The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Micron Technology

Youtube Subscribe

Open: 67.06 Close: 65.44 Change: -1.62

How to get information about Micron Technology Stock without reading the whole internet.

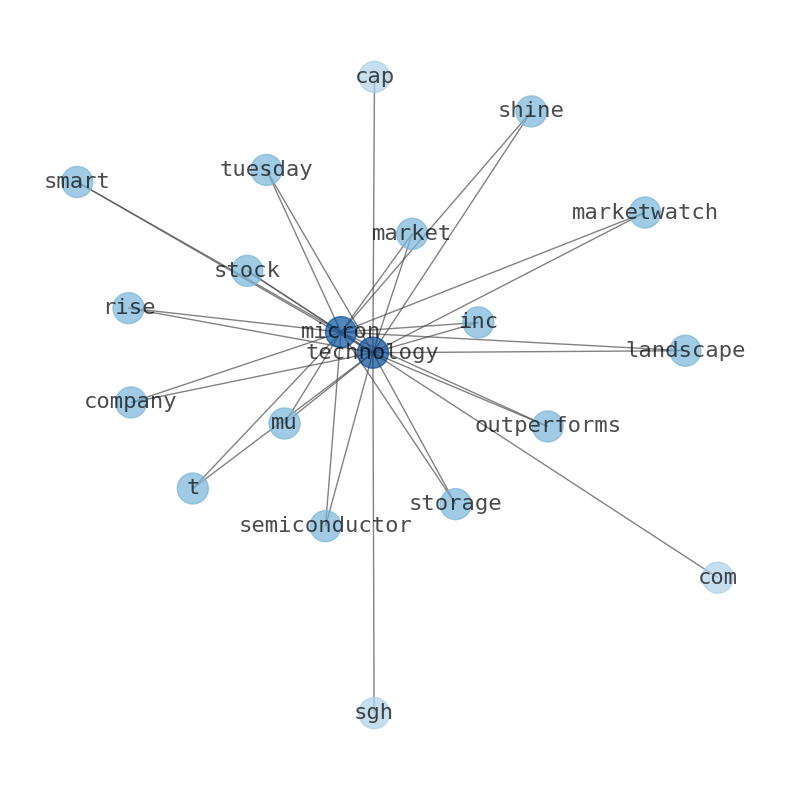

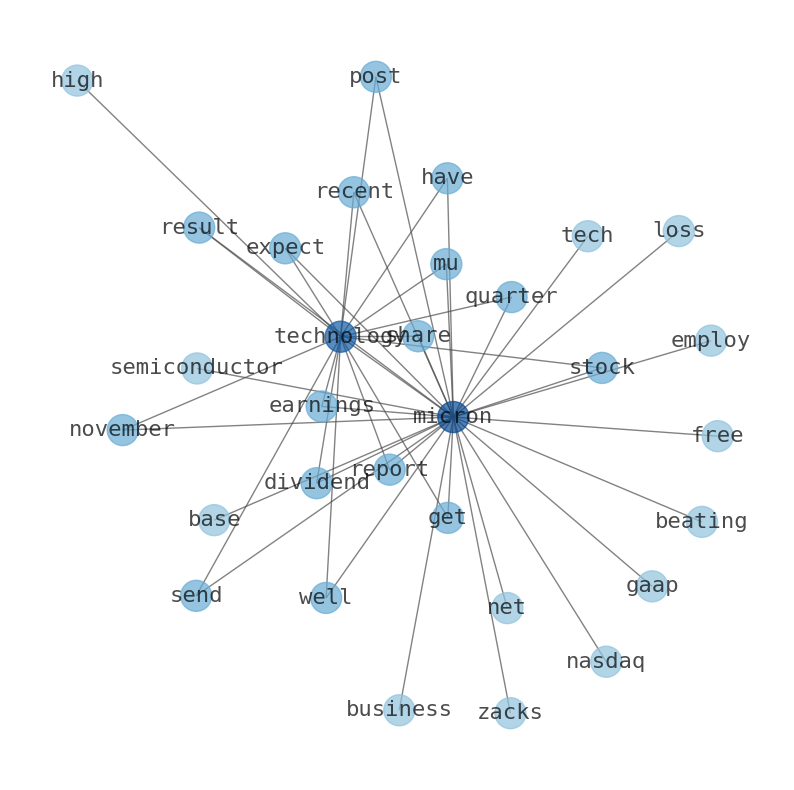

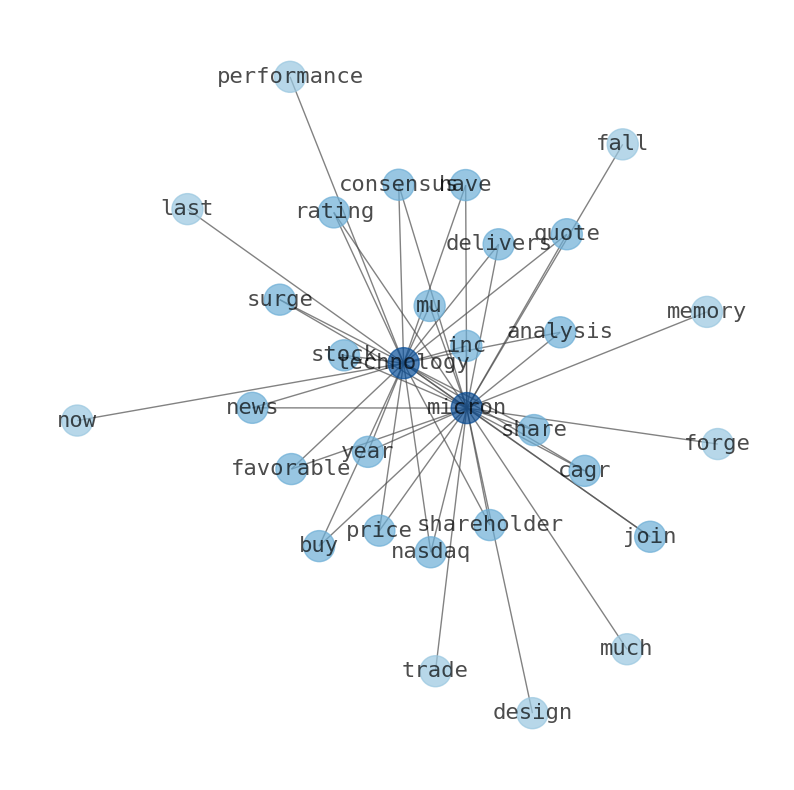

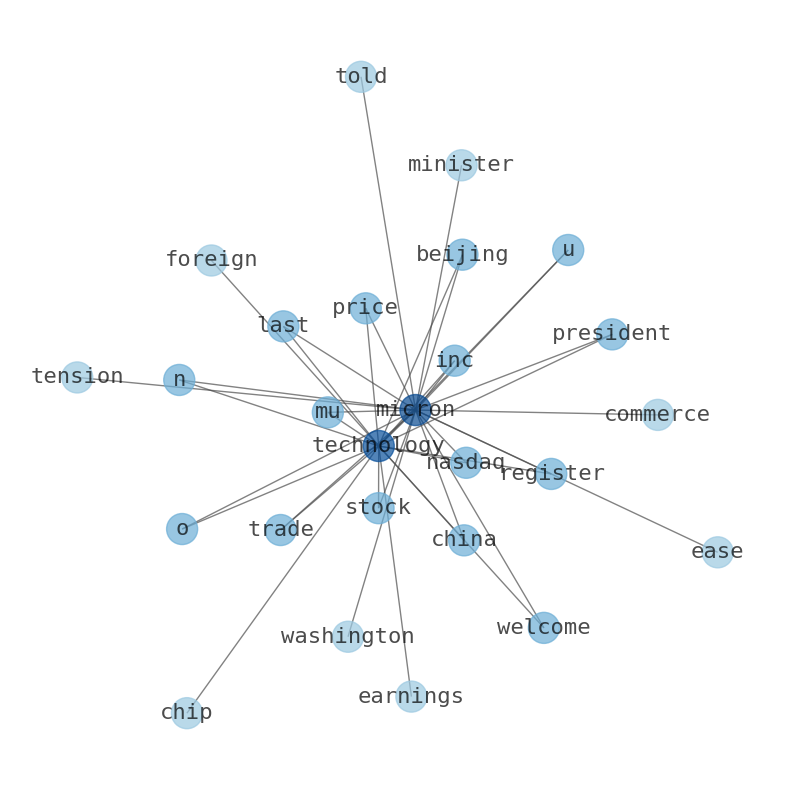

Are looking for the most relevant information about Micron Technology? Investor spend a lot of time searching for information to make investment decisions in Micron Technology. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Micron Technology are: Micron, Technology, share, stock, MU, Inc, quarter, and the most common words in the summary are: micron, technology, stock, market, inc, price, mu, . One of the sentences in the summary was: Micron Technology (NASDAQ:MU) reported a loss per share of 2.68. Other …

Stock Summary

Micron Technology, Inc. designs, develops, manufactures, and sells memory and storage products. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit and Embedded Business Unit. DRAM products are.

Today's Summary

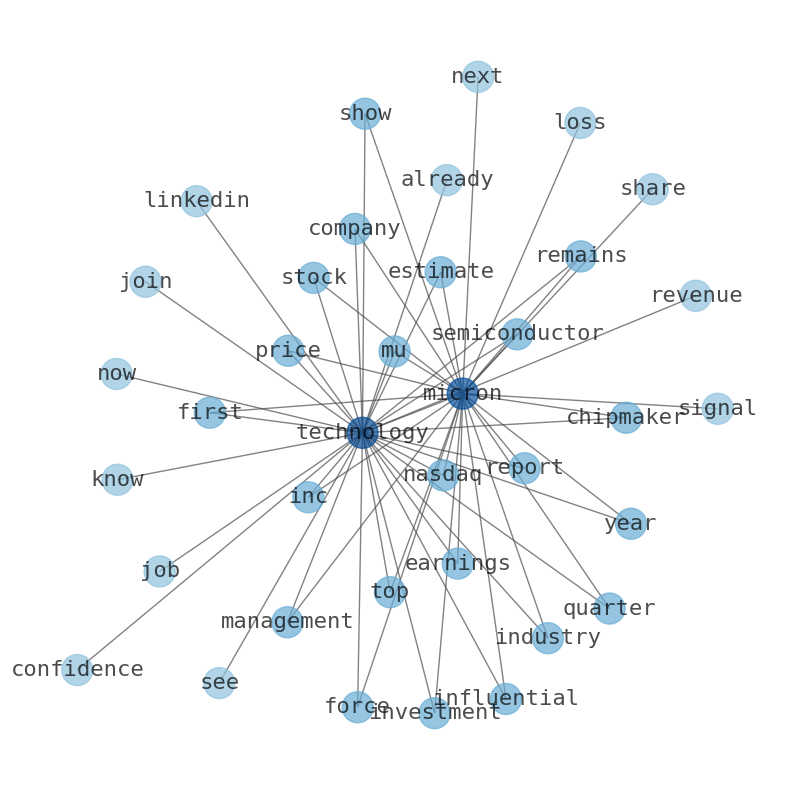

Micron Technology (NASDAQ:MU) reported a loss per share of 2.68. Analysts estimate an earnings decrease this quarter of$3.38 per share, an increase next quarter of $0.79 per share. The intrinsic value of one MU stock under the Base Case scenario is 65.46 USD.

Today's News

Bailard Inc. purchased 3,775 shares of Micron Technology, Inc. in the first quarter of this year. The investment management company shows confidence in the semiconductor manufacturers potential for growth. Micron Technology remains an influential force in the semiconductor industry. Chipmaker Micron tops revenue estimates on demand from booming AI. Micron Technology (NASDAQ:MU – Get Free Report ) last issued its earnings results on Wednesday, June 28th. The company also recently declared a quarterly dividend, which was paid on Tuesday. Micron Technology, Inc. (mu.mi) stock price, news, quote & history - yahoo finance. Micron, MOST Announce Opening of DECONSTRUCTED: Semiconductors and Other Secrets Inside Everyday Technology. Micron Technology: jobs | LinkedIn. Join now or see who you already know at Micron Tech. Micron Technology (NASDAQ:MU) reported a loss per share of 2.68. Micron Signals the Next Bull Market Is Well On Its Way. Micron Technology (NASDAQ: MU) provides advanced semiconductor systems. The company has filed 10000 patents. Source article provides a comprehensive analysis of Micron Technology including fair value estimates, risks and warnings, dividends, insider transactions, and financial health. The intrinsic value of one MU stock under the Base Case scenario is 65.46 USD. Micron Technology stock price is 66.67 USD today. Analysts estimate an earnings decrease this quarter of$3.38 per share, an increase next quarter of $0.79 per share. Will MU stock go up or go down? Will MU share price is forecast to RISE/FALL based on technical indicators?

Stock Profile

"Micron Technology, Inc. designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. It provides memory and storage technologies comprises DRAM products, which are dynamic random access memory semiconductor devices with low latency that provide high-speed data retrieval; NAND products that are non-volatile and re-writeable semiconductor storage devices; and NOR memory products, which are non-volatile re-writable semiconductor memory devices that provide fast read speeds under the Micron and Crucial brands, as well as through private labels. The company offers memory products for the cloud server, enterprise, client, graphics, networking, industrial, and automotive markets, as well as for smartphone and other mobile-device markets; SSDs and component-level solutions for the enterprise and cloud, client, and consumer storage markets; discrete storage products in component and wafers; and memory and storage products for the automotive, industrial, and consumer markets. It markets its products through its direct sales force, independent sales representatives, distributors, and retailers; and web-based customer direct sales channel, as well as through channel and distribution partners. Micron Technology, Inc. was founded in 1978 and is headquartered in Boise, Idaho."

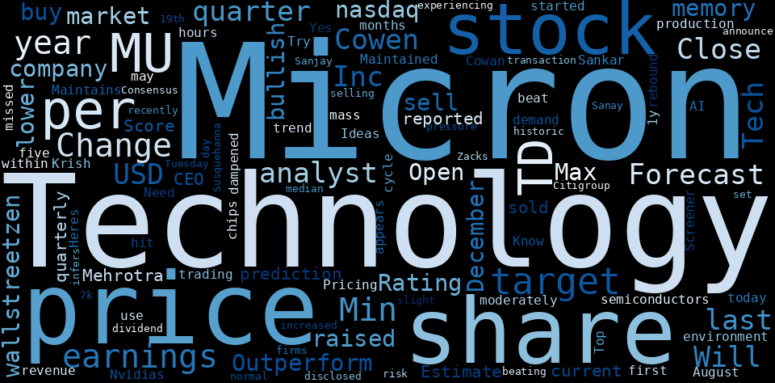

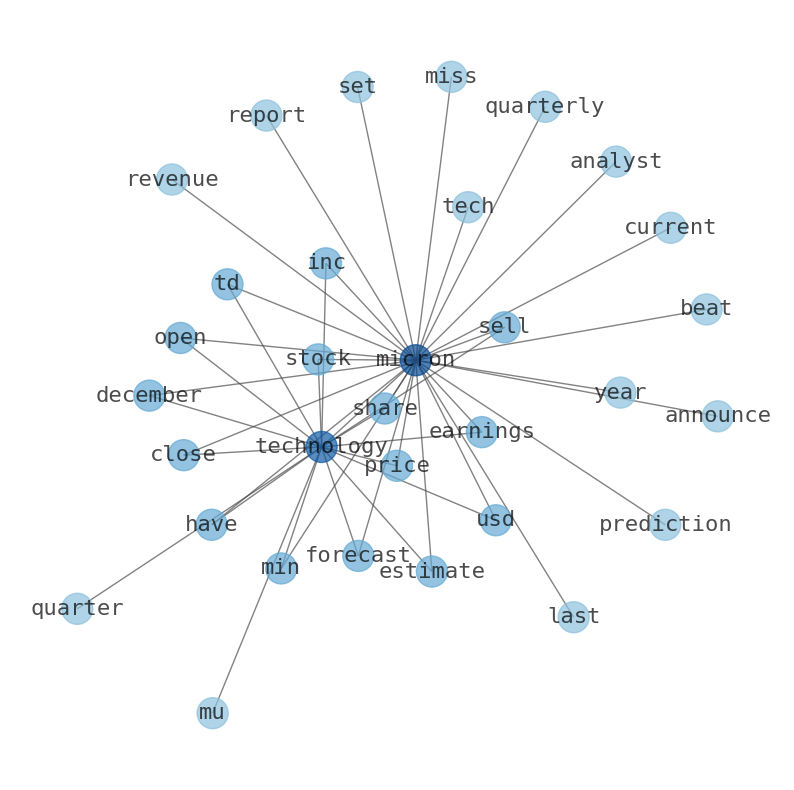

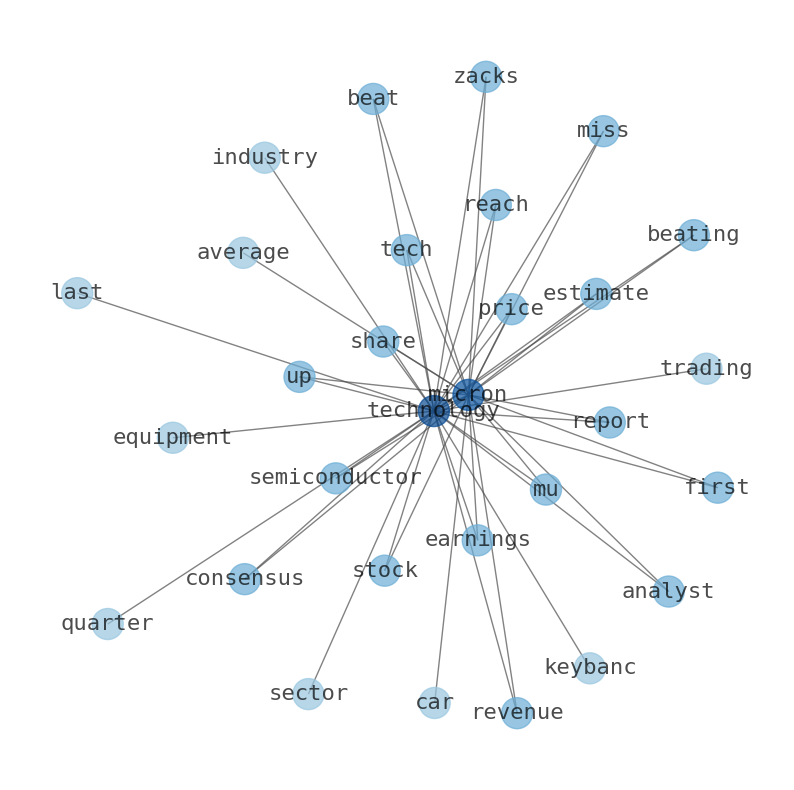

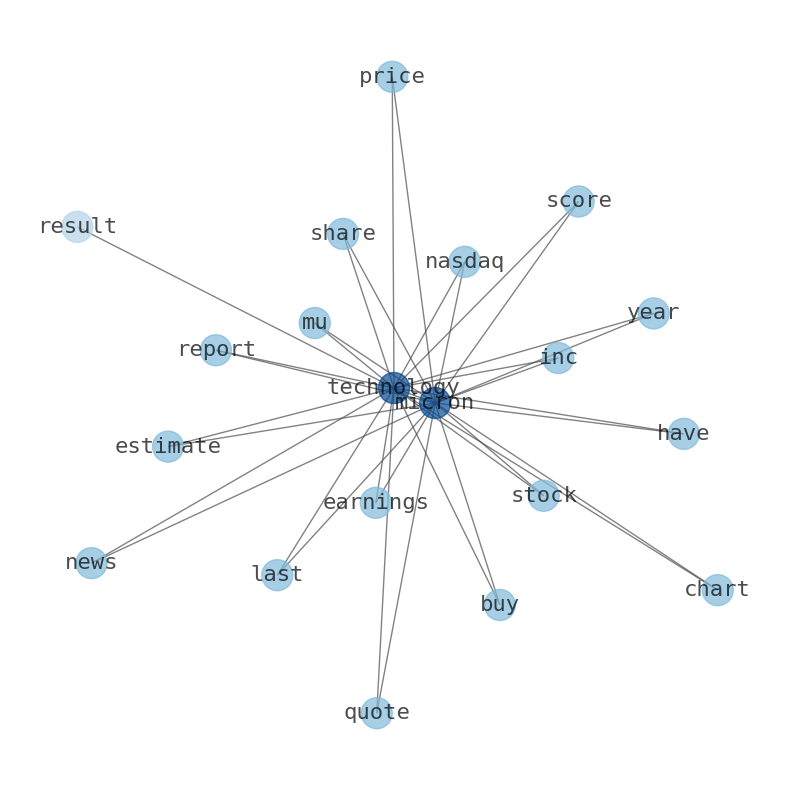

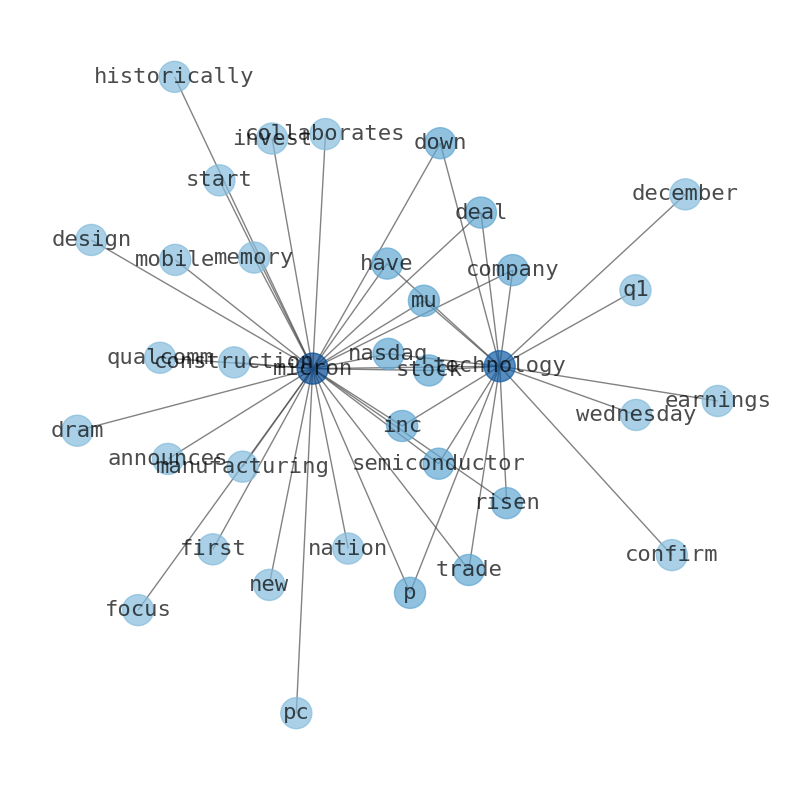

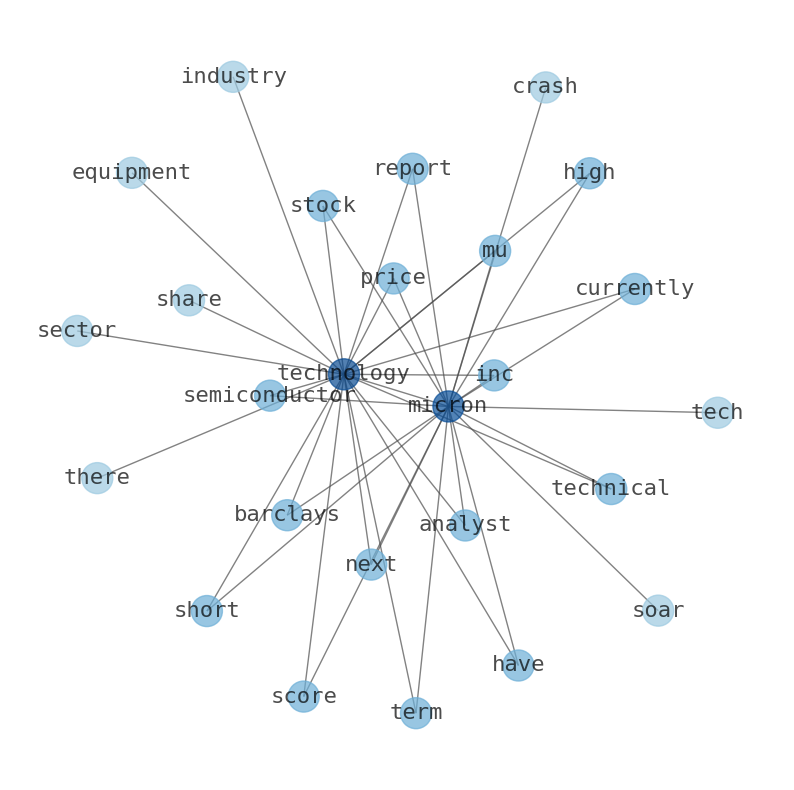

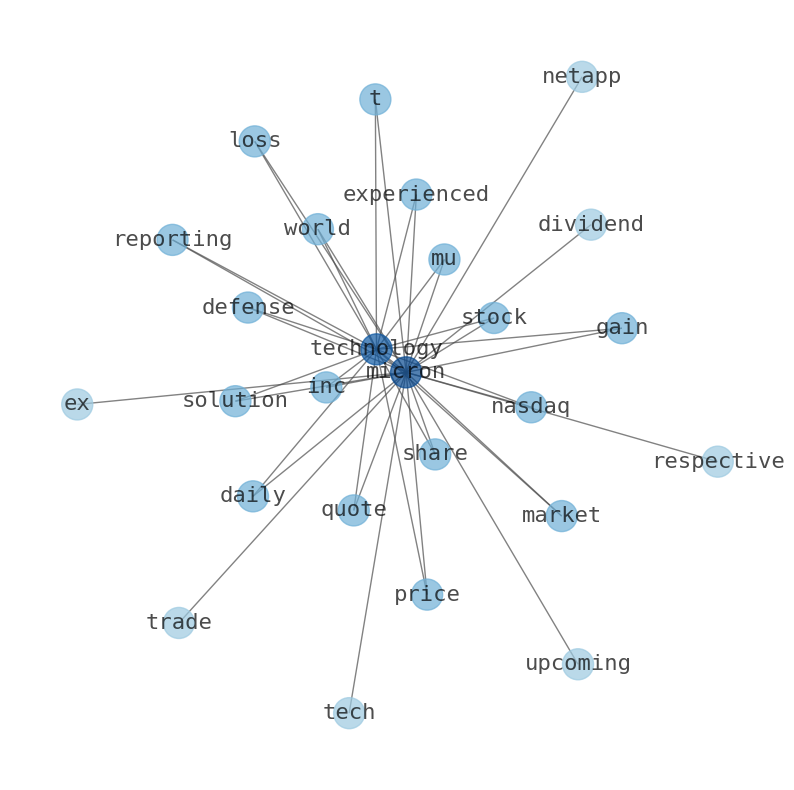

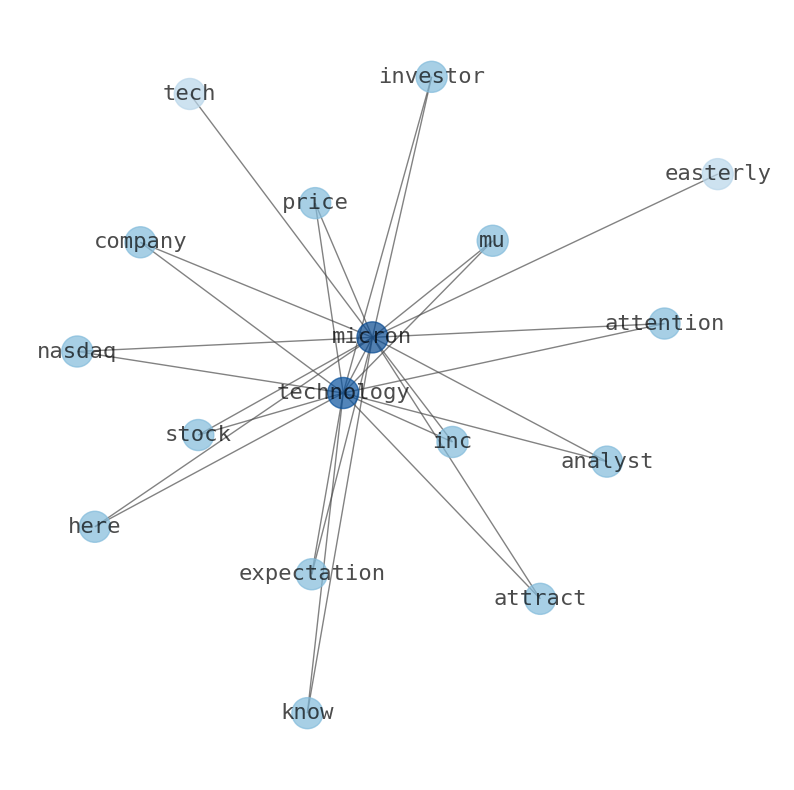

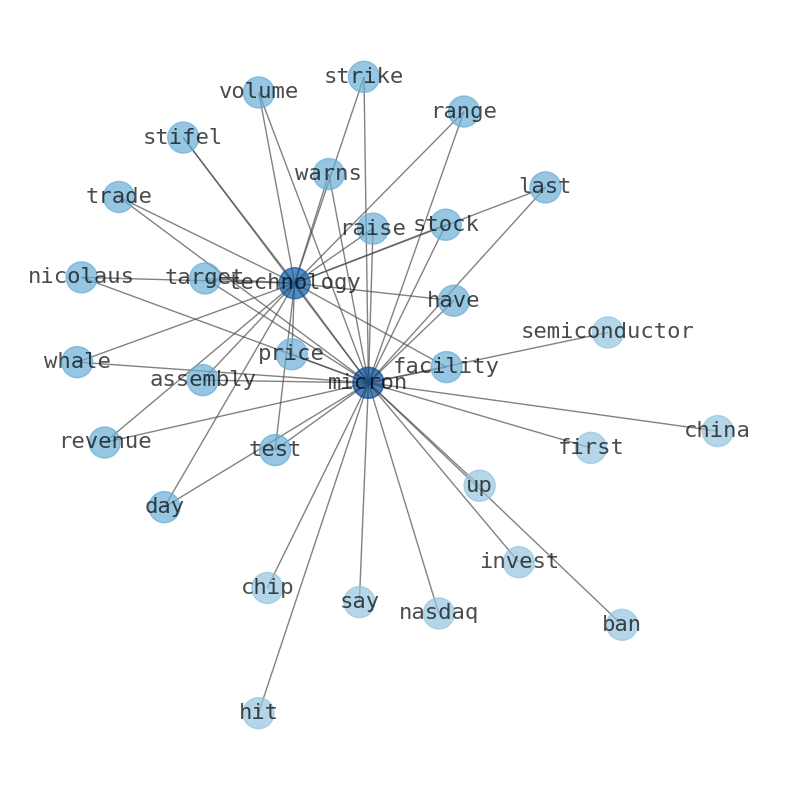

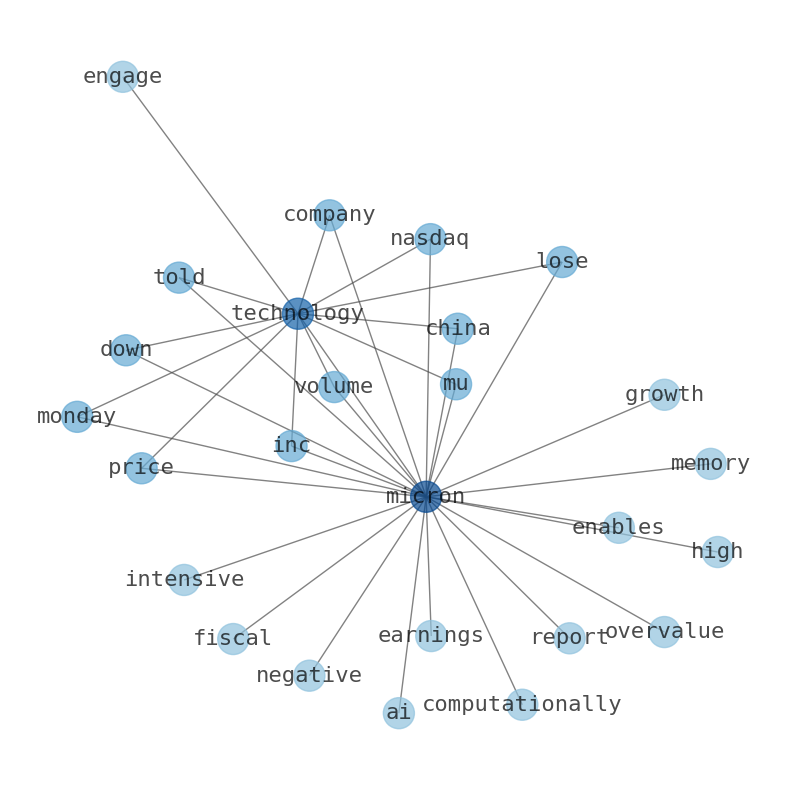

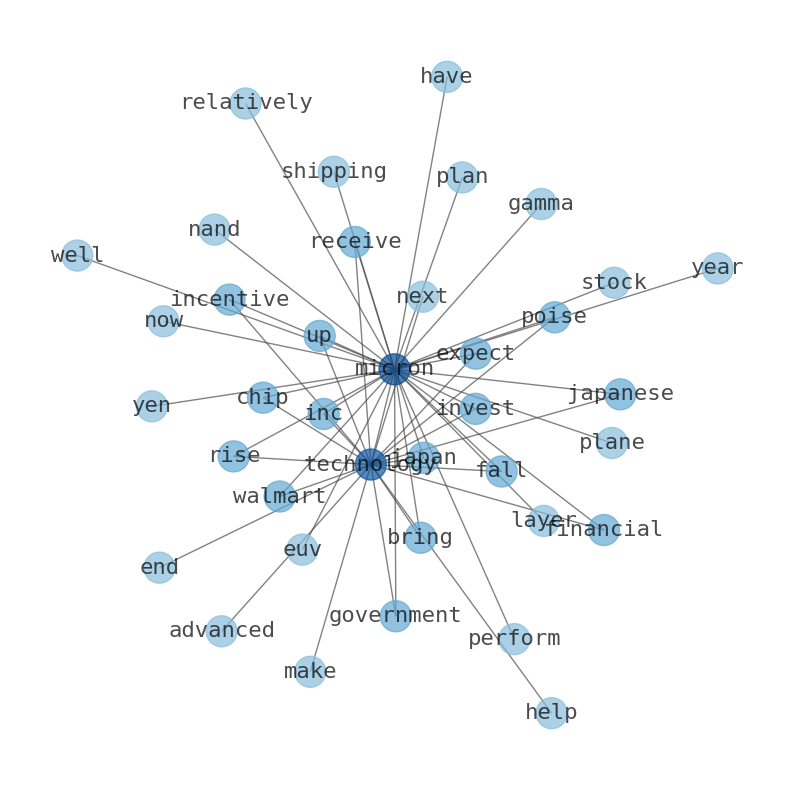

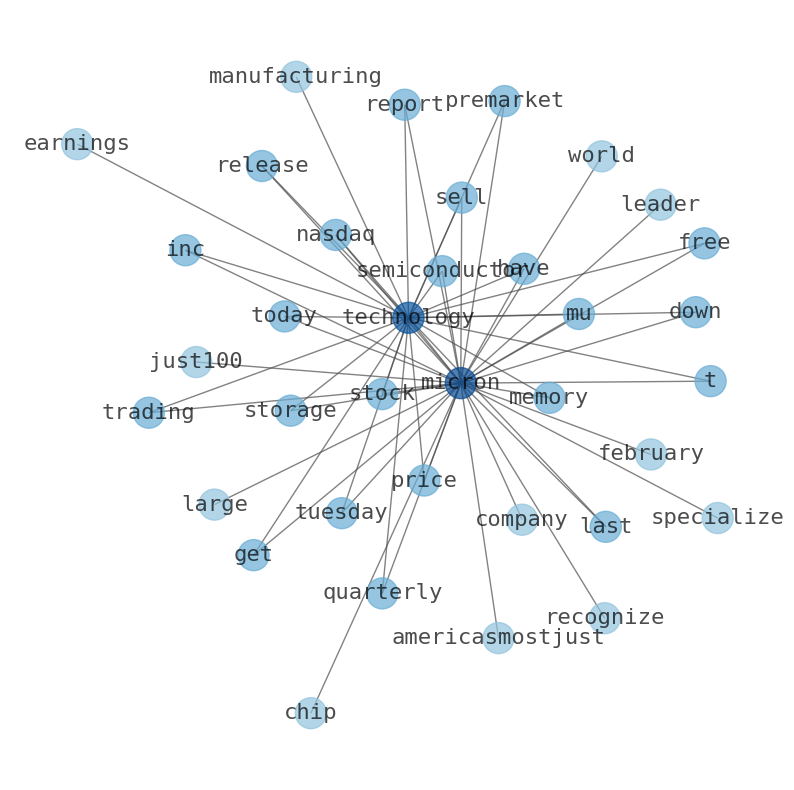

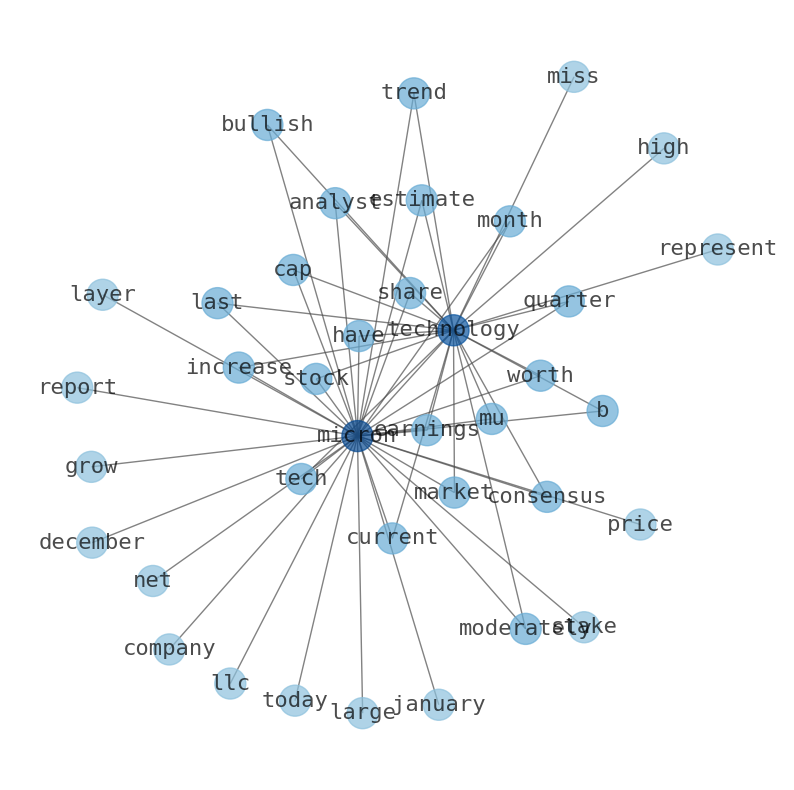

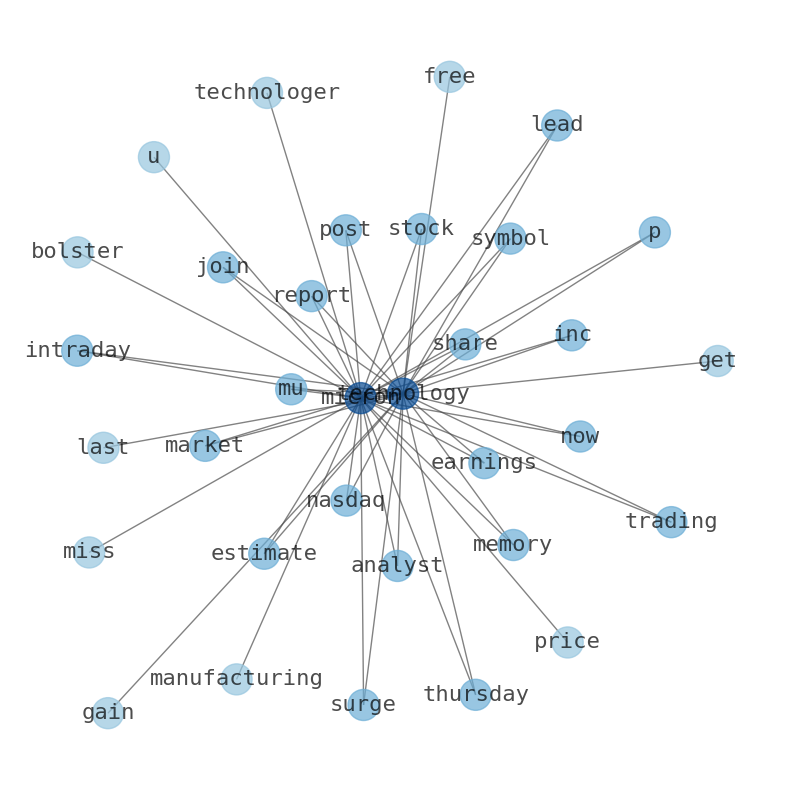

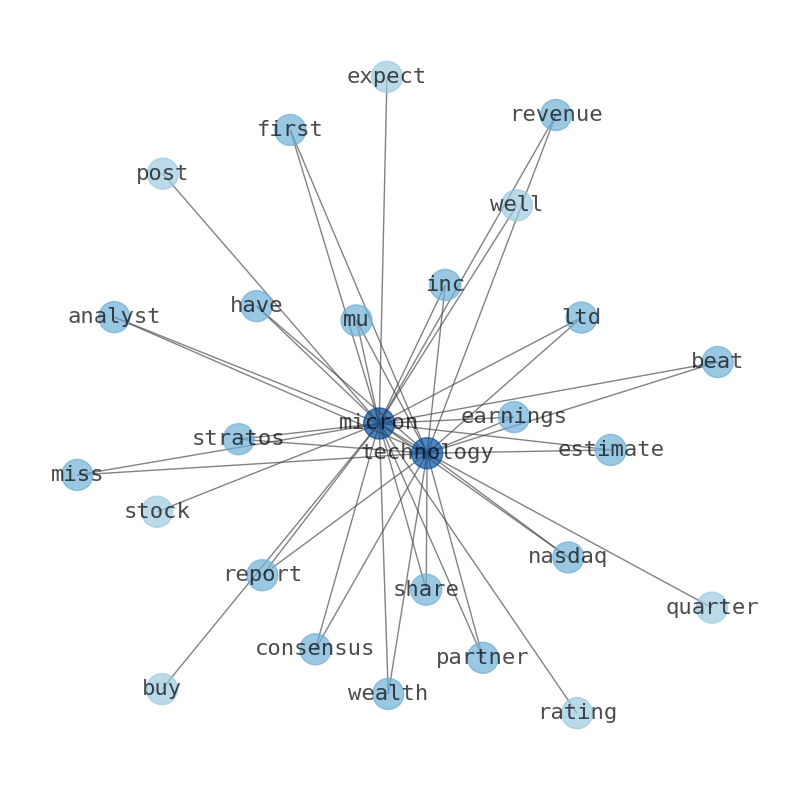

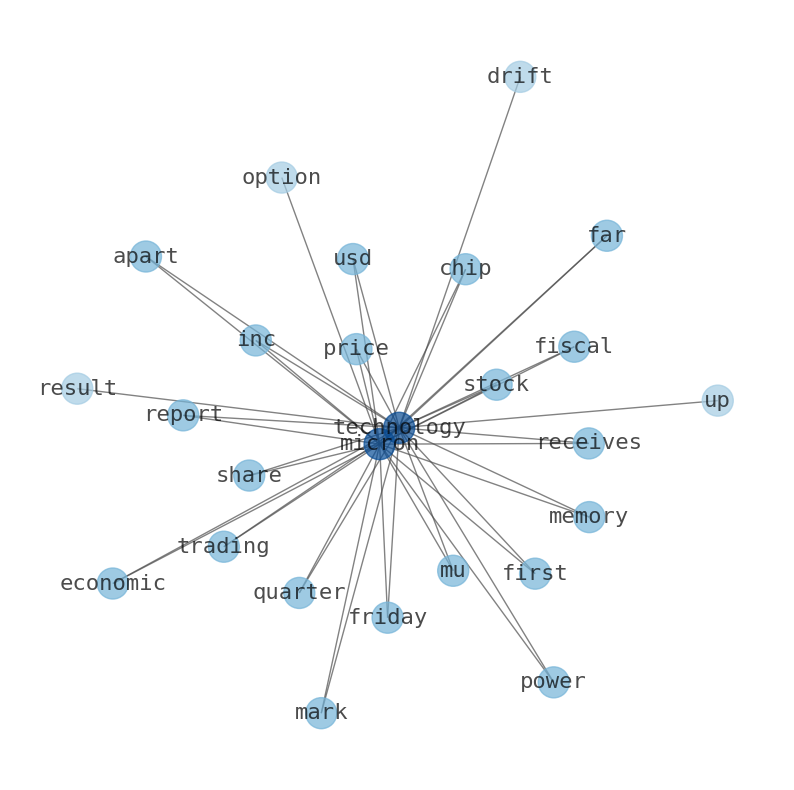

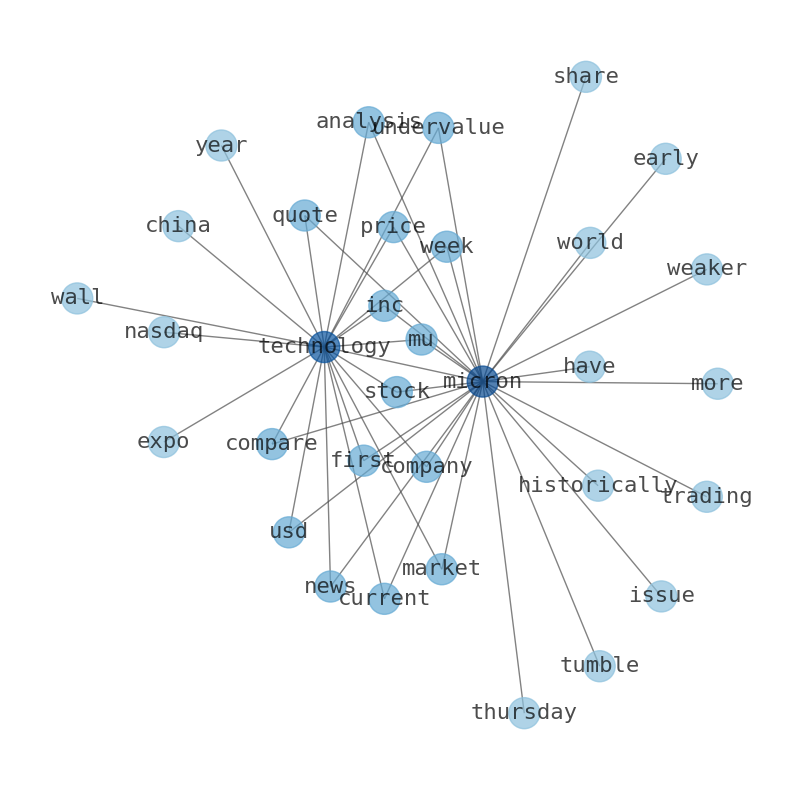

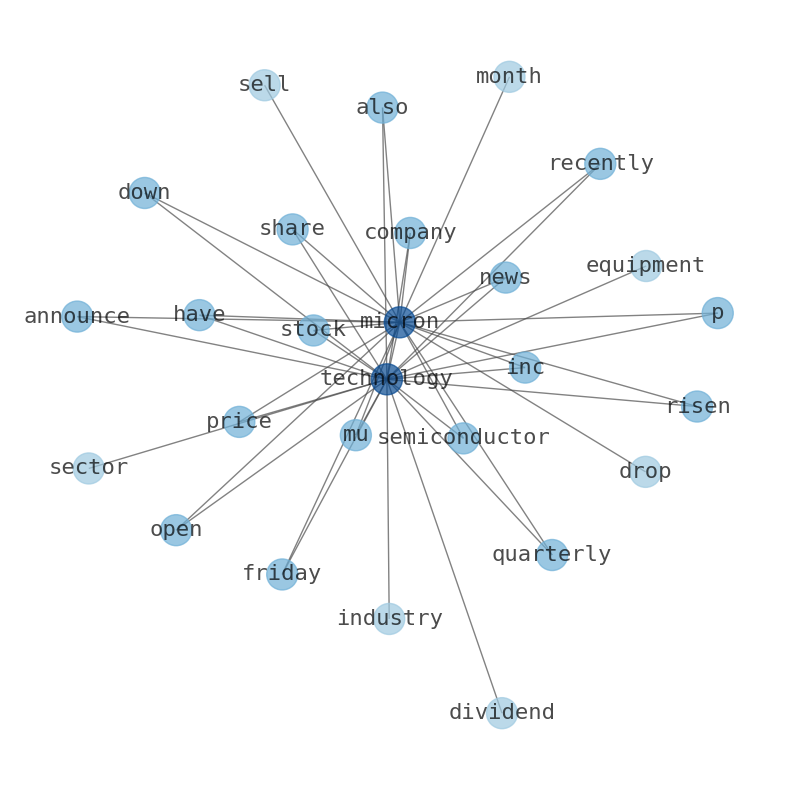

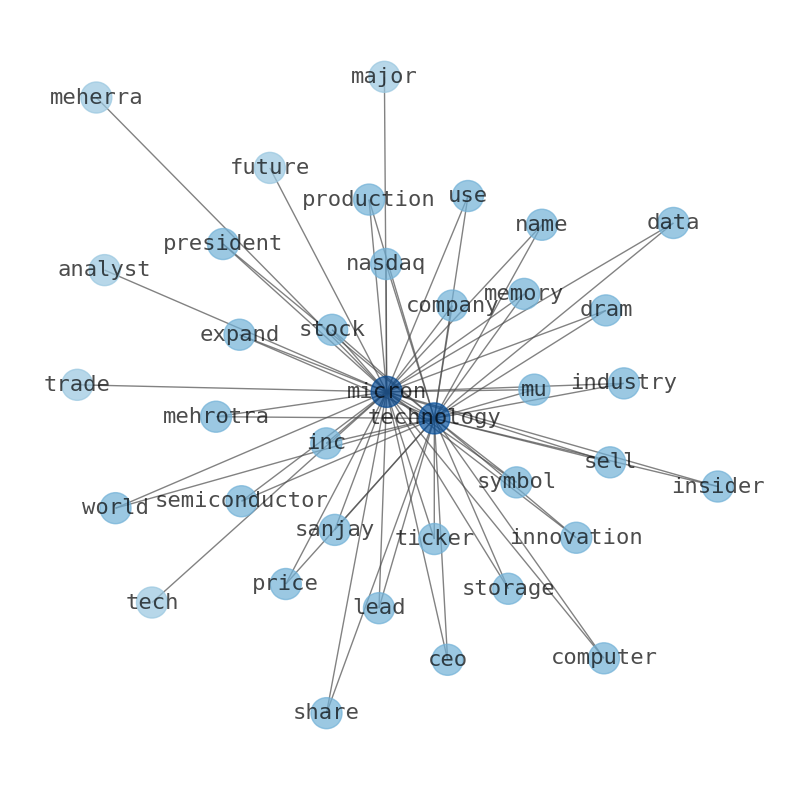

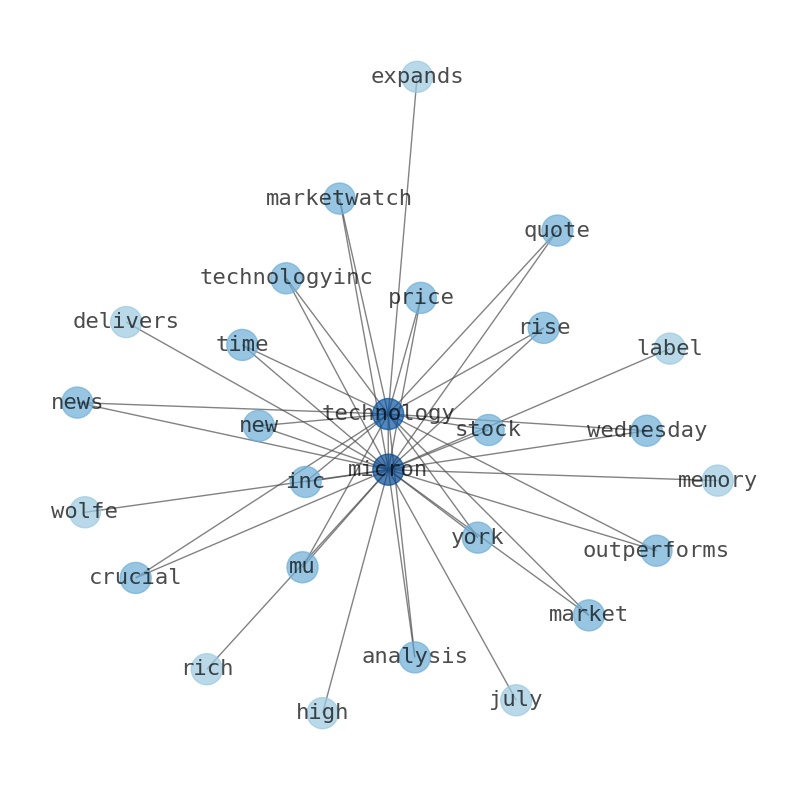

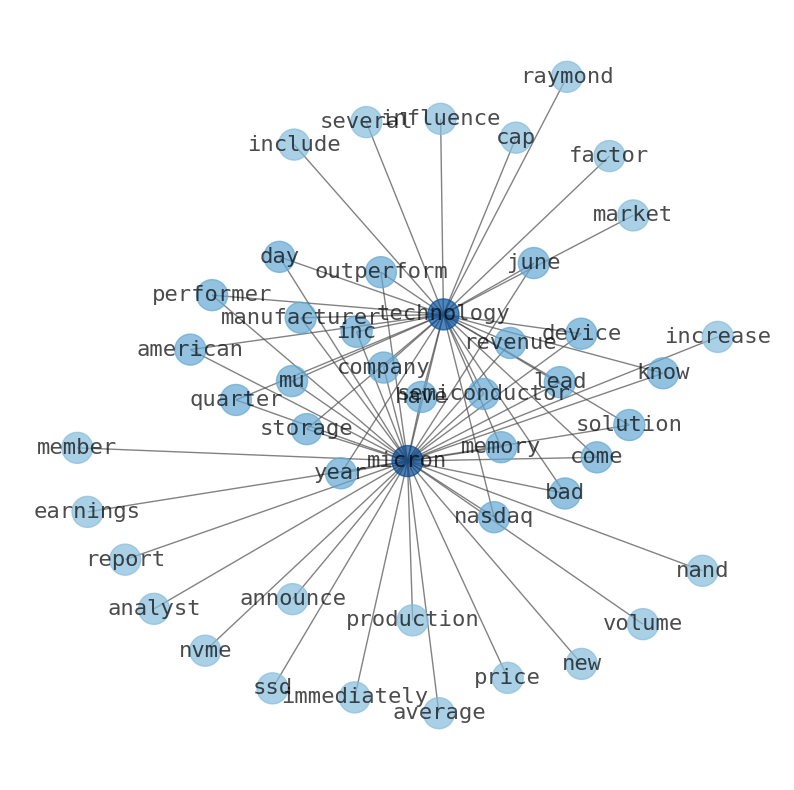

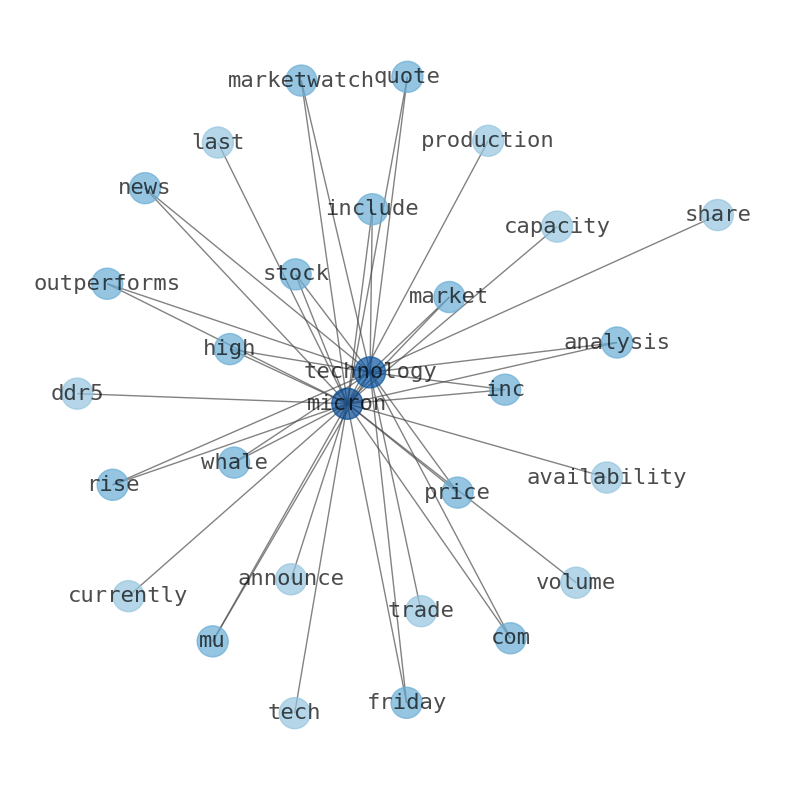

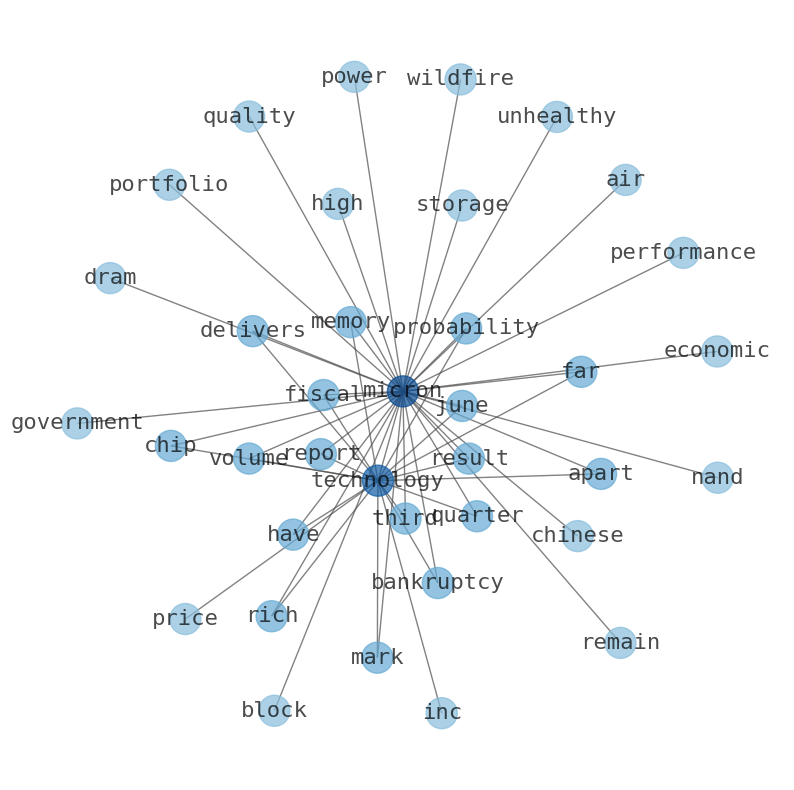

Keywords

The game is changing. There is a new strategy to evaluate Micron Technology fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Micron Technology are: Micron, Technology, share, stock, MU, Inc, quarter, and the most common words in the summary are: micron, technology, stock, market, inc, price, mu, . One of the sentences in the summary was: Micron Technology (NASDAQ:MU) reported a loss per share of 2.68. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #micron #technology #stock #market #inc #price #mu.

Read more →Related Results

Micron Technology

Open: 92.48 Close: 93.25 Change: 0.77

Read more →

Micron Technology

Open: 85.51 Close: 85.32 Change: -0.19

Read more →

Micron Technology

Open: 86.06 Close: 87.51 Change: 1.45

Read more →

Micron Technology

Open: 82.54 Close: 84.61 Change: 2.07

Read more →

Micron Technology

Open: 86.15 Close: 86.49 Change: 0.34

Read more →

Micron Technology

Open: 74.44 Close: 75.36 Change: 0.92

Read more →

Micron Technology

Open: 72.58 Close: 72.92 Change: 0.34

Read more →

Micron Technology

Open: 66.45 Close: 64.53 Change: -1.92

Read more →

Micron Technology

Open: 64.49 Close: 63.56 Change: -0.93

Read more →

Micron Technology

Open: 69.85 Close: 69.38 Change: -0.47

Read more →

Micron Technology

Open: 65.36 Close: 65.48 Change: 0.12

Read more →

Micron Technology

Open: 65.63 Close: 65.45 Change: -0.18

Read more →

Micron Technology

Open: 66.5 Close: 65.32 Change: -1.18

Read more →

Micron Technology

Open: 65.98 Close: 67.57 Change: 1.59

Read more →

Micron Technology

Open: 82.47 Close: 82.66 Change: 0.19

Read more →

Micron Technology

Open: 87.24 Close: 88.05 Change: 0.81

Read more →

Micron Technology

Open: 83.69 Close: 83.28 Change: -0.41

Read more →

Micron Technology

Open: 82.75 Close: 82.39 Change: -0.36

Read more →

Micron Technology

Open: 76.87 Close: 77.51 Change: 0.64

Read more →

Micron Technology

Open: 74.44 Close: 75.36 Change: 0.92

Read more →

Micron Technology

Open: 64.92 Close: 65.65 Change: 0.73

Read more →

Micron Technology

Open: 69.77 Close: 70.18 Change: 0.41

Read more →

Micron Technology

Open: 67.06 Close: 65.44 Change: -1.62

Read more →

Micron Technology

Open: 65.0 Close: 67.38 Change: 2.38

Read more →

Micron Technology

Open: 64.5 Close: 63.11 Change: -1.39

Read more →

Micron Technology

Open: 65.93 Close: 65.43 Change: -0.5

Read more →

Micron Technology

Open: 68.41 Close: 67.06 Change: -1.35

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo