The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Realty Income

Youtube Subscribe

Open: 50.87 Close: 50.85 Change: -0.02

Our AI found unexpected things about Realty Income Company Inc.

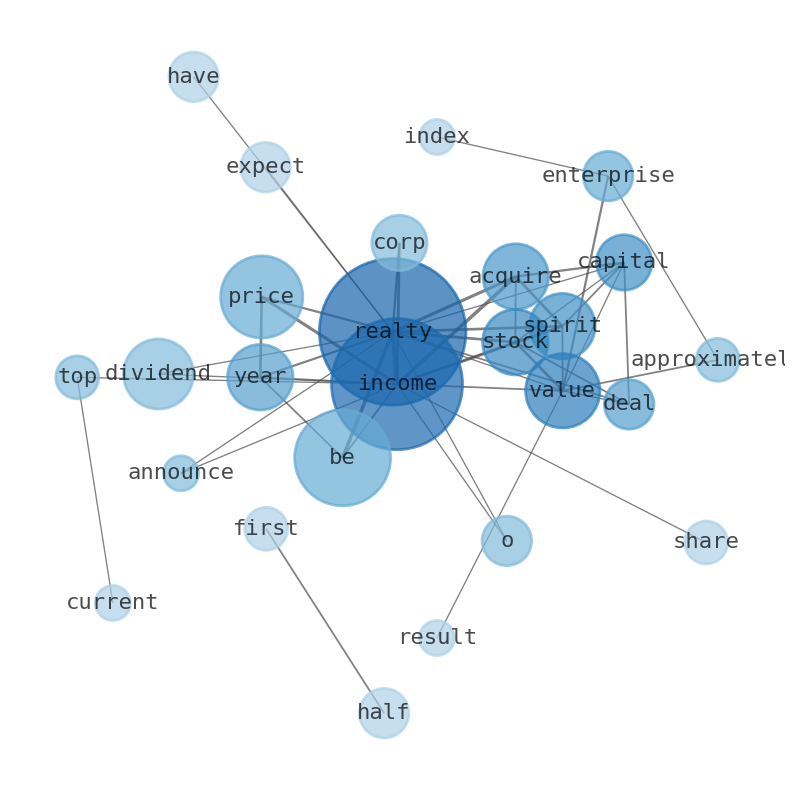

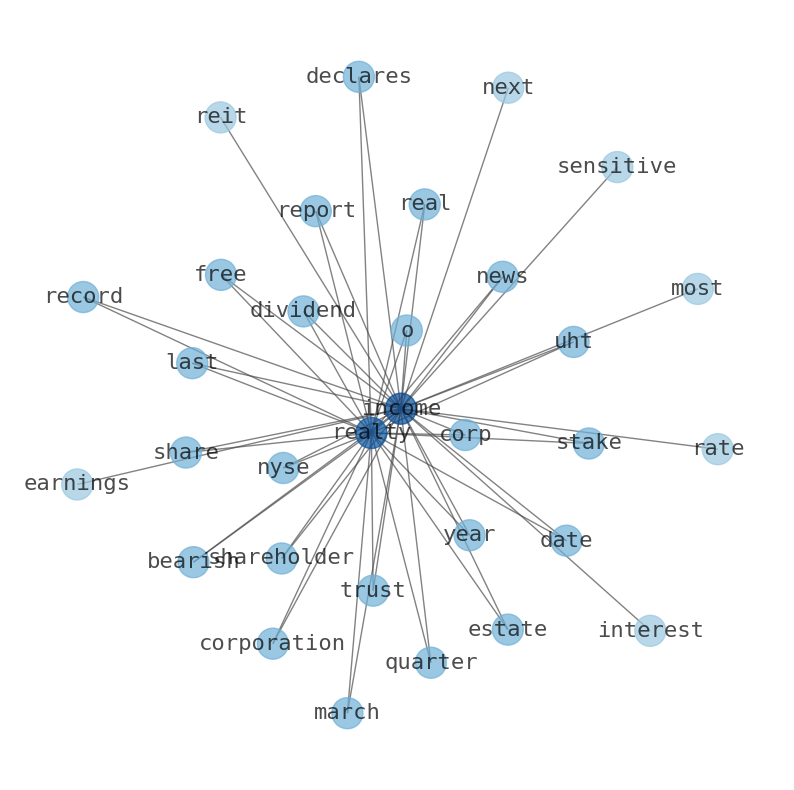

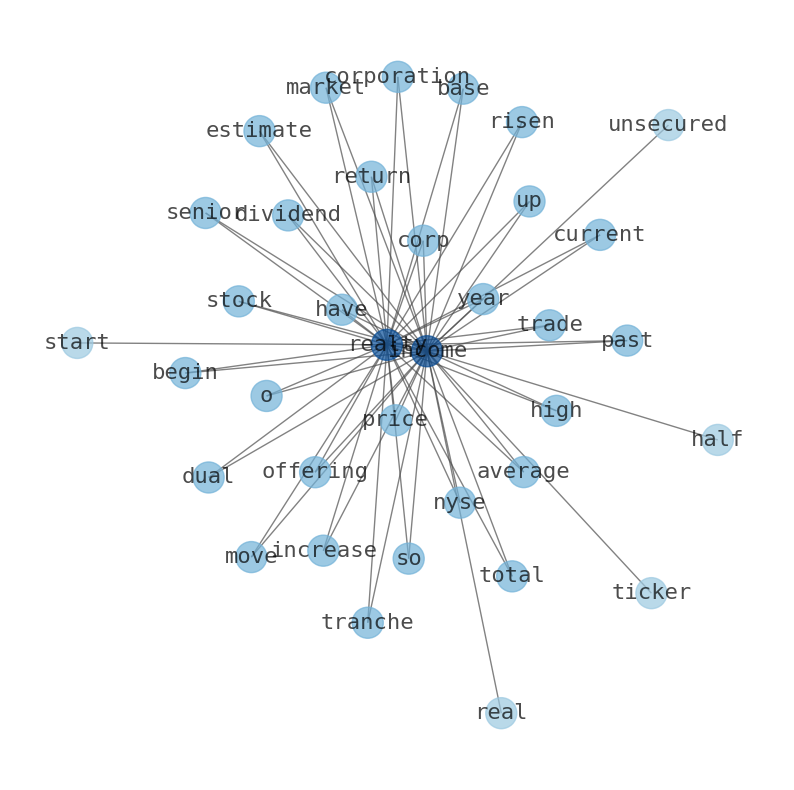

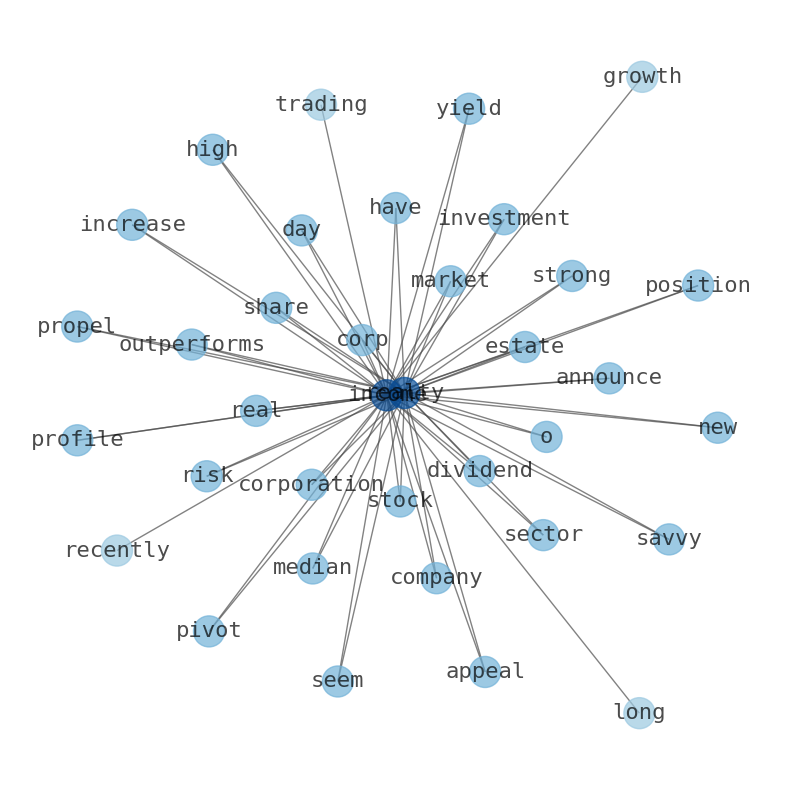

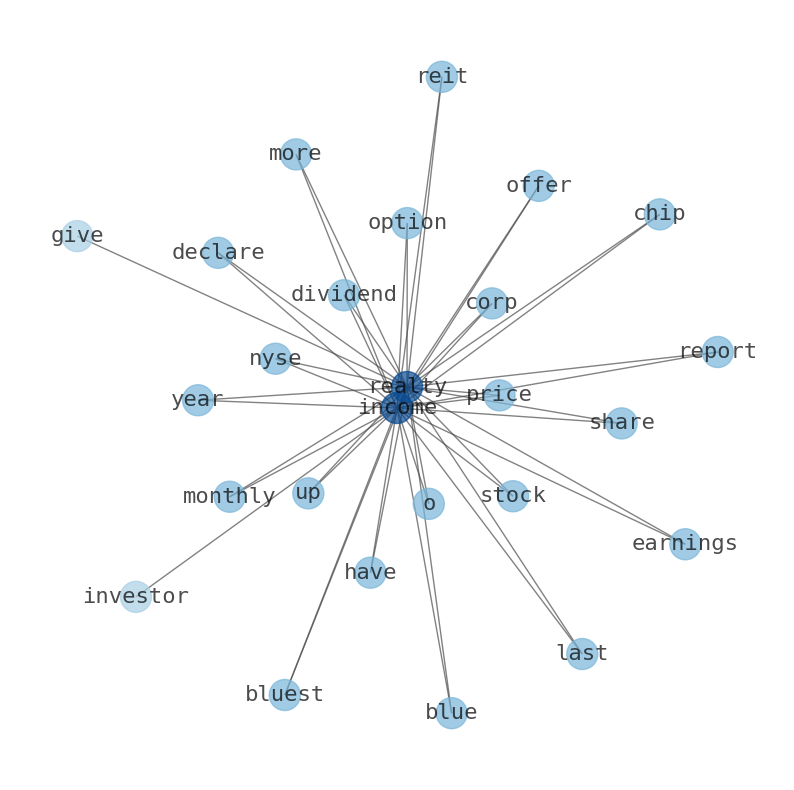

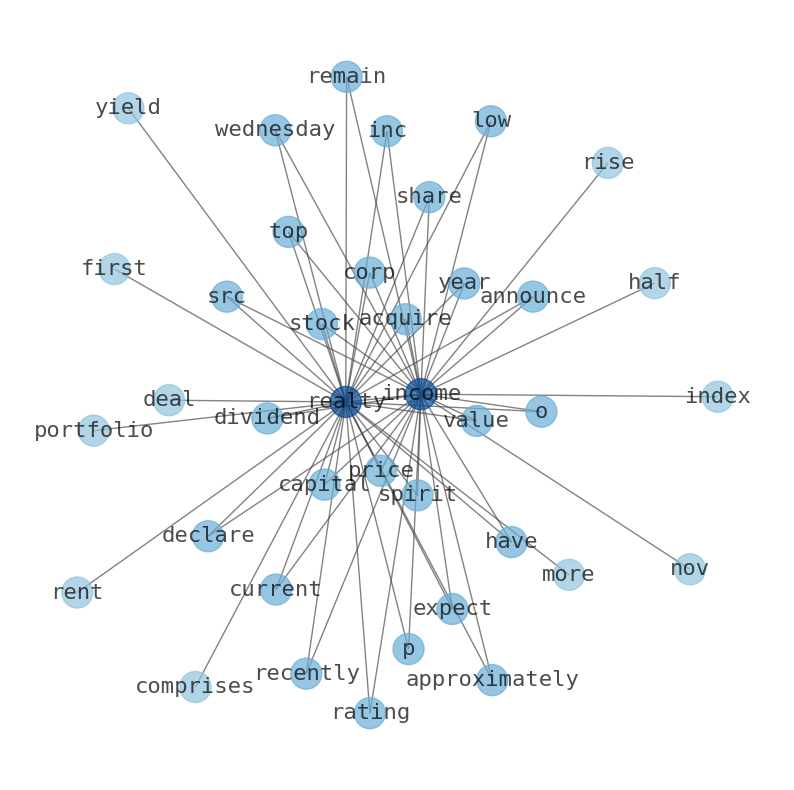

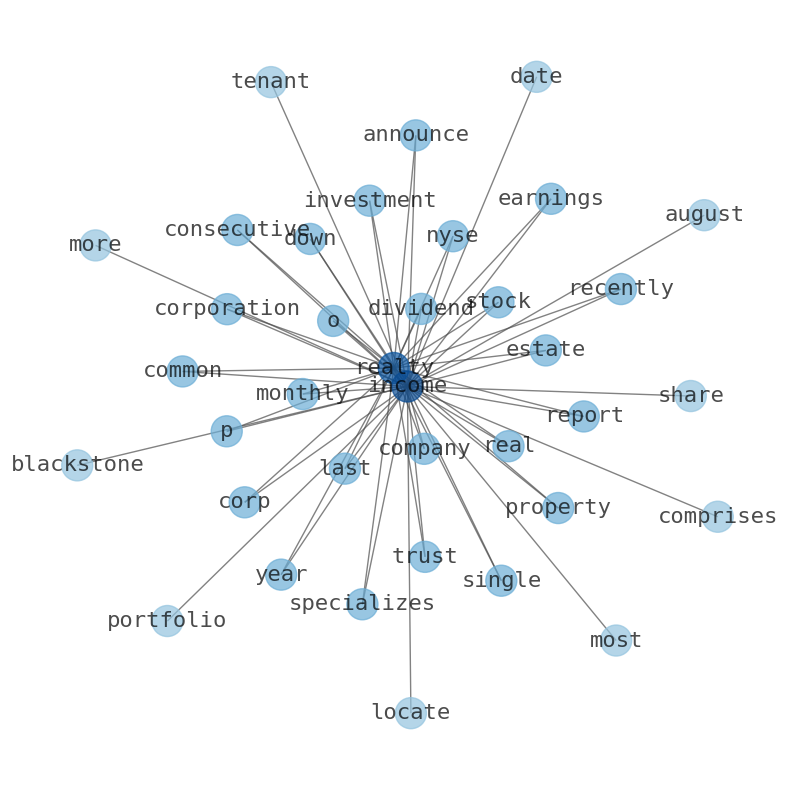

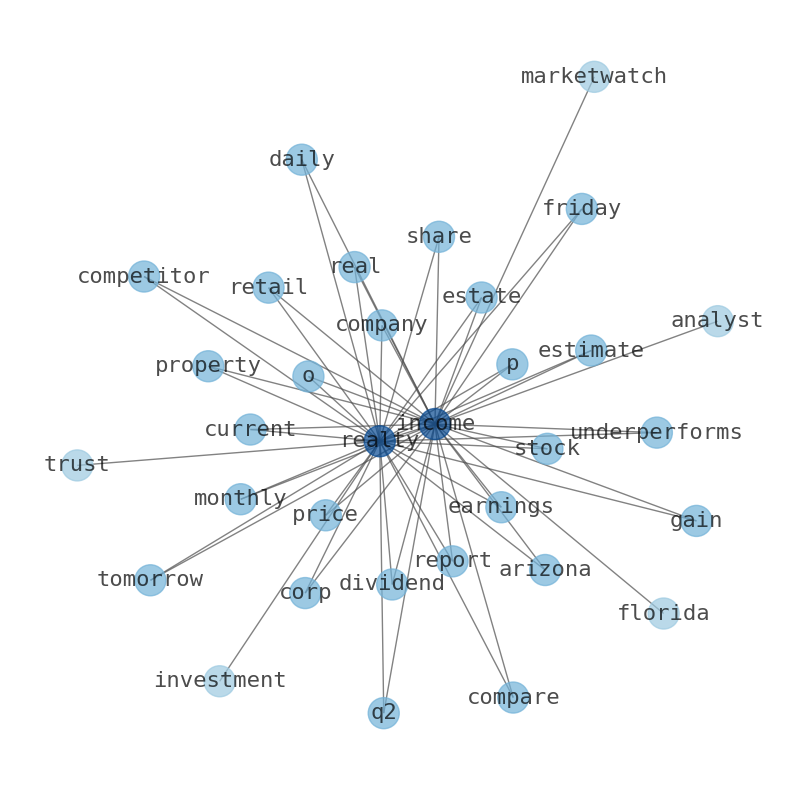

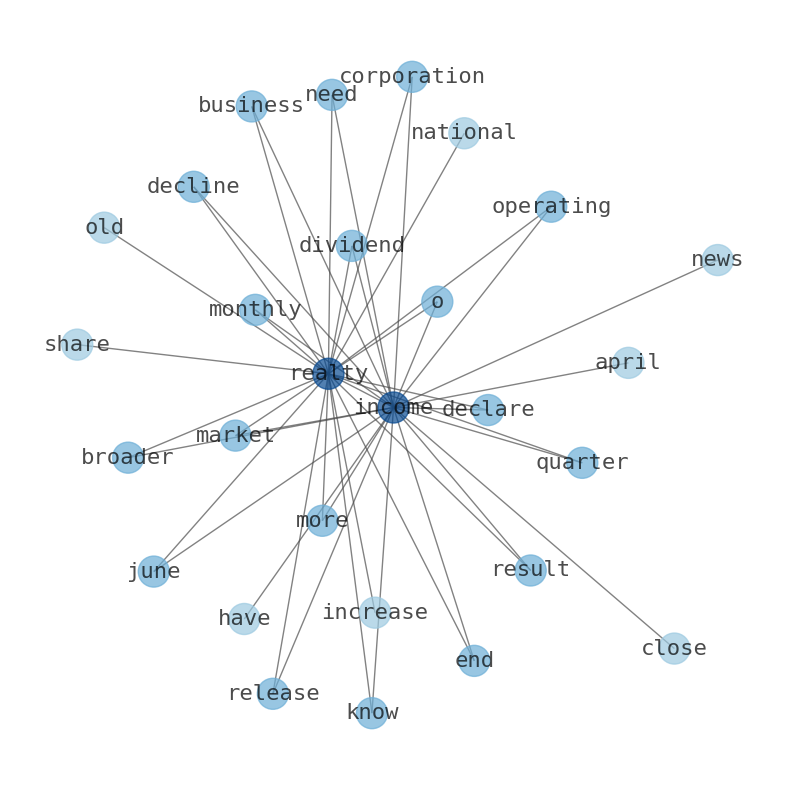

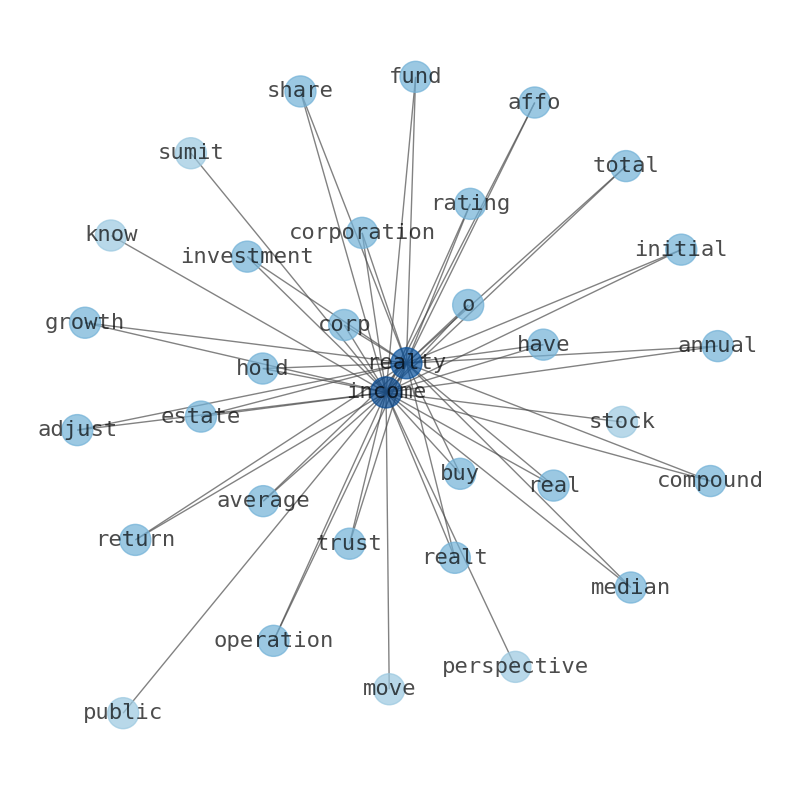

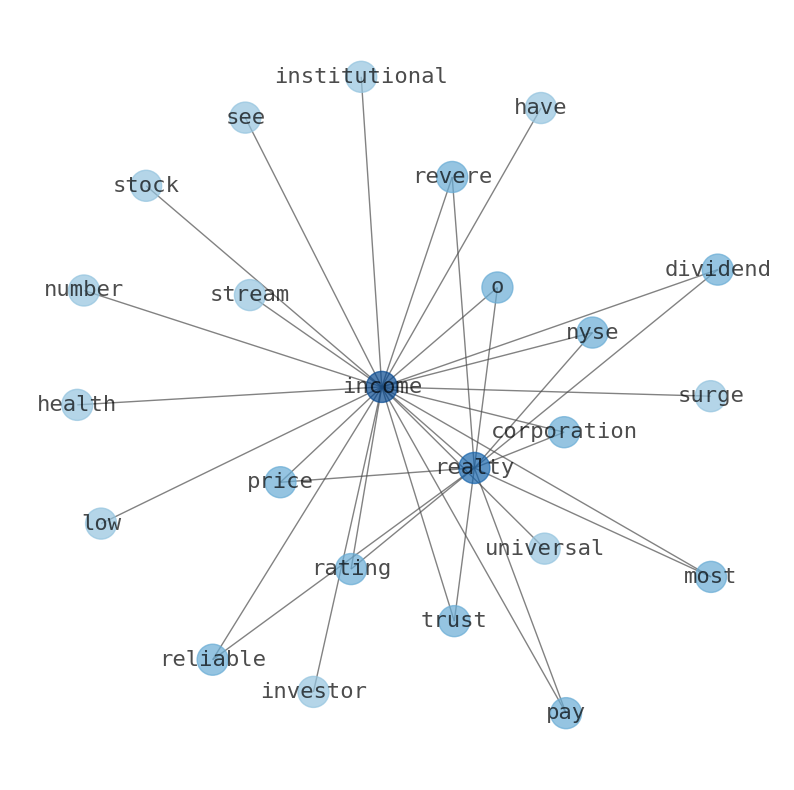

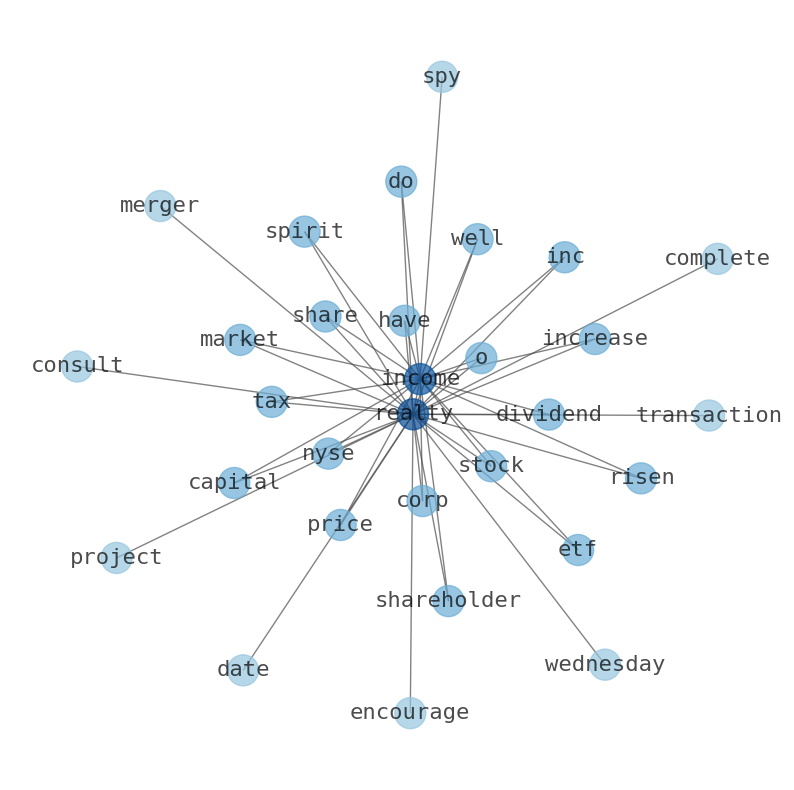

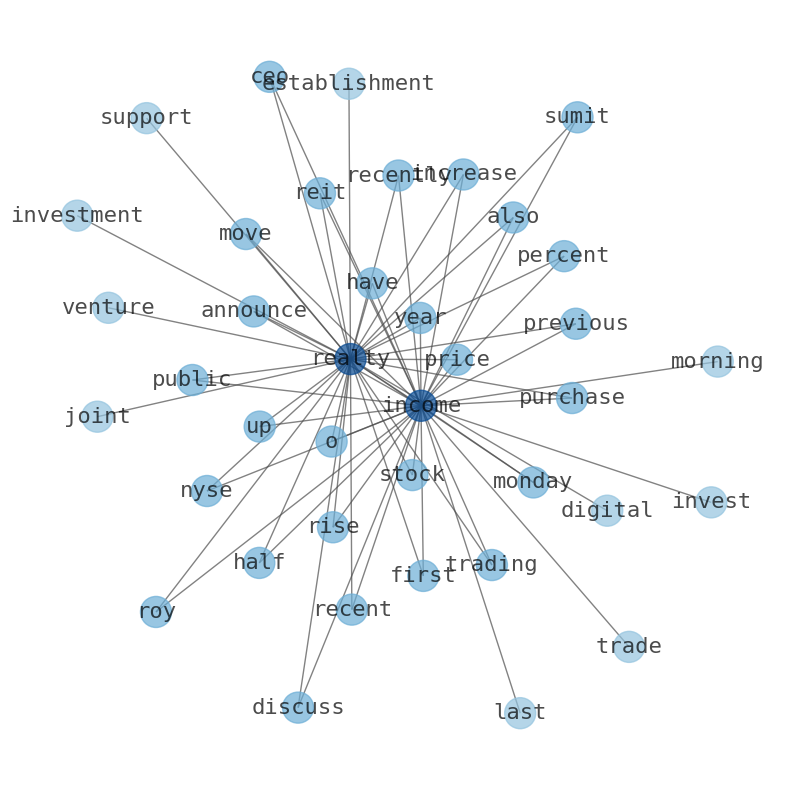

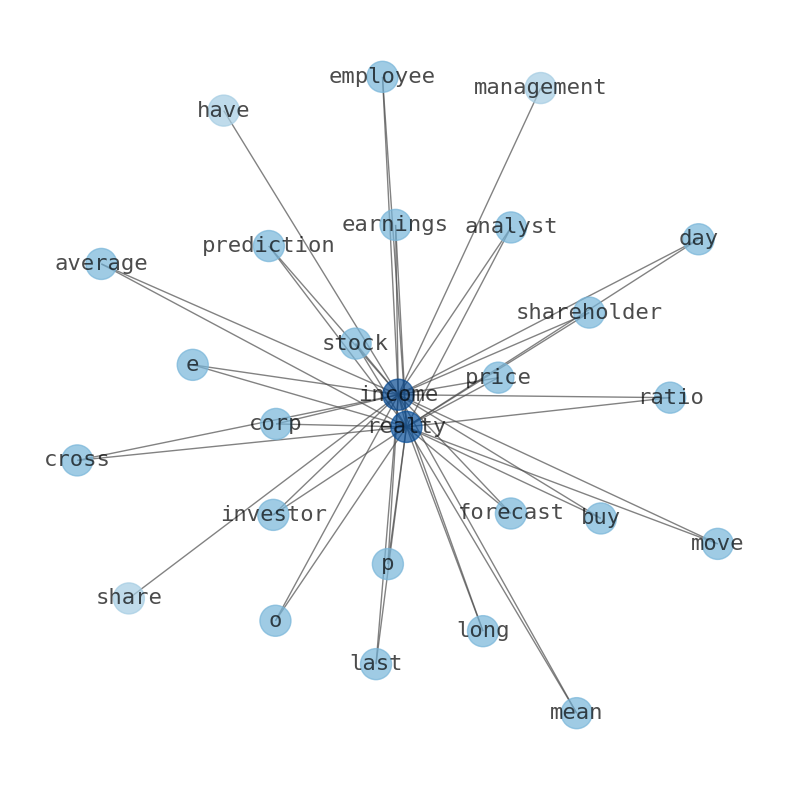

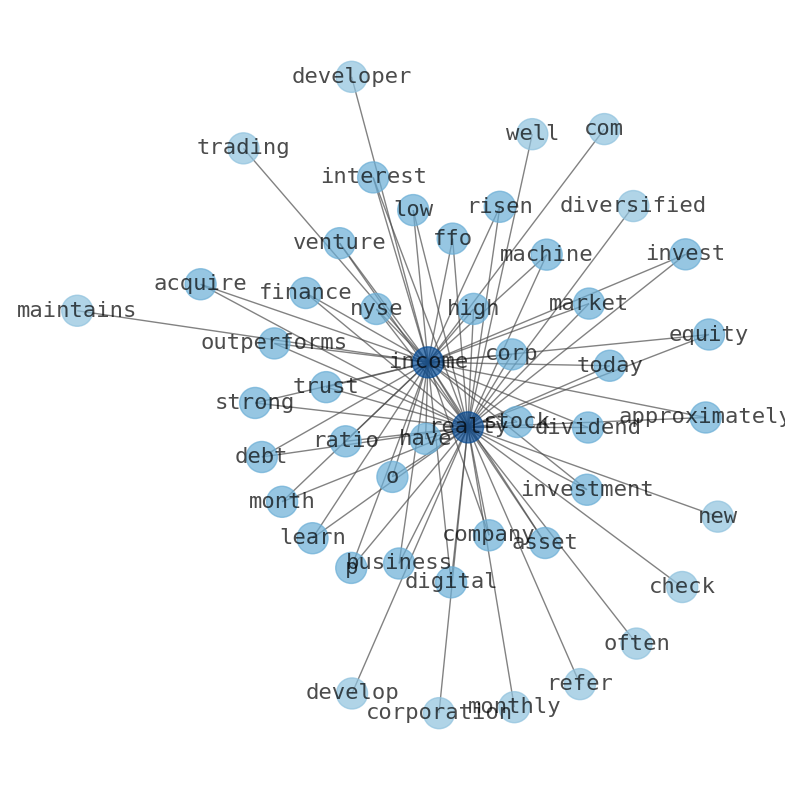

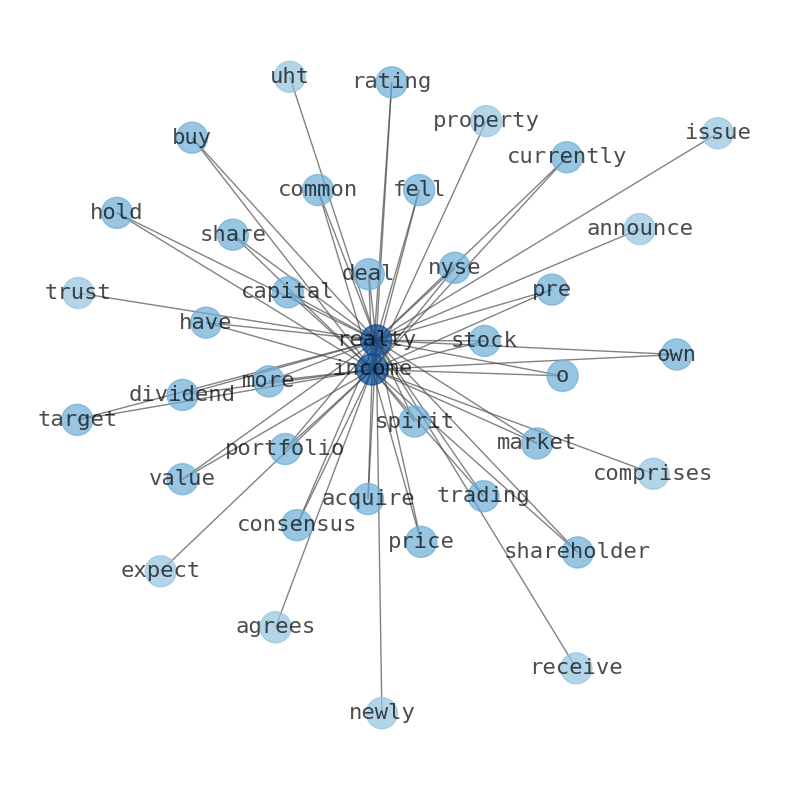

Are looking for the most relevant information about Realty Income? Investor spend a lot of time searching for information to make investment decisions in Realty Income. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Realty Income are: Realty, Income, price, value, income, acquire, Spirit, and the most common words in the summary are: realty, income, stock, dividend, price, market, spirit, . One of the sentences in the summary was: Analysts expect Realty income to post earnings of $1.00 per share …

Stock Summary

Realty Income is an S&P 500 company and member of the S&p 500 Dividend Aristocrats index. The company is structured as a real estate investment trust. To date, the company has declared 632 consecutive monthly.

Today's Summary

Realty Income Corp. is currently on sale and presents a great opportunity to buy high-quality assets at a discounted price. Analysts expect Realty income to post earnings of $1.00 per share for the quarter.

Today's News

Realty Income has agreed to acquire Spirit Realty Capital in an all-stock deal valued at about $9.3 billion. The deal is expected to close in the first quarter of 2024. Realty Income ( NYSE : O) pay a dividend of $ 0.26 per share of Class A Common Stock. Q3 earnings are confirmed for Monday, November 6, 2023. There is no upcoming split for Realty income. Realty Income announced they will acquire Spirit Realty Capital, Inc. It will lower rent concentration for nine of Realty Incomes current top 10 industries and 18 of its current top 20 clients. Realty Income (O) announced its intent to acquire Sprit Realty Capital (SRC) in an all-stock deal valued at $9.3 billion. With sound fundamentals and a dividend yield of 5.03%, its hard to argue against a bullish case for O. Analysts expect Realty Income to post earnings of $1.00 per share for the quarter. Realty Incomes recently declared a nov 23 dividend, which will be paid on Wednesday, November 15th. TheStreet lowered Realty income from a “b-” rating to a ‘c+’ rating in a report on Wednesday. Realty Income Corp is currently on sale and presents a great opportunity to buy high-quality assets at a discounted price. Over a 20-year period, a $10,000 investment would have grown to $25,200 and received an additional $21,000 in dividends. Realty Income will acquire Spirit in an all-stock transaction valued at an enterprise value of approximately $9.3 billion. The merger, once completed, will result in an enterprise. value of $63 billion for the combined company. Realty Income expects to remain in the top 200 of the S&P 500 index and become the 4th largest REIT in the index, by enterprise value, with a total enterprise value of approximately $63 billion. The resulting Realty income stock is expected to trade approximately $300 million of value daily. Realty Income price started in 2023 at $42.46, so the price increased by 16% from the beginning of the year. The forecasted Realty income price at the end of 2023 is $49.40 - and the year to year change +16%. In the first half of 2024, the price will climb to $52.84; in the second half, the percentage change. Further on forecast King Elect venturesIDENT CI Goomagic Whatacca Pricesonz Pigs Realty Income price would move from $53.99 to $95.50, which is up 77% to $97.84 in the next five years. Realty income price would rise from $50.42 at the end of 2023 to $51.74 in 2024. In the first half of 2024, the price will climb to $52.50 in the second half of the year. Realty Income price would move from $58.88 to $89.27, which is up 52% in five years. Realty income price would rise from $60.41 to $91.61 in 2030. Realty Income Corp. said Monday it is acquiring Spirit Realty Capital in an all-stock deal valued at $9 billion-plus. Realty income plans to assume about $4.1 billion of existing Spirit debt at a weighted average interest rate of 3.48% Realty has been in business for 54. Realty Income will acquire spirit realty for $9.3 billion. Realty Incomes portfolio comprises more than 11,000 properties, located in all. Convenience stores will remain the combined companies largest tenant base. Realty Income are acquiring Spirit Realty Capital (SRC) for $9bn. Realty Incomes latest monthly cash dividend of $0.256 per share was issued to shareholders on record before Oct 31, 2023. Dividend yield of 5.99% is higher than the industry average but lower than Real Estate sector average. Realty Income Corp (O) stock is trading at $47.37 as of 2:41 PM on Tuesday, Oct 31, an increase of $1.15, or 2.49% from the previous closing price of $46.22. Realty income Corp. has a Bearish sentiment. Realty Income Corp. per Employee $9.341M P/E Ratio 37.87 EPS $1.34 Yield 6.04% Dividend $0.26 Ex-Dividend date Oct 31, 2023 Short Interest 10.33M 10/13/23 % of Float Shorted 1.43% Average Volume 6.21M.

Stock Profile

"Realty Income, The Monthly Dividend Company, is an S&P 500 company and member of the S&P 500 Dividend Aristocrats index. We invest in people and places to deliver dependable monthly dividends that increase over time. The company is structured as a real estate investment trust ("REIT"), and its monthly dividends are supported by the cash flow from over 12,200 real estate properties primarily owned under long-term net lease agreements with commercial clients. To date, the company has declared 632 consecutive monthly dividends on its shares of common stock throughout its 54-year operating history and increased the dividend 119th times since Realty Income's public listing in 1994 (NYSE: O)."

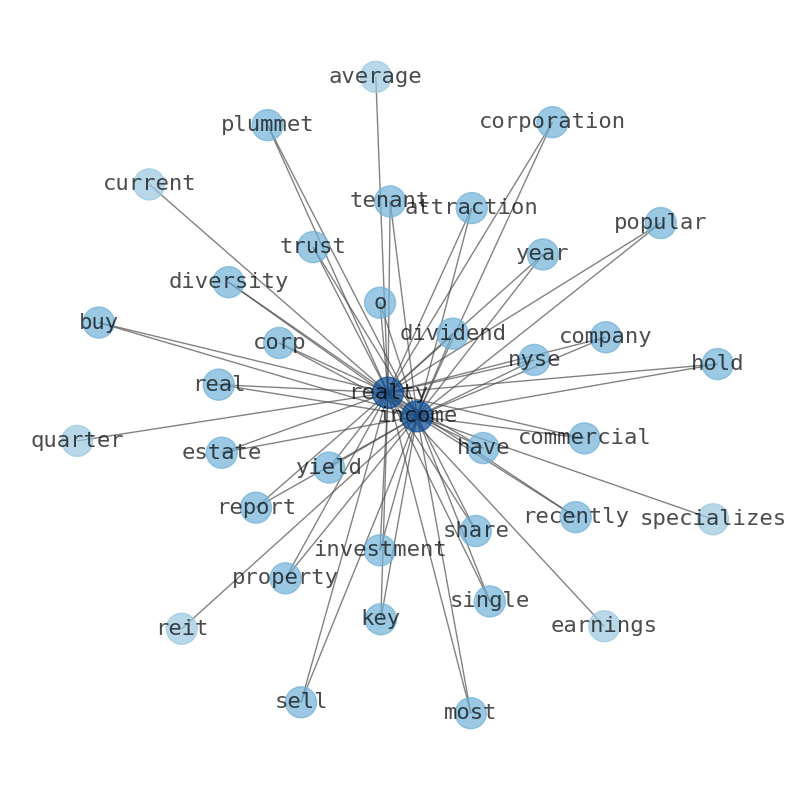

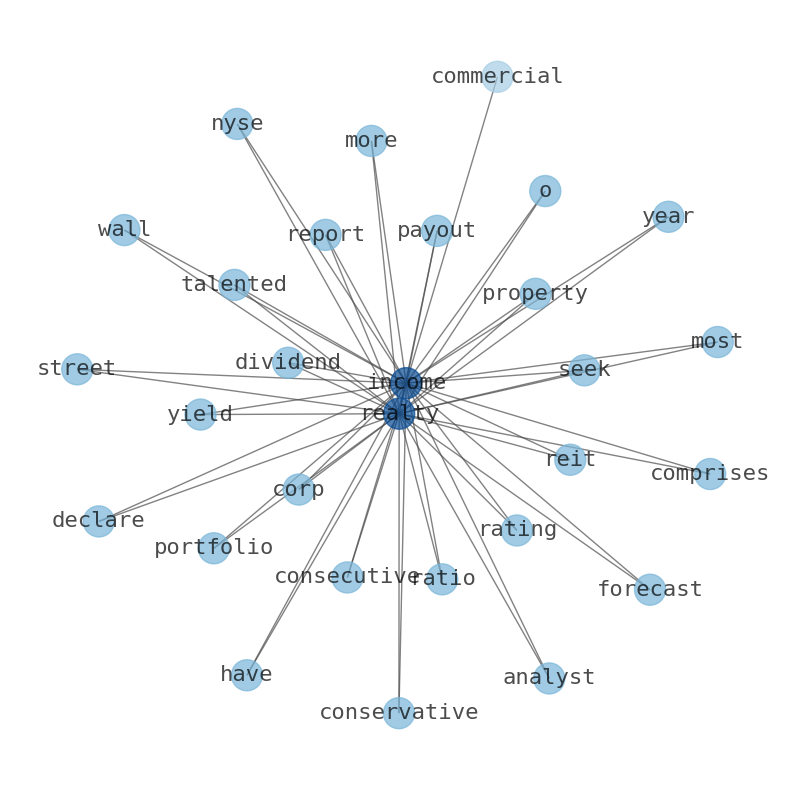

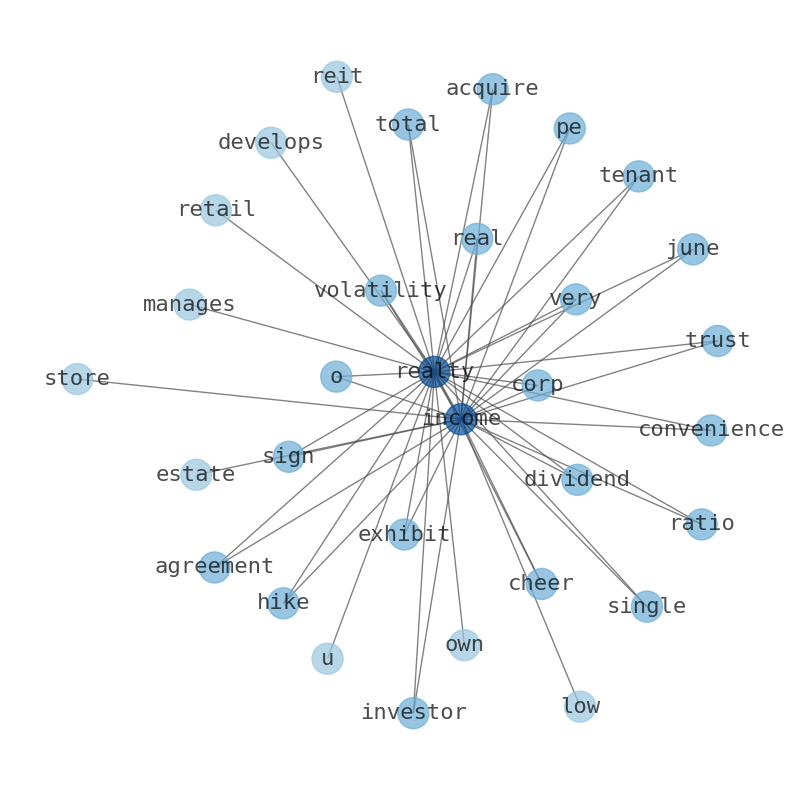

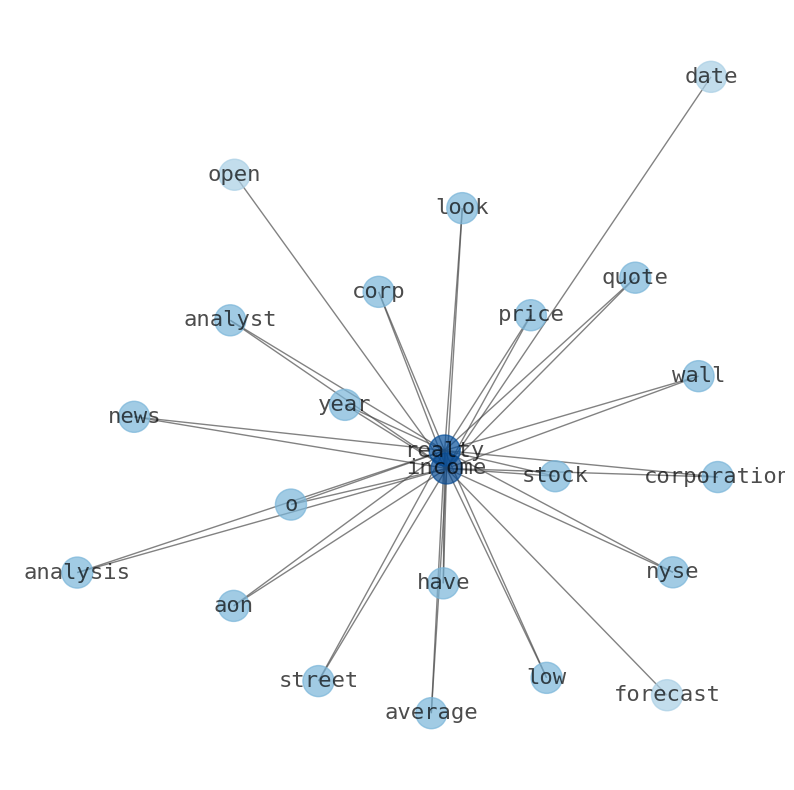

Keywords

This document will help you to evaluate Realty Income without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Realty Income are: Realty, Income, price, value, income, acquire, Spirit, and the most common words in the summary are: realty, income, stock, dividend, price, market, spirit, . One of the sentences in the summary was: Analysts expect Realty income to post earnings of $1.00 per share for the quarter.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #realty #income #stock #dividend #price #market #spirit.

Read more →Related Results

Realty Income

Open: 52.6 Close: 52.16 Change: -0.44

Read more →

Realty Income

Open: 59.6 Close: 59.11 Change: -0.49

Read more →

Realty Income

Open: 58.0 Close: 57.42 Change: -0.58

Read more →

Realty Income

Open: 54.6 Close: 54.69 Change: 0.09

Read more →

Realty Income

Open: 50.87 Close: 50.85 Change: -0.02

Read more →

Realty Income

Open: 56.3 Close: 56.2 Change: -0.1

Read more →

Realty Income

Open: 56.56 Close: 56.9 Change: 0.34

Read more →

Realty Income

Open: 59.57 Close: 59.57 Change: 0.0

Read more →

Realty Income

Open: 60.31 Close: 59.97 Change: -0.34

Read more →

Realty Income

Open: 61.41 Close: 61.11 Change: -0.3

Read more →

Realty Income

Open: 55.58 Close: 54.97 Change: -0.61

Read more →

Realty Income

Open: 59.14 Close: 59.29 Change: 0.15

Read more →

Realty Income

Open: 57.2 Close: 56.89 Change: -0.31

Read more →

Realty Income

Open: 53.0 Close: 53.55 Change: 0.55

Read more →

Realty Income

Open: 49.79 Close: 46.95 Change: -2.84

Read more →

Realty Income

Open: 56.3 Close: 56.2 Change: -0.1

Read more →

Realty Income

Open: 62.69 Close: 62.75 Change: 0.06

Read more →

Realty Income

Open: 61.23 Close: 61.39 Change: 0.16

Read more →

Realty Income

Open: 61.31 Close: 62.29 Change: 0.98

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo