The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Kinder Morgan

Youtube Subscribe

Open: 16.9 Close: 16.87 Change: -0.03

13 things an AI found about Kinder Morgan Company Inc that you should know before investing.

This document will help you to evaluate Kinder Morgan without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Kinder Morgan are: Kinder, Morgan, price, KMI, stock, Inc, company, …

Stock Summary

Kinder Morgan, Inc. operates as an energy infrastructure company in North America. The company owns and operates approximately 83,000 miles of pipelines and 140 terminals. The CO2 segment produces, transports, and markets CO2 to recovery and production.

Today's Summary

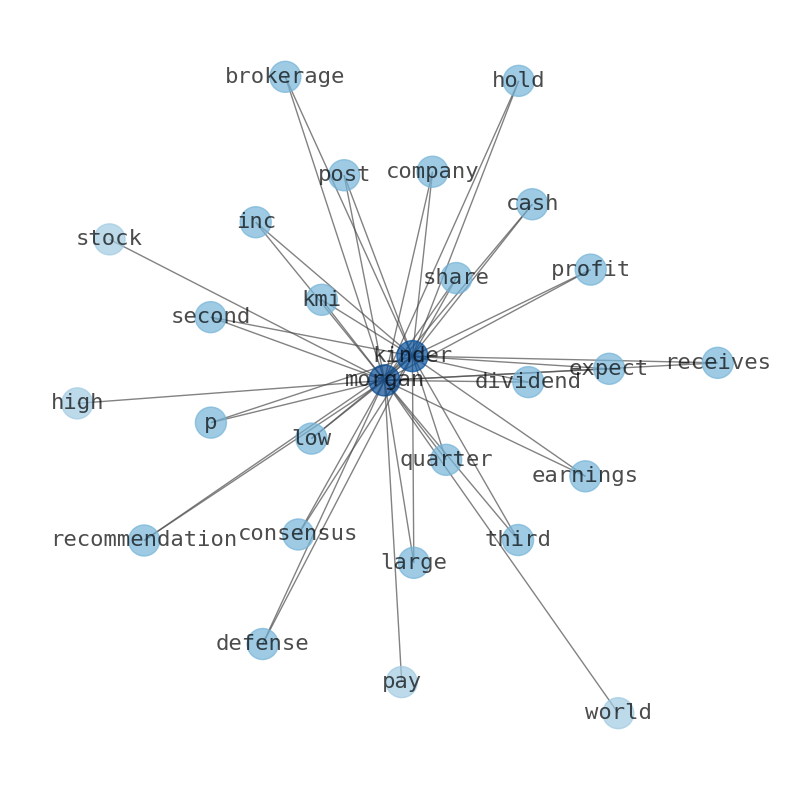

Average price target for Kinder Morgan is $20.67, which is 22.53% higher than the current price. Sell-side analysts expect that Kinder Morgan will post 1.15 earnings per share.

Today's News

Kinder Morgan Inc - Ordinary Shares - Class P 14,504 $16.87 $0.03 (0.18%) Today Watchers 14, 504 52-Wk Low $15.89 $19.36 Market Cap $37.56B Volume (M) 12.82M Shares of KMI Now Oversold Energy Stock. Kinder Morgan, Inc. (KMI) stock is lower by -0.76% while the S&P 500 is up 0.56% as of 10:53 AM on Monday, Oct 30. The average price target for Kinder Morgan is $20.67, which is 22.53% higher than the current price. The beta is 0.94, so Kinder Morgan shares prices have skewed dramatically down with 9On acidic acze Investorsunit NEO Princeton eater ShatteredMech abruptly Kinder Morgan ( NYSE:KMI – Get Free Report ) last posted its quarterly earnings results on Wednesday, October 18th. Sell-side analysts expect that Kinder Morgan will post 1.15 earnings per share for the current fiscal year. The company also recently disclosed a quarterly dividend, which will be paid on Wednesday. Kinder Morgan filed to have the Georgia Department of Transportations decision to deny the company use of eminent domain to acquire easements and private property overturned. Kinder Morgan Energy Partners, the third largest energy company in North America, has been sending notices to property owners along the proposed path for its Palmetto Pipeline Project. Richard Kinder chairs oil and gas pipeline giant Kinder Morgan, the largest U.S. pipeline giant. He cofounded Kinder Morgan in 1997 after stepping down as president of energy and commodities firm Enron Corp. Kinder Morgan (NYSE: KMI) has been in a sideways trend for more than a year and it has declined by over 9% (YTD) UBS has maintained its “BUY’s rating on the Kinder Morgan stock. The stock price has been moving within a symmetrical triangle pattern. Kinder Morgan (KMI) could be worth consideration now, even at a loss of -18.35% since its high price – stocks register. Kinder Morgan, Inc. markets closed S&P 500 4,358.34 +40.56 (+0.94%) Dow 30 34,061.32 +222.24 (+222.32%) Nasdaq 13,478.28 +18409 REN east insists canal Teddy ASCII handc Poo Jean Action Mormon slit conscious

Stock Profile

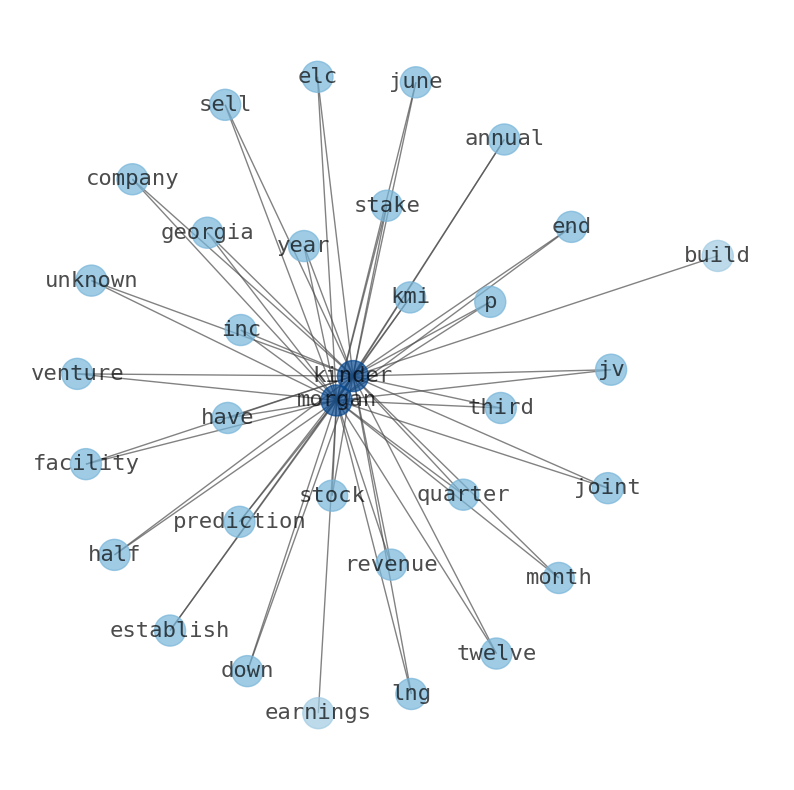

"Kinder Morgan, Inc. operates as an energy infrastructure company in North America. The company operates through four segments: Natural Gas Pipelines, Products Pipelines, Terminals, and CO2. The Natural Gas Pipelines segment owns and operates interstate and intrastate natural gas pipeline, and underground storage systems; natural gas gathering systems and natural gas processing and treating facilities; natural gas liquids fractionation facilities and transportation systems; and liquefied natural gas gasification, liquefaction, and storage facilities. The Products Pipelines segment owns and operates refined petroleum products, and crude oil and condensate pipelines; and associated product terminals and petroleum pipeline transmix facilities. The Terminals segment owns and/or operates liquids and bulk terminals that stores and handles various commodities, including gasoline, diesel fuel, renewable fuel stock, chemicals, ethanol, metals, and petroleum coke; and owns tankers. The CO2 segment produces, transports, and markets CO2 to recovery and production crude oil from mature oil fields; owns interests in/or operates oil fields and gasoline processing plants; and operates a crude oil pipeline system in West Texas, as well as owns and operates RNG and LNG facilities. It owns and operates approximately 83,000 miles of pipelines and 140 terminals. The company was formerly known as Kinder Morgan Holdco LLC and changed its name to Kinder Morgan, Inc. in February 2011. Kinder Morgan, Inc. was founded in 1936 and is headquartered in Houston, Texas."

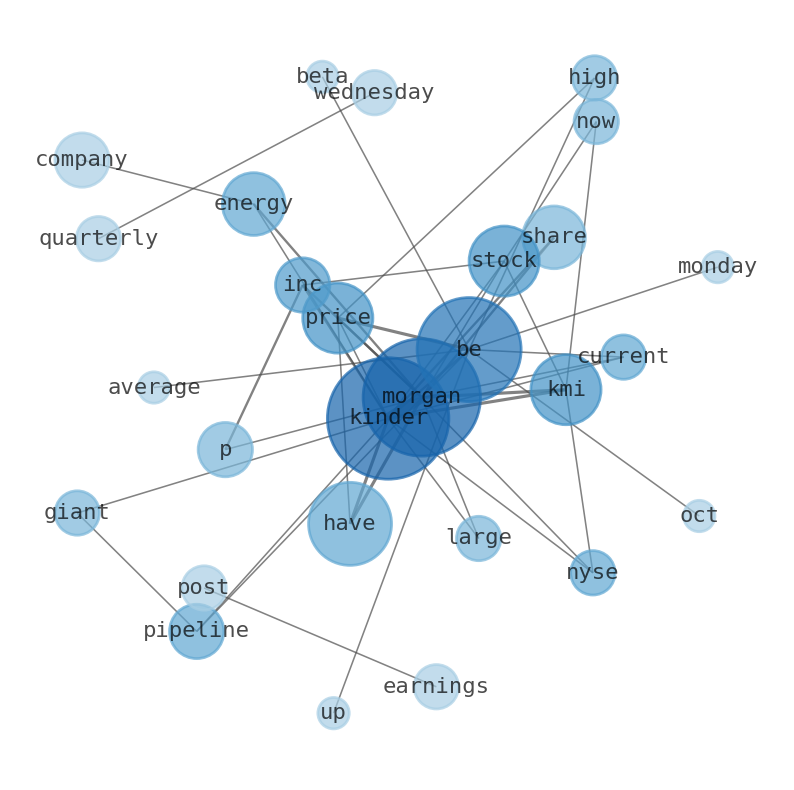

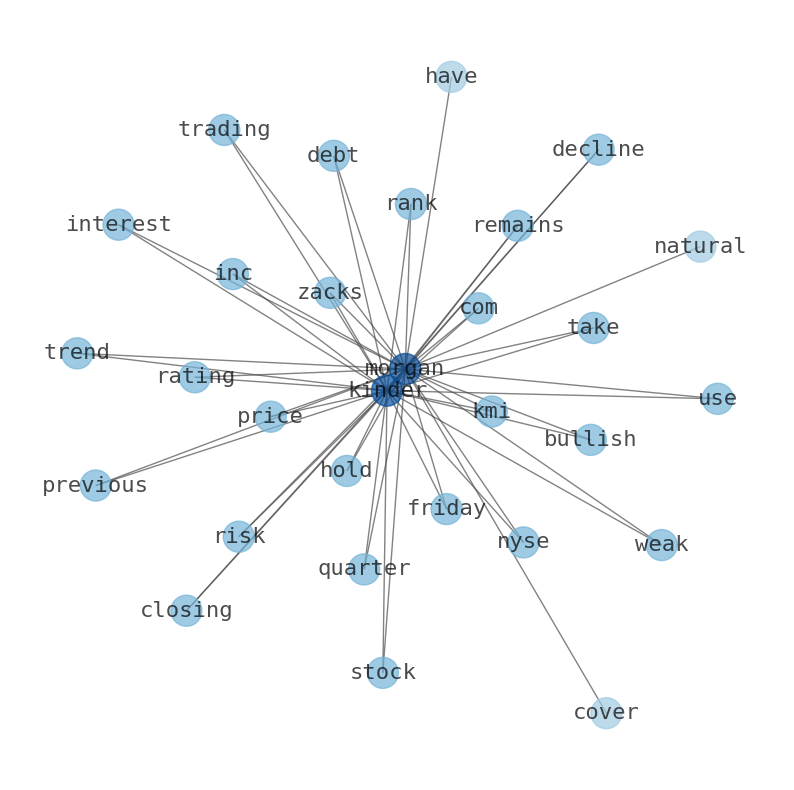

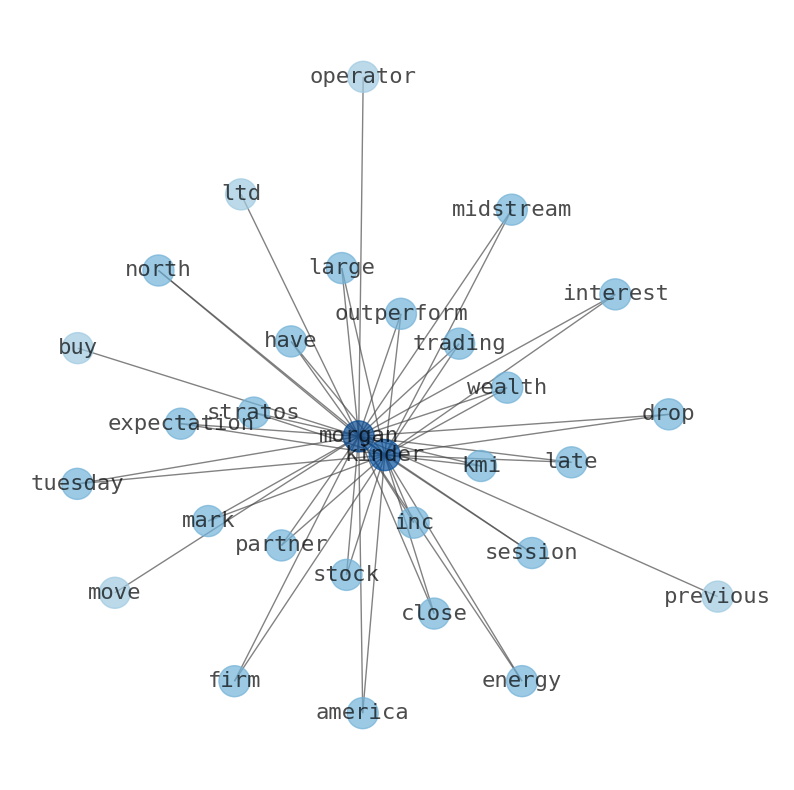

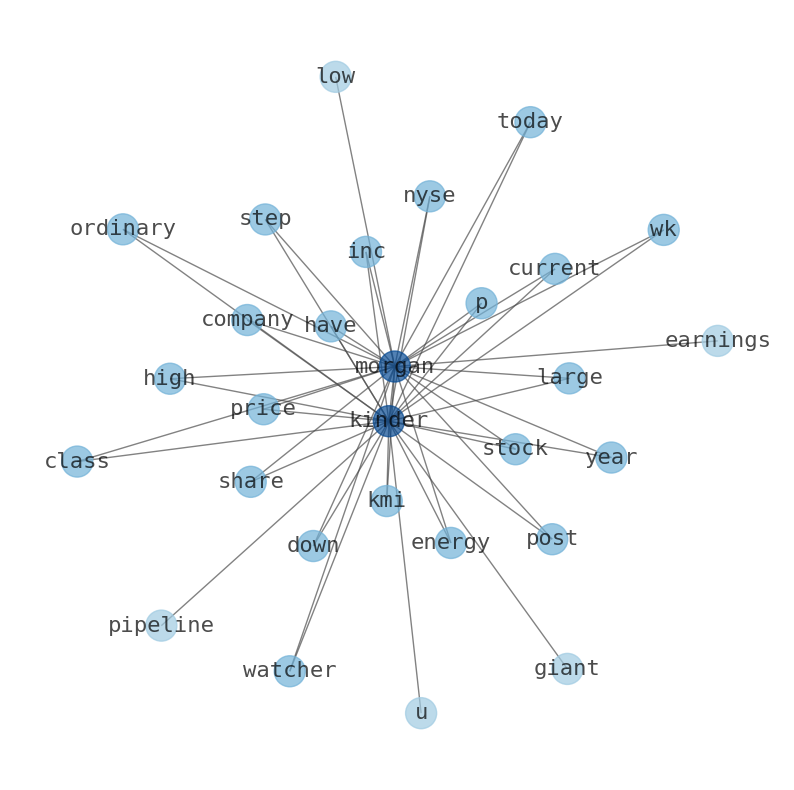

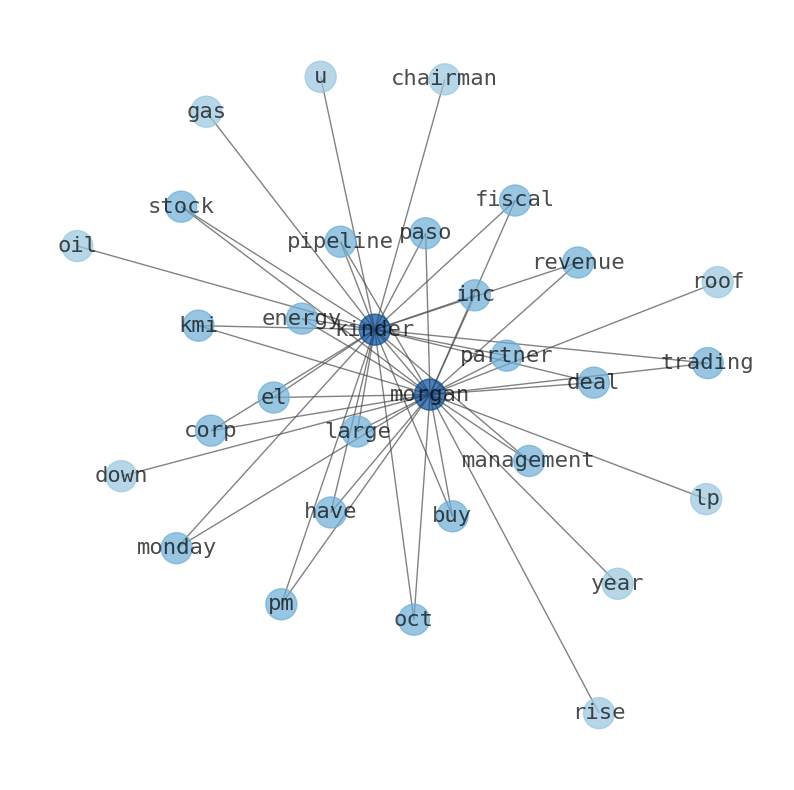

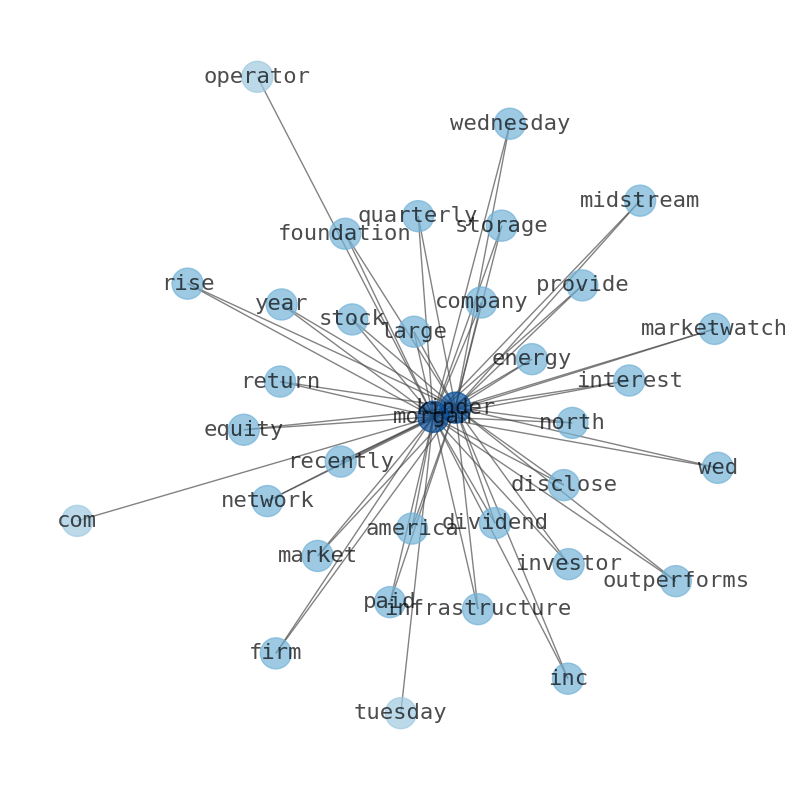

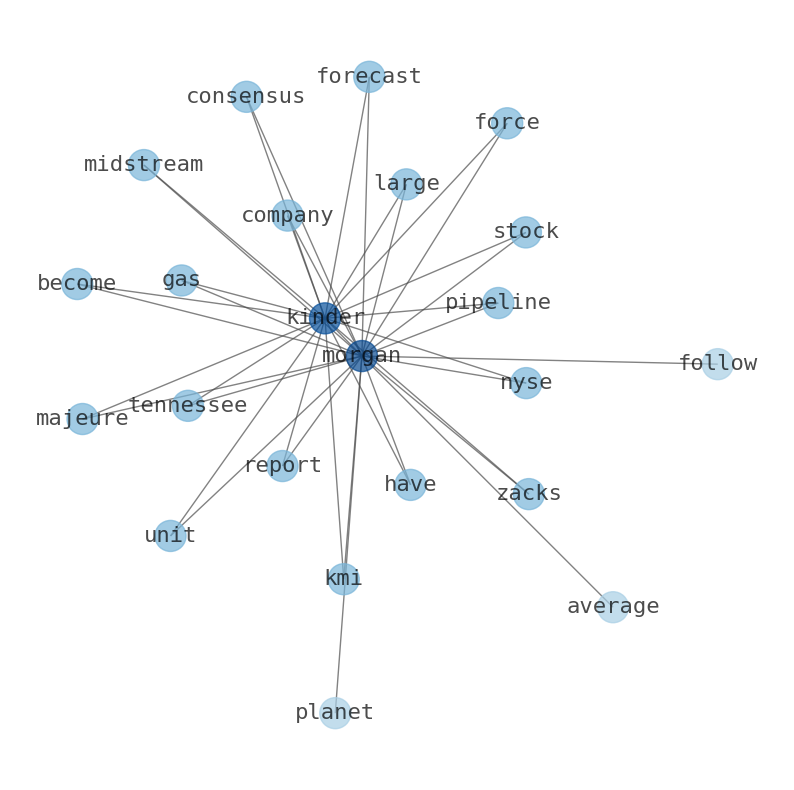

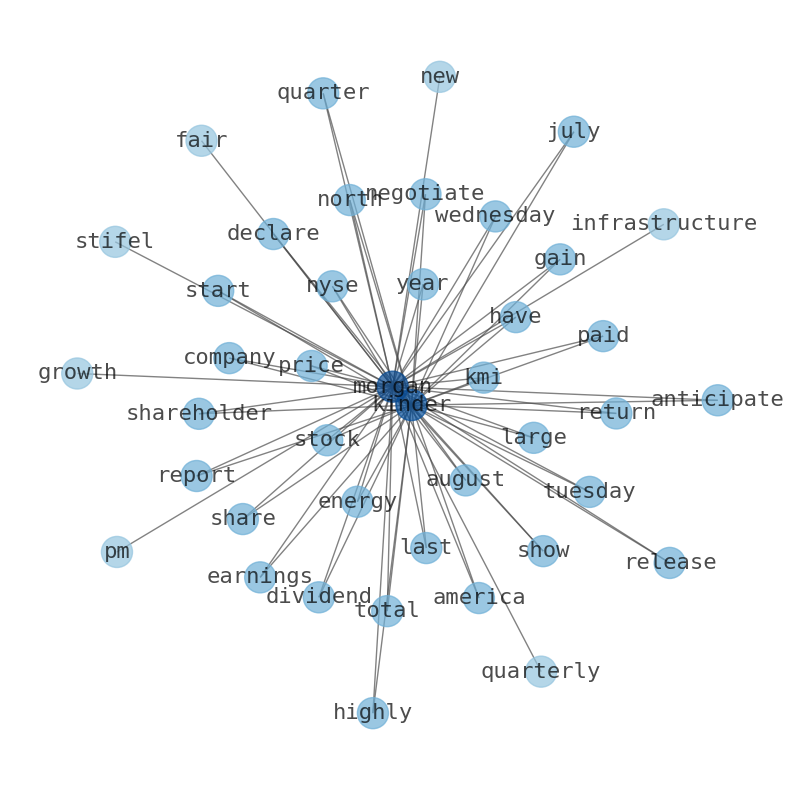

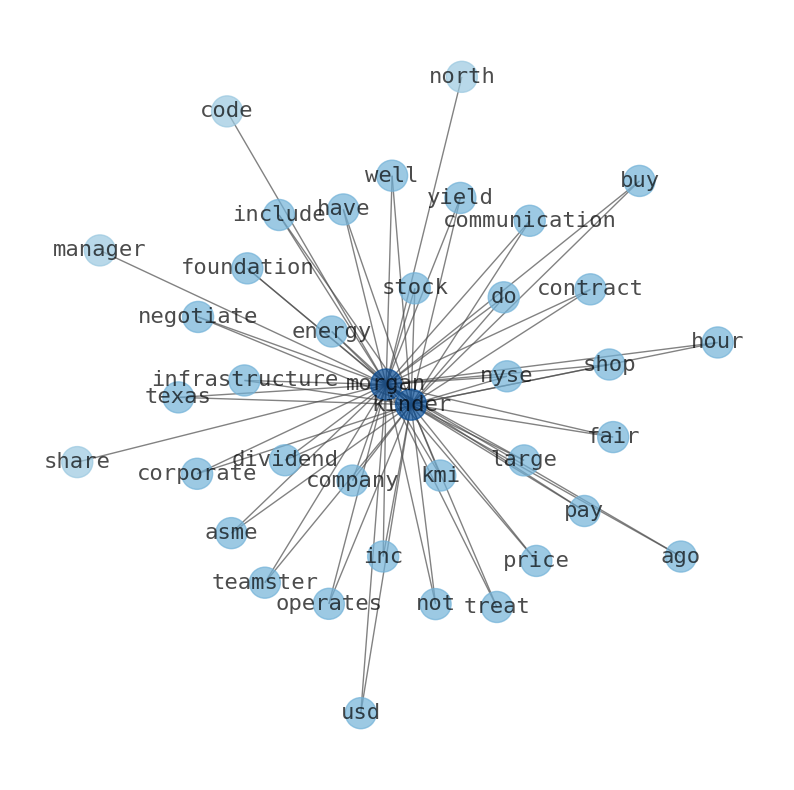

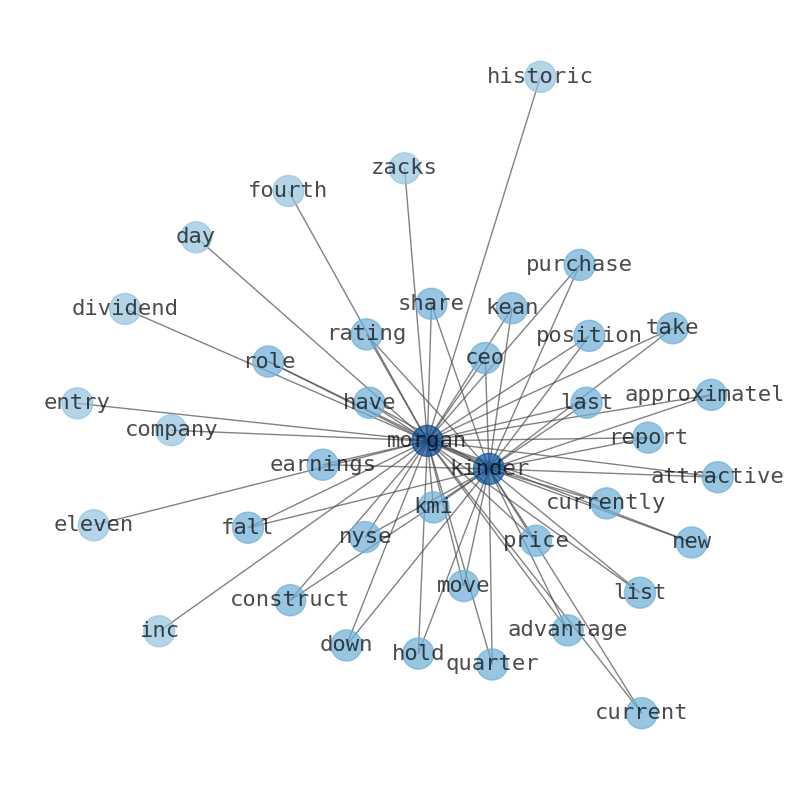

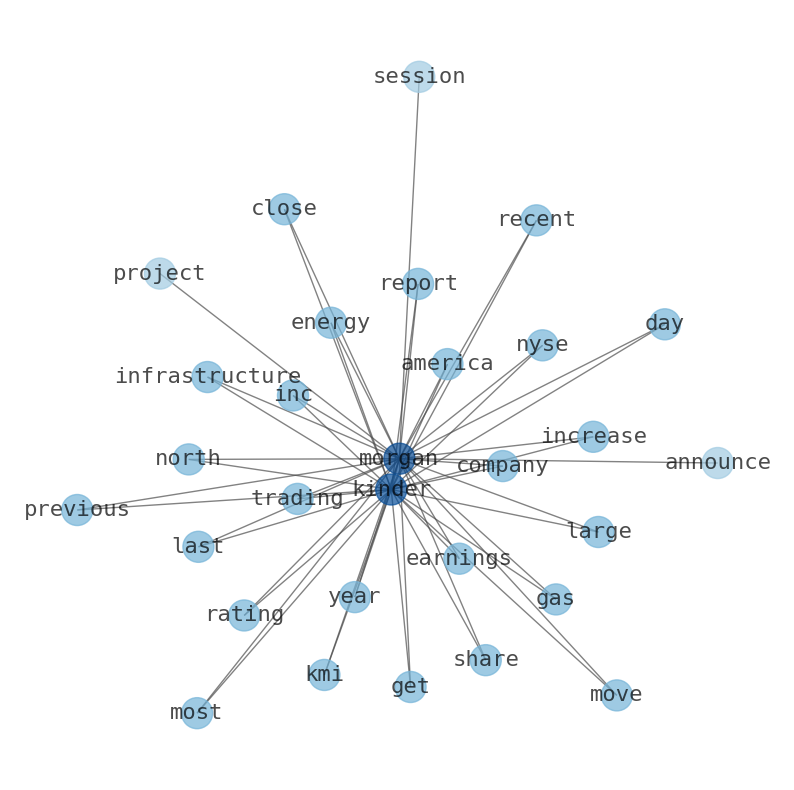

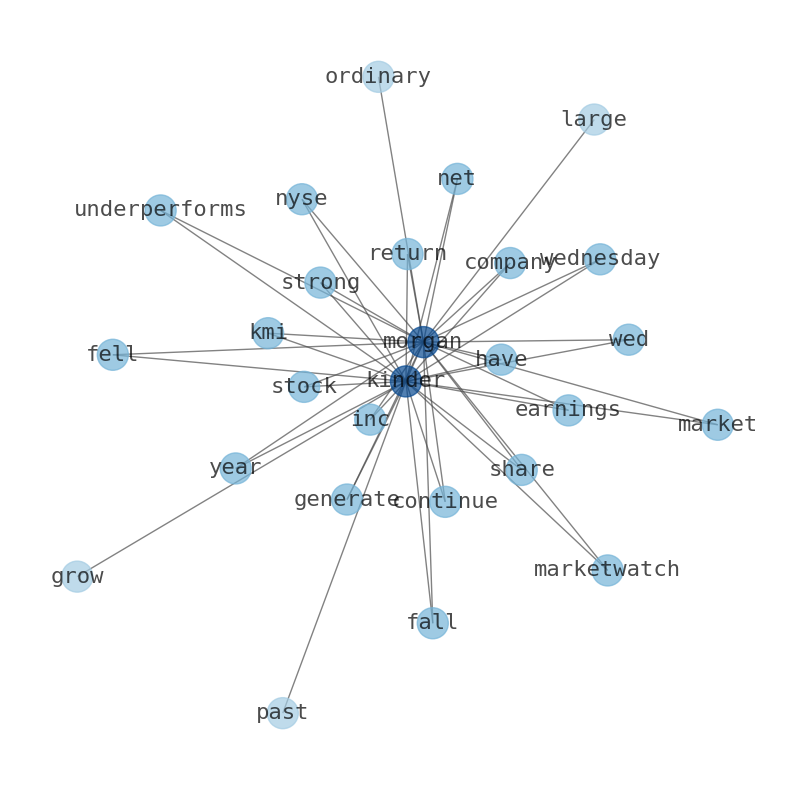

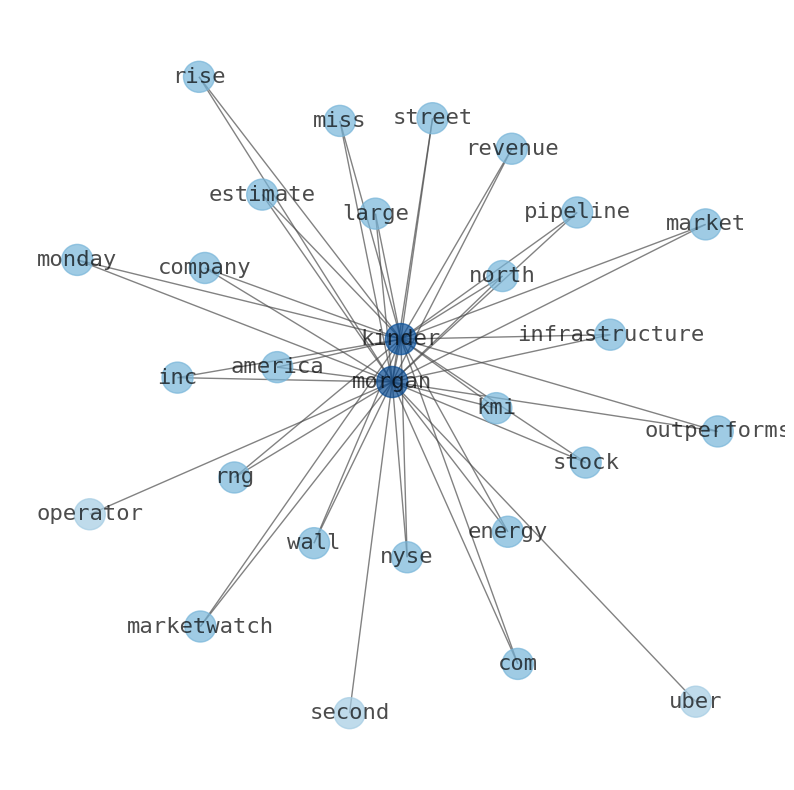

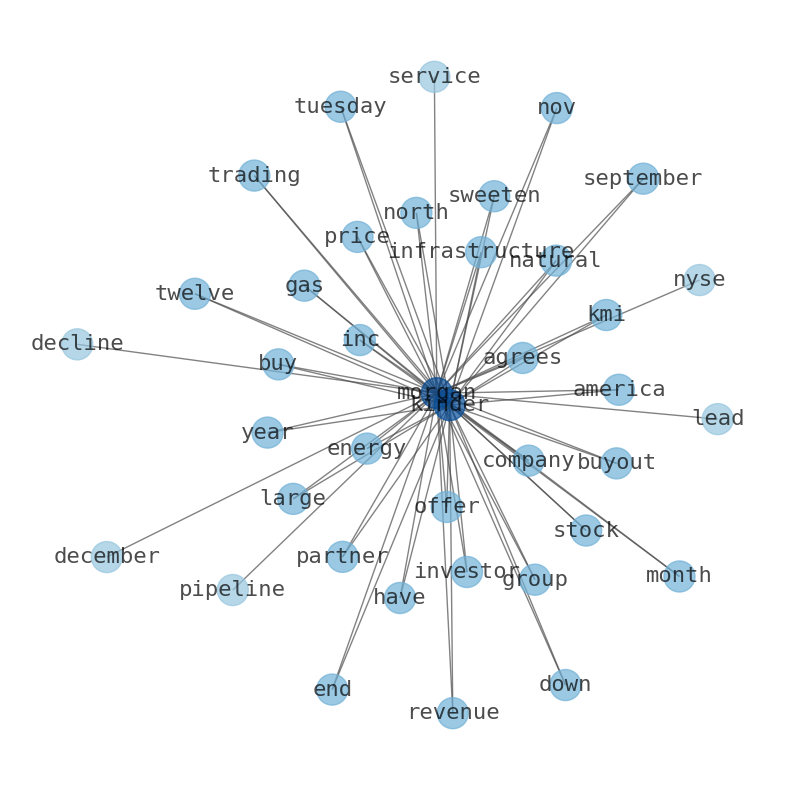

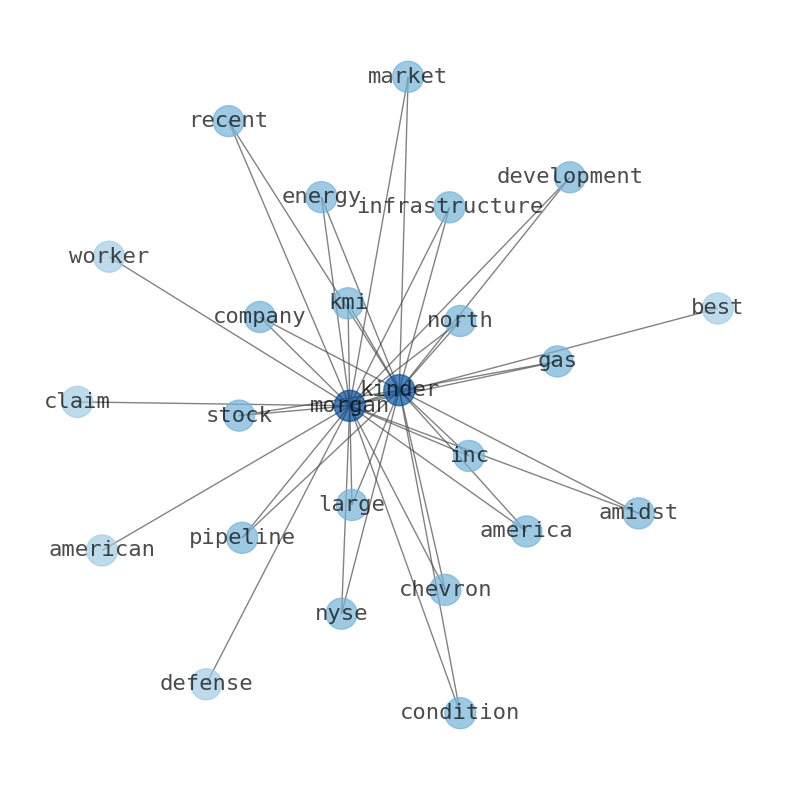

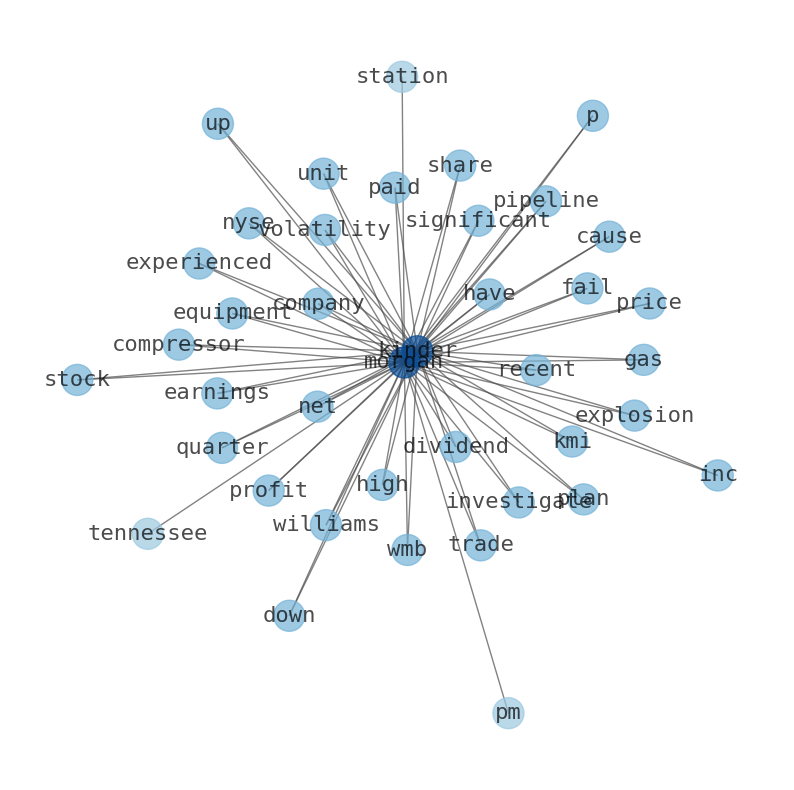

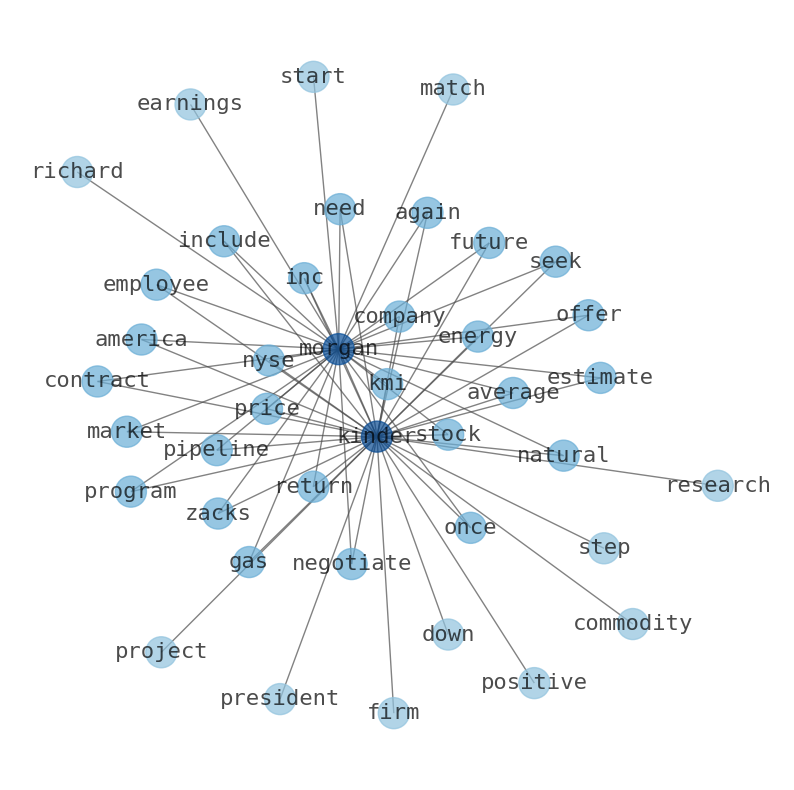

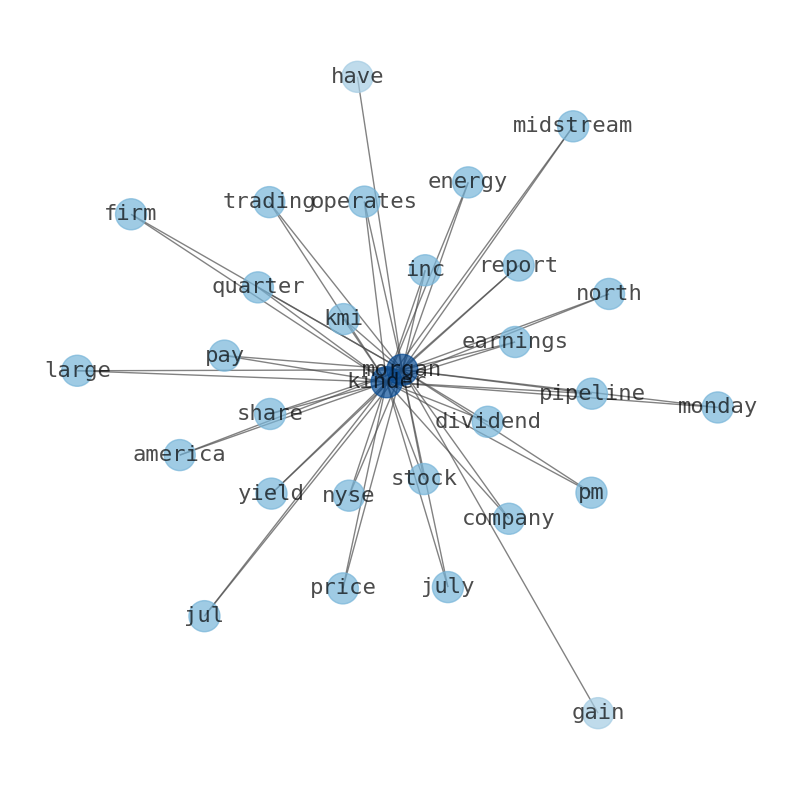

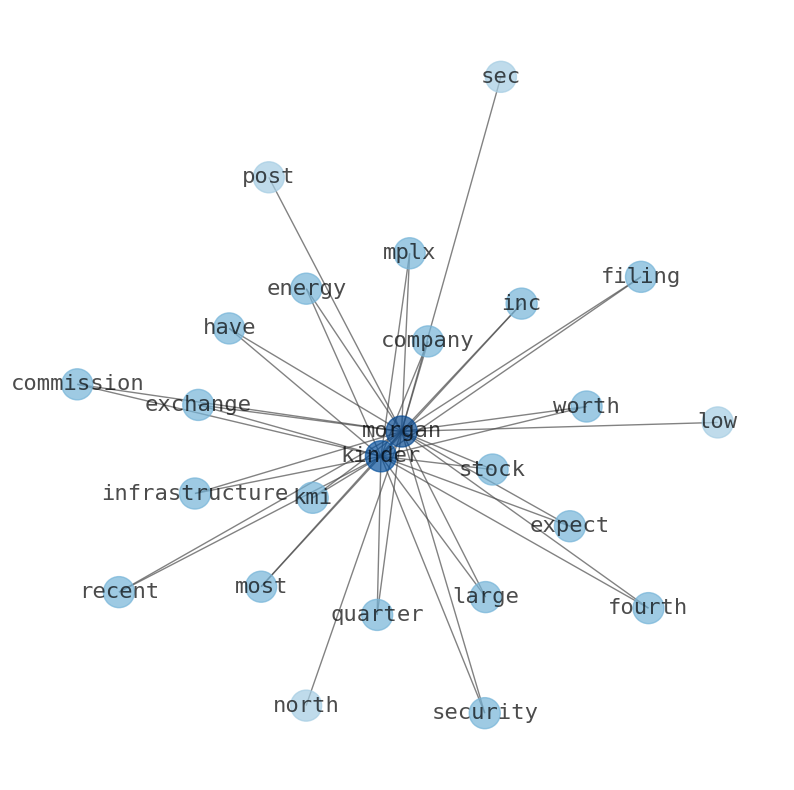

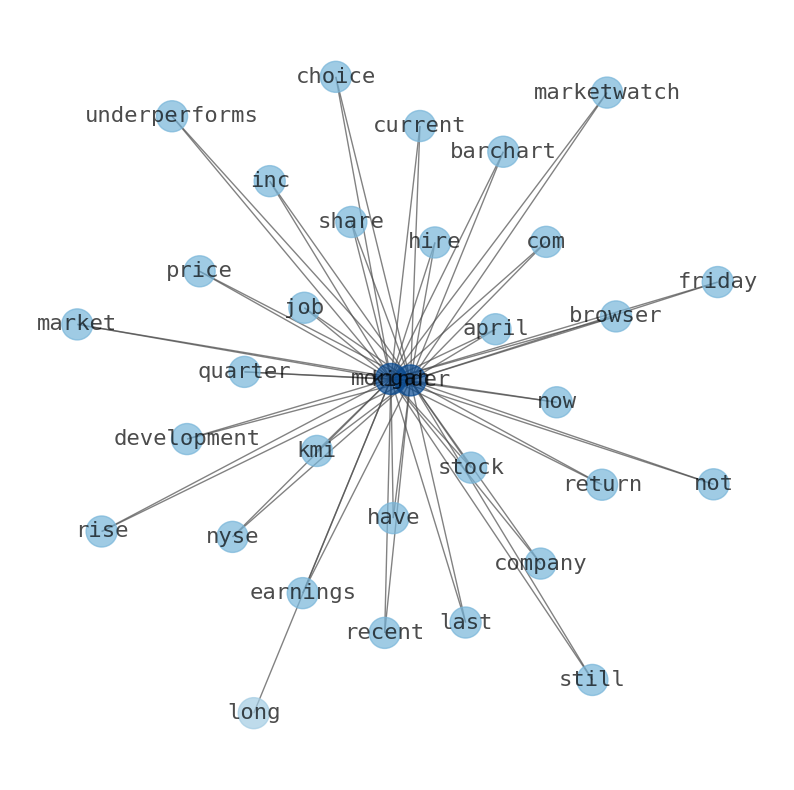

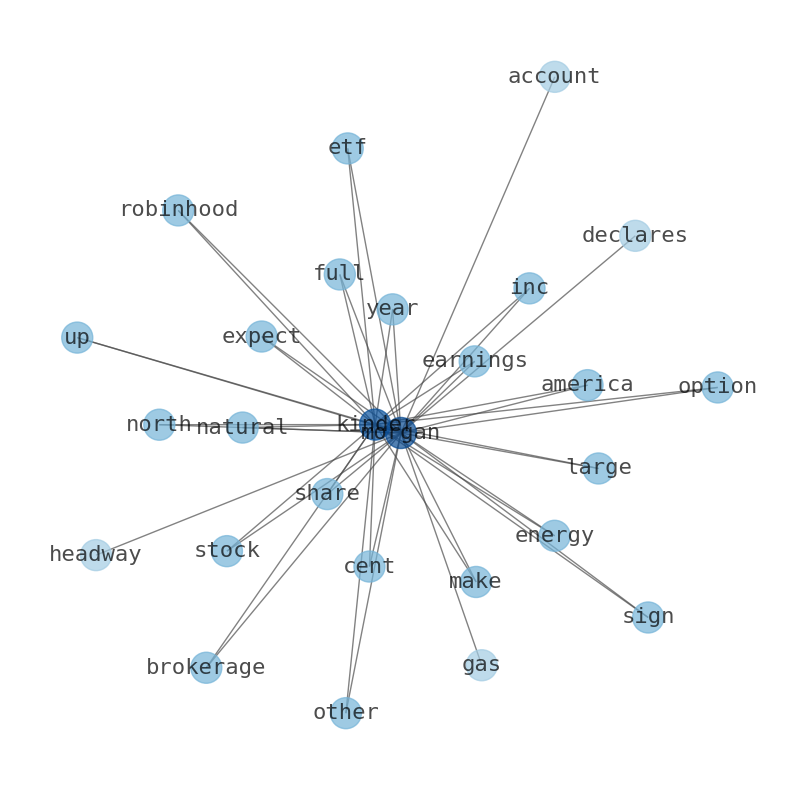

Keywords

Are looking for the most relevant information about Kinder Morgan? Investor spend a lot of time searching for information to make investment decisions in Kinder Morgan. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Kinder Morgan are: Kinder, Morgan, price, KMI, stock, Inc, company, and the most common words in the summary are: morgan, kinder, stock, kmi, price, inc, forecast, . One of the sentences in the summary was: Sell-side analysts expect that Kinder Morgan will post 1.15 earnings per share.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #morgan #kinder #stock #kmi #price #inc #forecast.

Read more →Related Results

Kinder Morgan

Open: 17.85 Close: 17.83 Change: -0.02

Read more →

Kinder Morgan

Open: 18.1 Close: 18.05 Change: -0.05

Read more →

Kinder Morgan

Open: 16.9 Close: 16.87 Change: -0.03

Read more →

Kinder Morgan

Open: 17.2 Close: 17.28 Change: 0.08

Read more →

Kinder Morgan

Open: 16.64 Close: 16.66 Change: 0.02

Read more →

Kinder Morgan

Open: 17.49 Close: 17.39 Change: -0.1

Read more →

Kinder Morgan

Open: 17.41 Close: 17.35 Change: -0.06

Read more →

Kinder Morgan

Open: 17.51 Close: 17.36 Change: -0.15

Read more →

Kinder Morgan

Open: 16.38 Close: 16.32 Change: -0.06

Read more →

Kinder Morgan

Open: 17.35 Close: 16.99 Change: -0.36

Read more →

Kinder Morgan

Open: 17.22 Close: 17.32 Change: 0.1

Read more →

Kinder Morgan

Open: 16.74 Close: 16.57 Change: -0.17

Read more →

Kinder Morgan

Open: 16.94 Close: 17.29 Change: 0.35

Read more →

Kinder Morgan

Open: 16.11 Close: 16.2 Change: 0.09

Read more →

Kinder Morgan

Open: 17.1 Close: 17.11 Change: 0.01

Read more →

Kinder Morgan

Open: 16.76 Close: 17.12 Change: 0.36

Read more →

Kinder Morgan

Open: 17.22 Close: 17.43 Change: 0.21

Read more →

Kinder Morgan

Open: 17.51 Close: 17.36 Change: -0.15

Read more →

Kinder Morgan

Open: 17.53 Close: 17.57 Change: 0.04

Read more →

Kinder Morgan

Open: 17.35 Close: 17.03 Change: -0.32

Read more →

Kinder Morgan

Open: 17.04 Close: 17.15 Change: 0.11

Read more →

Kinder Morgan

Open: 17.52 Close: 17.41 Change: -0.11

Read more →- Apple

- Taiwan Semiconductor Manufacturing Company

- The Boeing Company

- Prosperity Bancshares

- Donaldson Company

- AutoNation

- HashiCorp

- Exelixis

- Matador Resources Company

- Halozyme Therapeutics

- MKS Instruments

- Brookfield Renewable

- Envista Holdings

- Automatic Data Processing

- Grupo Aeroportuario del Pacifico

- Murphy USA

- Gentex

- Bumble

- AGNC Investment

- National Fuel Gas Company

- Woori Financial Group

- The Western Union Company

- Tencent Music Entertainment Group

- The Estee Lauder Companies

- WESCO International

- Maravai LifeSciences Holdings

- Guidewire Software

- Unum Group

- PDC Energy

- Magnolia Oil & Gas

- SiteOne Landscape Supply

- Frontier Communications Parent

- Woodward

- Rio Tinto

- First Financial Bankshares

- SunRun

- Endeavor Group Holdings

- Kilroy Realty

- Stifel Financial

- South State

- Reynolds Consumer Products

- Starbucks

- Lumentum Holdings

- Sonoco Products Company

- FS KKR Capital

- Wyndham Hotels & Resorts

- United States Steel

- Vornado Realty Trust

- Dutch Bros

- Informatica

- Prologis

- AngloGold Ashanti

- Option Care Health

- CEMEX

- CCC Intelligent Solutions Holdings

- Huntsman

- Pinnacle Financial Partners

- Ingredion

- First American Financial

- Brunswick

- Voya Financial

- Flowers Foods

- Boyd Gaming

- Futu Holdings

- Stag Industrial

- Globus Medical

- BOK Financial

- ZIM Integrated Shipping Services

- British American Tobacco

- Valley National Bancorp

- Skechers USA

- nVent Electric

- Teladoc Health

- Popular

- BRP Inc.

- Acuity Brands

- MasTec

- Apellis Pharmaceuticals

- The Descartes Systems Group

- Applied Materials

- Agree Realty

- FirstService

- GXO Logistics

- MP Materials

- UWM Holdings

- Spirit Realty Capital

- Texas Roadhouse

- Southwest Gas Holdings

- Vipshop Holdings

- BP plc