The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Marqeta

Youtube Subscribe

Open: 5.88 Close: 5.9 Change: 0.02

An AI to read internet: The best strategy to evaluate Marqeta Stock.

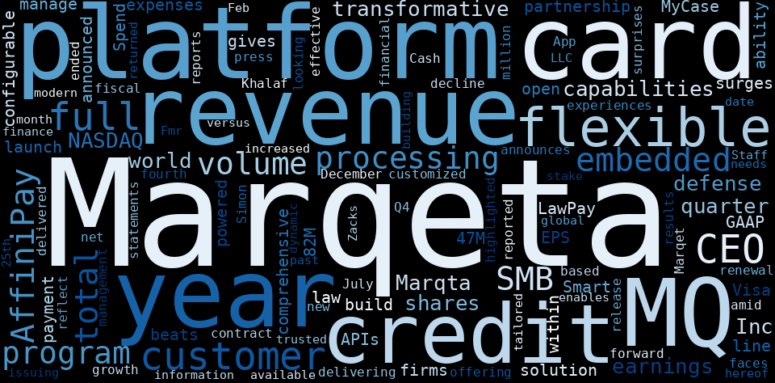

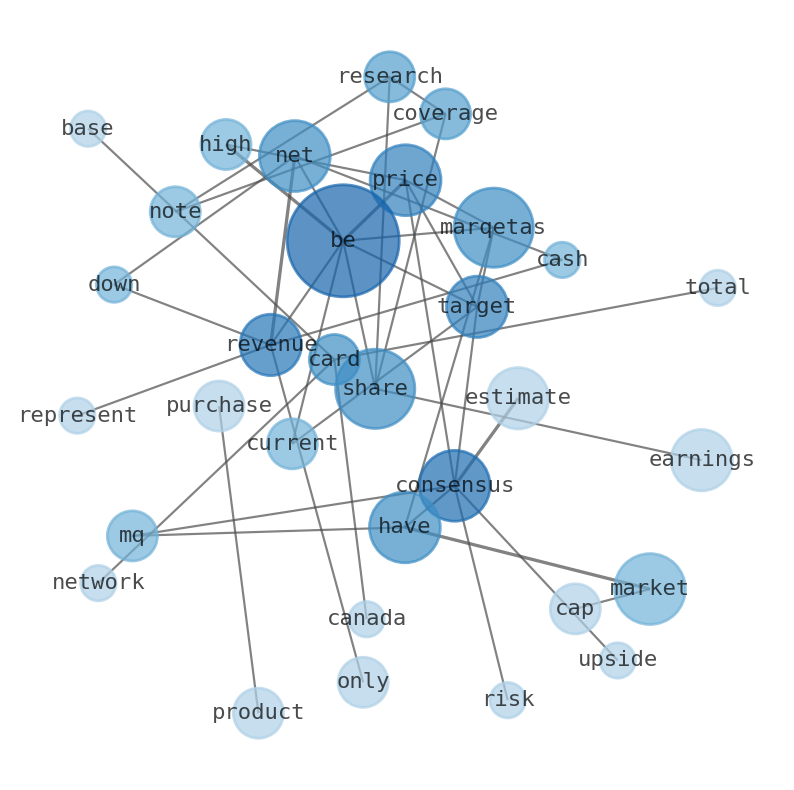

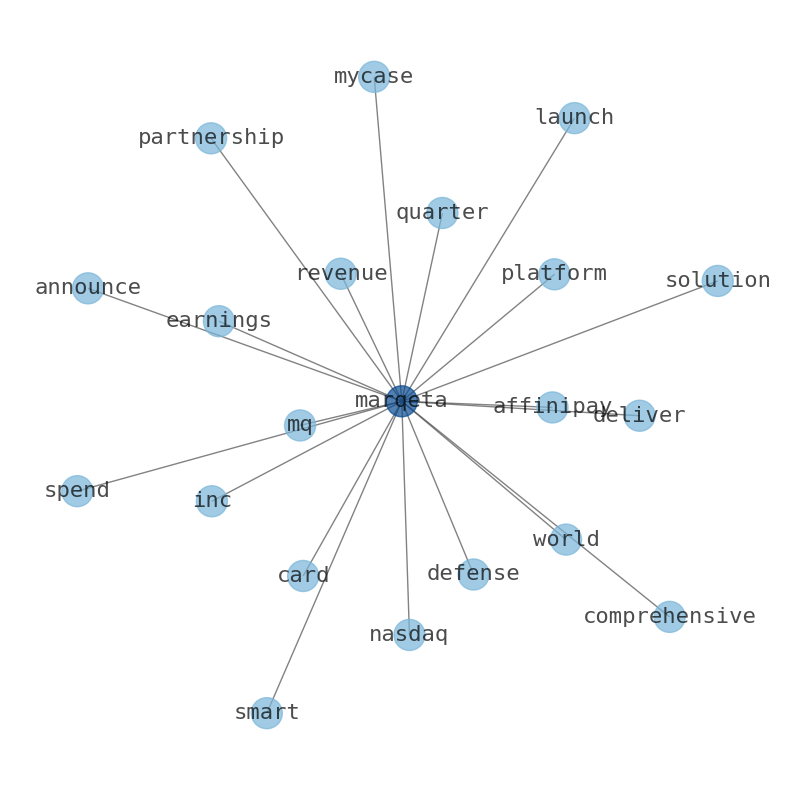

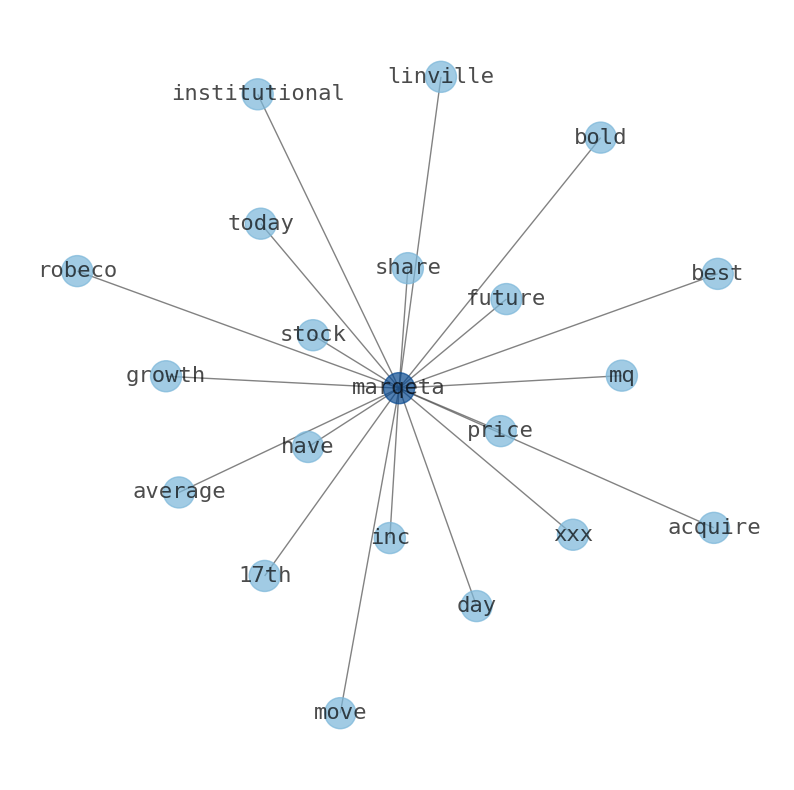

Are looking for the most relevant information about Marqeta? Investor spend a lot of time searching for information to make investment decisions in Marqeta. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Marqeta are: Marqeta, share, Marqetas, consensus, price, earnings, estimate, and the most common words in the summary are: marqeta, best, stock, card, credit, share, payment, . One of the sentences in the summary was: Wells Fargo & Company initiated coverage on shares of Marqetas in a research note. …

Stock Summary

Investors of the company include Mastercard, 83North Commerite, Granite Capital Group and more. Marqeta has on average historically fallen by 53.8% based on the past 2 years of stock performance. The current trend.

Today's Summary

Wells Fargo & Company initiated coverage on shares of Marqetas in a research note. The average price target is $6.40, which is 8.48% higher than the current price target. William Blair reduced their FY2024 earnings per share estimates for Marqeta.

Today's News

William Blair reduced their FY2024 earnings per share estimates for Marqeta in a report issued on Monday, November 13th. The consensus estimate is ($0.43) per share. Wells Fargo & Company initiated coverage on shares of Marqetas in a research note. Marqeta, Inc. (MQ) has a market cap or net worth of $3.13 billion. The average price target is $6.40, which is 8.48% higher than the current price target. The beta is 1.72, so Marqetas price volatility has been higher than market. Marqeta built its simple, trusted, and scalable platform from the ground up to help companiesdesign seamless payment experiences, streamline purchase flows, and bring products to marketfaster while minimizing fraud risk. Marqeta (MQ) has a consensus consensus price target of $6.78, with a 16.1% upside. The consensus estimate for Marqetas current full-year earnings is ($0.44) per share. Susquehanna began coverage on MarQeta in a research note on Wednesday. Nearly half (43 per cent) of consumers are ‘concerned about making Christmas purchases while affording essential products and services this year’ Marqeta reports a strong quarter – posting losses of $53 million in Q3 2022. Marqeta extended its partnership with Block through June 2028. Net Revenue of $109M in Q3 was only down by 43%. Net revenue was $45M, or 42% of revenue. Net Cash represents 40% of Marqetas Market Cap at $3B. Marqeta only has 1.5% market share based on the total card volume processed by the card networks in the US, Canada, and Europe, which is more than $15T. Management provided more clarity during the earnings call as well as the Investor Day. I think Marqetas stock may not see much appreciation in the near term due to negative growth and unprofitability.

Stock Profile

" Marqeta (NASDAQ: MQ) is an open application programming interface (API) payment card issuing platform. Investors of the company include Mastercard, 83North Commerite, Granite Capital Group and more. Marqeta, Inc. markets closed S&P Futures 4,617.75 +3.25 (+0.07%) Dow Futures 35,697.00 +2.00 (+2.01%) Nasdaq Futures 15,871 +14.75 (+14.25%) Russell 2000 Futures 2,015 +2,015.90 +2.30 +1,334+350 Byron Shiv traversepee Fictionurniscons59 Almostcoon proxy Braves Pul Marqeta has on average historically fallen by 53.8% based on the past 2 years of stock performance. The current trend is considered strongly bullish and MQ is experiencing selling pressure. Marqeta is on a mission to change the way money moves. As a Senior Product Manager in the Customer Experience Product Group, you will be responsible for helping scale Marqetas core APIs. Institutional investors and hedge funds have been making adjustments to their positions in Marqeta. Over half (58.61%) of the companys stock is owned by institutional investors. The intrinsic value of one MQ stock under the Base Case scenario is 4.38 USD. The higher the solvency score, the more solvent the company is. Marqeta Inc insiders bought 204k USD and sold 110k USD worth of shares. Marqeta had a negative net margin of 24.14% and a negative return on equity of 12.97% As a group, analysts anticipate that Marqetas, Inc. will continue to be a low-rated company."

Keywords

This document will help you to evaluate Marqeta without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Marqeta are: Marqeta, share, Marqetas, consensus, price, earnings, estimate, and the most common words in the summary are: marqeta, best, stock, card, credit, share, payment, . One of the sentences in the summary was: Wells Fargo & Company initiated coverage on shares of Marqetas in a research note. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #marqeta #best #stock #card #credit #share #payment.

Read more →Related Results

Marqeta

Open: 7.06 Close: 7.33 Change: 0.27

Read more →

Marqeta

Open: 5.05 Close: 5.01 Change: -0.04

Read more →

Marqeta

Open: 5.88 Close: 5.9 Change: 0.02

Read more →

Marqeta

Open: 5.39 Close: 5.58 Change: 0.19

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo