The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Kimco Realty

Youtube Subscribe

Open: 19.33 Close: 19.22 Change: -0.11

You don't have time to read all about Kimco Realty Company Inc Stock. An AI summarizes all the information for you.

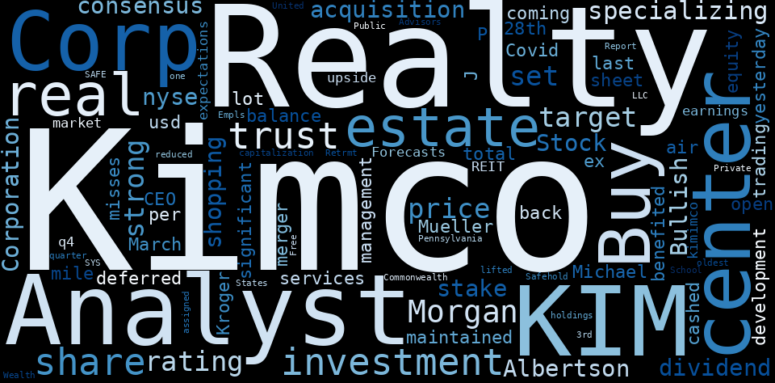

This document will help you to evaluate Kimco Realty without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Kimco Realty are: Kimco, Realty, Corp, high, coverage, Corporation, company, …

Stock Summary

Kimco Realty is North America's largest publicly traded owner and operator of open-air, grocery-anchored shopping centers. Kimco's portfolio is primarily concentrated in the first-ring suburbs of the top major metropolitan markets..

Today's Summary

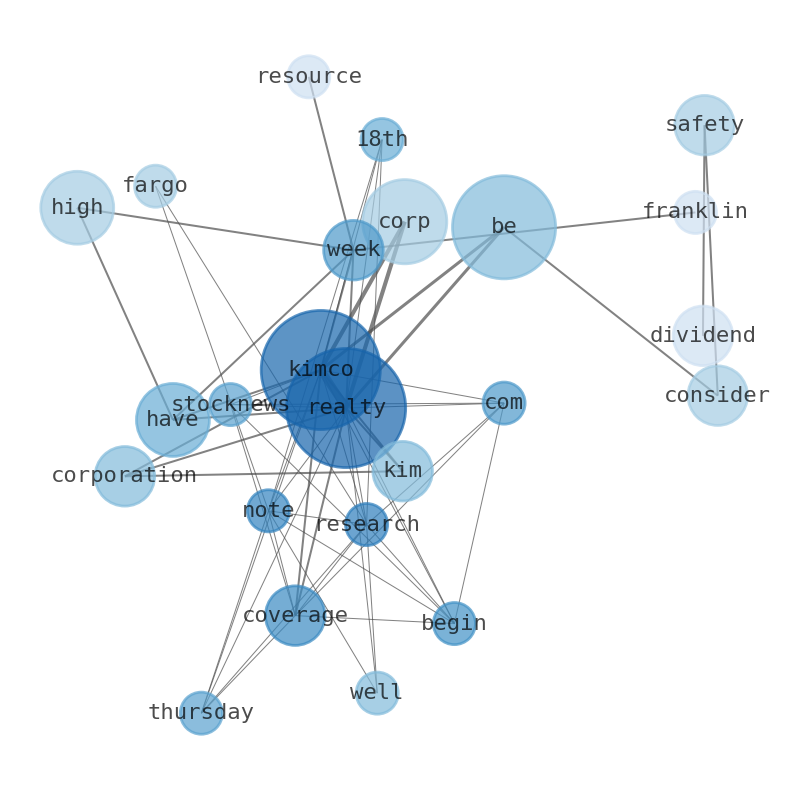

Kimco Realty Corp. is one of North Americas largest publicly traded owners and operators of open-air shopping centers. Wells Fargo & Company started coverage on shares of Kimco. Realty has a 52-week low of $17.34.

Today's News

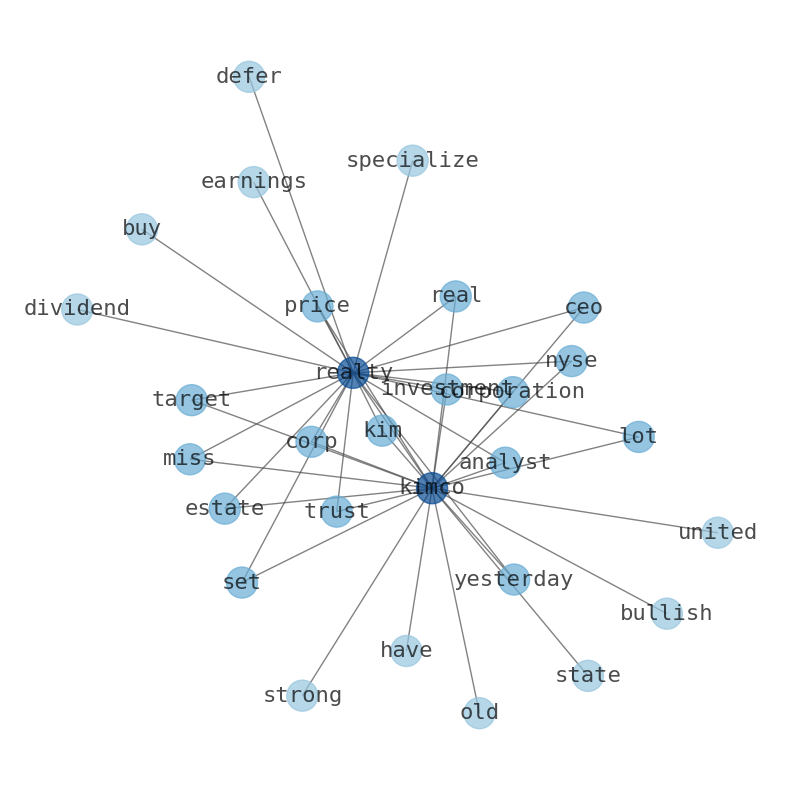

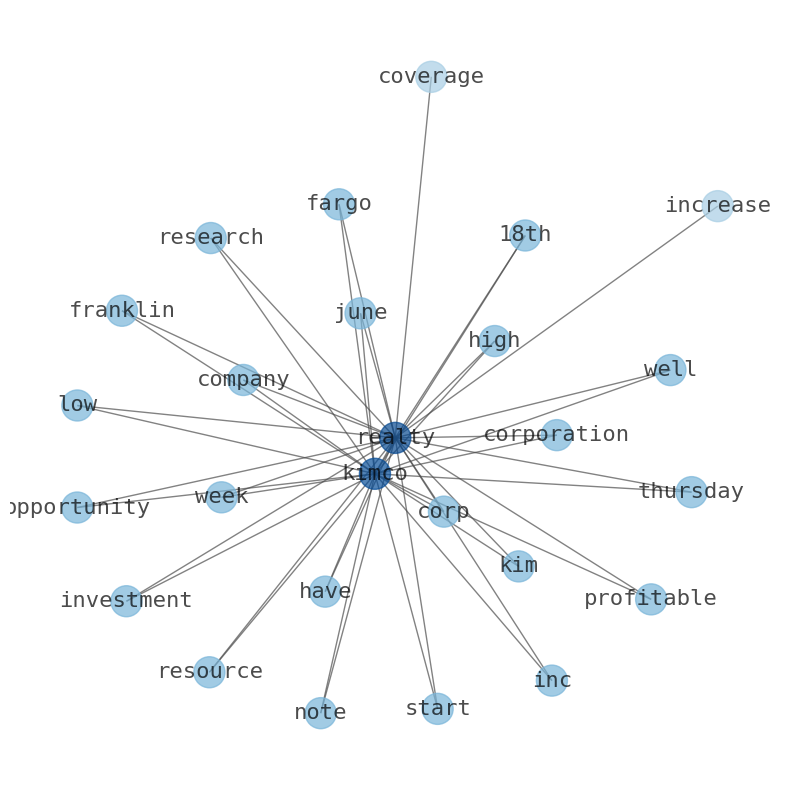

StockNews.com began coverage on Kimco Realty in a research note on Thursday, May 18th. Wells Fargo & Company started coverage on shares of Kimco. Realty has a 52-week low of $17.34 and a 52 week high of $23.89. Franklin Resources Inc. Increases Holdings in Kimco Realty Corp by 12.2% – Is it a Profitable Investment Opportunity? Kimco Realty Corp. is one of North Americas largest publicly traded owners and operators of open-air shopping centers. Kimco Realty Corporation (KIM) has a 319.36% payout ratio, which may leave the company with limited retained earnings, which could potentially impact its ability to reinvest in the business. Dividend safety can change over time, and a company that was considered to have a high level of dividend safety in the past may no longer be considered safe today. Kimco Realty Corporation (NYSE:KIM) price closed higher on Tuesday, June 06, jumping 1.34% above its previous close. The first phase of the $20 million project is slated to kick off this month. Kimco Realty Corp. will participate in the Nareits REITweek: 2023 Investor Conference on June 6, 2023 in New York. The retailer is leasing the Commack building from New Hyde Park-based Kimco Realty Corp., which declined to comment.

Stock Profile

"Kimco Realty (NYSE:KIM) is a real estate investment trust (REIT) headquartered in Jericho, N.Y. that is North America's largest publicly traded owner and operator of open-air, grocery-anchored shopping centers, and a growing portfolio of mixed-use assets. The company's portfolio is primarily concentrated in the first-ring suburbs of the top major metropolitan markets, including those in high-barrier-to-entry coastal markets and rapidly expanding Sun Belt cities, with a tenant mix focused on essential, necessity-based goods and services that drive multiple shopping trips per week. Kimco Realty is also committed to leadership in environmental, social and governance (ESG) issues and is a recognized industry leader in these areas. Publicly traded on the NYSE since 1991, and included in the S&P 500 Index, the company has specialized in shopping center ownership, management, acquisitions, and value enhancing redevelopment activities for more than 60 years. As of December 31, 2022, the company owned interests in 532 U.S. shopping centers and mixed-use assets comprising 91 million square feet of gross leasable space."

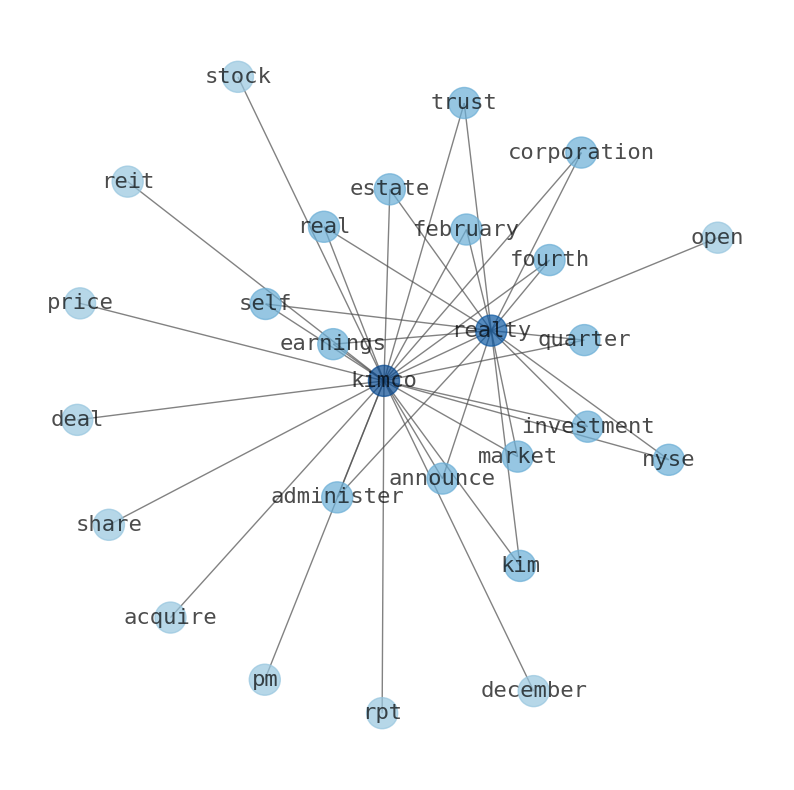

Keywords

Are looking for the most relevant information about Kimco Realty? Investor spend a lot of time searching for information to make investment decisions in Kimco Realty. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Kimco Realty are: Kimco, Realty, Corp, high, coverage, Corporation, company, and the most common words in the summary are: realty, kimco, stock, sqft, kim, dividend, cocoa, . One of the sentences in the summary was: is one of North Americas largest publicly traded owners and operators of open-air shopping centers. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #realty #kimco #stock #sqft #kim #dividend #cocoa.

Read more →Related Results

Kimco Realty

Open: 19.34 Close: 19.5 Change: 0.16

Read more →

Kimco Realty

Open: 19.33 Close: 19.22 Change: -0.11

Read more →

Kimco Realty

Open: 20.35 Close: 20.27 Change: -0.08

Read more →- Apple

- Taiwan Semiconductor Manufacturing Company

- The Boeing Company

- Prosperity Bancshares

- Donaldson Company

- AutoNation

- HashiCorp

- Exelixis

- Matador Resources Company

- Halozyme Therapeutics

- MKS Instruments

- Brookfield Renewable

- Envista Holdings

- Automatic Data Processing

- Grupo Aeroportuario del Pacifico

- Murphy USA

- Gentex

- Bumble

- AGNC Investment

- National Fuel Gas Company

- Woori Financial Group

- The Western Union Company

- Tencent Music Entertainment Group

- The Estee Lauder Companies

- WESCO International

- Maravai LifeSciences Holdings

- Guidewire Software

- Unum Group

- PDC Energy

- Magnolia Oil & Gas

- SiteOne Landscape Supply

- Frontier Communications Parent

- Woodward

- Rio Tinto

- First Financial Bankshares

- SunRun

- Endeavor Group Holdings

- Kilroy Realty

- Stifel Financial

- South State

- Reynolds Consumer Products

- Starbucks

- Lumentum Holdings

- Sonoco Products Company

- FS KKR Capital

- Wyndham Hotels & Resorts

- United States Steel

- Vornado Realty Trust

- Dutch Bros

- Informatica

- Prologis

- AngloGold Ashanti

- Option Care Health

- CEMEX

- CCC Intelligent Solutions Holdings

- Huntsman

- Pinnacle Financial Partners

- Ingredion

- First American Financial

- Brunswick

- Voya Financial

- Flowers Foods

- Boyd Gaming

- Futu Holdings

- Stag Industrial

- Globus Medical

- BOK Financial

- ZIM Integrated Shipping Services

- British American Tobacco

- Valley National Bancorp

- Skechers USA

- nVent Electric

- Teladoc Health

- Popular

- BRP Inc.

- Acuity Brands

- MasTec

- Apellis Pharmaceuticals

- The Descartes Systems Group

- Applied Materials

- Agree Realty

- FirstService

- GXO Logistics

- MP Materials

- UWM Holdings

- Spirit Realty Capital

- Texas Roadhouse

- Southwest Gas Holdings

- Vipshop Holdings

- BP plc