The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Danaher

Youtube Subscribe

Open: 225.54 Close: 224.58 Change: -0.96

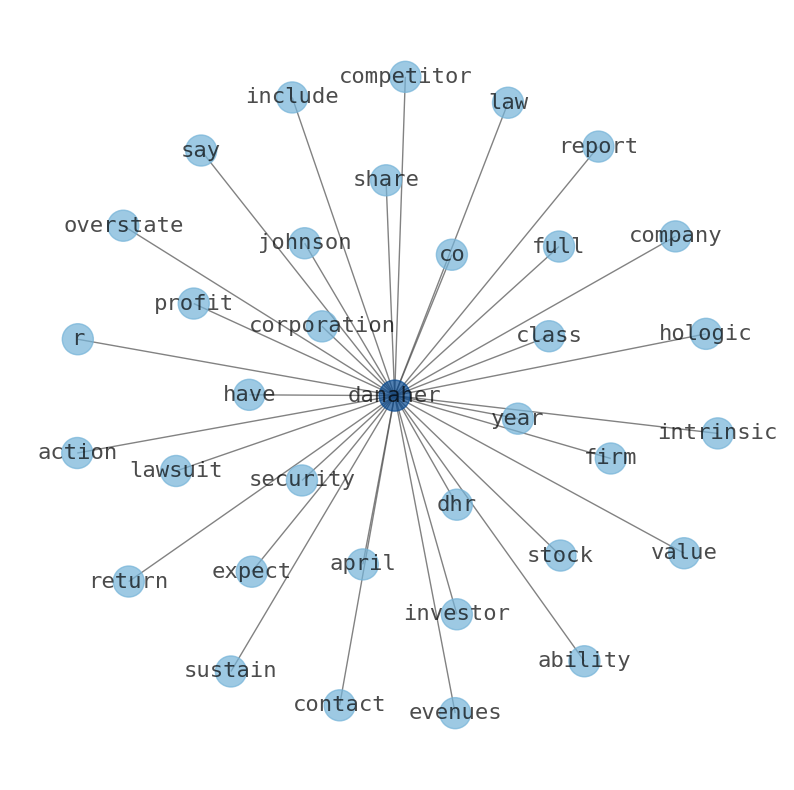

16 risks of investing in Danaher Stock found by an AI after reading the whole internet.

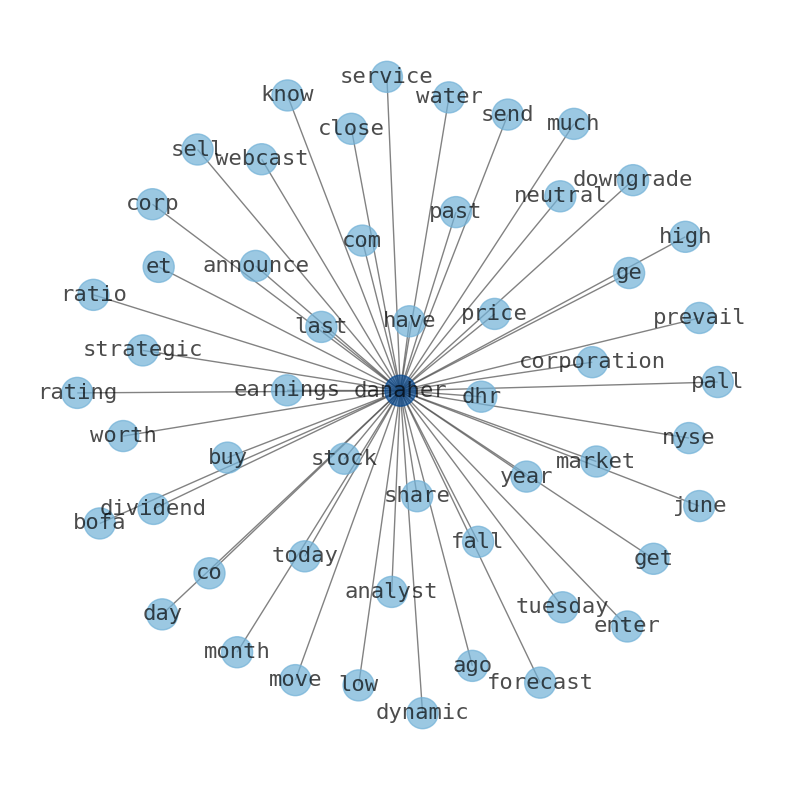

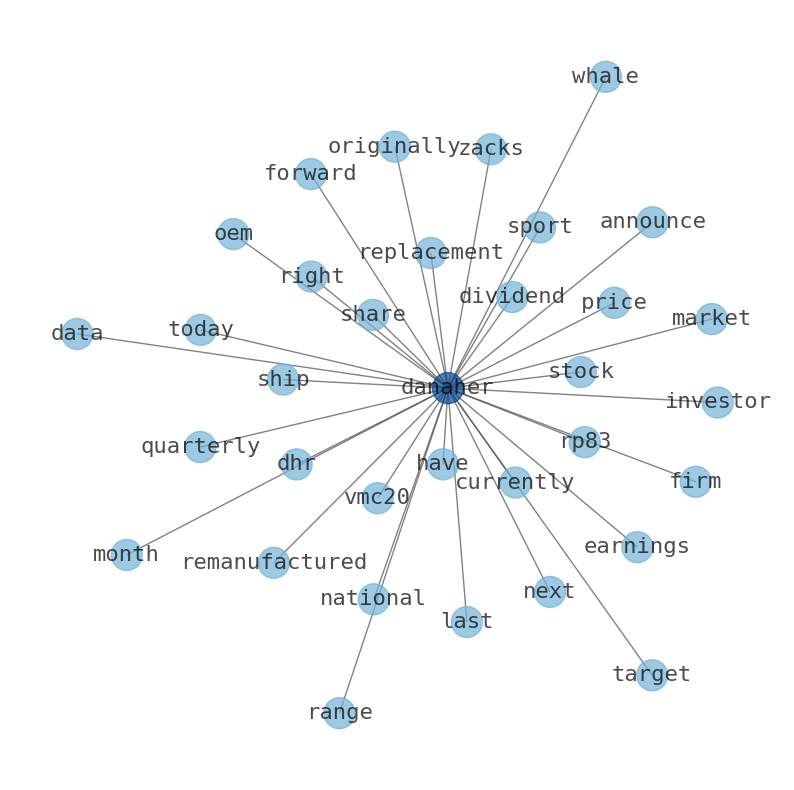

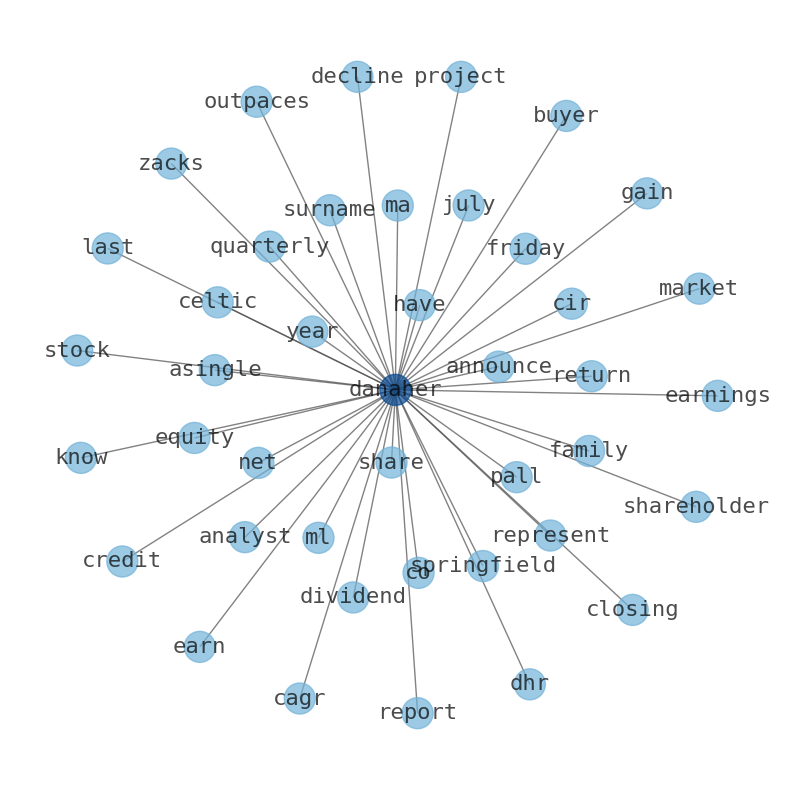

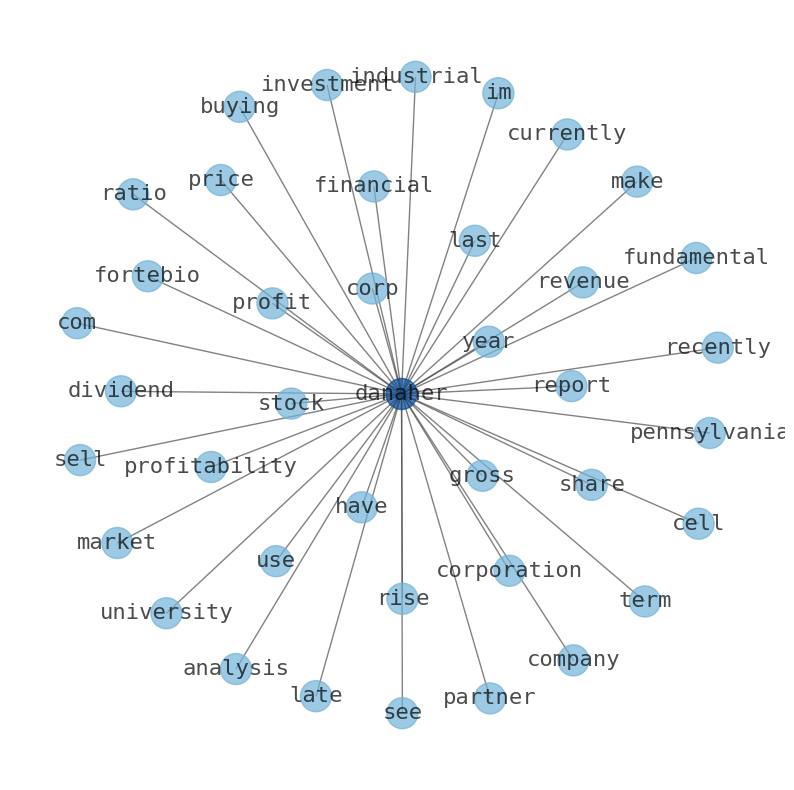

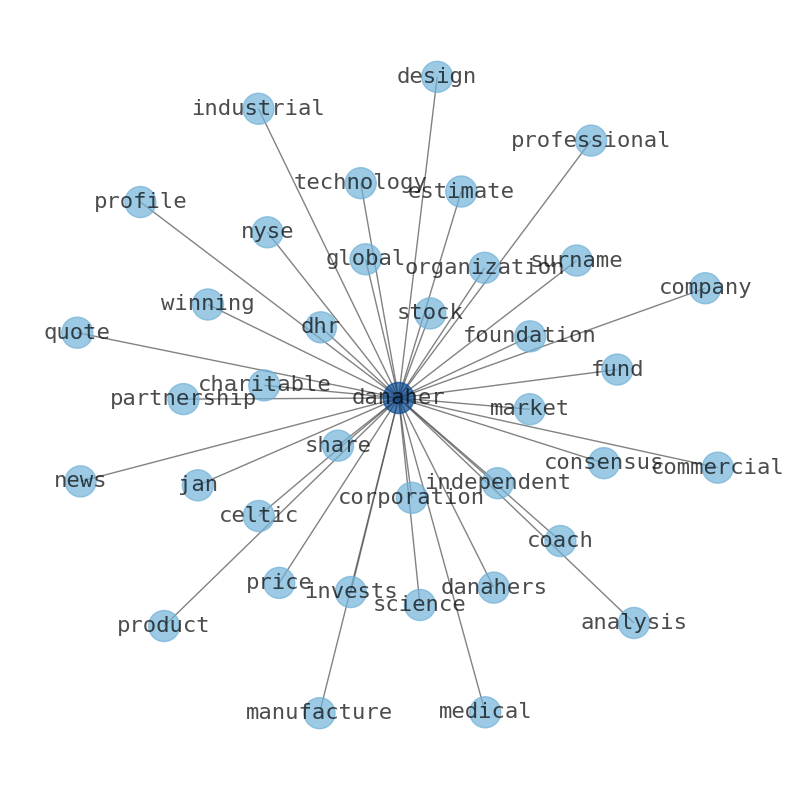

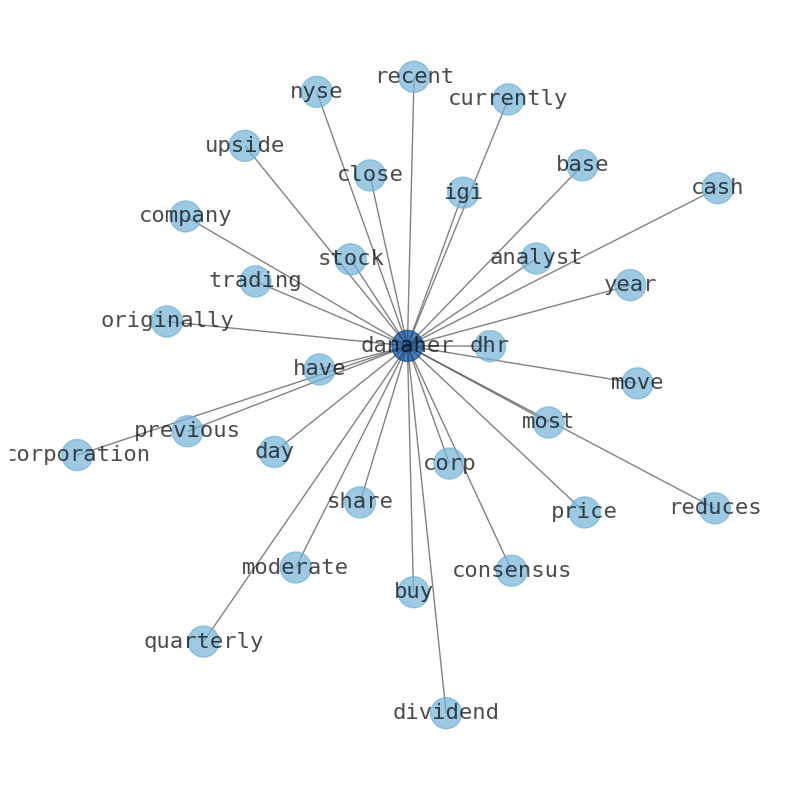

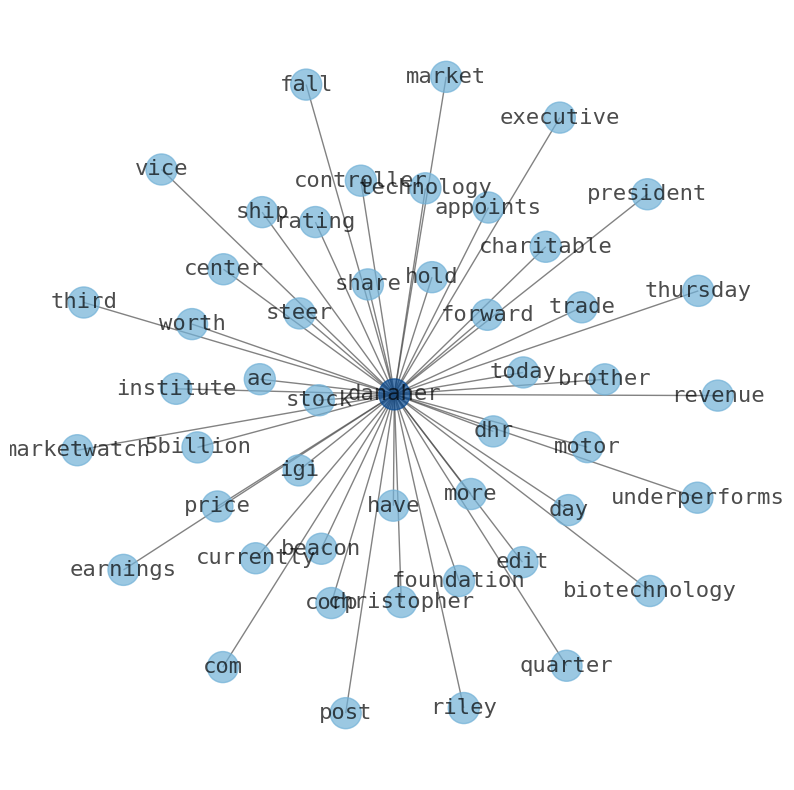

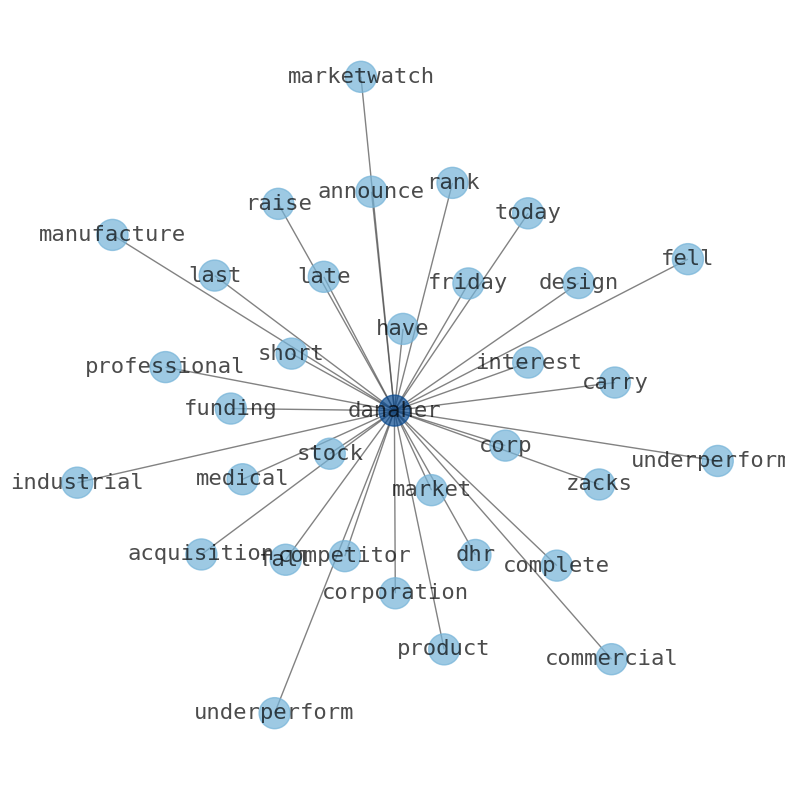

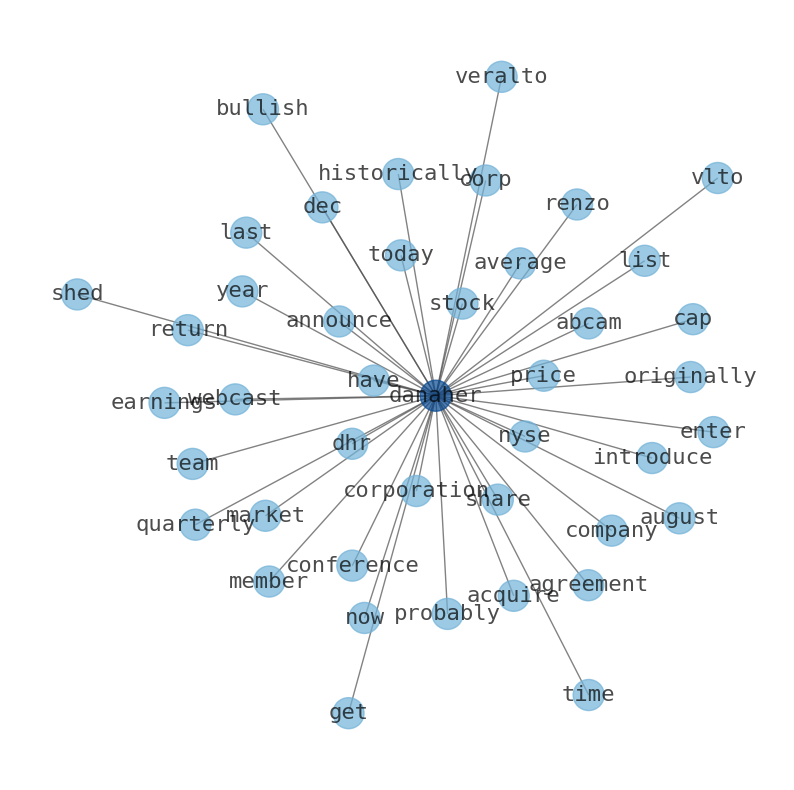

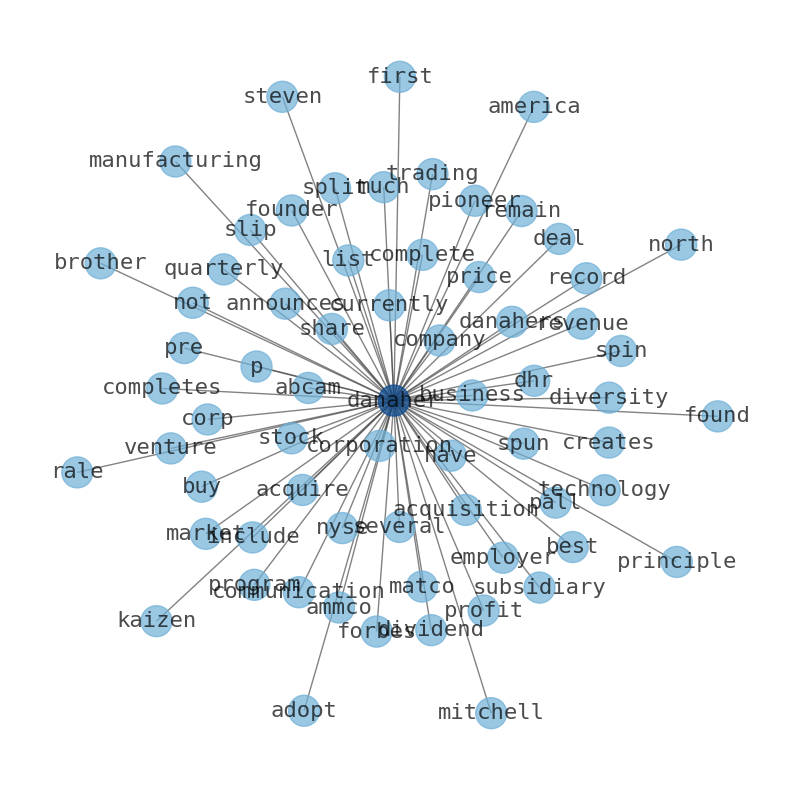

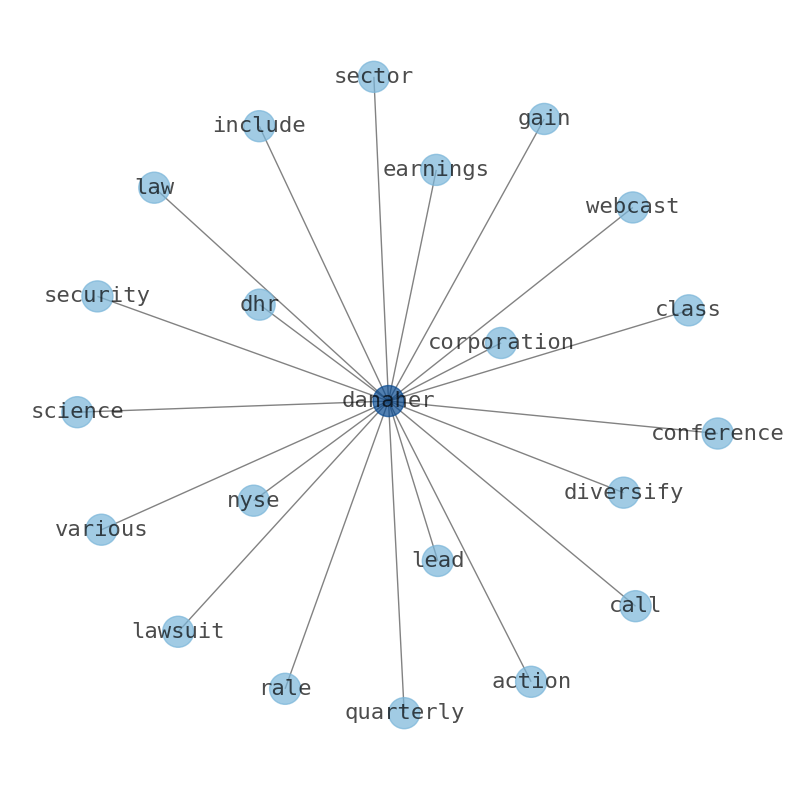

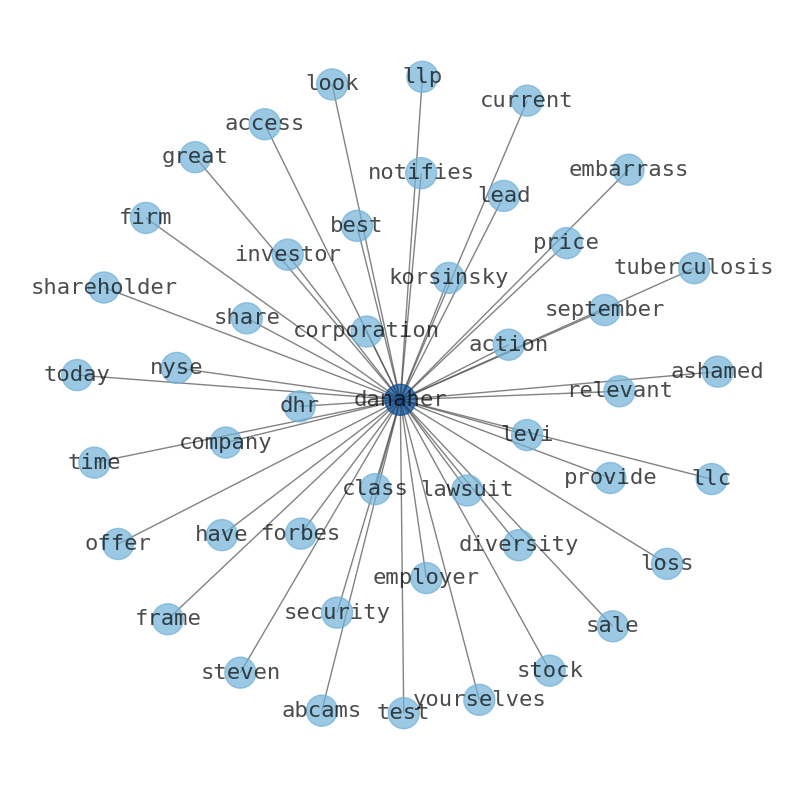

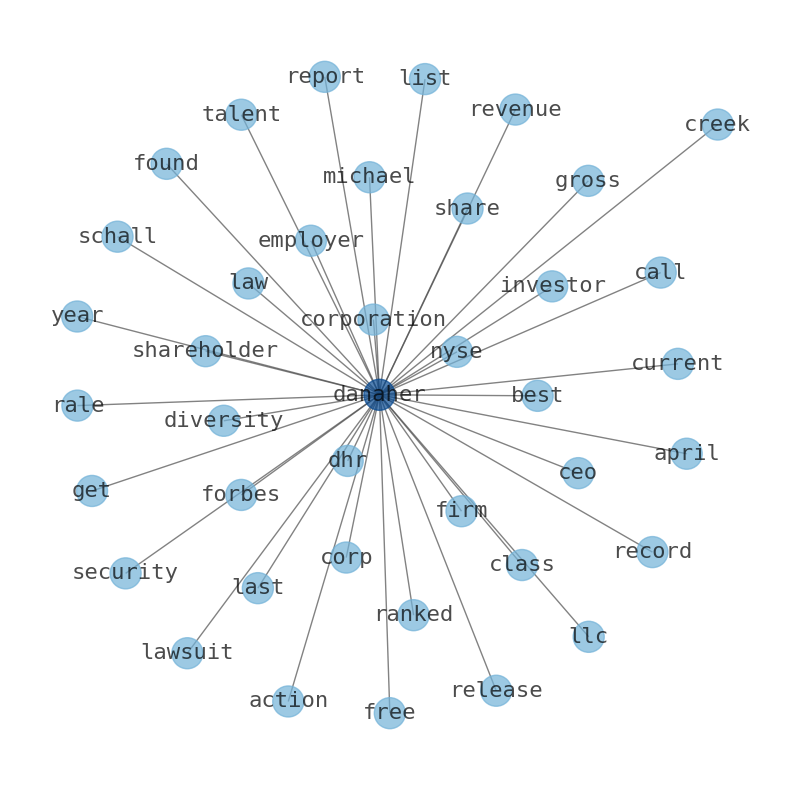

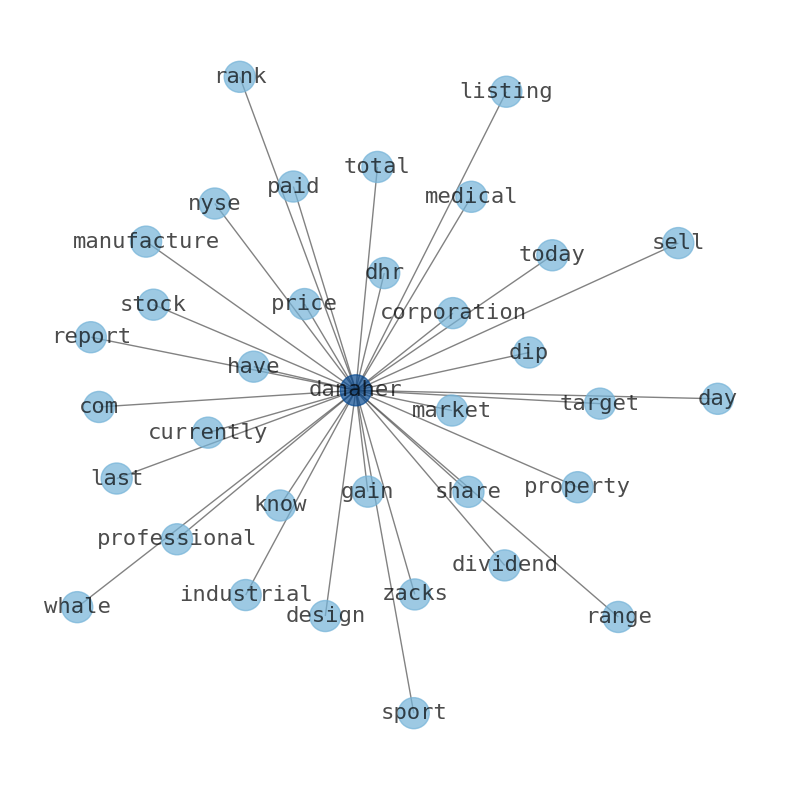

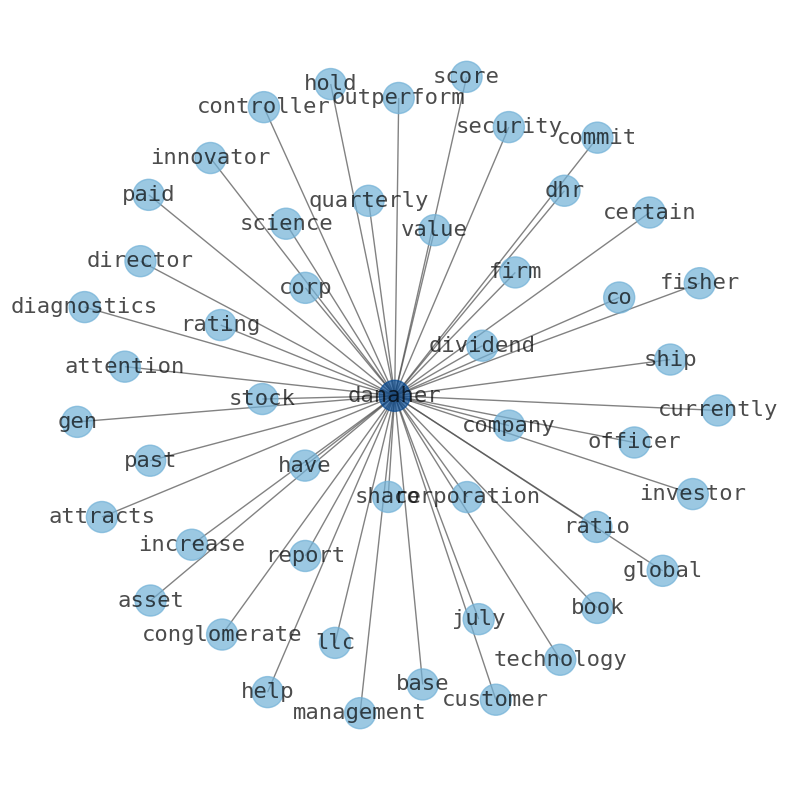

Are looking for the most relevant information about Danaher? Investor spend a lot of time searching for information to make investment decisions in Danaher. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Danaher are: Danaher, share, last, quarter, earnings, DHR, Abcam, and the most common words in the summary are: danaher, job, stock, curtis, model, best, market, . One of the sentences in the summary was: Danaher spun off its industrial technologies, measurement and petroleum businesses into Fortive Corporation.. Other …

Stock Summary

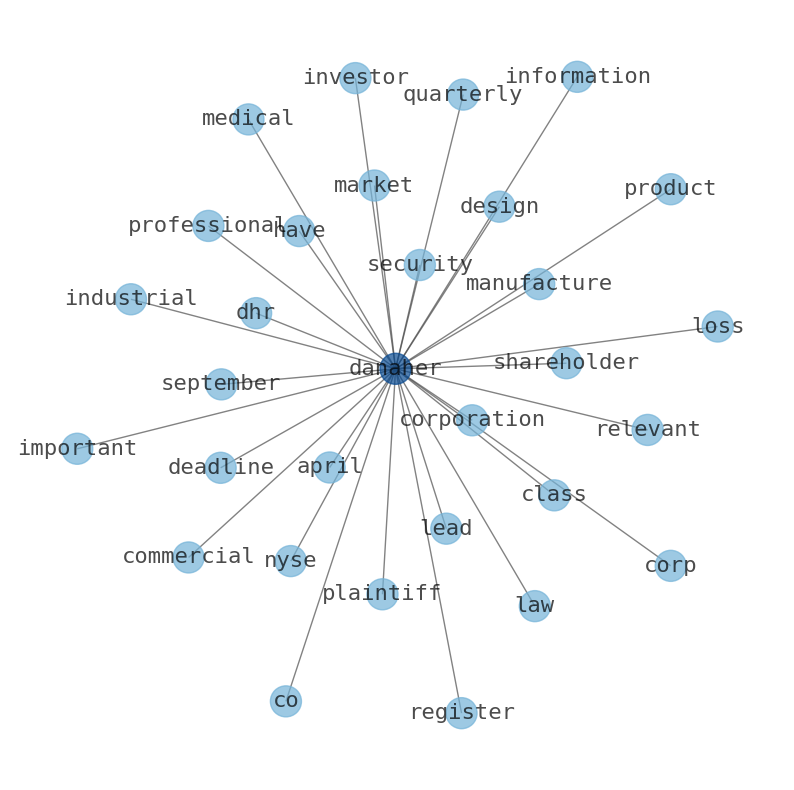

Danaher Corporation designs, manufactures, and markets professional, medical, industrial, and commercial products. The Life Sciences segment provides mass spectrometers, flow cytometry, genomics, lab automation, centrifugation, particle counting and characterization.

Today's Summary

Danaher Corp. per Employee $365.01K P/E Ratio 28.42 EPS $7.90 Yield 0.43% Dividend $0.27 Ex-Dividend date Oct 11, 2023. Danaher spun off its industrial technologies, measurement and petroleum businesses into Fortive Corporation.

Today's News

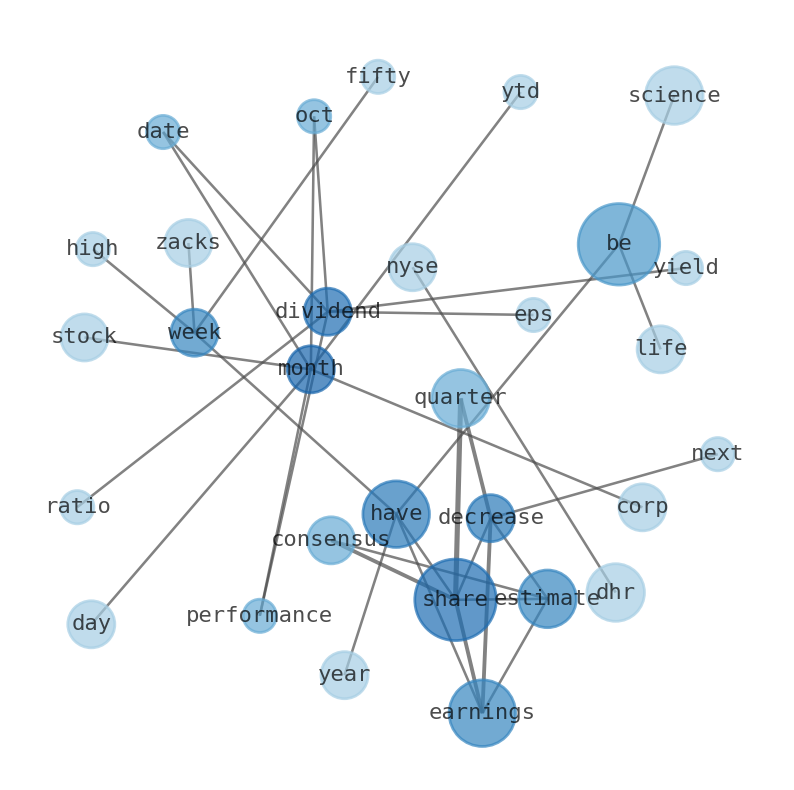

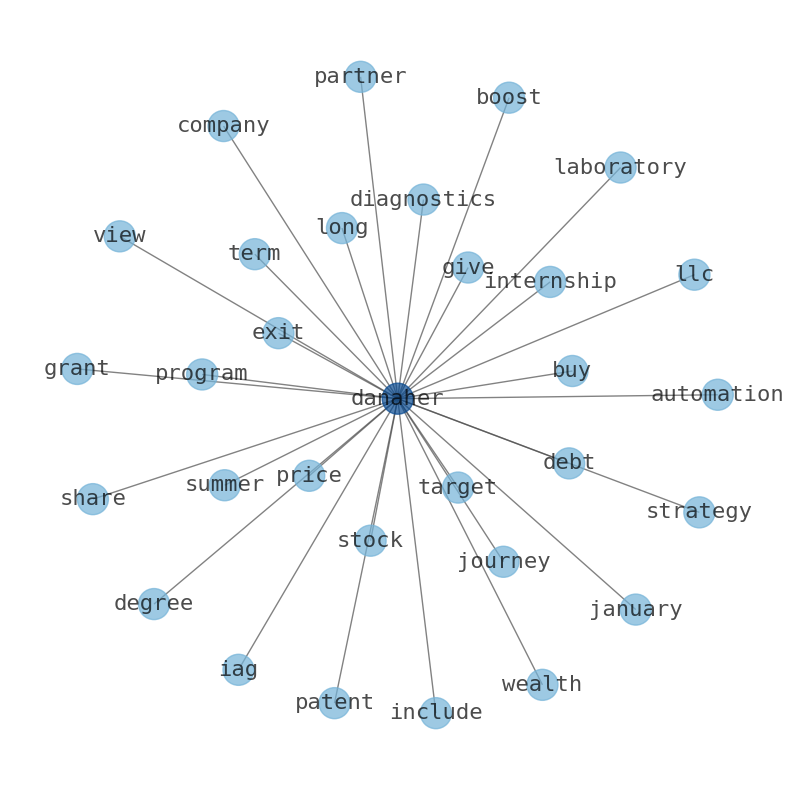

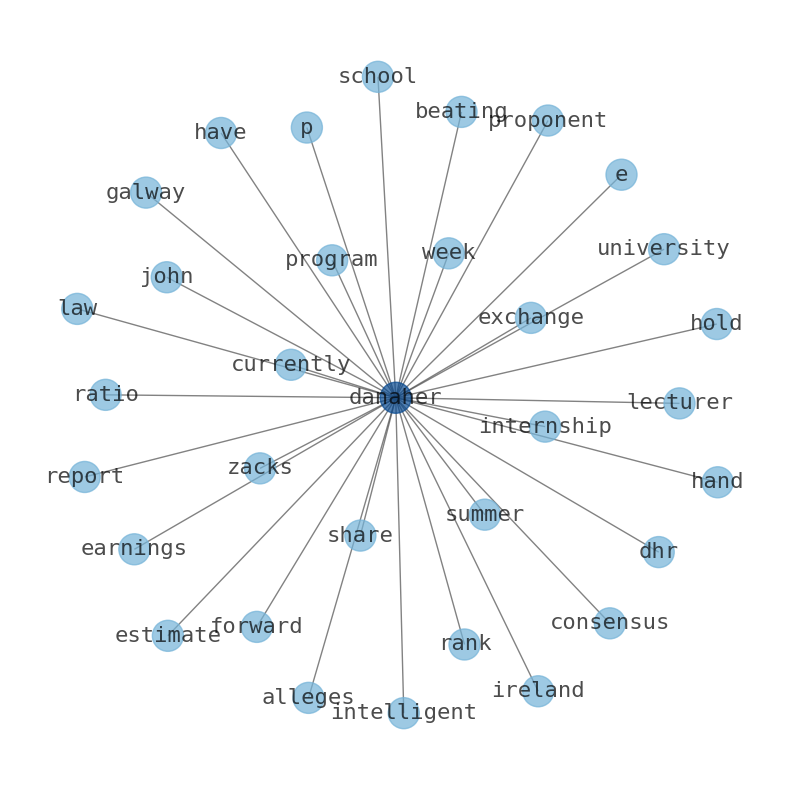

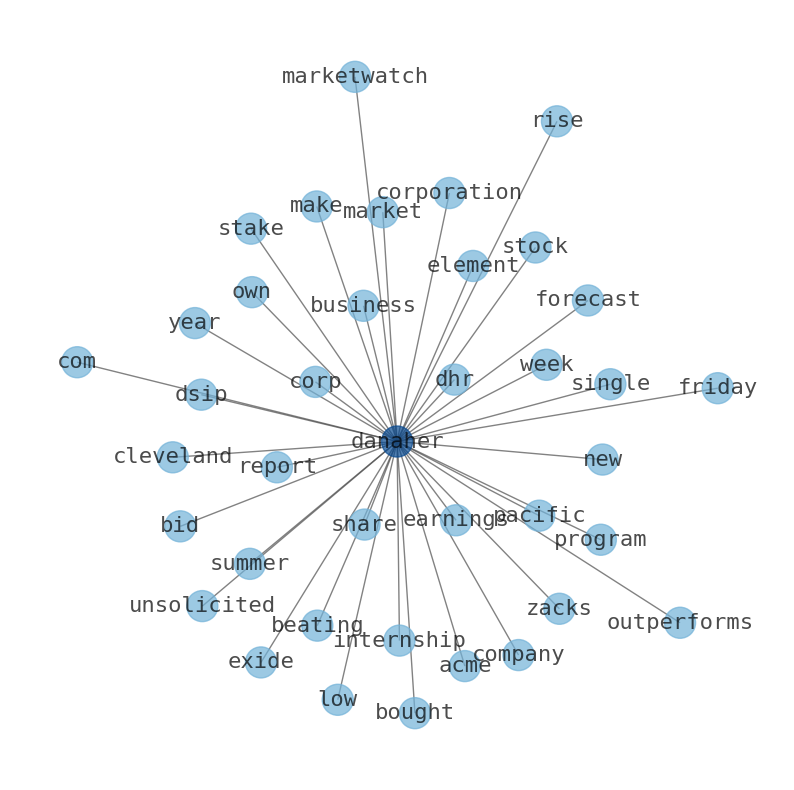

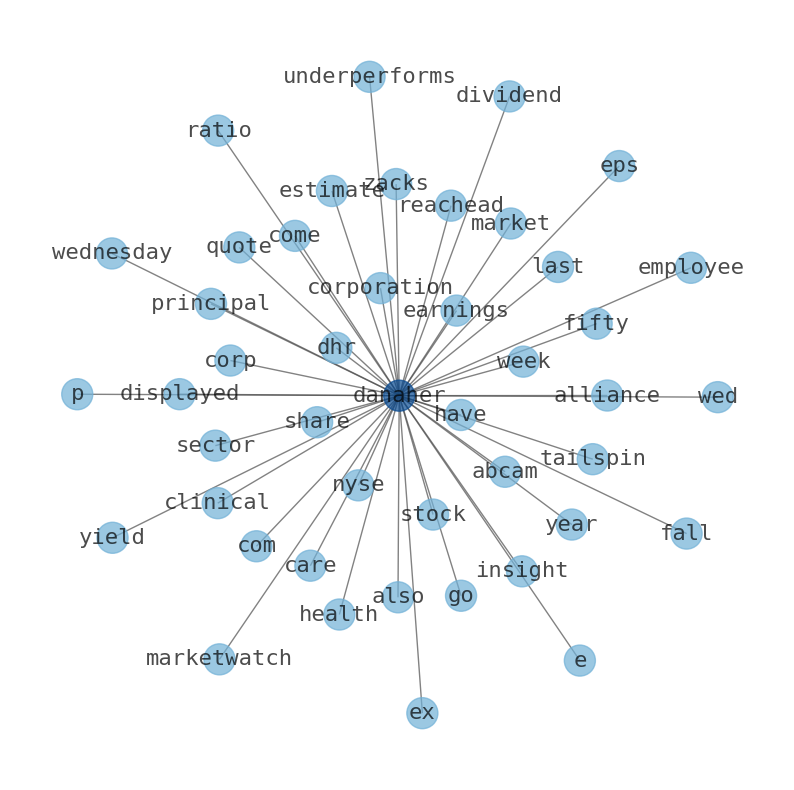

Danaher Corp. per Employee $365.01K P/E Ratio 28.42 EPS $7.90 Yield 0.43% Dividend $0.27 Ex-Dividend date Oct 11, 2023. Performance 5 Day -1.48% 1 Month -2.50% 3 Month 8.34% YTD -2 Danaher Corp. stock falls wed Wednesday, underperforms market - marketwatch.com. For the last reported quarter, Danaher came out with earnings of $2.02 per share versus the Zacks Consensus Estimate of $1.83 per share, representing a surprise of 10.38%. Danaher currently has an Earnings ESP of +0.19%. Analysts estimate an earnings decrease this quarter of $0.02 per share, a decrease next quarter of$0.00 per share. The consensus estimate for Danaher full-year earnings is $8.30 per share. Danaher has a fifty-two-week low of $182.09 and a 50-two week high of $247.62. Zacks Danaher (DHR) Rises As Market Takes a Dip: Key Facts Danaher reachead $226.75 at the closing of the latest trading day, reflecting a +0.67% change compared to its last close. In July 2016, Danaher spun off its industrial technologies, measurement and petroleum businesses into Fortive Corporation. Repair Service for Danaher ACS4808-350F01 AC Controller 83R09192A will include a complementary pick up from anywhere in USA (48 contiguous states) Danaher 24/80V VMC20-C1 Replaced w/83-83U03564A 83U03560A Danaher. Principal, clinical insights and alliances, diagnostics platform job in new york, united states of america | science jobs at danaher.com. Danaher Corporation NYSE: DHR shares went into a tailspin when the Abcam deal came into question, but the dip turned out to be a buying opportunity in this life-sciences company. Leading independent proxy advisor Glass Lewis recommended Abcam shareholders vote “FOR” Danaher Corporations Proposed Acquisition of Abcam. Danaher is in the Health Care sector and Life Sciences Tools & Services industry. There is no upcoming split for Danaher. Danaher stock quotes can also be displayed as NYSE : DHR. If you had invested in Danaher at $7.89 in 1997, your return over the last 26 years would have been 2,746.03%.

Stock Profile

"Danaher Corporation designs, manufactures, and markets professional, medical, industrial, and commercial products and services worldwide. The Biotechnology segments offers bioprocess technologies, consumables, and services; lab filtration, separation, and purification; lab-scale protein purification and analytical tools; reagents, membranes and services; and healthcare filtration solutions. The Life Sciences segment provides mass spectrometers; flow cytometry, genomics, lab automation, centrifugation, particle counting and characterization; microscopes; genomics consumables; and Gene and Cell Therapy to the pharmaceutical and biopharmaceutical, food and beverage, medical, and life sciences companies, as well as universities, medical schools and research institutions, and various industrial manufacturers. The Diagnostics segment provides chemistry, immunoassay, microbiology, and automation systems, as well as hematology, molecular, acute care, and pathology diagnostics products. This segment offers clinical instruments, reagents, consumables, software, and services for hospitals, physicians' offices, reference laboratories, and other critical care settings. The Environmental & Applied Solutions segment offers instrumentation, consumables, software, services, and disinfection systems to analyze, treat, and manage ultra-pure, potable, industrial, waste, ground, source, and ocean water in residential, commercial, municipal, industrial, and natural resource applications. It also provides instruments, software, services, and consumables for various color and appearance management, packaging design and quality management, packaging converting, printing, marking, coding, and traceability applications for consumer, pharmaceutical, and industrial products. The company was formerly known as Diversified Mortgage Investors, Inc. and changed its name to Danaher Corporation in 1984. The company was founded in 1969 and is headquartered in Washington, the District of Columbia."

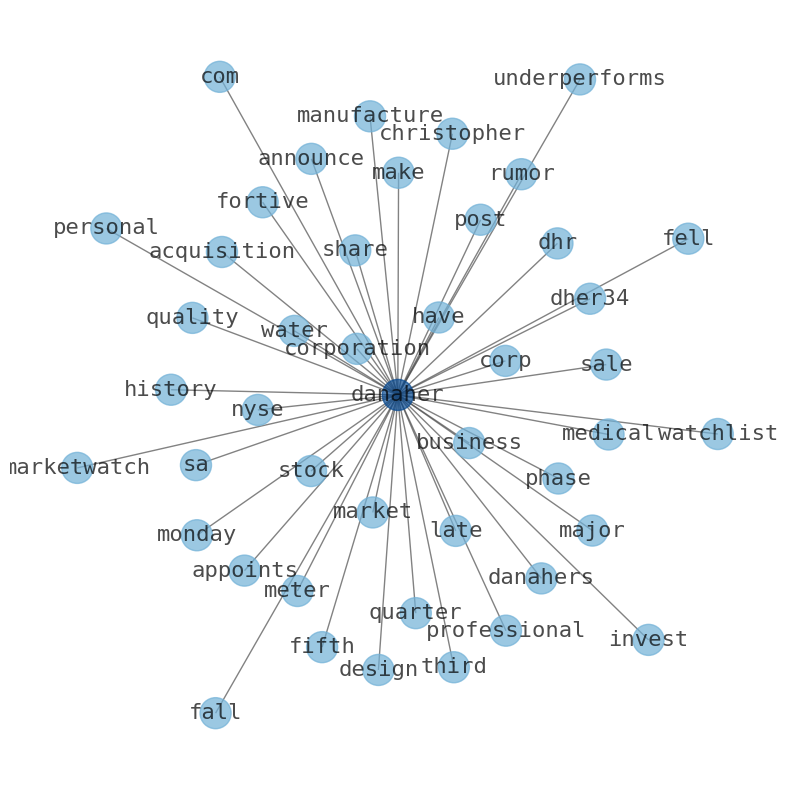

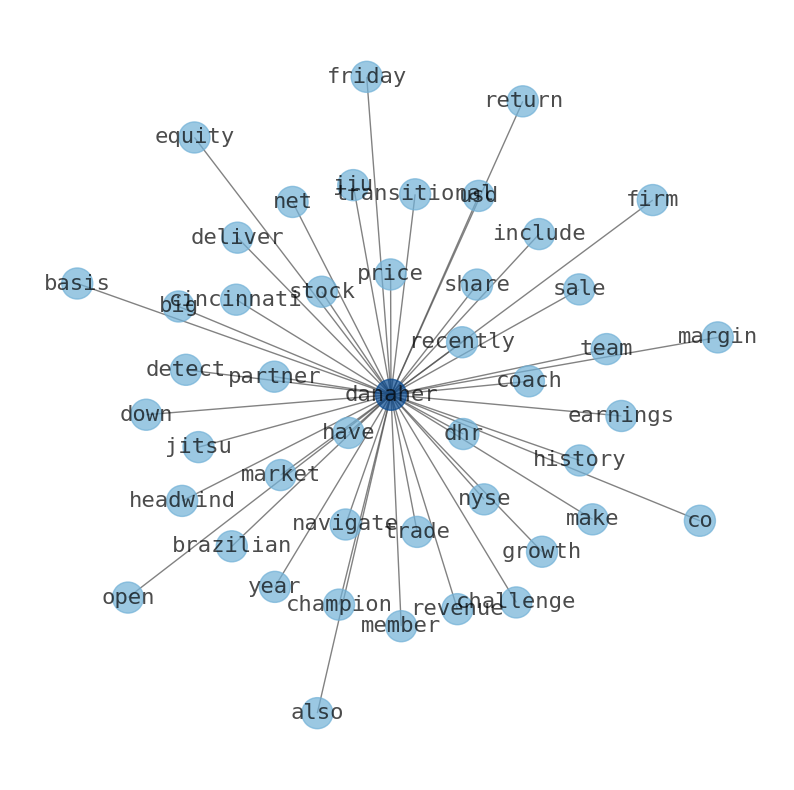

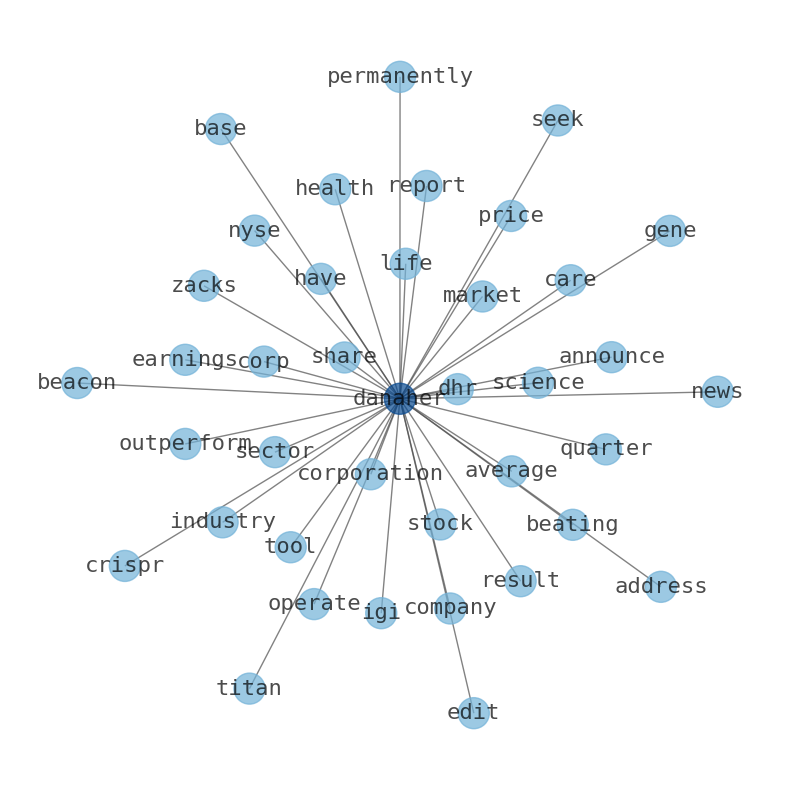

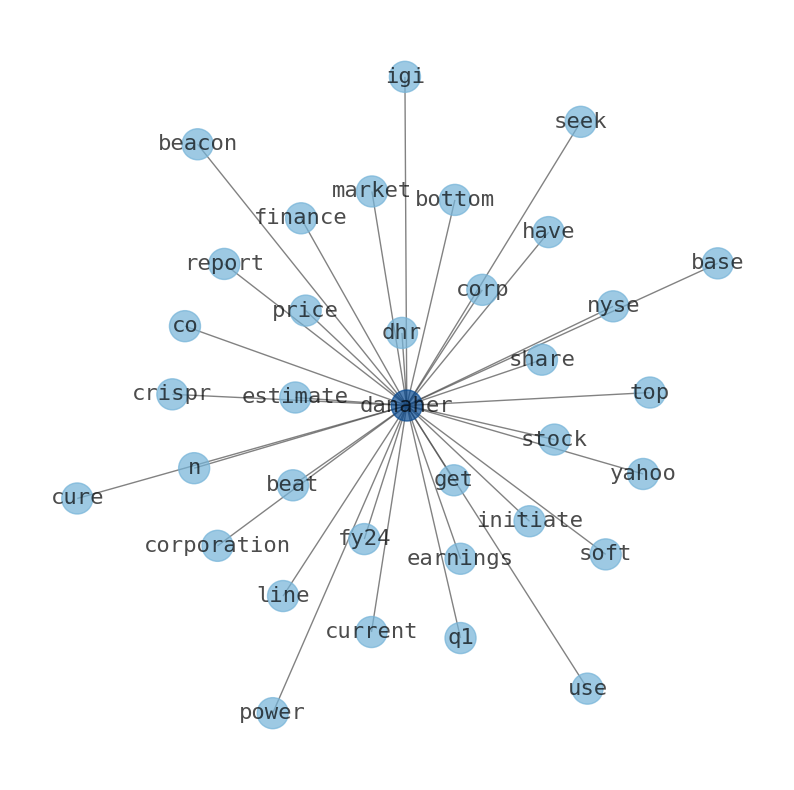

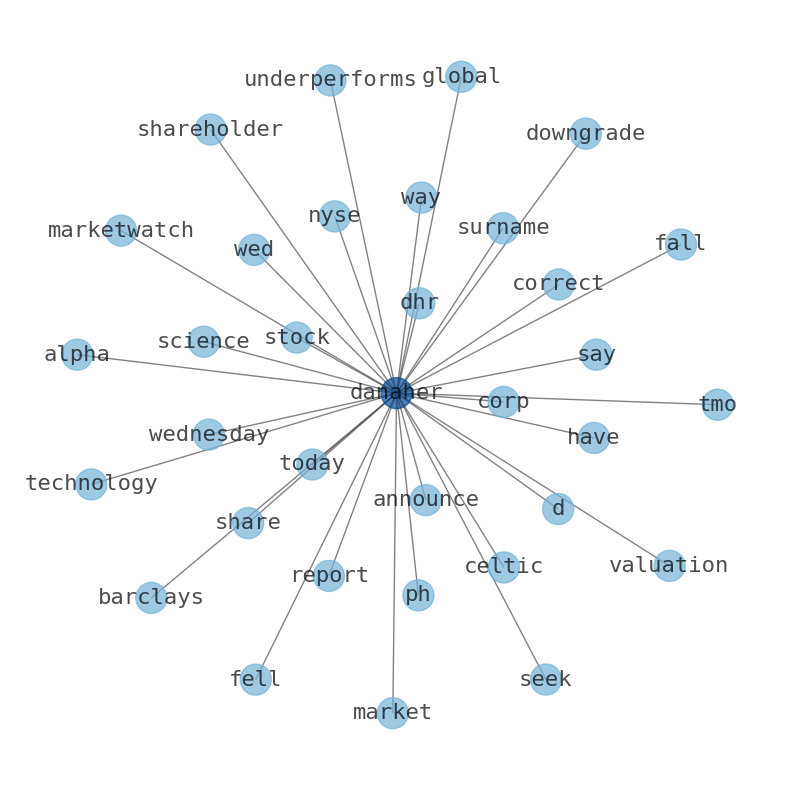

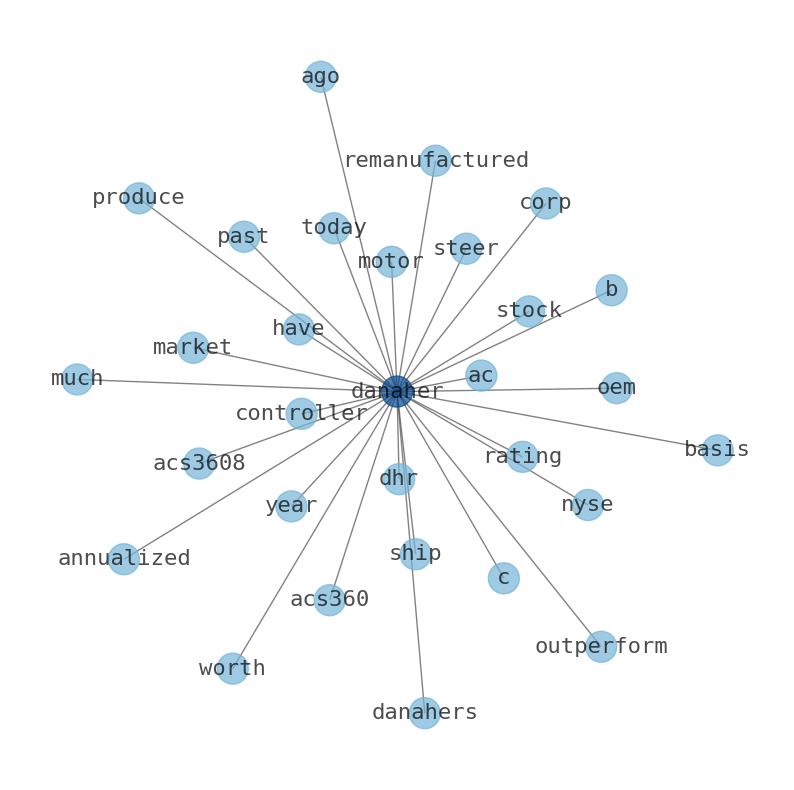

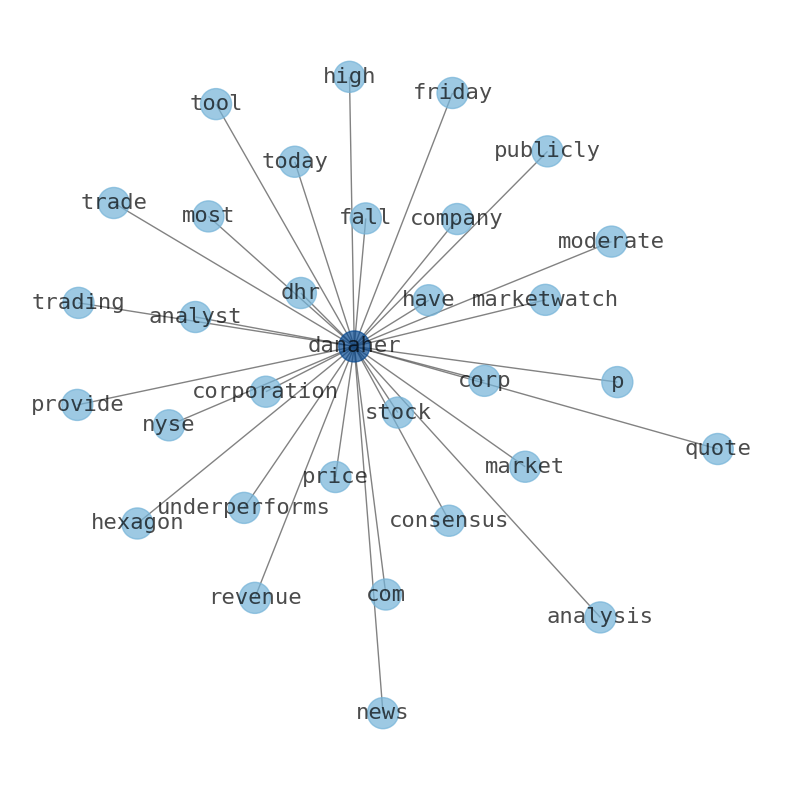

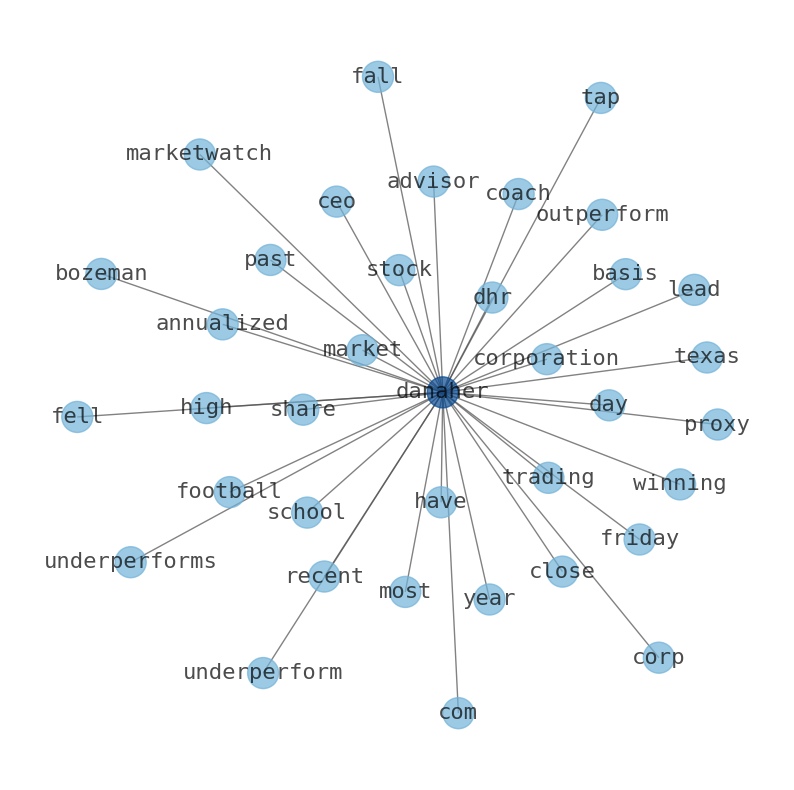

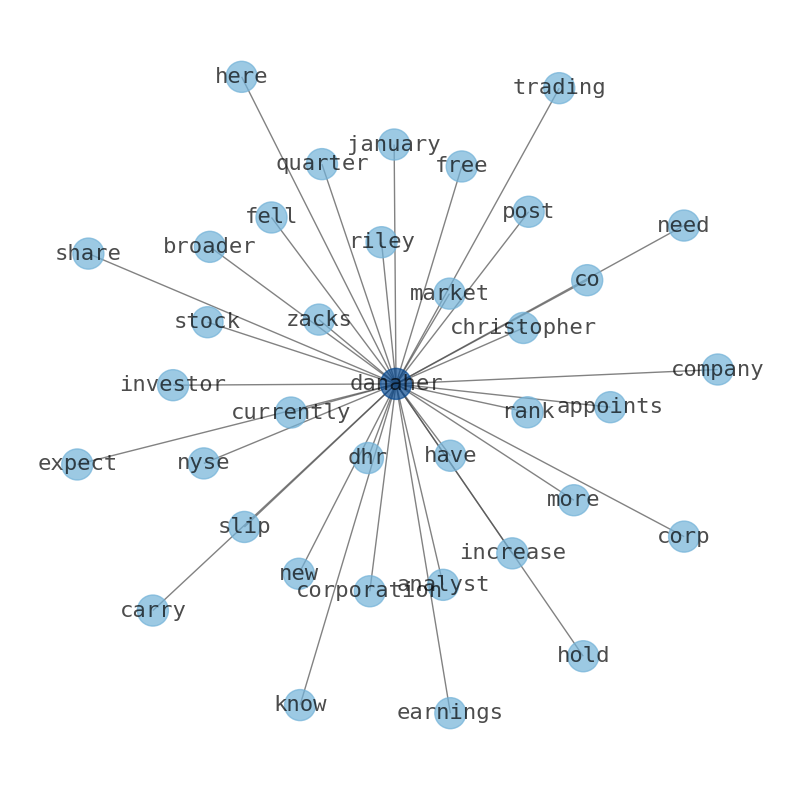

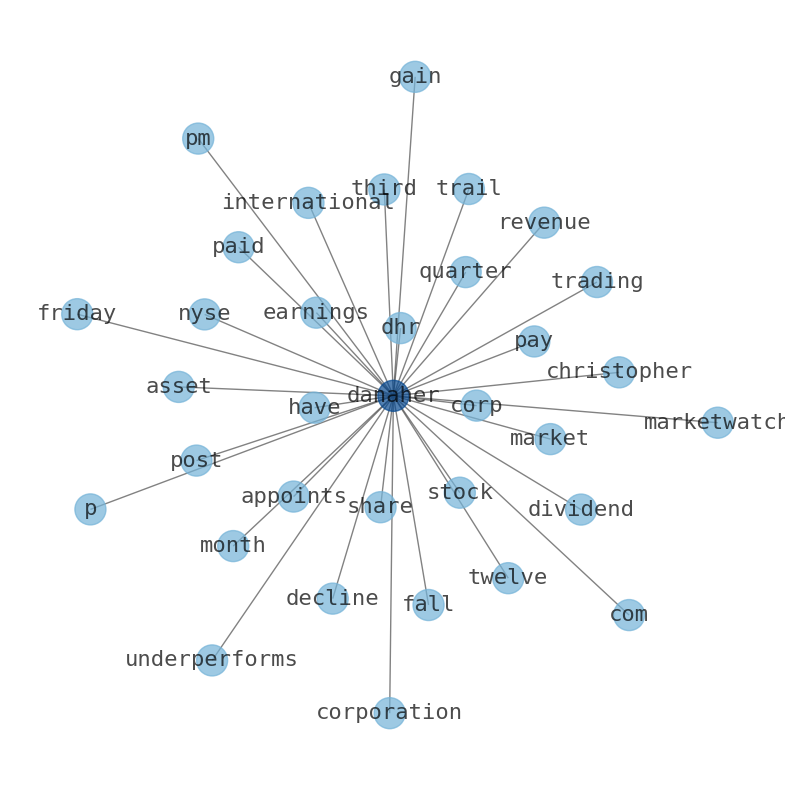

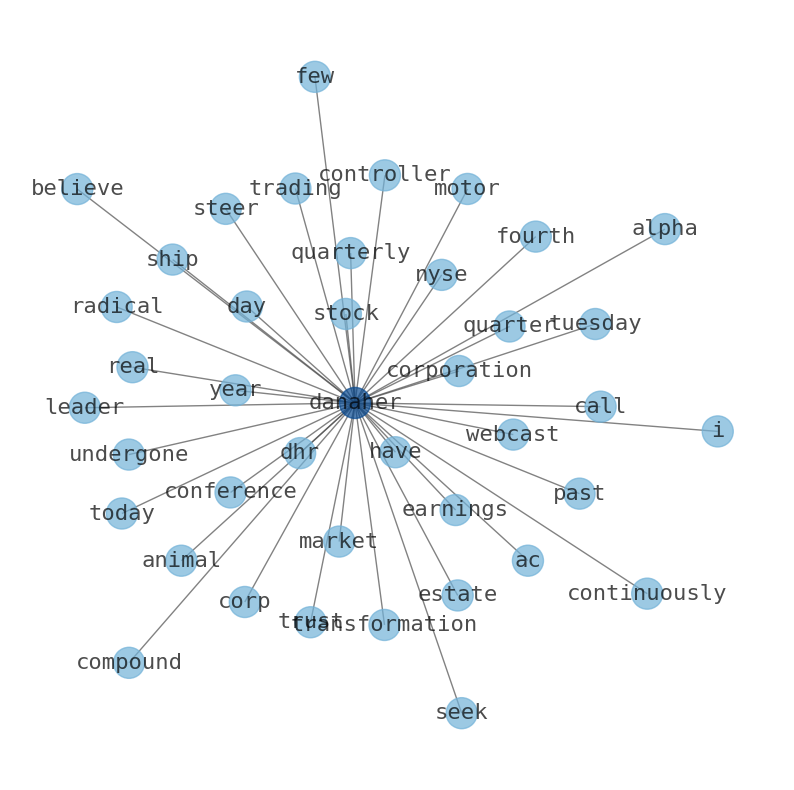

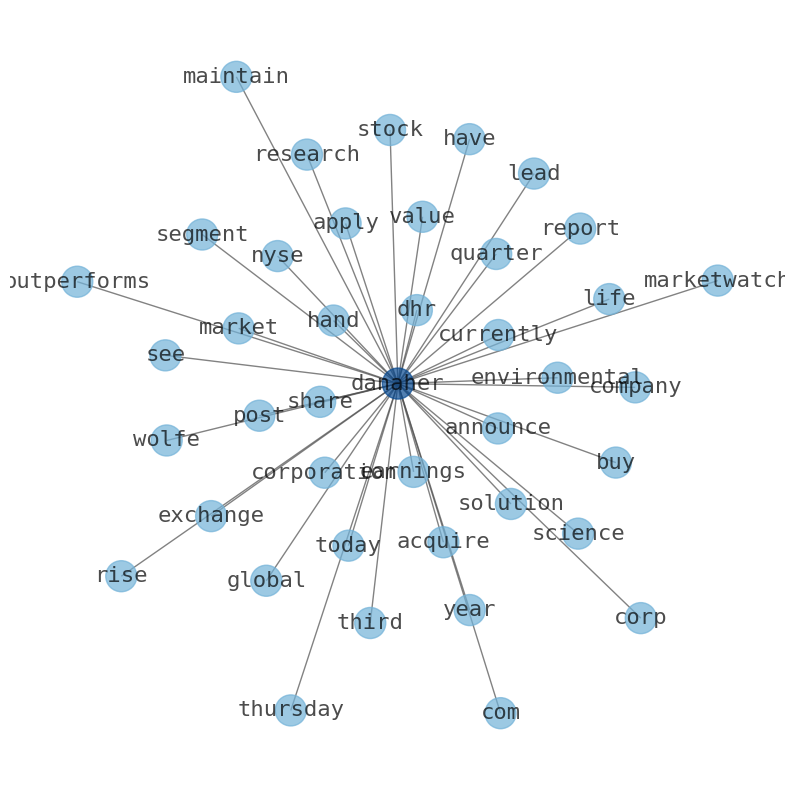

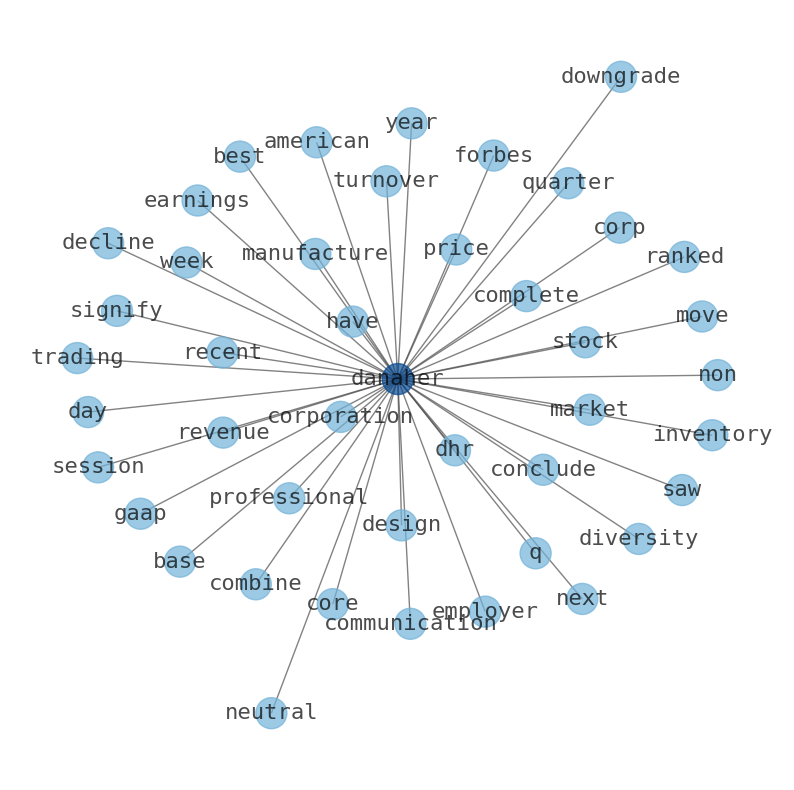

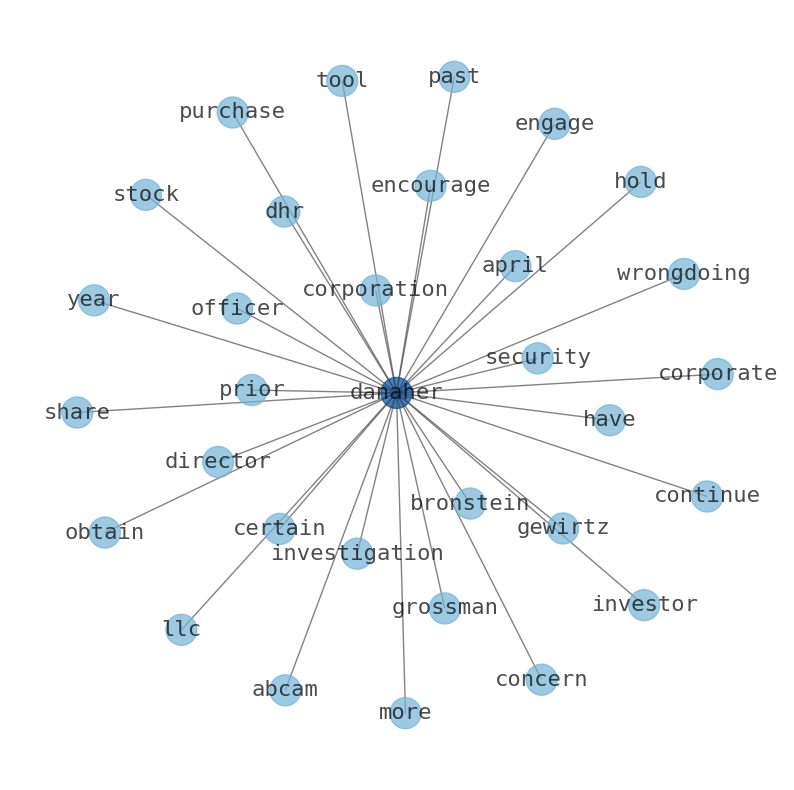

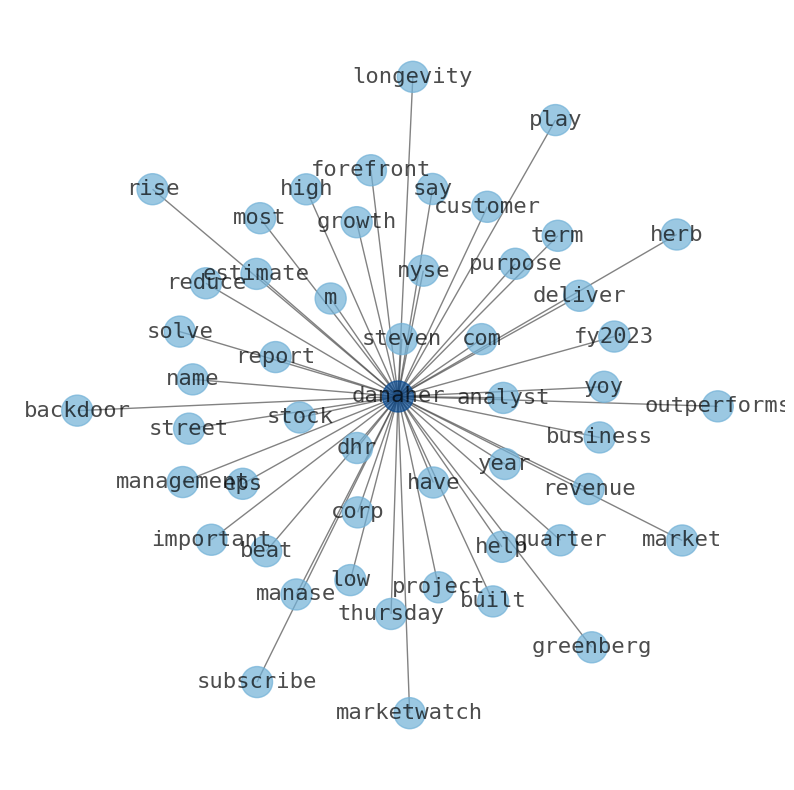

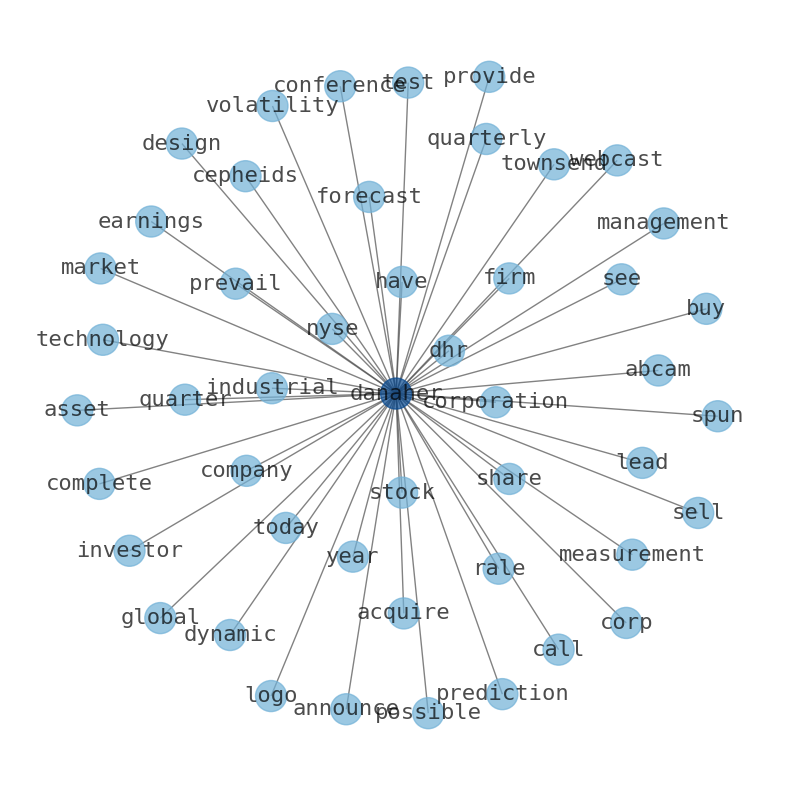

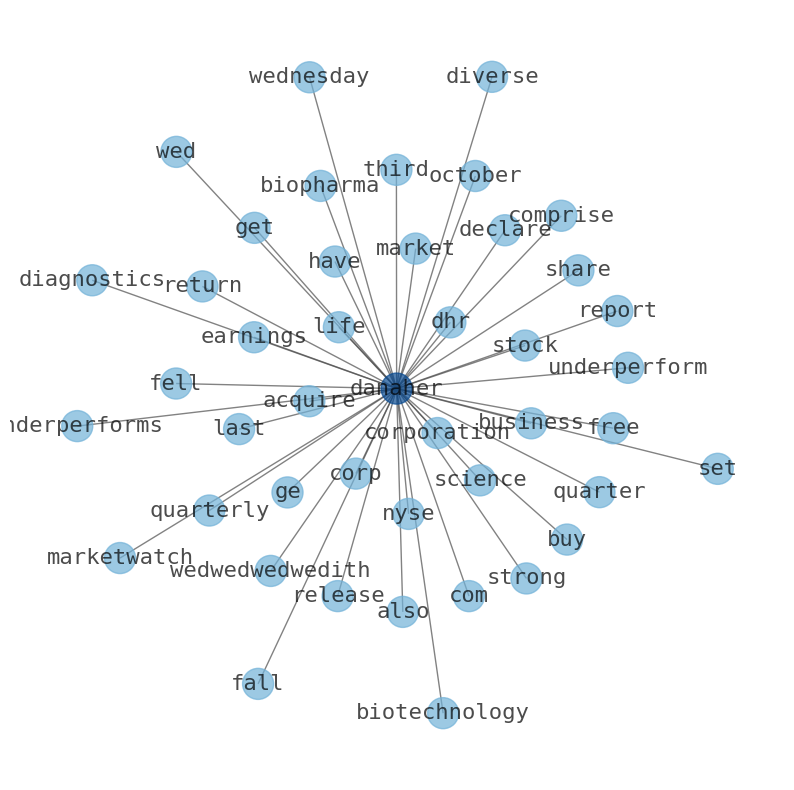

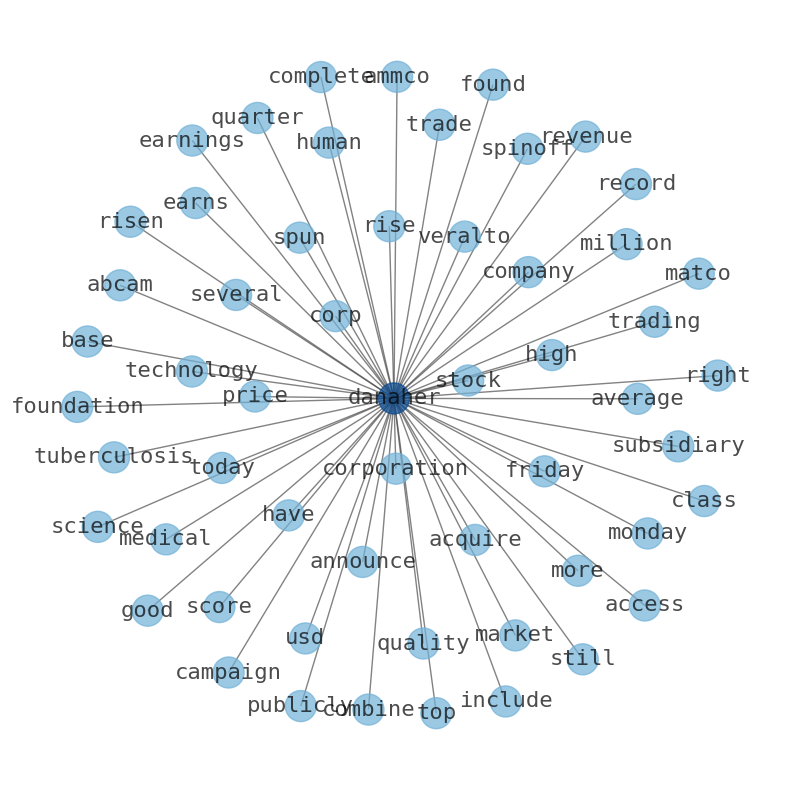

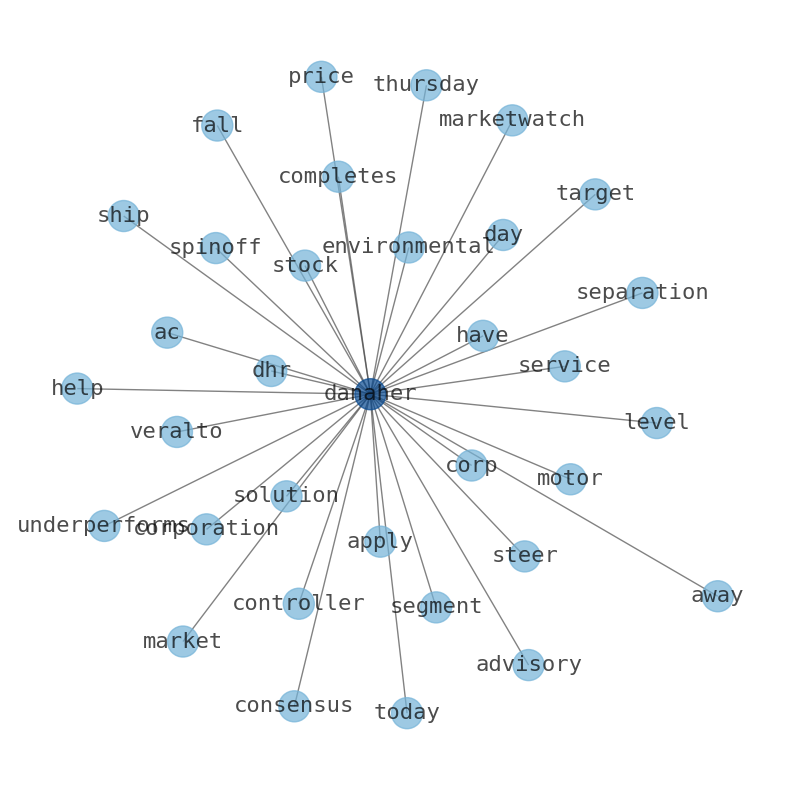

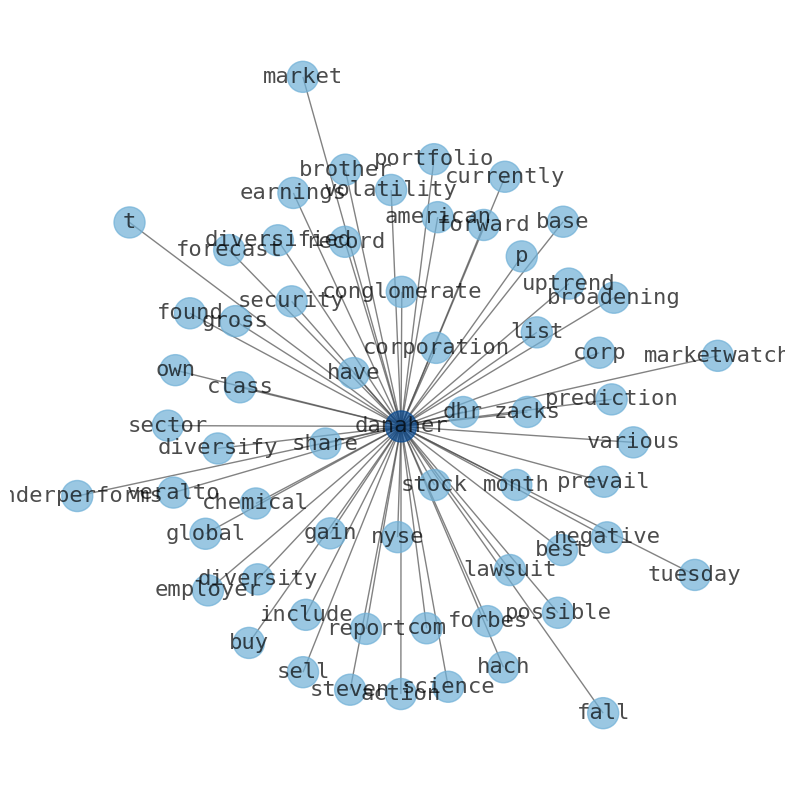

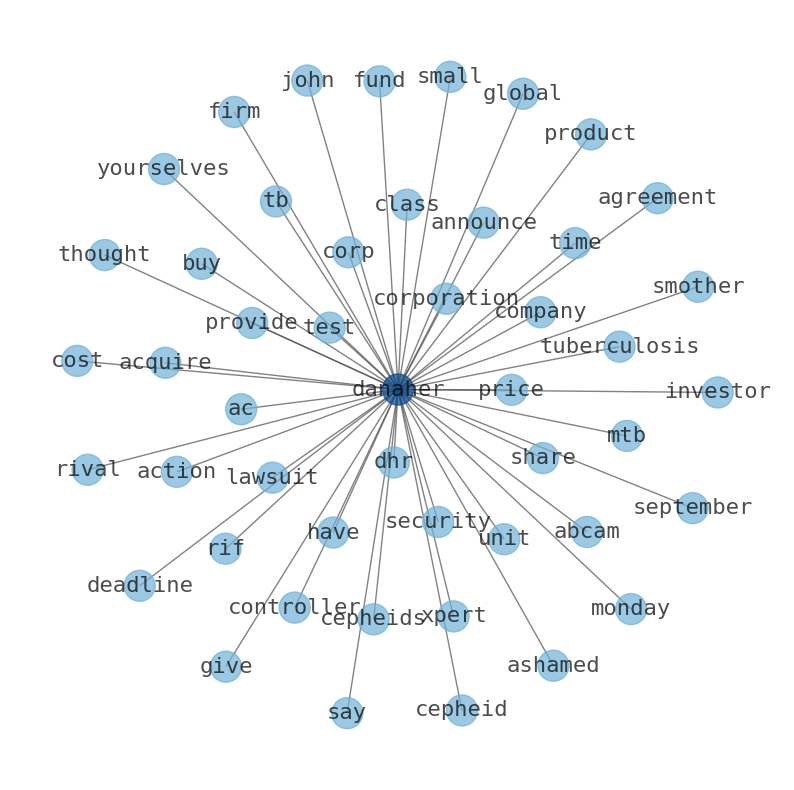

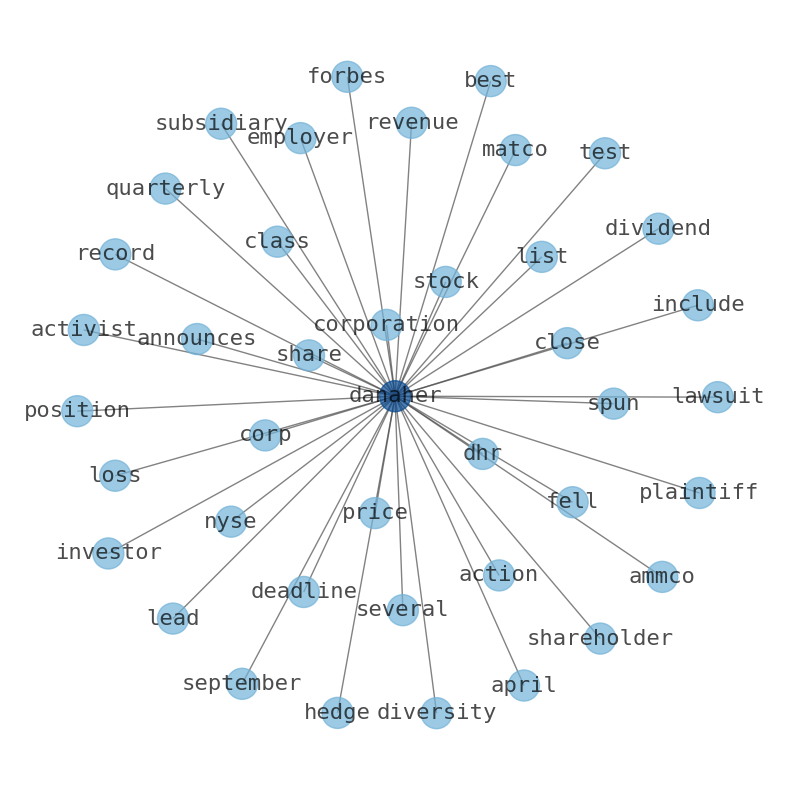

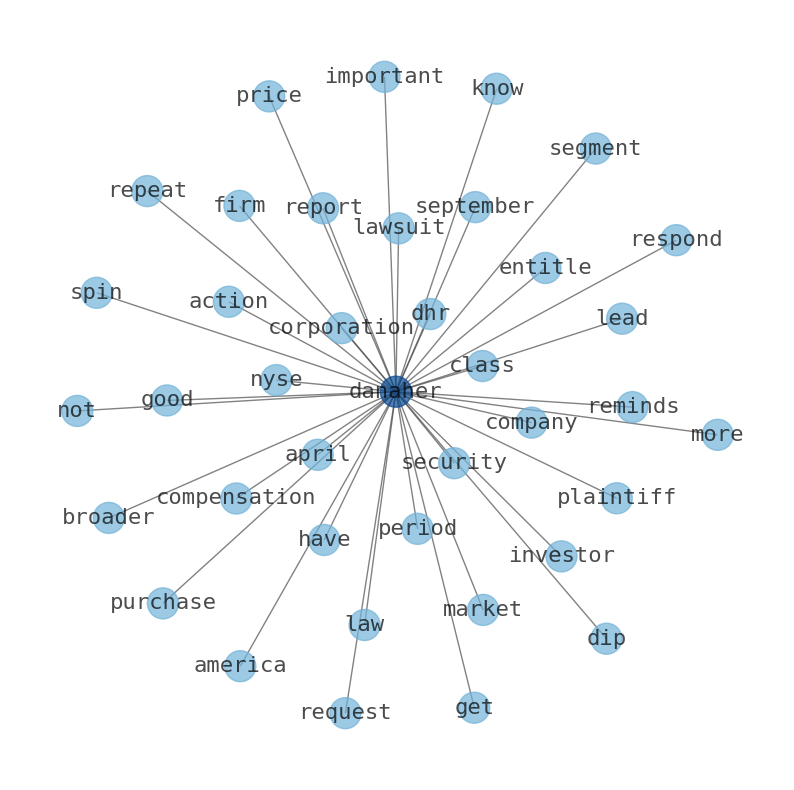

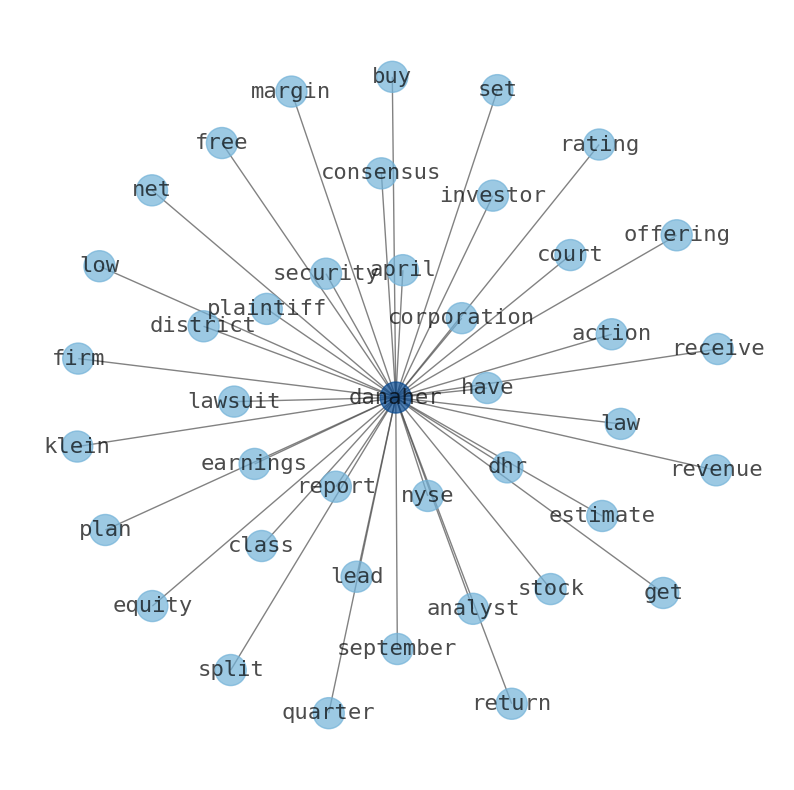

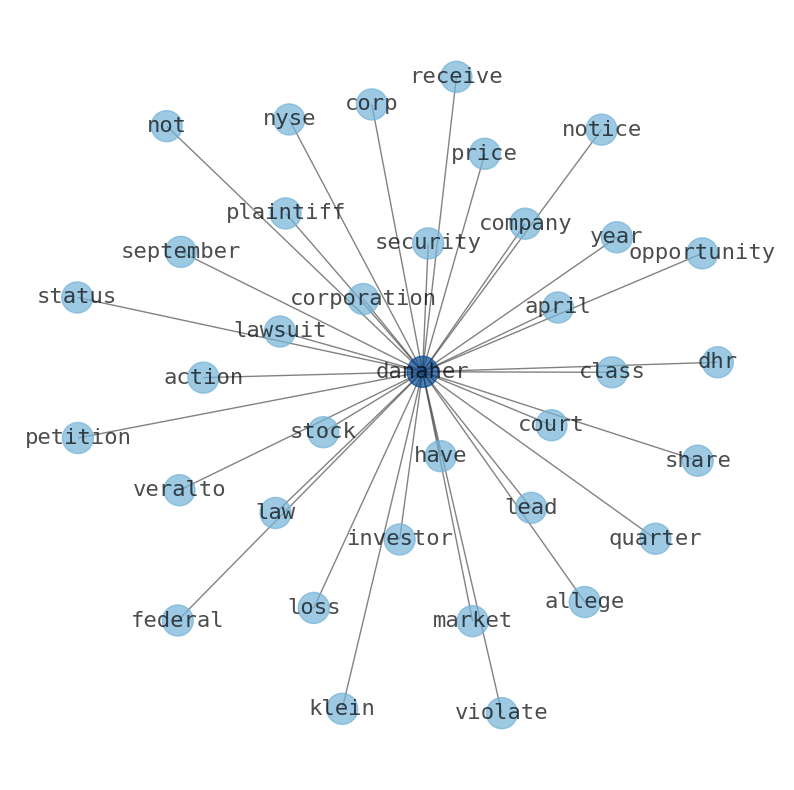

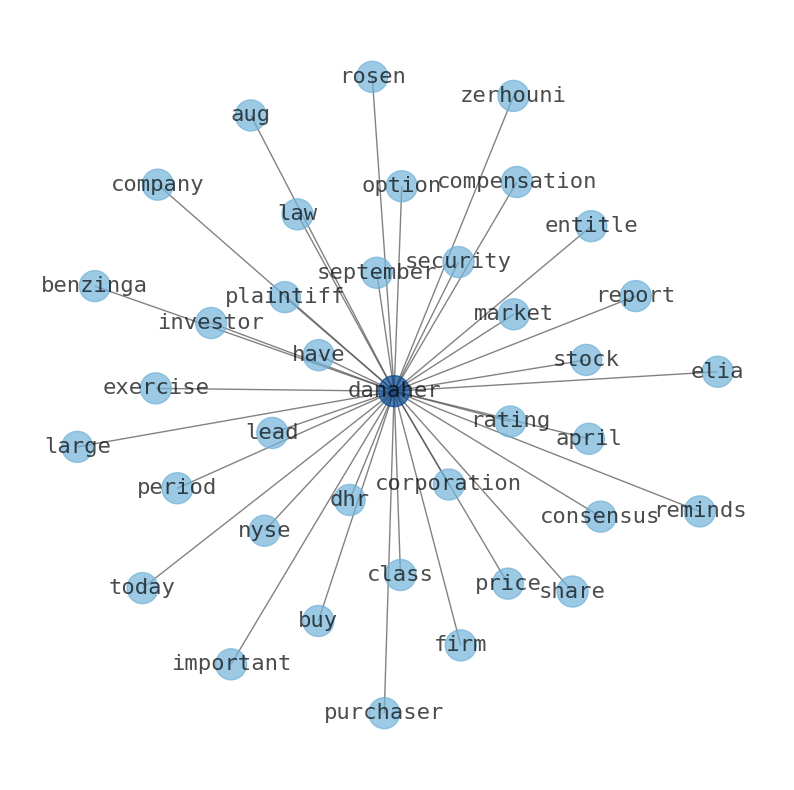

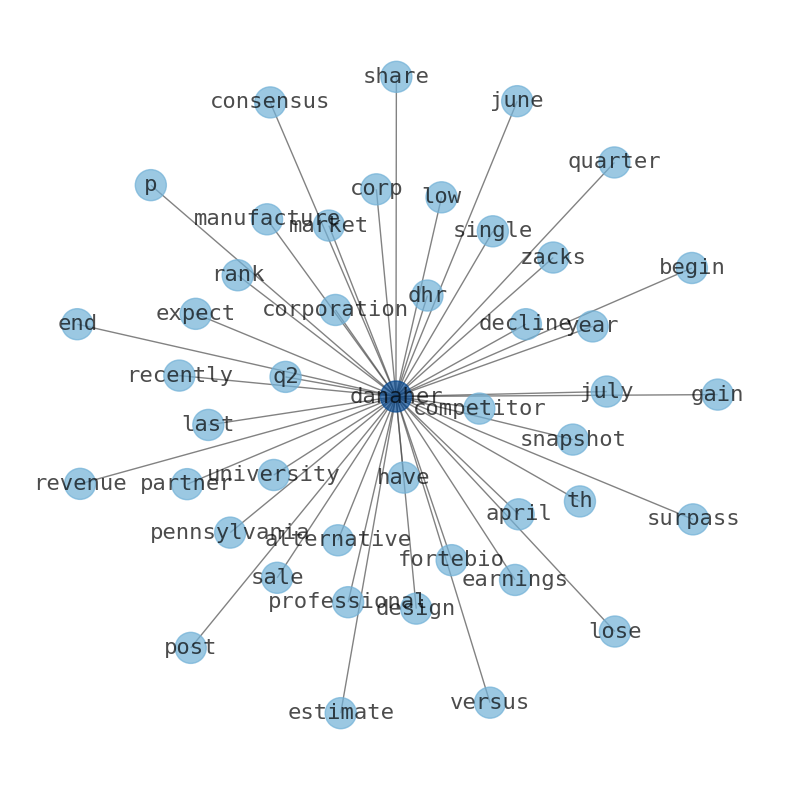

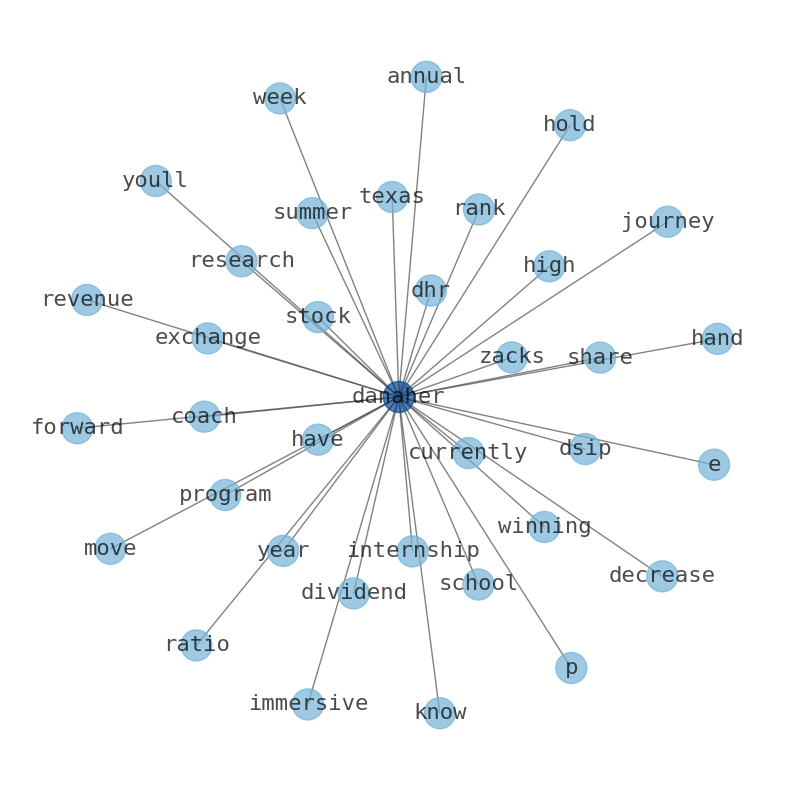

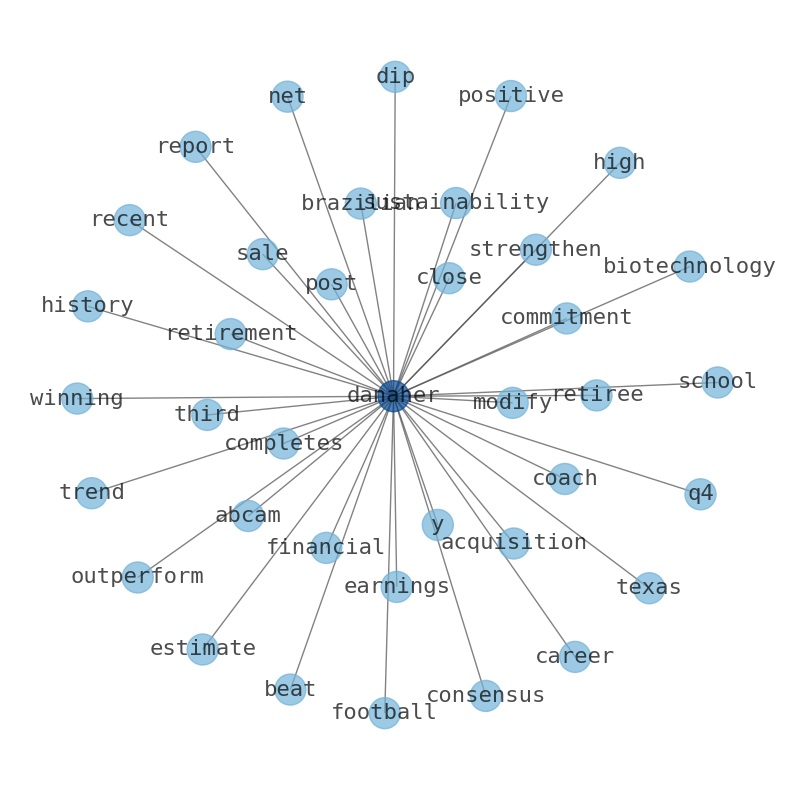

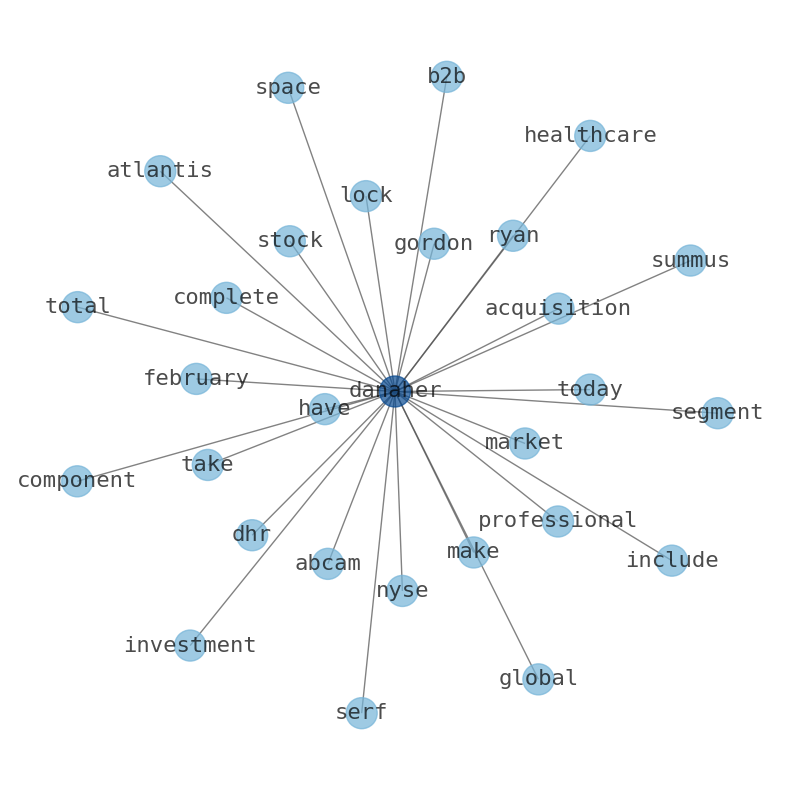

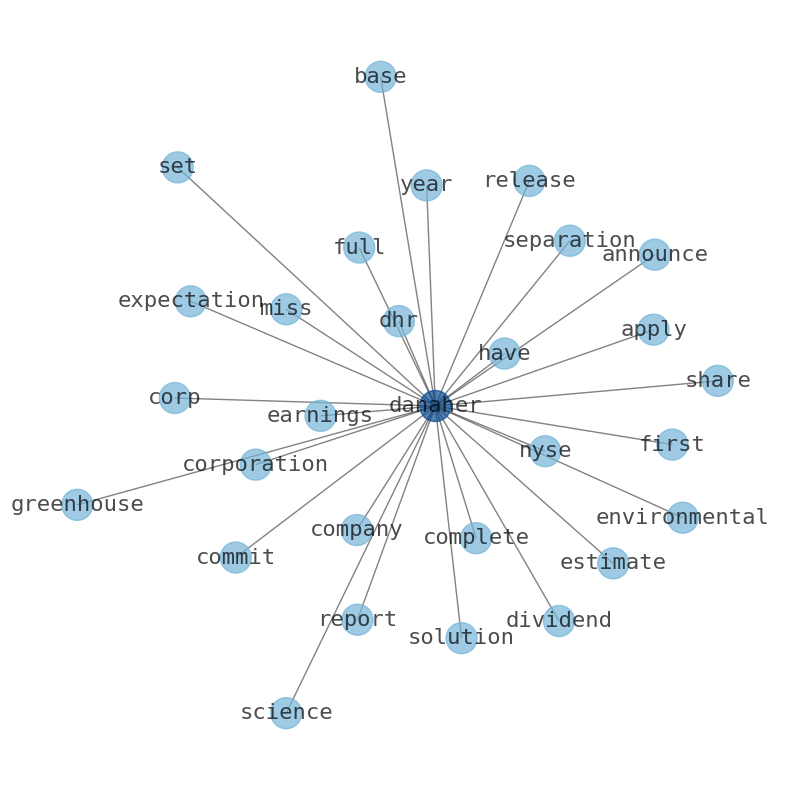

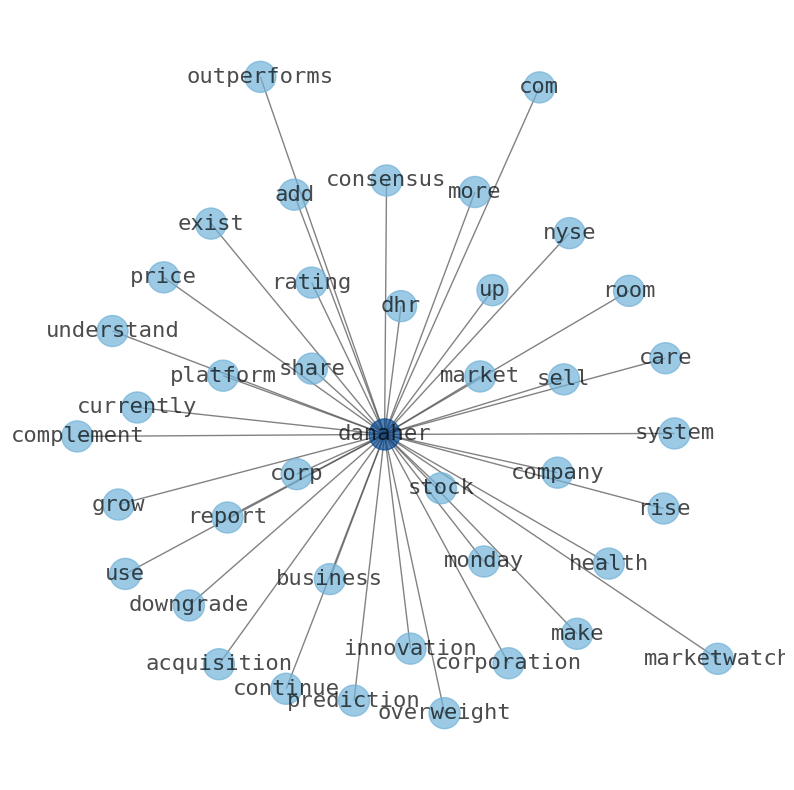

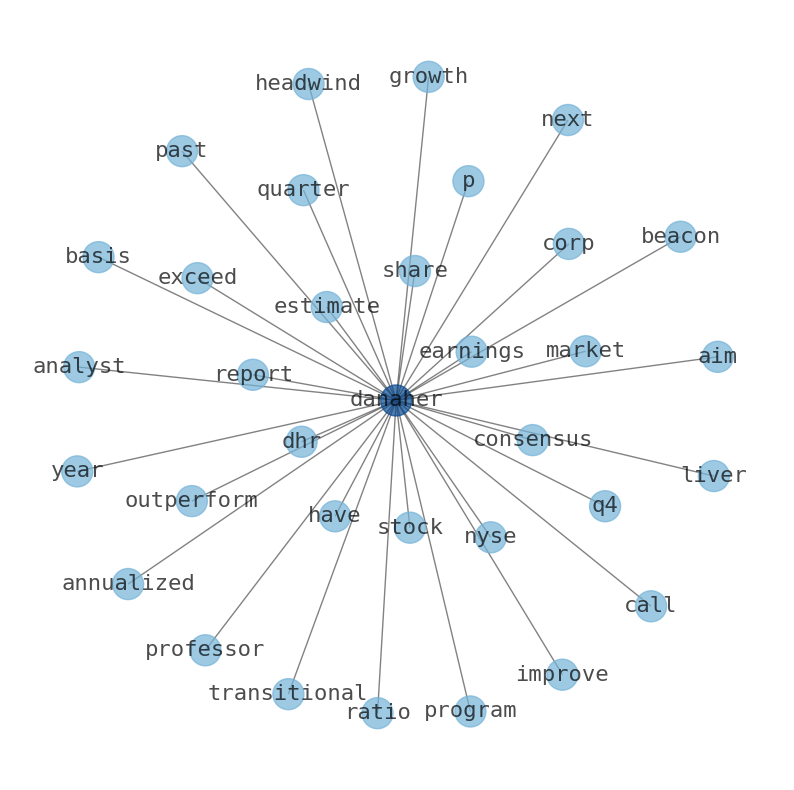

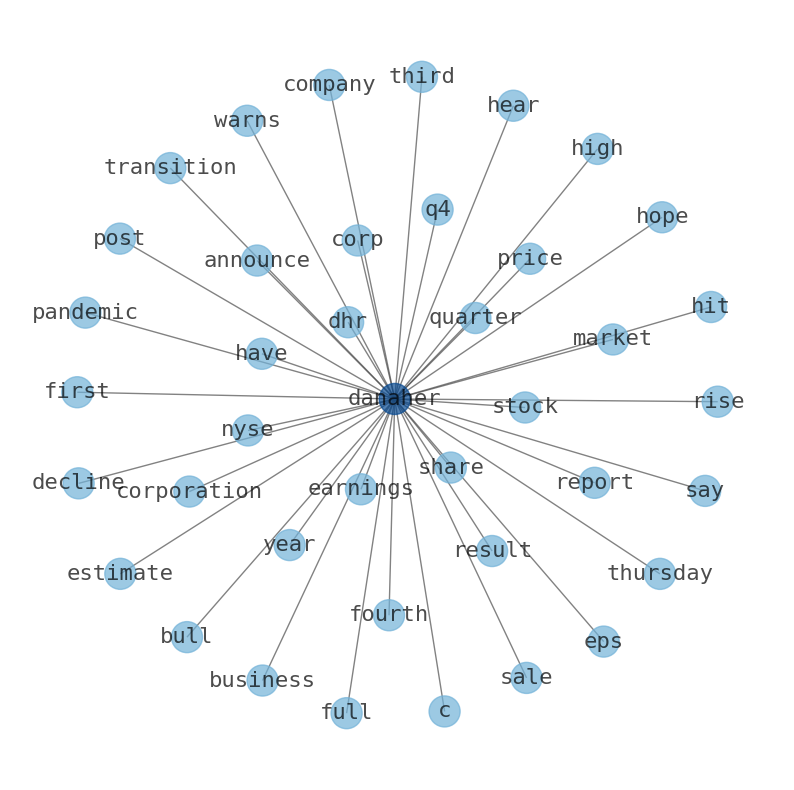

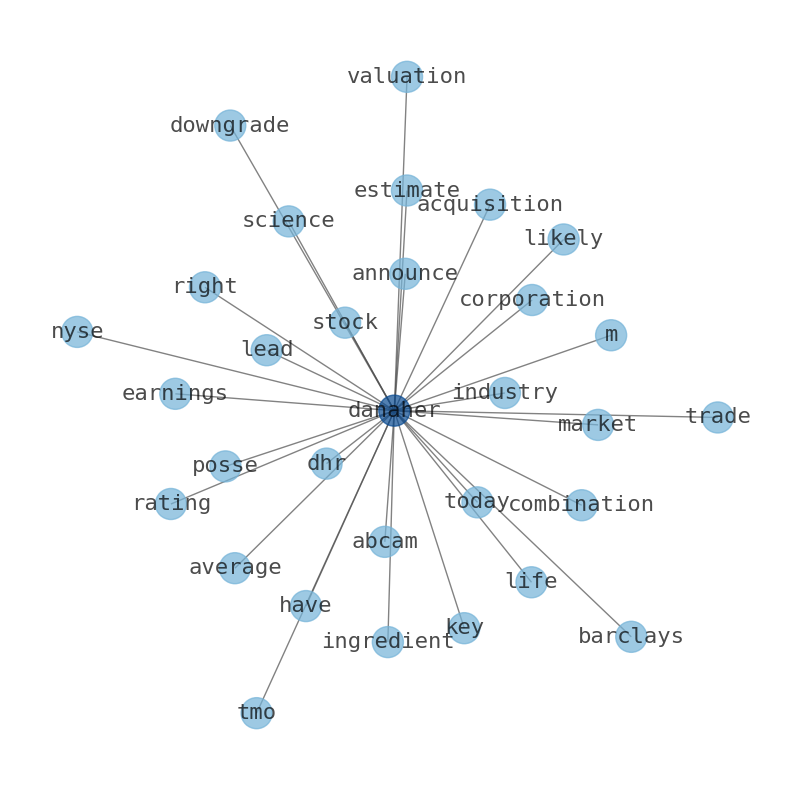

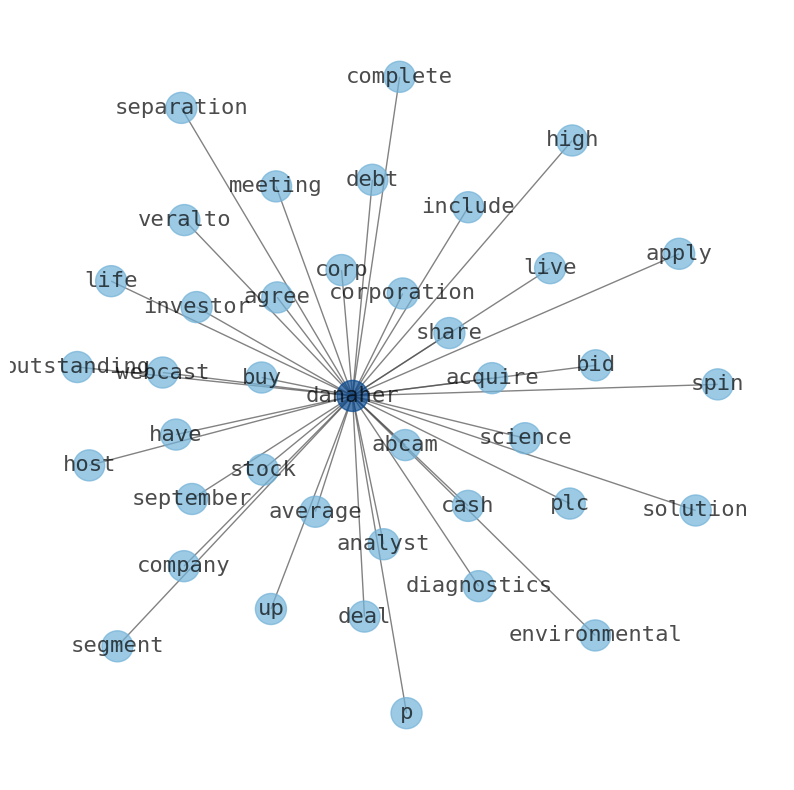

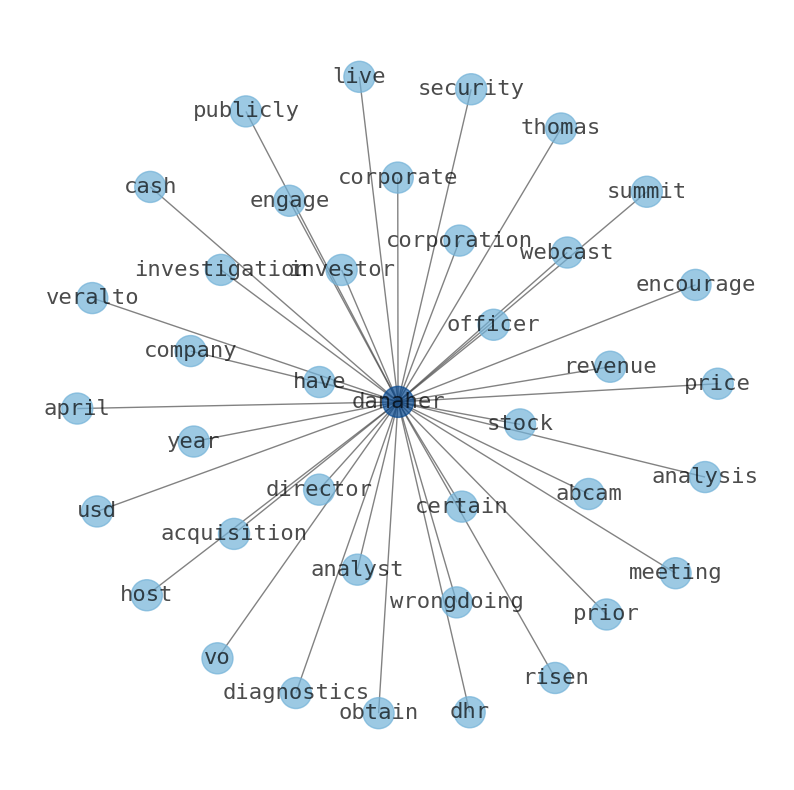

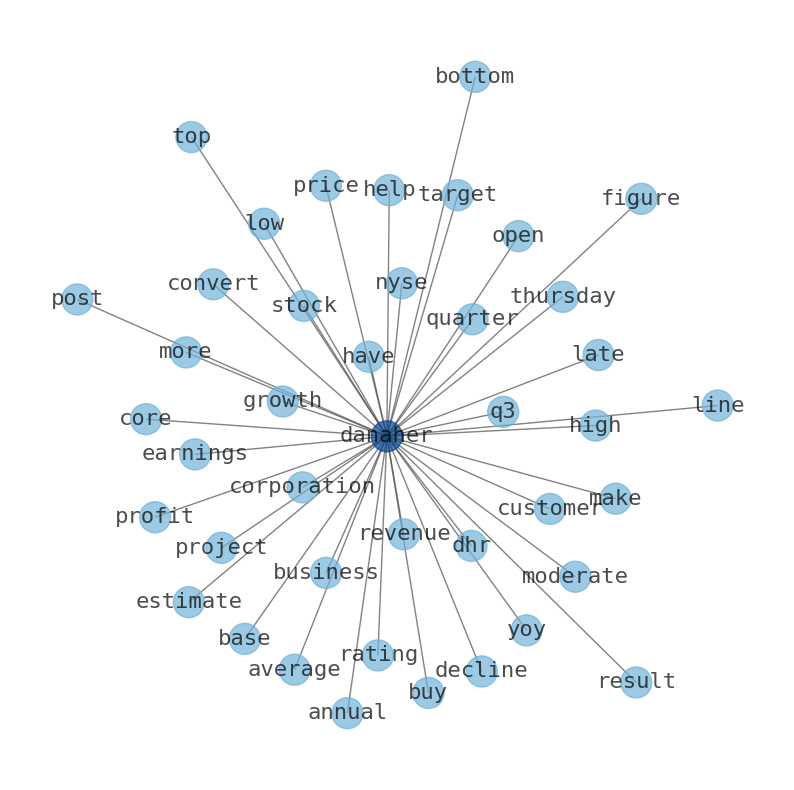

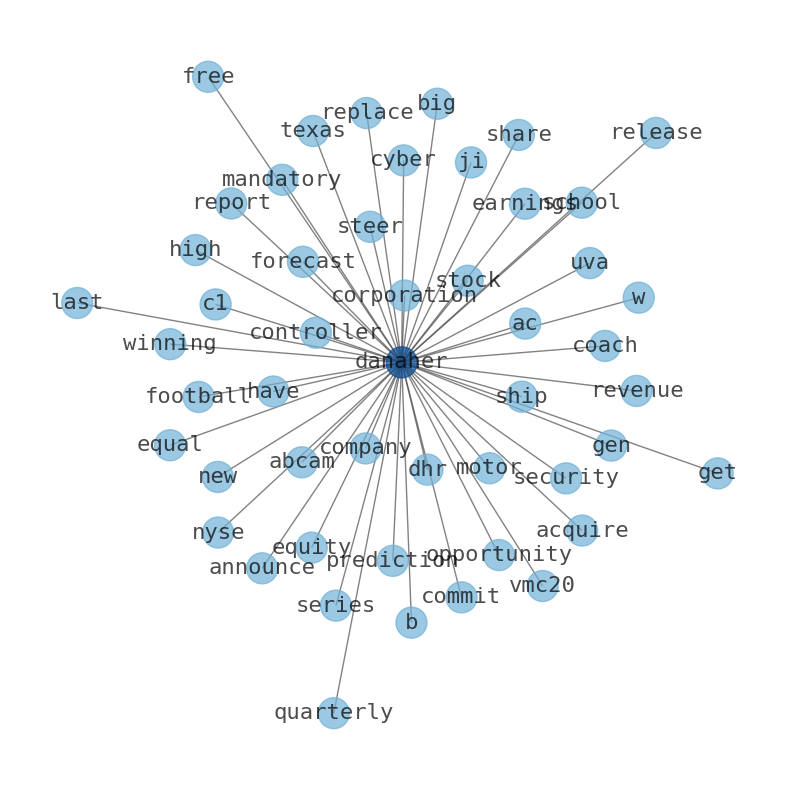

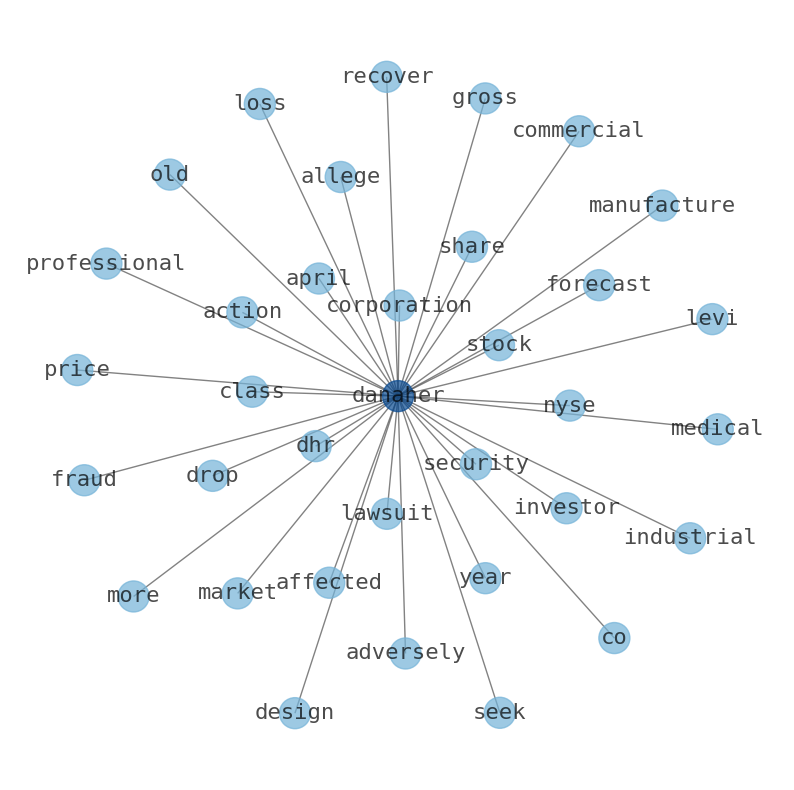

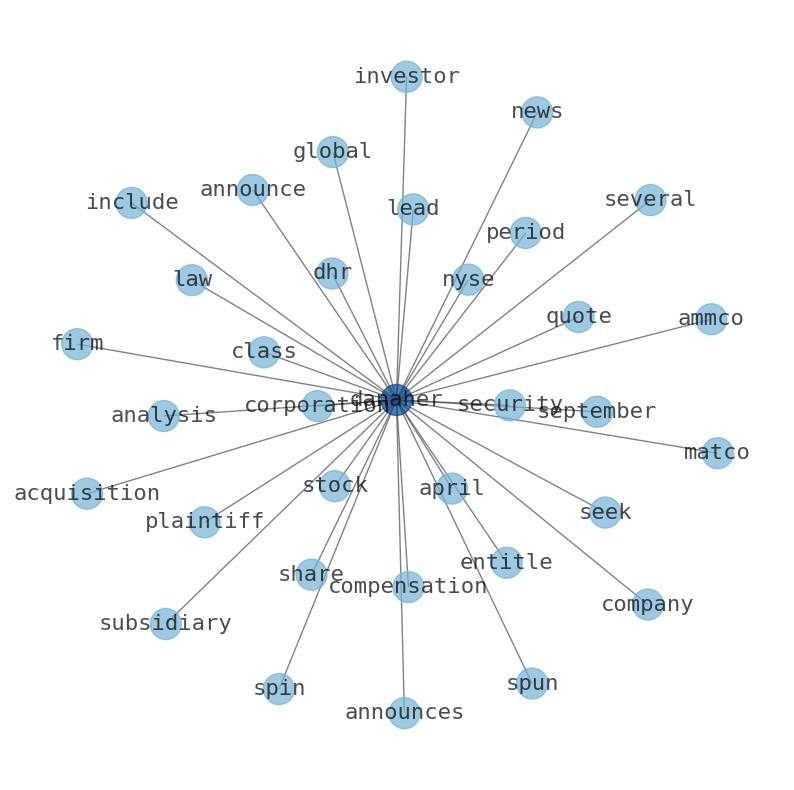

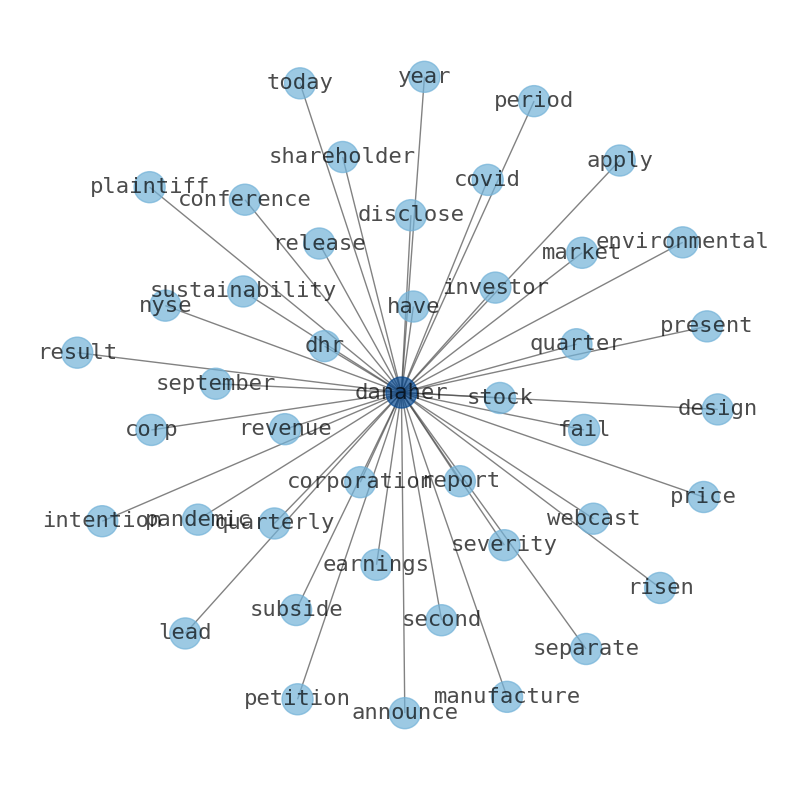

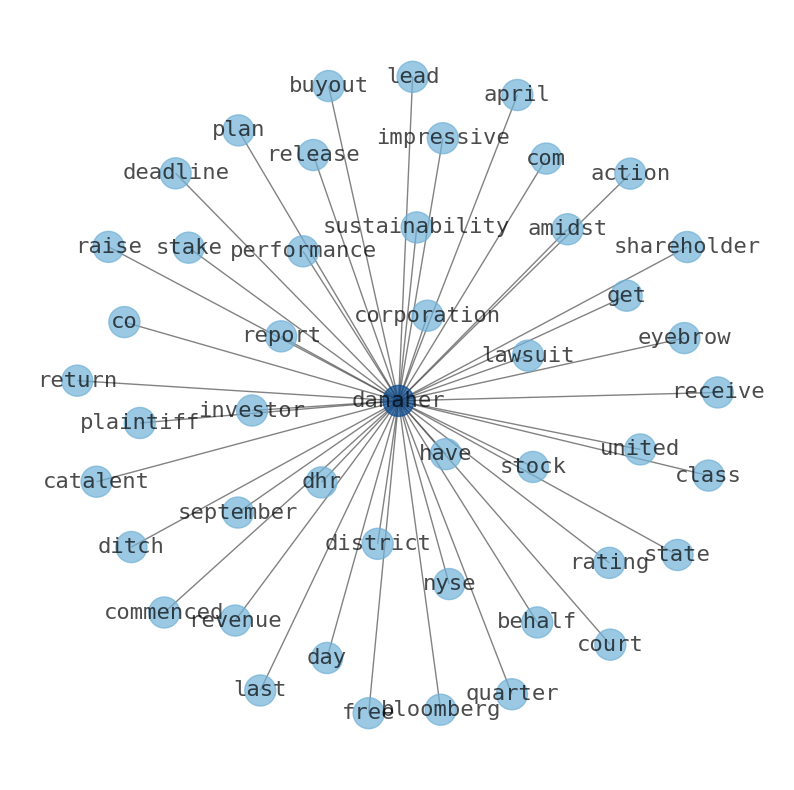

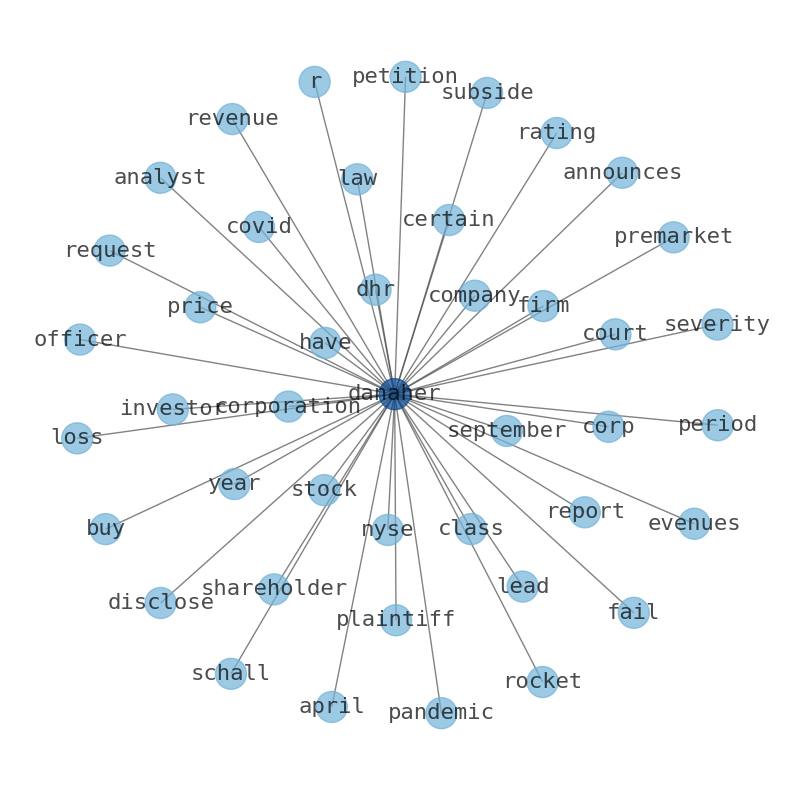

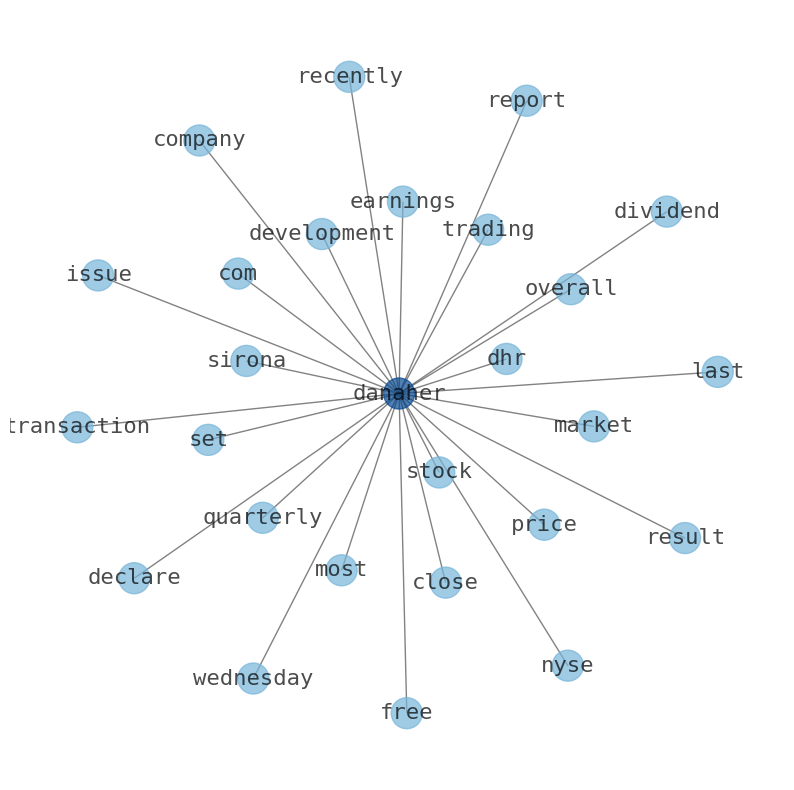

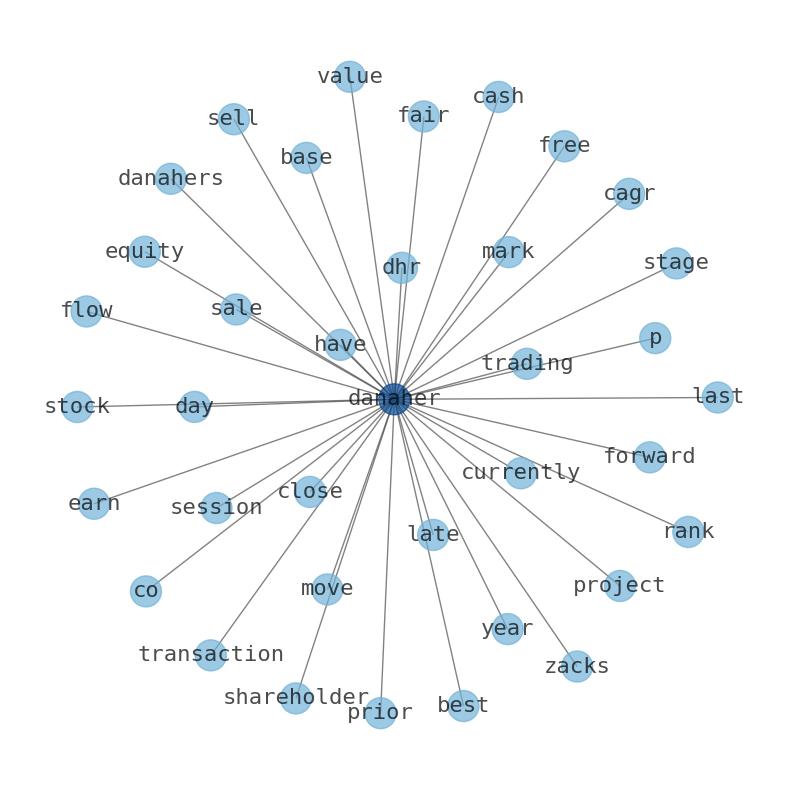

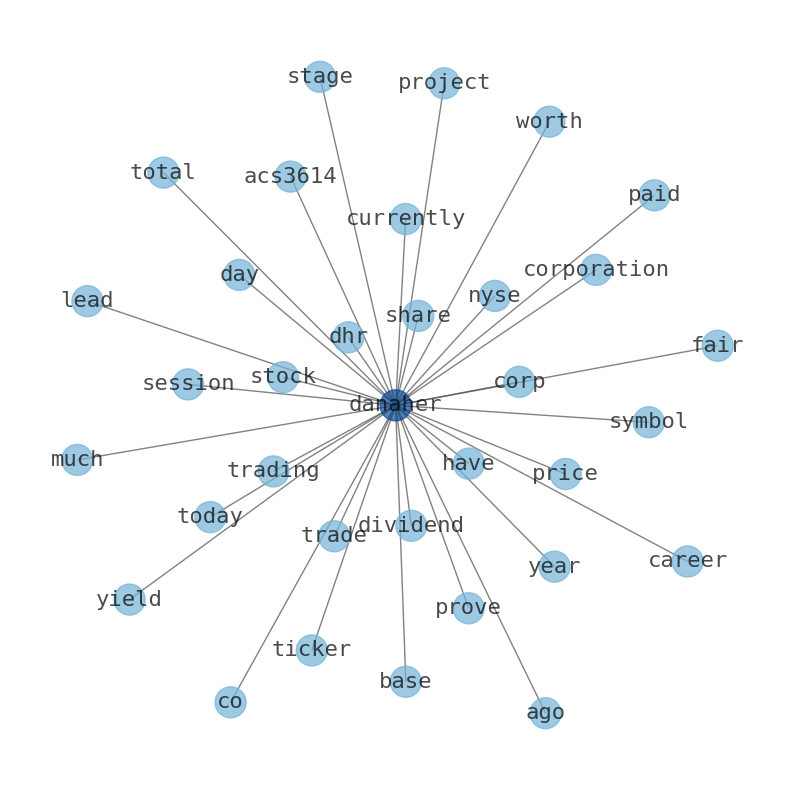

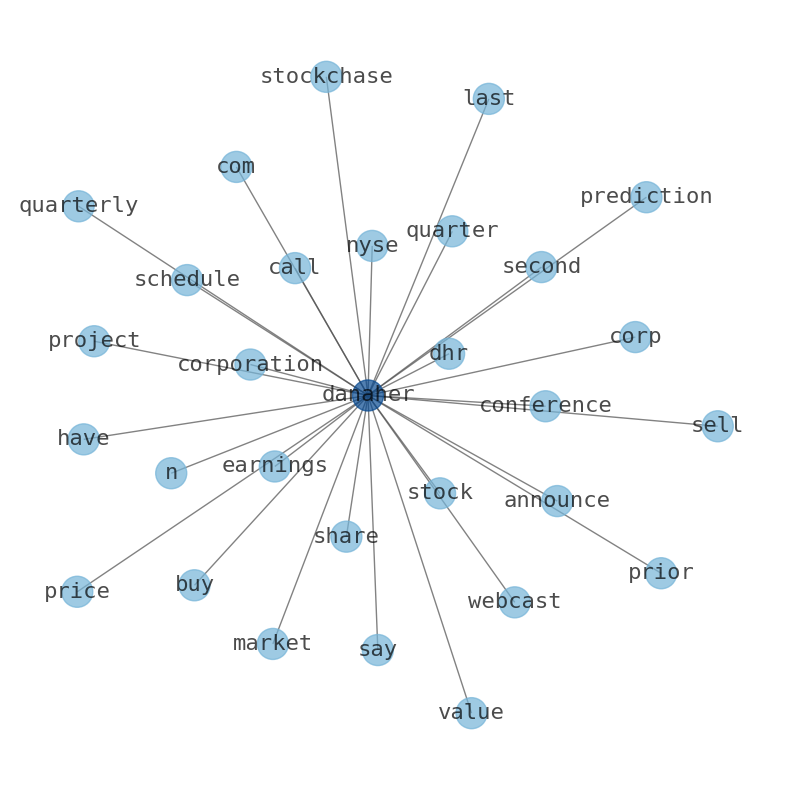

Keywords

The game is changing. There is a new strategy to evaluate Danaher fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Danaher are: Danaher, share, last, quarter, earnings, DHR, Abcam, and the most common words in the summary are: danaher, job, stock, curtis, model, best, market, . One of the sentences in the summary was: Danaher spun off its industrial technologies, measurement and petroleum businesses into Fortive Corporation.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #danaher #job #stock #curtis #model #best #market.

Read more →Related Results

Danaher

Open: 253.87 Close: 253.22 Change: -0.65

Read more →

Danaher

Open: 253.1 Close: 255.44 Change: 2.34

Read more →

Danaher

Open: 252.96 Close: 255.87 Change: 2.91

Read more →

Danaher

Open: 252.12 Close: 253.94 Change: 1.82

Read more →

Danaher

Open: 248.81 Close: 250.0 Change: 1.19

Read more →

Danaher

Open: 245.0 Close: 242.95 Change: -2.05

Read more →

Danaher

Open: 245.0 Close: 242.95 Change: -2.05

Read more →

Danaher

Open: 236.54 Close: 237.8 Change: 1.26

Read more →

Danaher

Open: 230.77 Close: 231.58 Change: 0.81

Read more →

Danaher

Open: 225.54 Close: 224.58 Change: -0.96

Read more →

Danaher

Open: 228.77 Close: 225.24 Change: -3.53

Read more →

Danaher

Open: 230.88 Close: 230.29 Change: -0.59

Read more →

Danaher

Open: 230.88 Close: 230.29 Change: -0.59

Read more →

Danaher

Open: 232.64 Close: 231.34 Change: -1.3

Read more →

Danaher

Open: 234.0 Close: 233.1 Change: -0.9

Read more →

Danaher

Open: 229.79 Close: 227.23 Change: -2.56

Read more →

Danaher

Open: 222.0 Close: 221.96 Change: -0.04

Read more →

Danaher

Open: 195.99 Close: 197.87 Change: 1.88

Read more →

Danaher

Open: 190.74 Close: 193.68 Change: 2.94

Read more →

Danaher

Open: 207.29 Close: 205.83 Change: -1.46

Read more →

Danaher

Open: 217.58 Close: 216.43 Change: -1.15

Read more →

Danaher

Open: 214.77 Close: 217.23 Change: 2.46

Read more →

Danaher

Open: 249.23 Close: 248.1 Change: -1.13

Read more →

Danaher

Open: 250.56 Close: 247.25 Change: -3.31

Read more →

Danaher

Open: 252.74 Close: 255.23 Change: 2.49

Read more →

Danaher

Open: 252.78 Close: 255.25 Change: 2.47

Read more →

Danaher

Open: 243.41 Close: 252.45 Change: 9.04

Read more →

Danaher

Open: 253.55 Close: 252.82 Change: -0.73

Read more →

Danaher

Open: 257.3 Close: 257.38 Change: 0.08

Read more →

Danaher

Open: 256.47 Close: 254.75 Change: -1.72

Read more →

Danaher

Open: 257.14 Close: 260.07 Change: 2.93

Read more →

Danaher

Open: 254.31 Close: 264.87 Change: 10.56

Read more →

Danaher

Open: 239.83 Close: 240.28 Change: 0.45

Read more →

Danaher

Open: 232.56 Close: 235.29 Change: 2.74

Read more →

Danaher

Open: 237.59 Close: 236.81 Change: -0.78

Read more →

Danaher

Open: 238.27 Close: 237.88 Change: -0.39

Read more →

Danaher

Open: 242.94 Close: 238.45 Change: -4.49

Read more →

Danaher

Open: 234.56 Close: 234.62 Change: 0.06

Read more →

Danaher

Open: 239.19 Close: 241.71 Change: 2.52

Read more →

Danaher

Open: 252.5 Close: 252.8 Change: 0.3

Read more →

Danaher

Open: 255.48 Close: 252.9 Change: -2.58

Read more →

Danaher

Open: 254.06 Close: 254.99 Change: 0.93

Read more →

Danaher

Open: 254.0 Close: 253.84 Change: -0.16

Read more →

Danaher

Open: 243.76 Close: 246.83 Change: 3.07

Read more →

Danaher

Open: 245.0 Close: 242.95 Change: -2.05

Read more →

Danaher

Open: 244.0 Close: 246.33 Change: 2.33

Read more →

Danaher

Open: 231.33 Close: 227.39 Change: -3.94

Read more →

Danaher

Open: 225.54 Close: 224.58 Change: -0.96

Read more →

Danaher

Open: 228.77 Close: 225.24 Change: -3.53

Read more →

Danaher

Open: 228.77 Close: 225.24 Change: -3.53

Read more →

Danaher

Open: 230.88 Close: 230.29 Change: -0.59

Read more →

Danaher

Open: 232.64 Close: 231.34 Change: -1.3

Read more →

Danaher

Open: 234.0 Close: 233.13 Change: -0.87

Read more →

Danaher

Open: 229.79 Close: 226.75 Change: -3.04

Read more →

Danaher

Open: 217.0 Close: 218.92 Change: 1.92

Read more →

Danaher

Open: 195.86 Close: 197.0 Change: 1.14

Read more →

Danaher

Open: 195.99 Close: 197.87 Change: 1.88

Read more →

Danaher

Open: 190.74 Close: 193.68 Change: 2.94

Read more →

Danaher

Open: 207.29 Close: 205.83 Change: -1.46

Read more →

Danaher

Open: 217.79 Close: 218.71 Change: 0.92

Read more →

Danaher

Open: 219.02 Close: 213.74 Change: -5.28

Read more →

Danaher

Open: 248.5 Close: 247.44 Change: -1.06

Read more →

Danaher

Open: 252.74 Close: 255.23 Change: 2.49

Read more →

Danaher

Open: 252.78 Close: 255.25 Change: 2.47

Read more →

Danaher

Open: 252.78 Close: 255.25 Change: 2.47

Read more →

Danaher

Open: 251.75 Close: 251.41 Change: -0.34

Read more →

Danaher

Open: 253.55 Close: 252.82 Change: -0.73

Read more →

Danaher

Open: 256.0 Close: 258.42 Change: 2.42

Read more →

Danaher

Open: 256.47 Close: 254.75 Change: -1.72

Read more →

Danaher

Open: 257.14 Close: 259.02 Change: 1.88

Read more →

Danaher

Open: 242.63 Close: 255.88 Change: 13.25

Read more →

Danaher

Open: 239.0 Close: 237.79 Change: -1.21

Read more →

Danaher

Open: 233.88 Close: 236.99 Change: 3.11

Read more →

Danaher

Open: 233.6 Close: 237.77 Change: 4.17

Read more →

Danaher

Open: 234.81 Close: 238.18 Change: 3.37

Read more →

Danaher

Open: 237.52 Close: 235.41 Change: -2.11

Read more →

Danaher

Open: 232.0 Close: 230.81 Change: -1.19

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo