The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Roper Technologies

Youtube Subscribe

Open: 559.16 Close: 556.87 Change: -2.29

The unbelievably easy way to evaluate Roper Technologies Company Inc Stock: Use an AI.

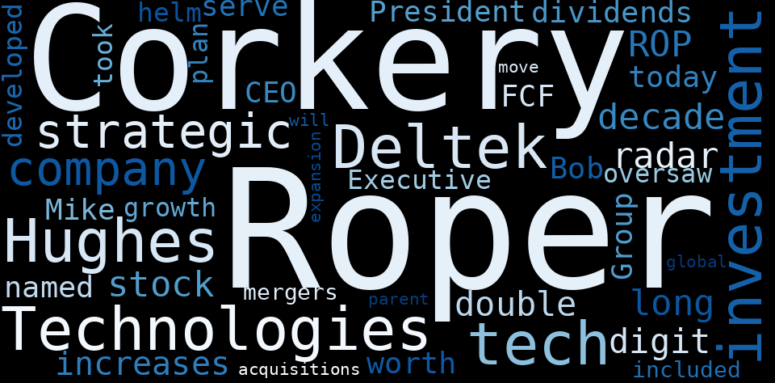

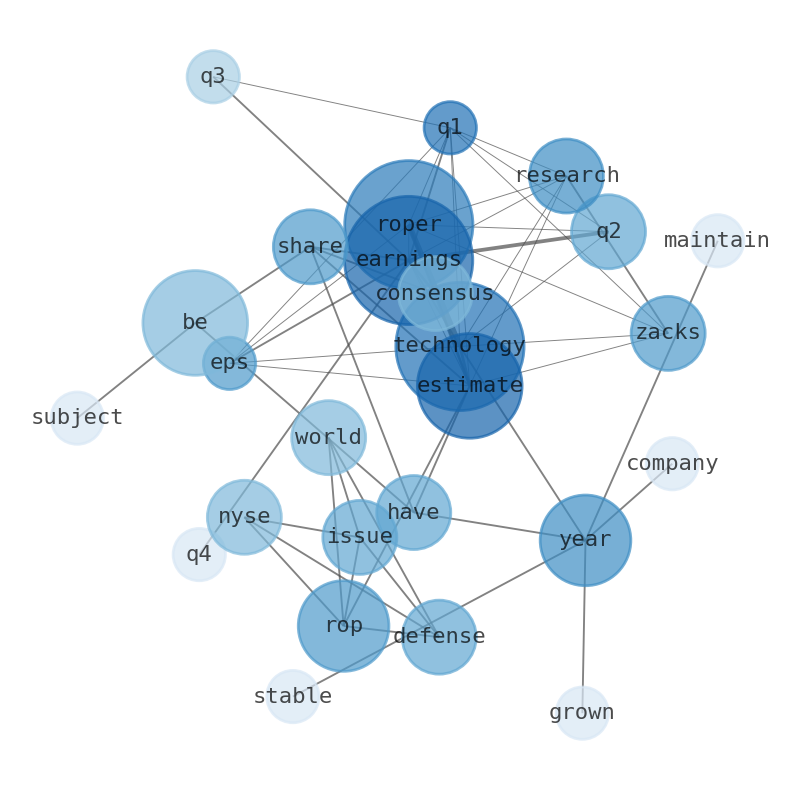

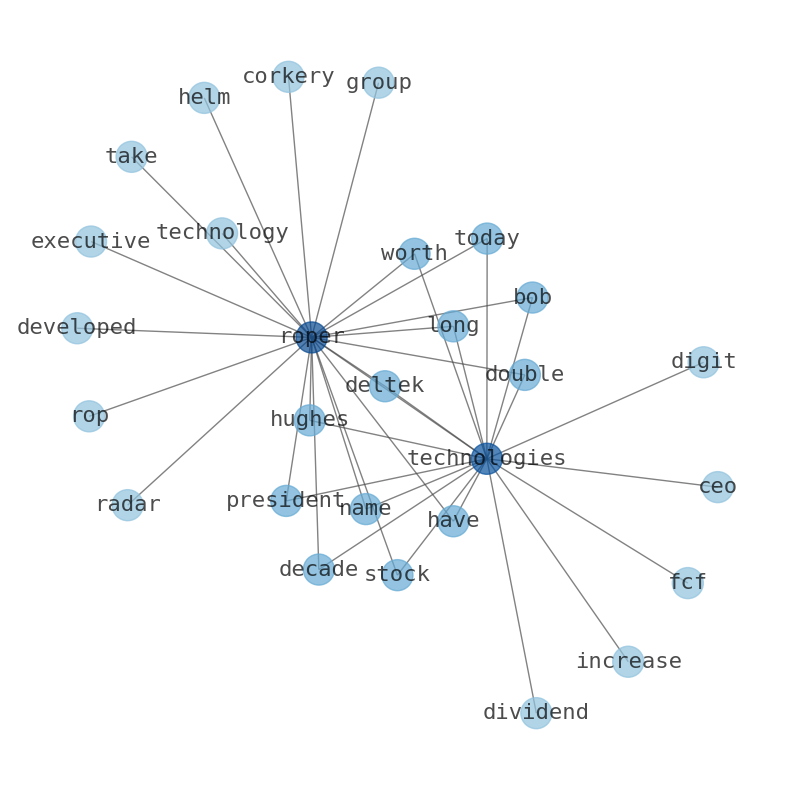

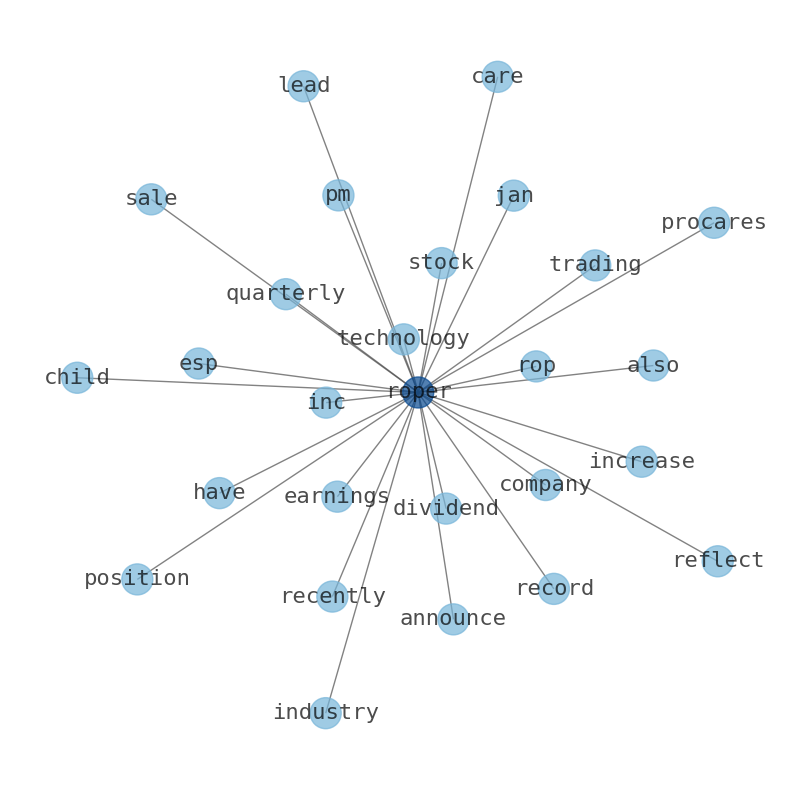

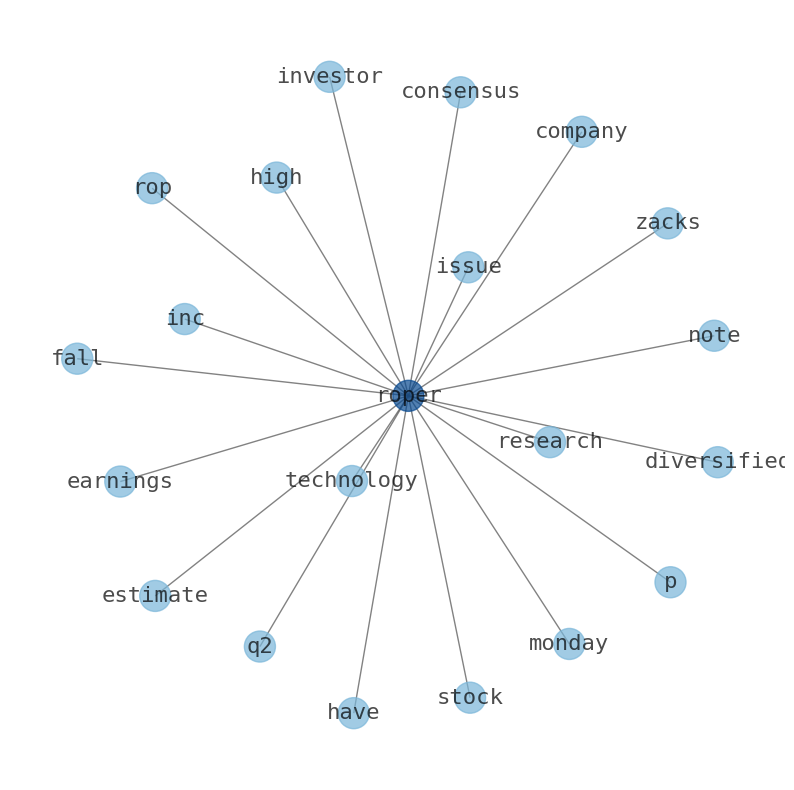

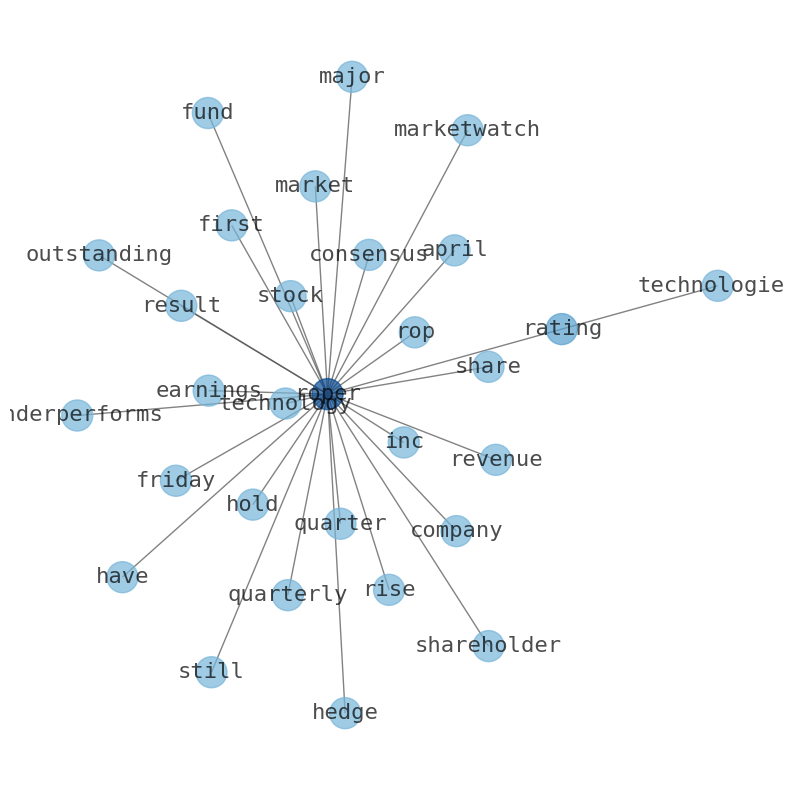

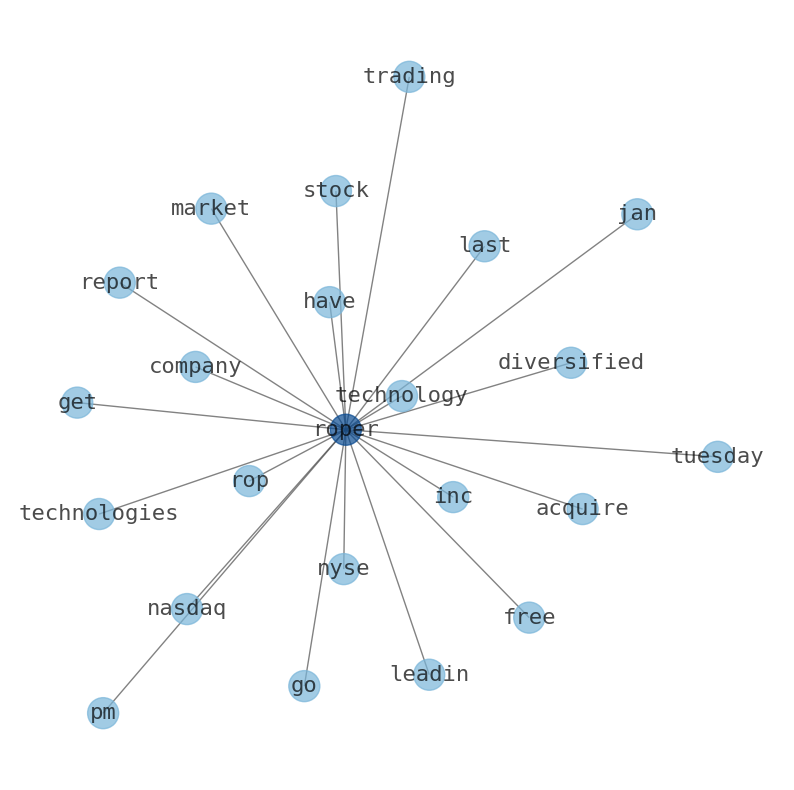

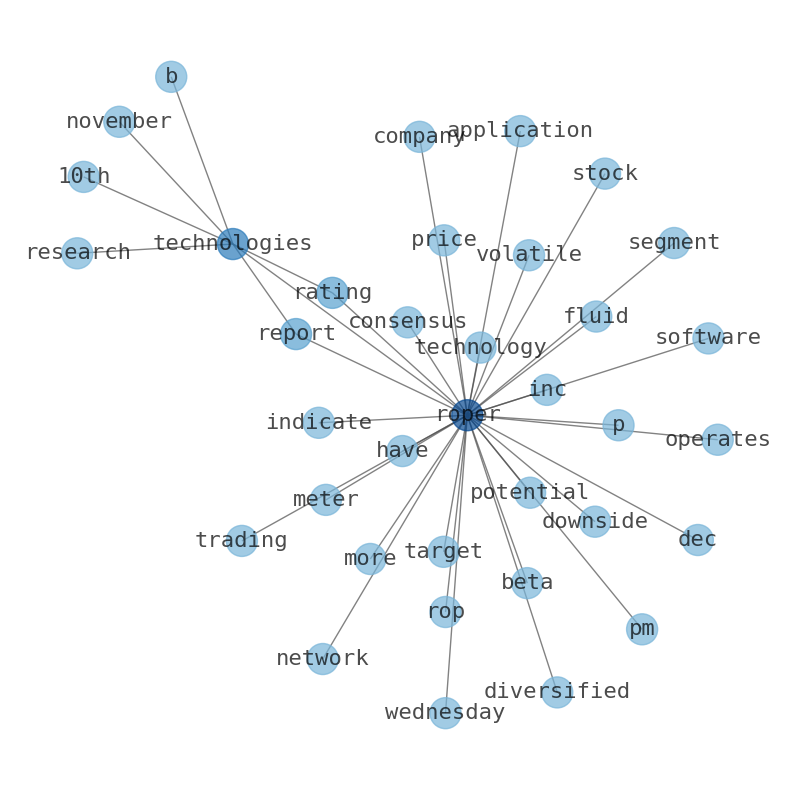

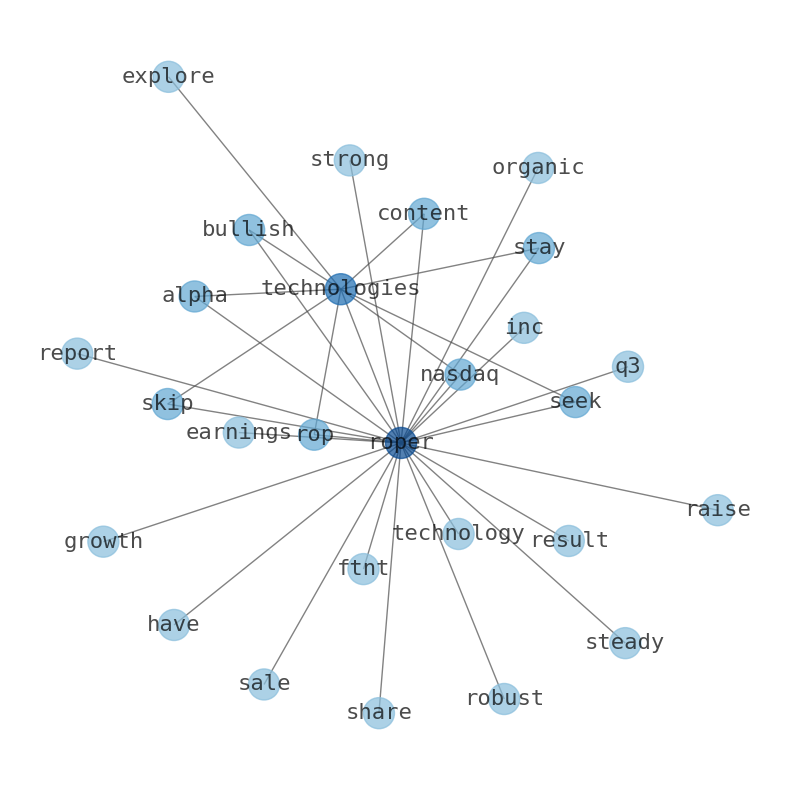

The game is changing. There is a new strategy to evaluate Roper Technologies fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Roper Technologies are: Roper, earnings, estimate, Technologies, year, consensus, share, …

Stock Summary

Roper Technologies, Inc. designs and develops software, and technology enabled products and solutions. The company offers management, campus solutions, diagnostic and laboratory information management, enterprise management, and transportation management. It also provides cloud-based data,.

Today's Summary

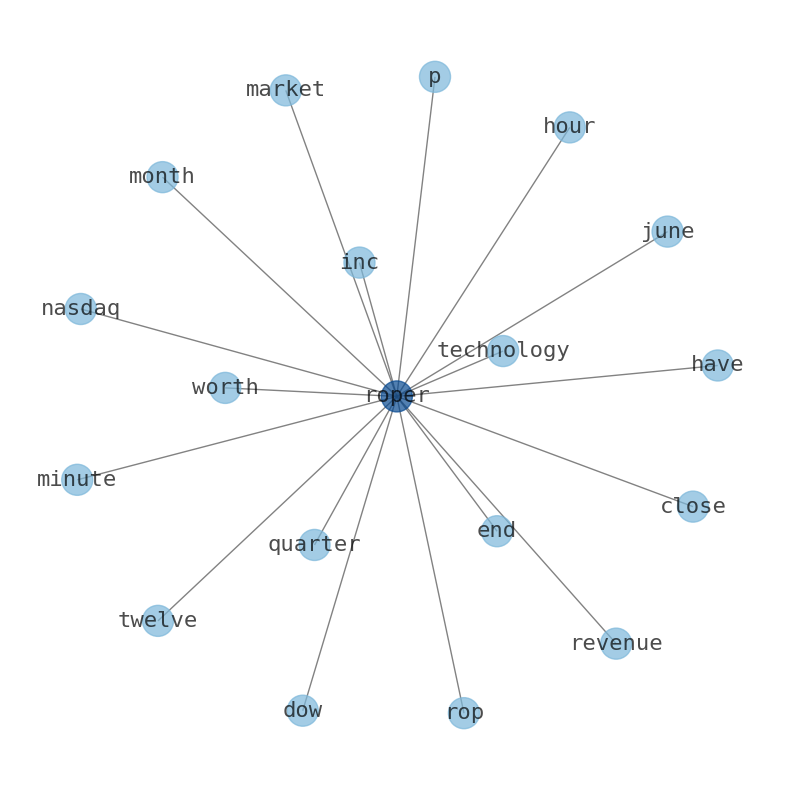

Roper Technologies has grown 26% each year, compound, over three years. The company maintained stable EBIT margins over the last year, all while growing revenue 15%. Roper Technology is a constituent of the Nasdaq 100, S&P 500 and Fortune 1000.

Today's News

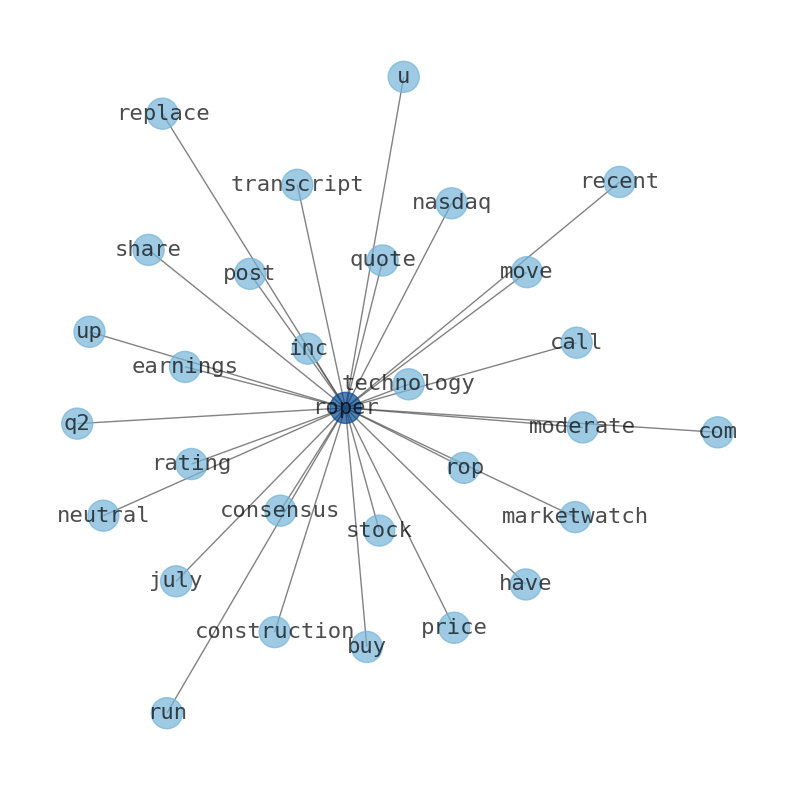

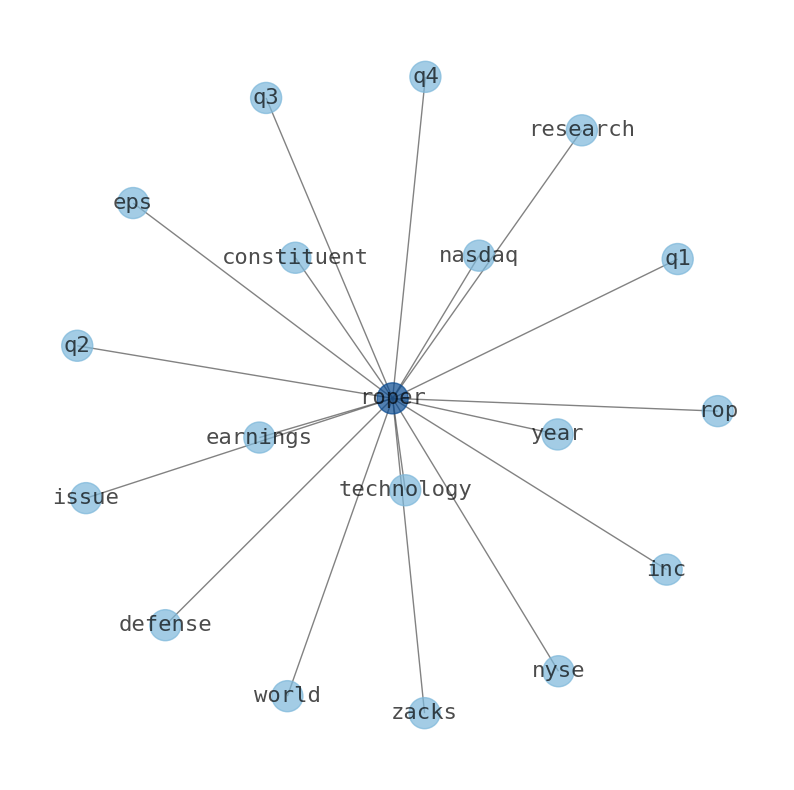

Zacks Research estimates for Roper Technologies Q1 2024 earnings at $4.39 EPS, Q2 2024 earnings, Q3 2024 earnings and Q4 2024 earnings. The consensus earnings estimate is $18.11 per share. ROP has been the subject of several other reports. Q2 2025 earnings estimate for Roper Technologies, Inc. (NYSE:ROP) issued by zacks research - defense world. (nyse:rop) Issued by Defense World Staff on Feb 23rd, 2024. The consensus estimate is $18.07 per share. Roper Technologies has grown 26% each year, compound, over three years. The company maintained stable EBIT margins over the last year, all while growing revenue 15%. Roper Technologies schedules fourth quarter 2023 financial results conference call. Roper technologies employee forced to retire? Roper Technology is a constituent of the Nasdaq 100, S&P 500 and Fortune 1000.

Stock Profile

"Roper Technologies, Inc. designs and develops software, and technology enabled products and solutions. The company offers management, campus solutions, diagnostic and laboratory information management, enterprise management, information solutions, transportation management, financial and compliance management, and cloud-based financial analytics and performance management software; cloud-based software to the property and casualty insurance industry; and software, services, and technologies for foodservice operations. It also provides cloud-based data, collaboration, and estimating automation software; electronic marketplace; visual effects and 3D content software; wireless sensor network and solutions; cloud-based software for the life insurance and financial services industries; supply chain software; health care service and software; RFID card readers; data analytics and information; and pharmacy software solutions. In addition, the company offers ultrasound accessories; dispensers and metering pumps; automated surgical scrub and linen dispensing equipment; water meters; optical and electromagnetic measurement systems; and medical devices. It distributes and sells its products through direct sales, manufacturers' representatives, resellers, and distributors. The company was formerly known as Roper Industries, Inc. and changed its name to Roper Technologies, Inc. in April 2015. The company was incorporated in 1981 and is based in Sarasota, Florida."

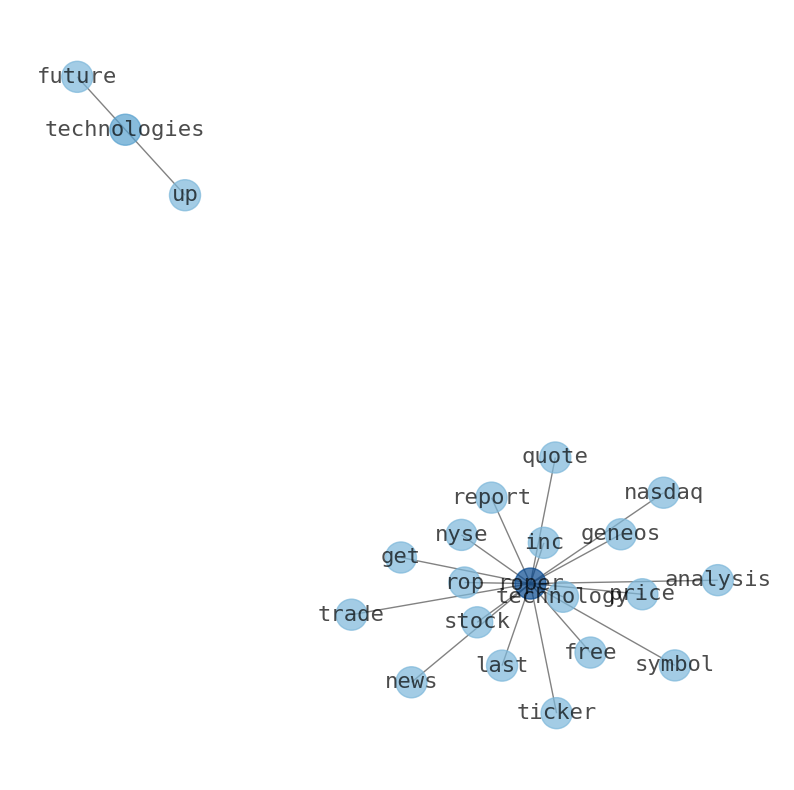

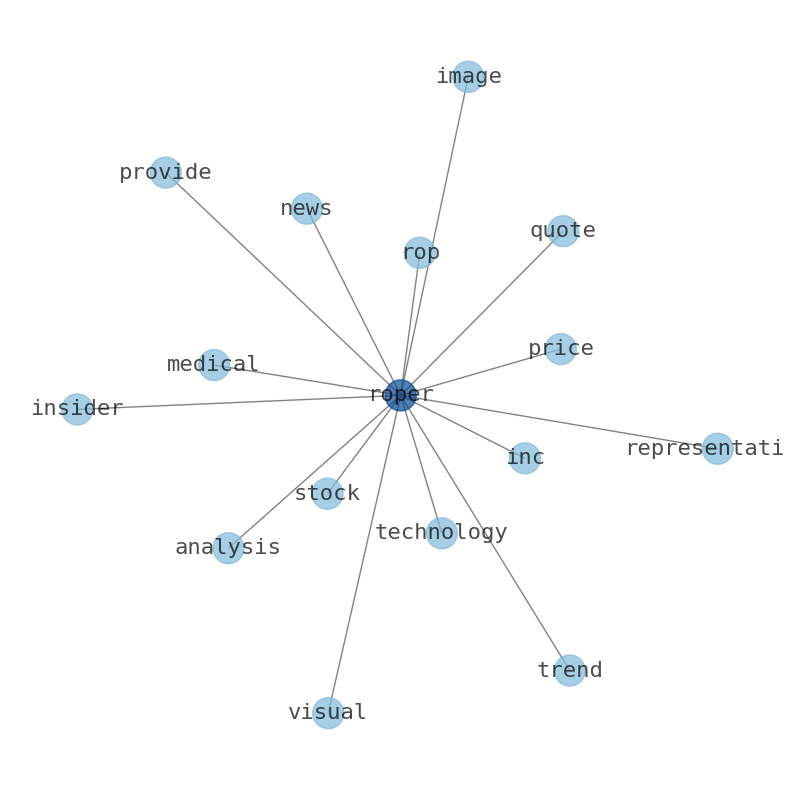

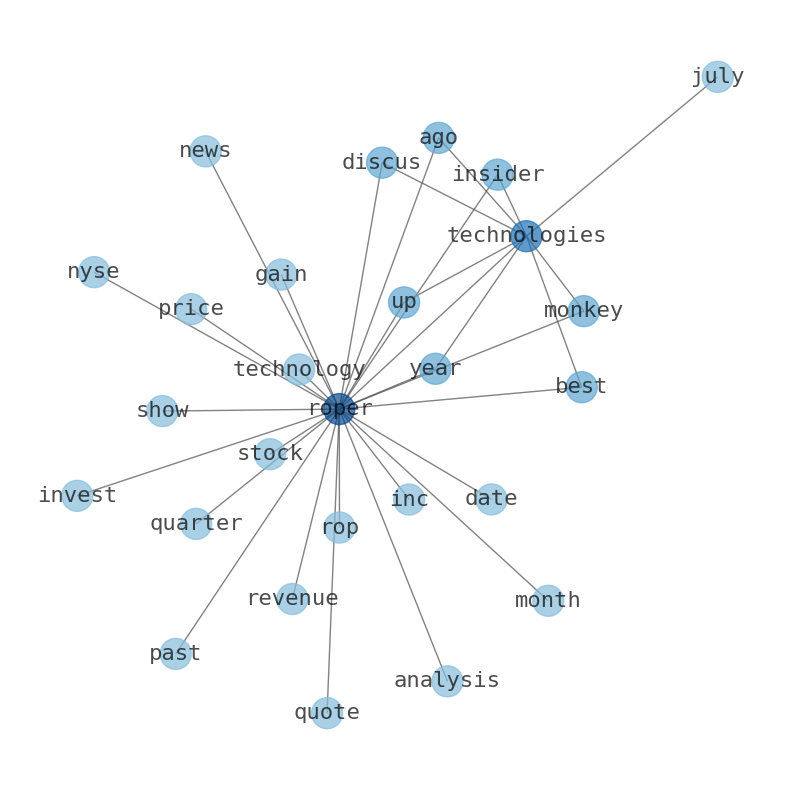

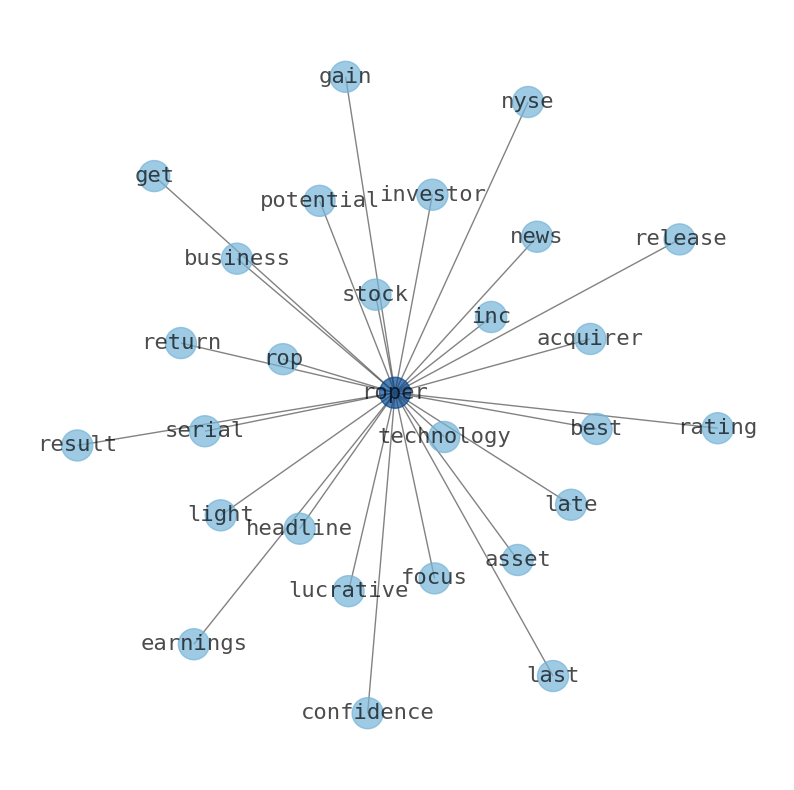

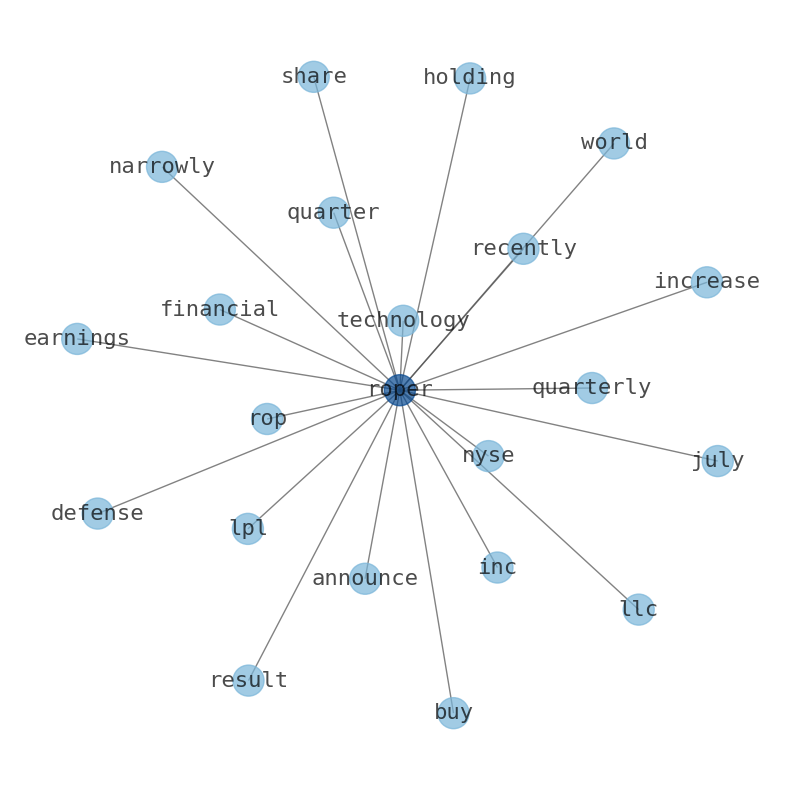

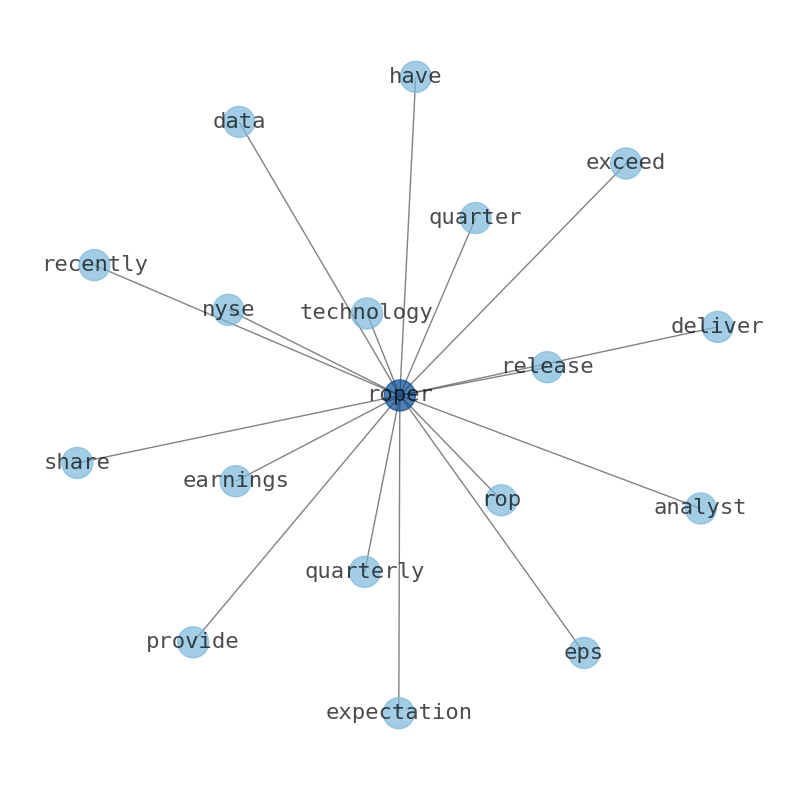

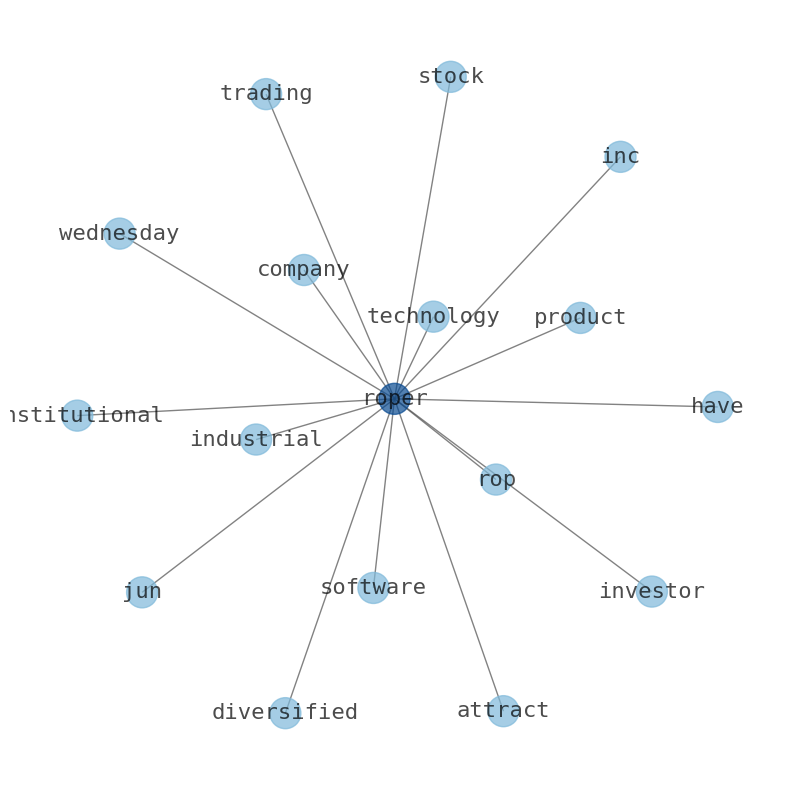

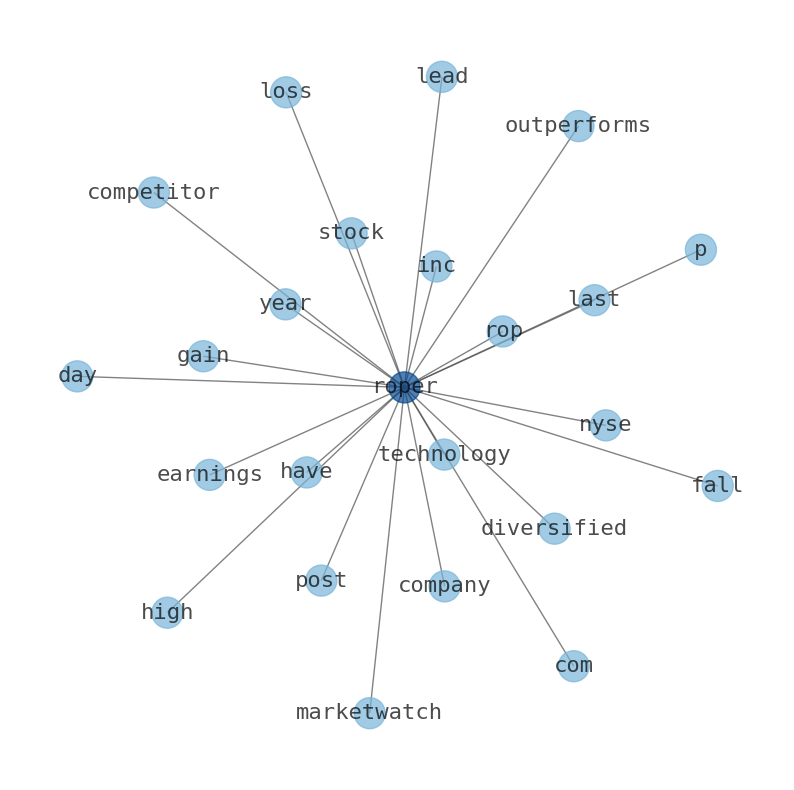

Keywords

Are looking for the most relevant information about Roper Technologies? Investor spend a lot of time searching for information to make investment decisions in Roper Technologies. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Roper Technologies are: Roper, earnings, estimate, Technologies, year, consensus, share, and the most common words in the summary are: roper, report, technology, free, halal, uncomfortable, comfortable, . One of the sentences in the summary was: The company maintained stable EBIT margins over the last year, all while growing revenue 15%. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #roper #report #technology #free #halal #uncomfortable #comfortable.

Read more →Related Results

Roper Technologies

Open: 546.17 Close: 545.95 Change: -0.22

Read more →

Roper Technologies

Open: 558.26 Close: 561.48 Change: 3.22

Read more →

Roper Technologies

Open: 543.15 Close: 542.85 Change: -0.3

Read more →

Roper Technologies

Open: 533.45 Close: 536.6 Change: 3.15

Read more →

Roper Technologies

Open: 495.38 Close: 494.85 Change: -0.54

Read more →

Roper Technologies

Open: 494.53 Close: 492.4 Change: -2.13

Read more →

Roper Technologies

Open: 480.1 Close: 477.23 Change: -2.87

Read more →

Roper Technologies

Open: 451.99 Close: 451.8 Change: -0.19

Read more →

Roper Technologies

Open: 455.04 Close: 458.86 Change: 3.82

Read more →

Roper Technologies

Open: 452.0 Close: 454.78 Change: 2.78

Read more →

Roper Technologies

Open: 559.16 Close: 556.87 Change: -2.29

Read more →

Roper Technologies

Open: 525.0 Close: 523.07 Change: -1.93

Read more →

Roper Technologies

Open: 544.44 Close: 542.97 Change: -1.47

Read more →

Roper Technologies

Open: 503.0 Close: 507.06 Change: 4.06

Read more →

Roper Technologies

Open: 487.31 Close: 487.57 Change: 0.26

Read more →

Roper Technologies

Open: 477.98 Close: 477.63 Change: -0.35

Read more →

Roper Technologies

Open: 470.97 Close: 471.62 Change: 0.65

Read more →

Roper Technologies

Open: 456.26 Close: 453.97 Change: -2.29

Read more →

Roper Technologies

Open: 459.85 Close: 457.72 Change: -2.13

Read more →

Roper Technologies

Open: 447.06 Close: 447.94 Change: 0.88

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo