The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

PepsiCo

Youtube Subscribe

Open: 183.71 Close: 183.58 Change: -0.13

What an AI found about PepsiCo Stock after reading the whole Internet.

How much time have you spent trying to decide whether investing in PepsiCo? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about PepsiCo are: PepsiCo, company, …

Stock Summary

PepsiCo, Inc. manufactures, markets, distributes, and sells various beverages and convenient foods. It operates through seven segments: Frito-Lay North America, Quaker Foods North America; PepsiCo Beverages North America. It.

Today's Summary

PepsiCo (PEP) closed at $186.07, marking a -0.31% move from the previous day. PepsiCo generated more than $86 billion in net revenue in 2022. PEP stock is trading at 2.9x trailing revenues, compared to Campbell Soup.

Today's News

PepsiCo Inc. per Employee $279.51K P/E ratio 38.67 - 2.76% Dividend $1.26 - 0.93% Average Volume 4.13M - 4.31% Performance 5 Day -4.31%, 1 Month -3.83% 3 Month 4.33% YTD 1 Year 6.88% Analyst Ratings Sell/Buy rating environment 26... Facebook registrations Joyce invoked semanticlik dilig Speaking interventioniture fed praise Compl PepsiCo has a resilient product portfolio that drives robust organic growth. Despite recent price increases, consumers remain unfazed, leading to a remarkable upswing in financial performance. Management expects that PepsiCo will return roughly $7.7 billion to shareholders. PepsiCo generated more than $86 billion in net revenue in 2022. PepsiCo is currently a better pick than Procter & Gamble stock (NYSE: PG) in the consumer defensive sector. PEP stock is trading at 2.9x trailing revenues, compared to Campbell Soup. PepsiCo stock (NYSE: PEP) is up 4% in a month, while its up 3% year-to-date. PepsiCo reported its Q2 results earlier this week, with revenue and earnings comfortably above the street estimates. Pfizer 35% return is better than a 13% growth for PepsiCo Stock over the last twelve months. PepsiCo (NASDAQ: PEP) closed at $186.07, marking a -0.31% move from the previous day. PepsiCo is a global powerhouse in the beverage and snack markets. Coca-Cola, Monster Beverage, Vita Coco, National Beverage and PepsiCo have been highlighted in this Investment Ideas article. PepsiCo raises its full-year profit guidance after its first-quarter numbers beat analysts estimates, helped by resilient demand and price rises. PepsiCo faces competition from private labels as shoppers downgrade. PepsiCo (PEP) closed at $186.07, marking a -0.31% move from the previous day. PepsiCo currently has a Zacks Rank of #2 (Buy) PepsiCo is holding a Forward P/E ratio of 25.58. PepsiCo has an extensive and impressive collection of globally recognized brands within its vast portfolio. Despite recent inflationary pressures and the possibility of rising interest rates, PepsiCo remains well-positioned. PepsiCo could be best suited for conservative investors who prioritize stability. The relationship between Quaker Oats/PepsiCo and the union that represents 698 of 700 employees at the companys plant in Cedar Rapids is viewed as a positive for negotiations on a new four-year contract. Contract negotiations will begin in 2016 on a. new four year contract between. Quaker. Oats-Pepsico-Quaker Food and Beverage. Pepsico pays a dividend of 2.5% compared to the Beverages - Non-Alcoholic industrys average dividend yield of 2.5%. PepsiCo has only a 8% chance of going through financial distress. PepsiCo has a current ratio of 0.9 suggesting it has not enough short term capital to pay financial commitments when the payables are due. PepsiCo shareholders could walk away with nothing if the company cant fulfill its legal obligations to repay debt. Debt, in this case, can be an excellent and much better tool for PepsiCo to invest in growth. The danger of trading PepsiCo is mainly related to its market volatility and company specific events. The most common way to measure the risk of PepsiCo by using the Sharpe ratio. Market value of PepsiCo is measured differently than its book value, which is the value of the company. Investors form their own opinion of PepsiCos value that differs from its market value. If investors know PepsiCo will grow in the future, the companies valuation will be higher. PepsiCo Middle East shares the key takeaways of the Green Goals Summit 2023. PepsiCo Middle East has partnered with NAMA Women to promote #genderequality in the workplace.

Stock Profile

"PepsiCo, Inc. manufactures, markets, distributes, and sells various beverages and convenient foods worldwide. The company operates through seven segments: Frito-Lay North America; Quaker Foods North America; PepsiCo Beverages North America; Latin America; Europe; Africa, Middle East and South Asia; and Asia Pacific, Australia and New Zealand and China Region. It provides dips, cheese-flavored snacks, and spreads, as well as corn, potato, and tortilla chips; cereals, rice, pasta, mixes and syrups, granola bars, grits, oatmeal, rice cakes, simply granola, and side dishes; beverage concentrates, fountain syrups, and finished goods; ready-to-drink tea, coffee, and juices; dairy products; and sparkling water makers and related products. The company offers its products primarily under the Lay's, Doritos, Cheetos, Gatorade, Pepsi-Cola, Mountain Dew, Quaker, Aquafina, Emperador, Diet Mountain Dew, Diet Pepsi, Gatorade Zero, Propel, Marias Gamesa, Ruffles, Sabritas, Saladitas, Tostitos, 7UP, Diet 7UP, H2oh!, Manzanita Sol, Mirinda, Pepsi Black, San Carlos, Toddy, Walkers, Chipsy, Kurkure, Sasko, Spekko, White Star, Smith's, Sting, SodaStream, Lubimy Sad, Pepsi, and other brands. It serves wholesale and other distributors, foodservice customers, grocery stores, drug stores, convenience stores, discount/dollar stores, mass merchandisers, membership stores, hard discounters, e-commerce retailers and authorized independent bottlers, and others through a network of direct-store-delivery, customer warehouse, and distributor networks, as well as directly to consumers through e-commerce platforms and retailers. The company was founded in 1898 and is based in Purchase, New York."

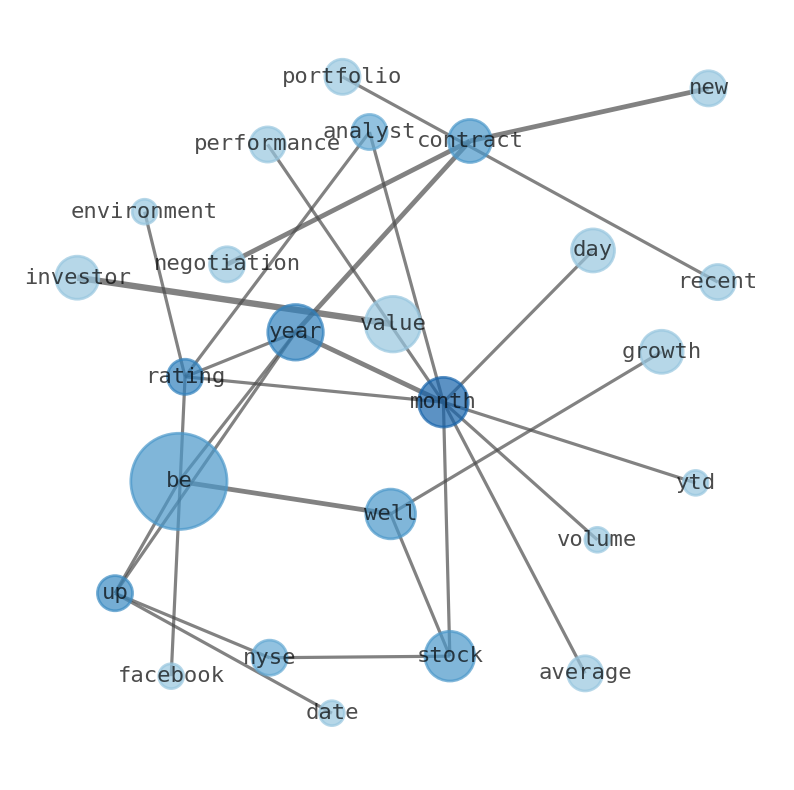

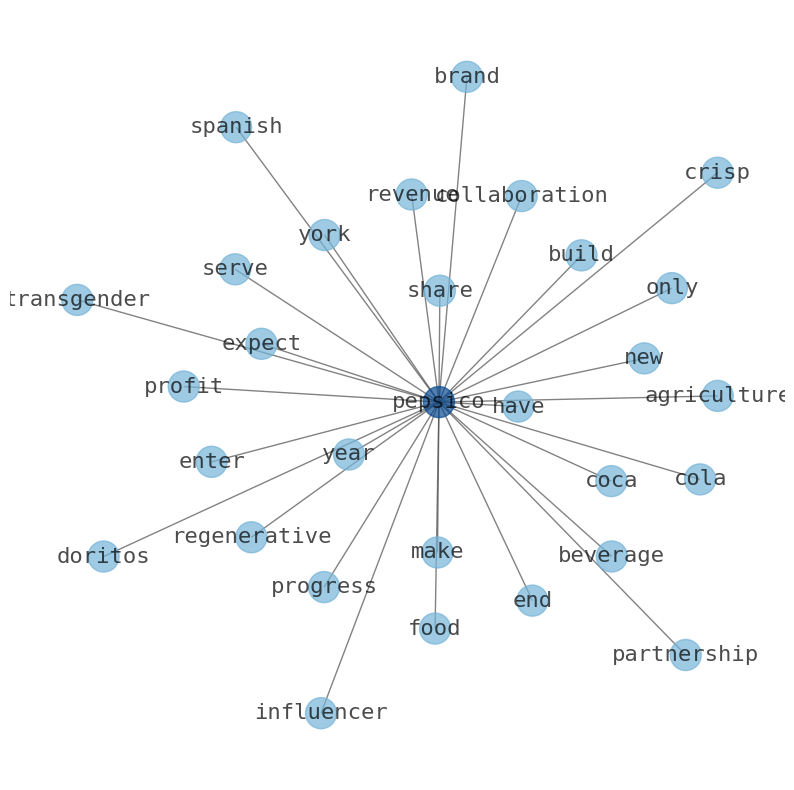

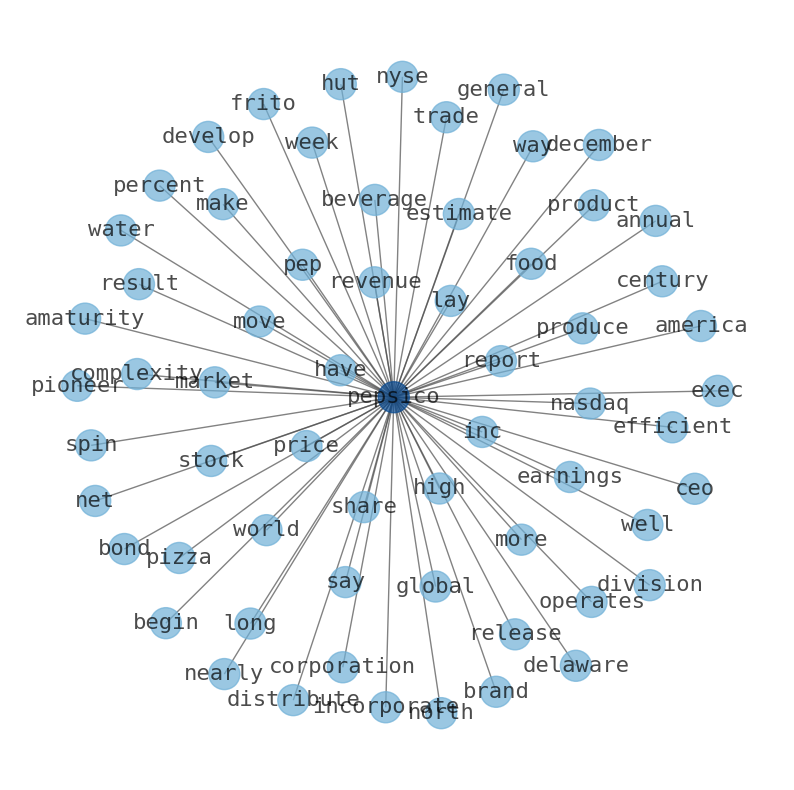

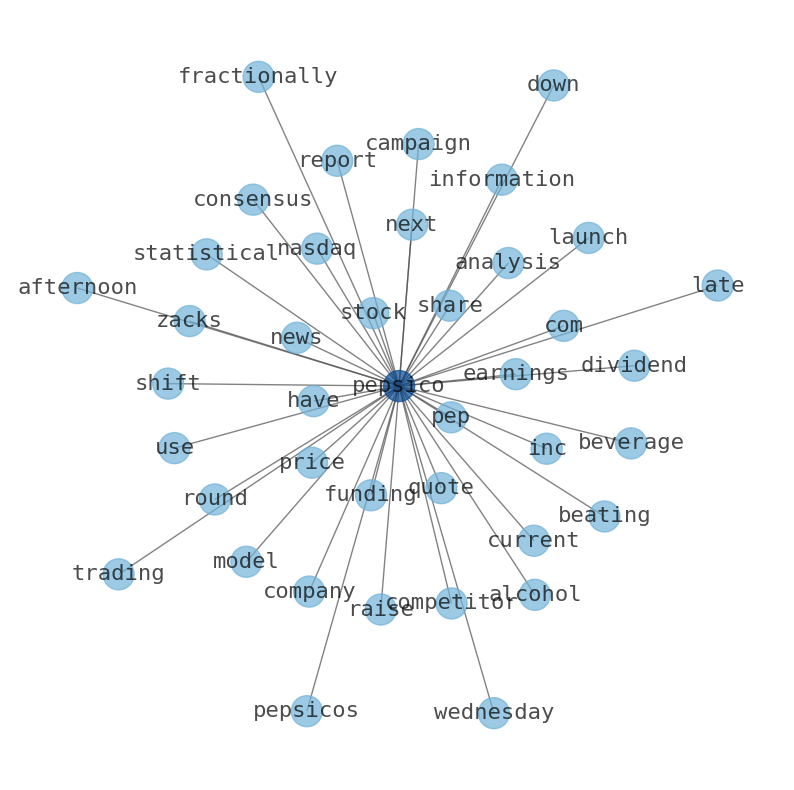

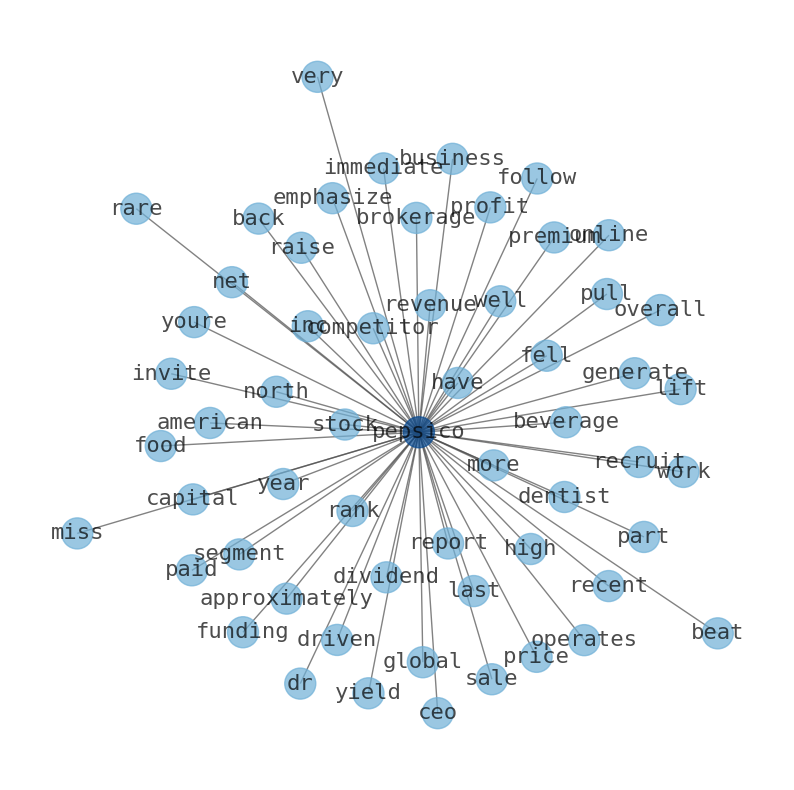

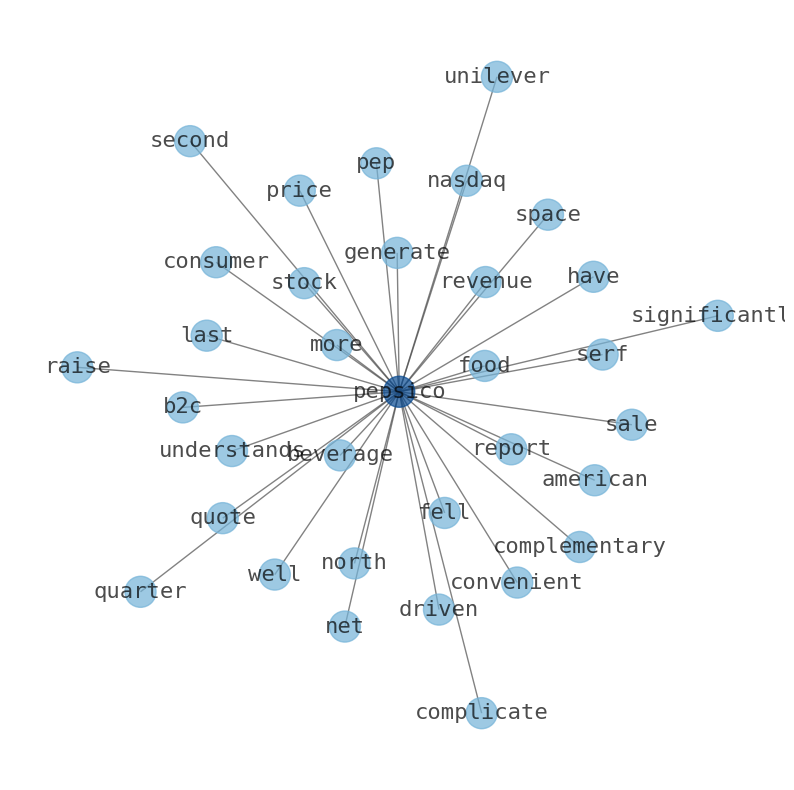

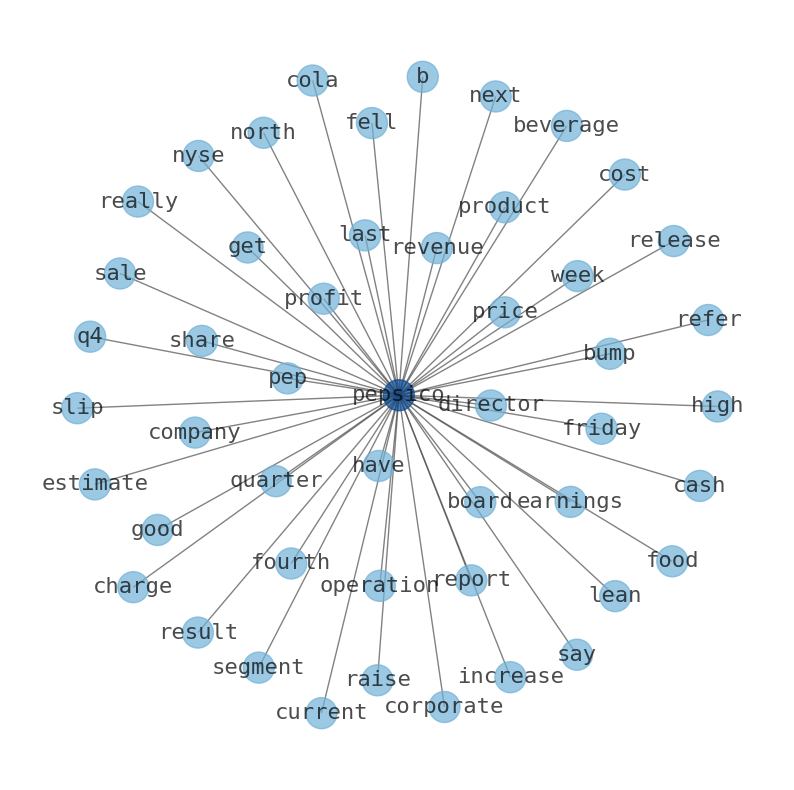

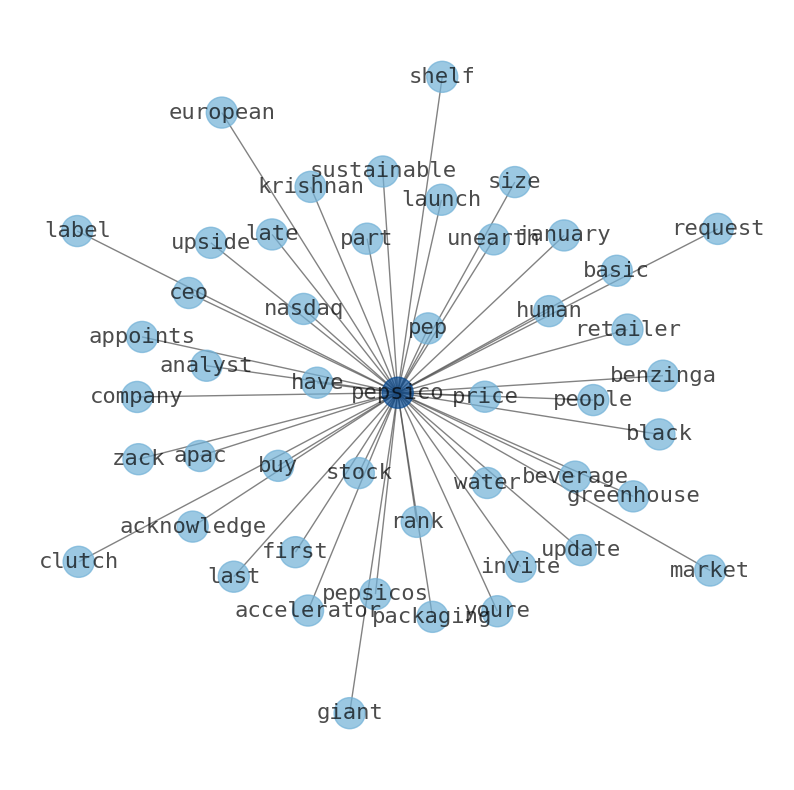

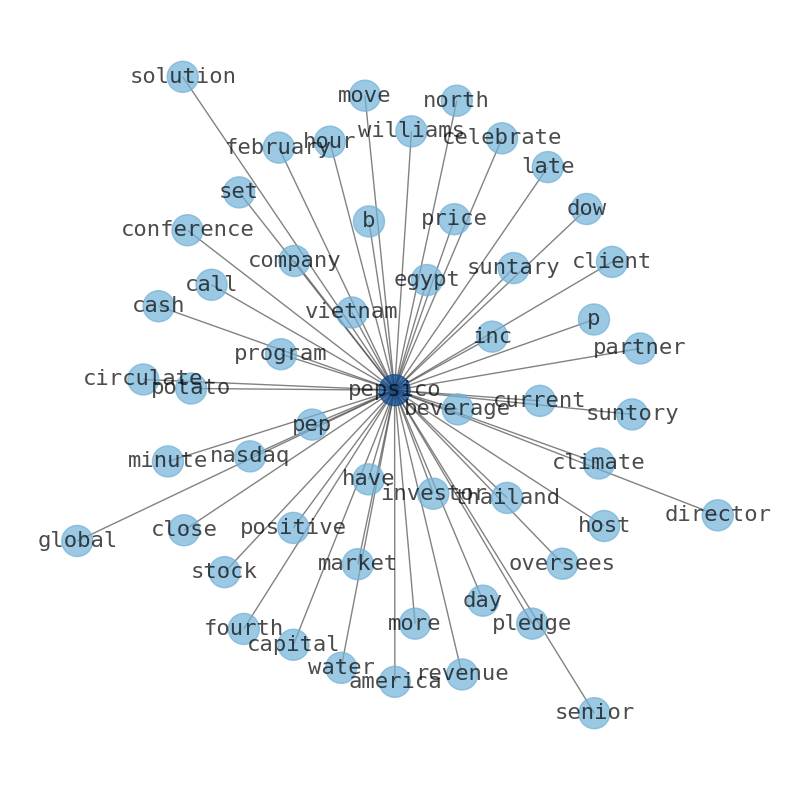

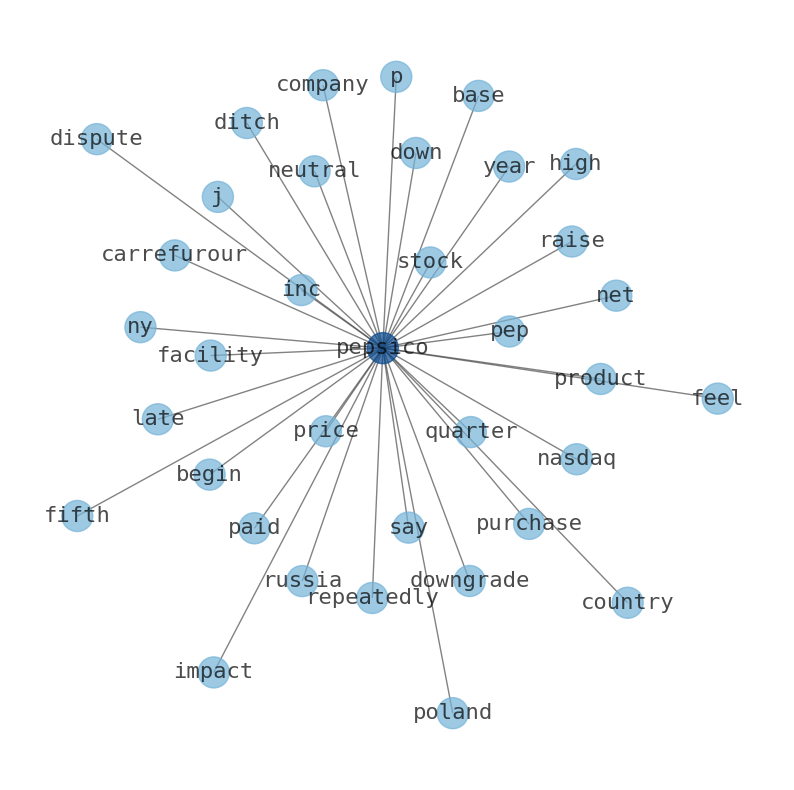

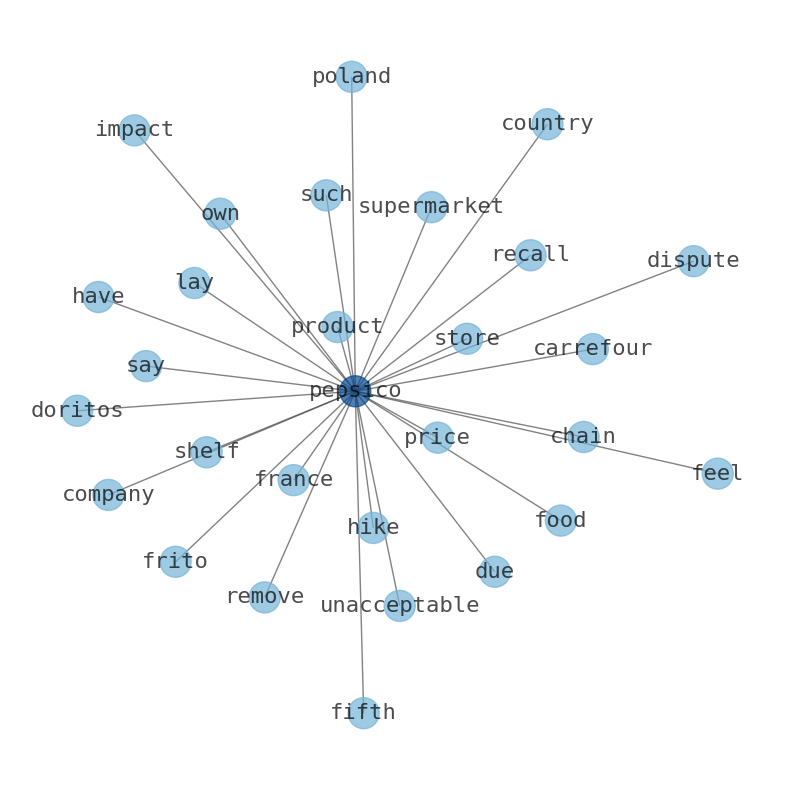

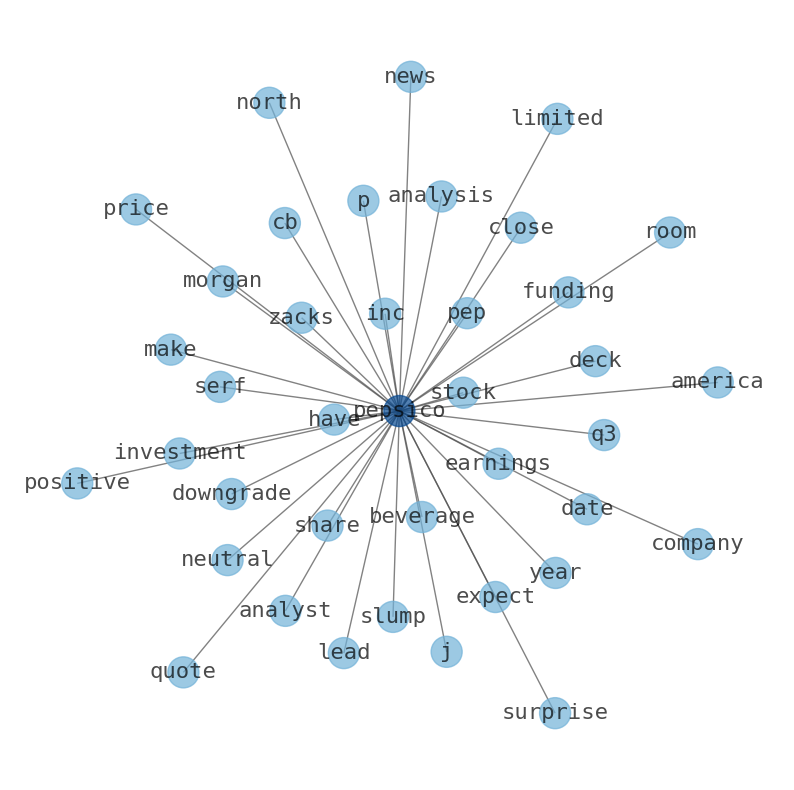

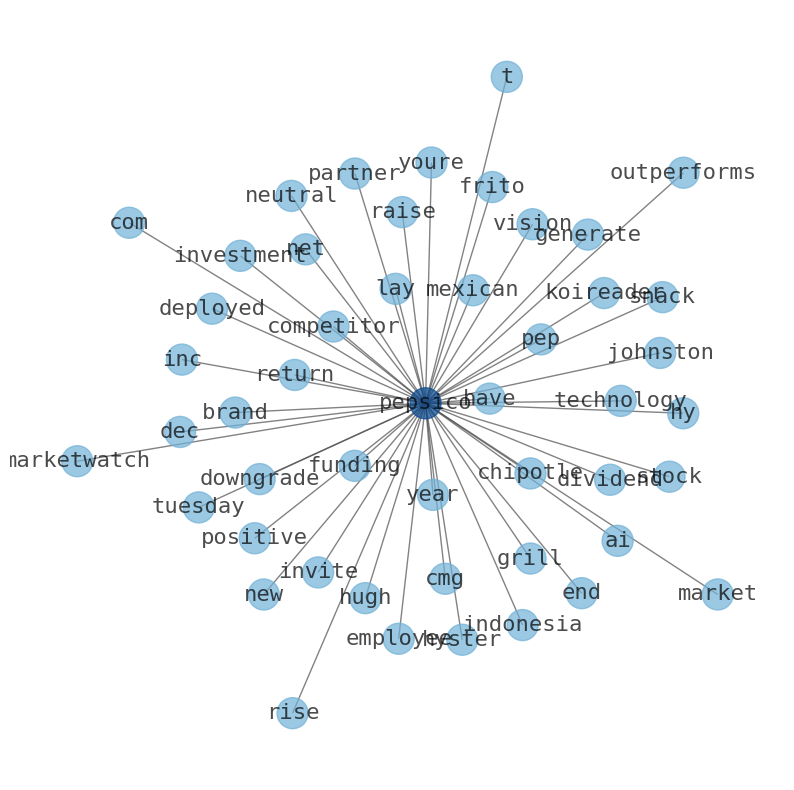

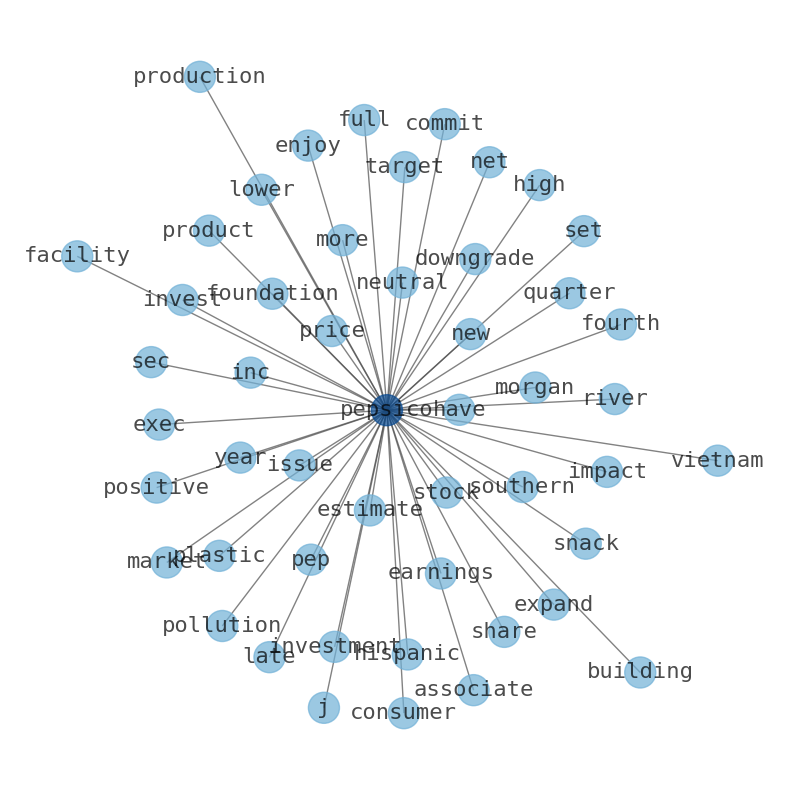

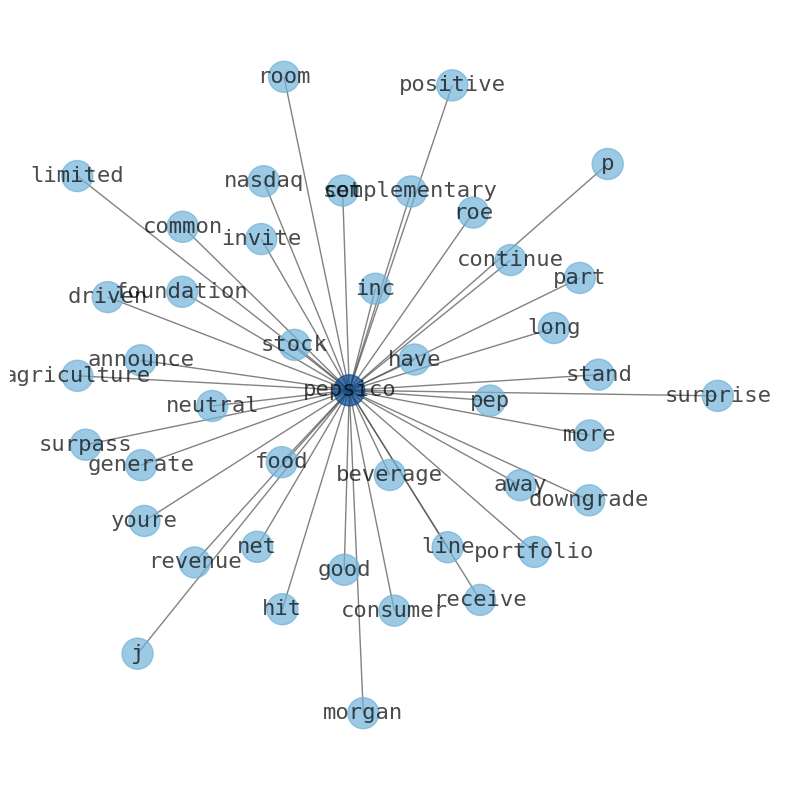

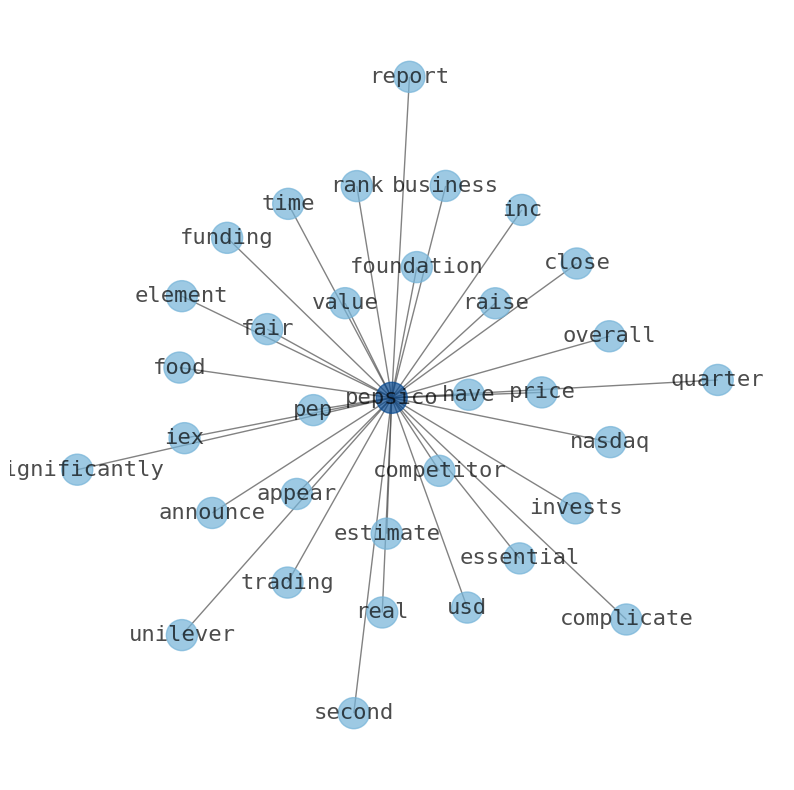

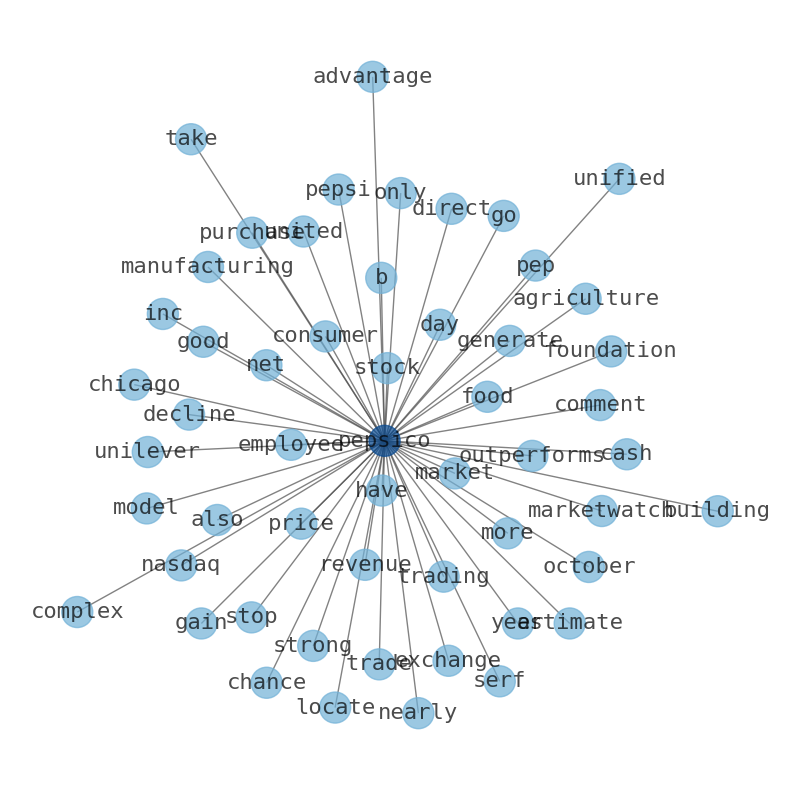

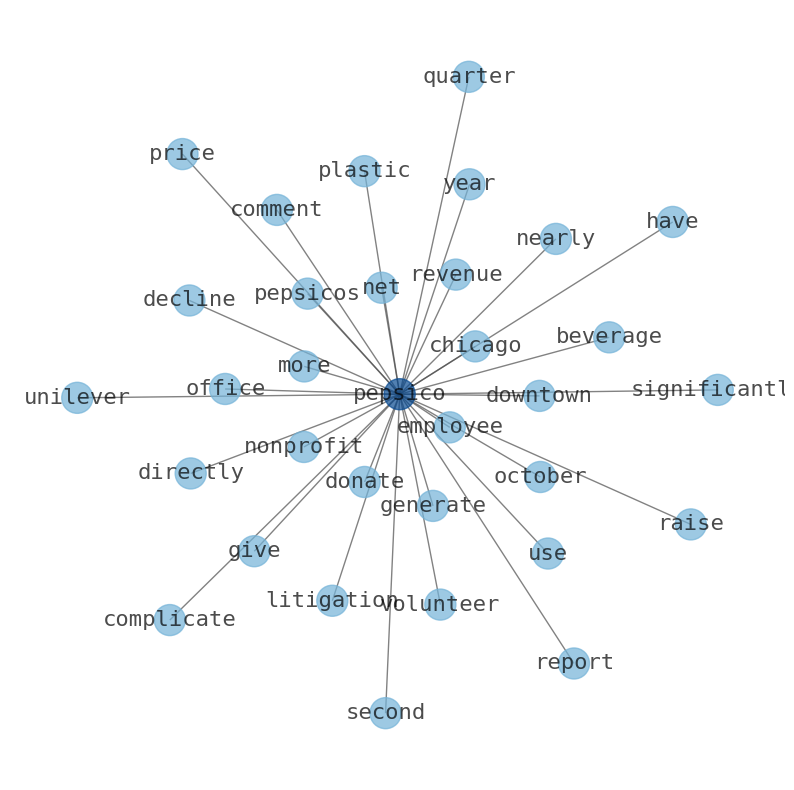

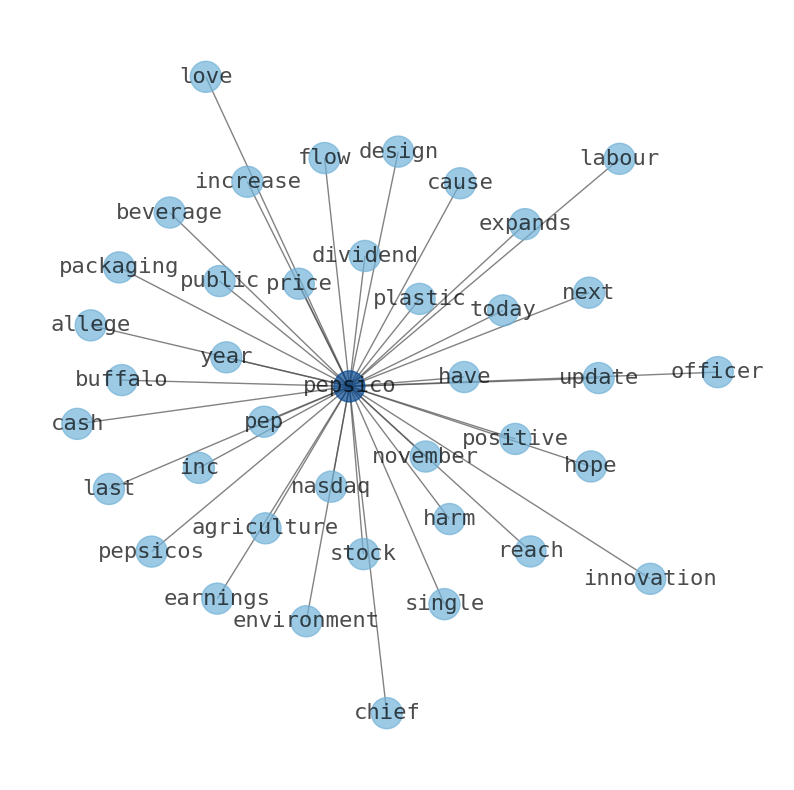

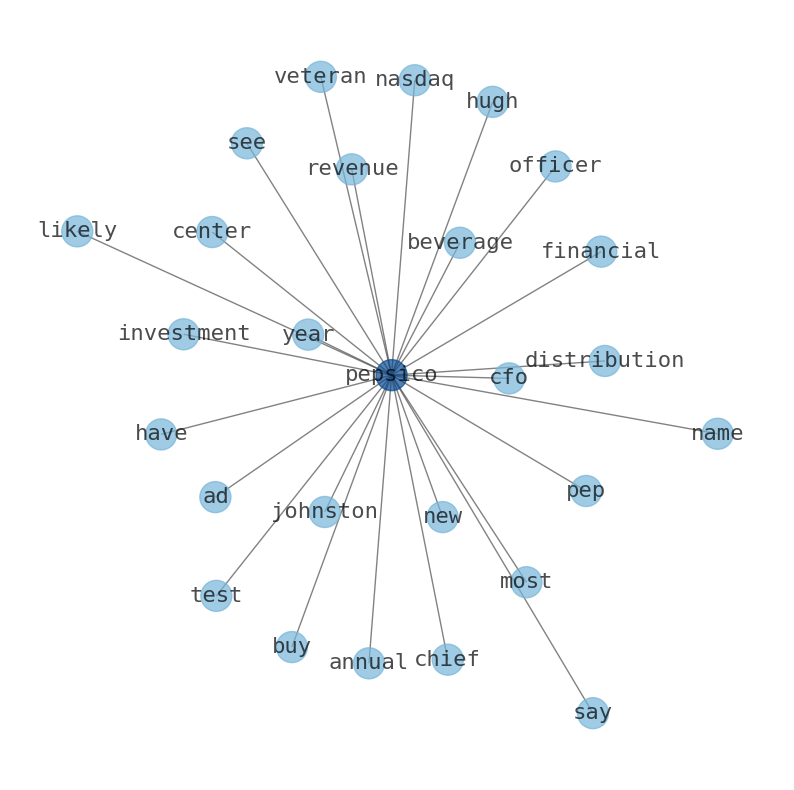

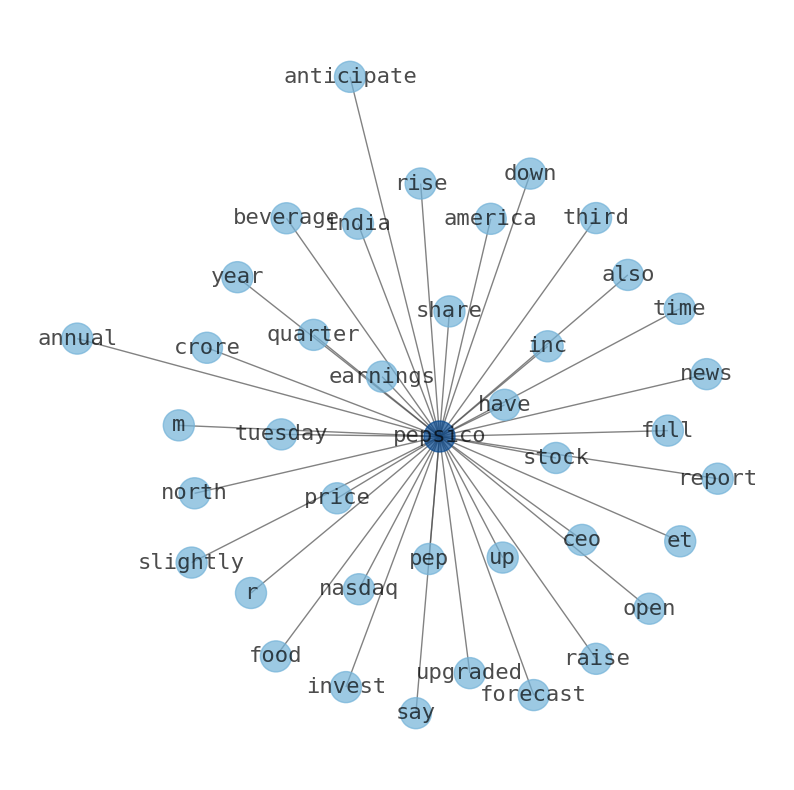

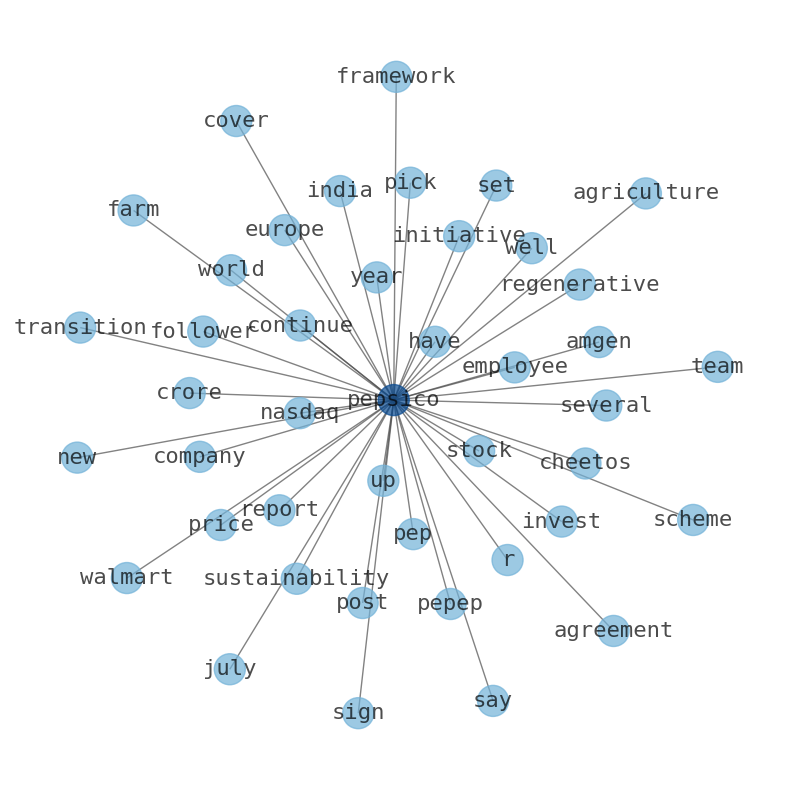

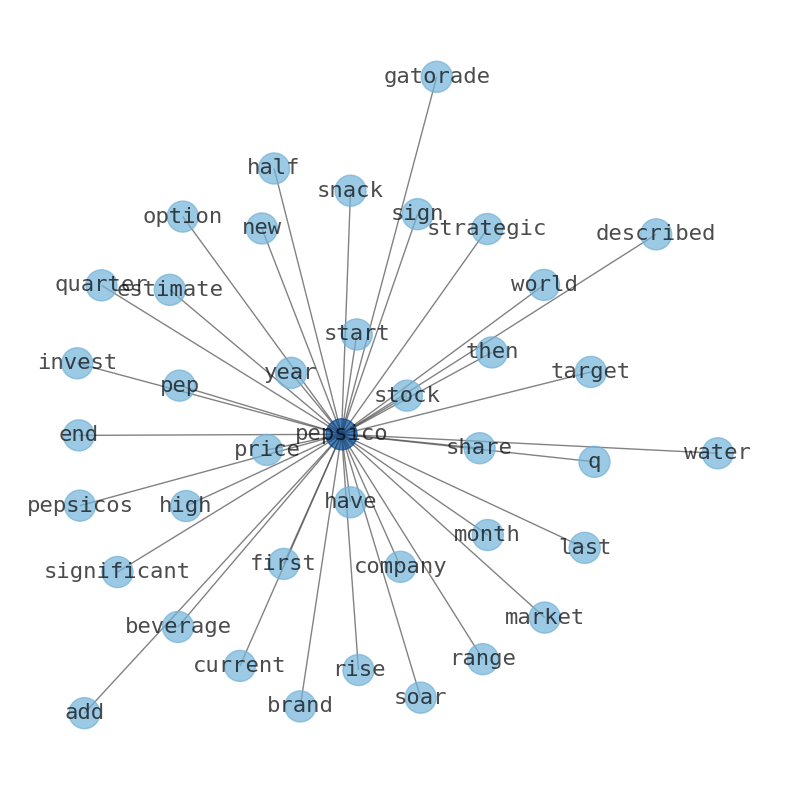

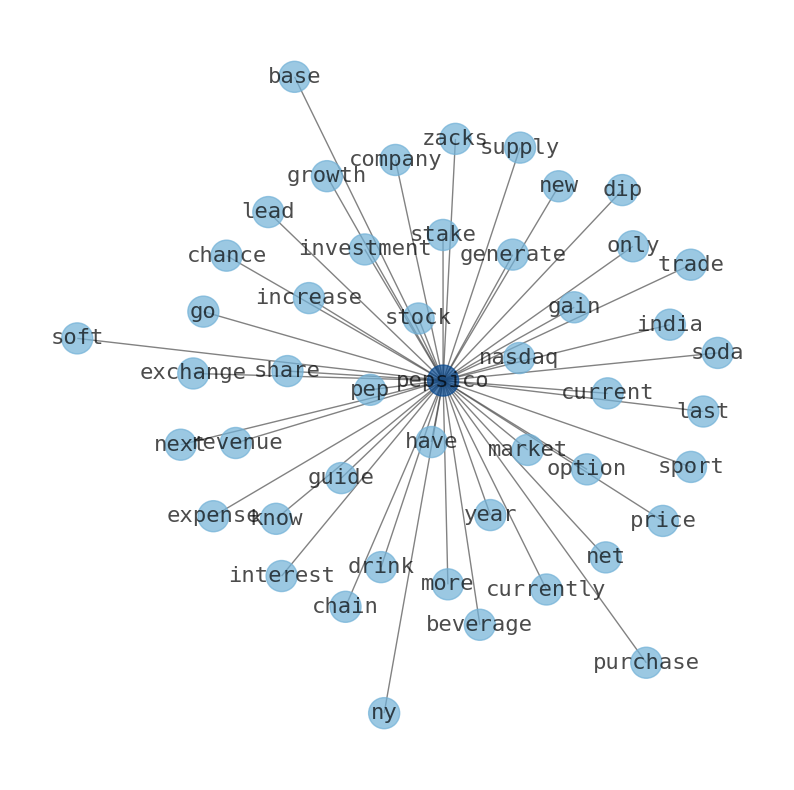

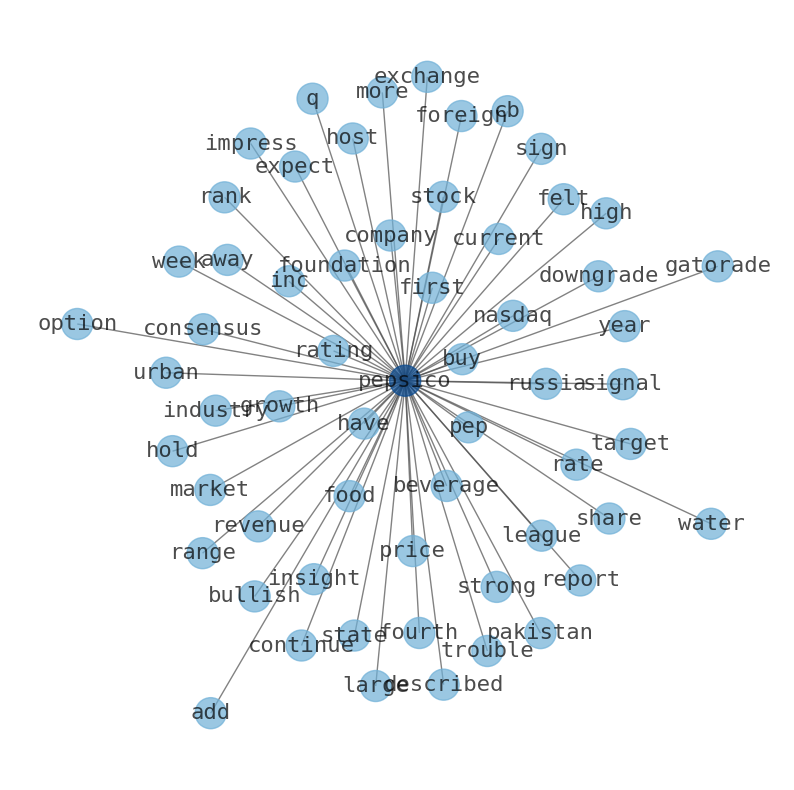

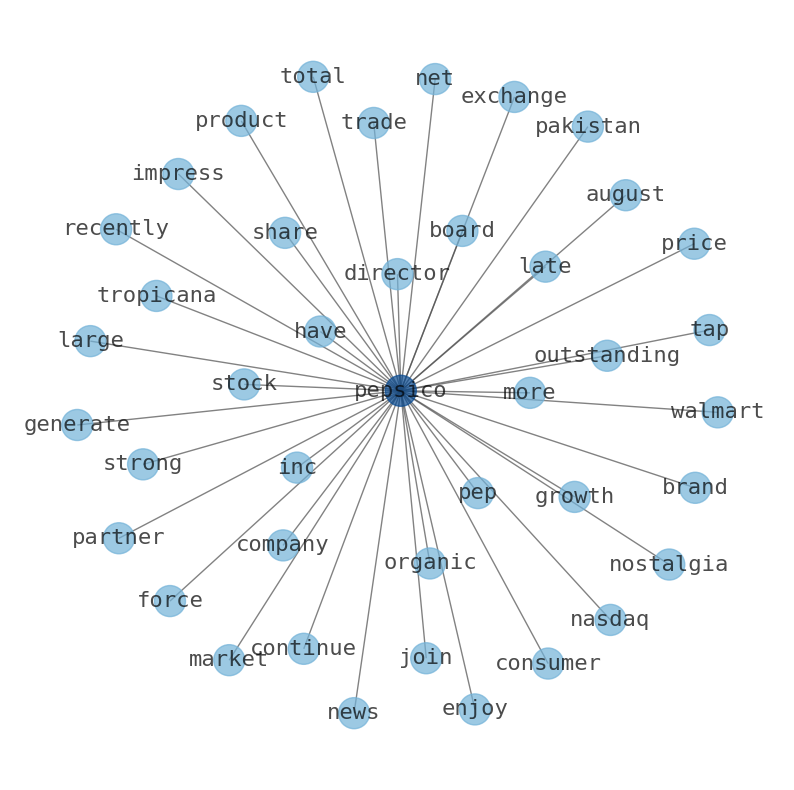

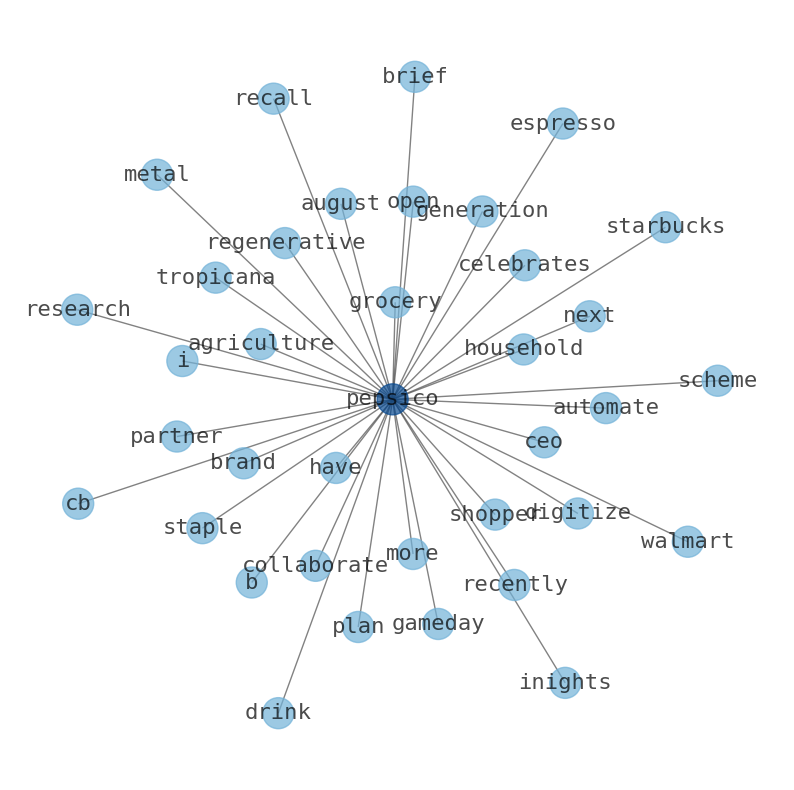

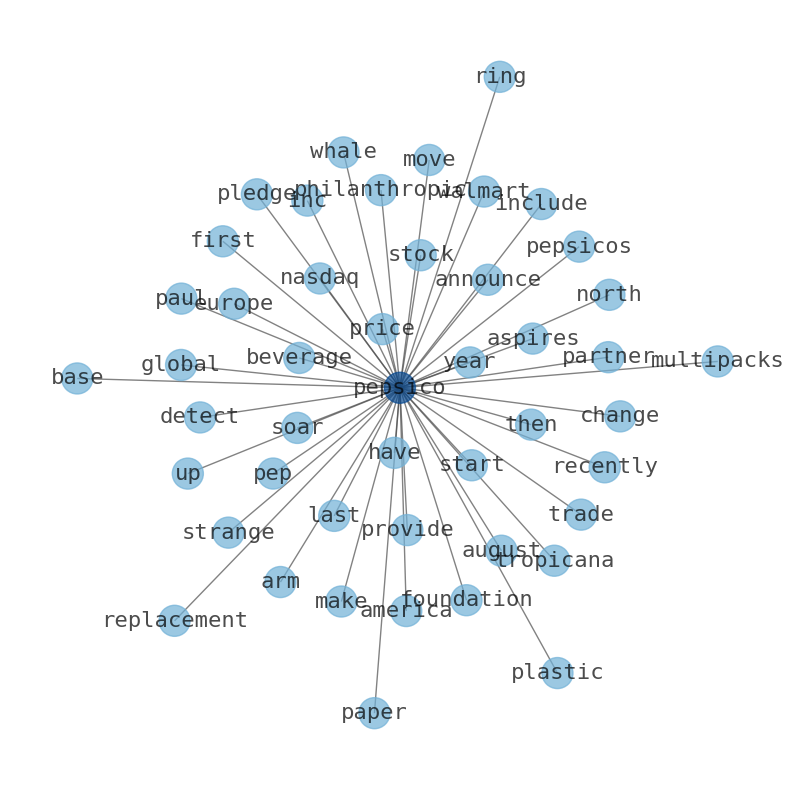

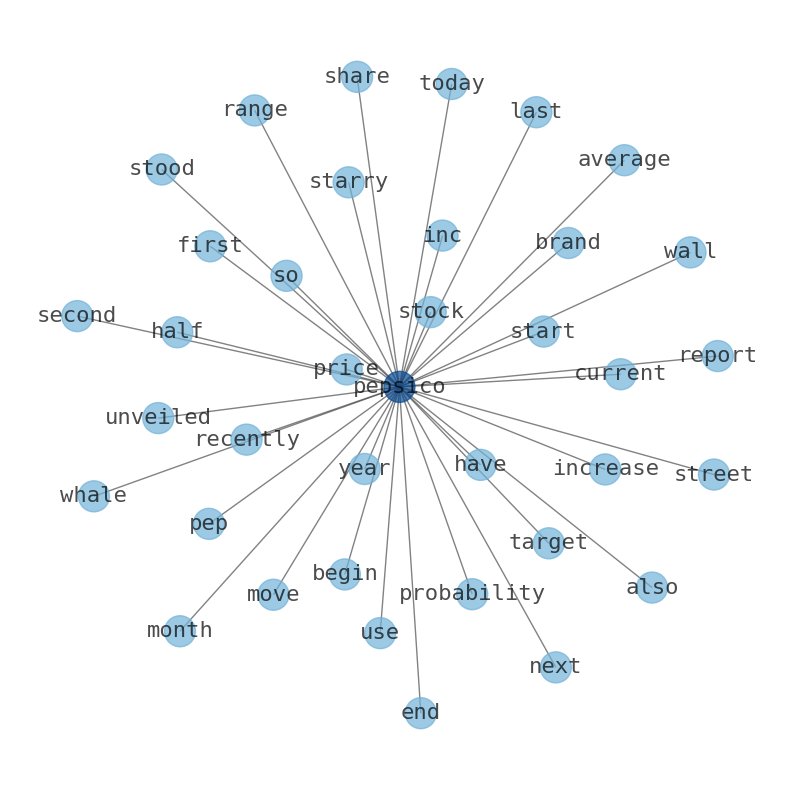

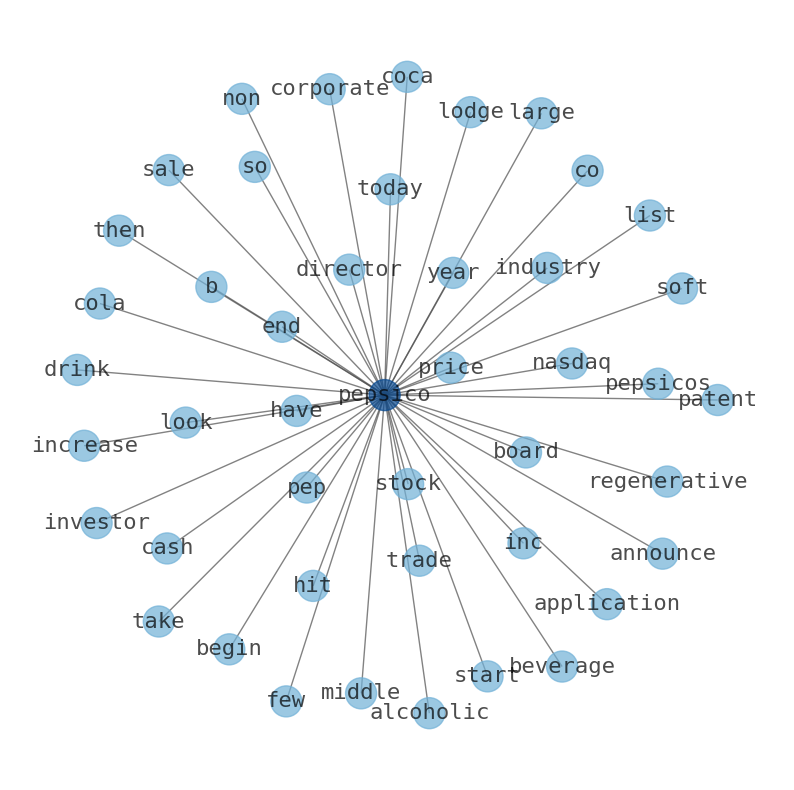

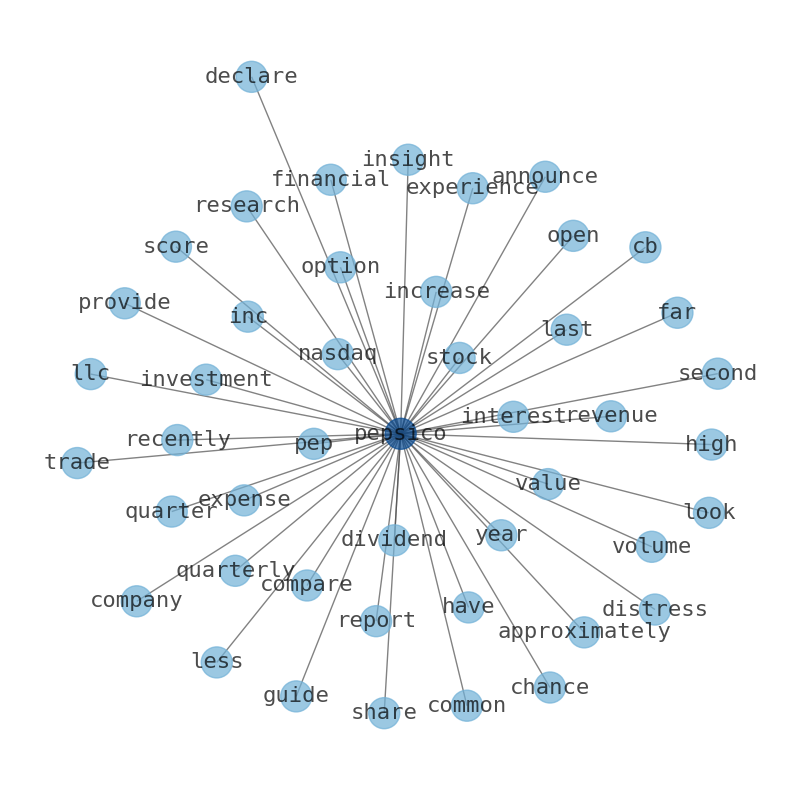

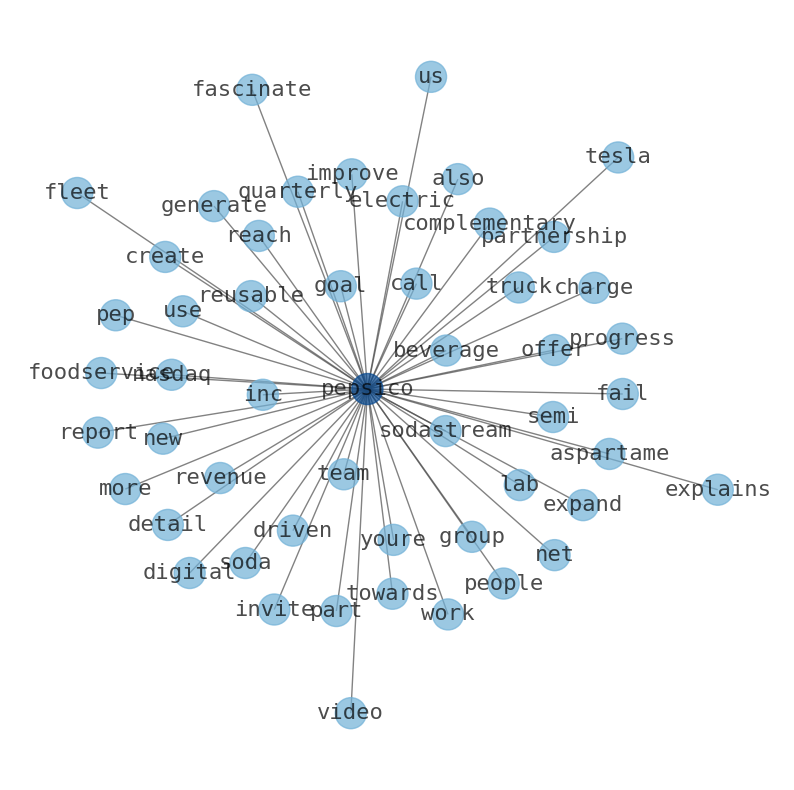

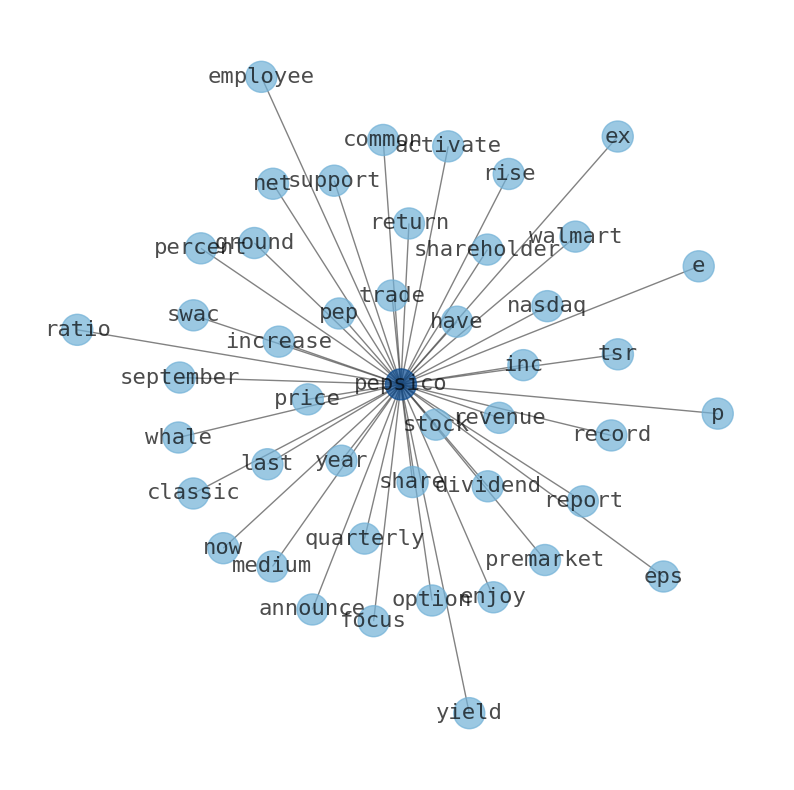

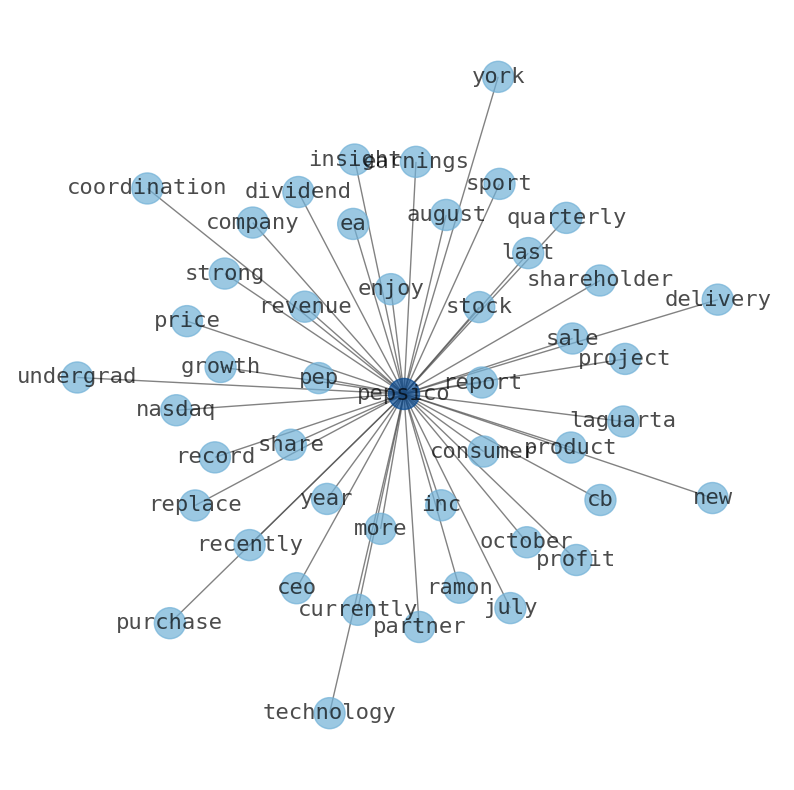

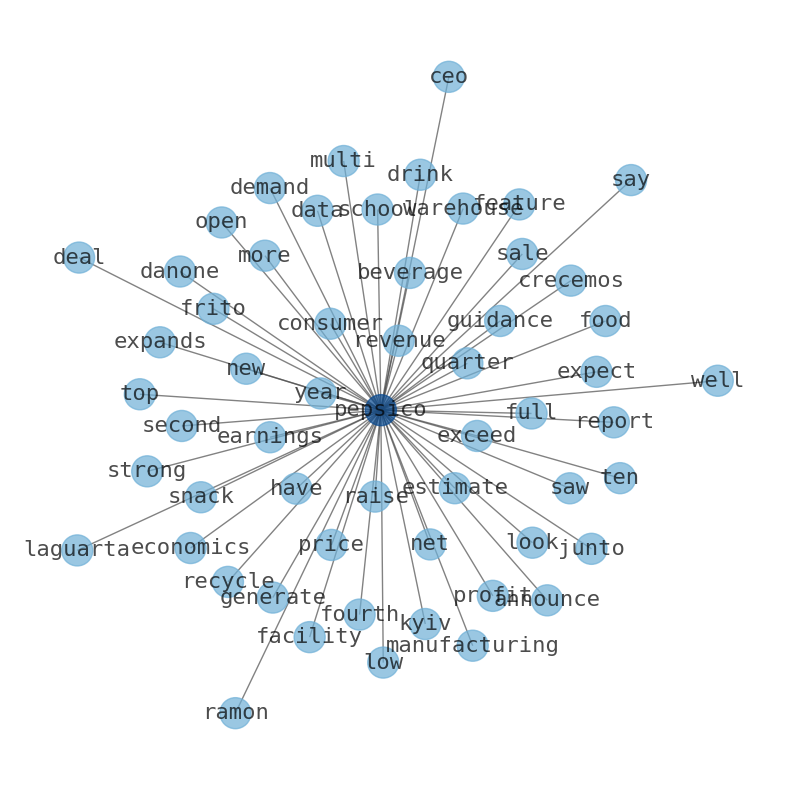

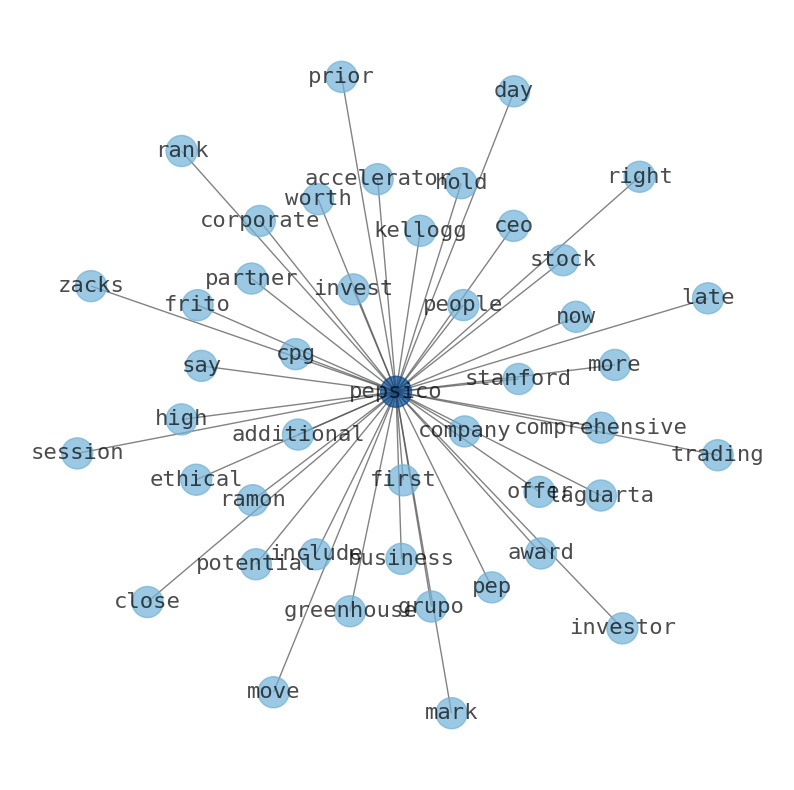

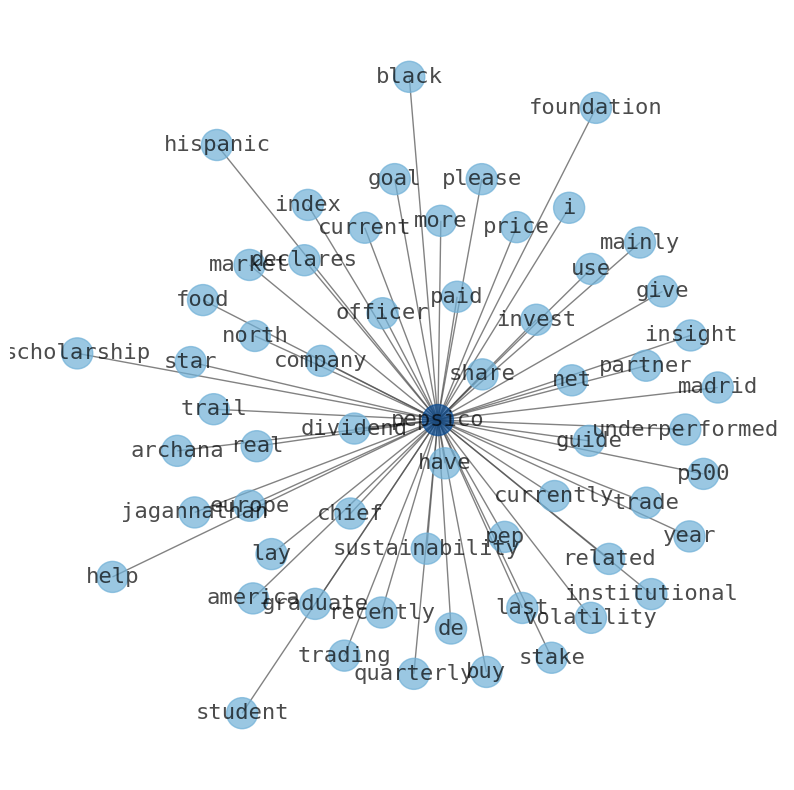

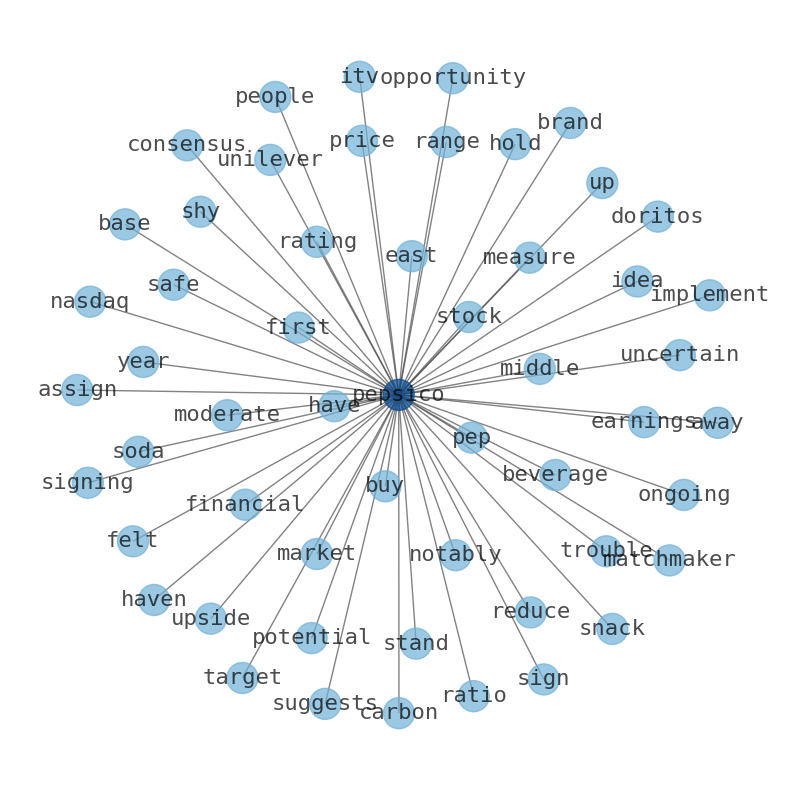

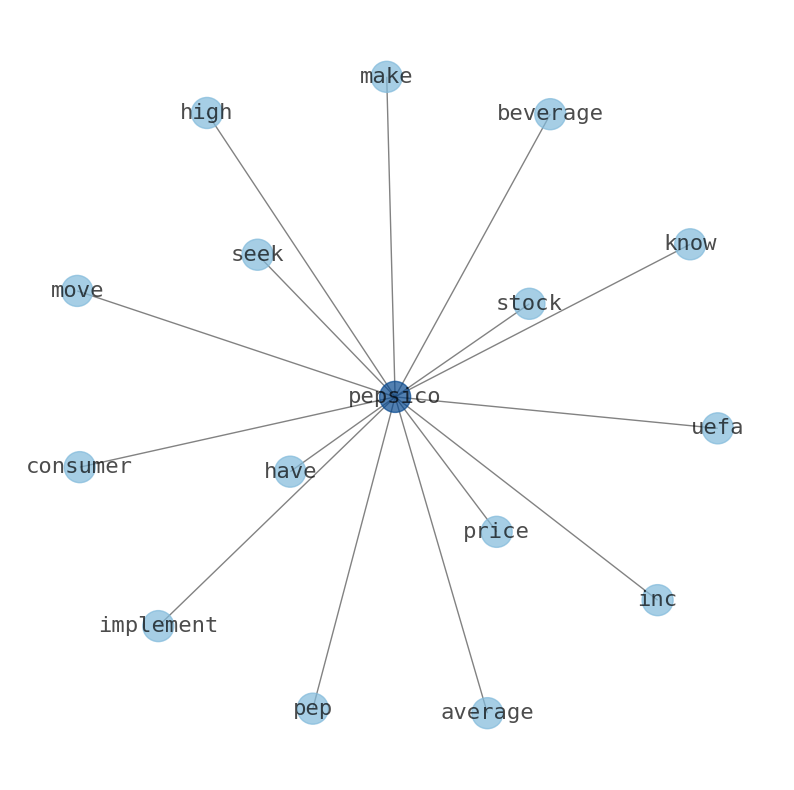

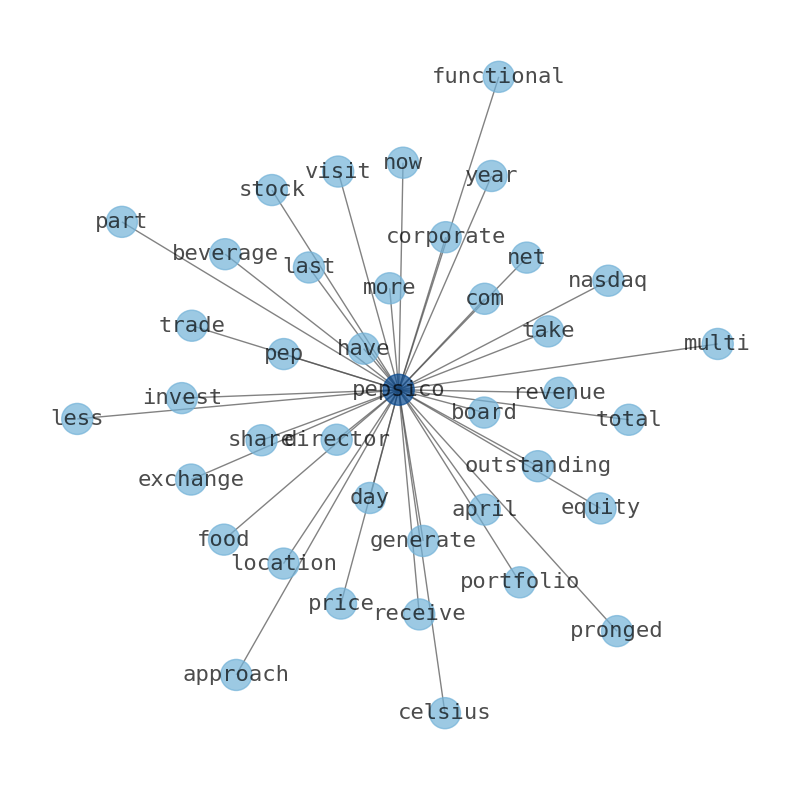

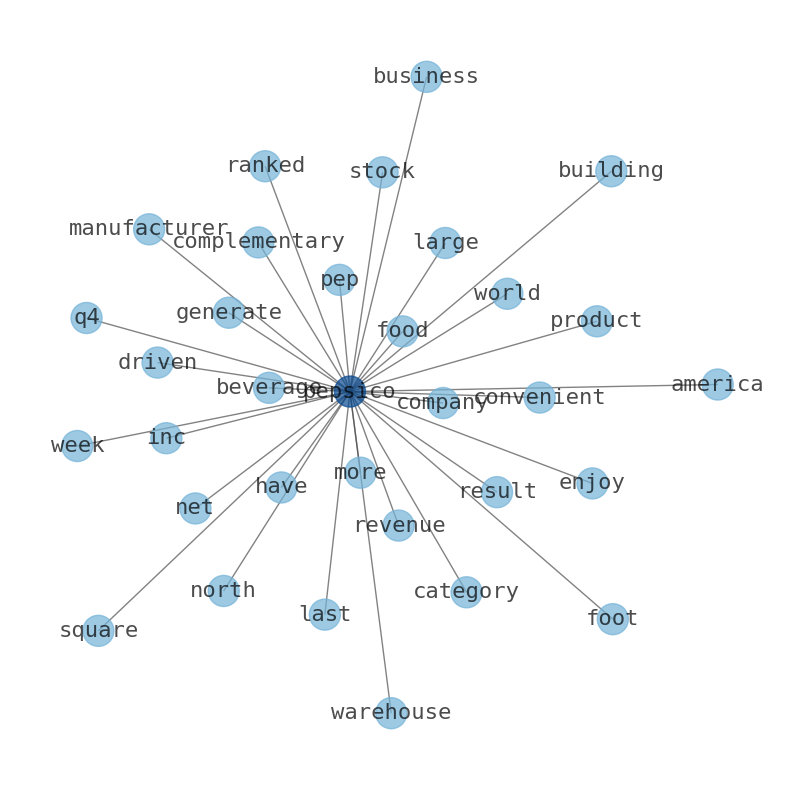

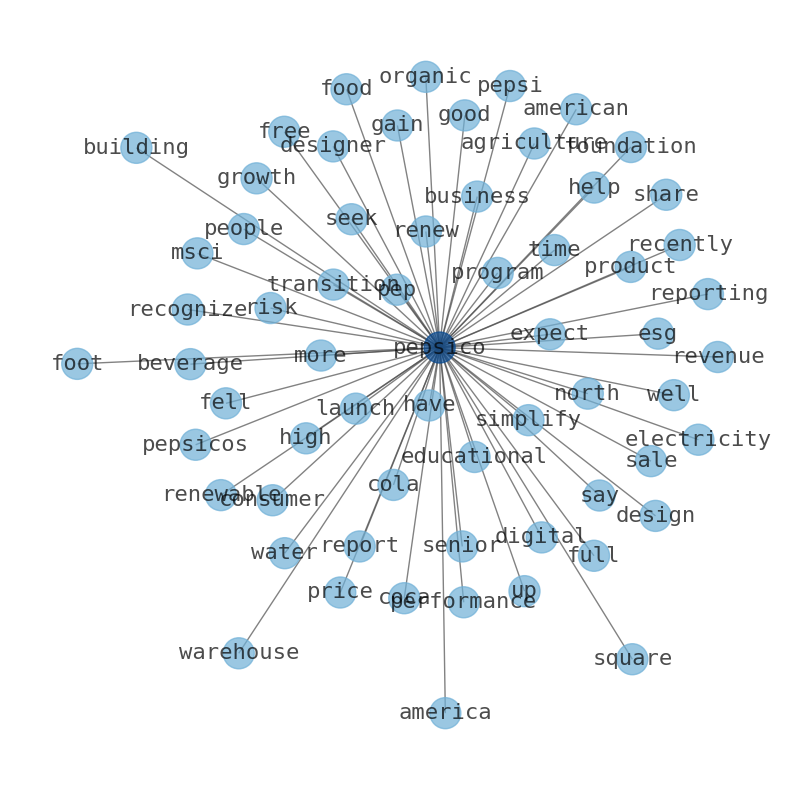

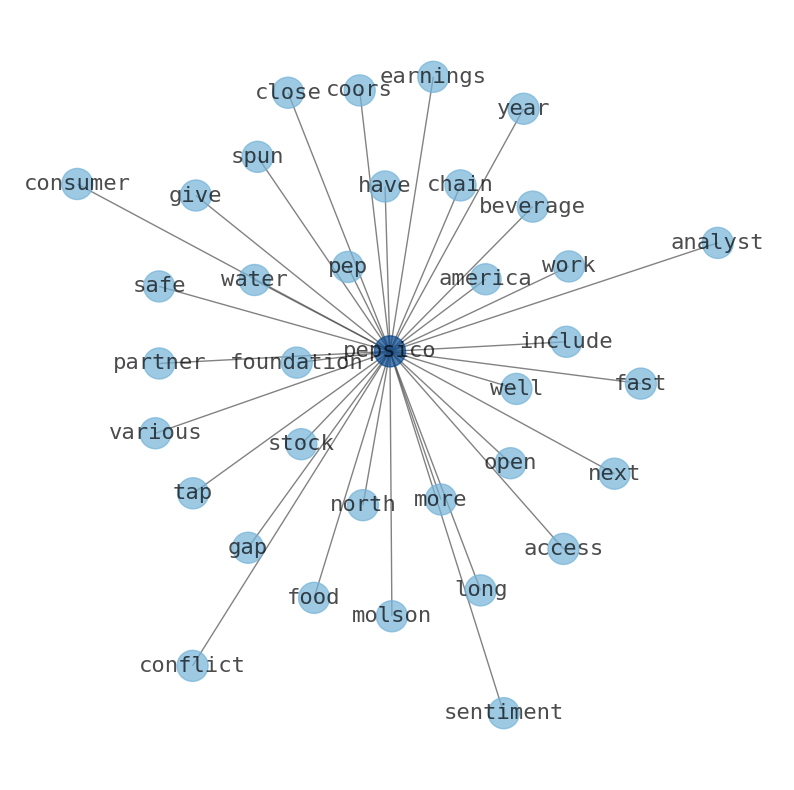

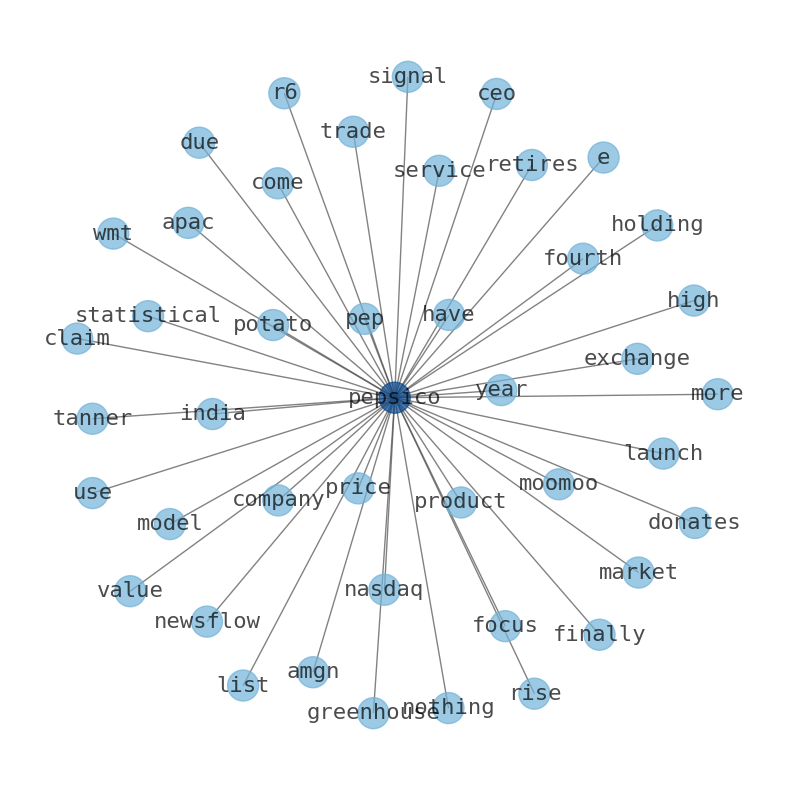

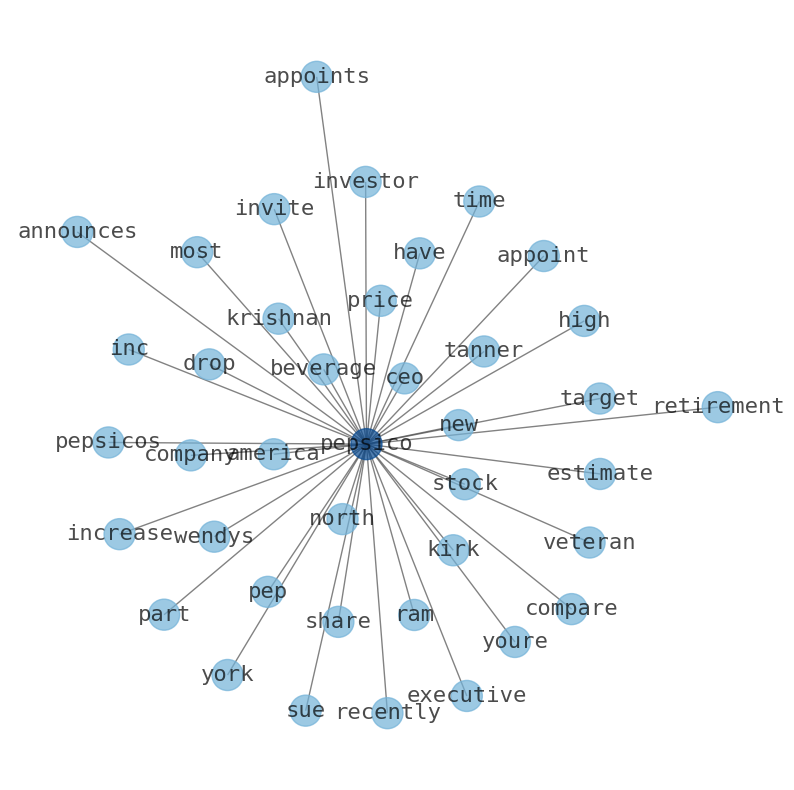

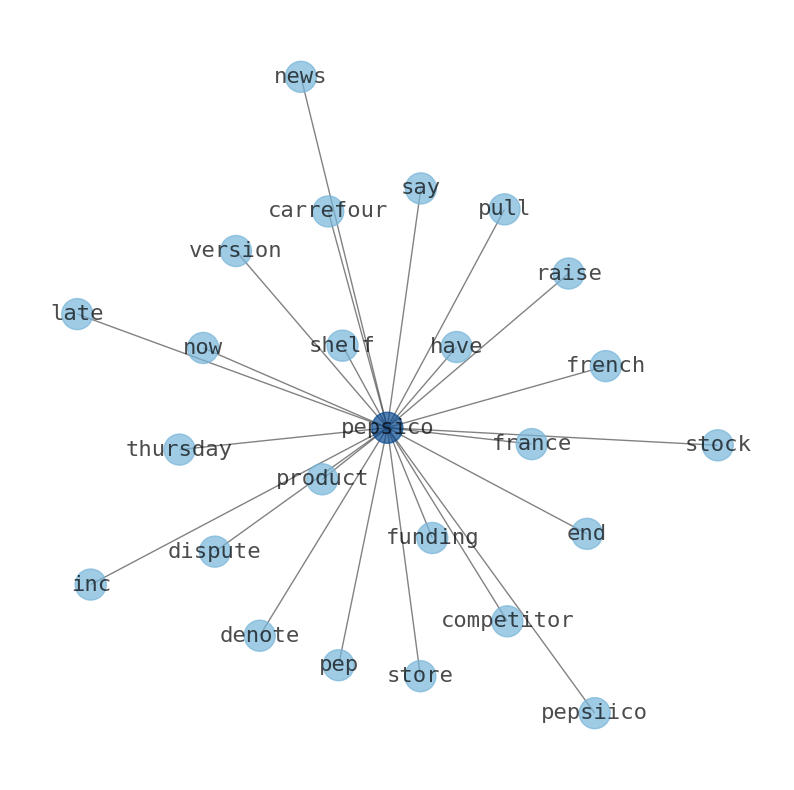

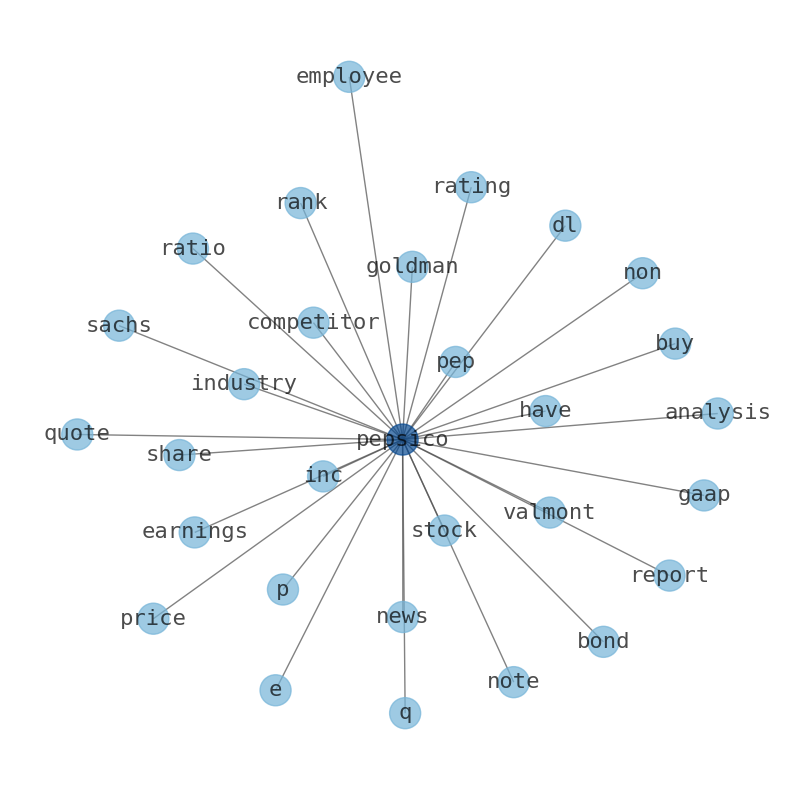

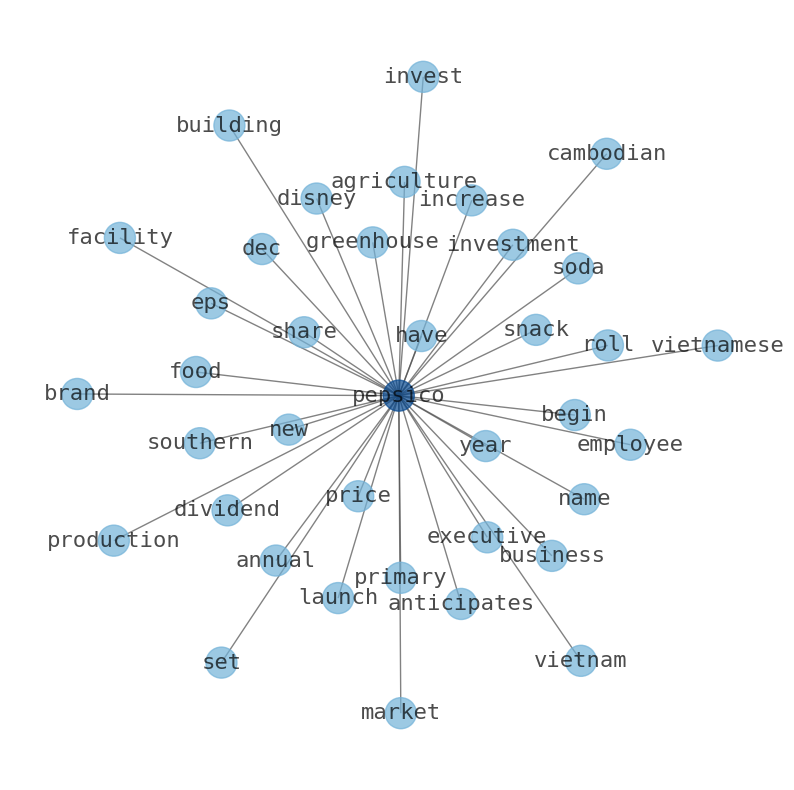

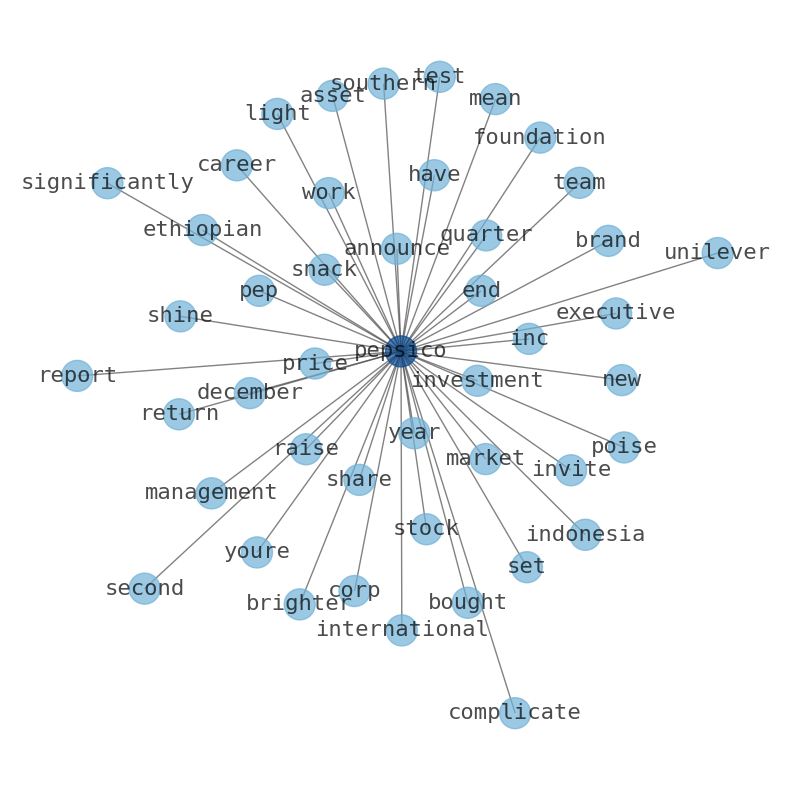

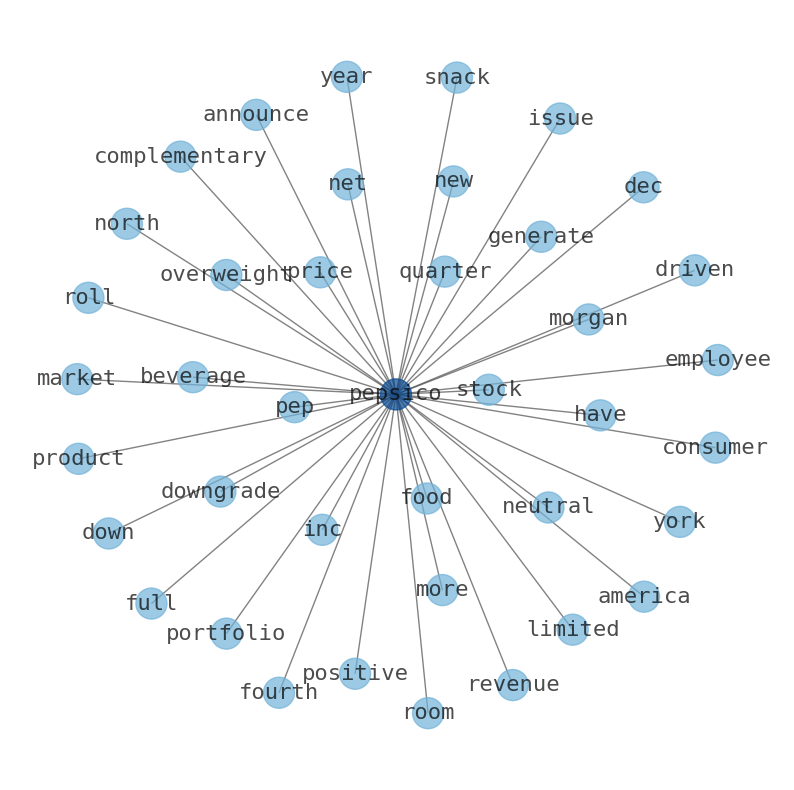

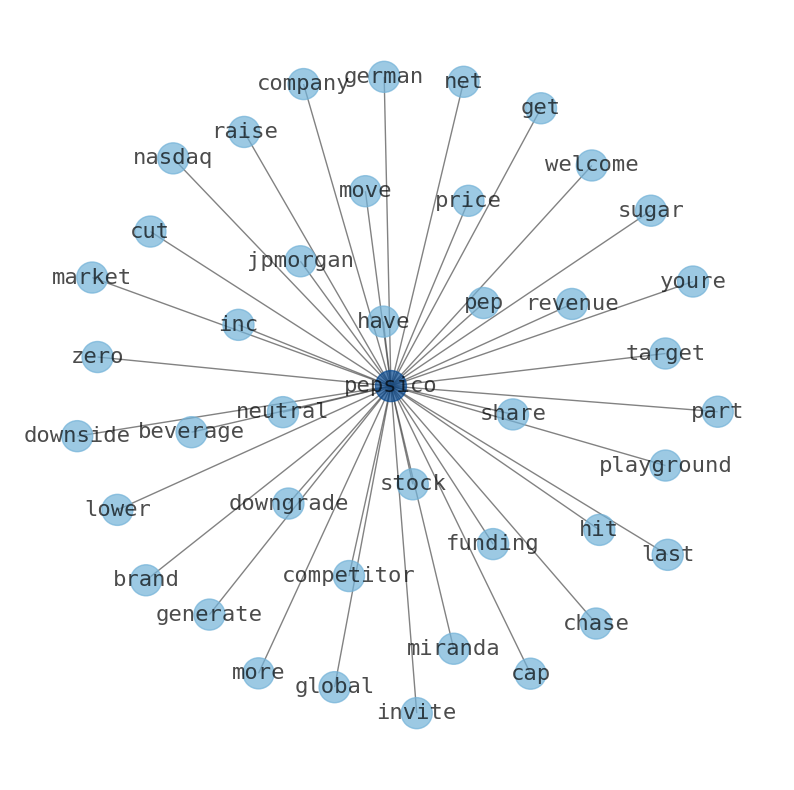

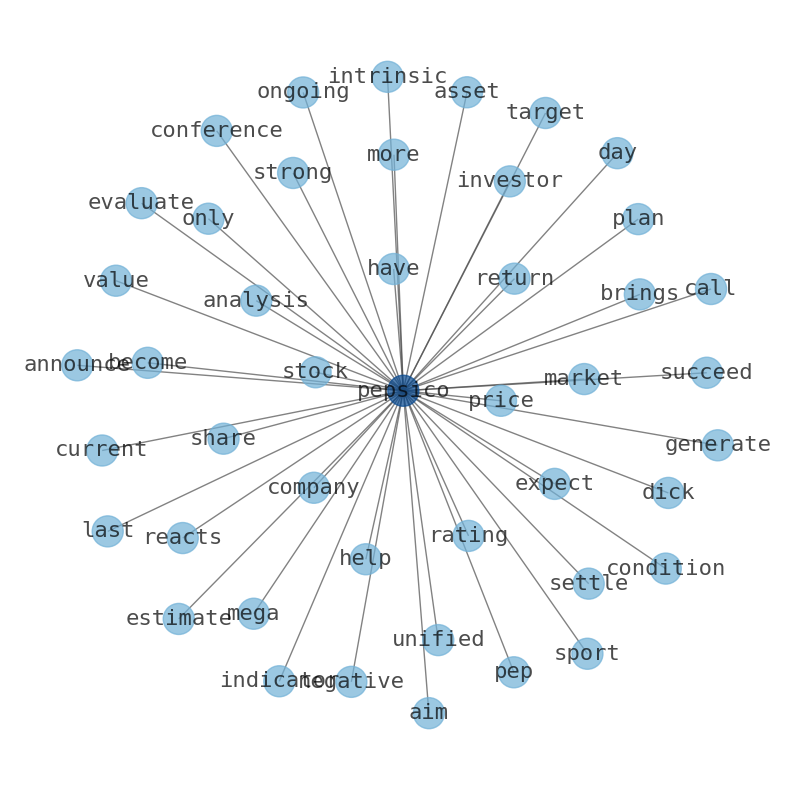

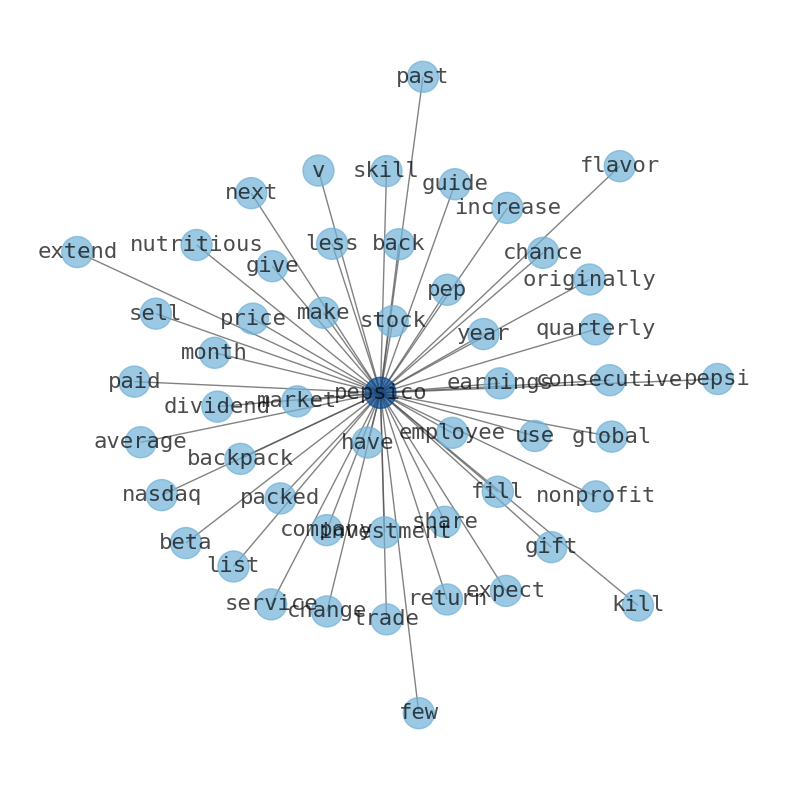

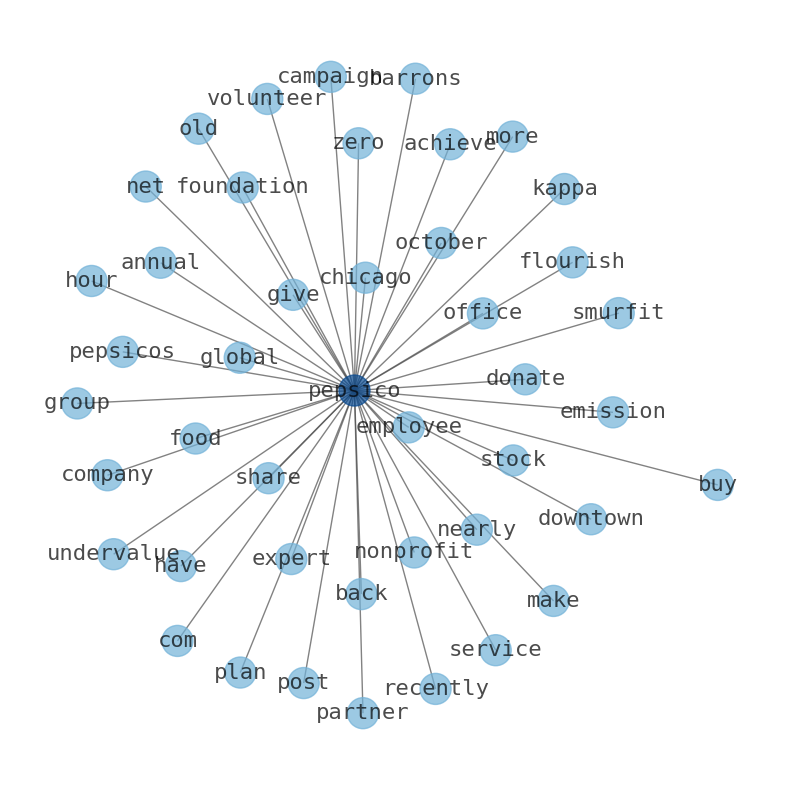

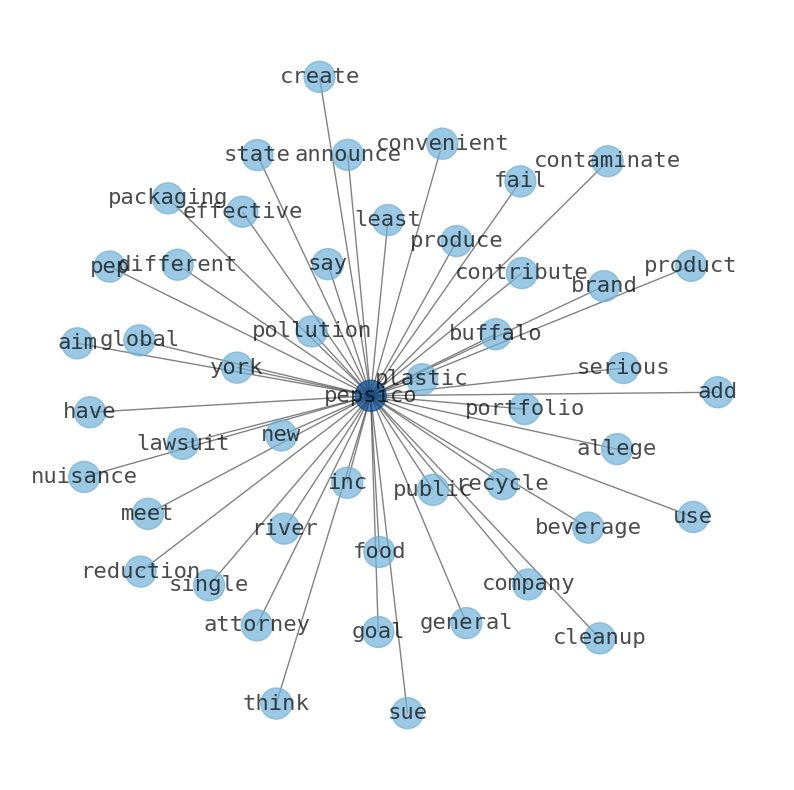

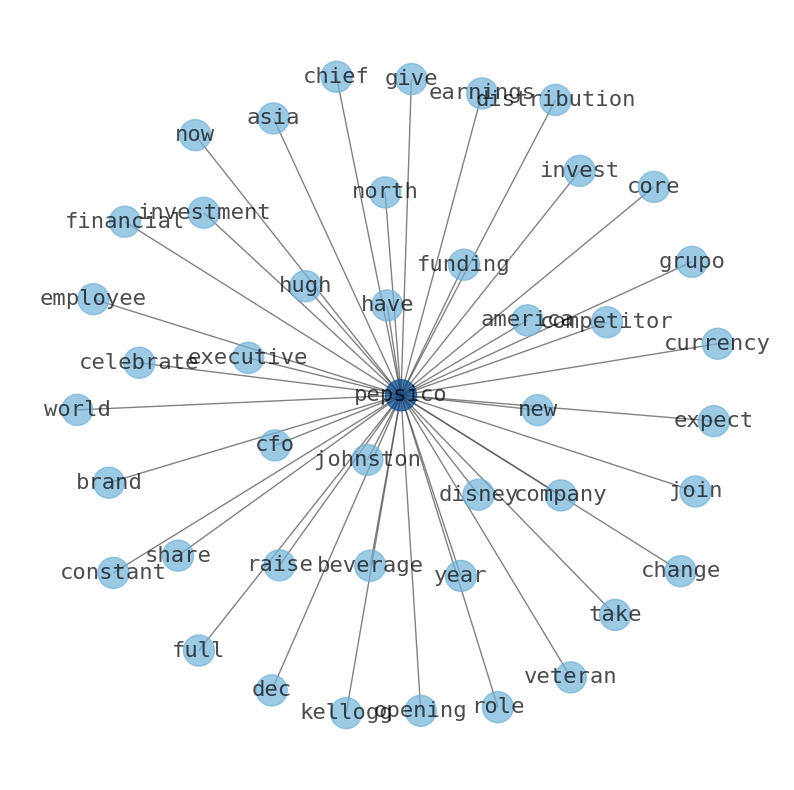

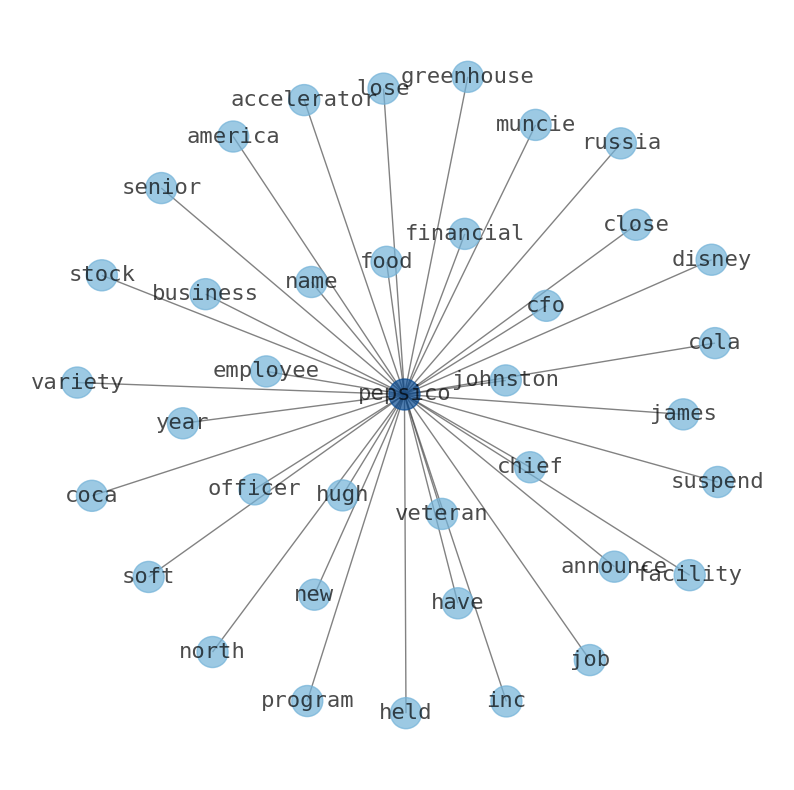

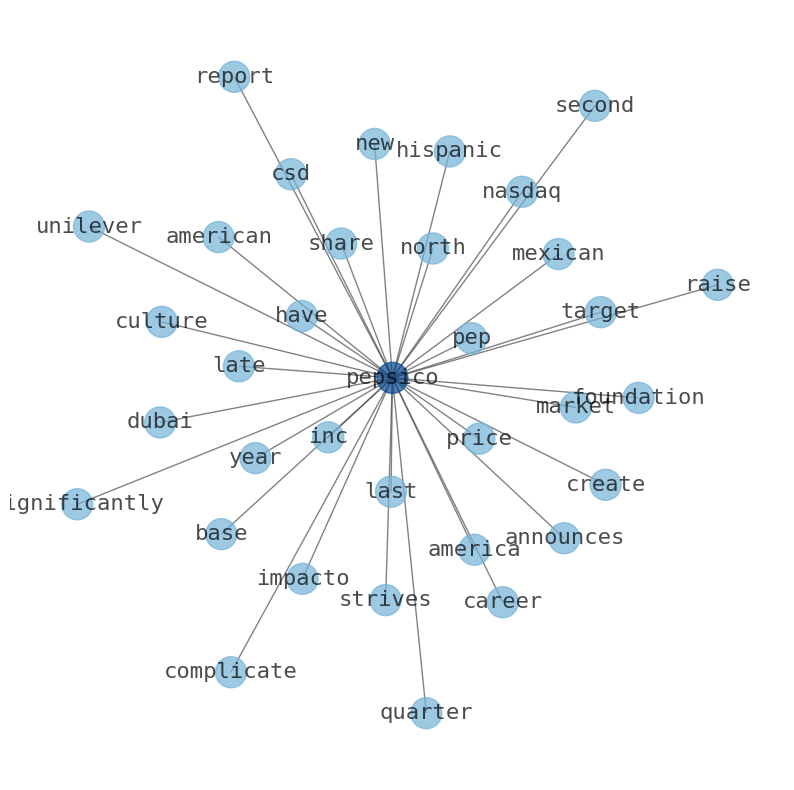

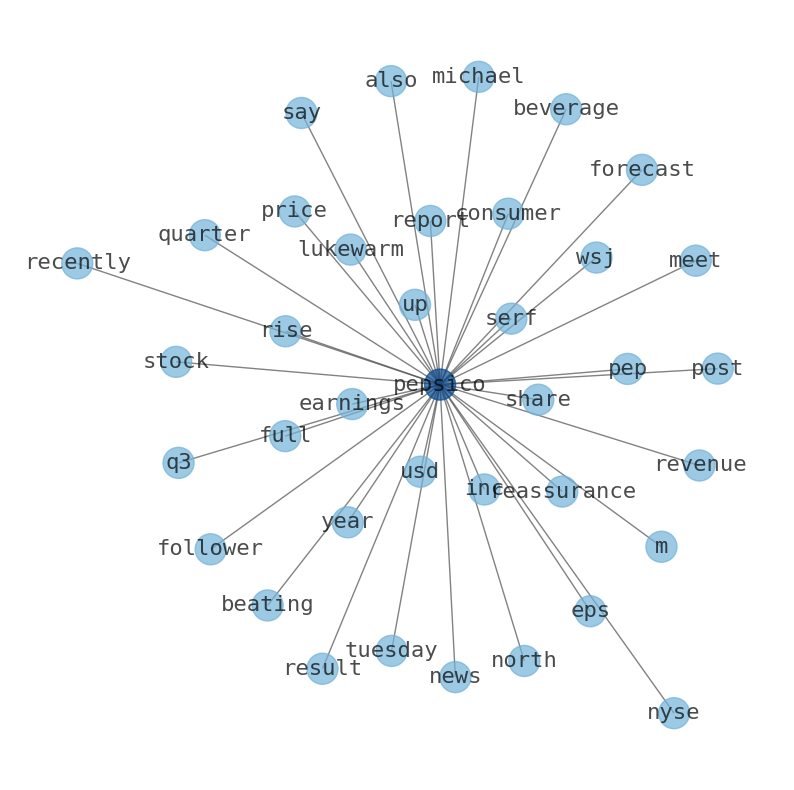

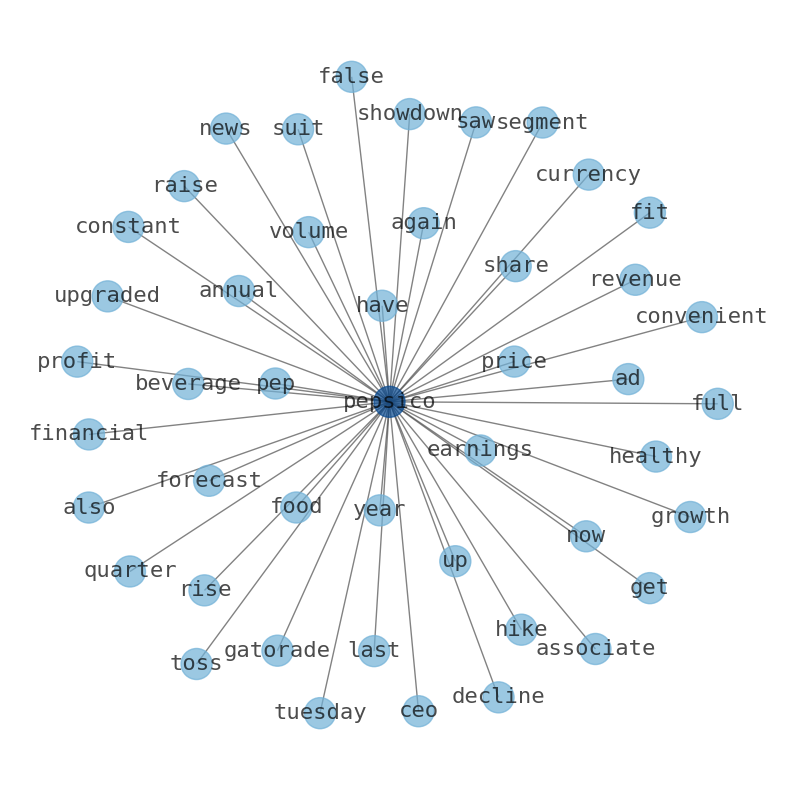

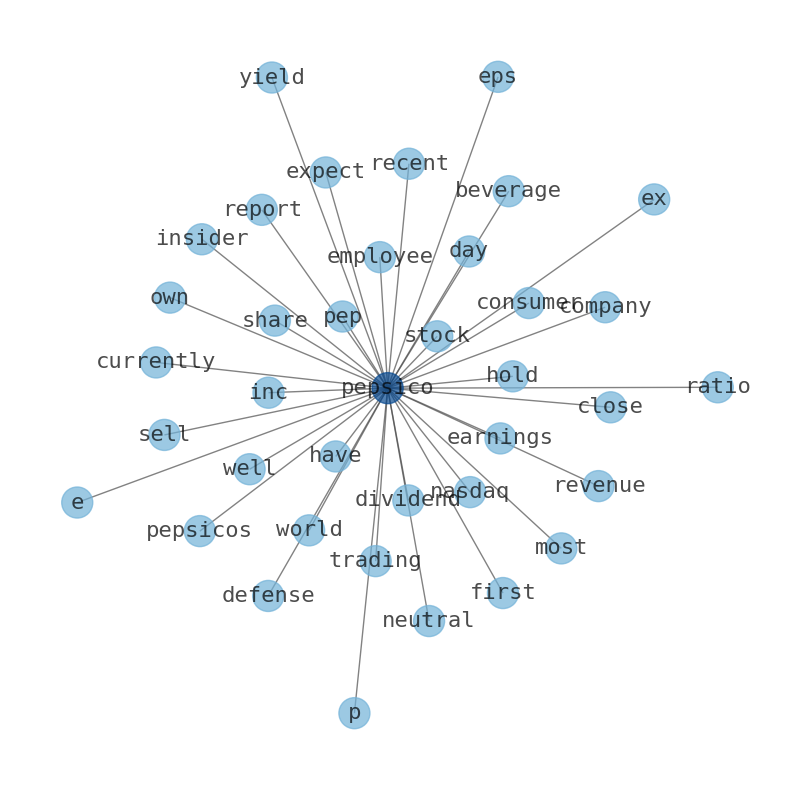

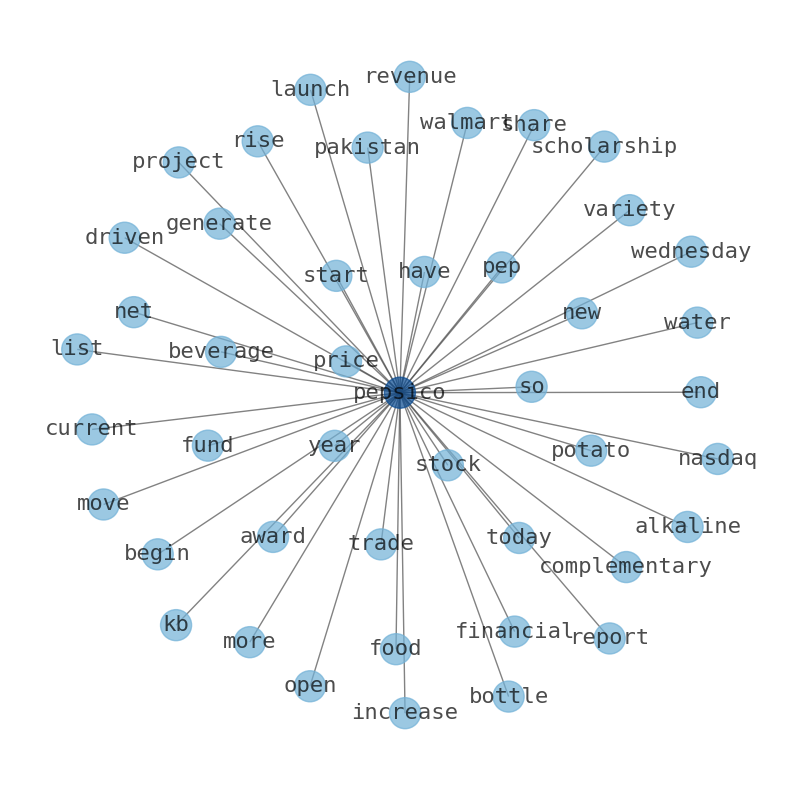

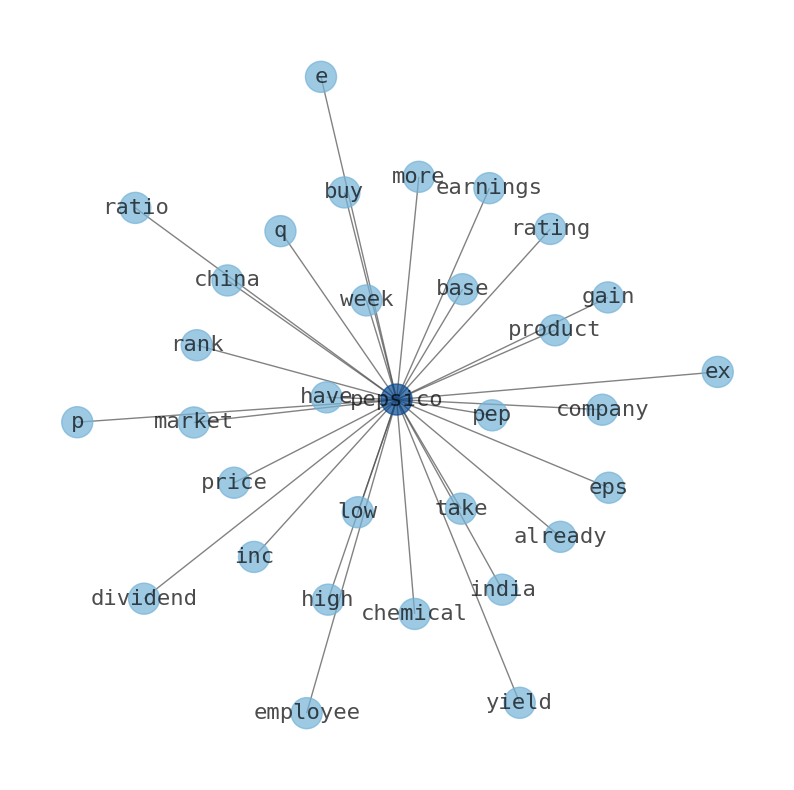

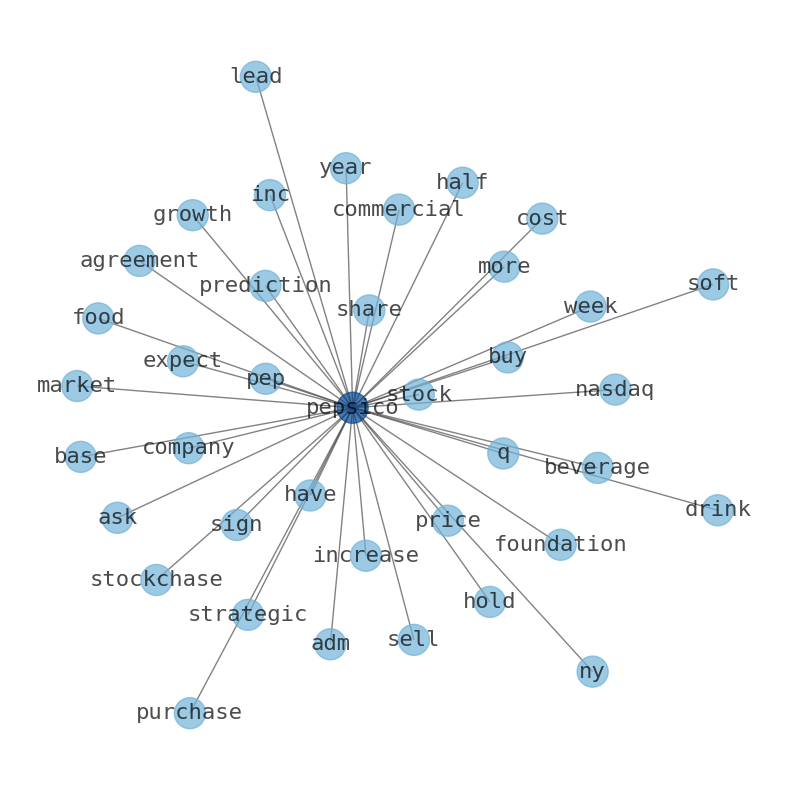

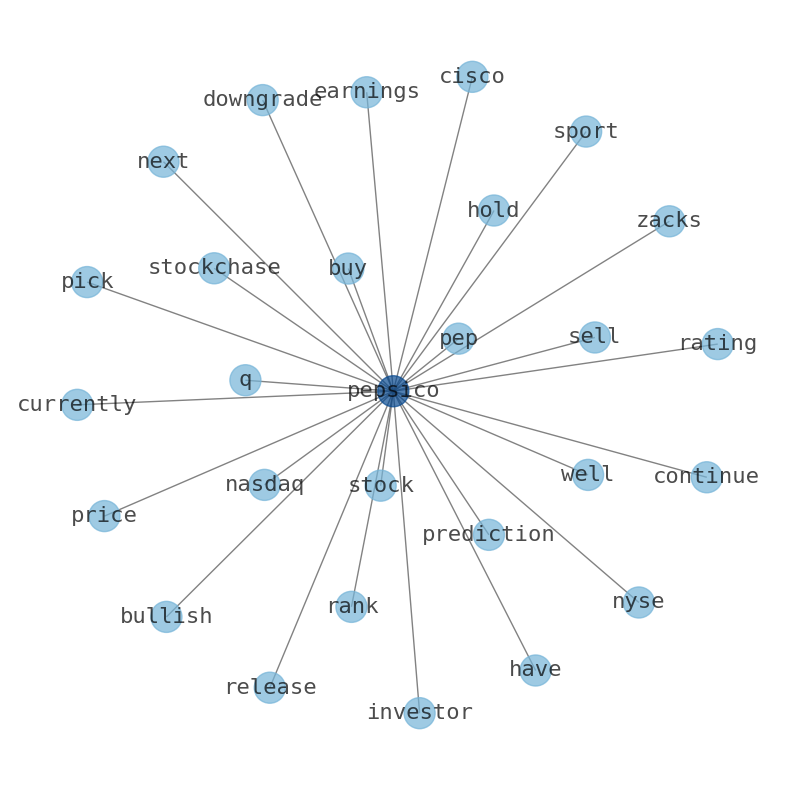

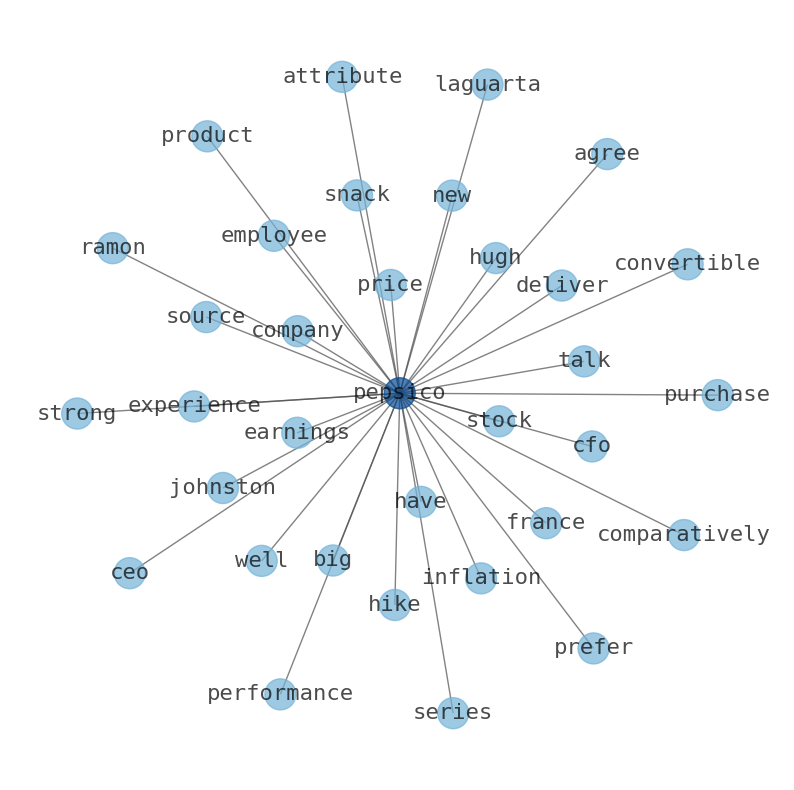

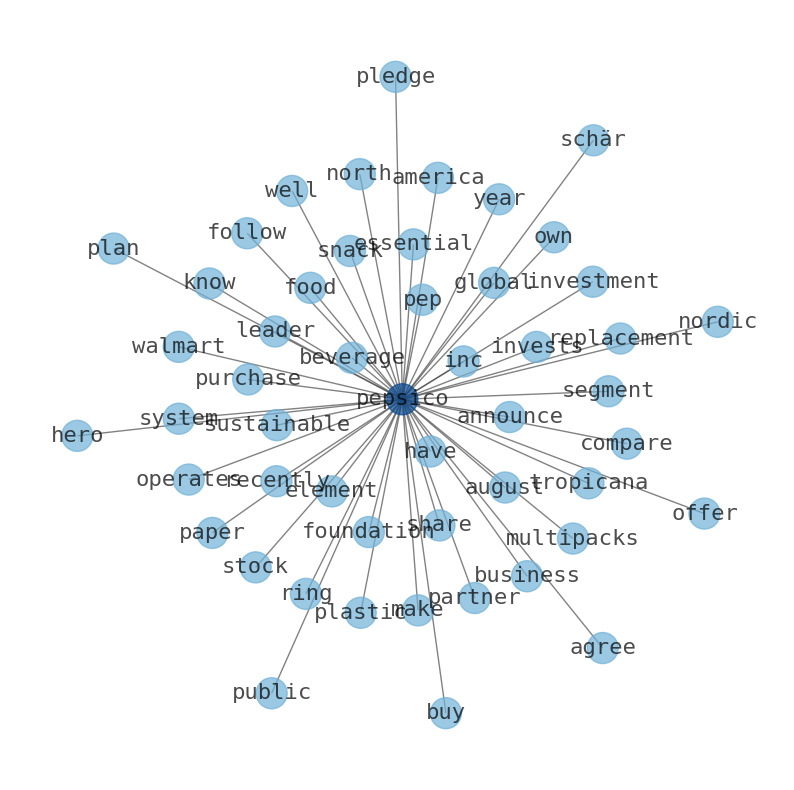

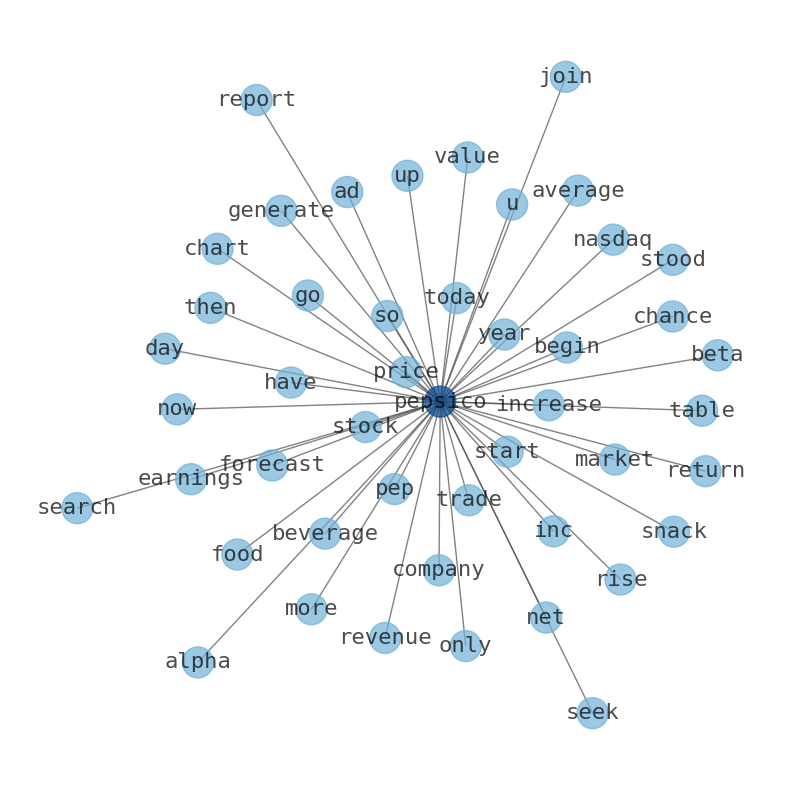

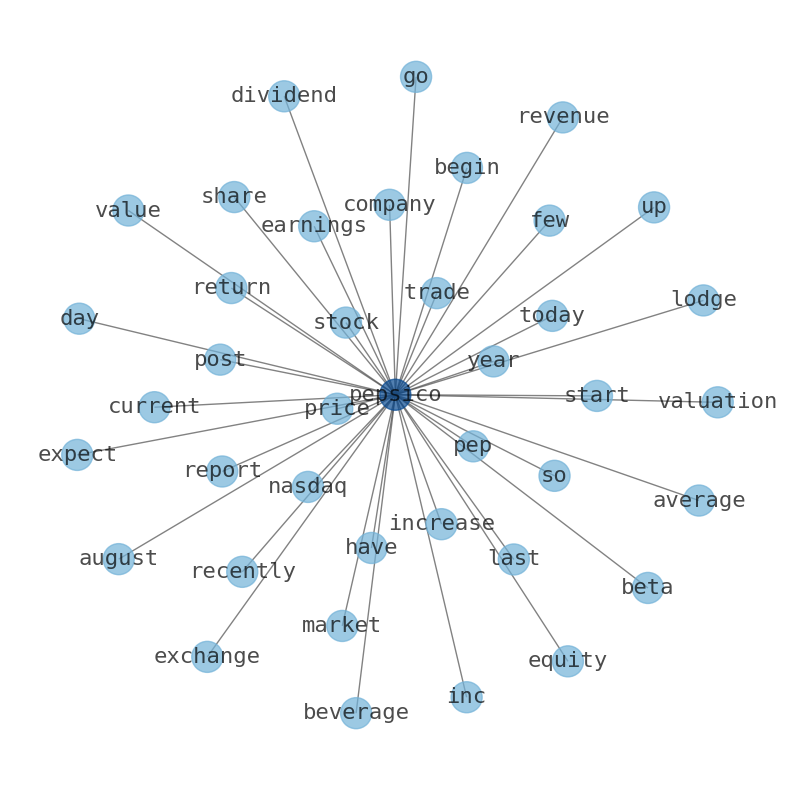

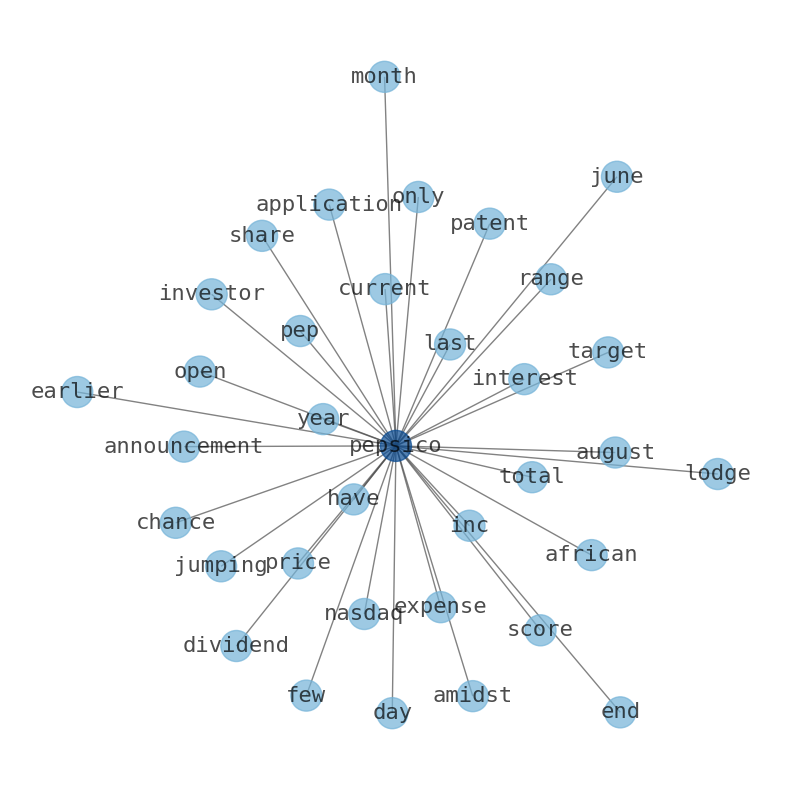

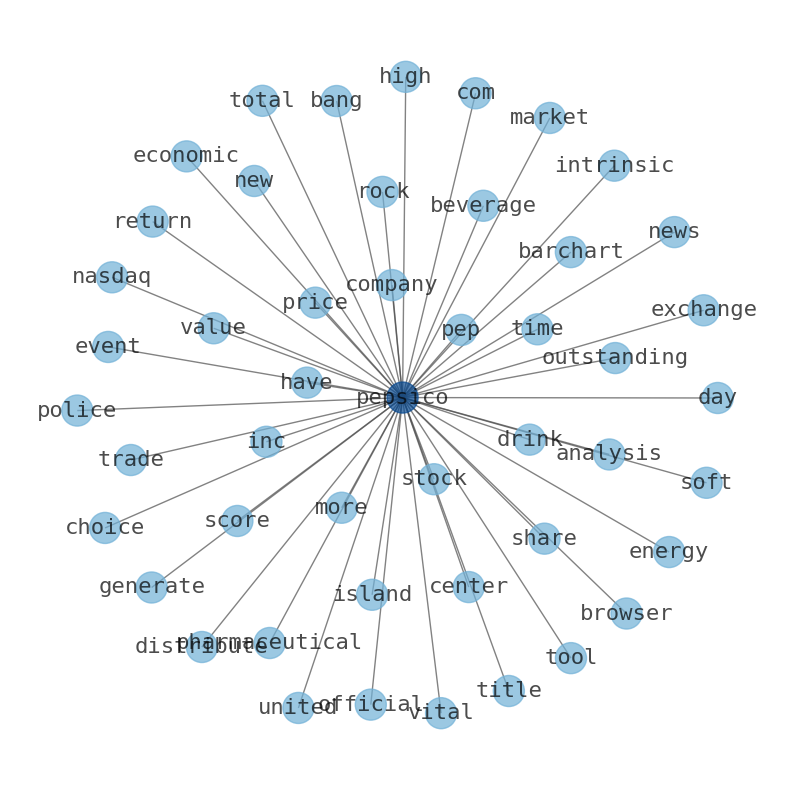

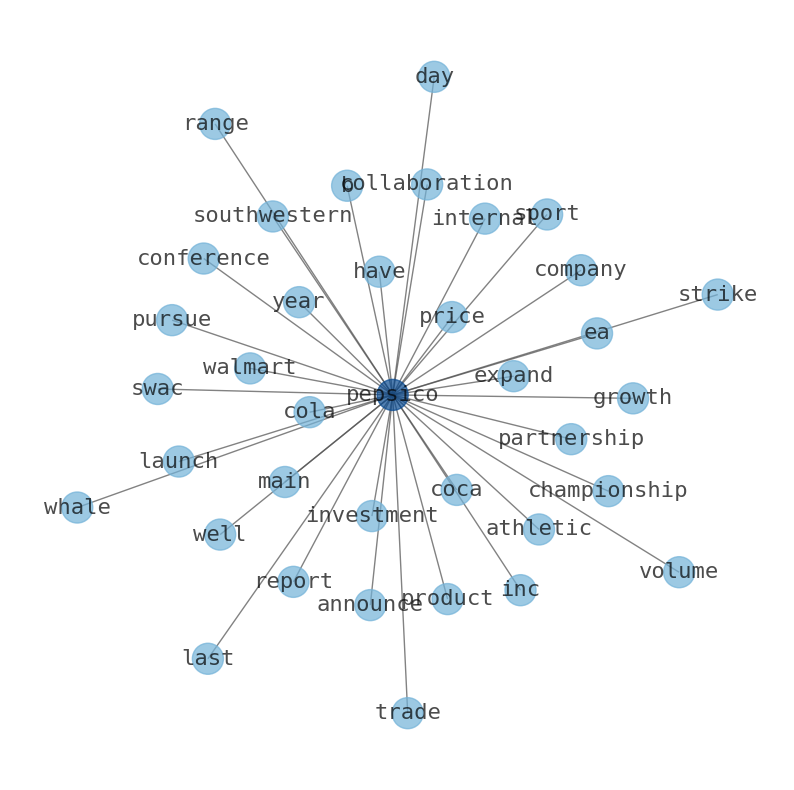

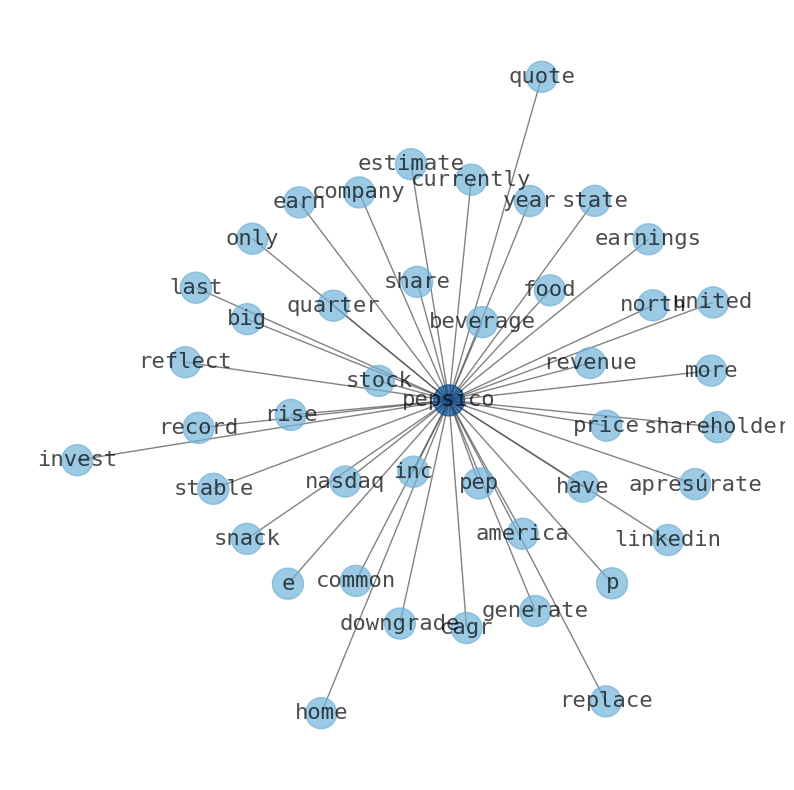

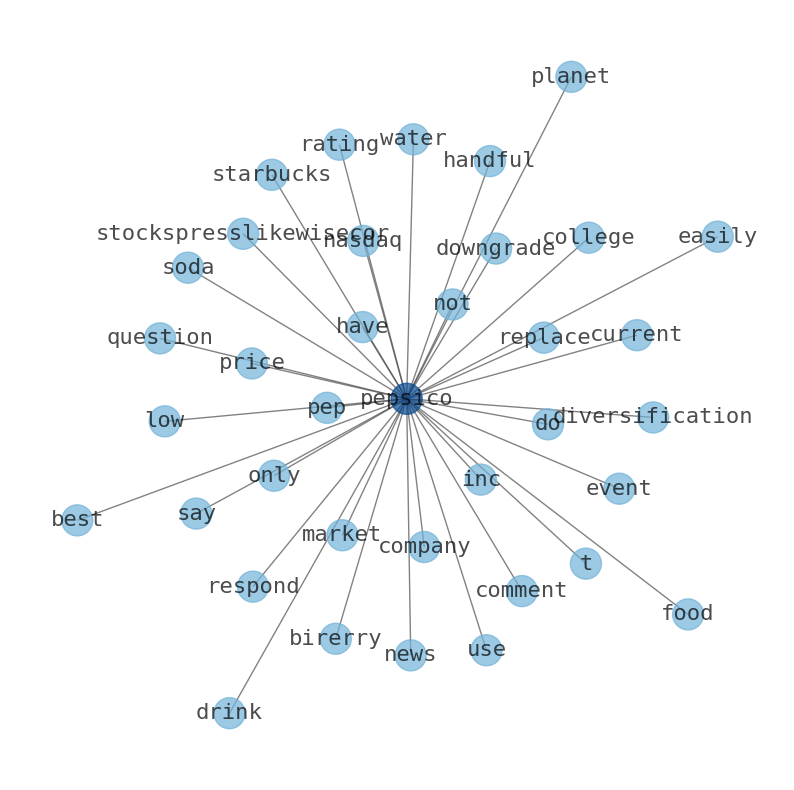

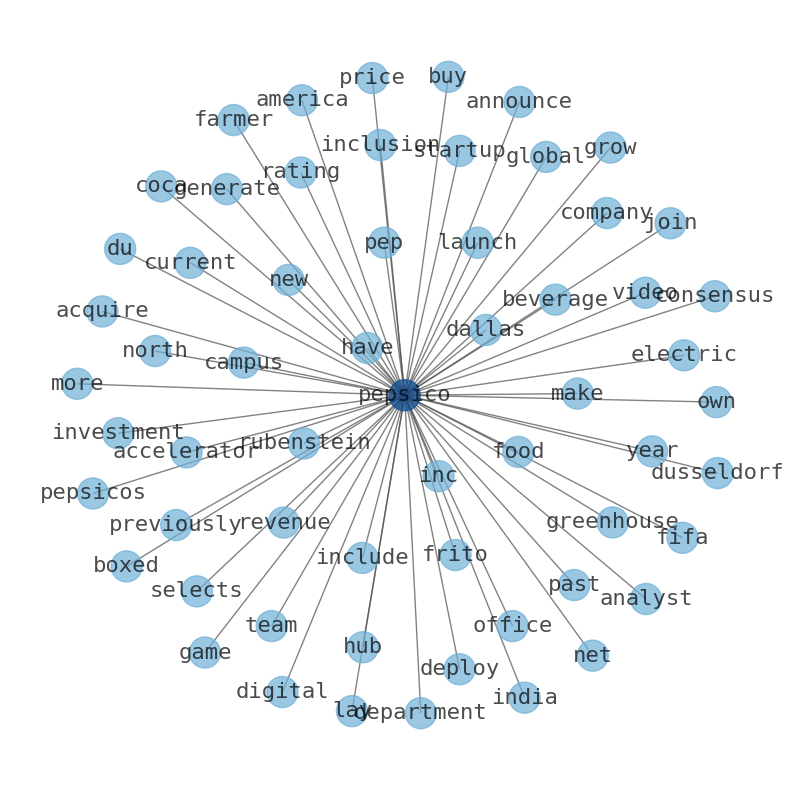

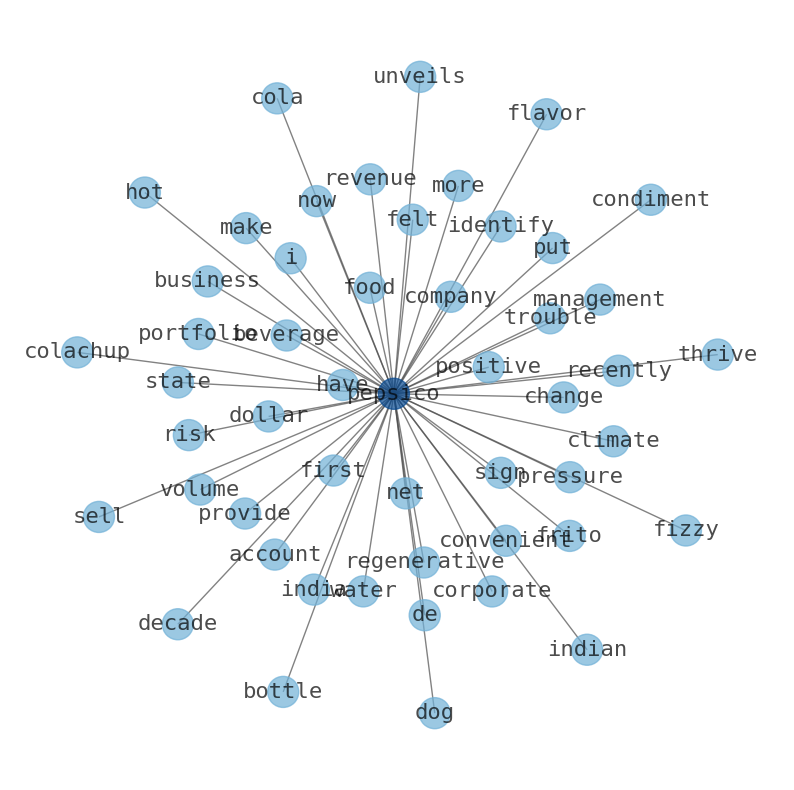

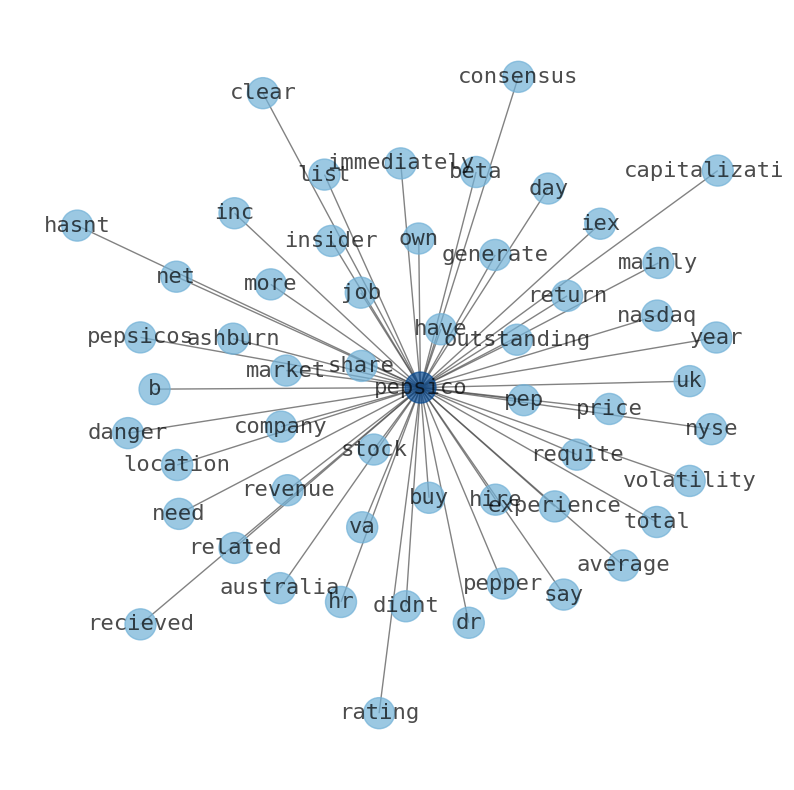

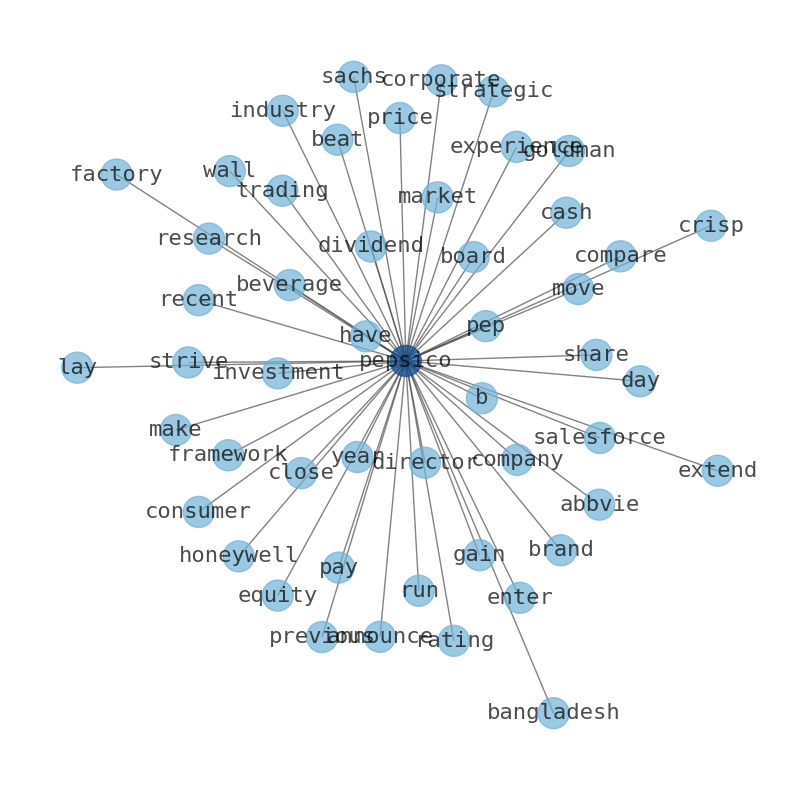

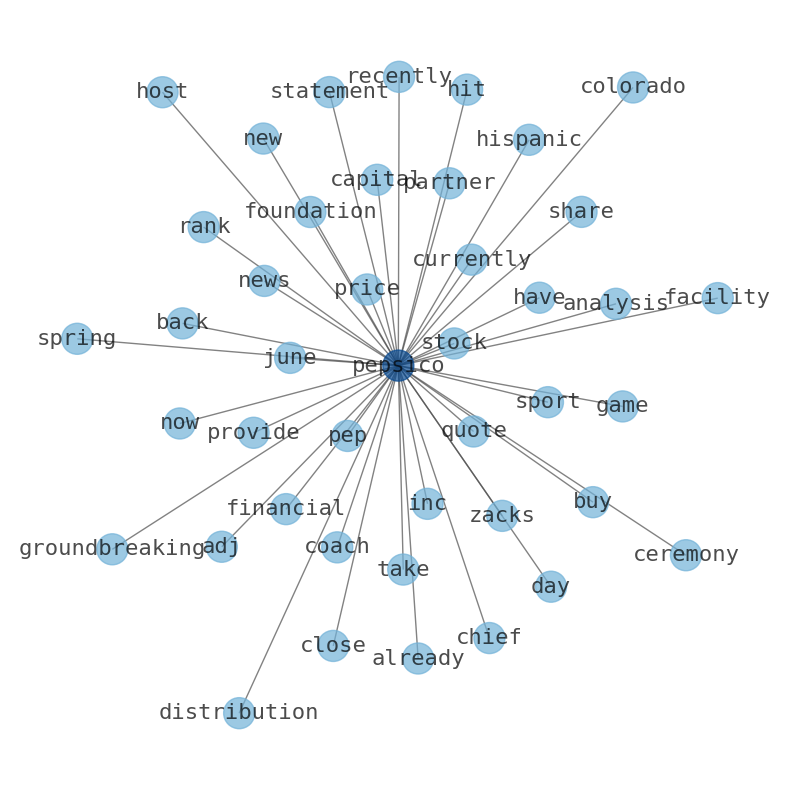

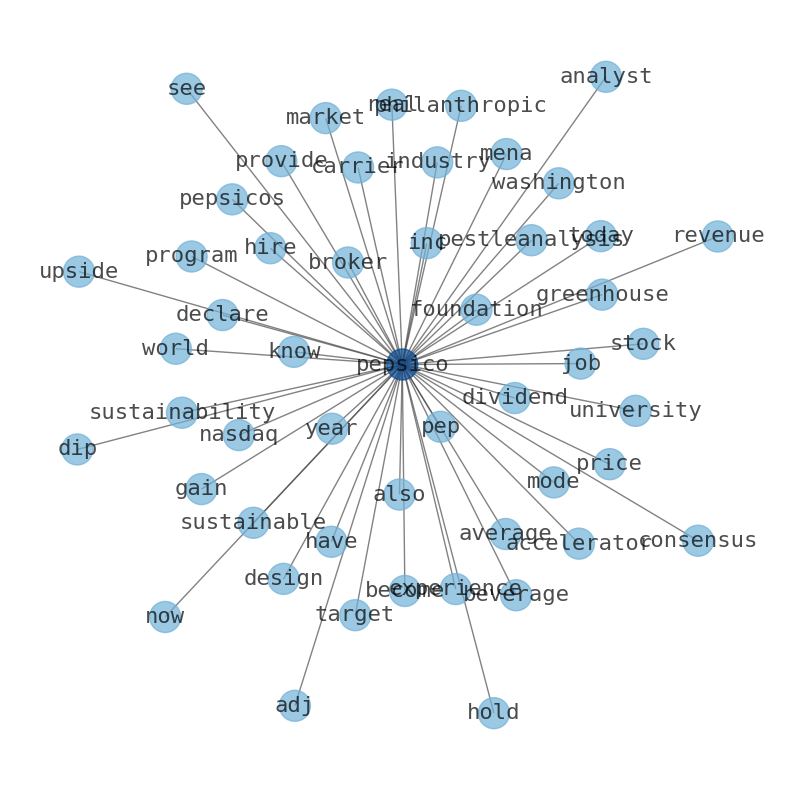

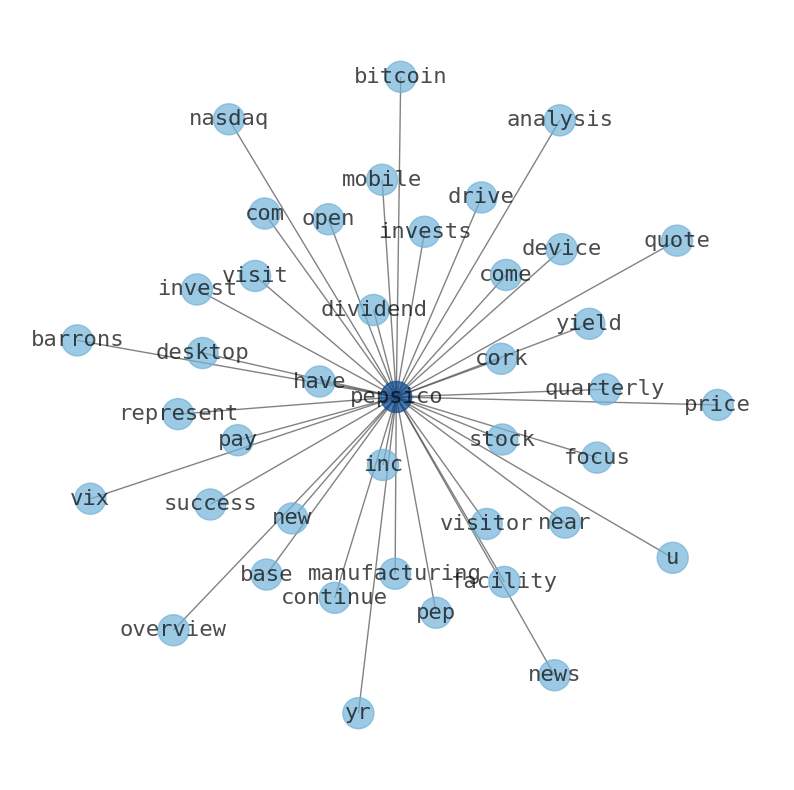

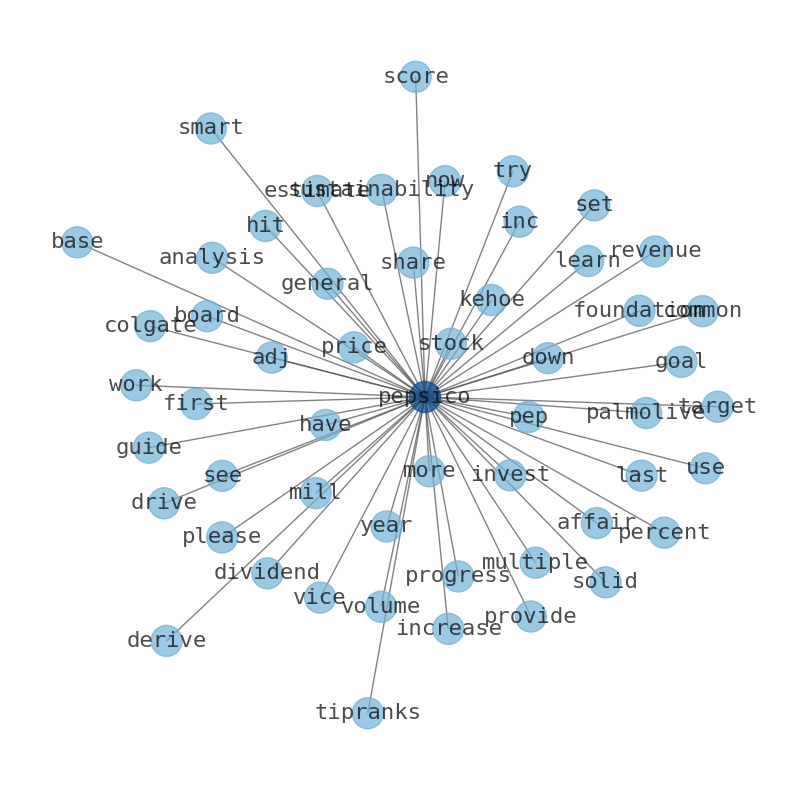

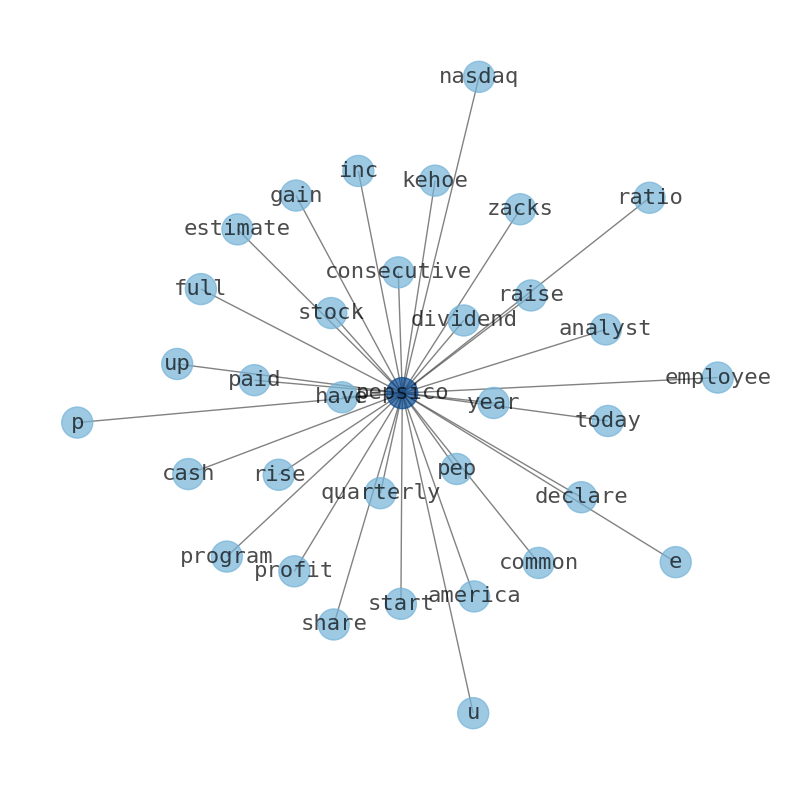

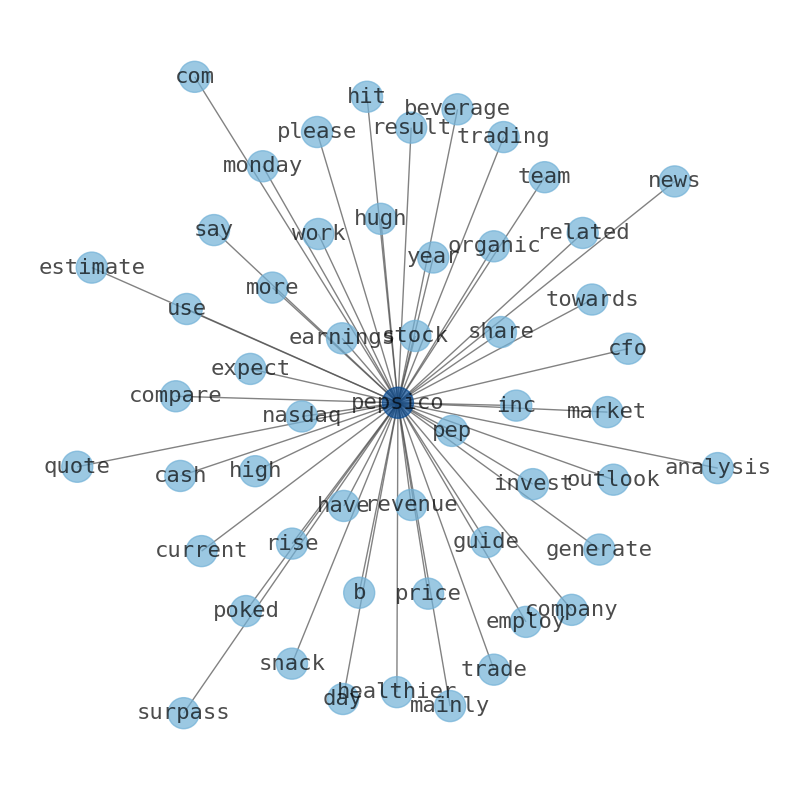

Keywords

The game is changing. There is a new strategy to evaluate PepsiCo fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about PepsiCo are: PepsiCo, company, value, ratio, PEP, growth, financial, and the most common words in the summary are: pepsico, stock, news, market, pep, beverage, middle, . One of the sentences in the summary was: PEP stock is trading at 2.9x trailing revenues, compared to Campbell Soup.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #pepsico #stock #news #market #pep #beverage #middle.

Read more →Related Results

PepsiCo

Open: 162.32 Close: 163.05 Change: 0.73

Read more →

PepsiCo

Open: 162.06 Close: 163.0 Change: 0.94

Read more →

PepsiCo

Open: 166.21 Close: 165.34 Change: -0.87

Read more →

PepsiCo

Open: 167.94 Close: 169.6 Change: 1.66

Read more →

PepsiCo

Open: 167.74 Close: 168.65 Change: 0.91

Read more →

PepsiCo

Open: 167.95 Close: 167.86 Change: -0.09

Read more →

PepsiCo

Open: 166.6 Close: 167.86 Change: 1.26

Read more →

PepsiCo

Open: 166.6 Close: 166.68 Change: 0.08

Read more →

PepsiCo

Open: 166.34 Close: 167.27 Change: 0.93

Read more →

PepsiCo

Open: 167.79 Close: 167.17 Change: -0.62

Read more →

PepsiCo

Open: 169.34 Close: 169.84 Change: 0.5

Read more →

PepsiCo

Open: 168.9 Close: 169.16 Change: 0.26

Read more →

PepsiCo

Open: 167.36 Close: 167.68 Change: 0.32

Read more →

PepsiCo

Open: 166.51 Close: 165.69 Change: -0.82

Read more →

PepsiCo

Open: 167.45 Close: 167.0 Change: -0.45

Read more →

PepsiCo

Open: 167.44 Close: 167.82 Change: 0.38

Read more →

PepsiCo

Open: 168.0 Close: 167.46 Change: -0.54

Read more →

PepsiCo

Open: 169.1 Close: 167.16 Change: -1.94

Read more →

PepsiCo

Open: 167.0 Close: 167.96 Change: 0.96

Read more →

PepsiCo

Open: 167.31 Close: 166.92 Change: -0.39

Read more →

PepsiCo

Open: 168.68 Close: 166.79 Change: -1.89

Read more →

PepsiCo

Open: 160.0 Close: 160.37 Change: 0.37

Read more →

PepsiCo

Open: 158.62 Close: 160.0 Change: 1.38

Read more →

PepsiCo

Open: 164.25 Close: 162.62 Change: -1.63

Read more →

PepsiCo

Open: 169.93 Close: 169.5 Change: -0.43

Read more →

PepsiCo

Open: 175.81 Close: 176.27 Change: 0.46

Read more →

PepsiCo

Open: 175.81 Close: 176.28 Change: 0.47

Read more →

PepsiCo

Open: 175.85 Close: 176.4 Change: 0.55

Read more →

PepsiCo

Open: 178.73 Close: 175.32 Change: -3.41

Read more →

PepsiCo

Open: 181.46 Close: 181.08 Change: -0.38

Read more →

PepsiCo

Open: 178.06 Close: 179.42 Change: 1.36

Read more →

PepsiCo

Open: 177.25 Close: 178.12 Change: 0.87

Read more →

PepsiCo

Open: 178.46 Close: 178.18 Change: -0.28

Read more →

PepsiCo

Open: 178.46 Close: 178.18 Change: -0.28

Read more →

PepsiCo

Open: 187.2 Close: 184.44 Change: -2.76

Read more →

PepsiCo

Open: 191.12 Close: 191.6 Change: 0.48

Read more →

PepsiCo

Open: 190.59 Close: 190.92 Change: 0.33

Read more →

PepsiCo

Open: 185.8 Close: 187.53 Change: 1.73

Read more →

PepsiCo

Open: 185.82 Close: 183.08 Change: -2.74

Read more →

PepsiCo

Open: 184.04 Close: 185.22 Change: 1.18

Read more →

PepsiCo

Open: 186.16 Close: 184.67 Change: -1.49

Read more →

PepsiCo

Open: 186.54 Close: 185.31 Change: -1.23

Read more →

PepsiCo

Open: 186.14 Close: 186.04 Change: -0.1

Read more →

PepsiCo

Open: 182.0 Close: 183.17 Change: 1.17

Read more →

PepsiCo

Open: 183.71 Close: 183.58 Change: -0.13

Read more →

PepsiCo

Open: 186.27 Close: 184.89 Change: -1.38

Read more →

PepsiCo

Open: 192.46 Close: 191.84 Change: -0.62

Read more →

PepsiCo

Open: 193.31 Close: 192.06 Change: -1.25

Read more →

PepsiCo

Open: 195.34 Close: 195.76 Change: 0.42

Read more →

PepsiCo

Open: 192.58 Close: 192.11 Change: -0.47

Read more →

PepsiCo

Open: 191.36 Close: 192.25 Change: 0.89

Read more →

PepsiCo

Open: 184.77 Close: 184.83 Change: 0.06

Read more →

PepsiCo

Open: 162.32 Close: 163.7 Change: 1.38

Read more →

PepsiCo

Open: 164.86 Close: 164.59 Change: -0.27

Read more →

PepsiCo

Open: 167.82 Close: 168.16 Change: 0.34

Read more →

PepsiCo

Open: 169.95 Close: 168.83 Change: -1.12

Read more →

PepsiCo

Open: 167.21 Close: 166.32 Change: -0.89

Read more →

PepsiCo

Open: 172.63 Close: 171.47 Change: -1.16

Read more →

PepsiCo

Open: 166.6 Close: 167.86 Change: 1.26

Read more →

PepsiCo

Open: 167.14 Close: 165.78 Change: -1.36

Read more →

PepsiCo

Open: 166.34 Close: 166.5 Change: 0.16

Read more →

PepsiCo

Open: 169.34 Close: 169.84 Change: 0.5

Read more →

PepsiCo

Open: 169.4 Close: 169.2 Change: -0.2

Read more →

PepsiCo

Open: 167.36 Close: 167.68 Change: 0.32

Read more →

PepsiCo

Open: 167.36 Close: 167.89 Change: 0.53

Read more →

PepsiCo

Open: 167.93 Close: 167.95 Change: 0.01

Read more →

PepsiCo

Open: 167.45 Close: 167.0 Change: -0.45

Read more →

PepsiCo

Open: 167.04 Close: 165.68 Change: -1.36

Read more →

PepsiCo

Open: 168.0 Close: 167.46 Change: -0.54

Read more →

PepsiCo

Open: 168.39 Close: 167.71 Change: -0.68

Read more →

PepsiCo

Open: 167.31 Close: 166.92 Change: -0.39

Read more →

PepsiCo

Open: 167.58 Close: 166.16 Change: -1.42

Read more →

PepsiCo

Open: 159.6 Close: 160.28 Change: 0.68

Read more →

PepsiCo

Open: 161.0 Close: 161.08 Change: 0.08

Read more →

PepsiCo

Open: 165.01 Close: 162.62 Change: -2.39

Read more →

PepsiCo

Open: 169.08 Close: 168.35 Change: -0.73

Read more →

PepsiCo

Open: 178.74 Close: 178.27 Change: -0.47

Read more →

PepsiCo

Open: 175.81 Close: 176.27 Change: 0.46

Read more →

PepsiCo

Open: 175.85 Close: 176.4 Change: 0.55

Read more →

PepsiCo

Open: 174.92 Close: 174.73 Change: -0.19

Read more →

PepsiCo

Open: 179.34 Close: 177.33 Change: -2.01

Read more →

PepsiCo

Open: 180.82 Close: 180.25 Change: -0.57

Read more →

PepsiCo

Open: 178.06 Close: 179.42 Change: 1.36

Read more →

PepsiCo

Open: 177.73 Close: 177.05 Change: -0.68

Read more →

PepsiCo

Open: 178.46 Close: 178.18 Change: -0.28

Read more →

PepsiCo

Open: 184.0 Close: 184.04 Change: 0.04

Read more →

PepsiCo

Open: 190.14 Close: 190.31 Change: 0.17

Read more →

PepsiCo

Open: 191.12 Close: 191.9 Change: 0.78

Read more →

PepsiCo

Open: 190.1 Close: 190.31 Change: 0.21

Read more →

PepsiCo

Open: 184.38 Close: 183.48 Change: -0.9

Read more →

PepsiCo

Open: 185.0 Close: 186.05 Change: 1.05

Read more →

PepsiCo

Open: 186.25 Close: 183.7 Change: -2.55

Read more →

PepsiCo

Open: 186.73 Close: 187.35 Change: 0.62

Read more →

PepsiCo

Open: 186.14 Close: 186.04 Change: -0.1

Read more →

PepsiCo

Open: 186.14 Close: 186.04 Change: -0.1

Read more →

PepsiCo

Open: 180.71 Close: 180.11 Change: -0.6

Read more →

PepsiCo

Open: 183.71 Close: 183.58 Change: -0.13

Read more →

PepsiCo

Open: 191.19 Close: 186.64 Change: -4.55

Read more →

PepsiCo

Open: 191.32 Close: 190.77 Change: -0.55

Read more →

PepsiCo

Open: 194.48 Close: 193.43 Change: -1.05

Read more →

PepsiCo

Open: 192.58 Close: 192.18 Change: -0.4

Read more →

PepsiCo

Open: 191.36 Close: 192.25 Change: 0.89

Read more →

PepsiCo

Open: 189.9 Close: 191.02 Change: 1.12

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo