The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

PepsiCo

Youtube Subscribe

Open: 160.0 Close: 160.37 Change: 0.37

The best way to get information about PepsiCo Stock: Use an AI.

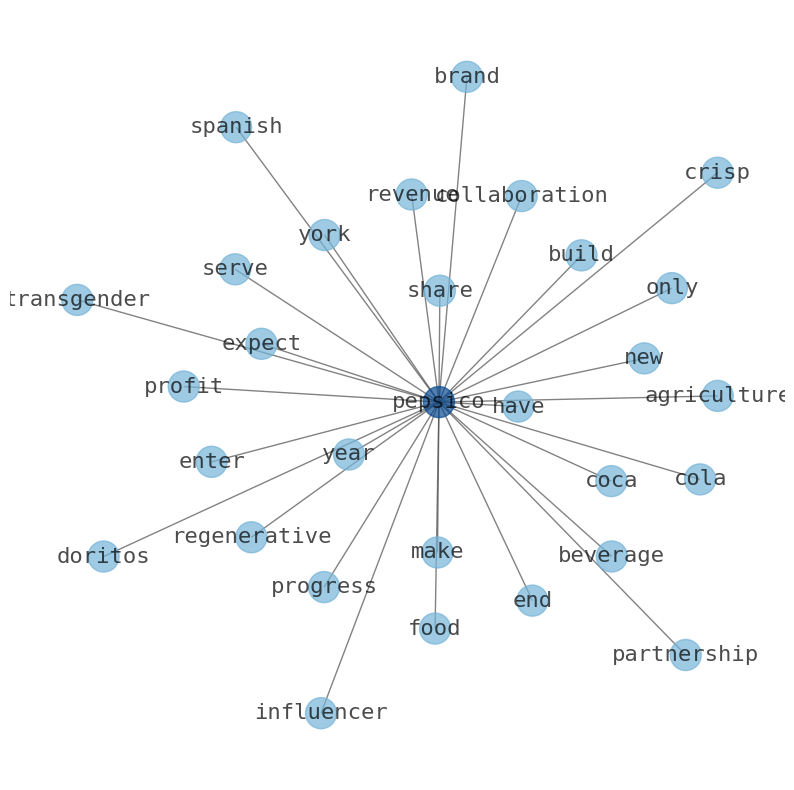

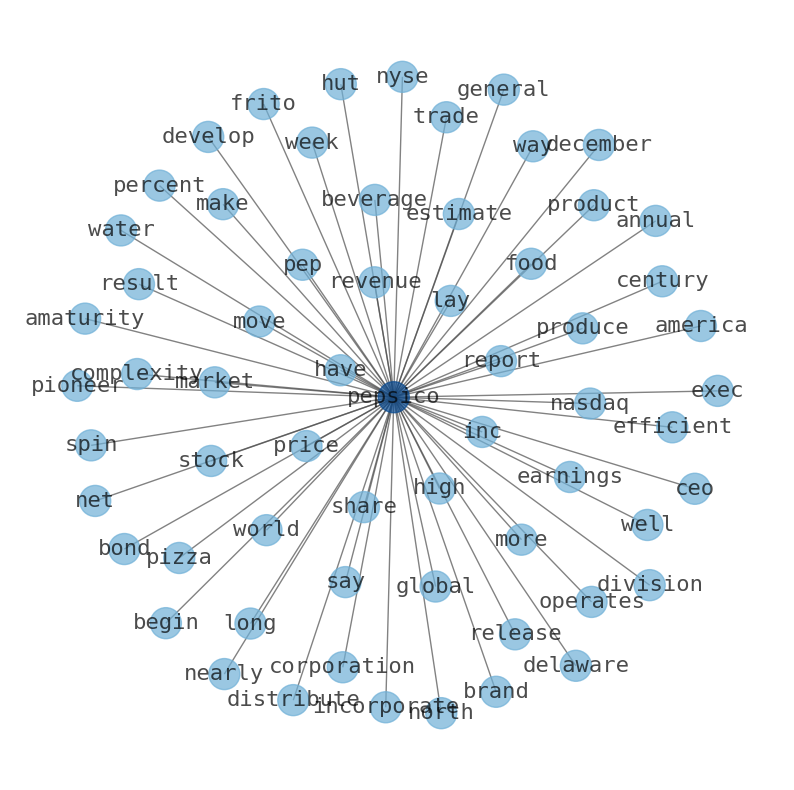

The game is changing. There is a new strategy to evaluate PepsiCo fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about PepsiCo are: PepsiCo, revenue, earnings, estimate, price, PEP, report, and the …

Stock Summary

PepsiCo, Inc. manufactures, markets, distributes, and sells various beverages and convenient foods. It operates through seven segments: Frito-Lay North America, Quaker Foods North America; PepsiCo Beverages North America. It.

Today's Summary

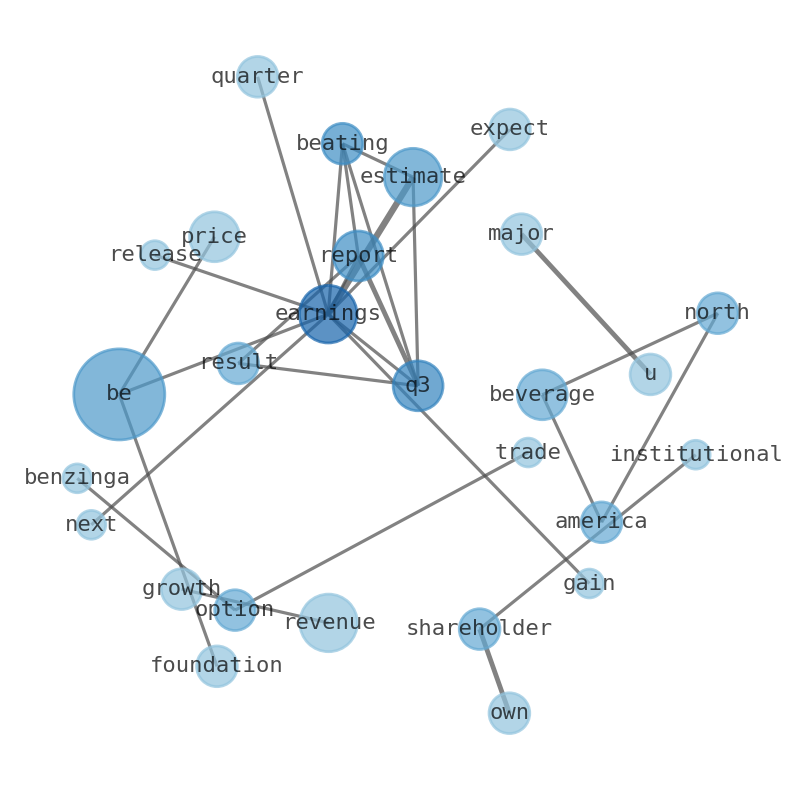

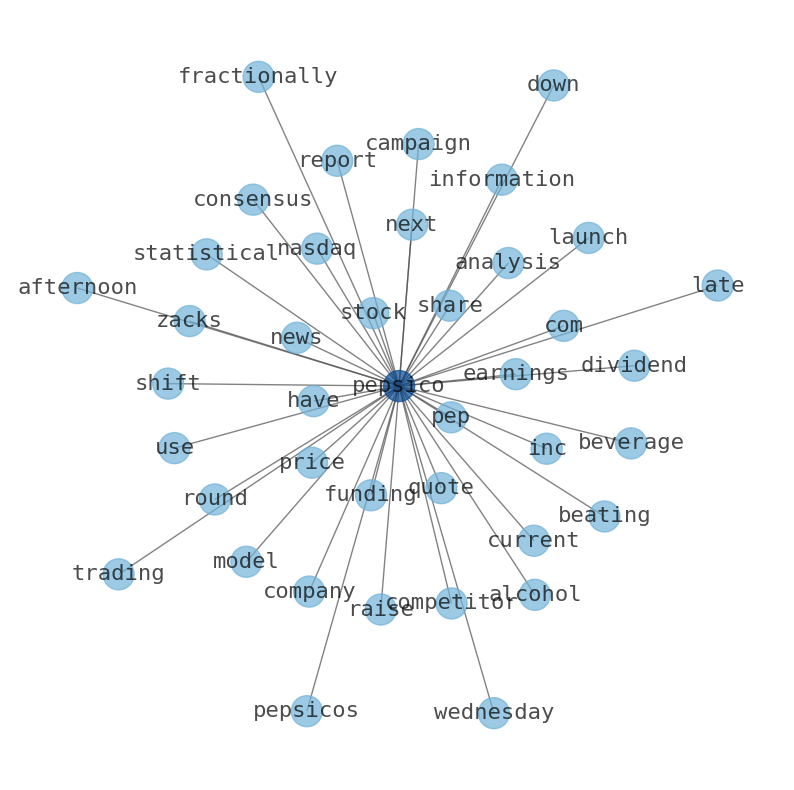

PepsiCo PEP (NYSE: PEP) recently reported its Q3 results, with revenues and earnings beating our estimates. PepsiCo has benefited from its small packs with a better pricing strategy. We estimate PepsiCos Valuation to be $194 per share, reflecting a 20% upside from current levels of $160.

Today's News

PepsiCo PEP (NYSE: PEP) recently reported its Q3 results, with revenues and earnings beating our estimates. PepsiCo has benefited from its small packs with a better pricing strategy. We estimate PepsiCos Valuation to be $194 per share, reflecting a 20% upside from current levels of $160. PepsiCo, Inc. (NASDAQ:PEP) is largely controlled by institutional shareholders who own 74% of the company. The top 25 shareholders own 41% of PepsiCo. The general public, who are usually individual investors, hold a 26% stake in PepsiCo. PepsiCo reported Q3 2023 earnings per share (EPS) of $2.24 , beating estimates of $1.15 by 3.95%. PepsiCo is expected to release next earnings on 02/08/2024 with an earnings per quarter estimate of. $160.00, this is a gain of 0.22%. PepsiCo reported impressive Q3 results despite macroeconomic headwinds. PepsiCo reiterated its target of 10% organic revenue growth in Fiscal Year 2023. Management expects the company to meet upper end of its Fiscal 2024 revenue growth target. PepsiCo brings 1,000 interns into 20 departments in offices throughout the United States each summer. PepsiCo can only succeed when our associates and the society we serve flourish. Consumers have also started to shift their preferences “towards smaller packages that offer the benefits of convenience, variety, portion control, and good value,” PepsiCo stated in prepared remarks. PepsiCo Beverages North America took a particularly hard hit with a 6% volume drop. CB Insights Intelligence Analysts have mentioned PepsiCo in 9 research briefs. PepsiCo has made 13 investments. Benzinga s options scanner spotted 16 uncommon options trades for PepsiCo. Whales have been targeting a price range from $155.0 to $190.0 for the last 3 months. With a volume of 3,386,715, the price of PEP is down -0.63% today. PepsiCo Foundation S.M.I.L.E. (Success Matters in Life and Education) scholarship is part of the PepsiCo Foundations Community College Scholarship Program. PepsiCo Beverages North America saw revenue rise 8% to $7.16bn in the third quarter of 2023. PepsiCo stocks have displayed a downward trend throughout this year. The critical factor behind these impressive stats is the price increase for PepsiCos products. Coca-Cola Leads PepsiCo in 33 of 40 Major U.S. Major U.-S. Coke to Scale Back AHA Sparkling Water in 2024. PepsiCo UK swaps out diesel for cooking oil in green logistics roll-out. Australian beverage companies pledge to accelerate sugar reduction by 2025. Coffee berry extract may boost alertness & mood: PepsiCo study. Coca-Cola Co. appears to be making a run for the pole position in the sports performance and hydration category with the $5.6bn acquisition of BodyArmor.

Stock Profile

"PepsiCo, Inc. manufactures, markets, distributes, and sells various beverages and convenient foods worldwide. The company operates through seven segments: Frito-Lay North America; Quaker Foods North America; PepsiCo Beverages North America; Latin America; Europe; Africa, Middle East and South Asia; and Asia Pacific, Australia and New Zealand and China Region. It provides dips, cheese-flavored snacks, and spreads, as well as corn, potato, and tortilla chips; cereals, rice, pasta, mixes and syrups, granola bars, grits, oatmeal, rice cakes, simply granola, and side dishes; beverage concentrates, fountain syrups, and finished goods; ready-to-drink tea, coffee, and juices; dairy products; and sparkling water makers and related products. The company offers its products primarily under the Lay's, Doritos, Cheetos, Gatorade, Pepsi-Cola, Mountain Dew, Quaker, Aquafina, Emperador, Diet Mountain Dew, Diet Pepsi, Gatorade Zero, Propel, Marias Gamesa, Ruffles, Sabritas, Saladitas, Tostitos, 7UP, Diet 7UP, H2oh!, Manzanita Sol, Mirinda, Pepsi Black, San Carlos, Toddy, Walkers, Chipsy, Kurkure, Sasko, Spekko, White Star, Smith's, Sting, SodaStream, Lubimy Sad, Pepsi, and other brands. It serves wholesale and other distributors, foodservice customers, grocery stores, drug stores, convenience stores, discount/dollar stores, mass merchandisers, membership stores, hard discounters, e-commerce retailers and authorized independent bottlers, and others through a network of direct-store-delivery, customer warehouse, and distributor networks, as well as directly to consumers through e-commerce platforms and retailers. The company was founded in 1898 and is based in Purchase, New York."

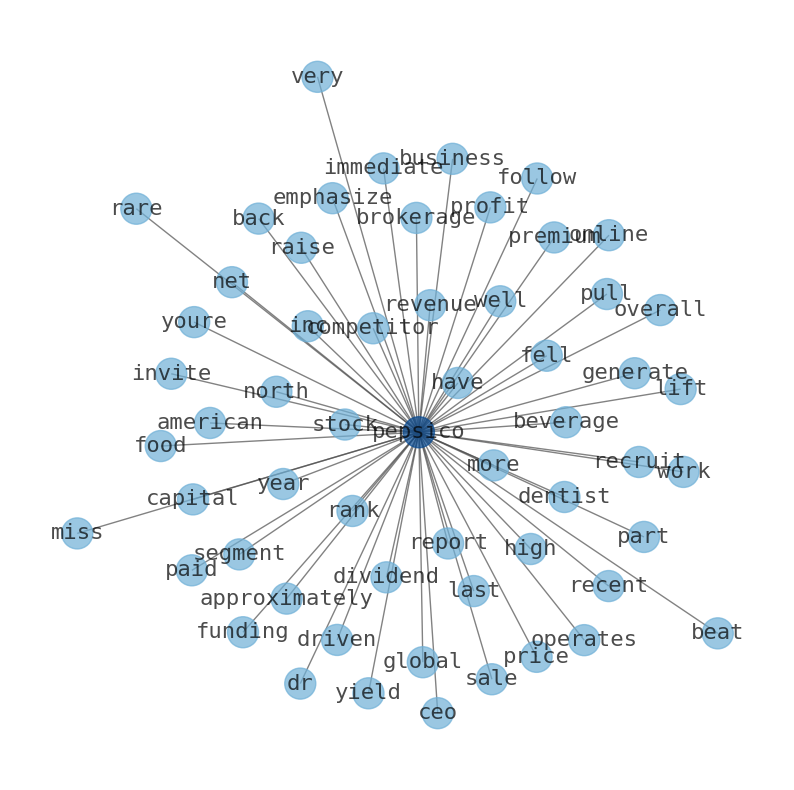

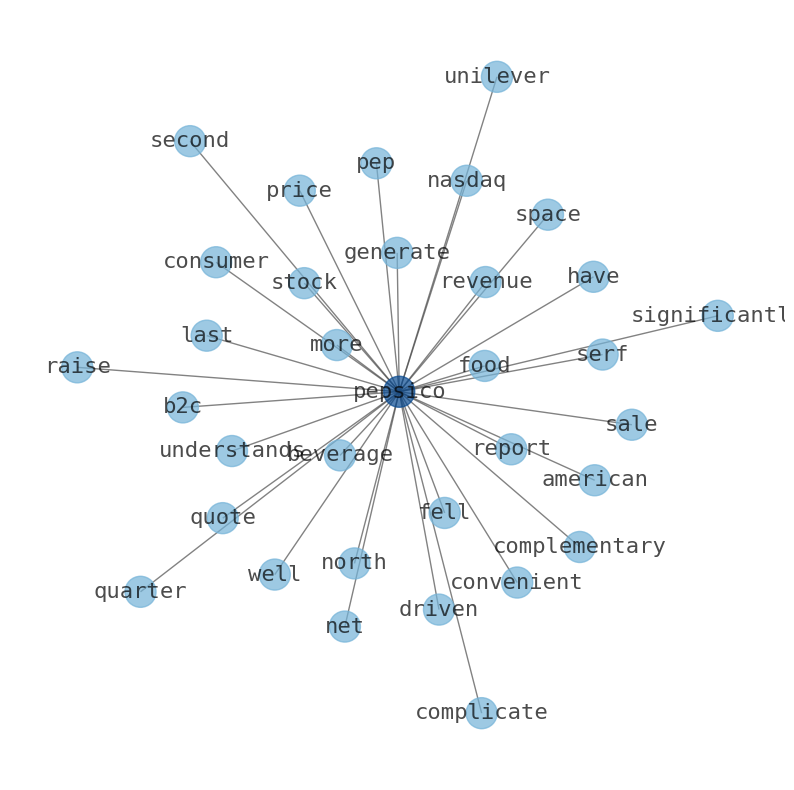

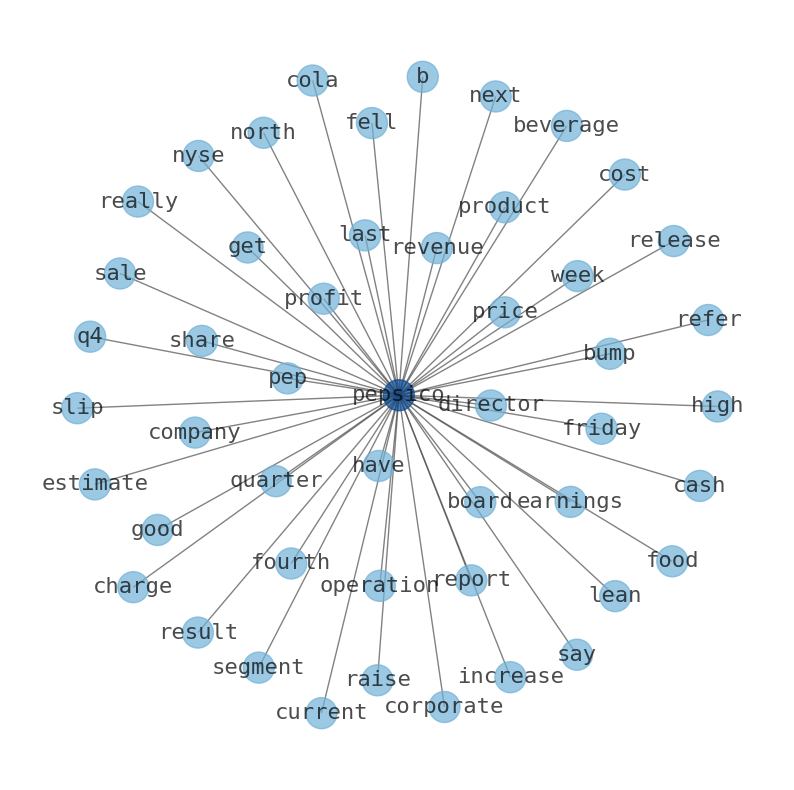

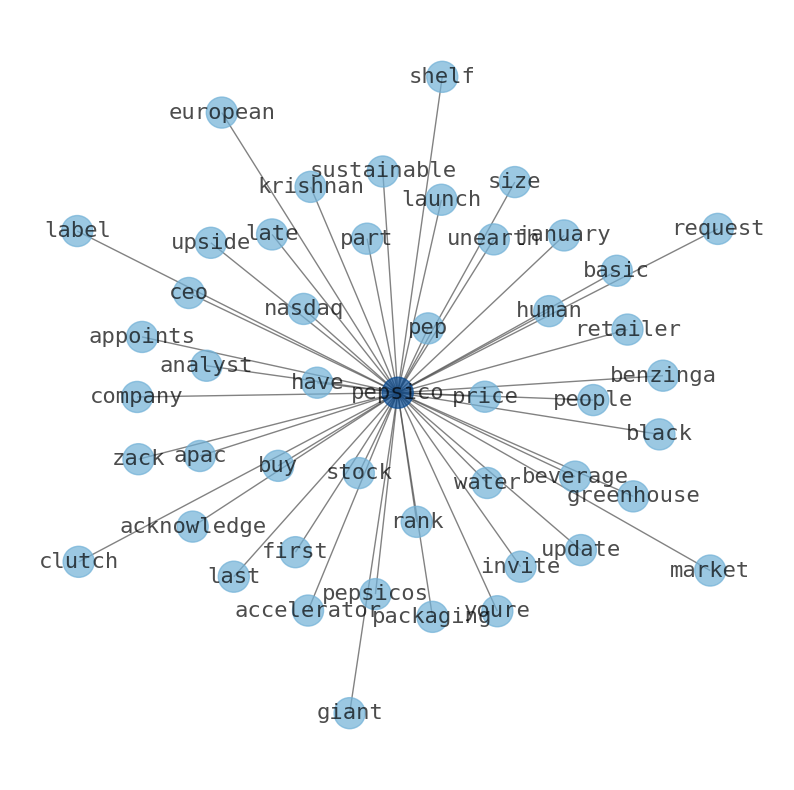

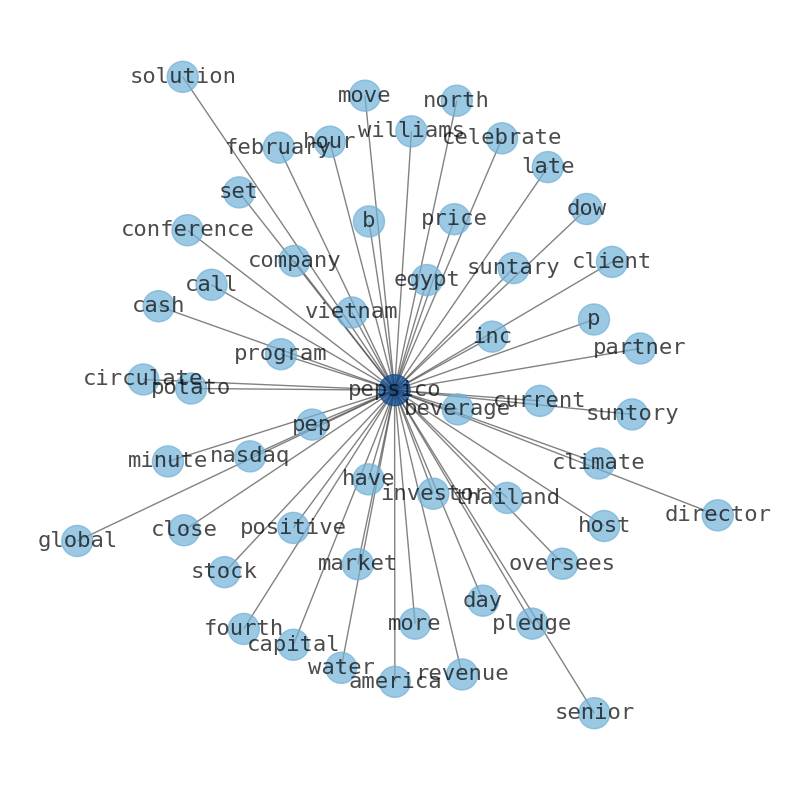

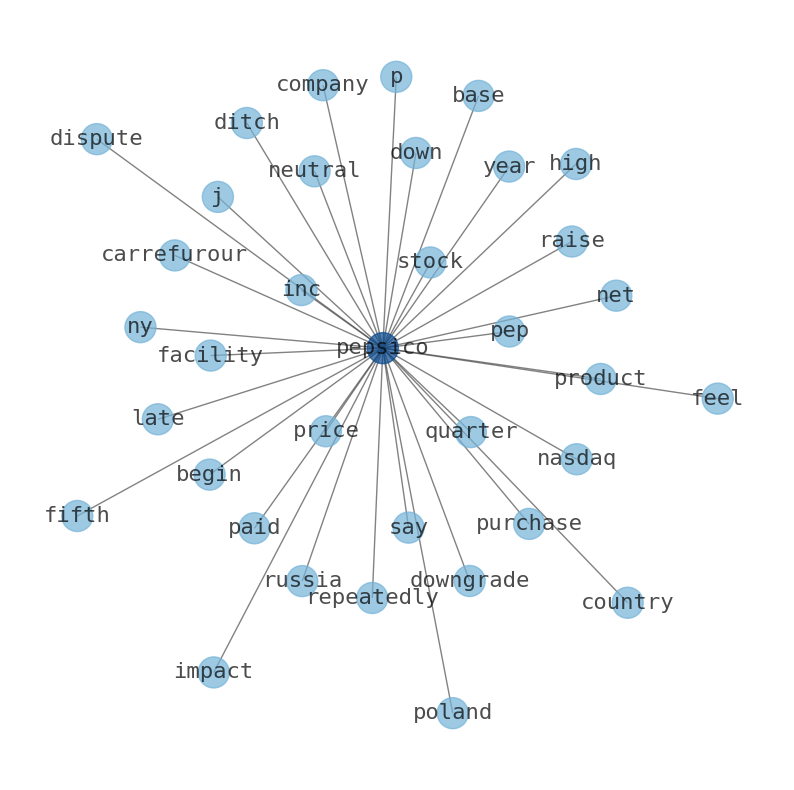

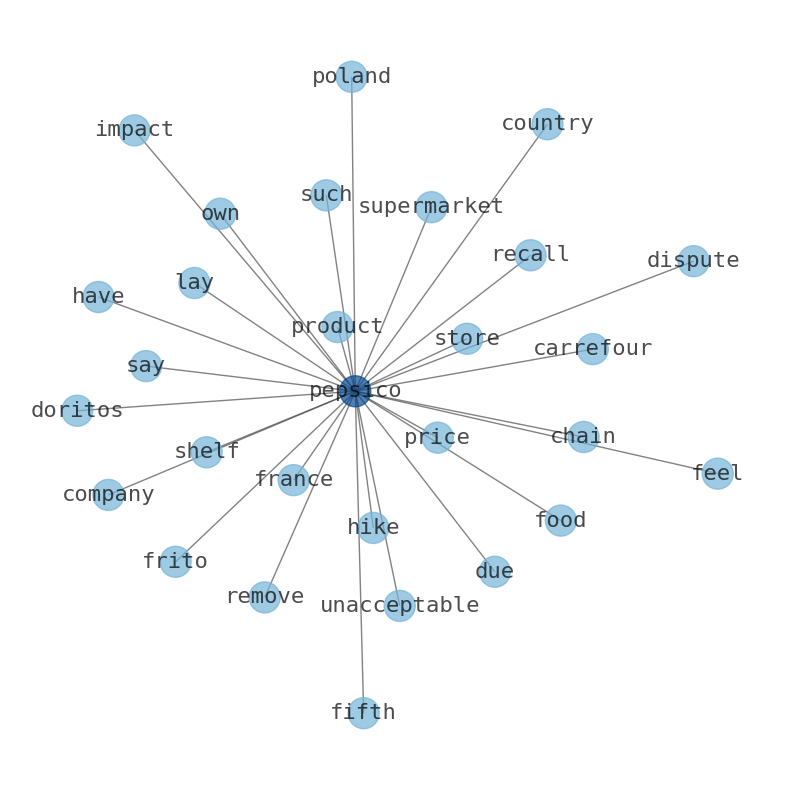

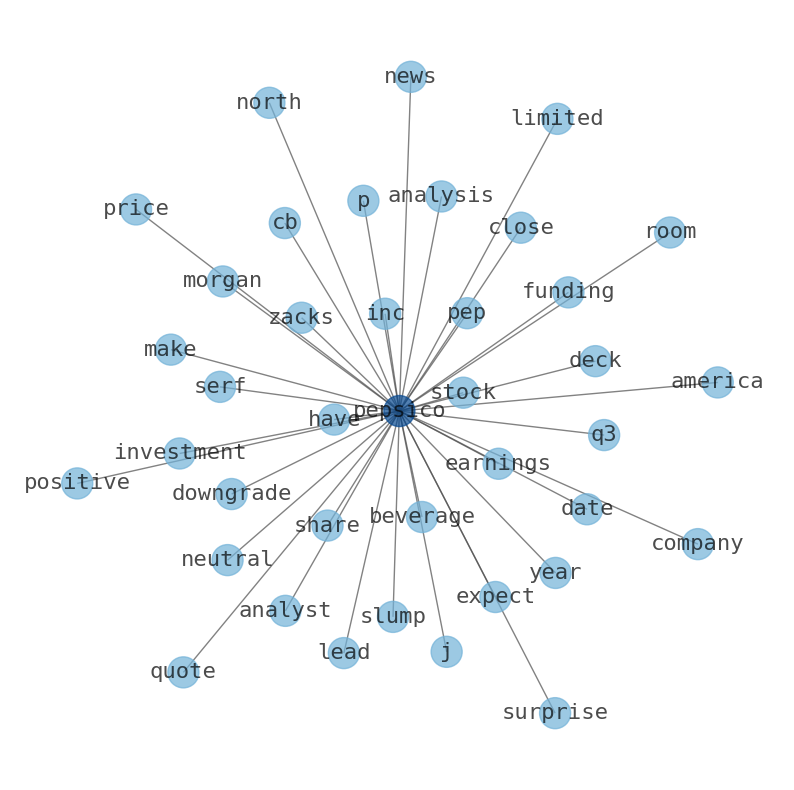

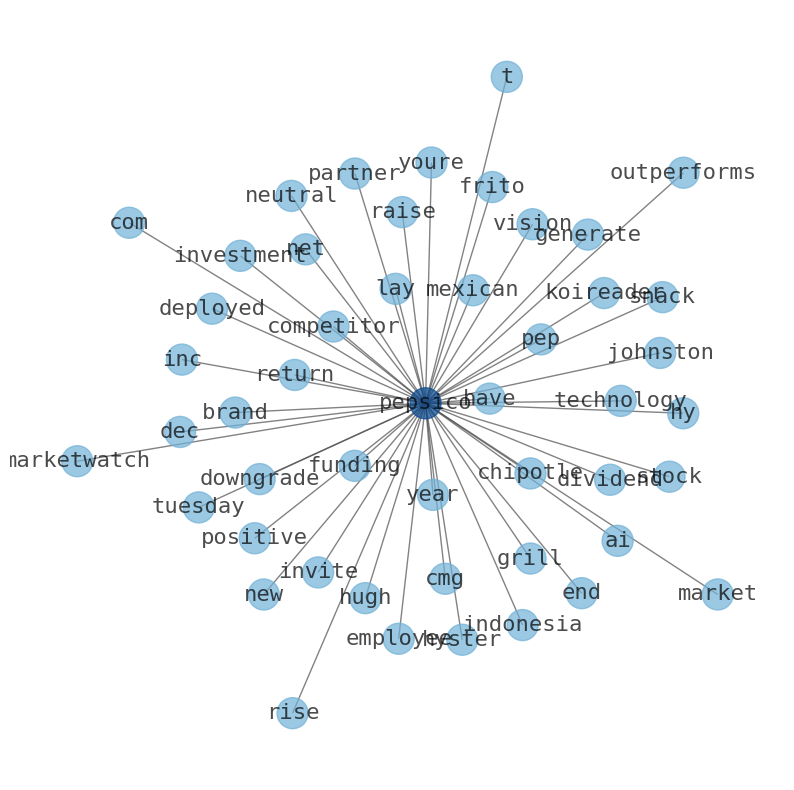

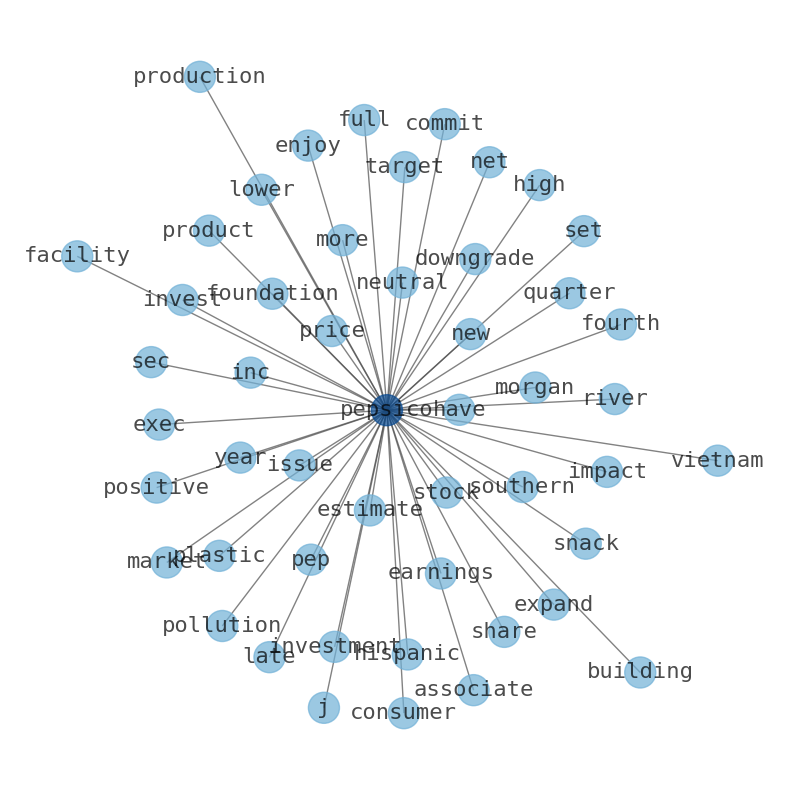

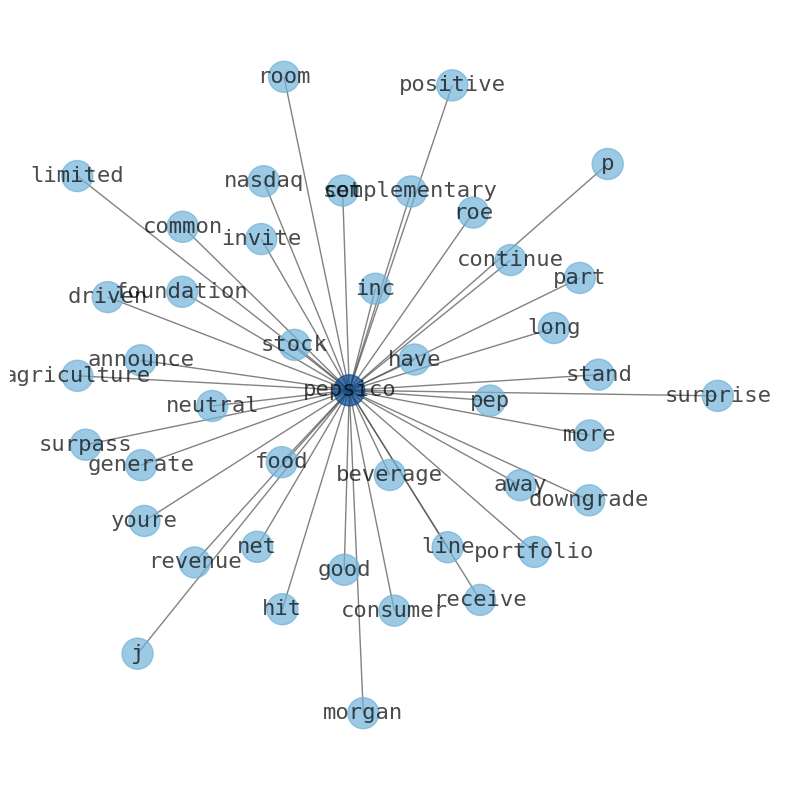

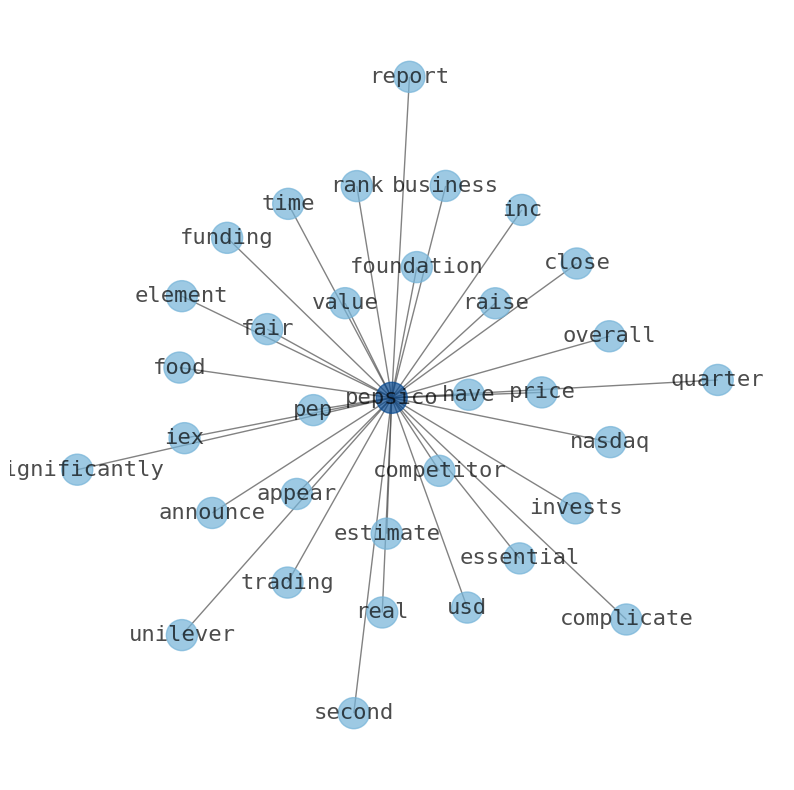

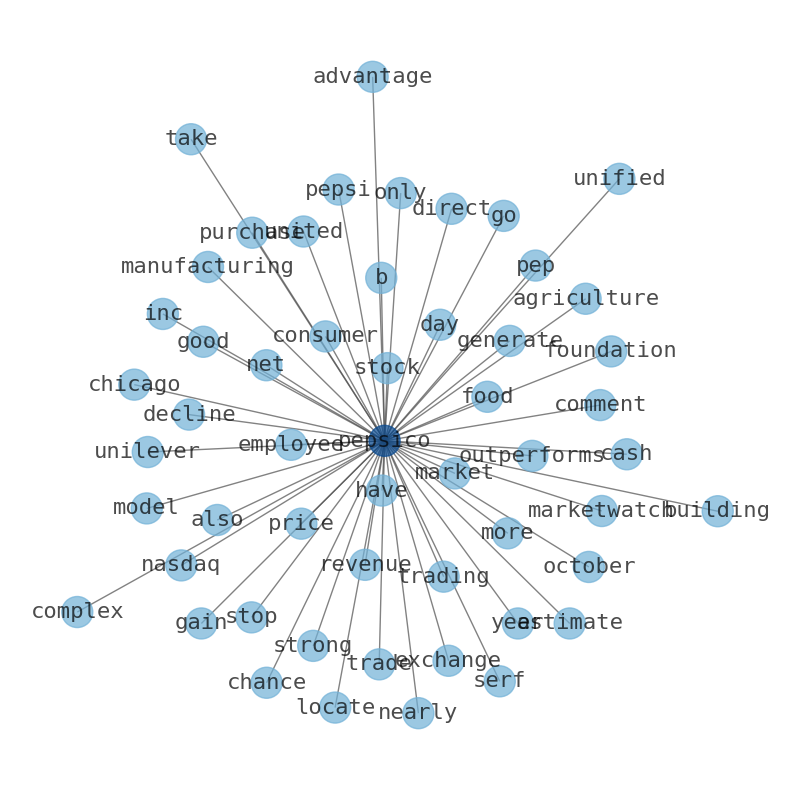

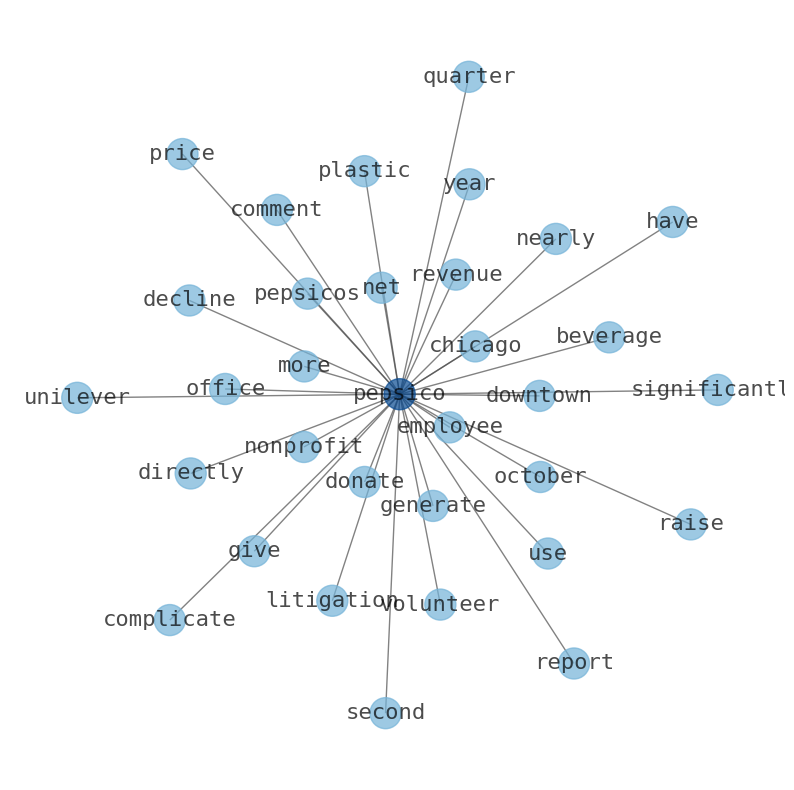

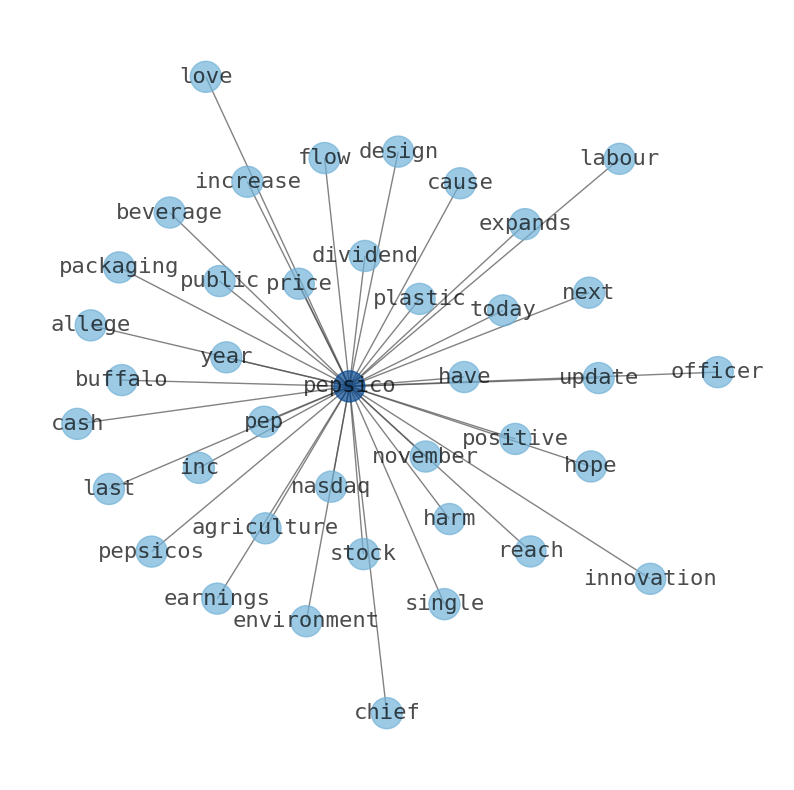

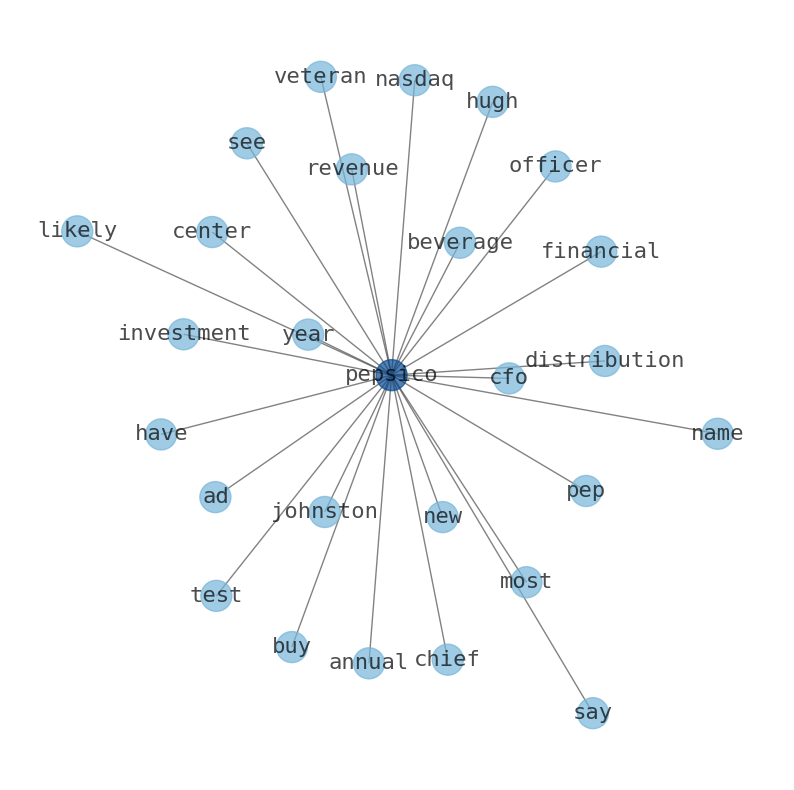

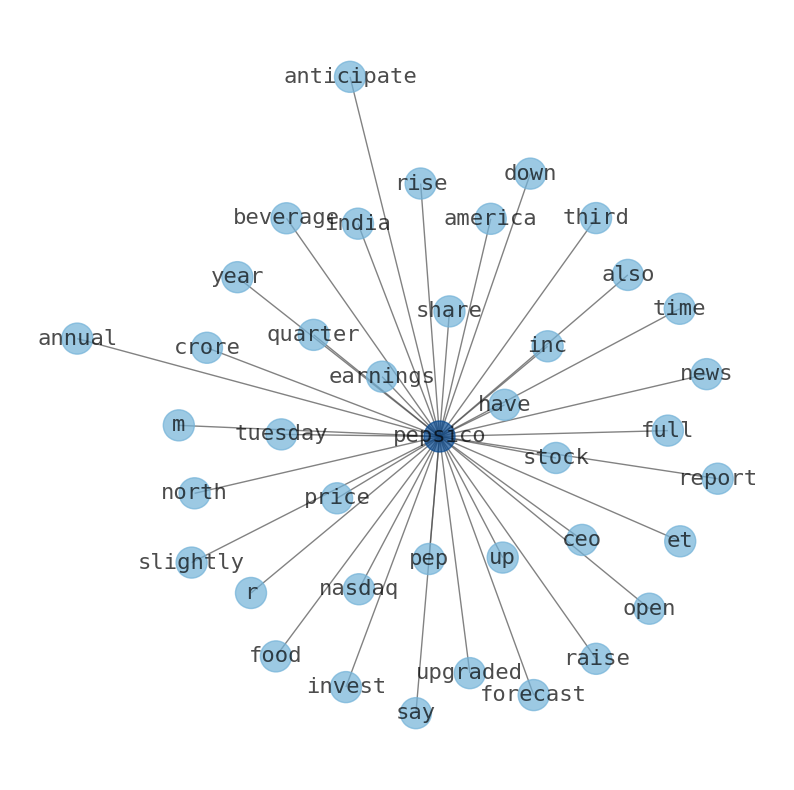

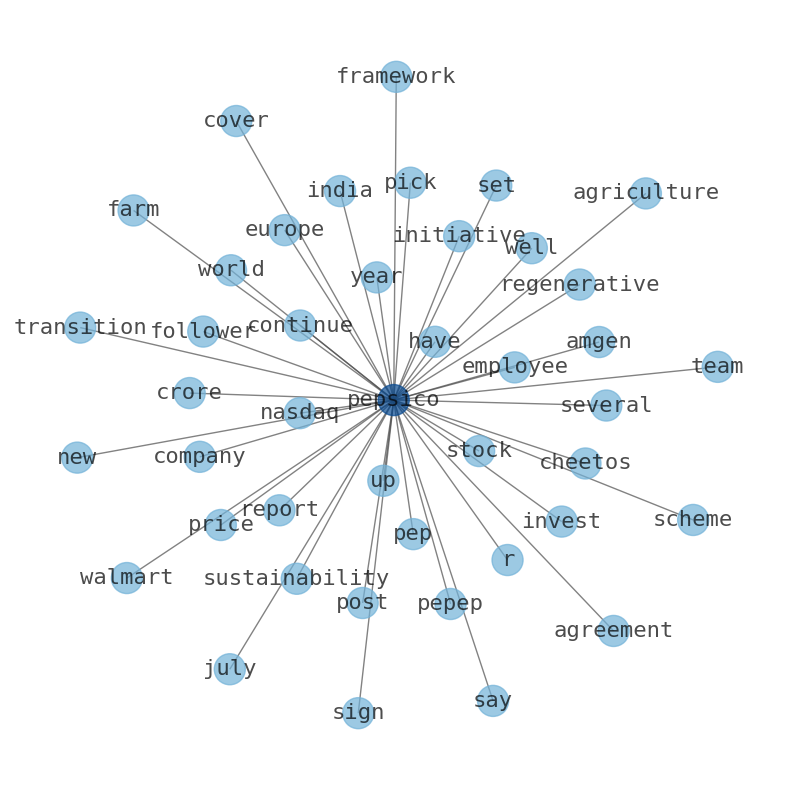

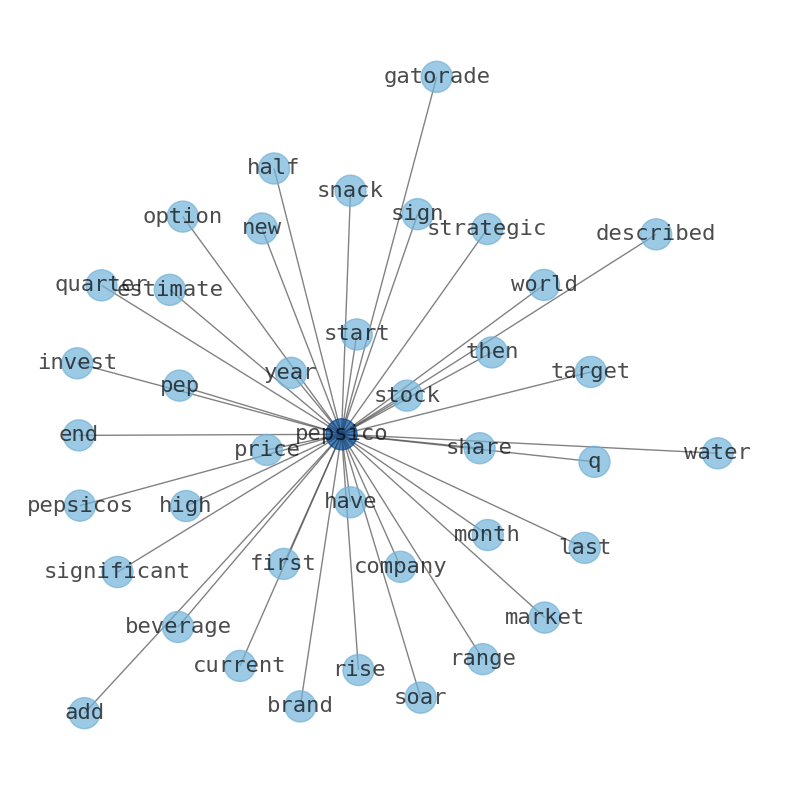

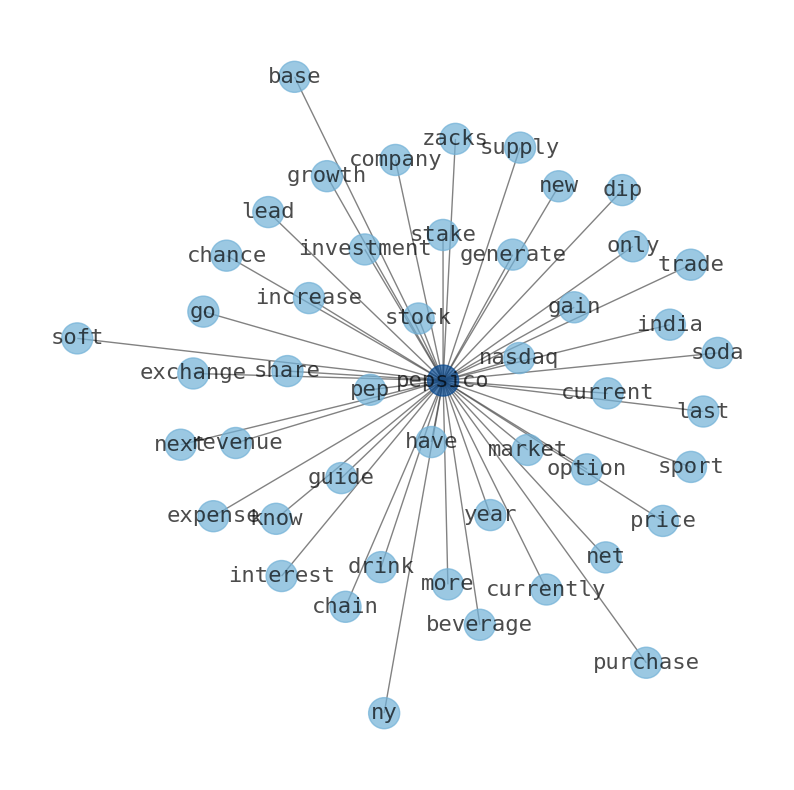

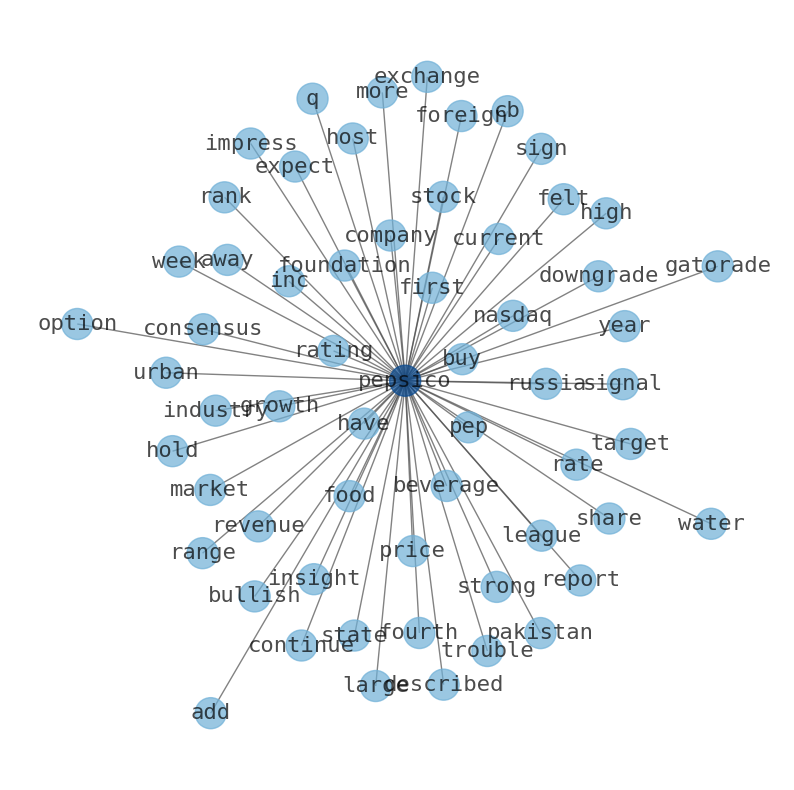

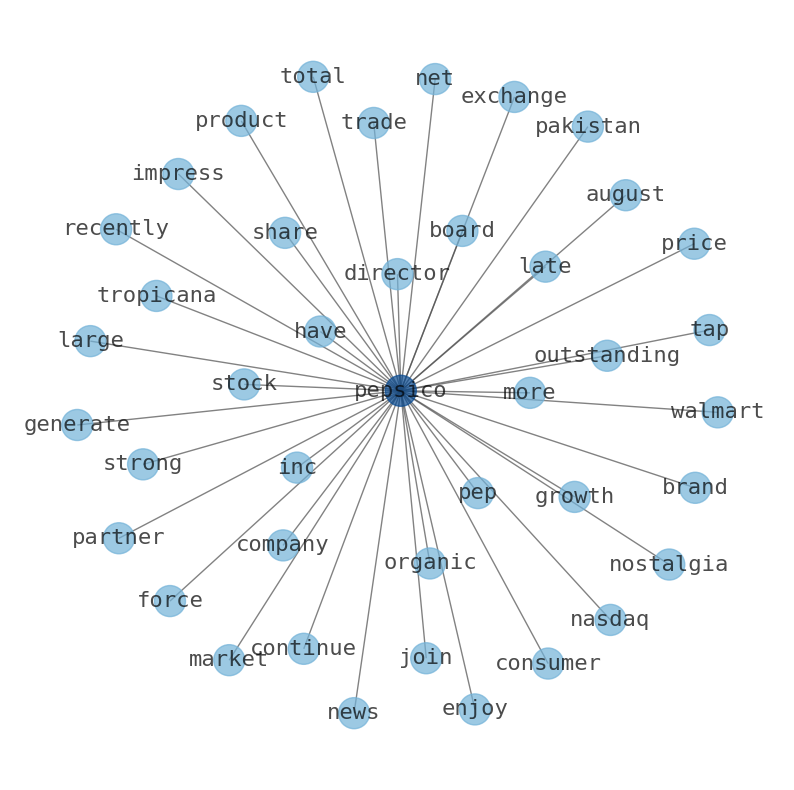

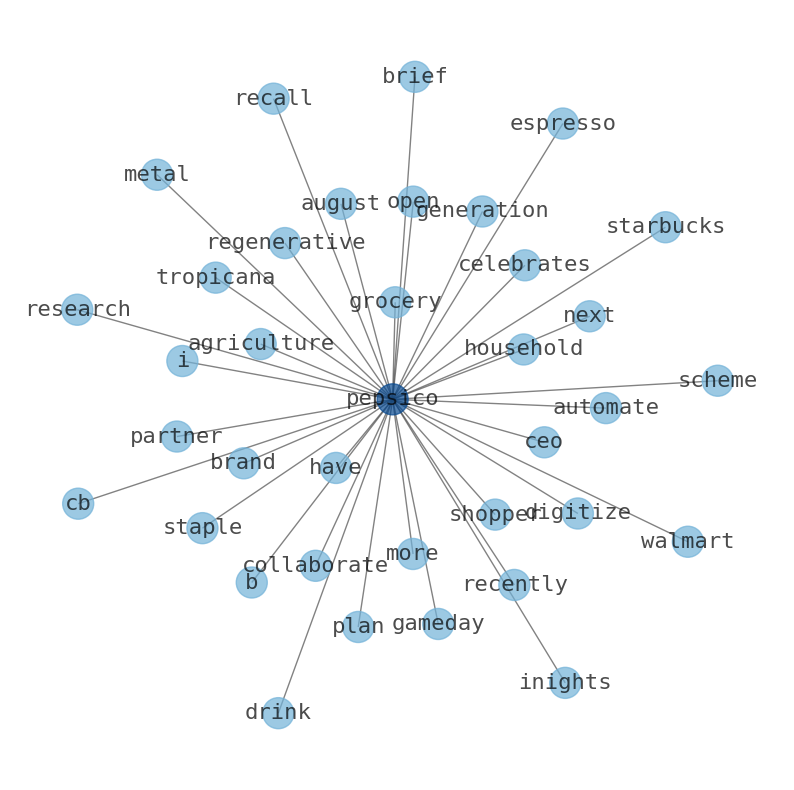

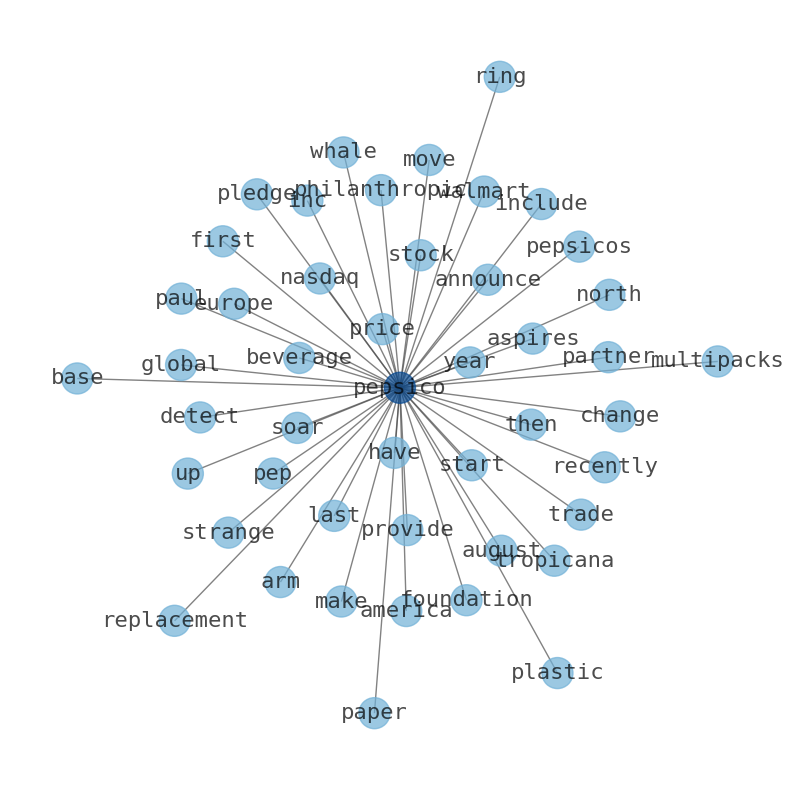

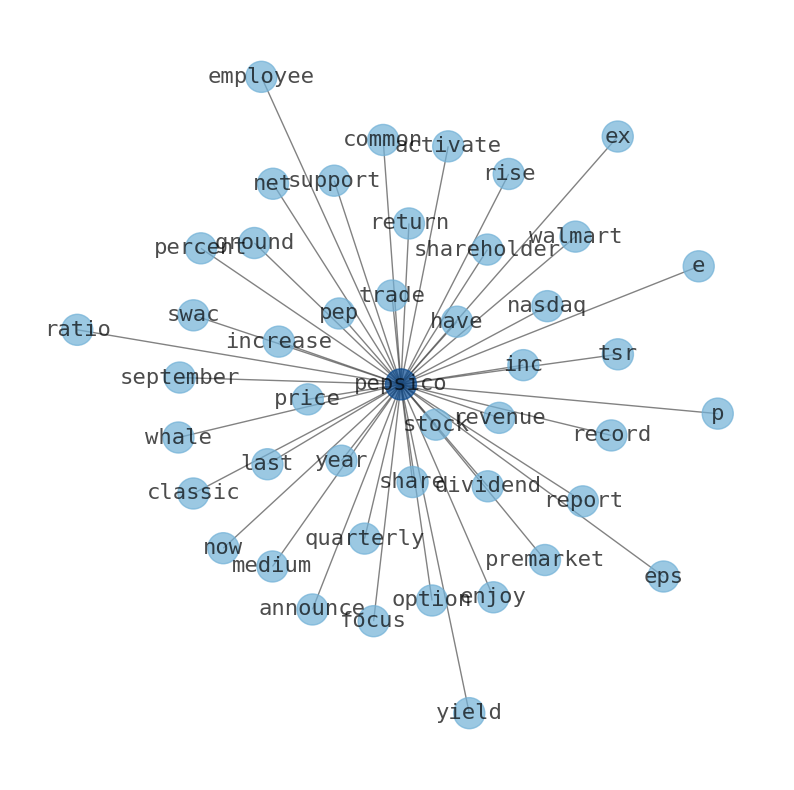

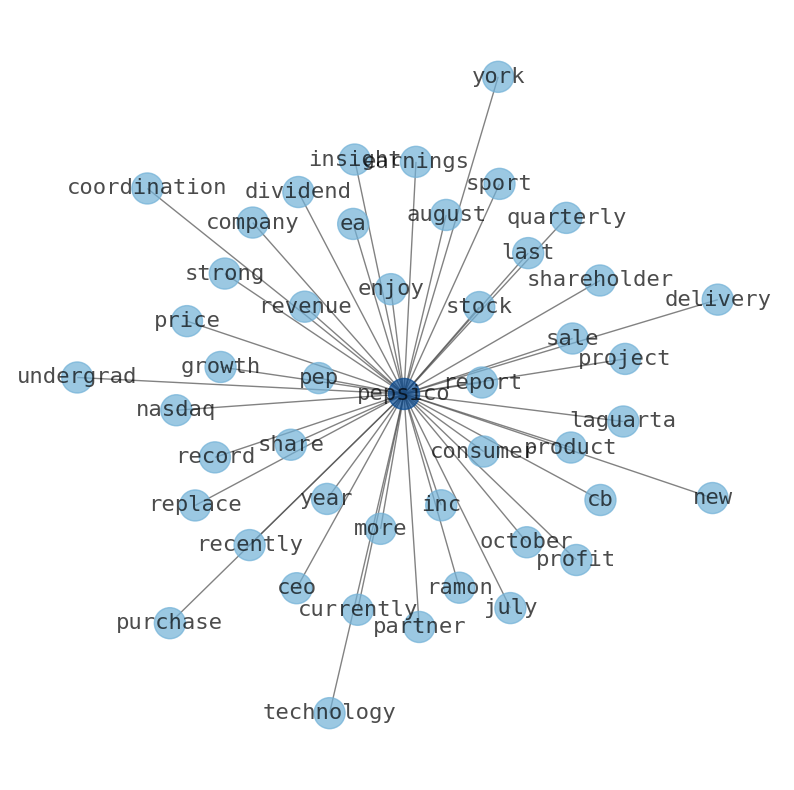

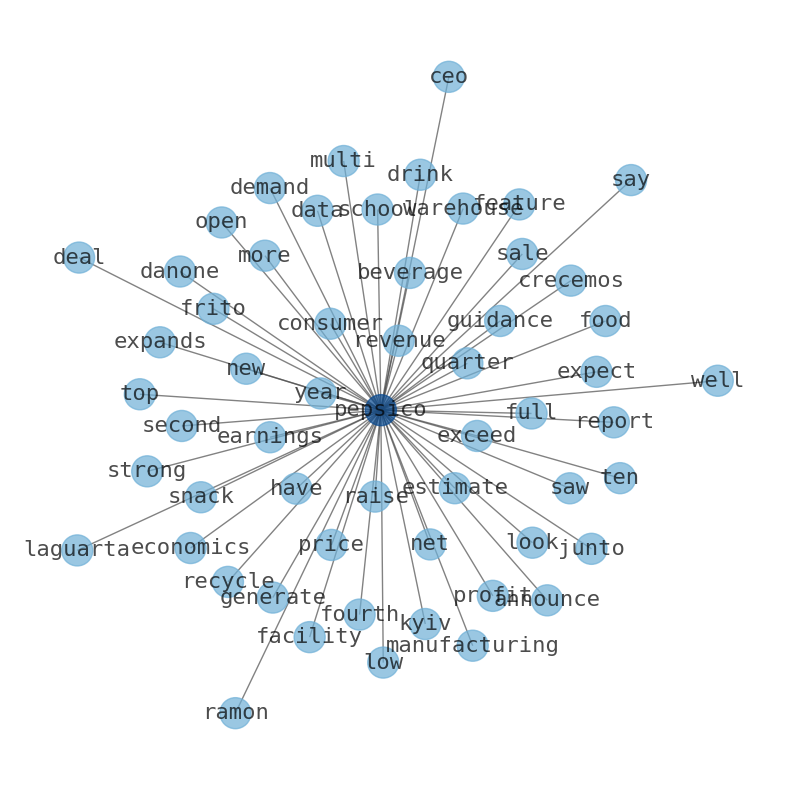

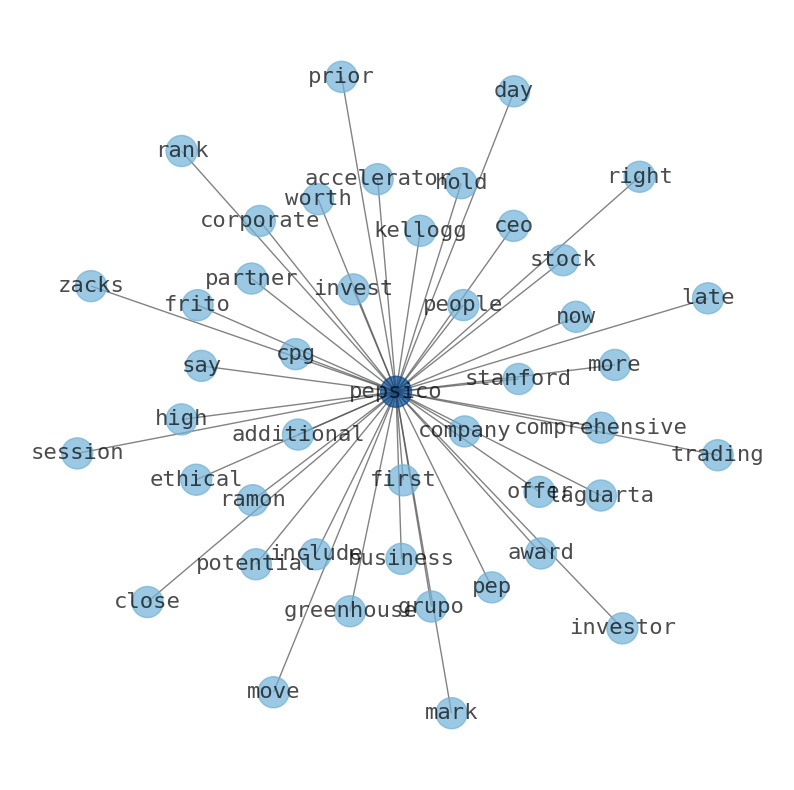

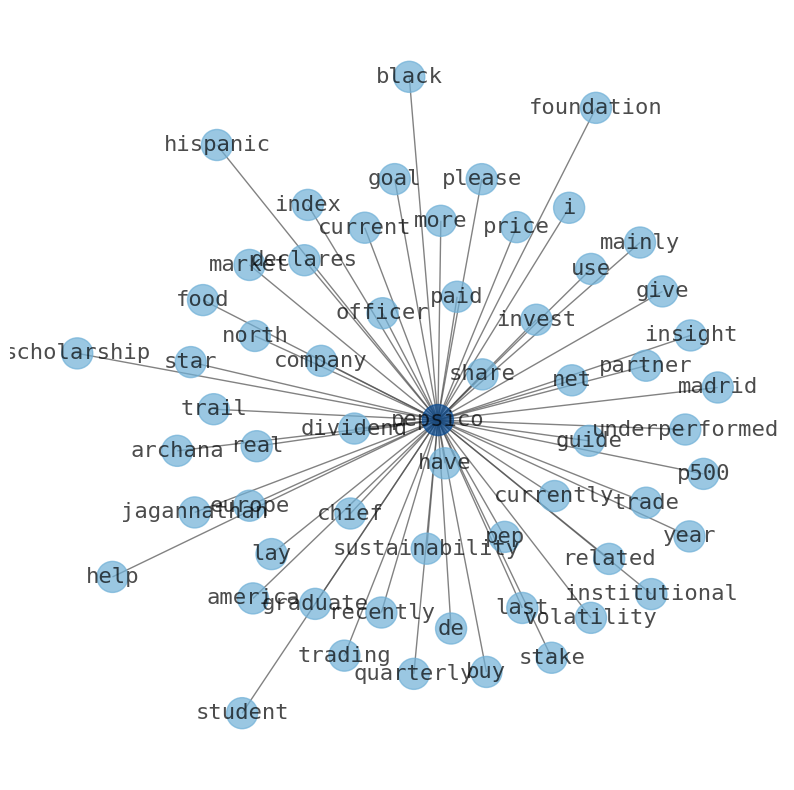

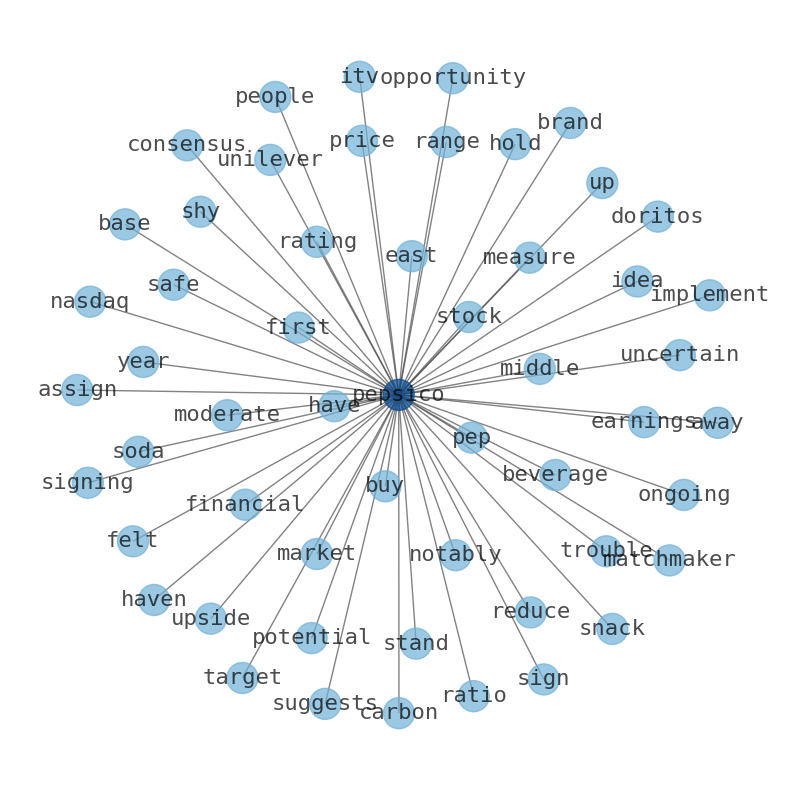

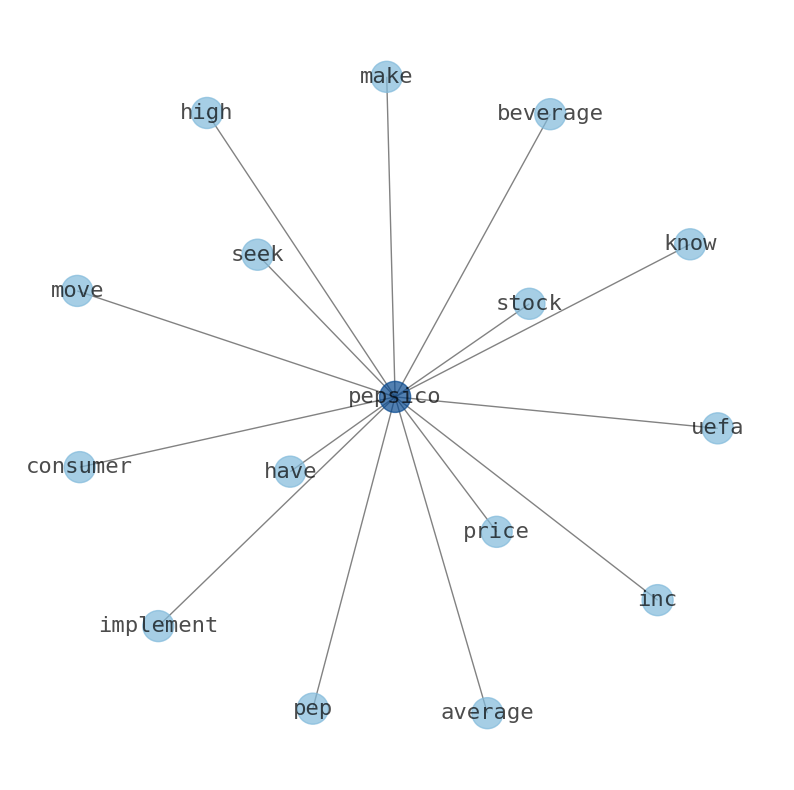

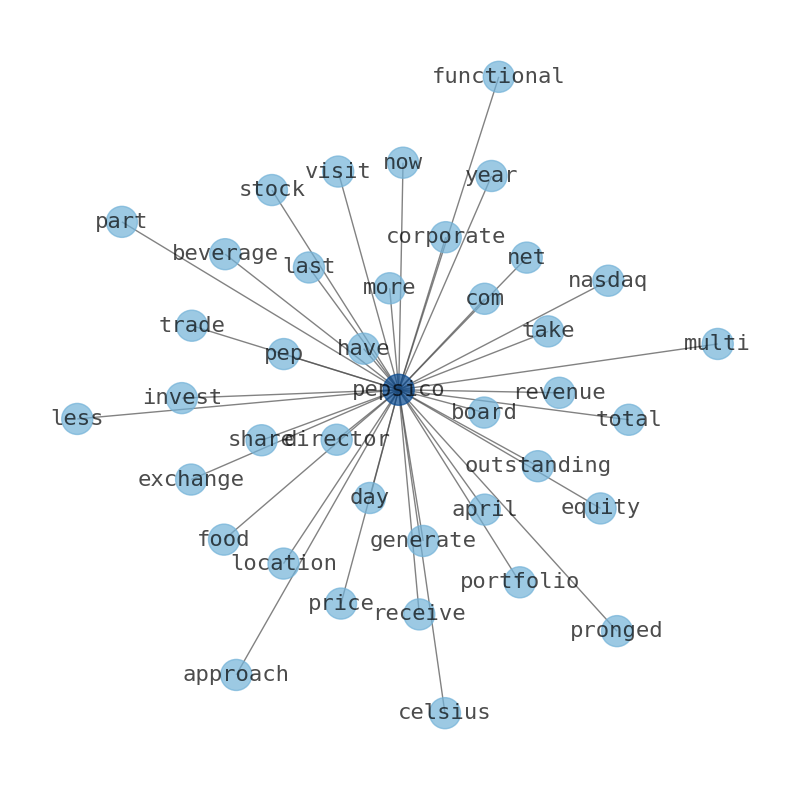

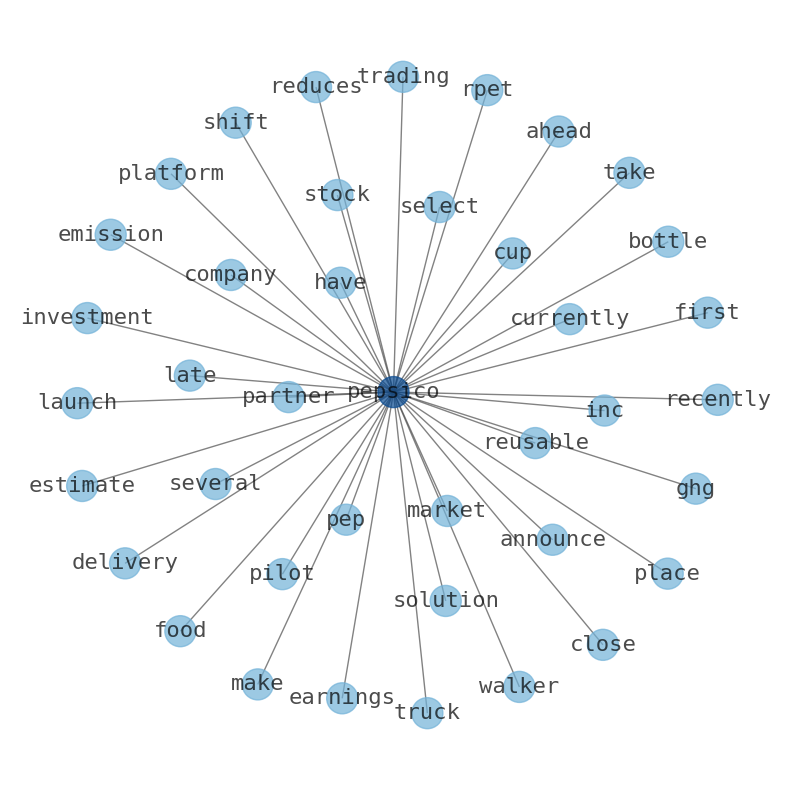

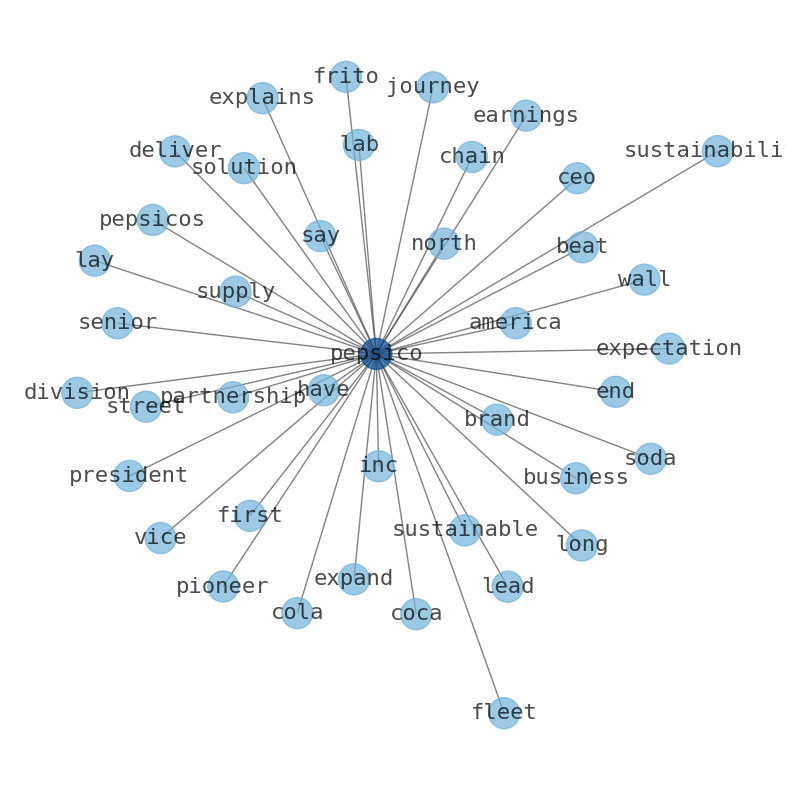

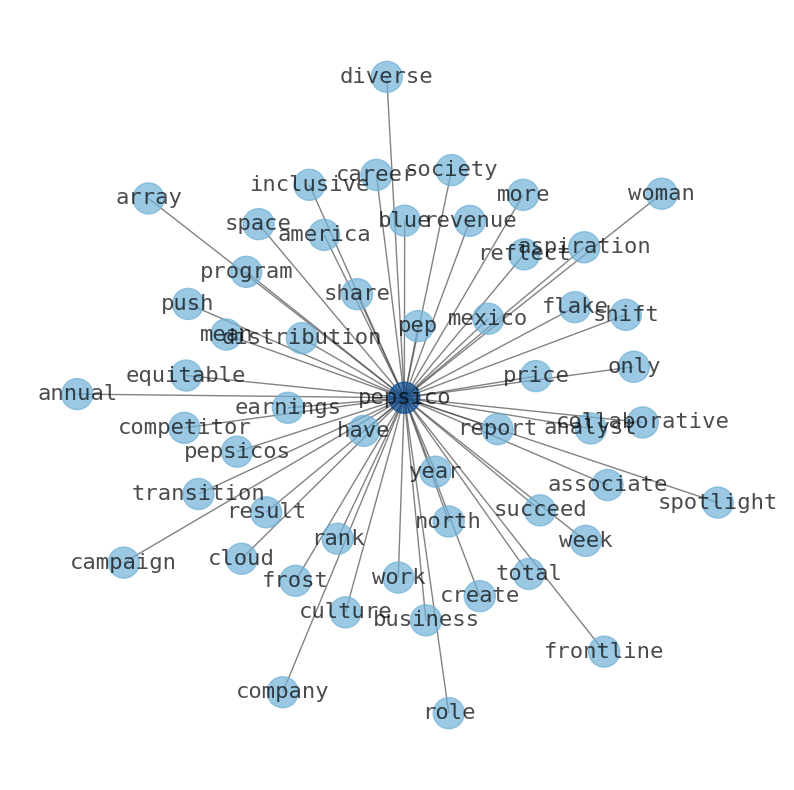

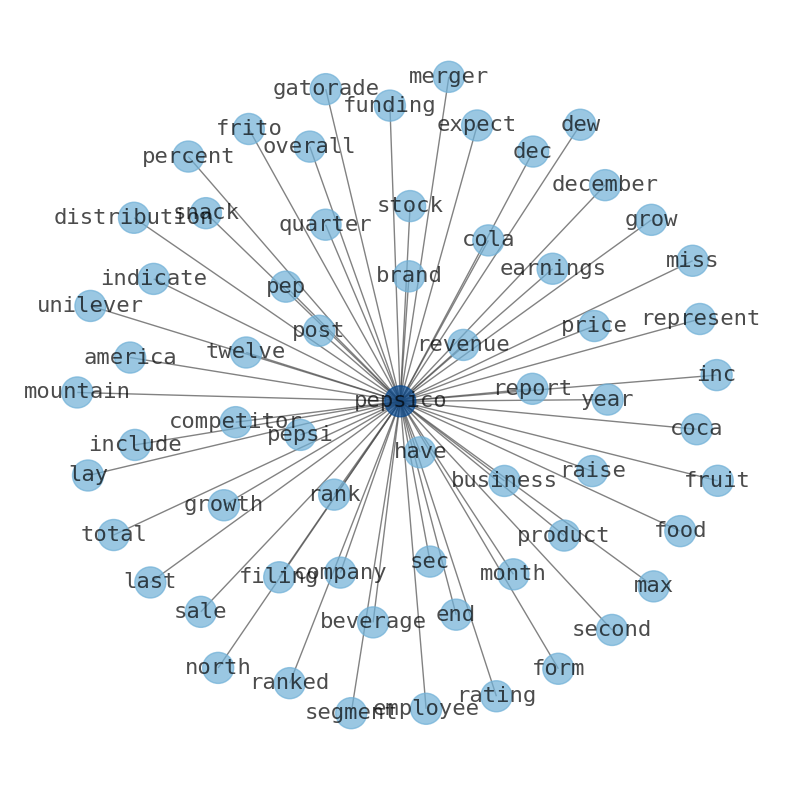

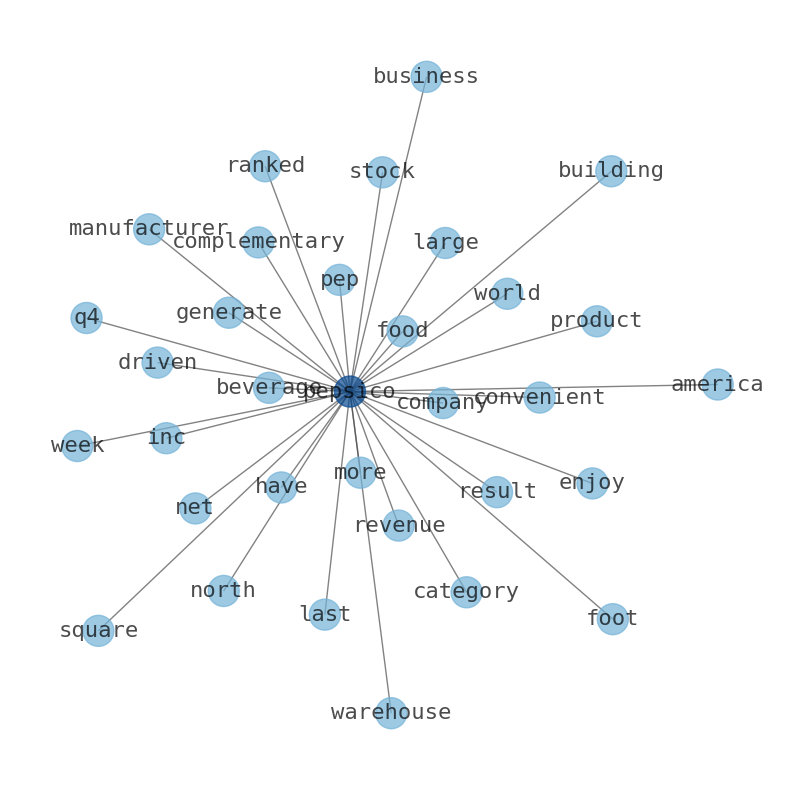

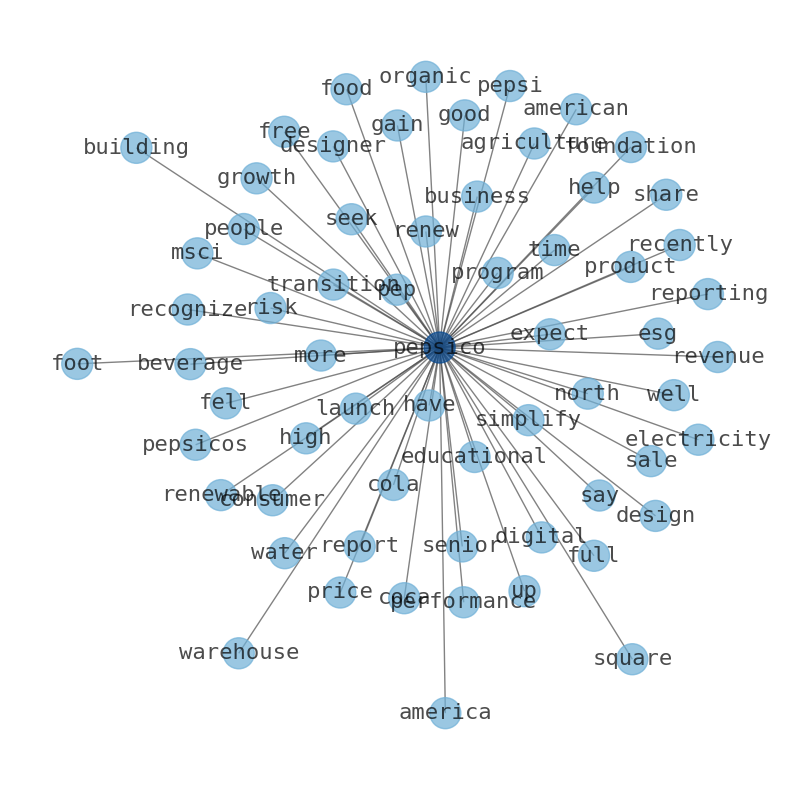

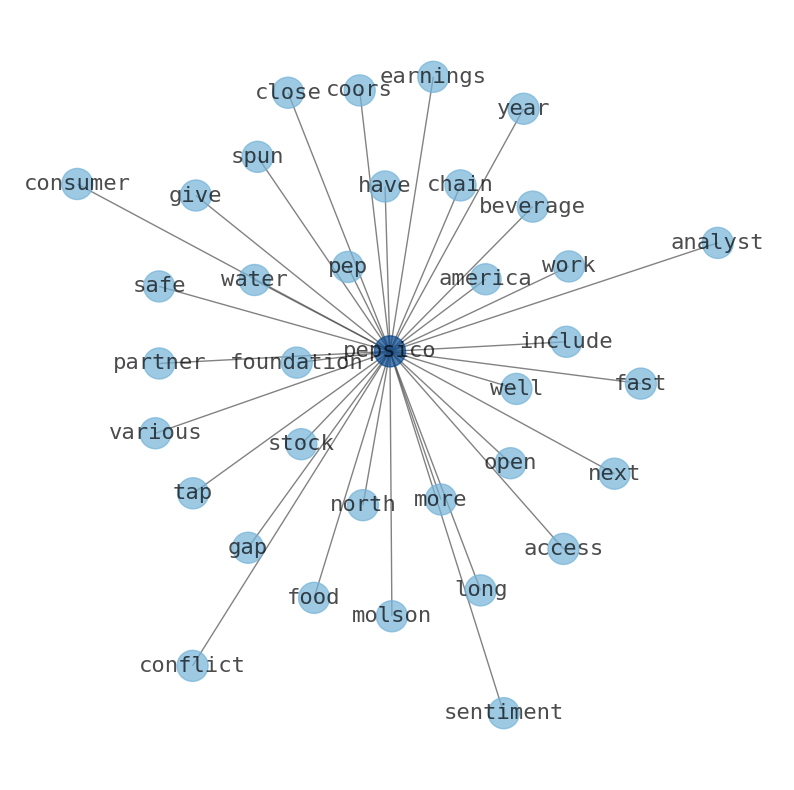

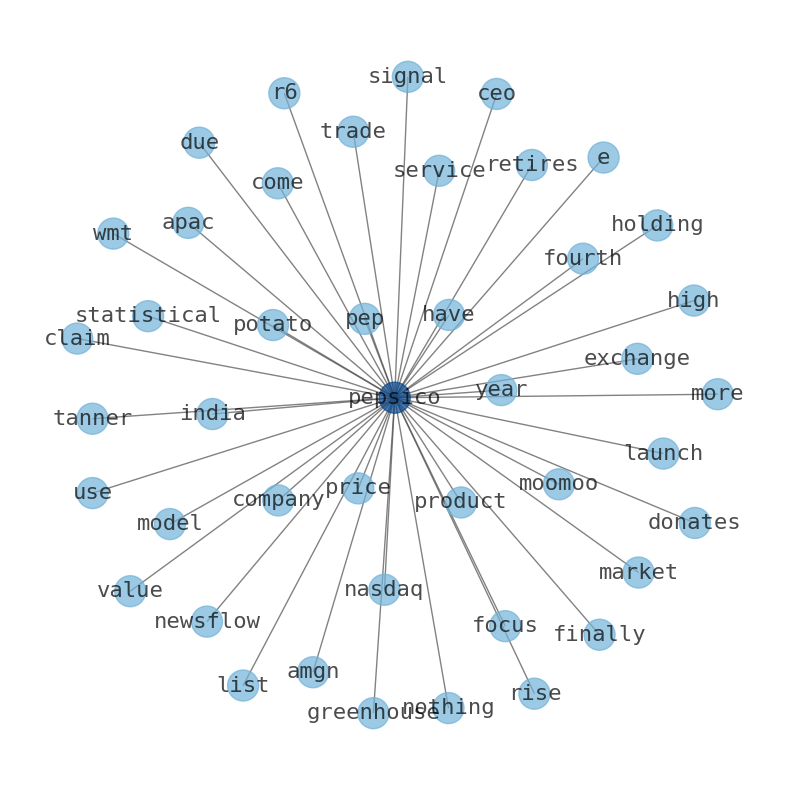

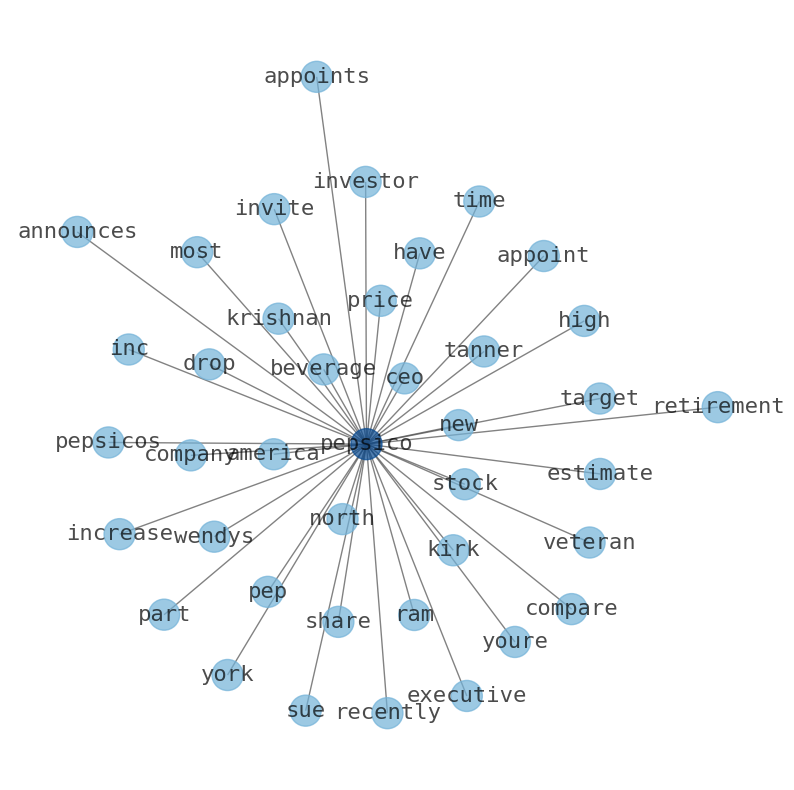

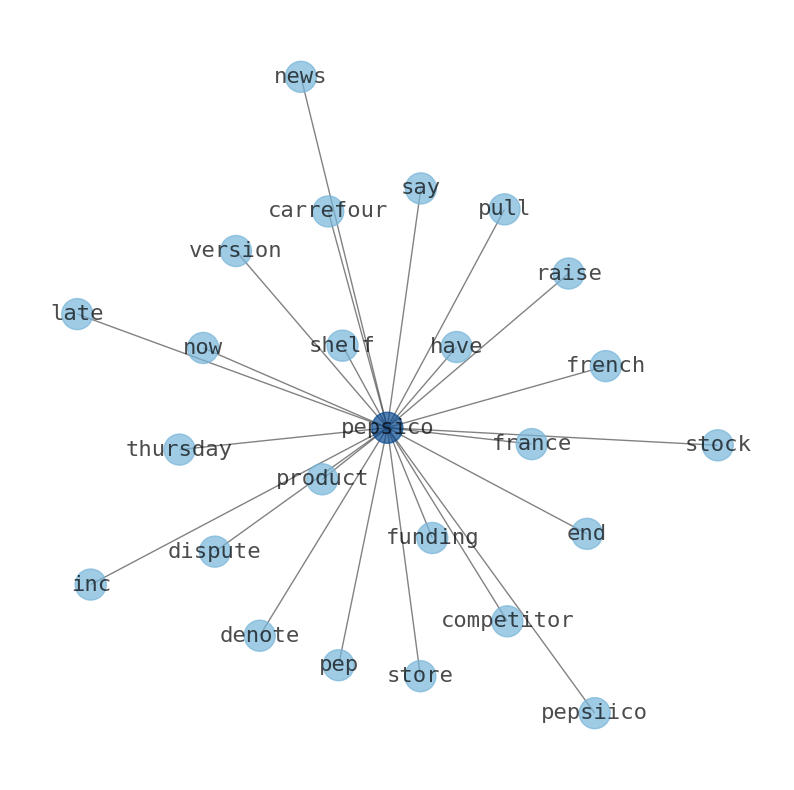

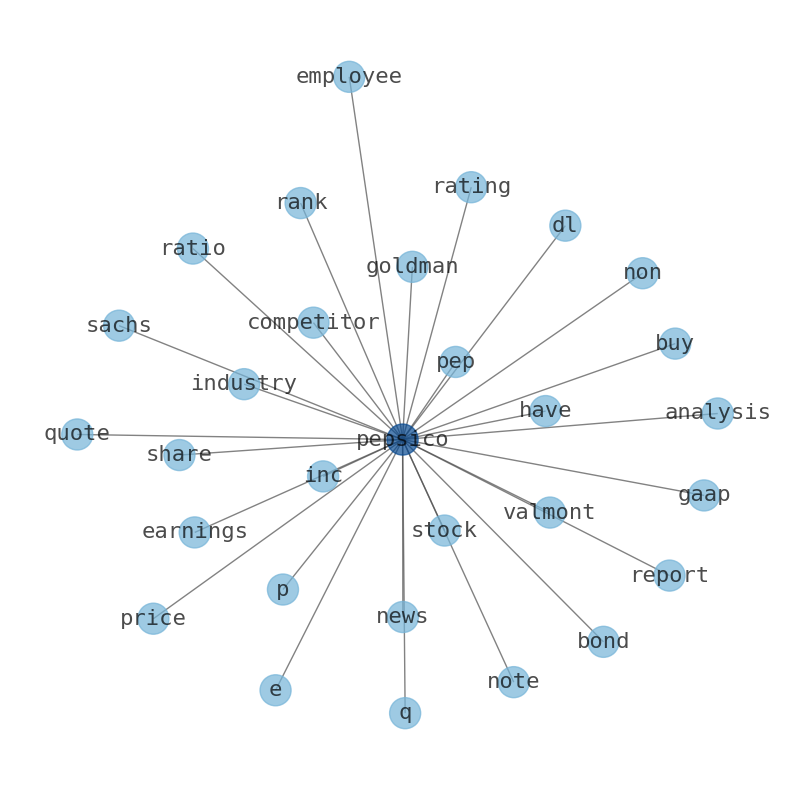

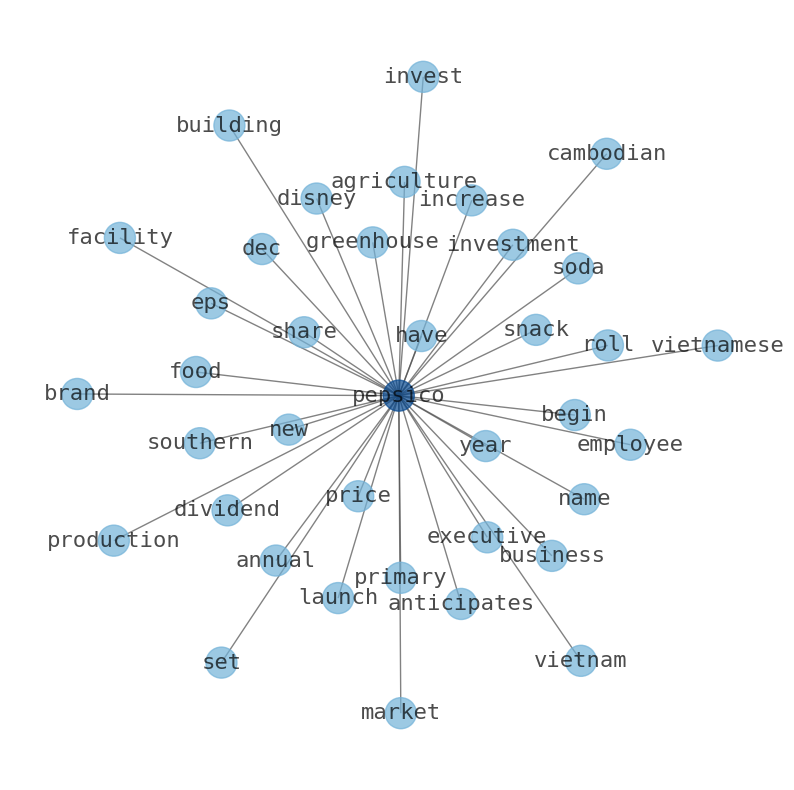

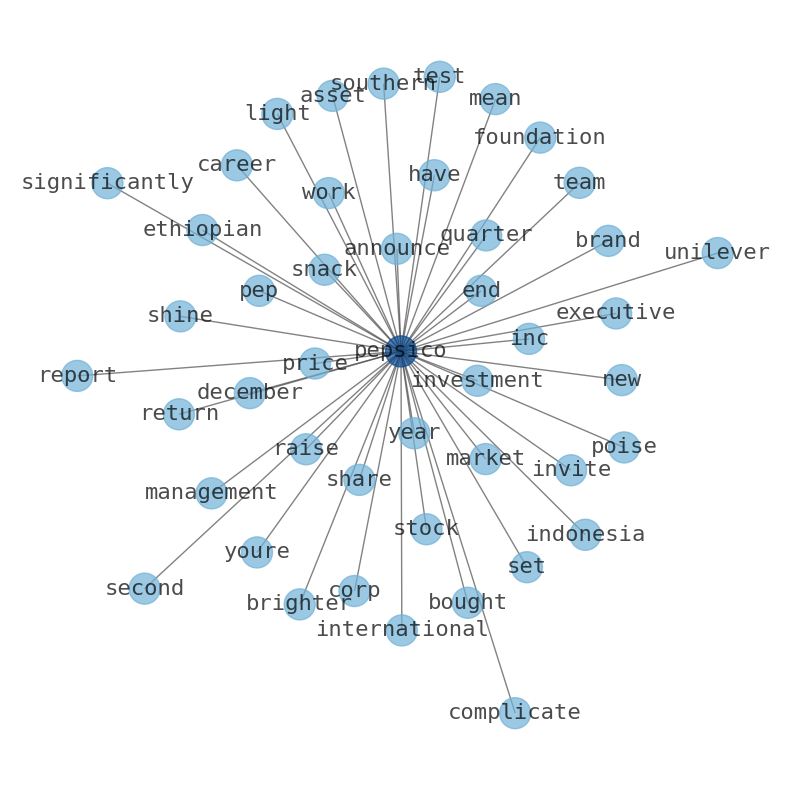

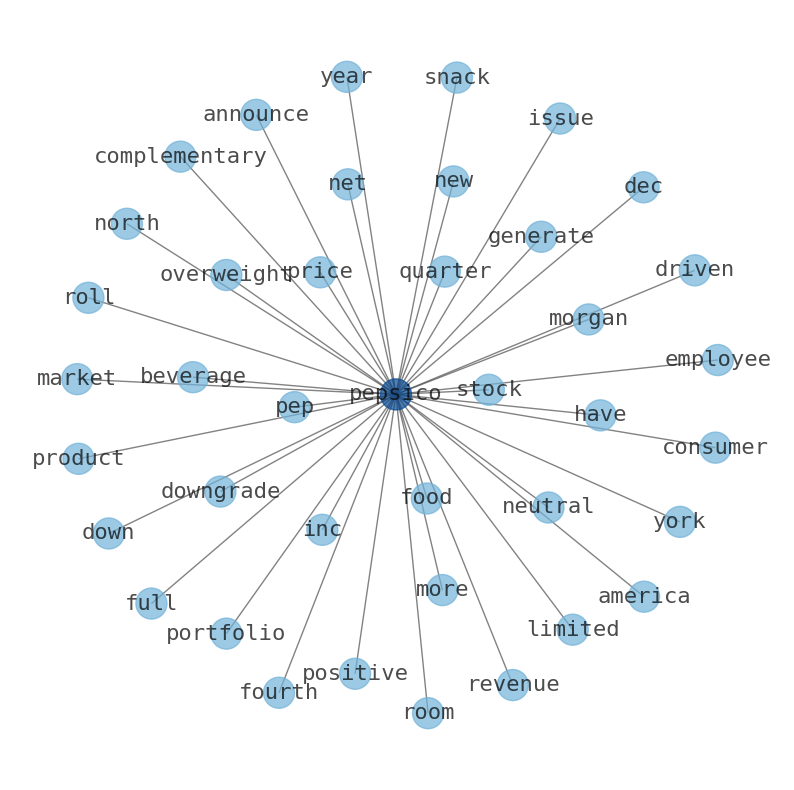

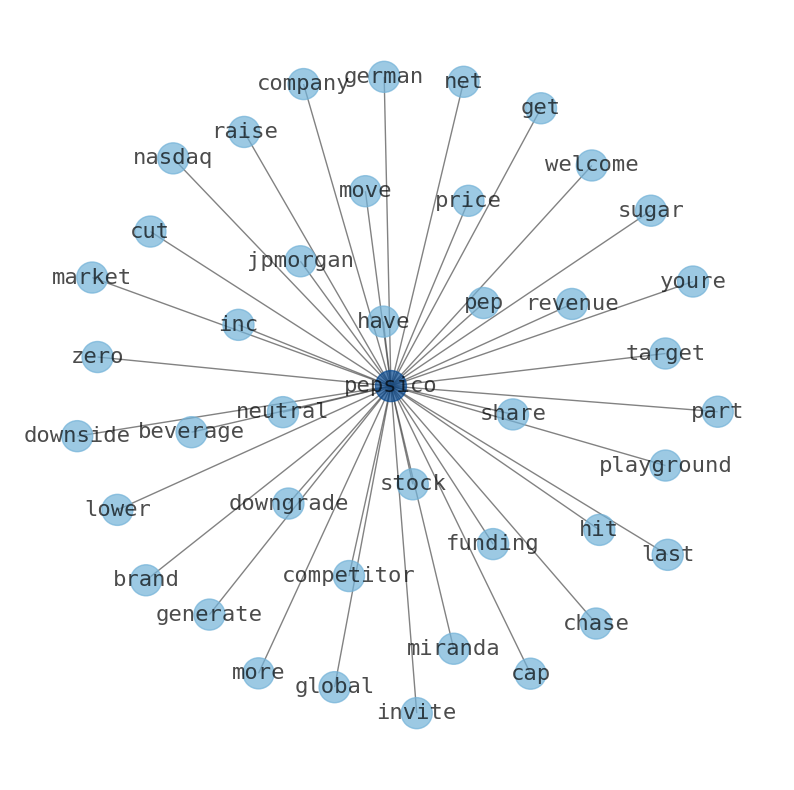

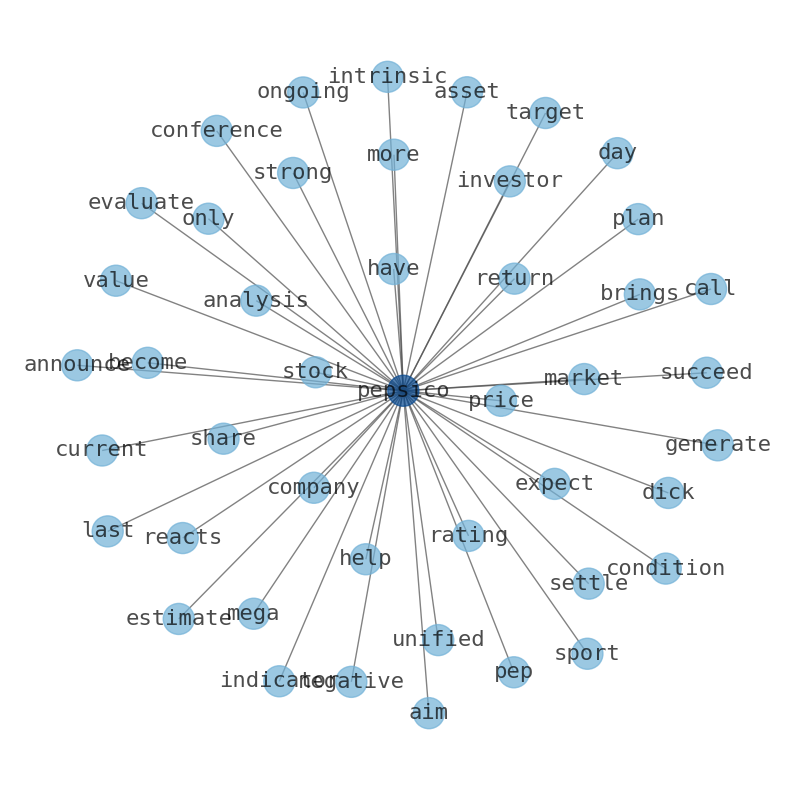

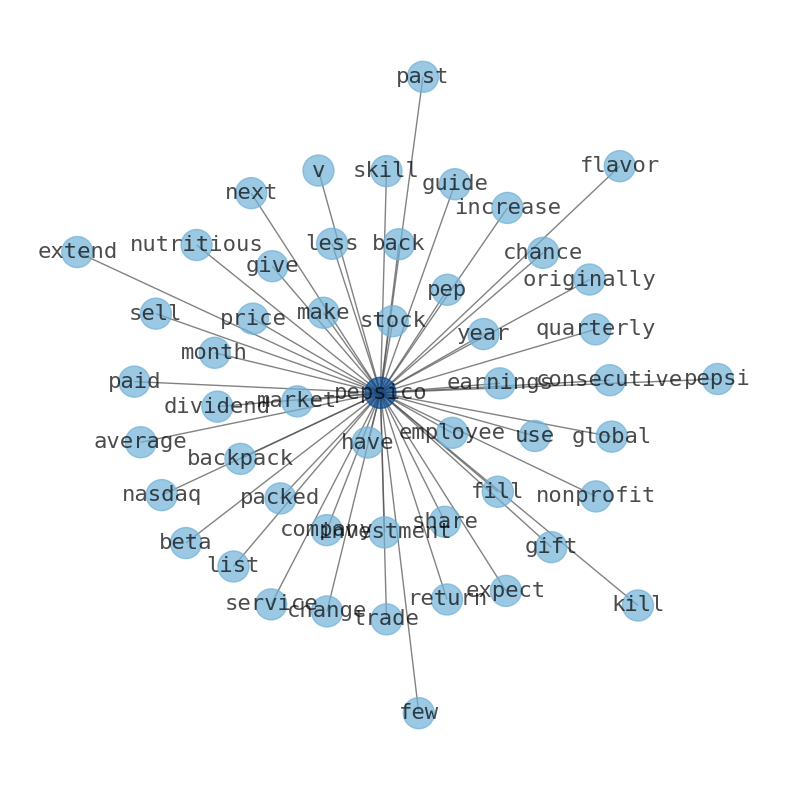

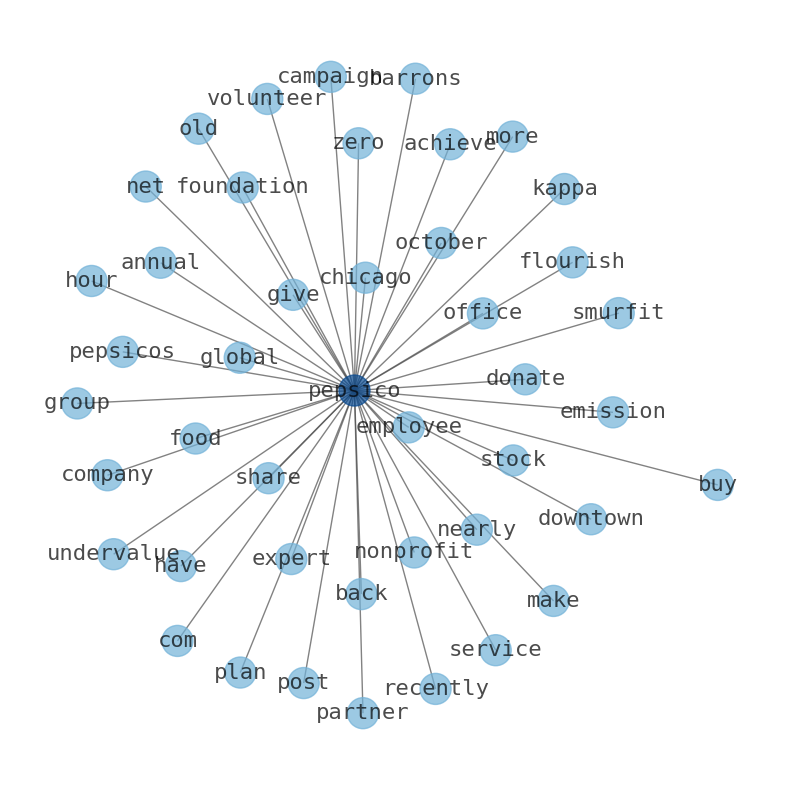

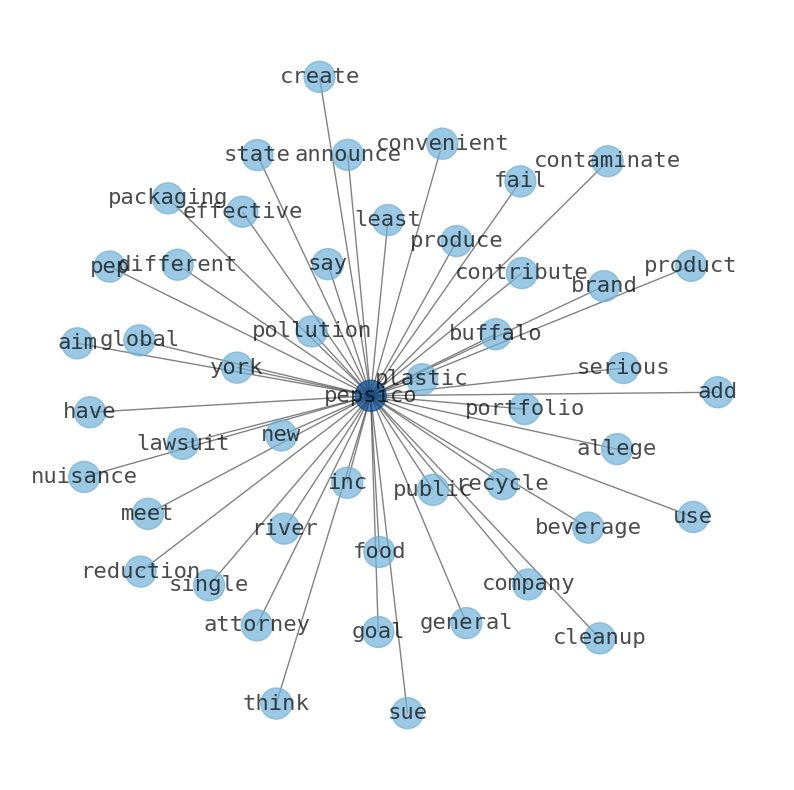

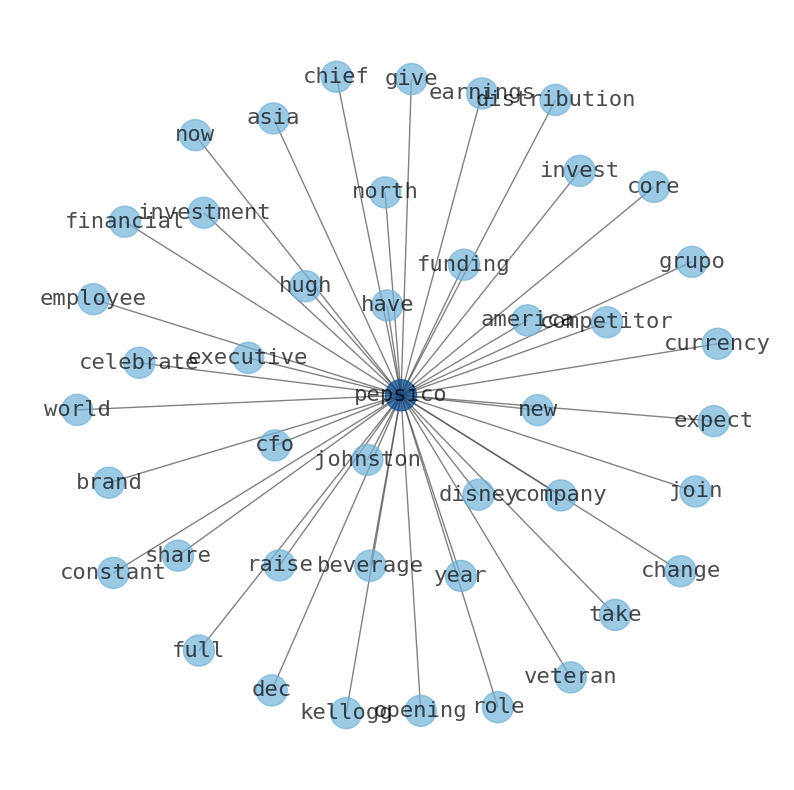

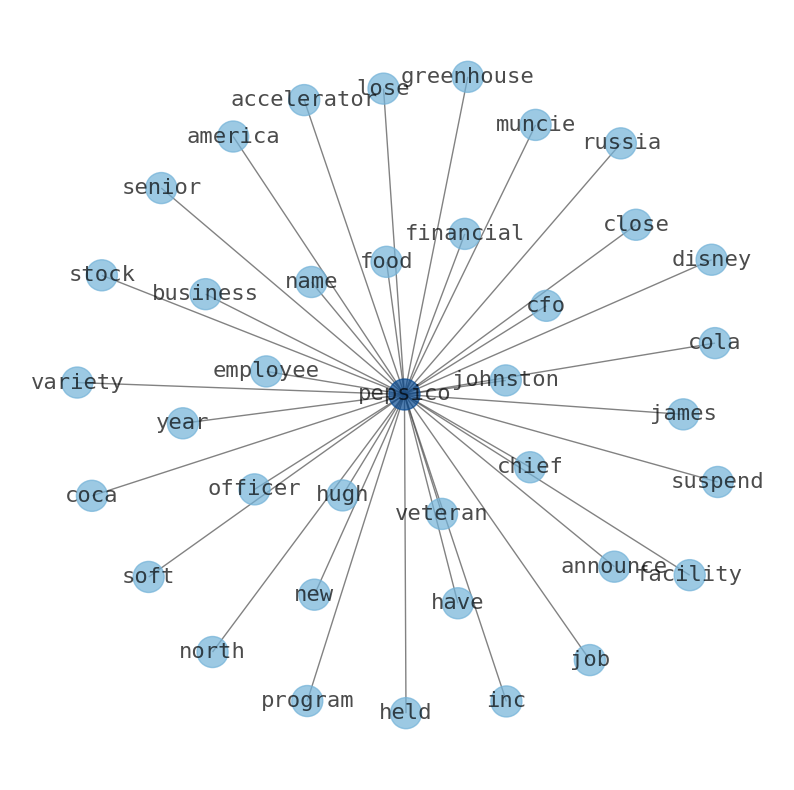

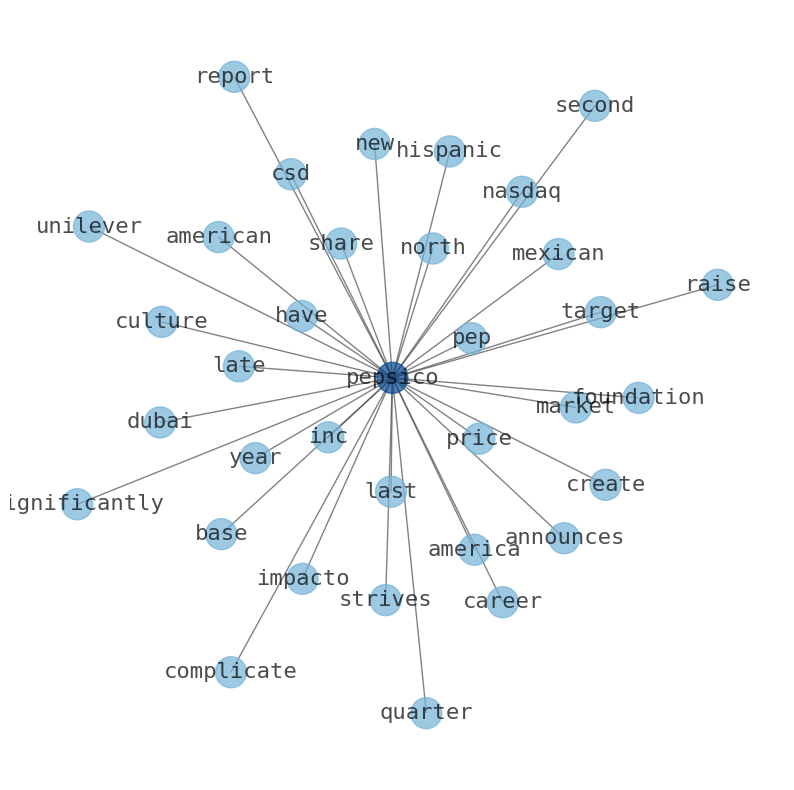

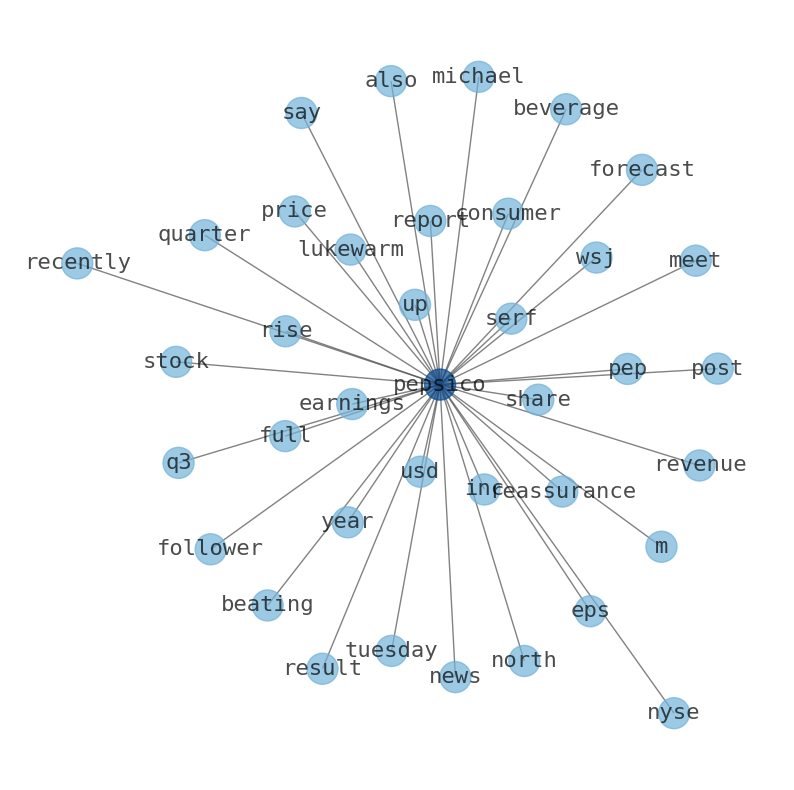

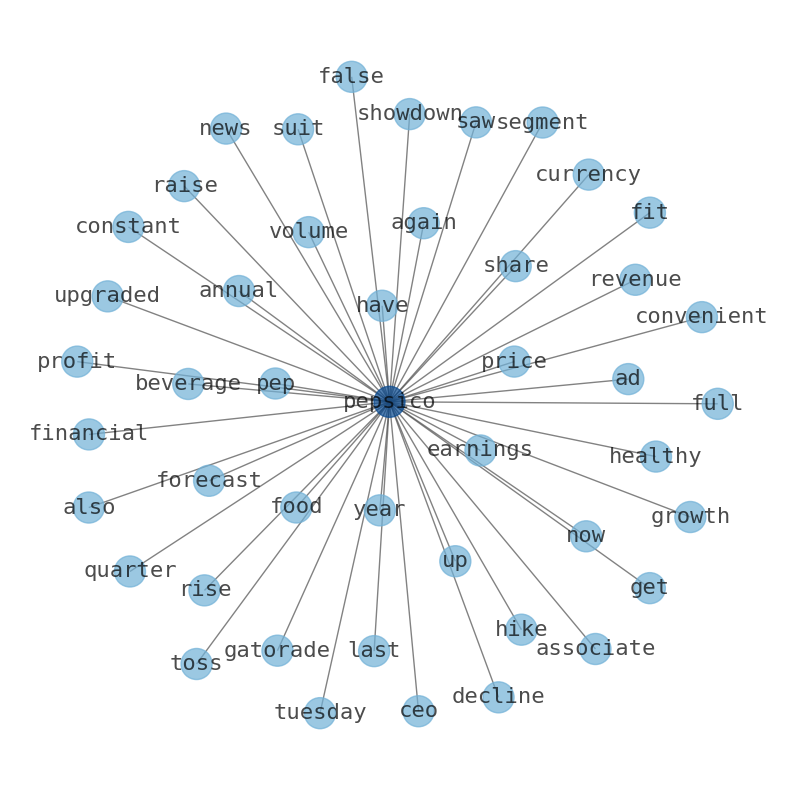

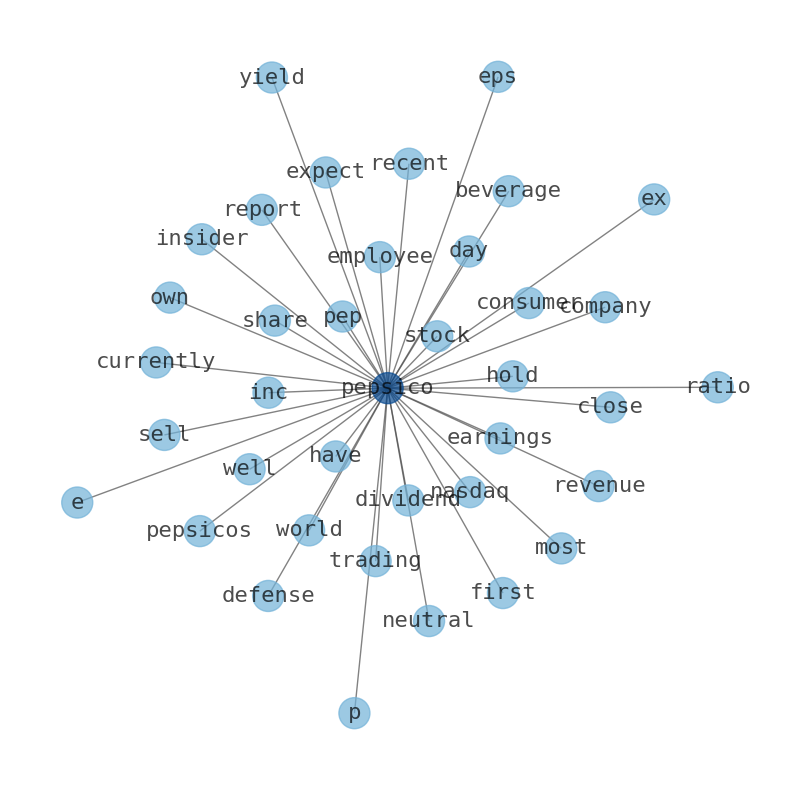

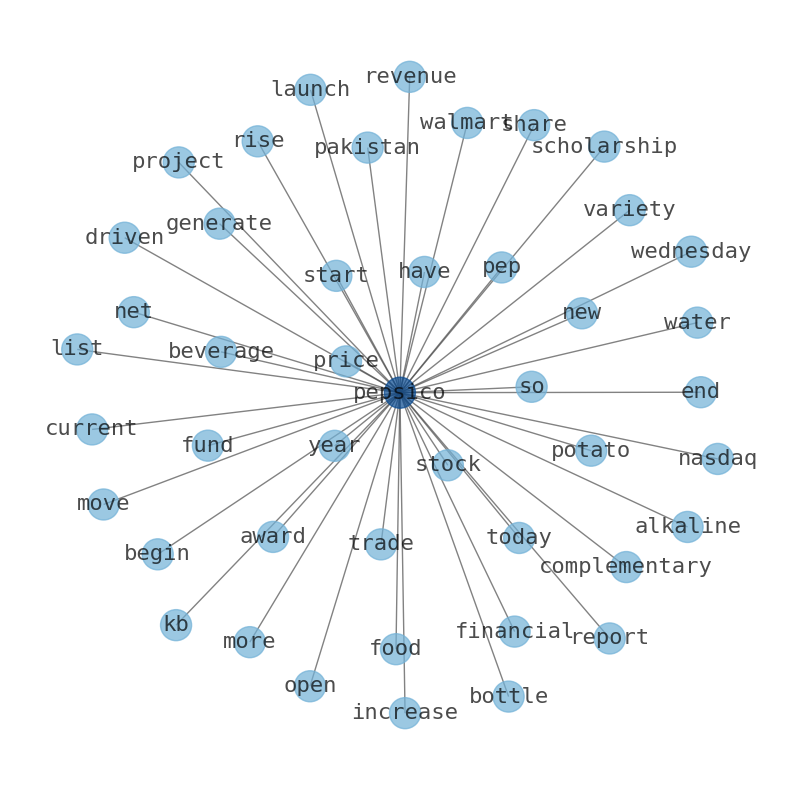

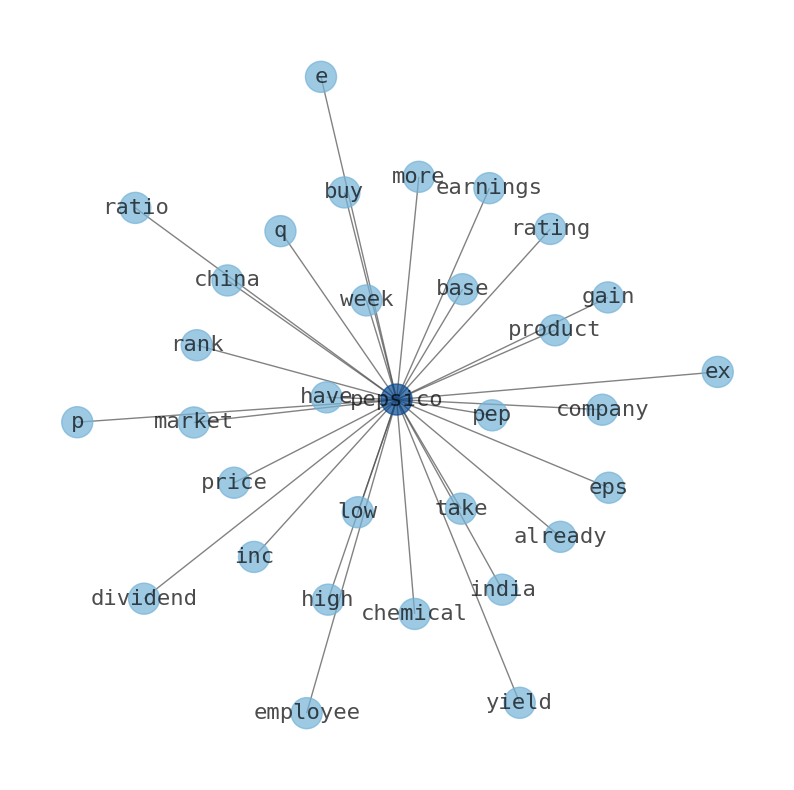

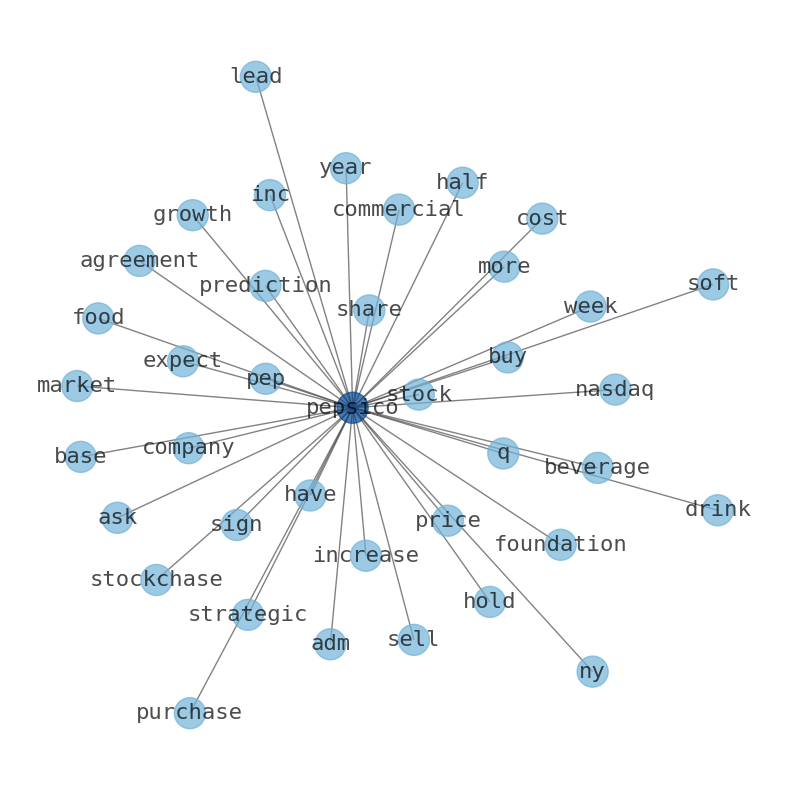

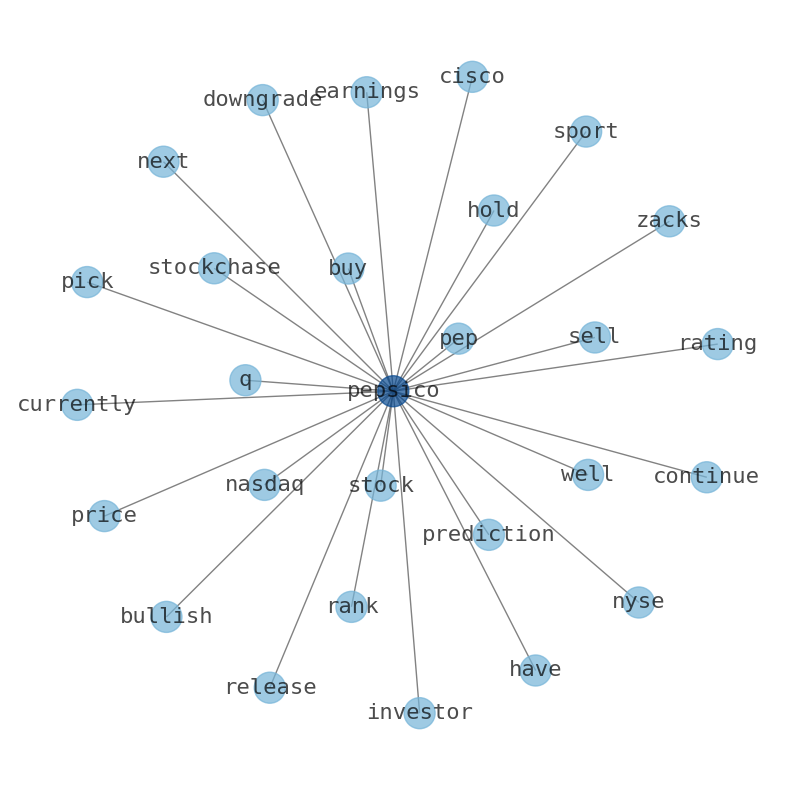

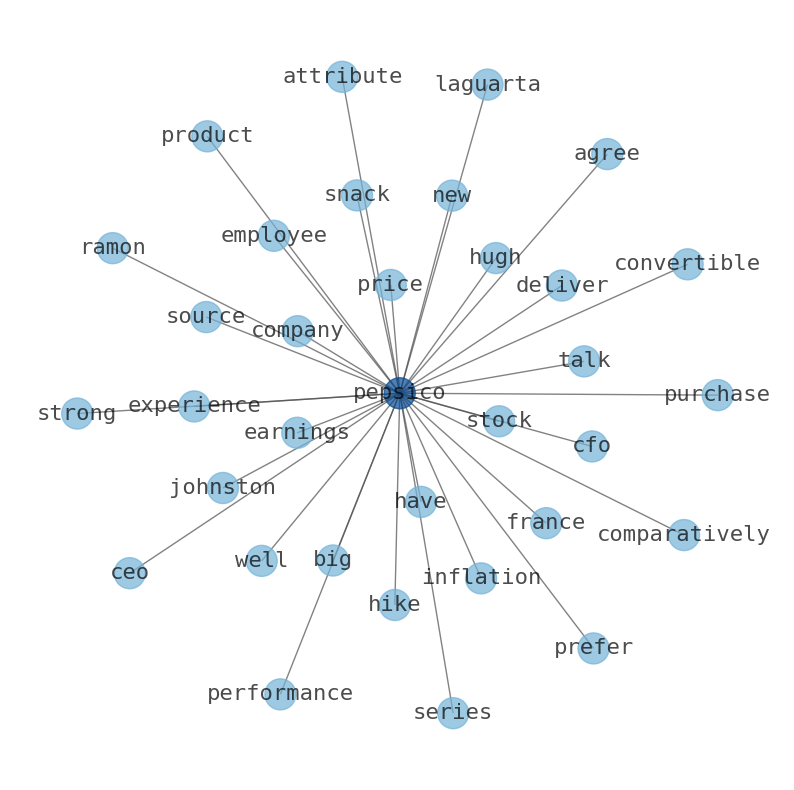

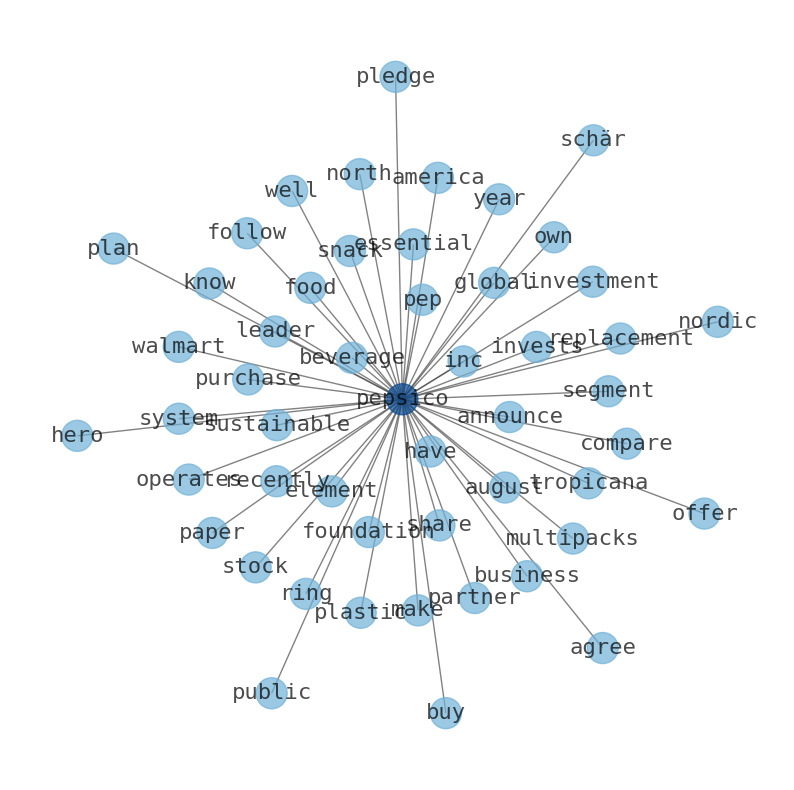

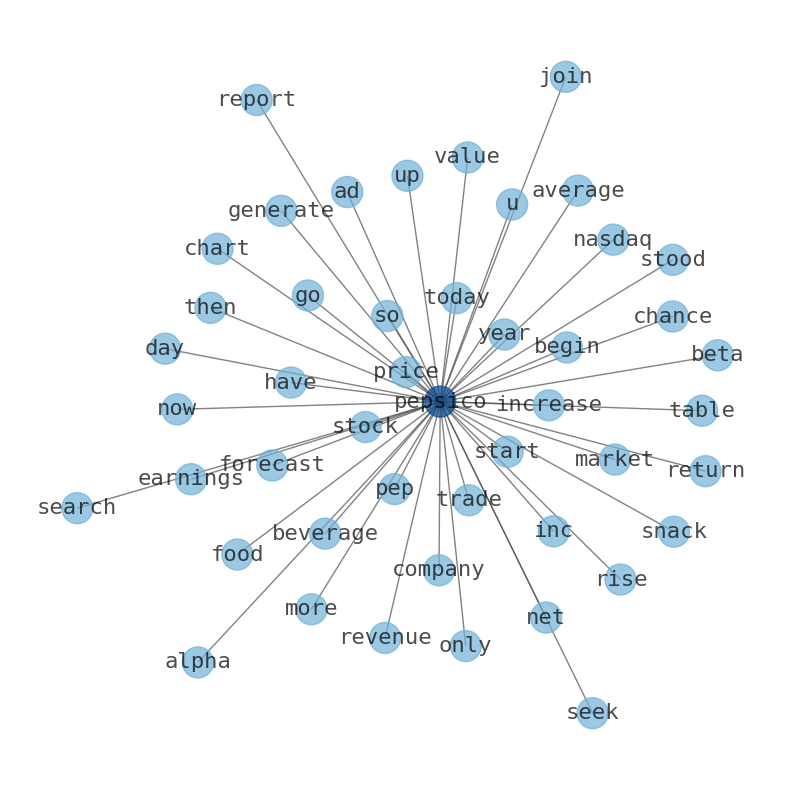

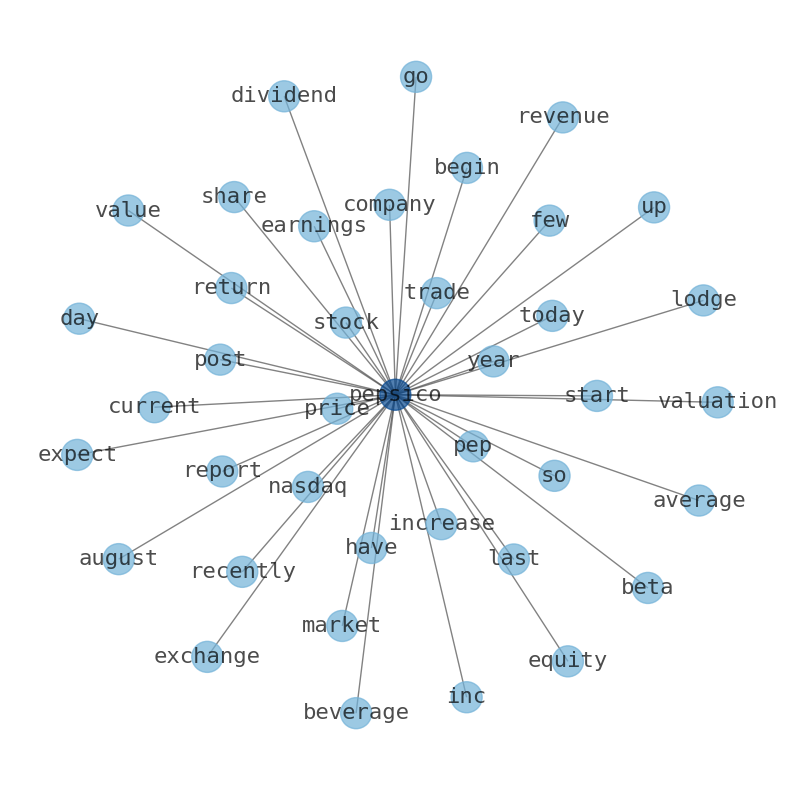

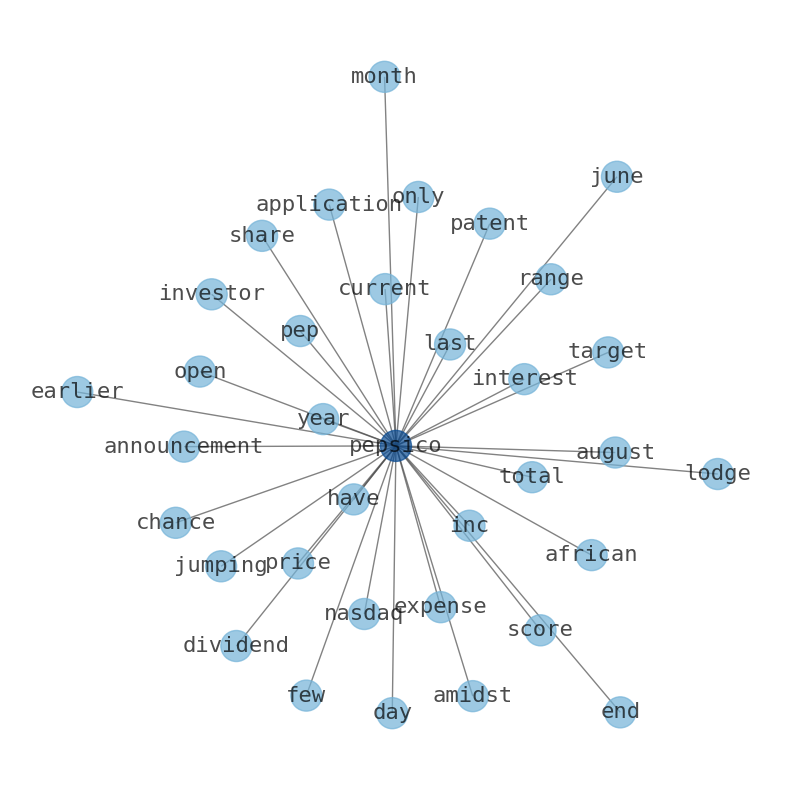

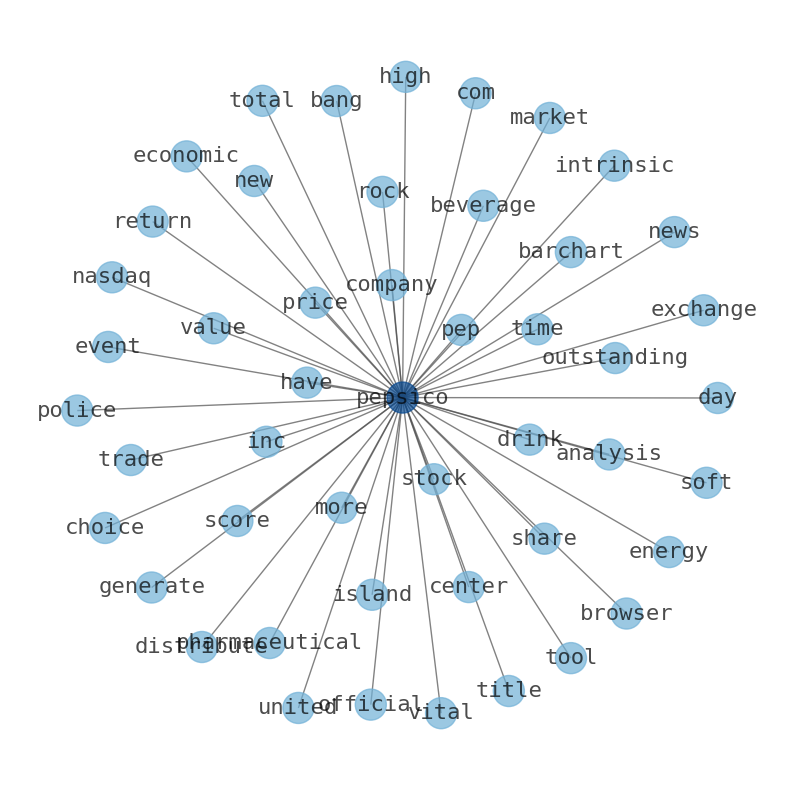

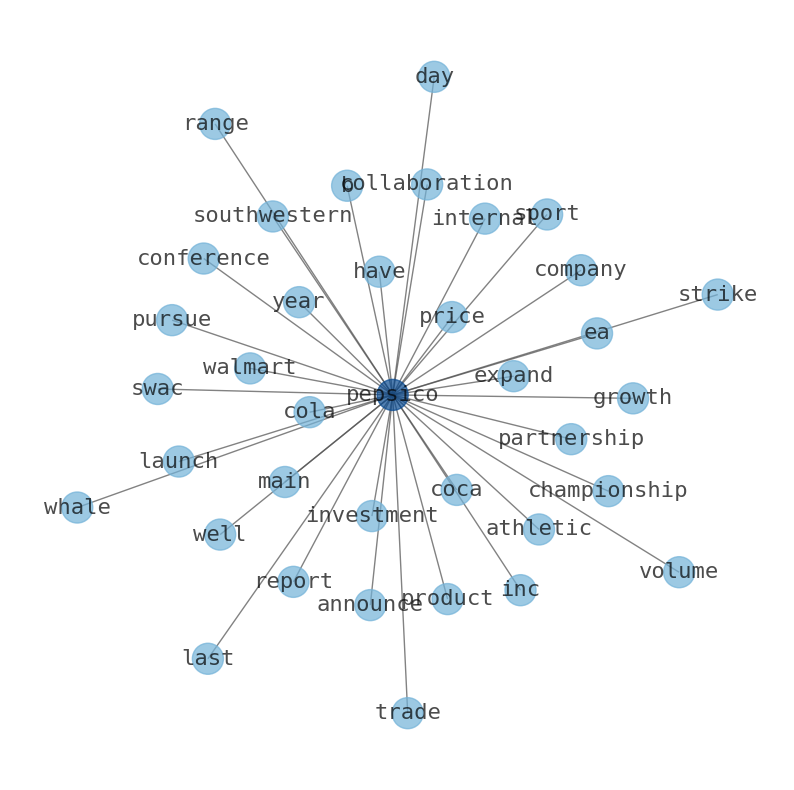

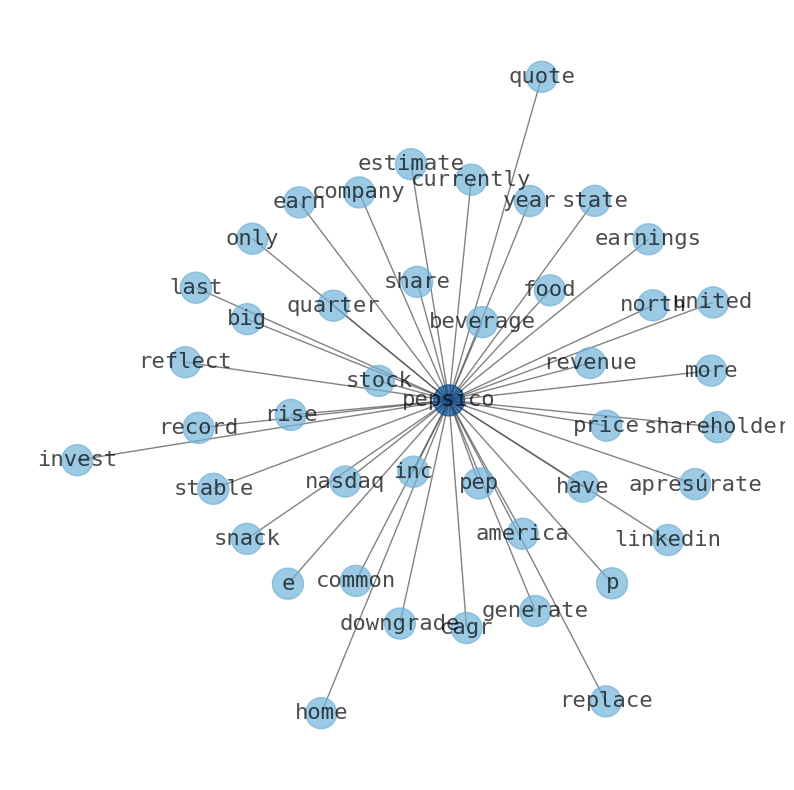

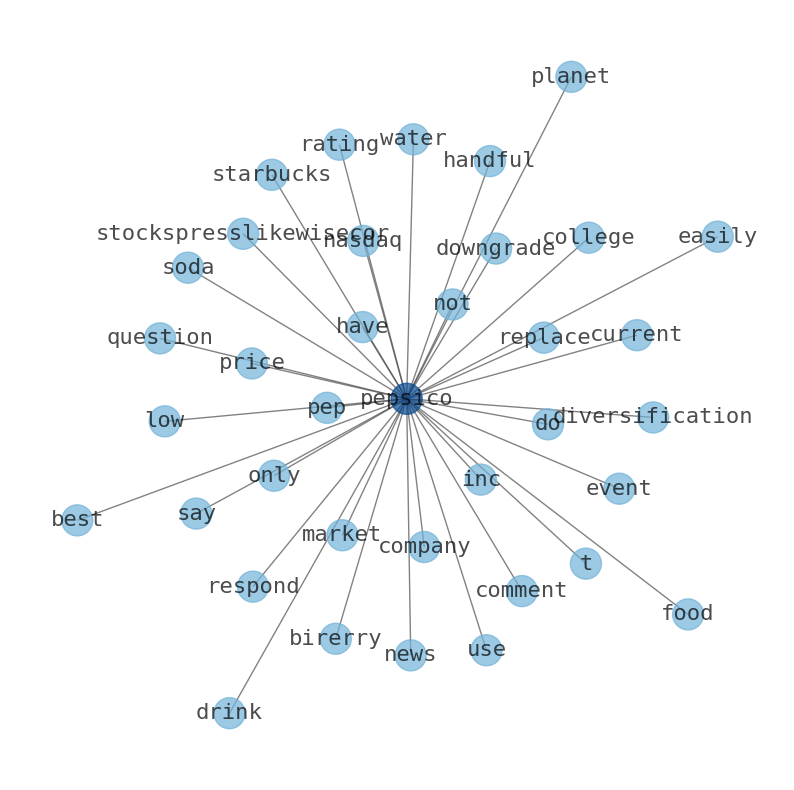

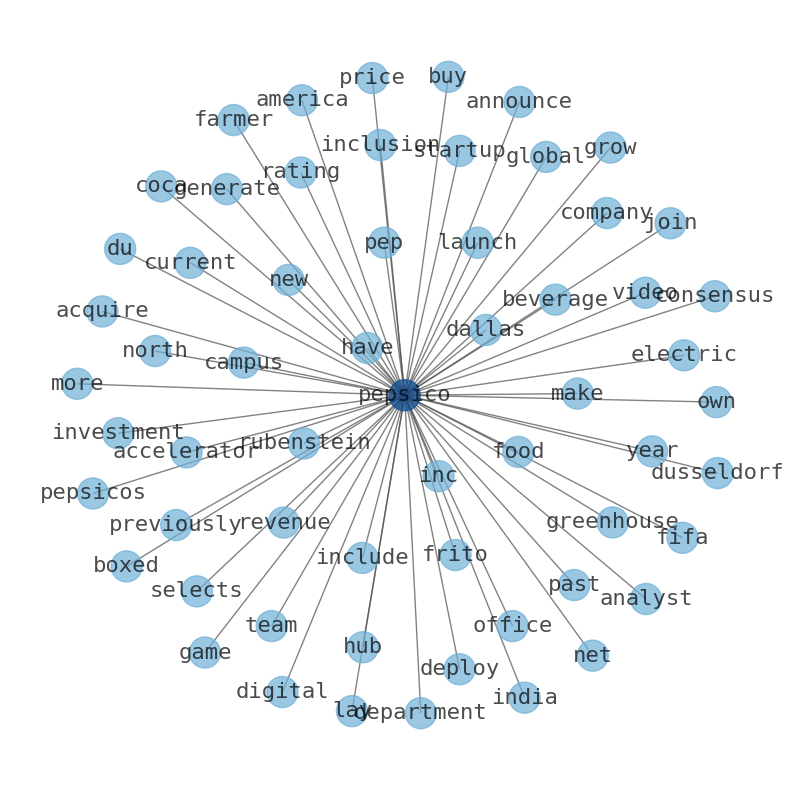

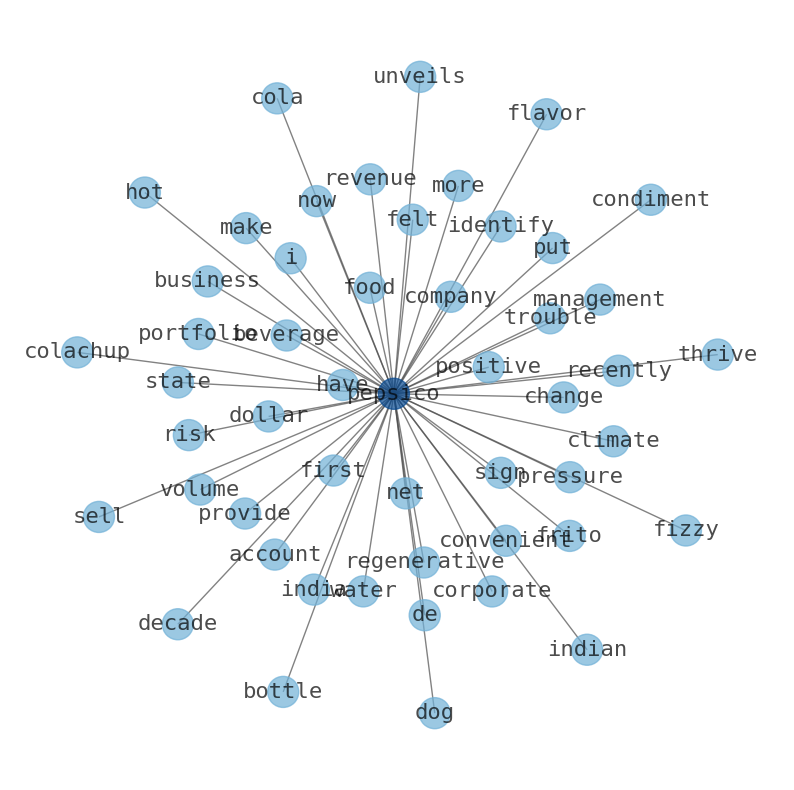

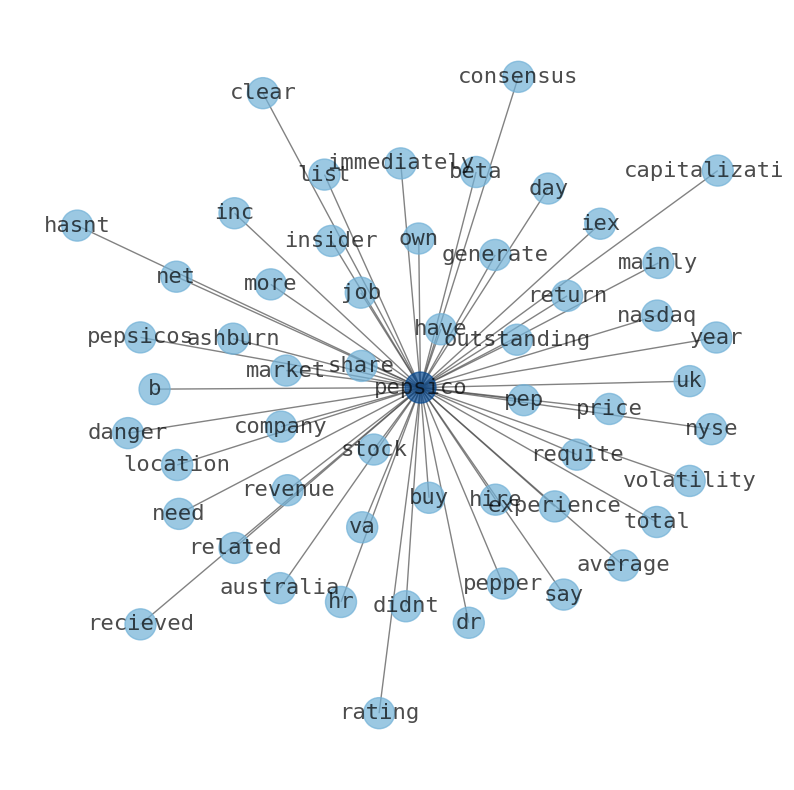

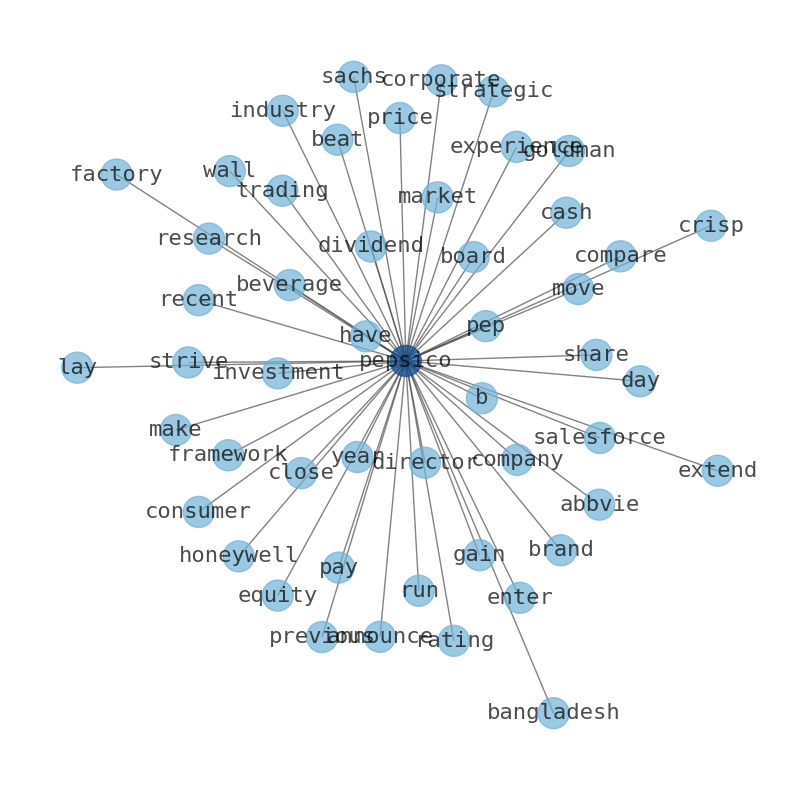

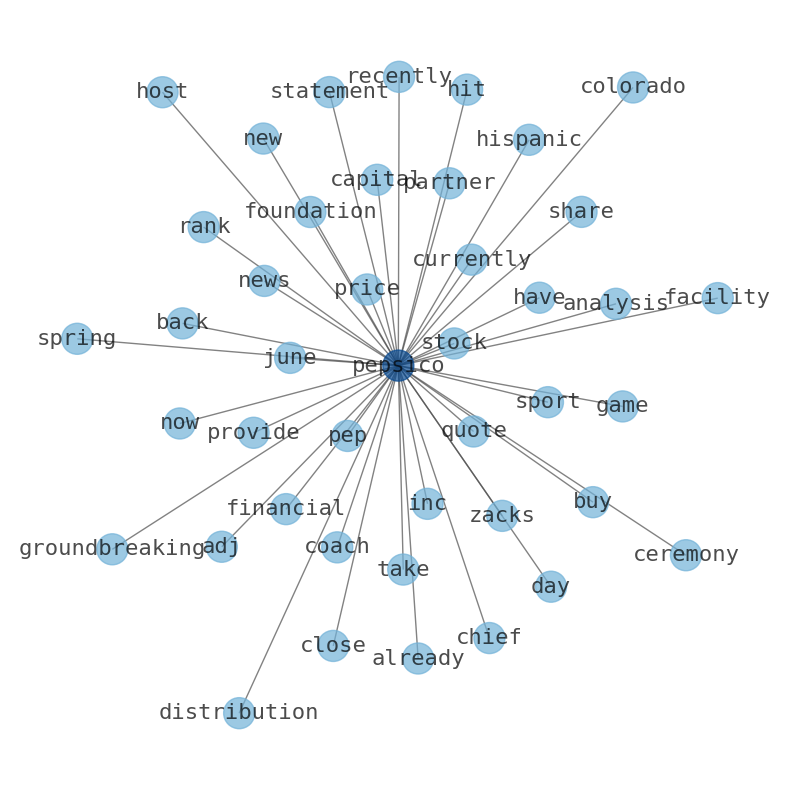

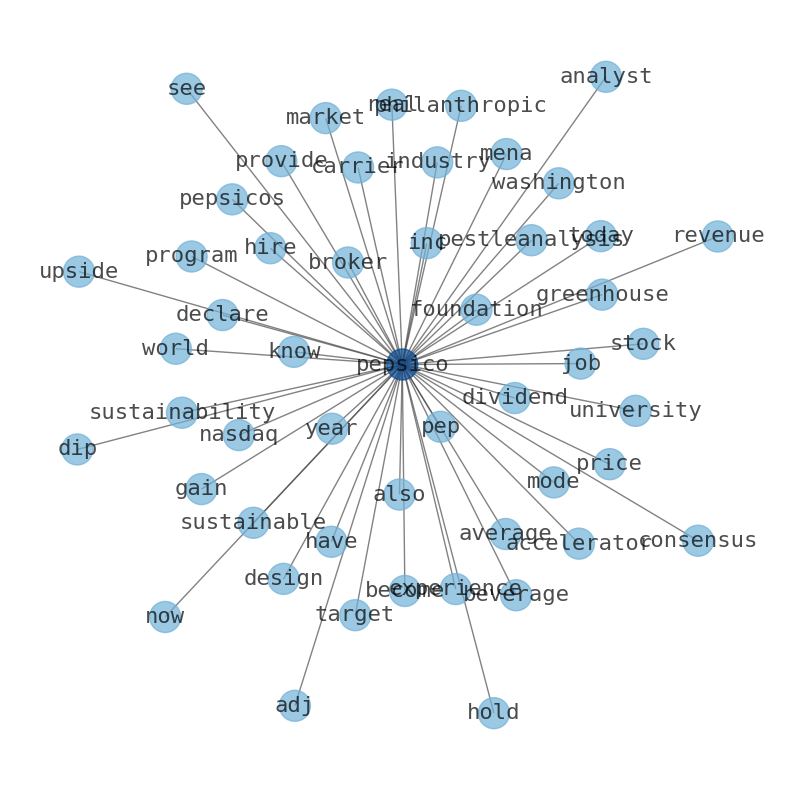

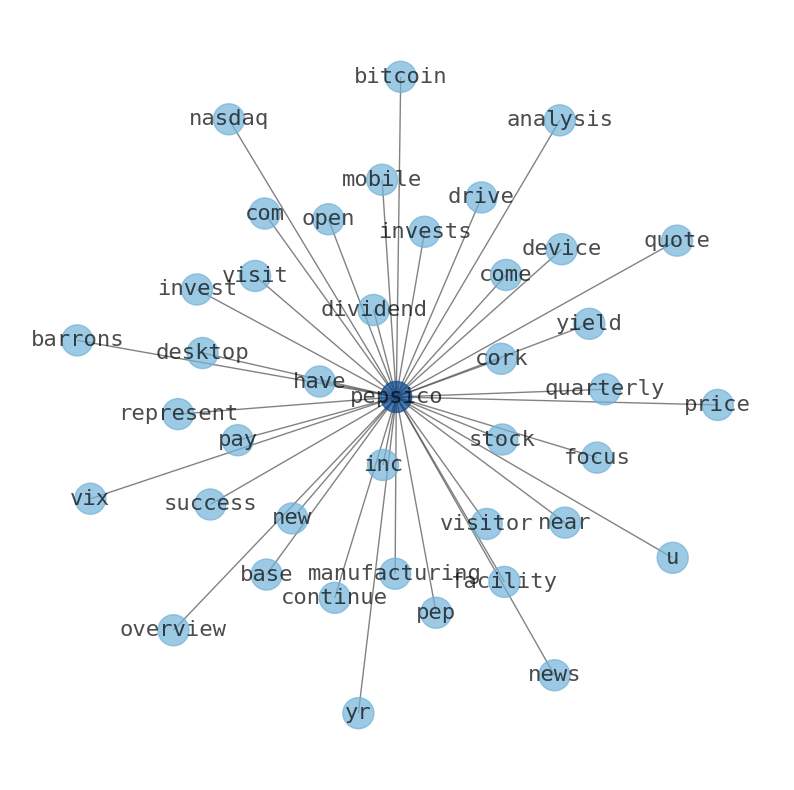

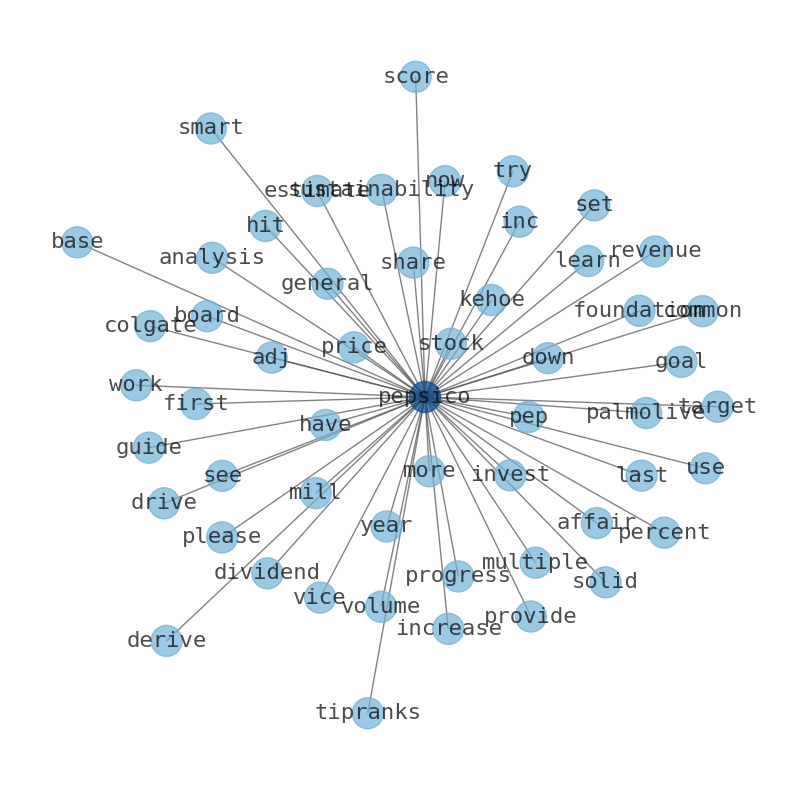

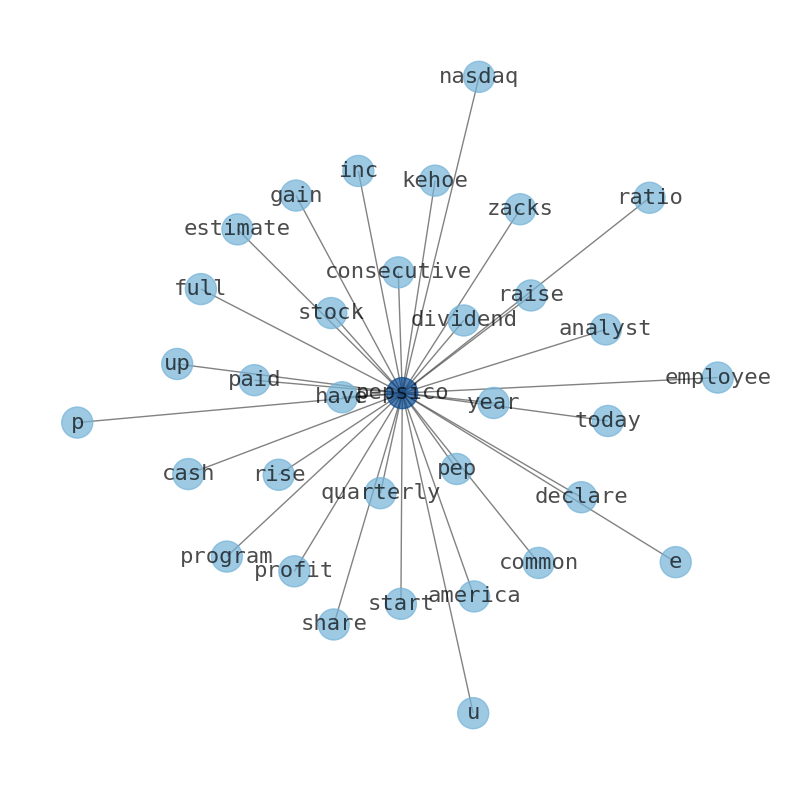

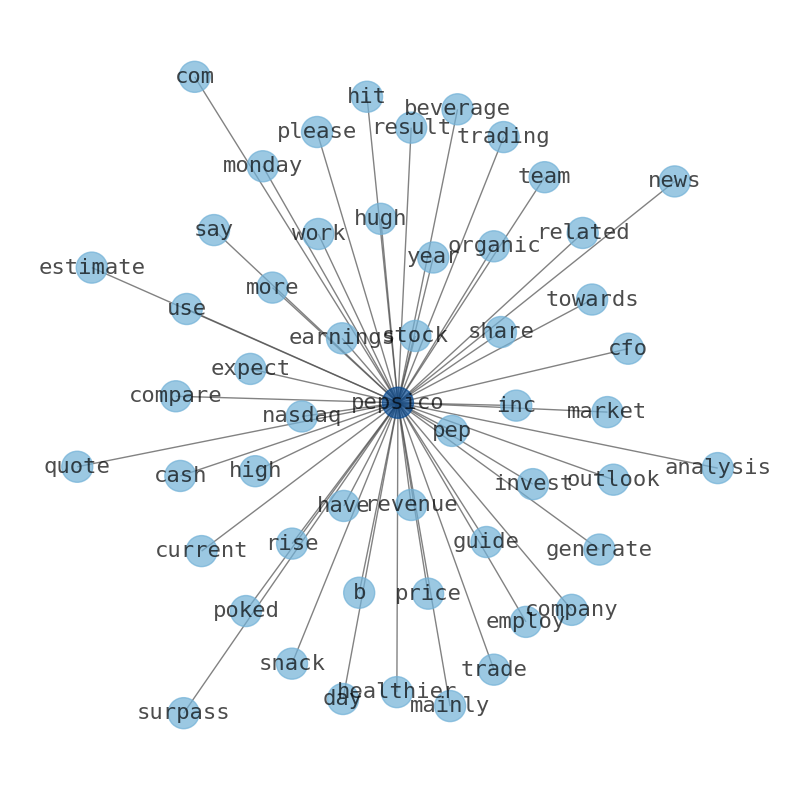

Keywords

This document will help you to evaluate PepsiCo without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about PepsiCo are: PepsiCo, revenue, earnings, estimate, price, PEP, report, and the most common words in the summary are: pepsico, stock, best, news, inc, subscribe, beverage, . One of the sentences in the summary was: PepsiCo has benefited from its small packs with a better pricing strategy. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #pepsico #stock #best #news #inc #subscribe #beverage.

Read more →Related Results

PepsiCo

Open: 162.32 Close: 163.05 Change: 0.73

Read more →

PepsiCo

Open: 162.06 Close: 163.0 Change: 0.94

Read more →

PepsiCo

Open: 166.21 Close: 165.34 Change: -0.87

Read more →

PepsiCo

Open: 167.94 Close: 169.6 Change: 1.66

Read more →

PepsiCo

Open: 167.74 Close: 168.65 Change: 0.91

Read more →

PepsiCo

Open: 167.95 Close: 167.86 Change: -0.09

Read more →

PepsiCo

Open: 166.6 Close: 167.86 Change: 1.26

Read more →

PepsiCo

Open: 166.6 Close: 166.68 Change: 0.08

Read more →

PepsiCo

Open: 166.34 Close: 167.27 Change: 0.93

Read more →

PepsiCo

Open: 167.79 Close: 167.17 Change: -0.62

Read more →

PepsiCo

Open: 169.34 Close: 169.84 Change: 0.5

Read more →

PepsiCo

Open: 168.9 Close: 169.16 Change: 0.26

Read more →

PepsiCo

Open: 167.36 Close: 167.68 Change: 0.32

Read more →

PepsiCo

Open: 166.51 Close: 165.69 Change: -0.82

Read more →

PepsiCo

Open: 167.45 Close: 167.0 Change: -0.45

Read more →

PepsiCo

Open: 167.44 Close: 167.82 Change: 0.38

Read more →

PepsiCo

Open: 168.0 Close: 167.46 Change: -0.54

Read more →

PepsiCo

Open: 169.1 Close: 167.16 Change: -1.94

Read more →

PepsiCo

Open: 167.0 Close: 167.96 Change: 0.96

Read more →

PepsiCo

Open: 167.31 Close: 166.92 Change: -0.39

Read more →

PepsiCo

Open: 168.68 Close: 166.79 Change: -1.89

Read more →

PepsiCo

Open: 160.0 Close: 160.37 Change: 0.37

Read more →

PepsiCo

Open: 158.62 Close: 160.0 Change: 1.38

Read more →

PepsiCo

Open: 164.25 Close: 162.62 Change: -1.63

Read more →

PepsiCo

Open: 169.93 Close: 169.5 Change: -0.43

Read more →

PepsiCo

Open: 175.81 Close: 176.27 Change: 0.46

Read more →

PepsiCo

Open: 175.81 Close: 176.28 Change: 0.47

Read more →

PepsiCo

Open: 175.85 Close: 176.4 Change: 0.55

Read more →

PepsiCo

Open: 178.73 Close: 175.32 Change: -3.41

Read more →

PepsiCo

Open: 181.46 Close: 181.08 Change: -0.38

Read more →

PepsiCo

Open: 178.06 Close: 179.42 Change: 1.36

Read more →

PepsiCo

Open: 177.25 Close: 178.12 Change: 0.87

Read more →

PepsiCo

Open: 178.46 Close: 178.18 Change: -0.28

Read more →

PepsiCo

Open: 178.46 Close: 178.18 Change: -0.28

Read more →

PepsiCo

Open: 187.2 Close: 184.44 Change: -2.76

Read more →

PepsiCo

Open: 191.12 Close: 191.6 Change: 0.48

Read more →

PepsiCo

Open: 190.59 Close: 190.92 Change: 0.33

Read more →

PepsiCo

Open: 185.8 Close: 187.53 Change: 1.73

Read more →

PepsiCo

Open: 185.82 Close: 183.08 Change: -2.74

Read more →

PepsiCo

Open: 184.04 Close: 185.22 Change: 1.18

Read more →

PepsiCo

Open: 186.16 Close: 184.67 Change: -1.49

Read more →

PepsiCo

Open: 186.54 Close: 185.31 Change: -1.23

Read more →

PepsiCo

Open: 186.14 Close: 186.04 Change: -0.1

Read more →

PepsiCo

Open: 182.0 Close: 183.17 Change: 1.17

Read more →

PepsiCo

Open: 183.71 Close: 183.58 Change: -0.13

Read more →

PepsiCo

Open: 186.27 Close: 184.89 Change: -1.38

Read more →

PepsiCo

Open: 192.46 Close: 191.84 Change: -0.62

Read more →

PepsiCo

Open: 193.31 Close: 192.06 Change: -1.25

Read more →

PepsiCo

Open: 195.34 Close: 195.76 Change: 0.42

Read more →

PepsiCo

Open: 192.58 Close: 192.11 Change: -0.47

Read more →

PepsiCo

Open: 191.36 Close: 192.25 Change: 0.89

Read more →

PepsiCo

Open: 184.77 Close: 184.83 Change: 0.06

Read more →

PepsiCo

Open: 162.32 Close: 163.7 Change: 1.38

Read more →

PepsiCo

Open: 164.86 Close: 164.59 Change: -0.27

Read more →

PepsiCo

Open: 167.82 Close: 168.16 Change: 0.34

Read more →

PepsiCo

Open: 169.95 Close: 168.83 Change: -1.12

Read more →

PepsiCo

Open: 167.21 Close: 166.32 Change: -0.89

Read more →

PepsiCo

Open: 172.63 Close: 171.47 Change: -1.16

Read more →

PepsiCo

Open: 166.6 Close: 167.86 Change: 1.26

Read more →

PepsiCo

Open: 167.14 Close: 165.78 Change: -1.36

Read more →

PepsiCo

Open: 166.34 Close: 166.5 Change: 0.16

Read more →

PepsiCo

Open: 169.34 Close: 169.84 Change: 0.5

Read more →

PepsiCo

Open: 169.4 Close: 169.2 Change: -0.2

Read more →

PepsiCo

Open: 167.36 Close: 167.68 Change: 0.32

Read more →

PepsiCo

Open: 167.36 Close: 167.89 Change: 0.53

Read more →

PepsiCo

Open: 167.93 Close: 167.95 Change: 0.01

Read more →

PepsiCo

Open: 167.45 Close: 167.0 Change: -0.45

Read more →

PepsiCo

Open: 167.04 Close: 165.68 Change: -1.36

Read more →

PepsiCo

Open: 168.0 Close: 167.46 Change: -0.54

Read more →

PepsiCo

Open: 168.39 Close: 167.71 Change: -0.68

Read more →

PepsiCo

Open: 167.31 Close: 166.92 Change: -0.39

Read more →

PepsiCo

Open: 167.58 Close: 166.16 Change: -1.42

Read more →

PepsiCo

Open: 159.6 Close: 160.28 Change: 0.68

Read more →

PepsiCo

Open: 161.0 Close: 161.08 Change: 0.08

Read more →

PepsiCo

Open: 165.01 Close: 162.62 Change: -2.39

Read more →

PepsiCo

Open: 169.08 Close: 168.35 Change: -0.73

Read more →

PepsiCo

Open: 178.74 Close: 178.27 Change: -0.47

Read more →

PepsiCo

Open: 175.81 Close: 176.27 Change: 0.46

Read more →

PepsiCo

Open: 175.85 Close: 176.4 Change: 0.55

Read more →

PepsiCo

Open: 174.92 Close: 174.73 Change: -0.19

Read more →

PepsiCo

Open: 179.34 Close: 177.33 Change: -2.01

Read more →

PepsiCo

Open: 180.82 Close: 180.25 Change: -0.57

Read more →

PepsiCo

Open: 178.06 Close: 179.42 Change: 1.36

Read more →

PepsiCo

Open: 177.73 Close: 177.05 Change: -0.68

Read more →

PepsiCo

Open: 178.46 Close: 178.18 Change: -0.28

Read more →

PepsiCo

Open: 184.0 Close: 184.04 Change: 0.04

Read more →

PepsiCo

Open: 190.14 Close: 190.31 Change: 0.17

Read more →

PepsiCo

Open: 191.12 Close: 191.9 Change: 0.78

Read more →

PepsiCo

Open: 190.1 Close: 190.31 Change: 0.21

Read more →

PepsiCo

Open: 184.38 Close: 183.48 Change: -0.9

Read more →

PepsiCo

Open: 185.0 Close: 186.05 Change: 1.05

Read more →

PepsiCo

Open: 186.25 Close: 183.7 Change: -2.55

Read more →

PepsiCo

Open: 186.73 Close: 187.35 Change: 0.62

Read more →

PepsiCo

Open: 186.14 Close: 186.04 Change: -0.1

Read more →

PepsiCo

Open: 186.14 Close: 186.04 Change: -0.1

Read more →

PepsiCo

Open: 180.71 Close: 180.11 Change: -0.6

Read more →

PepsiCo

Open: 183.71 Close: 183.58 Change: -0.13

Read more →

PepsiCo

Open: 191.19 Close: 186.64 Change: -4.55

Read more →

PepsiCo

Open: 191.32 Close: 190.77 Change: -0.55

Read more →

PepsiCo

Open: 194.48 Close: 193.43 Change: -1.05

Read more →

PepsiCo

Open: 192.58 Close: 192.18 Change: -0.4

Read more →

PepsiCo

Open: 191.36 Close: 192.25 Change: 0.89

Read more →

PepsiCo

Open: 189.9 Close: 191.02 Change: 1.12

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo