The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Otis Worldwide

Youtube Subscribe

Open: 84.84 Close: 84.54 Change: -0.3

Our AI found unexpected things about Otis Worldwide.

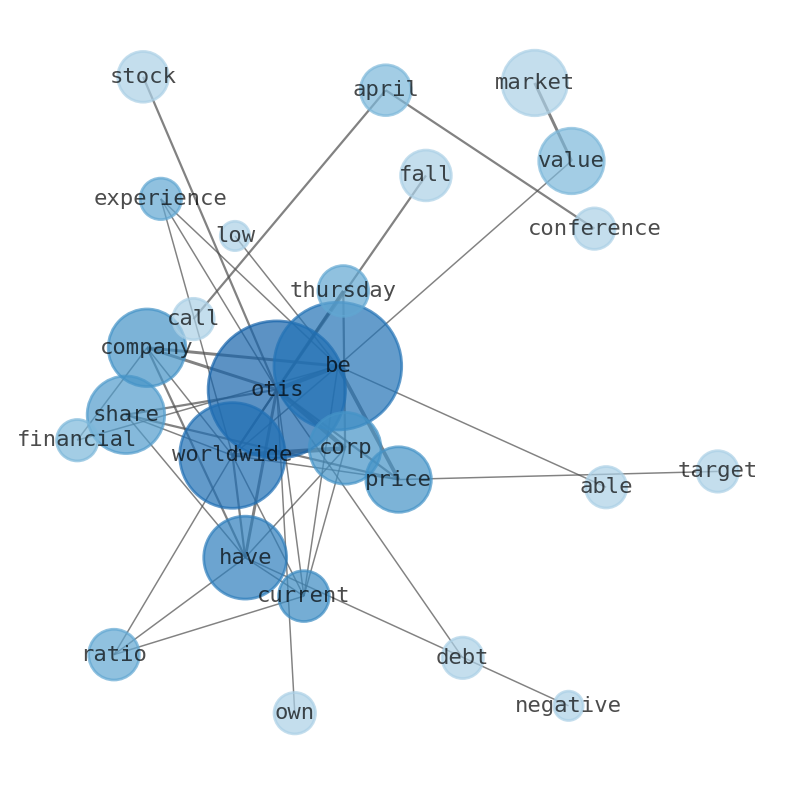

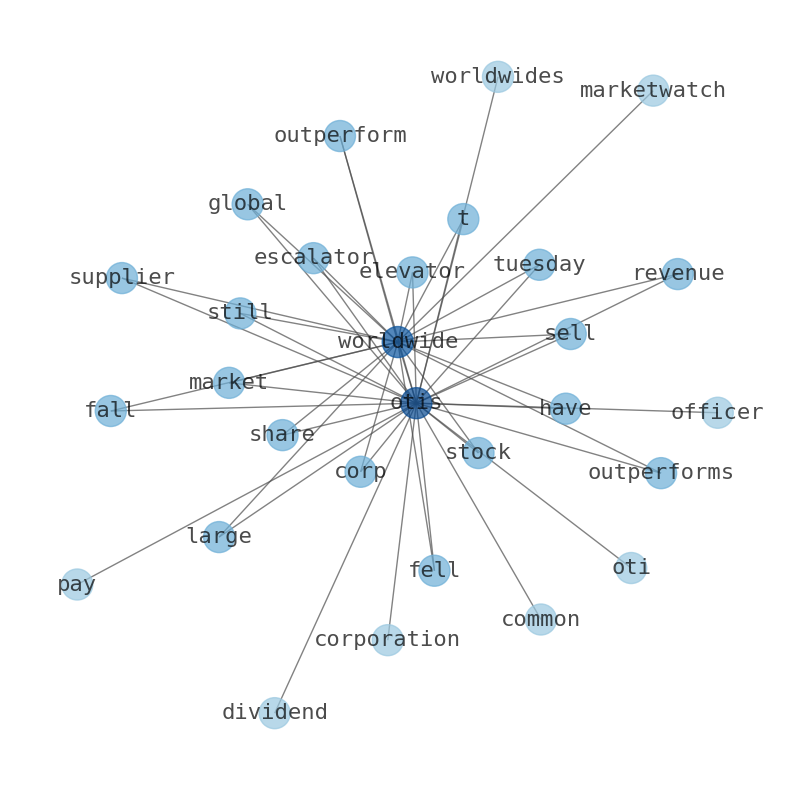

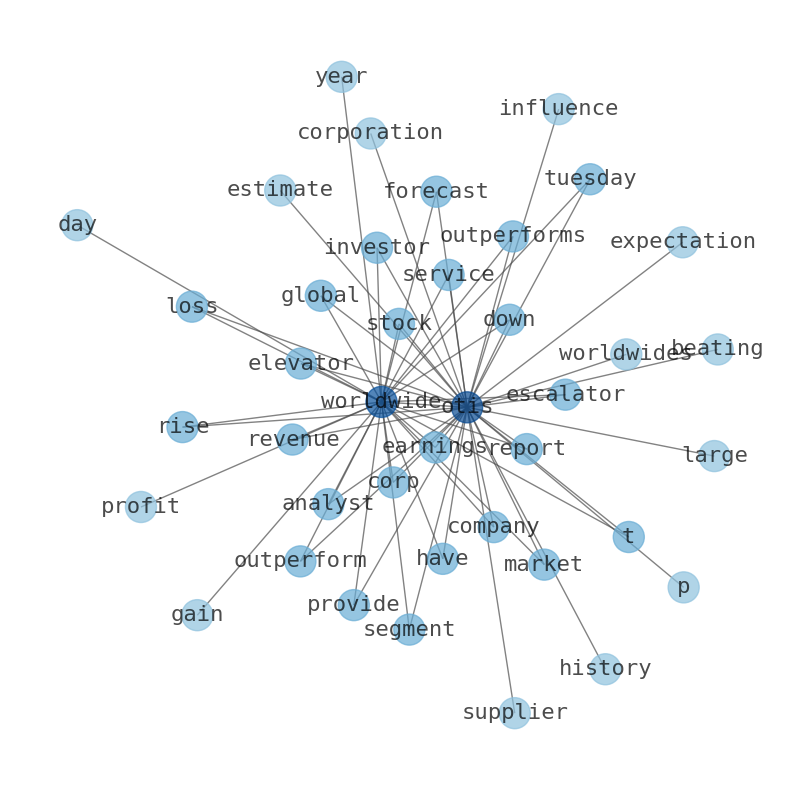

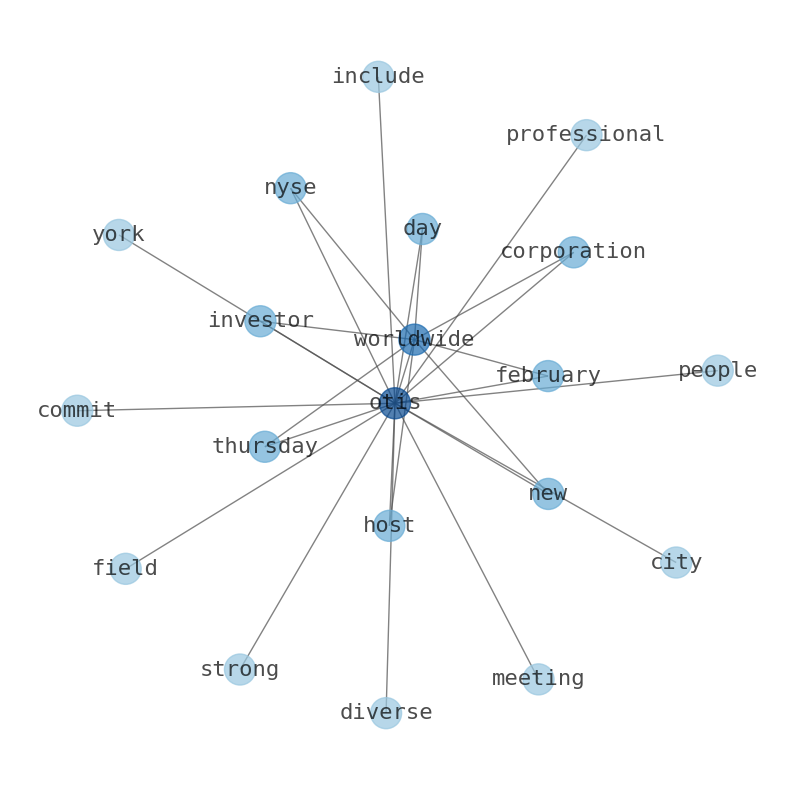

This document will help you to evaluate Otis Worldwide without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Otis Worldwide are: Otis, Worldwide, price, Corp, value, share, company, …

Stock Summary

Otis Worldwide Corporation designs, manufactures, sells, and installs elevators and escalators. The New Equipment segment designs, sells and installs a range of passenger and freight elevators. This segment serves real-estate and building developers, and.

Today's Summary

Otis Worldwide Corp. has 413.29 million shares outstanding. Average price target is $83.18, which is -1.61% lower than the current price. Company has accumulated 6.1 B in total debt. Current ratio of 0.95 indicates company has negative working capital.

Today's News

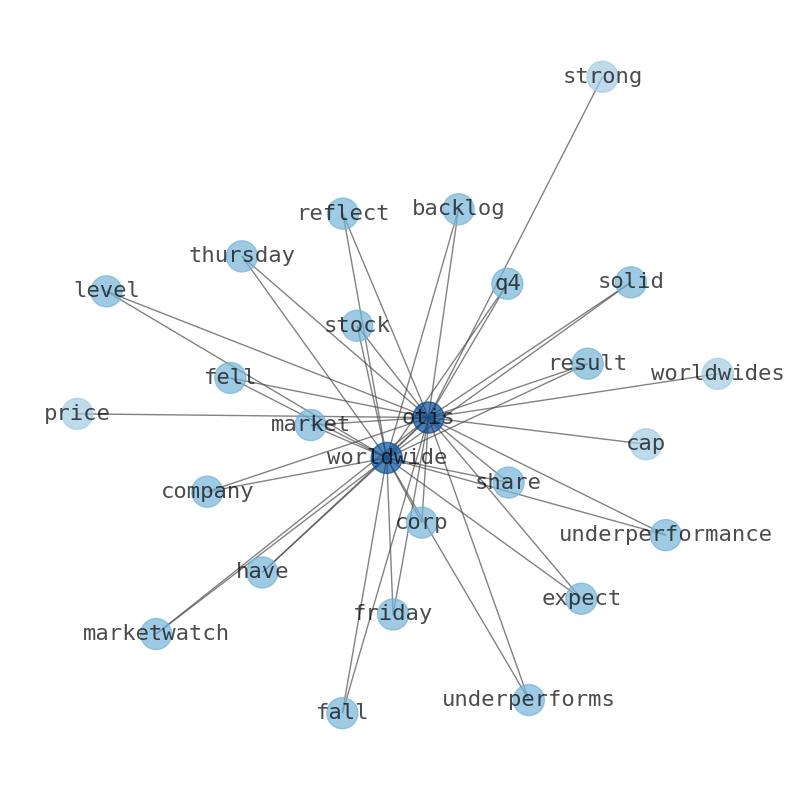

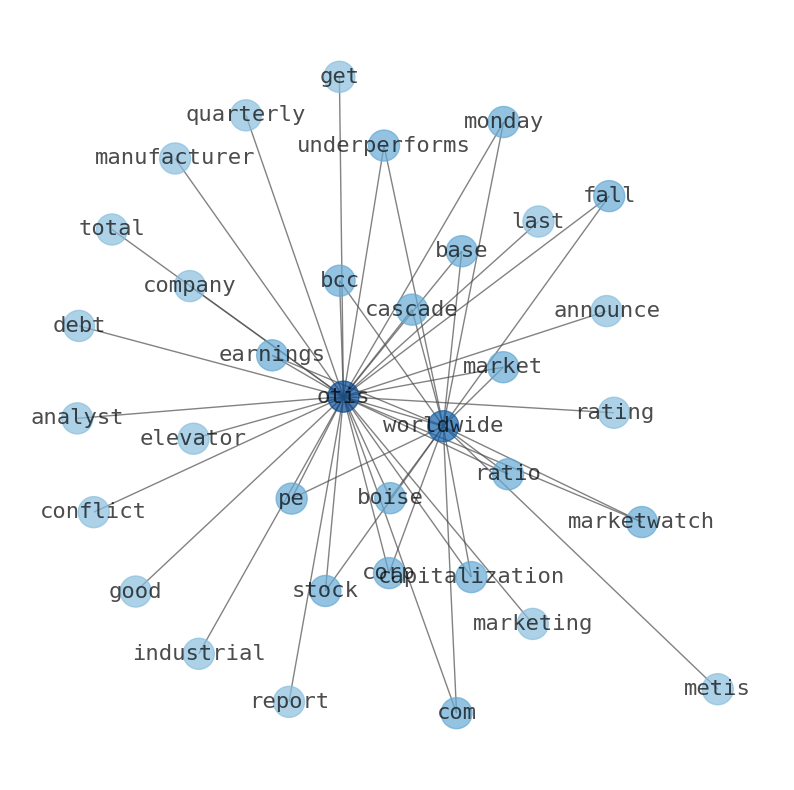

Otis Worldwide has 413.29 million shares outstanding. PEG ratio is 3.31.31. Average price target is $83.18, which is -1.61% lower than the current price. Otis Worldwide Corp is unlikely to experience financial distress in the next 2 years. The company has accumulated 6.1 B in total debt. Company has a current ratio of 0.95. Otis Worldwide Corp has a current ratio of 0.95, indicating that it has a negative working capital and may not be able to pay financial obligations in time and when they become due. Over 88.0% of the company shares are owned by pension funds. Otis Worldwide Corp is measured differently than its book value, which is the value of Otis that is recorded on the companys balance sheet. Otis Worldwides market value can be influenced by many factors that dont directly affect its underlying business (such as a pandemic or basic market pessimism) Market value can vary widely from intrinsic value. The ability to find closely correlated positions to Otis Worldwide could be a great tool in your tax-loss harvesting strategies. Otis is the worlds leading elevator and escalator manufacturing, installation and service company. Otis has been named to the DiversityInc list of Noteworthy Companies. Otis Worldwide trades on the NYSE under the ticker symbol OTIS. The analyst consensus target price for shares in Otis worldwide is $87.49. That is 2.39% above the last closing price of $85.45. Analysts have a consensus Earnings Per Share (EPS) forecast of $3.48. Otis Worldwide Corp. stock falls thursday, underperforms market - marketwatch. otis worldwide corp. stock fell thursday. Share price falls 1.06% SPX -0.17% DJIA - 0.66% Shares of Otis worldwide Corp. (OTIS) fall thursday as insiders sell shares. Otis Worldwide has been experiencing a flurry of market activity from investors and analysts. Hedge funds and other institutional investors now own 83.95% of Otis Worldwides stock. Metis Global Partners LLC increases ownership by 38.7%. SWOT Analysis for Otis Worldwide Strength Debt is well covered by earnings. For Otis, weve put together three fundamental items you should assess: Risks, Risks and 2 warning signs. Otis Worldwide Corporation (NYSE:OTIS) will host a conference call on Wednesday, April 26, 2023, at 8:30 a.m. Shareholders will be able to access the companys conference call from April 26 to April 26. The firm also recently disclosed a quarterly dividend, which will be paid on Friday, June 9.

Stock Profile

"Otis Worldwide Corporation engages in the manufacturing, installation, and servicing of elevators and escalators in the United States, China, and internationally. The company operates in two segments, New Equipment and Service. The New Equipment segment designs, manufactures, sells, and installs a range of passenger and freight elevators, as well as escalators and moving walkways for residential and commercial buildings, and infrastructure projects. This segment serves real-estate and building developers, and general contractors. The Service segment performs maintenance and repair services, as well as modernization services to upgrade elevators and escalators. Otis Worldwide Corporation was founded in 1853 and is headquartered in Farmington, Connecticut."

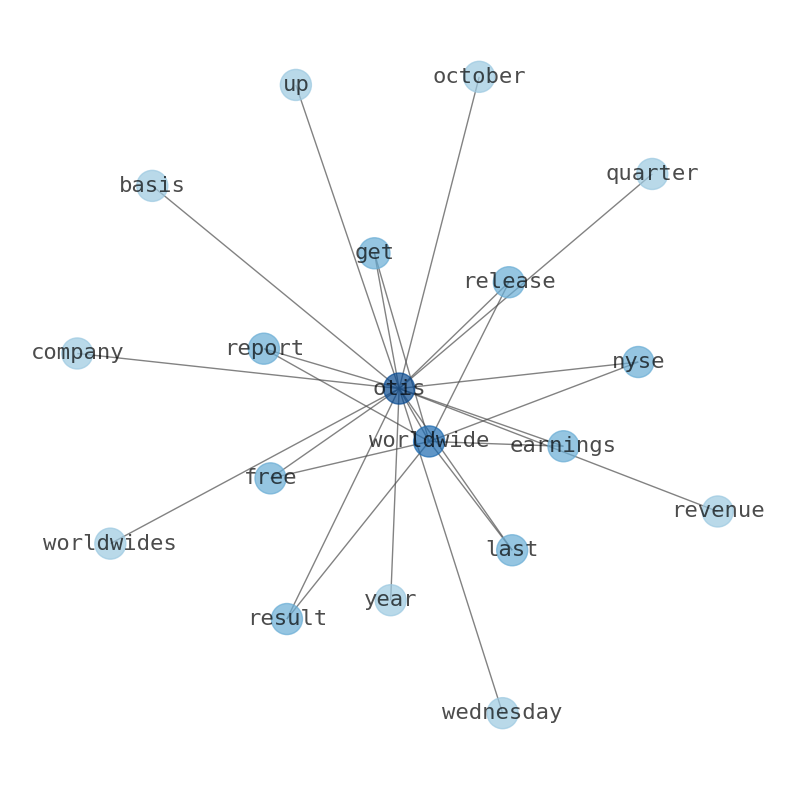

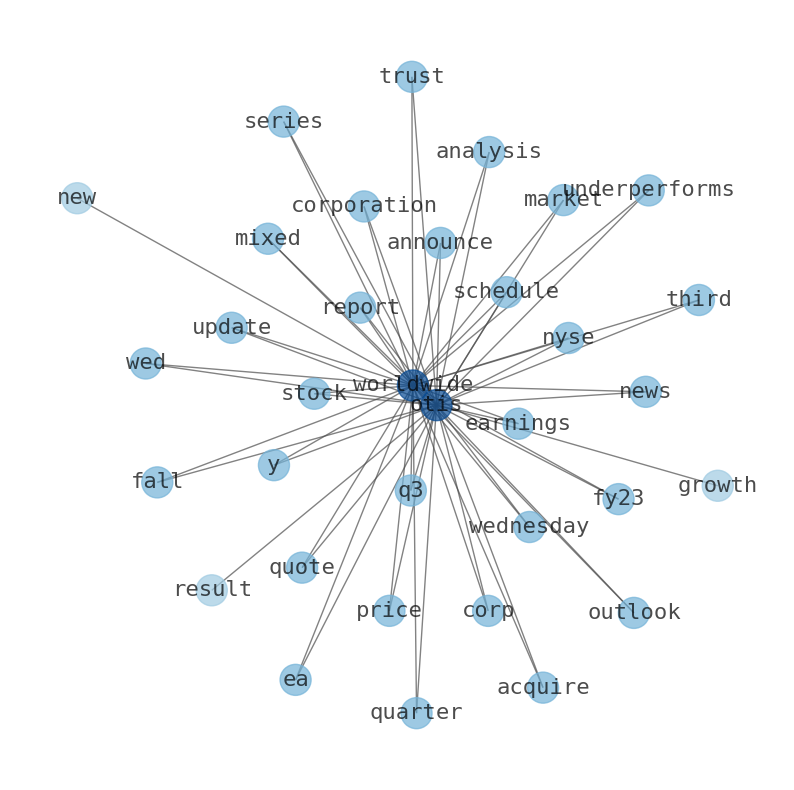

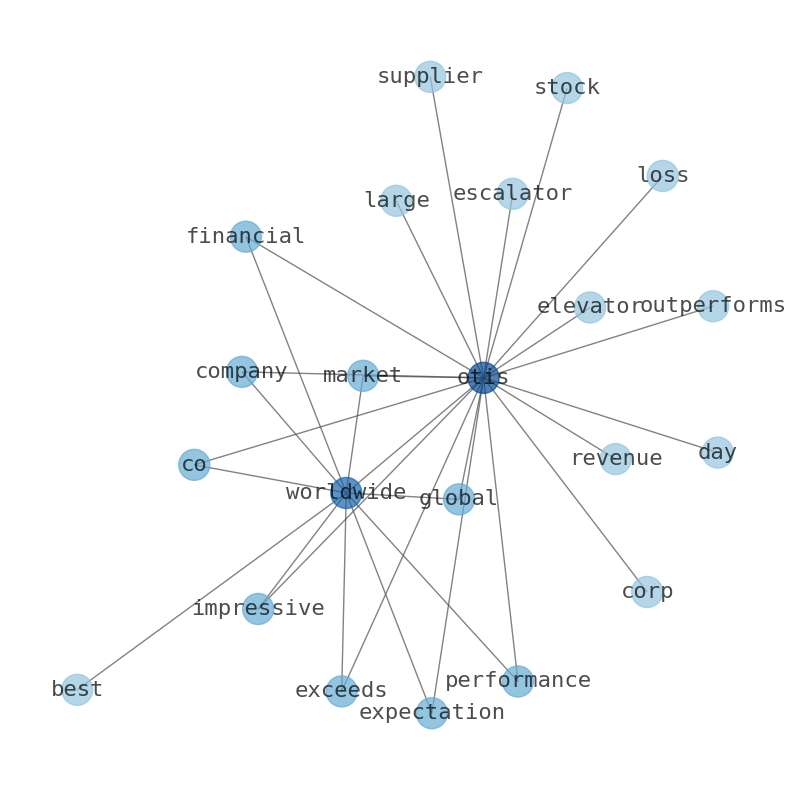

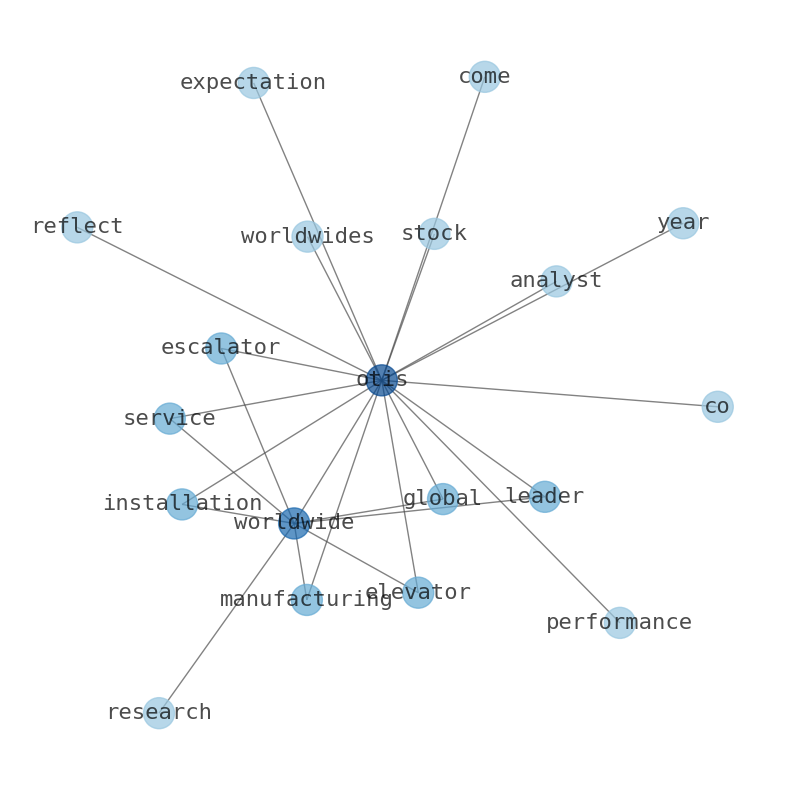

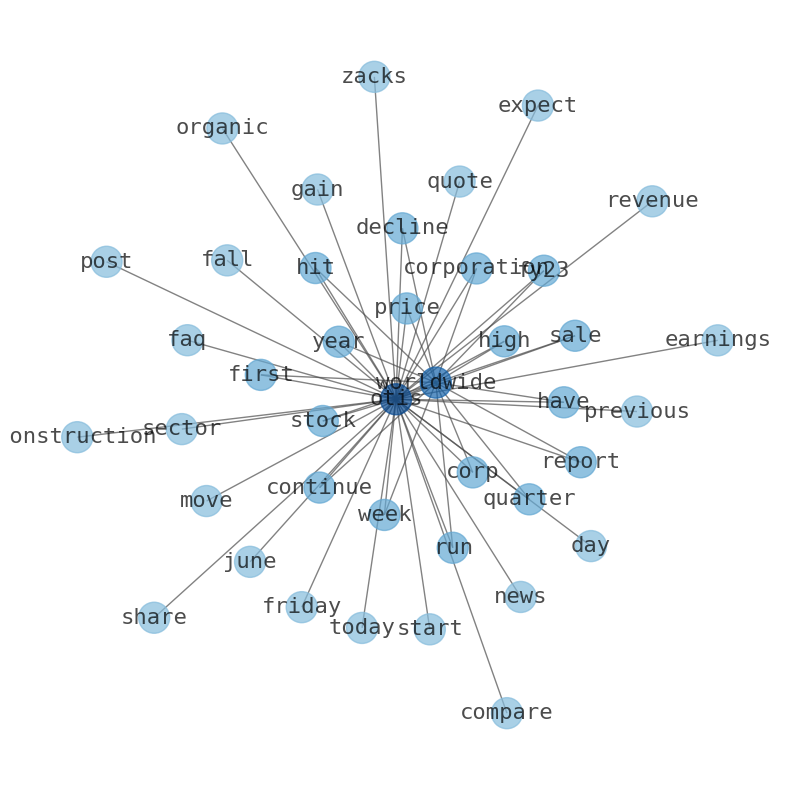

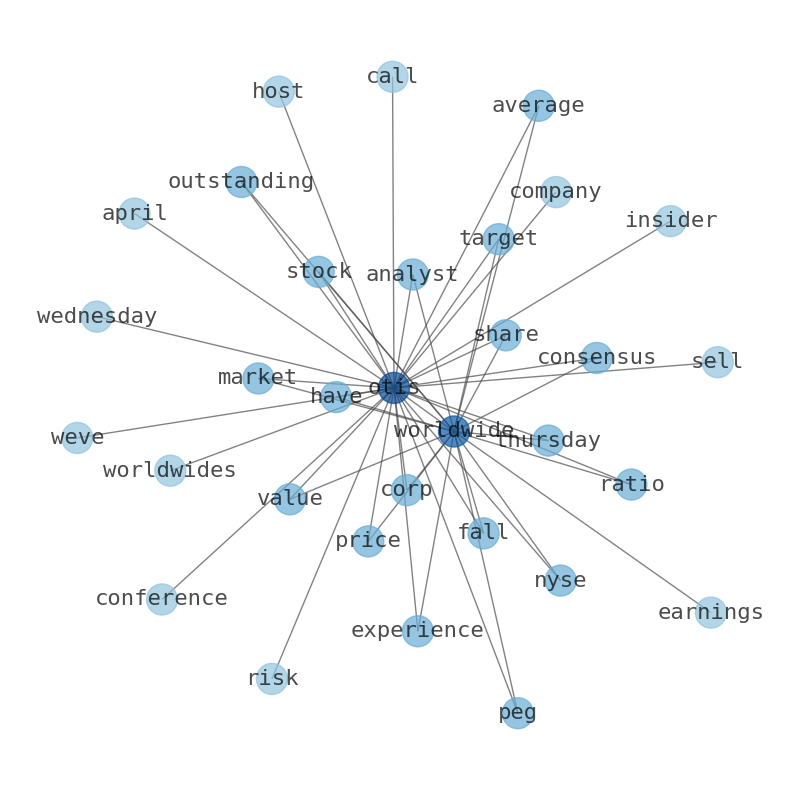

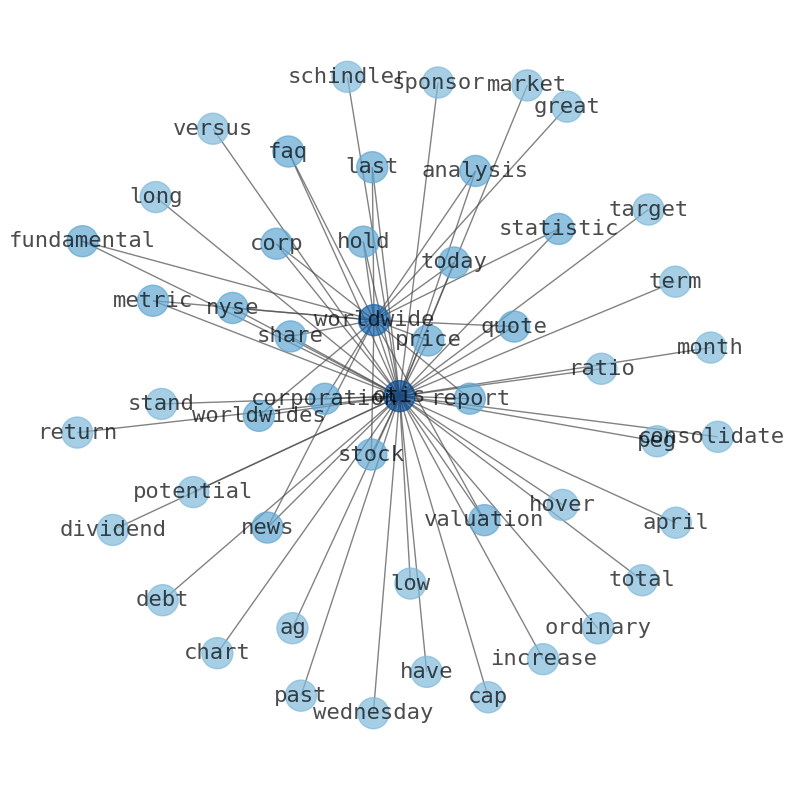

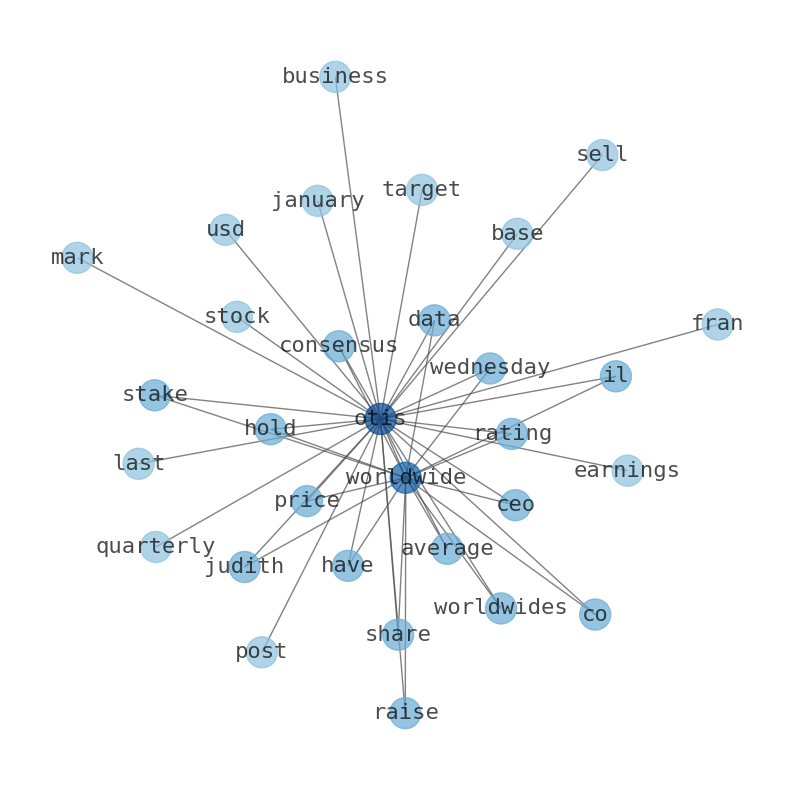

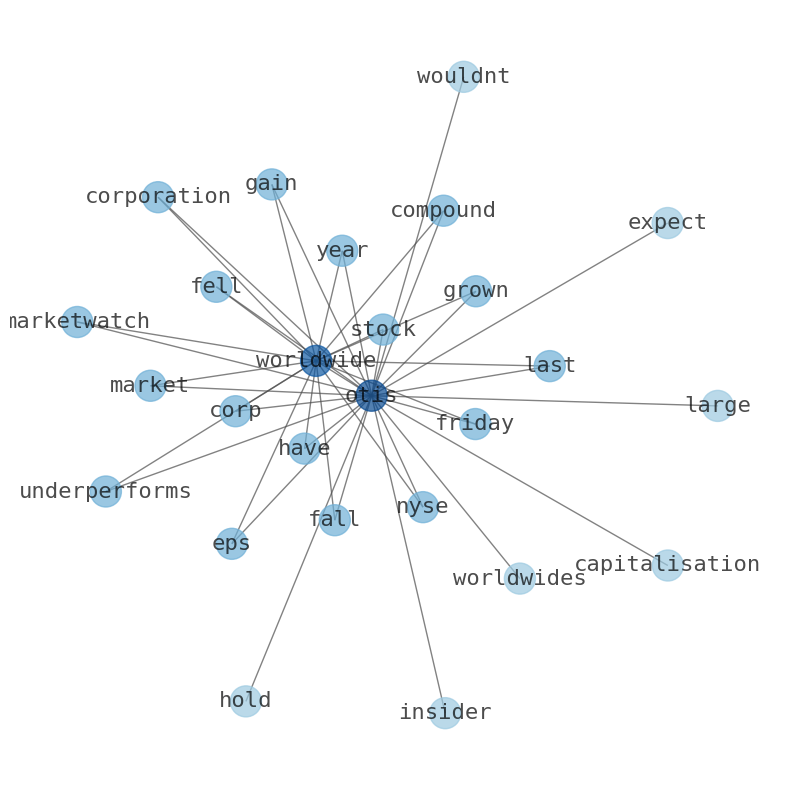

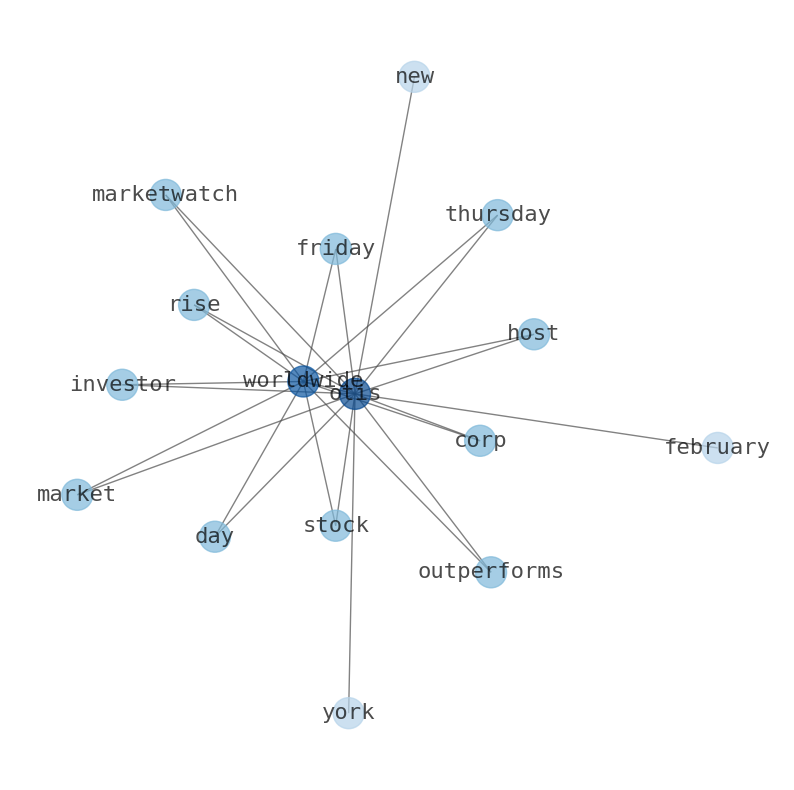

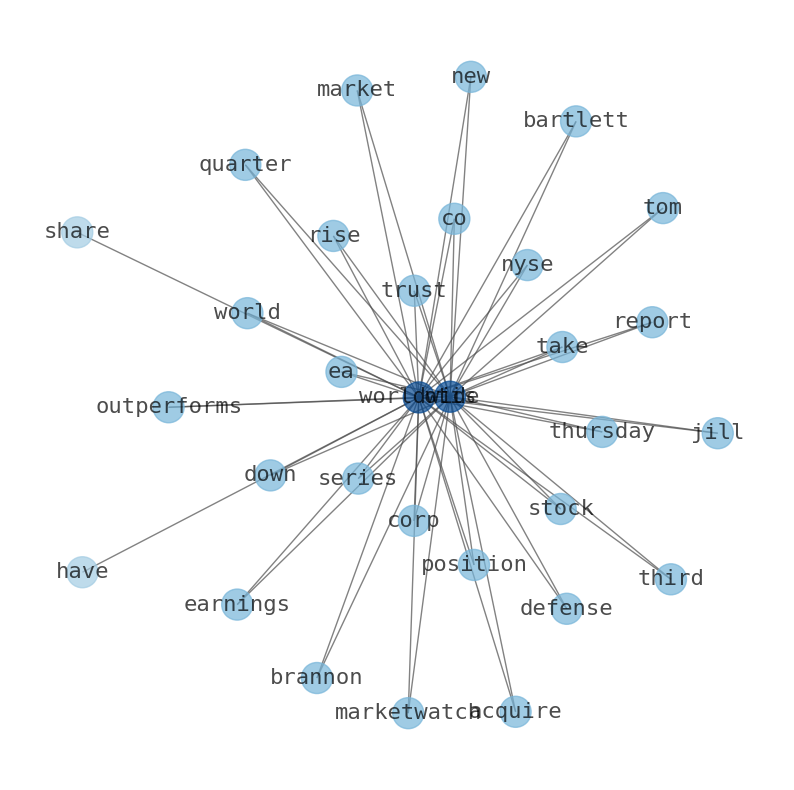

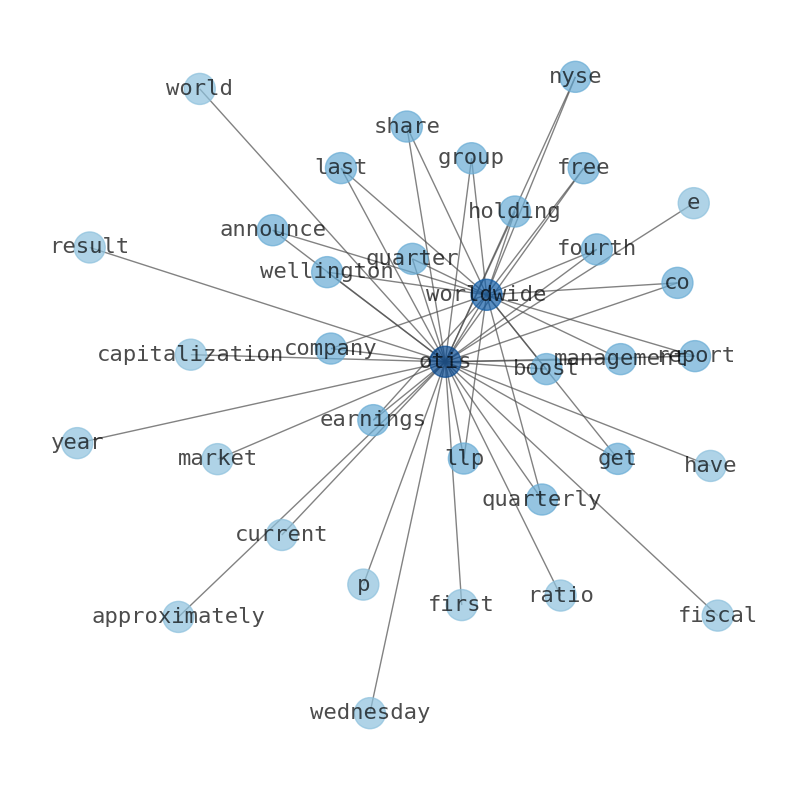

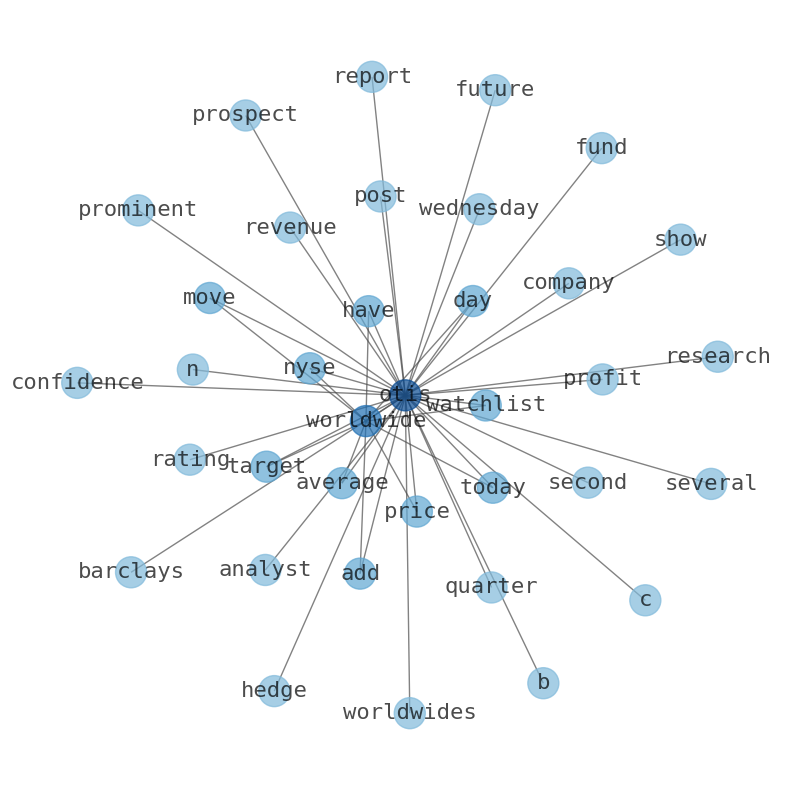

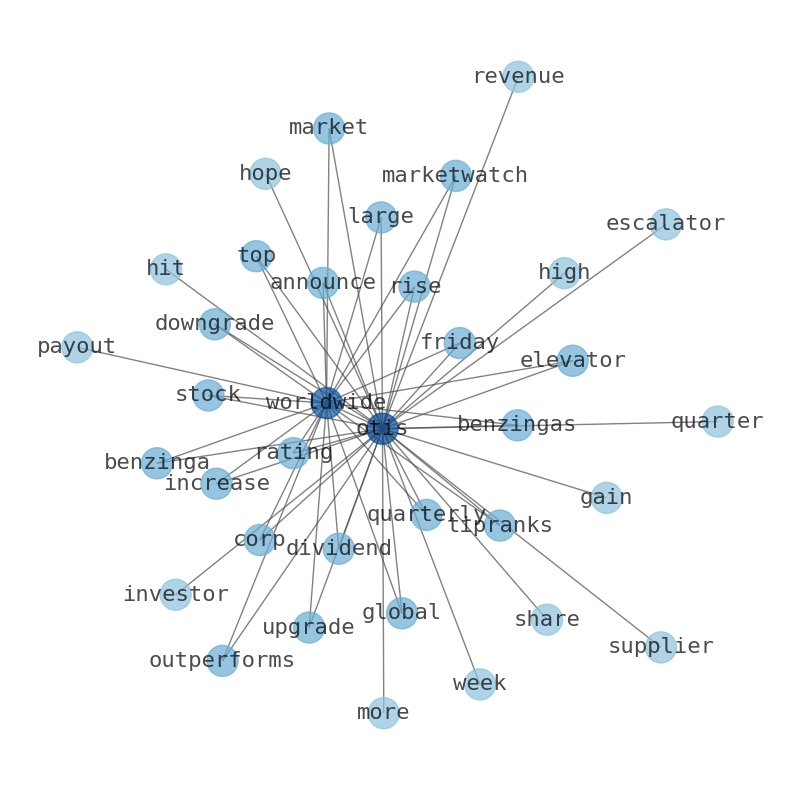

Keywords

Are looking for the most relevant information about Otis Worldwide? Investor spend a lot of time searching for information to make investment decisions in Otis Worldwide. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Otis Worldwide are: Otis, Worldwide, price, Corp, value, share, company, and the most common words in the summary are: otis, elevator, worldwide, company, price, job, stock, . One of the sentences in the summary was: Average price target is $83.18, which is -1.61% lower than the current price. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #otis #elevator #worldwide #company #price #job #stock.

Read more →Related Results

Otis Worldwide

Open: 90.81 Close: 91.24 Change: 0.43

Read more →

Otis Worldwide

Open: 91.9 Close: 91.74 Change: -0.16

Read more →

Otis Worldwide

Open: 85.8 Close: 86.75 Change: 0.95

Read more →

Otis Worldwide

Open: 85.14 Close: 84.94 Change: -0.2

Read more →

Otis Worldwide

Open: 75.1 Close: 75.47 Change: 0.37

Read more →

Otis Worldwide

Open: 83.18 Close: 83.73 Change: 0.55

Read more →

Otis Worldwide

Open: 87.28 Close: 87.25 Change: -0.03

Read more →

Otis Worldwide

Open: 85.88 Close: 85.66 Change: -0.22

Read more →

Otis Worldwide

Open: 84.84 Close: 84.54 Change: -0.3

Read more →

Otis Worldwide

Open: 85.87 Close: 86.26 Change: 0.39

Read more →

Otis Worldwide

Open: 92.27 Close: 91.24 Change: -1.03

Read more →

Otis Worldwide

Open: 87.49 Close: 87.51 Change: 0.02

Read more →

Otis Worldwide

Open: 85.8 Close: 86.75 Change: 0.95

Read more →

Otis Worldwide

Open: 75.75 Close: 75.52 Change: -0.23

Read more →

Otis Worldwide

Open: 83.7 Close: 83.27 Change: -0.43

Read more →

Otis Worldwide

Open: 90.18 Close: 90.96 Change: 0.78

Read more →

Otis Worldwide

Open: 86.12 Close: 86.86 Change: 0.74

Read more →

Otis Worldwide

Open: 84.89 Close: 84.4 Change: -0.49

Read more →

Otis Worldwide

Open: 86.05 Close: 85.46 Change: -0.59

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo