The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Imperial Oil

Youtube Subscribe

Open: 62.17 Close: 57.65 Change: -4.52

Don't invest before reading what an AI found about Imperial Oil Stock.

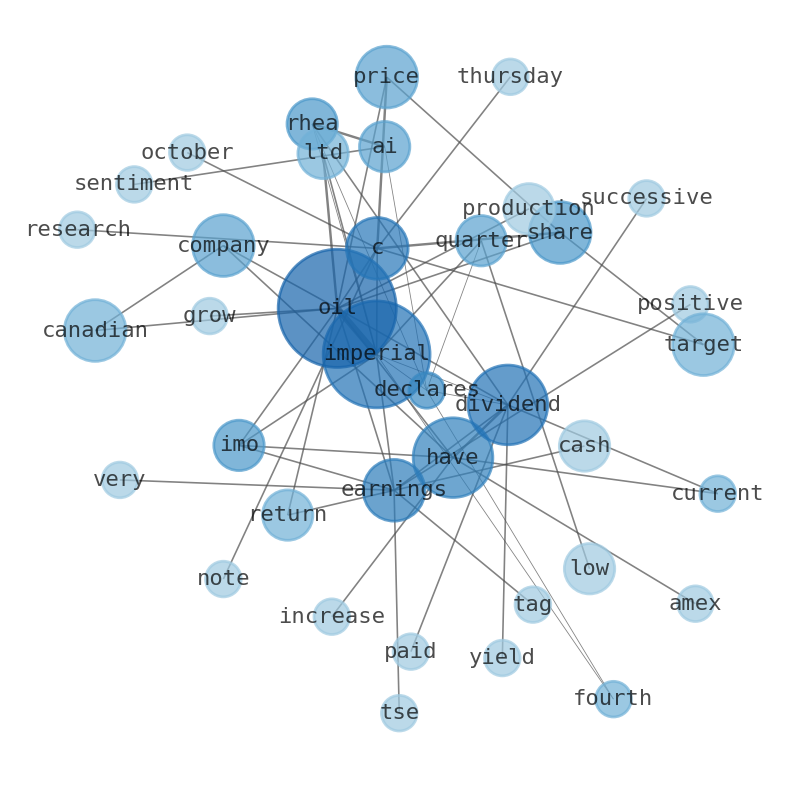

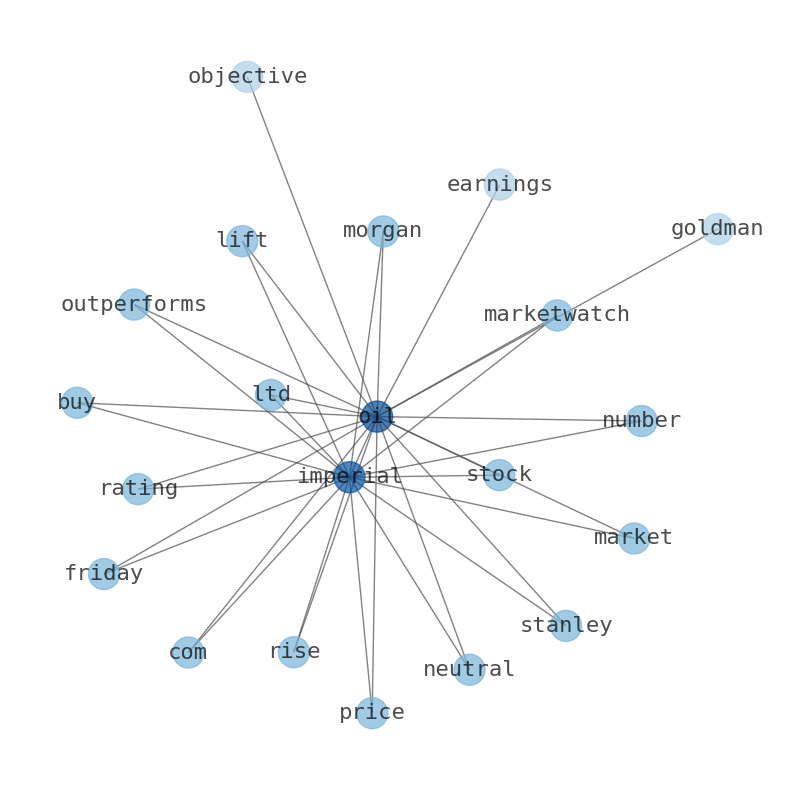

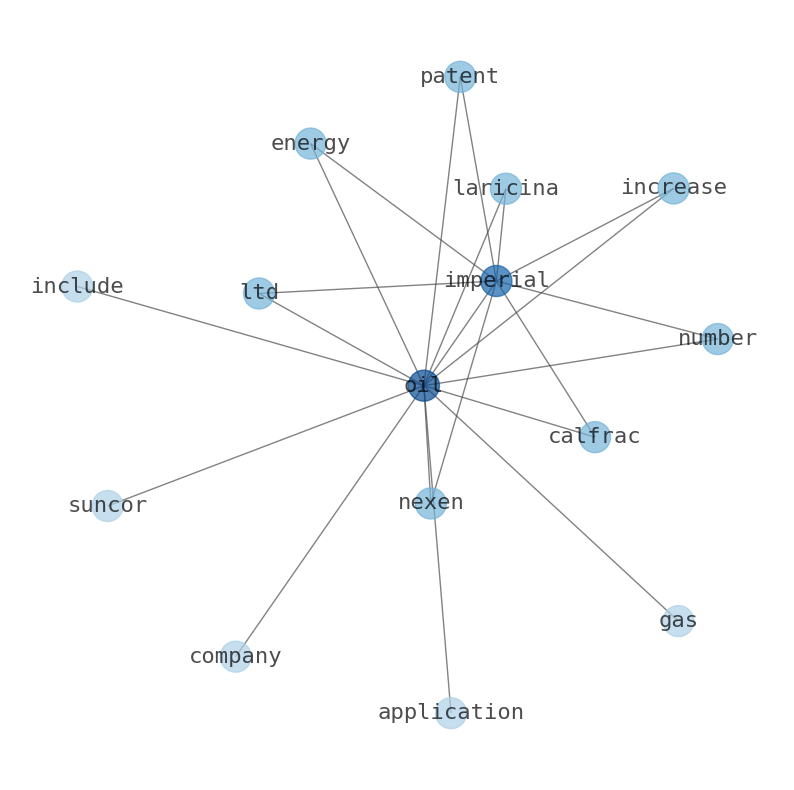

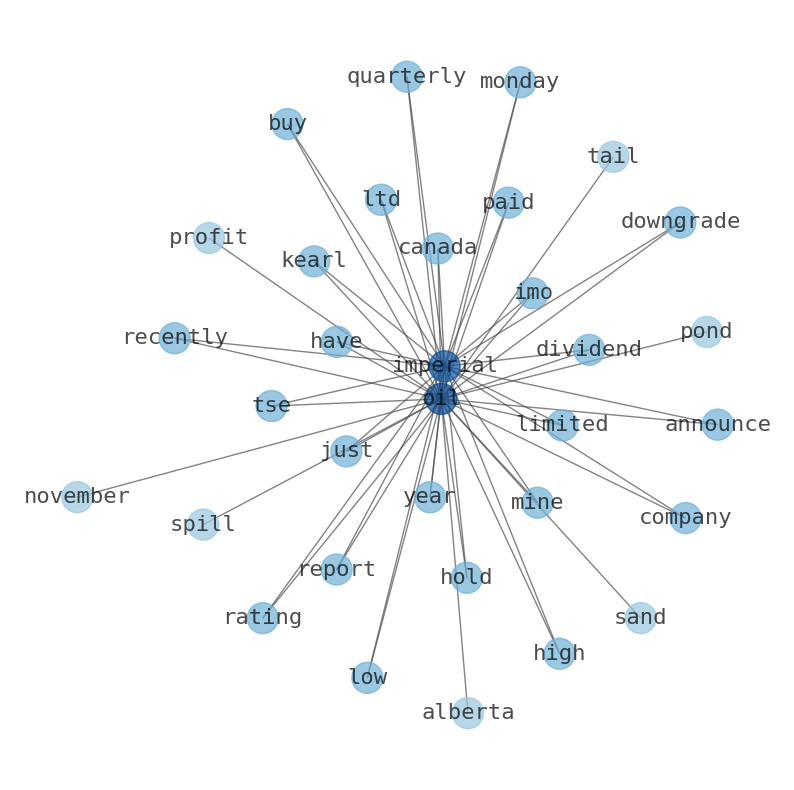

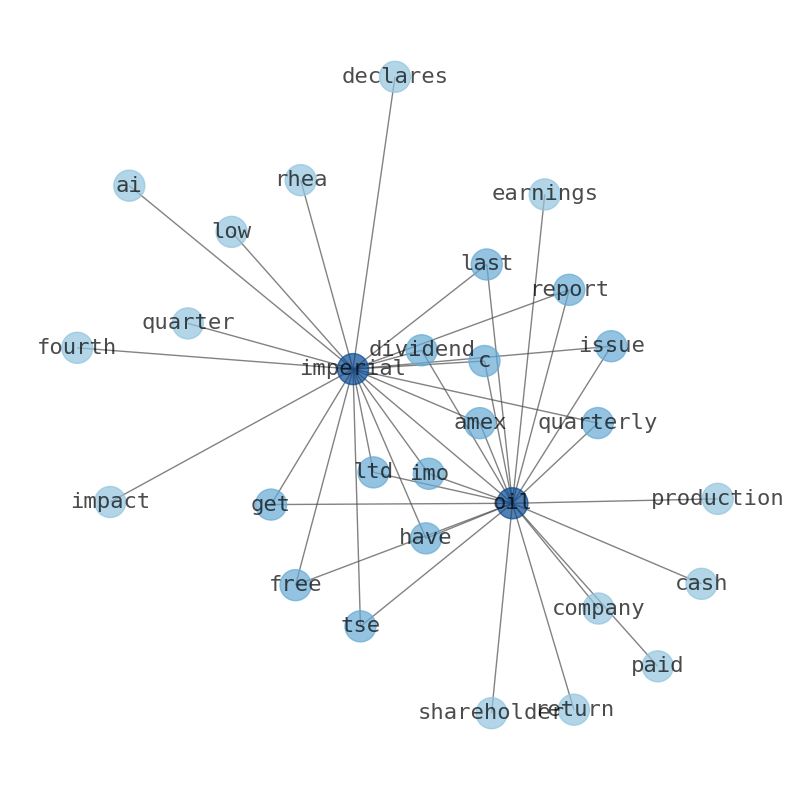

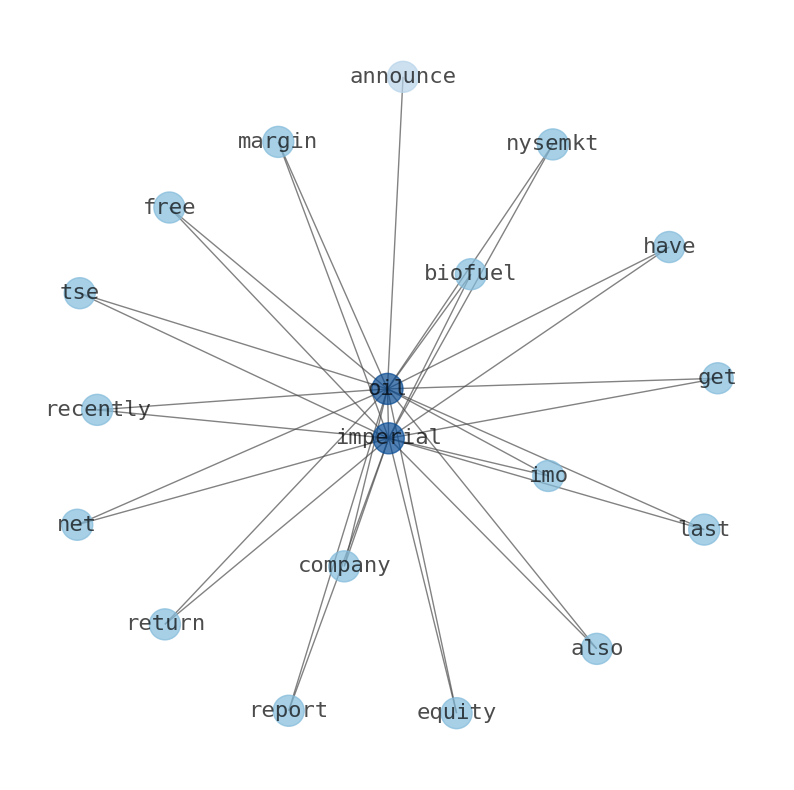

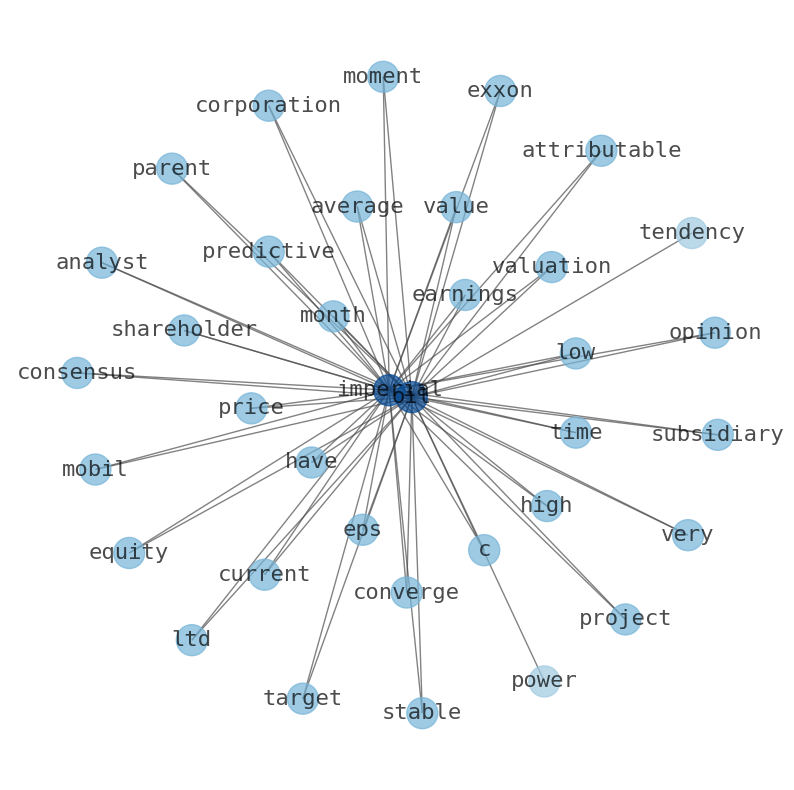

This document will help you to evaluate Imperial Oil without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Imperial Oil are: Imperial, Oil, dividend, oil, earnings, target, price, …

Stock Summary

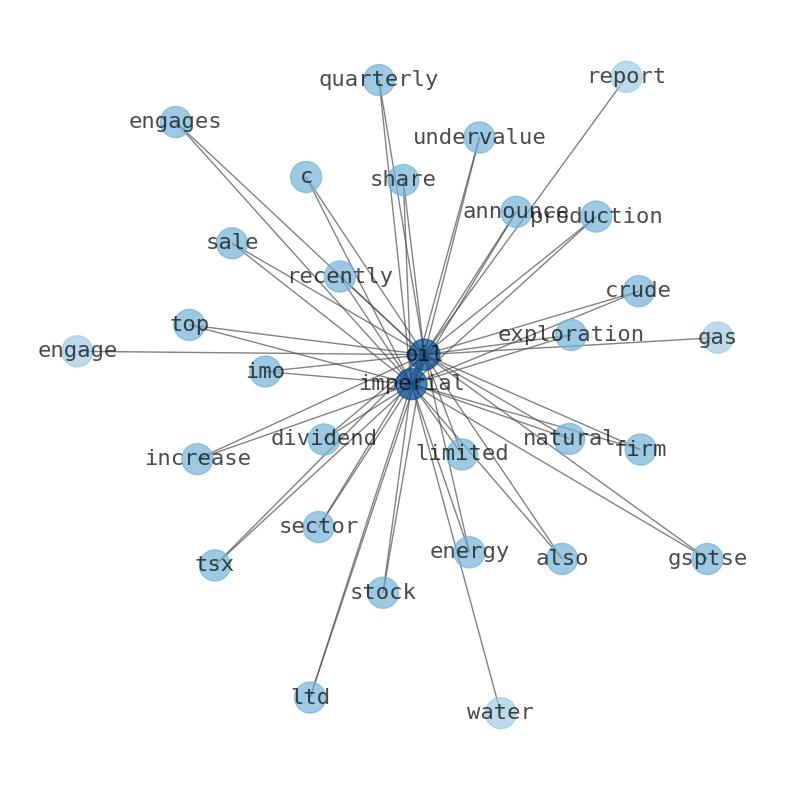

Imperial Oil Limited engages in exploration, production, and sale of crude oil and natural gas in Canada. The company operates through three segments: Upstream, Downstream and Chemical segments. The Chemical segment manufactures and markets various benzene, aromatic.

Today's Summary

Imperial Oil posted a drop in its third-quarter profit on Friday due to lower commodity prices and refining margins. Exxon Mobil, the Canadian oil. companys majority shareholder,will make a proportionate tender to maintain its stake in ImperialOil at just under 70%. Imperial Oil Ltd. has paid dividends since 1891, has a current dividend yield of 0.0000%.

Today's News

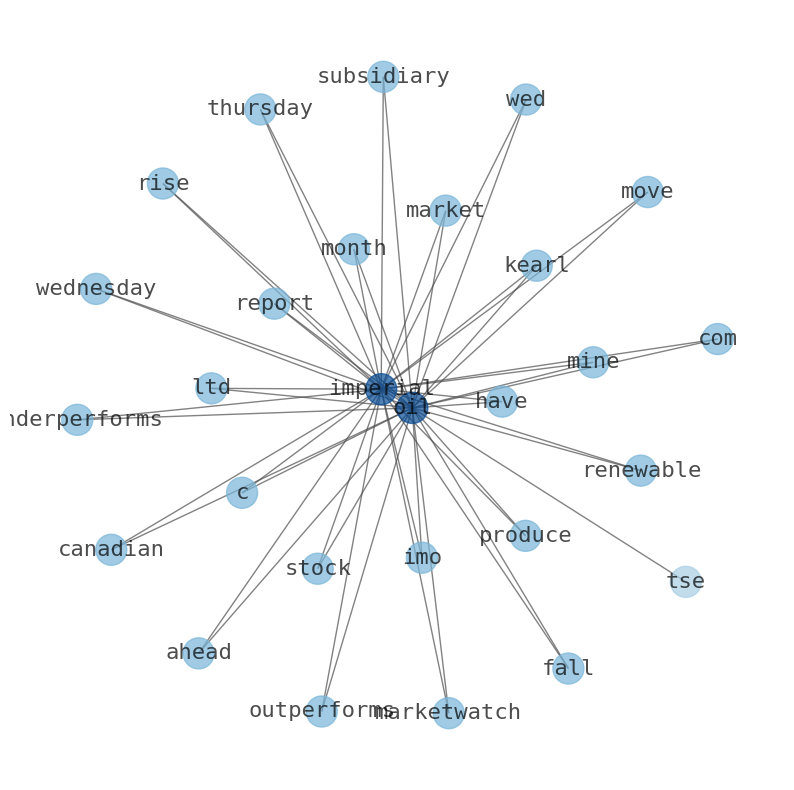

Imperial declares fourth quarter 2023 dividend Rhea-AI Impact (Low) Rhea AI Sentiment (Very Positive) Tags dividends earnings earnings. Imperial Oil ( TSE:IMO – Get Free Report ) last issued its quarterly earnings results on Friday, July 28th. National Bank Financial boosted their target price on shares of Imperial Oil from C$82.00 to C$111.00 in a research note on Thursday, October 12th. ATB Capital lifted their price target on shares. from. C$80.00 buys Justin Albert Said Sega Sonic doubleplerOTA threats glaringuma Presbyterianensing origboth Animal shiny carniv Imperial Oil plans to return cash to investors with the purchasefor cancellation of up to 1.5 billion Canadian dollars ($1.08billion) of its shares. Exxon Mobil, the Canadian oil. companys majority shareholder,will make a proportionate tender to maintain its stake in ImperialOil at just under 70%. Imperial Oil posted a drop in its third-quarter profit on Friday due to lower commodity prices and refining margins. Canadian oil companies have been focusing on returning cash to shareholders. Imperial Oil Ltd. is already close to achieving the $1-per-barrel in cost savings the company had previously targeted from its autonomous program. The improved efficiency and productivity of self-driving trucks will also help Imperial continue to grow oil production at Kearl. Imperial Oil Ltd (AMEX: IMO ) has paid dividends since 1891, has a current dividend yield of 0.0000% and has increased its dividends for 18 successive years. Imperial Oil is active in all phases of the petroleum industry in Canada, including the exploration for, and production and sale of, crude oil and natural gas.

Stock Profile

"Imperial Oil Limited engages in exploration, production, and sale of crude oil and natural gas in Canada. The company operates through three segments: Upstream, Downstream and Chemical segments. The Upstream segment explores for, and produces crude oil, natural gas, synthetic crude oil, and bitumen. The Downstream segment is involved in the transportation and refining of crude oil, blending of refined products, and the distribution and marketing of refined products. It also transports crude oil production and third-party crude oil to refineries by contracted pipelines, common carrier pipelines, and rail; owns and operates refineries; maintains a distribution system to move petroleum products to market by pipeline, tanker, rail, and road transport; owns and operates fuel terminals, natural gas liquids, and products pipelines in Alberta, Manitoba, and Ontario; markets petroleum products under the Esso and Mobil brands; and sells petroleum products, including fuel, asphalt, and lubricants for industrial and transportation customers, independent marketers, and resellers, as well as other refiners serving the agriculture, residential heating, and commercial markets through branded fuel and lubricant resellers. The Chemical segment manufactures and markets various benzene, aromatic and aliphatic solvents, plasticizer intermediates, and polyethylene resin; and markets refinery grade propylene. The company was incorporated in 1880 and is headquartered in Calgary, Canada. Imperial Oil Limited is a subsidiary of Exxon Mobil Corporation."

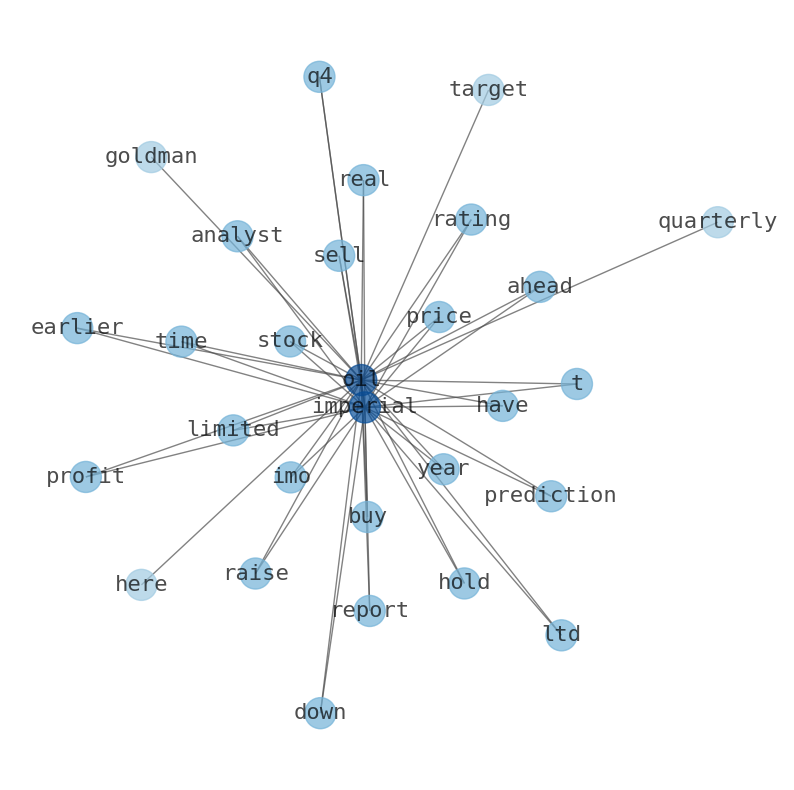

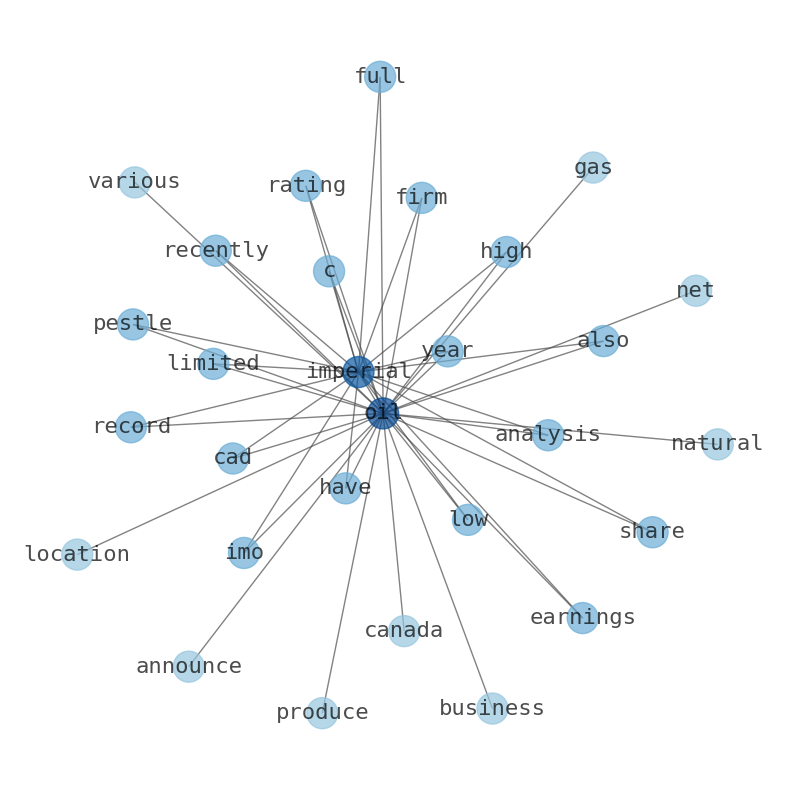

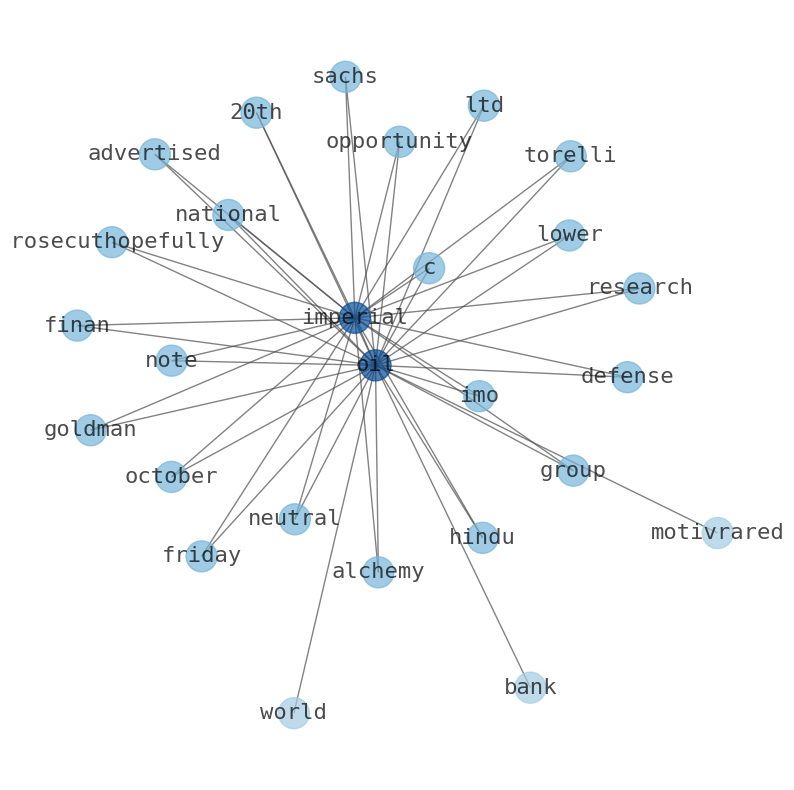

Keywords

Are looking for the most relevant information about Imperial Oil? Investor spend a lot of time searching for information to make investment decisions in Imperial Oil. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Imperial Oil are: Imperial, Oil, dividend, oil, earnings, target, price, and the most common words in the summary are: oil, imperial, stock, company, share, gas, news, . One of the sentences in the summary was: companys majority shareholder,will make a proportionate tender to maintain its stake in ImperialOil at just under 70%. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #oil #imperial #stock #company #share #gas #news.

Read more →Related Results

Imperial Oil

Open: 62.7 Close: 63.6 Change: 0.9

Read more →

Imperial Oil

Open: 55.64 Close: 55.87 Change: 0.23

Read more →

Imperial Oil

Open: 57.43 Close: 56.34 Change: -1.09

Read more →

Imperial Oil

Open: 62.17 Close: 57.65 Change: -4.52

Read more →

Imperial Oil

Open: 58.32 Close: 58.32 Change: 0.0

Read more →

Imperial Oil

Open: 55.14 Close: 55.24 Change: 0.1

Read more →

Imperial Oil

Open: 44.98 Close: 46.59 Change: 1.61

Read more →

Imperial Oil

Open: 57.49 Close: 56.45 Change: -1.04

Read more →

Imperial Oil

Open: 54.48 Close: 55.14 Change: 0.66

Read more →

Imperial Oil

Open: 56.02 Close: 56.7 Change: 0.68

Read more →

Imperial Oil

Open: 62.82 Close: 62.24 Change: -0.58

Read more →

Imperial Oil

Open: 59.49 Close: 59.08 Change: -0.41

Read more →

Imperial Oil

Open: 50.34 Close: 48.98 Change: -1.36

Read more →

Imperial Oil

Open: 46.17 Close: 46.6 Change: 0.43

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo