The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Marqeta

Youtube Subscribe

Open: 5.39 Close: 5.58 Change: 0.19

What an AI can tell you about Marqeta before investing.

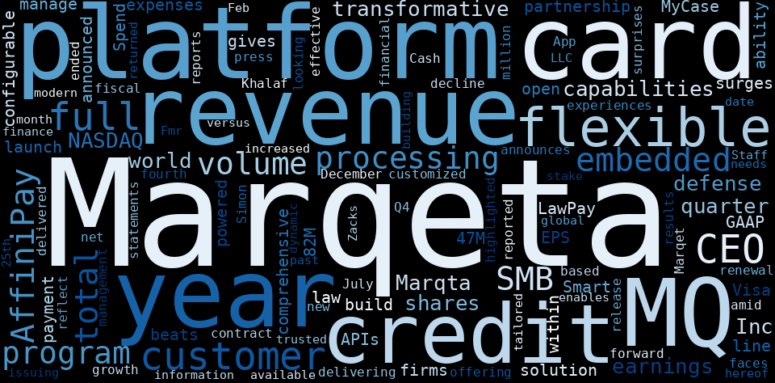

How much time have you spent trying to decide whether investing in Marqeta? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Marqeta are: Marqeta, Futures, …

Stock Summary

Investors of the company include Mastercard, 83North Commerite, Granite Capital Group and more. Marqeta has on average historically fallen by 53.8% based on the past 2 years of stock performance. The current trend.

Today's Summary

Investors of the company include Mastercard, 83North Commerite, Granite Capital Group and more. Marqeta has on average historically fallen by 53.8% based on the past 2 years of stock performance.

Today's News

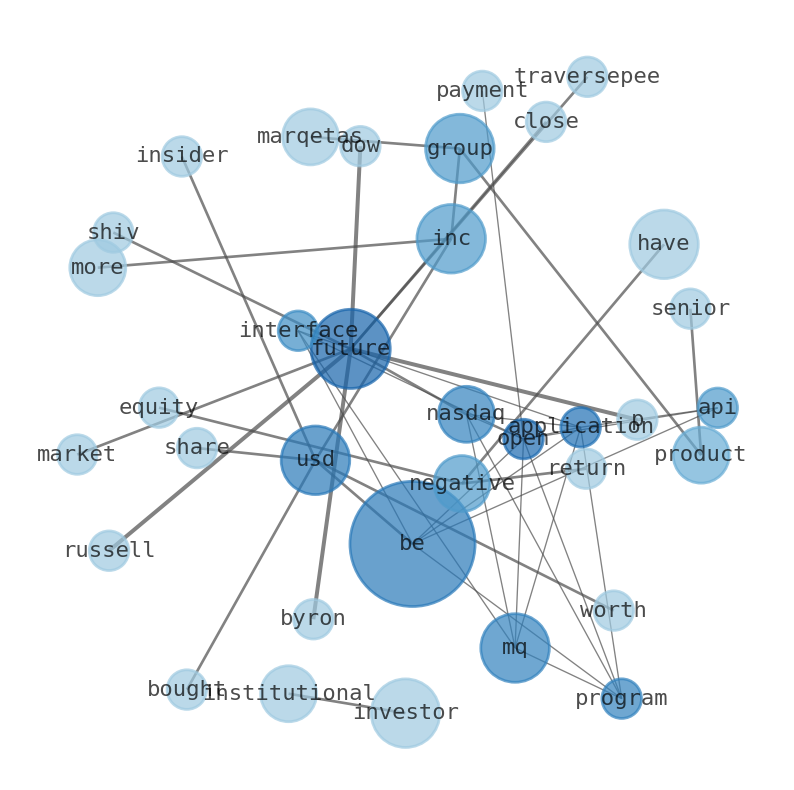

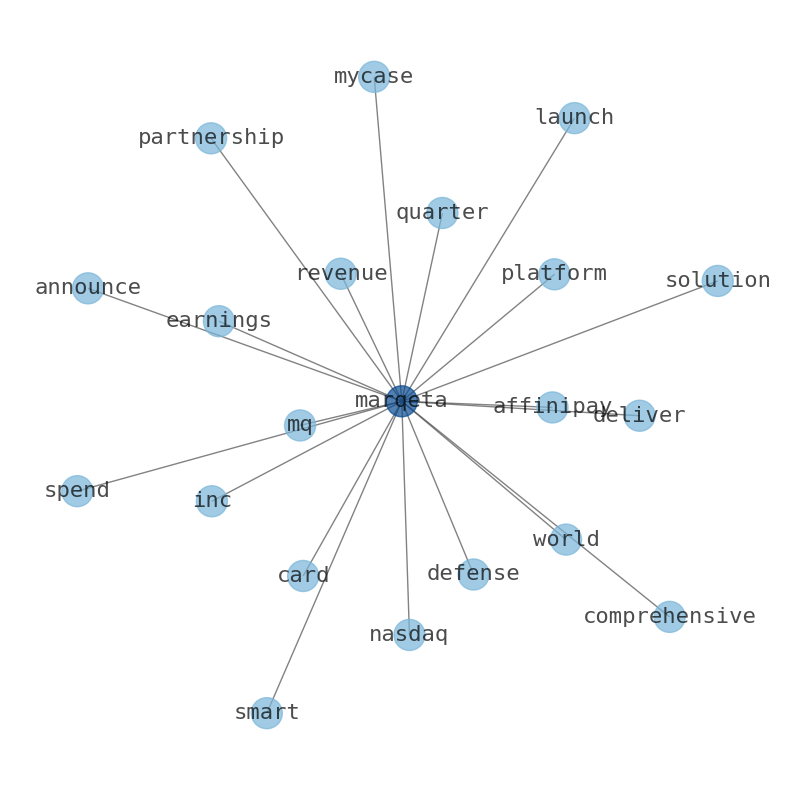

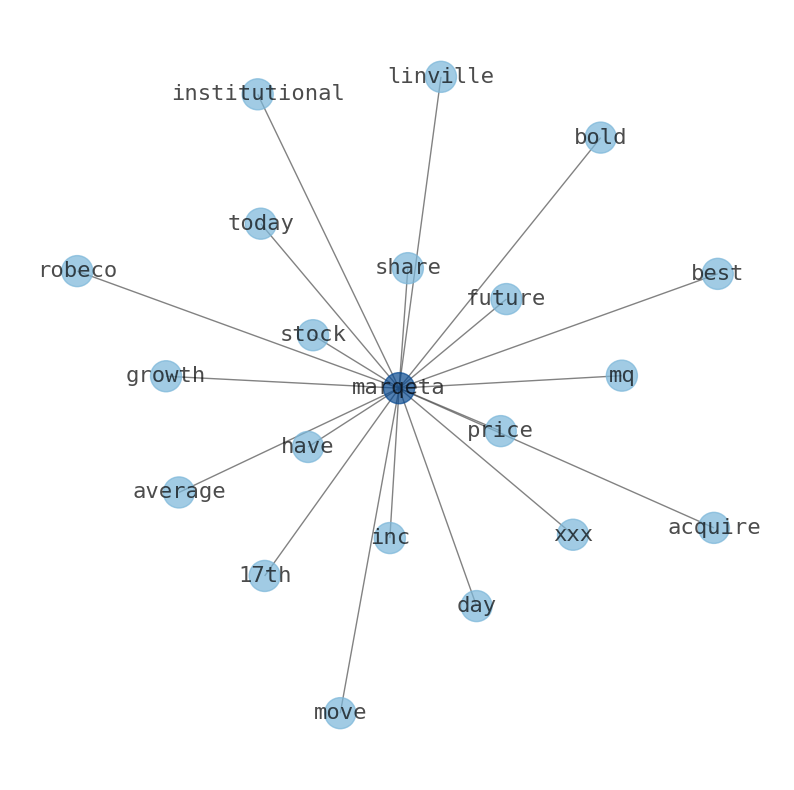

Marqeta (NASDAQ: MQ) is an open application programming interface (API) payment card issuing platform. Investors of the company include Mastercard, 83North Commerite, Granite Capital Group and more. Marqeta, Inc. markets closed S&P Futures 4,617.75 +3.25 (+0.07%) Dow Futures 35,697.00 +2.00 (+2.01%) Nasdaq Futures 15,871 +14.75 (+14.25%) Russell 2000 Futures 2,015 +2,015.90 +2.30 +1,334+350 Byron Shiv traversepee Fictionurniscons59 Almostcoon proxy Braves Pul Marqeta has on average historically fallen by 53.8% based on the past 2 years of stock performance. The current trend is considered strongly bullish and MQ is experiencing selling pressure. Marqeta is on a mission to change the way money moves. As a Senior Product Manager in the Customer Experience Product Group, you will be responsible for helping scale Marqetas core APIs. Institutional investors and hedge funds have been making adjustments to their positions in Marqeta. Over half (58.61%) of the companys stock is owned by institutional investors. The intrinsic value of one MQ stock under the Base Case scenario is 4.38 USD. The higher the solvency score, the more solvent the company is. Marqeta Inc insiders bought 204k USD and sold 110k USD worth of shares. Marqeta had a negative net margin of 24.14% and a negative return on equity of 12.97% As a group, analysts anticipate that Marqetas, Inc. will continue to be a low-rated company.

Stock Profile

" Marqeta (NASDAQ: MQ) is an open application programming interface (API) payment card issuing platform. Investors of the company include Mastercard, 83North Commerite, Granite Capital Group and more. Marqeta, Inc. markets closed S&P Futures 4,617.75 +3.25 (+0.07%) Dow Futures 35,697.00 +2.00 (+2.01%) Nasdaq Futures 15,871 +14.75 (+14.25%) Russell 2000 Futures 2,015 +2,015.90 +2.30 +1,334+350 Byron Shiv traversepee Fictionurniscons59 Almostcoon proxy Braves Pul Marqeta has on average historically fallen by 53.8% based on the past 2 years of stock performance. The current trend is considered strongly bullish and MQ is experiencing selling pressure. Marqeta is on a mission to change the way money moves. As a Senior Product Manager in the Customer Experience Product Group, you will be responsible for helping scale Marqetas core APIs. Institutional investors and hedge funds have been making adjustments to their positions in Marqeta. Over half (58.61%) of the companys stock is owned by institutional investors. The intrinsic value of one MQ stock under the Base Case scenario is 4.38 USD. The higher the solvency score, the more solvent the company is. Marqeta Inc insiders bought 204k USD and sold 110k USD worth of shares. Marqeta had a negative net margin of 24.14% and a negative return on equity of 12.97% As a group, analysts anticipate that Marqetas, Inc. will continue to be a low-rated company."

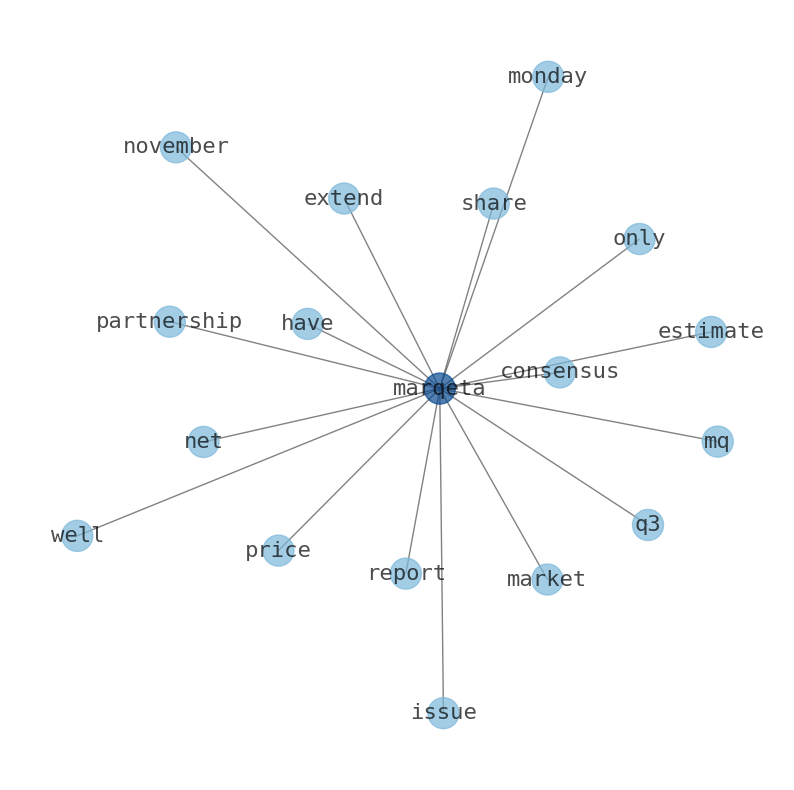

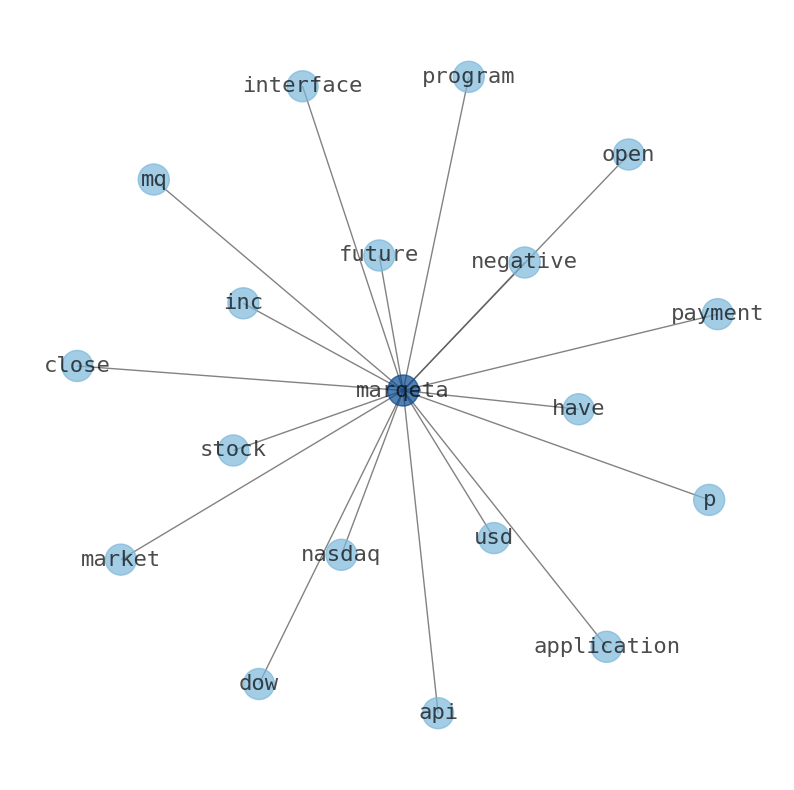

Keywords

The game is changing. There is a new strategy to evaluate Marqeta fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Marqeta are: Marqeta, Futures, MQ, company, Inc, stock, Group, and the most common words in the summary are: marqeta, year, stock, payment, product, price, usd, . One of the sentences in the summary was: Marqeta has on average historically fallen by 53.8% based on the past 2 years of stock performance.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #marqeta #year #stock #payment #product #price #usd.

Read more →Related Results

Marqeta

Open: 7.06 Close: 7.33 Change: 0.27

Read more →

Marqeta

Open: 5.05 Close: 5.01 Change: -0.04

Read more →

Marqeta

Open: 5.88 Close: 5.9 Change: 0.02

Read more →

Marqeta

Open: 5.39 Close: 5.58 Change: 0.19

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo