The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Signature Bank

Youtube Subscribe

Open: 0.01 Close: 0.27 Change: 0.26

Don't invest before reading what an AI found about Signature Bank Company Inc Stock.

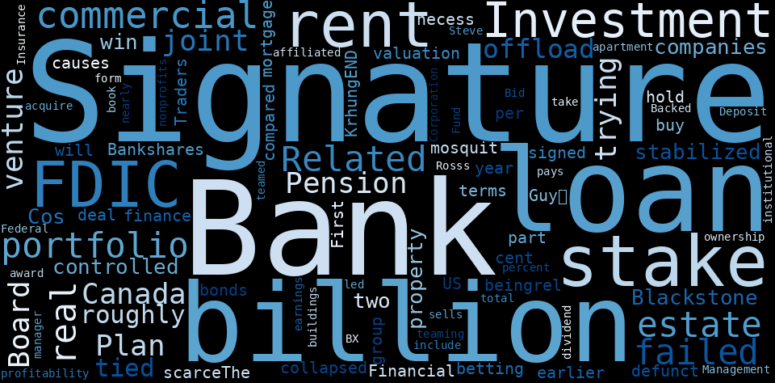

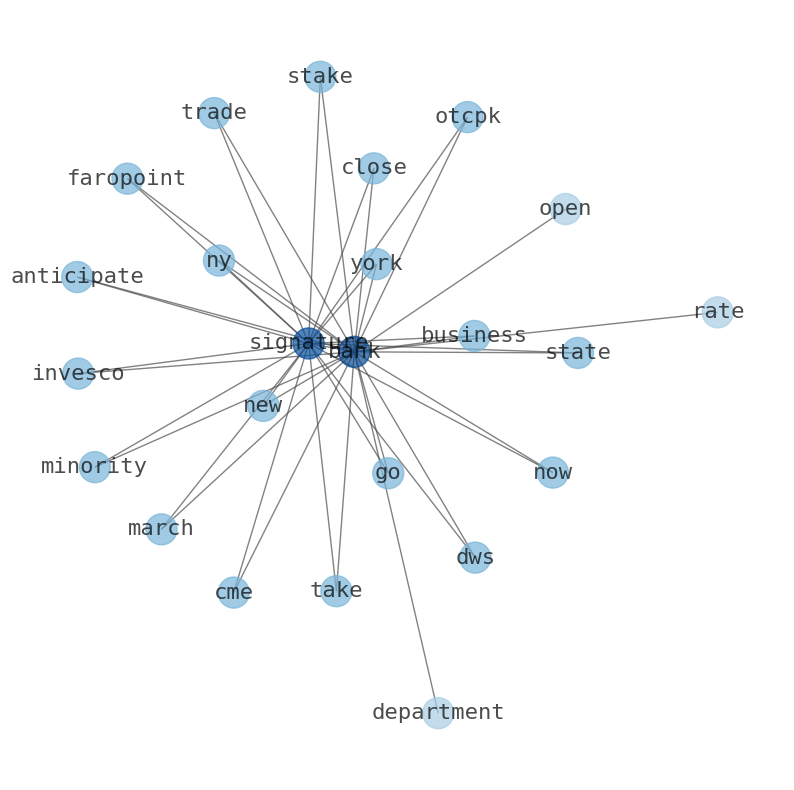

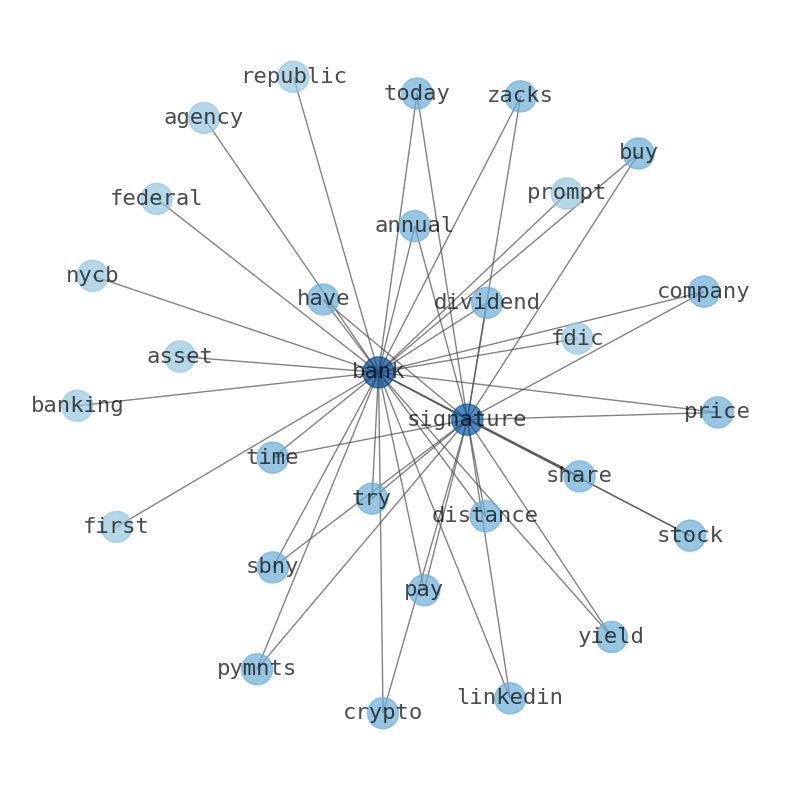

How much time have you spent trying to decide whether investing in Signature Bank? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Signature Bank are: …

Stock Summary

FDIC estimates the cost of the failure of Signature Bank to its Deposit Insurance Fund to be approximately $2.5 billion. FDIC in May proposed a special assessment on banks with over $5 billion in assets. NYCB and FD.

Today's Summary

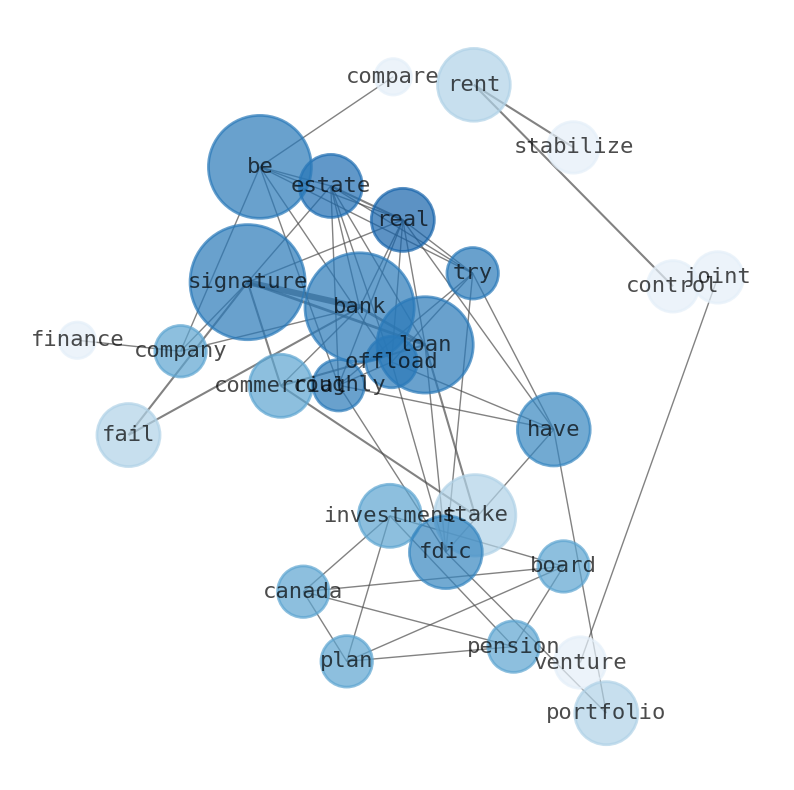

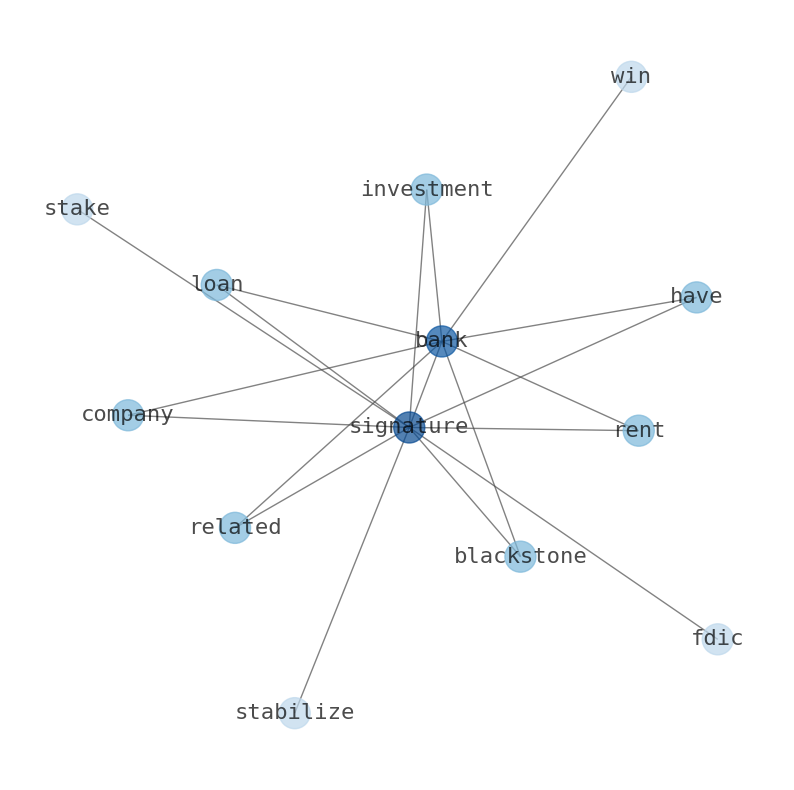

FDIC has been trying to offload roughly $33 billion of real estate loans from Signature after the bank collapsed earlier this year. Canada Pension Plan Investment Board is part of a group that has signed a deal to buy a 20 per cent stake in a joint venture that will hold a US$16.8-billion commercial mortgage loan portfolio of Signature Bank.

Today's News

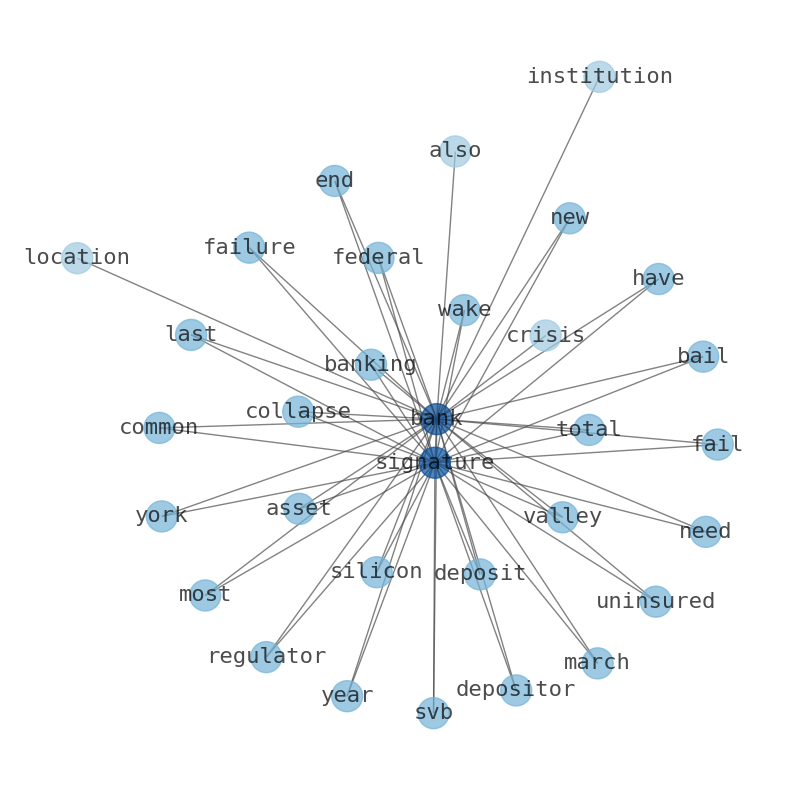

Canada Pension Plan Investment Board is part of a group that has signed a deal to buy a 20 per cent stake in a joint venture that will hold a US$16.8-billion commercial mortgage loan portfolio of Signature Bank. FDIC has been trying to offload roughly $33 billion of real estate loans from Signature after the bank collapsed earlier this year. Traders are betting that bonds tied to defunct Signature Bank are beingrel scarceThe Guy使 mosquit KrhungEND causes:necess |-- First Financial Bankshares and Signature Bank are both finance companies. The two companies are compared to each other in terms of valuation, profitability, and institutional ownership. Signature Bank pays out 350.2% of its earnings in the form of a dividend. Related Cos.-Backed Bid wins stake in signature banks loan book. Related Fund Management, an investment manager affiliated with Steve Rosss Related Cos., is teaming up with two nonprofits to take on a portfolio of property loans tied to rent-controlled and rent-stabilized apartment buildings from the failed Signature Bank. Blackstone (BX) -led joint venture has teamed up with the Federal Deposit Insurance Corporation (FDIC) to acquire a 20 percent stake in $16.8 billion of commercial real estate loans from failed Signature Bank. The award does not include Signatures rent-stabilized or rent-controlled loans, which total $15 billion. FDIC sells stake in commercial property loans from failed Signature Bank. Blackstone, Canada Pension Plan Investment Board win stake in nearly $17 billion portfolio. FDIC has been trying to offload roughly $33 billion of real estate.

Stock Profile

" Signature Bank - SBNY - Stock Price Today - Zacks Is It Time to Buy SBNY? Shares are down today. PYMNTS: Signature Bank tries to distance itself from crypto. pymnts on linkedin: signature bank tries to. distance itself. Signature Bank pays an annual dividend of $1.82 per share and has a dividend yield of 1,474.9%. The company has raised its dividend for 1 consecutive years. FDIC estimates the cost of the failure of Signature Bank to its Deposit Insurance Fund to be approximately $2.5 billion. New York Community Bank subsidiary Flagstar acquired a large segment of signature Bank for $2.7 billion. NYCB and FDIC are seeking to sell Signet, the real-time payments network. Recent failures of Silicon Valley Bank, Signature Bank and First Republic have prompted the federal banking agencies to move toward reversing the tailoring of enhanced prudential standards based on risk and complexity for banks with more than $100 billion in total assets. The FDIC in May proposed a special assessment on banks with over $5 billion in assets."

Keywords

The game is changing. There is a new strategy to evaluate Signature Bank fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Signature Bank are: Signature, loan, Bank, stake, FDIC, commercial, portfolio, and the most common words in the summary are: bank, signature, news, loan, market, new, real, . One of the sentences in the summary was: FDIC has been trying to offload roughly $33 billion of real estate loans from Signature after the bank collapsed earlier this year. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #bank #signature #news #loan #market #new #real.

Read more →Related Results

Signature Bank

Open: 0.01 Close: 0.27 Change: 0.26

Read more →

Signature Bank

Open: 0.04 Close: 0.03 Change: 0.0

Read more →

Signature Bank

Open: 0.08 Close: 0.03 Change: -0.05

Read more →

Signature Bank

Open: 0.11 Close: 0.1 Change: -0.01

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo