The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Micron Technology

Youtube Subscribe

Open: 64.5 Close: 63.11 Change: -1.39

Don't invest in Micron Technology before reading this automated analysis produce by an AI.

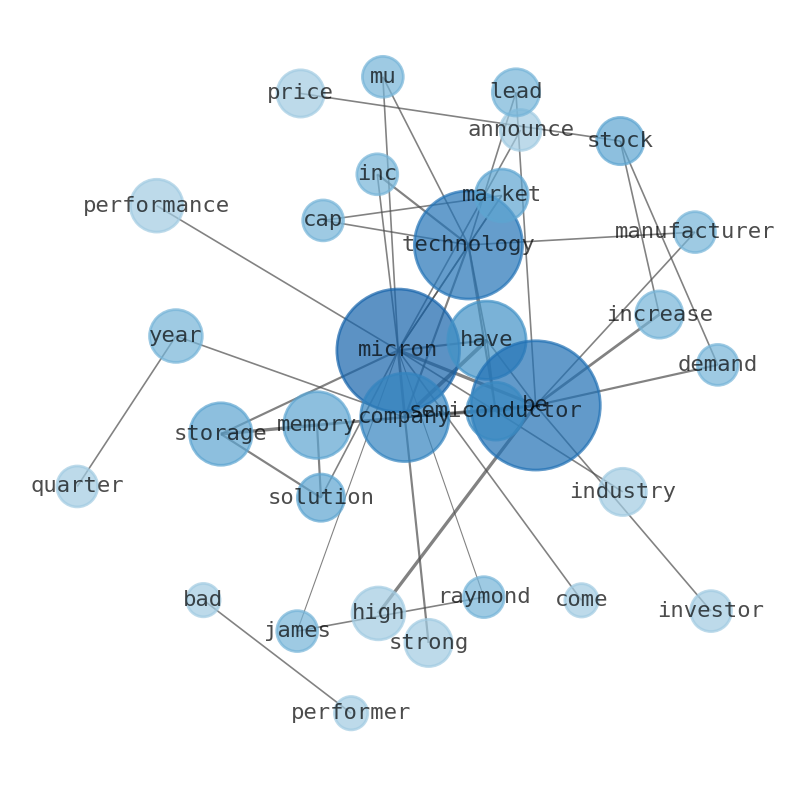

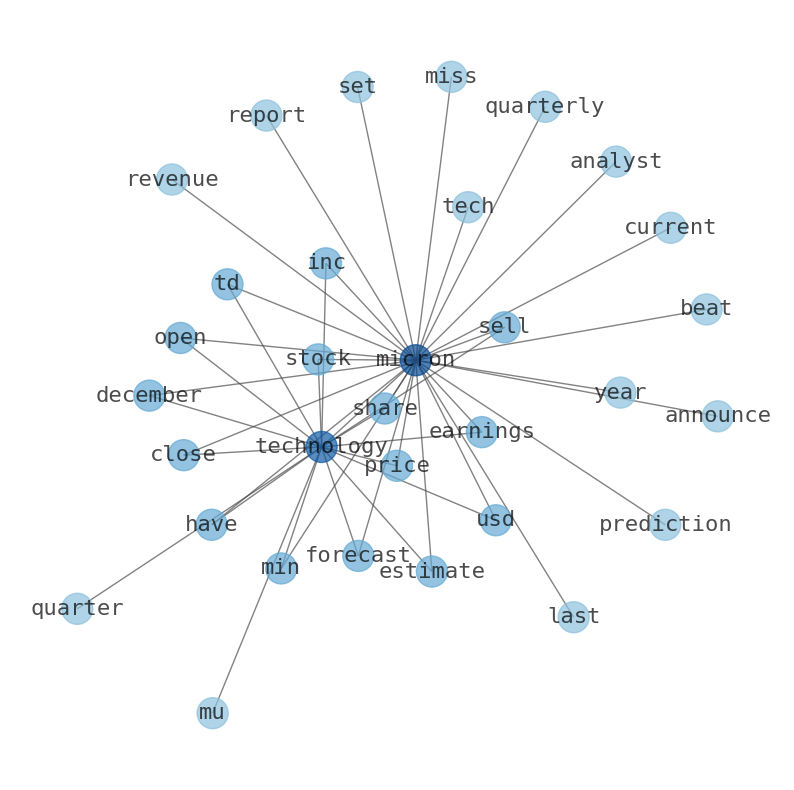

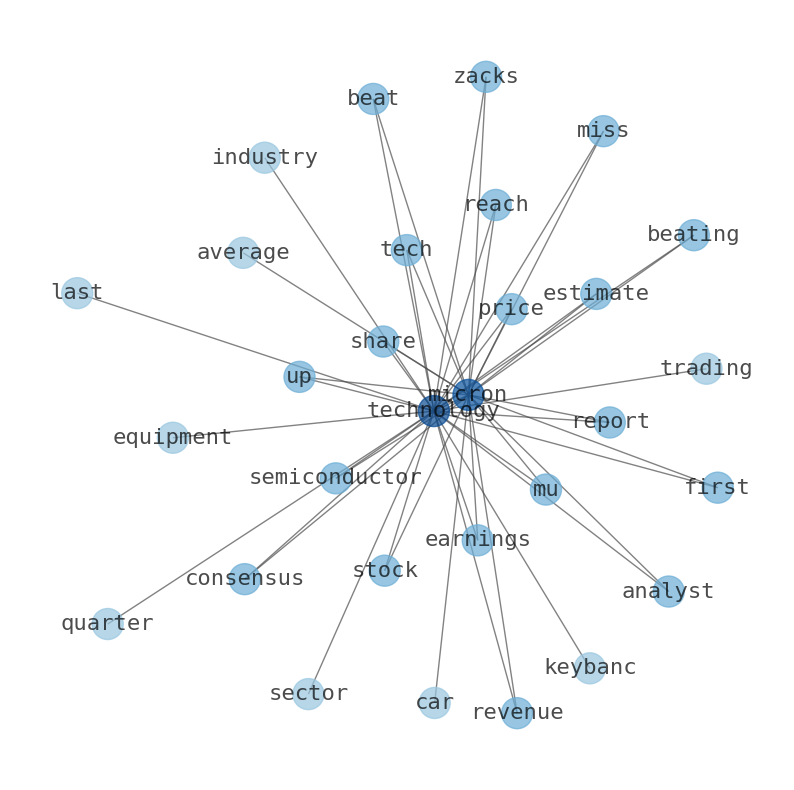

Are looking for the most relevant information about Micron Technology? Investor spend a lot of time searching for information to make investment decisions in Micron Technology. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Micron Technology are: Micron, Technology, company, memory, storage, semiconductor, year, and the most common words in the summary are: micron, technology, memory, company, stock, inc, market, . One of the sentences in the summary was: The company has a market capitalization of $73.1 billion.. Other searches …

Stock Summary

Micron Technology, Inc. designs, develops, manufactures, and sells memory and storage products. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit and Embedded Business Unit. DRAM products are.

Today's Summary

Raymond James Maintains Micron Technology (MU) Outperform Recommendation. The average price target represents an increase of 5.15%. The company has a market capitalization of $73.1 billion.

Today's News

Raymond James Maintains Micron Technology (MU) Outperform Recommendation Raymond James. Fintel reports that on June 29, 2023,Raymond James maintained coverage of Micron. The average price target represents an increase of 5.15%. Micron Technology was the worst performer in the Nasdaq 100 and second-worst performer in S&P 500 on Thursday. Chip maker says it expects margins to improve as industry supply-demand balance is gradually restored. Micron Technology, Inc. (NASDAQ: MU) Q3 2023 highlights revenue of $3.75 billion versus $3.69 billion for the prior quarter and $8.64 billion for same period last year. Micron announced a new DRAM and NAND assembly and test facility in India. Micron Technology announced the Micron 9400 NVMe™ SSD is in volume production and immediately available from channel partners and to global OEM customers for use in servers requiring the highest levels of storage performance. Micron announced the members of the members. Micron Technology outperformed analysts revenue and earnings expectations this quarter. The company has a market capitalization of $73.1 billion and more than $10.4 billion in cash. Micron Technologys inventory days came in at 170, 40 days above the five year average. Micron Technology is a well-known American memory and data storage solution provider. Founded in 1978, Micron is a leader in the production of memory and storage solutions for a wide range of applications. Micron Technology is a leading global manufacturer of semiconductor devices. The company has been around since 1978 and has continued to innovate and expand its product offerings. One of Micron Technologys most significant recent developments is the launch of their new NAND technology. The Micron Technology Market Cap is influenced by several factors, including economic conditions, company performance, and competition. When the economy is strong, investor confidence is high, and there is an increase in the demand for stocks. This results in a higher market cap for companies such as Micron. Micron Technology has come a long way and has established its name as one of the leading companies in the world of memory and storage solutions. The impact of Micron technology can be seen in the increased efficiency and performance of the devices that use it. Micron Technology ended the fiscal third quarter with revenue down 57% year over year to $3.8 billion, but grew steadily by nearly 2%. The company has a strong position in 5G technology. Micron Technology Inc is a leading semiconductor manufacturer that has been producing reliable, high-performance memory and storage products for over 40 years. The company has consistently delivered strong financial results through a combination of strategic investments, effective cost management, and a focus on delivering value to customers. Market capitalization is a measure of a companys total value. Micron Technology Market Cap is influenced by several factors, including economic conditions, company performance, and competition. When the economy is strong, investor confidence is high, and there is an increase in the demand for stocks, leading to a drop in stock prices. Micron Technology is one of the biggest American semiconductor manufacturers in the world. The company specializes in manufacturing dynamic random-access memory (DRAM), flash memory, and solid-state drives (SSDs) Micron is a major player in the semiconductor industry. Micron Technology Inc (MU) stock had a last price of $67.13 on June 28, 2023. The company has reported a revenue of $6.24 billion, with a net income of $1.7 billion. The price-to-earnings (P/E) ratio is 48.7, suggesting that investors are willing to pay a premium for the companys earnings. Micron Technology is known for its exceptional memory and storage solutions that power everything from gaming consoles to data centers. The semiconductor industry is one of the fastest growing industries in the world. Micron Technology is a company that specializes in producing semiconductors and memory storage devices. The company was established in 1978, and it is currently based in Boise, Idaho. The percentage of shares that are sold short for Micron has declined since its last report.

Stock Profile

"Micron Technology, Inc. designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. It provides memory and storage technologies comprises DRAM products, which are dynamic random access memory semiconductor devices with low latency that provide high-speed data retrieval; NAND products that are non-volatile and re-writeable semiconductor storage devices; and NOR memory products, which are non-volatile re-writable semiconductor memory devices that provide fast read speeds under the Micron and Crucial brands, as well as through private labels. The company offers memory products for the cloud server, enterprise, client, graphics, networking, industrial, and automotive markets, as well as for smartphone and other mobile-device markets; SSDs and component-level solutions for the enterprise and cloud, client, and consumer storage markets; discrete storage products in component and wafers; and memory and storage products for the automotive, industrial, and consumer markets. It markets its products through its direct sales force, independent sales representatives, distributors, and retailers; and web-based customer direct sales channel, as well as through channel and distribution partners. Micron Technology, Inc. was founded in 1978 and is headquartered in Boise, Idaho."

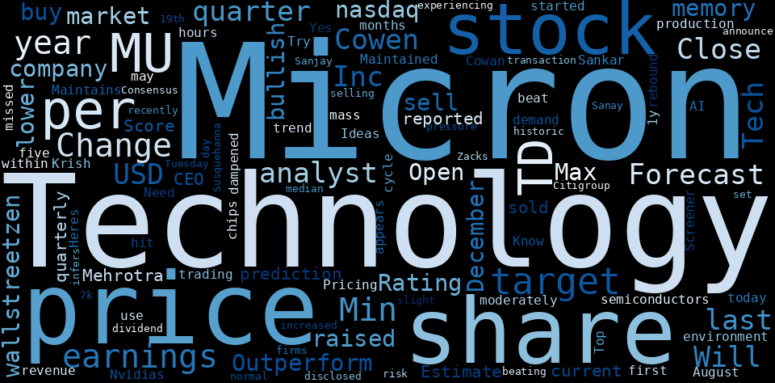

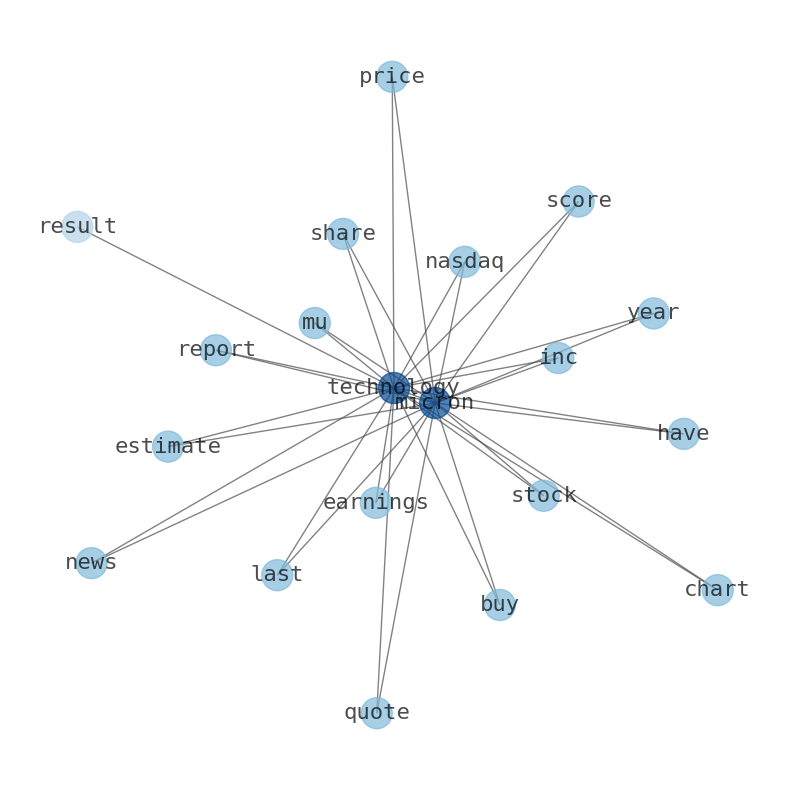

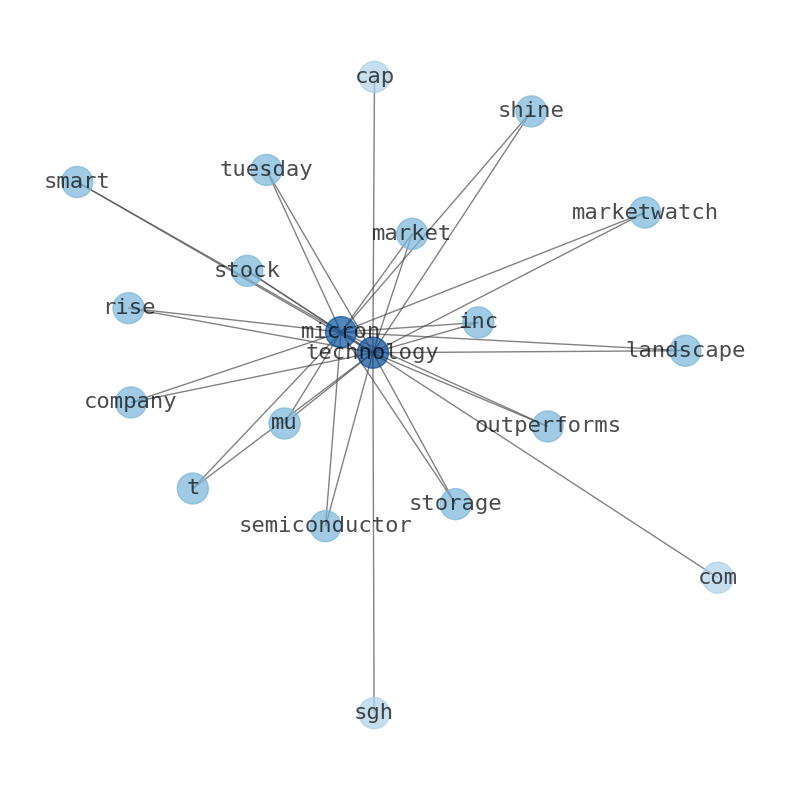

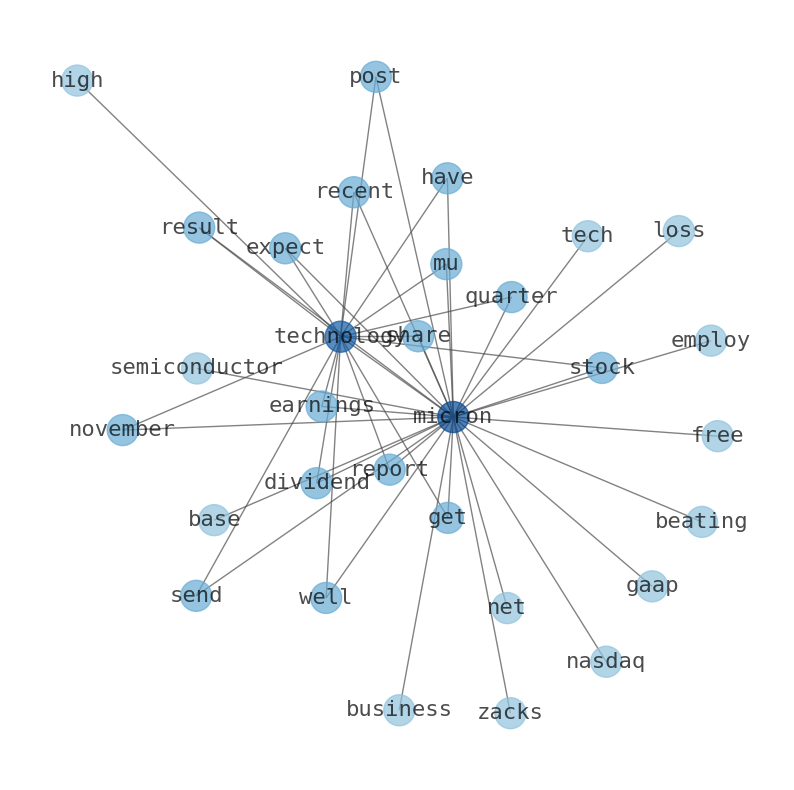

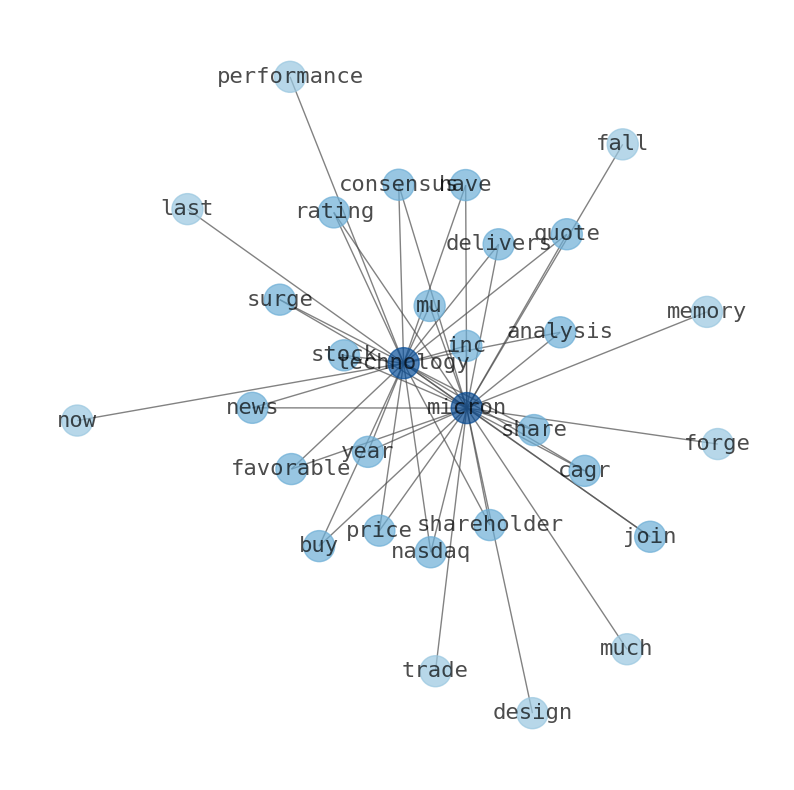

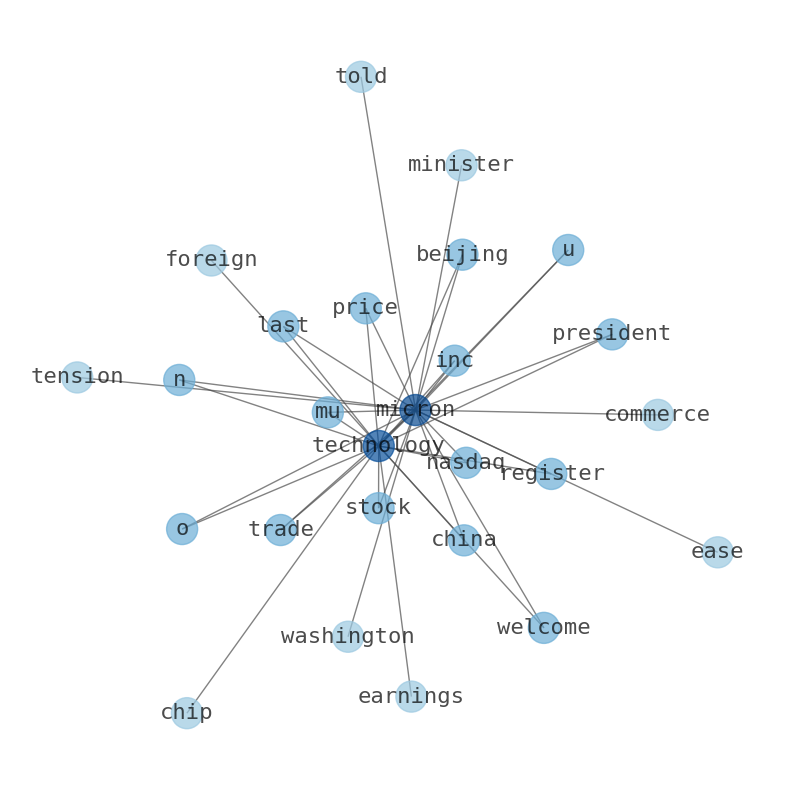

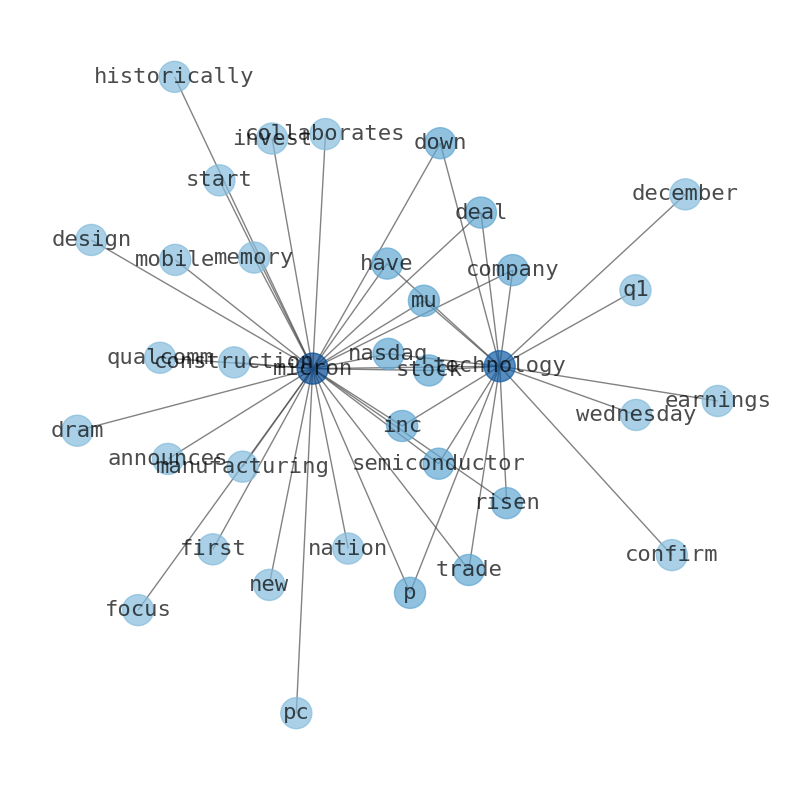

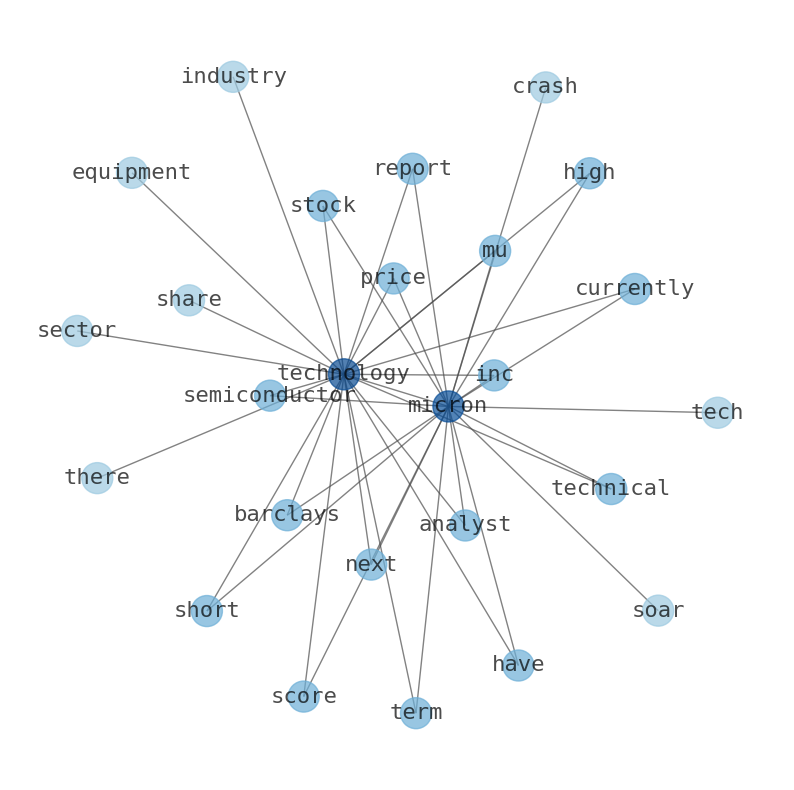

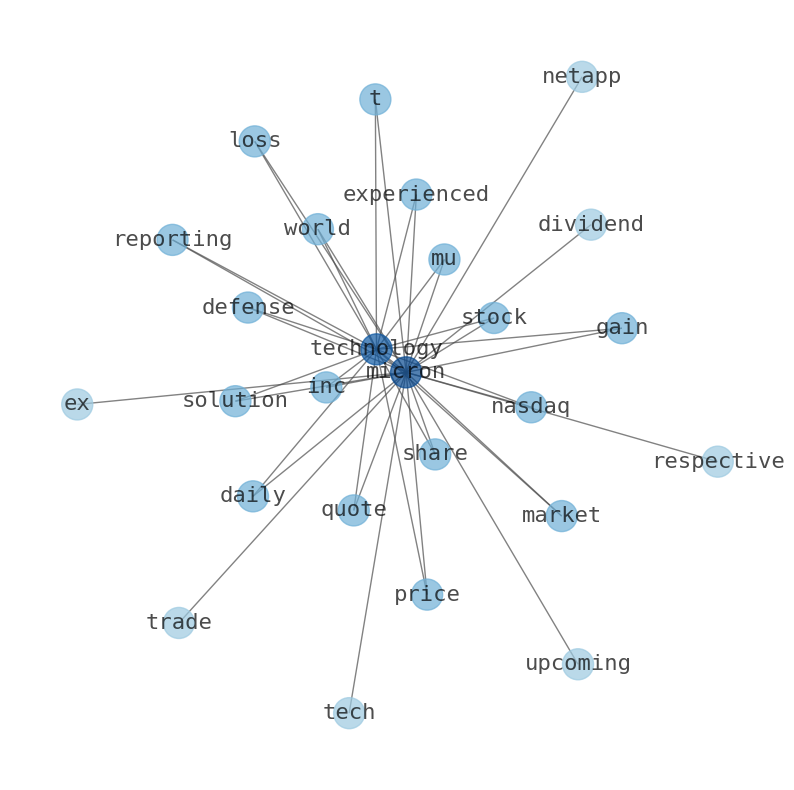

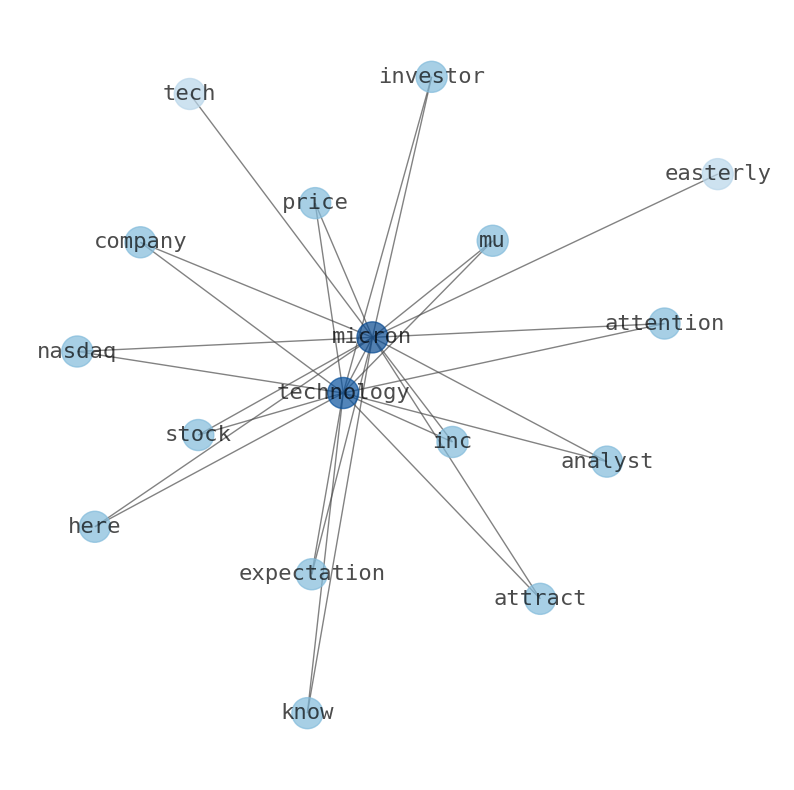

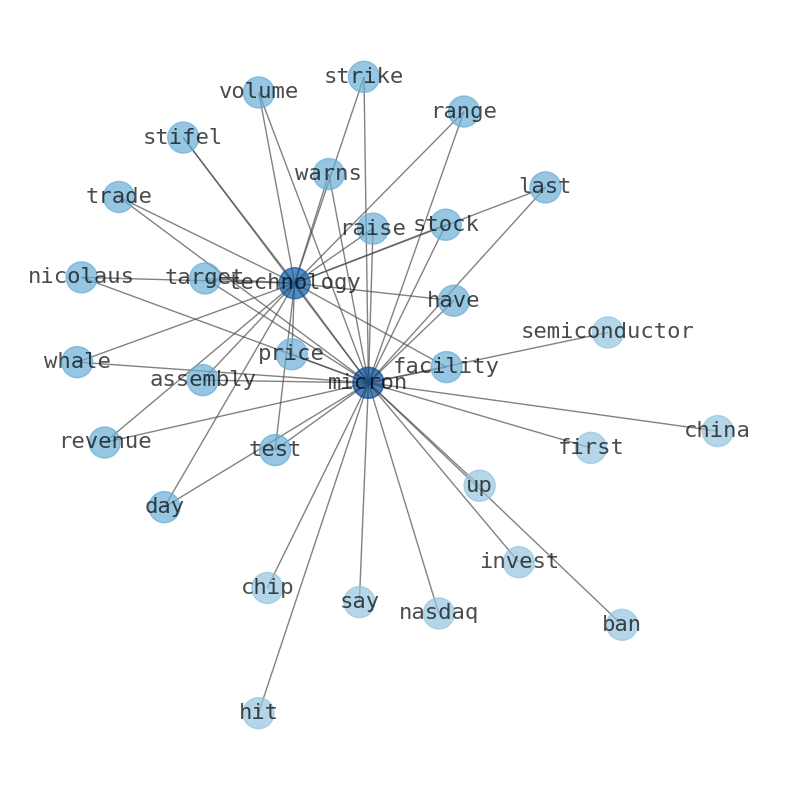

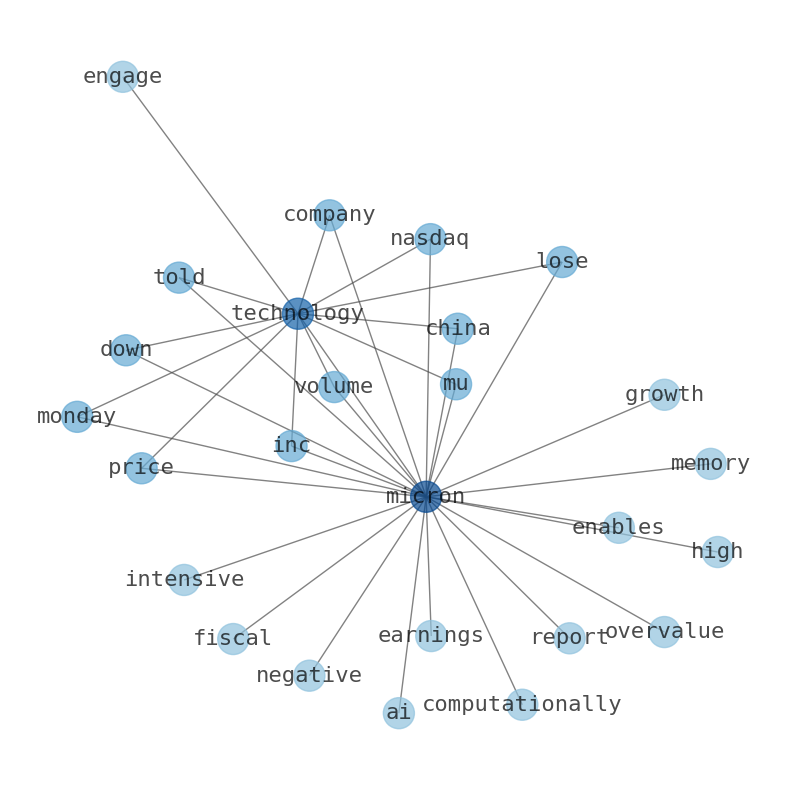

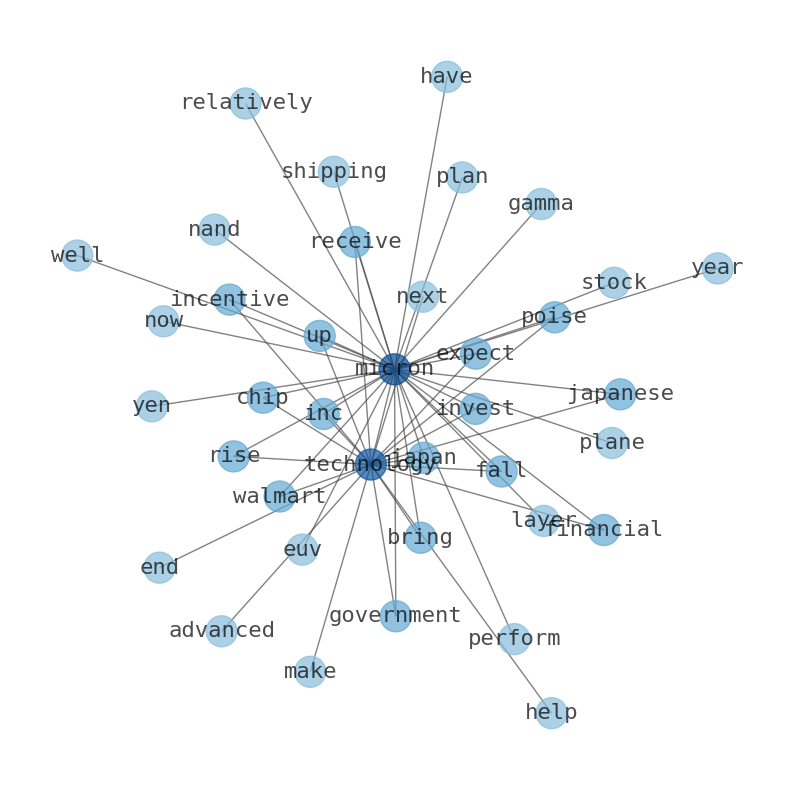

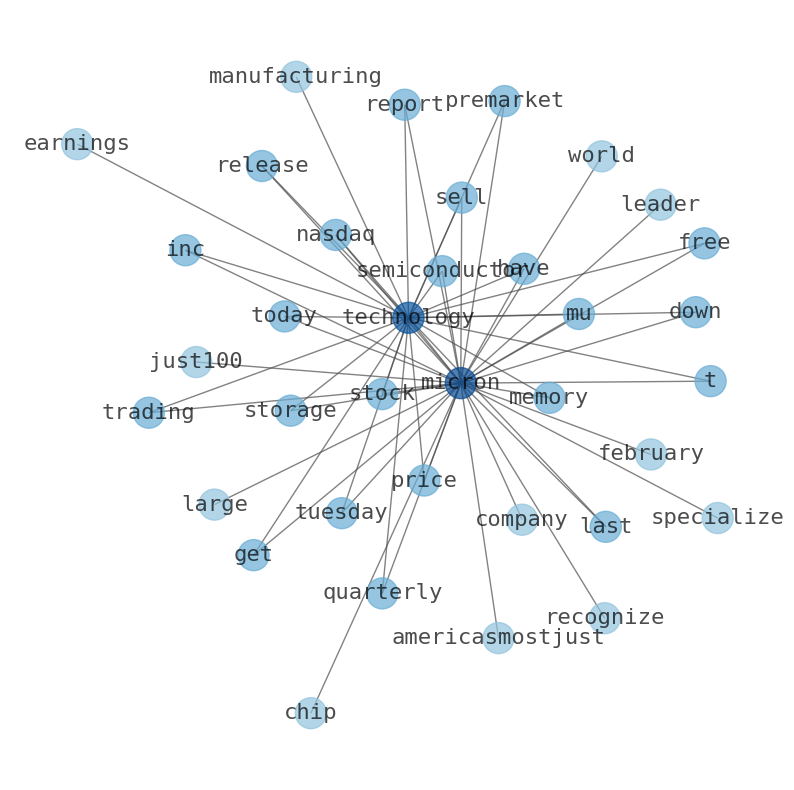

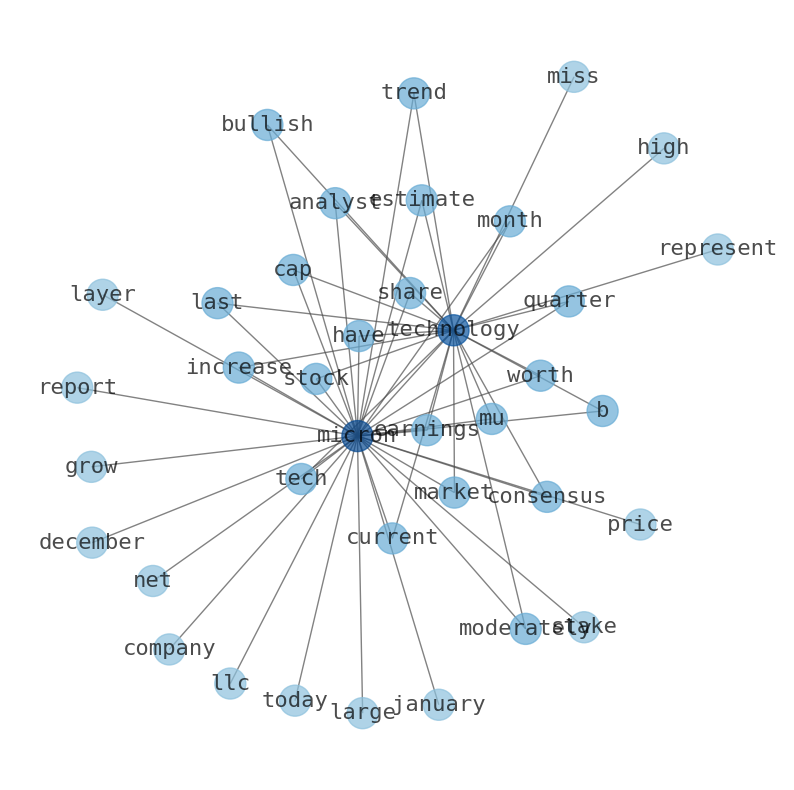

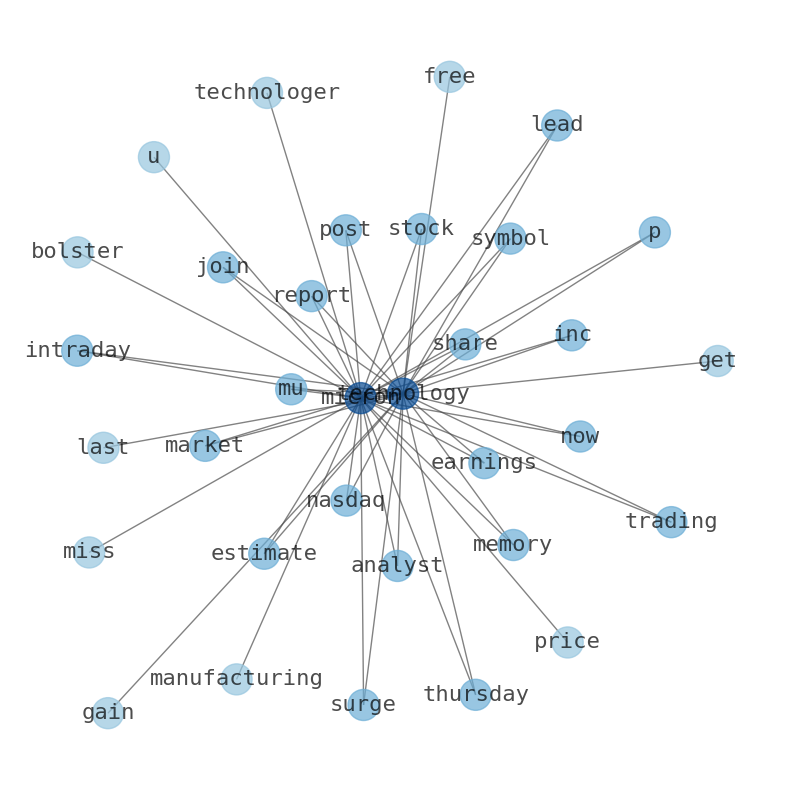

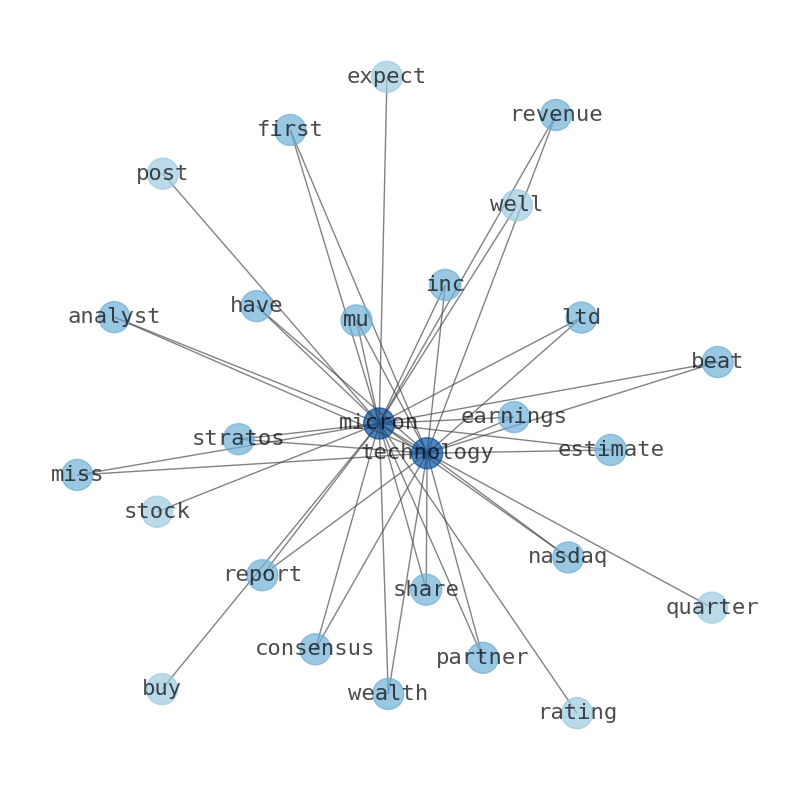

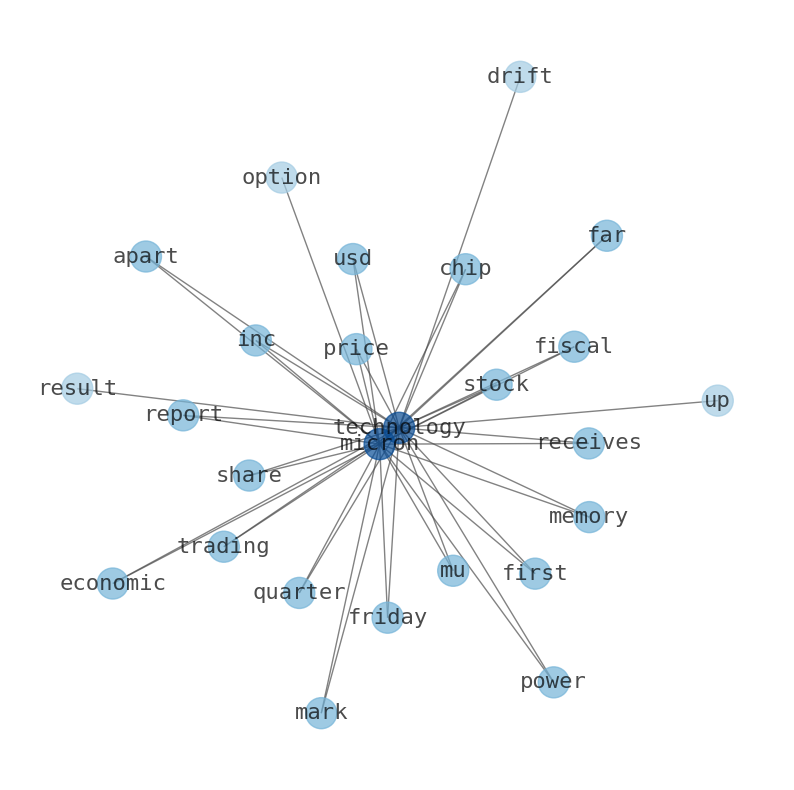

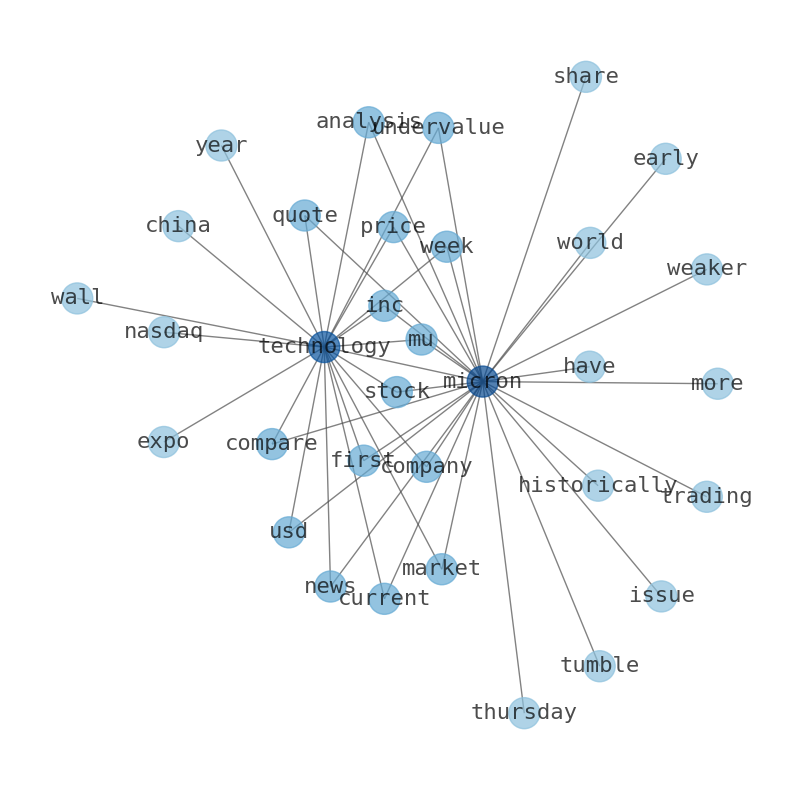

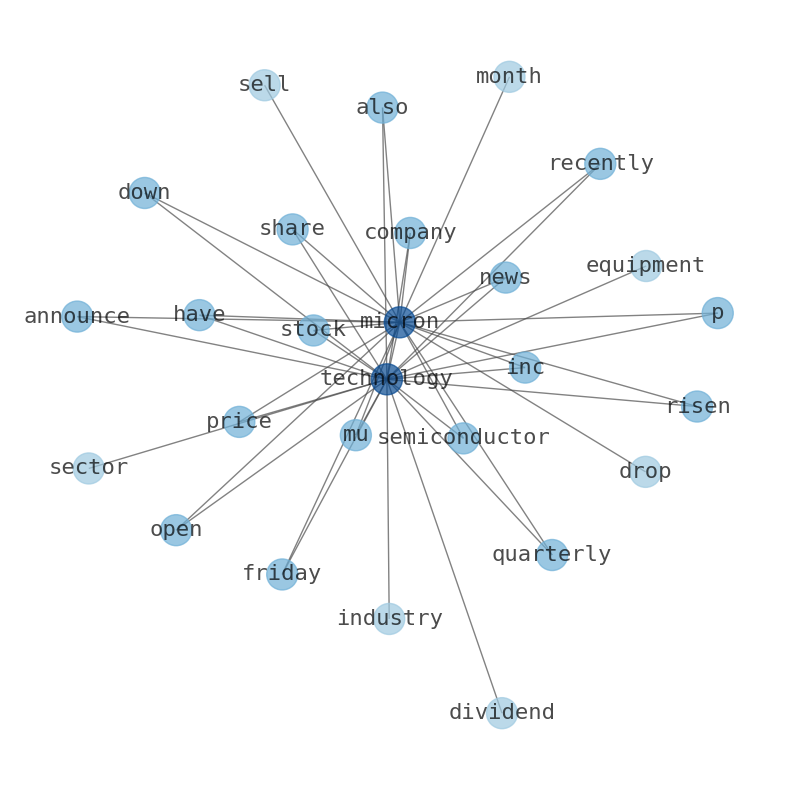

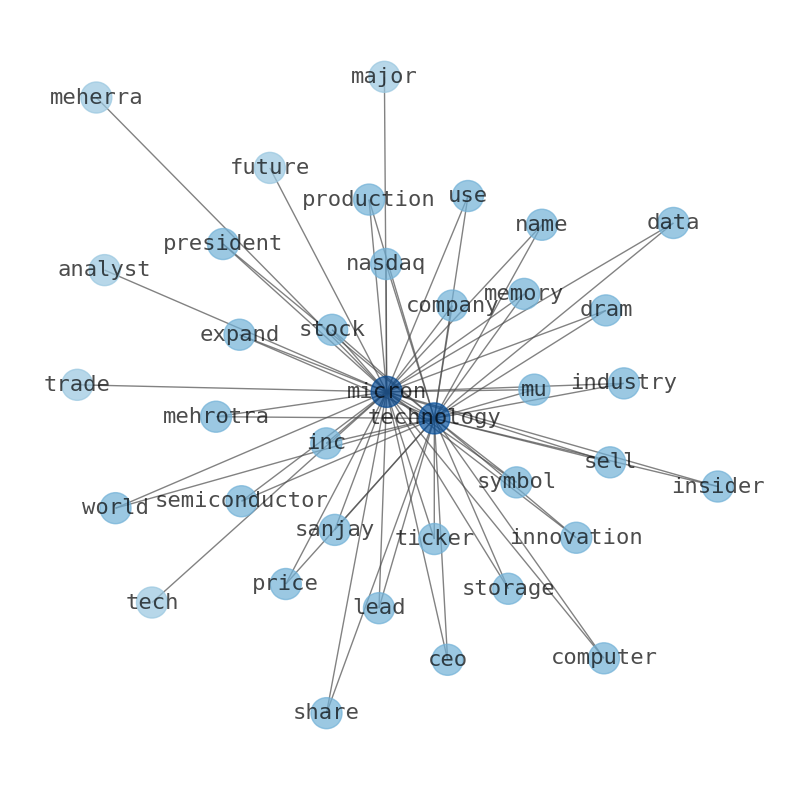

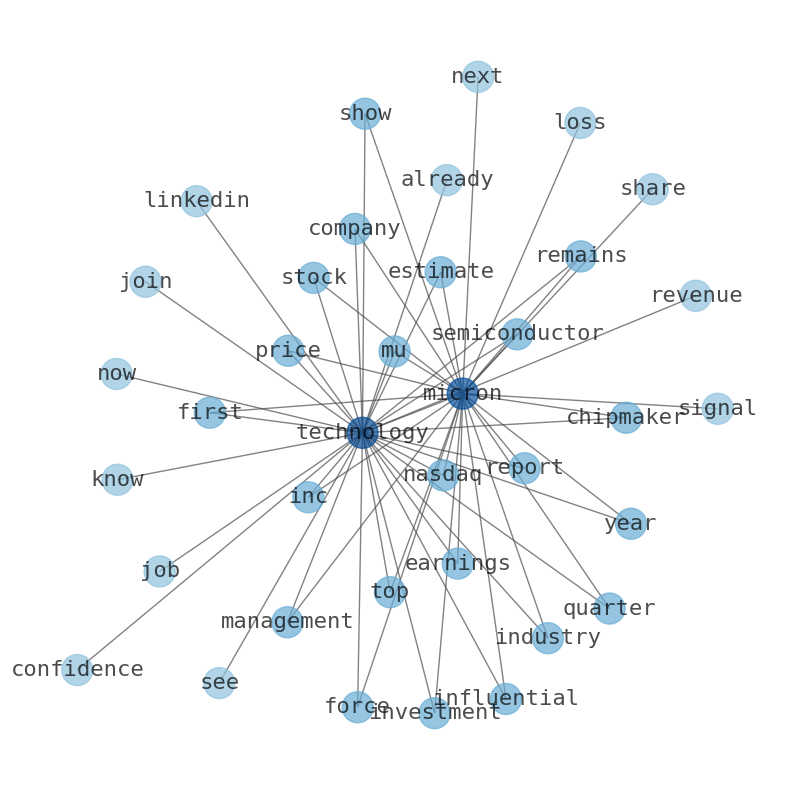

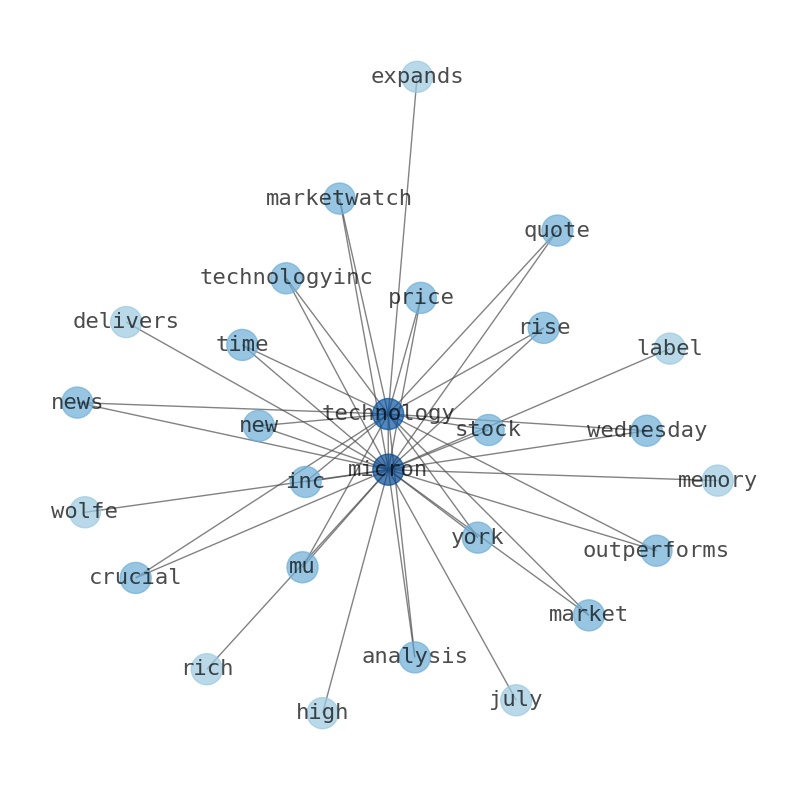

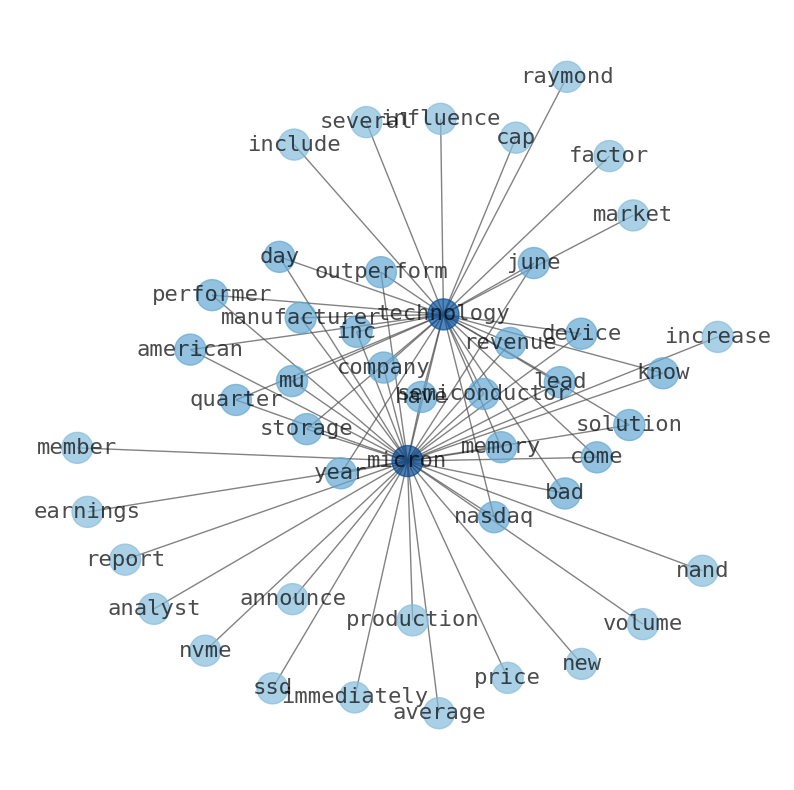

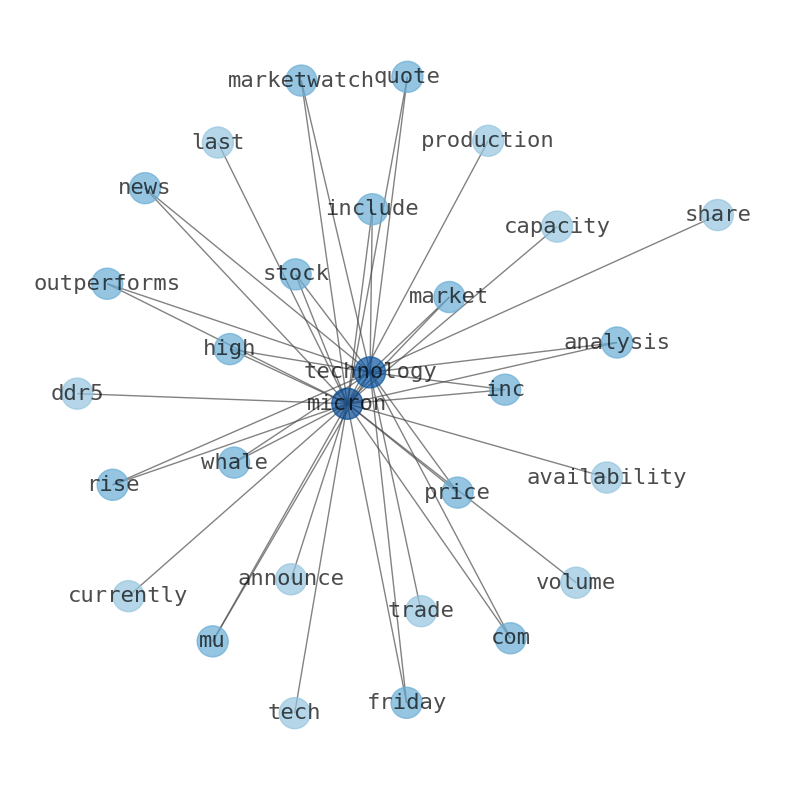

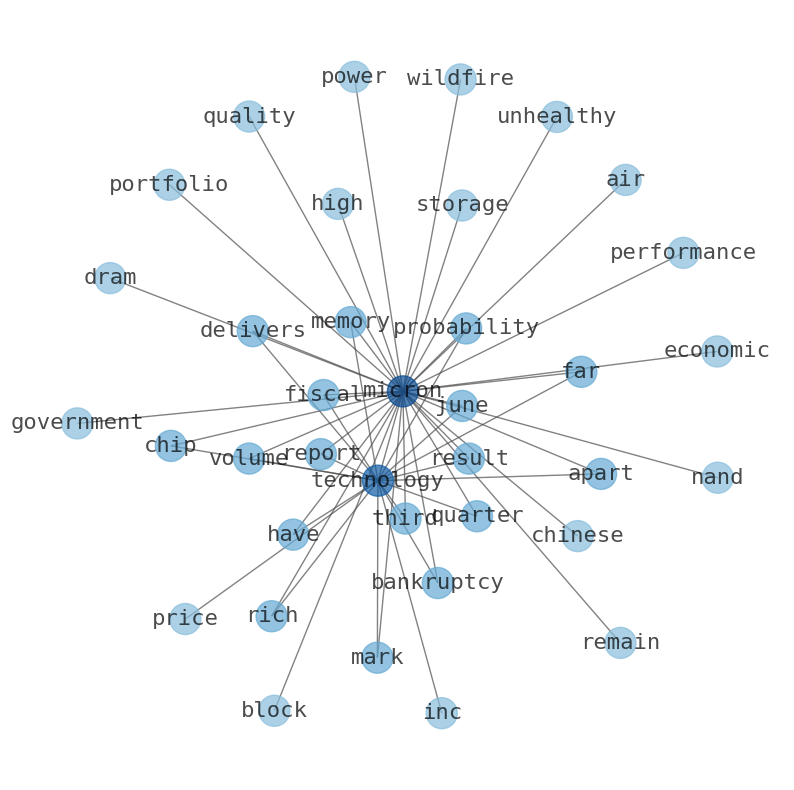

Keywords

This document will help you to evaluate Micron Technology without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Micron Technology are: Micron, Technology, company, memory, storage, semiconductor, year, and the most common words in the summary are: micron, technology, memory, company, stock, inc, market, . One of the sentences in the summary was: The company has a market capitalization of $73.1 billion.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #micron #technology #memory #company #stock #inc #market.

Read more →Related Results

Micron Technology

Open: 92.48 Close: 93.25 Change: 0.77

Read more →

Micron Technology

Open: 85.51 Close: 85.32 Change: -0.19

Read more →

Micron Technology

Open: 86.06 Close: 87.51 Change: 1.45

Read more →

Micron Technology

Open: 82.54 Close: 84.61 Change: 2.07

Read more →

Micron Technology

Open: 86.15 Close: 86.49 Change: 0.34

Read more →

Micron Technology

Open: 74.44 Close: 75.36 Change: 0.92

Read more →

Micron Technology

Open: 72.58 Close: 72.92 Change: 0.34

Read more →

Micron Technology

Open: 66.45 Close: 64.53 Change: -1.92

Read more →

Micron Technology

Open: 64.49 Close: 63.56 Change: -0.93

Read more →

Micron Technology

Open: 69.85 Close: 69.38 Change: -0.47

Read more →

Micron Technology

Open: 65.36 Close: 65.48 Change: 0.12

Read more →

Micron Technology

Open: 65.63 Close: 65.45 Change: -0.18

Read more →

Micron Technology

Open: 66.5 Close: 65.32 Change: -1.18

Read more →

Micron Technology

Open: 65.98 Close: 67.57 Change: 1.59

Read more →

Micron Technology

Open: 82.47 Close: 82.66 Change: 0.19

Read more →

Micron Technology

Open: 87.24 Close: 88.05 Change: 0.81

Read more →

Micron Technology

Open: 83.69 Close: 83.28 Change: -0.41

Read more →

Micron Technology

Open: 82.75 Close: 82.39 Change: -0.36

Read more →

Micron Technology

Open: 76.87 Close: 77.51 Change: 0.64

Read more →

Micron Technology

Open: 74.44 Close: 75.36 Change: 0.92

Read more →

Micron Technology

Open: 64.92 Close: 65.65 Change: 0.73

Read more →

Micron Technology

Open: 69.77 Close: 70.18 Change: 0.41

Read more →

Micron Technology

Open: 67.06 Close: 65.44 Change: -1.62

Read more →

Micron Technology

Open: 65.0 Close: 67.38 Change: 2.38

Read more →

Micron Technology

Open: 64.5 Close: 63.11 Change: -1.39

Read more →

Micron Technology

Open: 65.93 Close: 65.43 Change: -0.5

Read more →

Micron Technology

Open: 68.41 Close: 67.06 Change: -1.35

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo