The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Moodys

Youtube Subscribe

Open: 392.12 Close: 387.01 Change: -5.11

How to know if Moody's Stock is a risky investment without reading the whole internet.

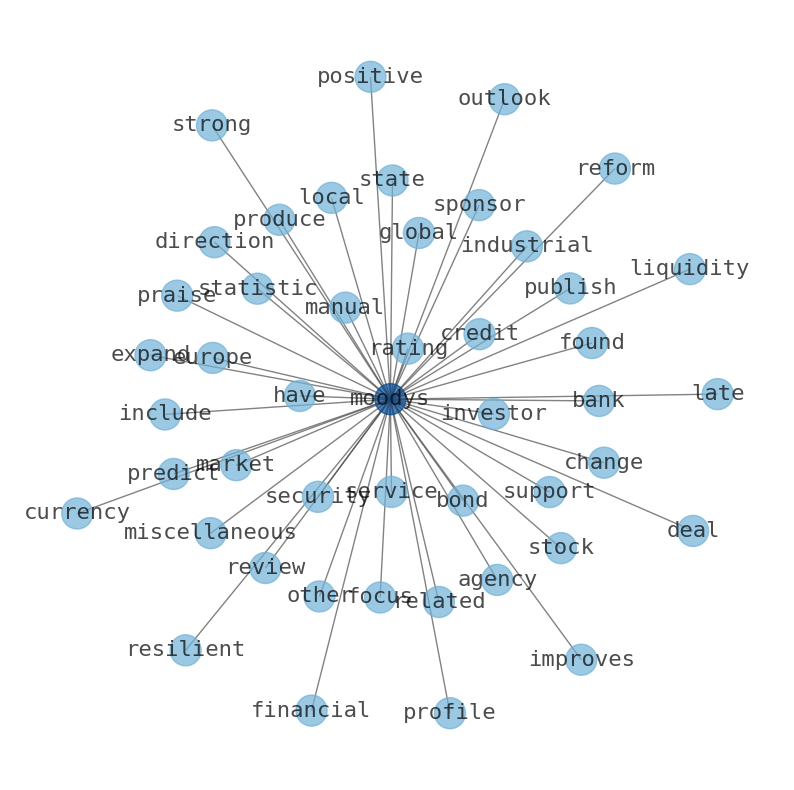

This document will help you to evaluate Moodys without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Moodys are: Moodys, strong, deposit, risk, Investors, Service, rating, and the …

Stock Summary

Moody's Corporation operates as an integrated risk assessment firm worldwide. Moody's Investors Service publishes credit ratings and provides assessment services on various debt obligations. Moody Analytics segment develops a range of products and services that support the risk management activities of institutional participants.

Today's Summary

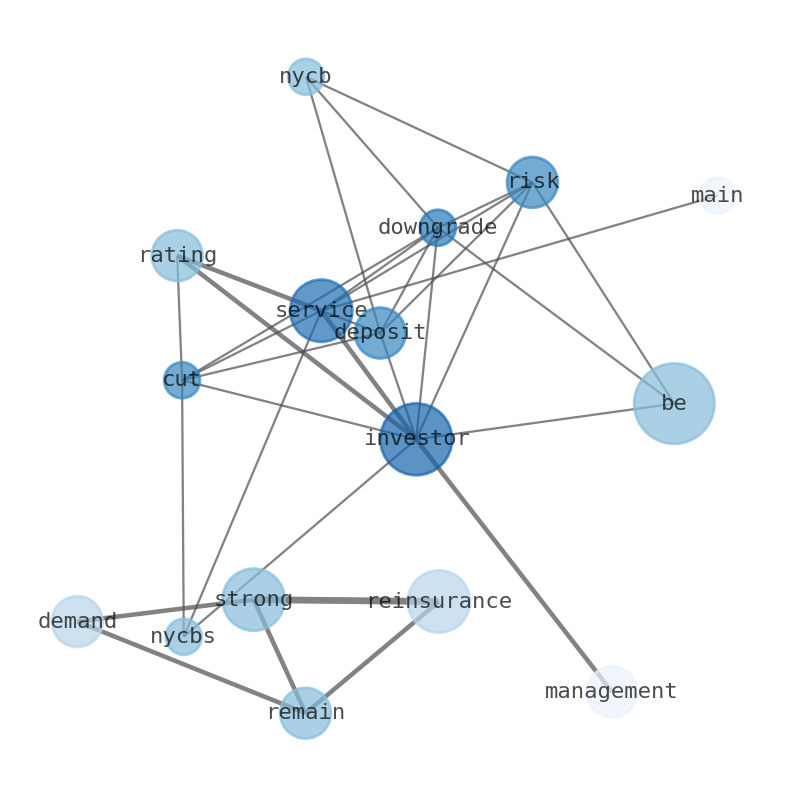

Moodys Investors Service cut deposit rating of NYCBs main banking subsidiary by four notches. €300 billion of European spec-grade corporate debt needs refinancing by 2026. Reinsurance demand to remain strong but prices to peak in 2024.

Today's News

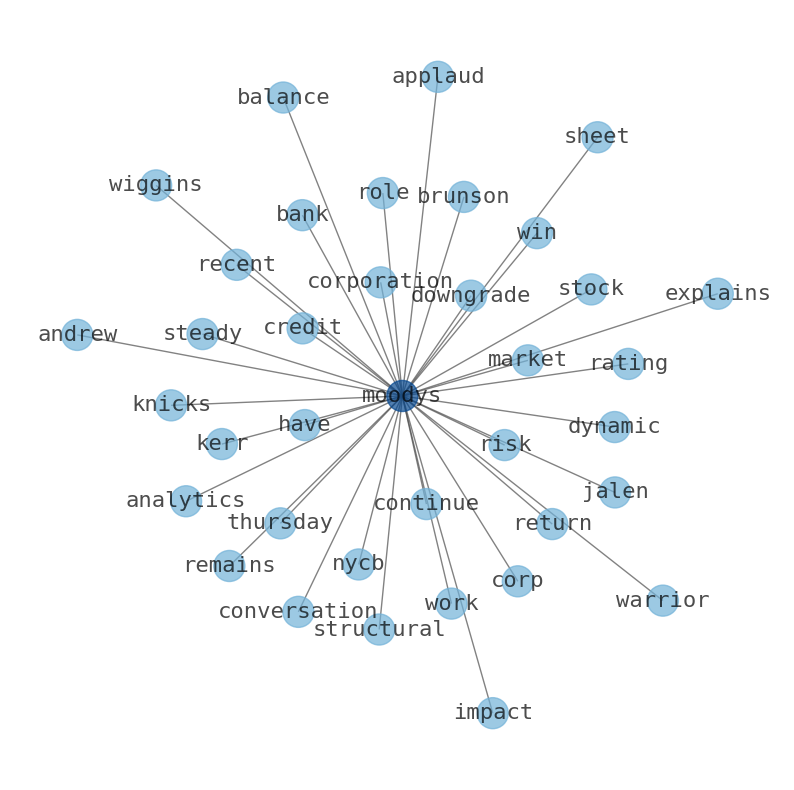

Some NYCB deposits may be at risk after another Moodys downgrade. Moodys Investors Service cut deposit rating of NYCBs main banking subsidiary by four notches. Demand for reinsurance will remain robust in 2024, supporting strong underwriting earnings absent major natural catastrophes. €300 billion of European spec-grade corporate debt needs refinancing by 2026. Moodys Corporation (NYSE: MCO) posted an updated management presentation for investors on its website, ir.moodys.com, on Thursday, February 29, 2024. Moodys Foundation has announced four new nonprofit partners for 2024. Moodys Corporation announced today that Rob Fauber, President and Chief Executive Officer, will speak at the J.P. Morgan Ultimate Services Investor Conference on November 16, 2023. Moodys is creating a unit to research and rate private credit. Moodys CEO Gregory Robinson, CFA, FRM, CAIA Managing Director | Head of Relationship Management, North America at Moodys Investors Service. Moodys credit rating for the United States was last set at Aaa with negative outlook. Moodys is proud to foster an environment that values and appreciates everyones unique abilities. Moodys employees volunteer with American Corporate Partners to mentor and help veterans. Moodys is the latest to predict a peak in reinsurance pricing in 2024, following strong rate increases in recent years. Reinsurance demand to remain strong but prices to peak in 2024. Moodys continues to provide meaningful opportunities for minority employees. Moodys Corp. on Wednesday tweaked the name of its credit-assessing unit and shortened its name. Moodys has predicted that alternative managers will start to build out their own origination capabilities, which will increase their market share but may also intensify risks in private markets.

Stock Profile

"Moody's Corporation operates as an integrated risk assessment firm worldwide. It operates in two segments, Moody's Investors Service and Moody's Analytics. The Moody's Investors Service segment publishes credit ratings and provides assessment services on various debt obligations, programs and facilities, and entities that issue such obligations, such as various corporate, financial institution, and governmental obligations, as well as and structured finance securities. Its ratings are disseminated through press releases to the public through electronic media, including the internet and real-time information systems used by securities traders and investors. The Moody's Analytics segment develops a range of products and services that support the risk management activities of institutional participants in financial markets; and offers subscription based research, data, and analytical products comprising credit ratings, credit research, quantitative credit scores and other analytical tools, economic research and forecasts, business intelligence and company information products, commercial real estate data and analytical tools, and learning solutions. It also offers offshore research and analytic services to the global financial and corporate sectors; and risk management software solutions, as well as related risk management advisory engagements services. The company was formerly known as Dun and Bradstreet Company and changed its name to Moody's Corporation in September 2000. Moody's Corporation was founded in 1900 and is headquartered in New York, New York."

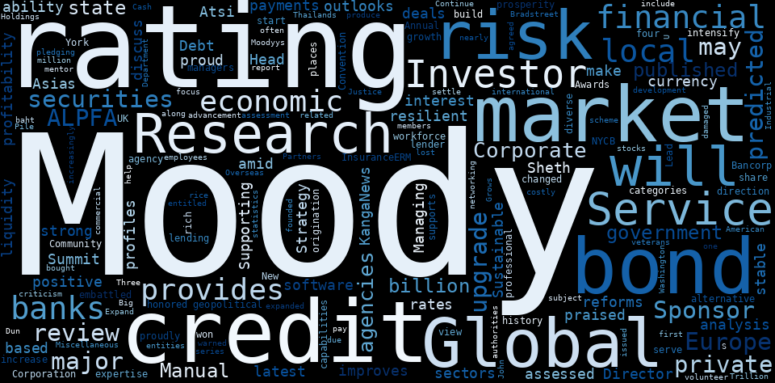

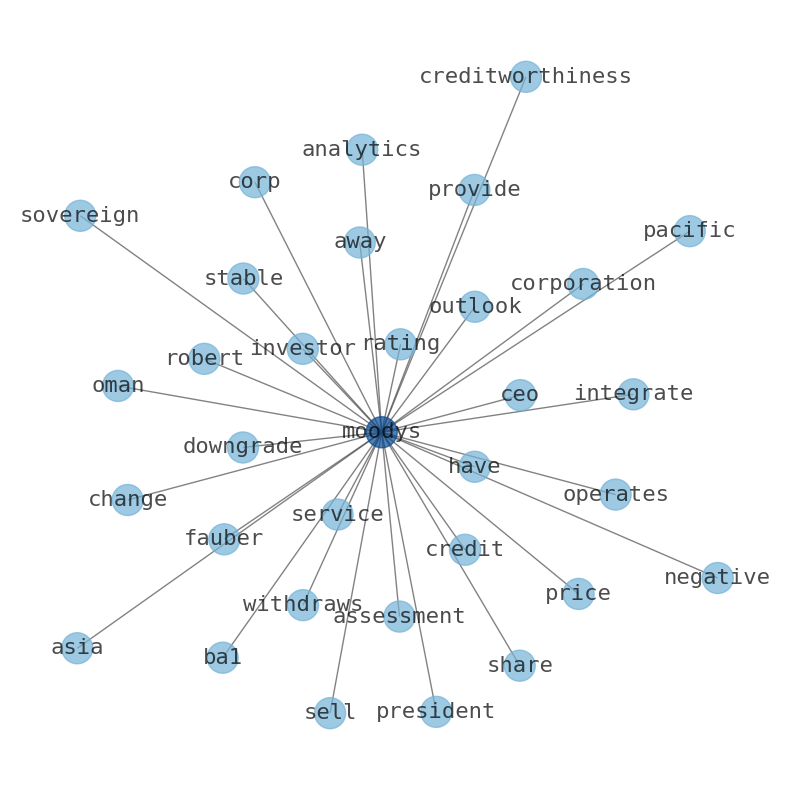

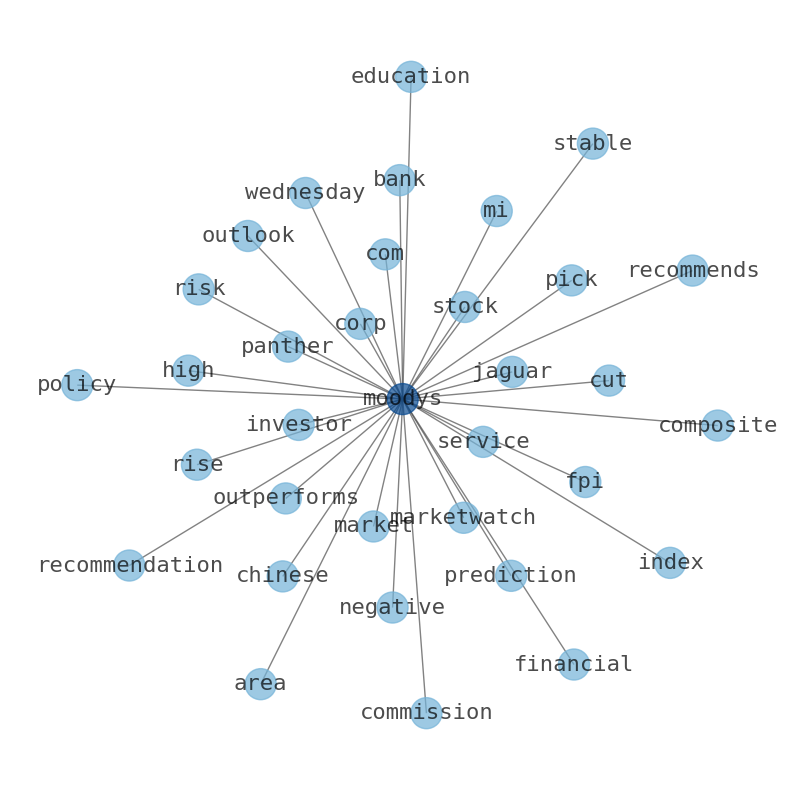

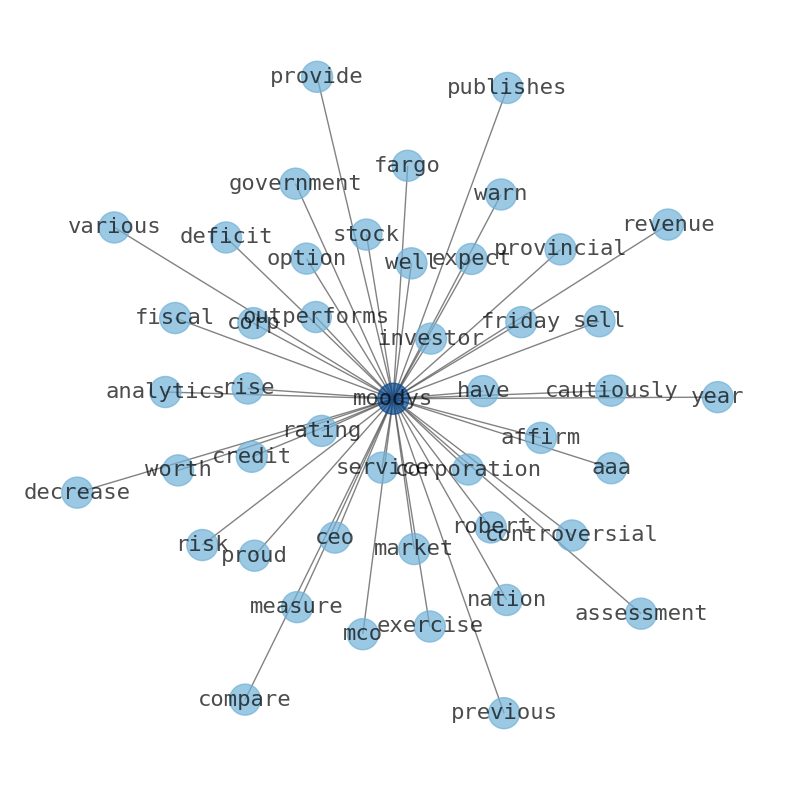

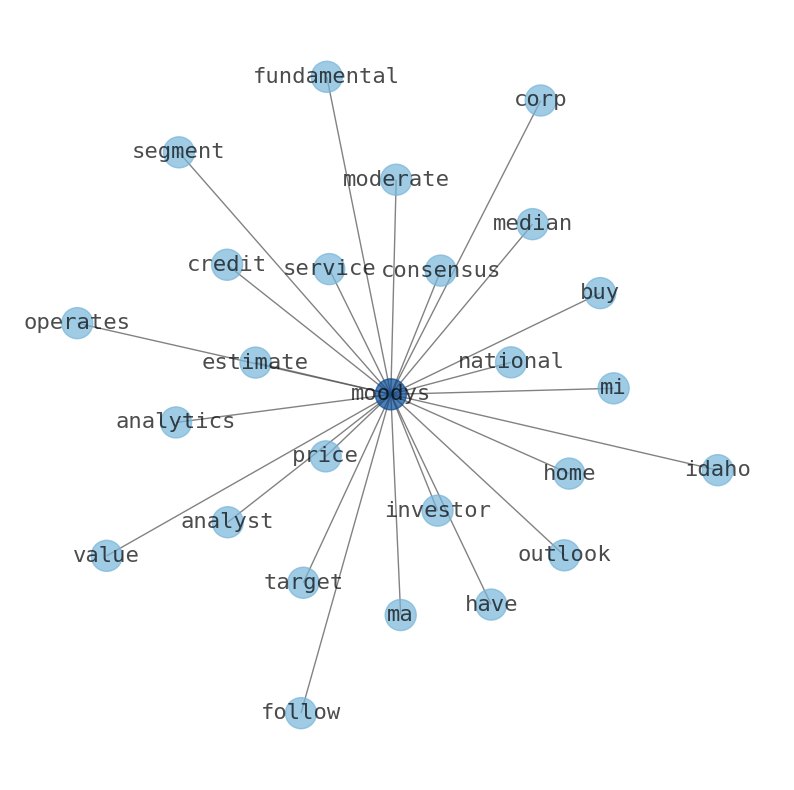

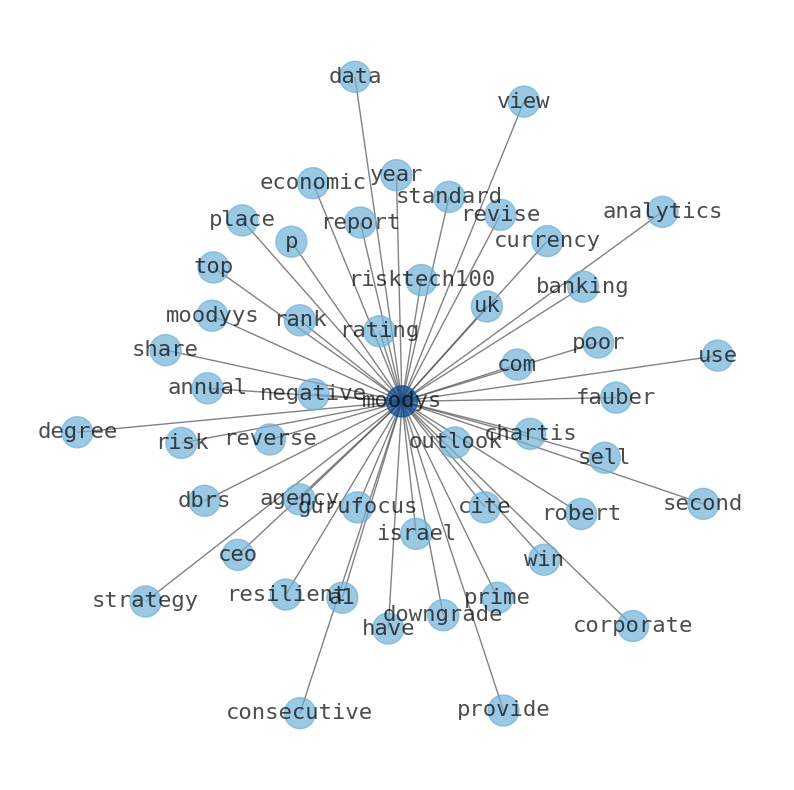

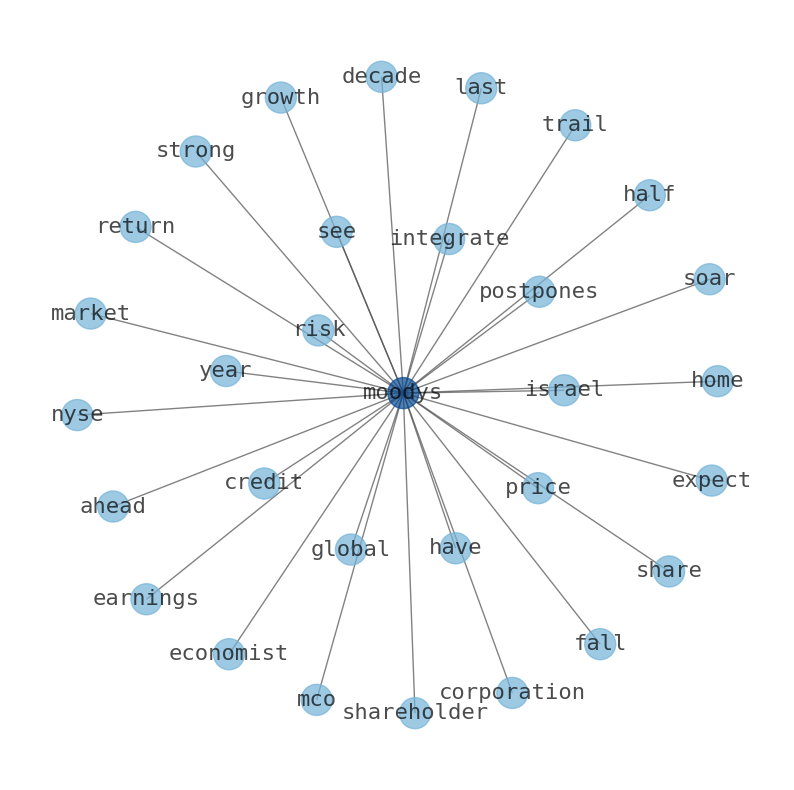

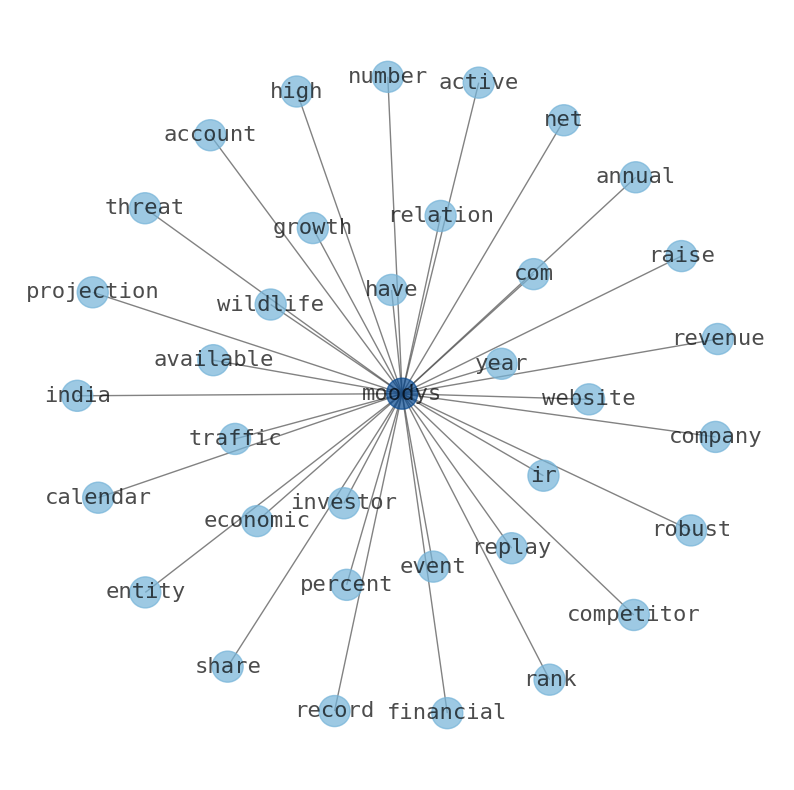

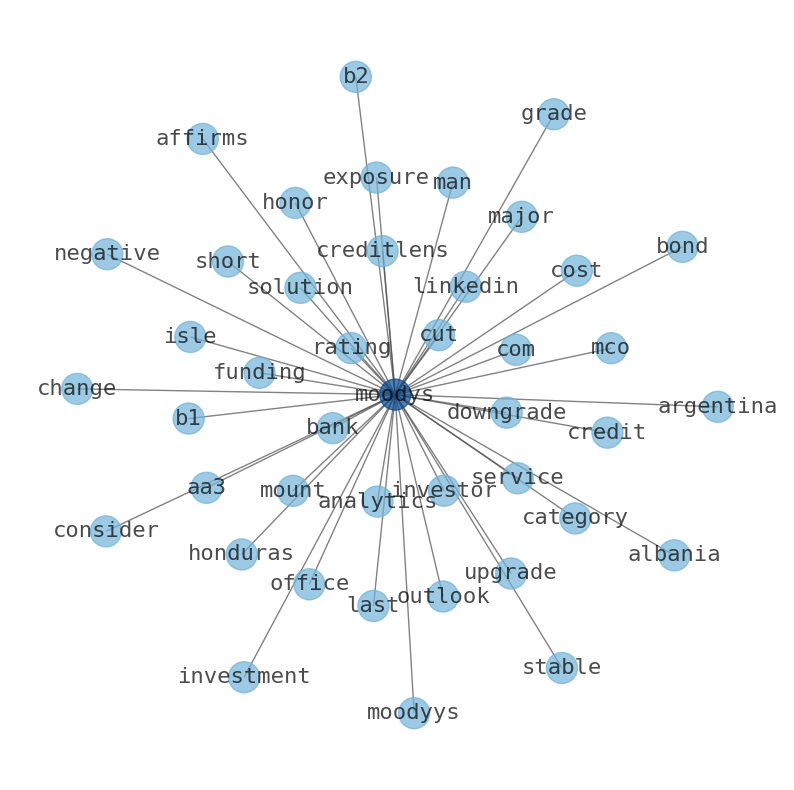

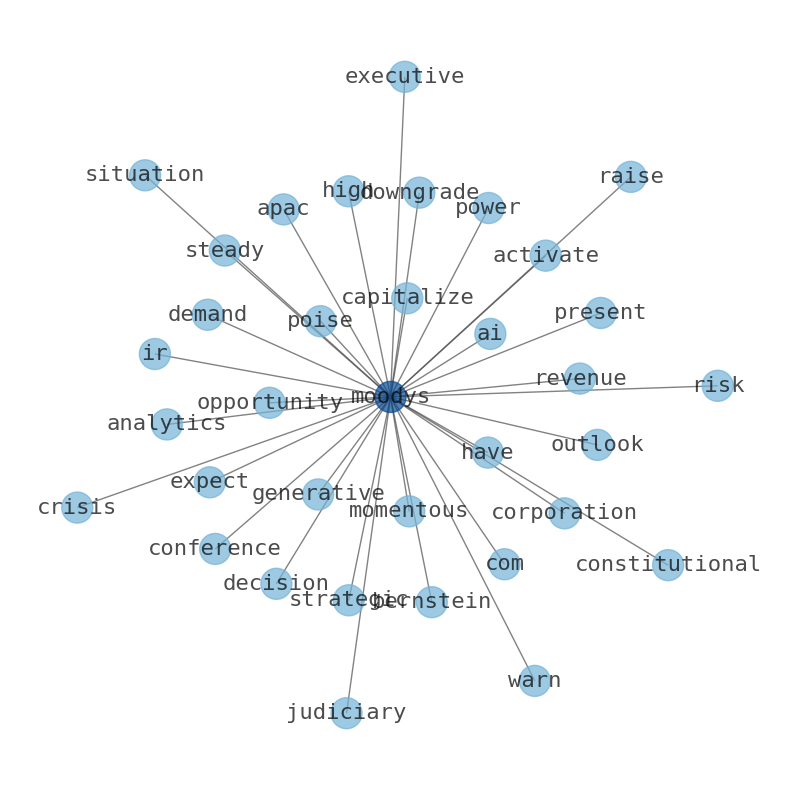

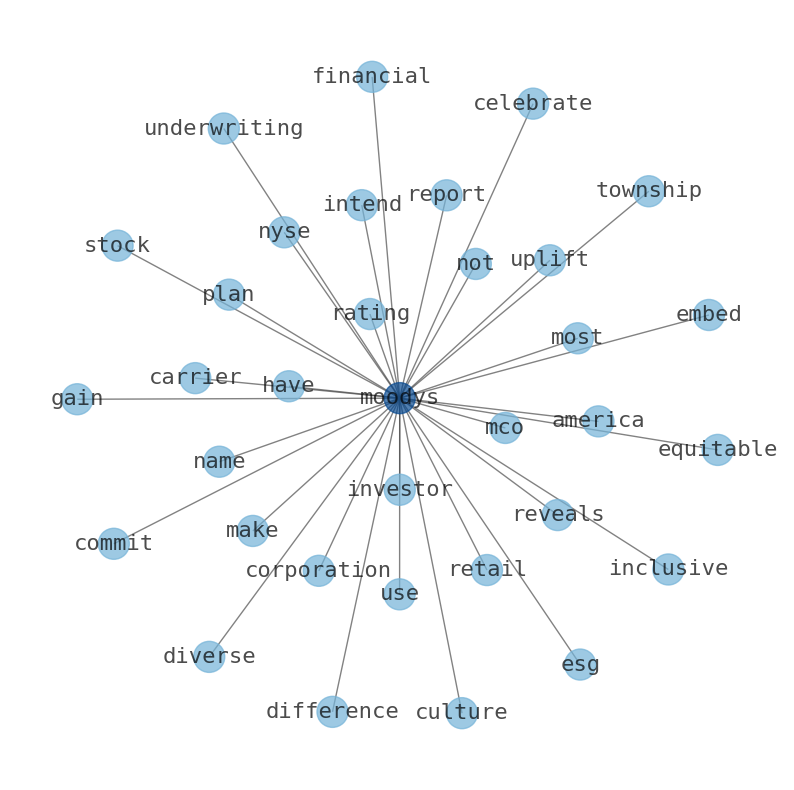

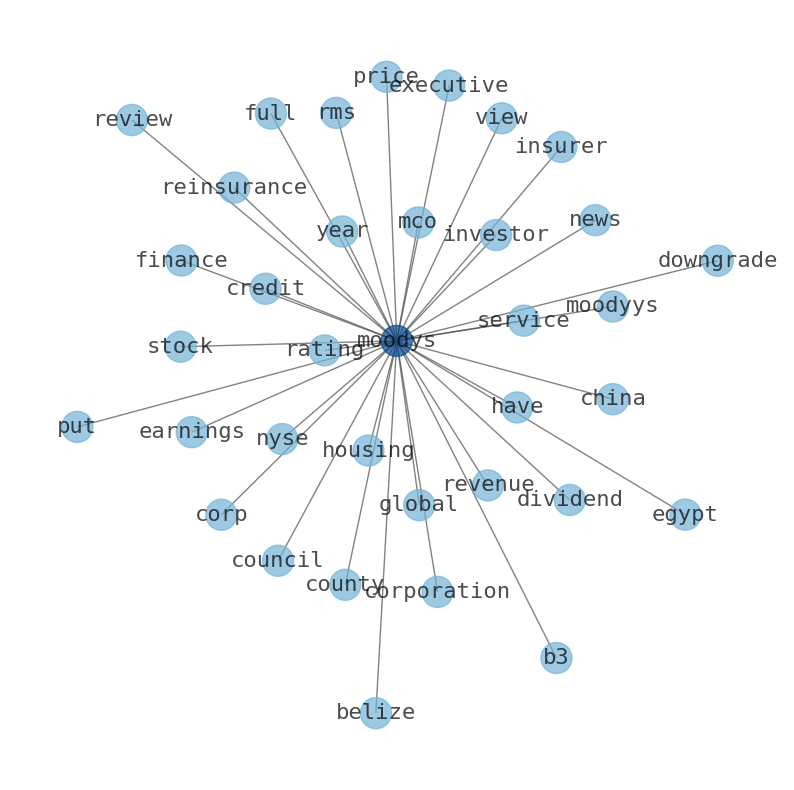

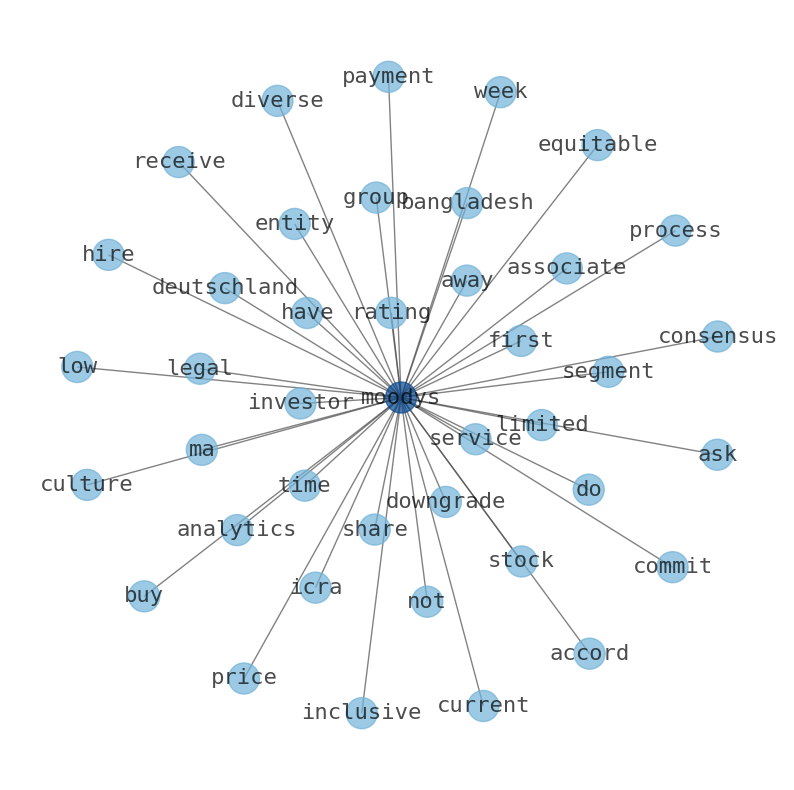

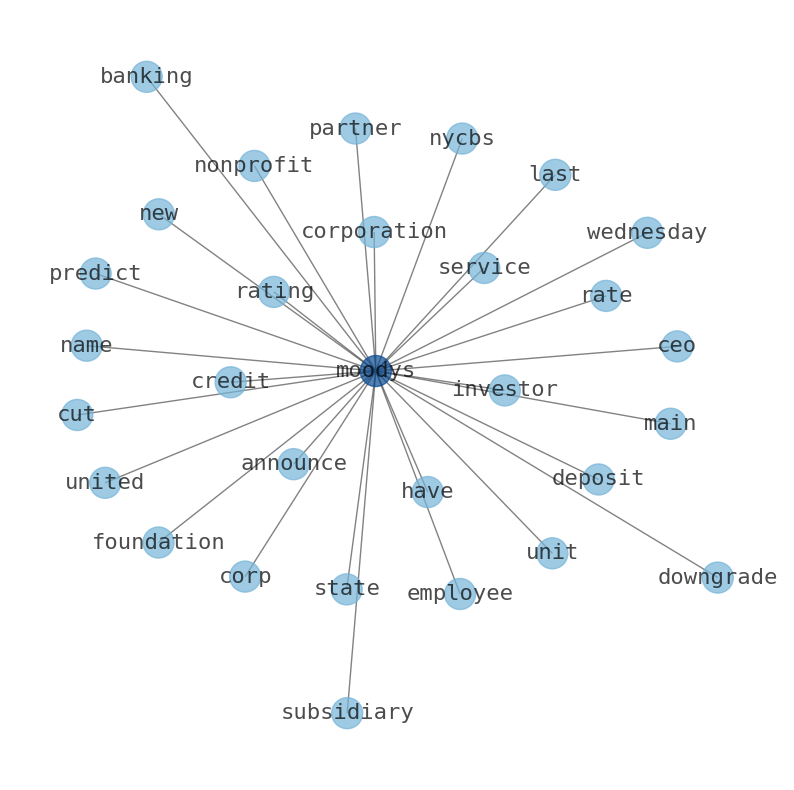

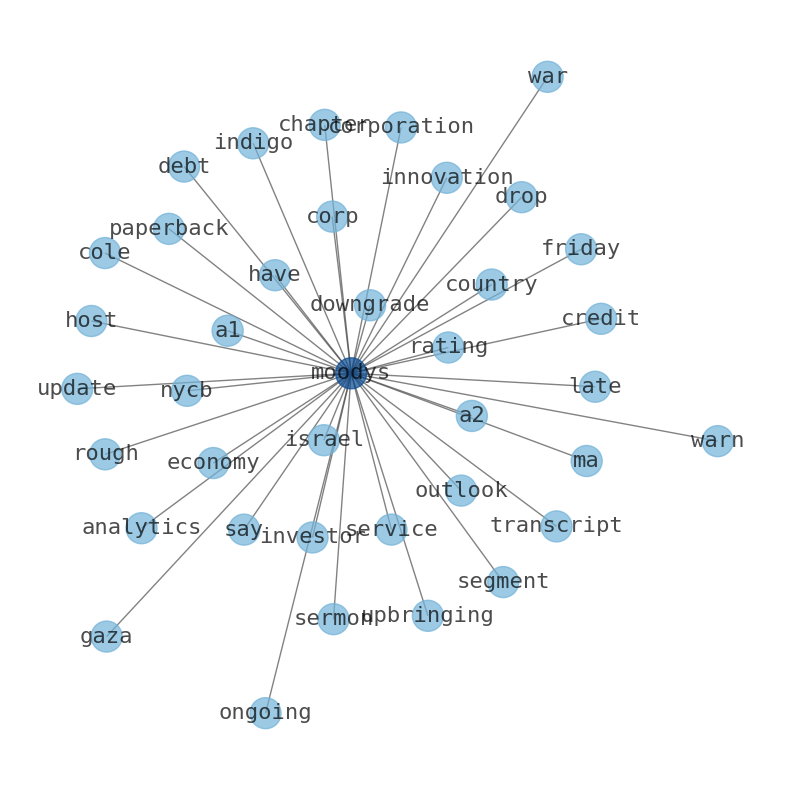

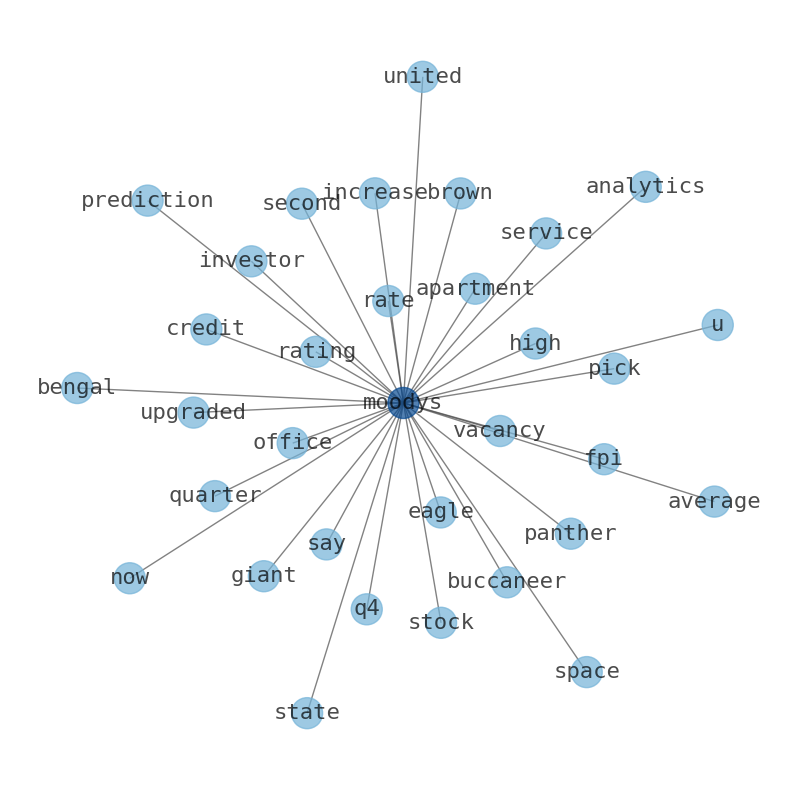

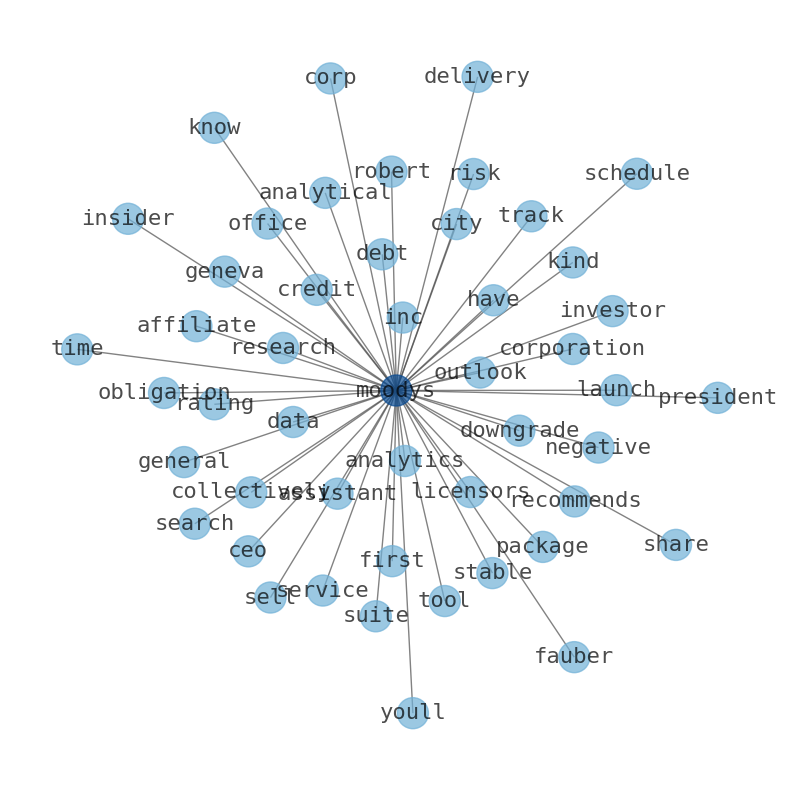

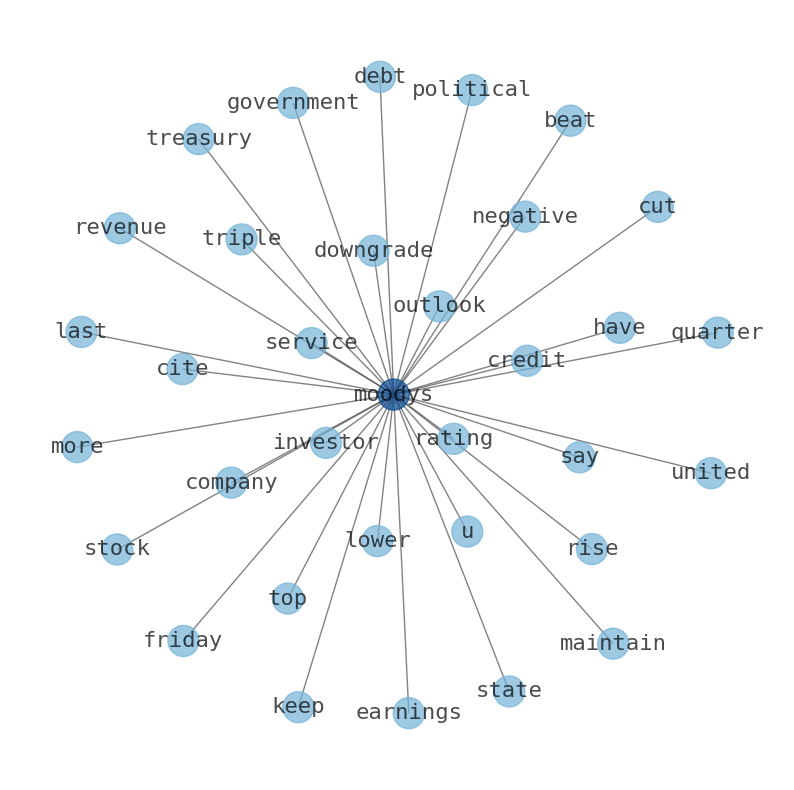

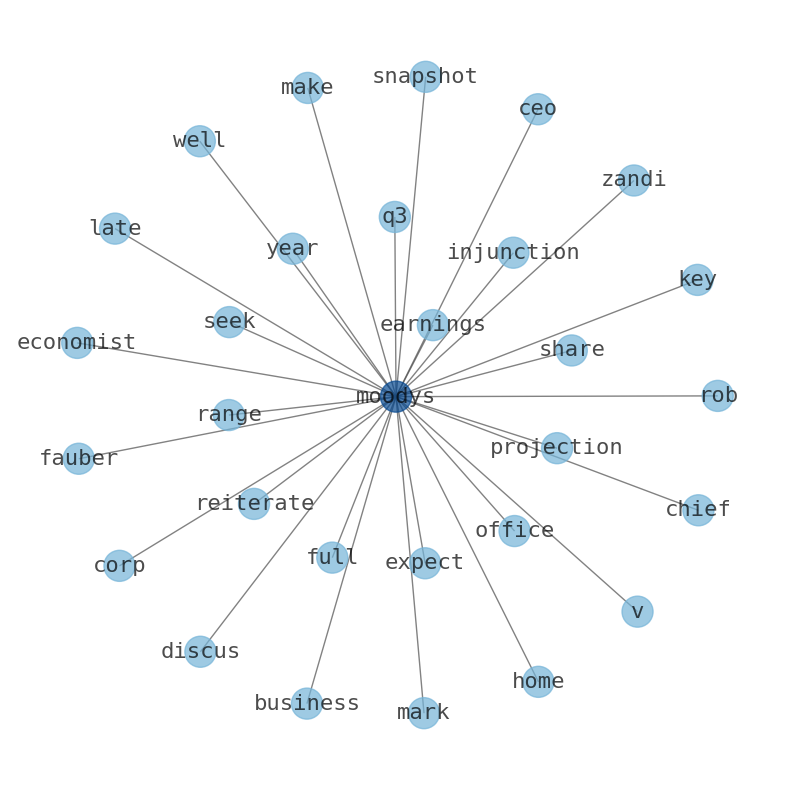

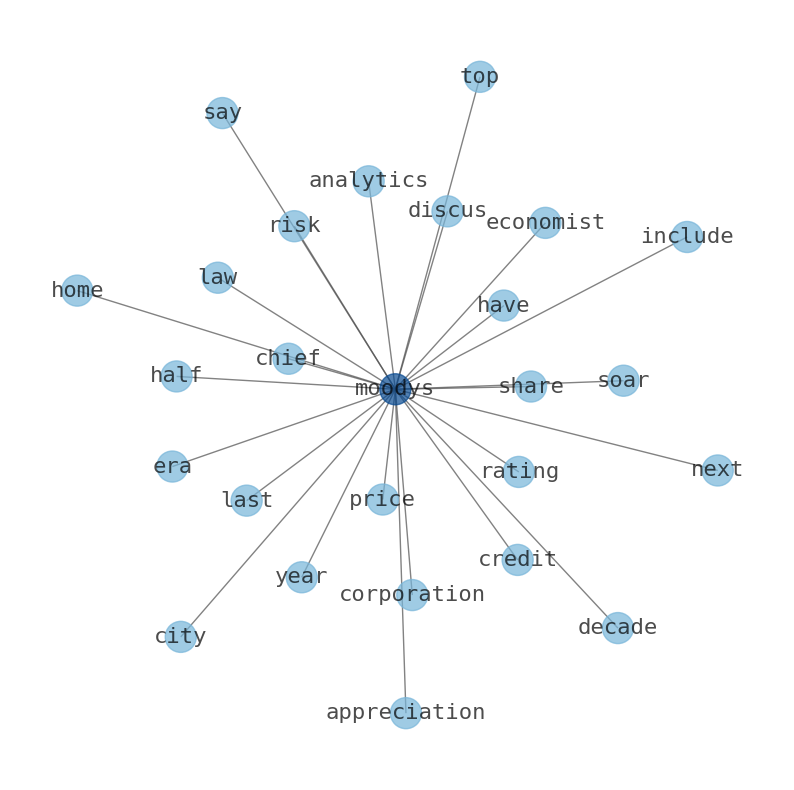

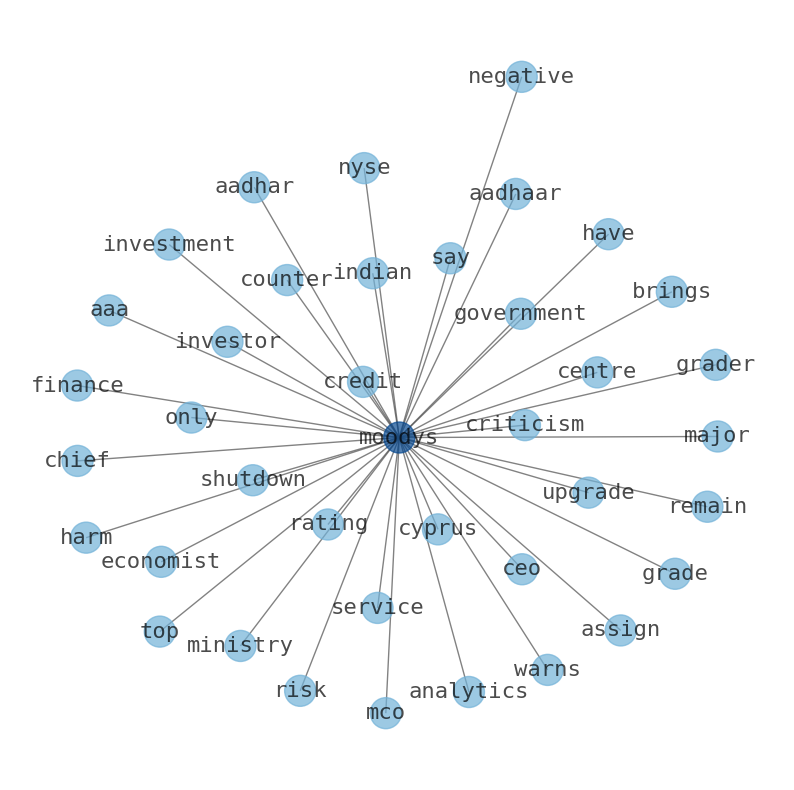

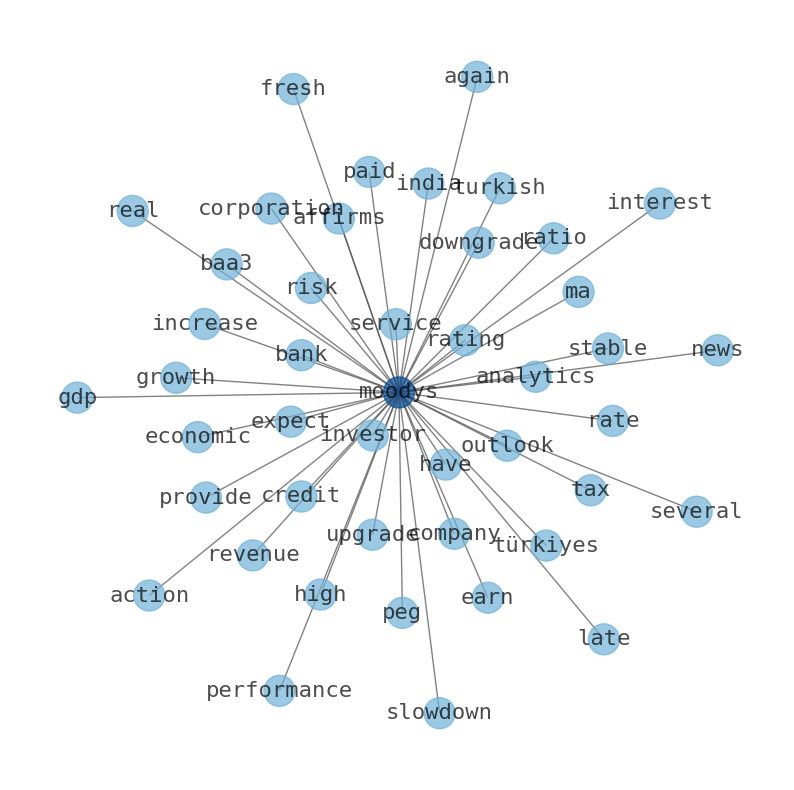

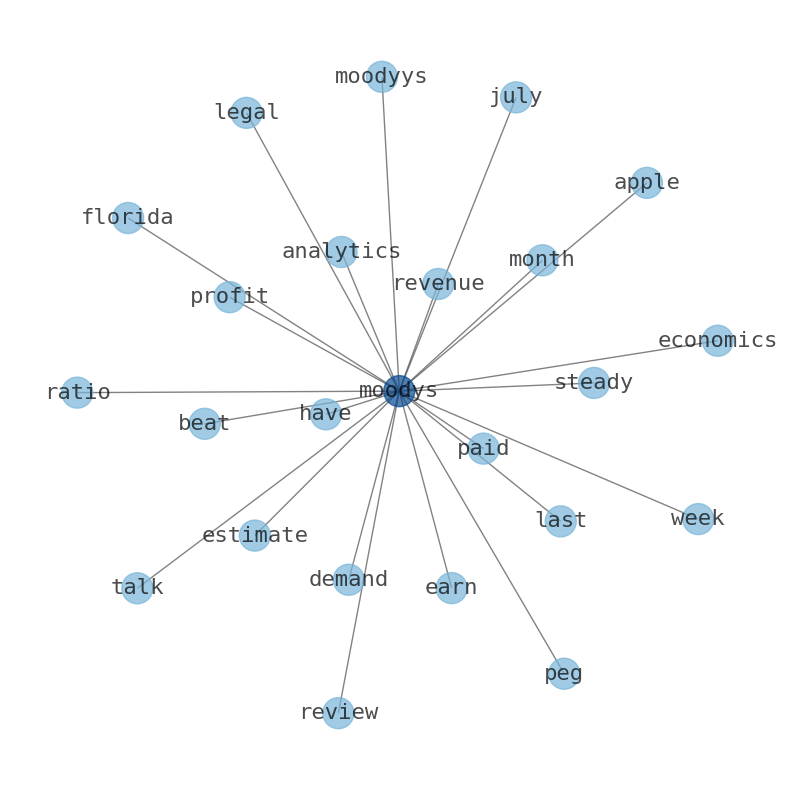

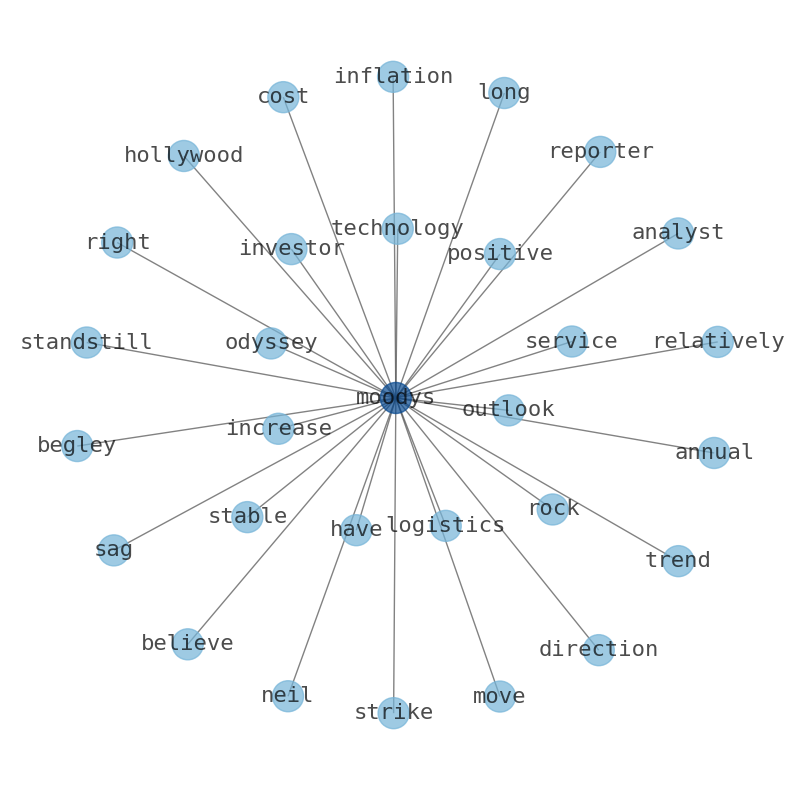

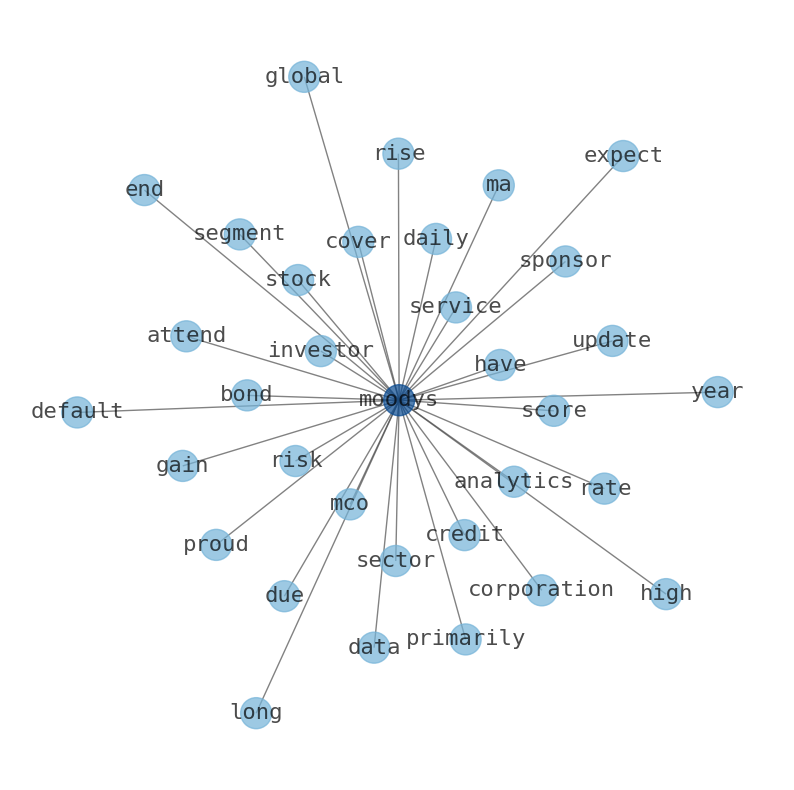

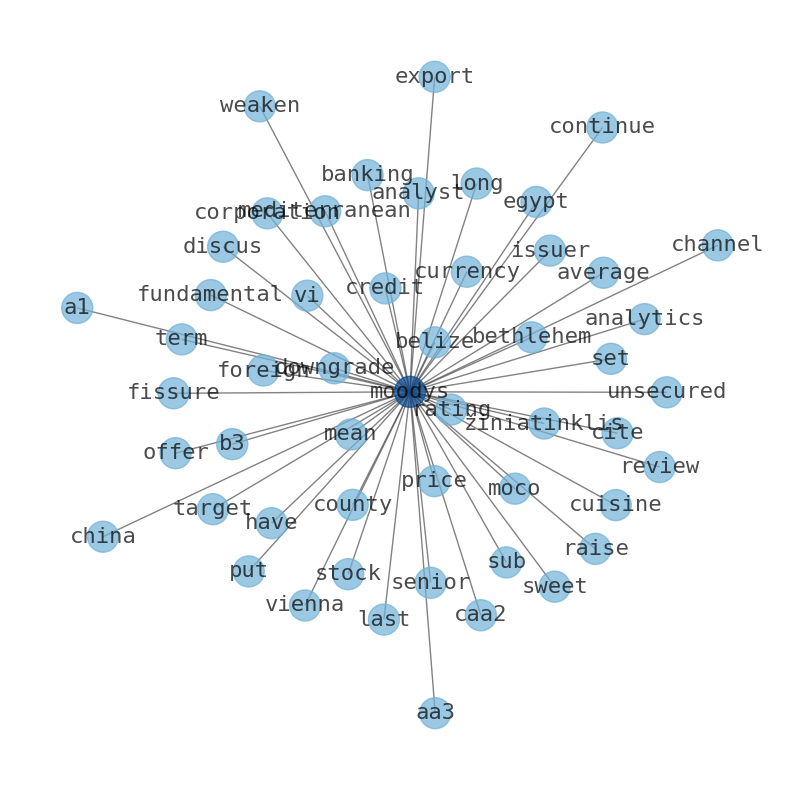

Keywords

The game is changing. There is a new strategy to evaluate Moodys fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Moodys are: Moodys, strong, deposit, risk, Investors, Service, rating, and the most common words in the summary are: job, best, credit, moodys, moody, new, rating, . One of the sentences in the summary was: Reinsurance demand to remain strong but prices to peak in 2024.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #job #best #credit #moodys #moody #new #rating.

Read more →Related Results

Moodys

Open: 389.34 Close: 390.3 Change: 0.96

Read more →

Moodys

Open: 380.82 Close: 382.5 Change: 1.68

Read more →

Moodys

Open: 385.46 Close: 386.84 Change: 1.38

Read more →

Moodys

Open: 390.63 Close: 390.3 Change: -0.33

Read more →

Moodys

Open: 364.0 Close: 371.05 Change: 7.05

Read more →

Moodys

Open: 318.99 Close: 325.8 Change: 6.81

Read more →

Moodys

Open: 310.38 Close: 309.6 Change: -0.78

Read more →

Moodys

Open: 319.34 Close: 320.97 Change: 1.63

Read more →

Moodys

Open: 339.69 Close: 339.32 Change: -0.37

Read more →

Moodys

Open: 342.13 Close: 342.41 Change: 0.28

Read more →

Moodys

Open: 354.55 Close: 361.04 Change: 6.49

Read more →

Moodys

Open: 340.14 Close: 342.1 Change: 1.96

Read more →

Moodys

Open: 333.55 Close: 337.28 Change: 3.73

Read more →

Moodys

Open: 316.55 Close: 323.39 Change: 6.84

Read more →

Moodys

Open: 392.12 Close: 387.01 Change: -5.11

Read more →

Moodys

Open: 407.6 Close: 401.09 Change: -6.51

Read more →

Moodys

Open: 375.06 Close: 375.42 Change: 0.36

Read more →

Moodys

Open: 388.66 Close: 387.58 Change: -1.08

Read more →

Moodys

Open: 342.7 Close: 343.51 Change: 0.81

Read more →

Moodys

Open: 310.74 Close: 301.97 Change: -8.77

Read more →

Moodys

Open: 319.34 Close: 321.4 Change: 2.06

Read more →

Moodys

Open: 320.93 Close: 316.17 Change: -4.76

Read more →

Moodys

Open: 324.65 Close: 327.02 Change: 2.37

Read more →

Moodys

Open: 355.5 Close: 353.46 Change: -2.04

Read more →

Moodys

Open: 355.58 Close: 359.44 Change: 3.86

Read more →

Moodys

Open: 338.77 Close: 338.19 Change: -0.58

Read more →

Moodys

Open: 333.55 Close: 337.28 Change: 3.73

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo