The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

DXP Enterprises

Youtube Subscribe

Open: 26.31 Close: 25.87 Change: -0.44

The stock market through the eyes of an AI: DXP Enterprises Company Inc Stock.

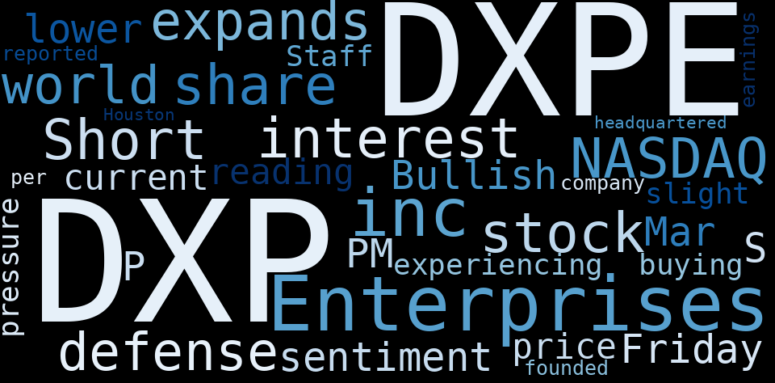

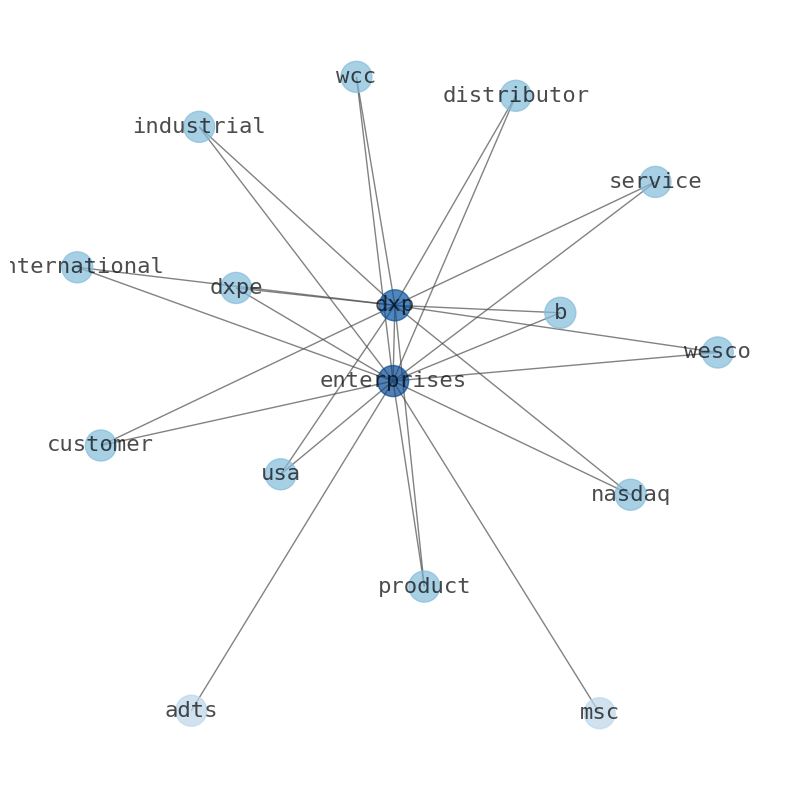

How much time have you spent trying to decide whether investing in DXP Enterprises? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about DXP Enterprises are: …

Stock Summary

DXP Enterprises, Inc. operates through three segments: Service Centers, Supply Chain Services, and Innovative Pumping Solutions. The SC segment offers MRO products, equipment, and integrated services, including technical expertise and logistics services. The.

Today's Summary

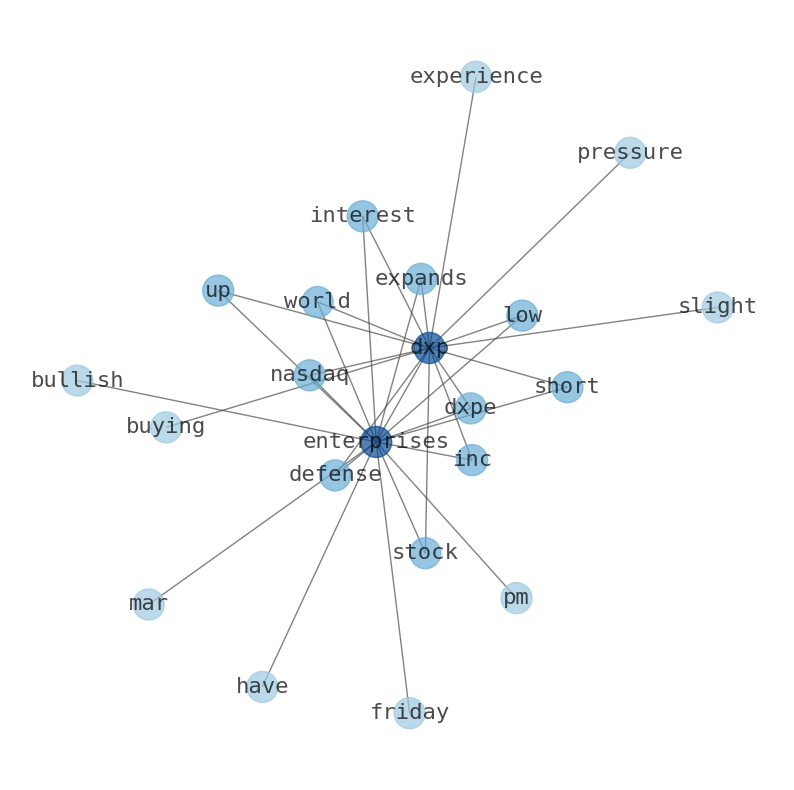

DXP Enterprises, Inc. (NASDAQ:DXPE) Could Be Worth Watching why dxp enterprises, inc. (nasdaq: DXPE) could be worth watching. DXPE is expected to experience a price decline over the next year.

Today's News

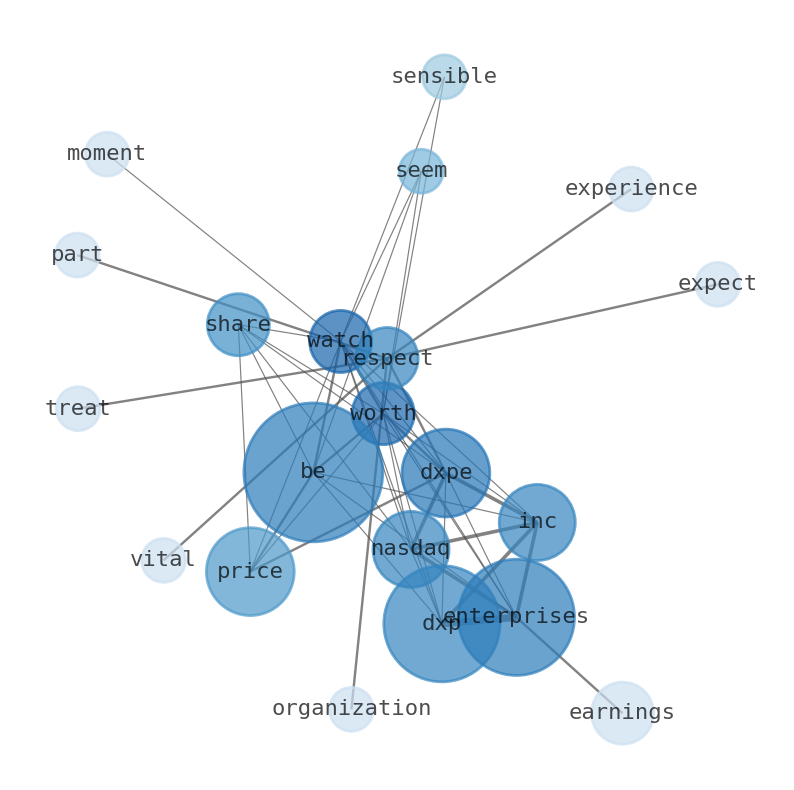

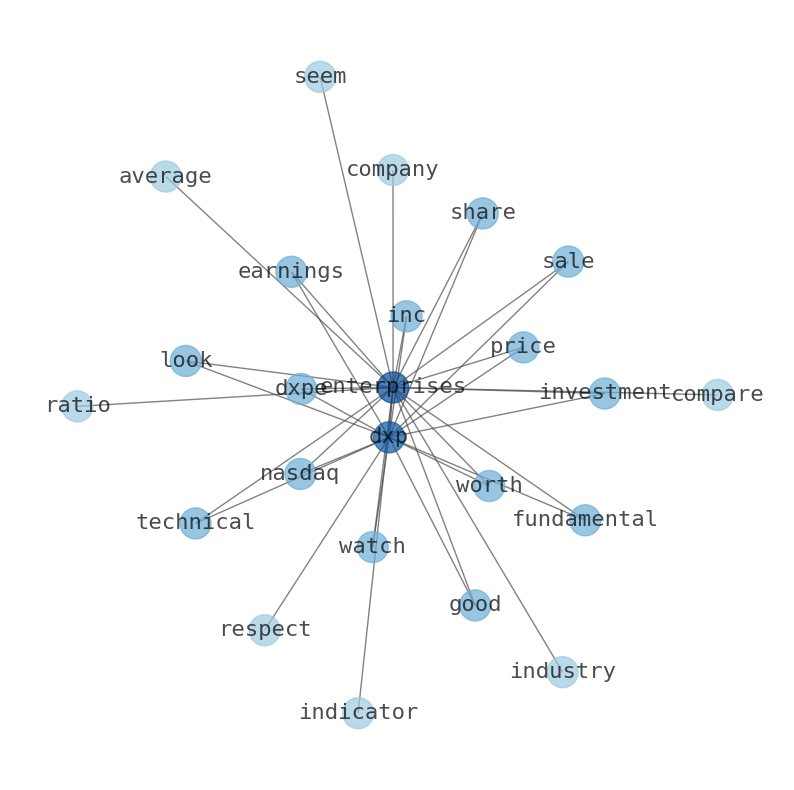

DXP Enterprises, Inc. (NASDAQ:DXPE) Could Be Worth Watching why dxp enterprises, inc. (nasdaq: DXPE) could be worth watching. The share price seems sensible at the moment according to my price multiple model, where I compare the companys price-to-earnings ratio to the industry average of 9.7. DXP Enterprises is a good investment by looking at earnings, sales, fundamental and technical indicators, competition as well as analyst projections. The key to understanding future value is determining which factors weigh more heavily than others. DXP Enterprises is rated # 5 in current valuation category among related companies. The most important aspect of a successful company is its ability to generate a profit. Profitability is also one of the essential criteria for including it into their portfolios. 36,799 shares in DXP Enterprises, Inc. (NASDAQ:DXPE) Acquired by Fisher Asset Management LLC. DXP Enterprises is one of the largest distributors of maintenance, repair, and operating (MRO) products in the United States. DXP employees are a vital part of the organization and treated with respect with respect. DXPE is expected to experience a price decline over the next year.

Stock Profile

"DXP Enterprises, Inc., together with its subsidiaries, engages in distributing maintenance, repair, and operating (MRO) products, equipment, and services in the United States and Canada. It operates through three segments: Service Centers (SC), Supply Chain Services (SCS), and Innovative Pumping Solutions (IPS). The SC segment offers MRO products, equipment, and integrated services, including technical expertise and logistics services. It offers a range of MRO products in the rotating equipment, bearing, power transmission, hose, fluid power, metal working, fastener, industrial supply, safety products, and safety services categories. This segment serves customers in the oil and gas, food and beverage, petrochemical, transportation, other general industrial, mining, construction, chemical, municipal, agriculture, and pulp and paper industries. The SCS segment manages procurement and inventory management solutions; and offers outsourced MRO solutions for sourcing MRO products, including inventory optimization and management, store room management, transaction consolidation and control, vendor oversight and procurement cost optimization, productivity improvement, and customized reporting services. Its programs include SmartAgreement, a procurement solution for various MRO categories; SmartBuy, an on-site or centralized MRO procurement solution; SmartSource, an on-site procurement and storeroom management solution; SmartStore, an e-Catalog solution; SmartVend, an industrial dispensing solution; and SmartServ, an integrated service pump solution. The IPS segment fabricates and assembles custom-made pump packages; remanufactures pumps; and manufactures branded private label pumps. The company was founded in 1908 and is based in Houston, Texas."

Keywords

The game is changing. There is a new strategy to evaluate DXP Enterprises fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about DXP Enterprises are: DXP, Enterprises, price, Inc, NASDAQDXPE, DXPE, share, and the most common words in the summary are: dxp, market, enterprise, digital, platform, experience, job, . One of the sentences in the summary was: DXP Enterprises, Inc. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #dxp #market #enterprise #digital #platform #experience #job.

Read more →Related Results

DXP Enterprises

Open: 44.78 Close: 45.13 Change: 0.35

Read more →

DXP Enterprises

Open: 26.31 Close: 25.87 Change: -0.44

Read more →

DXP Enterprises

Open: 35.65 Close: 34.68 Change: -0.97

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo