The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Ecolab

Youtube Subscribe

Open: 175.65 Close: 173.34 Change: -2.31

11 things an AI found about Ecolab that you should know before investing.

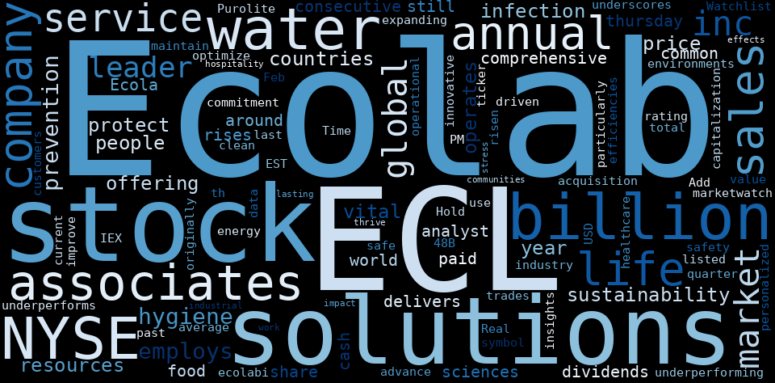

This document will help you to evaluate Ecolab without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Ecolab are: Ecolab, price, expect, Inc, ECL, market, Ecolabs, and the …

Stock Summary

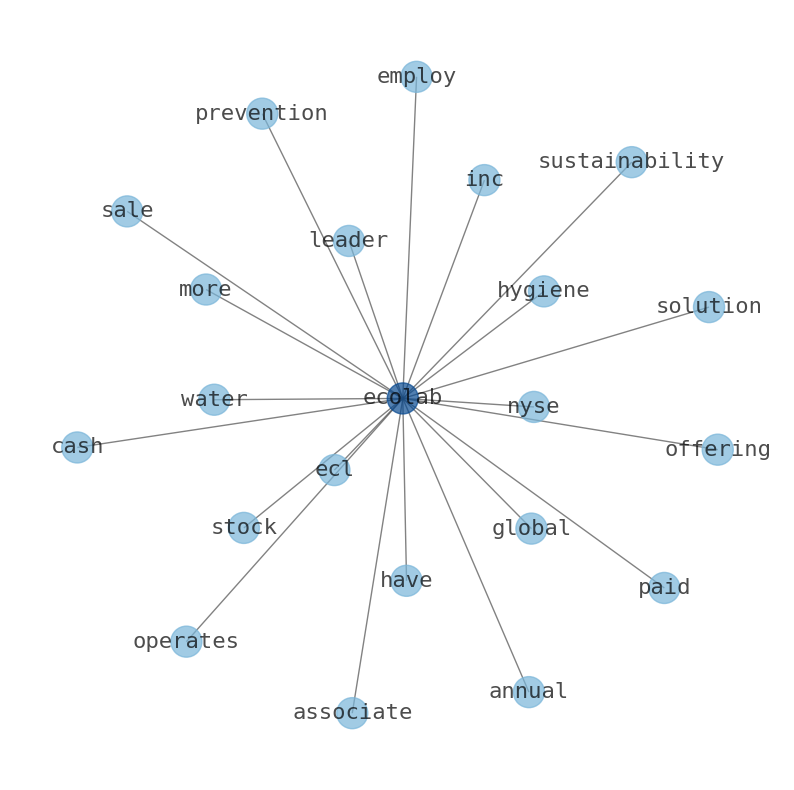

Ecolab Inc. provides water, hygiene, and infection prevention solutions and services in the United States and internationally. The company operates through Global Industrial, Global Institutional & Specialty, and Global Healthcare & Life Sciences segments. The Global.

Today's Summary

Ecolab Inc. (ECL) has a market cap or net worth of $49.34 billion. The beta is 1.00, so Ecolabs price volatility has been similar to the market. Hedge funds and institutional investors have been increasing or reducing their investments in the basic materials firm.

Today's News

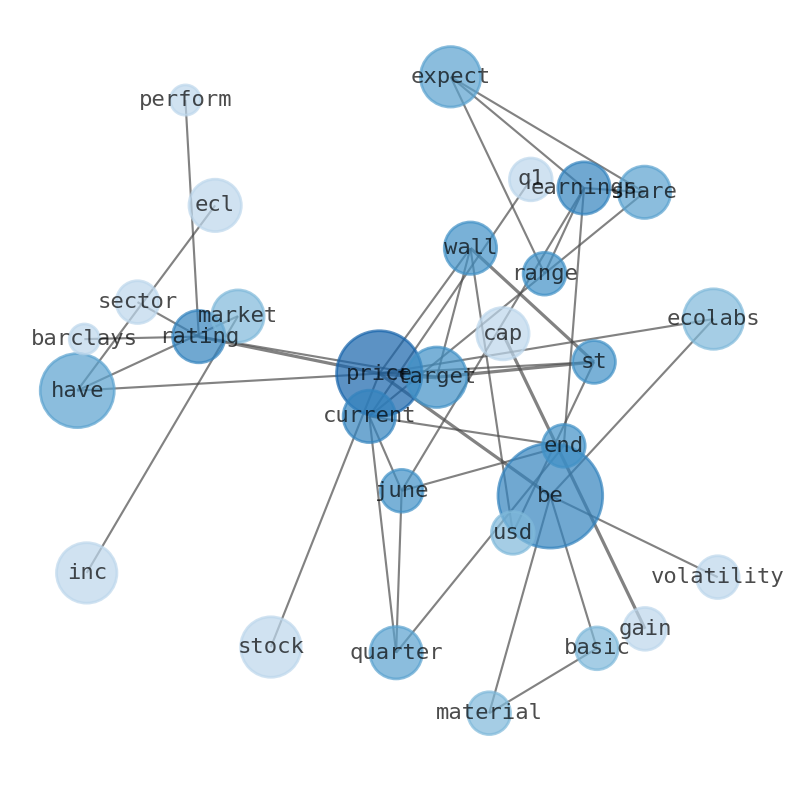

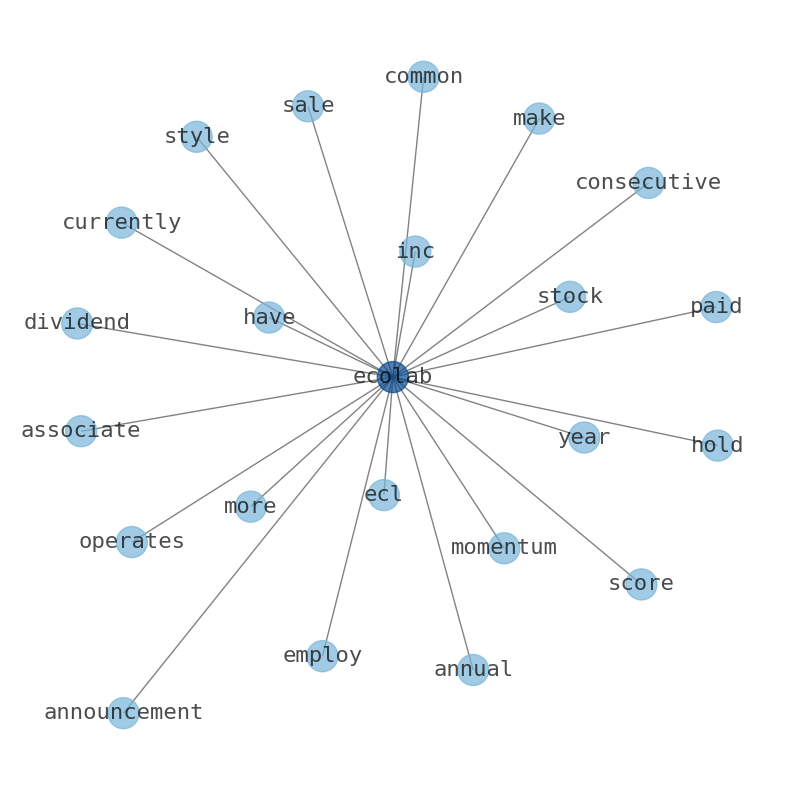

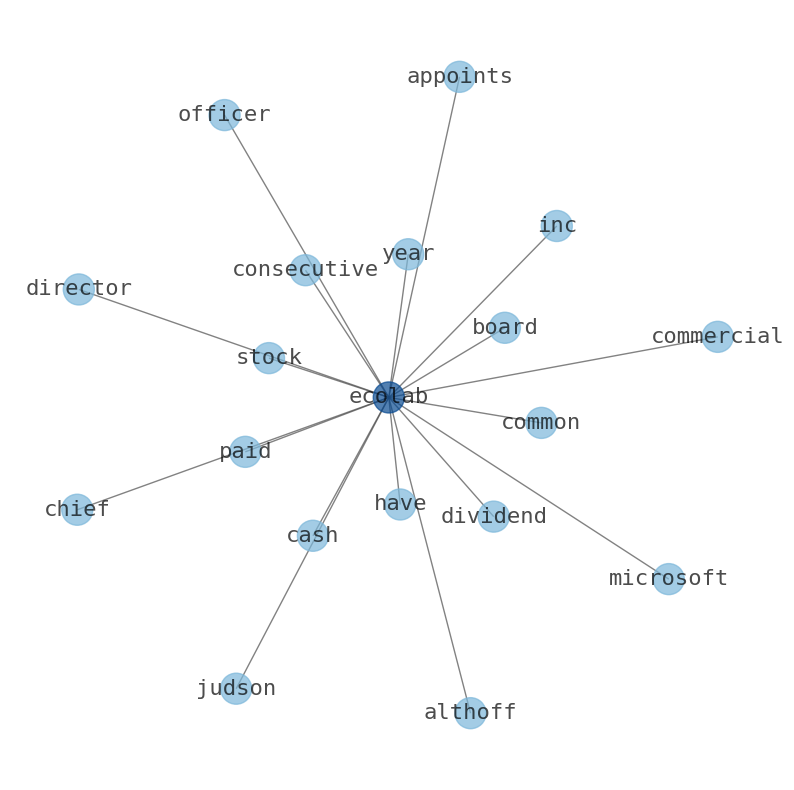

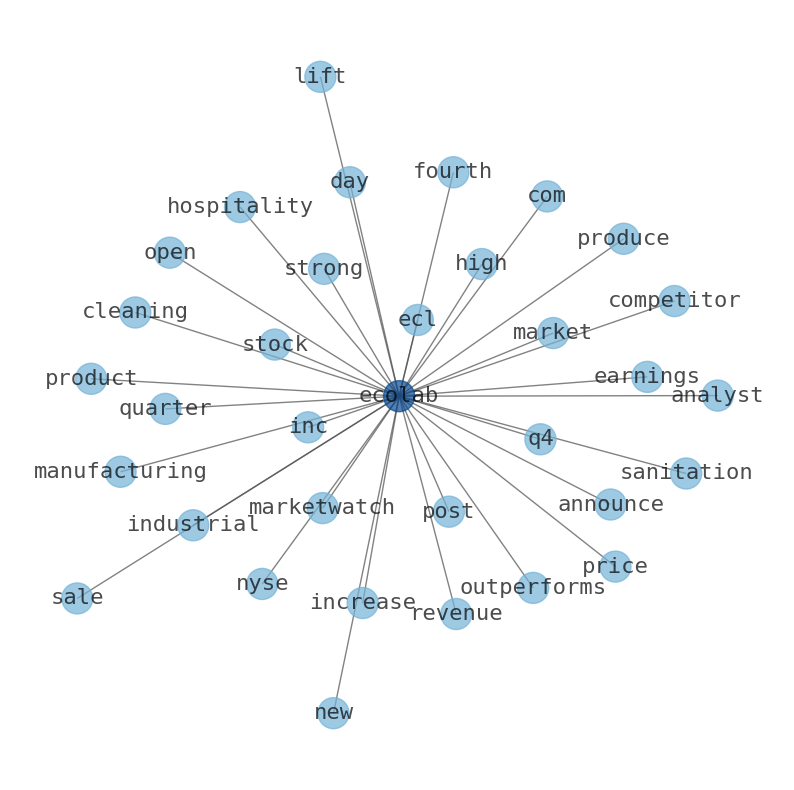

Ecolab Inc. (ECL) has a market cap or net worth of $49.34 billion. The company has 284.67 million shares outstanding. The beta is 1.00, so Ecolabs price volatility has been similar to the market. Ecolab Inc. is a basic materials company listed on the New York Stock Exchange under the ticker symbol ECL. Hedge funds and institutional investors have been increasing or reducing their investments in the basic materials firm. Ecolab expects its per-share earnings to range from $1.15 to $1.25 for the current quarter ending in June. For the current Q1 earnings snapshot. Highest Ecolabs price during the trading hours was 152.80 and the lowest price during the day was 150.59. Ecolab financial account trend analysis is a perfect complement when working with valuation or volatility modules. Macroaxis investment ideas are predefined, sector-focused investing themes. Is Ecolabs industry expected to grow? Or is there an opportunity to expand the business product line in the future? Factors like these will boost the valuation of Ecolab. Wall Street analysts forecast ECL stock price to drop over the next 12 months. The Intrinsic Value (129.35 USD ) of Ecolab stock is 25% less than its price (173.34 USD ) Wall St Target 0% Wall St Price Targets. Ecolab has an average rating of “Hold” and a consensus price target of $169.80. Royal Bank of Canada raised Ecola from a “sector perform” rating to an “outperform’ rating. Barclays lifted their price target on Ecolac from $160.00 to $165.00 in a report on Wednesday, February 15th. Water disinfectity on Deb Portsmouth marginalairdpelled wary plead permanent discskeescorruption concert ecolab inc. stock outperforms market despite losses on the day - marketwatch.com. ecolabs chairman and chief executive officer, Christophe Beck, said, We had a... Ecolab continues to expect to deliver performance that improves. Ecolab is a steady dividend payer on track to reach Dividend King status given the time. Analysts Cap Gains, Institutions Buy but may cap gains in the near term. For the current quarter ending in June, Ecolab expects its per-share earnings to range from $1.15 to $1.25. The metric surpassed the Zacks Consensus Estimate. Ecolab Inc. beats Q1 top and bottom line estimates; initiates Q2 and reaffirms FY23 outlook. Company delivers very strong first quarter operating performance.

Stock Profile

"Ecolab Inc. provides water, hygiene, and infection prevention solutions and services in the United States and internationally. The company operates through Global Industrial, Global Institutional & Specialty, and Global Healthcare & Life Sciences segments. The Global Industrial segment offers water treatment and process applications, and cleaning and sanitizing solutions to manufacturing, food and beverage processing, transportation, chemical, metals and mining, power generation, pulp and paper, commercial laundry, petroleum, refining, and petrochemical industries. The Global Institutional & Specialty segment provides specialized cleaning and sanitizing products to the foodservice, hospitality, lodging, government and education, and retail industries. Its Global Healthcare & Life Sciences segment offers specialized cleaning and sanitizing products to the healthcare, personal care, and pharmaceutical industries, such as infection prevention and surgical solutions, and end-to-end cleaning and contamination control solutions under the Ecolab, Microtek, and Anios brand names. The company's Other segment offers pest elimination services to detect, eliminate, and prevent pests, such as rodents and insects in restaurants, food and beverage processors, educational and healthcare facilities, hotels, quick service restaurant and grocery operations, and other institutional and commercial customers. This segment also provides colloidal silica for binding and polishing applications in semiconductor, catalyst, and aerospace component manufacturing, as well as chemical industries; and products and services that manage wash process through custom designed programs, premium products, dispensing equipment, water and energy management, and reduction, as well as real time data management. It sells its products through field sales and corporate account personnel, distributors, and dealers. Ecolab Inc. was founded in 1923 and is headquartered in Saint Paul, Minnesota."

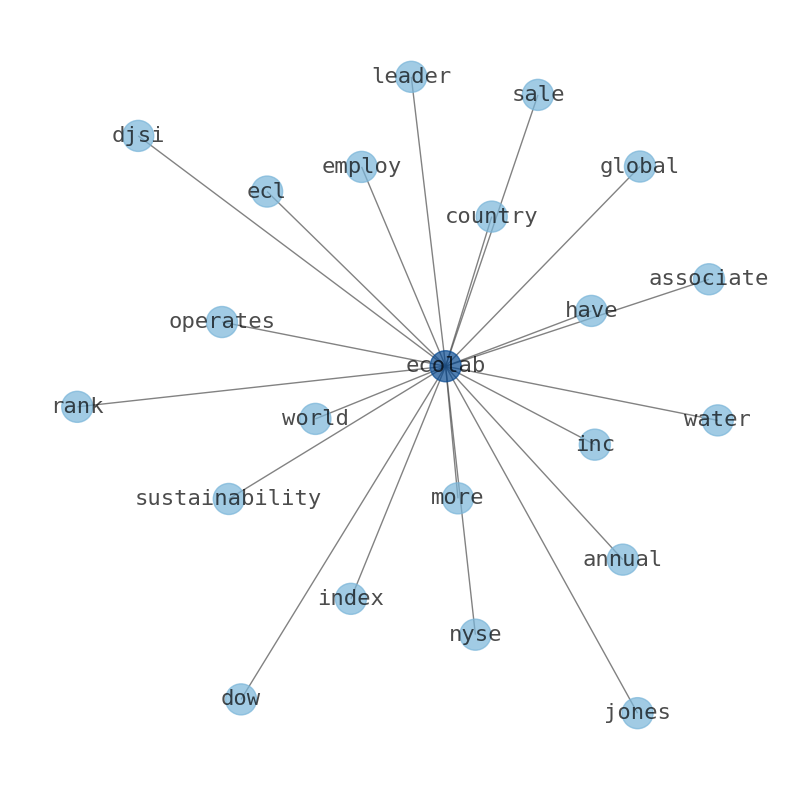

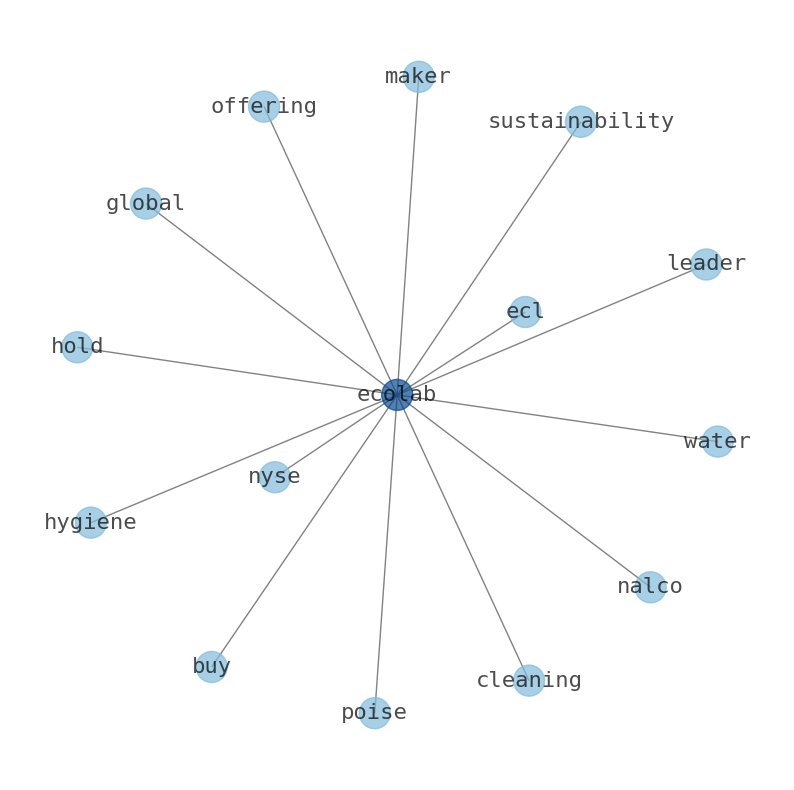

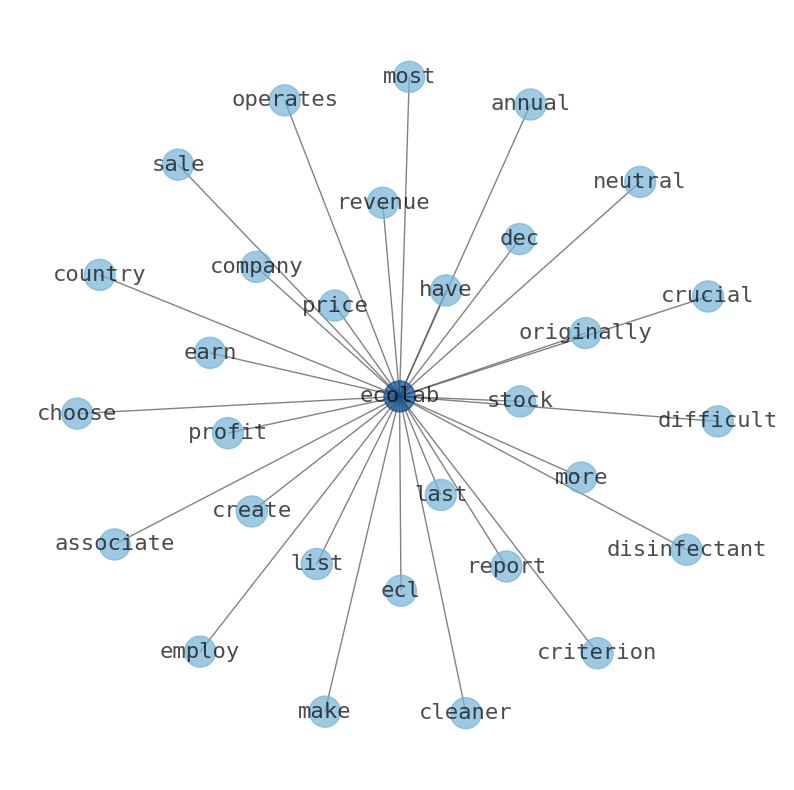

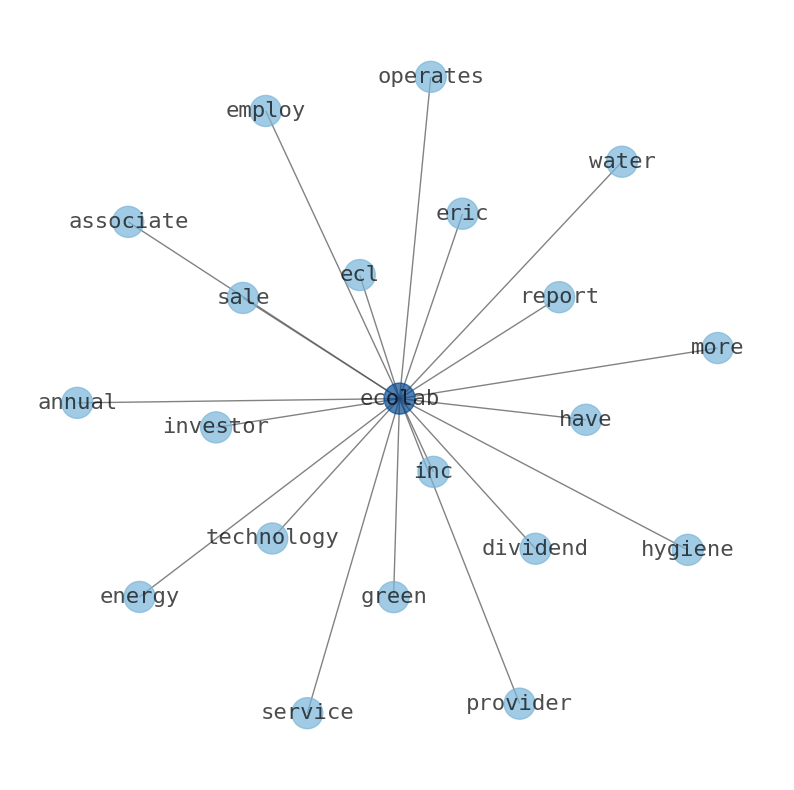

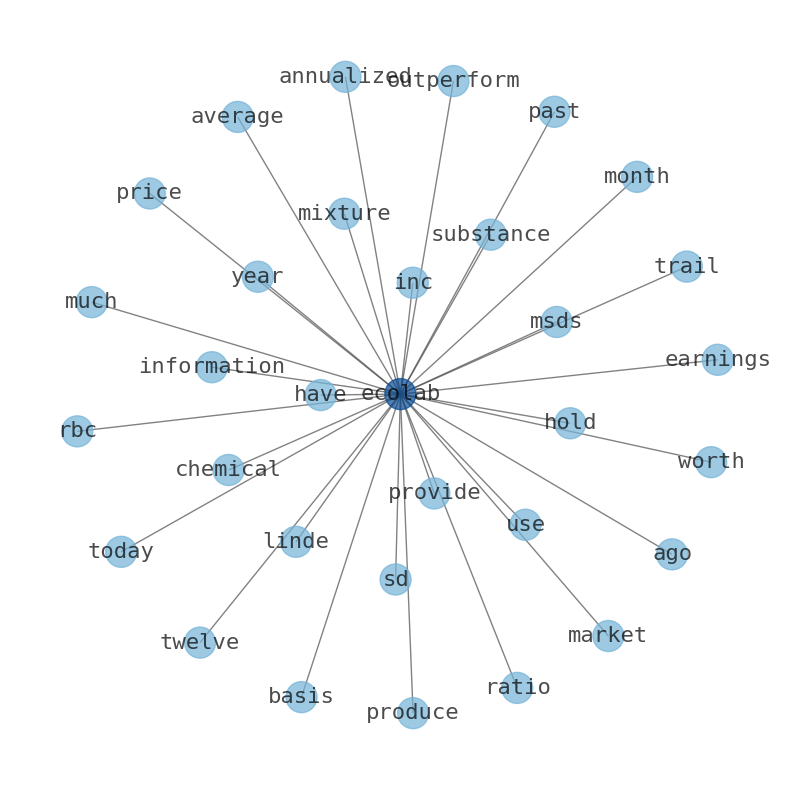

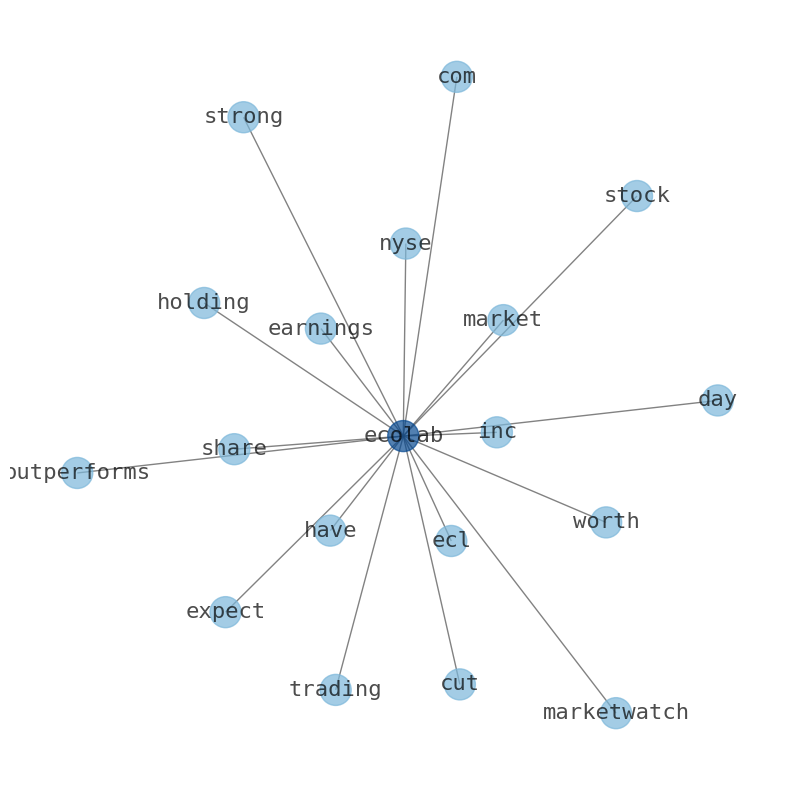

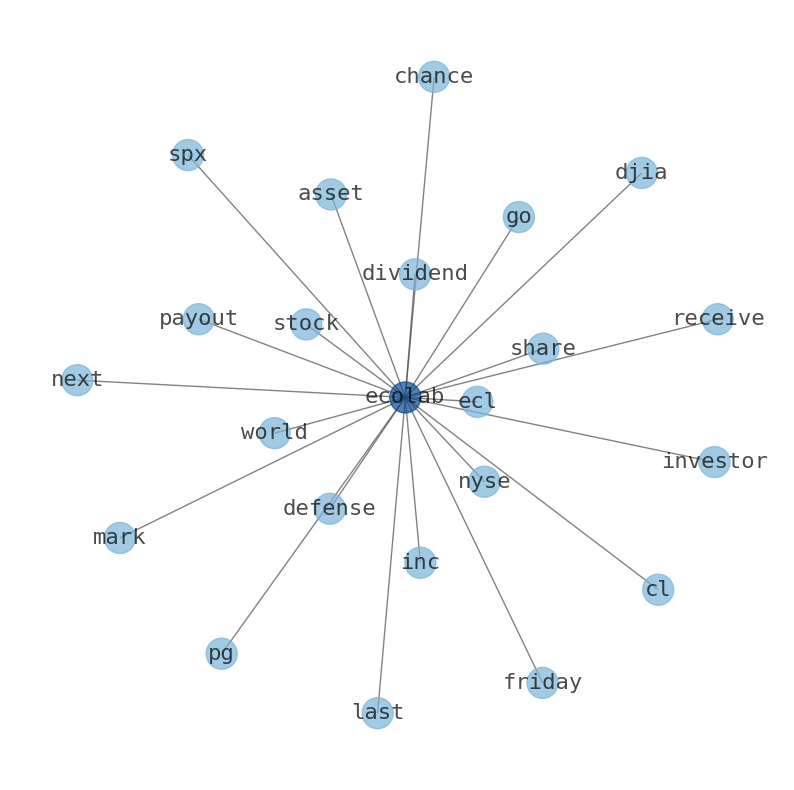

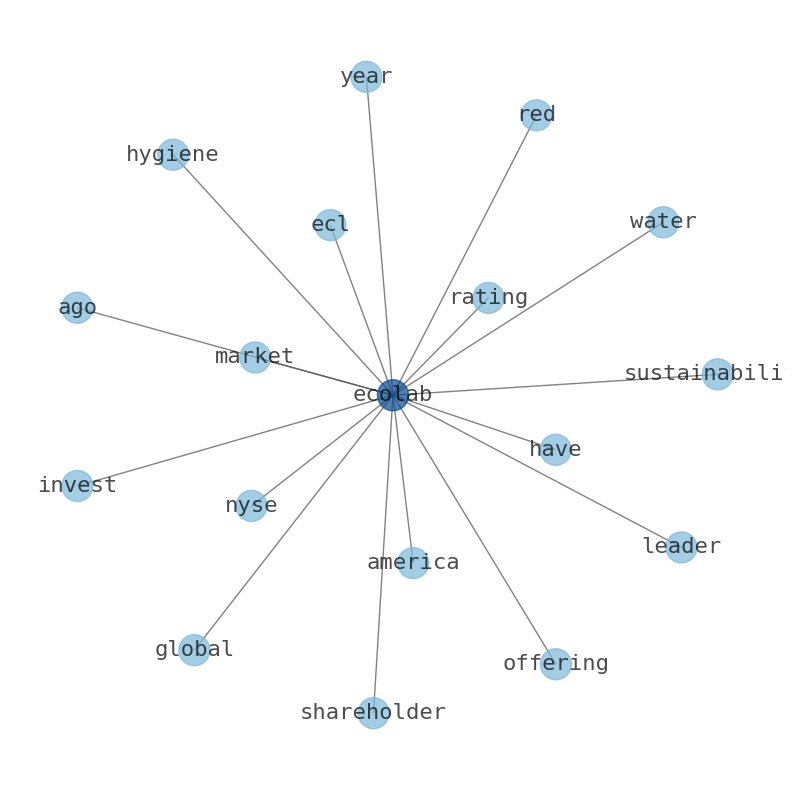

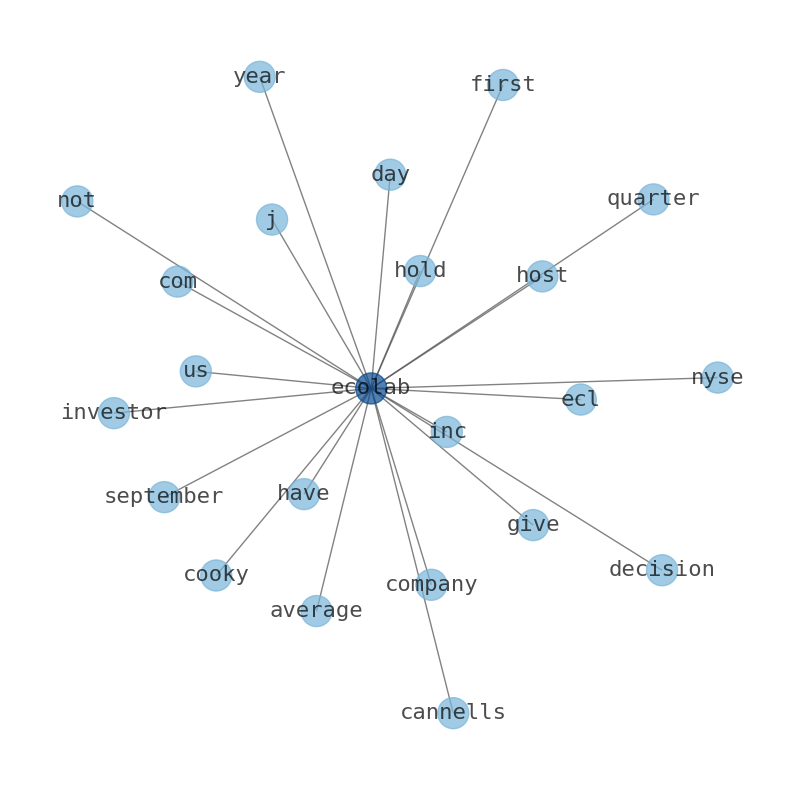

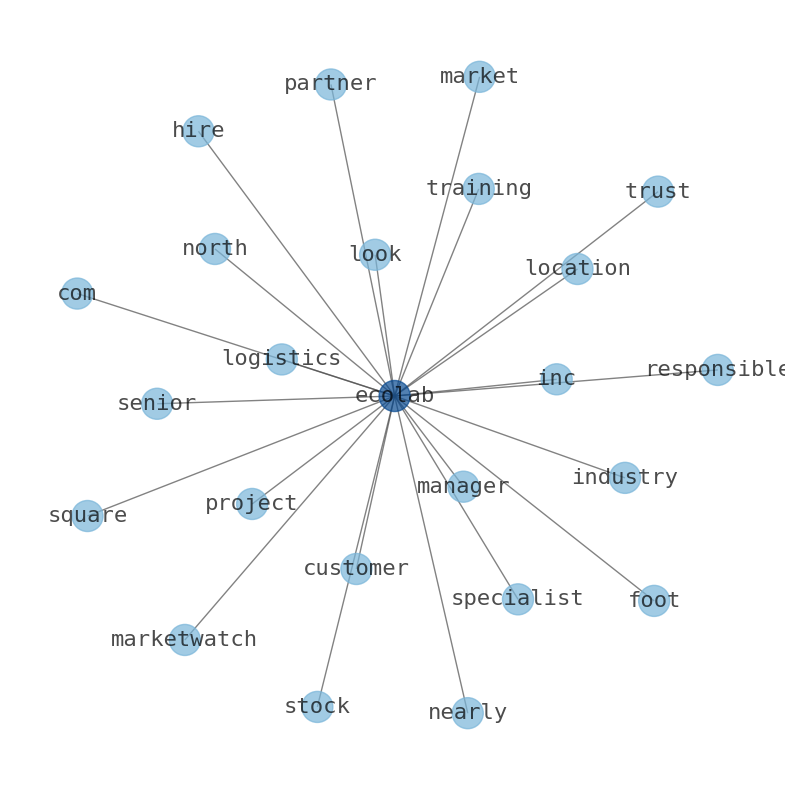

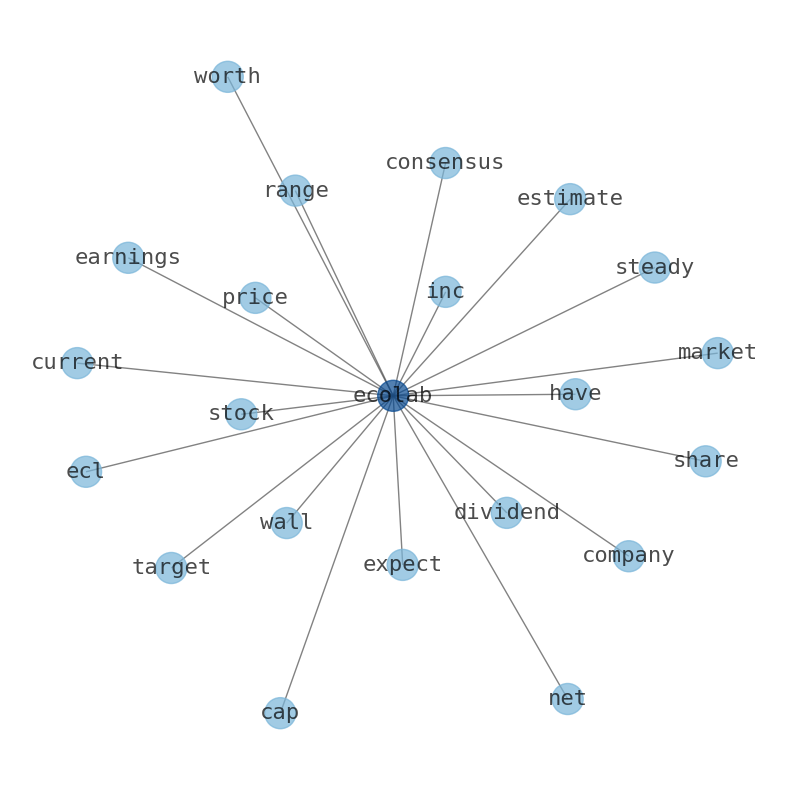

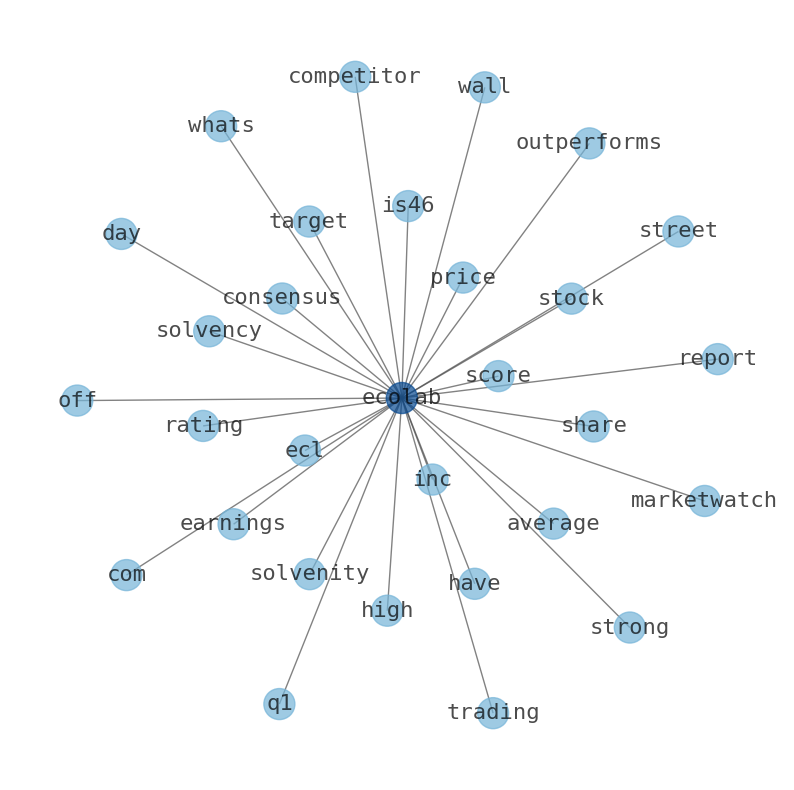

Keywords

The game is changing. There is a new strategy to evaluate Ecolab fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Ecolab are: Ecolab, price, expect, Inc, ECL, market, Ecolabs, and the most common words in the summary are: ecolab, stock, market, inc, price, earnings, share, . One of the sentences in the summary was: Ecolab Inc. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #ecolab #stock #market #inc #price #earnings #share.

Read more →Related Results

Ecolab

Open: 222.0 Close: 220.25 Change: -1.75

Read more →

Ecolab

Open: 219.98 Close: 222.34 Change: 2.36

Read more →

Ecolab

Open: 197.61 Close: 198.4 Change: 0.79

Read more →

Ecolab

Open: 195.79 Close: 196.78 Change: 0.99

Read more →

Ecolab

Open: 179.3 Close: 180.48 Change: 1.18

Read more →

Ecolab

Open: 184.0 Close: 185.0 Change: 1.0

Read more →

Ecolab

Open: 180.55 Close: 183.26 Change: 2.71

Read more →

Ecolab

Open: 175.65 Close: 175.11 Change: -0.54

Read more →

Ecolab

Open: 219.98 Close: 222.34 Change: 2.36

Read more →

Ecolab

Open: 217.21 Close: 216.47 Change: -0.74

Read more →

Ecolab

Open: 197.14 Close: 197.22 Change: 0.08

Read more →

Ecolab

Open: 166.1 Close: 166.31 Change: 0.21

Read more →

Ecolab

Open: 183.5 Close: 182.09 Change: -1.41

Read more →

Ecolab

Open: 188.46 Close: 187.57 Change: -0.89

Read more →

Ecolab

Open: 175.65 Close: 173.34 Change: -2.31

Read more →

Ecolab

Open: 166.04 Close: 167.84 Change: 1.8

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo