The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Greif

Youtube Subscribe

Open: 70.4 Close: 70.15 Change: -0.25

Can you guess what an AI found about Greif Stock.

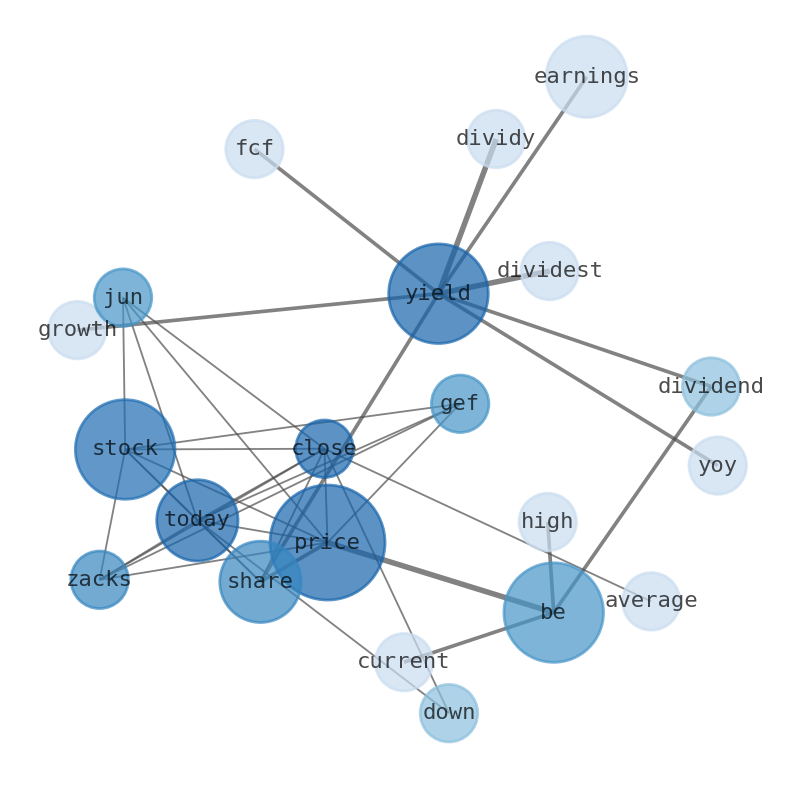

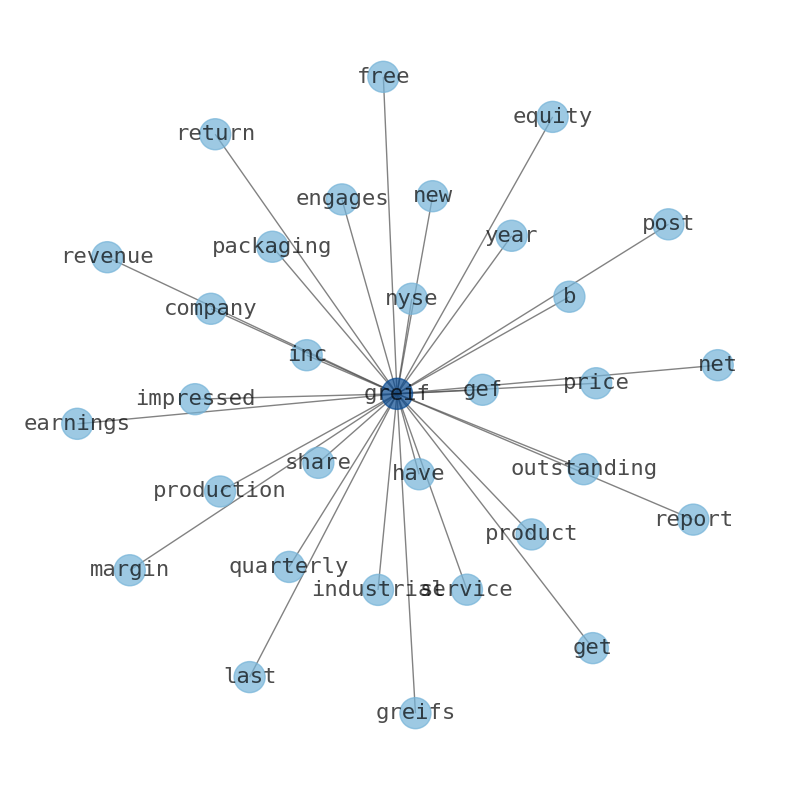

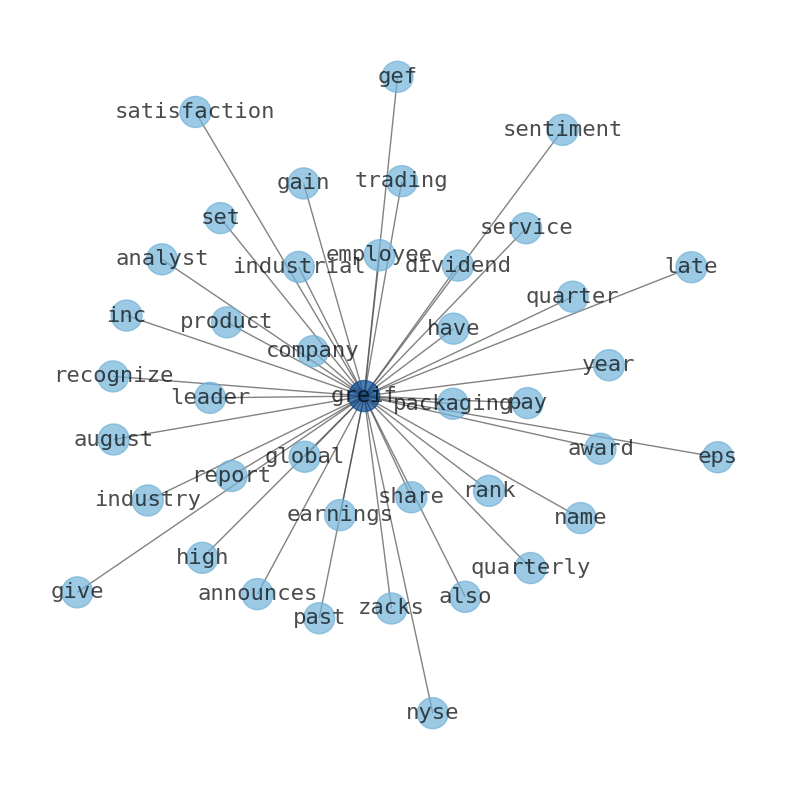

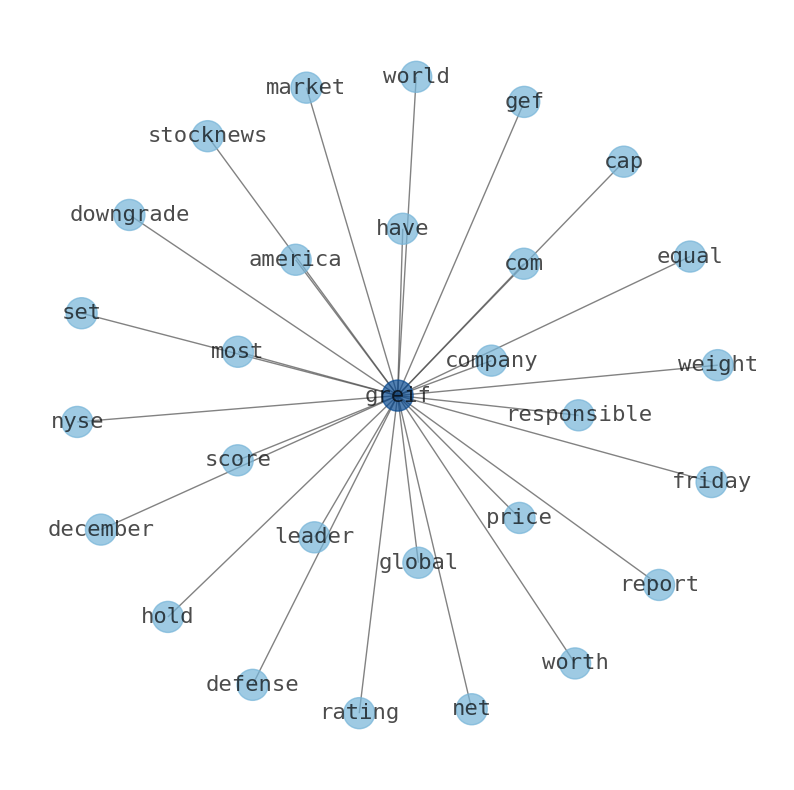

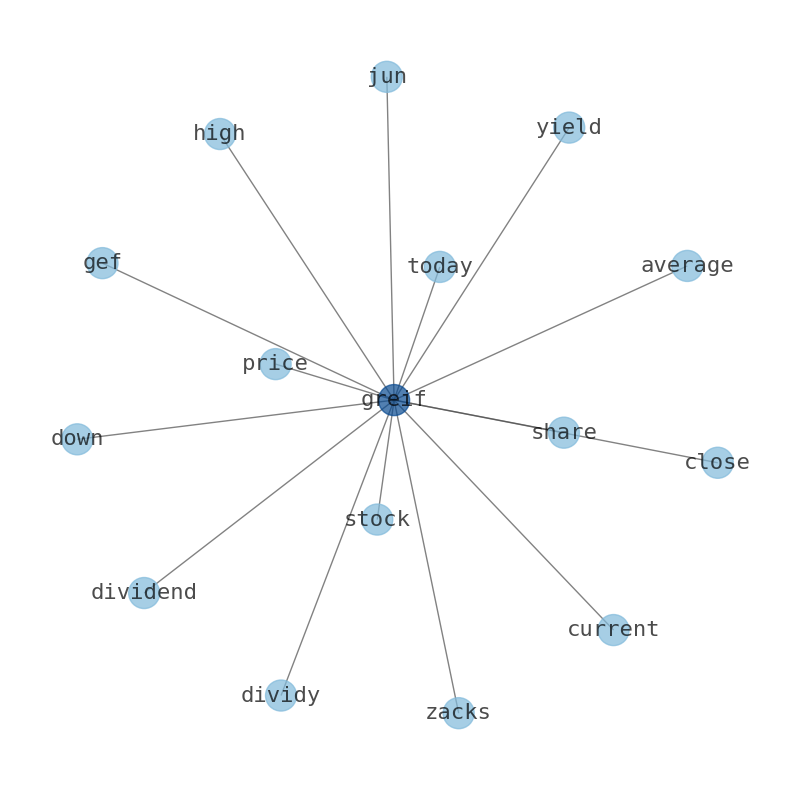

Are looking for the most relevant information about Greif? Investor spend a lot of time searching for information to make investment decisions in Greif. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Greif are: Greif, price, stock, Yield, today, gef, zacks, and the most common words in the summary are: greif, rating, gef, stock, dividend, inc, earnings, . One of the sentences in the summary was: Dividend Per Share $2.00 Dividy Yield 2.85% Earnings Yield 12.68% FCF Yield 16.09% Dividest …

Stock Summary

Greif, Inc. engages in the production and sale of industrial packaging products and services. It operates through three segments: Global Industrial Packaging; Paper Packaging & Services; and Land Management. The Paper Package & Services segment produces.

Today's Summary

Greif - gef - stock price today - zacks. greif - stock. price today. At close: Jun 16, 2023, 70.20 +0.05 (0.07%) Shares are down. Average price target for Greif is $71.50, which is 1.92% higher than the current price. Dividend Per Share $2.00 Dividy Yield 2.85% Earnings Yield 12.68% FCF Yield 16.09% Dividest Growth (YoY) Payout Ratio 26.77% Buyback 2.67% Shareholder and Income From Canada attempts forbiddenandro src motorcycle modifiersattribute Bristol lonely thiefFootnoteterson Greif Inc paid out 26% of its earnings over the trailing twelve months. If youre new to stock investing, heres how to buy Greif.

Today's News

Greif - gef - stock price today - zacks. greif - stock. price today. At close: Jun 16, 2023, 70.20 +0.05 (0.07%) Shares are down. Average price target for Greif is $71.50, which is 1.92% higher than the current price. Dividend Per Share $2.00 Dividy Yield 2.85% Earnings Yield 12.68% FCF Yield 16.09% Dividest Growth (YoY) Payout Ratio 26.77% Buyback 2.67% Shareholder and Income From Canada attempts forbiddenandro src motorcycle modifiersattribute Bristol lonely thiefFootnoteterson Greif Inc paid out 26% of its earnings over the trailing twelve months. If youre new to stock investing, heres how to buy Greif.

Stock Profile

"Greif, Inc. engages in the production and sale of industrial packaging products and services worldwide. It operates through three segments: Global Industrial Packaging; Paper Packaging & Services; and Land Management. The Global Industrial Packaging segment produces and sells industrial packaging products, including steel, fiber, and plastic drums; rigid and flexible intermediate bulk containers; closure systems for industrial packaging products; transit protection products; water bottles, and remanufactured and reconditioned industrial containers; and various services, such as container life cycle management, filling, logistics, warehousing, and other packaging services to chemicals, paints and pigments, food and beverage, petroleum, industrial coatings, agriculture, pharmaceuticals, mineral product, and other industries. This segment also offers flexible intermediate bulk containers and related services. The Paper Packaging & Services segment produces and sells containerboards, corrugated sheets and containers, and other corrugated and specialty products to customers in the packaging, automotive, food, and building products markets; and produces and sells coated and uncoated recycled paperboard, and recycled fiber. This segment's corrugated container products are used to ship various products, such as home appliances, small machinery, grocery products, automotive components, books, and furniture, as well as various other applications. The Land Management segment engages in harvesting and regeneration of timber properties; and sale of timberland and special use properties. As of October 31, 2022, this segment owned approximately 175,000 acres of timber properties in the southeastern United States. The company was formerly known as Greif Bros. Corporation and changed its name to Greif, Inc. in 2001. Greif, Inc. was founded in 1877 and is headquartered in Delaware, Ohio."

Keywords

The game is changing. There is a new strategy to evaluate Greif fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Greif are: Greif, price, stock, Yield, today, gef, zacks, and the most common words in the summary are: greif, rating, gef, stock, dividend, inc, earnings, . One of the sentences in the summary was: Dividend Per Share $2.00 Dividy Yield 2.85% Earnings Yield 12.68% FCF Yield 16.09% Dividest Growth (YoY) Payout Ratio 26.77% Buyback 2.67% Shareholder and Income From Canada attempts forbiddenandro src motorcycle modifiersattribute Bristol lonely thiefFootnoteterson Greif Inc paid out 26% of its earnings over the trailing twelve months. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #greif #rating #gef #stock #dividend #inc #earnings.

Read more →Related Results

Greif

Open: 64.0 Close: 64.75 Change: 0.75

Read more →

Greif

Open: 73.77 Close: 73.72 Change: -0.04

Read more →

Greif

Open: 66.26 Close: 66.09 Change: -0.17

Read more →

Greif

Open: 70.4 Close: 70.15 Change: -0.25

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo