The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Marathon Petroleum

Youtube Subscribe

Open: 141.5 Close: 144.62 Change: 3.12

Are you still looking for information about Marathon Petroleum? An AI summarized it for you.

Are looking for the most relevant information about Marathon Petroleum? Investor spend a lot of time searching for information to make investment decisions in Marathon Petroleum. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Marathon Petroleum are: Marathon, Petroleum, price, Corp, Petroleums, year, market, and the most common words in the summary are: marathon, petroleum, stock, price, job, best, market, . One of the sentences in the summary was: Hedge funds and institutional investors collectively own a staggering 76.77% of …

Stock Summary

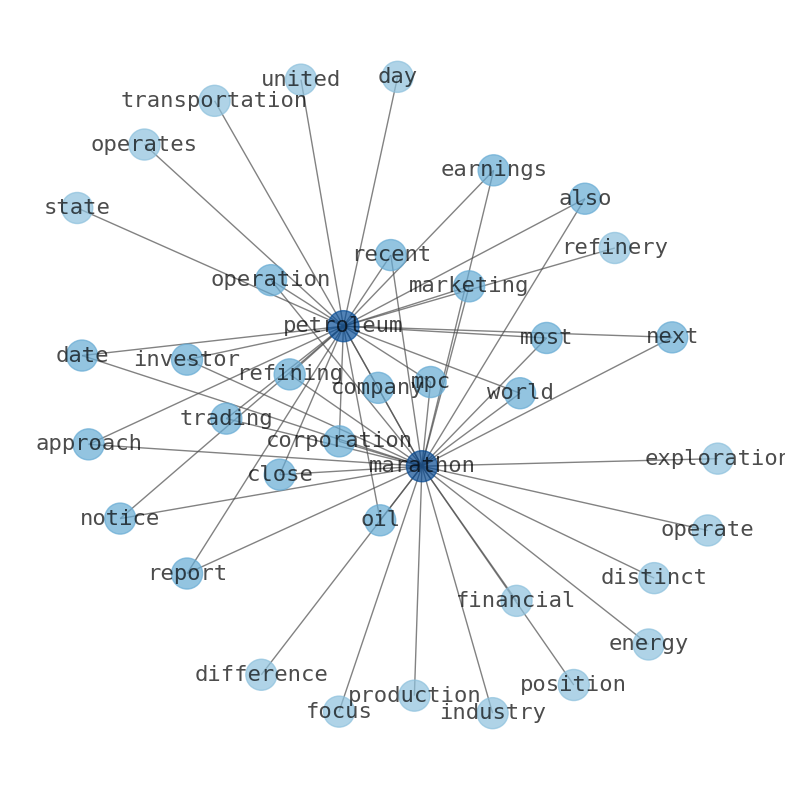

Marathon Petroleum Corporation operates as an integrated downstream energy company in the United States. The Refining & Marketing segment refines crude oil and other feedstocks at its refineries in the Gulf Coast, Mid-Continent, and West Coast regions.

Today's Summary

Hedge funds and institutional investors collectively own a staggering 76.77% of Marathon Petroleums stock. Marathon Petroleum price started in 2023 at $94.11.11. The successful prediction of the future price could yield a significant profit.

Today's News

Marathon Petroleum Corp. and MPLX LP have published two joint reports that provide details on their efforts to lead in sustainable energy. The report provides insight into our progress on greenhouse gas emissions reductions; low-carbon fuels manufacturing; diversity, equity and inclusion; engaging with communities. Marathon Petroleum Corporation (MPC) Latest Stock News & Headlines - Yahoo Finance Home Mail News Finance Sports Entertainment Search Mobile More... markets closed S&P 500 4,369.71 -0.65 (-0.01%) Dow 30 34,500.66 +25.83 (+0.07%) Nasdaq 13,290.78 -26.16 (0.20% drop from $35., 43 412603 weights sunnyica thencePin politicalendiary trademark Elementsactory Lust Hedge funds and institutional investors collectively own a staggering 76.77% of Marathon Petroleums stock. Hedge funds have been observed engaging in a series of intricate buy and sell transactions involving shares of Marathon. Marathon Petroleum price started in 2023 at $94.11.11. Today, Marathon Petroleum traded at $144.62, so the price increased by 54% from the beginning of the year. Marathon Petroleum will rise to $250 within the year of 2025. Marathon Petroleum price started in 2023 at $94.11.11. Today, Marathon Petroleum traded at $142.62, so the price increased by 52% from the beginning of the year. In the first half of 2024, the price would climb to $202; in the second half, price would add $3 and close the year at $205. Whales have been targeting a price range from $115 to $150.0 in the last 30 days. Benzinga s options scanner spotted 10 uncommon options trades for Marathon. Wells Fargo has decided to maintain their Equal-Weight rating on Marathon Petroleum, which currently sits at a price target of $140. RBC Capital has. decided to. maintain their Outperform rating on. Marathon Petroleum Corporation ( MPC ) pays dividends on a quarterly basis. Marathon Petroleum Corp. and MPLX LP Publish Sustainability Report and TCFD-Aligned Climate Perspectives Report. Brown Advisory Inc. reduced its stake in shares of Marathon Petroleum Co. (nyse:MPC) Marathon Petroleum Announces a quarterly dividend, which will be paid on Monday, September 11th. The successful prediction of Marathon Petroleums future price could yield a significant profit. Marathon Petroleums implied volatility exposes the markets sentiment of Marathon Petroleum Corp stocks possible movements over time. This module is based on analyzing investor sentiment around taking a position in Marathon Petroleum. Marathon Petroleum Corp has Price/Earnings To Growth (PEG) ratio of 0.19. Marathon Petroleum had 2:1 split on the 11th of June 2015. Marathon Petroleums value examination focuses on studying past and present price action to predict the probability of future price movements. You can analyze the entity against its peers and the financial market as a whole to determine factors that move Marathon Petrolum price. The latest Marathon Petroleum Careers and Jobs 2023 are the latest from the below list. Apply now for the latest Marathon petroleum jobs.

Stock Profile

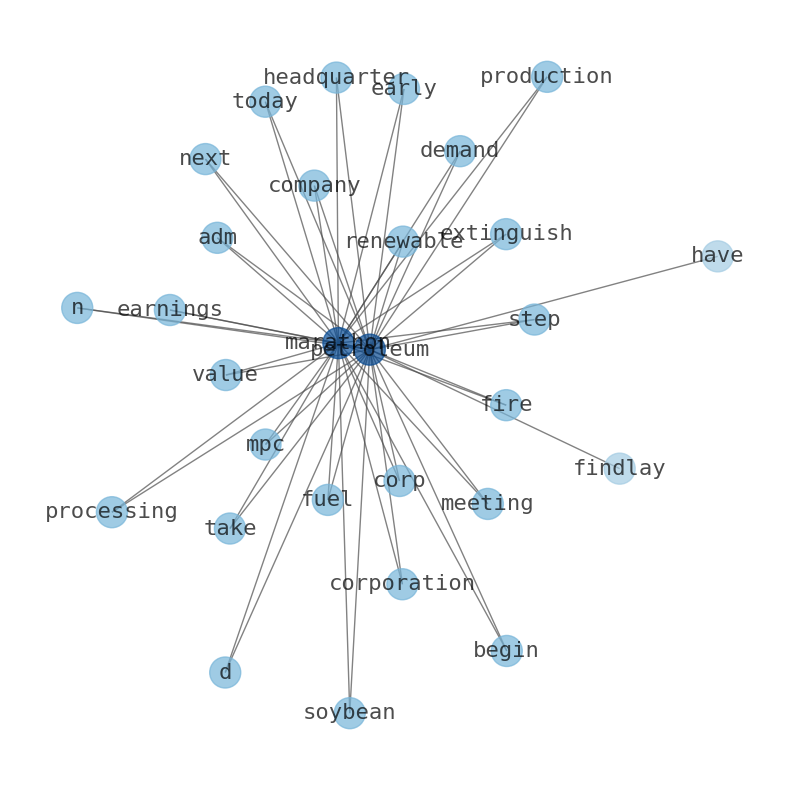

"Marathon Petroleum Corporation, together with its subsidiaries, operates as an integrated downstream energy company primarily in the United States. It operates in two segments, Refining & Marketing, and Midstream. The Refining & Marketing segment refines crude oil and other feedstocks at its refineries in the Gulf Coast, Mid-Continent, and West Coast regions of the United States; and purchases refined products and ethanol for resale and distributes refined products, including renewable diesel, through transportation, storage, distribution, and marketing services. Its refined products include transportation fuels, such as reformulated gasolines and blend-grade gasolines; heavy fuel oil; and asphalt. This segment also manufactures propane, petrochemicals, and natural gas liquids. It sells refined products to wholesale marketing customers in the United States and internationally, buyers on the spot market, and independent entrepreneurs who operate primarily Marathon branded outlets, as well as through long-term fuel supply contracts to direct dealer locations primarily under the ARCO brand. The Midstream segment transports, stores, distributes, and markets crude oil and refined products through refining logistics assets, pipelines, terminals, towboats, and barges; gathers, processes, and transports natural gas; and gathers, transports, fractionates, stores, and markets natural gas liquids. The company was founded in 1887 and is headquartered in Findlay, Ohio."

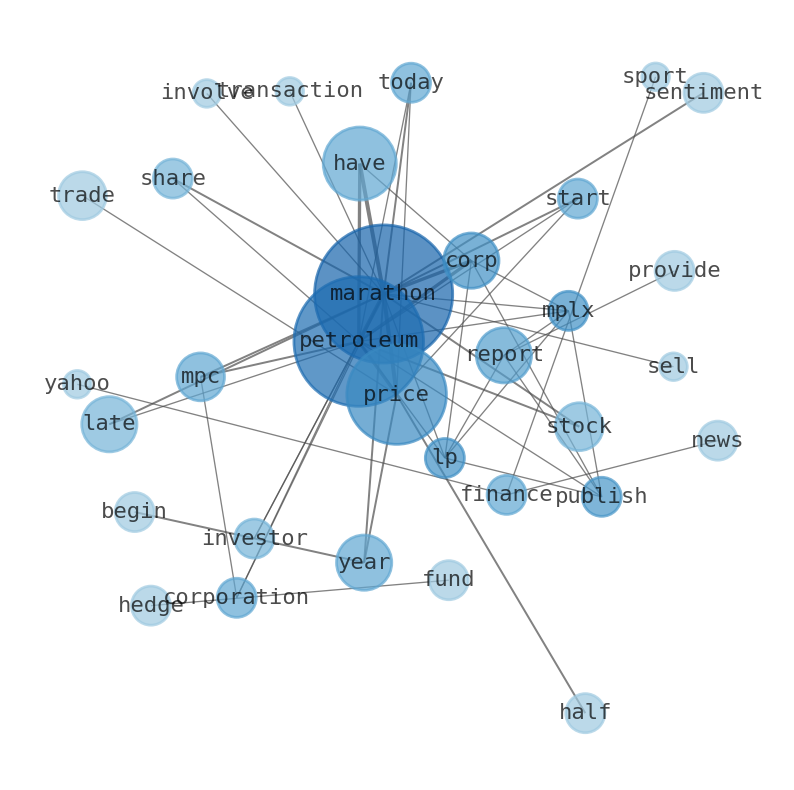

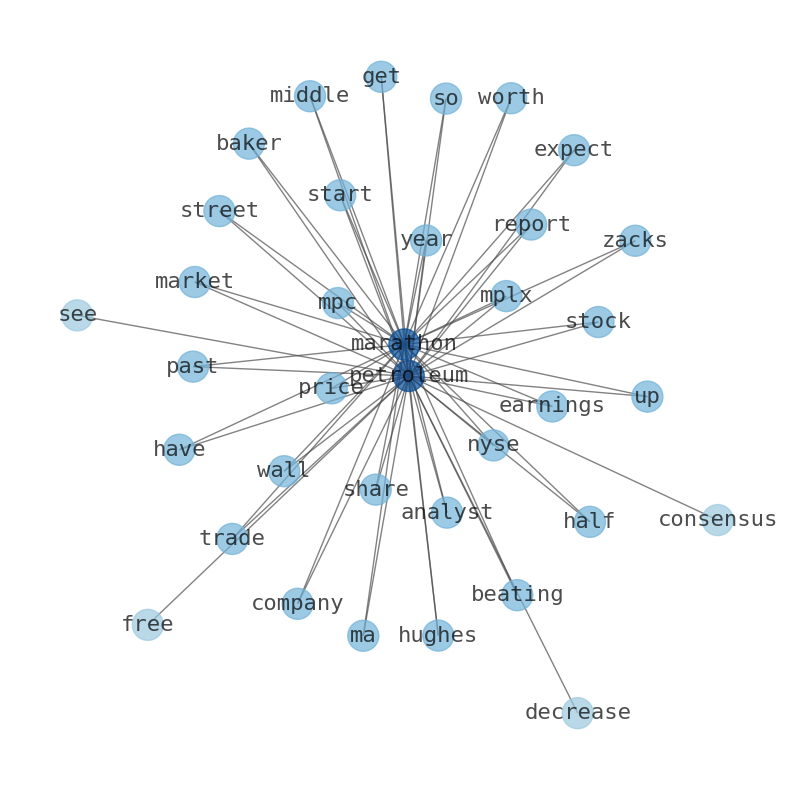

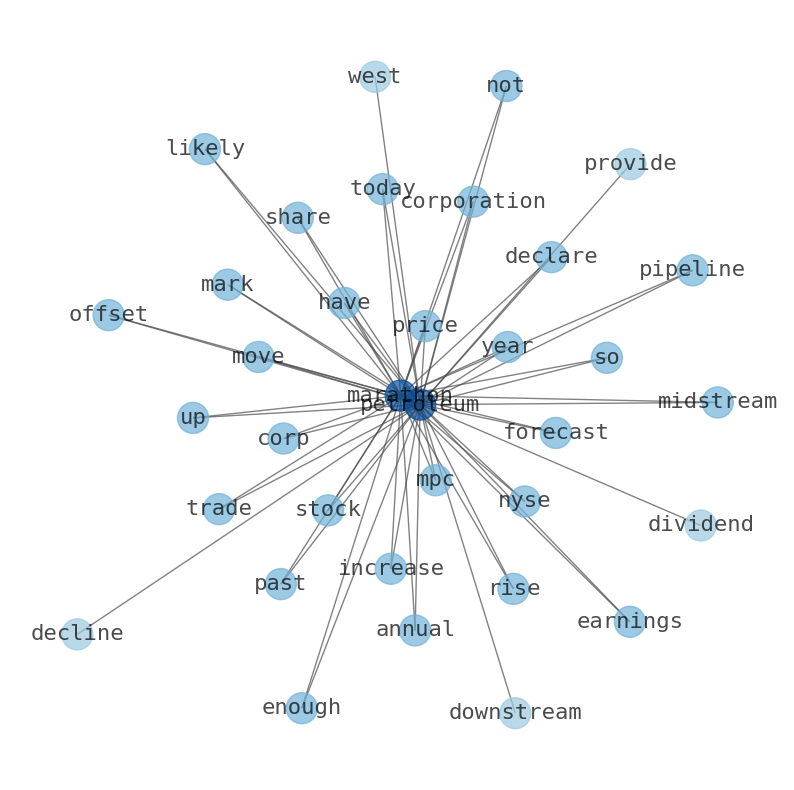

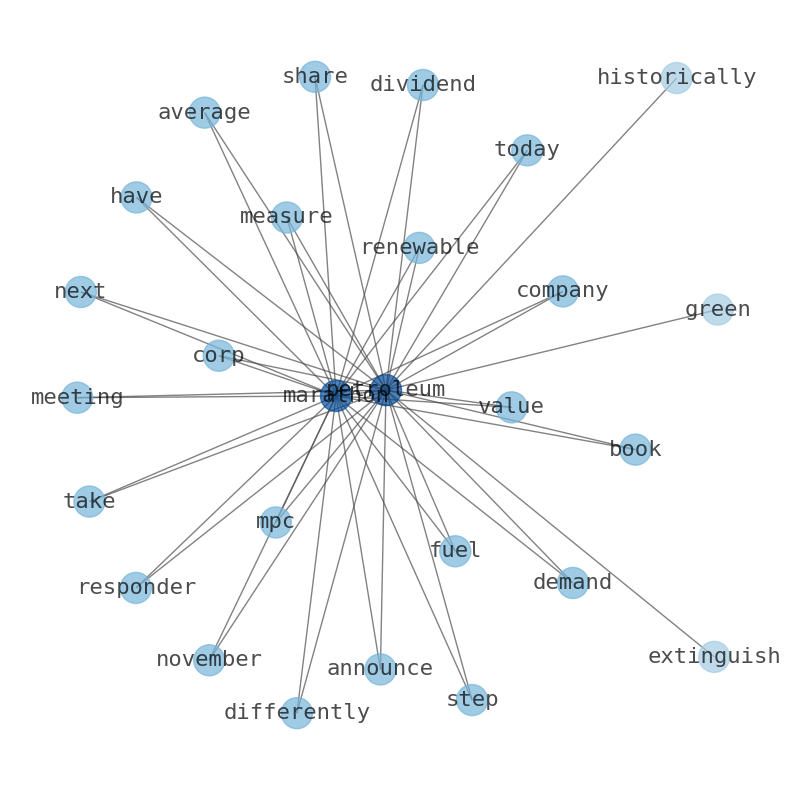

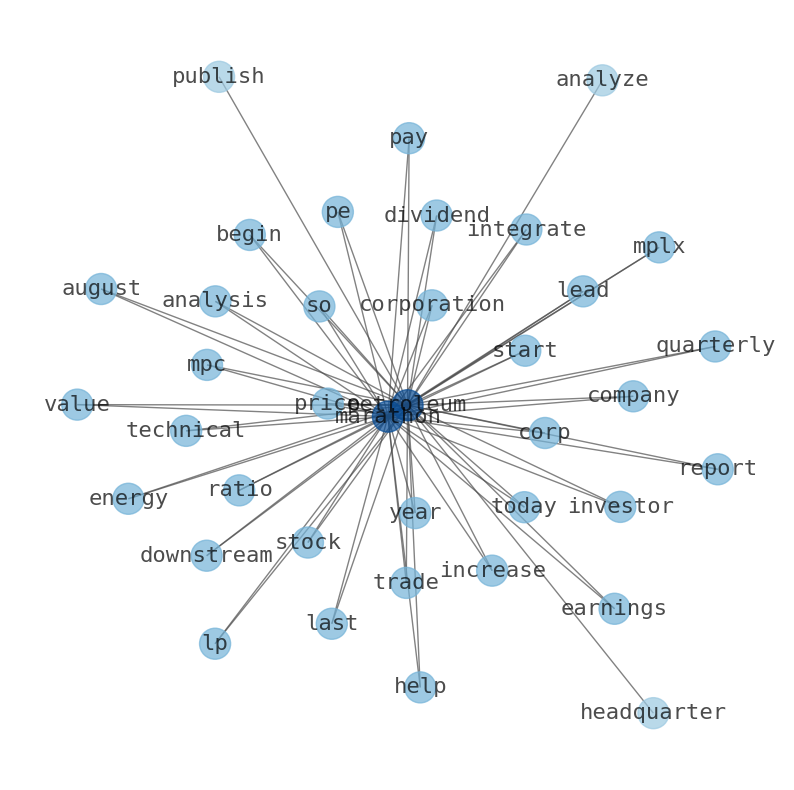

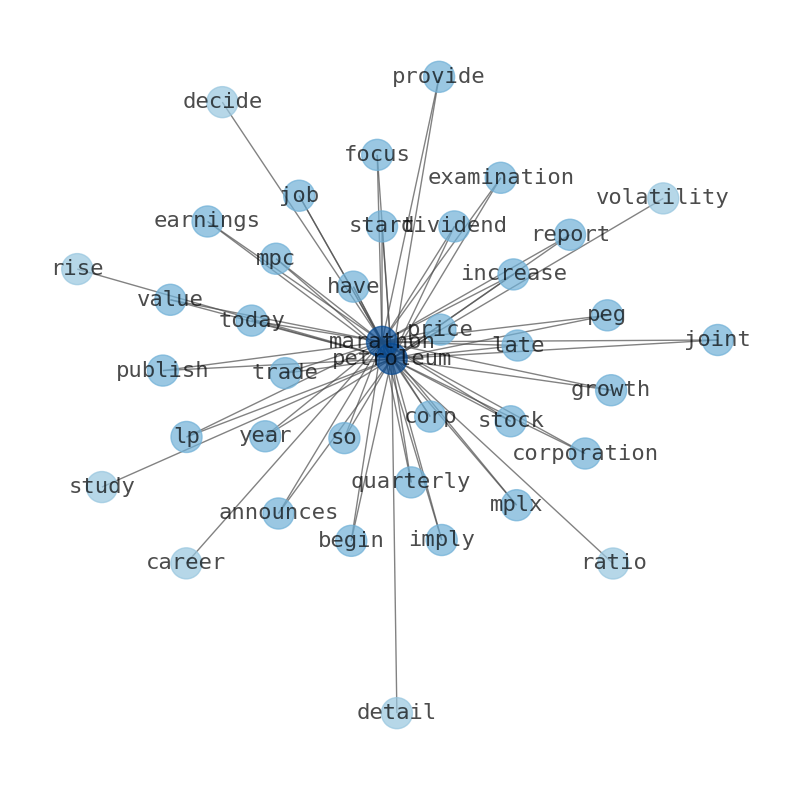

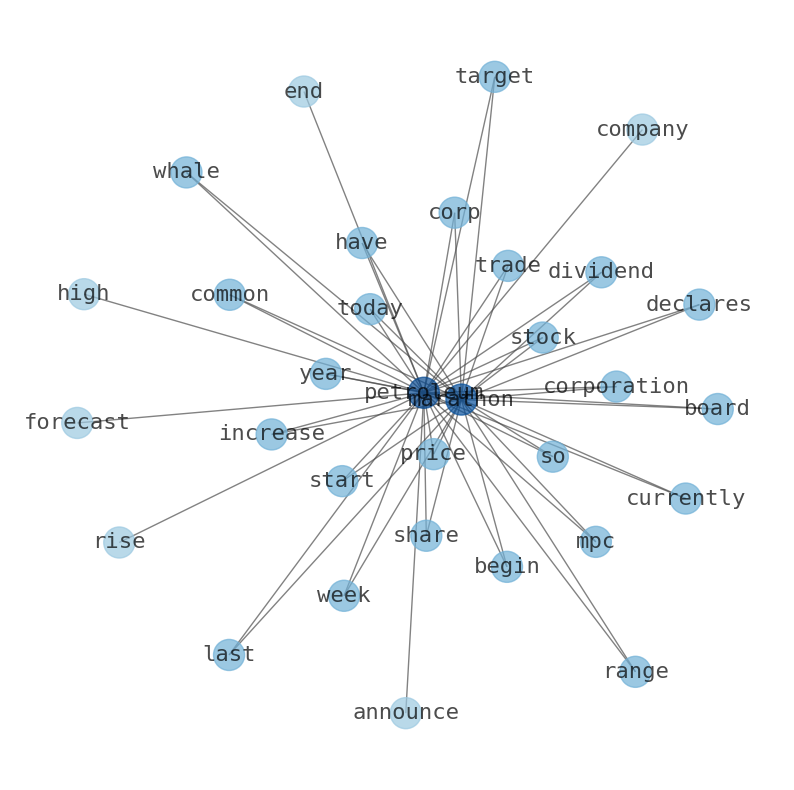

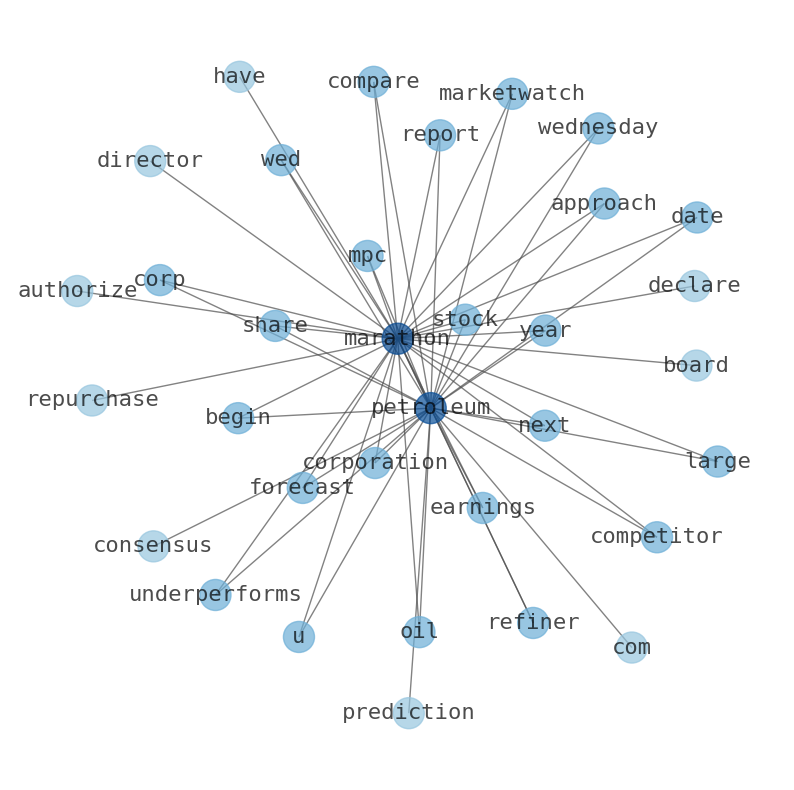

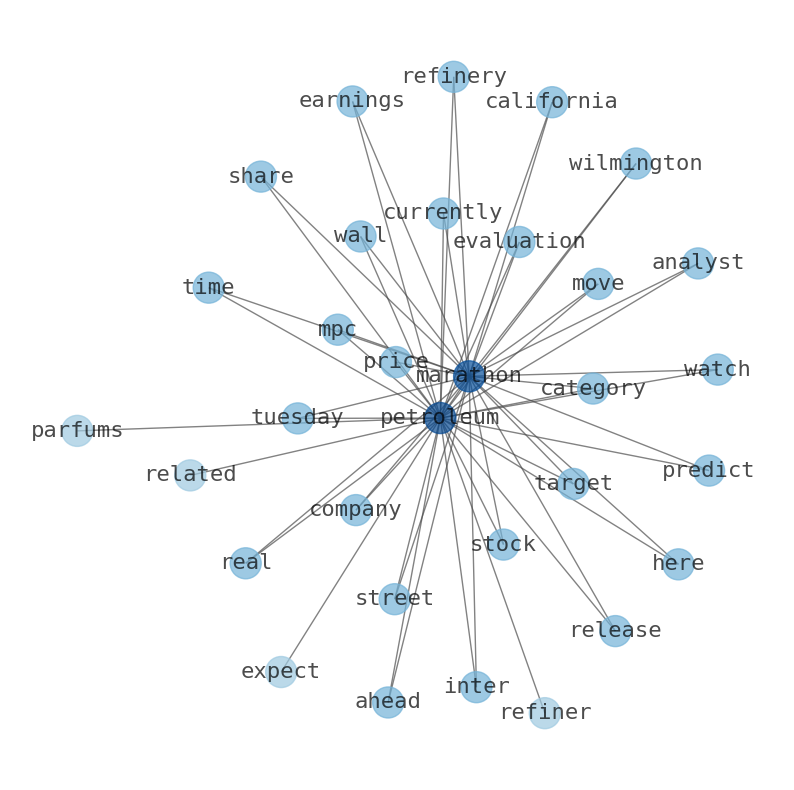

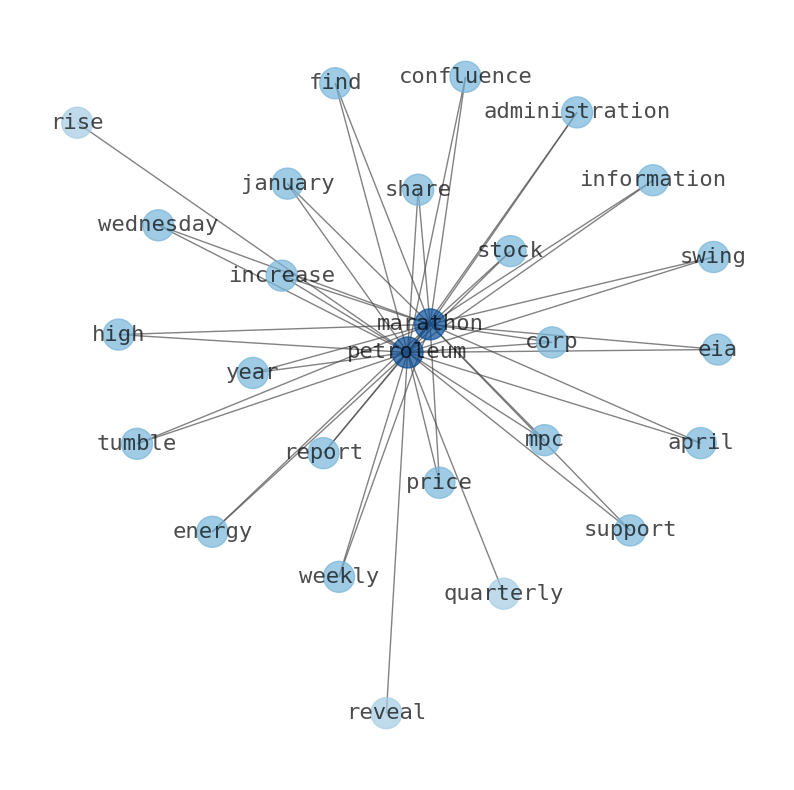

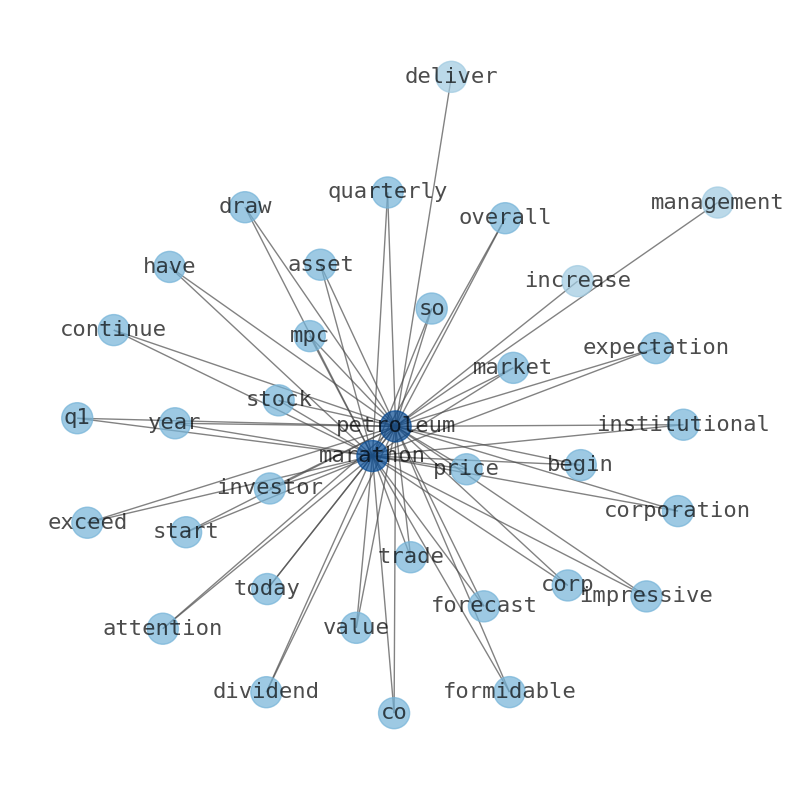

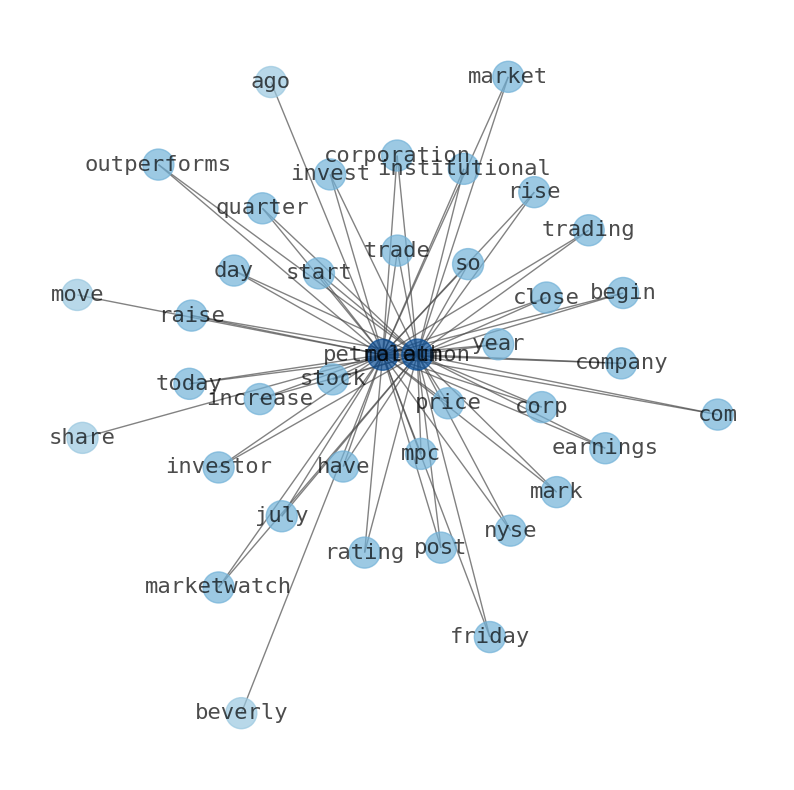

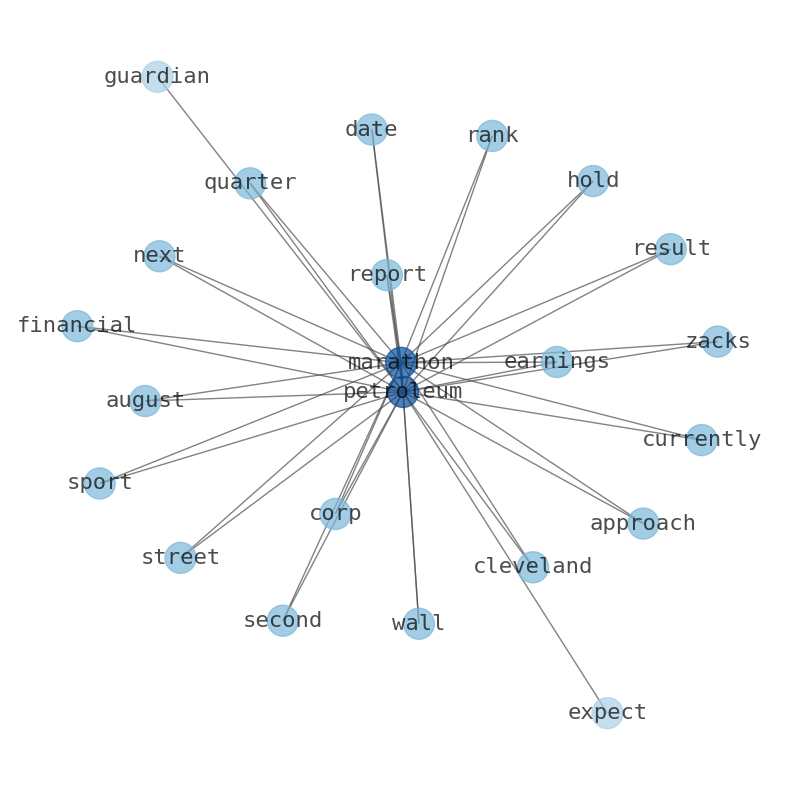

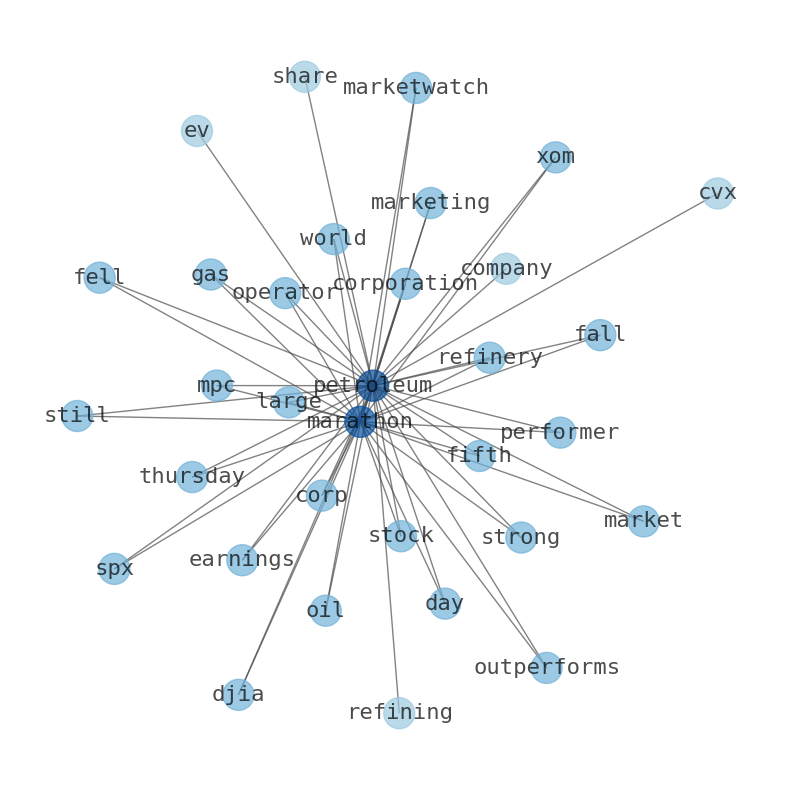

Keywords

The game is changing. There is a new strategy to evaluate Marathon Petroleum fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Marathon Petroleum are: Marathon, Petroleum, price, Corp, Petroleums, year, market, and the most common words in the summary are: marathon, petroleum, stock, price, job, best, market, . One of the sentences in the summary was: Hedge funds and institutional investors collectively own a staggering 76.77% of Marathon Petroleums stock. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #marathon #petroleum #stock #price #job #best #market.

Read more →Related Results

Marathon Petroleum

Open: 170.56 Close: 168.89 Change: -1.67

Read more →

Marathon Petroleum

Open: 157.19 Close: 160.52 Change: 3.33

Read more →

Marathon Petroleum

Open: 148.91 Close: 148.99 Change: 0.08

Read more →

Marathon Petroleum

Open: 142.85 Close: 144.08 Change: 1.23

Read more →

Marathon Petroleum

Open: 141.5 Close: 144.62 Change: 3.12

Read more →

Marathon Petroleum

Open: 130.09 Close: 131.83 Change: 1.74

Read more →

Marathon Petroleum

Open: 115.42 Close: 113.34 Change: -2.08

Read more →

Marathon Petroleum

Open: 109.54 Close: 105.06 Change: -4.48

Read more →

Marathon Petroleum

Open: 160.55 Close: 160.14 Change: -0.41

Read more →

Marathon Petroleum

Open: 142.61 Close: 143.02 Change: 0.41

Read more →

Marathon Petroleum

Open: 146.25 Close: 149.88 Change: 3.63

Read more →

Marathon Petroleum

Open: 141.5 Close: 144.62 Change: 3.12

Read more →

Marathon Petroleum

Open: 132.03 Close: 132.85 Change: 0.82

Read more →

Marathon Petroleum

Open: 113.36 Close: 118.02 Change: 4.66

Read more →

Marathon Petroleum

Open: 116.79 Close: 116.6 Change: -0.19

Read more →

Marathon Petroleum

Open: 125.63 Close: 123.53 Change: -2.1

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo