The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Public Service Enterprise Group

Youtube Subscribe

Open: 60.63 Close: 60.87 Change: 0.24

5 risks of investing in Public Service Enterprise Group Stock found by an AI after reading the whole internet.

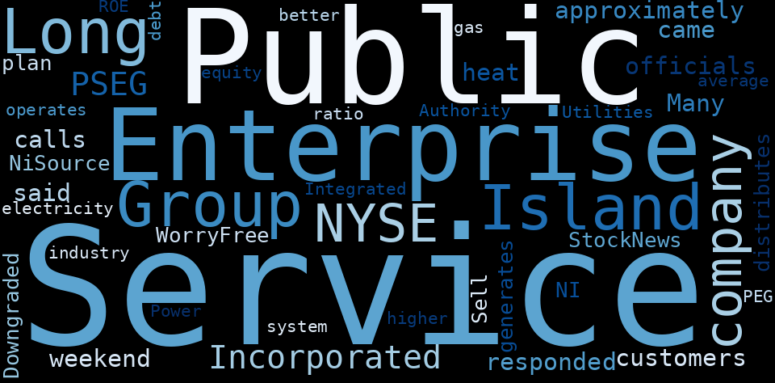

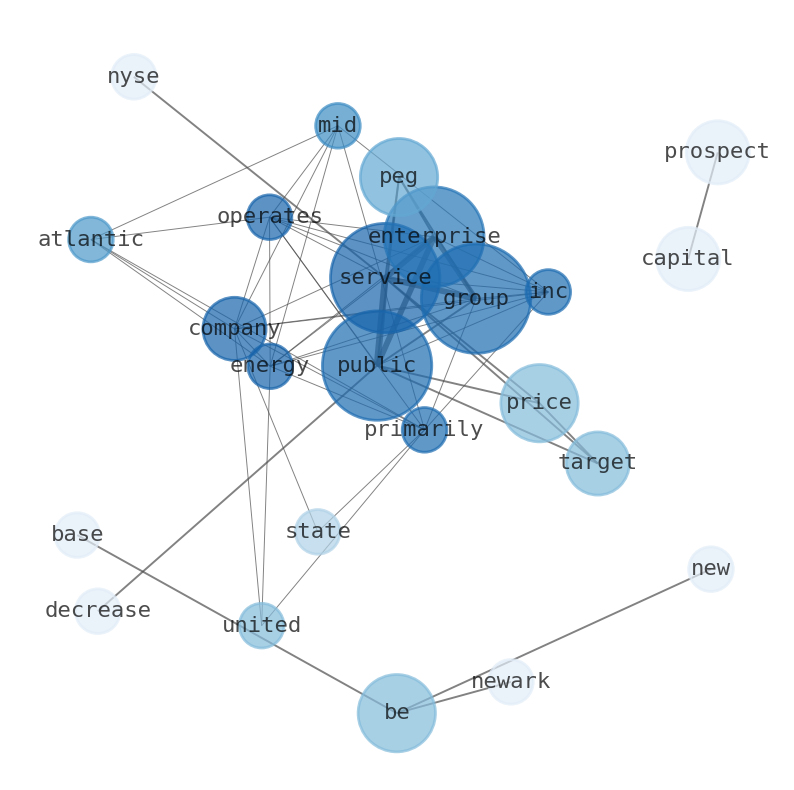

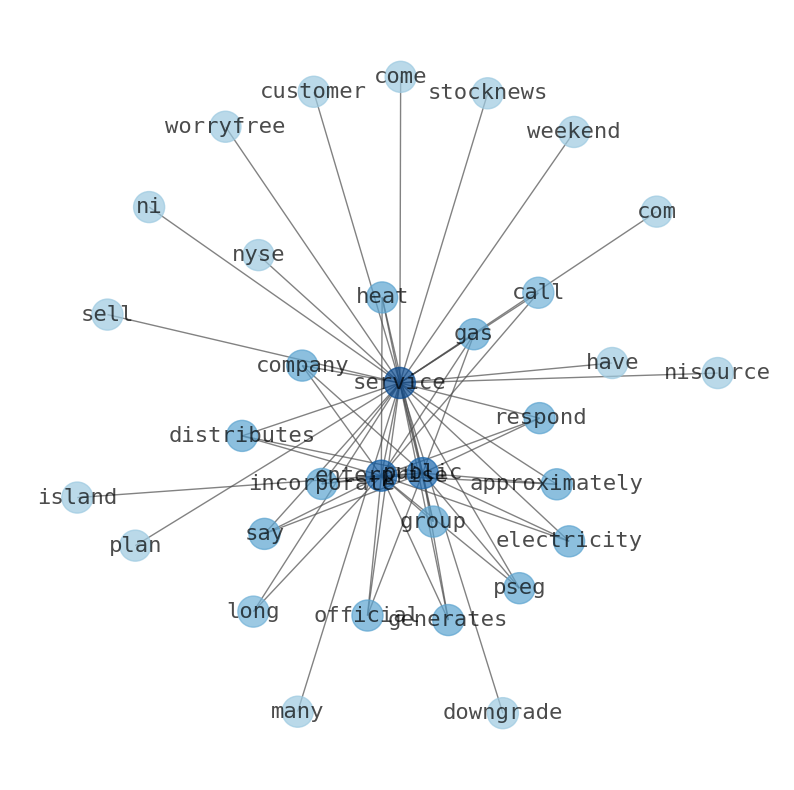

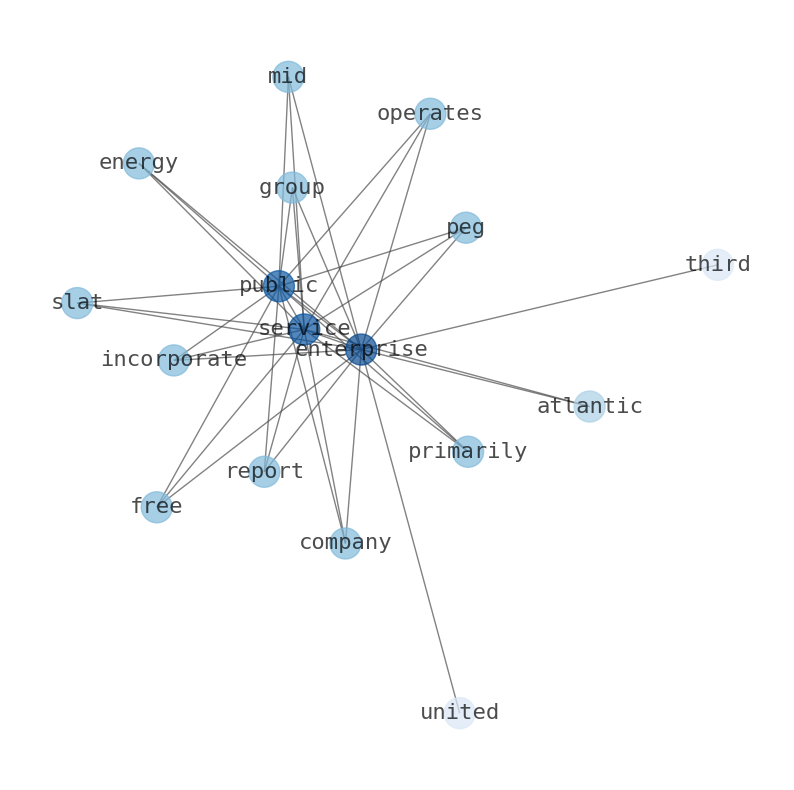

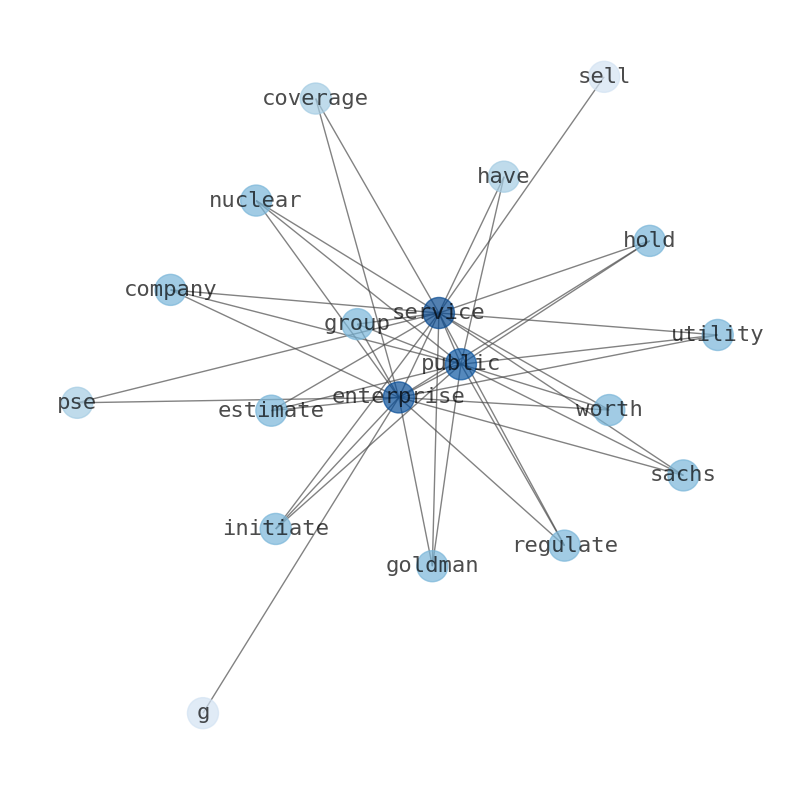

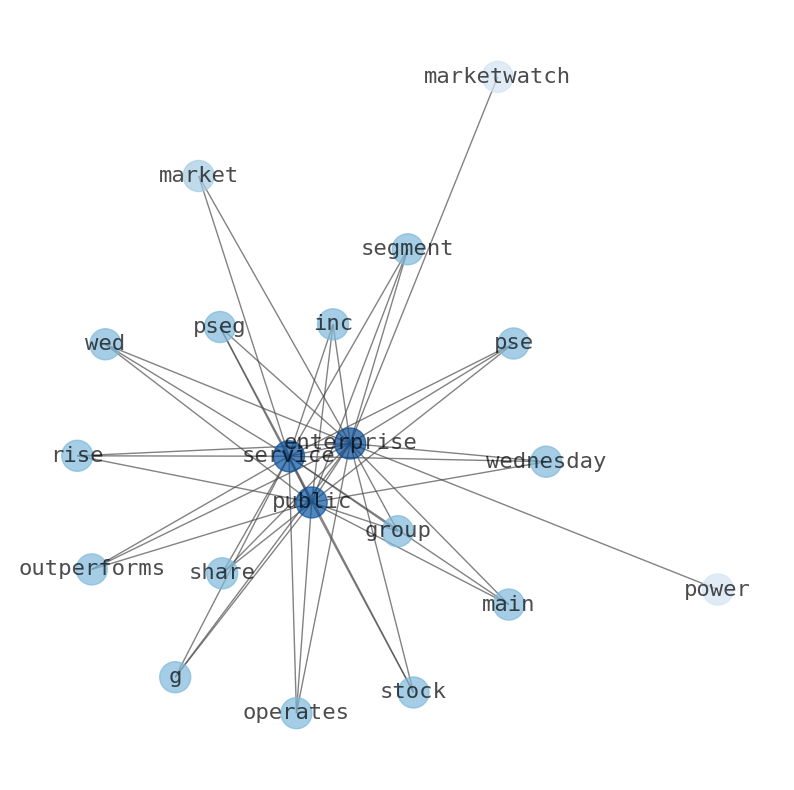

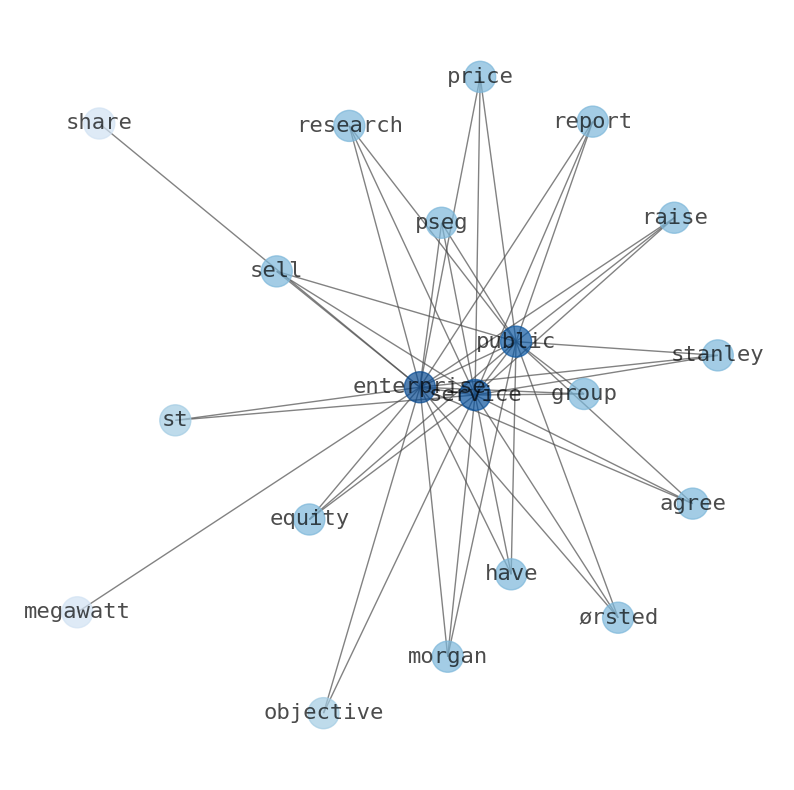

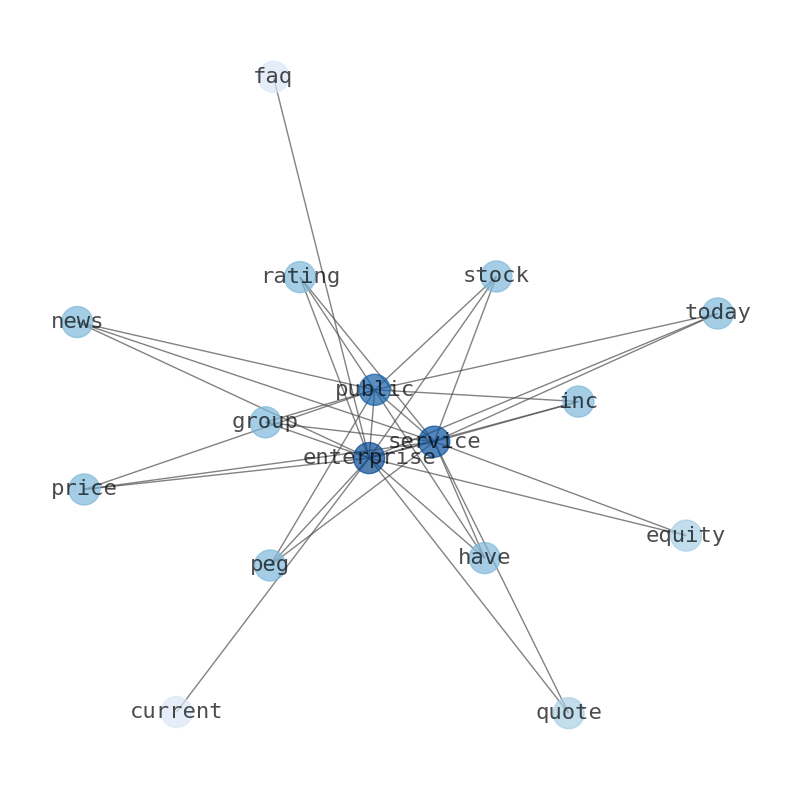

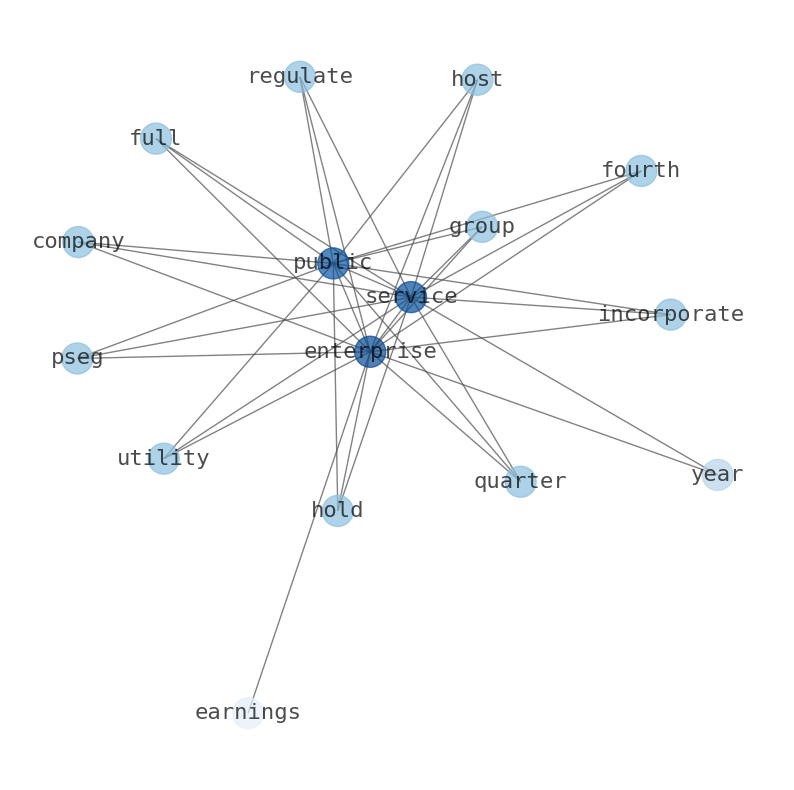

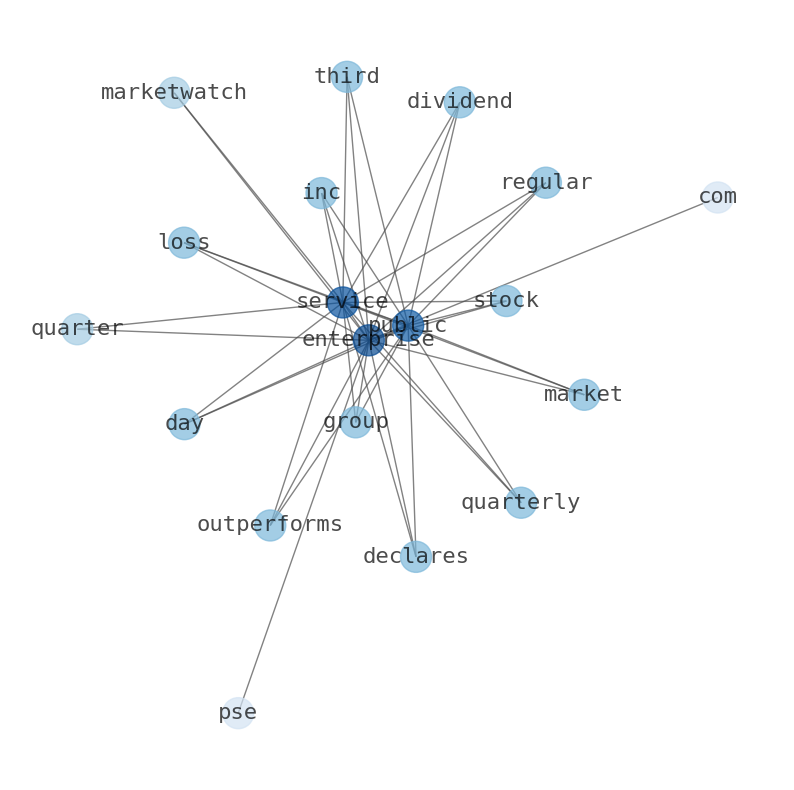

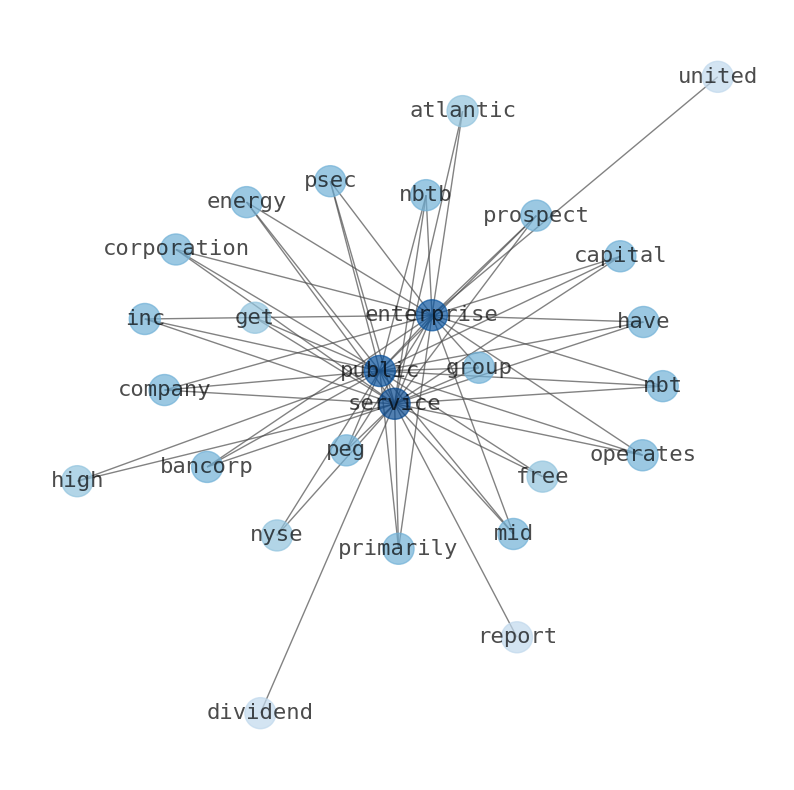

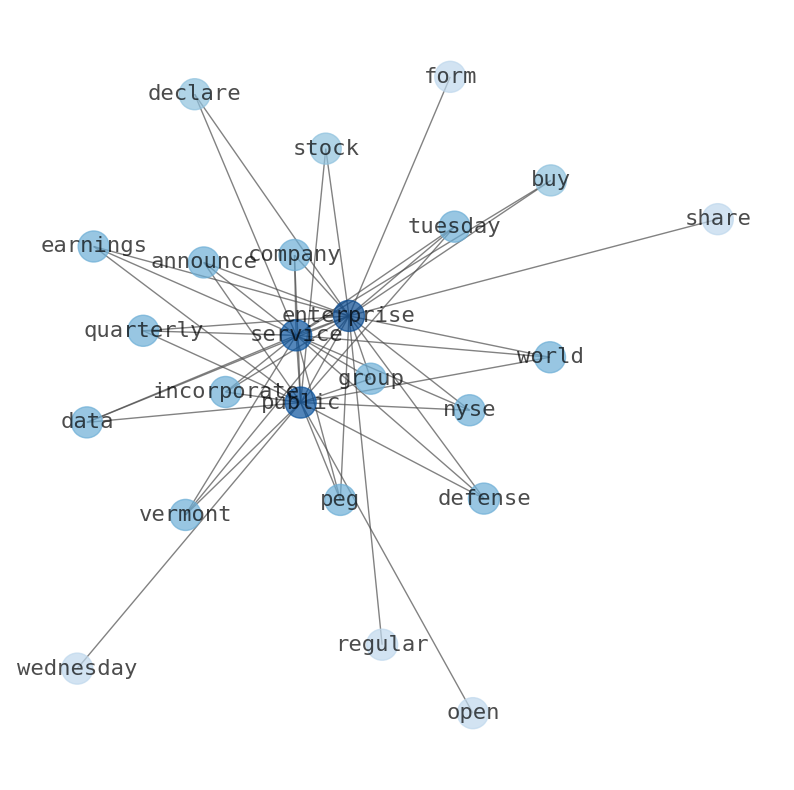

Are looking for the most relevant information about Public Service Enterprise Group? Investor spend a lot of time searching for information to make investment decisions in Public Service Enterprise Group. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Public Service Enterprise Group are: Public, Service, Group, Enterprise, price, company, A, and the most common words in the summary are: service, public, group, enterprise, stock, best, company, . One of the sentences in the summary was: Goldman Sachs has a “neutral” …

Stock Summary

Public Service Enterprise Group Incorporated operates as an energy company primarily in Mid-Atlantic United States. The PSE&G segment transmits electricity; distributes electricity and gas to residential, commercial, and industrial customers. The company also invests.

Today's Summary

Goldman Sachs Group initiated coverage on Public Service Enterprise Group on June 7th. Goldman Sachs has a “neutral” rating alongside a target price of $64.00. JPMorgan Chase & Co. decreased their target price from $70.00 to $67.00.

Today's News

Public Service Enterprise Group Inc. operates as an energy company primarily in Mid-Atlantic United States. The company was incorporated in 1985 and is based in Newark, New Jersey. A rating of 86 puts Public Service. Enterprise Group. Prospect Capital Corporation (PSEC), Public Service Enterprise Group (PEG), NBT Bancorp (NBTB) have the highest dividend yield stocks on this list. Prospect Capital Corp. has a trailing twelve months price to earnings ratio. Goldman Sachs Group initiated coverage on Public Service Enterprise Group on June 7th and assigned it a “neutral” rating alongside a target price of $64.00. JPMorgan Chase & Co. decreased their target price from $70.00 to $67.00 for Public Service. Public Service Enterprise Group ( NYSE:PEG – Get Free Report ) last released its quarterly earnings data on Tuesday, August 1st. The business also recently declared a quarterly dividend, which will be paid on Friday, September 29th. CEO Ralph A. PEG opened at $60.71 on Thursday.

Stock Profile

"Public Service Enterprise Group Incorporated, through its subsidiaries, operates as an energy company primarily in Mid-Atlantic United States. The company operates through PSE&G and PSEG Power. The PSE&G segment transmits electricity; distributes electricity and gas to residential, commercial, and industrial customers, as well as invests in solar generation projects, and energy efficiency and related programs; and offers appliance services and repairs. As of December 31, 2022, it had electric transmission and distribution system of 25,000 circuit miles and 864,000 poles; 55 switching stations with an installed capacity of 39,653 megavolt-amperes (MVA), and 235 substations with an installed capacity of 9,735 MVA; four electric distribution headquarters and five electric sub-headquarters; and 18,000 miles of gas mains, 12 gas distribution headquarters, two sub-headquarters, and one meter shop, as well as 56 natural gas metering and regulating stations. Public Service Enterprise Group Incorporated was incorporated in 1985 and is based in Newark, New Jersey."

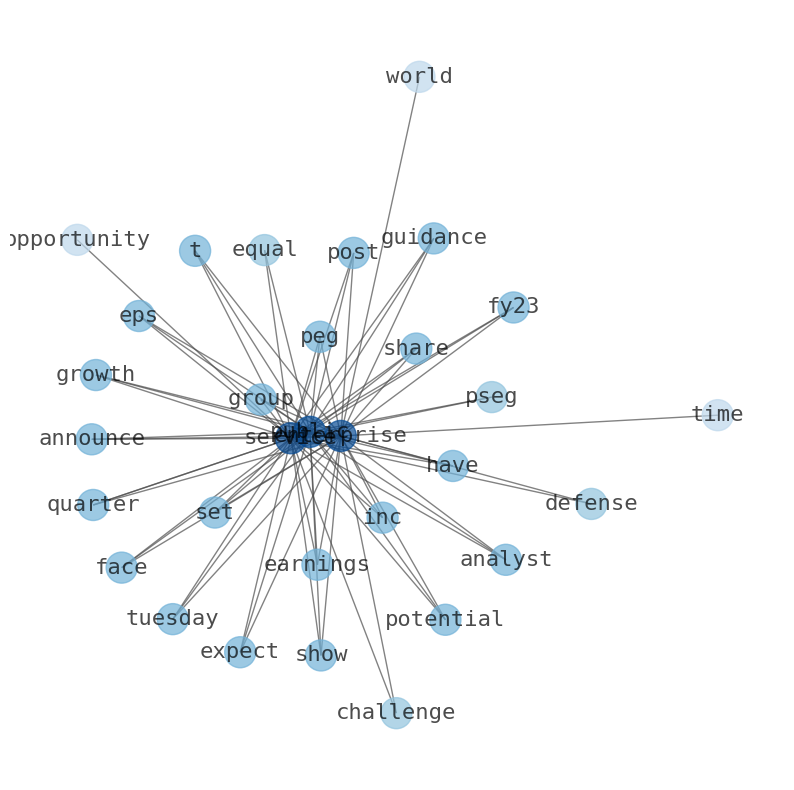

Keywords

How much time have you spent trying to decide whether investing in Public Service Enterprise Group? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Public Service Enterprise Group are: Public, Service, Group, Enterprise, price, company, A, and the most common words in the summary are: service, public, group, enterprise, stock, best, company, . One of the sentences in the summary was: Goldman Sachs has a “neutral” rating alongside a target price of $64.00. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #service #public #group #enterprise #stock #best #company.

Read more →Related Results

Public Service Enterprise Group

Open: 57.89 Close: 58.15 Change: 0.26

Read more →

Public Service Enterprise Group

Open: 61.0 Close: 60.11 Change: -0.89

Read more →

Public Service Enterprise Group

Open: 60.89 Close: 61.12 Change: 0.23

Read more →

Public Service Enterprise Group

Open: 62.49 Close: 62.54 Change: 0.05

Read more →

Public Service Enterprise Group

Open: 61.93 Close: 62.14 Change: 0.21

Read more →

Public Service Enterprise Group

Open: 64.43 Close: 64.17 Change: -0.26

Read more →

Public Service Enterprise Group

Open: 61.43 Close: 61.65 Change: 0.22

Read more →

Public Service Enterprise Group

Open: 61.0 Close: 60.8 Change: -0.2

Read more →

Public Service Enterprise Group

Open: 60.63 Close: 60.87 Change: 0.24

Read more →

Public Service Enterprise Group

Open: 61.86 Close: 62.58 Change: 0.72

Read more →

Public Service Enterprise Group

Open: 62.5 Close: 63.45 Change: 0.95

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo