The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

ResMed

Youtube Subscribe

Open: 219.8 Close: 217.94 Change: -1.86

The 10 top things that an AI found about ResMed... they will surprise you

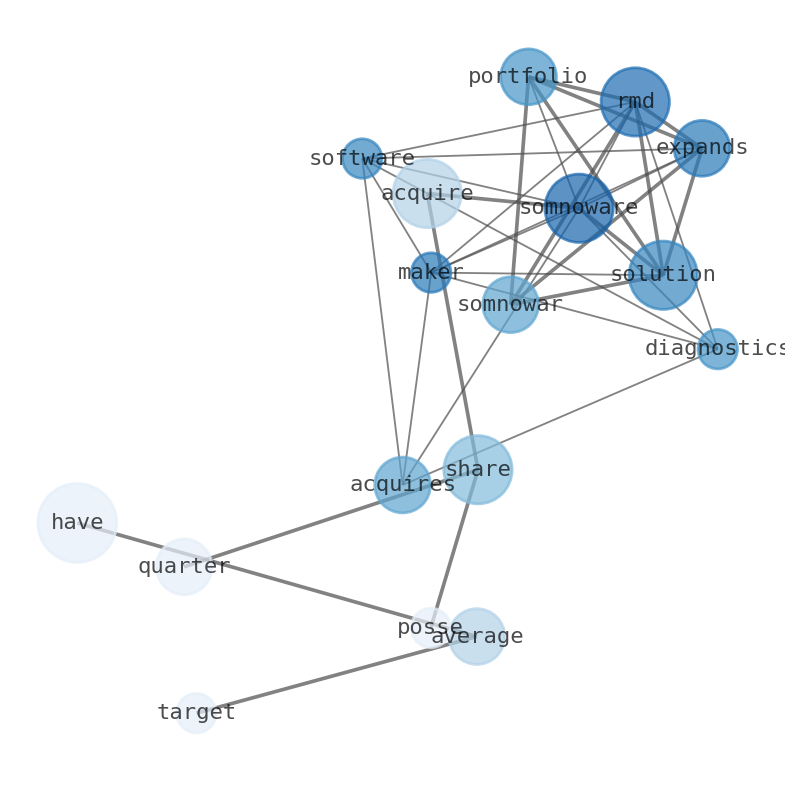

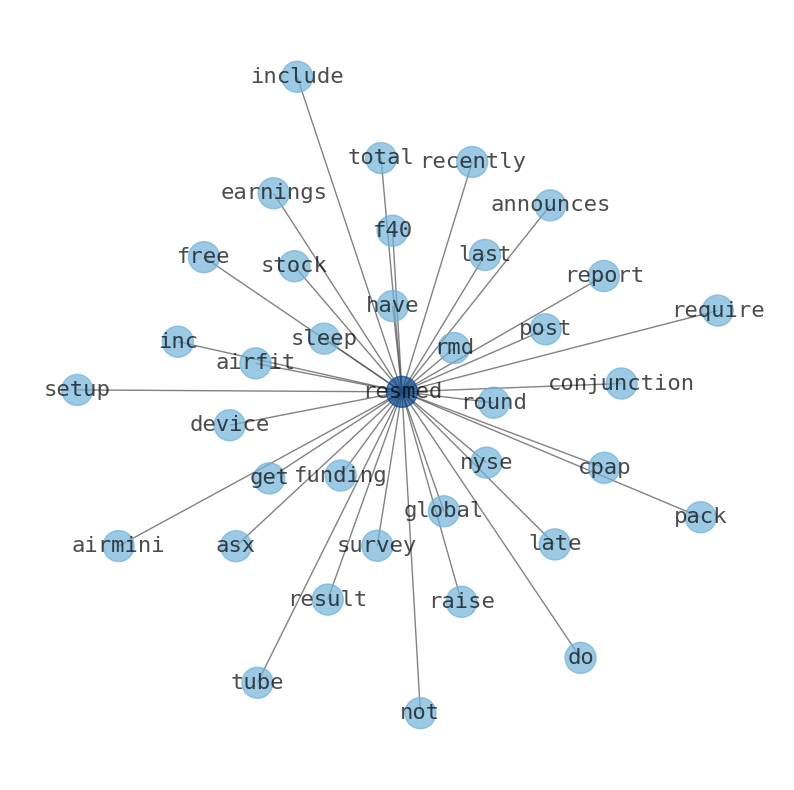

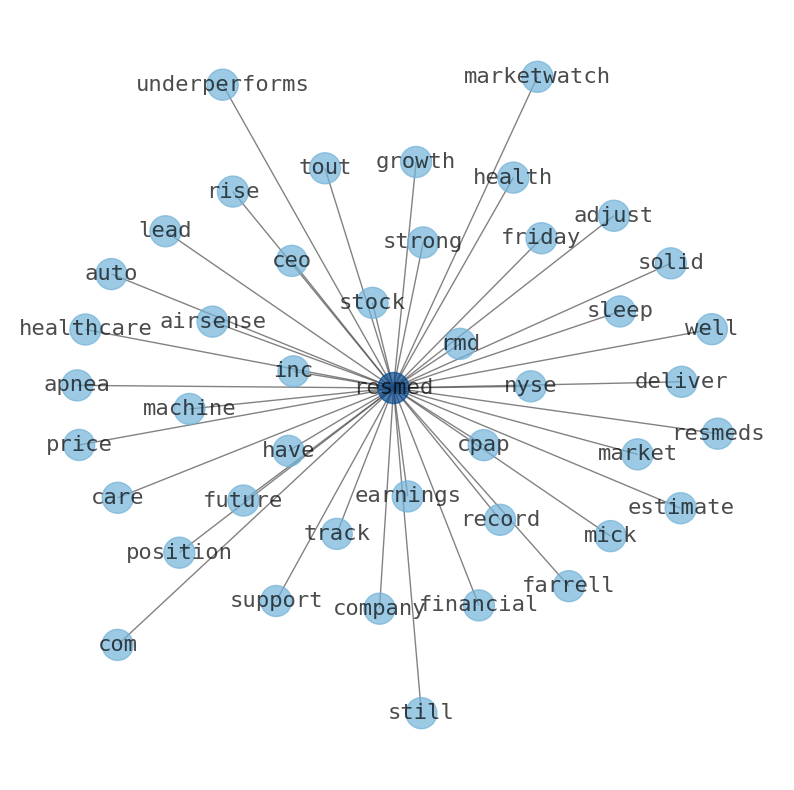

The game is changing. There is a new strategy to evaluate ResMed fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about ResMed are: ResMed, acquire, share, Resmed, solution, RMD, quarter, and the …

Stock Summary

ResMed Inc. develops, manufactures, distributes, and markets medical devices and cloud-based software applications. The company also provides AirView, a cloud--based system that enables remote monitoring and changing of patients' device settings..

Today's Summary

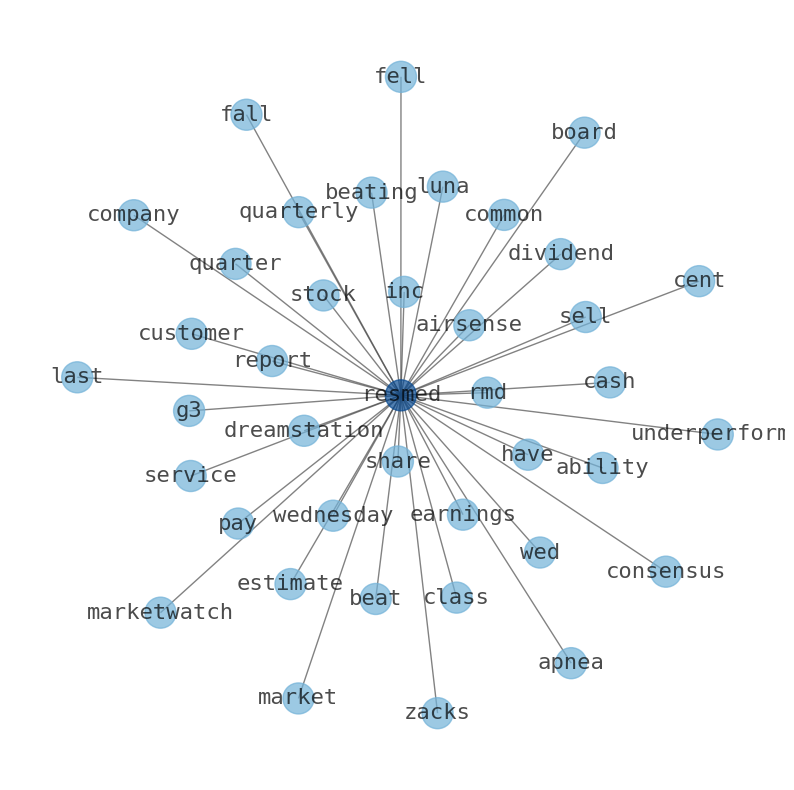

ResMed delivered earnings and revenue surprises of 7.01% and 7.95% for the quarter ended March 2023. Revenue increased by 29% to $1,116.9 million; up 31% on a constant currency basis. Mackenzie Financial Corp has experienced an astonishing 597.8% growth in its stake in ResMed.

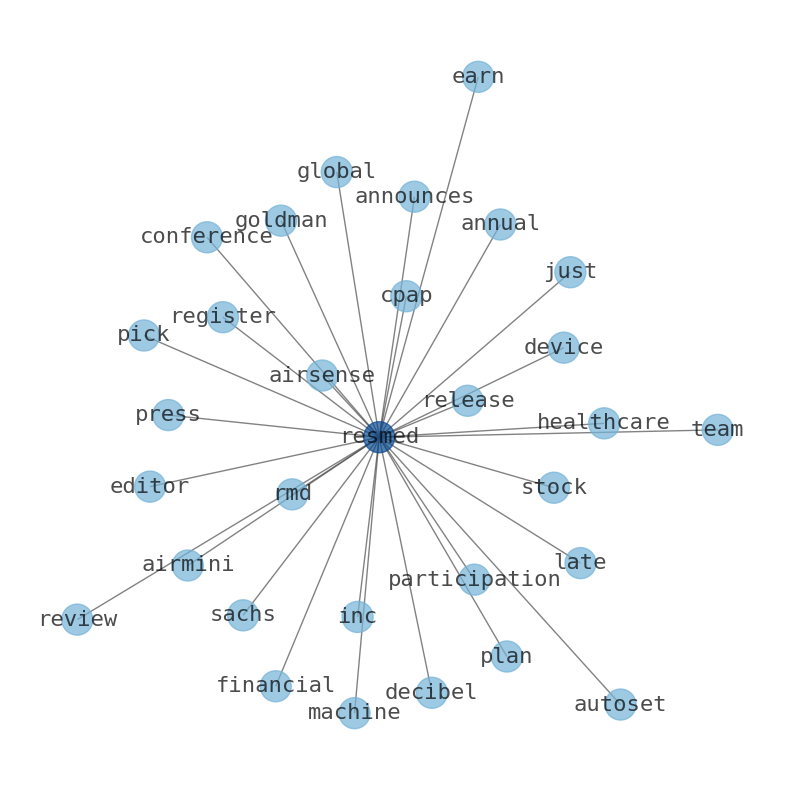

Today's News

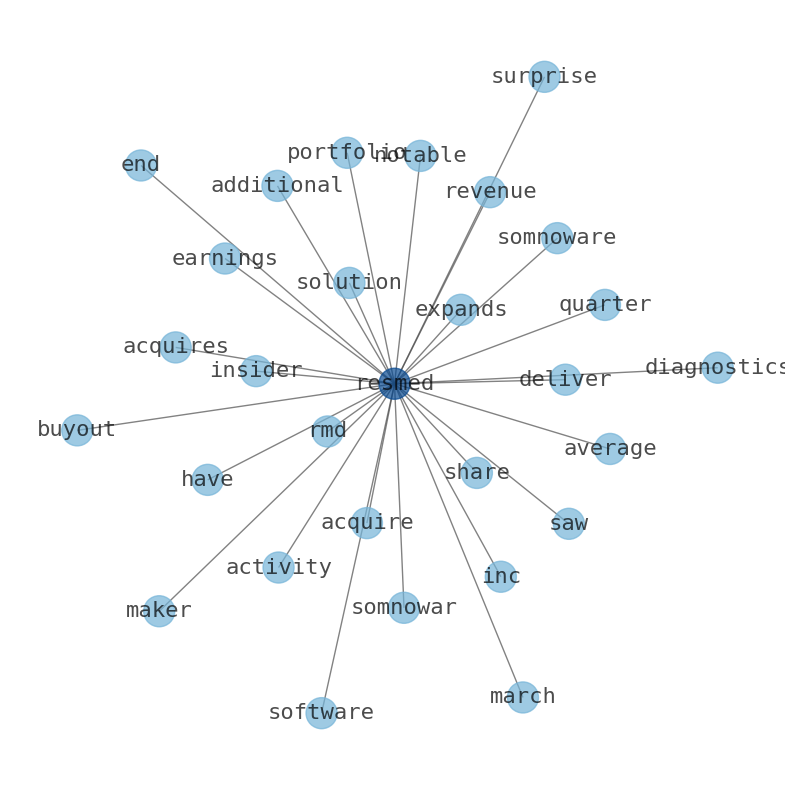

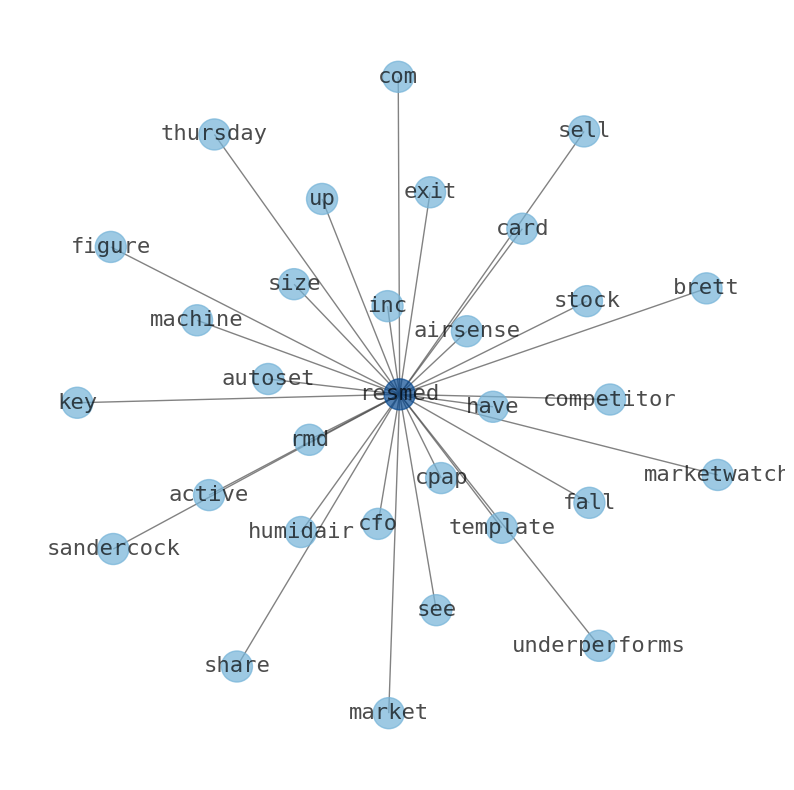

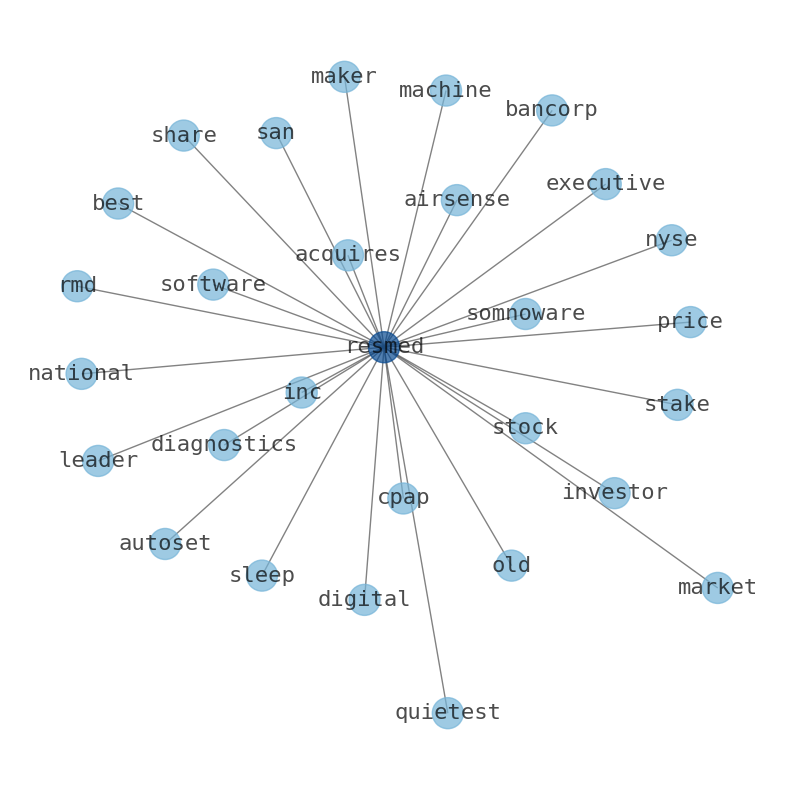

Resmed acquires diagnostics software maker somnoware. Resmed (rmd) expands solutions portfolio with somnowar buyout. ResMed (RMD) Expands Solutions Portfolio With Somnowar. ResMed (RMD) delivered earnings and revenue surprises of 7.01% and 7.95% for the quarter ended March 2023. Revenue increased by 29% to $1,116.9 million; up 31% on a constant currency basis. David Pendarvis, chief administrative officer, global general counsel, and secretary, plans to retire. ResMed has an average rating of “Moderate Buy” and an average target price of $263.43. ResMeds dividend payout ratio (DPR) is presently 29.98% Mackenzie Financial Corp has experienced an astonishing 597.8% growth in its stake in ResMed Inc. Mackenzie now possesses 135,141 shares of ResMed, after acquiring an additional 115,773 shares throughout the quarter. ResMed saw notable insider activity as CFO Brett Sandercock and insider Kaushik Ghoshal sold shares. ResMed recently acquired privately held Somnoware (also a Medtrade exhibitor). ResMed acquires Somnowares. There are a few universal CPAP batteries designed to work with all machines regardless of voltage or amp requirements. These batteries feature either a dedicated AC or DC outlet, they can power most small appliances. ResMed Inc. has less short interest than most of its peers, according to Benzinga Pro. The company has acquired Somnoware, which will integrate its offerings into the ResMed brand and solution ecosystem.

Stock Profile

"ResMed Inc. develops, manufactures, distributes, and markets medical devices and cloud-based software applications for the healthcare markets. The company operates in two segments, Sleep and Respiratory Care, and Software as a Service. It offers various products and solutions for a range of respiratory disorders, including technologies to be applied in medical and consumer products, ventilation devices, diagnostic products, mask systems for use in the hospital and home, headgear and other accessories, dental devices, and cloud-based software informatics solutions to manage patient outcomes, as well as provides customer and business processes. The company also provides AirView, a cloud-based system that enables remote monitoring and changing of patients' device settings; myAir, a personalized therapy management application for patients with sleep apnea that provides support, education, and troubleshooting tools for increased patient engagement and improved compliance; U-Sleep, a compliance monitoring solution that enables home medical equipment (HME)to streamline their sleep programs; connectivity module and propeller solutions; and Propeller portal. It offers out-of-hospital software solution, such as Brightree business management software and service solutions to providers of HME, pharmacy, home infusion, orthotics, and prosthetics services; MatrixCare care management and related ancillary solutions to senior living, skilled nursing, life plan communities, home health, home care, and hospice organizations, as well as related accountable care organizations; and HEALTHCAREfirst that offers electronic health record, software, billing and coding services, and analytics for home health and hospice agencies. The company markets its products primarily to sleep clinics, home healthcare dealers, and hospitals through a network of distributors and direct sales force in approximately 140 countries. ResMed Inc. was founded in 1989 and is headquartered in San Diego, California."

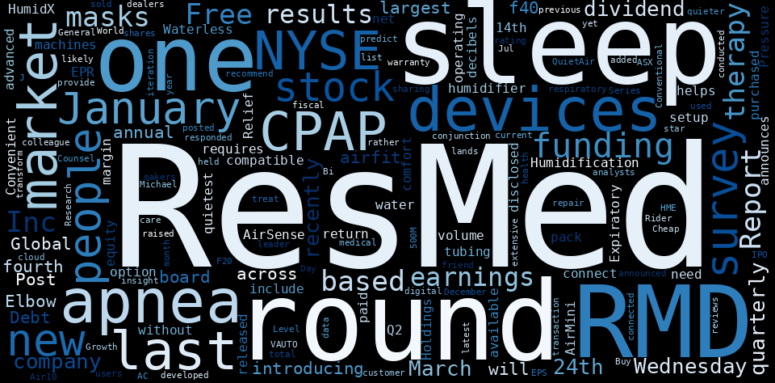

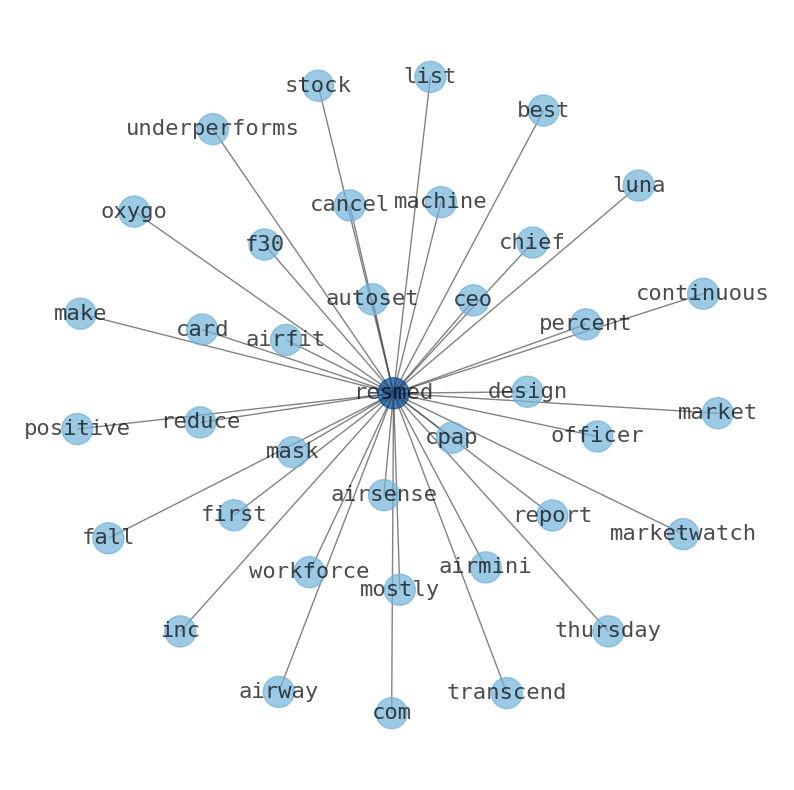

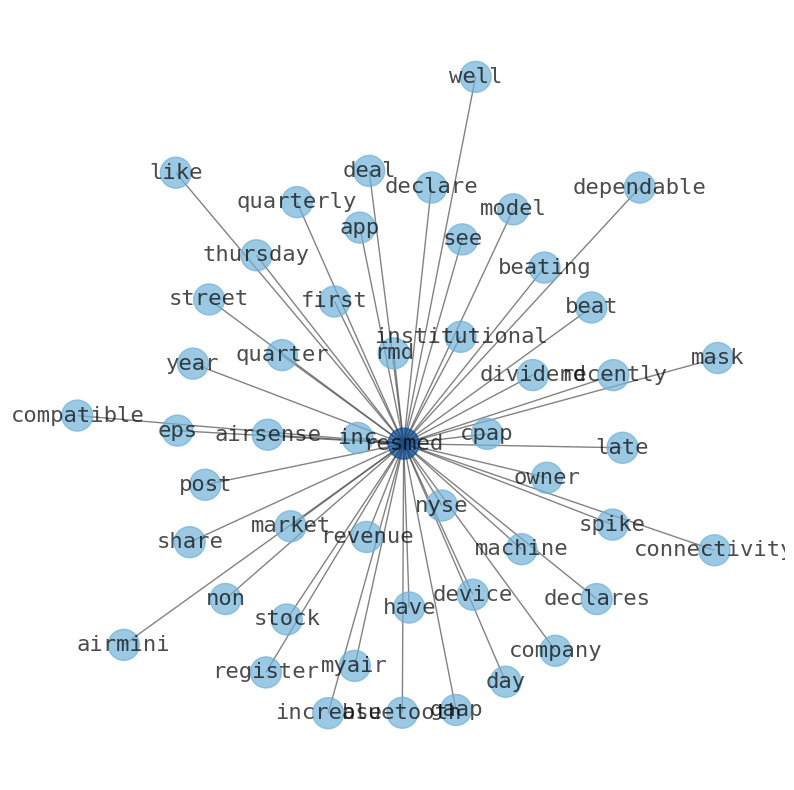

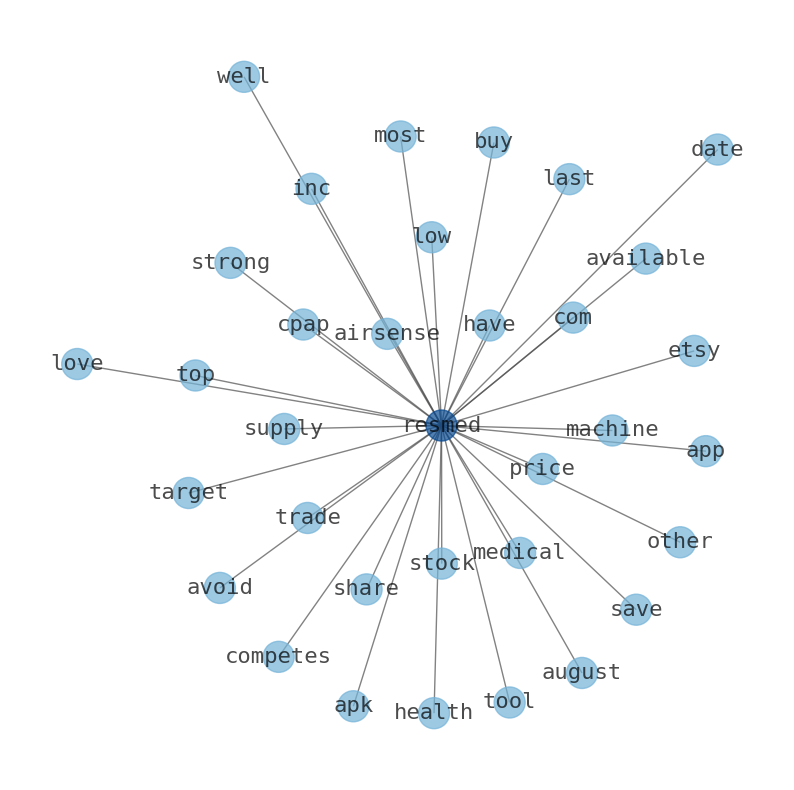

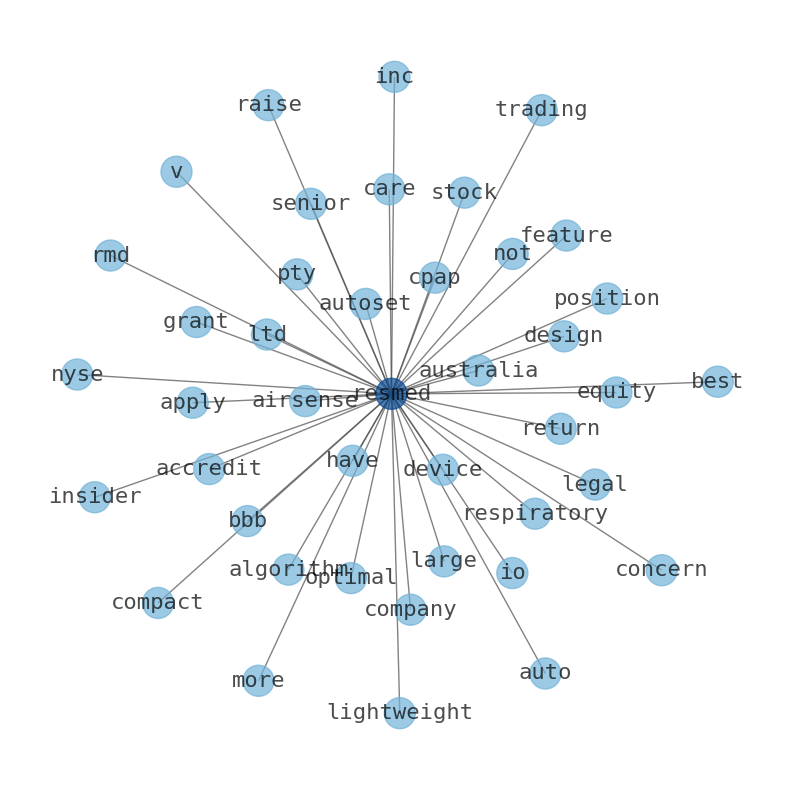

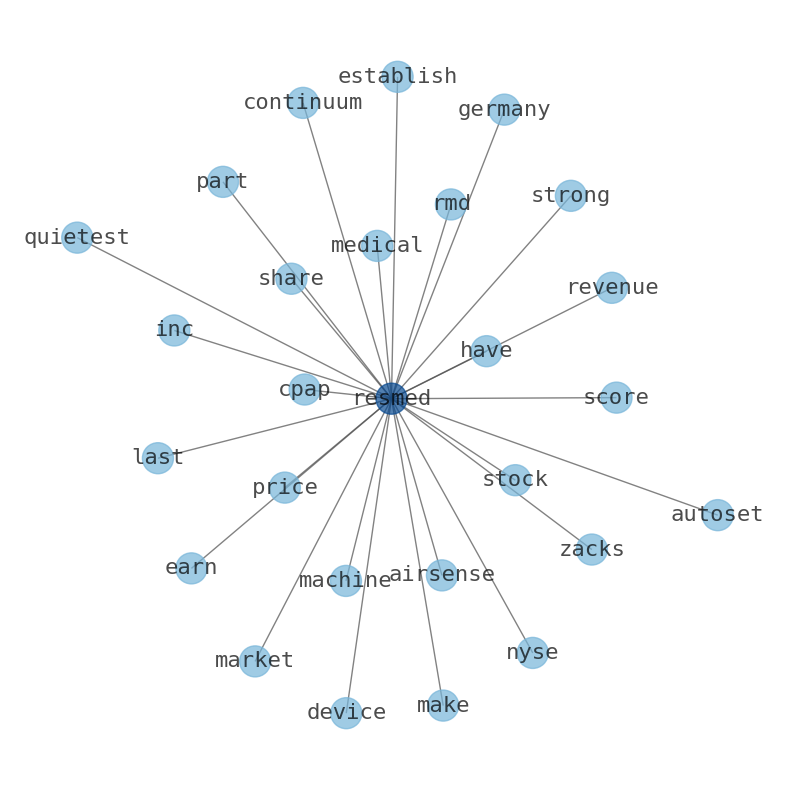

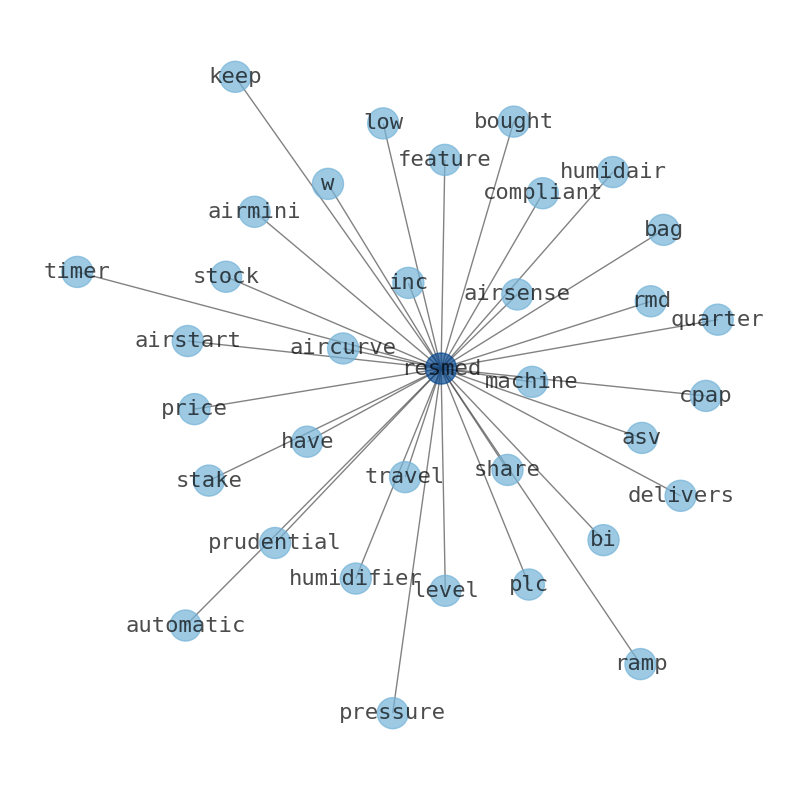

Keywords

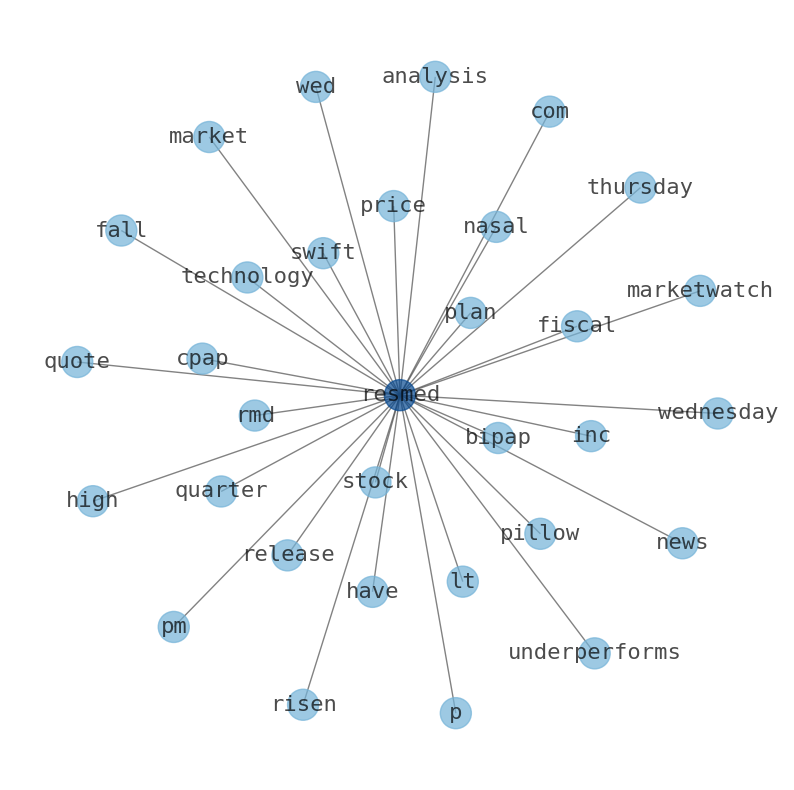

This document will help you to evaluate ResMed without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about ResMed are: ResMed, acquire, share, Resmed, solution, RMD, quarter, and the most common words in the summary are: resmed, cpap, stock, jul, mask, pm, last, . One of the sentences in the summary was: ResMed delivered earnings and revenue surprises of 7.01% and 7.95% for the quarter ended March 2023. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #resmed #cpap #stock #jul #mask #pm #last.

Read more →Related Results

ResMed

Open: 188.84 Close: 190.05 Change: 1.21

Read more →

ResMed

Open: 179.65 Close: 179.17 Change: -0.48

Read more →

ResMed

Open: 163.67 Close: 162.87 Change: -0.8

Read more →

ResMed

Open: 144.82 Close: 134.65 Change: -10.17

Read more →

ResMed

Open: 145.45 Close: 143.69 Change: -1.76

Read more →

ResMed

Open: 219.8 Close: 217.94 Change: -1.86

Read more →

ResMed

Open: 216.22 Close: 215.27 Change: -0.95

Read more →

ResMed

Open: 174.43 Close: 173.19 Change: -1.24

Read more →

ResMed

Open: 164.58 Close: 167.58 Change: 3.0

Read more →

ResMed

Open: 157.45 Close: 158.51 Change: 1.06

Read more →

ResMed

Open: 151.66 Close: 150.05 Change: -1.61

Read more →

ResMed

Open: 161.15 Close: 159.62 Change: -1.53

Read more →

ResMed

Open: 214.95 Close: 215.0 Change: 0.05

Read more →

ResMed

Open: 215.4 Close: 213.53 Change: -1.87

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo