The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Marriott International

Youtube Subscribe

Open: 180.0 Close: 175.63 Change: -4.37

Is Marriott International Company Inc a good investment? This what an AI found.

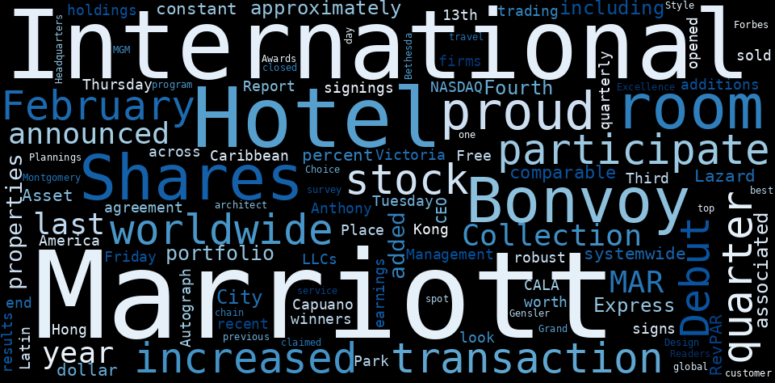

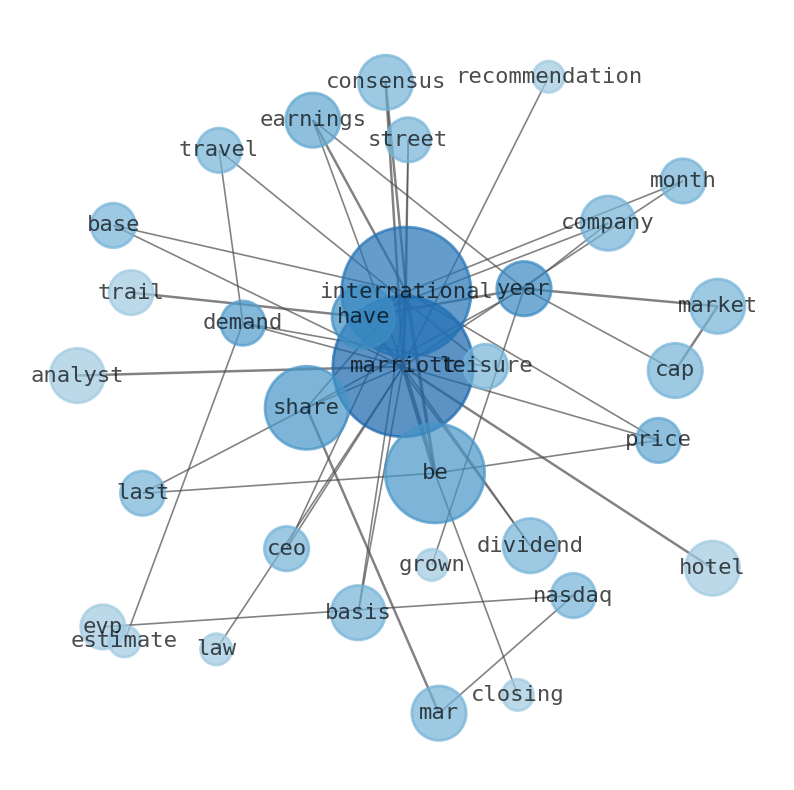

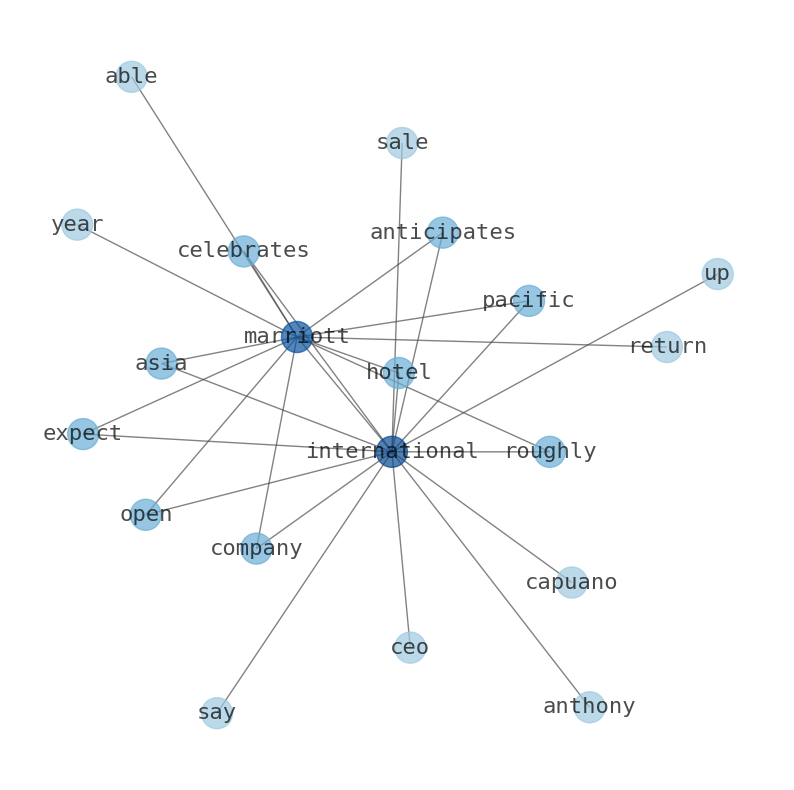

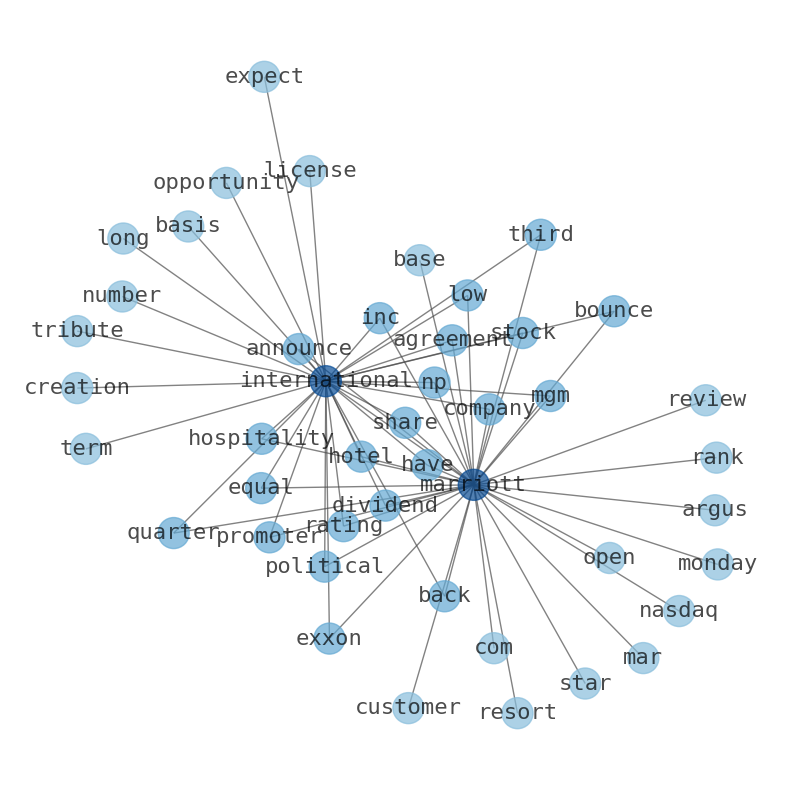

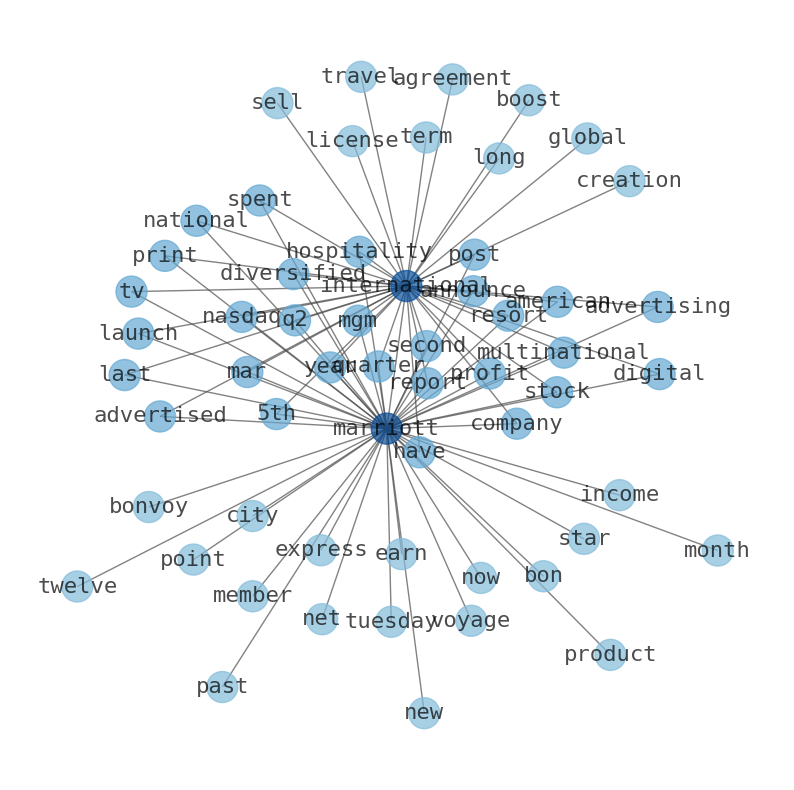

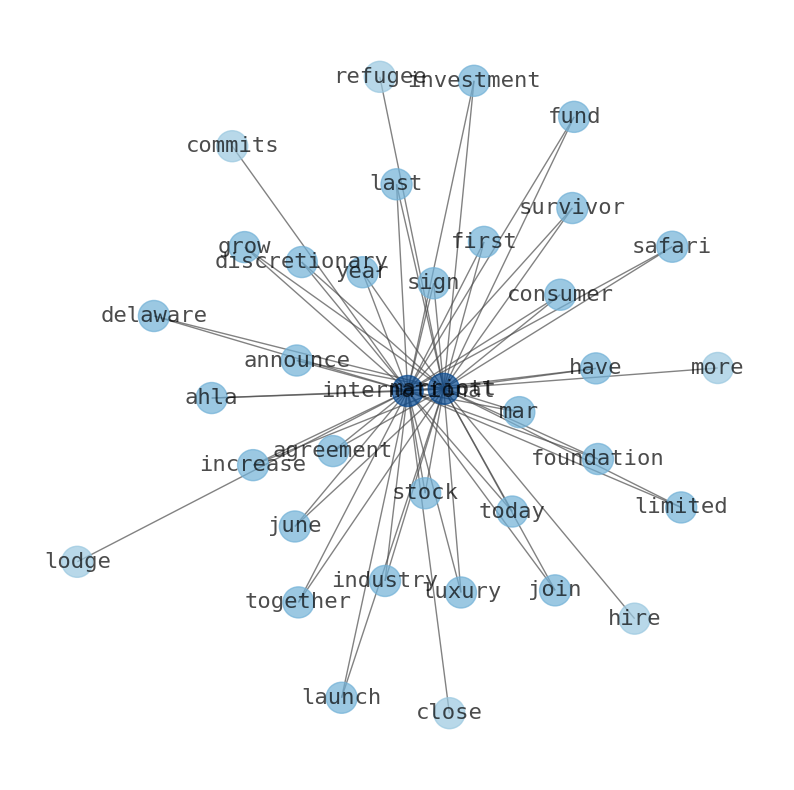

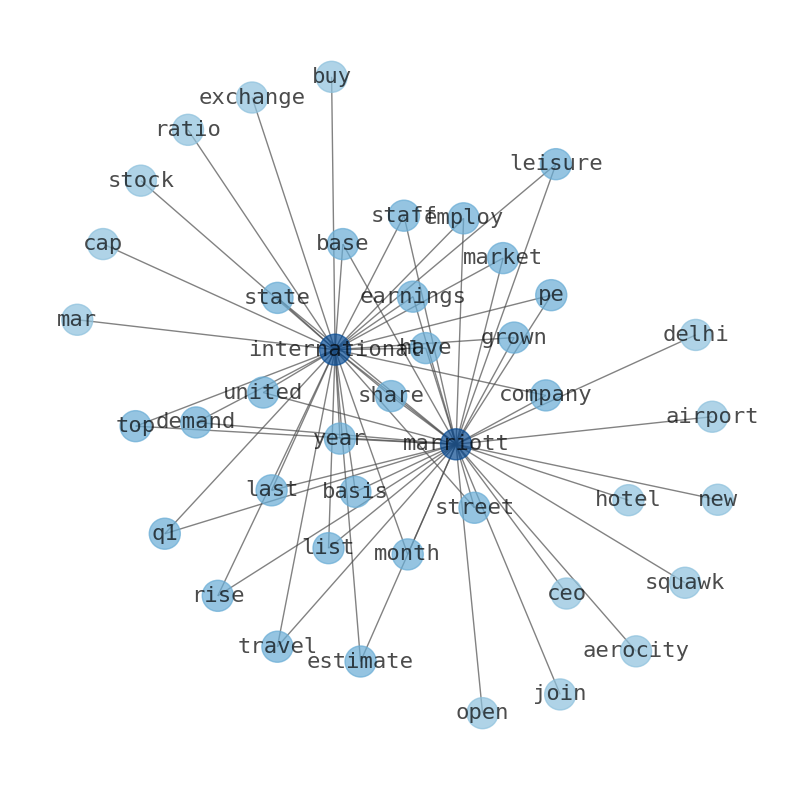

The game is changing. There is a new strategy to evaluate Marriott International fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Marriott International are: Marriott, International, share, earnings, basis, year, company, …

Stock Summary

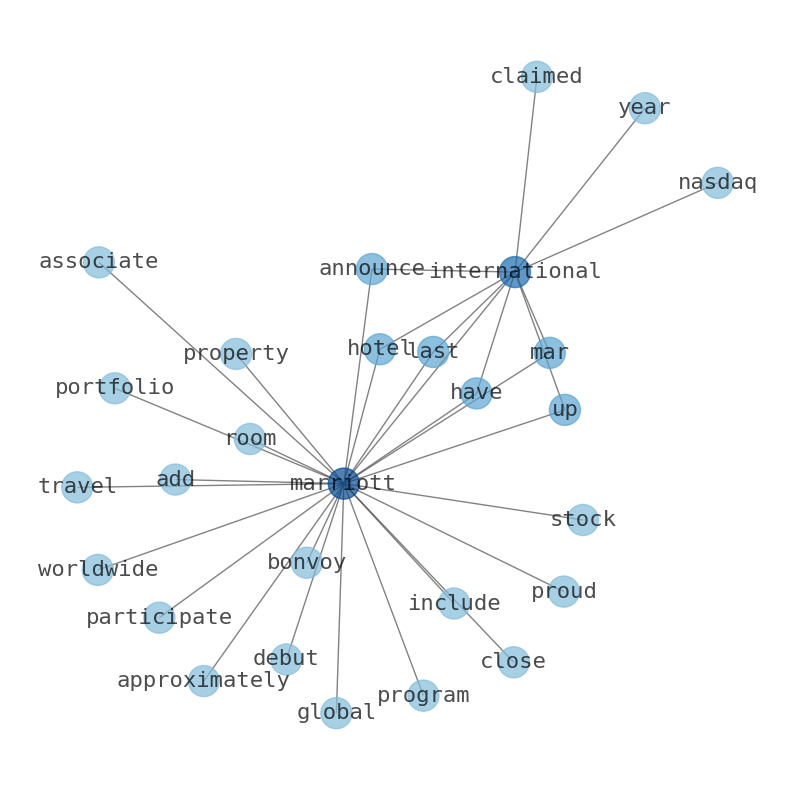

Marriott International, Inc. operates, franchises, and licenses hotel, residential, timeshare, and other lodging properties worldwide. It operates properties under 30 brand names in 138 countries and territories. The company operates through U.S. and Canada.

Today's Summary

Wall Street analysts think its a good time to buy Marriott International stock. The consensus analyst rating on Marriott International is a Buy. The company has a market cap of $54.55bn and has a trailing dividend yield of 0.61%.

Today's News

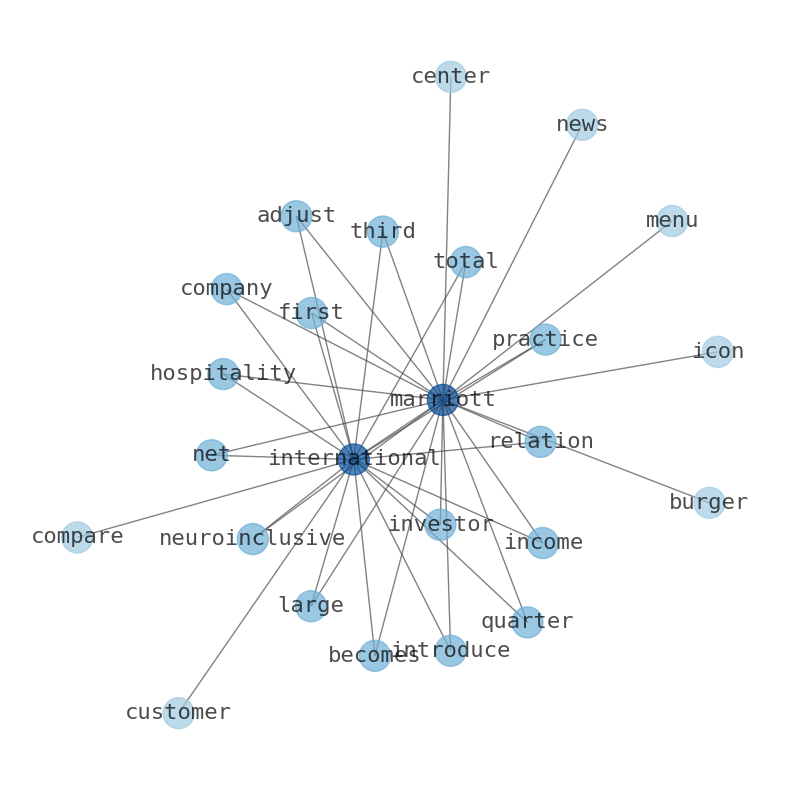

Marriott International tops Q1 earnings estimates amid leisure travel demand amid rising demand of leisure travel. Marriott International does not discriminate on the basis of disability, veteran status or any other basis protected under federal, state or local laws. Marriott CEO Tony Capuano, Marriott International CEO, joins Squawk on the Street. Marriott International has grown its earnings per share by 47% per year, over the last three years. The company has a market cap of $54.55bn and has a trailing dividend yield of 0.61%. The overall consensus recommendation for Marriott International is Hold. Marriott International shares listed in the United States Exchange: NSQ Ticker Symbol: MAR. The analyst consensus target price for shares in Marriott International is $187.47. That is 4.74% above the last closing price of $178.99. The Marriott International PE ratio based on its reported earnings over the past 12 months is 20.75. Marriott International, Inc. (NASDAQ:MAR) evp drew pinto sells 700 shares of stock - defense world. (nasdaq:mar) Evp Drew Pinto sold 700 shares in a transaction that occurred on Monday, May 8th. Charge Zone to install 100+ EV charging stations at Marriott hotels in India. Marriott to open 2 new hotels at Delhi Airport Aerocity in 2025. Marriott International is a global hospitality company founded in 1927 by J.Willard Marriot. With over 7,000 properties in 131 countries and territories, the company connects travelers and guests through its 30 different hotel brands. Marriott Internationals market cap in 2012 stood at an impressive $14.48 billion, a 53.6% increase from the previous years market cap of $9 43 billion. Marriott International is a lodging business based in the US. Marriott International employs 377,000 staff and has a trailing 12-month revenue of around $5.4 billion. Marriott International shares were split on a 1061:1000 basis on 22 November 2011. Shareholders could enjoy a 0.9% return on their shares, in the form of dividend payments. Marriott Internationals most recent dividend payout was on 31 March 2023. WallStreetZen was built to help everyday investors do more accurate fundamental analysis in less time. The consensus analyst rating on Marriott International is a Buy. Wall Street analysts think its a good time to buy Marriott International stock.

Stock Profile

"Marriott International, Inc. operates, franchises, and licenses hotel, residential, timeshare, and other lodging properties worldwide. The company operates through U.S. and Canada, and International segments. It operates its properties under the JW Marriott, The Ritz-Carlton, Ritz-Carlton Reserve, W Hotels, The Luxury Collection, St. Regis, EDITION, Bvlgari, Renaissance, Le Méridien, Marriott, Sheraton, Westin, Four Points, Delta Hotels by Marriott, Autograph Collection, Tribute Portfolio, Marriott Hotels, Marriott Executive Apartments, Marriott Vacation Club, Gaylord Hotels, Design Hotels, Courtyard, Residence Inn, Fairfield, SpringHill Suites, TownePlace Suites, Protea Hotels, Aloft Hotels, AC Hotels by Marriott, Element Hotels, and Moxy Hotels brand names. It operates properties under 30 brand names in 138 countries and territories. Marriott International, Inc. was founded in 1927 and is headquartered in Bethesda, Maryland."

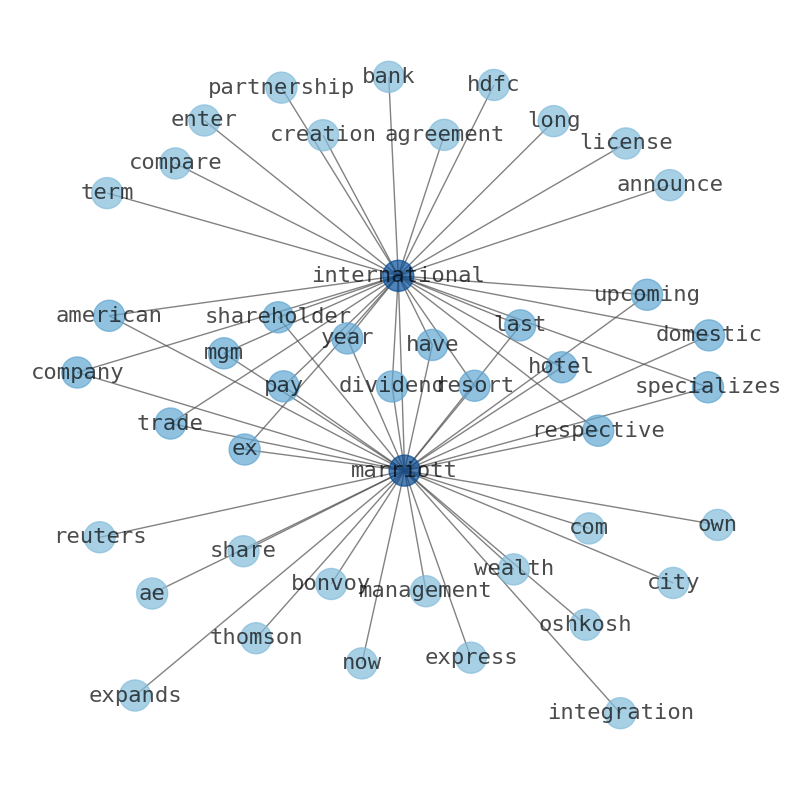

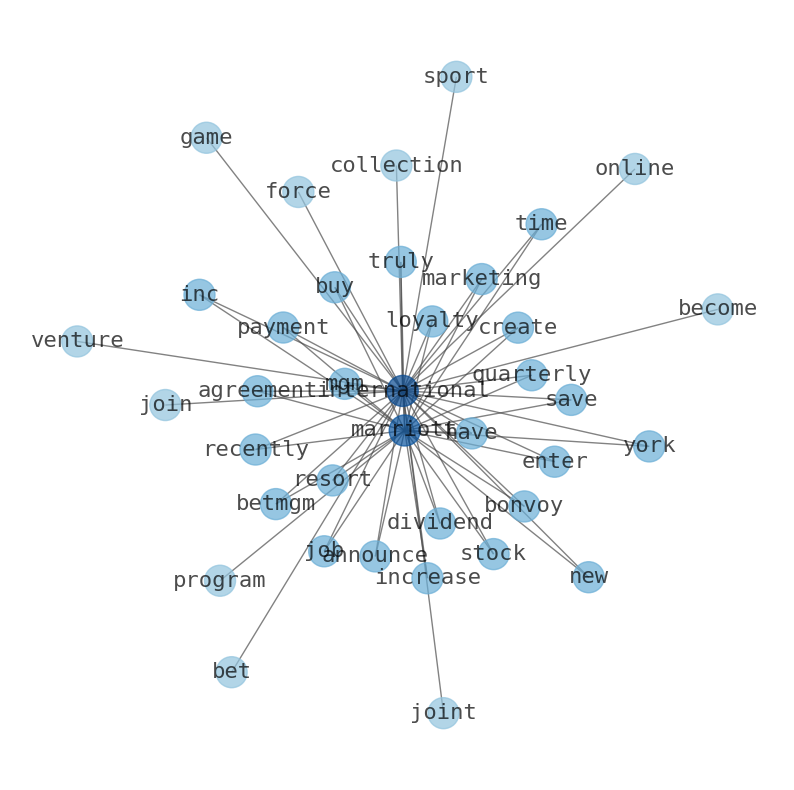

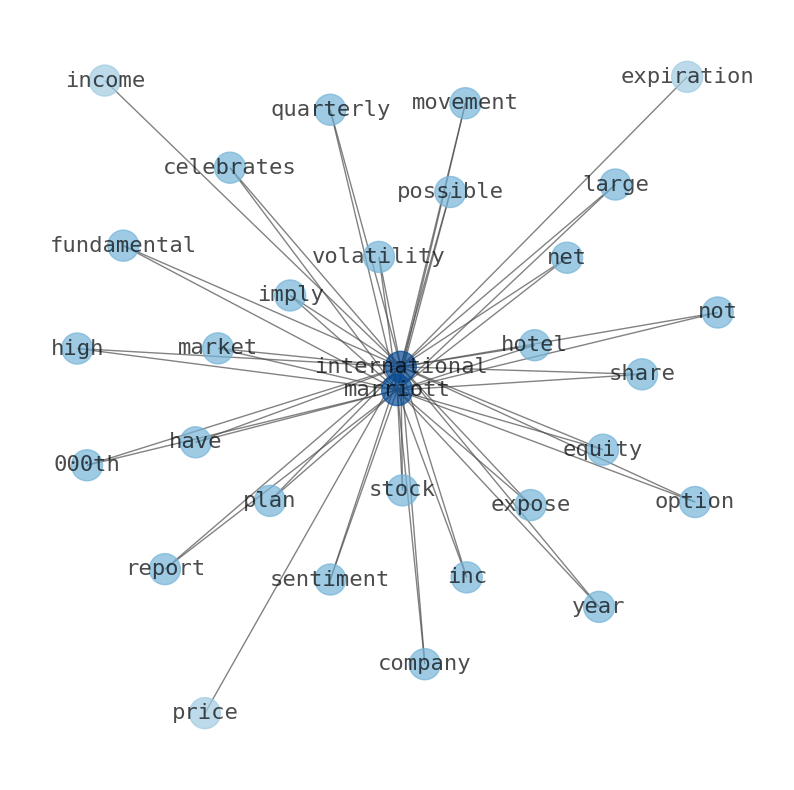

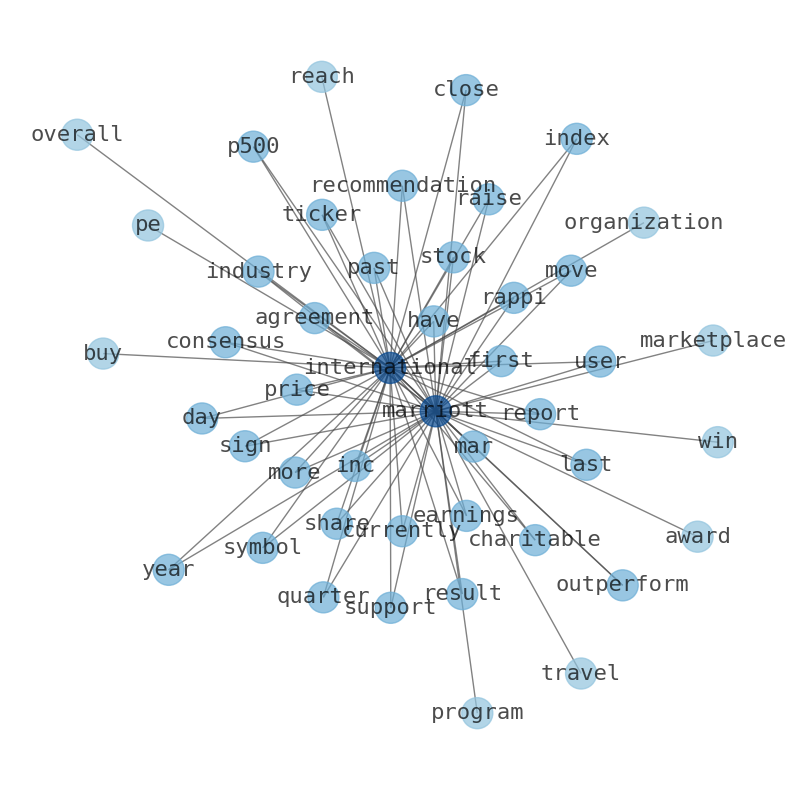

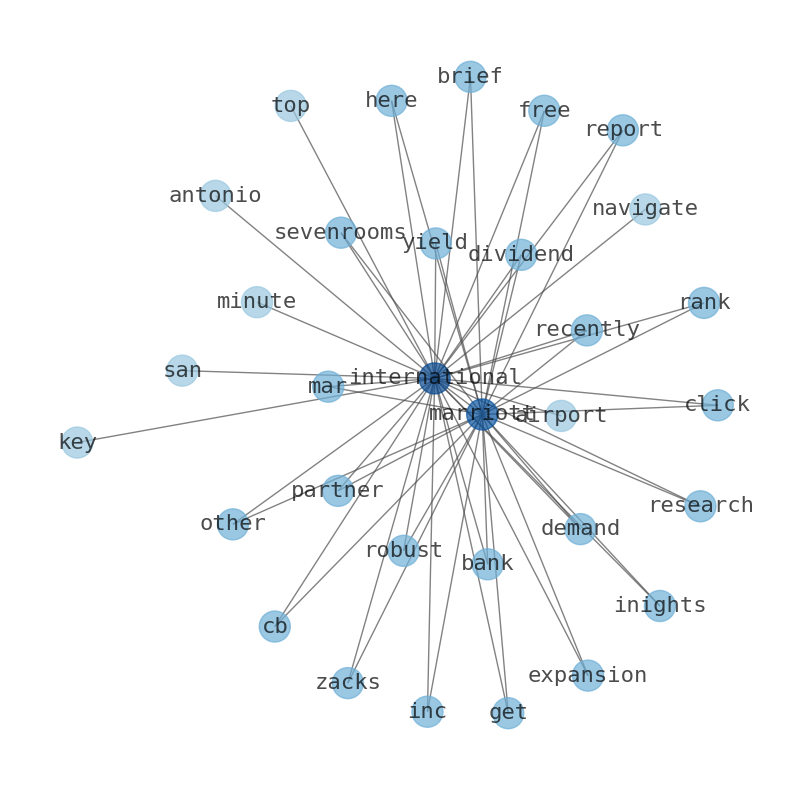

Keywords

This document will help you to evaluate Marriott International without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Marriott International are: Marriott, International, share, earnings, basis, year, company, and the most common words in the summary are: marriott, international, hotel, job, share, stock, new, . One of the sentences in the summary was: Wall Street analysts think its a good time to buy Marriott International stock. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #marriott #international #hotel #job #share #stock #new.

Read more →Related Results

Marriott International

Open: 247.17 Close: 250.28 Change: 3.11

Read more →

Marriott International

Open: 202.75 Close: 209.28 Change: 6.53

Read more →

Marriott International

Open: 199.63 Close: 199.79 Change: 0.16

Read more →

Marriott International

Open: 197.82 Close: 199.61 Change: 1.79

Read more →

Marriott International

Open: 177.27 Close: 176.36 Change: -0.91

Read more →

Marriott International

Open: 171.47 Close: 171.76 Change: 0.29

Read more →

Marriott International

Open: 237.53 Close: 242.23 Change: 4.7

Read more →

Marriott International

Open: 191.19 Close: 194.82 Change: 3.63

Read more →

Marriott International

Open: 202.02 Close: 202.98 Change: 0.96

Read more →

Marriott International

Open: 183.41 Close: 184.23 Change: 0.82

Read more →

Marriott International

Open: 167.79 Close: 171.14 Change: 3.35

Read more →

Marriott International

Open: 180.0 Close: 175.63 Change: -4.37

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo