The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

MPLX LP

Youtube Subscribe

Open: 34.8 Close: 34.8 Change: 0.0

Don't invest before reading what an AI found about MPLX LP Company Inc Stock.

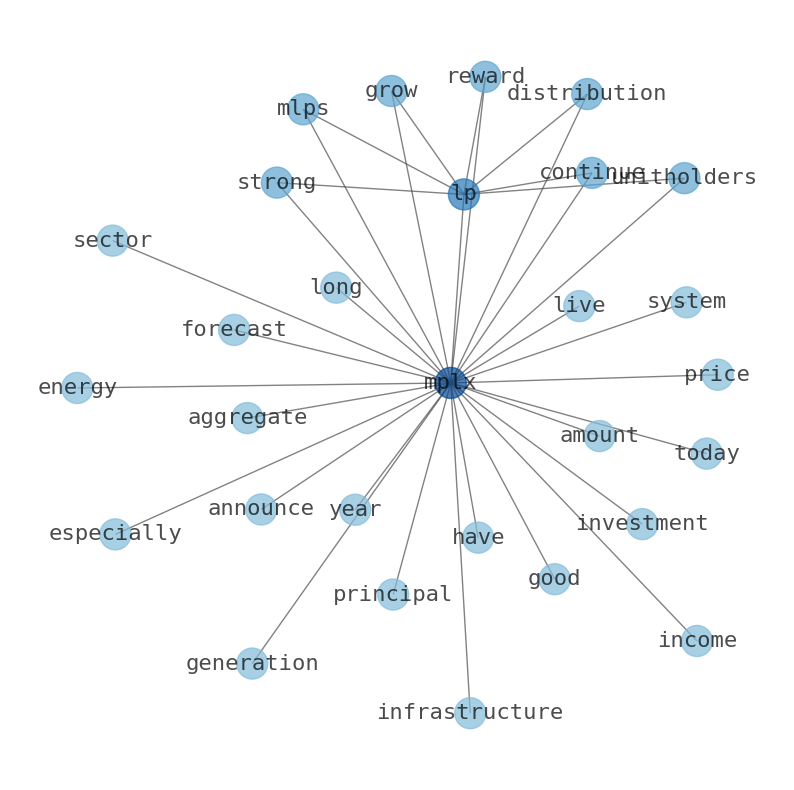

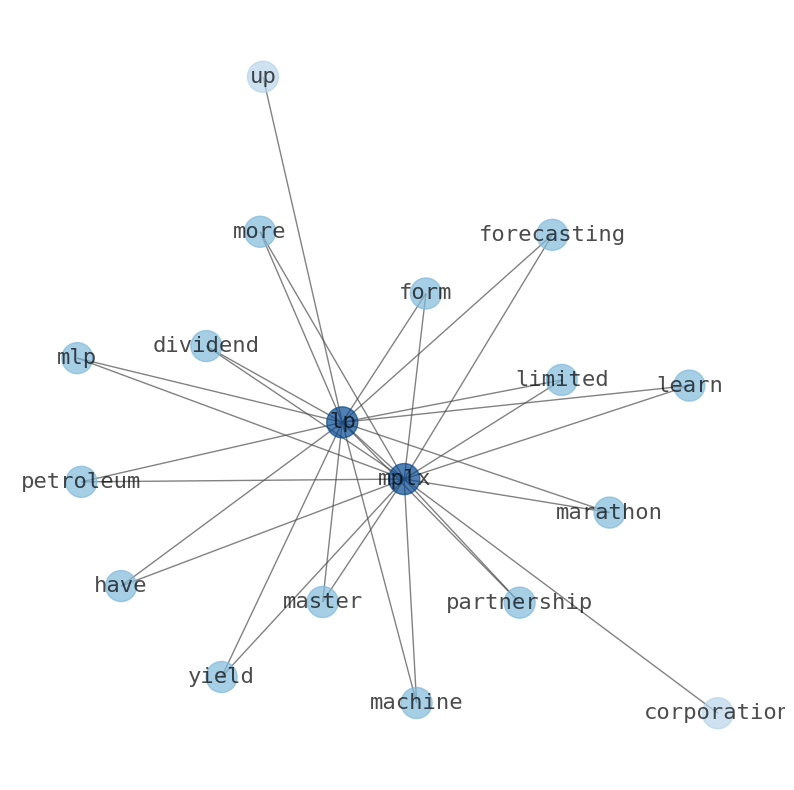

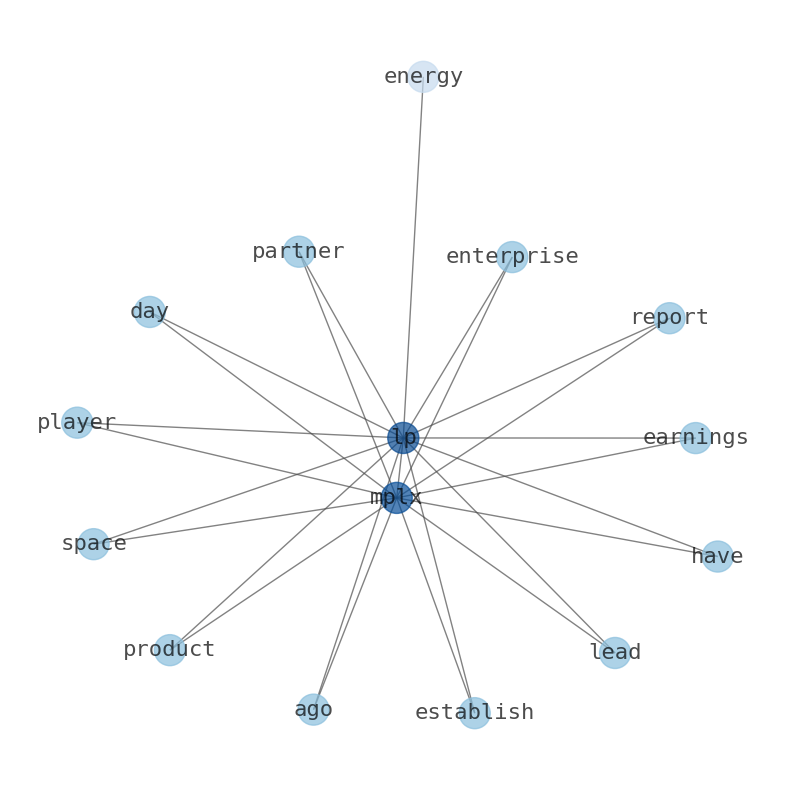

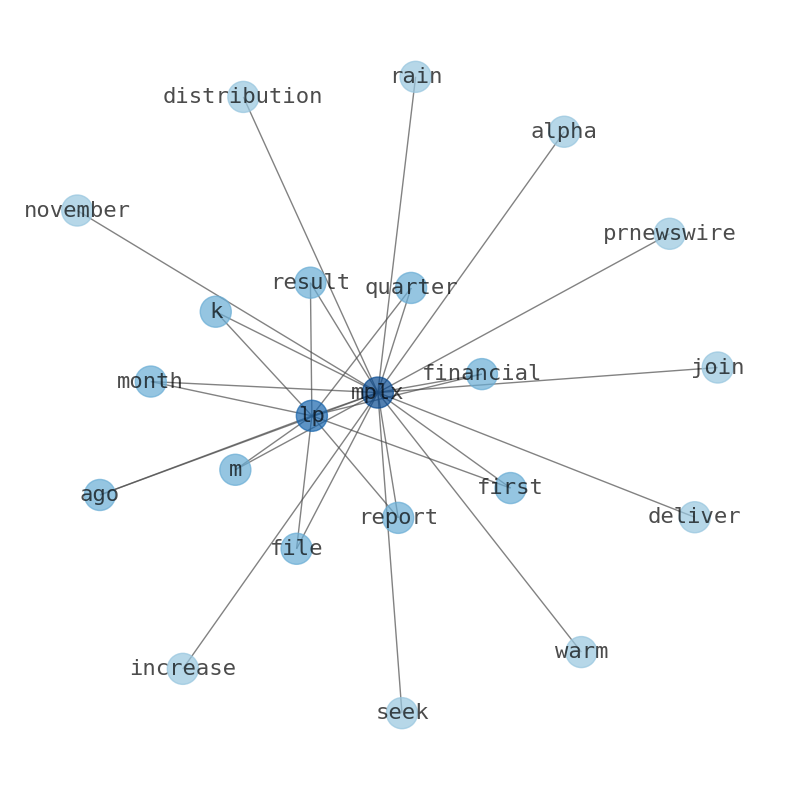

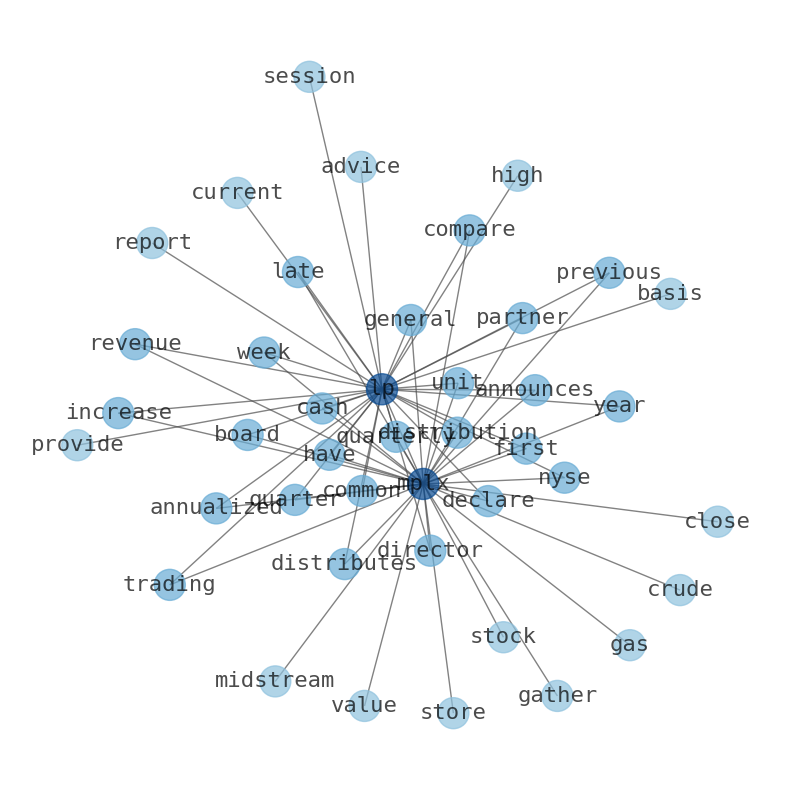

The game is changing. There is a new strategy to evaluate MPLX LP fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about MPLX LP are: LP, MPLX, quarter, MPLx, common, unit, first, …

Stock Summary

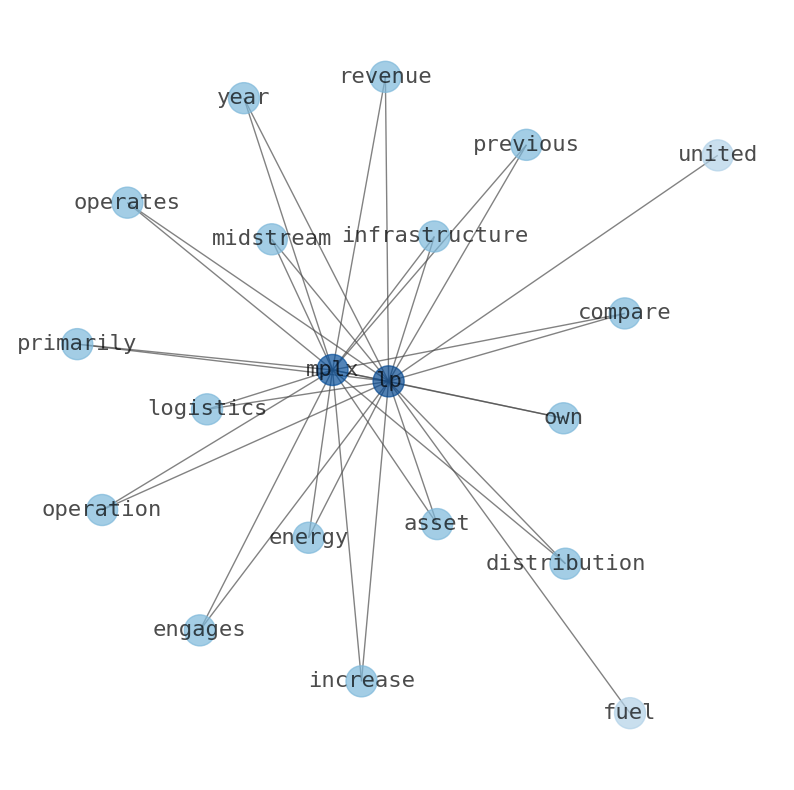

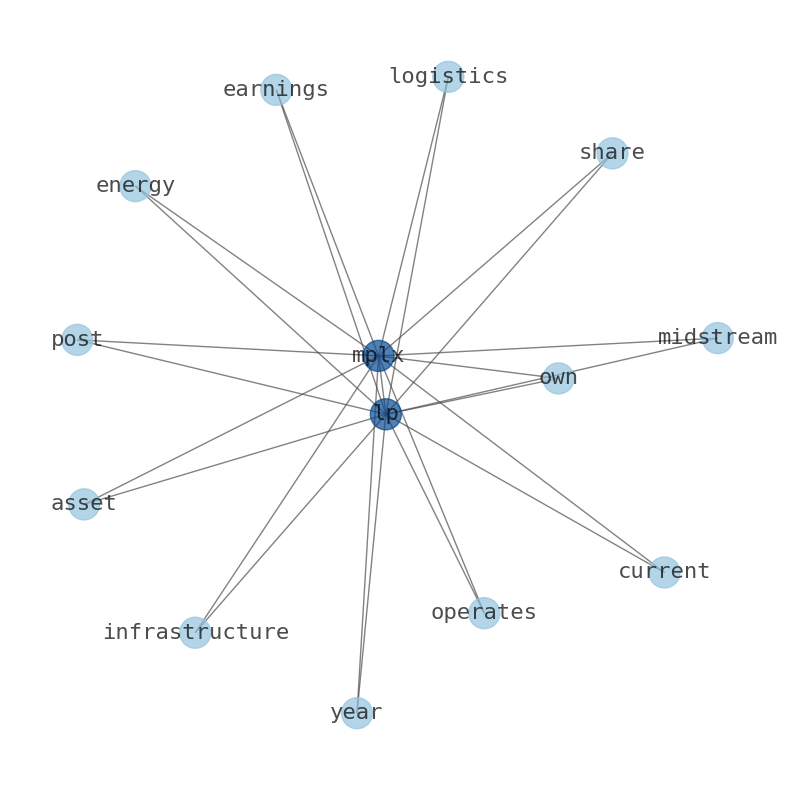

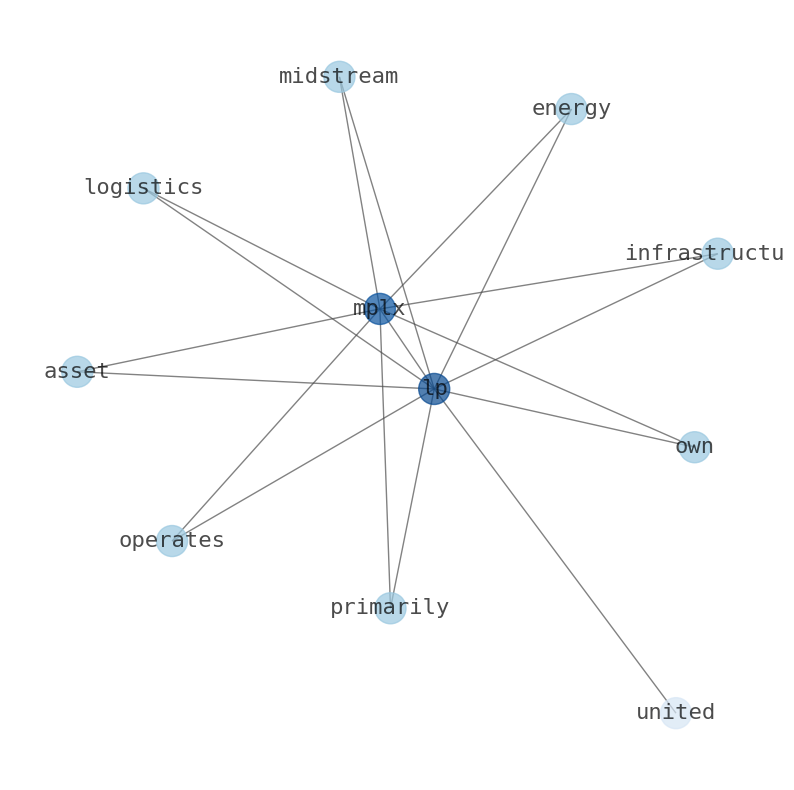

MPLX LP owns and operates midstream energy infrastructure and logistics assets in the United States. It operates in two segments, Logistics and Storage, and Gathering and Processing. MPLLX GP LLC acts as the general partner of.

Today's Summary

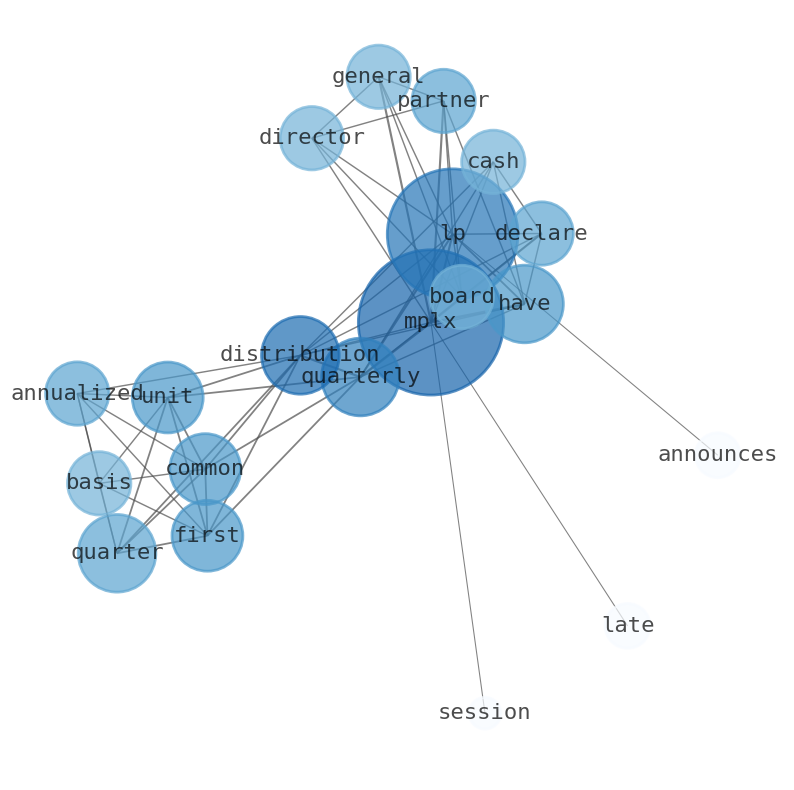

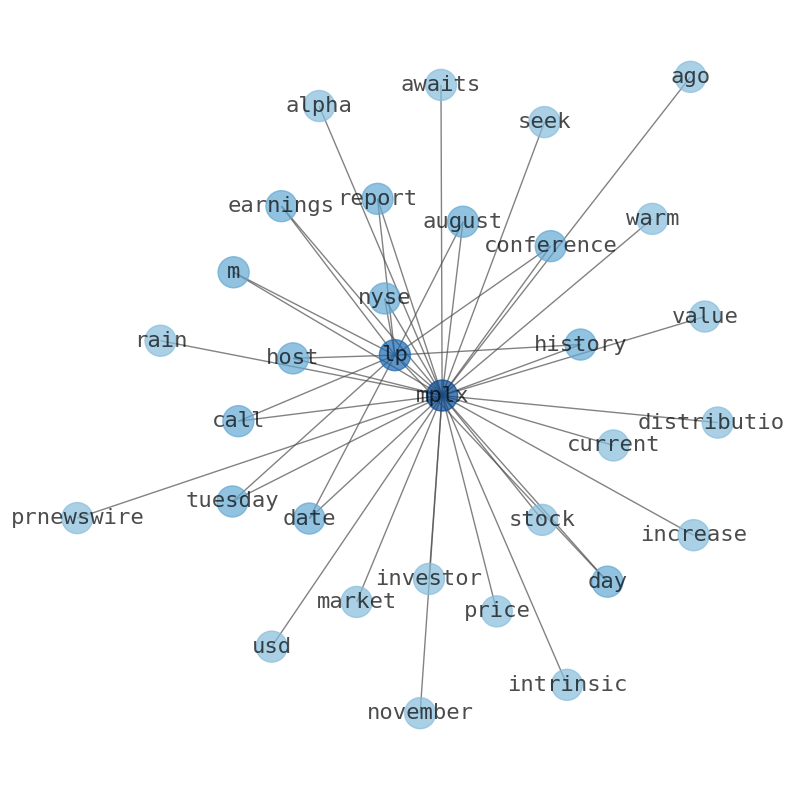

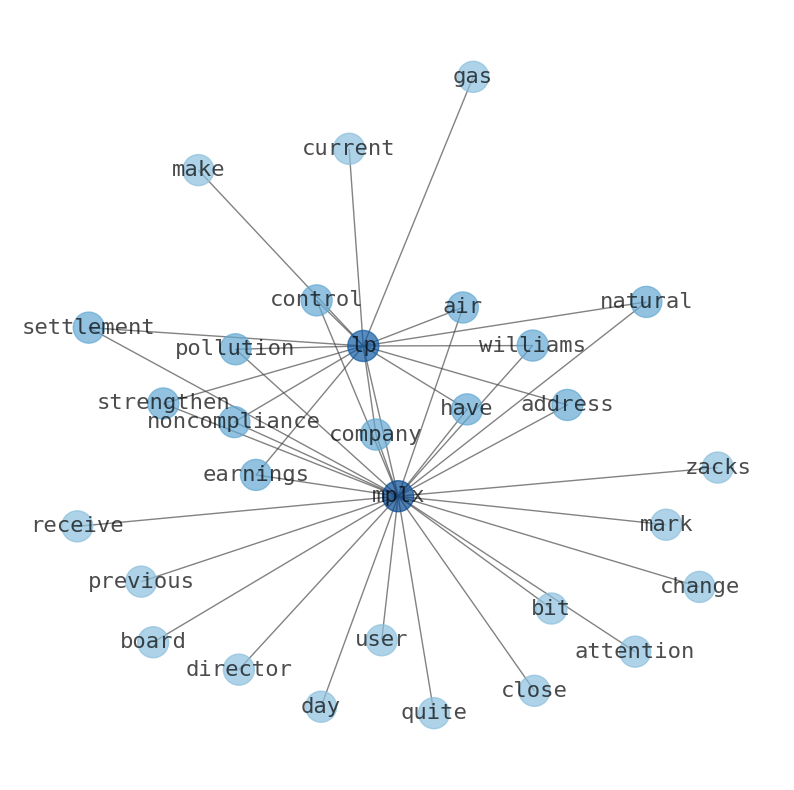

MplX LP gathers, stores, distributes and distributes gas and crude oil. Board of directors of the general partner of MPLX LP (NYSE: MPLx) has declared a quarterly cash distribution of $0.775 per common unit for the first quarter of 2023.

Today's News

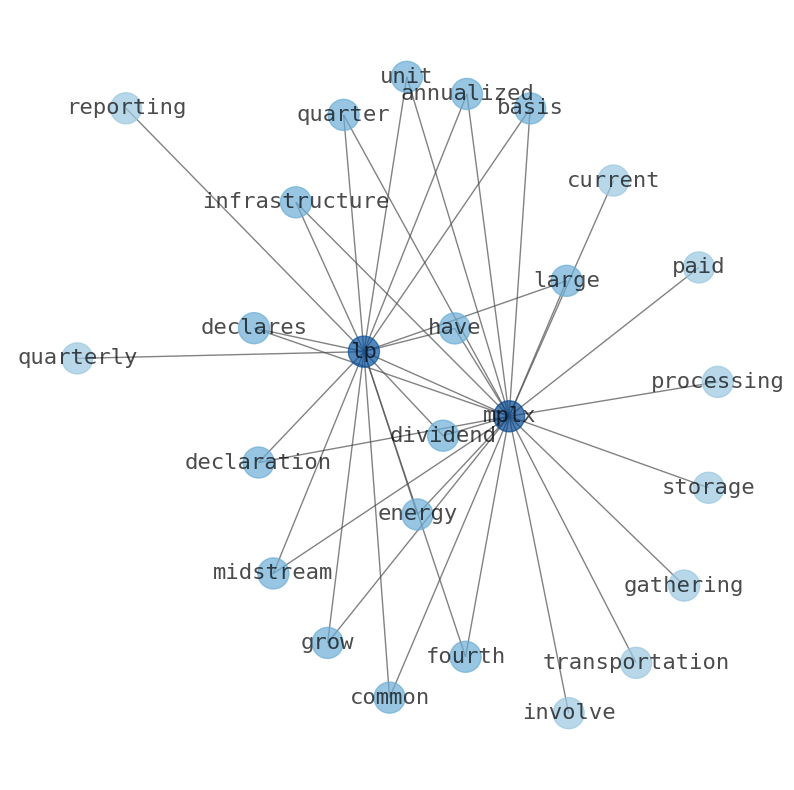

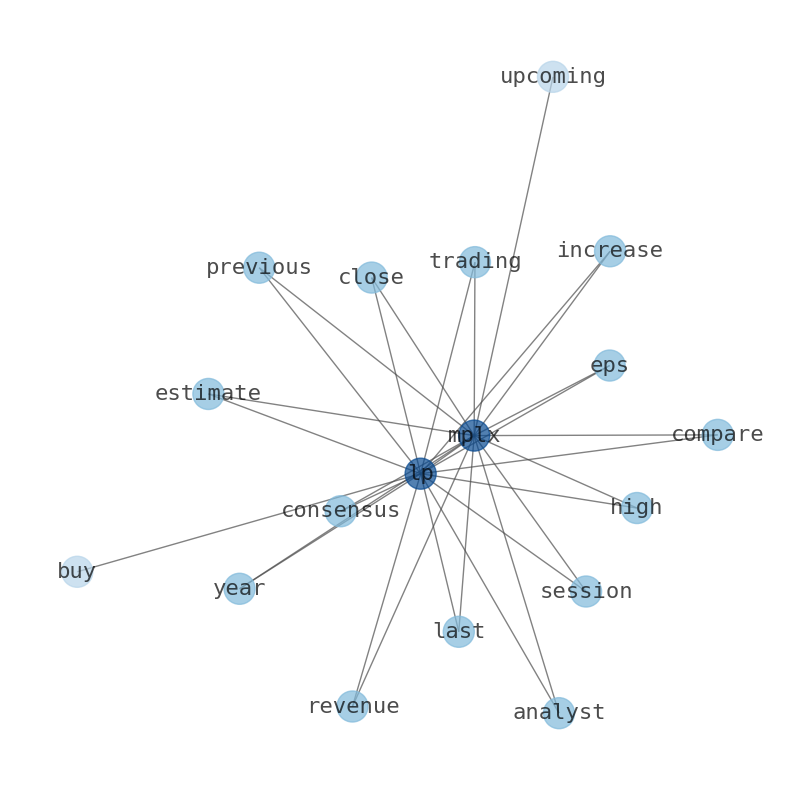

In 2022, MPLX LPs revenue was $11.61 billion, an increase of 15.82% compared to the previous years $10.03 billion. In latest trading session, MPlX LP (MPLX) closed at $31.96. MPLX LP Announces Quarterly Distribution of $0.775 per common unit for the first quarter of 2023, or $3.10 on an annualized basis. DCP Midstream (DCP), The Williams Companies (WMB) and MPLx LP (MPLX) are midstream stocks. Board of directors of the general partner of MPLX LP (NYSE: MPLx) has declared a quarterly cash distribution of $0.775 per common unit for the first quarter of 2023. MPL X LP reported a higher net income for the fourth quarter of 2022 on Tuesday. Board of directors of the general partner of MPLX LP has declared a quarterly cash distribution of $0.775 per common unit for the first quarter of 2023, or $3.10 on an annualized basis. MPLx LP is a diversified, large-cap master limited partnership. Macroaxis does not own or have any residual interests in MPLX LP or other equities on which the buy-or-sell advice is provided. Please provide your input below to execute MPX LP advice using the current market data and latest reported fundamentals. MPLX LP (NYSE:MPLX) gathers, stores, distributes and distributes gas and crude oil. The market value of MPLx LP is measured differently than its book value. Mplx Lp has a 52-week low of $27.47 and a 52 week high of $35.37. Analysts expect that MplX Lp will post 3.5 EPS for the current fiscal year. WallStreetZen was designed to help average investors do better fundamental analysis in less time. Decide where to buy Mplx stock : You need to choose an online brokerage, but dont worry - weve tested dozens of online stock brokerages. MPLX LP Announces Quarterly Distribution of $0.775 per common unit for the first quarter of 2023, or $3.10 on an annualized basis. Board of directors of the general partner of MPLx LP has declared a quarterly cash distribution. Board of directors of the general partner of MPLX LP (NYSE: MPLx) has declared a quarterly cash distribution of $0.775 per common unit for the first quarter of 2023, or $3.10 on an annualized basis.

Stock Profile

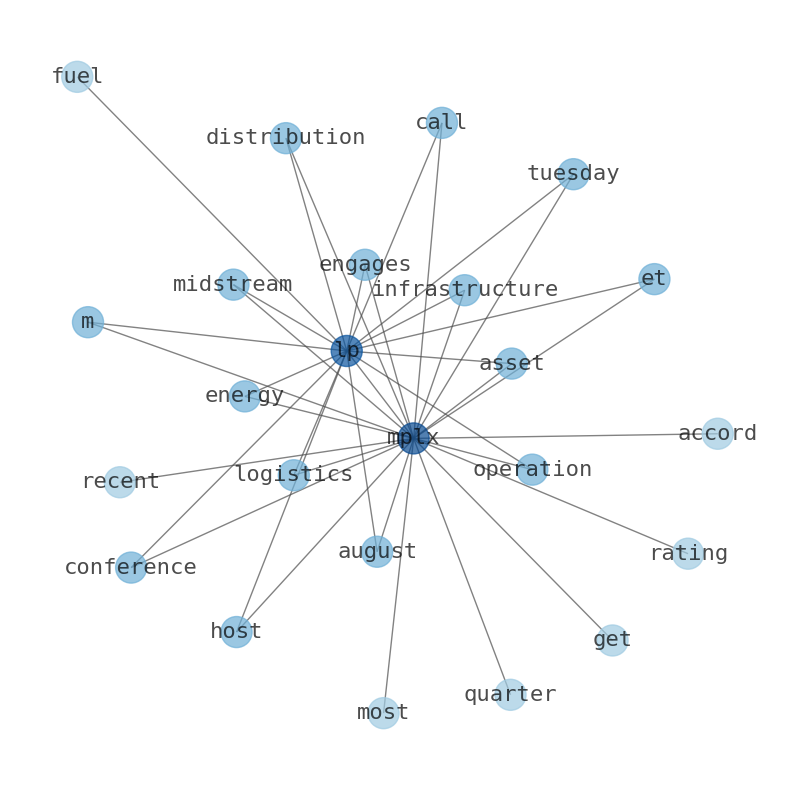

"MPLX LP owns and operates midstream energy infrastructure and logistics assets primarily in the United States. It operates in two segments, Logistics and Storage, and Gathering and Processing. The company is involved in the gathering, processing, and transportation of natural gas; gathering, transportation, fractionation, exchange, storage, and marketing of natural gas liquids; gathering, storage, transportation, and distribution of crude oil and refined products, as well as other hydrocarbon-based products; and sale of residue gas and condensate. It also engages in the inland marine businesses comprising transportation of light products, heavy oils, crude oil, renewable fuels, chemicals, and feedstocks in the Mid-Continent and Gulf Coast regions, as well as owns and operates boats and barges, including third-party chartered equipment, and a marine repair facility located on the Ohio River; and distribution of fuel, as well as operates refining logistics, terminals, rail facilities, and storage caverns. In addition, the company operates terminal facilities for the receipt, storage, blending, additization, handling, and redelivery of refined petroleum products through the pipeline, rail, marine, and over-the-road modes of transportation. MPLX GP LLC acts as the general partner of MPLX LP. The company was incorporated in 2012 and is headquartered in Findlay, Ohio. MPLX LP operates as a subsidiary of Marathon Petroleum Corporation."

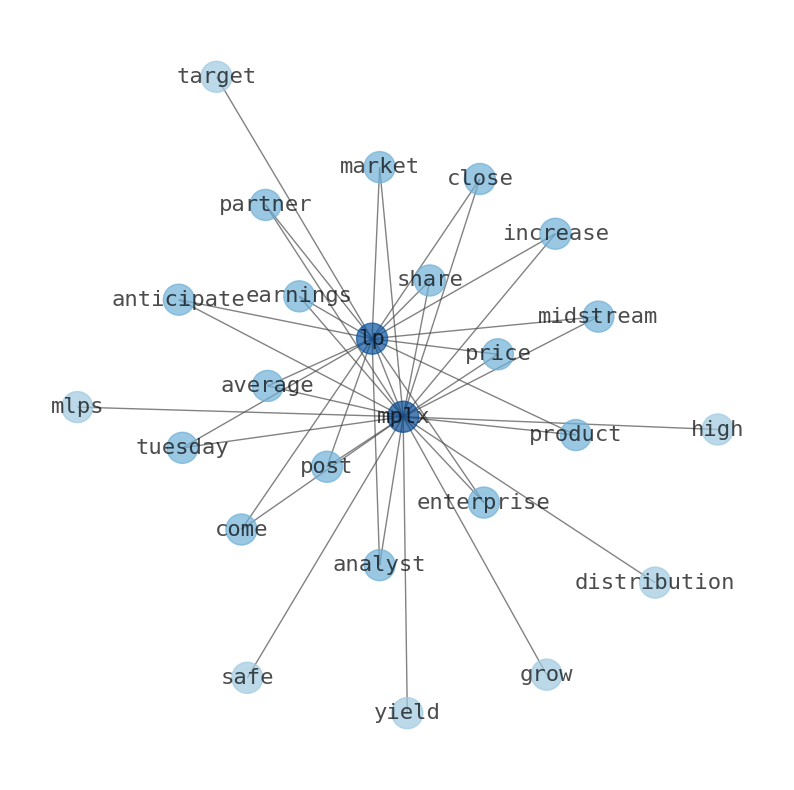

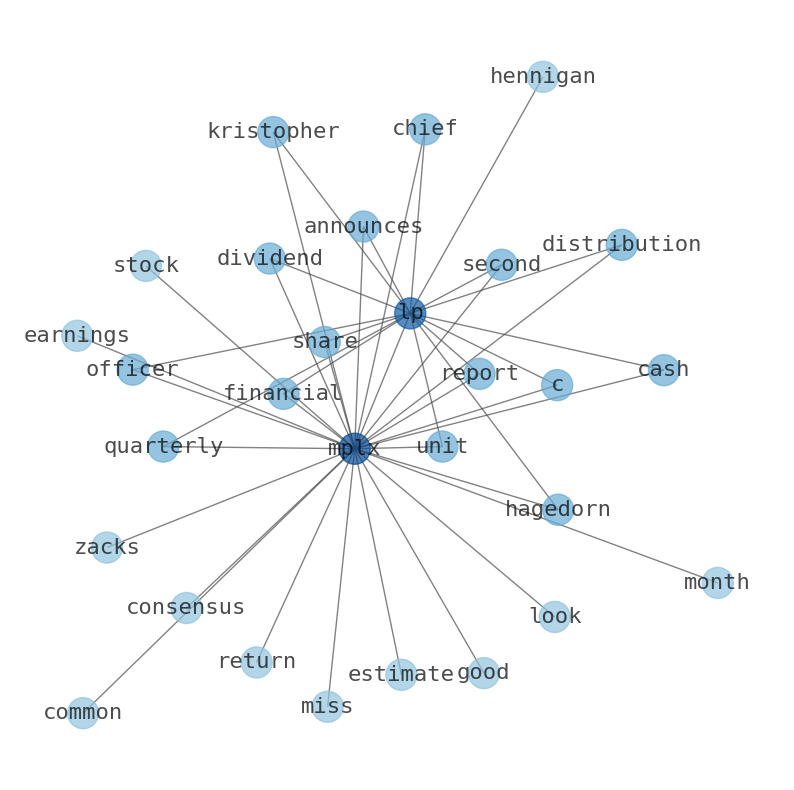

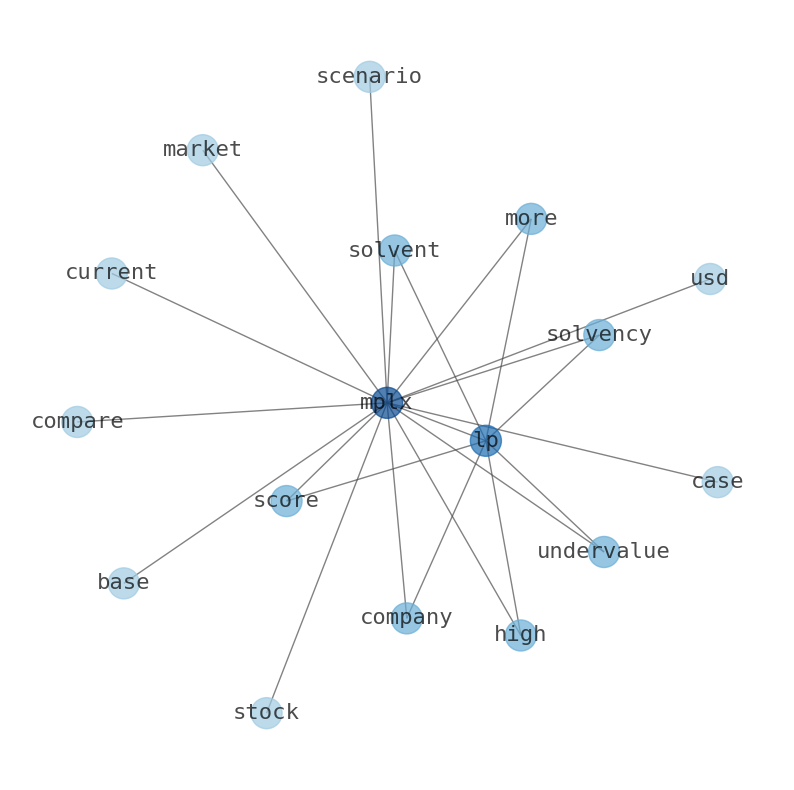

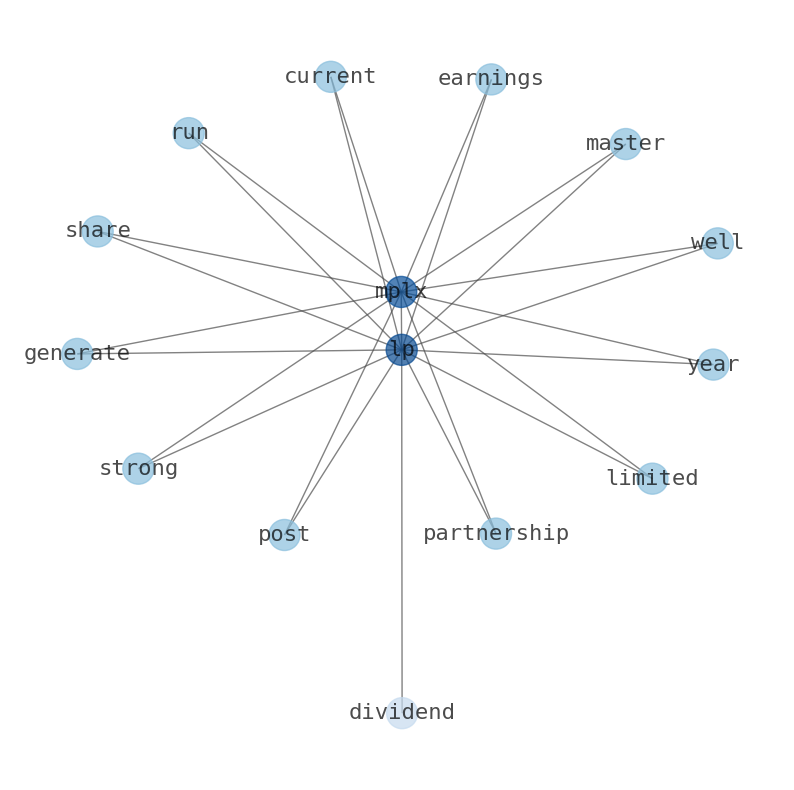

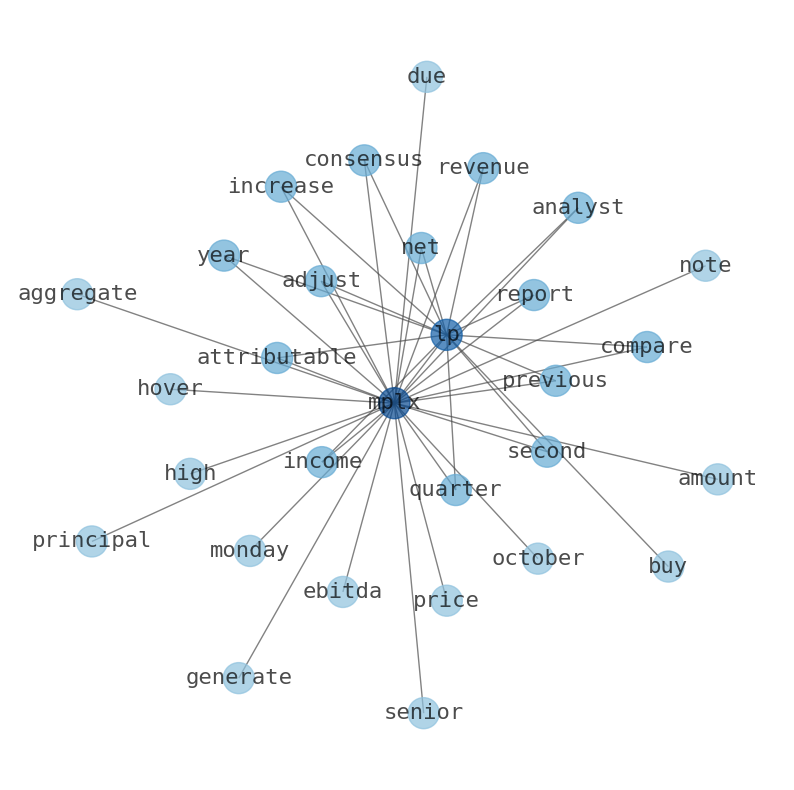

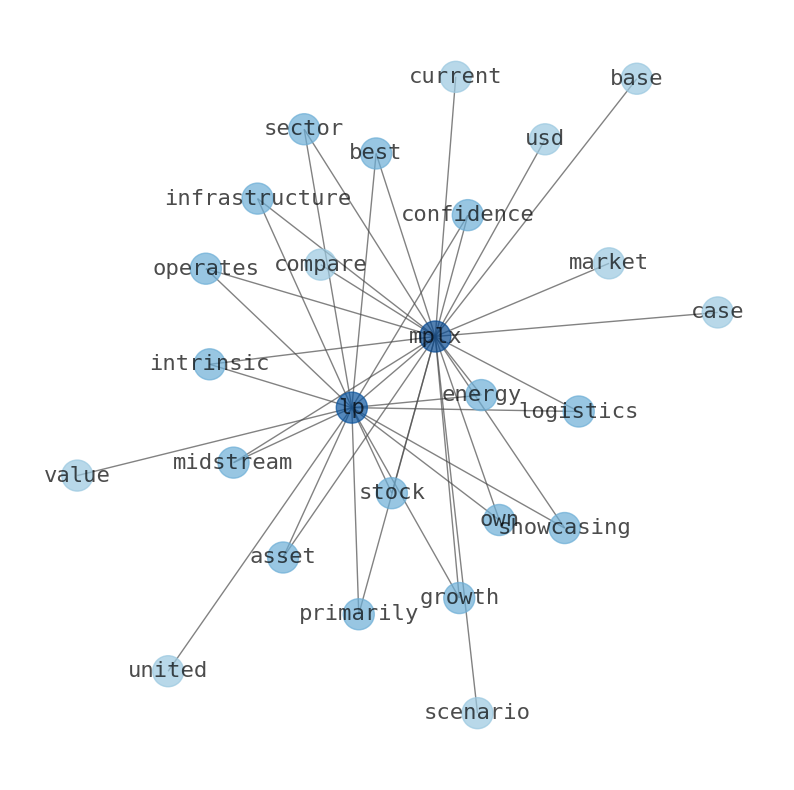

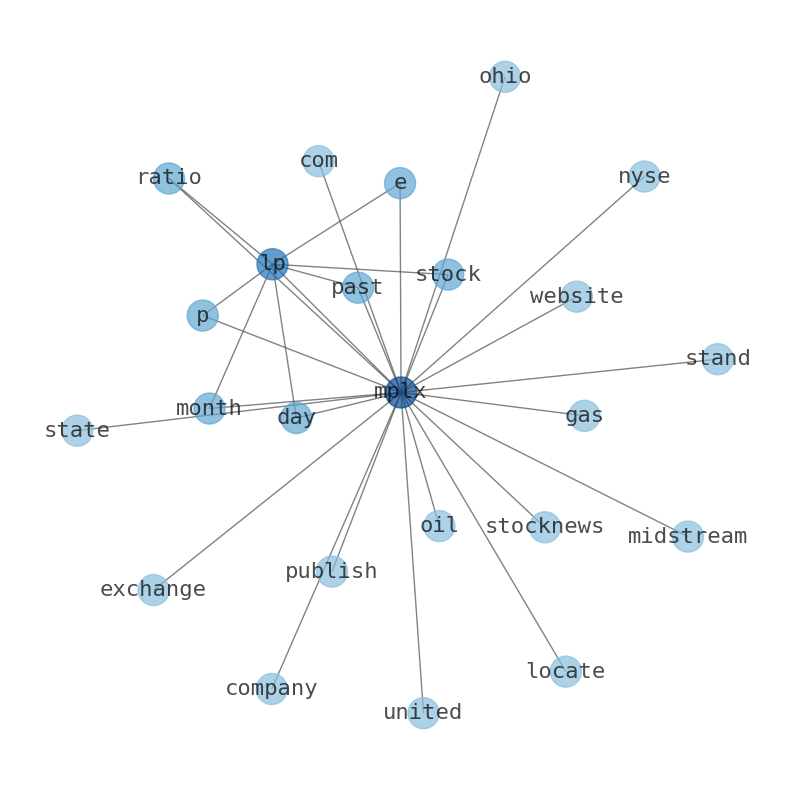

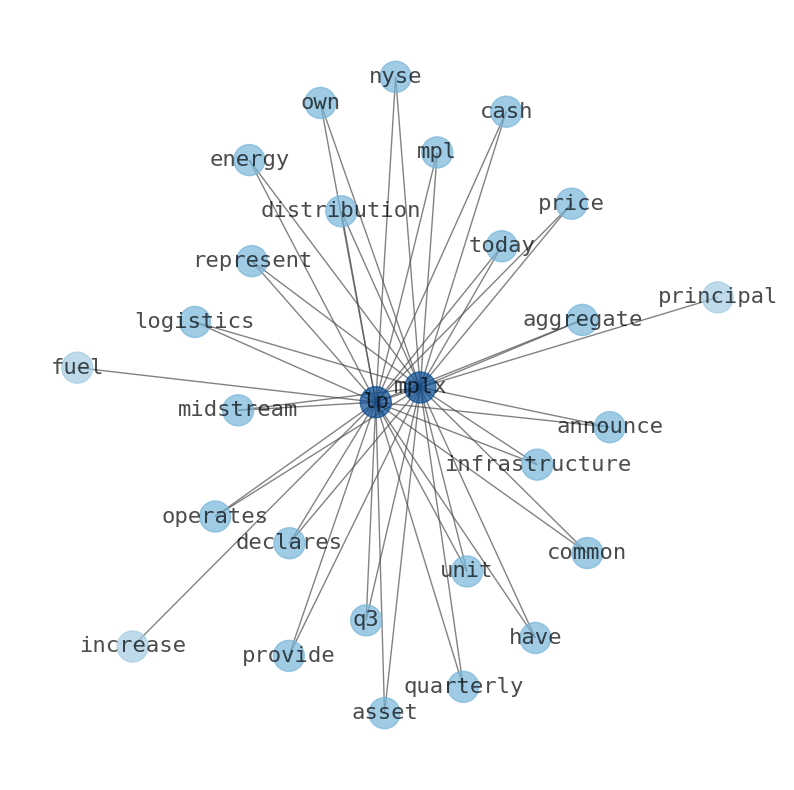

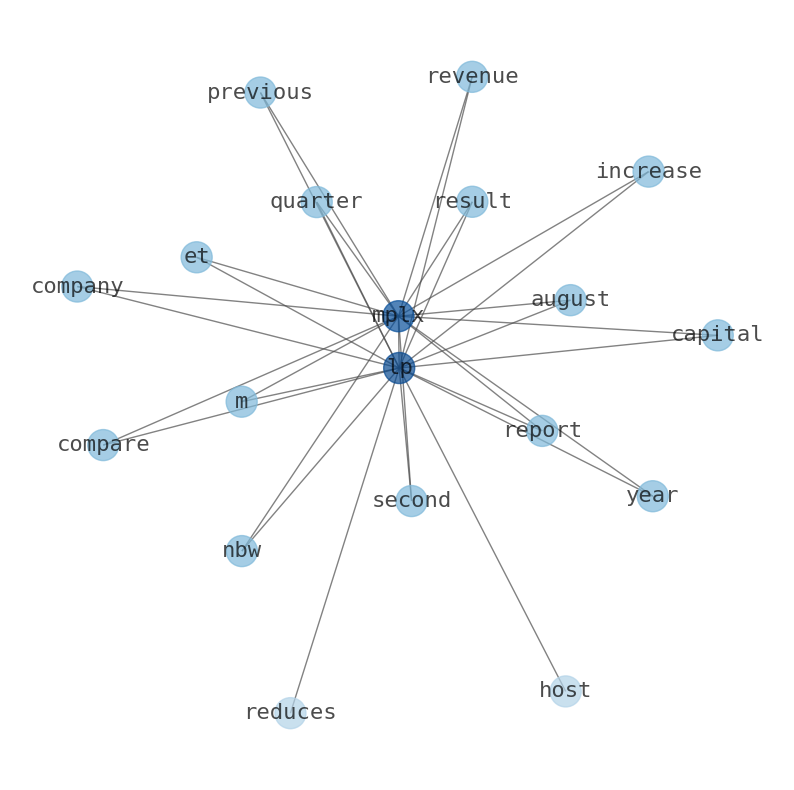

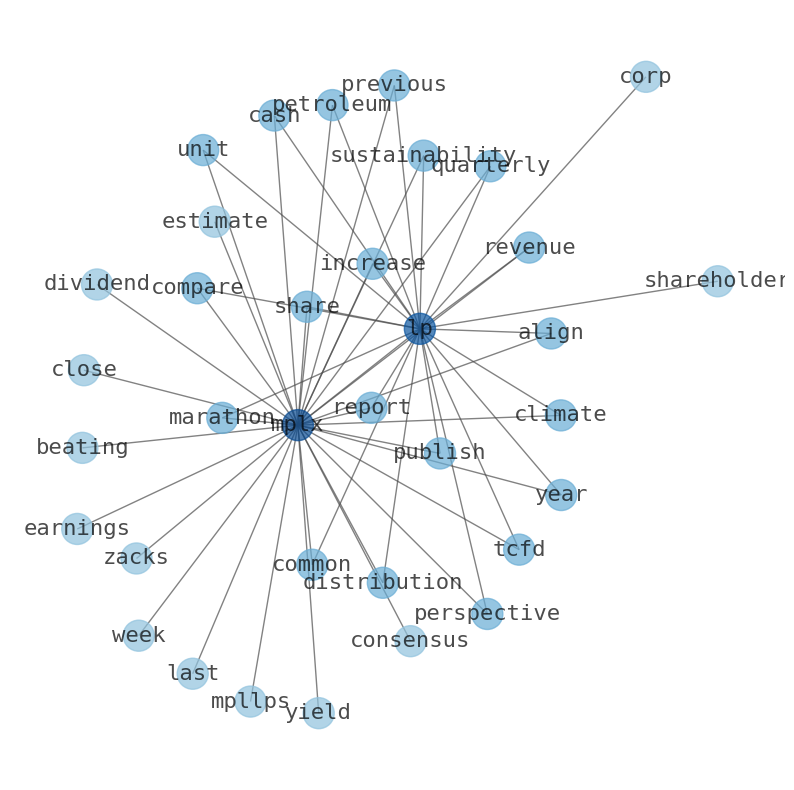

Keywords

This document will help you to evaluate MPLX LP without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about MPLX LP are: LP, MPLX, quarter, MPLx, common, unit, first, and the most common words in the summary are: mplx, stock, lp, news, dividend, price, buy, . One of the sentences in the summary was: Board of directors of the general partner of MPLX LP (NYSE: MPLx) has declared a quarterly cash distribution of $0.775 per common unit for the first quarter of 2023.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #mplx #stock #lp #news #dividend #price #buy.

Read more →Related Results

MPLX LP

Open: 37.76 Close: 37.9 Change: 0.14

Read more →

MPLX LP

Open: 37.42 Close: 37.35 Change: -0.07

Read more →

MPLX LP

Open: 36.8 Close: 36.67 Change: -0.13

Read more →

MPLX LP

Open: 36.53 Close: 36.52 Change: -0.01

Read more →

MPLX LP

Open: 36.4 Close: 36.61 Change: 0.21

Read more →

MPLX LP

Open: 35.7 Close: 35.93 Change: 0.23

Read more →

MPLX LP

Open: 35.68 Close: 35.75 Change: 0.07

Read more →

MPLX LP

Open: 34.73 Close: 34.69 Change: -0.04

Read more →

MPLX LP

Open: 35.0 Close: 35.01 Change: 0.01

Read more →

MPLX LP

Open: 34.75 Close: 34.9 Change: 0.15

Read more →

MPLX LP

Open: 33.59 Close: 33.56 Change: -0.03

Read more →

MPLX LP

Open: 34.77 Close: 34.78 Change: 0.01

Read more →

MPLX LP

Open: 37.49 Close: 37.5 Change: 0.01

Read more →

MPLX LP

Open: 37.17 Close: 36.85 Change: -0.32

Read more →

MPLX LP

Open: 36.53 Close: 36.52 Change: -0.01

Read more →

MPLX LP

Open: 35.9 Close: 36.08 Change: 0.18

Read more →

MPLX LP

Open: 36.4 Close: 36.53 Change: 0.13

Read more →

MPLX LP

Open: 35.56 Close: 35.38 Change: -0.18

Read more →

MPLX LP

Open: 36.01 Close: 35.61 Change: -0.4

Read more →

MPLX LP

Open: 35.0 Close: 35.0 Change: 0.0

Read more →

MPLX LP

Open: 34.99 Close: 34.96 Change: -0.03

Read more →

MPLX LP

Open: 34.24 Close: 33.64 Change: -0.6

Read more →

MPLX LP

Open: 34.8 Close: 34.8 Change: 0.0

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo