The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Motorola Solutions

Youtube Subscribe

Open: 338.61 Close: 340.68 Change: 2.08

How to get information about Motorola Solutions without reading the whole internet.

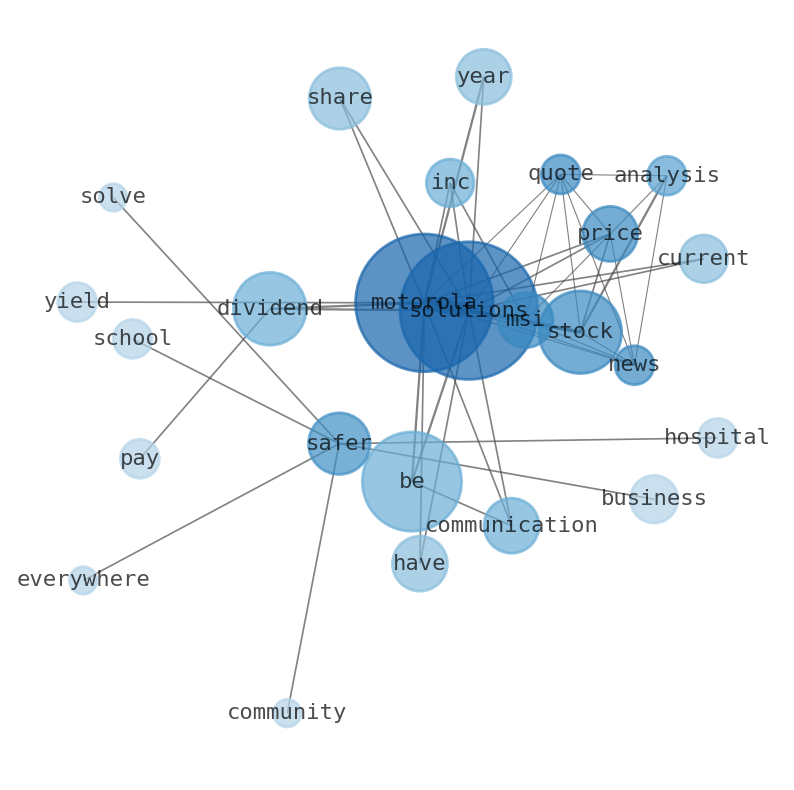

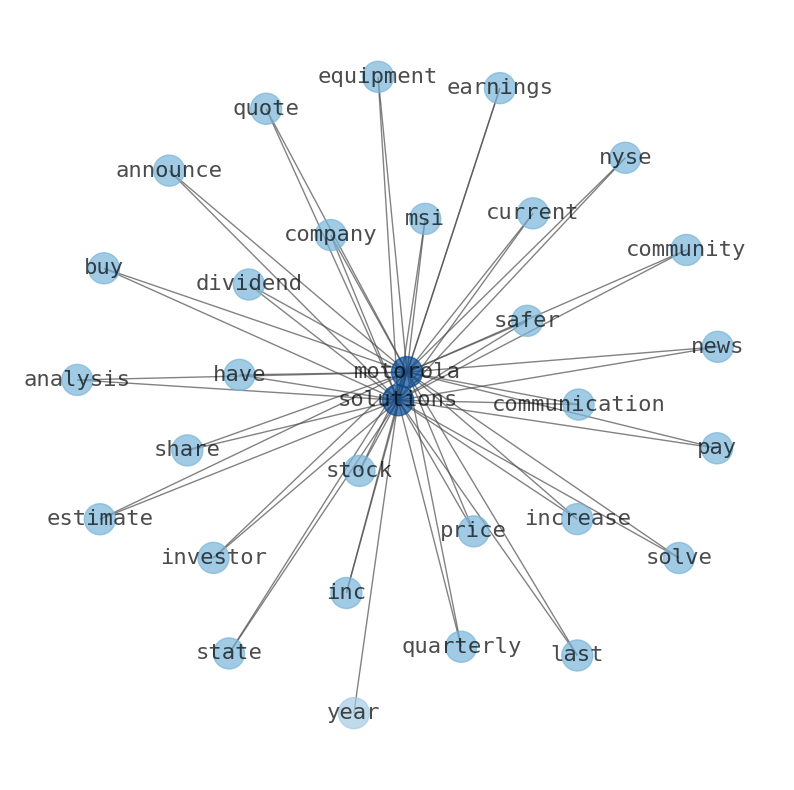

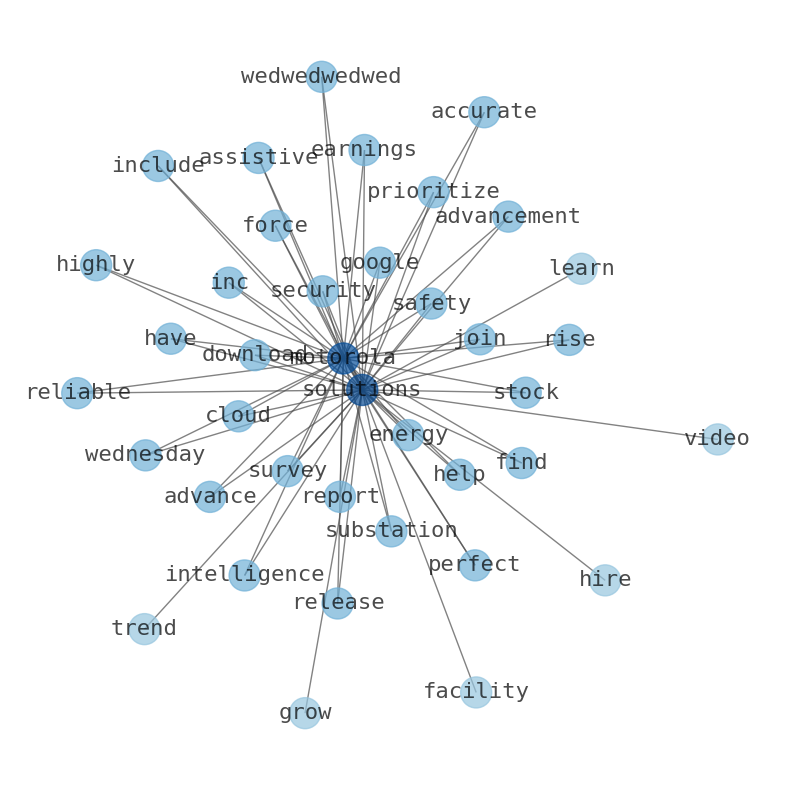

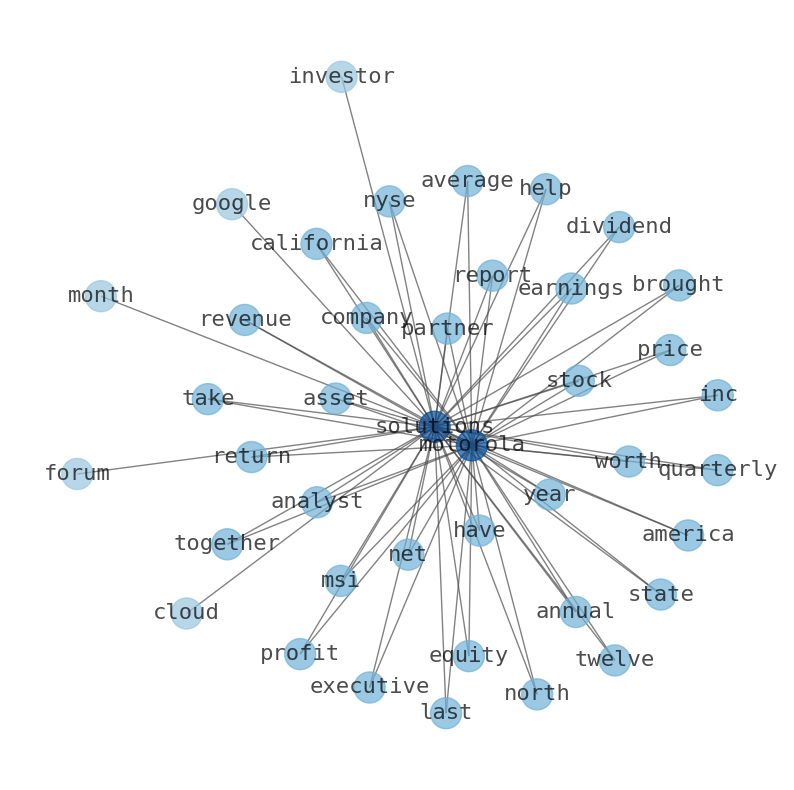

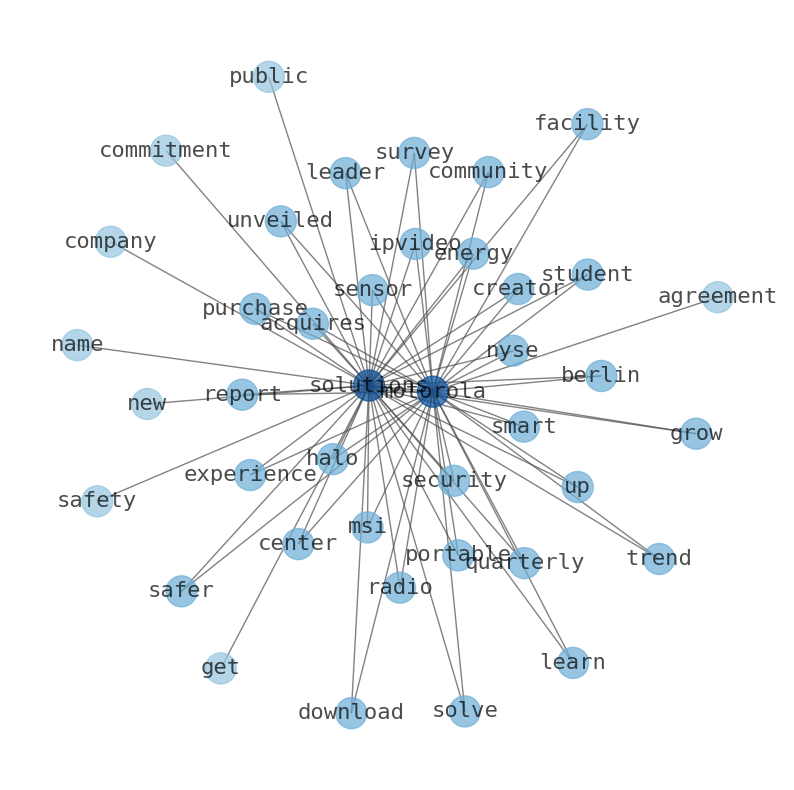

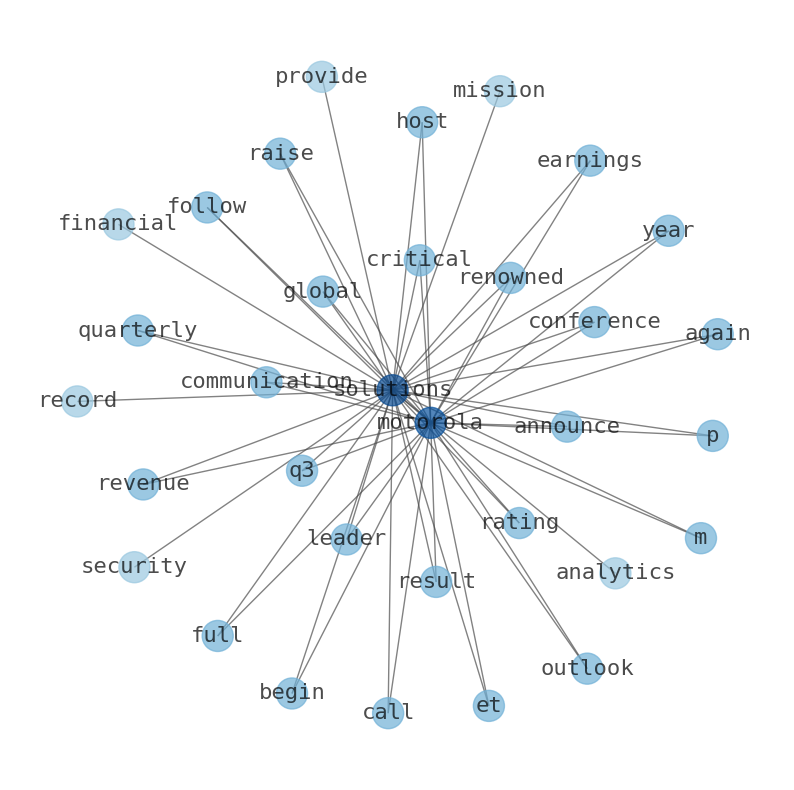

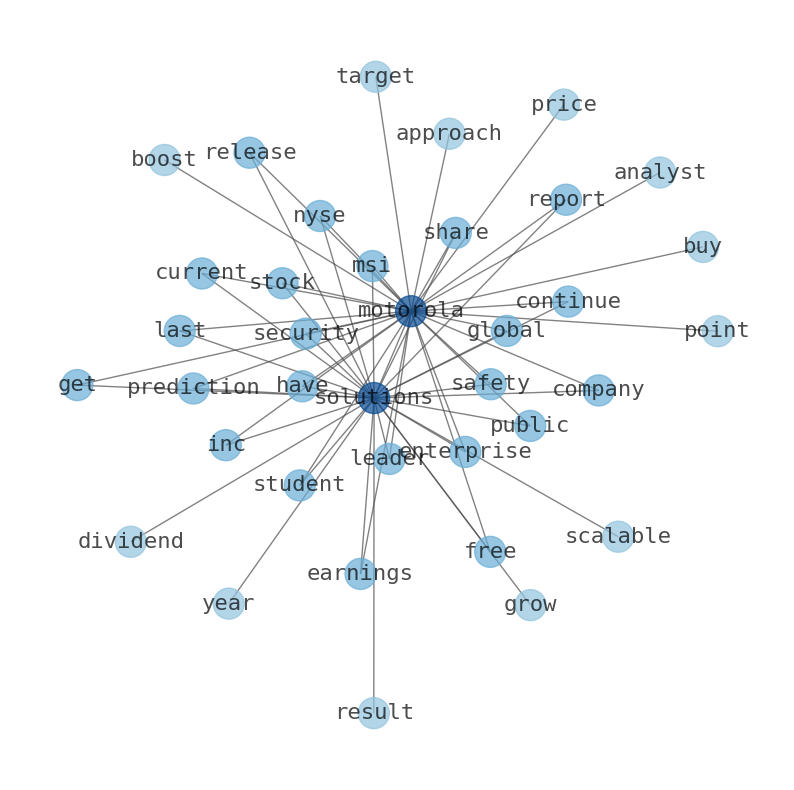

The game is changing. There is a new strategy to evaluate Motorola Solutions fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Motorola Solutions are: Motorola, Solutions, stock, dividend, company, safer, Inc, …

Stock Summary

Motorola Solutions, Inc. provides public safety and enterprise security solutions in the United States, the UK, Canada, Canada and internationally. The company operates in two segments, Products and Systems Integration, and Software and Services. Motorola Solutions provides land.

Today's Summary

Motorola Solutions announced its quarterly earnings on Thursday, February 8th. The company also announced a quarterly dividend, which will be paid on Monday, April 15th. Wall Street analysts recommend Motorola Solutions stock as a Buy, Hold or Sell.

Today's News

Motorola Solutions, Inc. (MSI) stock price, quote & news - stock analysis. Motorola Solutions (MSi) stock Price, Quote & News - Stock Analysis. Motorola Solutions announced its quarterly earnings on Thursday, February 8th. The company also announced a quarterly dividend, which will be paid on Monday, April 15th. Sei Investments Co. raised its stake in shares of Motorola Solutions, Inc. (nyse:msi) position lifted by sei investments co - defense world. - defense. Motorola Solutions, Inc. (NYSE:MSI) passed our checks, and its about to pay a us$0.98 dividend. Last years total dividend payments show that Motorola Solutions has a trailing yield of 1.2% on the current share price of US$335.41. Motorola Solutions investors that purchase the stock on the 14th of March will not receive the dividend. Motorola Solutions had revenue of $9.98B in the twelve months ending December 31, 2023, with 9.50% growth year-over-year. Motorola Solutions is a leading provider of communications and analytics, primarily serving public safety departments as well as schools, hospitals, and businesses. Motorola Solutions has partnered with the state of California to enhance disaster preparedness and response capabilities through the Rave Prepare platform. Motorola Solutions provides mission-critical communications products and services. This press release contains forward-looking statements within the meaning of applicable federal securities law. Motorola Solutions cautions the reader that the risks and uncertainties below, as well as those in its SEC filings. Motorola Solutions Quarterly Good Will 3.4 billion. Over 86.0% of the company shares are owned by institutional investors. Gaining a greater understanding of Motorola Solutions profitability requires more research than a typical breakdown of the companys financial statements. When accessing Motorola Solutions net worth, its important to look at multiple sources. Motorola Solutions stock price converges to an average value over time is called mean reversion. Motorola Solutions current Retained Earnings is estimated to increase to about 3.1 B. The Motorola Solutions Current Common Stock Shares Outstanding is. estimated to. increase to 206 M while Net Income Applicable To Common Shares is projected to decrease to under 997. M. Motorola Solutions is a communication equipment company located in Illinois, United States, which is part of the Technology sector. Motorola Solutions stock last closed at $338.03 , up 0.78% from the previous day, and has increased 29.44% in one year. The market value of Motorola Solutions can be influenced by many factors that dont directly affect its underlying business. Wall Street analysts recommend Motorola Solutions stock as a Buy, Hold, or Sell. The consensus analyst rating on Motorola Solutions is a Strong Buy. Dividend is 1.07% compared to the Communication Equipment industrys average dividend yield of 11.52%. Motorola Solutions pays a dividend of 1.7%. Motorola Solutions is solving for safer communities, safer schools, safer hospitals, safer businesses – safer everywhere – at www.motorolasolutions.com.

Stock Profile

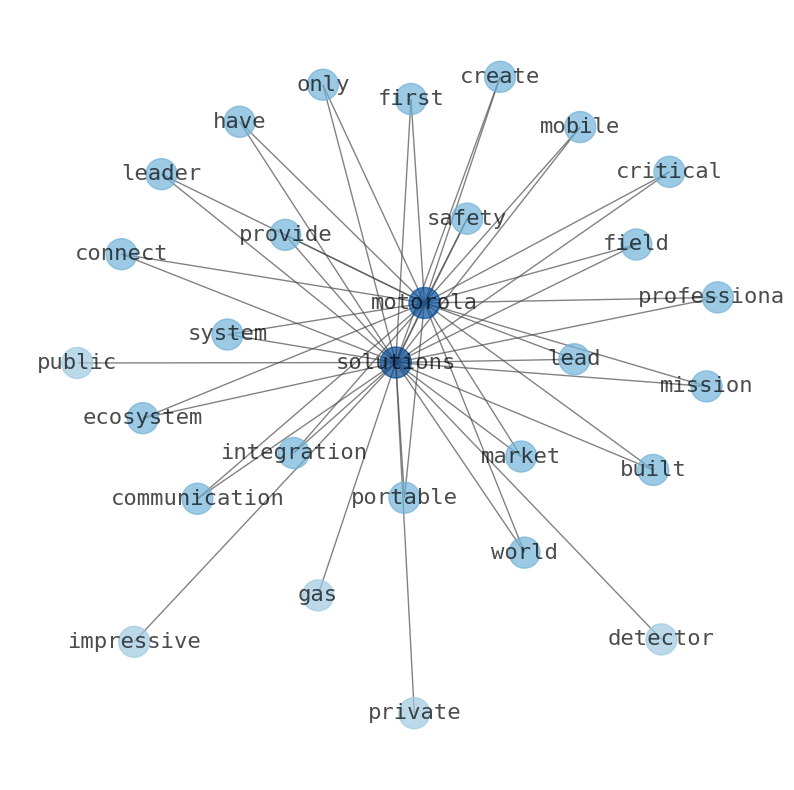

"Motorola Solutions, Inc. provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally. The company operates in two segments, Products and Systems Integration, and Software and Services. The Products and Systems Integration segment offers a portfolio of infrastructure, devices, accessories, and video security devices and infrastructure, as well as the implementation and integration of systems, devices, software, and applications for government, public safety, and commercial customers who operate private communications networks and video security solutions, as well as manage a mobile workforce. Its land mobile radio communications, and video security and access control devices include two-way portable and vehicle-mounted radios, fixed and mobile video cameras, and accessories; radio network core and central processing software, base stations, consoles, and repeaters; and video analytics, network video management hardware and software, and access control solutions. The Software and Services segment provides public safety and enterprise command center, unified communications applications, mobile video equipment, and video software solutions; repair, technical support, and maintenance services; and monitoring, software updates, and cybersecurity services. The company was formerly known as Motorola, Inc. and changed its name to Motorola Solutions, Inc. in January 2011. Motorola Solutions, Inc. was founded in 1928 and is headquartered in Chicago, Illinois."

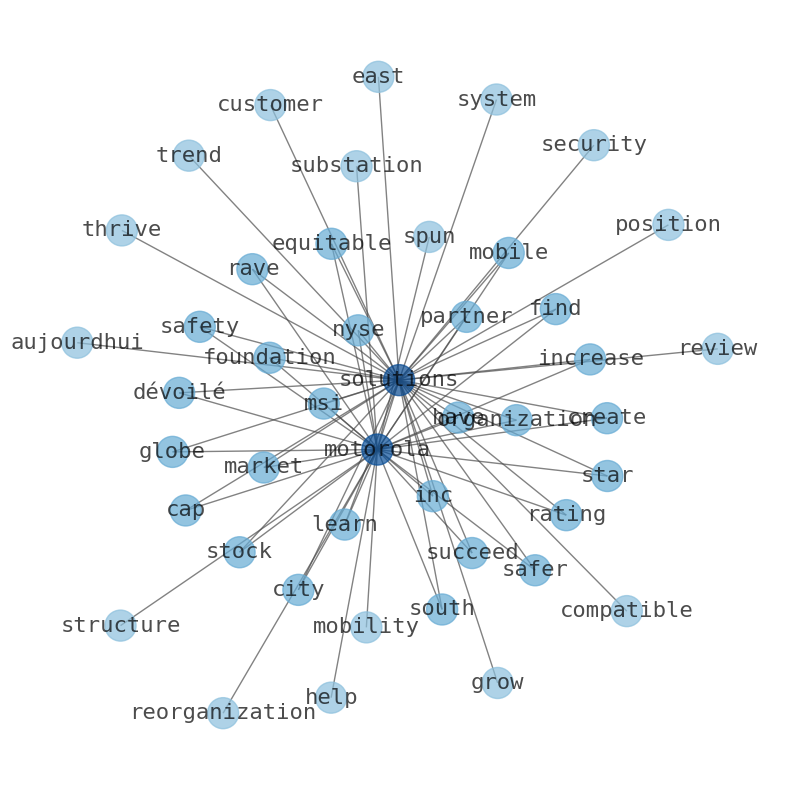

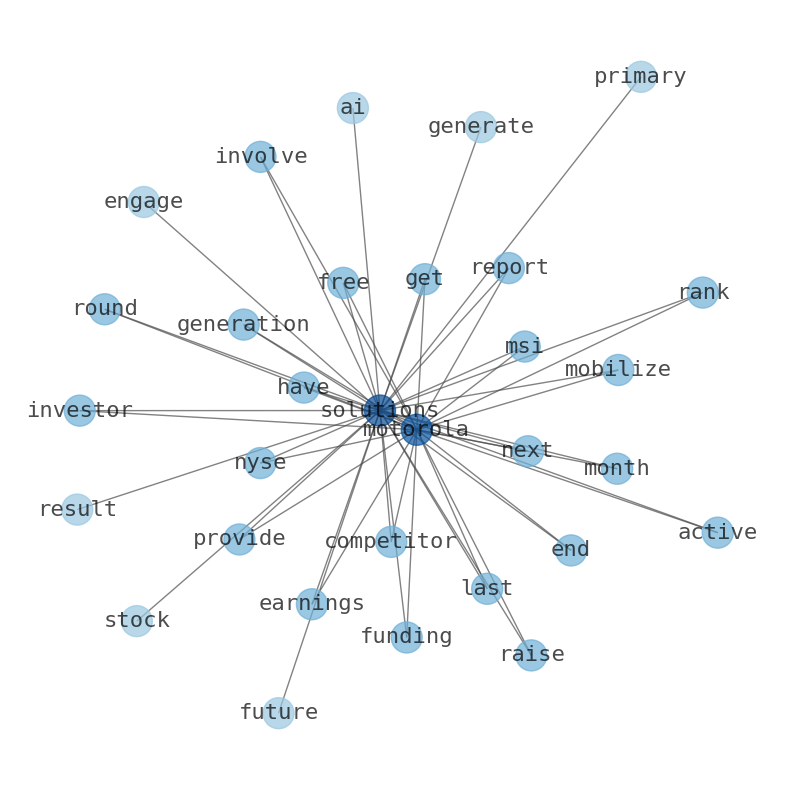

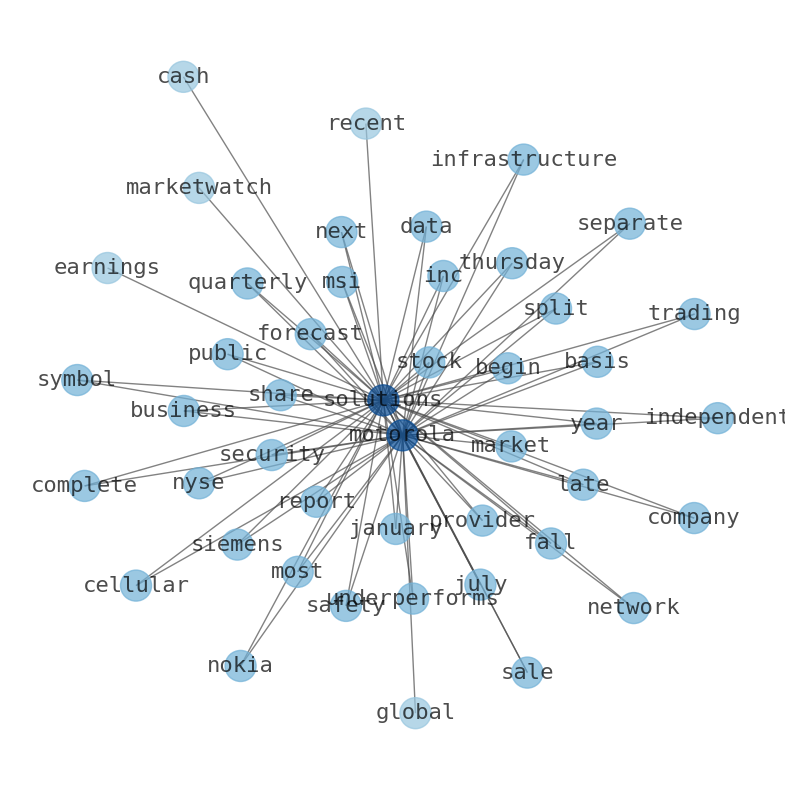

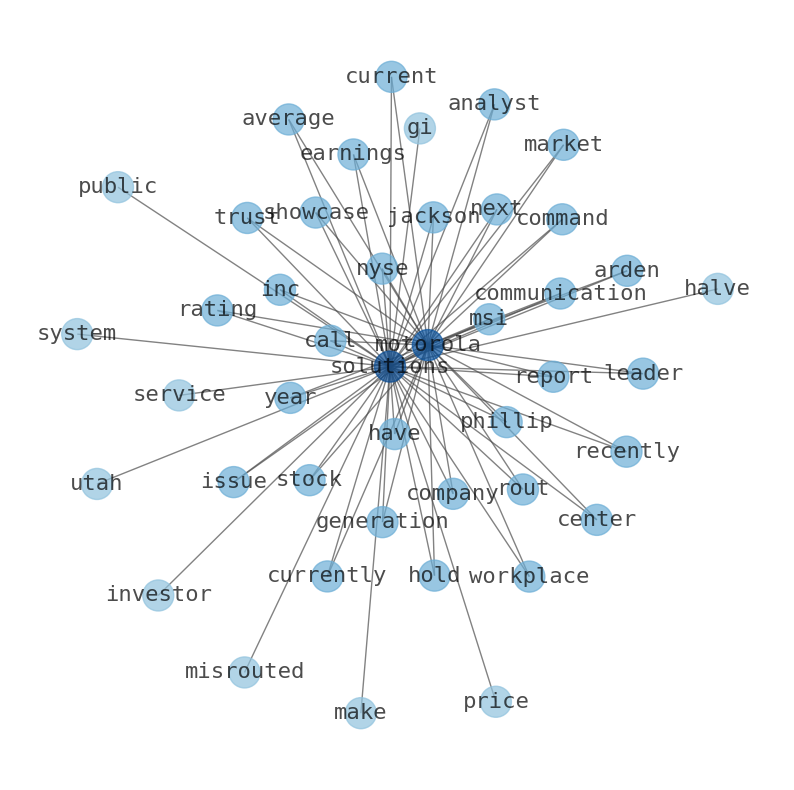

Keywords

Are looking for the most relevant information about Motorola Solutions? Investor spend a lot of time searching for information to make investment decisions in Motorola Solutions. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Motorola Solutions are: Motorola, Solutions, stock, dividend, company, safer, Inc, and the most common words in the summary are: solution, motorola, stock, price, market, msi, share, . One of the sentences in the summary was: Wall Street analysts recommend Motorola Solutions stock as a Buy, Hold or Sell.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #solution #motorola #stock #price #market #msi #share.

Read more →Related Results

Motorola Solutions

Open: 338.61 Close: 340.68 Change: 2.08

Read more →

Motorola Solutions

Open: 328.5 Close: 327.93 Change: -0.57

Read more →

Motorola Solutions

Open: 324.0 Close: 323.83 Change: -0.17

Read more →

Motorola Solutions

Open: 272.15 Close: 276.39 Change: 4.24

Read more →

Motorola Solutions

Open: 290.39 Close: 291.49 Change: 1.1

Read more →

Motorola Solutions

Open: 279.92 Close: 280.39 Change: 0.47

Read more →

Motorola Solutions

Open: 333.87 Close: 335.41 Change: 1.54

Read more →

Motorola Solutions

Open: 316.28 Close: 312.68 Change: -3.6

Read more →

Motorola Solutions

Open: 294.0 Close: 299.42 Change: 5.42

Read more →

Motorola Solutions

Open: 280.55 Close: 280.92 Change: 0.37

Read more →

Motorola Solutions

Open: 290.74 Close: 293.28 Change: 2.54

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo