The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Crown Holdings

Youtube Subscribe

Open: 81.11 Close: 80.79 Change: -0.32

You'll be sorry if you don't use an AI to decide whether to invest in Crown Holdings Company Inc Stock.

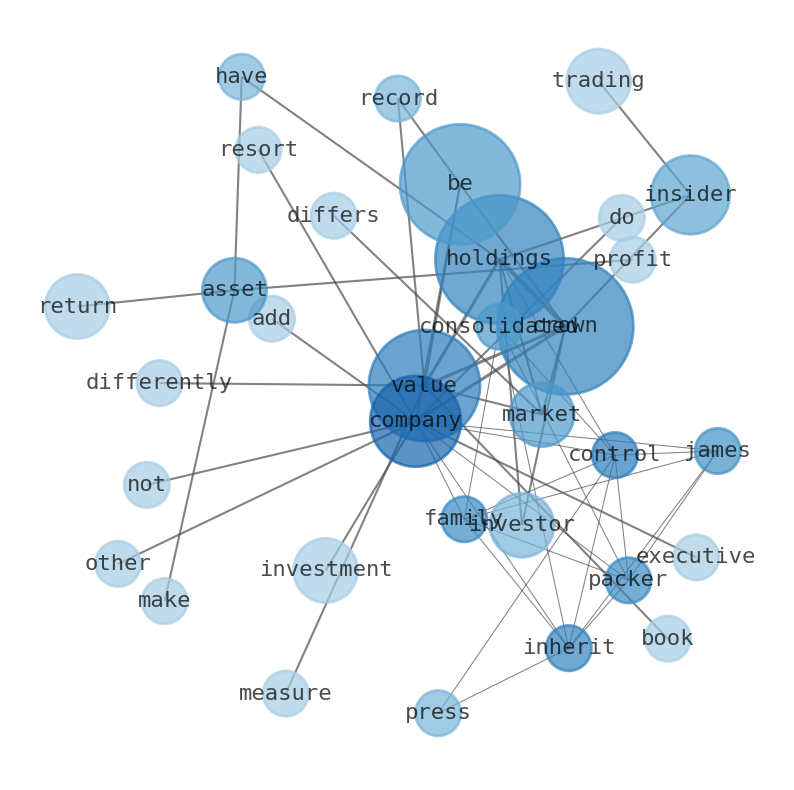

The game is changing. There is a new strategy to evaluate Crown Holdings fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Crown Holdings are: Crown, Holdings, value, company, Return, year, insider, …

Stock Summary

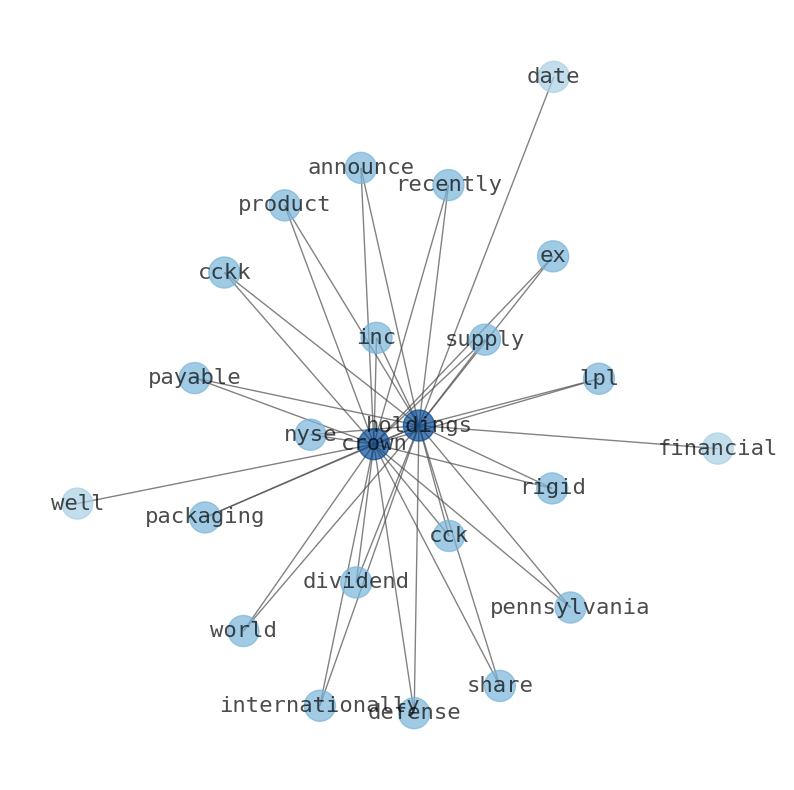

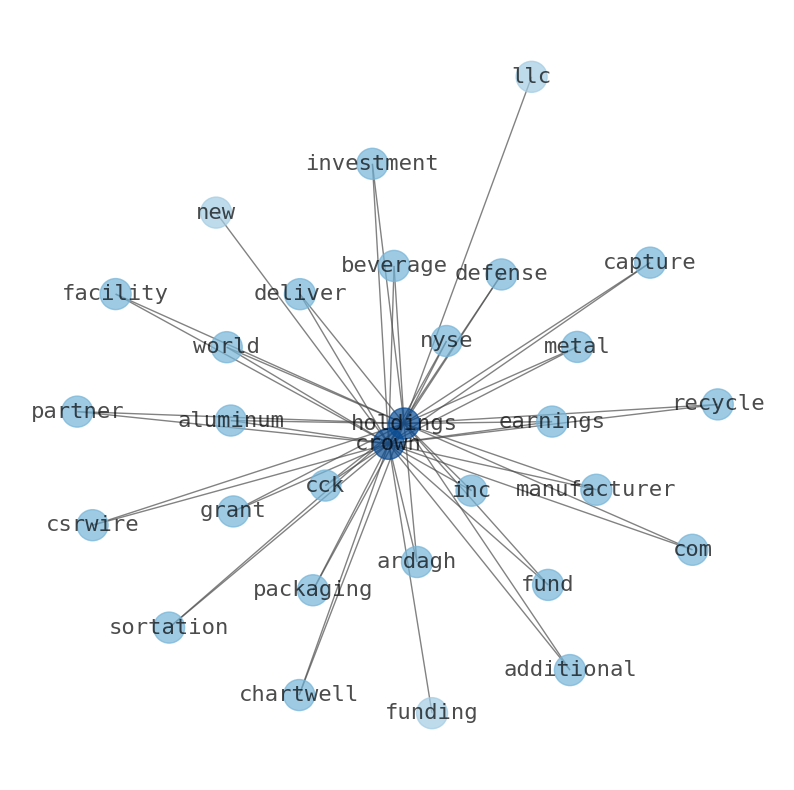

Crown Holdings, Inc. supplies rigid packaging products in Pennsylvania and internationally. The company operates through Americas Beverage, European Beverage and Asia Pacific. The Transit Packaging segment provides industrial products; protective solutions; automation products, equipment, and.

Today's Summary

James Packer inherited control of family company Consolidated Press Holdings Limited. Current Liabilities is expected to rise to about 4 B this year.

Today's News

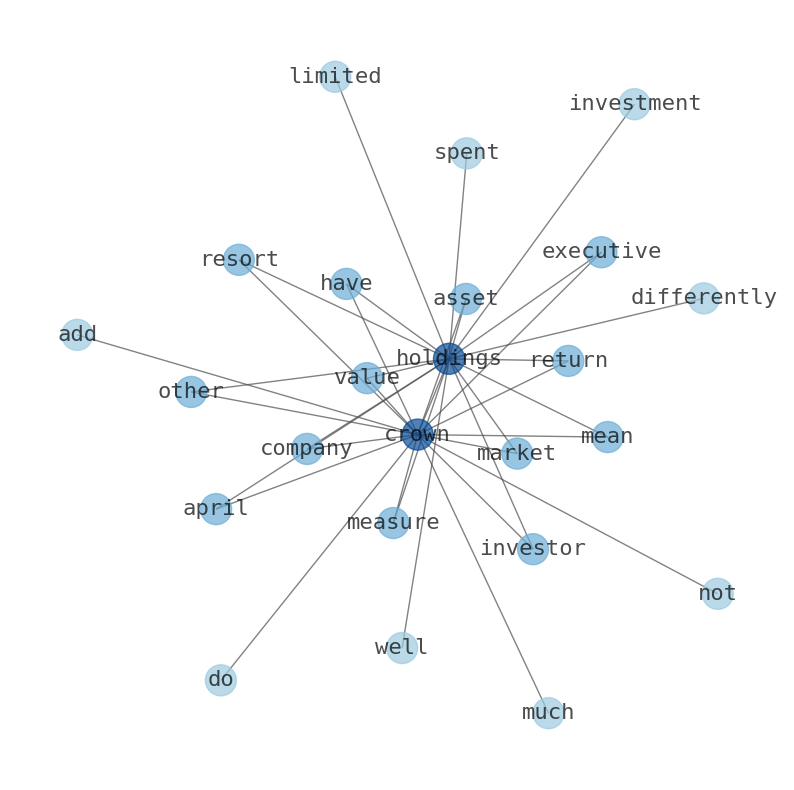

James Packer inherited control of family company Consolidated Press Holdings Limited, as well as investments in Crown Resorts and other companies. The company executives did not add much value to Crown Holdings investors in April. Crown Holdings has Return on Asset of 0.0521% which means that on every $100 spent on assets, it made $021 of profit. Return on Investment is quite stable at the moment as compared to the past year. Current Liabilities is expected to rise to about 4 B this year. Recent studies suggest that insider trading raises the cost of capital for securities issuers and decreases overall economic growth. Insider trading by specific Crown Holdings insiders is commonly permitted. Crown Holdings is measured differently than its book value, which is the value of Crown that is recorded on the companys balance sheet. Investors form their own opinion of Crown Holdings value that differs from its market value. Crown Holdings market value can be influenced by many factors that dont directly affect Crown Holdings underlying business.

Stock Profile

"Crown Holdings, Inc., together with its subsidiaries, supplies rigid packaging products in Pennsylvania and internationally. It operates through Americas Beverage, European Beverage, Asia Pacific, and Transit Packaging segments. The Americas Beverage segment manufactures recyclable aluminum beverage cans and ends, glass bottles, steel crowns, and aluminum caps. The European Beverage segment manufactures recyclable aluminum beverage cans and ends. The Asia Pacific segment primarily consisting of beverage and non-beverage cans primarily for food cans and specialty packaging. The Transit Packaging segment provides industrial products; protective solutions; automation products, equipment, and tools; and steel and plastic strap, industrial film, and other related products. This segment also offers transit protection products, such as airbags, edge protectors, and honeycomb products, as well as manual, semi-automatic, and automatic equipment and tools used in end of line manufacturing applications to apply industrial solutions consumables. The company also provides aerosol cans and ends. Crown Holdings, Inc. was founded in 1892 and is headquartered in Yardley, Pennsylvania."

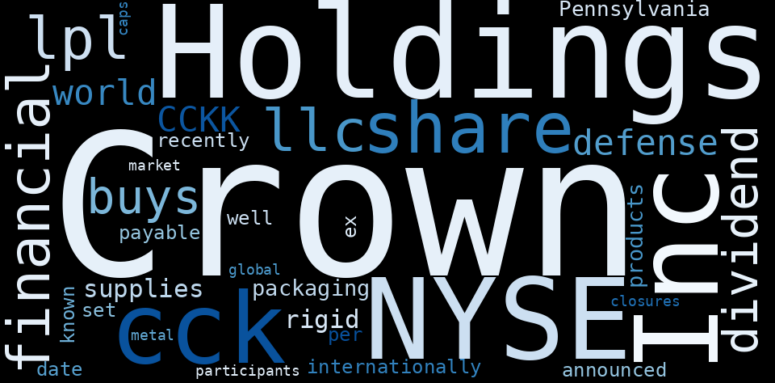

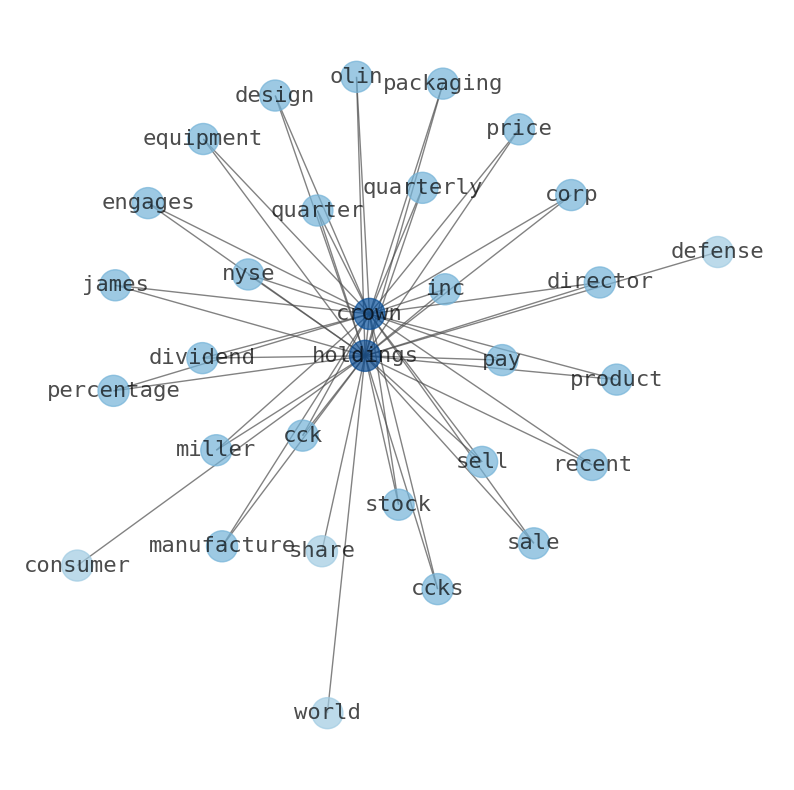

Keywords

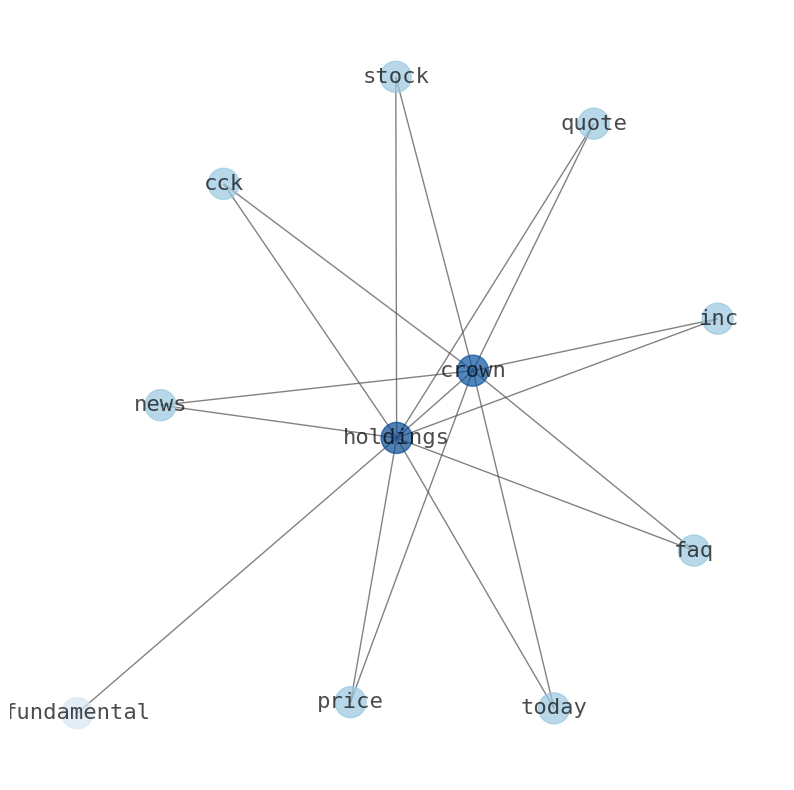

How much time have you spent trying to decide whether investing in Crown Holdings? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Crown Holdings are: Crown, Holdings, value, company, Return, year, insider, and the most common words in the summary are: crown, holding, stock, market, price, news, share, . One of the sentences in the summary was: Current Liabilities is expected to rise to about 4 B this year.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #crown #holding #stock #market #price #news #share.

Read more →Related Results

Crown Holdings

Open: 79.99 Close: 80.42 Change: 0.43

Read more →

Crown Holdings

Open: 83.47 Close: 84.3 Change: 0.83

Read more →

Crown Holdings

Open: 83.98 Close: 83.41 Change: -0.57

Read more →

Crown Holdings

Open: 86.38 Close: 87.43 Change: 1.05

Read more →

Crown Holdings

Open: 81.11 Close: 80.79 Change: -0.32

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo