The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Duke Energy

Youtube Subscribe

Open: 88.2 Close: 89.4 Change: 1.2

Are you still looking for information about Duke Energy Company Inc? An AI summarized it for you.

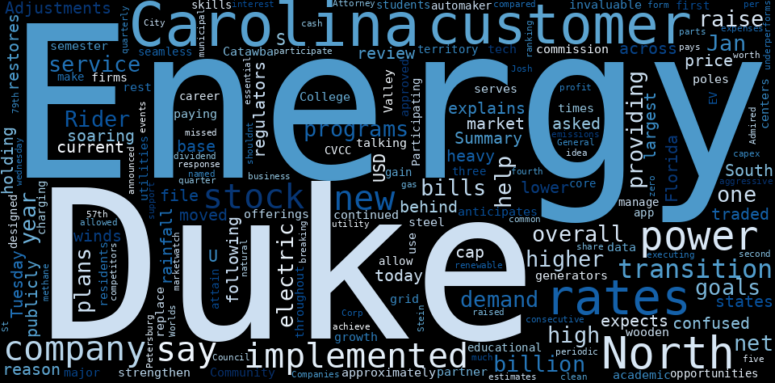

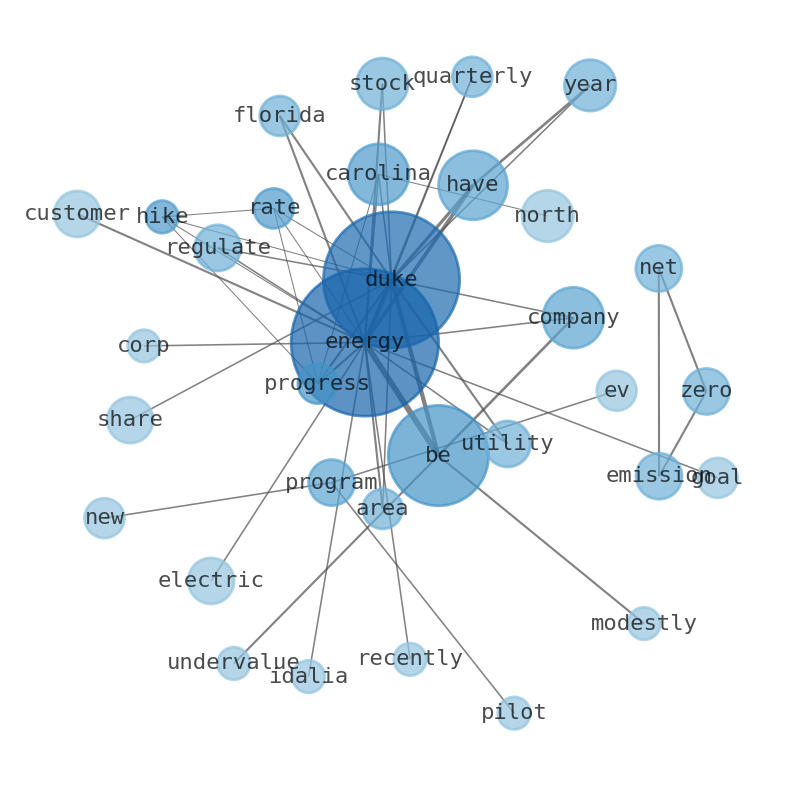

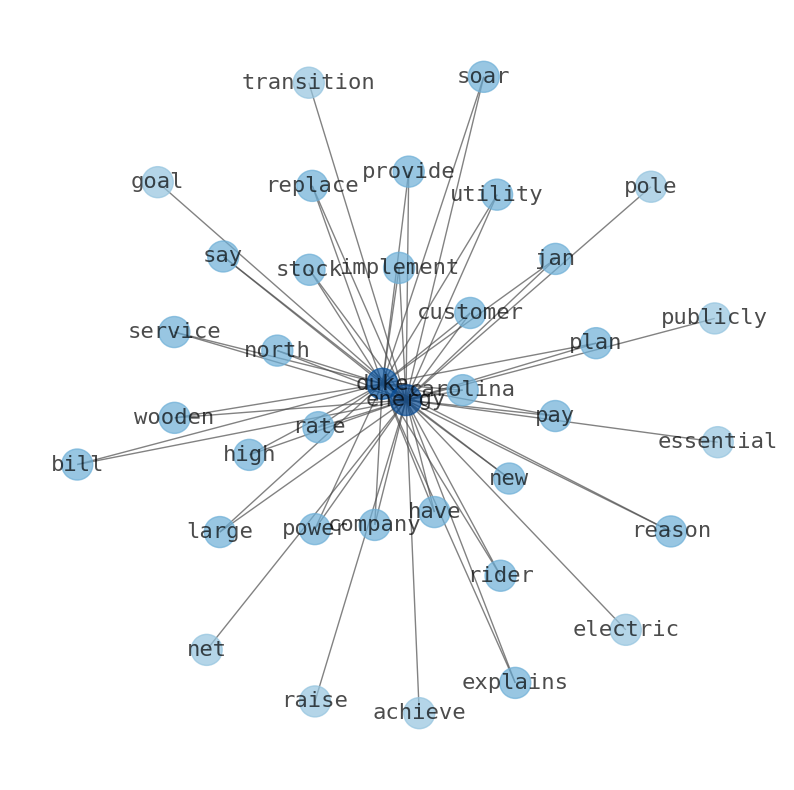

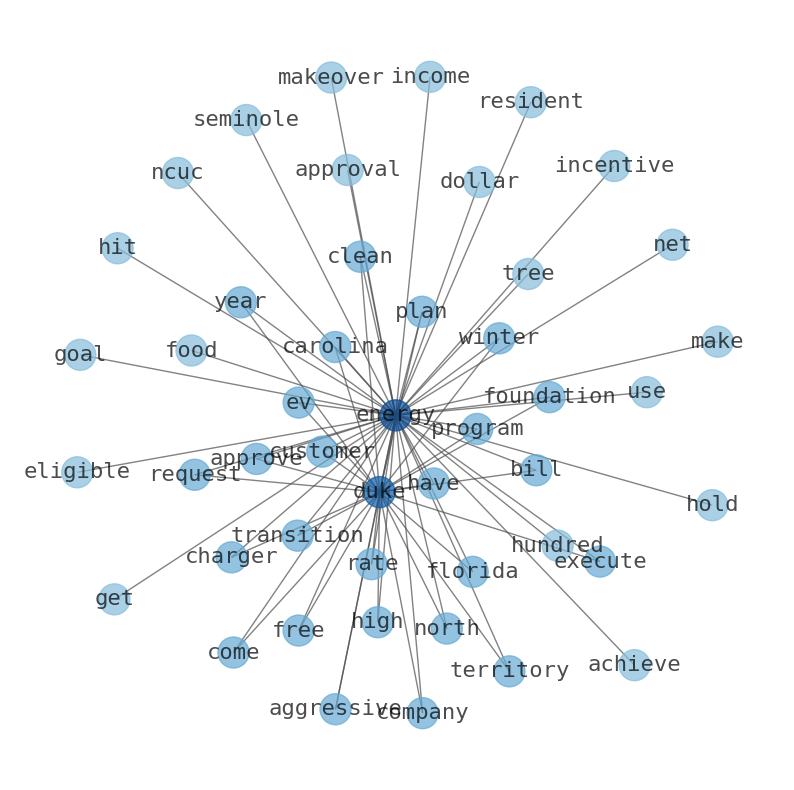

This document will help you to evaluate Duke Energy without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Duke Energy are: Duke, Energy, energy, North, year, company, stock, …

Stock Summary

Duke Energy Corporation operates through two segments, Electric Utilities and Infrastructure and Gas Utilities and infrastructure. The GU&I segment distributes natural gas to residential, commercial, industrial, and power generation natural gas customers. The EU&I segments generates.

Today's Summary

Duke Energy ( NYSE:DUK ) is believed to be modestly undervalued. At its current price of $89.12 per share and a market cap of $68.12, Duke Energy stock has historically risen by 6.1% based on the past 51 years of stock performance.

Today's News

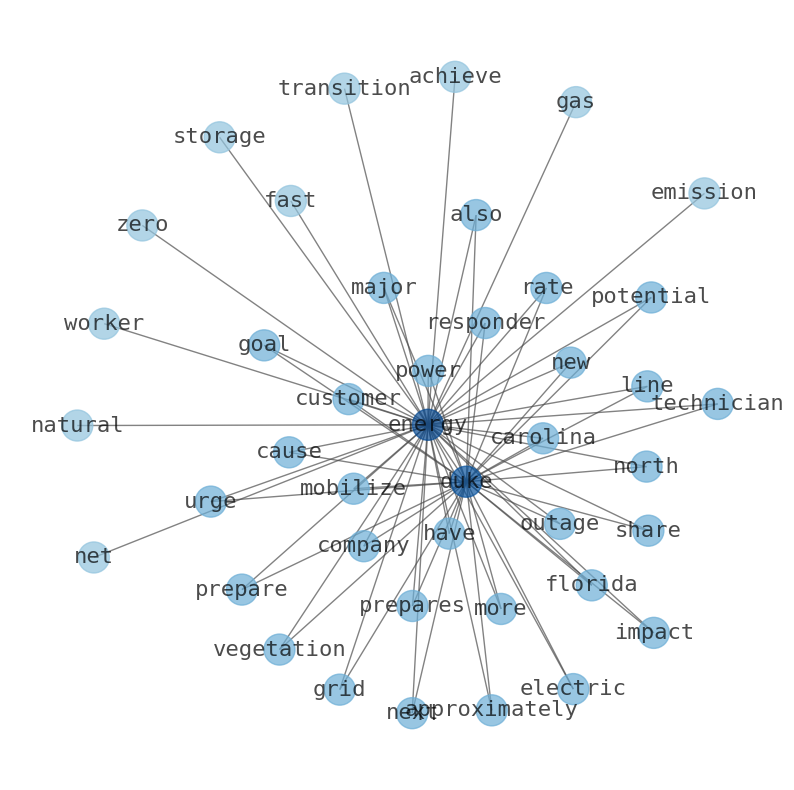

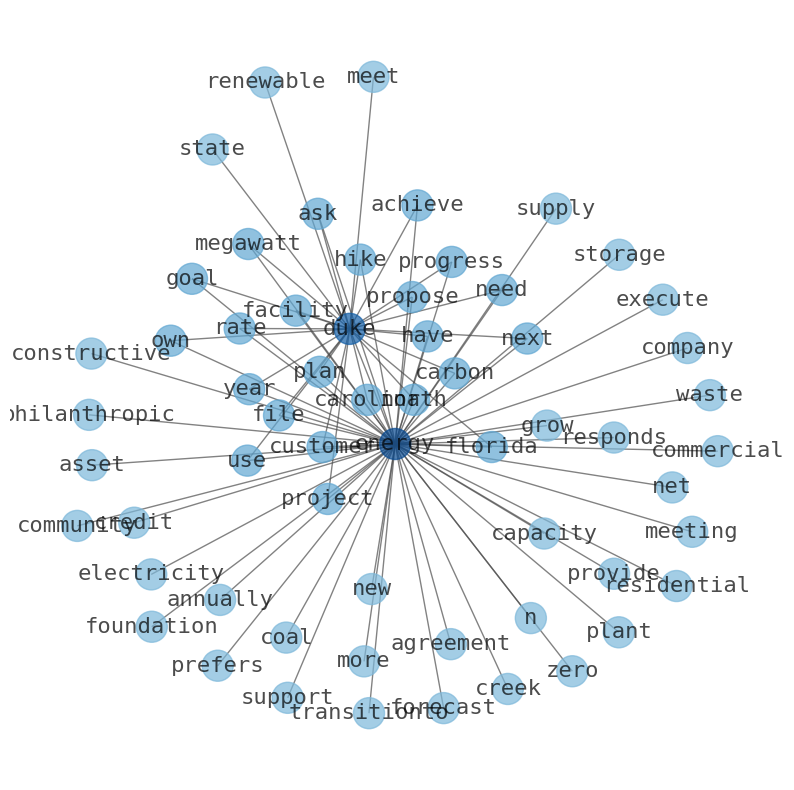

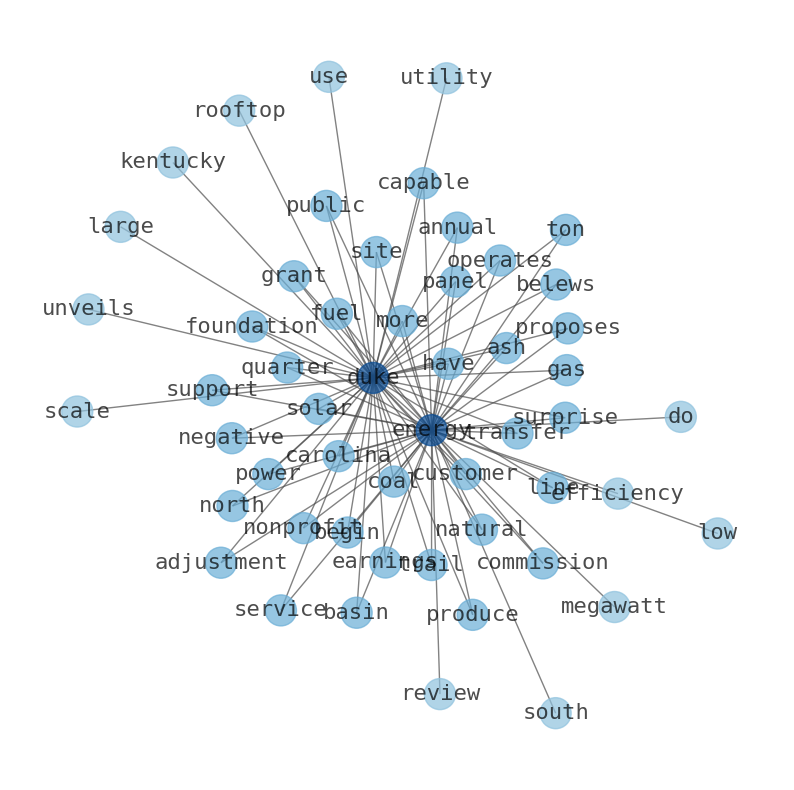

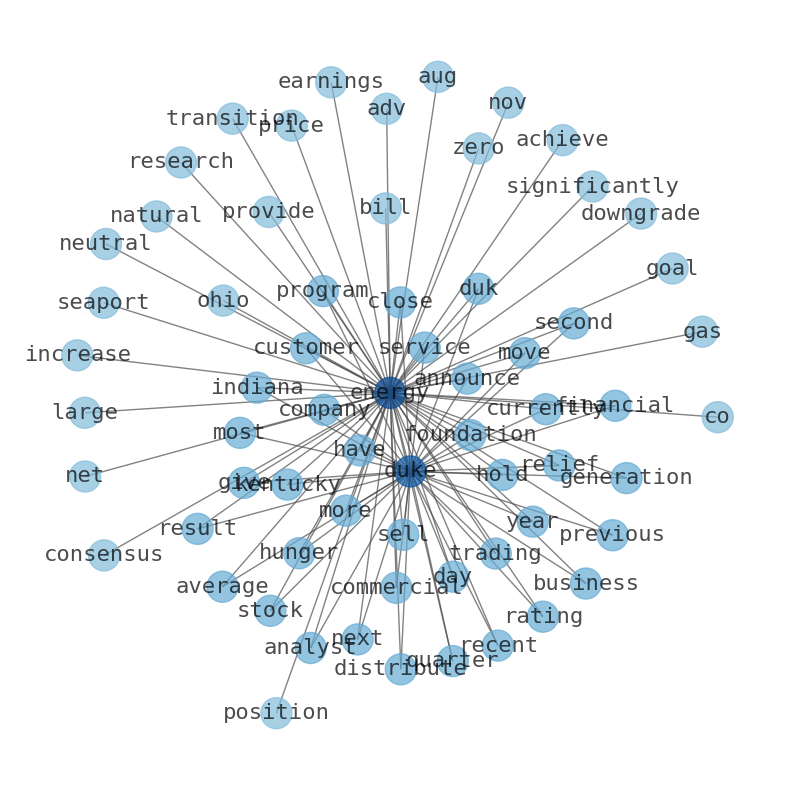

Duke Energy Carolinas petition to raise prices continues in North Carolina. Advocates criticized Duke Energy Progress rate hikes as too steep, but praised commissioners for ordering the new program. Duke Energy is working with General Motors, Ford Motor Company and BMW of North America to launch a new electric vehicle (EV) pilot program in North Carolina. The program is aimed at bringing certainty to the cost of EV charging. Duke Energy is executing an aggressive clean energy transition to achieve its goals of net-zero methane emissions from its natural gas business by 2030 and net-worth zero carbon emissions from electricity generation by 2050. Duke Energy was named to Fortunes 2023 Worlds Most Admired Companies list and Forbes worlds Best Employers list. Duke Energy Florida will restore 95% of customers who experienced the worst of the storm no later than 11:30 p.m. Duke Energy ( NYSE:DUK ) is believed to be modestly undervalued. Duke Energy is executing an ambitious clean energy transition to achieve its goals of net-zero methane emissions from its natural gas business by 2030 and net zero carbon emissions from electricity generation by 2050. At its current price of $89.12 per share and a market cap of $68. Duke Energy ( NYSE:DUK ) is believed to be modestly undervalued. Duke Energy has been profitable 10 years over the past 10 years. The average annual revenue growth of Duke Energy is 2.8%, which ranks worse than 73.75% of 480 companies in the Utilities - Regulated industry. Duke Energy Carolinas reaches partial agreement with North Carolina Public Staff to strengthen system reliability, reduce the requested rate increase. Settlement and testimony will be reviewed by regulators in a hearing that begins Aug. 11. Duke Energy stock has historically risen by 6.1% based on the past 51 years of stock performance. Duke Energy has risen higher in 33 of those 51 years over the subsequent 52-week period, corresponding to a historical accuracy of 64.71% Duke Energy is a publicly traded company. Duke Energy Corp. shares rise as stock market sees mixed trading. Duke Energy recently announced a quarterly dividend payment scheduled for Monday, September 18th. Duke Energy will launch a new electric vehicle (EV) pilot program. Institutional investors own around 63.68% of Duke Energys stock presently. Duke Energy recently reported its quarterly earnings results on August 8th where it posted earnings per share (EPS) of $0.91 for the quarter that fell short by ($0.07) Duke Energy earned revenue amounting to approximately $6.58 billion. Duke Energy stock last closed at $87.49, up 0.97% from the previous day, and has decreased 18.05% in one year. Duke Energy is currently +4.45% from its 52-week low of $83.76, and -21.36% from $111.26. Duke Energy has a phased plan to reach its goal by Sunday night. Duke Energy had restored power to 156,000 customers in its service area Thursday. Duke Energy Florida aims to have 95% of impacted customers restored by Wednesday night, except for those in hardest hit areas of Tropical Storm Idalia. Duke Energy owns 10,500 megawatts of energy capacity, supplying electricity to 1.9 million customers across a 13,000-square-mile service area. Duke Energy is one of the largest energy holding companies in the U.S. It has an electric generating capacity of 51,000 megawatts through its regulated utilities and its non-regulated Renewables unit. Duke Energy declared a regular quarterly dividend of $1.02 per share on July 13, 2023. Duke Energy Corporation is an energy company. Duke Energy Corp. is an electric utility company. The EU&I segment conducts operations primarily through the regulated public utilities of Duke Energy Carolinas, Duke Energy Progress, Duke. Energy Florida and Indiana are preparing for Hurricane Idalia. Duke Energy Progress rate hike order also cuts rooftop solar payments for businesses. North Carolina regulators have approved changes in how business rooftop solar owners are compensated for excess energy sent to the grid.

Stock Profile

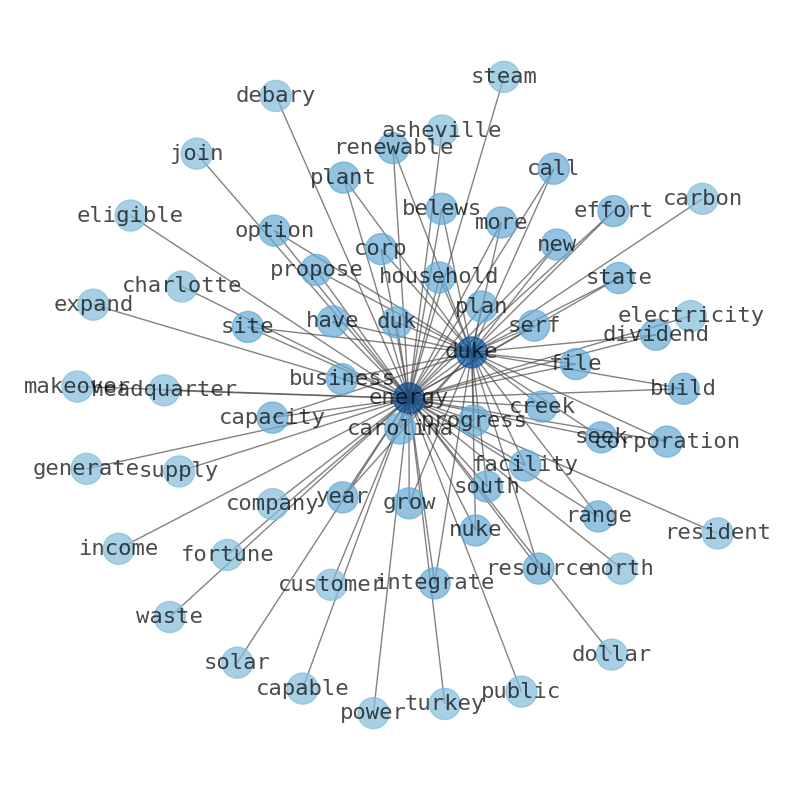

"Duke Energy Corporation, together with its subsidiaries, operates as an energy company in the United States. It operates through two segments, Electric Utilities and Infrastructure (EU&I) and Gas Utilities and Infrastructure (GU&I). The EU&I segment generates, transmits, distributes, and sells electricity in the Carolinas, Florida, and the Midwest; and uses coal, hydroelectric, natural gas, oil, solar and wind sources, renewables, and nuclear fuel to generate electricity. This segment also engages in the wholesale of electricity to municipalities, electric cooperative utilities, and load-serving entities. The GU&I segment distributes natural gas to residential, commercial, industrial, and power generation natural gas customers; and invests in pipeline transmission projects, renewable natural gas projects, and natural gas storage facilities. The company was formerly known as Duke Energy Holding Corp. and changed its name to Duke Energy Corporation in April 2006. The company was founded in 1904 and is headquartered in Charlotte, North Carolina."

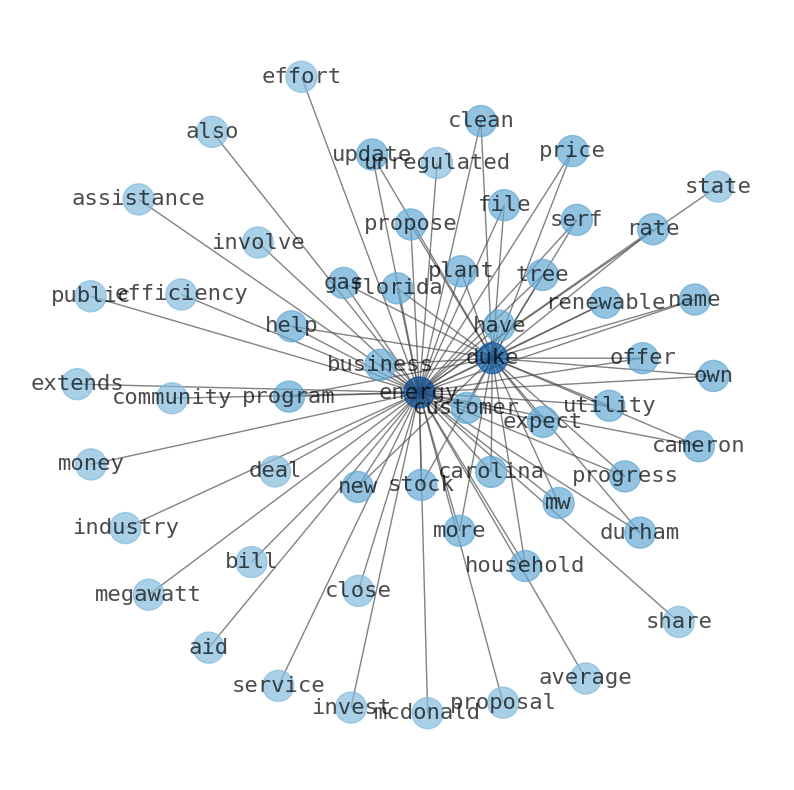

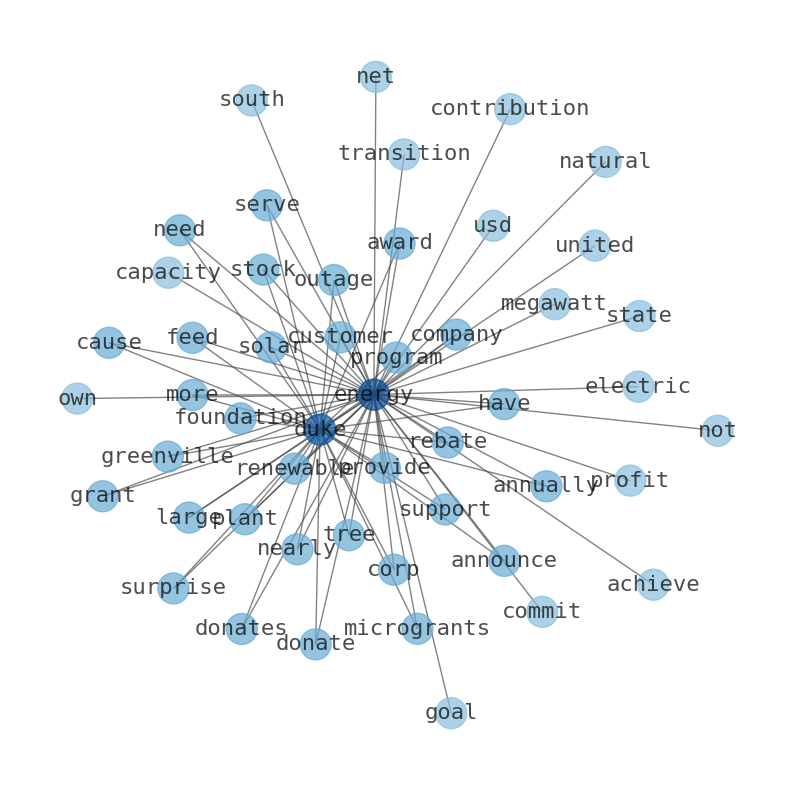

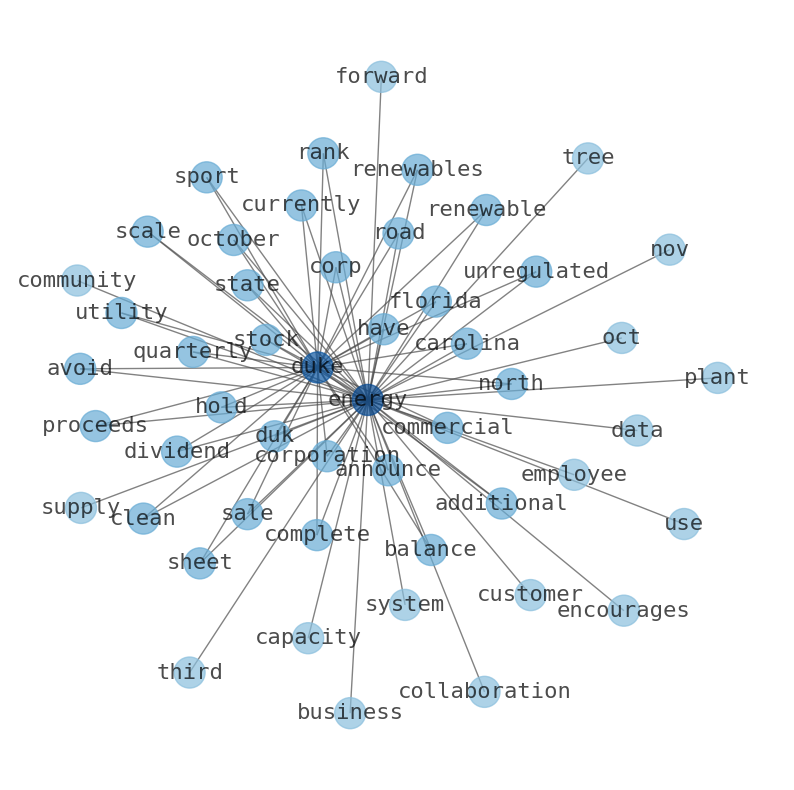

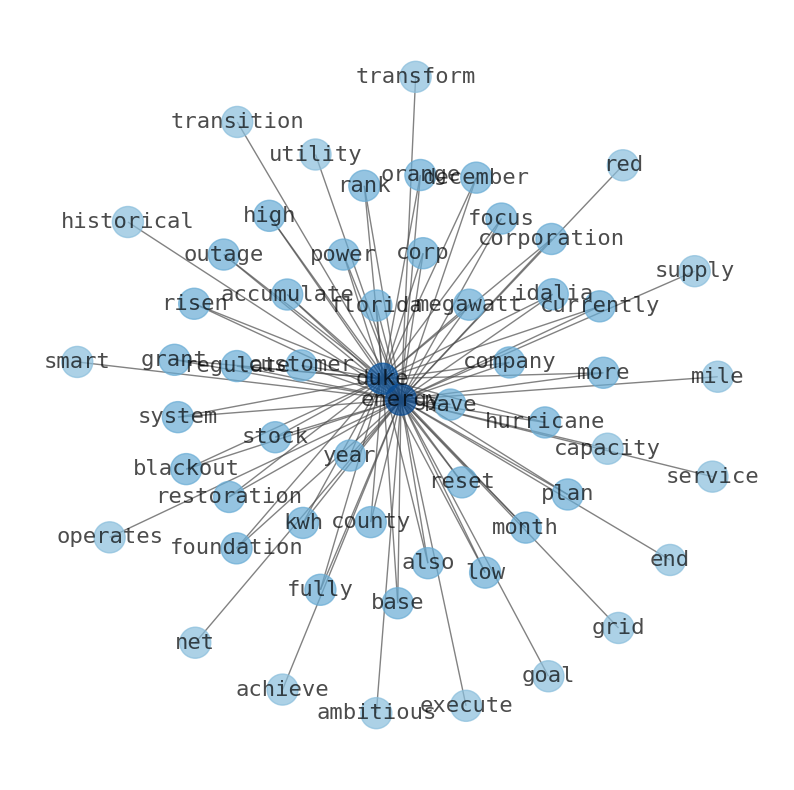

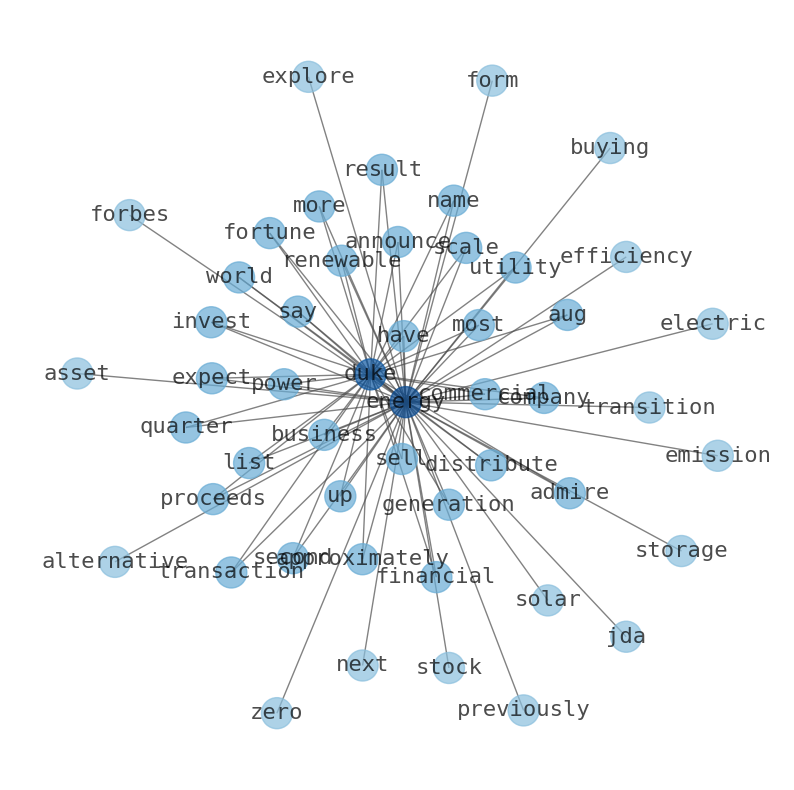

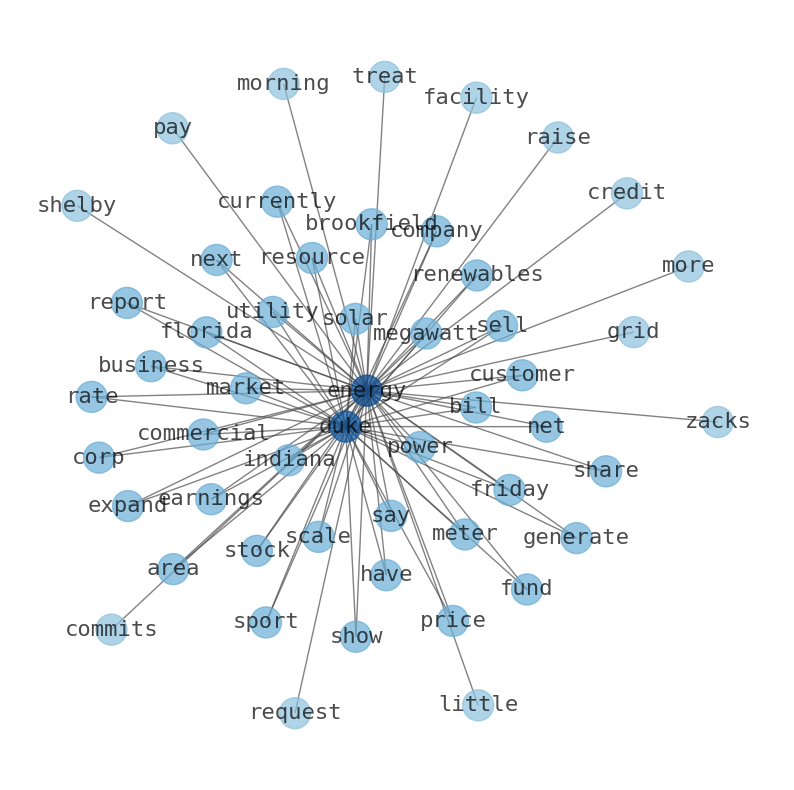

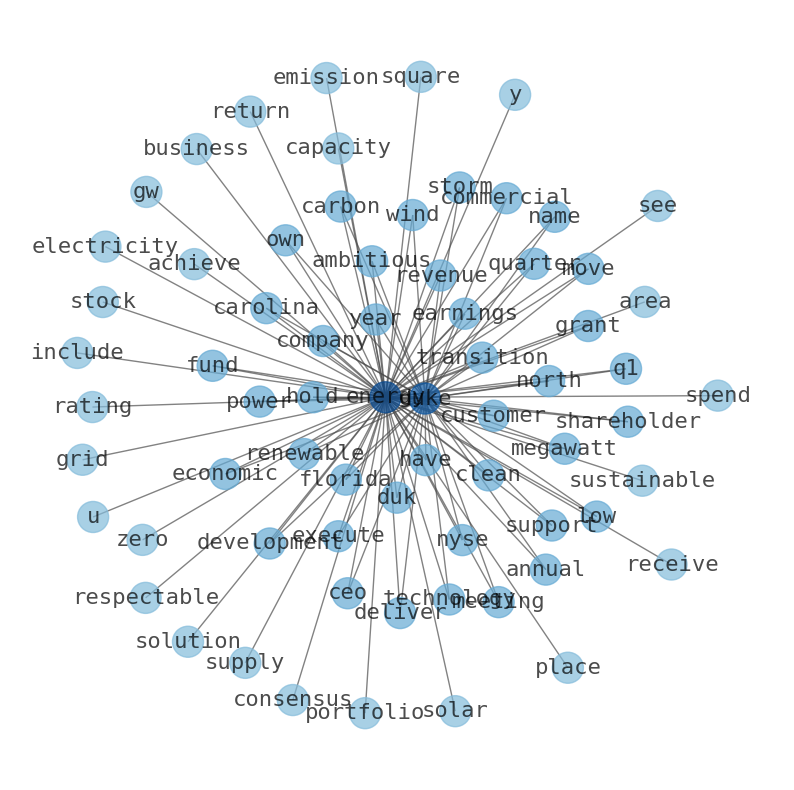

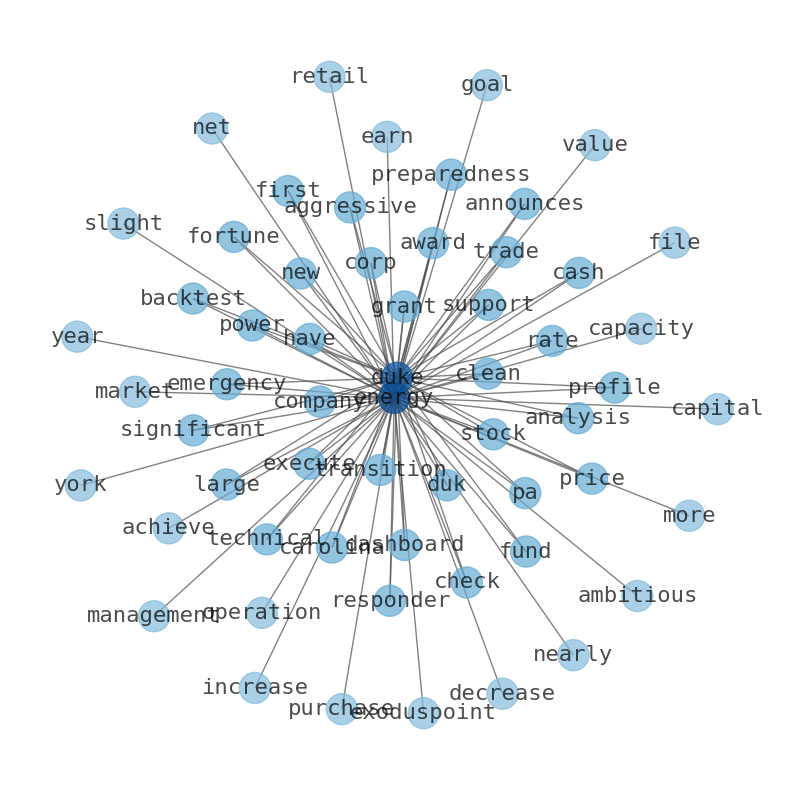

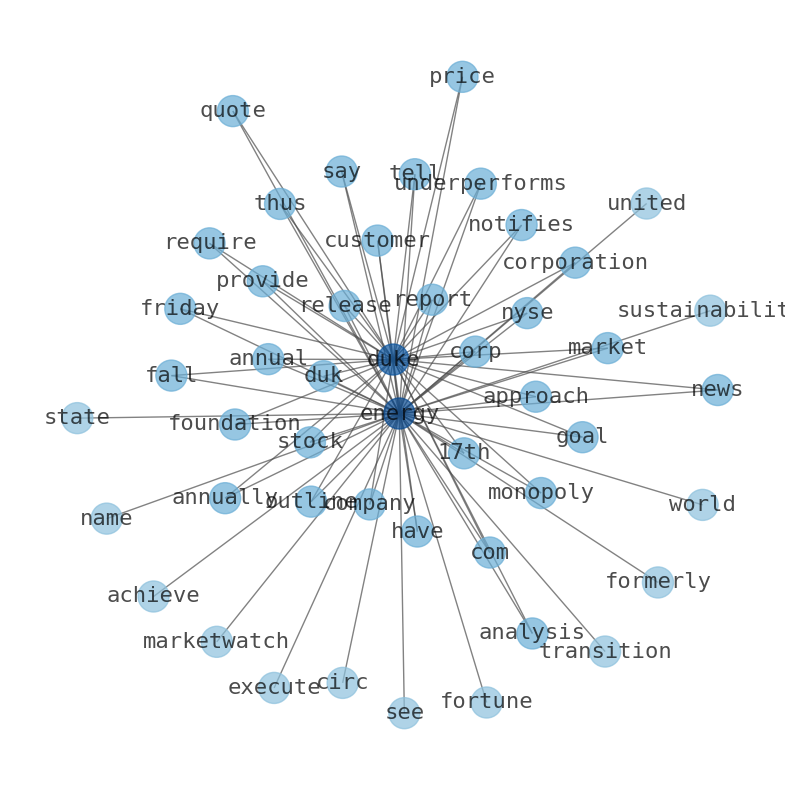

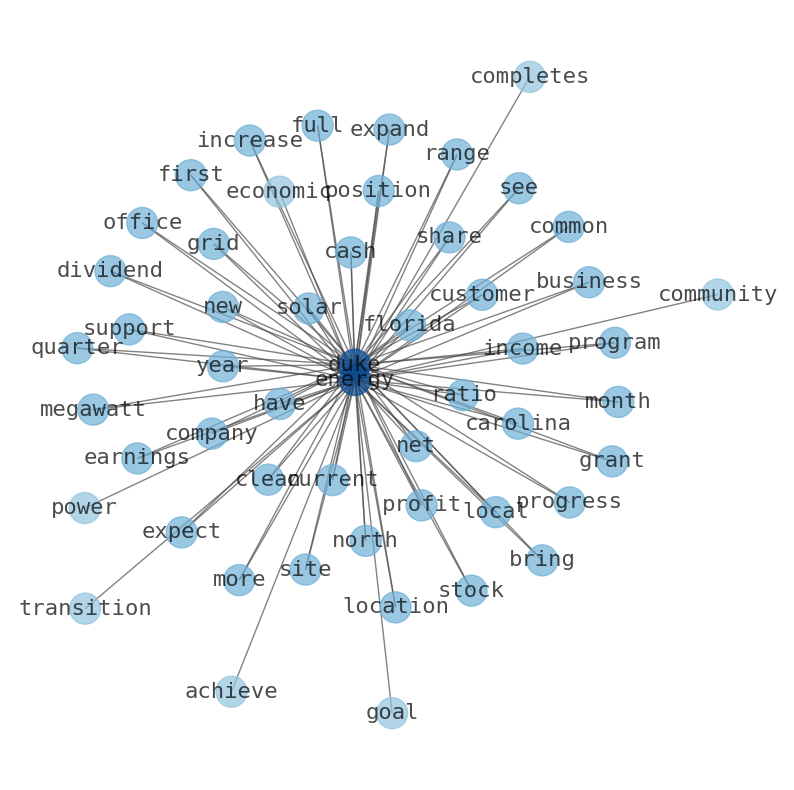

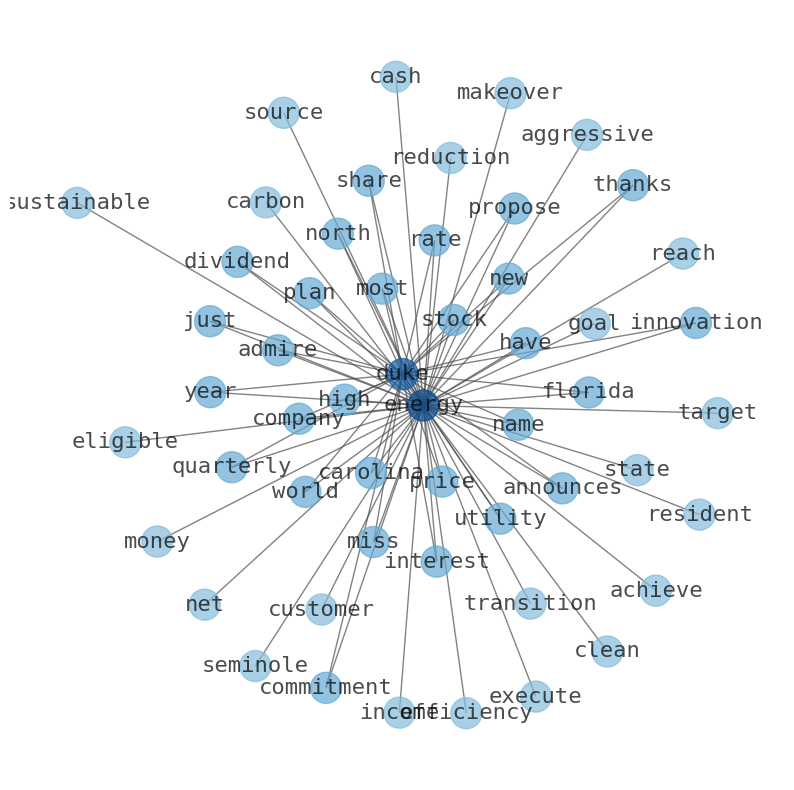

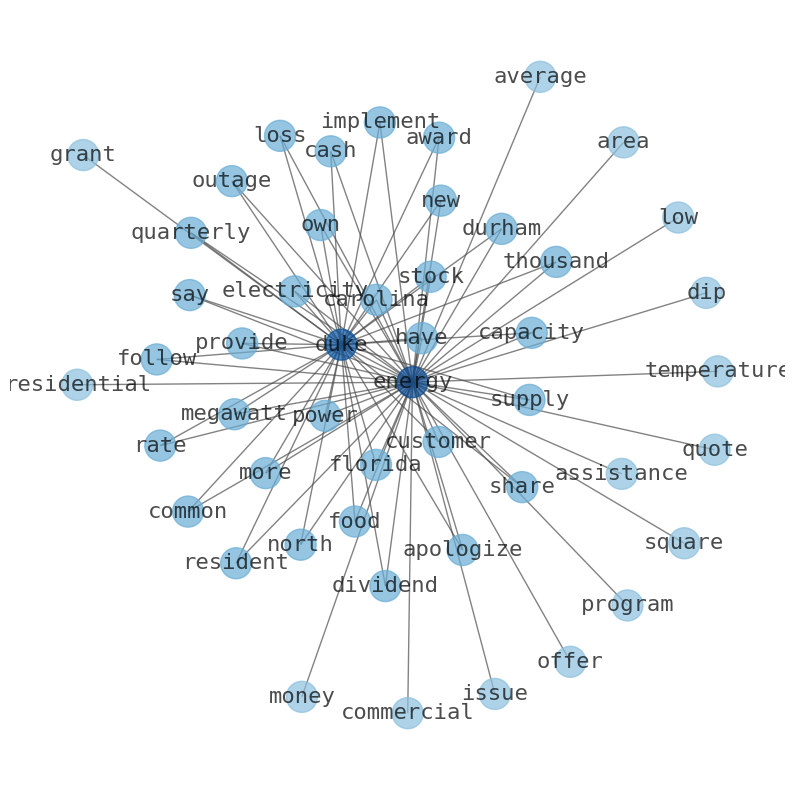

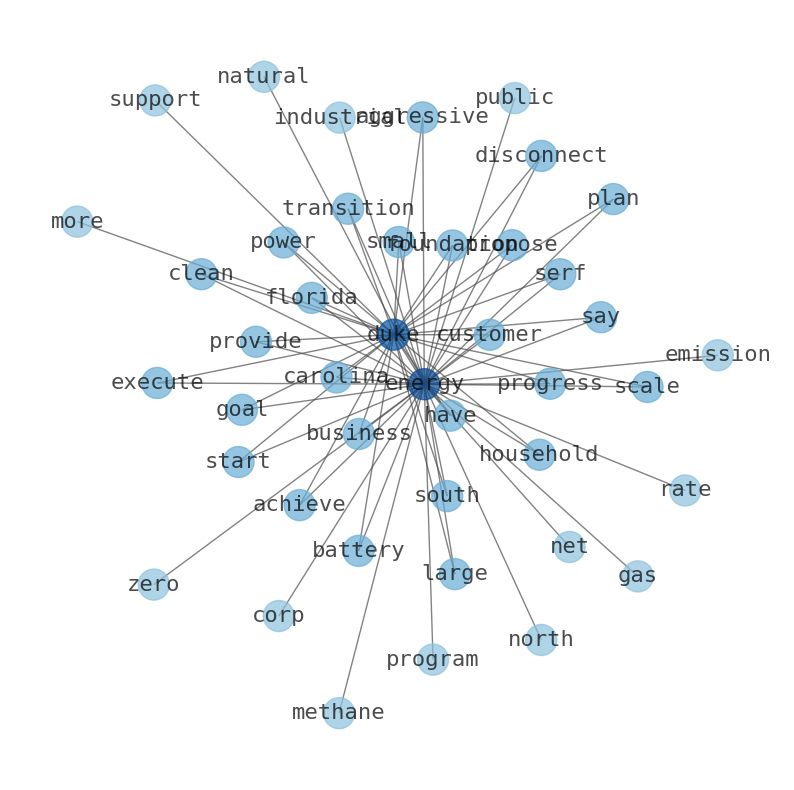

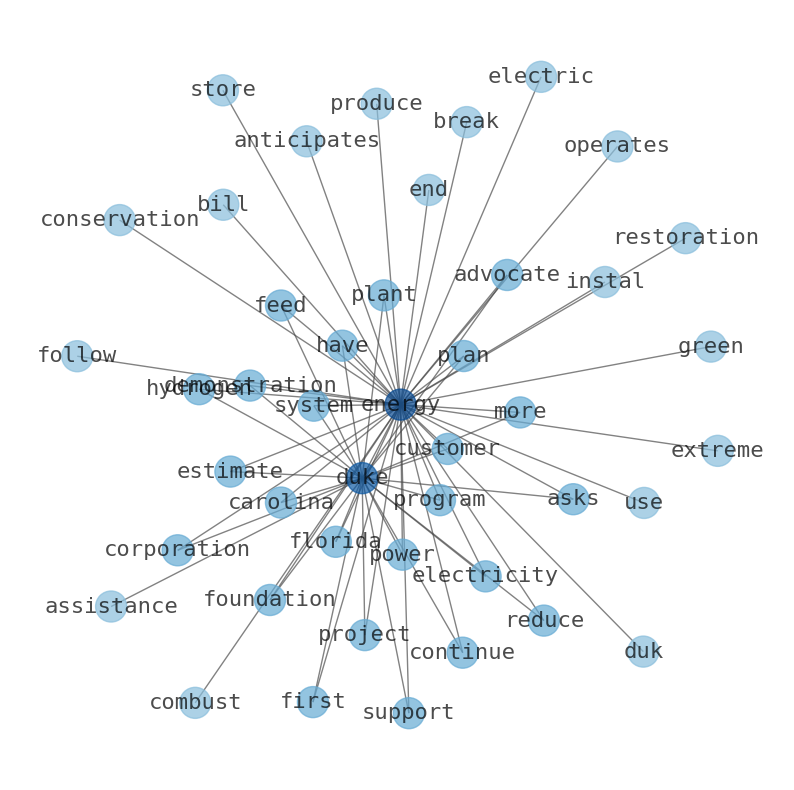

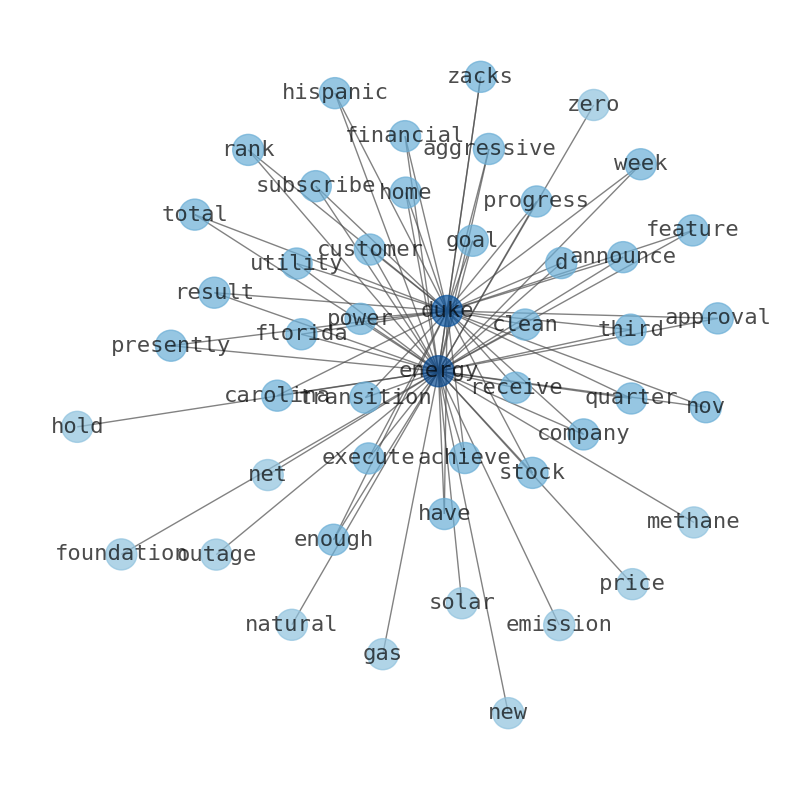

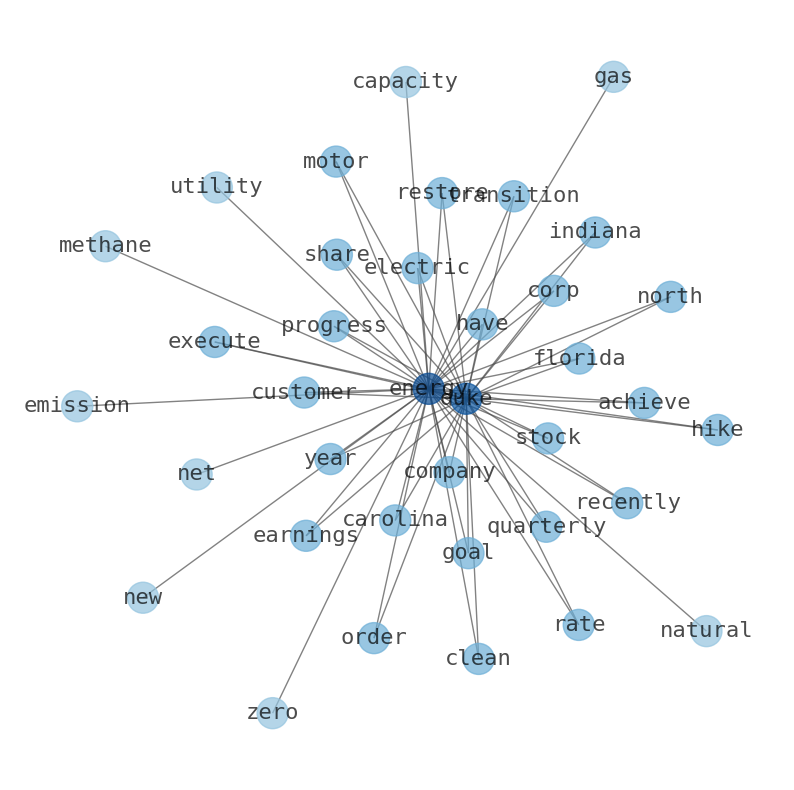

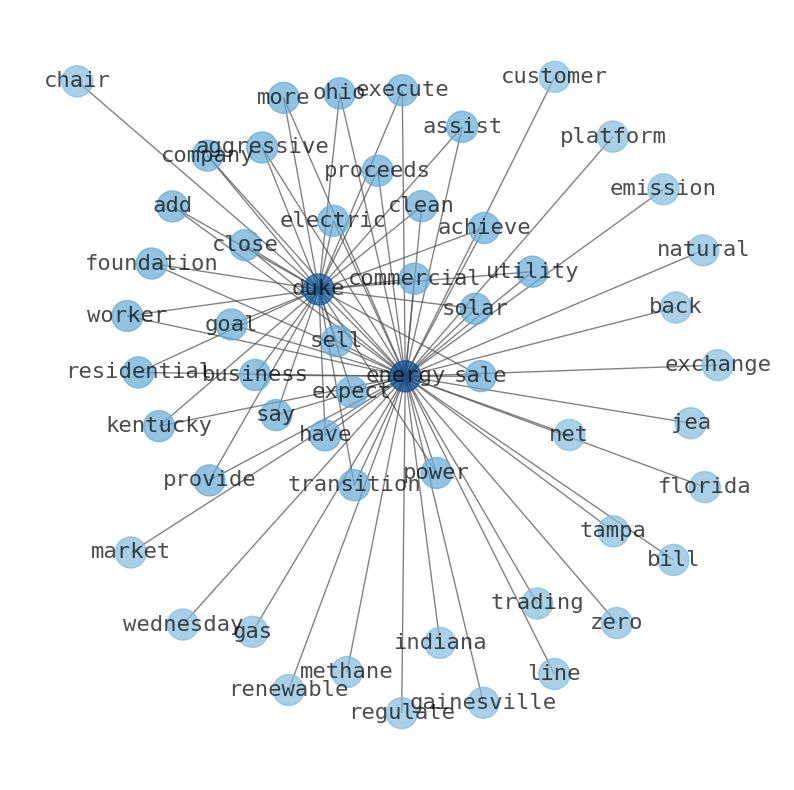

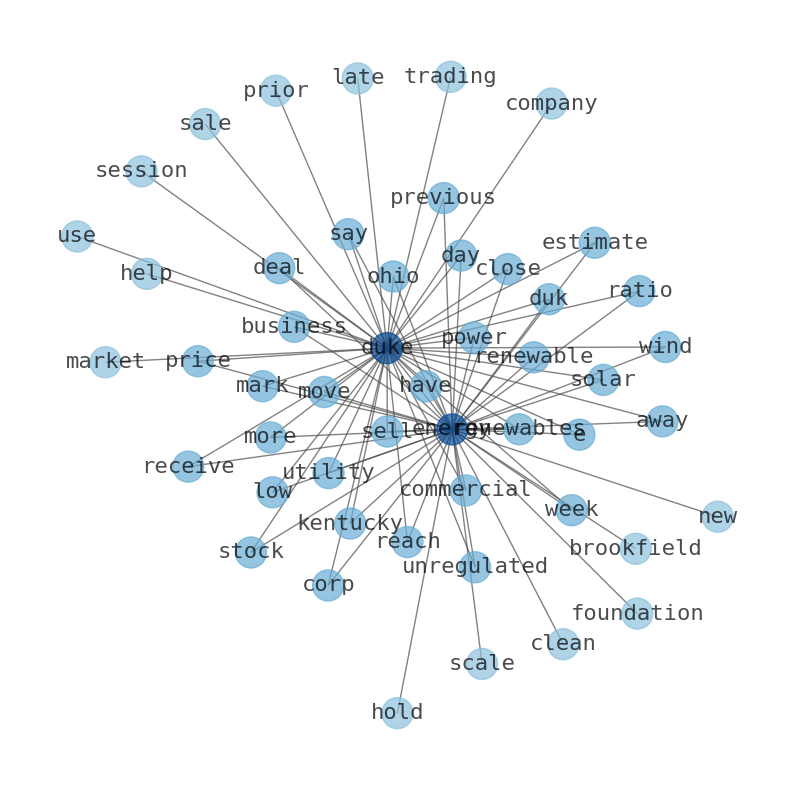

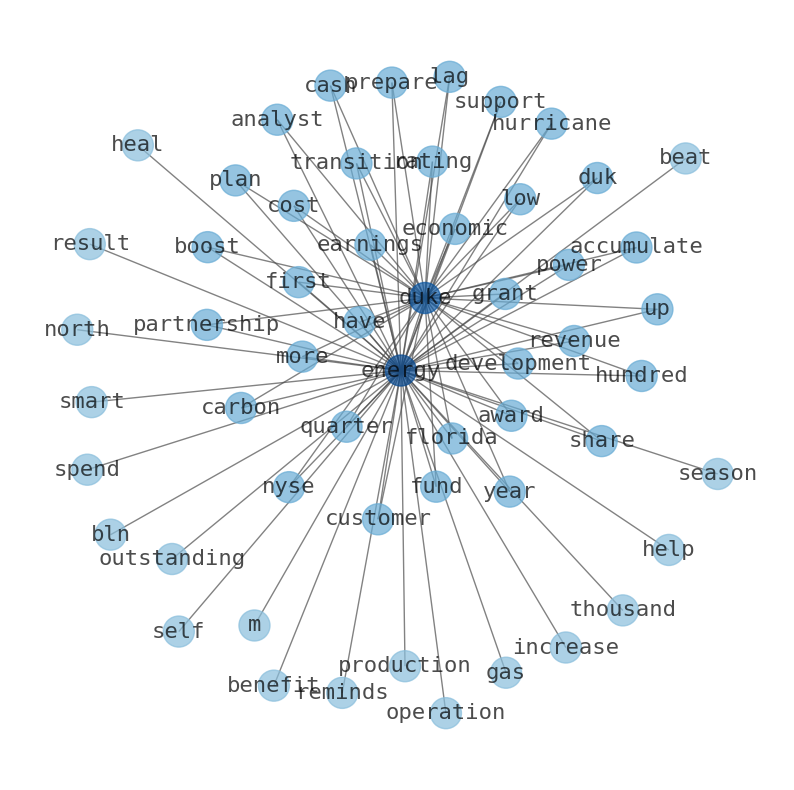

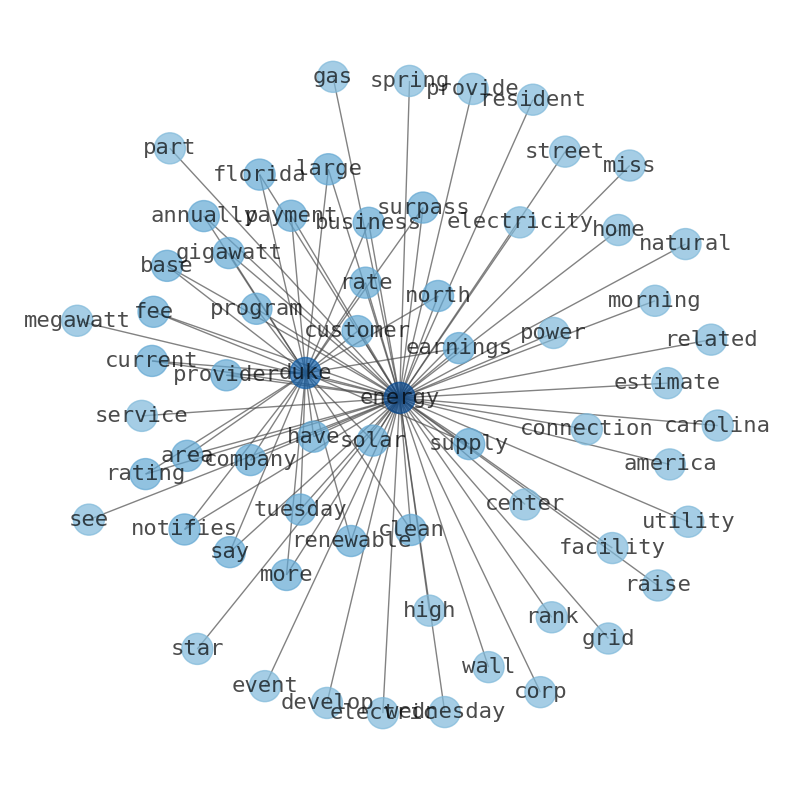

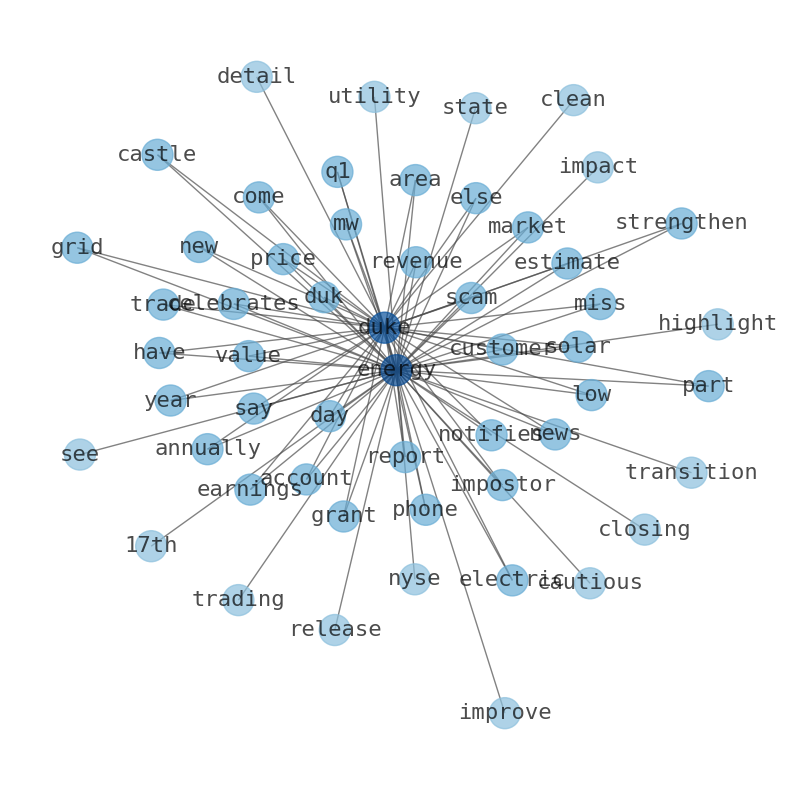

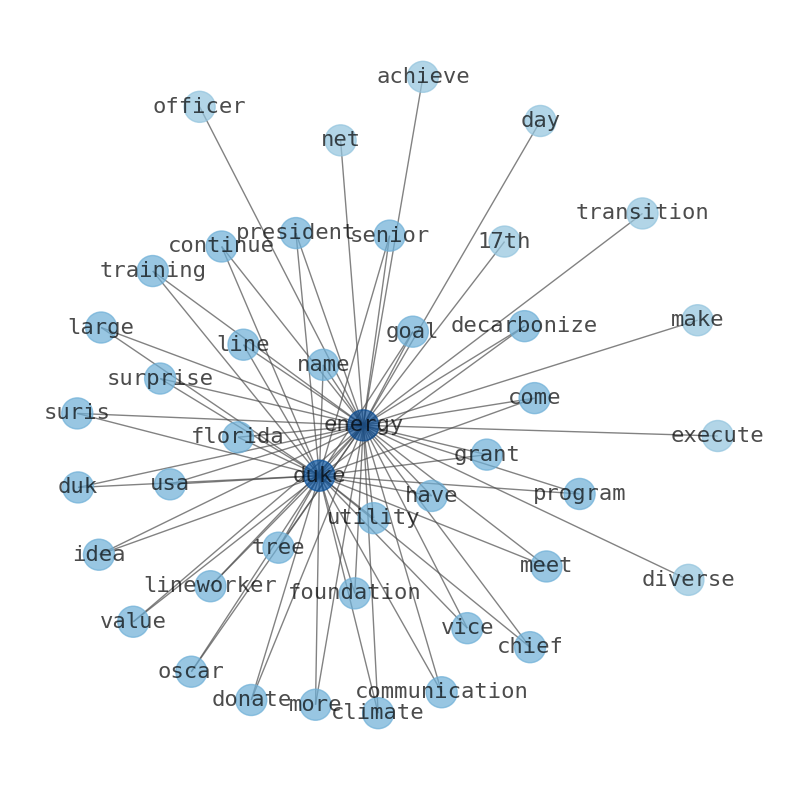

Keywords

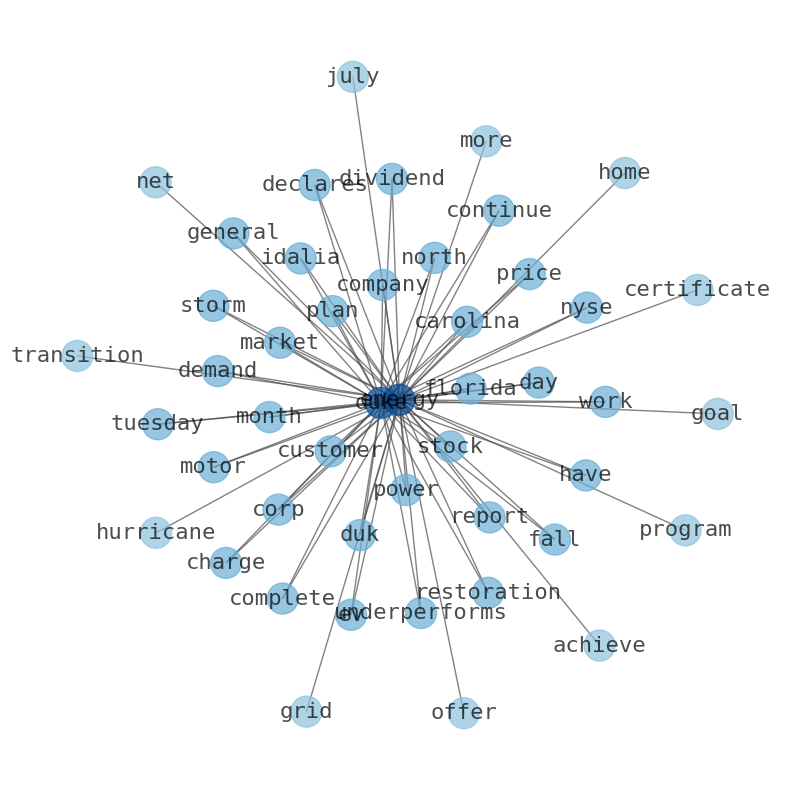

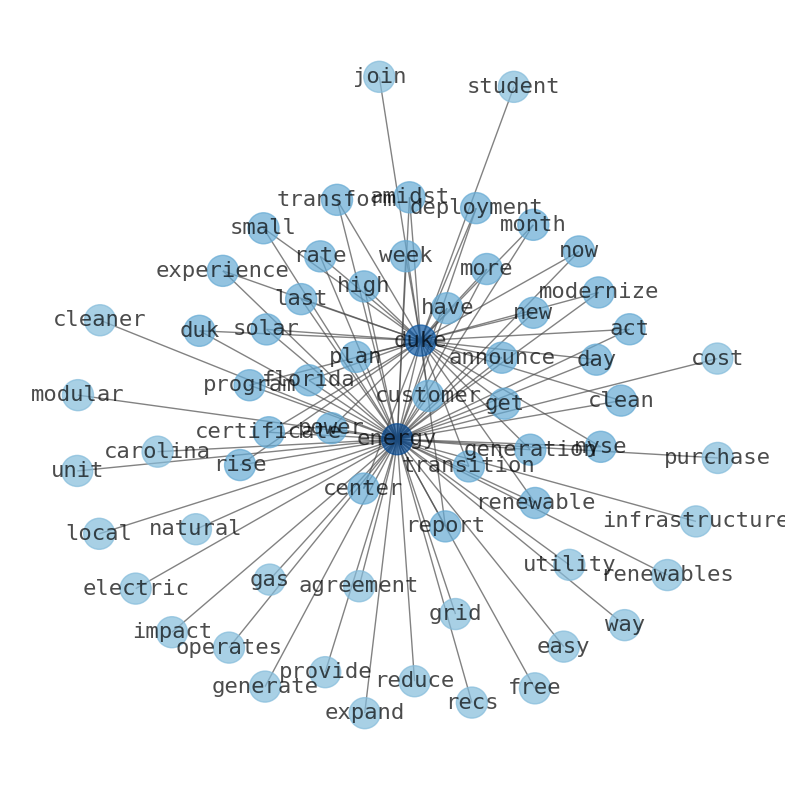

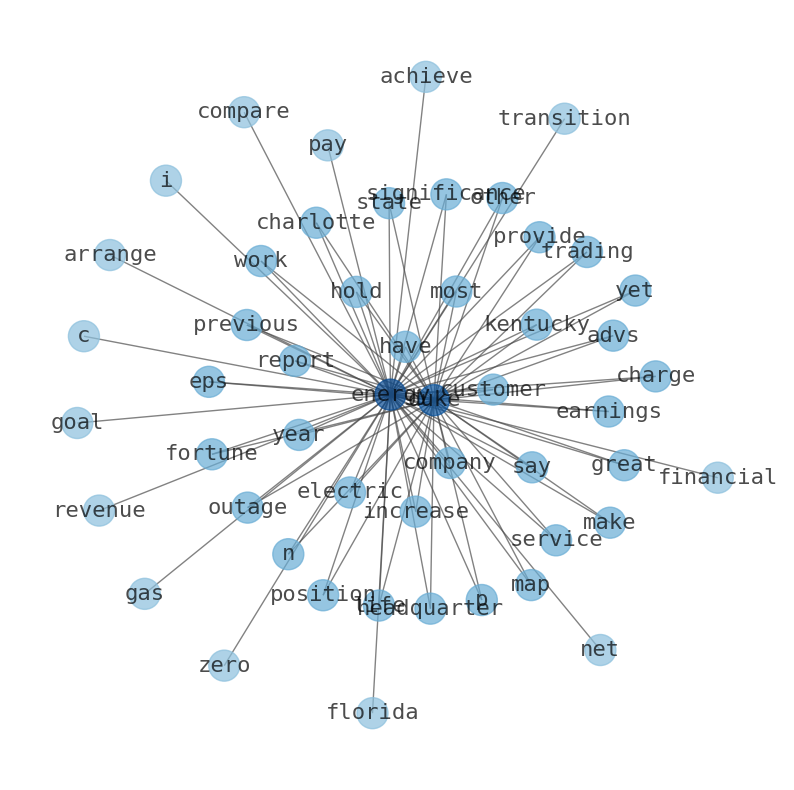

The game is changing. There is a new strategy to evaluate Duke Energy fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Duke Energy are: Duke, Energy, energy, North, year, company, stock, and the most common words in the summary are: energy, duke, stock, news, customer, carolina, power, . One of the sentences in the summary was: Duke Energy ( NYSE:DUK ) is believed to be modestly undervalued. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #energy #duke #stock #news #customer #carolina #power.

Read more →Related Results

Duke Energy

Open: 92.07 Close: 91.88 Change: -0.19

Read more →

Duke Energy

Open: 95.69 Close: 95.53 Change: -0.16

Read more →

Duke Energy

Open: 94.45 Close: 94.39 Change: -0.06

Read more →

Duke Energy

Open: 92.2 Close: 92.64 Change: 0.44

Read more →

Duke Energy

Open: 87.64 Close: 88.82 Change: 1.18

Read more →

Duke Energy

Open: 95.34 Close: 95.18 Change: -0.16

Read more →

Duke Energy

Open: 88.2 Close: 89.42 Change: 1.22

Read more →

Duke Energy

Open: 90.2 Close: 90.58 Change: 0.38

Read more →

Duke Energy

Open: 90.84 Close: 90.7 Change: -0.14

Read more →

Duke Energy

Open: 93.09 Close: 93.01 Change: -0.08

Read more →

Duke Energy

Open: 89.93 Close: 90.88 Change: 0.95

Read more →

Duke Energy

Open: 91.2 Close: 90.16 Change: -1.04

Read more →

Duke Energy

Open: 91.74 Close: 91.14 Change: -0.6

Read more →

Duke Energy

Open: 91.3 Close: 90.83 Change: -0.47

Read more →

Duke Energy

Open: 93.26 Close: 92.51 Change: -0.75

Read more →

Duke Energy

Open: 97.72 Close: 98.05 Change: 0.33

Read more →

Duke Energy

Open: 92.26 Close: 91.69 Change: -0.57

Read more →

Duke Energy

Open: 96.3 Close: 95.56 Change: -0.74

Read more →

Duke Energy

Open: 93.9 Close: 94.46 Change: 0.56

Read more →

Duke Energy

Open: 89.2 Close: 89.54 Change: 0.34

Read more →

Duke Energy

Open: 88.94 Close: 88.68 Change: -0.26

Read more →

Duke Energy

Open: 88.2 Close: 89.4 Change: 1.2

Read more →

Duke Energy

Open: 90.0 Close: 90.46 Change: 0.46

Read more →

Duke Energy

Open: 90.51 Close: 91.2 Change: 0.69

Read more →

Duke Energy

Open: 90.73 Close: 89.42 Change: -1.31

Read more →

Duke Energy

Open: 93.09 Close: 93.01 Change: -0.08

Read more →

Duke Energy

Open: 90.02 Close: 89.77 Change: -0.25

Read more →

Duke Energy

Open: 92.18 Close: 92.18 Change: 0.0

Read more →

Duke Energy

Open: 91.3 Close: 92.0 Change: 0.7

Read more →

Duke Energy

Open: 88.71 Close: 87.99 Change: -0.72

Read more →

Duke Energy

Open: 93.26 Close: 92.51 Change: -0.75

Read more →

Duke Energy

Open: 99.0 Close: 98.35 Change: -0.65

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo