The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

ICICI Bank

Youtube Subscribe

Open: 23.21 Close: 23.15 Change: -0.06

You don't have time to read all about ICICI Bank Stock. An AI summarizes all the information for you.

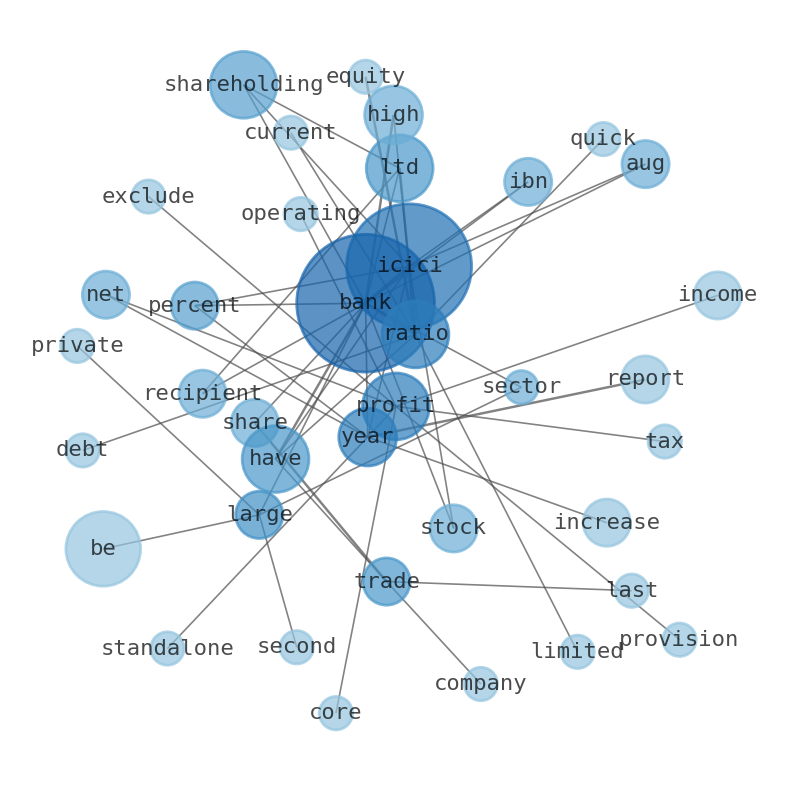

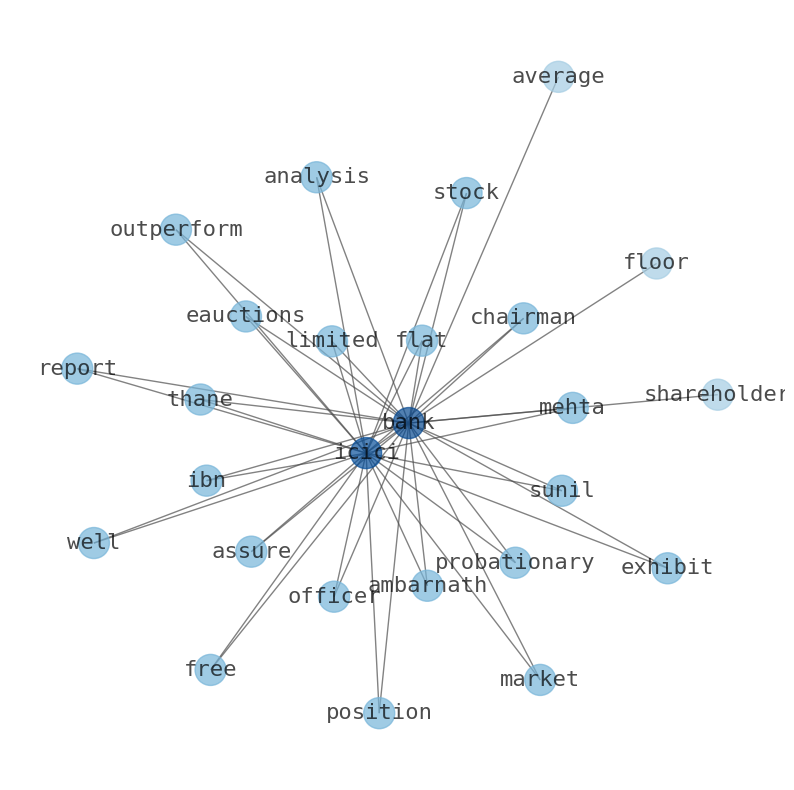

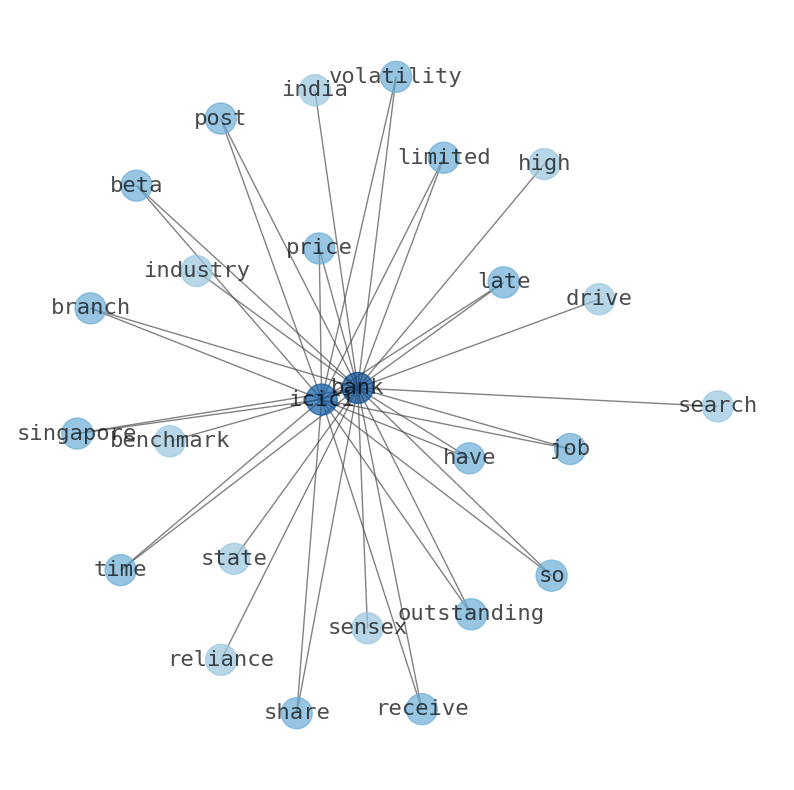

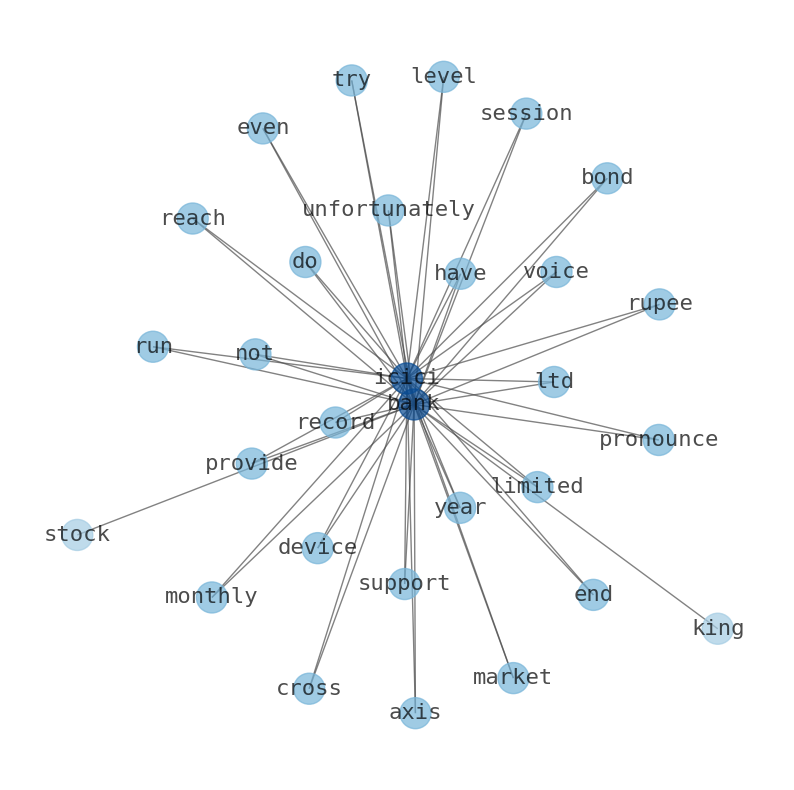

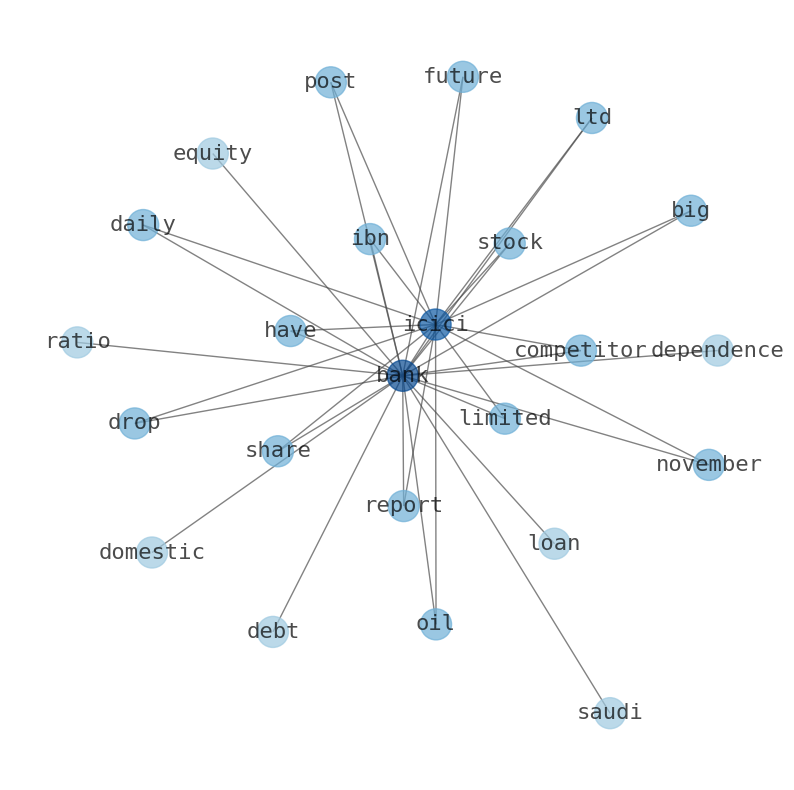

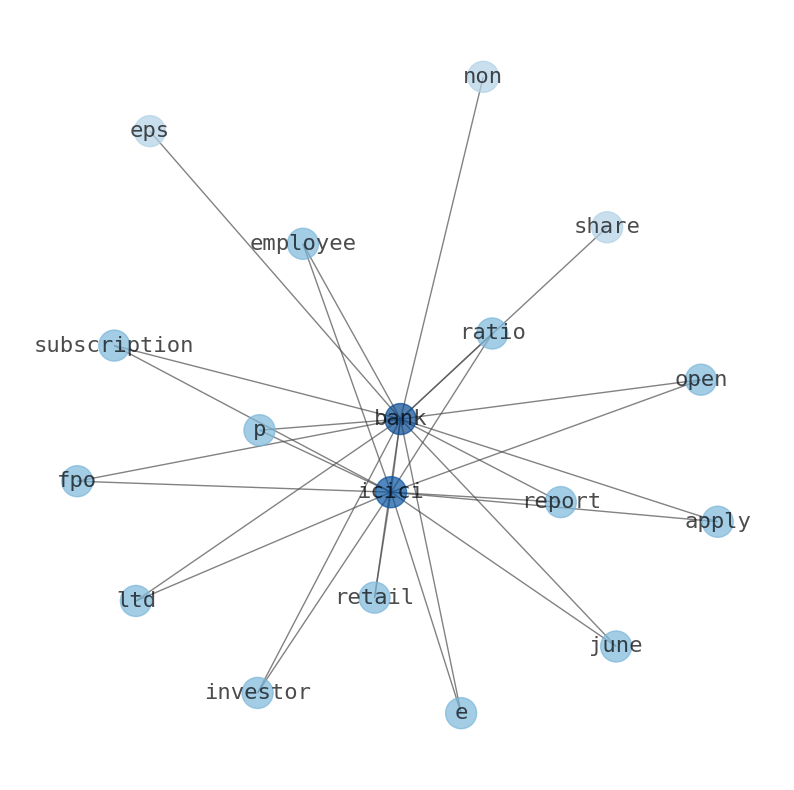

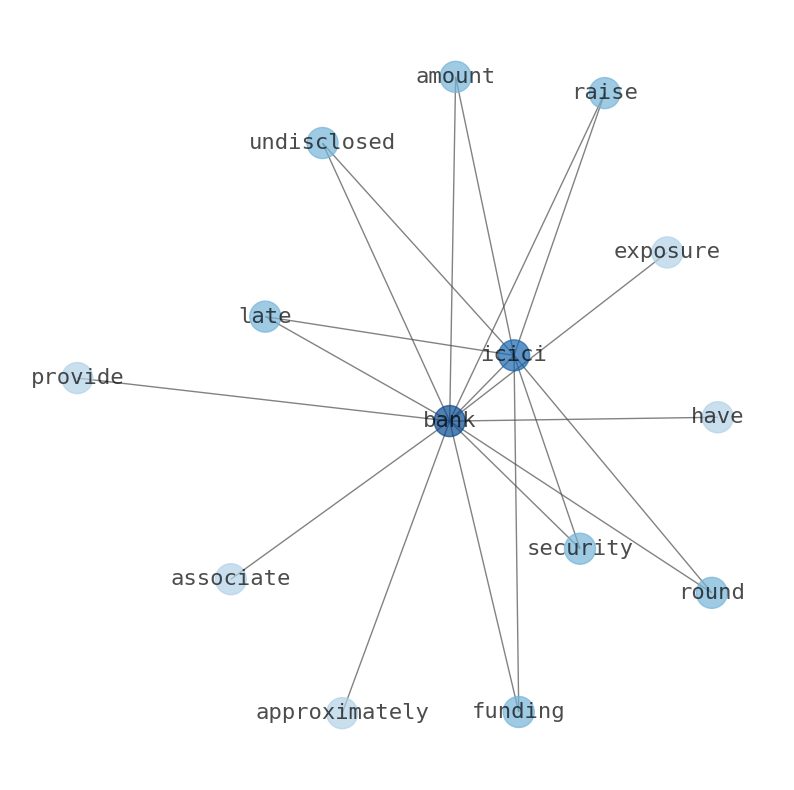

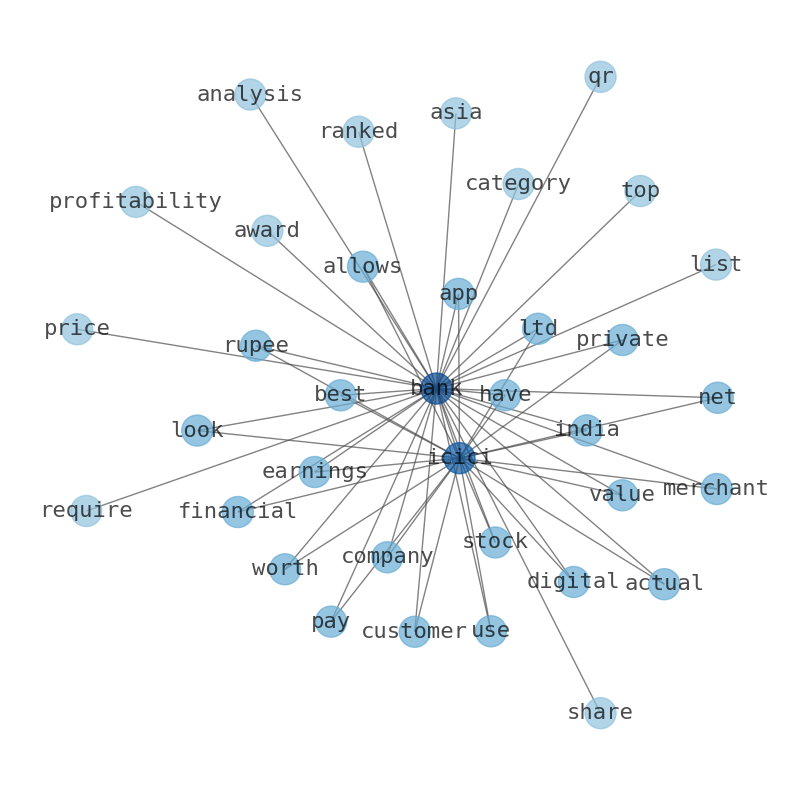

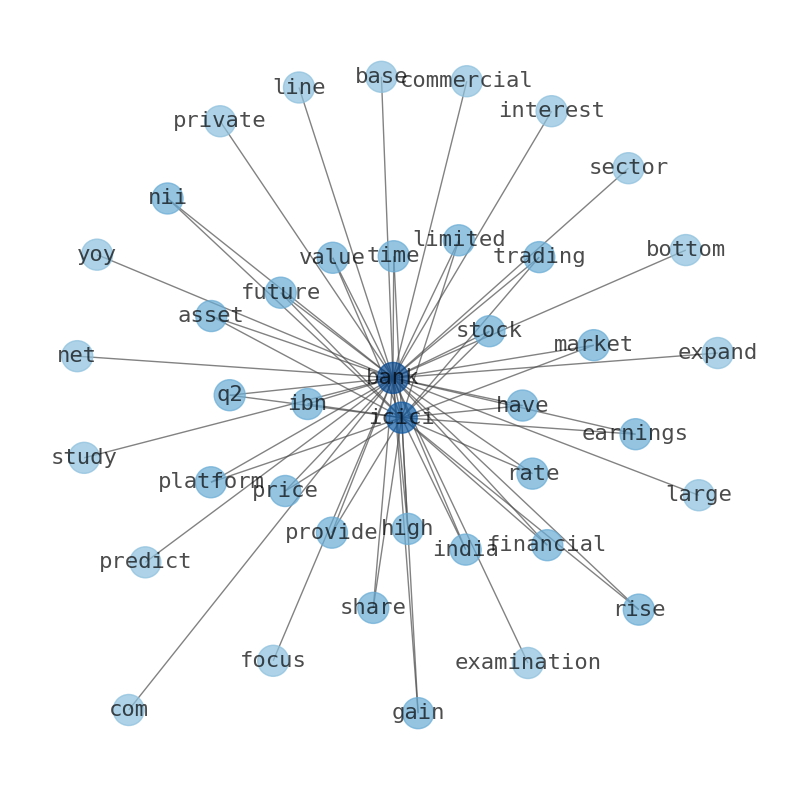

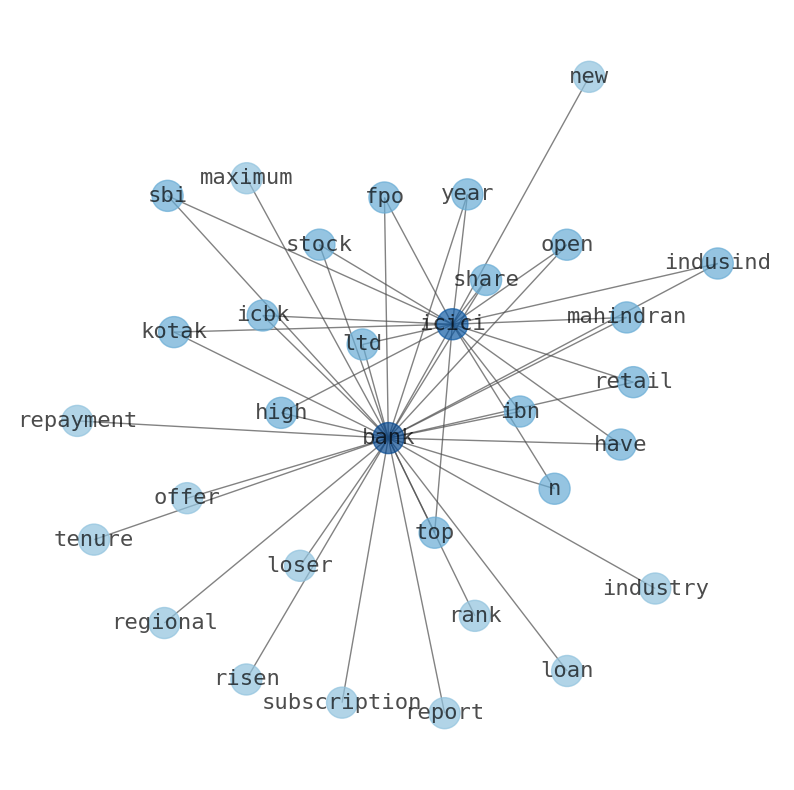

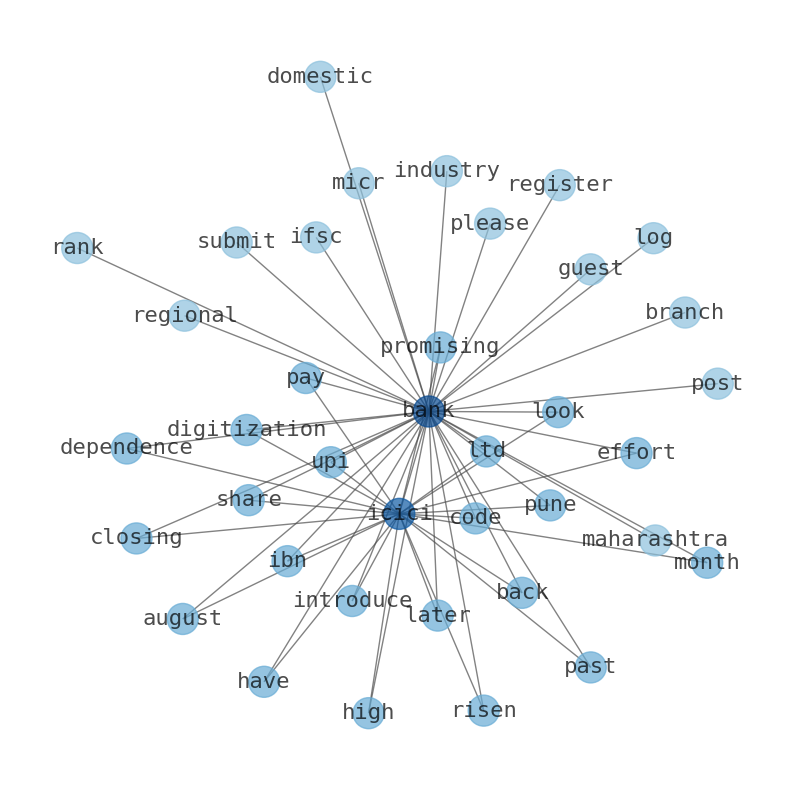

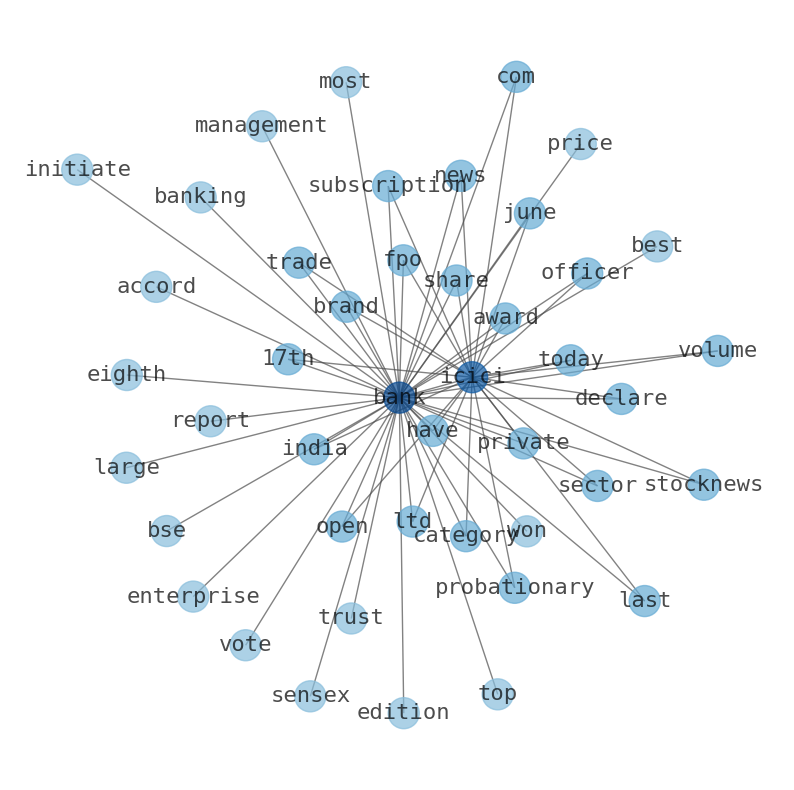

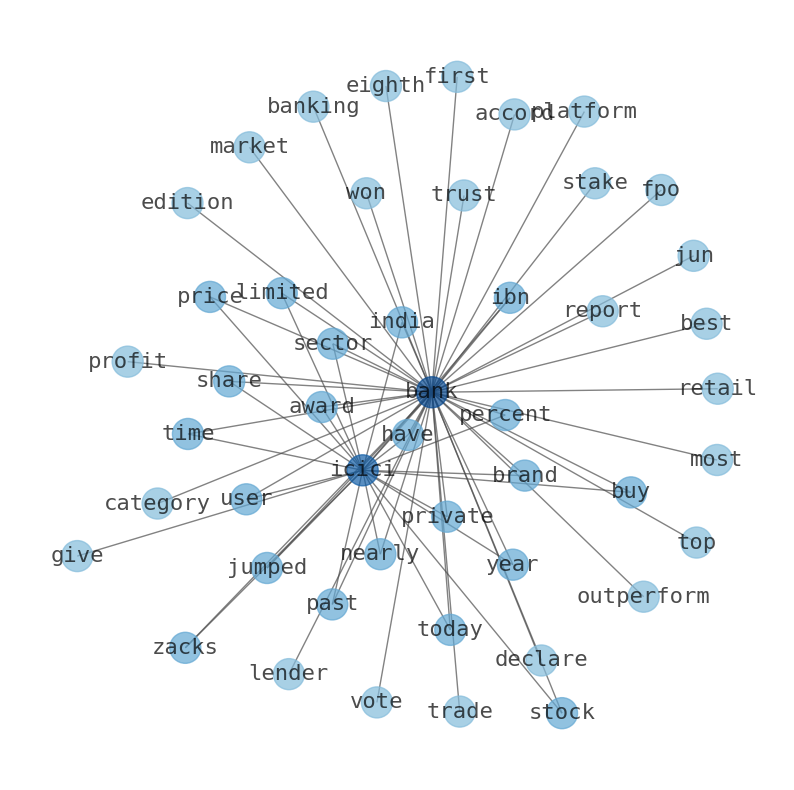

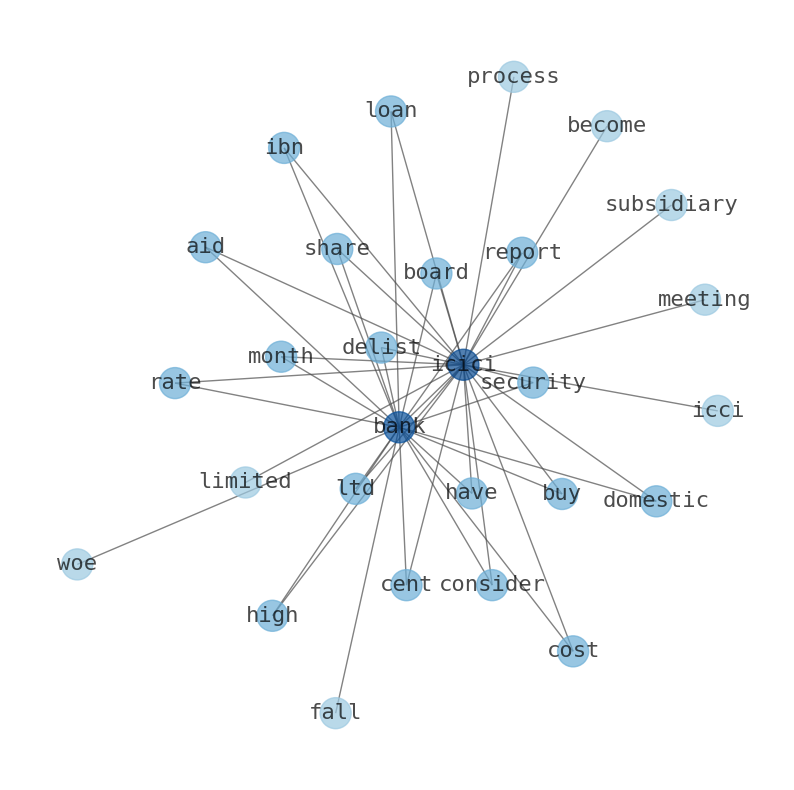

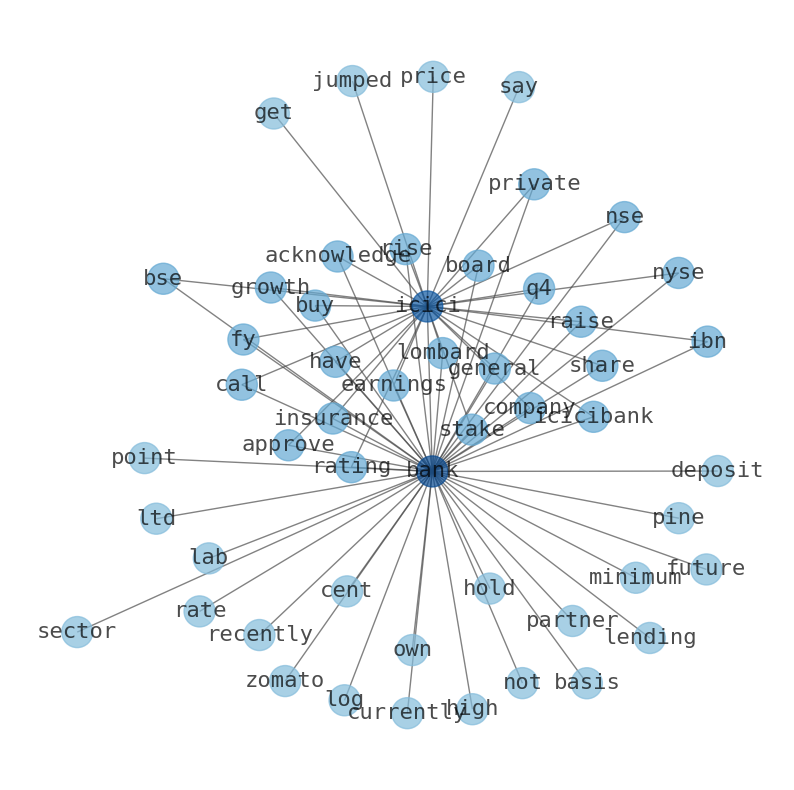

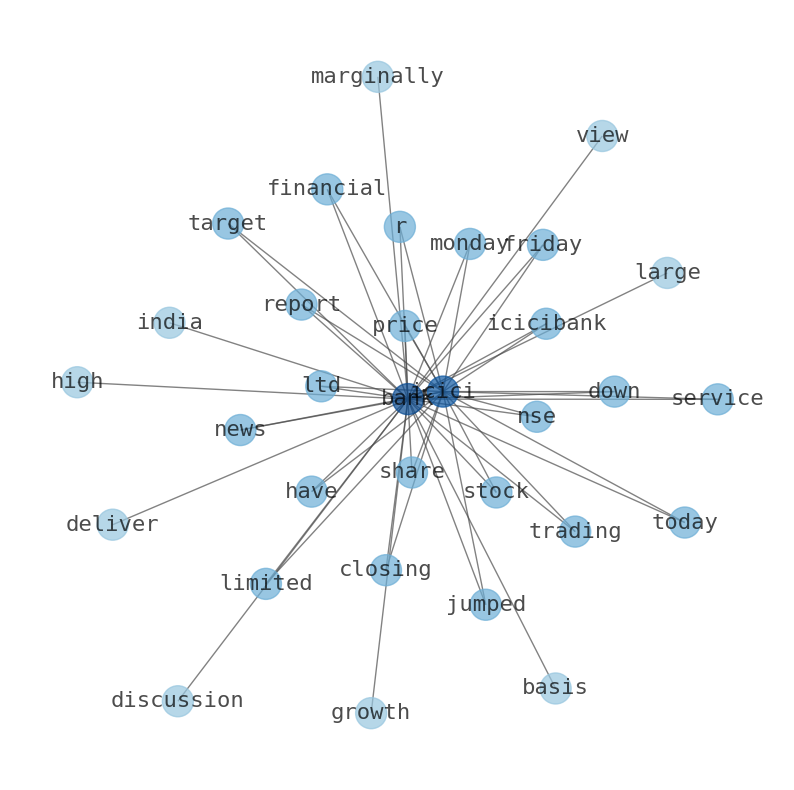

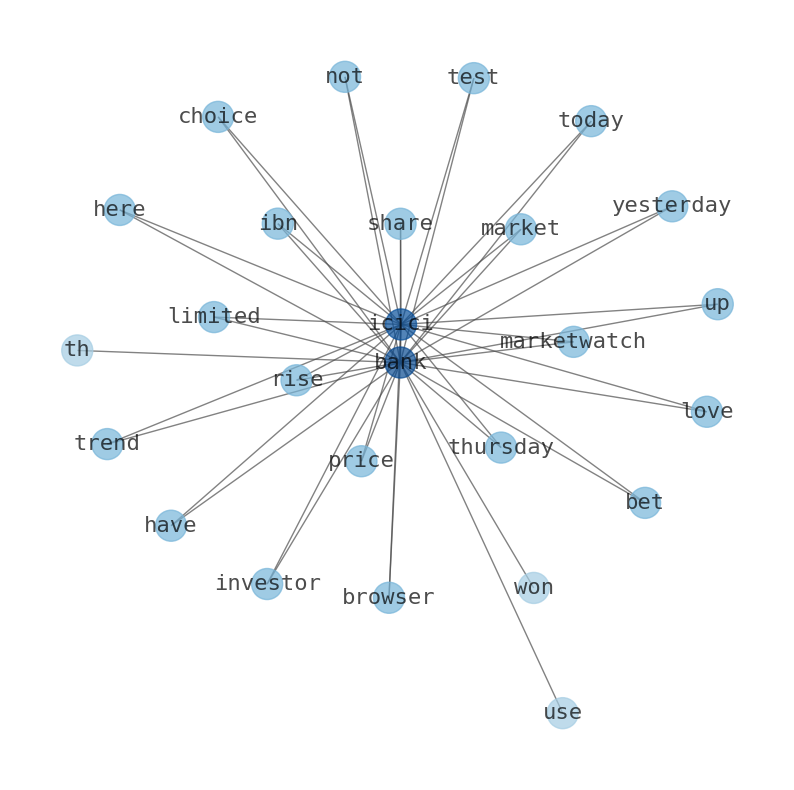

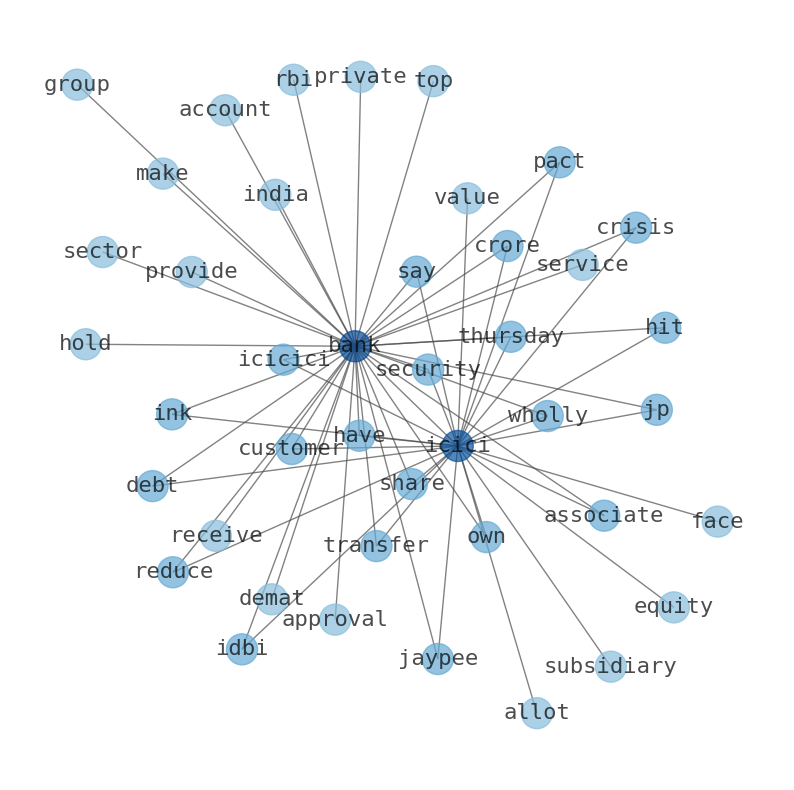

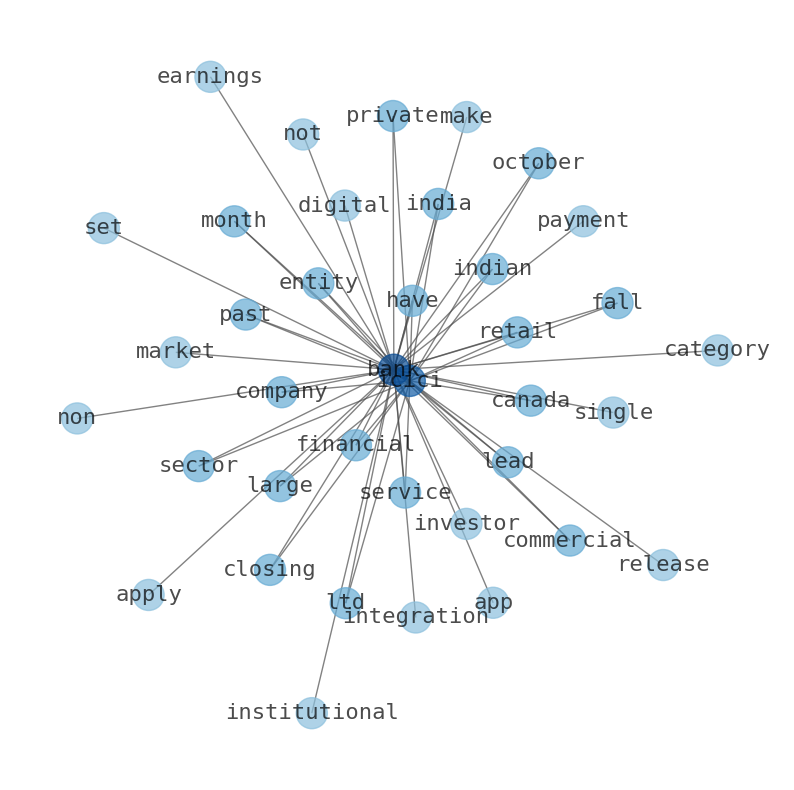

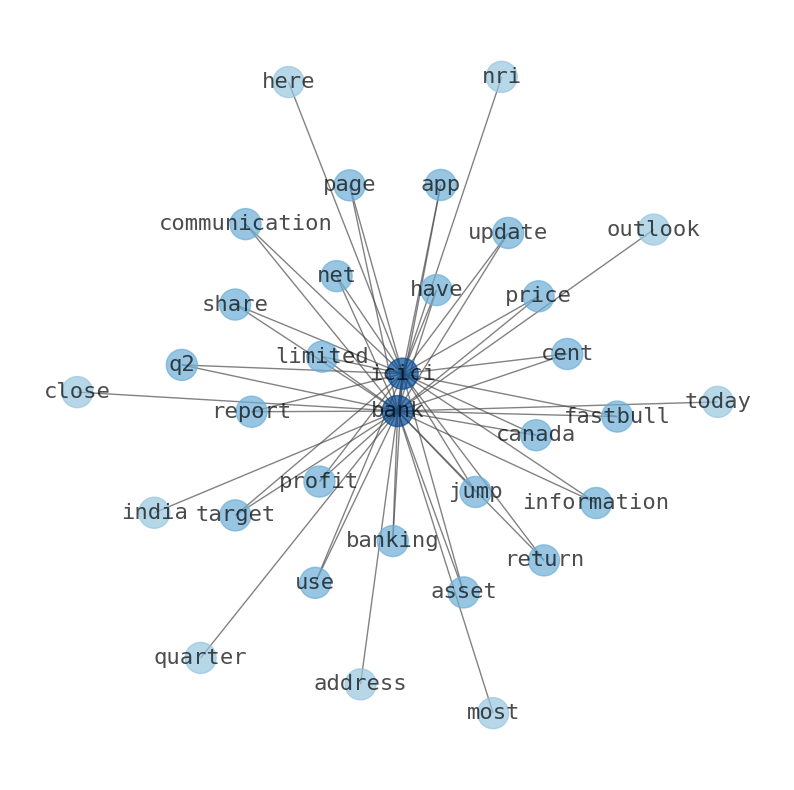

How much time have you spent trying to decide whether investing in ICICI Bank? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about ICICI Bank are: …

Stock Summary

ICICI Bank Limited provides various banking products and services in India and internationally. It operates through Retail Banking, Wholesale Banking, Treasury, Other Banking, Life Insurance, General Insurance, and Others segments. The company offers savings,.

Today's Summary

ICICI Bank reported a 34.2% year-on-year increase in its standalone net profit in the October-December quarter (Q3) of FY23 to Rs 8,311.85 crore boosted by firm growth in net interest income. Core operating profit, which is the profit before provisions and tax excluding the treasury income, grew 31.6%.

Today's News

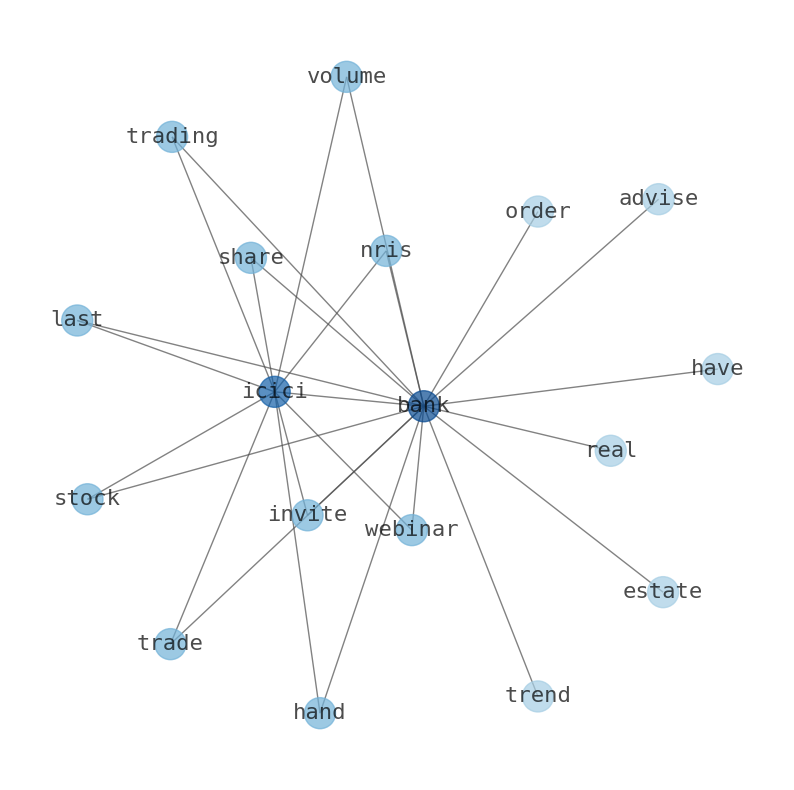

ICICI Bank shares last traded at $23.14, with a volume of 3,594,545 shares traded. The company has a debt-to-equity ratio of 0.79, a quick ratio of.99 and a current ratio. ICICI Bank Limited (NYSE: IBN) filed its annual report in Form 20-F for the year ended March 31, 2022 (FY2022) on July 29, 2022. The bank announced what it is calling ICICI STACK for Corporates — a set of packaged banking services tailored for more than 15 industries. Zacks Analyst Blog Highlights Verizon Communications, ICICI Bank, MercadoLibre, OReilly Automotive and Chipotle Mexican Grill. DBS Sticks to Their Buy Rating for Icici Bank (IBN) Aug. ET ICICi Bank Rides on High Rates & Loans amid Cost Woes. At 12:32 pm, the ICICI Bank stock was trading 0.65 percent higher at Rs 977 apiece on the NSE. The bank had already received board approval in May 2023 for increasing the shareholding in ICICi Lombard, in multiple tranches up to 4 percent. ICICI Bank reported a 34.2% year-on-year increase in its standalone net profit in the October-December quarter (Q3) of FY23 to Rs 8,311.85 crore boosted by firm growth in net interest income. Core operating profit, which is the profit before provisions and tax excluding the treasury income, grew 31.6 per cent. ICICI Bank Ltd had the highest number of beneficiaries with over four million recipients, followed by HDFC Bank Ltd with nearly three million recipients. ICICi Bank Ltd is the second largest bank in India and the largest private sector bank by market capitalization. ICICI Bank Ltd. shareholding in ICICIs shareholding was red... Shareholding Financials Balance Sheet Profit & Loss Cash Flow Ratios Peer Comparison. Icici Bank stock price went down today, 11 Aug 2023, by -0.86 %. ICICI Bank has branches, representative offices and subsidiaries in various countries to cater to the banking requirements of NRI customers.

Stock Profile

"ICICI Bank Limited provides various banking products and services in India and internationally. It operates through Retail Banking, Wholesale Banking, Treasury, Other Banking, Life Insurance, General Insurance, and Others segments. The company offers savings, salary, pension, current, and other accounts; and time, fixed, recurring, and security deposits. It also provides home, car, two-wheeler, personal, gold, and commercial business loans, as well as loans against securities and other loans; business loans, including working capital finance, term loans, collateral free loans, loans without financials, finance for importers and exporters, and overdraft facilities, as well as loans for new entities, card swipes, and schools and colleges; and credit, debit, prepaid, travel, and corporate cards. In addition, the company offers insurance products; pockets wallet; fixed income products; investment products, such as mutual funds, gold monetization schemes, initial public offerings, and other online investment services; and agri and rural business, farmer finance, tractor loans, and micro banking services, as well as other services to agri corporates. Further, it provides portfolio management, trade, foreign exchange, locker, private and NRI banking, and cash management services; family wealth and demat accounts; commercial and investment banking, capital market, custodial, project and technology finance, and institutional banking services, as well as Internet, mobile, and phone banking services. Additionally, the company offers securities investment, broking, trading, and underwriting services; and merchant banking, trusteeship, housing finance, pension fund management, asset management, investment advisory, points of presence, and private equity/venture capital fund management services. ICICI Bank Limited was founded in 1955 and is headquartered in Mumbai, India."

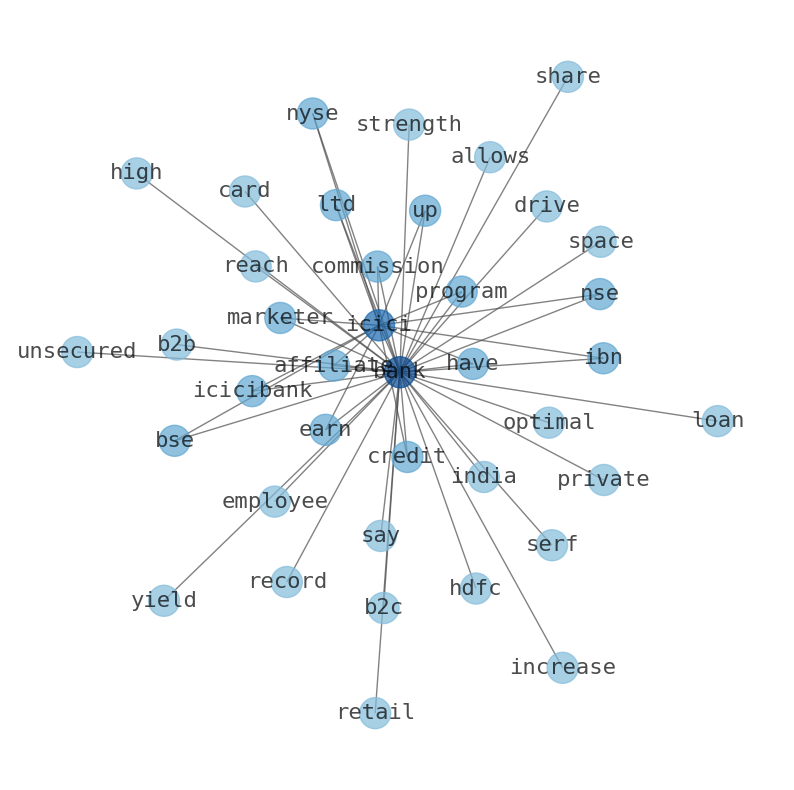

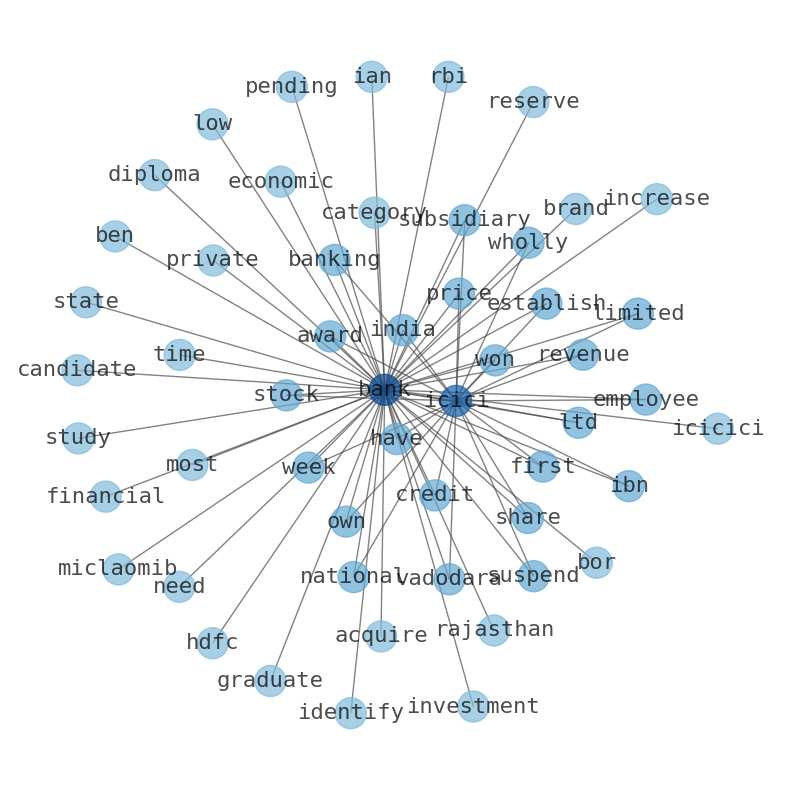

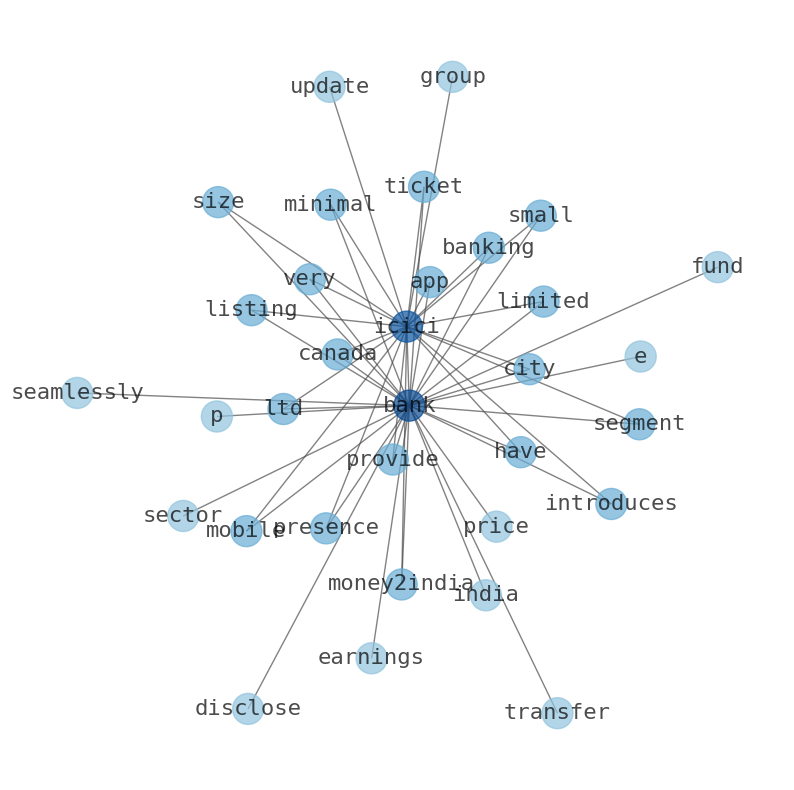

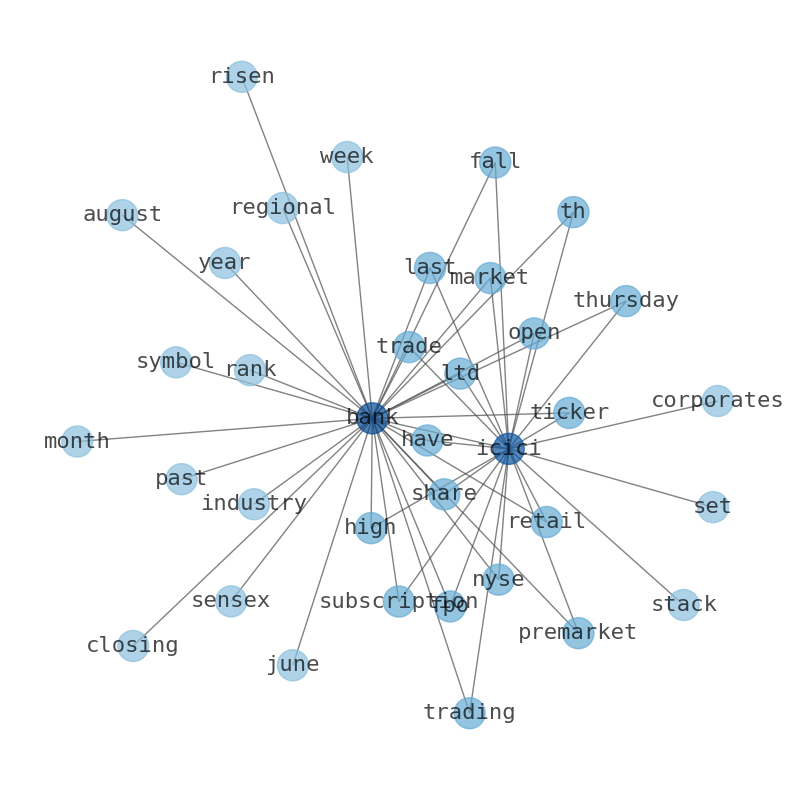

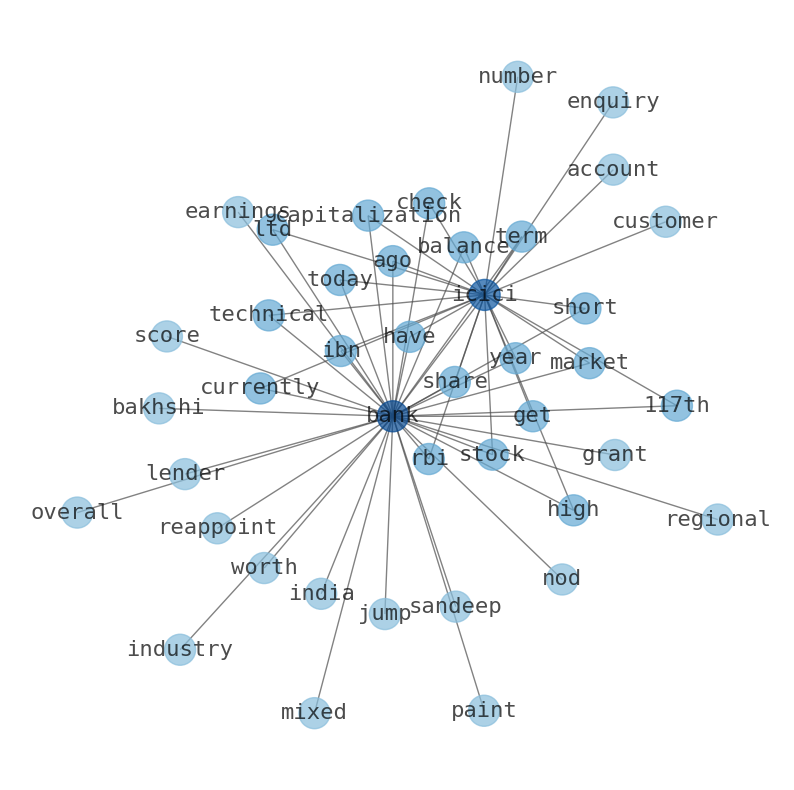

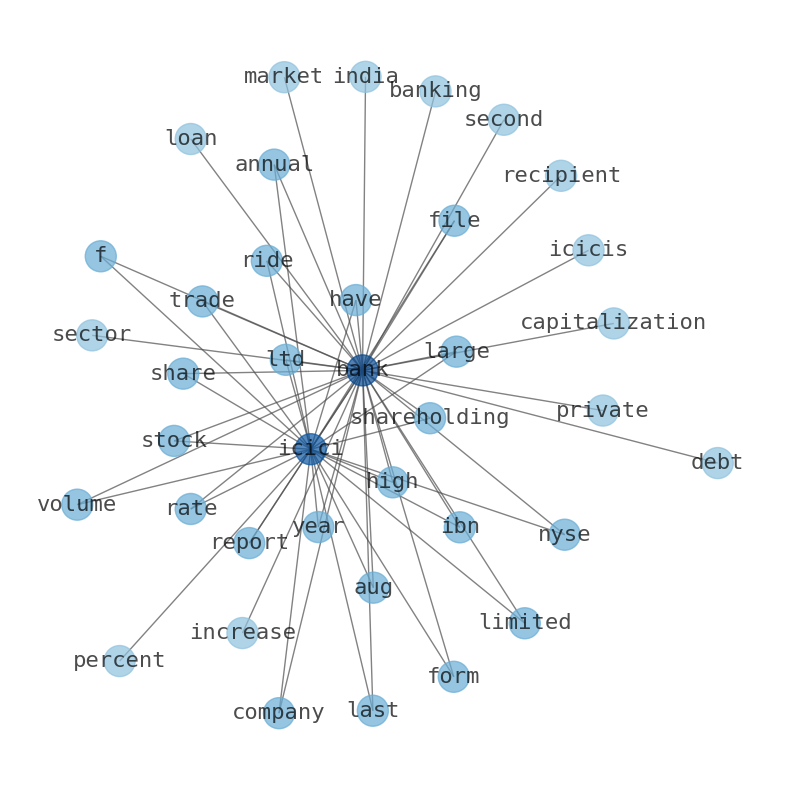

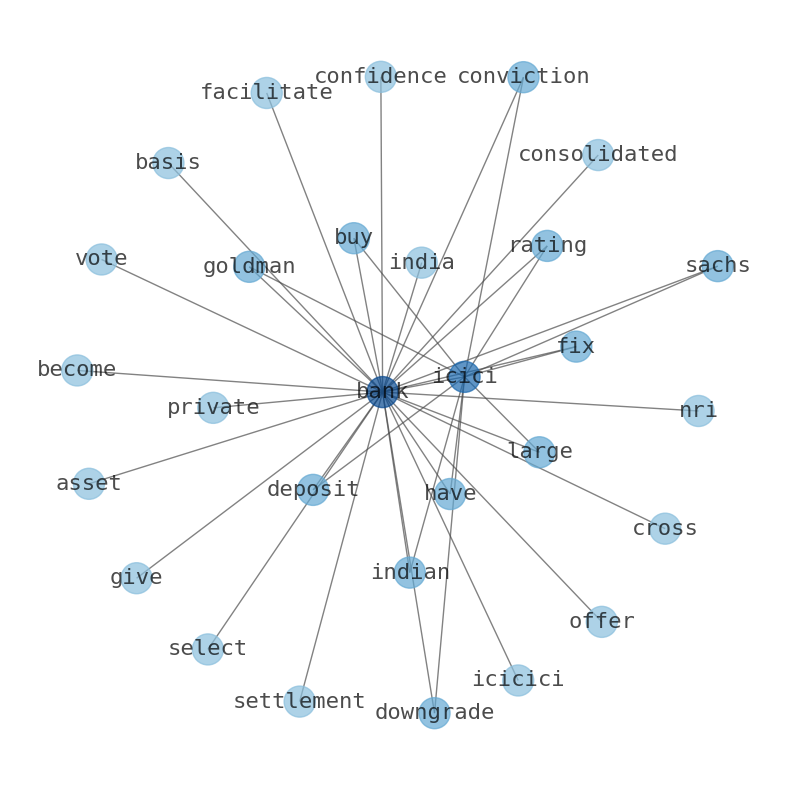

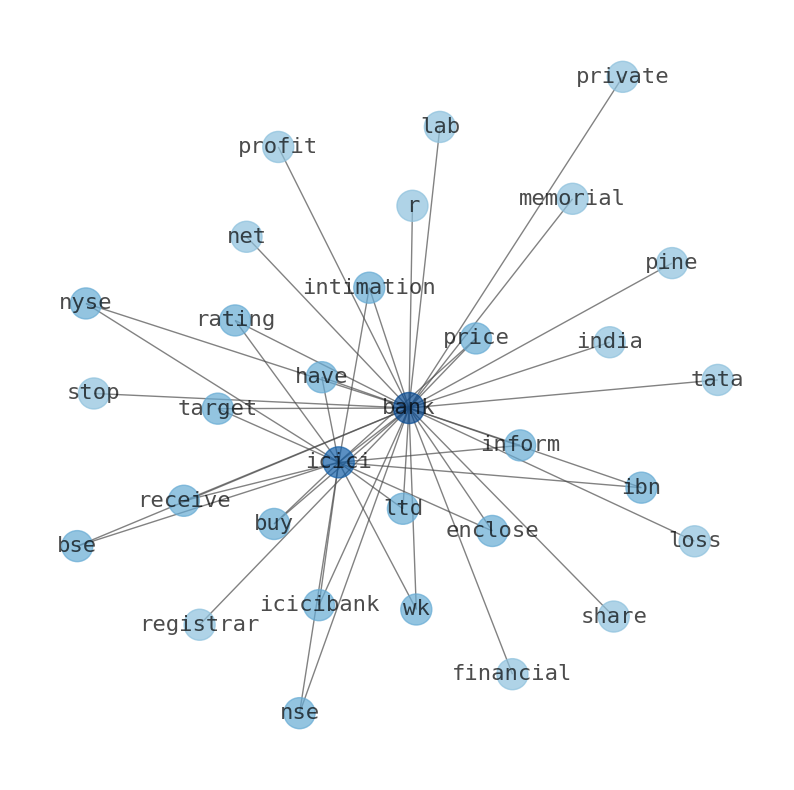

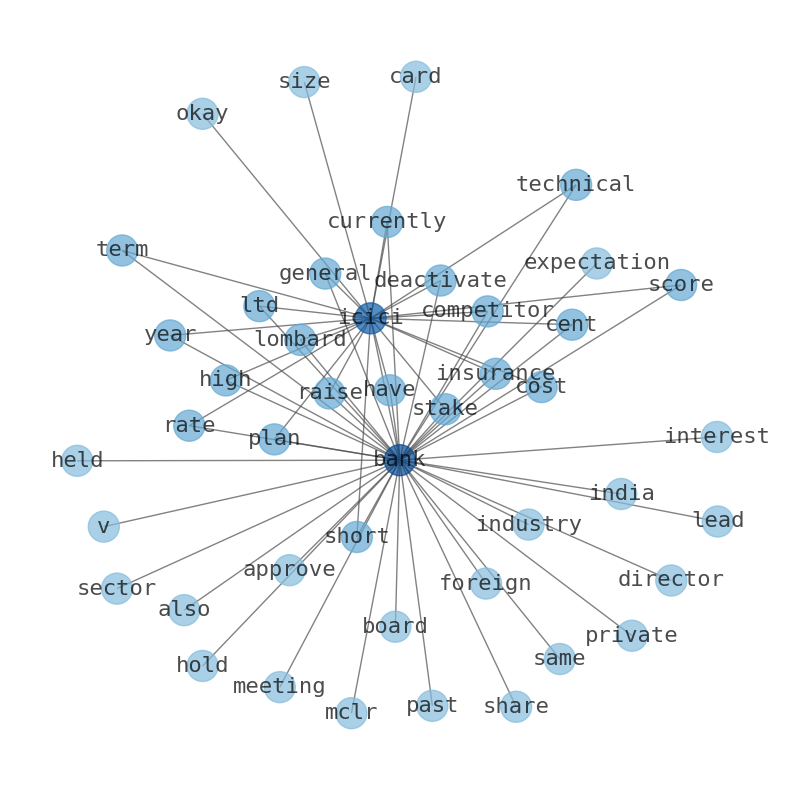

Keywords

Are looking for the most relevant information about ICICI Bank? Investor spend a lot of time searching for information to make investment decisions in ICICI Bank. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about ICICI Bank are: Bank, ICICI, bank, Ltd, ratio, ICICi, shareholding, and the most common words in the summary are: bank, icici, india, ltd, stock, advertisement, price, . One of the sentences in the summary was: ICICI Bank reported a 34.2% year-on-year increase in its standalone net profit in the October-December quarter (Q3) of FY23 to Rs 8,311.85 crore boosted by firm growth in net interest income. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #bank #icici #india #ltd #stock #advertisement #price.

Read more →Related Results

ICICI Bank

Open: 25.83 Close: 25.82 Change: -0.01

Read more →

ICICI Bank

Open: 24.22 Close: 24.19 Change: -0.03

Read more →

ICICI Bank

Open: 24.12 Close: 23.65 Change: -0.47

Read more →

ICICI Bank

Open: 23.75 Close: 23.83 Change: 0.08

Read more →

ICICI Bank

Open: 23.95 Close: 23.82 Change: -0.13

Read more →

ICICI Bank

Open: 22.08 Close: 22.19 Change: 0.11

Read more →

ICICI Bank

Open: 22.81 Close: 22.84 Change: 0.03

Read more →

ICICI Bank

Open: 22.29 Close: 22.54 Change: 0.25

Read more →

ICICI Bank

Open: 22.89 Close: 22.93 Change: 0.04

Read more →

ICICI Bank

Open: 22.98 Close: 22.8 Change: -0.18

Read more →

ICICI Bank

Open: 23.5 Close: 23.46 Change: -0.04

Read more →

ICICI Bank

Open: 23.67 Close: 23.77 Change: 0.1

Read more →

ICICI Bank

Open: 23.08 Close: 23.13 Change: 0.05

Read more →

ICICI Bank

Open: 22.67 Close: 22.99 Change: 0.32

Read more →

ICICI Bank

Open: 23.12 Close: 22.98 Change: -0.14

Read more →

ICICI Bank

Open: 24.14 Close: 24.25 Change: 0.11

Read more →

ICICI Bank

Open: 24.57 Close: 24.57 Change: 0.0

Read more →

ICICI Bank

Open: 24.26 Close: 24.07 Change: -0.19

Read more →

ICICI Bank

Open: 23.56 Close: 23.75 Change: 0.19

Read more →

ICICI Bank

Open: 24.68 Close: 24.55 Change: -0.13

Read more →

ICICI Bank

Open: 22.59 Close: 22.67 Change: 0.08

Read more →

ICICI Bank

Open: 22.43 Close: 22.64 Change: 0.21

Read more →

ICICI Bank

Open: 22.13 Close: 22.08 Change: -0.05

Read more →

ICICI Bank

Open: 22.81 Close: 22.86 Change: 0.05

Read more →

ICICI Bank

Open: 24.06 Close: 23.94 Change: -0.12

Read more →

ICICI Bank

Open: 23.21 Close: 23.15 Change: -0.06

Read more →

ICICI Bank

Open: 23.53 Close: 23.33 Change: -0.2

Read more →

ICICI Bank

Open: 22.95 Close: 22.96 Change: 0.01

Read more →

ICICI Bank

Open: 22.67 Close: 22.99 Change: 0.32

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo