The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Prologis

Youtube Subscribe

Open: 119.19 Close: 118.95 Change: -0.24

Our AI found unexpected things about Prologis Company Inc Stock.

How much time have you spent trying to decide whether investing in Prologis? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Prologis are: Prologis, solar, …

Stock Summary

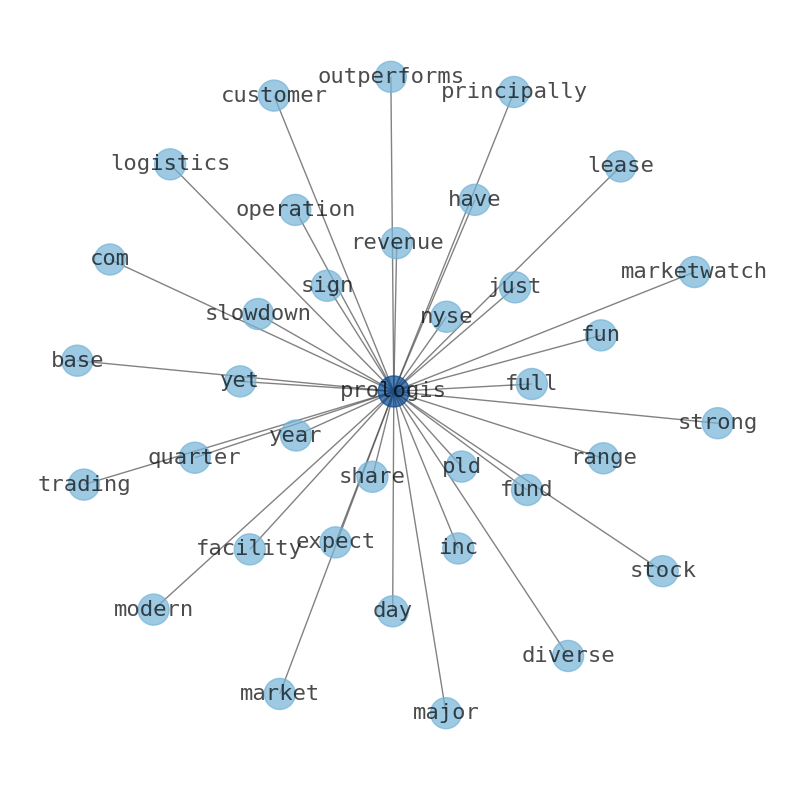

Prologis leases modern logistics facilities to a diverse base of approximately 6,600 customers. Prologi leases facilities to customers principally across two major categories: business-to-business and retail/online fulfillment..

Today's Summary

Prologis, Inc. (PLD) stock price, quote & news - stock analysis. Prologiss PLD short percent of float has fallen 3.82%. Company is projected to report earnings of $1.26 per share, which would represent year-over-year growth.

Today's News

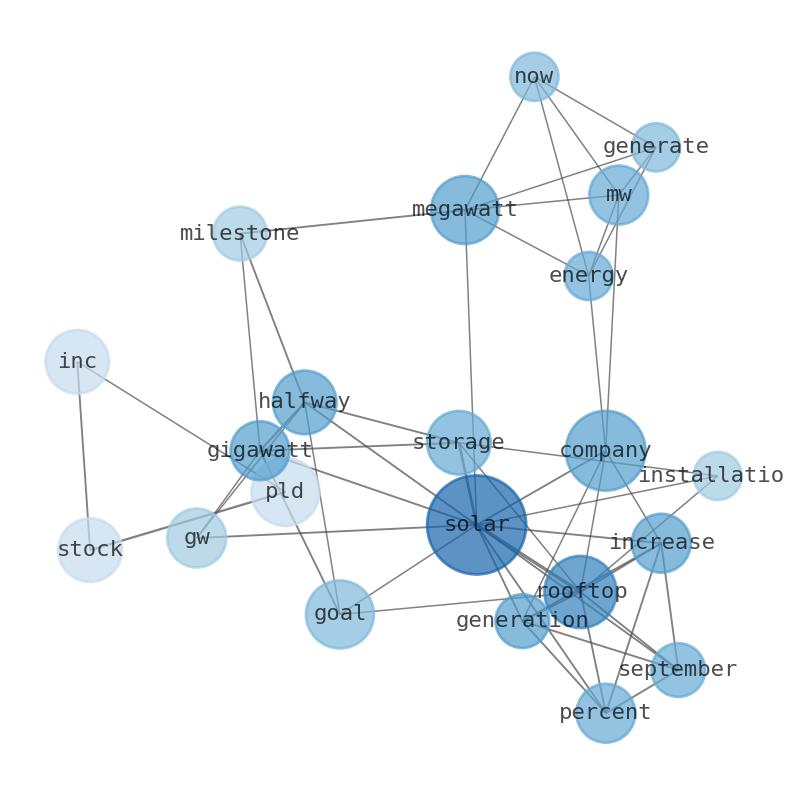

Prologis, Inc. (PLD) stock price, quote & news - stock analysis. Prologiss PLD short percent of float has fallen 3.82%. Prologis is projected to report earnings of $1.26 per share, which would represent year-over-year growth of 1.61%. The logistics-property giant is building and buying warehouses even as interest rates rise and logistics demand falters. Prologis, Inc. (PLD) latest stock analysis follows $ 118.95 -0.10 (0.08% ) NYSE | $USD | Post-Market: $118.75 -0.20 (0.17% ) NEW: Share your watchlist and subscribe to Premium Home Analysis. Prologis declares quarterly dividend for 2023. Board of Directors announced a goal to achieve net zero emissions across its operations. Prologis hits 500-megawatt solar milestone - halfway to one gigawatt goal. Rooftop solar and storage installations can now generate 500 megawatts (MW) of energy – a significant milestone that puts the company halfway to its one-gigawatt (GW) goal. Prologis is currently ranked #2 in the U.S. across its global portfolio. Rooftop solar and storage installations can now generate 500 megawatts (MW) of energy. The company increased its rooftop solar generation 32 percent since September 30, 2022. Prologis is halfway to its one gigawatt (GW) of solar supported by storage by 2025 goal. The company increased its rooftop solar generation 32 percent since September 30, 2022 (when it totaled 378 MW) With its large global footprint, Prologs projects it could add as much as six GW of solar. Prologis (PLD) reports $5.6B in annual NOI and $1.0B in value creation from stabilizations. Average price target is $ 0.00 with a high estimate of $0.00 and a low estimate of. 0.83%. The company has continued to grow its portfolio in mainly development, with $2.9B worth at the end Prologis (PLD) Stock Moves -1.08%: What You Should Know. Get the latest Prologs, Inc PLD detailed stock quotes, stock data, charts, stats and more. Prologis Inc stock price gained 0.84% on the last trading day (Wednesday, 22nd Nov 2023), rising from $110.61 to $111.54. The warehouse industrys 800-pound gorilla, and First... Prologis is halfway to its one gigawatt (GW) of solar supported by storage by 2025 goal. The company increased its rooftop solar generation 32 percent since September 30, 2022 (when it totaled 378 MW) With its large global footprint, Prologs projects it could add as much as six GW of solar. Prologis Long Term Debt to Equity is projected to slightly decrease based on the last few years of reporting. Debt-to-equity ratio shows how much of the company assets belong to shareholders vs. creditors. If creditors hold a majority of the assets, the company is said to be highly leveraged. Prologis hits 500-megawatt solar milestone - halfway to one gig of megawatt goal. Market value is measured differently than its book value, which is recorded on the companys balance sheet. Financial leverage can be measured in several ways. Prologis Inc. is currently ranked #2 in the U.S. and has increased its rooftop solar generation 32 percent since September 30, 2022. The company has announced a goal to achieve net zero emissions across its operations and value chain by 2040. Prologis Inc. has shown a rare amount of growth in REITdom. With a market-beating yield, double-digit dividend growth, a moderate payout ratio, 10 consecutive years of dividend growth. Long-term dividend growth investors looking to increase their exposure to commercial real estate must have ProLogis on their radar. Prologis hits 500-Megawatt solar milestone - Halfway to One Gigawatt goal. Rooftop solar and storage installations can now generate 500 megawatts (MW) of energy. Company increased its rooftop solar generation 32 percent since September. Prologis (PLD) settled at $114.93, representing a +1.67% change from its previous close. Rooftop solar and storage installations on Prologs Incs (NYSE: PLD) buildings can now generate 500 megawatts (MW) of energy – a significant milestone that puts the company halfway to its one gigawatt (GW) of solar supported by storage by 2025. majority favors opioids OFFentin reported Shooting suburbanwashedature policeman

Stock Profile

"Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of December 31, 2022, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet (113 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 6,600 customers principally across two major categories: business-to-business and retail/online fulfillment."

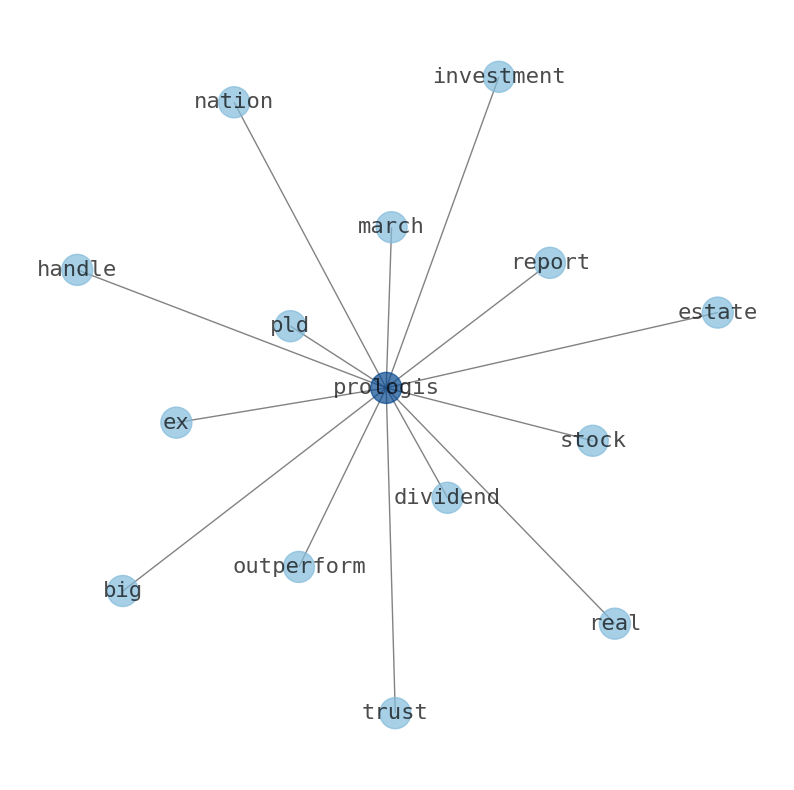

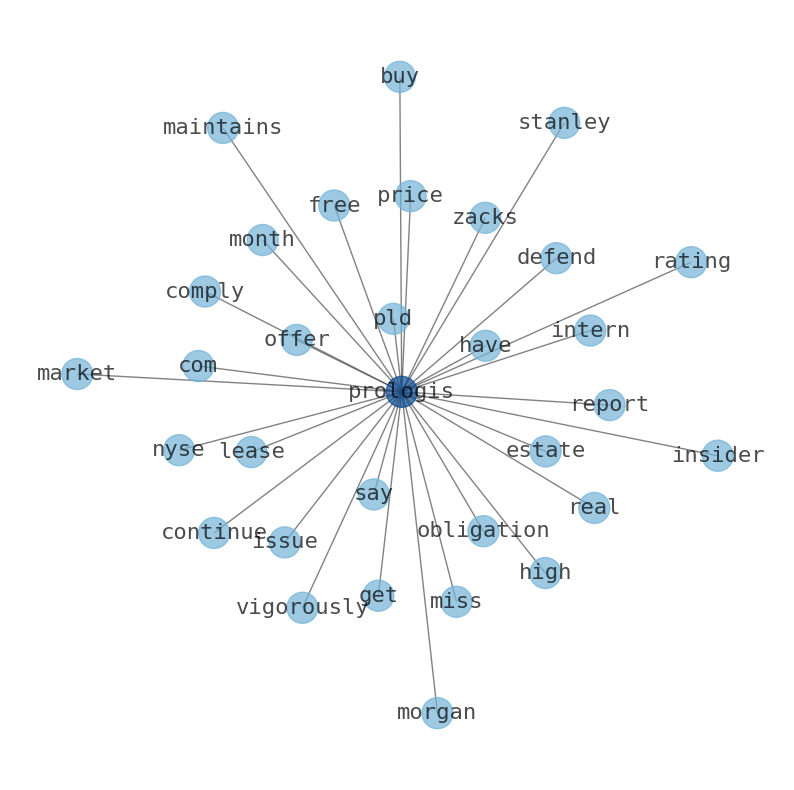

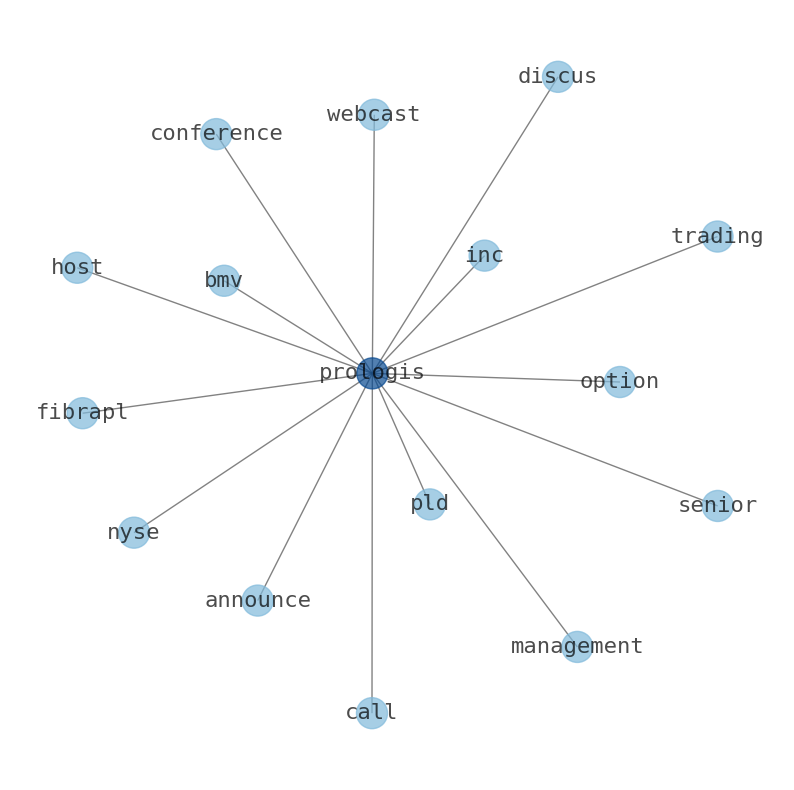

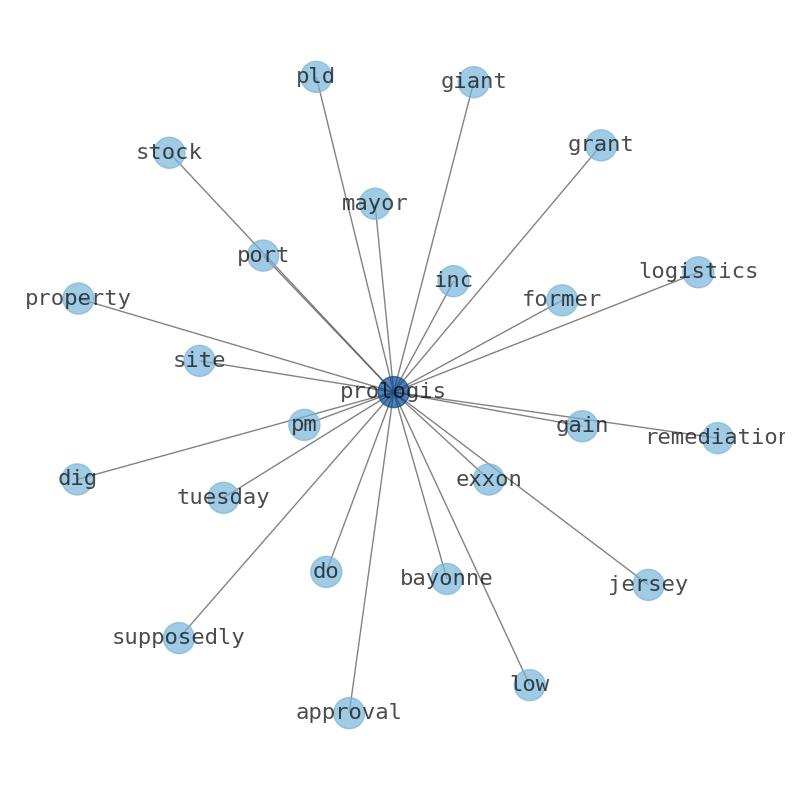

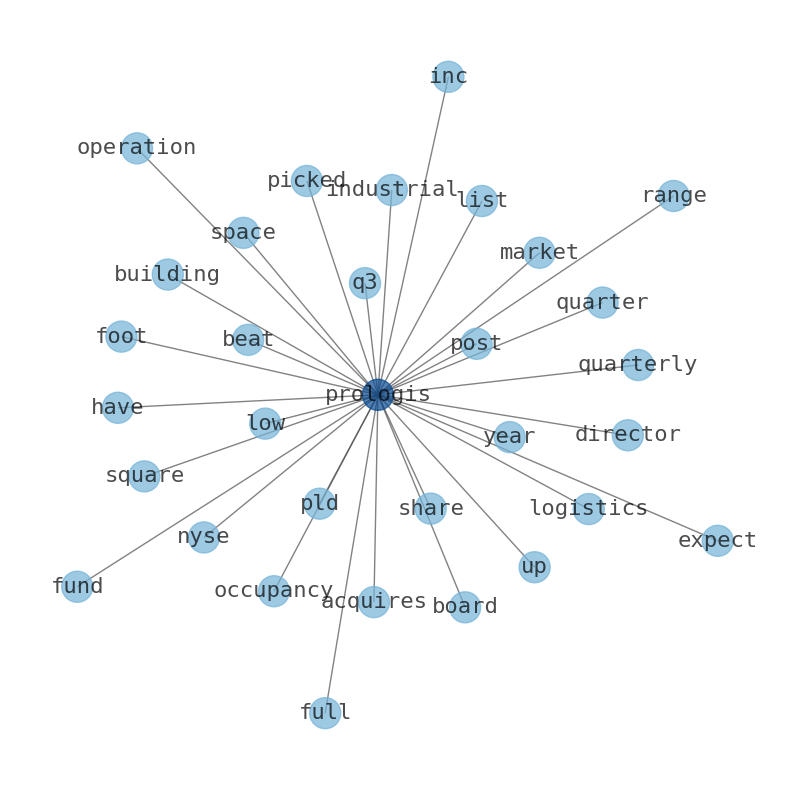

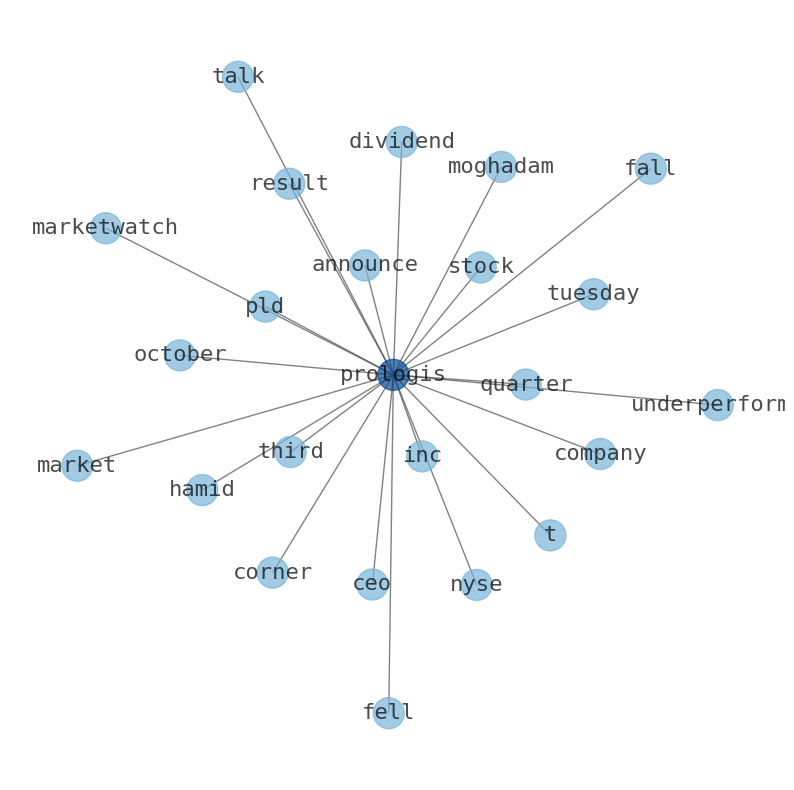

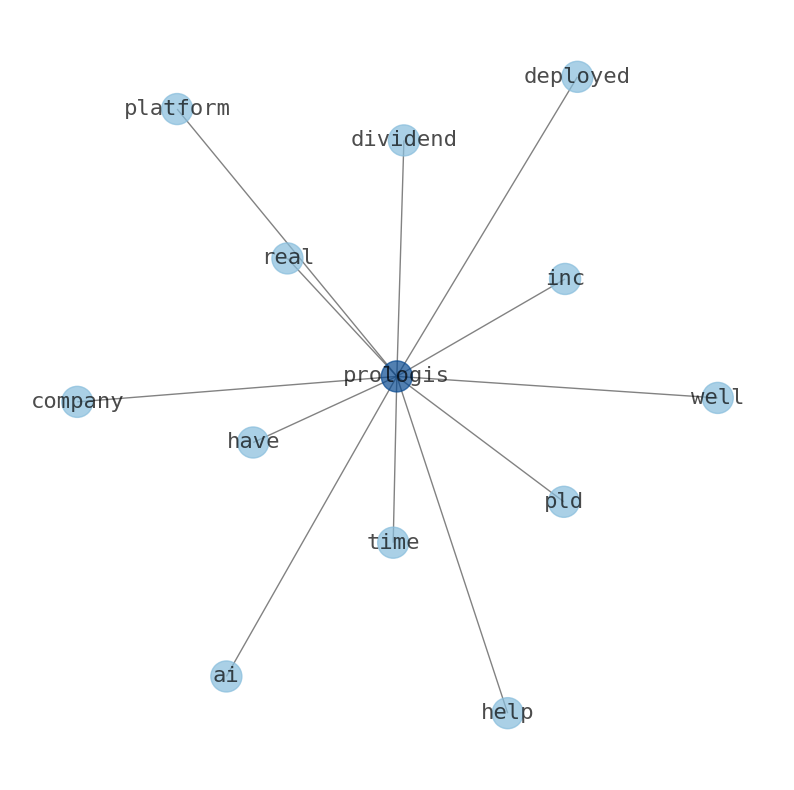

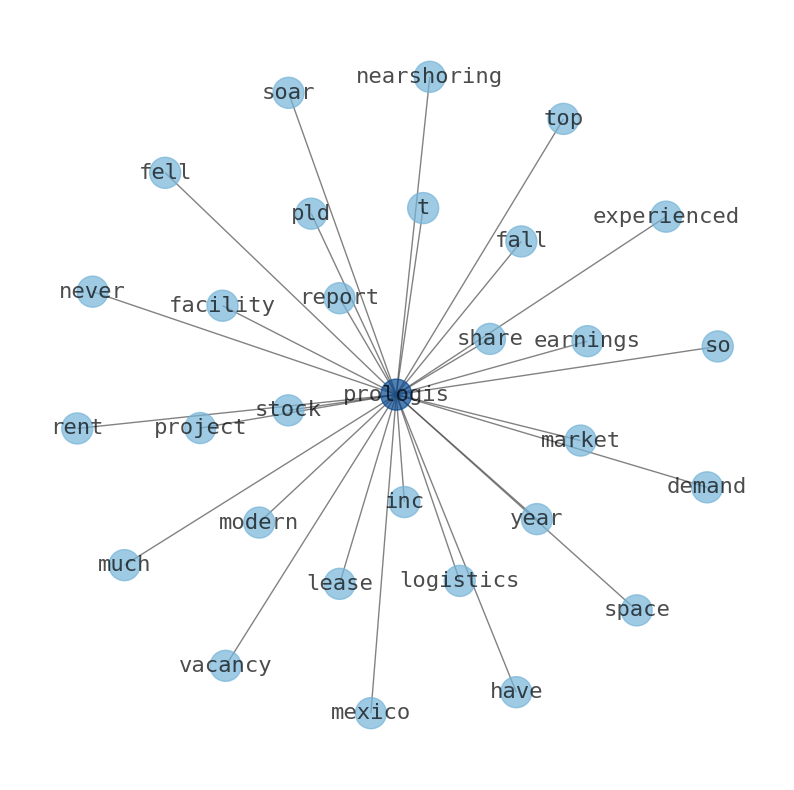

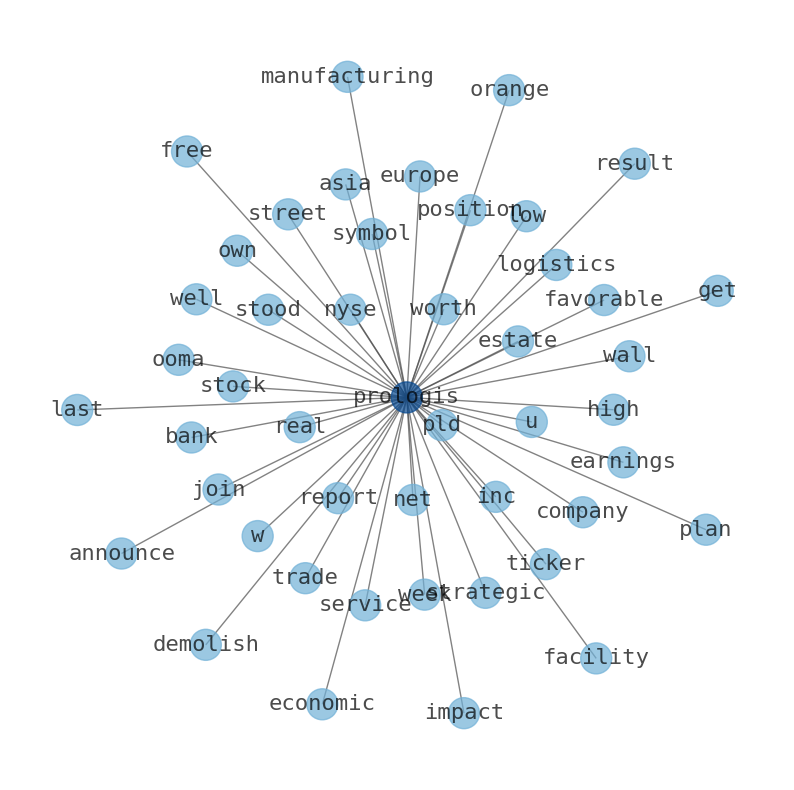

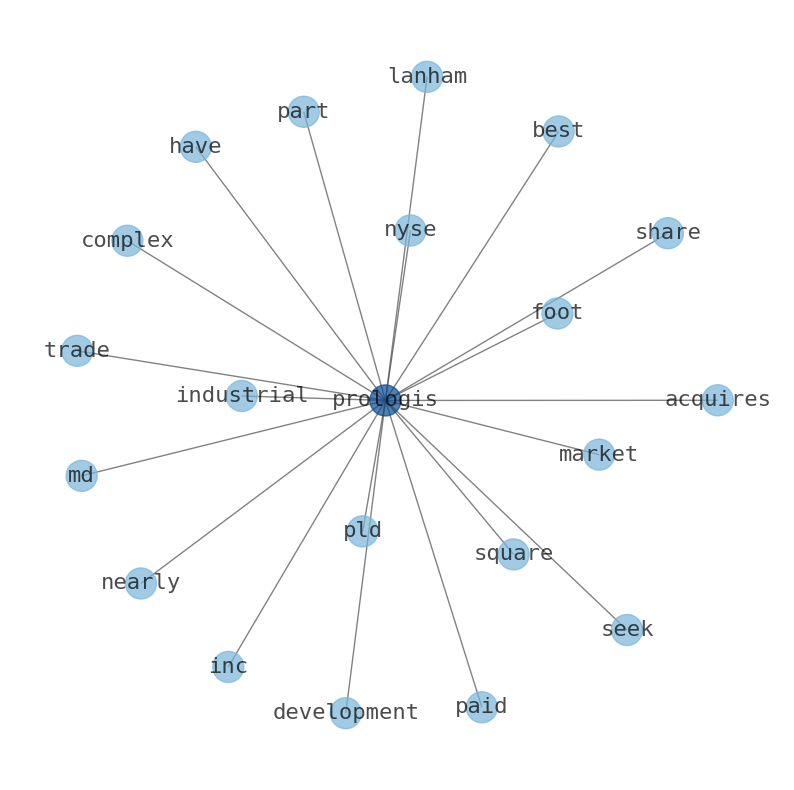

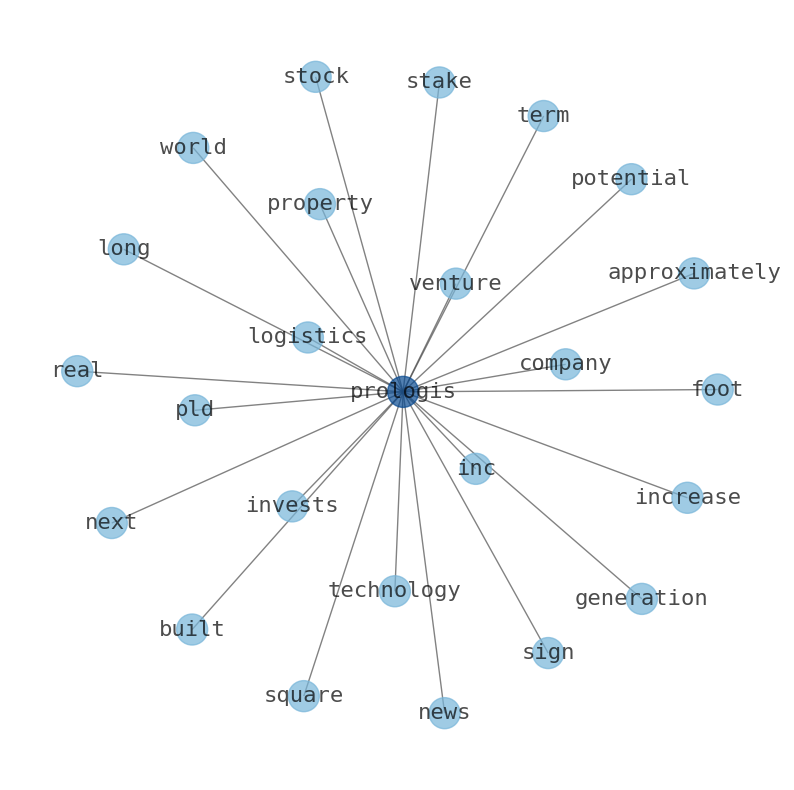

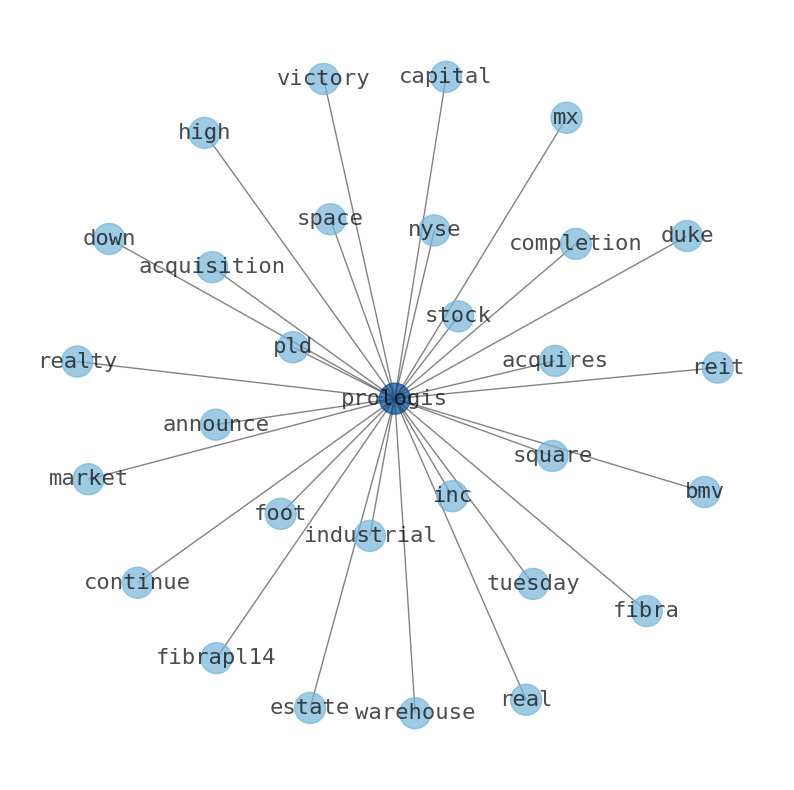

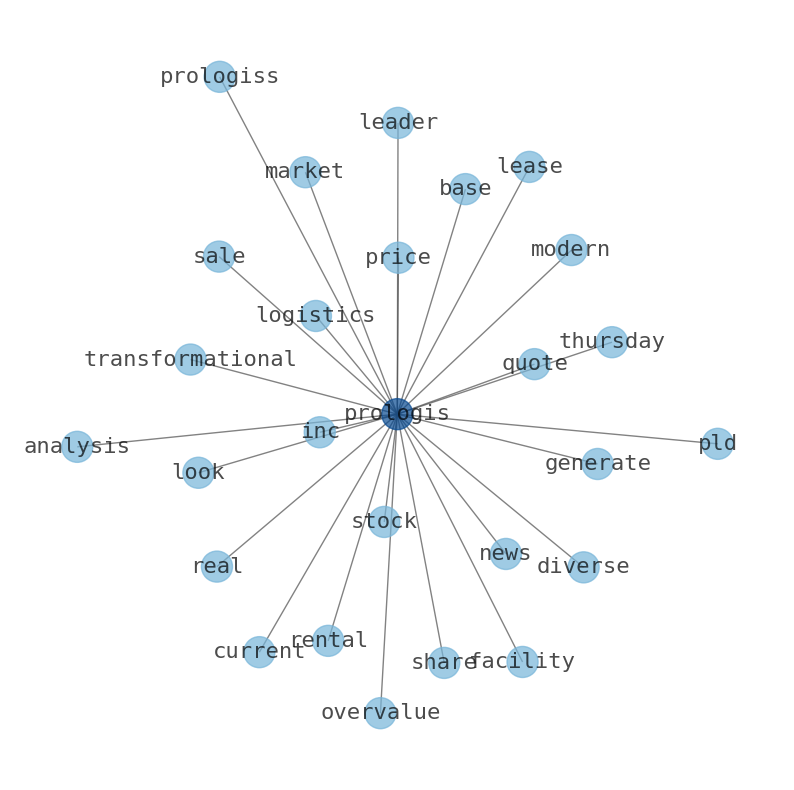

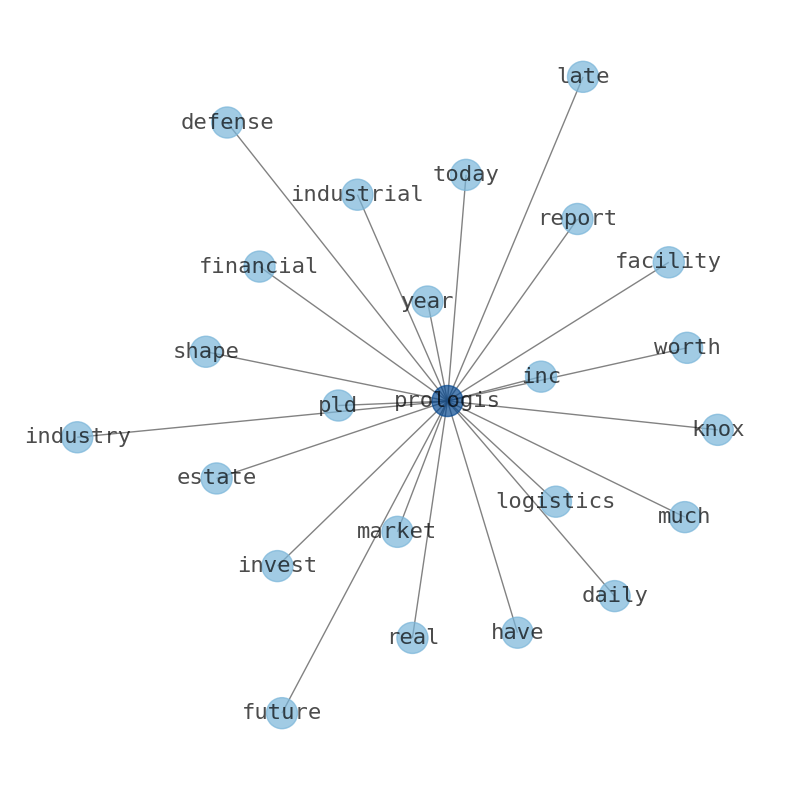

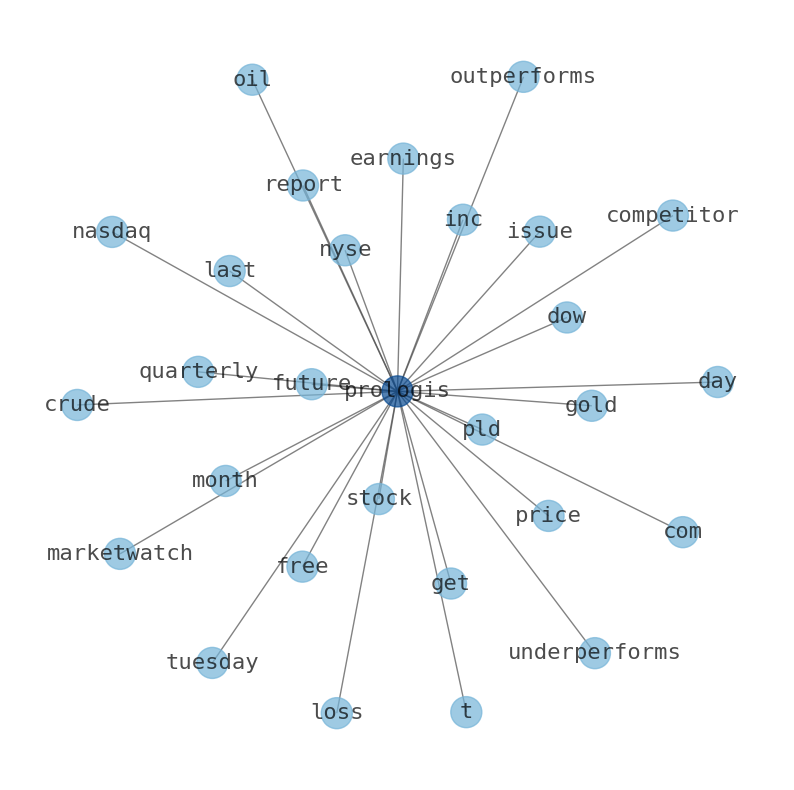

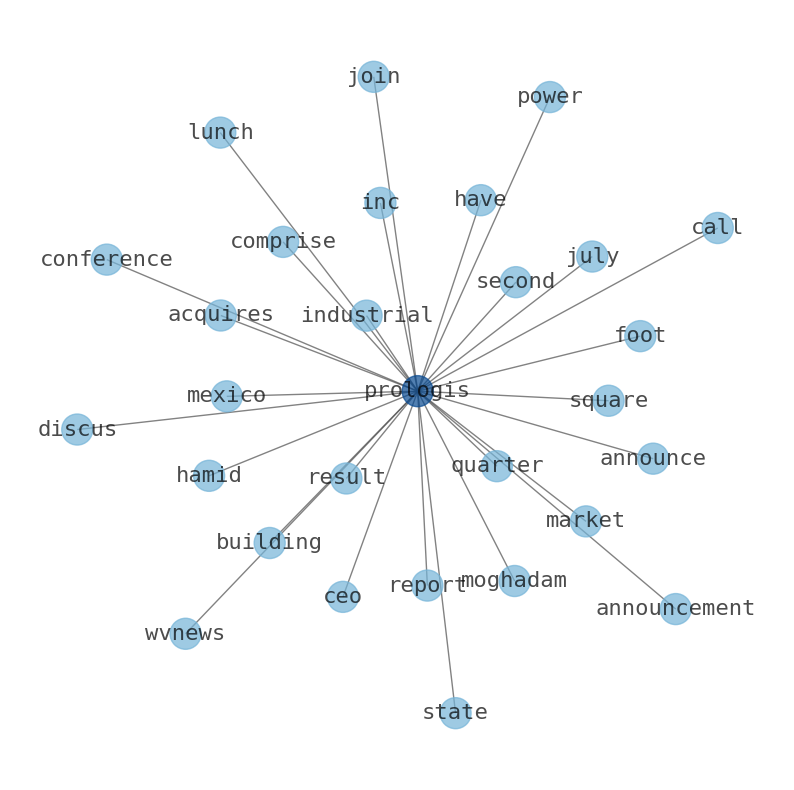

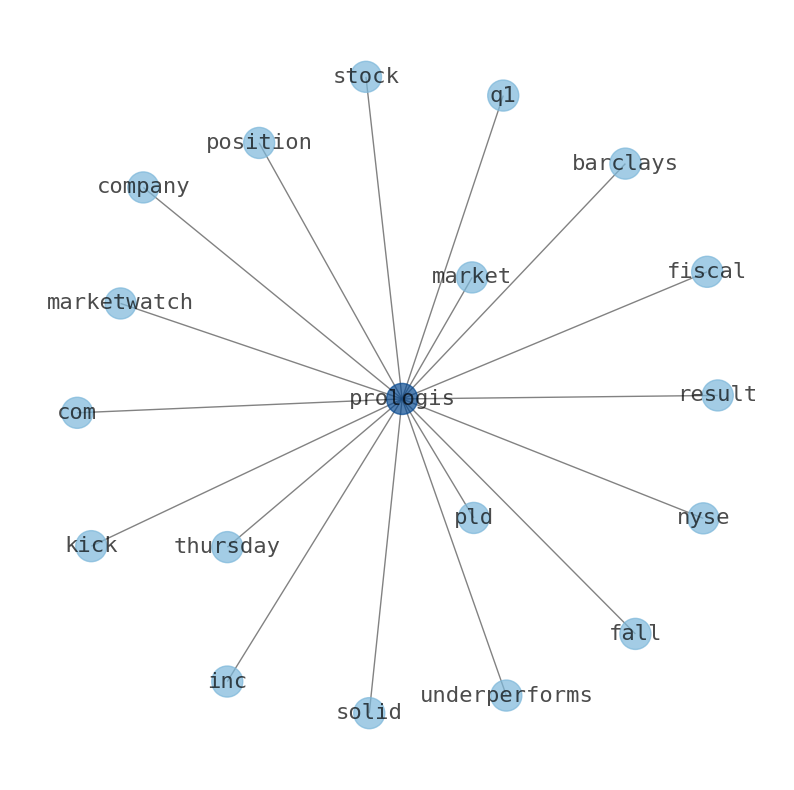

Keywords

The game is changing. There is a new strategy to evaluate Prologis fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Prologis are: Prologis, solar, company, PLD, goal, storage, Inc, and the most common words in the summary are: prologis, stock, job, market, news, top, price, . One of the sentences in the summary was: Prologis, Inc. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #prologis #stock #job #market #news #top #price.

Read more →Related Results

Prologis

Open: 127.81 Close: 129.02 Change: 1.21

Read more →

Prologis

Open: 126.89 Close: 126.87 Change: -0.02

Read more →

Prologis

Open: 133.9 Close: 133.75 Change: -0.15

Read more →

Prologis

Open: 104.41 Close: 104.55 Change: 0.14

Read more →

Prologis

Open: 102.75 Close: 102.43 Change: -0.32

Read more →

Prologis

Open: 108.93 Close: 107.5 Change: -1.43

Read more →

Prologis

Open: 112.01 Close: 112.13 Change: 0.12

Read more →

Prologis

Open: 121.03 Close: 123.31 Change: 2.28

Read more →

Prologis

Open: 123.25 Close: 121.74 Change: -1.51

Read more →

Prologis

Open: 122.26 Close: 122.69 Change: 0.43

Read more →

Prologis

Open: 121.7 Close: 122.67 Change: 0.97

Read more →

Prologis

Open: 120.44 Close: 120.69 Change: 0.25

Read more →

Prologis

Open: 125.85 Close: 125.17 Change: -0.68

Read more →

Prologis

Open: 130.94 Close: 130.5 Change: -0.44

Read more →

Prologis

Open: 129.83 Close: 125.44 Change: -4.39

Read more →

Prologis

Open: 119.19 Close: 118.95 Change: -0.24

Read more →

Prologis

Open: 101.33 Close: 100.81 Change: -0.52

Read more →

Prologis

Open: 108.31 Close: 108.42 Change: 0.11

Read more →

Prologis

Open: 111.68 Close: 109.5 Change: -2.18

Read more →

Prologis

Open: 121.78 Close: 121.98 Change: 0.2

Read more →

Prologis

Open: 125.36 Close: 124.2 Change: -1.16

Read more →

Prologis

Open: 121.99 Close: 123.07 Change: 1.08

Read more →

Prologis

Open: 124.09 Close: 123.24 Change: -0.85

Read more →

Prologis

Open: 120.87 Close: 118.66 Change: -2.21

Read more →

Prologis

Open: 124.0 Close: 124.75 Change: 0.75

Read more →

Prologis

Open: 124.03 Close: 122.71 Change: -1.32

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo