The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Occidental Petroleum

Youtube Subscribe

Open: 56.52 Close: 55.55 Change: -0.97

Is Occidental Petroleum a good investment? This what an AI found.

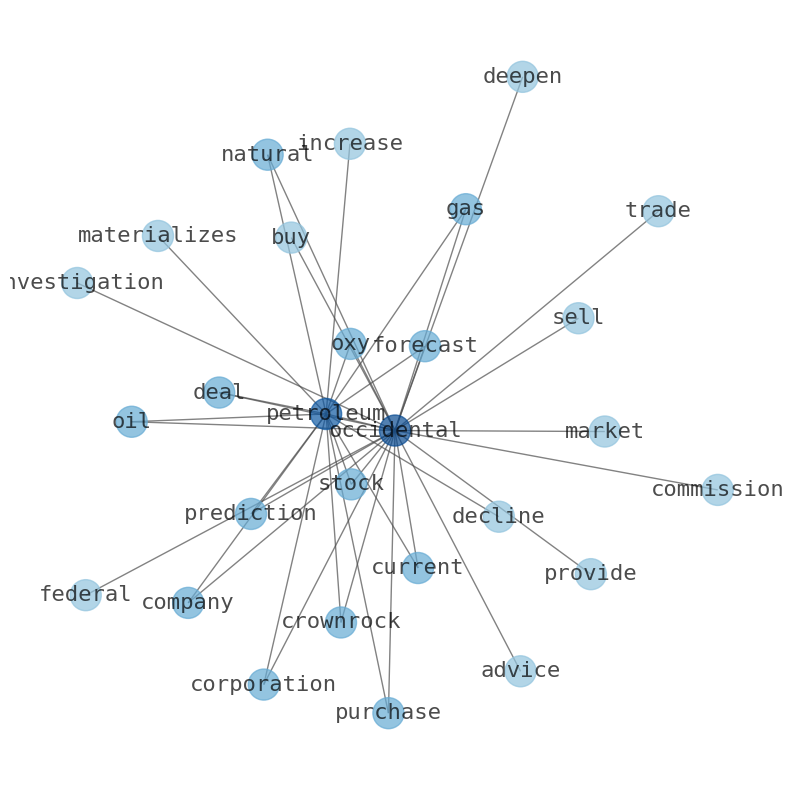

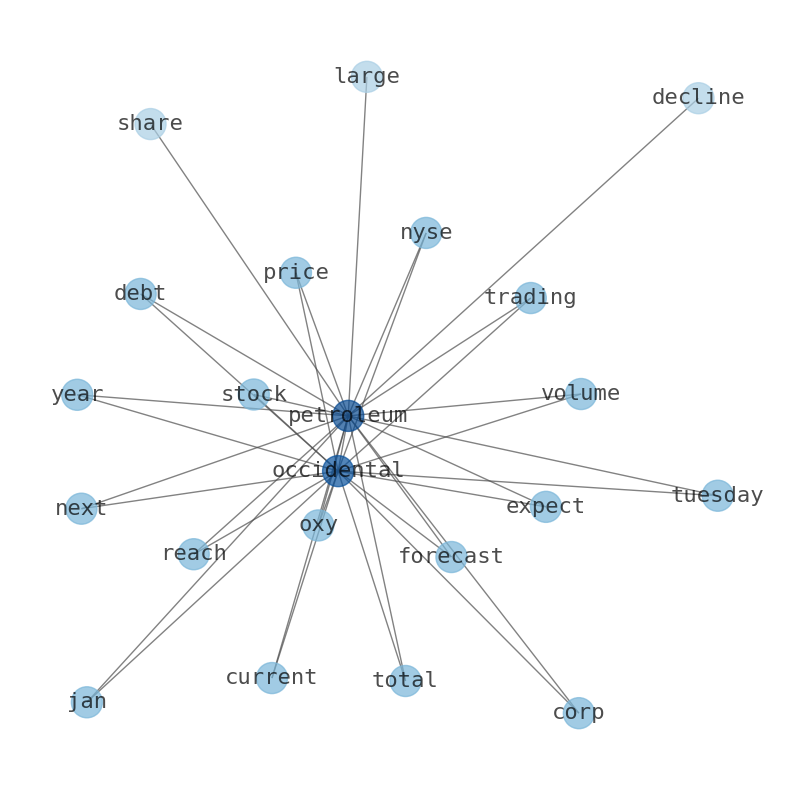

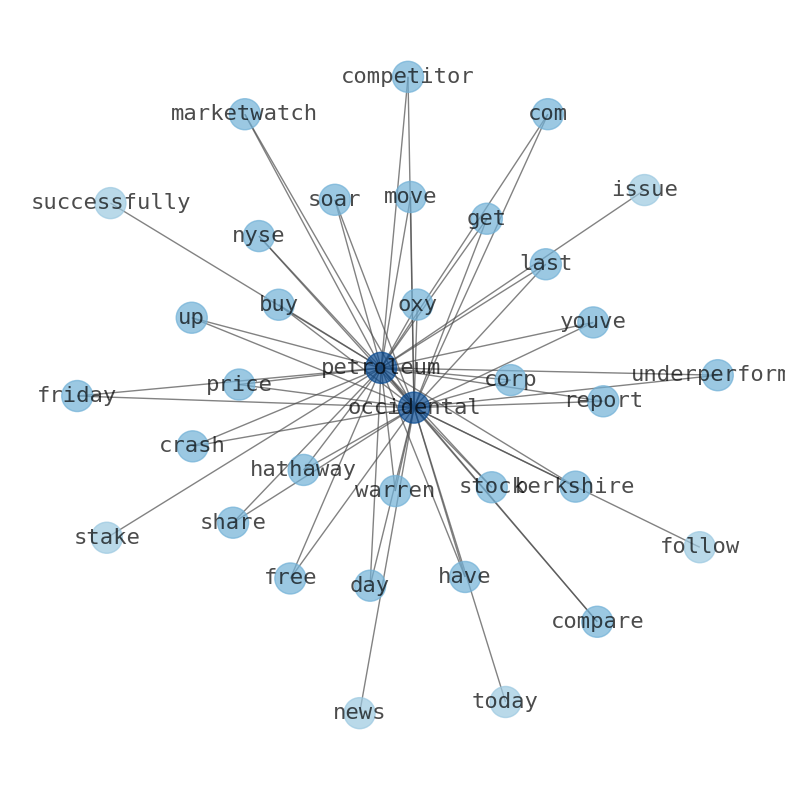

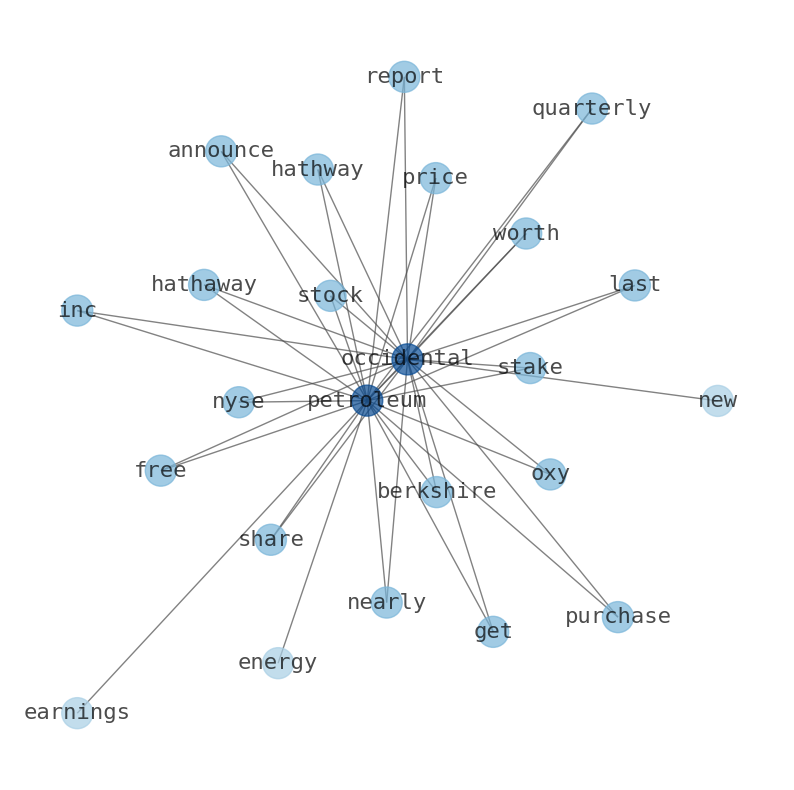

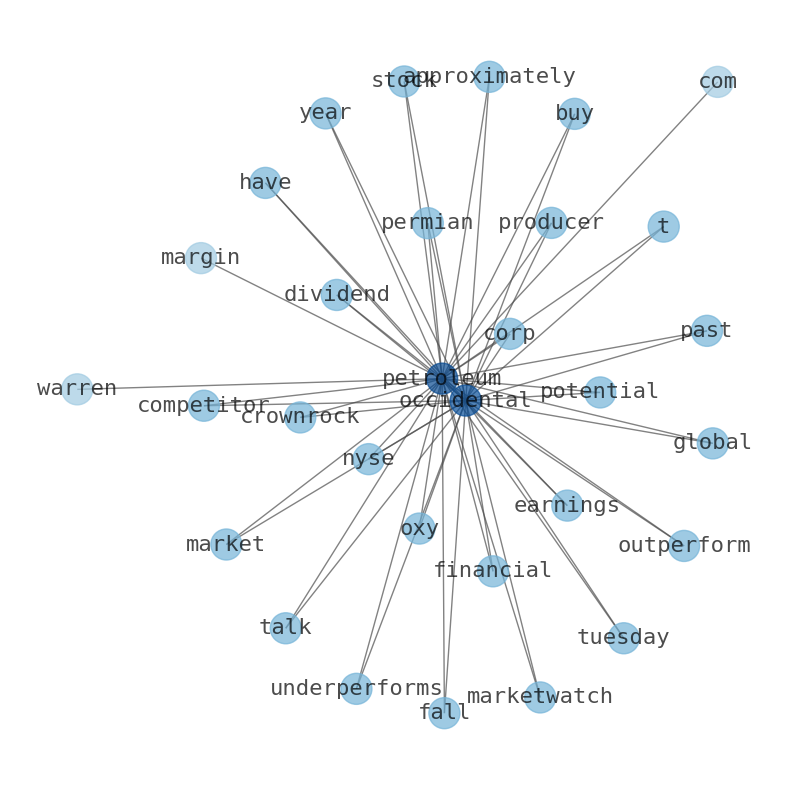

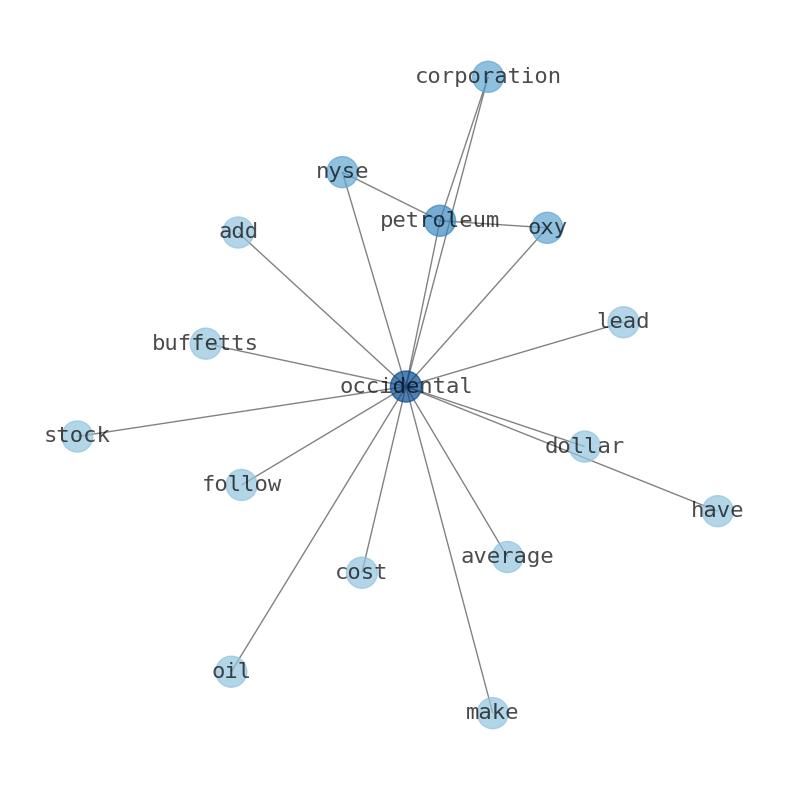

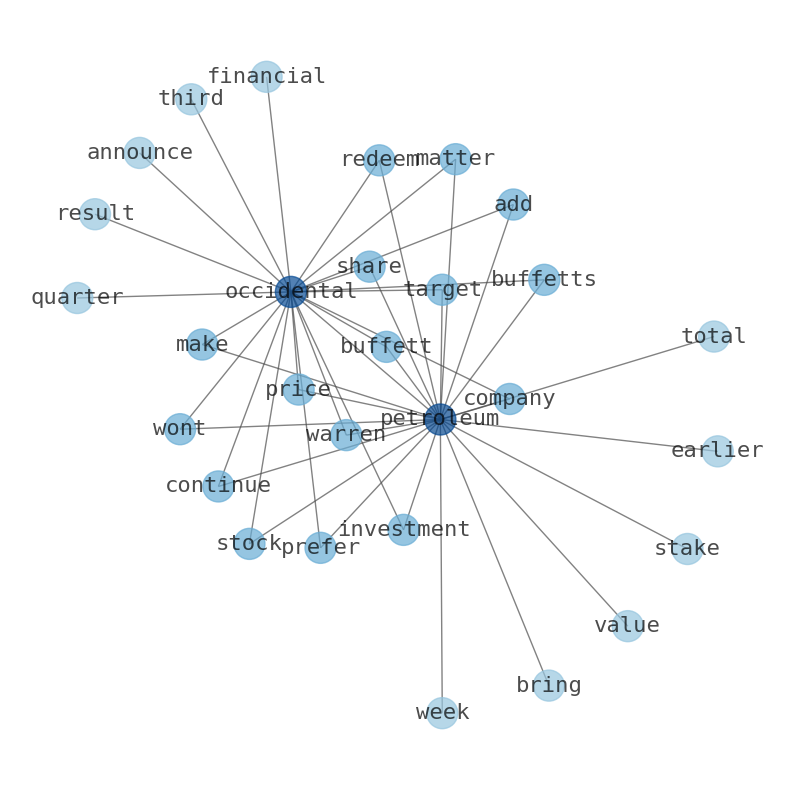

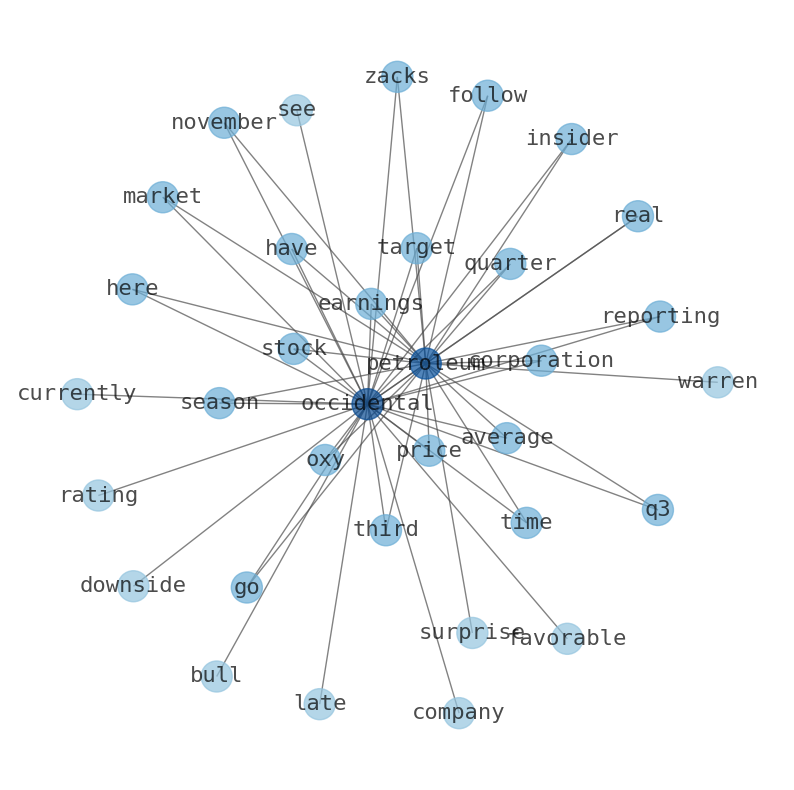

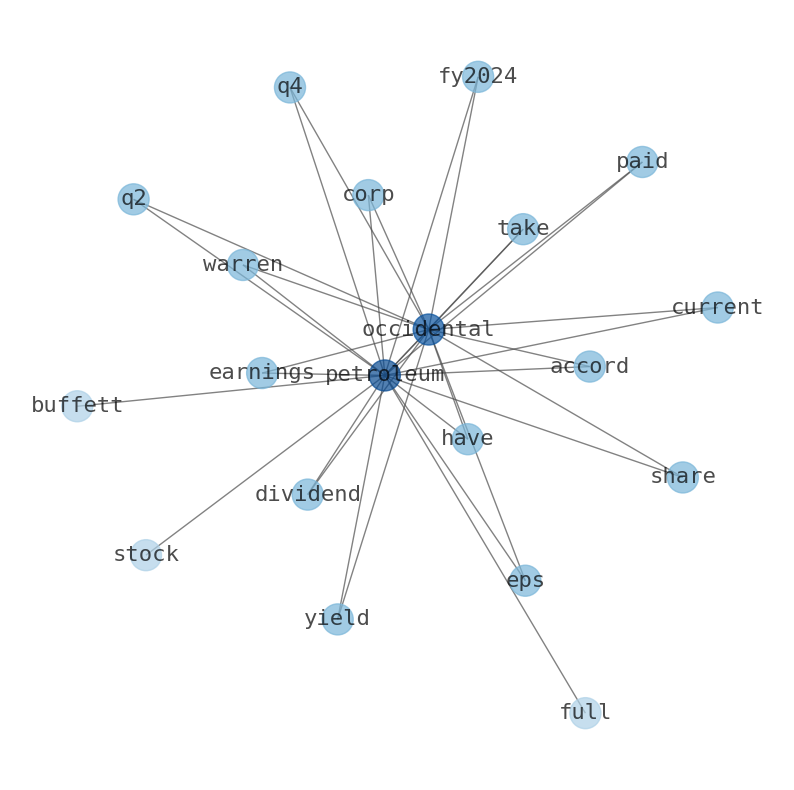

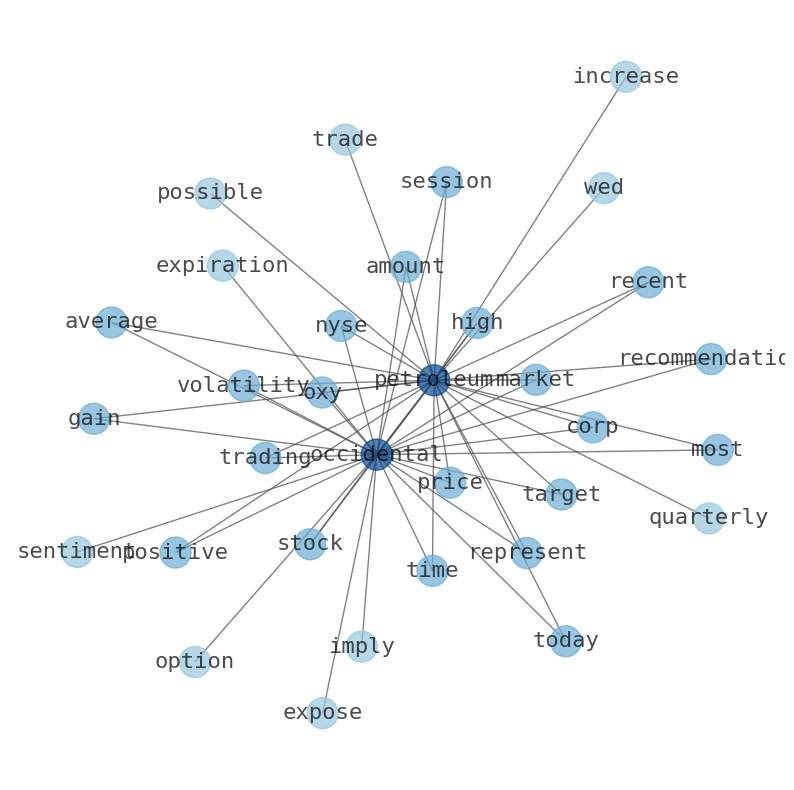

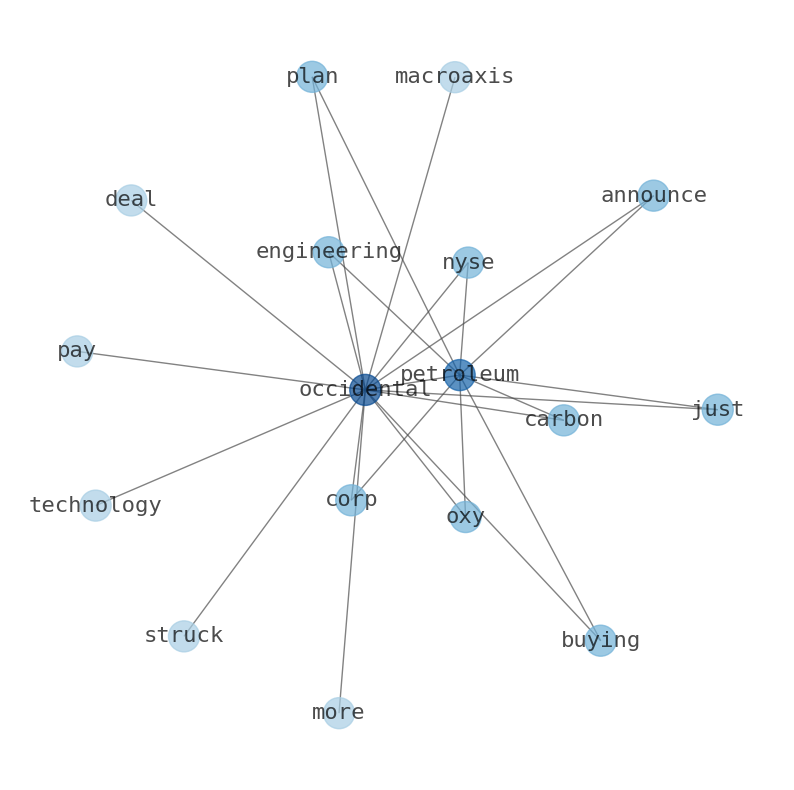

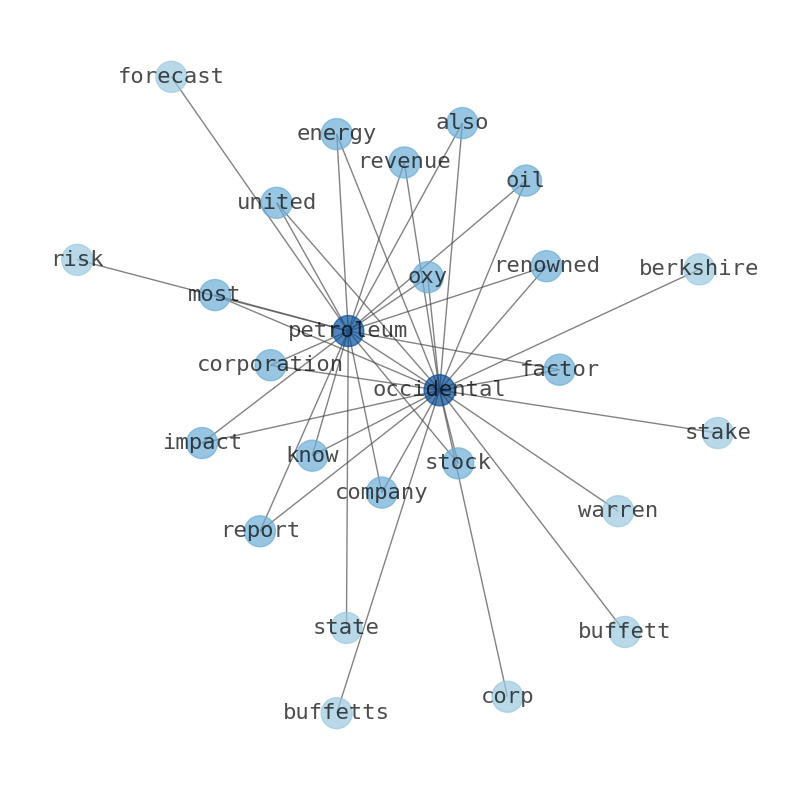

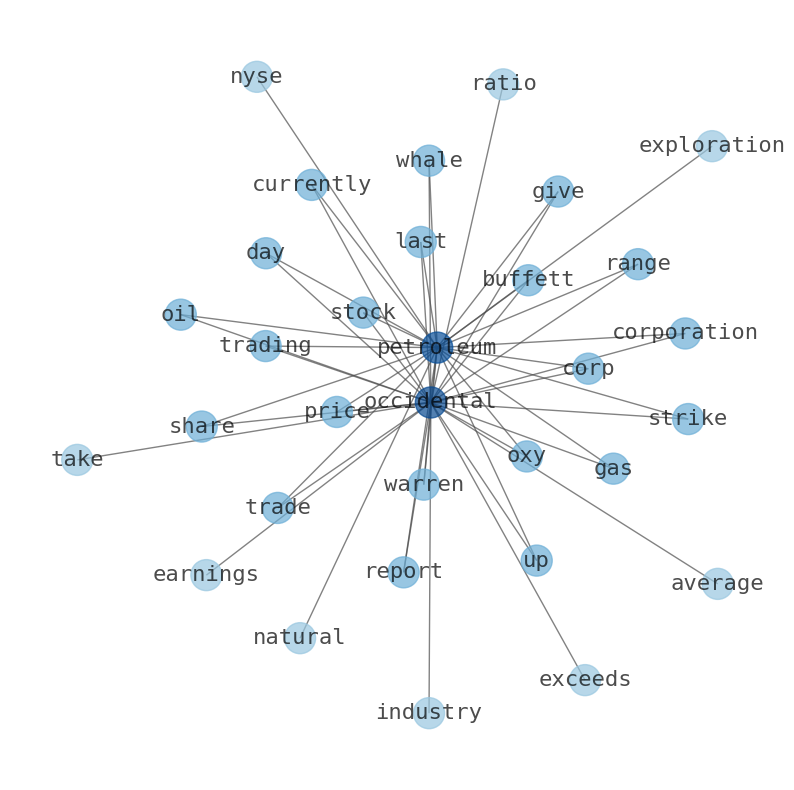

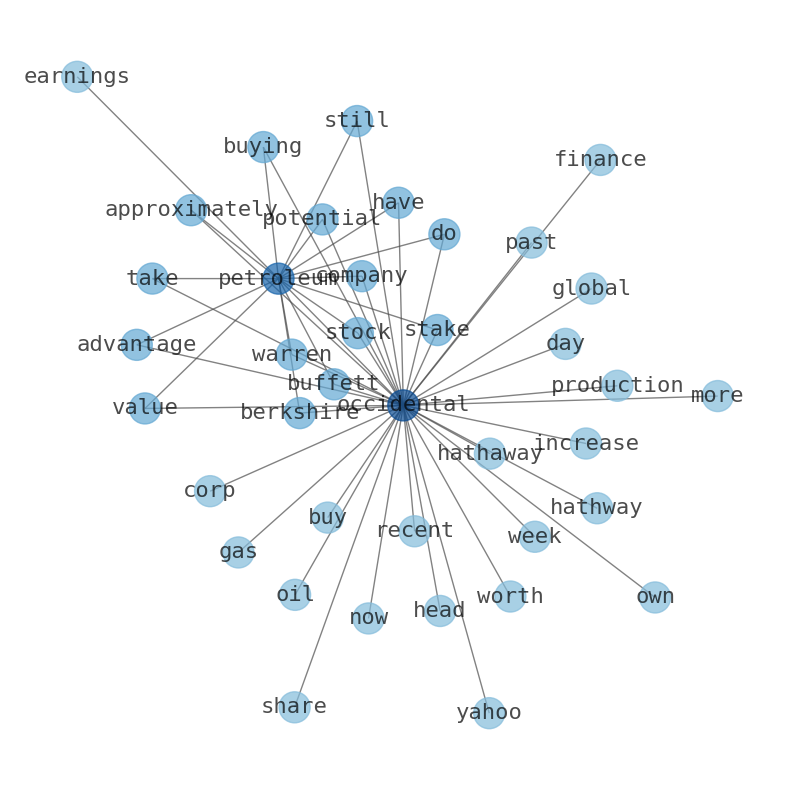

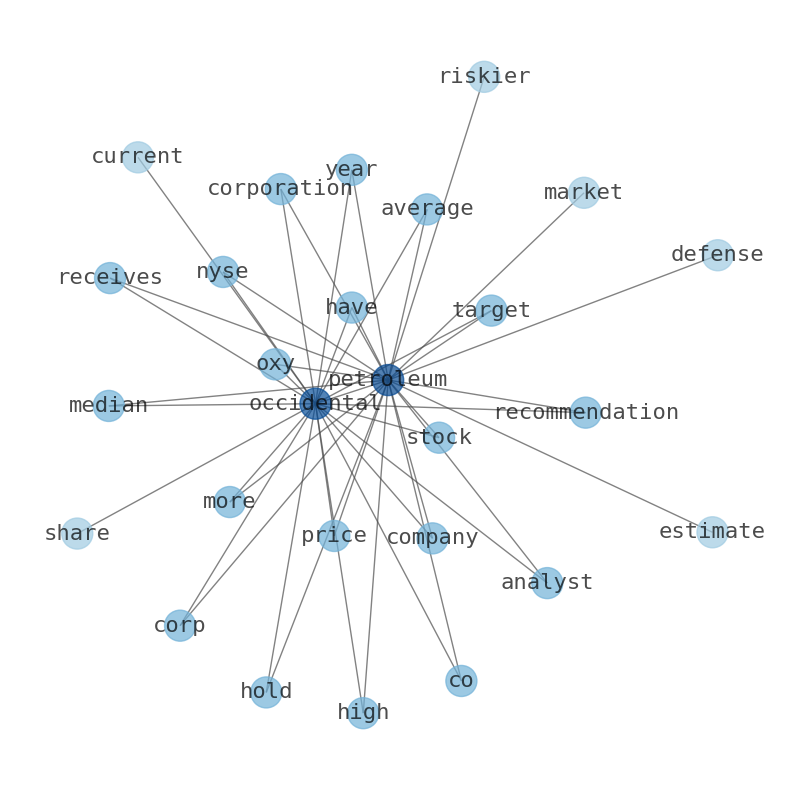

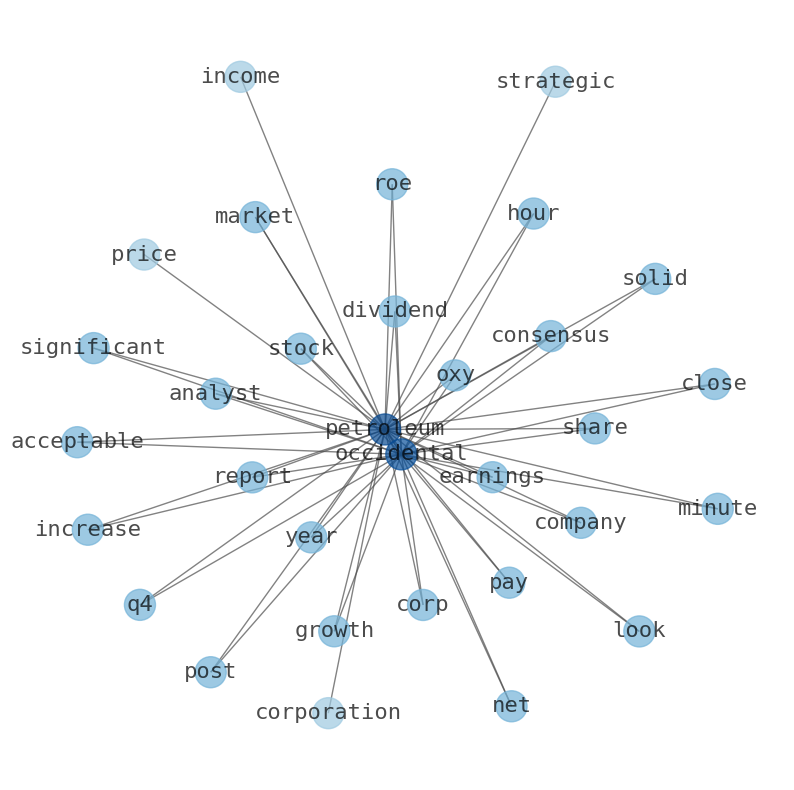

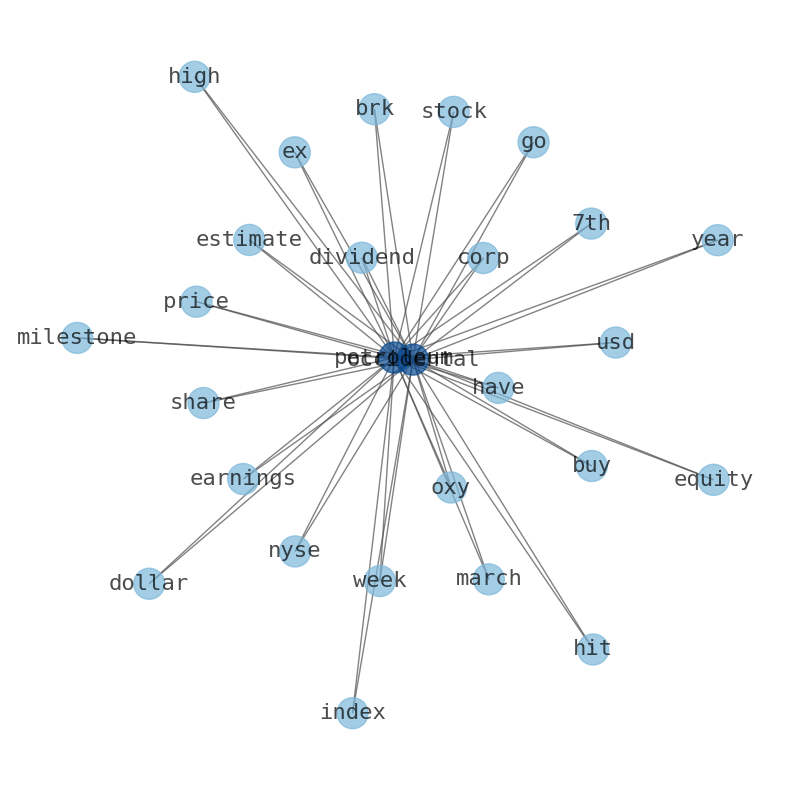

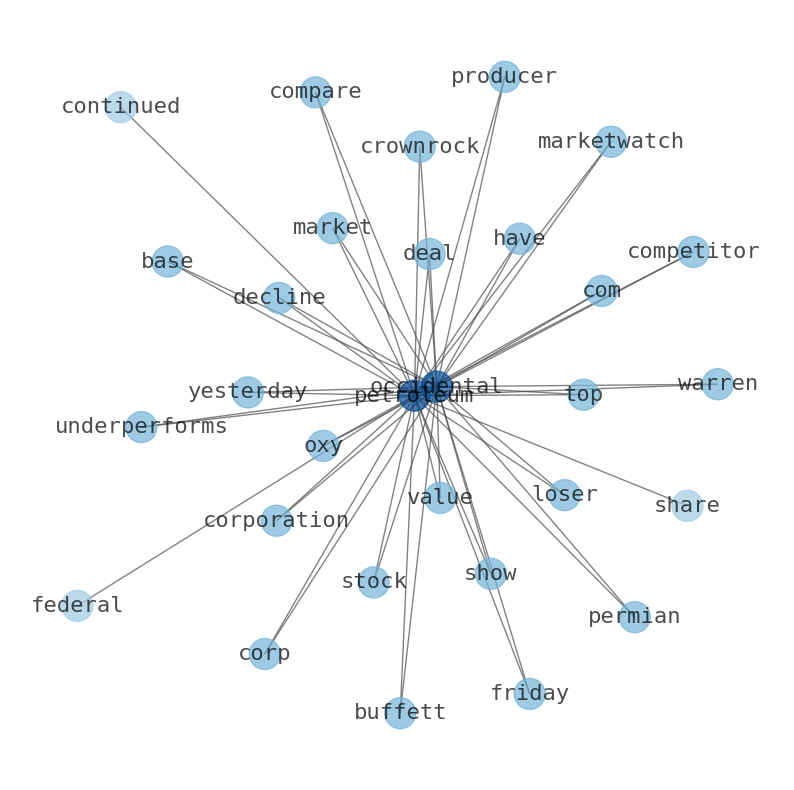

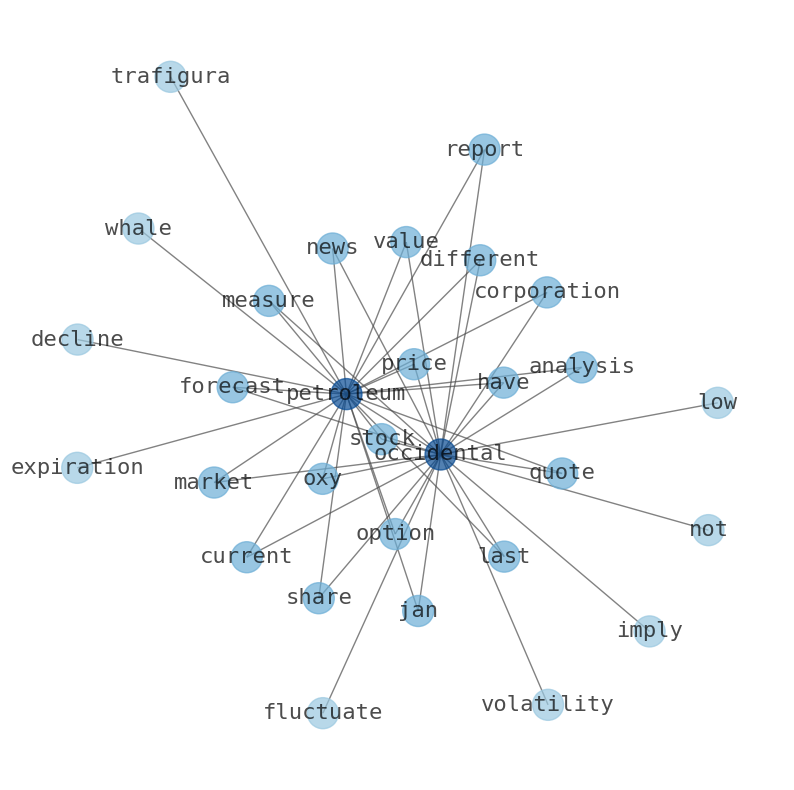

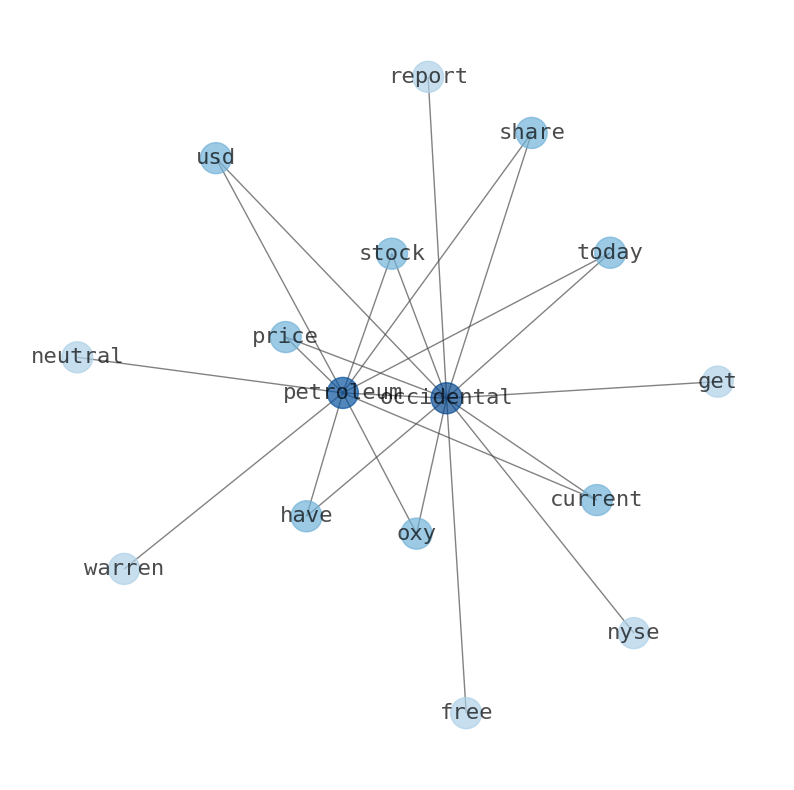

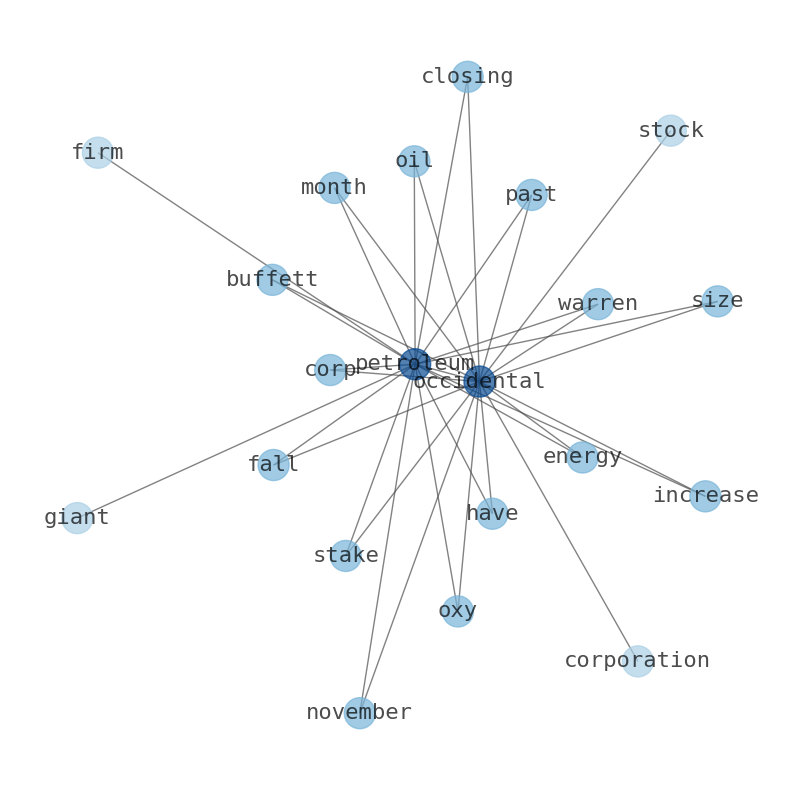

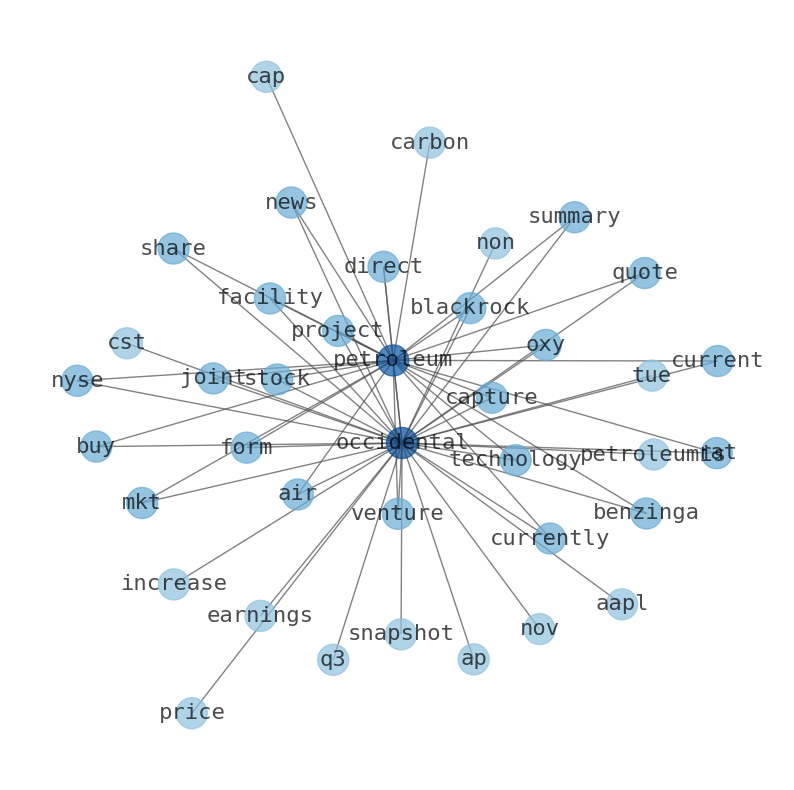

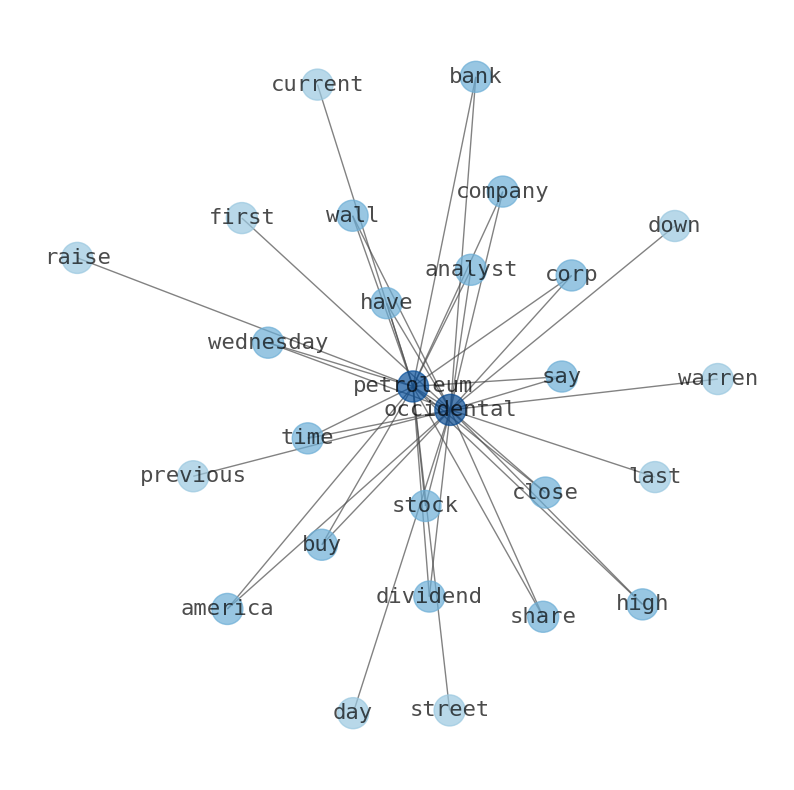

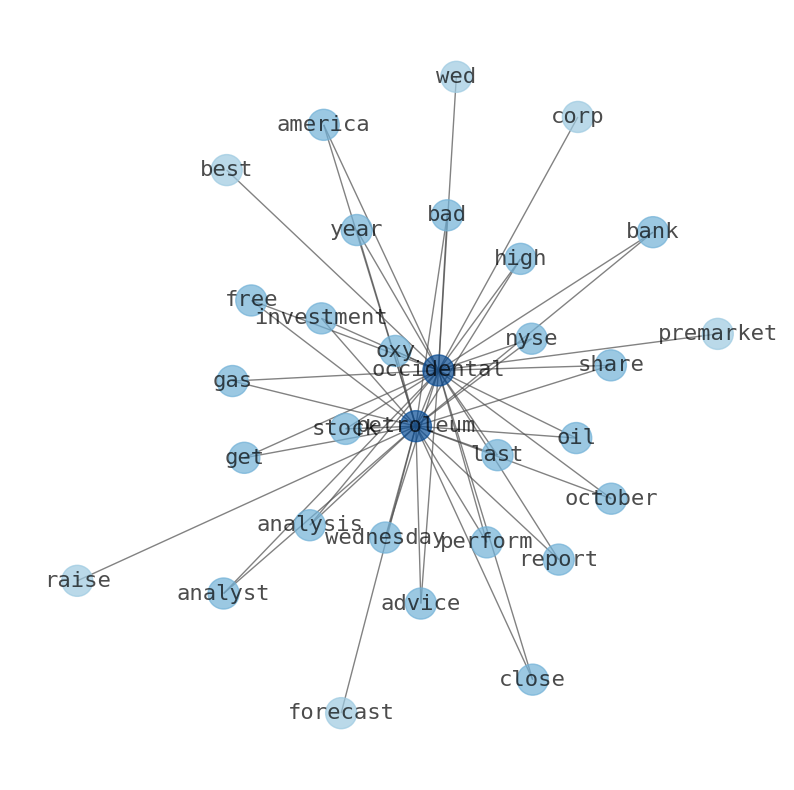

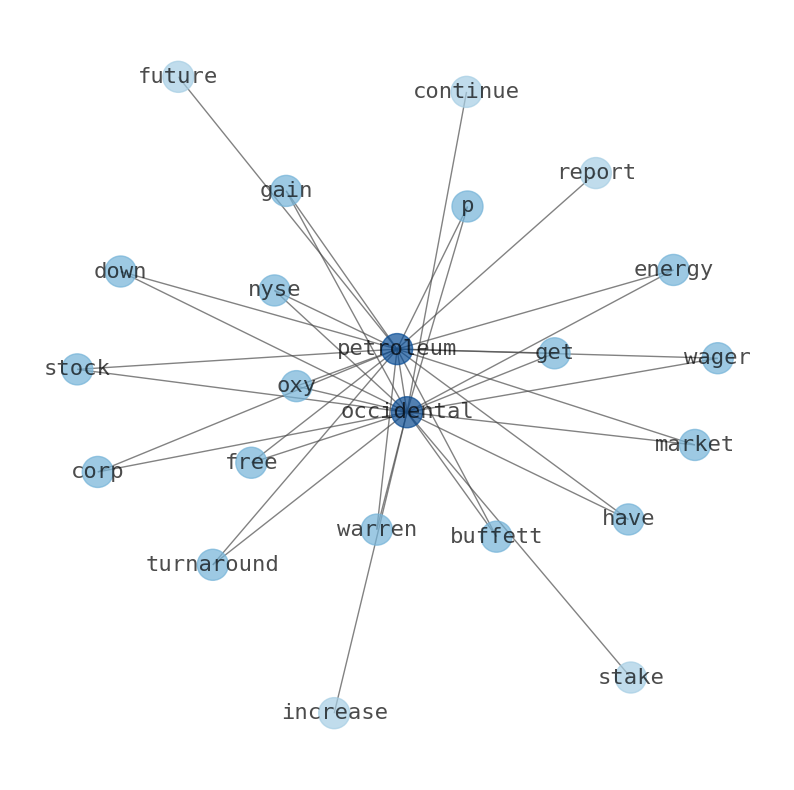

How much time have you spent trying to decide whether investing in Occidental Petroleum? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Occidental Petroleum are: …

Stock Summary

Occidental Petroleum Corporation engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, North Africa, and Latin America. The company's Oil and Gas segment explores for, develops, and.

Today's Summary

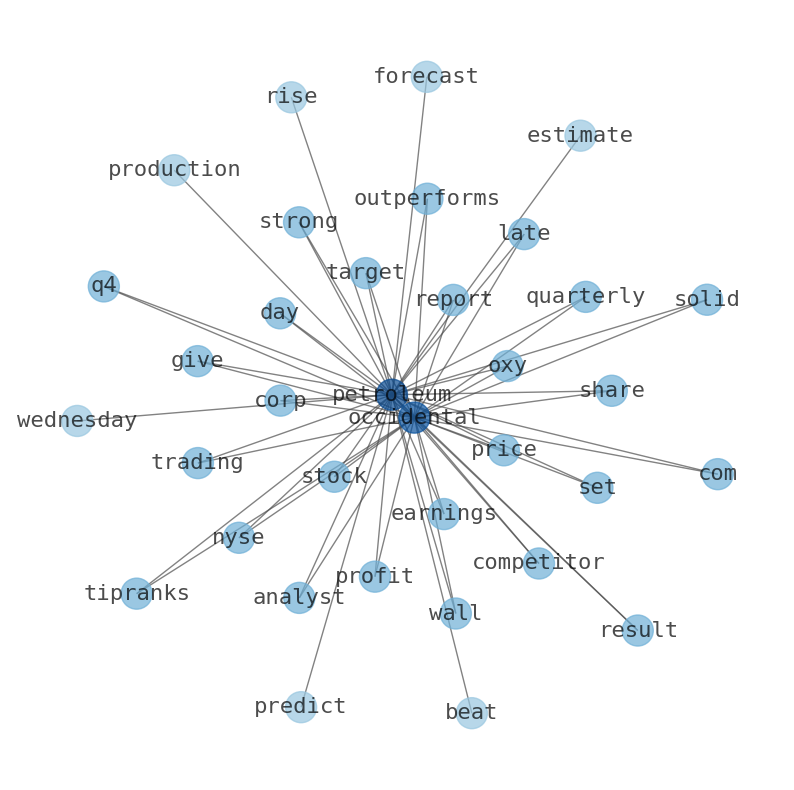

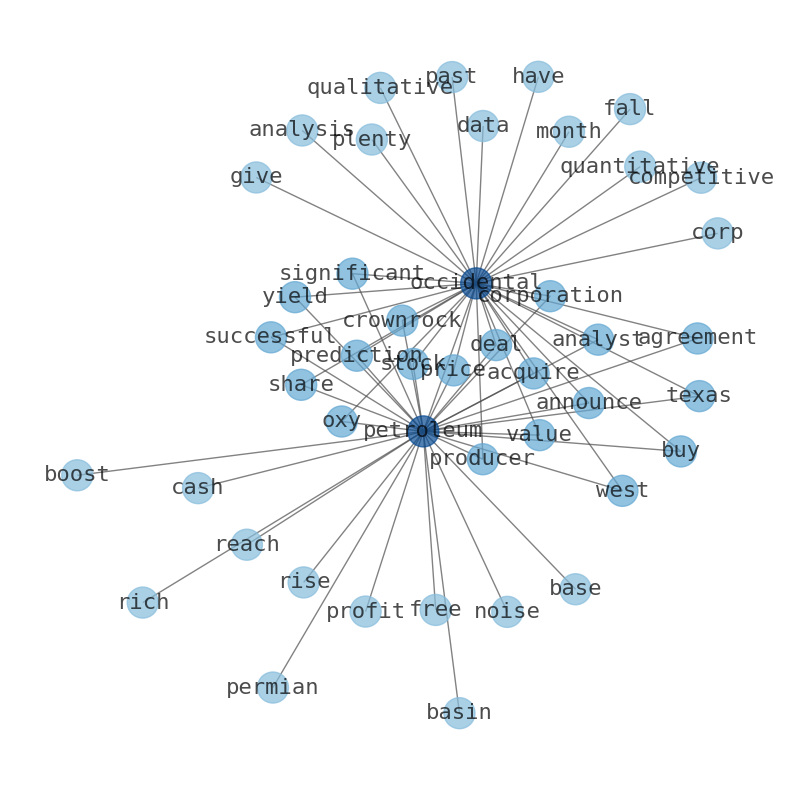

Occidental Petroleums stock price prediction is based on noise-free headlines and recent hype associated with Occidental Petroleum. Wall Street analysts predict that Occidental. Petroleum s share price could reach $71.50 by Dec 12, 2024.

Today's News

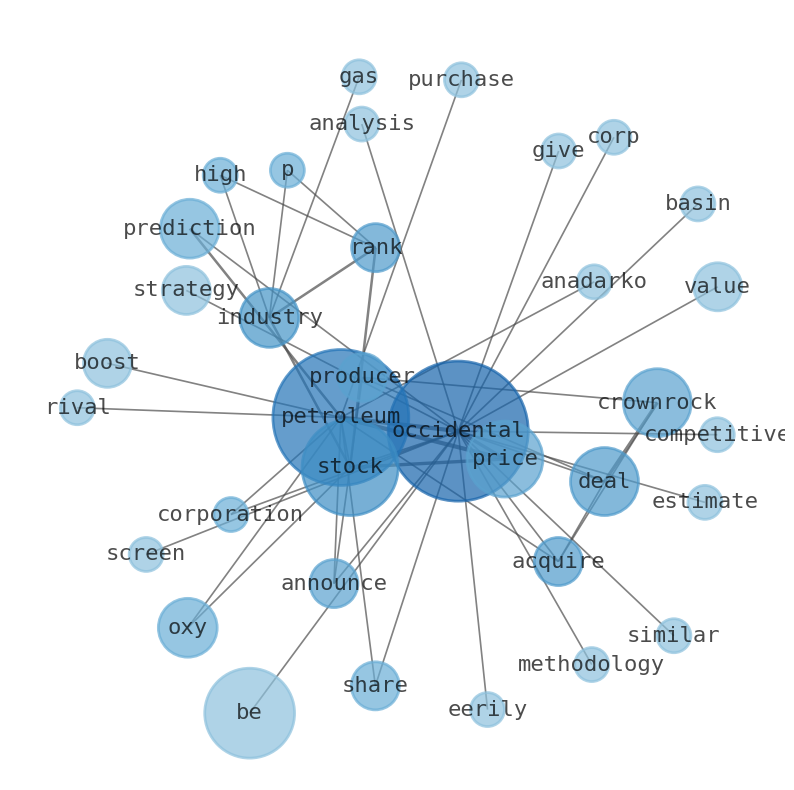

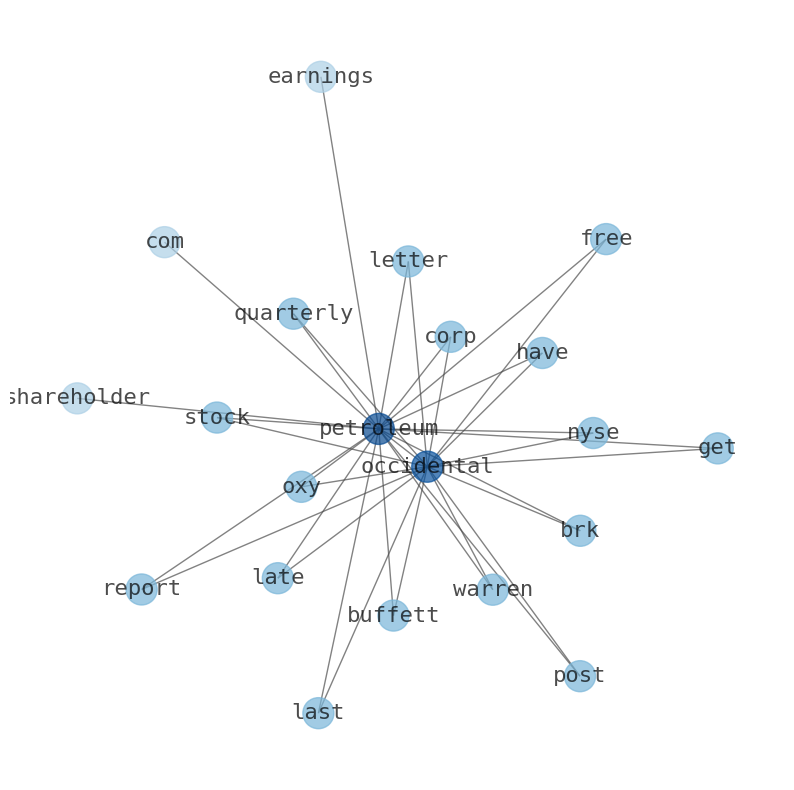

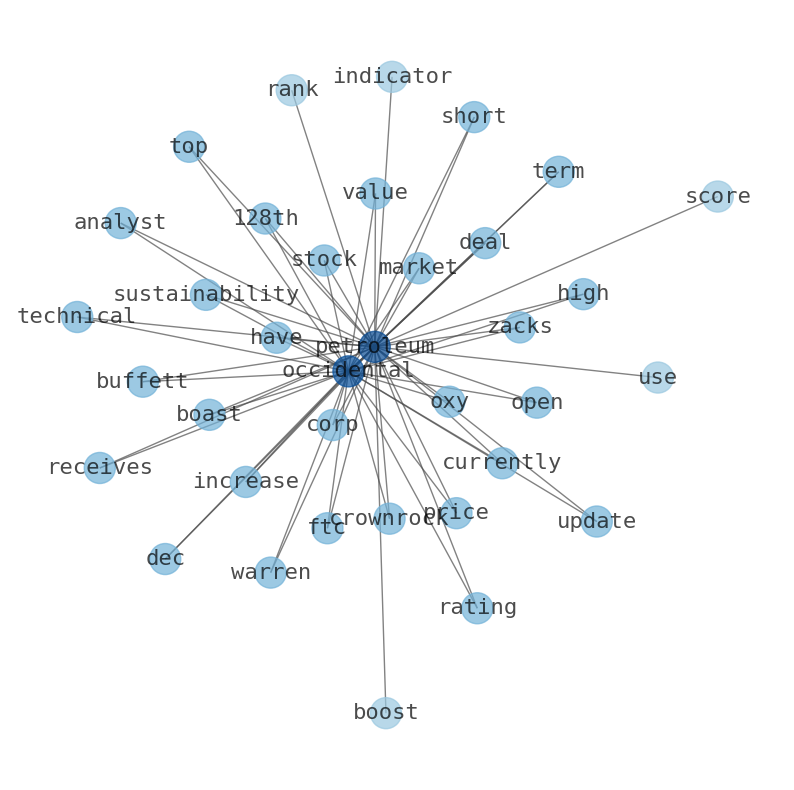

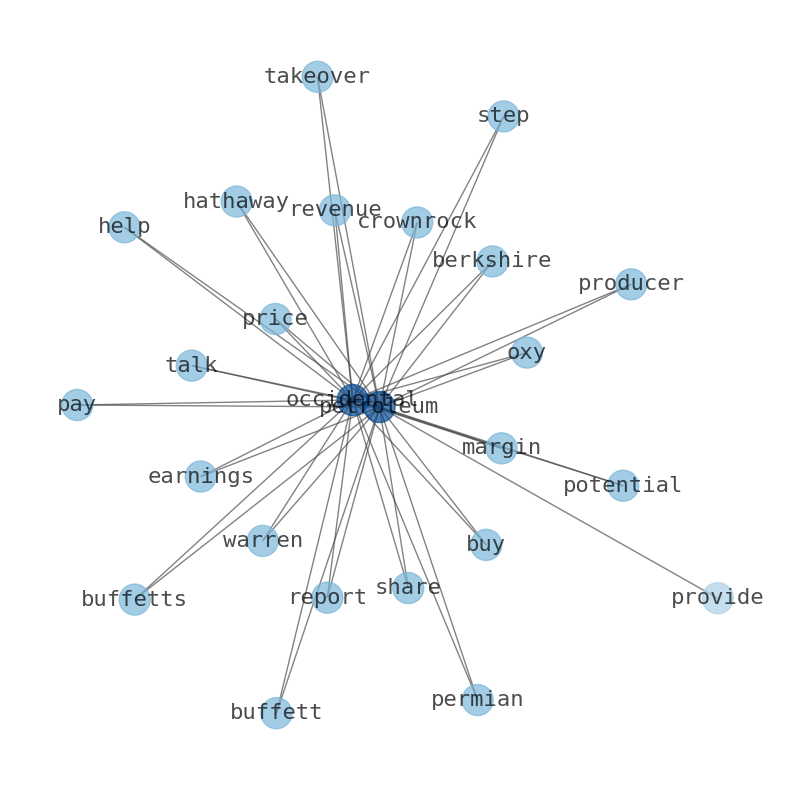

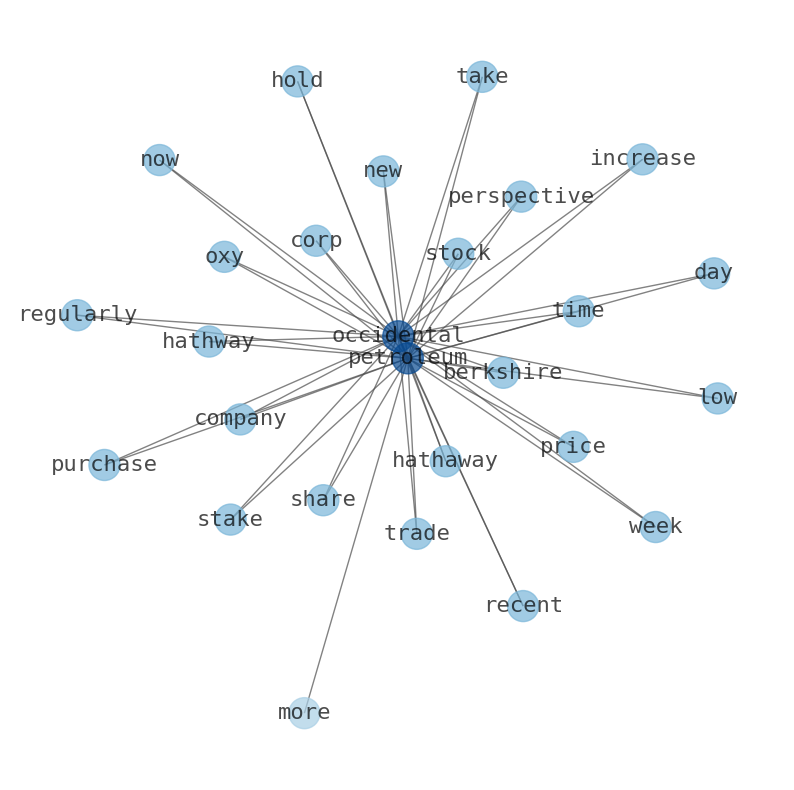

Occidental Petroleum announced a $10.8 billion agreement to buy West Texas producer CrownRock. The deal would boost its assets in the Midland region of the petroleum-rich Permian Basin. Shares of Occidental Petroleums rose about 0.2% to $56. Occidental Petroleum Corporation ( OXY) is acquiring CrownRock in a cash-and-stock deal. The strategy is eerily similar to Occidentals funding plan in 2019. Occidental Petroleum Corp has fallen 6.31% over the past month, closing at $60.98 on November 10. In the Oil & Gas E&P industry, which ranks 58 out of 146 industries, the stock ranks higher than 63% of stocks. Occidental Petroleum announced on Monday it will acquire energy producer CrownRock in a deal valued at $12 billion, including debt. The CrownRock deal would be Occidentals first major acquisition since its widely criticized and debt-laden purchase of rival Anadarko Petroleum. Occidental Petroleums stock price prediction is based on noise-free headlines and recent hype associated with Occidental Petroleum. We use our internally-built news screening methodology to estimate the value of Occidental. Occidental Petroleums competitive analysis will give you plenty of quantitative and qualitative data to validate your investment decisions or develop an entirely new strategy toward taking a position in Occidental Petroleum. The successful prediction of Occidental Petroleum stock price could yield a significant profit to investors. Successful prediction of the Occidental Petroleums stock price is possible. The efficient-market hypothesis suggests that all published stock prices of traded companies already reflect all publicly available information. Occidental Petroleums industry expected to grow? Or is there an opportunity to expand the business product line in the future? Factors like these will boost the valuation of Occidental Petroleum. Wall Street analysts predict that Occidental Petroleum s share price could reach $71.50 by Dec 12, 2024. The consensus among 12 analysts covering ( NYSE : OXY ) stock is to Buy OXY.

Stock Profile

"Occidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, North Africa, and Latin America. It operates through three segments: Oil and Gas, Chemical, and Midstream and Marketing. The company's Oil and Gas segment explores for, develops, and produces oil and condensate, natural gas liquids (NGLs), and natural gas. Its Chemical segment manufactures and markets basic chemicals, including chlorine, caustic soda, chlorinated organics, potassium chemicals, ethylene dichloride, chlorinated isocyanurates, sodium silicates, and calcium chloride; and vinyls comprising vinyl chloride monomer, polyvinyl chloride, and ethylene. The Midstream and Marketing segment gathers, processes, transports, stores, purchases, and markets oil, condensate, NGLs, natural gas, carbon dioxide, and power. This segment also trades around its assets consisting of transportation and storage capacity; and invests in entities. Occidental Petroleum Corporation was founded in 1920 and is headquartered in Houston, Texas."

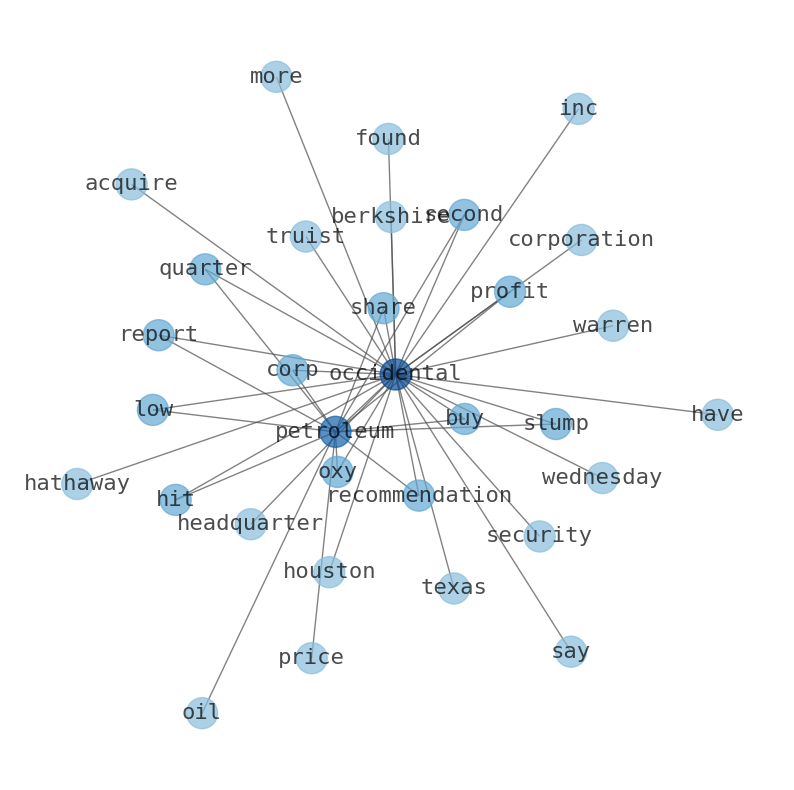

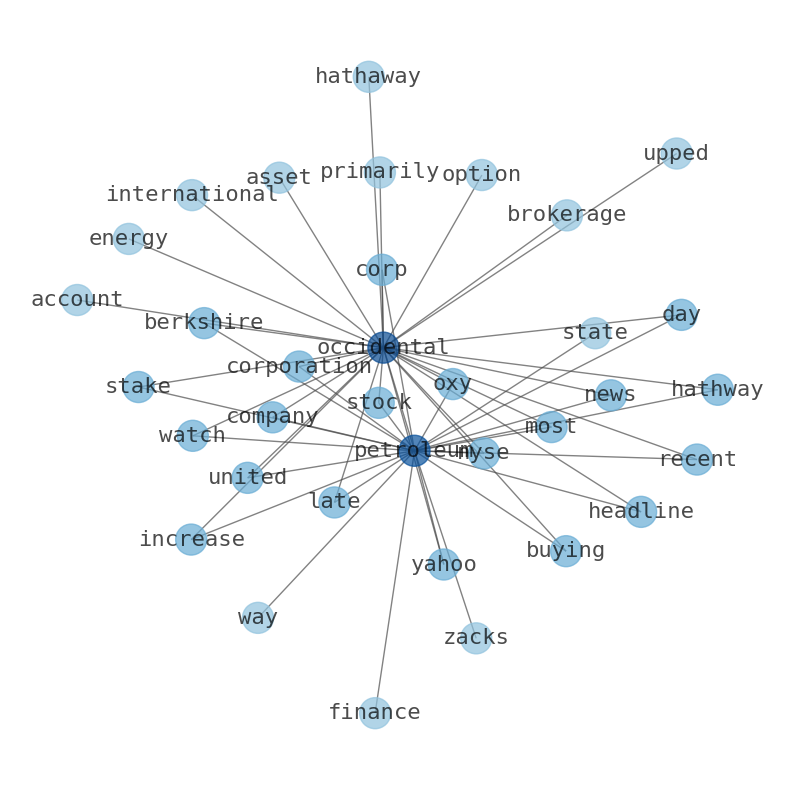

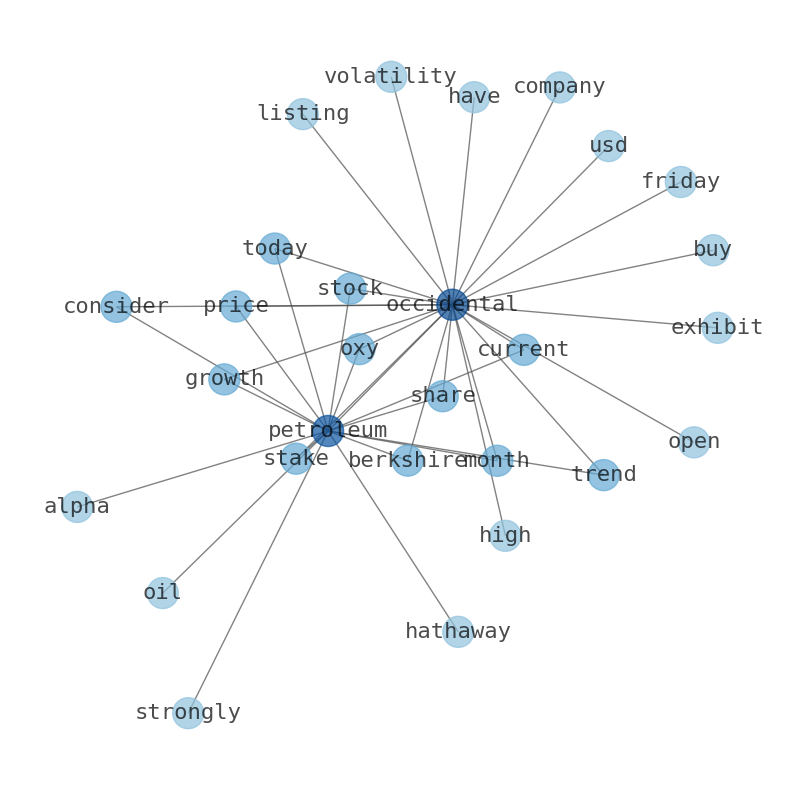

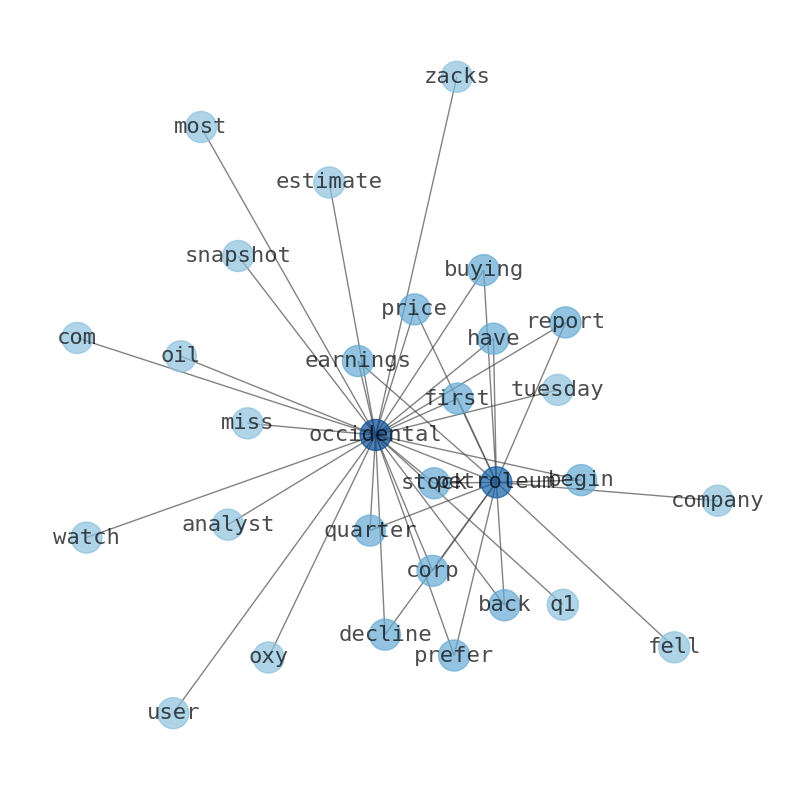

Keywords

The game is changing. There is a new strategy to evaluate Occidental Petroleum fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Occidental Petroleum are: Occidental, Petroleum, stock, Petroleums, price, CrownRock, deal, and the most common words in the summary are: occidental, petroleum, best, stock, bloomberg, crownrock, market, . One of the sentences in the summary was: Occidental Petroleums stock price prediction is based on noise-free headlines and recent hype associated with Occidental Petroleum. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #occidental #petroleum #best #stock #bloomberg #crownrock #market.

Read more →Related Results

Occidental Petroleum

Open: 62.36 Close: 62.65 Change: 0.29

Read more →

Occidental Petroleum

Open: 60.38 Close: 60.52 Change: 0.14

Read more →

Occidental Petroleum

Open: 58.23 Close: 58.4 Change: 0.17

Read more →

Occidental Petroleum

Open: 56.42 Close: 56.74 Change: 0.32

Read more →

Occidental Petroleum

Open: 56.19 Close: 55.99 Change: -0.2

Read more →

Occidental Petroleum

Open: 60.0 Close: 59.71 Change: -0.29

Read more →

Occidental Petroleum

Open: 61.34 Close: 60.81 Change: -0.53

Read more →

Occidental Petroleum

Open: 57.98 Close: 57.28 Change: -0.7

Read more →

Occidental Petroleum

Open: 59.87 Close: 60.06 Change: 0.19

Read more →

Occidental Petroleum

Open: 61.67 Close: 61.92 Change: 0.25

Read more →

Occidental Petroleum

Open: 63.3 Close: 61.75 Change: -1.55

Read more →

Occidental Petroleum

Open: 61.42 Close: 63.27 Change: 1.85

Read more →

Occidental Petroleum

Open: 65.73 Close: 66.5 Change: 0.77

Read more →

Occidental Petroleum

Open: 62.17 Close: 62.24 Change: 0.07

Read more →

Occidental Petroleum

Open: 59.73 Close: 60.04 Change: 0.31

Read more →

Occidental Petroleum

Open: 59.12 Close: 58.94 Change: -0.18

Read more →

Occidental Petroleum

Open: 58.61 Close: 58.81 Change: 0.2

Read more →

Occidental Petroleum

Open: 60.3 Close: 60.58 Change: 0.28

Read more →

Occidental Petroleum

Open: 60.69 Close: 60.49 Change: -0.2

Read more →

Occidental Petroleum

Open: 58.21 Close: 57.45 Change: -0.76

Read more →

Occidental Petroleum

Open: 56.42 Close: 56.74 Change: 0.32

Read more →

Occidental Petroleum

Open: 56.23 Close: 56.42 Change: 0.19

Read more →

Occidental Petroleum

Open: 59.63 Close: 60.61 Change: 0.98

Read more →

Occidental Petroleum

Open: 61.34 Close: 60.81 Change: -0.53

Read more →

Occidental Petroleum

Open: 56.52 Close: 55.55 Change: -0.97

Read more →

Occidental Petroleum

Open: 57.98 Close: 57.28 Change: -0.7

Read more →

Occidental Petroleum

Open: 60.85 Close: 60.96 Change: 0.11

Read more →

Occidental Petroleum

Open: 61.1 Close: 60.98 Change: -0.12

Read more →

Occidental Petroleum

Open: 62.97 Close: 63.01 Change: 0.04

Read more →

Occidental Petroleum

Open: 66.27 Close: 65.18 Change: -1.09

Read more →

Occidental Petroleum

Open: 65.3 Close: 64.57 Change: -0.73

Read more →

Occidental Petroleum

Open: 63.0 Close: 63.75 Change: 0.75

Read more →

Occidental Petroleum

Open: 58.11 Close: 58.59 Change: 0.48

Read more →

Occidental Petroleum

Open: 59.12 Close: 58.94 Change: -0.18

Read more →

Occidental Petroleum

Open: 58.4 Close: 58.52 Change: 0.12

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo