The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Dutch Bros

Youtube Subscribe

Open: 27.34 Close: 27.4 Change: 0.06

You don't have read the whole internet to decide whether to invest in Dutch Bros. Use an AI.

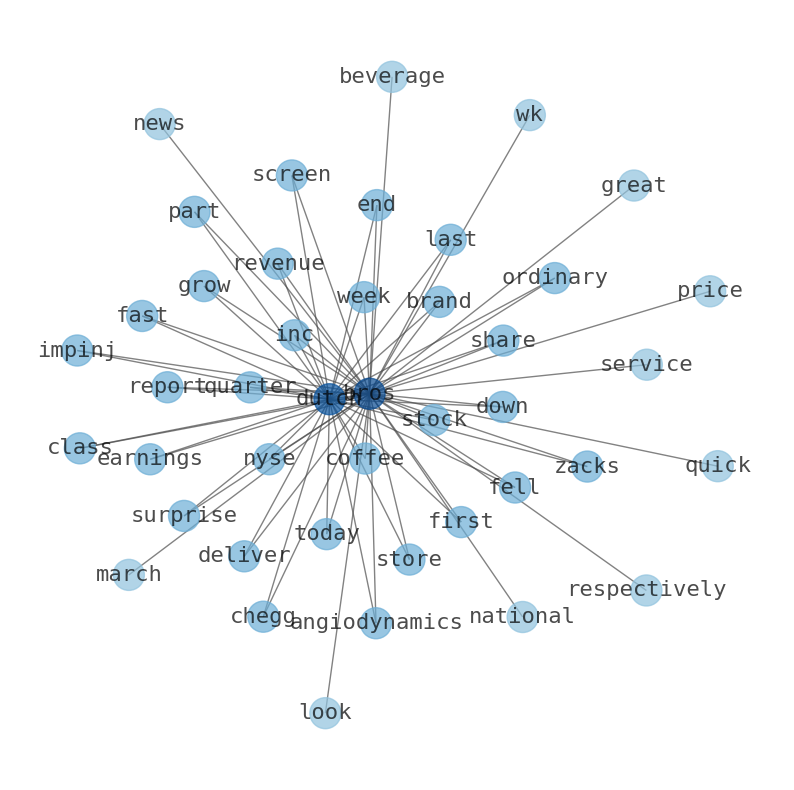

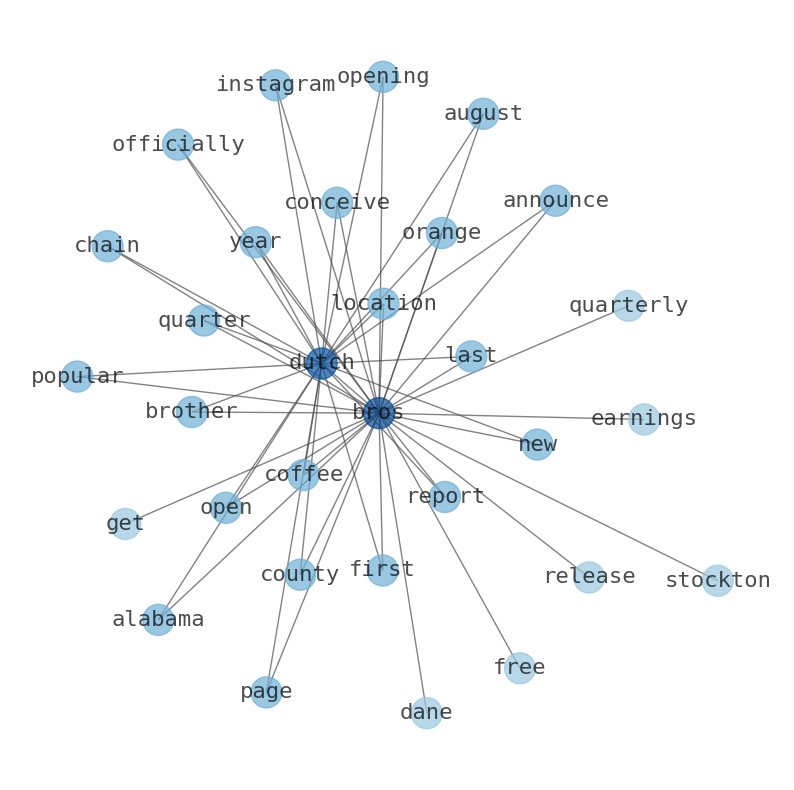

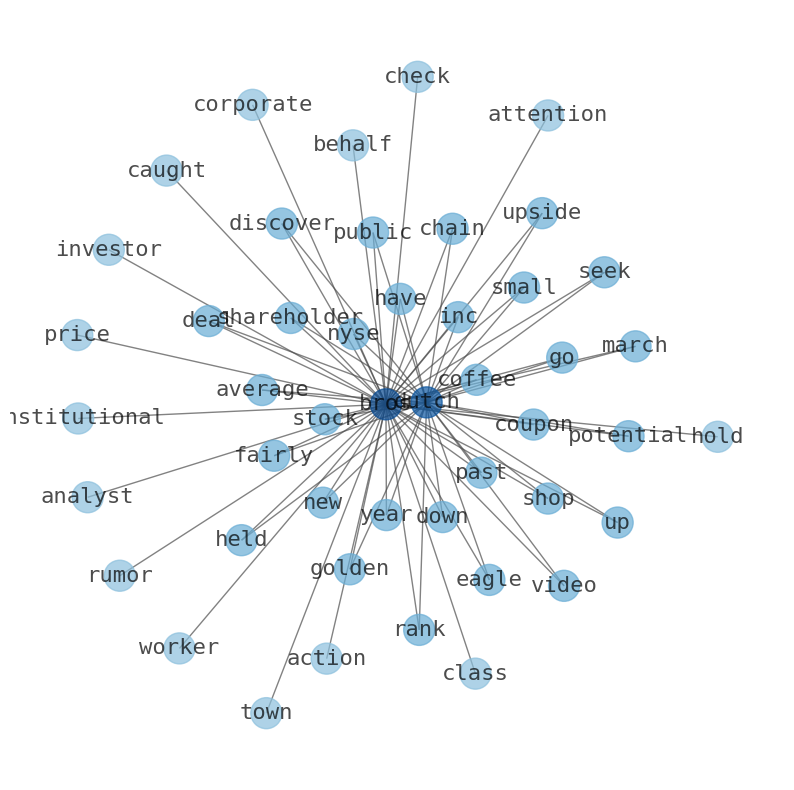

How much time have you spent trying to decide whether investing in Dutch Bros? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Dutch Bros are: …

Stock Summary

Dutch Bros Inc. operates and franchises drive-thru shops. The company offers coffee-based beverages, including custom drinks, cold brews, and freeze blended beverages. It also provides tea, lemonade, sodas, smoothies.

Today's Summary

Dutch Bros generated a negative expected return over the last 90 days. The company currently holds 625.42 M in liabilities with Debt to Equity (D/E) ratio of 2.33. Dutch Bros is expanding rapidly via new store openings.

Today's News

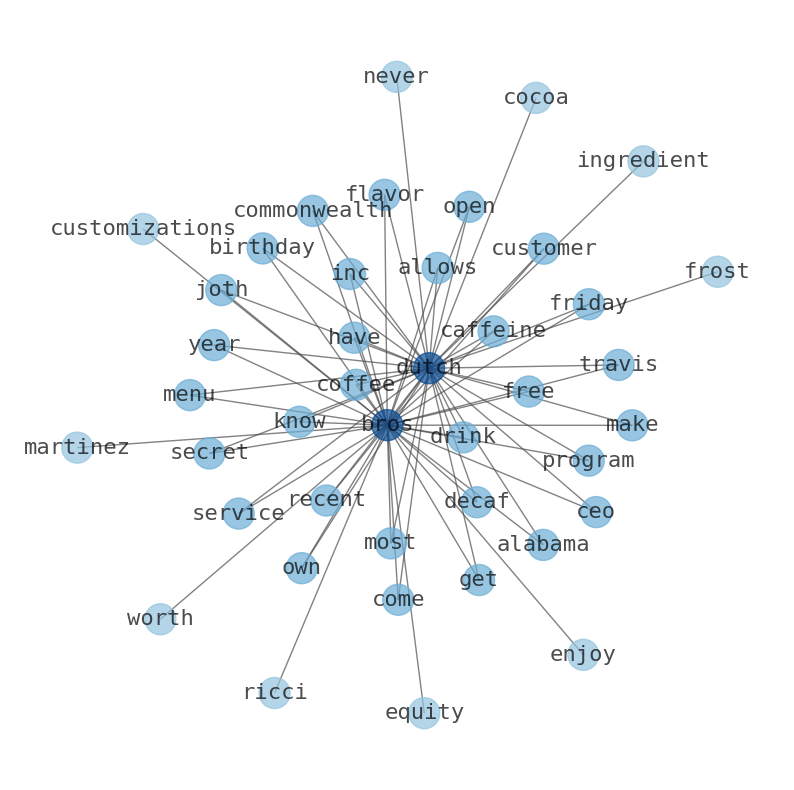

Goldman Sachs ups year-end S&P 500 target to 5,200, says Big Tech must do heavy lifting to be replaced. Dutch Bros Inc. to Host Fourth Quarter and Fiscal Year 2023 Conference Call and Webcast on February 21, 2024. Dutch Bros is in Consumer Discretionary sector and Hotels, Restaurants & Leisure industry. Dutch Bros generated a negative expected return over the last 90 days. The company currently holds 625.42 M in liabilities with Debt to Equity (D/E) ratio of 2.33. Dutch Bros has a current ratio of 0.48, indicating that it has a negative working capital. Dutch Bros has return on total asset (ROA) of 0.0236% which means that it generated a profit of $0.0 236 on every $100 spent on assets. At this time, Dutch Bros Return on Invested Capital is comparatively stable as compared to the past year. Dutch Bros stock analysis is the technique used by a trader or investor to examine and evaluate how Dutch Bros prices is reacting to, or reflecting on a current market direction and economic conditions. The investors can use it to make informed decisions about market timing. Dutch Bros is a good investment by looking at such factors as earnings, sales, fundamental and technical indicators, competition as well as analyst projections. Dutch Bros market value can be influenced by many factors that dont directly affect Dutch Bros underlying business (such as a pandemic or basic market pessimism) Market value can vary widely from intrinsic value. Free Medium Drink at Dutch Bros Coffee - Hunt4Freebies. Get a FREE Medium Drink when you download the free Dutch Bros coffee app for iOS or Android and create an account. Starbucks is a roaster and retailer of specialty coffee, operating over 30,000 stores in 80 markets, while Dutch Bros has more than 800 coffee shops in 17 states. Dutch Bros valuation is nothing short of obscene despite its recent share price drop. Dutch Bros is expanding rapidly via new store openings, but theres a potential second leg of growth that long-term investors need to consider. ToST : 22.42 (+16.77%) BROS : 27.40 (-0.29%) Dutch Bros expects to spend up to $31 million on moving part of its operations from its Oregon headquarters to Arizona. Through February 18, any Dutch Luv featured drink sold to local food organizations.

Stock Profile

"Dutch Bros Inc. operates and franchises drive-thru shops. The company offers coffee-based beverages, including custom drinks, cold brews, and freeze blended beverages, as well as Blue Rebel energy drinks. It also provides tea, lemonade, sodas, smoothies, and other beverages through company-operated shops and online channels. Dutch Bros Inc. was founded in 1992 and is headquartered in Grants Pass, Oregon."

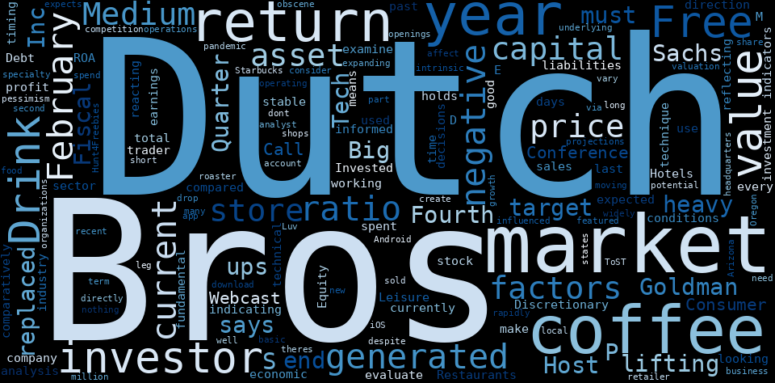

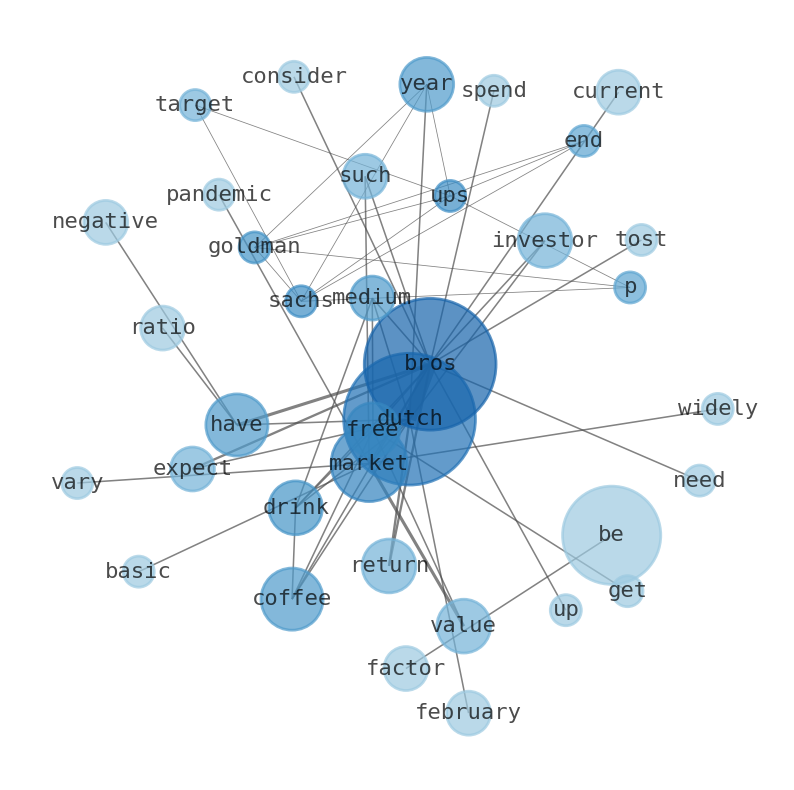

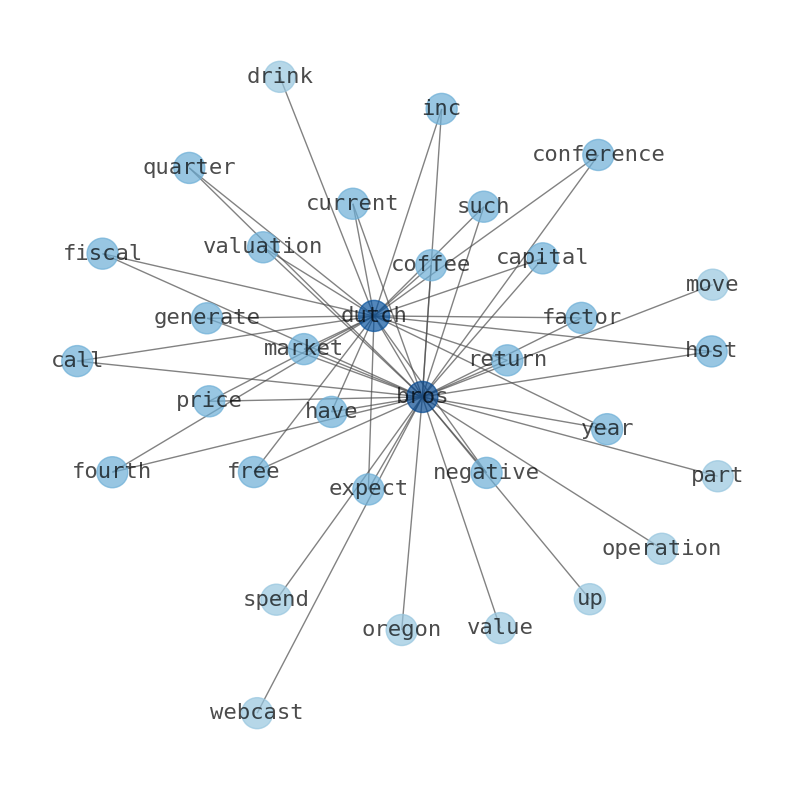

Keywords

Are looking for the most relevant information about Dutch Bros? Investor spend a lot of time searching for information to make investment decisions in Dutch Bros. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Dutch Bros are: Dutch, Bros, market, investor, value, coffee, February, and the most common words in the summary are: bros, dutch, stock, price, market, earnings, day, . One of the sentences in the summary was: The company currently holds 625.42 M in liabilities with Debt to Equity (D/E) ratio of 2.33. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #bros #dutch #stock #price #market #earnings #day.

Read more →Related Results

Dutch Bros

Open: 27.34 Close: 27.4 Change: 0.06

Read more →

Dutch Bros

Open: 28.57 Close: 28.33 Change: -0.24

Read more →

Dutch Bros

Open: 28.41 Close: 28.02 Change: -0.39

Read more →

Dutch Bros

Open: 26.5 Close: 26.99 Change: 0.49

Read more →

Dutch Bros

Open: 27.89 Close: 27.99 Change: 0.1

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo