is a full-function scan tool that provides coverage for nearly 50 domestic, Asian and European vehicle makes dating back to 1983. The scan tool offers OEM-specific coverage for more than 100 vehicle systems. Snap-on has introduced the ECPRJ032 300 Lumen Rechargeable Lightweight Pocket Light and FLEXCLIPLG and small Flexible Tool Clips.

Stock Profile

"Snap-on Incorporated manufactures and markets tools, equipment, diagnostics, and repair information and systems solutions for professional users worldwide. It operates through Commercial & Industrial Group, Snap-on Tools Group, Repair Systems & Information Group, and Financial Services segments. The company provides hand tools, including wrenches, sockets, ratchet wrenches, pliers, screwdrivers, punches and chisels, saws and cutting tools, pruning tools, torque measuring instruments, and other related products; power tools, such as cordless, pneumatic, and hydraulic and corded tools; and tool storage products comprising tool chests, roll cabinets, and other products. It also provides handheld and computer-based diagnostic products, service and repair information products, diagnostic software solutions, electronic parts catalogs, business management systems and services, point-of-sale systems, integrated systems for vehicle service shops, original equipment manufacturer purchasing facilitation services, and warranty management systems and analytics; and engineered solutions. In addition, the company offers solutions for the service of vehicles and industrial equipment that include wheel alignment equipment, wheel balancers, tire changers, vehicle lifts, test lane equipment, collision repair equipment, vehicle air conditioning service equipment, brake service equipment, fluid exchange equipment, transmission troubleshooting equipment, safety testing equipment, battery chargers, and hoists, as well as after-sales support services and training programs. Further, it provides financing programs to facilitate the sales of its products and support its franchise business. The company serves the aviation and aerospace, agriculture, infrastructure construction, government and military, mining, natural resources, power generation, and technical education industries Snap-on Incorporated was founded in 1920 and is headquartered in Kenosha, Wisconsin."

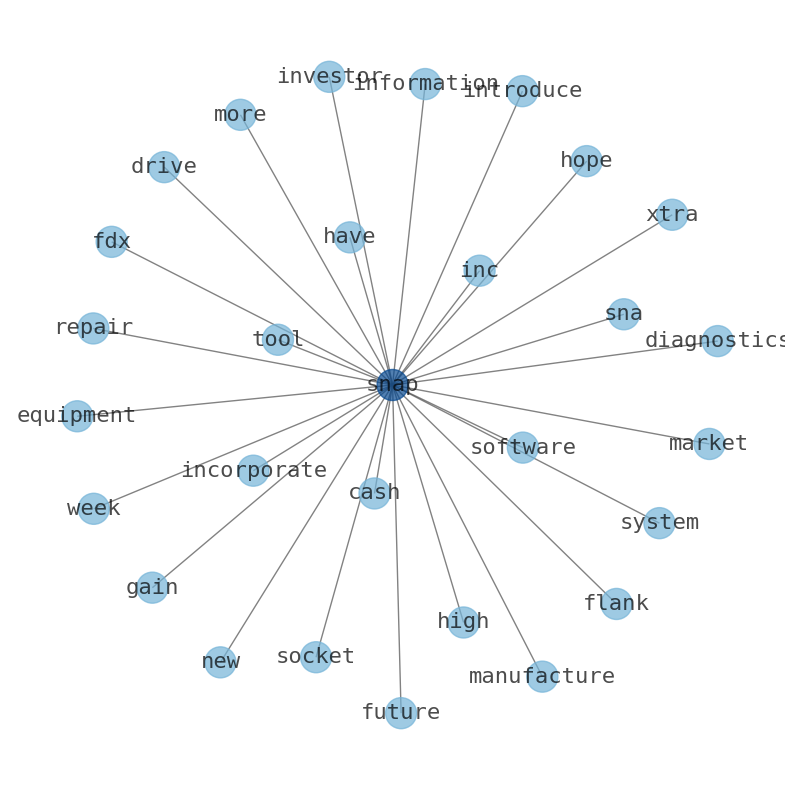

Keywords

Are looking for the most relevant information about Snap-on? Investor spend a lot of time searching for information to make investment decisions in Snap-on. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Snap-on are: Snapon, tool, Aug, anniversary, car, scan, coverage, and the most common words in the summary are: tool, snapon, price, tillman, new, vwaudi, ses, . One of the sentences in the summary was: per employee $387.16K P/E ratio 14.67 EPS $18.04 Yield 2.45% Dividend $1.62 Ex-Dividend Date Aug 17, 2023 Short Interest 1.59M - 1.05% Average Volume 258.47K Performance 5 Day -1.45%, 1 month -2.73% 2 month After growth. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #tool #snapon #price #tillman #new #vwaudi #ses.

Read more →Related Results

Snap-on

Open: 264.44 Close: 264.65 Change: 0.21

Read more →

Snap-on

Open: 263.48 Close: 262.37 Change: -1.11

Read more →

Snap-on

Open: 260.3 Close: 258.01 Change: -2.29

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo