The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Schlumberger

Youtube Subscribe

Open: 48.47 Close: 47.94 Change: -0.53

The stock market through the eyes of an AI: Schlumberger Company Inc.

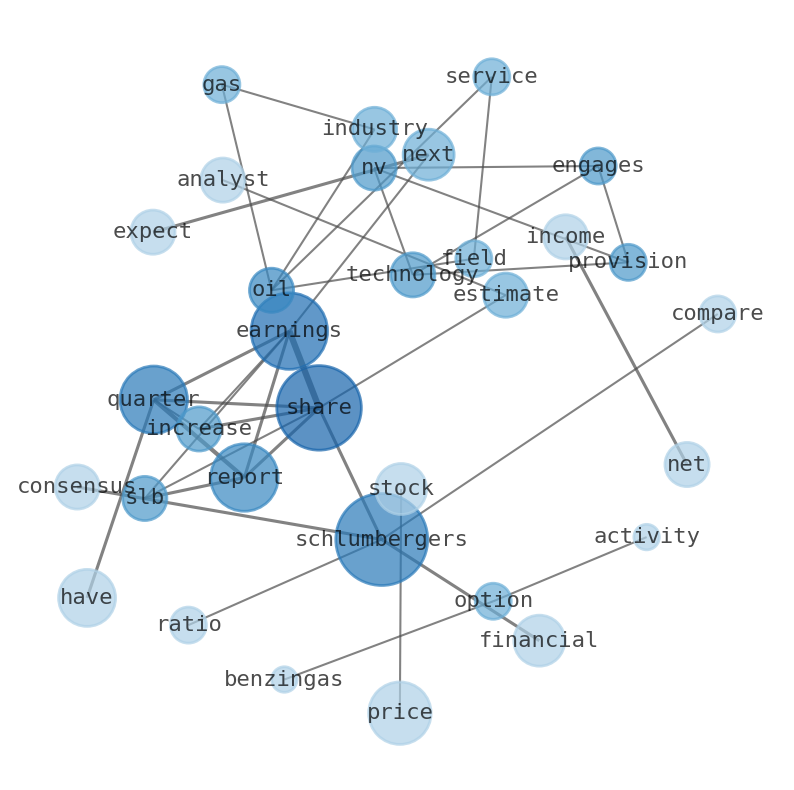

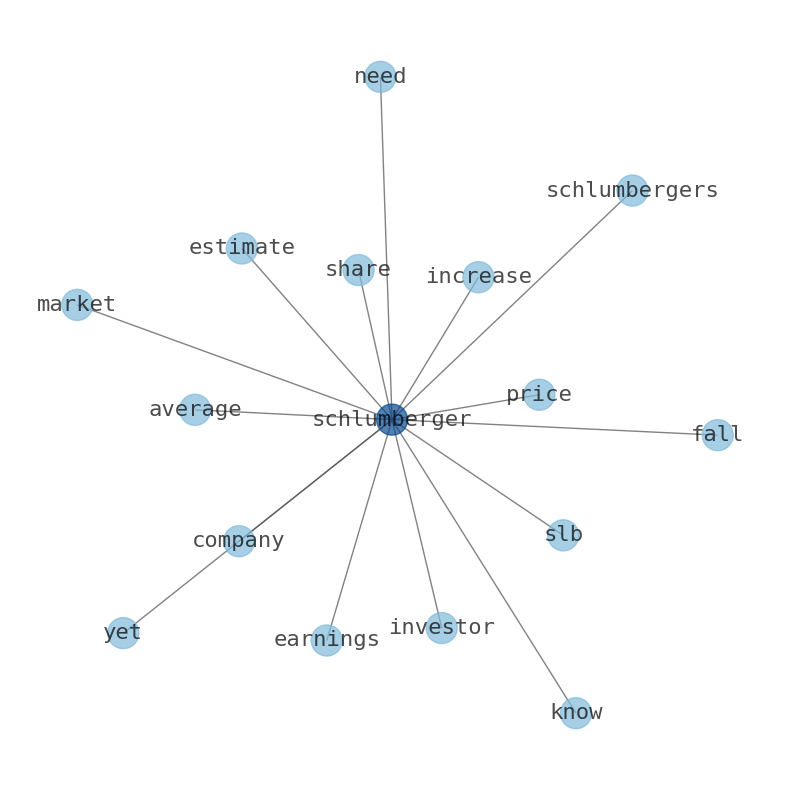

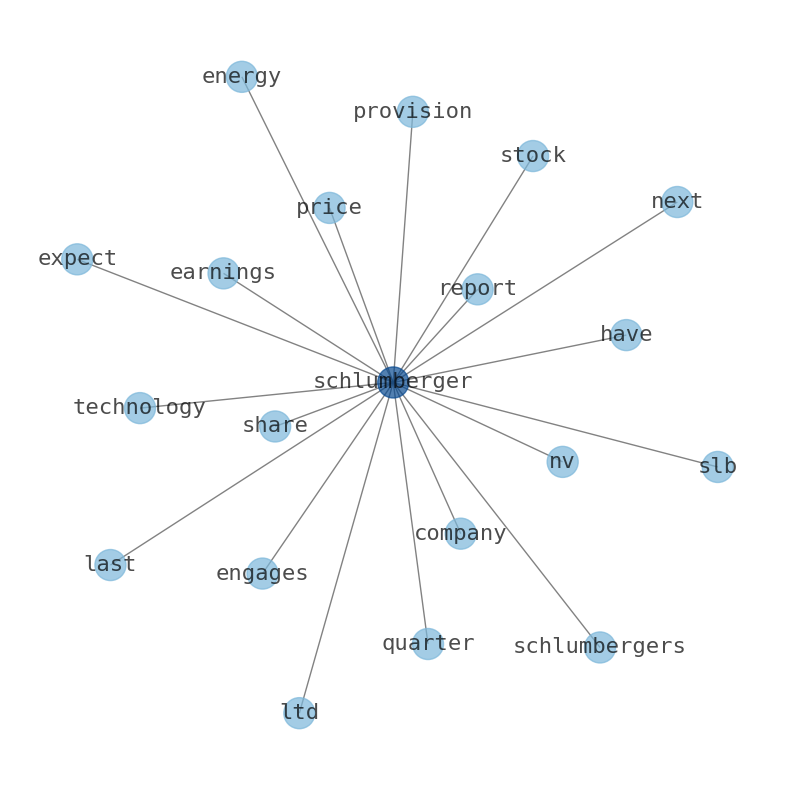

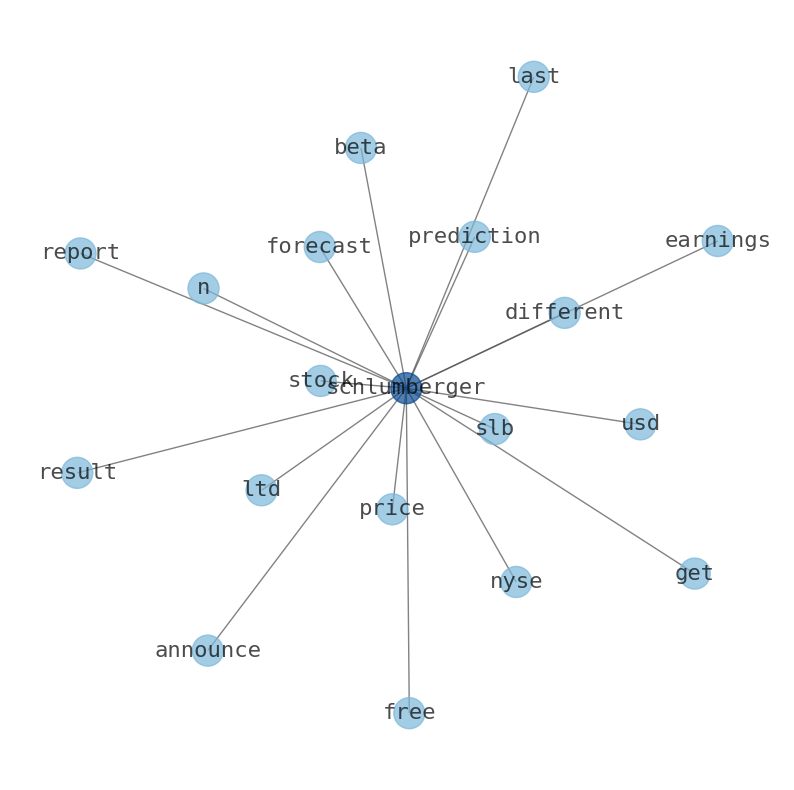

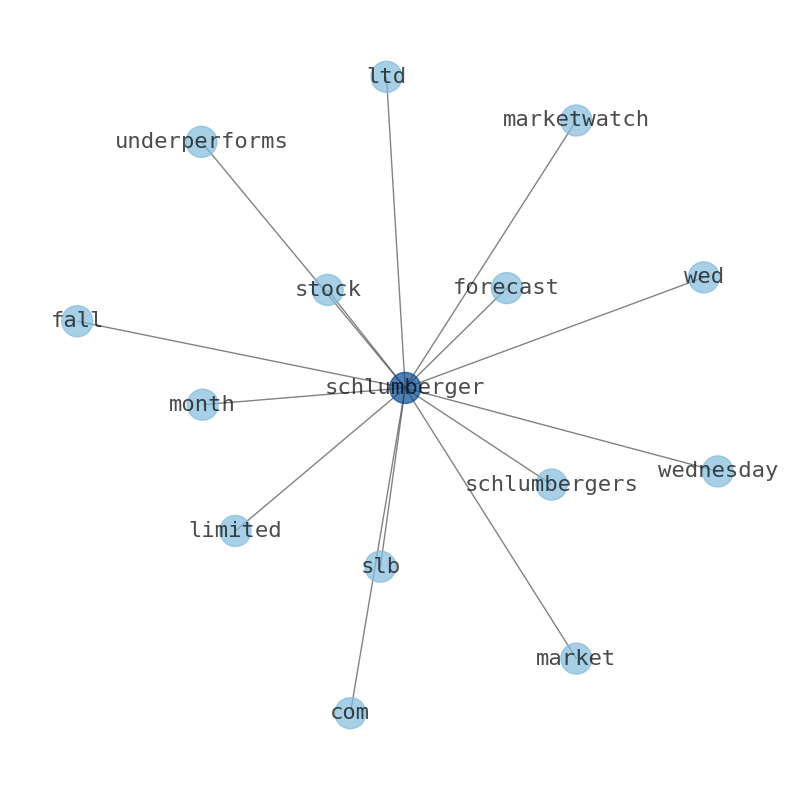

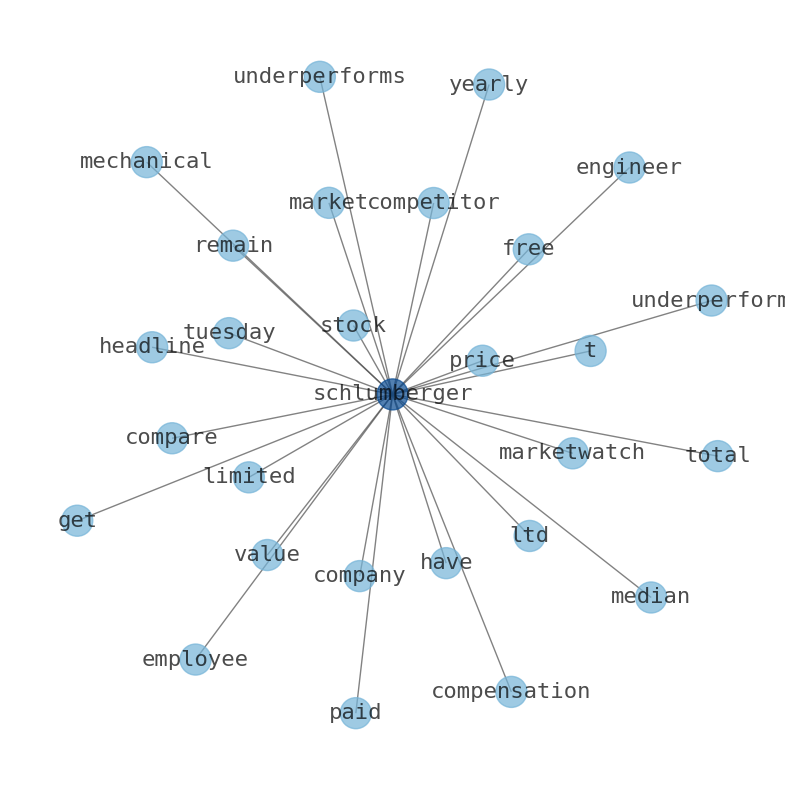

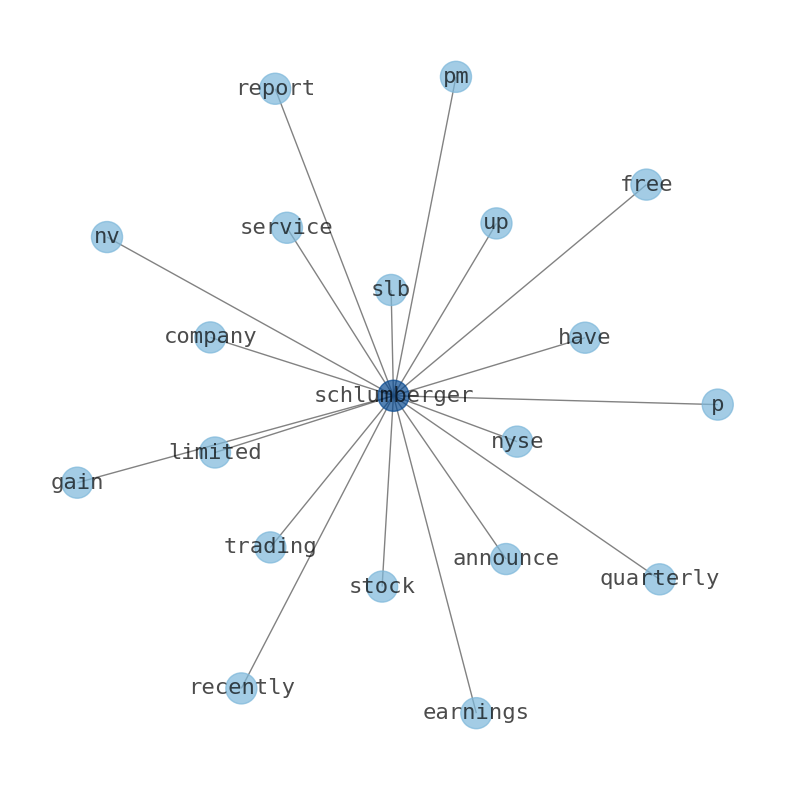

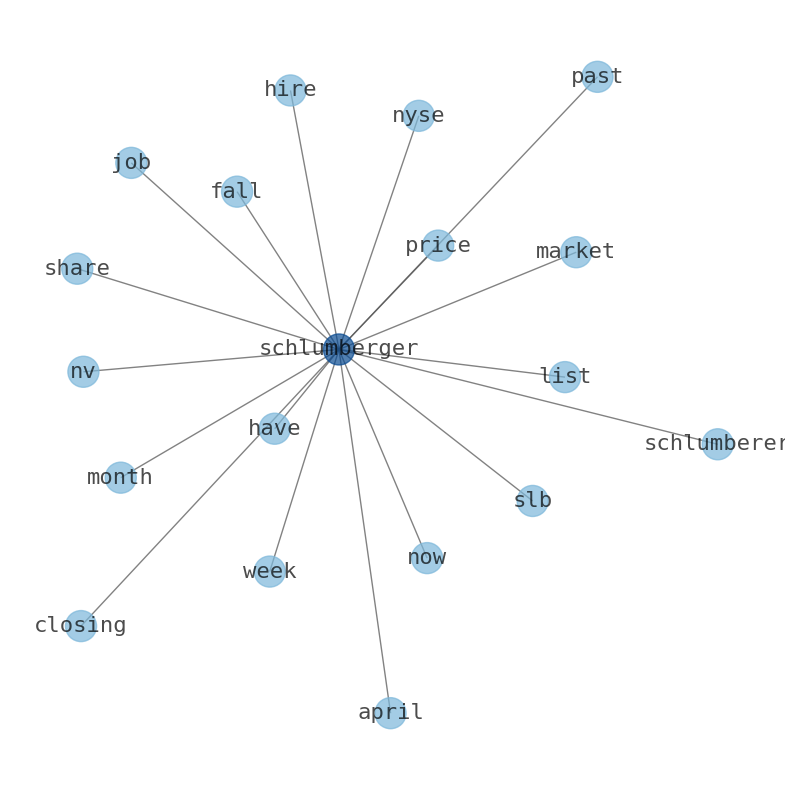

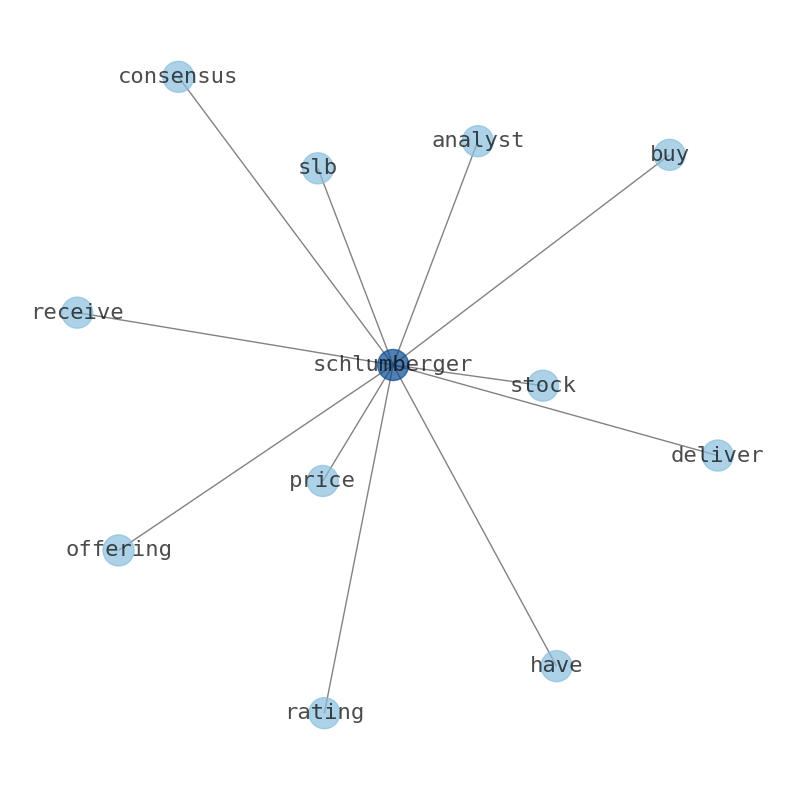

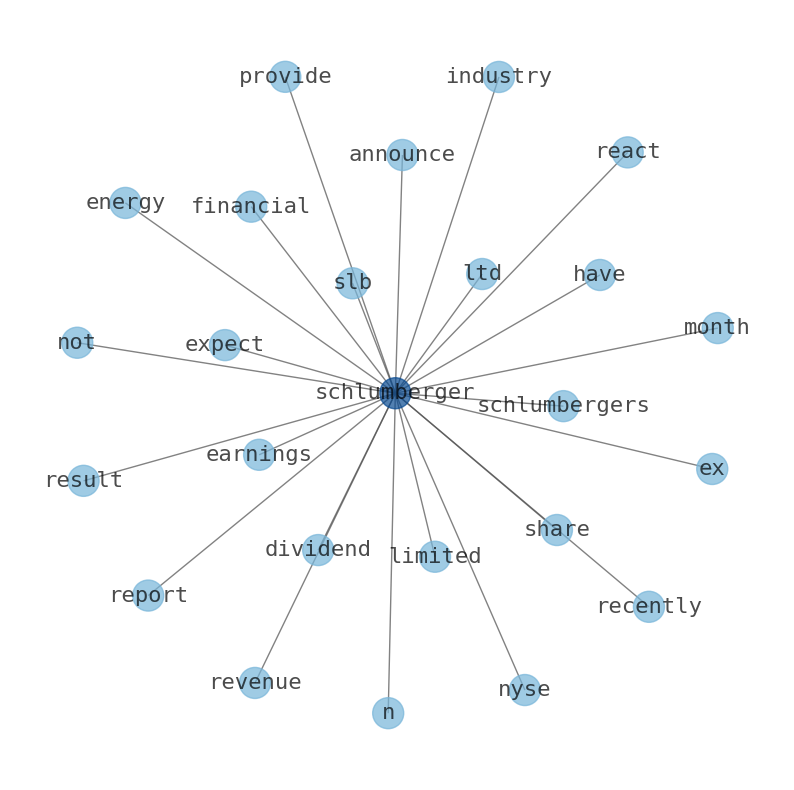

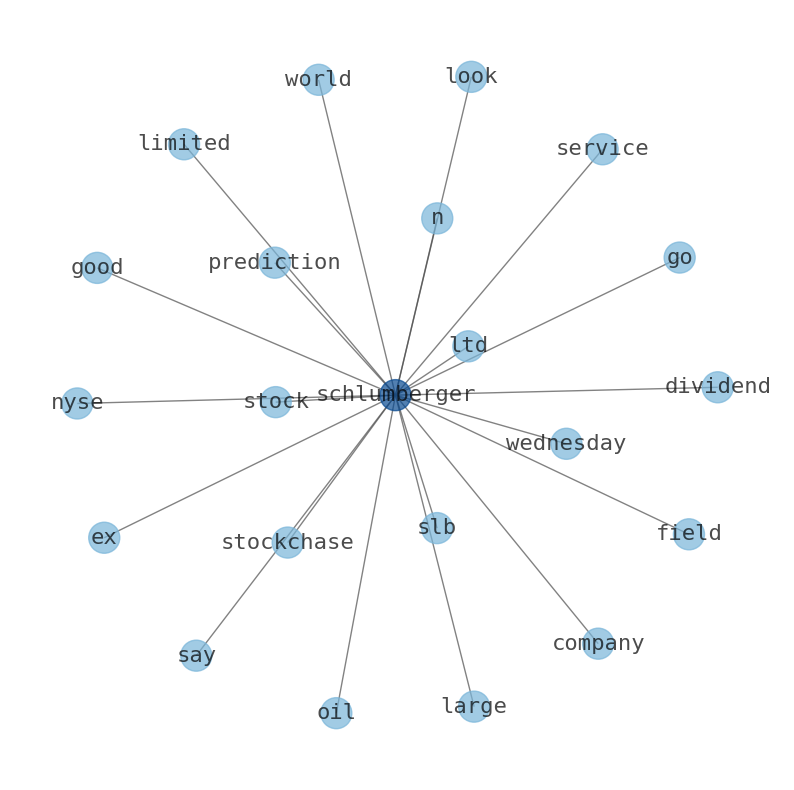

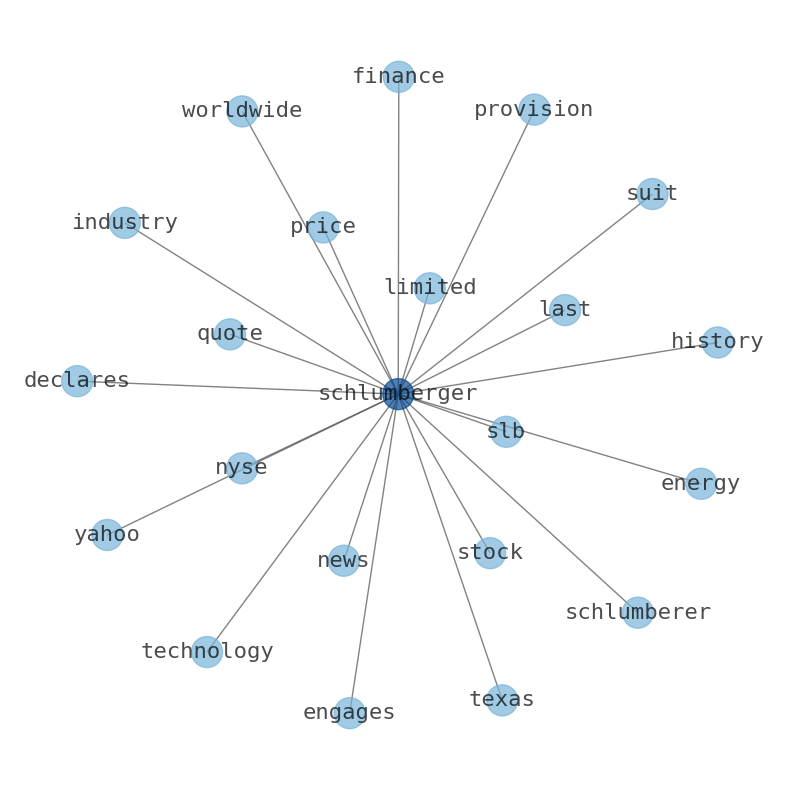

Are looking for the most relevant information about Schlumberger? Investor spend a lot of time searching for information to make investment decisions in Schlumberger. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Schlumberger are: Schlumberger, Schlumbergers, share, earnings, quarter, report, price, and the most common words in the summary are: schlumberger, stock, earnings, price, schlumbergers, market, slb, . One of the sentences in the summary was: Schlumberger (SLB) reported earnings of $0.86 per share, beating the Zacks Consensus Estimate of …

Stock Summary

Schlumberger Limited engages in the provision of technology for the energy industry. The company operates through four divisions: Digital & Integration, Reservoir Performance, Well Construction, and Production Systems. Schlumbergers also provides drilling fluid systems, drilling.

Today's Summary

Schlumberger (SLB) reported earnings of $0.86 per share, beating the Zacks Consensus Estimate of $ 0.84 per share. The successful prediction of Schlumbergers future price could yield a profit.

Today's News

Schlumberger NV engages in the provision of technology for reservoir characterization, drilling, production, and processing to the oil and gas industry. Schlumbergers stock underperforms monday when compared to competitors - marketwatch.com. Colgate-Palmolive Now #124 Largest Company, Surpassing Schlumberger The Online Investor. Intermede Investment Partners Ltd lessened its position in Schlumbergers Limited (NYSE:SLB Free Report) by 4.1% during the third quarter, according to its most recent 13F filing. Schlumberger (SLB) reported earnings of $0.86 per share, beating the Zacks Consensus Estimate of $ 0.84 per share. Schlumbergers dividend payout ratio (DPR) is 34.25%. Schlumbergers is one of my favorite oil field services providers. Benzingas options scanner highlighted 14 extraordinary options activities for Schlumberger. Big money trades within a strike price range of $42.5 to $62.5 over the last month. Schlumberger stock price is 48.55 and Schlumbergers 200-day simple moving average is 52.55, creating a Sell signal. Analysts estimate an earnings increase this quarter of$0.16 per share, a decrease next quarter of $0.03 per share. Schlumbergar Cuvee Klimt Der Kuss Sekt Brut Austria. Schlumberger shares entered oversold territory on Wednesday, changing hands as low as $47.88 per share. Shares of Schlumbergers revenue was $33.14 billion, an increase of 17.96% compared to the previous years $28.09 billion. In 2023, Schlumberger Limited provides technology for the energy industry. Schlumberger NV engages in the provision of energy technology. The company was founded in 1926 and is headquartered in Houston, Texas. Schlumberger has consistently reported growth in revenue and net income over the past four quarters. Earnings per share has increased to $0.21 per share. By analyzing these quarterly earnings results, investors can assess Schlumbergers profitability. Schlumberger regularly releases detailed earnings reports, offering comprehensive insights into the companys financial performance. Analyzing the trends and metrics presented in the companys earnings summary is a crucial step in evaluating the company as a potential investment opportunity. Analyst estimates can serve as a guide, helping investors gauge the consensus view on Schlumbergers earnings outlook. Schlumberger Ltd. working in more than 85 countries and employing people who represent over 140 nationalities. The successful prediction of Schlumbergers future price could yield a profit. FOMO can cause potential investors in Schlumberger to buy its stock at a price that has no basis in reality. This module is based on analyzing investor sentiment. Schlumberger expected not to react to the next headline with the price going to stay at about the same level and average media hype impact volatility of over 100%. The volatility of relative hype elasticity to Schlumbergers is about 13015.38% with expected price after next announcement by competition of 48.55. The successful prediction could yield a significant profit. Schlumberger Nv Stock is a publicly listed company on the Nasdaq exchange. The process typically begins with a thorough review of Schlumbergers financial statements. Key financial ratios are used to gauge profitability and efficiency. Schlumberger (SLB) is expected to report earnings per share (EPS) of $2.92 in the next quarter. Analysts have positive expectations for Schlumbergers financial performance. This growth signals a promising outlook for the oil and gas field services industry. The consensus leans towards a positive outlook. Schlumbergers annual revenue and net income are XXXX billion. Schlumberger reported earnings of $0.86 per share for the last reported quarter, Q4 2023. The company has generated a net income of $4.20 billion over the last four quarters.

Stock Profile

"Schlumberger Limited engages in the provision of technology for the energy industry worldwide. The company operates through four divisions: Digital & Integration, Reservoir Performance, Well Construction, and Production Systems. The company provides field development and hydrocarbon production, carbon management, integration of adjacent energy systems; reservoir interpretation and data processing services for exploration data; and well construction and production improvement services and products. It also offers subsurface geology and fluids evaluation information; open and cased hole services; exploration and production pressure, and flow-rate measurement services; and pressure pumping, well stimulation, and coiled tubing equipment solutions. In addition, the company offers mud logging, directional drilling, measurement-while-drilling, and logging-while-drilling services, as well as engineering support services; supplies drilling fluid systems; designs, manufactures, and markets roller cone and fixed cutter drill bits; bottom-hole-assembly and borehole enlargement technologies; well cementing products and services; well planning, well drilling, engineering, supervision, logistics, procurement, and contracting of third parties, as well as drilling rig management solutions; and drilling equipment and services, as well as land drilling rigs and related services. Further, it provides artificial lift production equipment and optimization services; supplies packers, safety valves, sand control technology, and various intelligent well completions technology and equipment; designs and manufactures valves, chokes, actuators, and surface trees; and OneSubsea an integrated solutions, products, systems, and services, including wellheads, subsea trees, manifolds and flowline connectors, control systems, connectors, and services. The company was formerly known as Socie´te´ de Prospection E´lectrique. Schlumberger Limited was founded in 1926 and is based in Houston, Texas."

Keywords

How much time have you spent trying to decide whether investing in Schlumberger? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Schlumberger are: Schlumberger, Schlumbergers, share, earnings, quarter, report, price, and the most common words in the summary are: schlumberger, stock, earnings, price, schlumbergers, market, slb, . One of the sentences in the summary was: Schlumberger (SLB) reported earnings of $0.86 per share, beating the Zacks Consensus Estimate of $ 0.84 per share. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #schlumberger #stock #earnings #price #schlumbergers #market #slb.

Read more →Related Results

Schlumberger

Open: 52.26 Close: 52.57 Change: 0.31

Read more →

Schlumberger

Open: 48.47 Close: 47.94 Change: -0.53

Read more →

Schlumberger

Open: 53.48 Close: 53.03 Change: -0.45

Read more →

Schlumberger

Open: 52.89 Close: 52.93 Change: 0.04

Read more →

Schlumberger

Open: 57.36 Close: 56.41 Change: -0.95

Read more →

Schlumberger

Open: 48.94 Close: 53.31 Change: 4.37

Read more →

Schlumberger

Open: 44.33 Close: 43.25 Change: -1.08

Read more →

Schlumberger

Open: 48.88 Close: 48.82 Change: -0.06

Read more →

Schlumberger

Open: 48.69 Close: 48.55 Change: -0.14

Read more →

Schlumberger

Open: 51.98 Close: 52.39 Change: 0.41

Read more →

Schlumberger

Open: 55.58 Close: 55.7 Change: 0.12

Read more →

Schlumberger

Open: 53.94 Close: 56.05 Change: 2.11

Read more →

Schlumberger

Open: 46.14 Close: 46.59 Change: 0.45

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo